Issuer Free Writing Prospectus dated January 24, 2025

Filed pursuant to Rule 433 of the Securities Act of 1933, as amended

Relating to preliminary prospectus dated January 21, 2025

Registration Statement No. 333-273597

Nasdaq Ticker: VTA

Vittoria Limited Free Writing Prospectus January 2025 No offer to buy the securities of Vittoria Limited can be accepted and no part of the purchase price can be received until the registration statement has become effective, and any such offer may be withdrawn or revoked, without obligation or commitment of any kind, at any time prior to notice of its acceptance given after the effective date. 1

Statement This presentation relates to the proposed public offering of class A ordinary shares (“Class A Ordinary Shares”) of Vittoria Limited (“we”, “us”, or “our”) and should be read together with the Registration Statement we filed with the U . S . Securities and Exchange Commission (the “SEC”) for the offering to which this presentation relates and may be accessed through the following web link : https : //www . sec . gov/Archives/edgar/data/ 1960348 / 000121390025004923 /ea 0200823 - 09 . htm No offer to buy the securities of Vittoria Limited can be accepted and no part of the purchase price can be received until the registration statement has become effective, and any such offer may be withdrawn or revoked, without obligation or commitment of any kind, at any time prior to notice of its acceptance given after the effective date . The Registration Statement has not yet become effective . Before you invest, you should read the prospectus in the Registration Statement (including the risk factors described therein) and other documents we have with the SEC in their entirety for more complete information about us and the offering . You may get these documents for free by visiting EDGAR on the SEC website at http : //www . sec . gov . Alternatively, we or our underwriter will arrange to send you the prospectus if you contact Eddid Securities USA Inc . via ecm@eddidusa . com . This presentation shall not constitute an offer to sell, or the solicitation of an offer to buy, nor will there be any sale of these securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such state or jurisdiction . The offering will only be made by means of a prospectus pursuant to a registration that is filed with the SEC after such registration statement becomes effective . An investment in our shares involves a high degree of risk . Before deciding whether to invest in our shares, you should consider carefully the risk factors, together with all of the other information set forth in the prospectus, including the section titled “Management’s discussion and analysis of financial condition and results of operations” and our consolidated financial statements and related notes . If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be materially and adversely affected, which could cause the trading price of our shares to decline, resulting in a loss of all or part of your investment . The risks described in the prospectus may not be the only ones that we face . Additional risks not presently known to us or that we currently deem immaterial may also affect our business . You should only consider investing in our shares if you can bear the risk of loss of your entire investment . 2JQ0 JQ1

Statement (cont.) This presentation contains forward - looking statements, all of which are subject to risks and uncertainties . Forward - looking statements give our current expectations or forecasts of future events . You can find many (but not all) of these statements by the use of words such as “approximates,” “believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,” “intends,” “plans,” “will,” “would,” “should,” “could,” “may” or other similar expressions in this presentation . These statements are likely to address our growth strategy, financial results and product and development programs . You must carefully consider any such statements and should understand that many factors could cause actual results to differ from our forward - looking statements . These factors may include inaccurate assumptions and a broad variety of other risks and uncertainties, including some that are known and some that are not . No forward - looking statement can be guaranteed and actual future results may vary materially . Factors that could cause actual results to differ from those discussed in the forward - looking statements include, but are not limited to : future financial and operating results, including revenues, income, expenditures, cash balances and other financial items ; our ability to execute our growth, expansion and acquisition strategies, including our ability to meet our goals, our ability to apply for new licenses and launch a fund, and our ability to enhance our research capabilities ; current and future economic and political conditions ; our expectations regarding demand for and market acceptance of our subsidiaries’ services ; our expectations regarding the expansion of our subsidiaries’ client base ; our subsidiaries’ relationships with their business partners ; competition in our industries ; relevant government policies and regulations relating to our industries ; our capital requirements and our ability to raise any additional financing which we may require ; our subsidiaries’ ability to protect their intellectual property rights and secure the right to use other intellectual property that they deem to be essential or desirable to the conduct of their business ; our subsidiaries’ right to use their trademark in Hong Kong and the U . S .; our ability to hire and retain qualified management personnel and key employees in order to develop our subsidiaries’ business ; our ability to retain the services of our directors and executives ; overall industry and market performance ; uncertainty about the COVID – 19 pandemic and the impact it may continue to have on the Company’s business and results of operations ; uncertainty about the travel restrictions and quarantine measures on traveling between Hong Kong and mainland China and their impact on the ability of our subsidiaries’ clients to employ our services and other assumptions described in this presentation underlying or relating to any forward - looking statements . We describe material risks, uncertainties and assumptions that could affect our business, including our financial condition and results of operations, under “Risk Factors” . We base our forward - looking statements on our management’s beliefs and assumptions based on information available to our management at the time the statements are made . We caution you that actual outcomes and results may, and are likely to, differ materially from what is expressed, implied or forecast by our forward - looking statements . Accordingly, you should be careful about relying on any forward - looking statements . Except as required under the federal securities laws, we do not have any intention or obligation to update any forward - looking statements after the distribution of this presentation, whether as a result of new information, future events, changes in assumptions, or otherwise . This presentation contains certain data and information that we obtained from various government and publications . Statistical data in these publications may include projections based on a number of assumptions . The financial industries in Hong Kong, the PRC and the U . S . may not grow at the rate projected by market data, or at all . Failure of our industries to grow at the projected rate may have a material and adverse effect on our subsidiaries’ business and the market price of our Ordinary Shares . In addition, the new and rapidly changing nature of the financial industries results in significant uncertainties for any projections or estimates relating to the growth prospects or future condition of our industry . Furthermore, if any one or more of the assumptions underlying the market data are later found to be incorrect, actual results may differ from the projections based on these assumptions . Past performance is not indicative of future results . There is no guarantee that any specific outcome will be achieved Investments . You should not place undue reliance on these forward - looking statements . Investments may be speculative, illiquid and there is a total risk of loss . 3

