Filed pursuant to Rule 433 of the Securities Act, as amended

Issuer Free Writing Prospectus dated November 22, 2024

Relating to the Preliminary Prospectus dated November 22, 2024

Registration Statement File No. 333-281474

Investor Presentation November 2024

Next Slide Forward - Looking Statements 1 This presentation (the “Presentation”) about Toppoint Holdings Inc. (the “Company” or “Toppoint”) contains “forward - looking statements” that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this Presentation, including statements regarding our future results of operations and financial position, strategy and plans, and our expectations for future operations, are forward - looking statements. We have attempted to identify forward - looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should,” or “will” or the negative of these terms or other comparable terminology. Our actual results may differ materially or perhaps significantly from those discussed herein, or implied by, these forward - looking statements. In addition, any forward - looking statements contained in this Presentation are only estimates or predictions of future events based on information currently available to our management and management’s current beliefs about the potential outcome of future events. There are a significant number of factors that could cause actual results to differ materially from statements made in this Presentation, including, without limitation, those described under the “Summary of Risk Factors” section below. The forward - looking statements included in this Presentation are made as of the date of this Presentation and Toppoint undertakes no obligation to publicly update or revise any forward - looking statements, other than as required by applicable law. The Company has filed a registration statement (including a preliminary prospectus) on Form S - 1, as amended (File No. 333 - 281474) (the “Registration Statement”) with the Securities and Exchange Commission (the “SEC”) for the offering to which this Presentation relates. Before you invest, you should read the preliminary prospectus in the Registration Statement, including the “Risk Factors” set forth therein, and the other documents the Company has filed with the SEC for more complete information about the Company and the offering. You may obtain these documents for free by visiting the SEC website at www.sec.gov . Alternatively, the Company, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by contacting A.G.P./Alliance Global Partners , 590 Madison Avenue, 28th Floor, New York, NY 10022; Phone Number: (212) 624 - 2060; Email: prospectus@allianceg.com, or contacting Toppoint Holdings Inc., 1250 Kenas Road, North Wales, PA 19454; Phone Number: (551) 866 - 1320; Email: John@toppointtrucking.com. This Presentation and any oral statements made in connection with this Presentation do not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of the securities of Toppoint in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. The Company’s securities may only be sold pursuant to an effective registration statement filed with the SEC. Industry and market data used in this Presentation has been obtained from publicly available third - party industry publications and sources as well as from research reports prepared for other purposes. The Company has not independently verified the data obtained from these sources. You are cautioned not to give undue weight to such industry and market data.

Summary of Risk Factors ● We operate in the highly competitive and fragmented truckload and transportation industry, and our failure to stay competitive could impair our ability to improve our profitability and materially adversely affect our results of operations . ● We may not be successful in managing our growth or implement our business strategies . ● Our business is subject to general economic, business and regulatory factors affecting the truckload industry that are largely beyond our control, any of which could have a material adverse effect on our results of operations. ● A significant portion of our business and revenue derive from our brokerage model, where we support owner - operators to grow their fleets within our umbrella . This business model and use of owner - operators expose us to different risks that a traditional fleet ownership and management business may not experience . ● Fluctuations in the price or availability of fuel and surcharge collection may increase our costs of operation, which could materially and adversely affect our margins . ● A significant portion of our revenue is concentrated in a small number of large customers . Any loss or significant reduction of business with one or more of them could have a material adverse effect on our business, financial condition and results of operations . ● We have engaged in transactions with related parties, and such transactions present possible conflicts of interest that could have an adverse effect on our business and results of operations . ● Changes to trade regulation, quotas, duties or tariffs, caused by the changing U.S. and geopolitical environments or otherwise, may materially adversely affect customer demand for our services. ● We are dependent on systems, networks and other information technology assets (and the data contained therein) and a failure in the foregoing, including those caused by cybersecurity breaches, could cause a significant disruption to our business. ● If we are unable to recruit, develop and retain our key employees, our business, financial condition and operating results could be adversely affected. ● We operate in a highly regulated industry and increased costs of compliance with, or liability for violation of, existing or future federal or state regulations could have a materially adverse effect on our business . Next Slide

Toppoint Holdings Inc. Issuer NYSE American / TOPP Listing/Symbol $10,000,000 - $15,000,000 Expected Offering Size $4.00 - $6.00 per share Expected Price Range 2,500,000 shares of common stock Shares Offered 15% (375,000 shares) Over - Allotment Plan to use the net proceeds of this offering for geographic expansions, investments in physical and IT infrastructure, expansion of sales team and marketing efforts, and general working capital and other corporate purposes. Use of Proceeds A.G.P. Sole Book Runner Next Slide Offering Summary

