As filed with the U.S. Securities and Exchange Commission on August 9, 2024

Registration No. 333-279801

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ASEP MEDICAL HOLDINGS INC.

(Exact Name of Registrant as Specified in Its Charter)

Not Applicable

(Translation of Registrant’s Name into English)

| British Columbia | | 541710 | | Not Applicable |

(State or other Jurisdiction of Incorporation or Organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

420 – 730 View Street

Victoria, BC V8W 3Y7

Canada

Tel: 778-600-0509

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Clark Wilson LLP

Suite 900 - 885 West Georgia St

Vancouver, BC, V6C 3H1

604-687-5700

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copy to:

Darrin Ocasio, Esq. Glenn Burlingame, Esq. Sichenzia Ross Ference Carmel LLP 1185 Avenue of the Americas, 31st Floor New York, NY 10036 Tel: (212) 930-9700 Fax: (212) 930 9725 | | Anthony W. Basch, Esq. Yan (Natalie) Wang, Esq. Chenxi Lu, Esq. Kaufman & Canoles, P.C. 1021 East Cary Street, Suite 1400 Richmond, VA 23219 Tel: (804) 771-5700 Fax: (888) 360-9092 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission acting pursuant to said Section 8(a) may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | | SUBJECT TO COMPLETION | | DATED AUGUST 9, 2024 |

Units, each Unit consisting of

One Common Share or One Pre-Funded Warrant to Purchase One Common Share, and

One Common Warrant to purchase One Common Share

Up to Common Shares underlying the Pre-Funded Warrants, and

Up to Common Shares underlying the Common Warrants

This is an initial public offering in the United States of up to units (“Units”) of ASEP Medical Holdings Inc., with each Unit consisting of one common share no par value (“common share”), and one warrant to purchase one common share (each a “common warrant”), based on an assumed initial public offering price of $ per Unit, the midpoint of the range discussed below. Our common shares are currently quoted on the Canadian Stock Exchange under the trading symbol “ASEP” and on the OTC Pink operated by the OTC Markets Group Inc. (the “OTC Pink”) under the trading symbol “SEPSF”. On May 28, 2024, the closing price of our common shares on CSE was CAD 0.1850 and the last reported sale price for our common shares on the OTC Pink was $0.05.

We anticipate that the initial public offering price of each Unit will be between $[__] and $[__] per Unit. We are offering all Units offered by this prospectus. This prospectus also covers the common shares issuable upon exercise of the Pre-Funded Warrants, and the common warrants.

We are also offering to each purchaser of Units that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our common shares outstanding immediately following the consummation of this offering, the opportunity to purchase Units consisting of one pre-funded warrant (in lieu of one common share, each a “Pre-Funded Warrant”), and one common warrant. Subject to limited exceptions, a holder of Pre-Funded Warrants will not have the right to exercise any portion of its Pre-Funded Warrants if the holder, together with its affiliates, would beneficially own in excess of 4.99% (or, at the election of the holder, such limit may be increased to up to 9.99%) of the number of common shares outstanding immediately after giving effect to such exercise. Each Pre-Funded Warrant will be exercisable for one common share. The purchase price of each Unit including a Pre-Funded Warrant will be equal to the price per Unit that includes one common share, minus $0.0001, and the remaining exercise price of each Pre-Funded Warrant will equal $0.0001 per share. The Pre-Funded Warrants will be immediately exercisable (subject to the beneficial ownership cap) and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. For each Unit including a Pre-Funded Warrant we sell (without regard to any limitation on exercise set forth therein), the number of Units including a share of common stock we are offering will be decreased on a one-for-one basis. The Pre-Funded Warrant may be exercised on a cashless basis.

The Units have no stand-alone rights and will not be certificated or issued as stand-alone securities. The common shares and Pre-Funded Warrants can each be purchased in this offering only with the accompanying common warrants, as part of a Unit, but the components of the Unit are immediately separable and will be issued separately in this offering. See “Description of Securities” in this prospectus for more information.

We have applied to list the common shares on The Nasdaq Stock Market LLC under the symbol “SEPS”. No assurance can be given that our application will be approved. Completion of this offering is contingent on the approval of our listing application for trading of our common shares on the Nasdaq Capital Market. There is no established trading market for any of our common shares, Pre-Funded Warrants, or common warrants. We do not expect a market to develop for our Pre-Funded Warrants or our common warrants, neither do we intend to apply for a listing of any Pre-Funded Warrants, or common warrants on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the Pre-Funded Warrants and the common warrants will be limited.