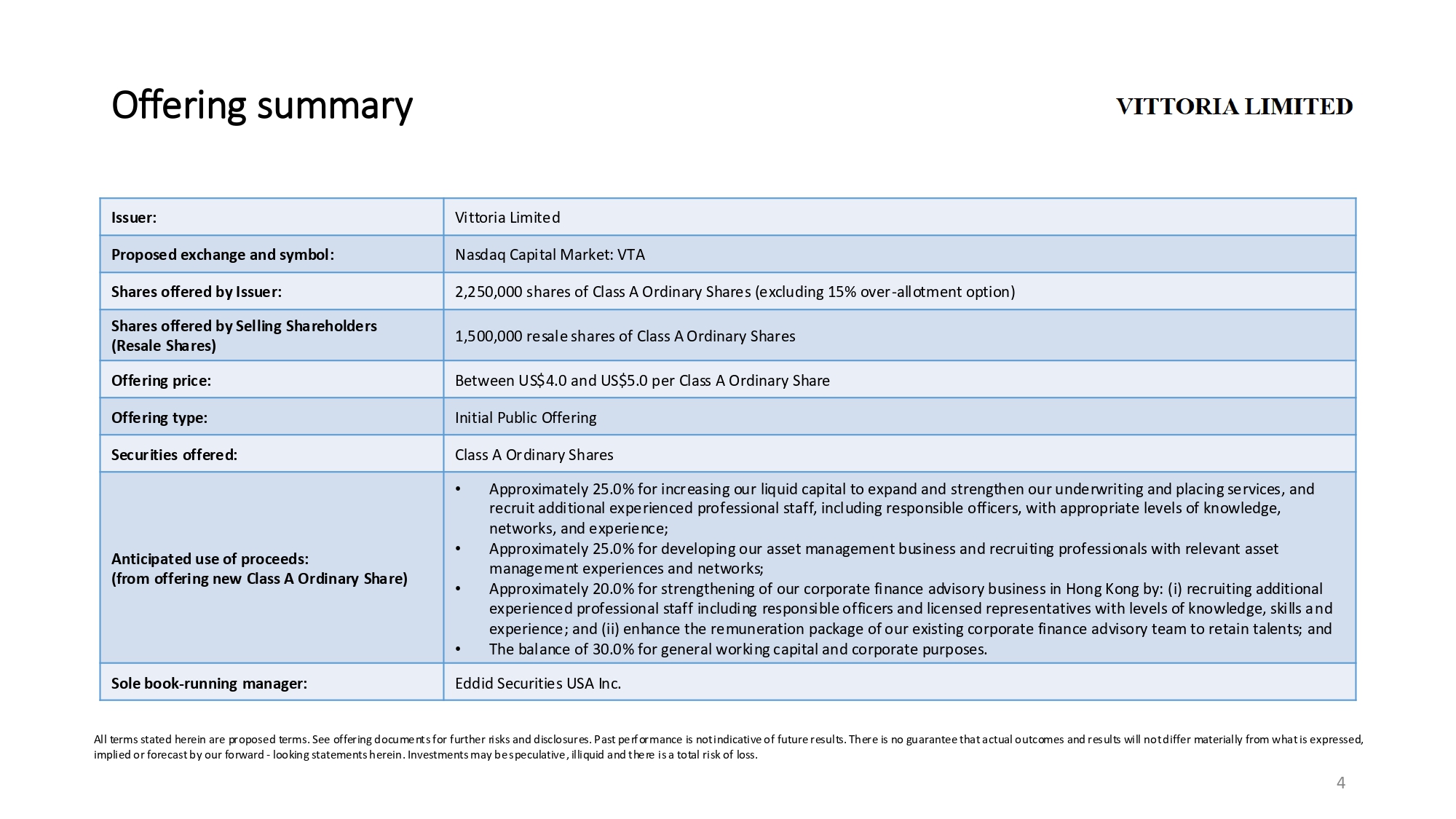

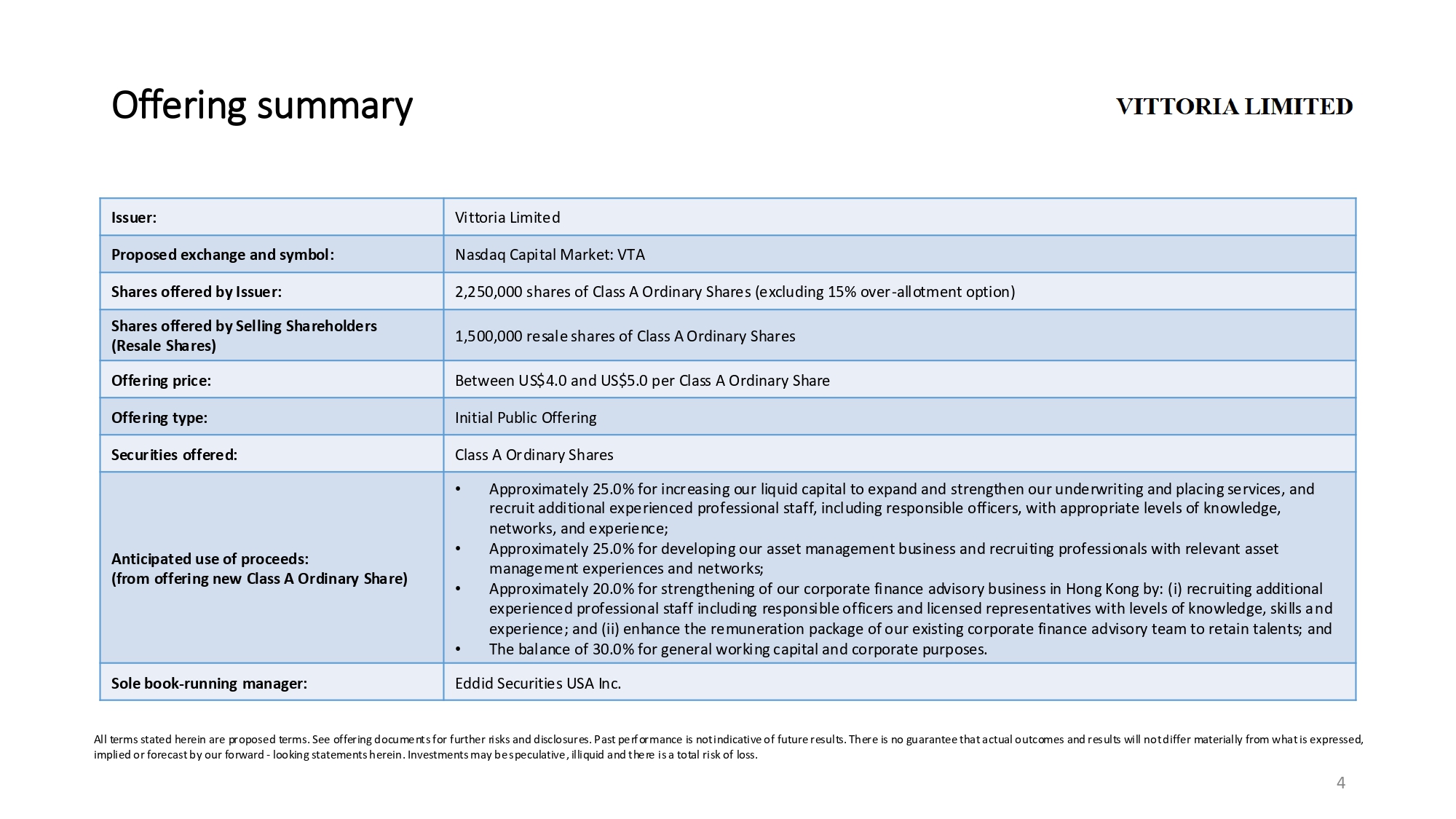

Offering summary Vittoria Limited Issuer: Nasdaq Capital Market: VTA Proposed exchange and symbol: 2,250,000 shares of Class A Ordinary Shares (excluding 15% over - allotment option) Shares offered by Issuer: 1,500,000 resale shares of Class A Ordinary Shares Shares offered by Selling Shareholders (Resale Shares) Between US$4.0 and US$5.0 per Class A Ordinary Share Offering price: Initial Public Offering Offering type: Class A Ordinary Shares Securities offered: • Approximately 25.0% for increasing our liquid capital to expand and strengthen our underwriting and placing services, and recruit additional experienced professional staff, including responsible officers, with appropriate levels of knowledge, networks, and experience; • Approximately 25.0% for developing our asset management business and recruiting professionals with relevant asset management experiences and networks; • Approximately 20.0% for strengthening of our corporate finance advisory business in Hong Kong by: ( i ) recruiting additional experienced professional staff including responsible officers and licensed representatives with levels of knowledge, skills a nd experience; and (ii) enhance the remuneration package of our existing corporate finance advisory team to retain talents; and • The balance of 30.0% for general working capital and corporate purposes. Anticipated use of proceeds: (from offering new Class A Ordinary Share) Eddid Securities USA Inc. Sole book - running manager: All terms stated herein are proposed terms. See offering documents for further risks and disclosures. Past performance is not in dicative of future results. There is no guarantee that actual outcomes and results will not differ materially from what is ex pre ssed, implied or forecast by our forward - looking statements herein. Investments may be speculative, illiquid and there is a total ri sk of loss. 4 JQ0 JQ1

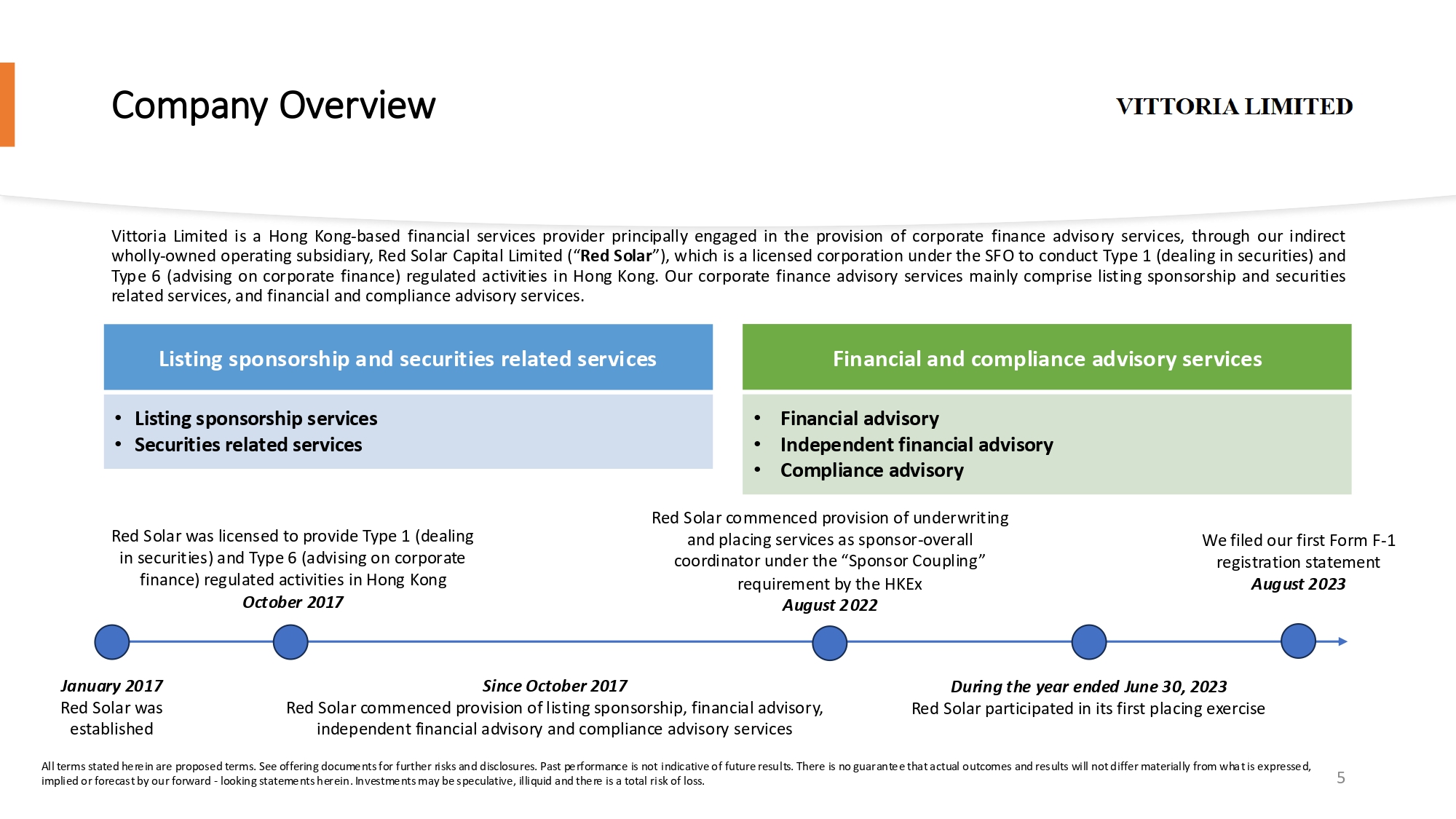

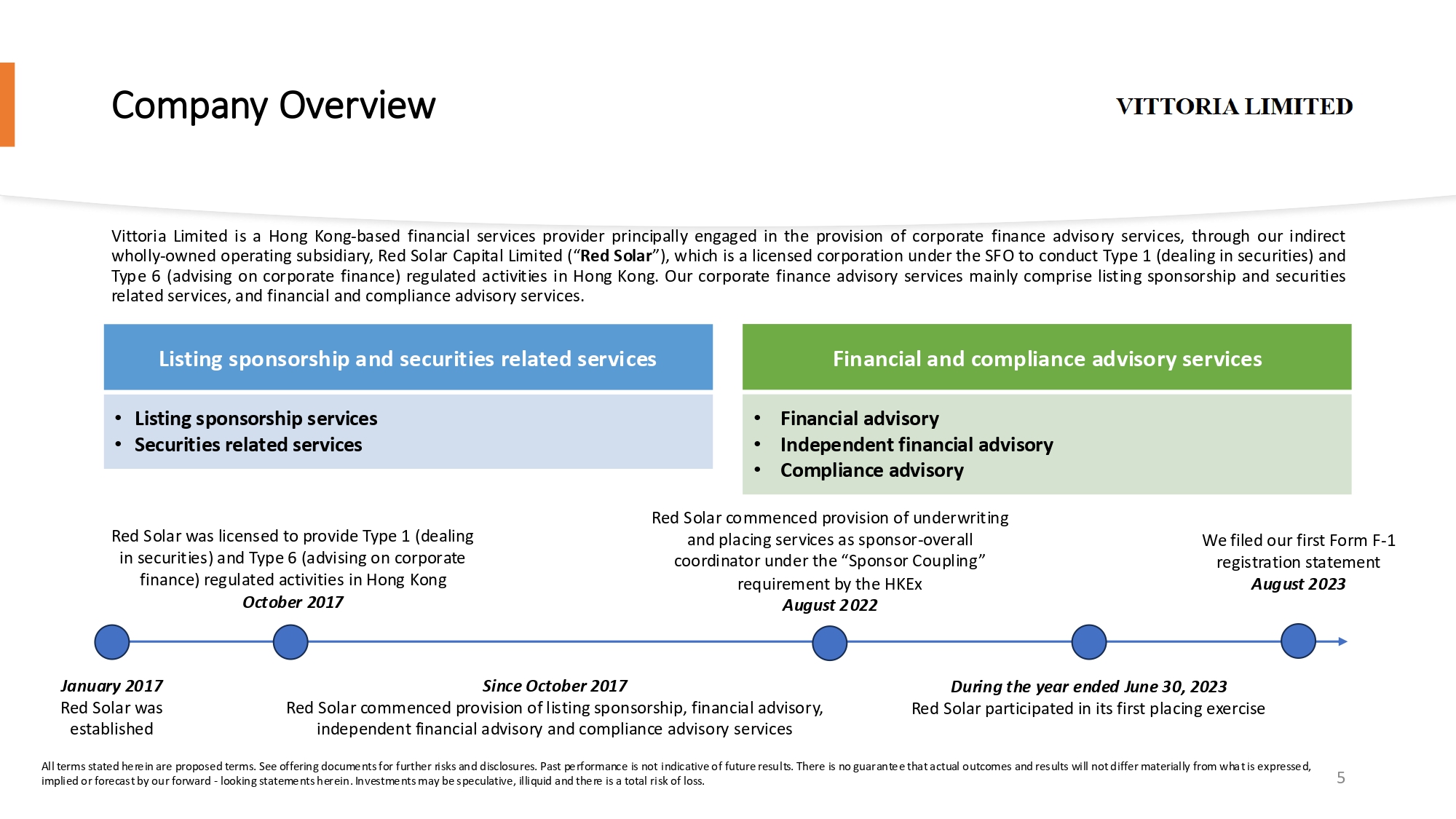

Company Overview Vittoria Limited is a Hong Kong - based financial services provider principally engaged in the provision of corporate finance advisory services, through our indirect wholly - owned operating subsidiary, Red Solar Capital Limited (“ Red Solar ”), which is a licensed corporation under the SFO to conduct Type 1 (dealing in securities) and Type 6 (advising on corporate finance) regulated activities in Hong Kong . Our corporate finance advisory services mainly comprise listing sponsorship and securities related services, and financial and compliance advisory services . Listing sponsorship and securities related services • Listing sponsorship services • Securities related services Financial and compliance advisory services • Financial advisory • Independent financial advisory • Compliance advisory January 2017 Red Solar was established Red Solar was licensed to provide Type 1 (dealing in securities) and Type 6 (advising on corporate finance) regulated activities in Hong Kong October 2017 Since October 2017 Red Solar commenced provision of listing sponsorship, financial advisory, independent financial advisory and compliance advisory services Red Solar commenced provision of underwriting and placing services as sponsor - overall coordinator under the “Sponsor Coupling” requirement by the HKEx August 2022 We filed our first Form F - 1 registration statement August 2023 5 All terms stated herein are proposed terms. See offering documents for further risks and disclosures. Past performance is not in dicative of future results. There is no guarantee that actual outcomes and results will not differ materially from what is ex pre ssed, implied or forecast by our forward - looking statements herein. Investments may be speculative, illiquid and there is a total ri sk of loss. During the year ended June 30, 2023 Red Solar participated in its first placing exercise FW0 FW1 FW2 FW3 FW4 FW5 FW6 JW7