>280+ Recycling Centers & Commodity Traders Toppoint at a Glance ~15% Gross Profit / Load Next Slide 53.17% Compounded Average Client Number Growth 2015 - 2023 504,616 Tons of Waste Paper Hauled 2023 34% NJ / 30% Philly Ports Waste Paper Export Drayage Market Share ~86 Trucks in Our Fleet >2000+ Locations 7 Ports

Next Slide Waste Paper Recycling Market The global recycled paper market, valued at $32.6 billion in 2021, is projected to reach $42.4 billion by 2028, growing at a CAGR of 3.8%¹. The demand for sustainable packaging, particularly in containerboard production driven by the e - commerce boom, has fueled growth². The U.S. remains the largest exporter of recovered paper, supplying 33% of global exports in 2021 with 16 million tons³. However, U.S. exports dropped 17% in 2023, reaching a 19 - year low at 14.3 million tons, largely due to China’s import restrictions⁴ and a decline in global demand⁵. Despite this downturn, the market is expected to improve gradually. Rising awareness of recycling practices and improvements in sorting technology are predicted to enhance the supply of high - quality recovered paper⁶. Additionally, brands are increasingly shifting from plastic to sustainable materials, further driving demand for recycled paper⁷. Despite a decline in demand for recovered paper exports, partly due to increased production and consumption of recovered paper by U.S. mills — now comprising 43.9% of finished paper production — domestic production is expected to reach its capacity limits, and the export market is projected to stabilize and recover⁹. Sources: 1. Fastmarkets (January 25, 2024). Key Clues to Watch Out for in the Global Recovered Paper Market | 2024 Preview. 2. General Kinematics (March 21, 2024). New Data: ISRI Reports Decline in Recycled Paper Exports In 2023. 3. Fastmarkets (May 28, 2024). US Mills to Use Record RCP Volumes and OCC Demand Set to Grow to 25.1 Million Tons This Year. 4. Resource Recycling (February 13, 2024). Fiber Exports Drop 17%, Plastic Shipments Hit Record Low. 5. Fastmarkets (January 25, 2024). Key Clues to Watch Out for in the Global Recovered Paper Market | 2024 Preview. 6. General Kinematics (March 21, 2024). New Data: ISRI Reports Decline in Recycled Paper Exports In 2023. 7. Fastmarkets (May 28, 2024). US Mills to Use Record RCP Volumes and OCC Demand Set to Grow to 25.1 Million Tons This Year. Market Opportunity Metal Recycling Market The global metal recycling market, valued at $9.2 billion in 2022, is expected to grow at a 5.4% CAGR from 2022 to 2032¹. Metal recycling reduces greenhouse gas emissions, conserves natural resources, and uses 95% less energy than new metal production². However, challenges include the need to manually separate metals from other materials and degradation in certain metals like aluminum after multiple reuse cycles³. The U.S. scrap metal market has seen fluctuating trends. In 2023, exports of iron and steel scrap dropped by 10% to 18 million metric tons, while aluminum scrap exports increased by 3.3% to 2 million metric tons⁴. The U.S. remains the largest exporter of aluminum scrap globally, with India and Malaysia as top destinations⁵. China is a major driver of the global scrap metal market, using ferrous and non - ferrous metals for infrastructure development⁶. However, with tightening availability of scrap metal worldwide and rising domestic consumption, countries are expected to focus on internal use, limiting exports⁷. Global demand for steel scrap is projected to increase at a 3.3% CAGR, while supply will grow at only 3% over the next eight years⁸. Sources : 1. Fact.MR (2022). U.S. Scrap Metal Recycling Market Outlook (2022 - 2032). 2. Precedence Research (2020). Metal Recycling Market Size, Share, Growth Outlook, Trends, Revenue, Consumption and Forecast 2020 to 2027. 3. Ibid. 4. Statista (May 27, 2024). Iron and Steel Scrap Exports from the United States from 2010 to 2023. 5. Statista (May 29, 2024). Aluminum Waste and Scrap Export Volume from the U.S. 2015 - 2023. 6. IBISWorld (2022). Scrap Metal Recycling in the US – Market Size 2003 - 2028. 7. GMK Center (November 20, 2023). Global Scrap Market in 2023: Current Trends. 8. Boston Consulting Group (March 12, 2024). Shortfalls in Scrap Will Challenge the Steel Industry.