We are both an “emerging growth company” and a “foreign private issuer” as defined under the U.S. federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements for this and future filings. See “Prospectus Summary — Implications of Being an Emerging Growth Company” and “Prospectus Summary — Implications of Being a Foreign Private Issuer.”

An investment in our securities is highly speculative, involves a high degree of risk and should be considered only by persons who can afford the loss of their entire investment. See “Risk Factors” beginning on page 9 of this prospectus.

| | | Per Unit comprising Common Share and common warrant | | | Per Unit comprising Pre-Funded Warrant and common warrant | | | Total Without Over- Allotment Option | | | Total With Over- Allotment Option | |

| Initial public offering price | | $ | | | | $ | | | | $ | | | | $ | | |

| Underwriting discounts and commissions (8%) (1) | | $ | | | | $ | | | | $ | | | | $ | | |

| Proceeds, before expenses, to us | | $ | | | | $ | | | | $ | | | | $ | | |

| (1) | We have also agreed to pay a non-accountable expense allowance to Aegis Capital Corp. (“Aegis”) as the underwriter, of one percent (1%) of the gross proceeds received in this offering and to reimburse the underwriter for other out-of-pocket expenses related to the offering. In addition, Aegis will receive warrants to purchase up to a total of [__] common shares (equal to five percent (5%) of the aggregate number of common shares included in the Units and issuable upon exercise of the Pre-Funded Warrants sold in this offering, excluding the exercise of the over-allotment option described in the paragraph below) and exercisable at a price per share equal to 125% of the offering price (the “Underwriter’s Warrants”), which are also being registered under this registration statement. For a description of compensation to be received by the underwriter, see “Underwriting.” |

We have granted the underwriter an option, exercisable for forty-five (45) days from the closing of the offering, to purchase up to an additional [__] common shares and/or Pre-Funded Warrants and [ ] common warrants (equal to fifteen percent (15%) of the total number of Units to be offered by us in this offering) on the same terms as the common shares, Pre-Funded Warrants, and common warrants being purchased by the underwriter from us. For a description of the other compensation to be received by the underwriter, see “Underwriting.”

The underwriter expects to deliver the securities comprising the Units against payment in U.S. dollars on or about [___], 2024.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION NOR HAS THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Sole Book – Running Manager

Aegis Capital corp.

The date of this prospectus is , 2024.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form F-1 that we filed with the U.S. Securities and Exchange Commission (the “SEC”). You should read this prospectus and the information and documents incorporated herein by reference carefully. Such documents contain important information you should consider when making your investment decision. See “Where You Can Find Additional Information” and “Incorporation of Certain Documents by Reference” in this prospectus.

You should rely only on the information contained in or incorporated by reference into this prospectus. We have not authorized anyone to provide you with information different from, or in addition to, that contained in or incorporated by reference into this prospectus. This prospectus is an offer to sell only the securities offered hereby but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in or incorporated by reference into this prospectus is current only as of their respective dates or on the date or dates that are specified in those documents. Our business, financial condition, results of operations and prospects may have changed since those dates.

Unless the context otherwise requires the terms “ASEP Medical Holdings Inc.,” “ASEP,” “we,” “us,” “our,” the “Company,” and “our business” refer to ASEP Medical Holdings Inc., a Canadian public company together with its subsidiaries.

We are not offering to sell or seeking offers to purchase these securities in any jurisdiction where the offer or sale is not permitted. We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the jurisdiction of the United States who come into possession of this prospectus are required to inform themselves about and to observe any restrictions relating to this offering and the distribution of this prospectus applicable to that jurisdiction.

TRADEMARKS AND TRADENAMES

All service marks, trademarks and trade names referred to in this prospectus are the property of their respective owners. Solely for convenience, the trademarks and trade names in this prospectus are referred to without the ®, © and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

PRESENTATION OF FINANCIAL INFORMATION

We publish our consolidated financial statements in Canadian dollars as of April 29, 2024. In this prospectus, unless otherwise specified, all references to “C$” and “CAD$” means Canadian dollars and all references to “$”and “dollars” mean United States dollars.

This prospectus includes our audited annual consolidated financial statements, or the “Financial Statements.” Our audited consolidated financial statements for the years ended December 31, 2023 and December 31, 2022 were prepared in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB, the independent, private-sector body that develops and approves IFRS, and Interpretations issued by the International Financial Reporting Interpretations Committee, or IFRIC. None of the financial statements were prepared in accordance with generally accepted accounting principles in the United States.