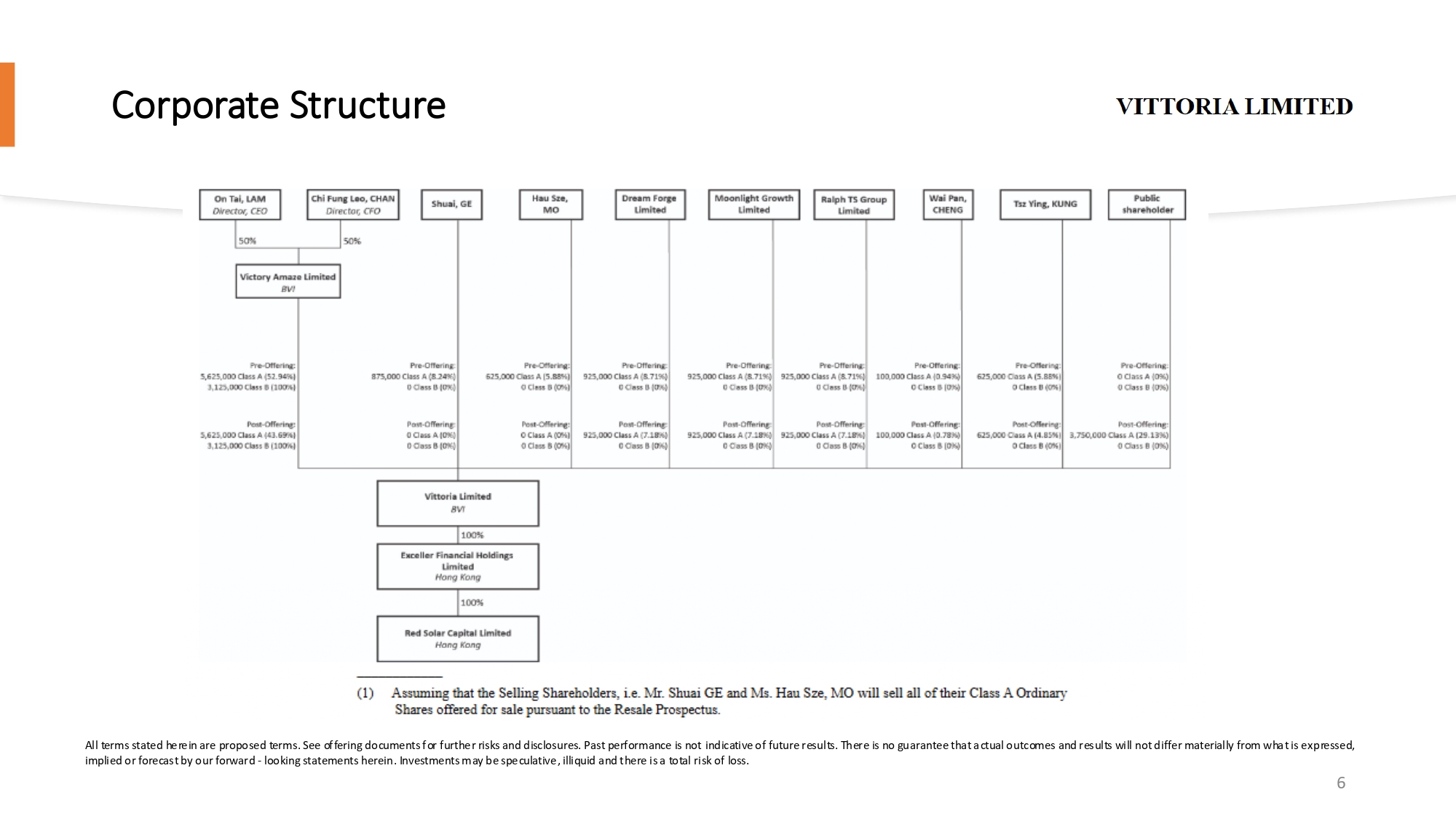

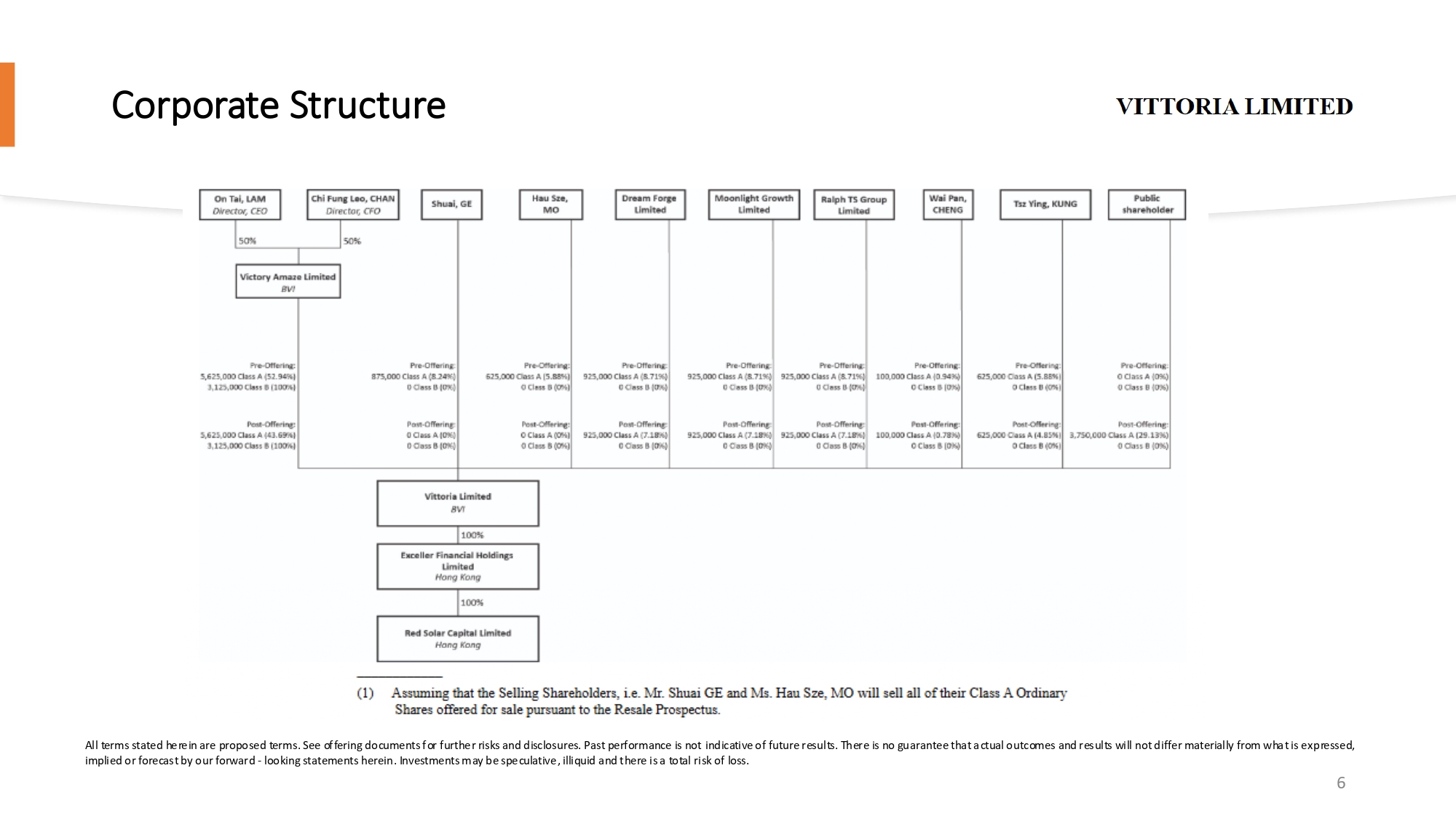

Corporate Structure 6 All terms stated herein are proposed terms. See offering documents for further risks and disclosures. Past performance is not in dicative of future results. There is no guarantee that actual outcomes and results will not differ materially from what is ex pre ssed, implied or forecast by our forward - looking statements herein. Investments may be speculative, illiquid and there is a total ri sk of loss.

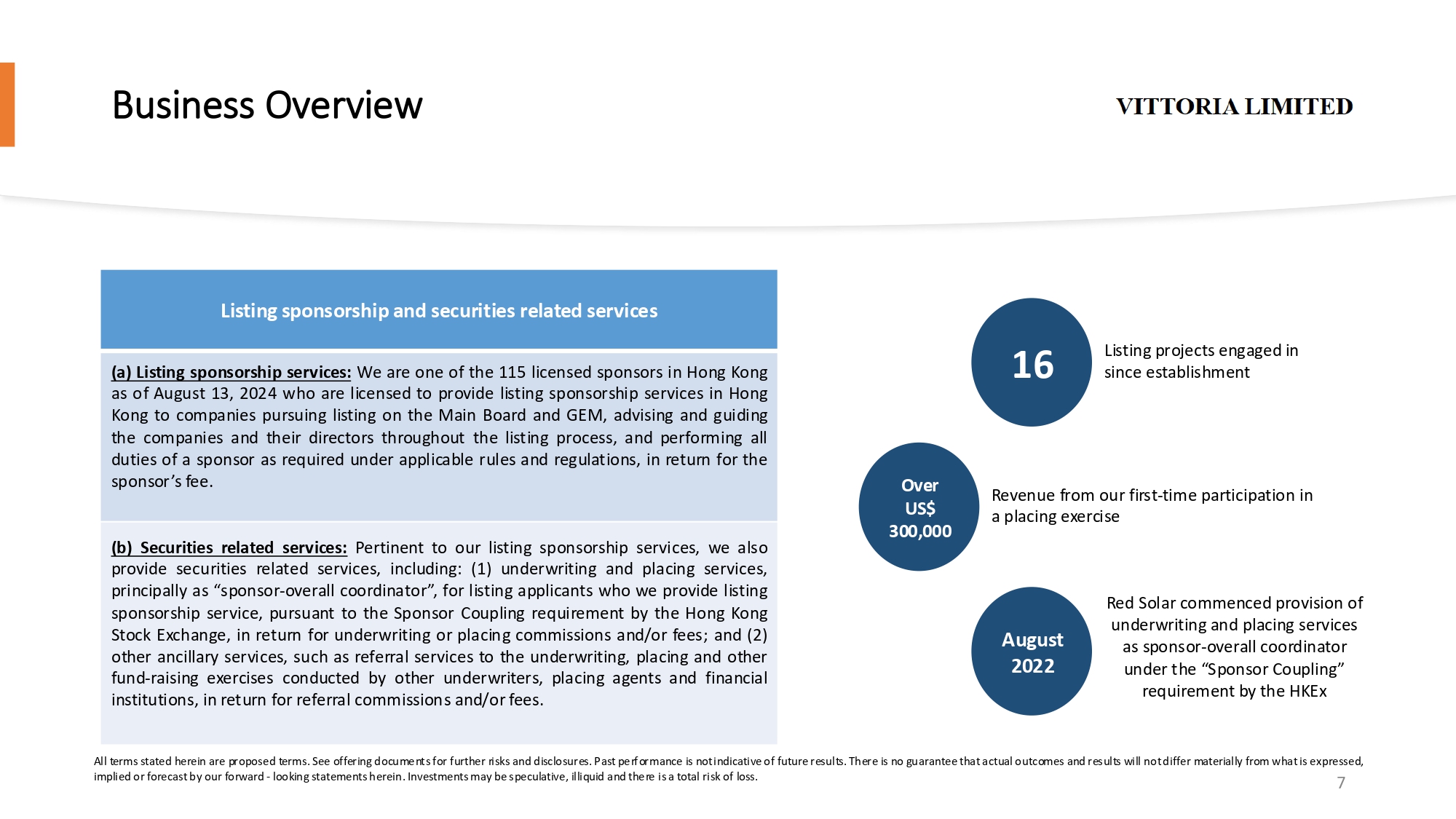

Business Overview Listing sponsorship and securities related services (a) Listing sponsorship services : We are one of the 115 licensed sponsors in Hong Kong as of August 13 , 2024 who are licensed to provide listing sponsorship services in Hong Kong to companies pursuing listing on the Main Board and GEM, advising and guiding the companies and their directors throughout the listing process, and performing all duties of a sponsor as required under applicable rules and regulations, in return for the sponsor’s fee . (b) Securities related services : Pertinent to our listing sponsorship services, we also provide securities related services, including : ( 1 ) underwriting and placing services, principally as “sponsor - overall coordinator”, for listing applicants who we provide listing sponsorship service, pursuant to the Sponsor Coupling requirement by the Hong Kong Stock Exchange, in return for underwriting or placing commissions and/or fees ; and ( 2 ) other ancillary services, such as referral services to the underwriting, placing and other fund - raising exercises conducted by other underwriters, placing agents and financial institutions, in return for referral commissions and/or fees . 16 Listing projects engaged in since establishment August 2022 Red Solar commenced provision of underwriting and placing services as sponsor - overall coordinator under the “Sponsor Coupling” requirement by the HKEx Over US$ 300,000 Revenue from our first - time participation in a placing exercise 7 All terms stated herein are proposed terms. See offering documents for further risks and disclosures. Past performance is not in dicative of future results. There is no guarantee that actual outcomes and results will not differ materially from what is ex pre ssed, implied or forecast by our forward - looking statements herein. Investments may be speculative, illiquid and there is a total ri sk of loss. JK0 FW1 FW2 FW3 FW4 FW5