Company Overview A Leading Logistics Provider in the Recycling Export Supply Chain for the NJ - PA - MD - FL Regions Headquartered in North Whales, PA, Toppoint Holdings Inc. is a Nevada holding company and conducts its business through its wholly - owned operating subsidiary, Toppoint Inc, a Pennsylvania company founded in 2014. We have become a key player in the New Jersey and Pennsylvania regional trucking market for waste paper, evidenced by our significant market share. In addition to waste paper, our portfolio also includes the shipment of scrap metal and wooden logs from large waste companies, recycling centers and commodity traders to the ports of Newark, NJ, and Philadelphia, PA. We continue to expand our footprints domestically and internationally and have ventured into the recycling export transport market of Tampa, Jacksonville and Miami, FL, and Baltimore, MD in 2023, and Ensenada, Mexico in 2024. We intend to explore the international market in Canada, the United Kingdom and Australia in the near future. From time to time, we offer trucking services for plastic and other commodities and provide logistics brokerage solutions servicing the major ports in California, Georgia, South Carolina, Texas and Illinois, as well as commercial rail lines. Next Slide

Toppoint’s Client Base: Largest Fortune 500 Waste Companies + Over 280 Recycling Centers / Commodity Traders with Nearly 2,300 Locations Our growing client base relies on us as their partner to provide a “white glove service” to ensure their time - sensitive, ultra - high throughput commodities are safely loaded and delivered right to container ships. We pride ourselves on providing this high - volume task accurately and on time. Next Slide