INDUSTRY AND MARKET DATA

This prospectus includes statistical, market and industry data and forecasts which we obtained from publicly available information and independent industry publications and reports that we believe to be reliable sources. These publicly available industry publications and reports generally state that they obtain their information from sources that they believe to be reliable. Although we are responsible for all of the disclosures contained in this prospectus, including such statistical, market and industry data, we have not independently verified any of the data from third-party sources, nor have we ascertained the underlying economic assumptions relied upon therein. In addition, while we believe the market opportunity information included in this prospectus is generally reliable and is based on reasonable assumptions, such data involves risks and uncertainties, including those discussed under the heading “Risk Factors.”

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

We have made statements in this prospectus, including under “Prospectus Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Our Business” and elsewhere that constitute forward-looking statements. Forward-looking statements involve risks and uncertainties, such as statements about our plans, objectives, expectations, assumptions or future events. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “we believe,” “we intend,” “may,” “should,” “will,” “could” and similar expressions denoting uncertainty or an action that may, will or is expected to occur in the future. These statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from any future results, performances or achievements expressed or implied by the forward-looking statements. Examples of forward-looking statements include, but are not limited to, statements about the following:

● our prospects, including our future business, revenues, expenses, net income, earnings per share, gross margins, profitability, cash flows, cash position, liquidity, financial condition and results of operations, backlog of orders and revenue, our targeted growth rate, our goals for future revenues and earnings, and our expectations about realizing the revenues in our backlog and in our sales pipeline;

● the potential impact of COVID-19 on our business and results of operations;

● the effects on our business, financial condition and results of operations of current and future economic, business, market and regulatory conditions, including the current economic and market conditions and their effects on our customers and their capital spending and ability to finance purchases of our products, services, technologies and systems;

● the effects of fluctuations in sales on our business, revenues, expenses, net income, earnings per share, margins, profitability, cash flows, capital expenditures, liquidity, financial condition and results of operations;

● our products, services, technologies and systems, including their quality and performance in absolute terms and as compared to competitive alternatives, their benefits to our customers and their ability to meet our customers’ requirements, and our ability to successfully develop and market new products, services, technologies and systems;

● our markets, including our market position and our market share;

● our ability to successfully develop, operate, grow and diversify our operations and businesses;

● our business plans, strategies, goals and objectives, and our ability to successfully achieve them;

● the sufficiency of our capital resources, including our cash and cash equivalents, funds generated from operations, availability of borrowings under our credit and financing arrangements and other capital resources, to meet our future working capital, capital expenditure, lease and debt service and business growth needs;

● the value of our assets and businesses, including the revenues, profits and cash flows they are capable of delivering in the future;

● the effects on our business operations, financial results, and prospects of business acquisitions, combinations, sales, alliances, ventures and other similar business transactions and relationships;

● industry trends and customer preferences and the demand for our products, services, technologies and systems; and

● the nature and intensity of our competition, and our ability to successfully compete in our markets.

These statements are necessarily subjective, are based upon our current plans, intentions, objectives, goals, strategies, beliefs, projections and expectations, and involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from any future results, performance or achievements described in or implied by such statements. Actual results may differ materially from expected results described in our forward-looking statements, including with respect to correct measurement and identification of factors affecting our business or the extent of their likely impact, the accuracy and completeness of the publicly-available information with respect to the factors upon which our business strategy is based, or the success of our business. Furthermore, industry forecasts are likely to be inaccurate, especially over long periods of time.

Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of whether, or the times by which, our performance or results may be achieved. Forward-looking statements are based on information available at the time those statements are made and management’s belief as of that time with respect to future events and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that may cause actual results, our performance or achievements, or industry results to differ materially from those contemplated by such forward-looking statements include, without limitation, those discussed under the caption “Risk Factors” in this prospectus as well as other risks and factors identified from time to time in our SEC filings.

PROSPECTUS SUMMARY

This summary highlights information that we present more fully in the rest of this prospectus. This summary does not contain all of the information you should consider before buying common shares in this offering. This summary contains forward-looking statements that involve risks and uncertainties, such as statements about our plans, objectives, expectations, assumptions or future events. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “we believe,” “we intend,” “may,” “should,” “will,” “could,” and similar expressions denoting uncertainty or an action that may, will or is expected to occur in the future. These statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from any future results, performances or achievements expressed or implied by the forward-looking statements. You should read the entire prospectus carefully, including the “Risk Factors” section and the financial statements and the notes to those statements.