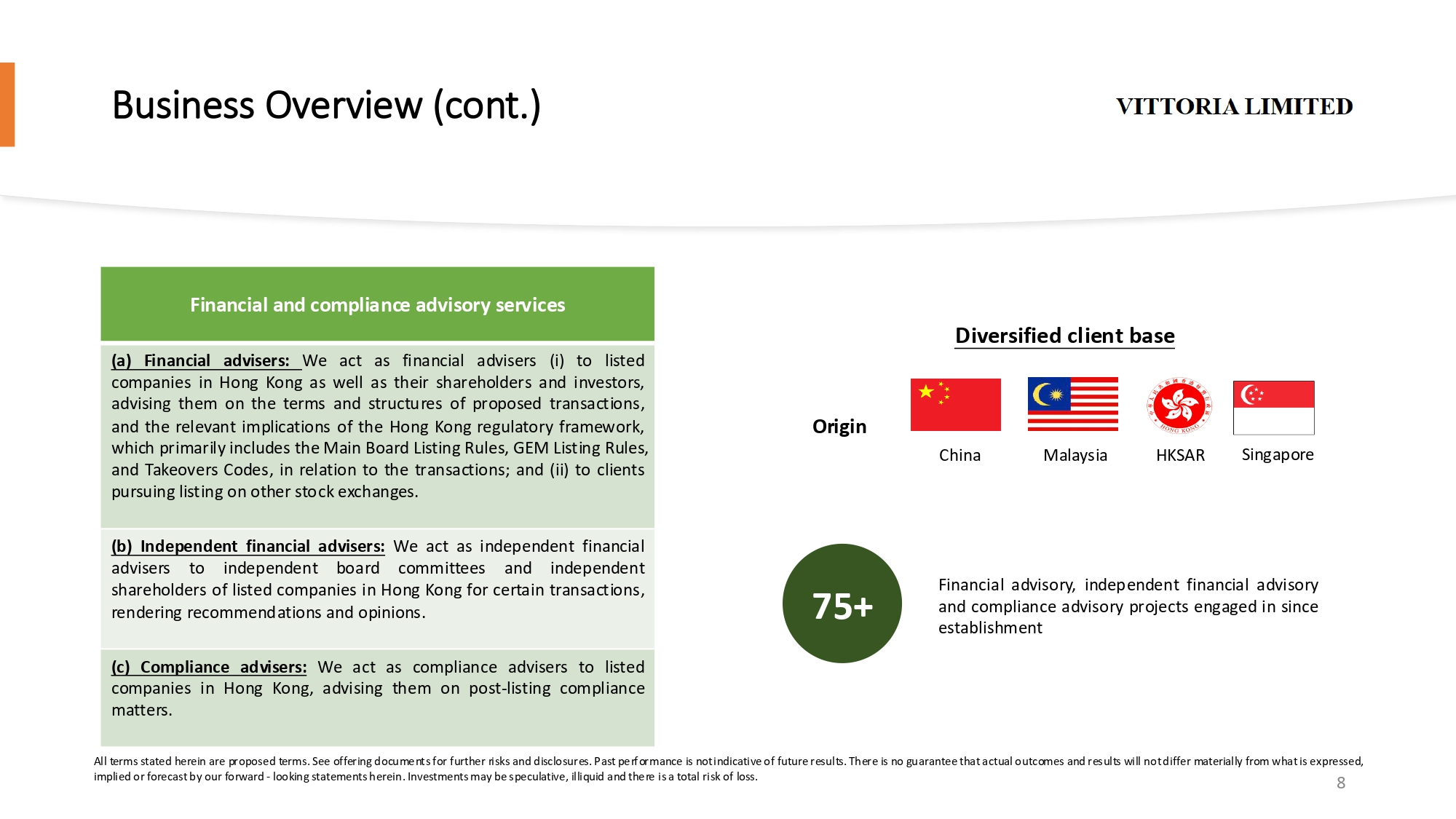

Business Overview (cont.) Financial and compliance advisory services (a) Financial advisers : We act as financial advisers ( i ) to listed companies in Hong Kong as well as their shareholders and investors, advising them on the terms and structures of proposed transactions, and the relevant implications of the Hong Kong regulatory framework, which primarily includes the Main Board Listing Rules, GEM Listing Rules, and Takeovers Codes, in relation to the transactions ; and (ii) to clients pursuing listing on other stock exchanges . (b) Independent financial advisers : We act as independent financial advisers to independent board committees and independent shareholders of listed companies in Hong Kong for certain transactions, rendering recommendations and opinions . (c) Compliance advisers : We act as compliance advisers to listed companies in Hong Kong, advising them on post - listing compliance matters . Diversified client base China HKSAR Malaysia Origin 75+ Financial advisory, independent financial advisory and compliance advisory projects engaged in since establishment 8 Singapore All terms stated herein are proposed terms. See offering documents for further risks and disclosures. Past performance is not in dicative of future results. There is no guarantee that actual outcomes and results will not differ materially from what is ex pre ssed, implied or forecast by our forward - looking statements herein. Investments may be speculative, illiquid and there is a total ri sk of loss. JK0 FW1 FW2 FW3 FW4

Investment highlights – A summary of our competitive strengths and growth strategies 9 We can provide comprehensive corporate finance services, thereby creating cross - selling opportunities and synergies across different services We have established a strong client base and extensive business network across a wide spectrum of sectors We will strengthen our underwriting and placing services to create synergies across different business lines We will develop our asset management business to enable us to provide more comprehensive services to our institutional and professional investor clients We may act as the underwriter to IPOs which are not sponsored by us, and explore business opportunities for secondary market fund raising transactions All terms stated herein are proposed terms. See offering documents for further risks and disclosures. Past performance is not in dicative of future results. There is no guarantee that actual outcomes and results will not differ materially from what is ex pre ssed, implied or forecast by our forward - looking statements herein. Investments may be speculative, illiquid and there is a total ri sk of loss. JK0 JK1 JK2

Competitive Strengths We offer comprehensive corporate finance advisory services, and our proven track record and experience in the highly - regulated Hong Kong financial market help us go beyond We have a proven and experienced management team consisting of industry veterans We have established a strong client base and extensive business network We value service quality and control, hence adopted a prudent compliance and risk management system and conduct our business in a compliant way 10 All terms stated herein are proposed terms. See offering documents for further risks and disclosures. Past performance is not in dicative of future results. There is no guarantee that actual outcomes and results will not differ materially from what is ex pre ssed, implied or forecast by our forward - looking statements herein. Investments may be speculative, illiquid and there is a total ri sk of loss. FW0 FW1

Competitive Strengths (cont.) 11 As a licensed corporation under the SFO to carry out Type 1 (dealing in securities) and Type 6 (advising on corporate finance) regulated activities, our operating subsidiary could carry out all types of Type 6 regulated activities in Hong Kong, including listing sponsorship, financial and compliance advisory and all matters and transactions falling within the ambit of the Takeovers Codes . For instance, we could : x act as pre - IPO financial advisor to our clients, advising them in early stage on corporate structure, financial management, corporate governance and pre - IPO funding ; x act as a sponsor in listing applications in Hong Kong during the IPO stage ; x participate in underwriting and placing exercises, either as an overall coordinator (head of underwriting syndicate) under the “sponsor coupling” requirement for Main Board IPOs, or underwriting syndicate member / placing agent in IPOs or other fundraising activities in the Stock Exchange x act as financial adviser to listed companies in Hong Kong, advising them on transactions involving the Main Board Listing Rules, GEM Listing Rules or Takeovers Codes x act as an independent financial adviser to independent board committees and independent shareholders of listed companies in Hong Kong where required by rules and regulations x act as compliance advisers and offer all - round compliance advisory services to our clients to ensure their compliance with the Main Board Listing Rules, GEM Listing Rules, or Takeovers Codes and other relevant rules and regulations . • We could fulfill our clients’ needs at different stages of their business in a compliant manner; • It help us foster our long - term solid relationship with our clients • We could create cross - selling opportunities and synergies across our different services and maximize our revenue All terms stated herein are proposed terms. See offering documents for further risks and disclosures. Past performance is not in dicative of future results. There is no guarantee that actual outcomes and results will not differ materially from what is ex pre ssed, implied or forecast by our forward - looking statements herein. Investments may be speculative, illiquid and there is a total ri sk of loss. FW0

Competitive Strengths (cont.) 12 We have established a strong and diverse base of clients . » Our major clients are mainly listing applicants pursuing listing and listed companies on the Main Board or GEM, as well as private companies and investors ; » from a wide range of fields : information technology, IT securities, advanced technologies, mobile gaming, virtual assets and non - fungible - tokens, manufacturing, natural resources and materials, wholesale and retail of consumer products, sales and marketing, financial institutions and service providers, as well as bars and restaurants A strong client base puts us in a good position to strengthen our underwriting and placing services and develop our asset management business in the future . we can provide underwriting and placing services to these high net - worth clients for their secondary / future fund - raising exerc ises we can provide asset management services to them All terms stated herein are proposed terms. See offering documents for further risks and disclosures. Past performance is not in dicative of future results. There is no guarantee that actual outcomes and results will not differ materially from what is ex pre ssed, implied or forecast by our forward - looking statements herein. Investments may be speculative, illiquid and there is a total ri sk of loss. FW0

Competitive Strengths (cont.) 13 We also have : Our “manager(s) - in - charge” policy ensures supervision and management of different functions during our operation It enables us to identify, assess and manage our business, financial and operational risks in our business in a timely manner, helping us prevent potential losses and liabilities and raise the confidence of clients, investors and shareholders Since the commencement of our business in October 2017 , no fine, penalty nor disciplinary action has been made against us, our responsible officers, licensed representatives, or any of our personnel A proven and experienced management team consisting of industry veterans Our founders and directors have over 20 years of experience in the corporate finance and accounting industries It enables us to implement our business strategies, provide quality services to our clients, manage our compliance and risks, identify and capture business opportunities, maintain relationships with existing clients, and procure prospective clients . A prudent compliance and risk management system All terms stated herein are proposed terms. See offering documents for further risks and disclosures. Past performance is not in dicative of future results. There is no guarantee that actual outcomes and results will not differ materially from what is ex pre ssed, implied or forecast by our forward - looking statements herein. Investments may be speculative, illiquid and there is a total ri sk of loss. FW0

Growth Strategies To strengthen our underwriting and placing services To develop our asset management business and invest in industries / areas with good growth potential, such as fin - tech, ESG, etc. To strengthen our corporate finance advisory services, including recruiting additional professionals with expertise and experience to support our business development To promote and enhance our brand To develop a Software - as - a - Service (“SaaS”) Platform to provide financial due diligence and compliance services 14 All terms stated herein are proposed terms. See offering documents for further risks and disclosures. Past performance is not in dicative of future results. There is no guarantee that actual outcomes and results will not differ materially from what is ex pre ssed, implied or forecast by our forward - looking statements herein. Investments may be speculative, illiquid and there is a total ri sk of loss.FW0