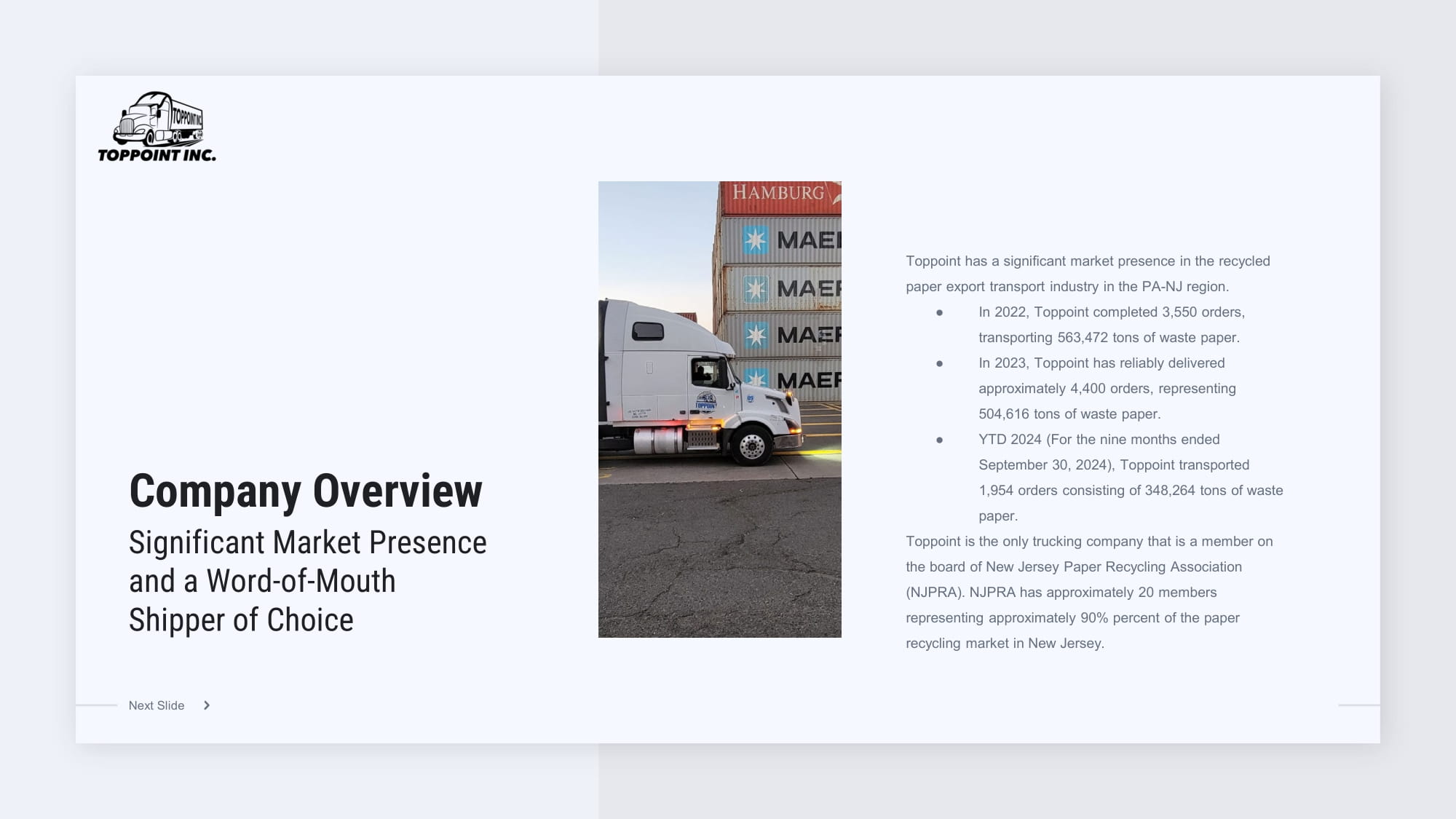

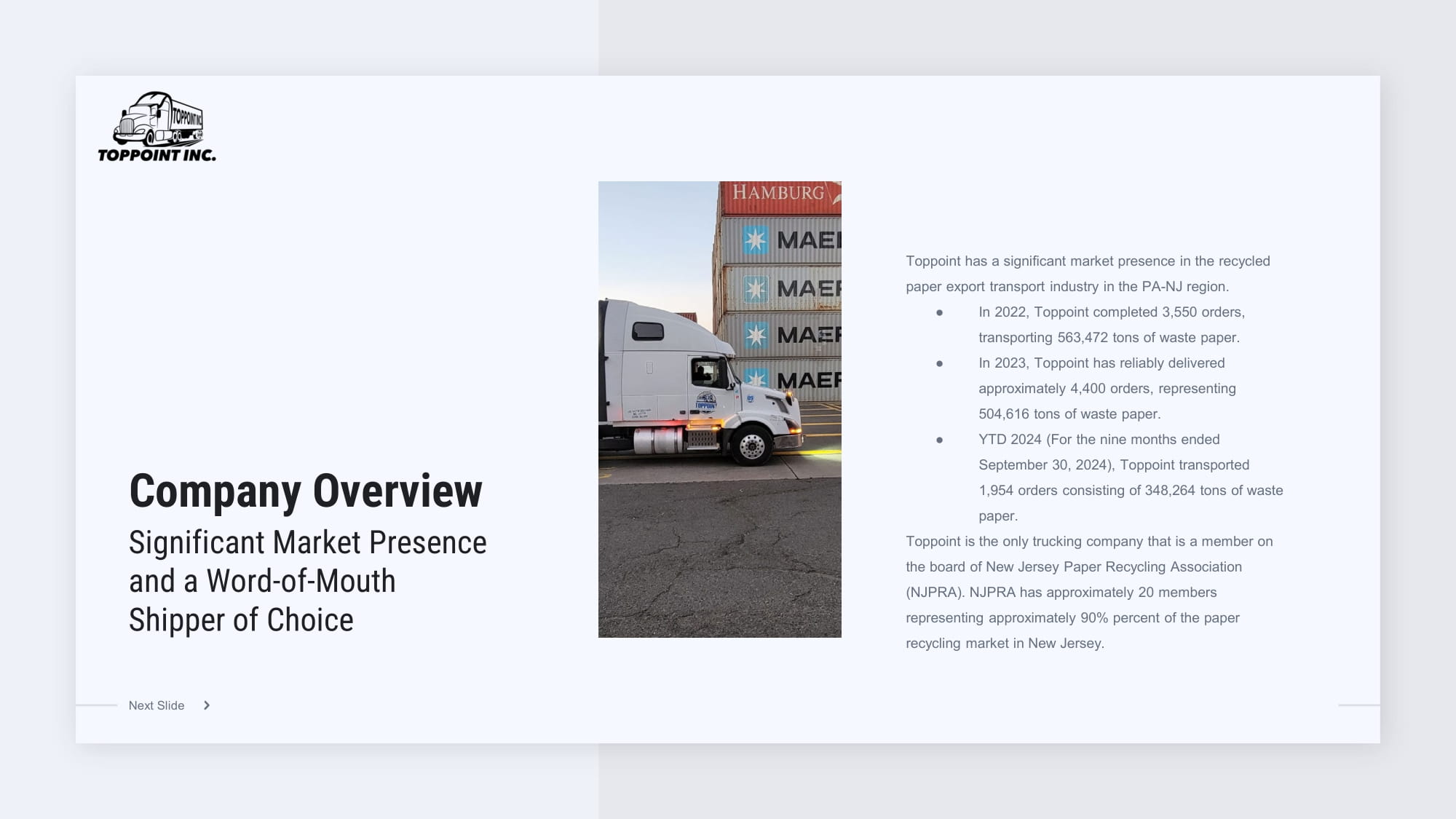

Company Overview Significant Market Presence and a Word - of - Mouth Shipper of Choice Next Slide Toppoint has a significant market presence in the recycled paper export transport industry in the PA - NJ region. Ɣ Ɣ ● In 2022, Toppoint completed 3,550 orders, transporting 563,472 tons of waste paper. In 2023, Toppoint has reliably delivered approximately 4,400 orders, representing 504,616 tons of waste paper. YTD 2024 (For the nine months ended September 30, 2024), Toppoint transported 1,954 orders consisting of 348,264 tons of waste paper. Toppoint is the only trucking company that is a member on the board of New Jersey Paper Recycling Association (NJPRA). NJPRA has approximately 20 members representing approximately 90% percent of the paper recycling market in New Jersey.

Company Overview Toppoint’s Business Verticals 01. Waste Paper Products Paper products remain our core commodity of export and we approached 34% of the waste paper export drayage volumes through New Jersey’s ports and approximately 30% through Philadelphia’s ports, according to data sourced from IHS Markit. 04. Brokerage and Other From time to time, we offer trucking services for plastic and other commodities and provide logistics brokerage solutions servicing the major ports in California, Georgia, South Carolina, Texas and Illinois, as well as commercial rail lines. 02. Waste Metal and Forestry We expanded into scrap metal and wood product exports to diversify our offerings and supply our growing fleet. Serving additional commodities allows us to keep a strong pipeline of loads for our Vendors to deliver and mitigate risks against commodity price fluctuations that affect demand for export. 03. Import We also hold a minority market share in the import sector for ports of Newark, NJ, Philadelphia, PA, Baltimore, MD, and Jacksonville, Tampa and Miami, Florida; picking up containers from ships and dropping at client locations. Next Slide

Company Overview Recruitment Assistance Next Slide Retention Tactics Adoption / Company Culture Budget Management Business Management Training Internal Growth Funding + Highest Level of Support to Our Truck Drivers / Owners Our truck drivers/owners (which we refer to as “Vendors”) are Toppoint’s bloodline. The core belief in “culture drives success” has helped us grow our team to approximately 86 dedicated trucks. We provide the highest level of care and support and as a unique driver of growth amongst our Vendors, we provide internal strategic fleet growth consulting and financial literacy. We help our drivers create a timeline to transition to owner - operators. Most importantly, we assist our owner - operators in expanding their own fleets of trucks with:

Competitive Strengths: • A Large Vendor Pool with Approximately 86 Trucks • Ability to Offer Competitive Pricing • Capability to Provide Real - Time Visibility into Shipments and Quickly Respond • A Global Team and a Fully Remote Workspace • Healthy Cash Flows • Maintaining a Satisfactory DOT Safety Rating, the Highest Awarded by the DOT • Innovative and experienced management team with extensive operating expertise. Next Slide

Company Overview Ability to Offer Competitive Pricing In the relatively lower - profit recycled paper transport industry, maintaining competitive prices is an important factor in our continued market share expansion. We employ proprietary analytics systems to effectively track our operating results and financial position in real time and continuously enhance processes, with a view to helping customers reduce warehouse costs, lower shipping expenses and maintain operational flexibility. In addition, our full truckload shipping offerings meet the needs of companies requiring maximum movement of the commodities they trade with lower transport costs per unit. Provide Real - Time Visibility into Every Shipment We have adopted a system industry leading telematics to allow us and our customers to easily monitor the status and location of the freight at all times. We typically receive and process 250 driver and truck location updates daily. A large Vendor Pool with Approximately 86 Trucks This allows us to cover our customers’ transport needs with first - to - final - mile - delivery capabilities. Next Slide

Sustainable Business Practices We pride ourselves on being an economically viable, socially responsible and environmentally friendly enterprise. We contribute to a sustainable society through our initiatives to reduce cost and enhance recycling logistics efficiency for a greener future. Proactively Aligned with Our Clients’ Strategic Growth Initiatives We solidify our partnerships with clients year - over - year. The number of our clients has grown from 10 in 2015 to 303 in 2023 at a CAGR of approximately 53.17%. Capitalizing on our know - how in developing logistics solutions over the years, we can propose integrated transportation solutions that cover loading, transport, port drayage, unloading and sea freight routes selection. Next Slide