Business Overview

We are focused on combating global health issues through diagnostic and therapeutic solutions by acquiring assets, technologies and/or businesses in the areas of life sciences and medical diagnostics. Currently, we are focused on the issue of antibiotic failure, which encompasses the widespread and deadly crises of sepsis and biofilm infections. Antibiotic failure occurs when an infection is not responsive to antibiotics. Per year, there are estimated to be over 49 million cases of sepsis and more than 11 million deaths due to sepsis1. Since the major front line treatment for sepsis is potent antibiotics, this high death rate represents antibiotic failure. Furthermore, severe COVID-19, caused by infection with a coronavirus (SARS-CoV-2), is severe sepsis and caused a further 6-18 million deaths to date. In the U.S., 65% of all infections are due to biofilms that are highly resistant to antibiotics, which is estimated to cost global health care $368 billion dollars annually.2

Sepsis and antibiotic resistant infections impose significant burdens on healthcare systems and create the need for new diagnostics and therapeutics. In 2020, the global sepsis diagnostic market was valued at $569.49 million and is projected to reach $1.2 billion by 2030, based on a compound annual growth rate (“CAGR”) of 7.8% from 2021 to 2030.3 Our therapeutic anti-biofilm products are directed at wound care, oral health care and sinusitis, which have global markets of $22.5 billion (CAGR 4.1%), 2.8 billion (CAGR 3.5%) and $33.7 billion (CAGR 6.4%) respectively.5 The global antibiotic market is $40.9 billion and has a CAGR of 3.7%.5