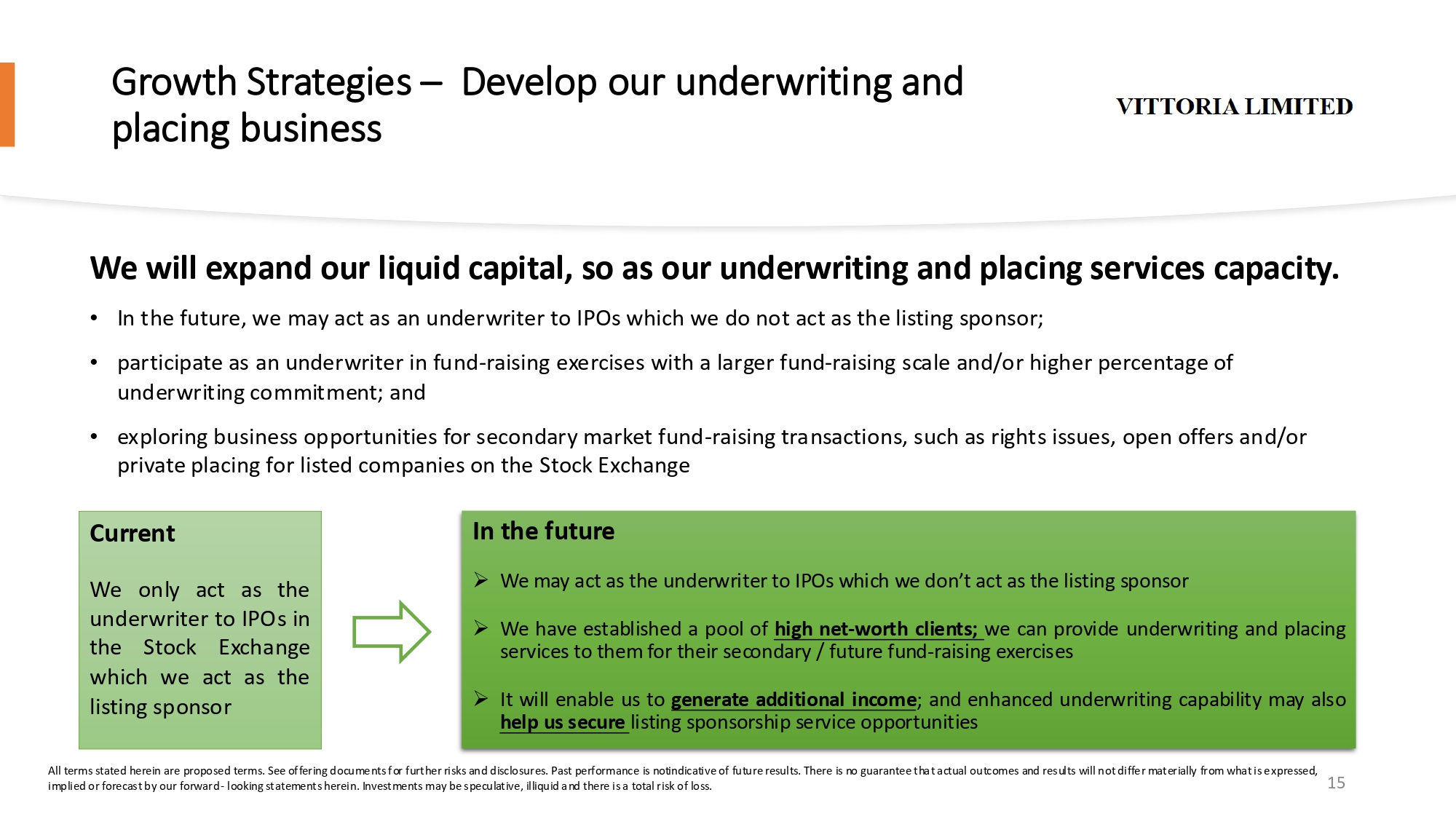

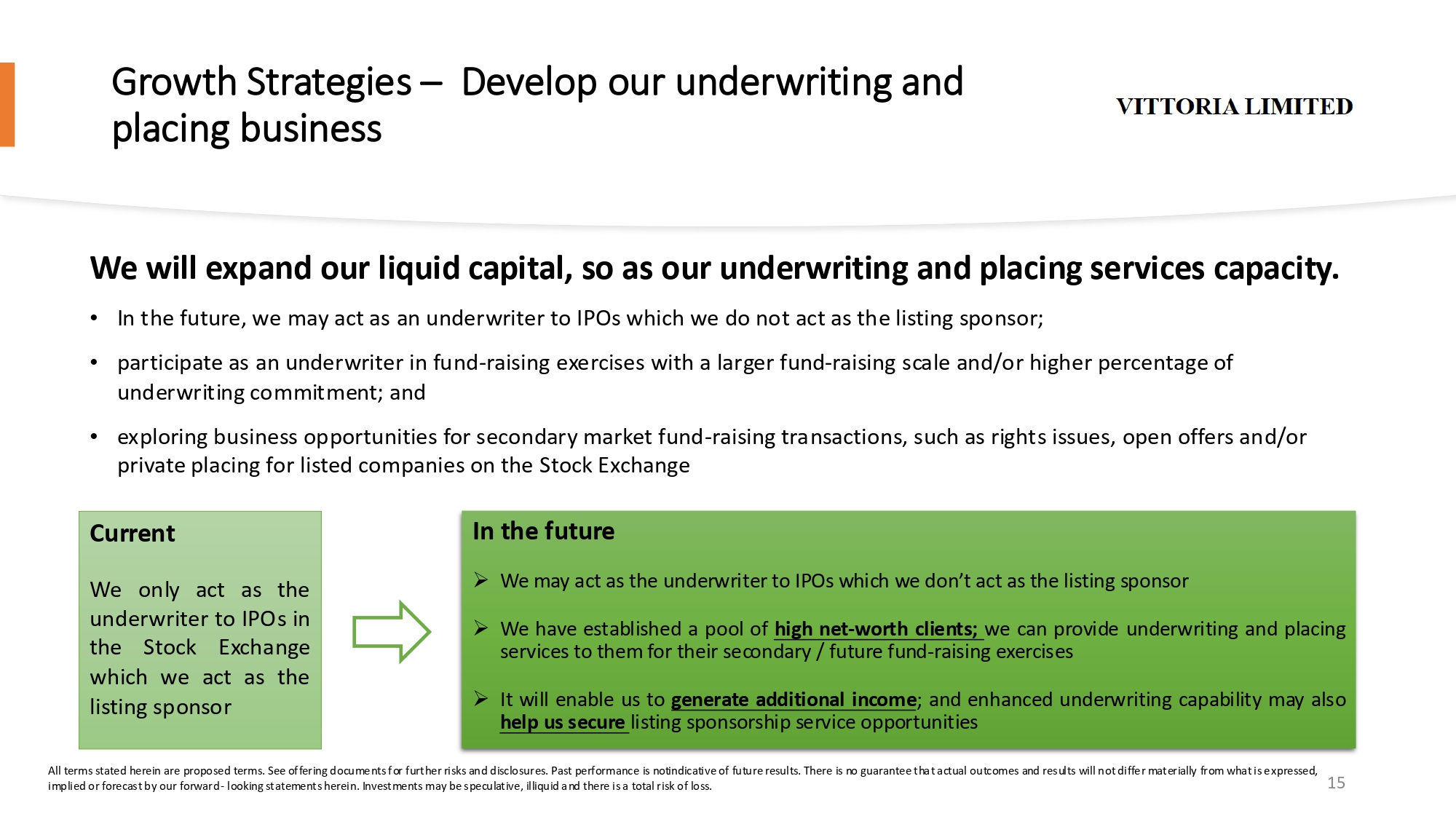

Growth Strategies – Develop our underwriting and placing business We will expand our liquid capital, so as our underwriting and placing services capacity . • In the future, we may act as an underwriter to IPOs which we do not act as the listing sponsor; • participate as an underwriter in fund - raising exercises with a larger fund - raising scale and/or higher percentage of underwriting commitment; and • exploring business opportunities for secondary market fund - raising transactions, such as rights issues, open offers and/or private placing for listed companies on the Stock Exchange 15 Current We only act as the underwriter to IPOs in the Stock Exchange which we act as the listing sponsor In the future » We may act as the underwriter to IPOs which we don’t act as the listing sponsor » We have established a pool of high net - worth clients ; we can provide underwriting and placing services to them for their secondary / future fund - raising exercises » It will enable us to generate additional income ; and enhanced underwriting capability may also help us secure listing sponsorship service opportunities All terms stated herein are proposed terms. See offering documents for further risks and disclosures. Past performance is not in dicative of future results. There is no guarantee that actual outcomes and results will not differ materially from what is ex pre ssed, implied or forecast by our forward - looking statements herein. Investments may be speculative, illiquid and there is a total ri sk of loss.

Growth Strategies – Develop our asset management business We plan to set up our asset management arm and apply to the HKSFC for licenses to carry on Type 4 (advising on securities) and Type 9 (asset management) regulated activities, by recruiting professionals with relevant experiences and networks . We are of the view that the asset management business could enable us to provide more comprehensive services to our high net - worth , institutional and professional investor clients which we already established . • Plan to launch a fund with the objective to invest in a portfolio consisting primarily of equities, bonds and other securities of companies in prevailing global investment hot topics, such as Fin - tech and ESG projects • Plan to enhance our research capabilities to better serve our asset management team, high - net - worth individual clients and institutional investors by continuously recruiting qualified research analysts to support the investment decision - making and investment management processes of the asset management team Build up research team Target global investment hot topics 16 All terms stated herein are proposed terms. See offering documents for further risks and disclosures. Past performance is not in dicative of future results. There is no guarantee that actual outcomes and results will not differ materially from what is ex pre ssed, implied or forecast by our forward - looking statements herein. Investments may be speculative, illiquid and there is a total ri sk of loss. JK0

Growth Strategies – We are eager to expand into international capital markets We observe the rising demand for financial advisory services from companies located in Mainland China, Hong Kong, and Southeast Asia, to conduct IPO in the U.S. capital market or other fund - raising activities in the international capital market We plan to replicate our expertise in the Hong Kong capital market, acting as the financial advisers to clients who wish to gain access to the international capital market, offering advisory services Since late 2022, we have been engaged as the financial adviser to clients pursuing IPO in U.S. stock exchange 17 All terms stated herein are proposed terms. See offering documents for further risks and disclosures. Past performance is not in dicative of future results. There is no guarantee that actual outcomes and results will not differ materially from what is ex pre ssed, implied or forecast by our forward - looking statements herein. Investments may be speculative, illiquid and there is a total ri sk of loss.

Growth Strategies – We plan to develop a Software - as - a - Service (“SaaS”) Platform 18 We plan to develop a SaaS platform to create an ecosystem for clients and professional parties to connect and facilitate their collaboration on various corporate finance activities. The Platform’s key functions include: ( i ) enabling our clients to establish their own IPO/corporate data room to facilitate the due diligence process and ensure compliance with regulatory requirements (ii) generating immediate analyses of important qualifications and parameters required for IPOs or other corporate actions (iii) checking for the latest regulatory changes, notices, and rules, thus assisting our clients to develop more robust compliance systems (iv) generating memos, reports and other necessary reporting documents All terms stated herein are proposed terms. See offering documents for further risks and disclosures. Past performance is not in dicative of future results. There is no guarantee that actual outcomes and results will not differ materially from what is ex pre ssed, implied or forecast by our forward - looking statements herein. Investments may be speculative, illiquid and there is a total ri sk of loss.