Company Overview Established Dashboards to Measure Business Performance. US and Overseas Staff Allow for 24/7 Response. Performance Tracking Built on our dispatch system, we have utilized a real - time dashboard to keep track of our daily, weekly, monthly, quarterly and year to end operating results and financial position, including among others, our sales growth, gross profit, gross profit margin and number of loads transported. As such, we keep abreast of the performance and health of our business and can make timely adjustments in our execution to achieve our strategic goals. Employees & Independent Contractors Our dedicated growing staff are strategically located in the US and overseas, to allow for immediate response for inquiries by our Customers and Vendors 24/7. We provide a fully remote engaging workspace that encourage a healthy work - life balance and drives our committed team with minimal employee turnover and consistent accountability Next Slide

Toppoint Maintains a Satisfactory DOT Safety Rating, the Highest Awarded by the DOT. A top concern for operating in dense urban areas is ensuring our cargo is delivered as promised, the patrons on the roads we share are free of harm, and our drivers go home to their loved ones nightly. We require DOT/FMCSA compliant drug testing including pre - employment and quarterly random drug and alcohol testing. New drivers go through documented training and current drivers go through refresher training annually. This allows Toppoint to maintain a satisfactory DOT safety rating, the highest awarded by the DOT. Next Slide

Customer Assign Driver Loading Goods Port Drayage Dispatcher Start Ride Regional/Short Distance Haul Unloading and Delivered Trucking Drivers are dispatched using our proprietary app to ensure an accurate seamless delivery experience. Next Slide