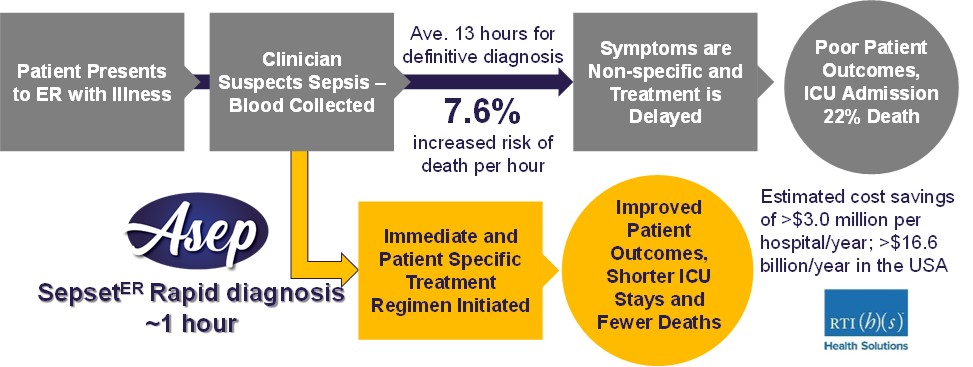

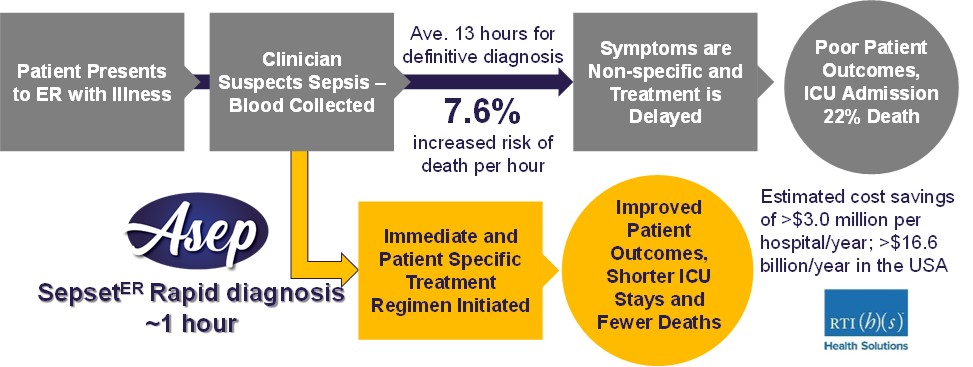

Our fight against sepsis and antibiotic failure has two fronts, diagnostic and therapeutic. Our diagnostic product consists of a novel assay that is intended to provide earlier, faster risk assessment/diagnosis to enable informed treatment of sepsis. Based on data from published clinical research studies with more than 700 patients our diagnostic technology is designed to detect sepsis based on whether a patient has unique molecular signatures of sepsis specific to their immune response instead of detecting the presence of a pathogen, and, as such, does not differentiate between bacterial and viral sepsis. Furthermore, although sepsis is the body’s response to an infection, not all patients with sepsis have an identifiable pathogen associated with sepsis development. Conventional sepsis diagnoses can take approximately 13 to 48 hours, but our technology has the potential to provide results in approximately 1 hour after a blood draw in the emergency room or intensive care unit. Our diagnostic technology has been developed using data acquired in a large clinical study performed by our founding scientists.

Our therapeutic product consists of patented pharmaceutical peptides that target presently untreatable biofilm infections and the associated pathology caused by inflammation. Currently, 65% of all infections are caused by biofilms and there are no approved drugs to fight them. Our technology involves small potent broad-spectrum anti-biofilm and anti-inflammatory peptides6. Our therapeutic products are directed against wound, oral and sinusitis biofilm infections. Our peptides have been optimized using a combination of conventional structure-activity relationship studies and artificial intelligence (AI) aided discovery. The AI studies have employed neural networks to relate structural descriptors, based on the primary sequences of the peptides, to activity, and predict the activities of computationally-generated peptide sequences6a. We are increasingly employing generative and explainable AI methods to generate further improved peptides. Proceeds from this offering will be applied to further develop therapeutic product candidates in these areas in addition to sepsis diagnostics.

Our peptides have not been shown to be safe and effective in humans. Statements related to safety and efficacy are within the sole authority of the FDA. Indeed, we have not performed human clinical studies to formally demonstrate a safety profile for our therapeutic candidates that is consistent with our animal model results, which are not pre-clinical studies and cannot support an investigational new drug (“IND”) application, and play no part in the regulatory approval process. Pre-clinical studies must be conducted to enable the Company to perform human clinical trials. Currently, we do not have any commercial products that compete in the markets for sepsis diagnostics and anti-infective therapeutics. Further, none of our products have yet been approved by the Food and Drug Administration or other regulators as safe and effective. Almost all funding obtained by the Company to date has gone towards product development and associated activities and thus represents a loss of $5,757,286 for the year ended December 31, 2022, and $2,343,563 for the period from January 20, 2021 (incorporation) to December 31, 2021; we anticipate that we will require future funding for these activities. As of the date of this prospectus, our auditor has included an explanatory paragraph in their opinion that accompanies our audited consolidated financial statements as of and for the year ended December 31, 2022, indicating that our current liquidity position raises substantial doubt about our ability to continue as a going concern. Please see “Risks Associated with Our Business” in this summary on page 6 and the section entitled “Risk Factors” for a description of the risks and limitations we may face.

1 Rudd, K.E., Johnson, S.C., Agesa, K.M., Shackelford, K.A., Tsoi, D., Kievlan, D.R., Colombara, D.V., Ikuta, K.S., Kissoon, N., Finfer, S., Fleischmann-Struzek, C (2020). Global, regional, and national sepsis incidence and mortality, 1990–2017: analysis for the Global Burden of Disease Study. The Lancet. 395(10219), 200-11.

2 Cámara et al. (2022) Economic significance of biofilms: a multidisciplinary and cross-sectoral challenge. NPJ Biofilms and Microbiomes 8:42.

3 https://www.globenewswire.com/news-release/2022/10/18/2536561/0/en/Global-Sepsis-Therapeutics-Market-to-Reach-435-9-Billion-by-2027.html

4 https://www.globenewswire.com/news-release/2022/10/18/2536561/0/en/Global-Sepsis-Therapeutics-Market-to-Reach-435-9-Billion-by-2027.html

5 https://www.globenewswire.com/en/news-release/2023/04/06/2642247/0/en/Antibiotics-Market-Size-58-4-Bn-by-2032-at-3-7-CAGR-Global-Analysis-by-Market-us.html; https://www.grandviewresearch.com/industry-analysis/wound-care-market; https://www.businessresearchinsights.com/market-reports/sinusitis-drugs-market-101686; https://www.grandviewresearch.com/industry-analysis/oral-care-market