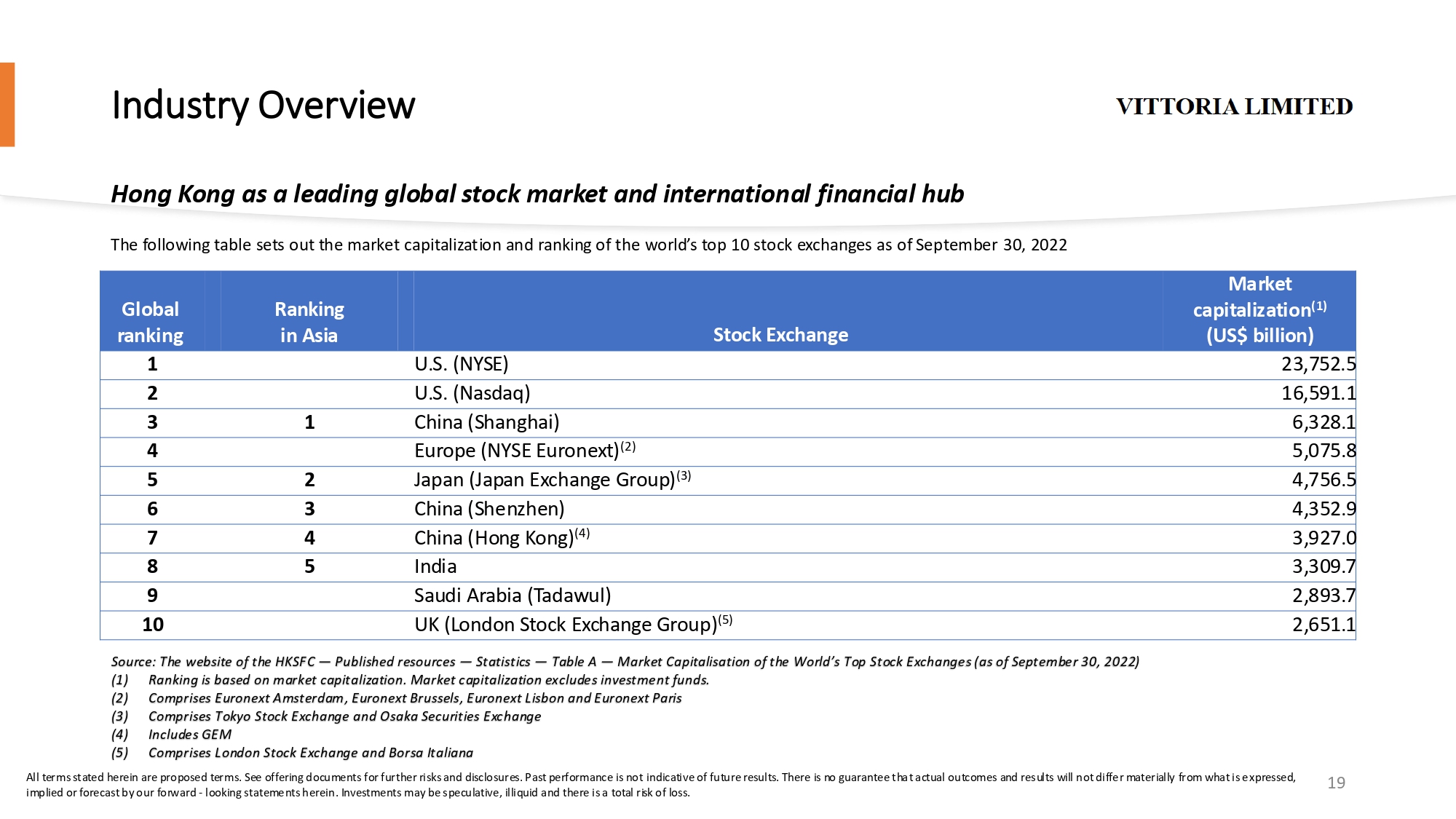

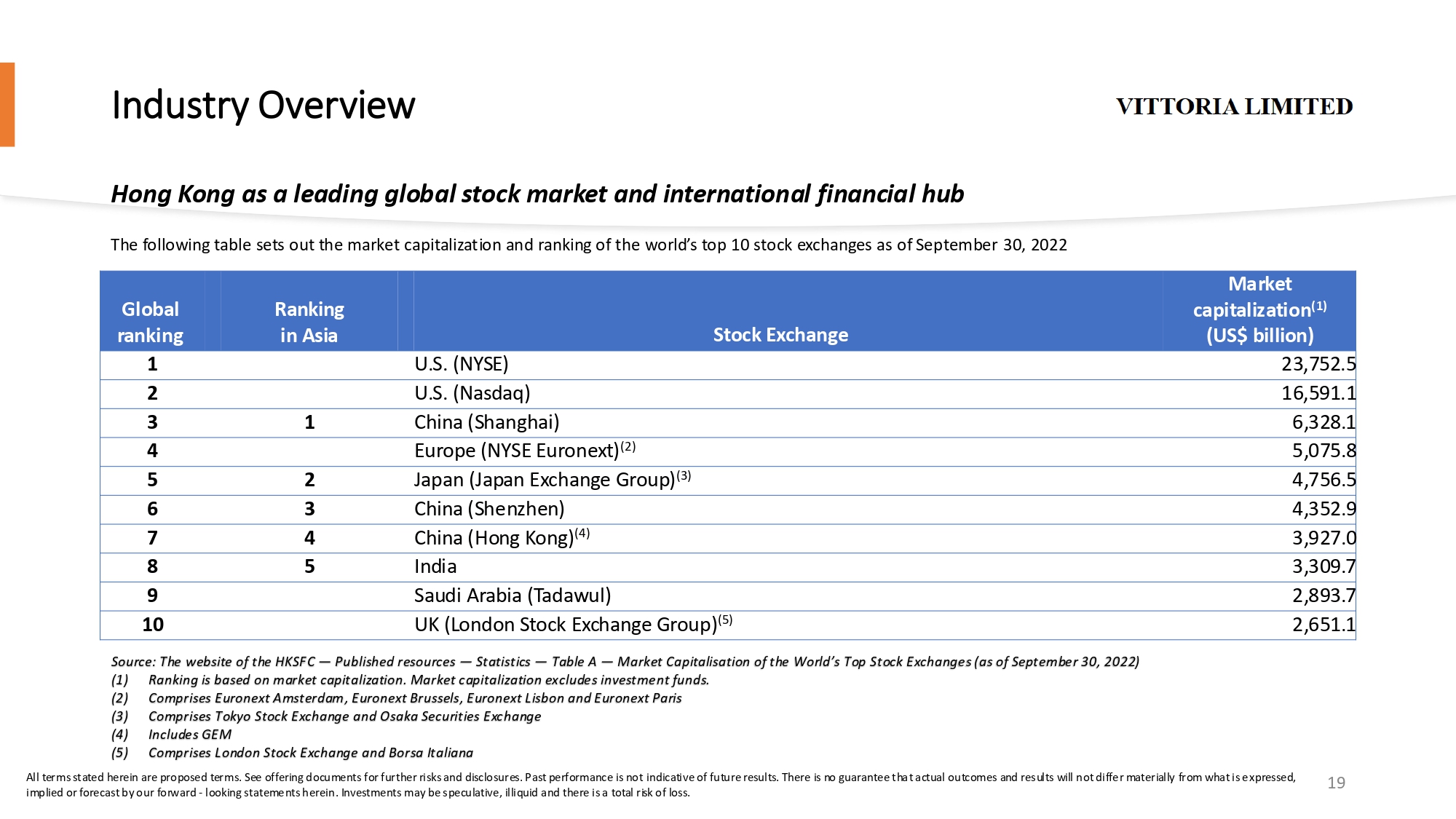

Industry Overview Market capitalization (1) (US$ billion) Stock Exchange Ranking in Asia Global ranking 23,752.5 U.S. (NYSE) 1 16,591.1 U.S. (Nasdaq) 2 6,328.1 China (Shanghai) 1 3 5,075.8 Europe (NYSE Euronext) (2) 4 4,756.5 Japan (Japan Exchange Group) (3) 2 5 4,352.9 China (Shenzhen) 3 6 3,927.0 China (Hong Kong) (4) 4 7 3,309.7 India 5 8 2,893.7 Saudi Arabia (Tadawul) 9 2,651.1 UK (London Stock Exchange Group) (5) 10 The following table sets out the market capitalization and ranking of the world’s top 10 stock exchanges as of September 30, 202 2 Source : The website of the HKSFC — Published resources — Statistics — Table A — Market Capitalisation of the World’s Top Stock Exchanges (as of September 30 , 2022 ) ( 1 ) Ranking is based on market capitalization . Market capitalization excludes investment funds . ( 2 ) Comprises Euronext Amsterdam, Euronext Brussels, Euronext Lisbon and Euronext Paris ( 3 ) Comprises Tokyo Stock Exchange and Osaka Securities Exchange ( 4 ) Includes GEM ( 5 ) Comprises London Stock Exchange and Borsa Italiana Hong Kong as a leading global stock market and international financial hub 19 All terms stated herein are proposed terms. See offering documents for further risks and disclosures. Past performance is not in dicative of future results. There is no guarantee that actual outcomes and results will not differ materially from what is ex pre ssed, implied or forecast by our forward - looking statements herein. Investments may be speculative, illiquid and there is a total ri sk of loss.

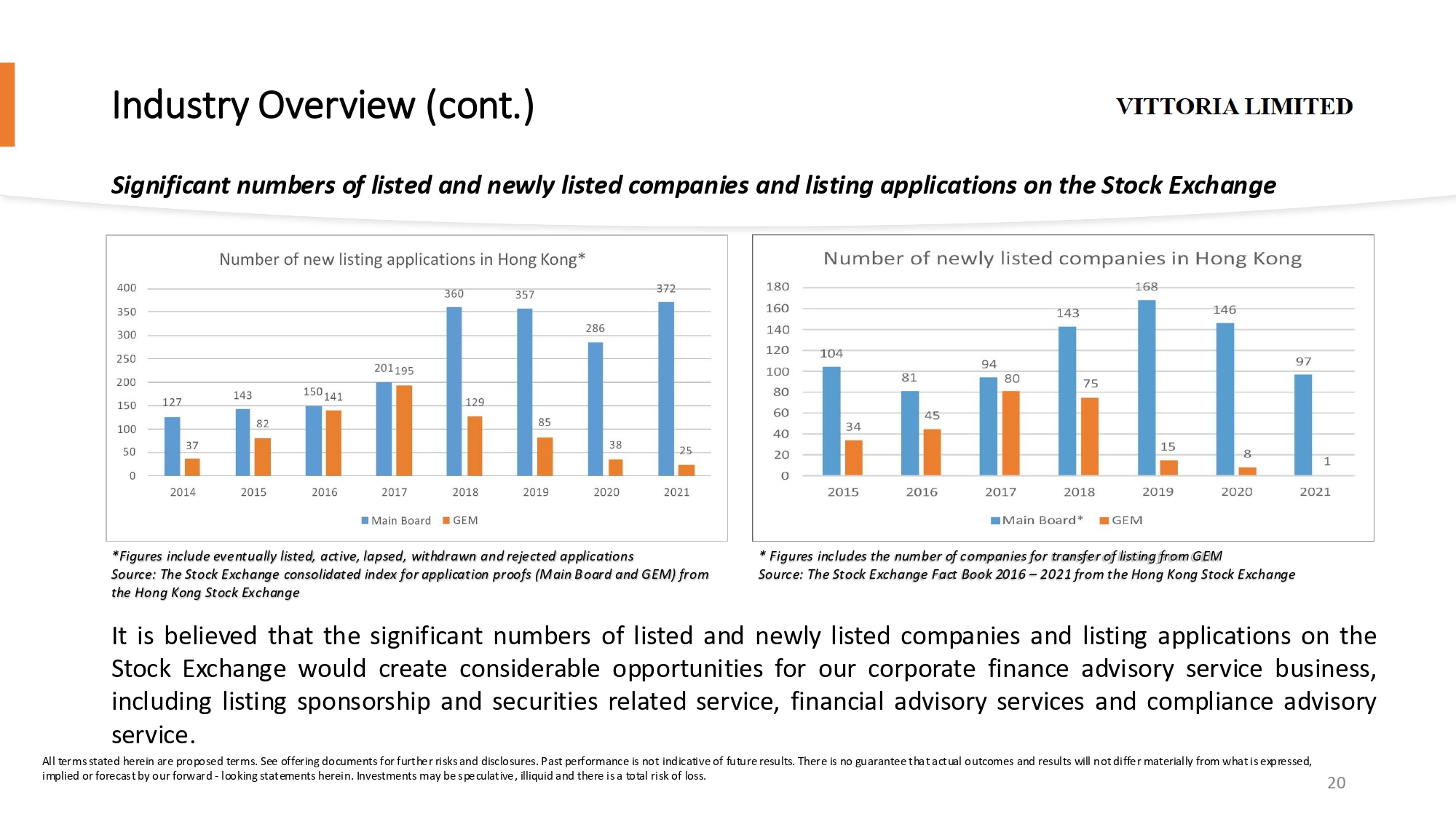

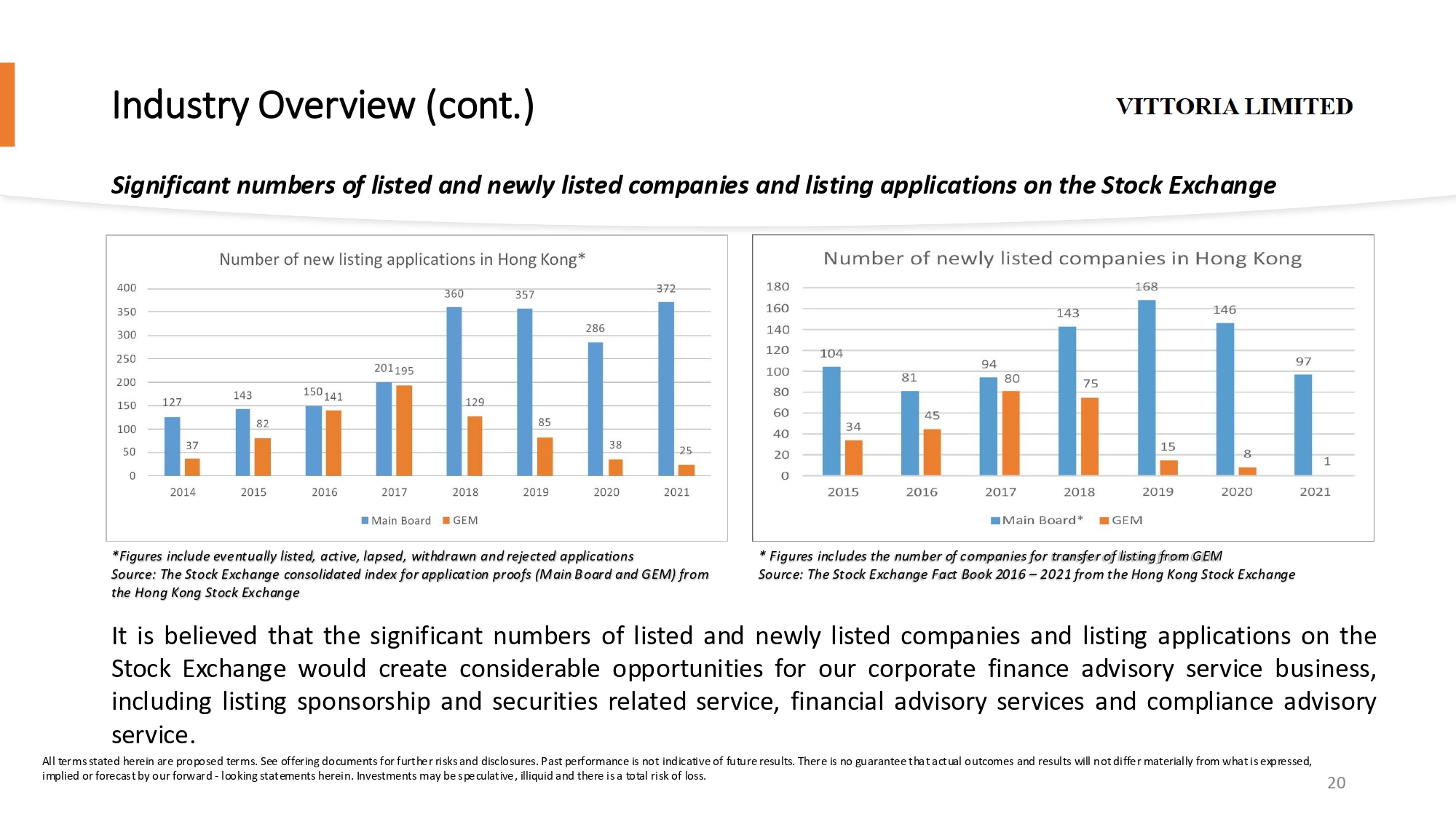

Industry Overview (cont.) It is believed that the significant numbers of listed and newly listed companies and listing applications on the Stock Exchange would create considerable opportunities for our corporate finance advisory service business, including listing sponsorship and securities related service, financial advisory services and compliance advisory service . *Figures include eventually listed, active, lapsed, withdrawn and rejected applications Source: The Stock Exchange consolidated index for application proofs (Main Board and GEM) from the Hong Kong Stock Exchange S ignificant numbers of listed and newly listed companies and listing applications on the Stock Exchange * Figures includes the number of companies for transfer of listing from GEM Source: The Stock Exchange Fact Book 2016 – 2021 from the Hong Kong Stock Exchange 20 All terms stated herein are proposed terms. See offering documents for further risks and disclosures. Past performance is not in dicative of future results. There is no guarantee that actual outcomes and results will not differ materially from what is ex pre ssed, implied or forecast by our forward - looking statements herein. Investments may be speculative, illiquid and there is a total ri sk of loss.