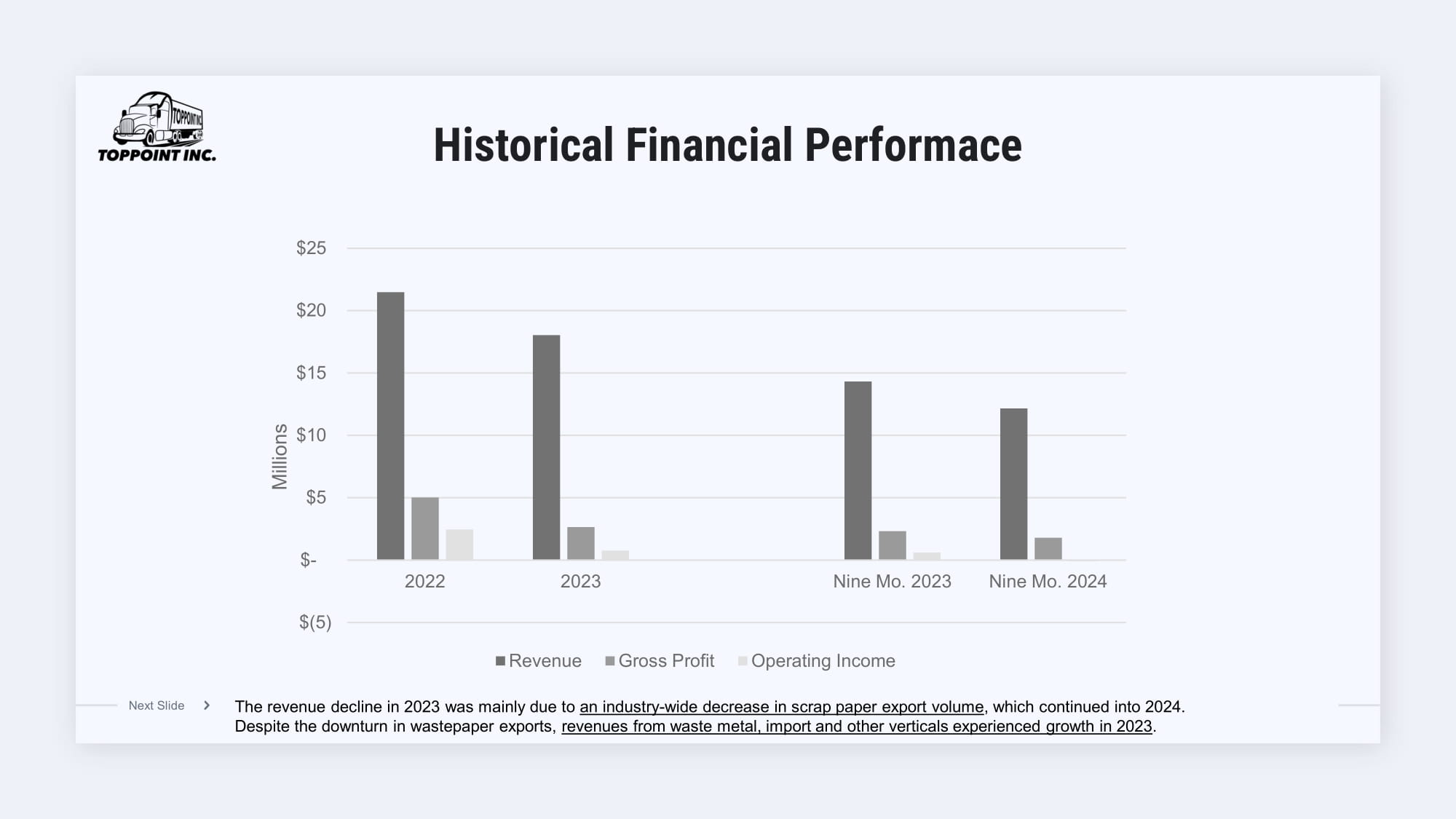

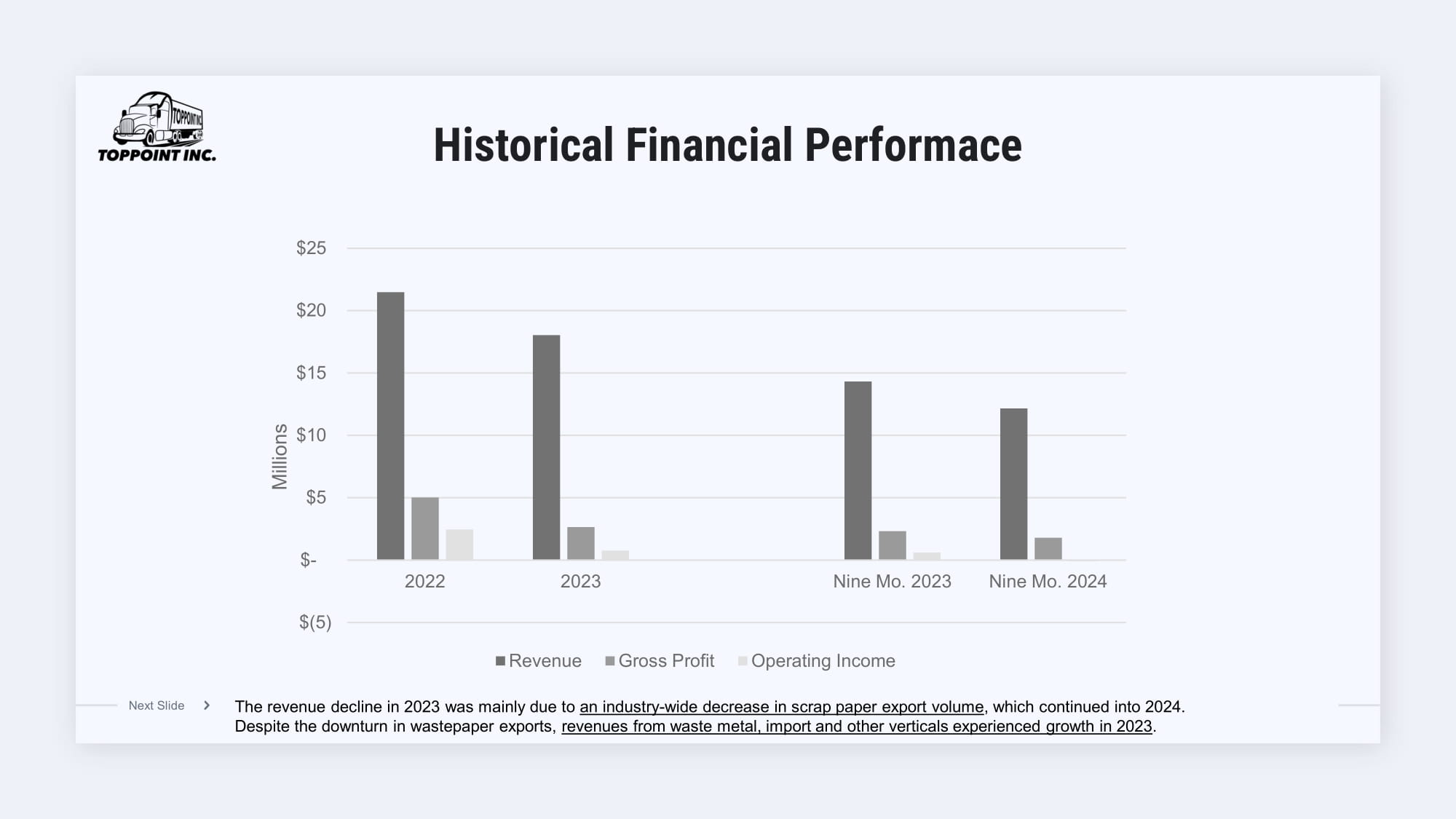

Next Slide Historical Financial Performace $(5) $25 $20 $15 $10 $5 $ - 2022 2023 Nine Mo. 2023 Nine Mo. 2024 Millions Revenue Gross Profit Operating Income The revenue decline in 2023 was mainly due to an industry - wide decrease in scrap paper export volume , which continued into 2024. Despite the downturn in wastepaper exports, revenues from waste metal, import and other verticals experienced growth in 2023 .