6 Fuente-NúñezC, REW Hancock et al. 2014. Broad-spectrum anti-biofilm peptide that targets a cellular stress response. PLoS Pathogens 10(5):e1004152; Fuente-Núñez C, REW Hancock et al. 2015. D-enantiomeric peptides that eradicate wild-type and multi-drug resistant bacterial biofilms and protect against lethal Pseudomonas aeruginosa infections. Chem. Biol. 22:196–205; Pletzer, D., S.C. Mansour, and R.E.W. Hancock. 2018. Synergy between conventional antibiotics and anti-biofilm peptides in a murine,sub-cutaneous abscess model caused by recalcitrant ESKAPE pathogens. PLoS Pathogens 14(6):e1007084; Reffuveille F, C. REW Hancock et al. 2014. A broad-spectrum anti-biofilm peptide enhances antibiotic action against bacterial biofilms. Antimicrob. Agents Chemother. 58:5363-5371; Zhang, T., L.Xia, Z. Wang, R.E.W. Hancock, and M. Haapasalo. 2021. Recovery of oral in vitro biofilms after exposure to peptides and chlorhexidine. J. Endodontics 47:466-471; Alford, M.A., K.-Y.G. Choi, M.J. Trimble, H. Masoudi, P. Kalsi, D. Pletzer, R.E.W. Hancock. 2021. Murine models of sinusitis infection for screening antimicrobial and immunomodulatory therapies. Frontiers Cell. Infect. Microbiol. 11:621081; Wu, B.C., A.H. Lee, and R.E.W. Hancock. 2017. Mechanisms of the innate defense regulator peptide-1002 anti-inflammatory activity in a sterile inflammation mouse model. J. Immunol. 199:3592-3603.

6a. Cherkasov, A., K. Hilpert, H. Jenssen, C.D. Fjell, M. Waldbrook, S.C. Mullaly, R. Volkmer and R.E.W. Hancock. 2009. Use of artificial intelligence in the design of small peptide antibiotics effective against a broad spectrum of highly antibiotic resistant Superbugs. ACS Chemical Biol. 4:65-74.

Haney, E.F., Y. Brito-Sánchez, M.J. Trimble, S.C. Mansour, A. Cherkasov, and R.E.W. Hancock. 2018. Computer-aided discovery of peptides that specifically attack bacterial biofilms. Sci. Reports 8:1871 .

Company History and Development

On January 20, 2021, we were incorporated under the British Columbia Business Corporations Act (“BCBCA”) under the name Trenchant Life Sciences Investment Corp. On November 9, 2021, we changed our name to ASEP Medical Holdings Inc.

On November 22, 2021, we commenced trading on the Canadian Securities Exchange (“CSE”) as a life sciences issuer under the trading symbol “ASEP”. On April 19, 2022, we commenced trading on the OTCQB under the trading symbol “SEPSF”, although we currently trade on the OTC Pink. On November 10, 2022, we commenced trading on the Frankfurt Stock Exchange (“FSE”) under the trading symbol “FSX:JJ8”.

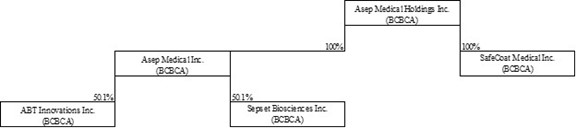

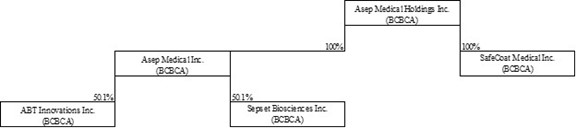

Since our inception in 2021, ASEP has been a committed innovator within the medical industry. We strive to mitigate the global crisis of antibiotic failure by improving patients’ odds of survival and quality of life. Currently, we are developing therapeutic and diagnostic products through two of our subsidiaries. As of the date of this prospectus, we have the following subsidiaries:

| | | Principal Activity | | Location | | Percentage | |

| Asep Medical Inc. | | Life Sciences | | British Columbia, Canada | | | 100 | % |

| ABT Innovations Inc. (“ABT”)# | | Life Sciences | | British Columbia, Canada | | | 50.1 | % |

| Sepset Biosciences Inc. (“Sepset”) | | Life Sciences | | British Columbia, Canada | | | 50.1 | % |

| SafeCoat Medical Inc. (“SafeCoat”)(1) | | Life Sciences | | British Columbia, Canada | | | 100 | % |

| OHP Innovations Inc. (“OHP”)* | | Life Sciences | | British Columbia, Canada | | | 100 | % |

(1) Pursuant to the Start-Up License Agreement (as defined herein), UBC and certain inventors will collectively own 12% of the total issued and outstanding common shares of SafeCoat following the issuance of the consideration shares. As at the date of this Registration Statement, the consideration shares have not yet been issued and ASEP owns 100% of SafeCoat. ASEP will own 88% of SafeCoat, with UBC and inventors receiving a total of 12% of shares as a requirement of the licensing agreement with UBC.