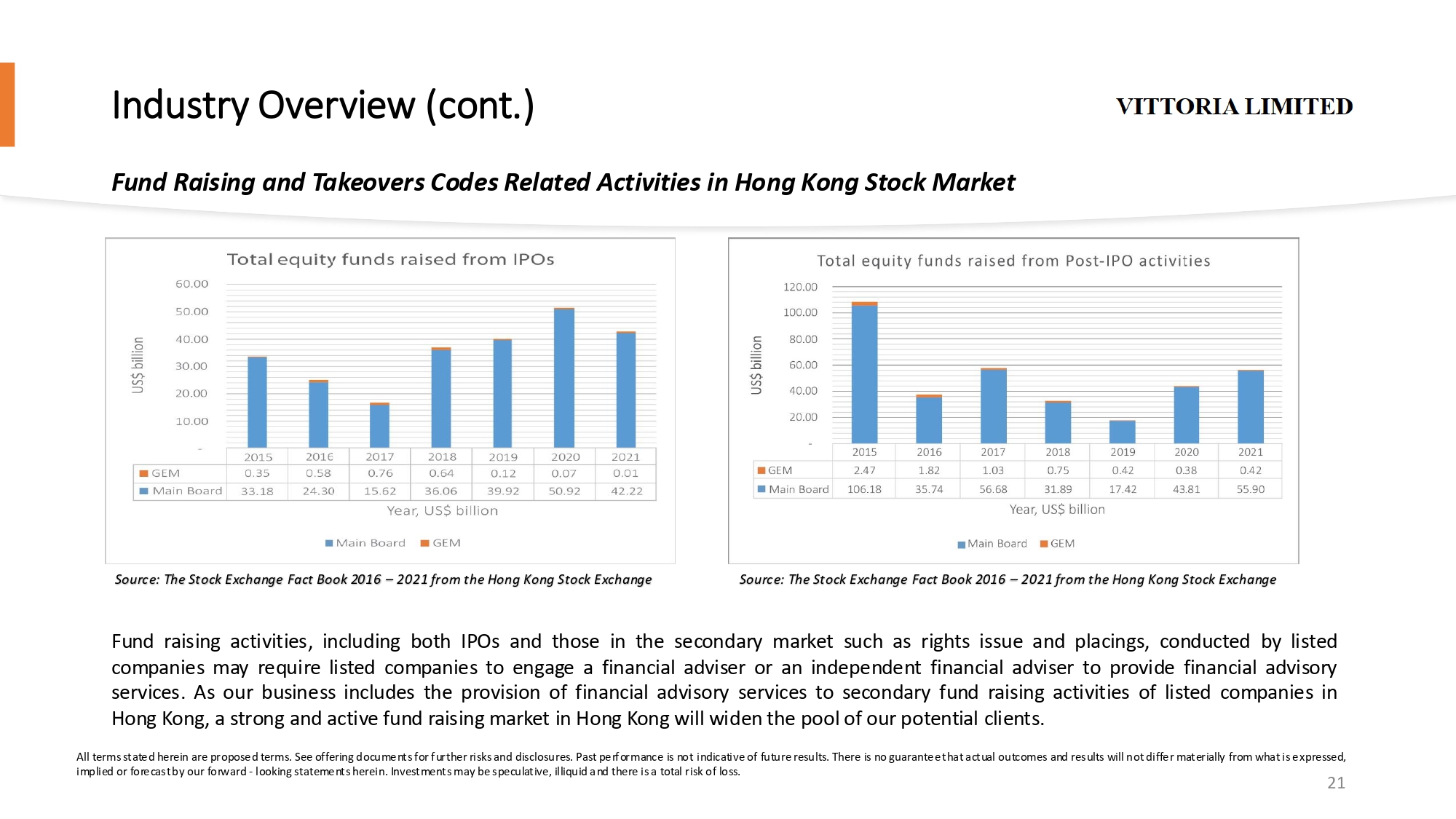

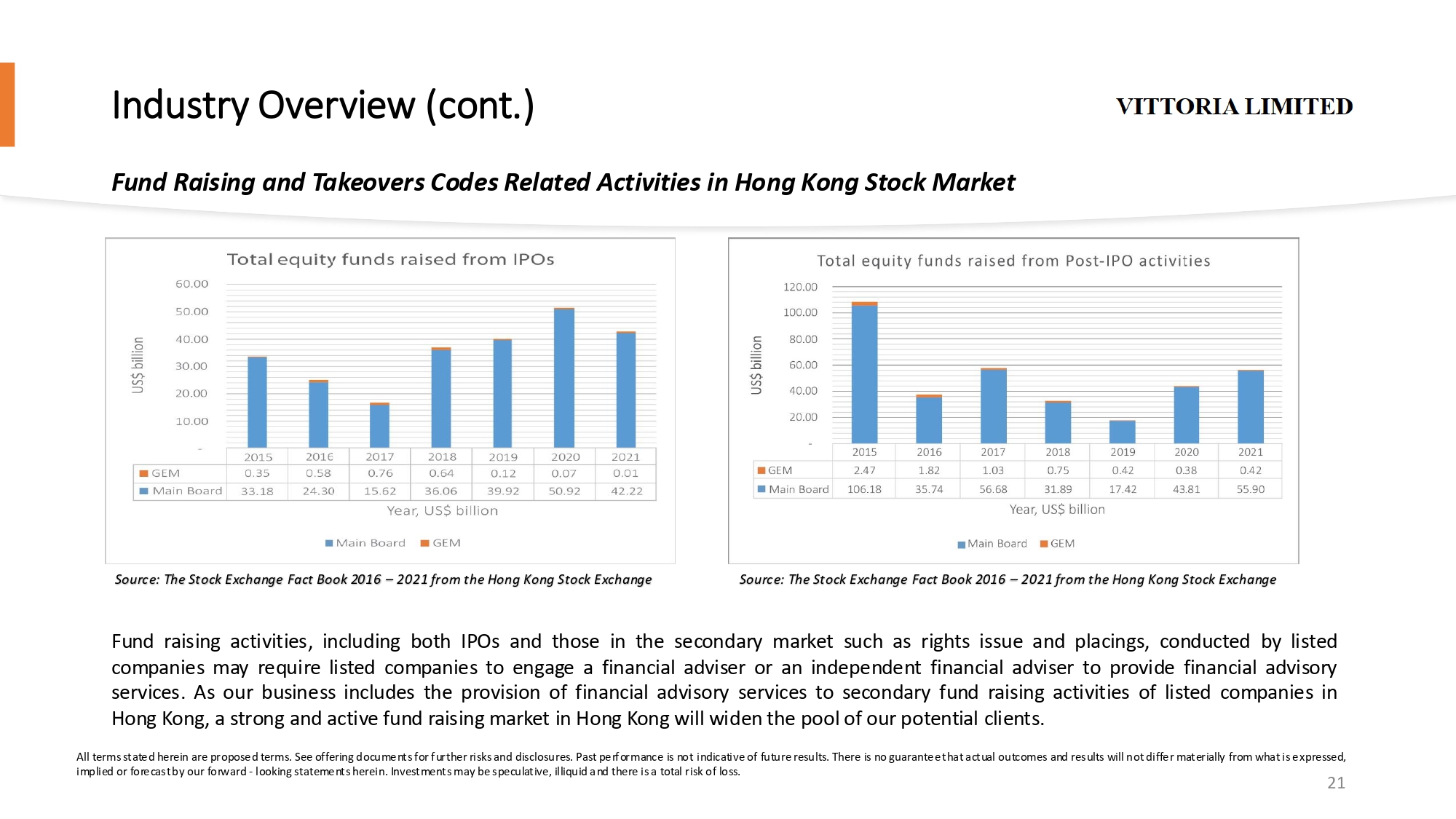

Industry Overview (cont.) Fund Raising and Takeovers Codes Related Activities in Hong Kong Stock Market Fund raising activities, including both IPOs and those in the secondary market such as rights issue and placings, conducted by listed companies may require listed companies to engage a financial adviser or an independent financial adviser to provide financial advisory services . As our business includes the provision of financial advisory services to secondary fund raising activities of listed companies in Hong Kong, a strong and active fund raising market in Hong Kong will widen the pool of our potential clients . Source: The Stock Exchange Fact Book 2016 – 2021 from the Hong Kong Stock Exchange Source: The Stock Exchange Fact Book 2016 – 2021 from the Hong Kong Stock Exchange 21 All terms stated herein are proposed terms. See offering documents for further risks and disclosures. Past performance is not in dicative of future results. There is no guarantee that actual outcomes and results will not differ materially from what is ex pre ssed, implied or forecast by our forward - looking statements herein. Investments may be speculative, illiquid and there is a total ri sk of loss. FW0FW1

Experienced Management Team On Tai, LAM Director , Chief Executive Officer, and the Chairman of the Board Mr . Lam is the co - founder of our Group . He currently serves as the Director of our operating subsidiary , Red Solar, since January 2017 . Mr . Lam is responsible for our Group’s overall management, strategic planning, and business development . Mr . Lam has more than 24 years of experience in capital markets, investment banking, and the financial services industry, with over 21 years of experience of advising on numerous corporate finance projects, including various IPOs and corporate restructuring transactions . Prior to establishing our Group, Mr . Lam has worked in several well - known investment banks, including ICBC International Capital Limited, CCB International Capital Limited and CCB International Asset Management Limited, where he was responsible for numerous IPOs, financial advisory services and private equity investment projects . Mr . Lam is currently an independent non - executive director of Oi Wah Pawnshop Credit Holdings Limited (stock code : 1319 . HK), a company listed on the Main Board of the Stock Exchange . Mr . Lam also served as a non - executive director of Jiyi Household International Holdings Limited (stock code : 1495 . HK), a company listed on the Main Board of the Stock Exchange from June 2015 to November 2018 . Mr . Lam received his diploma in general business management from the Lingnan College (now known as the Lingnan University) in Hong Kong in November 1994 , and his master’s degree in business administration from the University of Sheffield in the United Kingdom in December 1996 . He also obtained his bachelor’s degree in laws from the University of Wolverhampton in the United Kingdom in July 1998 through a distance learning course . Chi Fung Leo, CHAN Director , Chief Financial Officer Mr . Chan is the co - founder of our Group . He currently serves as the Director of our operating subsidiary , Red Solar, since January 2017 . He is responsible for our Group’s overall management, strategic planning, and business development . Mr . Chan has over 20 years of experience in corporate finance advisory and accounting, with a prominent track record of leading various IPOs and merger and acquisition projects serving various Hong Kong, China, and international investment banks and financial services firms . Prior to founding our Group, Mr . Chan served as the managing director of LY Capital Limited, from May 2016 to October 2017 . From May 2015 to April 2016 , Mr . Chan served as the deputy managing director of VBG Capital Limited . From December 2011 to April 2015 , he served in CITIC Securities International Company Limited, with the last position being the director of its corporate finance department . From August 2007 to December 2011 , he worked at BNP Paribas (Asia Pacific) Limited as an associate in its corporate finance department . From June 2006 to July 2007 , he worked as an associate at the corporate finance department of CCB International Capital Limited . Since August 2017 , Mr . Chan has been an independent non - executive director of Sisram Medical Ltd, a listed company on the Stock Exchange (stock code : 1696 . HK) . Since June 2018 , Mr . Chan has also been an independent non - executive director of Ziyuanyuan Holdings Group Limited, a listed company on the Stock Exchange (stock code : 8223 . HK) . From October 2020 to June 2023 , Mr . Chan has been an independent non - executive director of Jinke Smart Services Group Co . , Ltd (stock code : 9666 . HK) . Since June 2023 , Mr . Chan has also been an independent non - executive director of Luyuan Group Holding Cayman Ltd, a listed company on the Stock Exchange (stock code : 2451 . HK) . Mr . Chan obtained his bachelor’s degree in business administration from the Hong Kong University of Science and Technology in Hong Kong in November 2001 . He has been a member of Hong Kong Institute of Certified Public Accountants since October 2005 . 22 All terms stated herein are proposed terms. See offering documents for further risks and disclosures. Past performance is not in dicative of future results. There is no guarantee that actual outcomes and results will not differ materially from what is ex pre ssed, implied or forecast by our forward - looking statements herein. Investments may be speculative, illiquid and there is a total ri sk of loss. FW0 FW1 FW2 FW3 FW4