Increasing wallet shares of current clients. Growth Strategies Next Slide Building storage and warehousing capability. Continuing to improve information technology (IT) Infrastructure. Selectively exploring opportunities of strategic alliance, investments and acquisitions. Enhancing ability to attract, incentivize and retain a talented workforce.

End Q4 2023 - * Achieved* 10 trucks servicing the Jacksonville, Tampa and Miami ports and 5 trucks servicing the Port of Baltimore Global Growth Strategies | Emerging Markets End Q4 2024 - *In - Progress* 5 trucks servicing the Port of Ensenada, Mexico FLORIDA Tampa ONTARIO Toronto 2026 - 2027 trucks servicing largest UK container terminals and largest export ports in Australia Southampton Felixstowe London Immingham Liverpool UNITED KINGDOM Port of Hedland Port of Brisbane Port of Melbourne AUSTRALIA MARYLAND Miami Baltimore Jacksonville Ensenada MEXICO 2025 Next Slide trucks servicing the Port of Toronto, Canada

Investment Highlights Next Slide Record A proven track record in the recycling export transport sector with reliable, timely and competitively priced delivery services 01. Sustainability We transport recyclable resources to the global network of processors and manufacturers efficiently, contributing to a sustainable society 02. Scalable Business Model We support our drivers/owners to grow with internal recruitment, training and DOT compliance. 05. Insight Experienced, committed, highly efficient management with deep industry insight 06. Growth 8 years of 53.17% average growth in client number 03. Dominant Market Share We made up approximately 34% of the waste paper export drayage volumes through New Jersey’s ports and approximately 30% through Philadelphia’s ports, according to data sourced from IHS Markit. 04.

Next Slide Board of Directors Hok C Chan, Founder, CEO, Chairman of the Board and President Mr. Chan founded and has been the chief executive officer and sole director of our operating subsidiary, Toppoint Inc, since its inception in 2014. He previously launched Toppoint International Recycling Co. in 2010, growing it into a successful business that he sold to a private equity firm in 2014 for $4 million. Mr. Chan has been instrumental in leading Toppoint’s expansion and growth within the recycling industry. John Feliciano III, CFO, Director and Secretary Mr. Feliciano has served as our principal financial officer since 2022 and joined Toppoint Inc as the Chief of Strategy in 2020. Prior to joining Toppoint, he oversaw sales to drive EBITDA growth at Durante Rentals, contributing to a successful acquisition of the business by Clairvest, a private equity firm in 2019. He also consulted for Point - of - Rental Software, providing operational and strategic consulting services from July 2020 to December 2023. Dingding He, Indepent Director Appointee Mr. Hing brings over 19 years of experience in capital markets, has served as CEO of Link Holdings Limited since May 2023. He previously held senior leadership roles at Ta Yang Group Holdings. Throughout his career, he has served on the boards and committees of multiple public companies listed in Hong Kong and Singapore, contributing to their corporate growth and governance. Pablo A Santana, Independent Director Appointee Mr. Santana has been Sales Account Manager at Custom Truck One Source Inc (NYSE: CTOS) since 2021. His prior role at C&C Lift Truck Inc. saw him lead sales development for warehouse and supply chain operations. He possesses vast understanding of the trucking and material handling industries as well as public company processes. Tan Ying Lo, Independent Director Appointee Mr. Lo has served as an Assistant Project Manager at Missions Points Network Limited since 2021, successfully implemented CRM campaigns and programs. Previously, she coordinated over 2,000 virtual events during the pandemic at OPPA System Limited and helped develop business strategies at HKT The Club, a major telecom company in Hong Kong.

Next Slide Contact Information John Feliciano III CFO and Director Toppoint Holdings Inc. John@toppointtrucking.com Mobile: (917) 440 - 8423 www.toppointtrucking.com IR Contact: Crescendo Communications Tel: (212) 671 - 1020 TOPP@crescendo - ir.com