Independent non - executive directors Ernest Lam Director , Chief Executive Officer Yun Pun, WONG Independent Director Mr . Wong currently serves the independent director and the chairman of audit committee of AGBA Group Holding Limited (NASDAQ : AGBA) since December 2021 . Mr . Wong also currently acts as the Chief Financial Officer of Inception Growth Acquisition Limited, a publicly listed special purpose acquisition corporation (NASDAQ : IGTA) since April, 2021 . Mr . Wong has years of executive experience with multiple leadership positions and a track record in helping private companies enter the public market . He has been the principal of Ascent Partners Advisory Service Limited, a finance advisory firm, since March 2020 . From November 2017 to December 2020 , Mr . Wong held the position of Chief Financial Officer at Tottenham Acquisition I Limited, a publicly listed special purpose acquisition corporation, which merged with Clene Nanomedicine Inc . (NASDAQ : CLNN) in December 2020 . From August 2015 to September 2017 , he served as Chief Financial Officer at Raytron Technologies Limited, a leading Chinese national high - tech enterprise . His main responsibilities in these roles have included overseeing the financial functions of the firms, assisting in establishing corporate ventures for investment, and working on deal origination of new businesses in the corporate groups . Prior to these efforts, he was Chief Financial Officer and Executive Director of Tsing Capital from January 2012 to July 2015 , where he managed four funds with a total investment amount of US $ 600 million and focused on environmental and clean technology investments . Mr . Wong also served as senior director and chief financial officer of Spring Capital, a US $ 250 million fund, from October 2008 until June 2011 . Additionally, Mr . Wong was the chief financial officer of Natixis Private Equity Asia from November 2006 till October 2008 and an associate director of JAFCO Asia from March 2002 to October 2006 . Mr . Wong was a finance manager for Icon Medialab from July 2000 to December 2001 , a senior finance manager of Nielsen from August 1998 to July 2000 , Planning - Free Shopper from April 1992 to August 1998 , and an auditor at PricewaterhouseCoopers from August 1989 until March 2000 . Mr . Wong earned his Masters of Business degree in 2003 from Curtin University in Australia and a Professional Diploma in Company Secretaryship and Administration from the Hong Kong Polytechnic University in 1989 . Mr . Wong is the fellowship member of HKICPA . 23 All terms stated herein are proposed terms. See offering documents for further risks and disclosures. Past performance is not in dicative of future results. There is no guarantee that actual outcomes and results will not differ materially from what is ex pre ssed, implied or forecast by our forward - looking statements herein. Investments may be speculative, illiquid and there is a total ri sk of loss. FW0

Independent non - executive directors Ernest Lam Director , Chief Executive Officer Jenny, CHEN Independent Director Ms . Chen has more than 14 years’ experience in the legal profession . She co - founded CFN Lawyers, a Hong Kong law firm in association with Broad & Bright in January 2013 and is currently a partner of the firm . Prior to that, she worked as a corporate associate in Maples and Calder (Hong Kong) LLP from January 2012 to January 2013 , an associate general counsel of American International Assurance Company, Limited from September 2009 to May 2011 , and a corporate associate in DLA Piper Hong Kong from July 2006 to September 2009 . She also worked at Woo Kwan Lee & Lo from July 2002 to June 2006 with her last position as an assistant solicitor . Ms . Chen obtained her LL . B degree from the Law School of the University of Hong Kong in November 2001 and completed her Postgraduate Certificate in Laws (PCLL) at the same university in June 2002 . Ms . Chen was admitted to practice as a solicitor in Hong Kong in September 2004 and a solicitor in England and Wales in September 2005 . Ernest Lam Director , Chief Executive Officer Kwok On, NG Independent Director Mr . Ng currently serves the independent director of AGBA Group Holding Limited (NASDAQ : AGBA) since February 2019 . Mr . Ng has over 30 years of broad experience engaging in the fields of education, media, retailing marketing and finance . He is a pioneer of IT in education and he was the author of “Digital English Lab”, one of the first digital book series in Hong Kong . Since September 2018 , he has been the Chief Executive Officer of e - chat, an IPFS block chain social media focused company . From March 2017 to April 2018 , Mr . Ng was the Chief Financial Officer of Duofu Holdings Group Co . Limited . In February 2016 , Mr . Ng founded Shang Finance Limited and was the Chief Executive Officer until February 2017 . From March 2015 to November 2015 , Mr . Ng was the Chief Financial Officer of World Unionpay Group Shares Limited . In August 2003 , Mr . Ng established Fuji (Hong Kong) Co . Ltd . and was the Chief Executive Officer until December 2014 . Mr . Ng obtained a Certificate of Education majoring in English from the University of Hong Kong in 2000 . 24 All terms stated herein are proposed terms. See offering documents for further risks and disclosures. Past performance is not in dicative of future results. There is no guarantee that actual outcomes and results will not differ materially from what is ex pre ssed, implied or forecast by our forward - looking statements herein. Investments may be speculative, illiquid and there is a total ri sk of loss. FW0 FW1 FW2

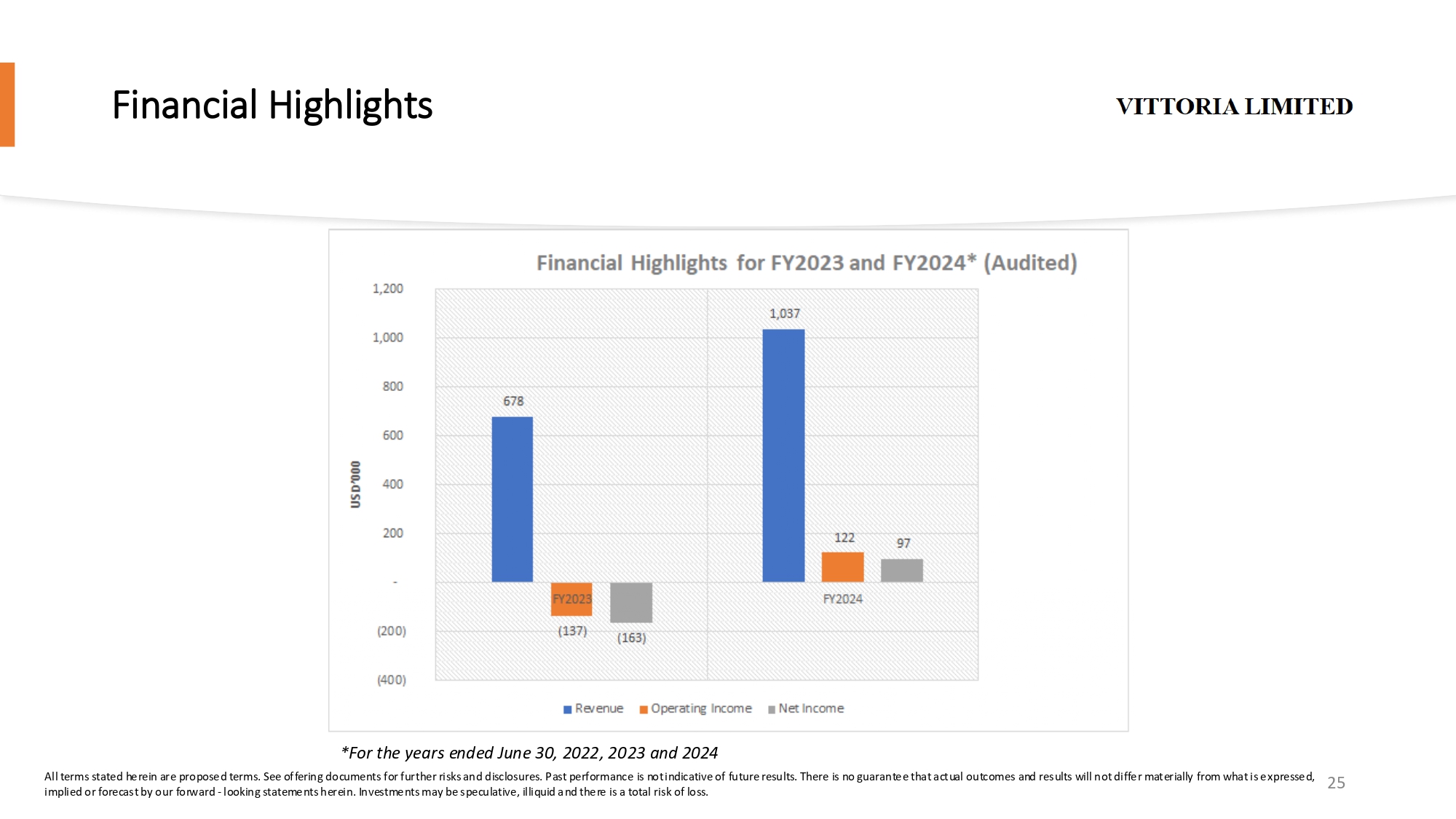

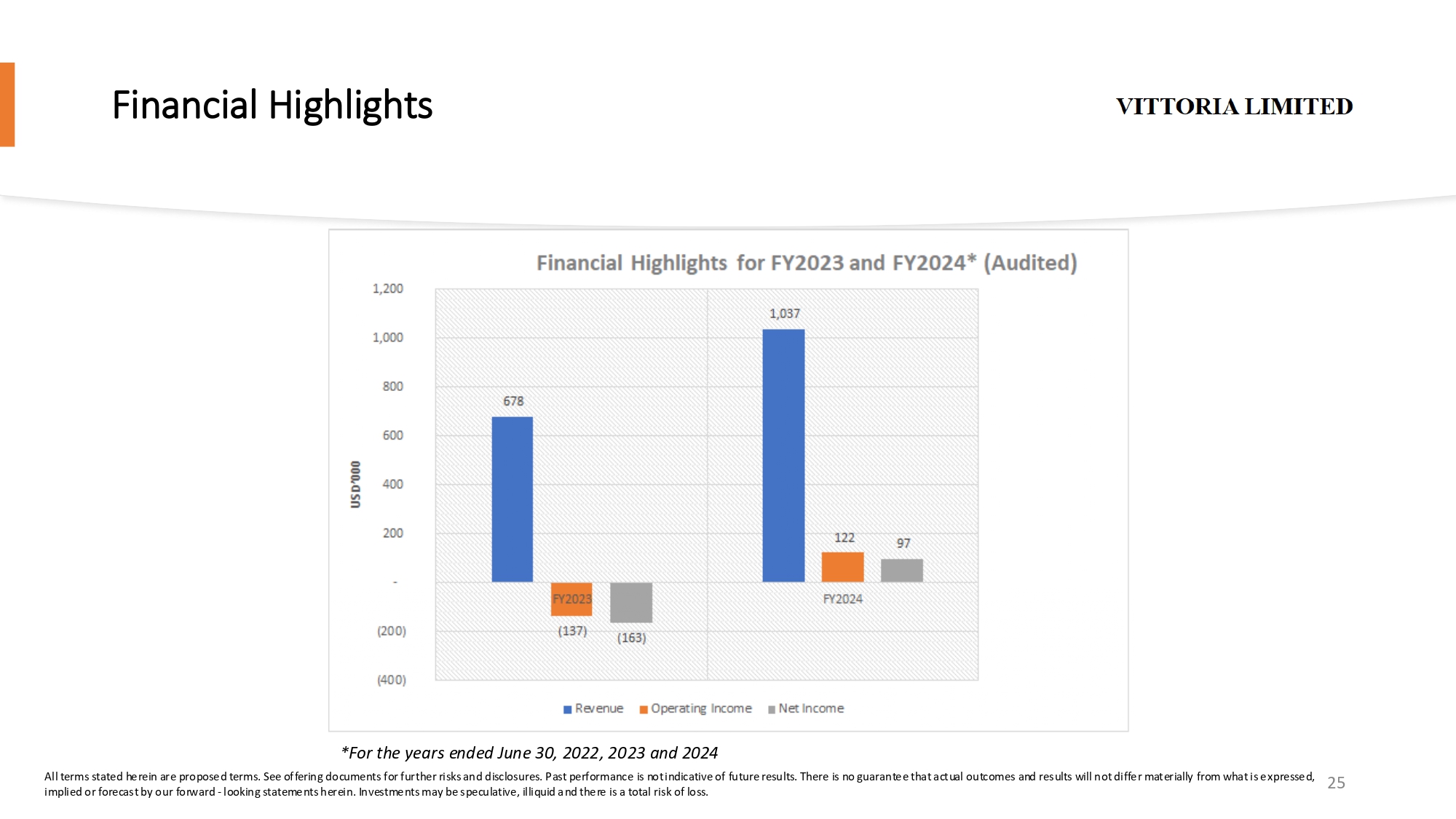

Financial Highlights *For the years ended June 30, 2022, 2023 and 2024 25 All terms stated herein are proposed terms. See offering documents for further risks and disclosures. Past performance is not in dicative of future results. There is no guarantee that actual outcomes and results will not differ materially from what is ex pre ssed, implied or forecast by our forward - looking statements herein. Investments may be speculative, illiquid and there is a total ri sk of loss. JQ0 FW1

Contact us Issuer : Address: Unit 402B, 4/F, China Insurance Group Building, No. 141 Des Voeux Road Central, Central, Hong Kong Underwriter : Eddid Securities USA Inc. Email: ecm@eddidusa.com Email: info@vittoria.ltd 26 Address: 40 Wall Street, Suite 1606, New York, NY 10005 许棋鸿 0 JQ1