# Our subsidiary ABT owns 100% of ABT Peptides Inc, an inactive company incorporated in British Columbia, Canada.

* Our subsidiary OHP is inactive.

ABT Innovations Inc.

ABT was incorporated on July 3, 2015 pursuant to the provisions of the BCBCA under the name “ABT Innovations Inc.” for the purpose of ensuring the commercialization of the broad peptide technology developed by its founder, Dr. Robert E.W. Hancock. ABT’s peptide technology covers a broad range of therapeutic applications including bacterial biofilm infections. Bacterial biofilms are serious global health concern due to their abilities to shelter bacteria from antibiotics and host defense during infection. Therefore, biofilms contribute to persistent chronic infections; they play a significant role in human infections as diverse as medical device infections, chronic infections, lung, bladder, wound, dental, skin, ear-nose and throat, sinusitis, orthopedic, etc., representing two thirds of all infections.7 Our technology also includes anti-inflammatories, anti-infective immune-modulators and vaccine adjuvants.

Sepset Biosciences Inc.

Sepset was incorporated on April 23, 2015 pursuant to the provisions of the BCBCA under the name “Sepset Biosciences Inc.” for the purpose of ensuring the commercialization of a diagnostic kit for predicting the onset of severe sepsis and organ failure that was developed by its founder, Dr. Robert E.W. Hancock. The Sepset diagnostic technology involves a patient gene expression signature predictive of the development of severe sepsis and organ failure. The SepsetER test involves drawing a small amount of a patient’s blood and determining whether the patient presents with the sepsis markers in their gene expression profiles as assessed by nucleic acid amplification technologies. The SepsetER diagnostic technology differs from current diagnostic tests by enabling diagnosis of severe sepsis within 1-2 hours of first clinical presentation (i.e., in the emergency room), while other diagnostics only provide definitive diagnosis after 13-48 hours of first clinical presentation. We believe this will enable critical early decisions to be made by physicians regarding appropriate therapies leading to reduced overall morbidity and mortality due to sepsis.

SafeCoat Medical Inc.

On December 1, 2022, we entered into a definitive Earn-In and Option Agreement with SafeCoat Medical Inc. (“SafeCoat”) and the security holders of SafeCoat, whereby we acquired a 50.1% equity interest of SafeCoat and were granted the option to acquire the remaining common shares of SafeCoat from the securityholders, such that, subject to any future ownership interest of the University of British Columbia (“UBC”), we would own 100% of common shares of SafeCoat, free and clear of all liens. On December 12, 2022, we exercised the option and completed our 100% acquisition of SafeCoat. On July 31, 2023, ASEP, through SafeCoat, entered into an exclusive worldwide license agreement with UBC for the use, development and commercialization of medical device coating technology. Through this agreement, UBC and certain inventors of the technology will hold 12% of SafeCoat while ASEP will hold 88% following the issuance of the consideration shares. Pursuant to the Start-Up License Agreement (as defined herein), UBC and certain non-waiving inventors (namely Dr. Jayachandran Kizhakkedathu, Dr. Dirk Lange, Dr. Robert Hancock, and Dr. Kai Yu) will collectively own 12% (8% to UBC and 1% to each of the non-waiving inventors) of the total issued and outstanding common shares of SafeCoat following the issuance of the consideration shares. As at the date of this Registration Statement, the consideration shares have not yet been issued and ASEP owns 100% of SafeCoat. Following such issuance, ASEP will own 88% of SafeCoat, with UBC and the non-waiving inventors receiving a total of 12% of shares (as further described above) as a requirement of the licensing agreement with UBC.

SafeCoat’s technology provides coatings for medical devices that are non-fouling (i.e. do not readily bind live or dead bacteria) and are protected by a peptide coating that kills bacteria. This product addresses the definitive risk of infection of medical devices including prosthetics, implants, catheters and stents, etc. Indeed, over half of the nearly 2 million healthcare-associated infections in the U.S. annually can be attributed to indwelling medical devices.8

ASEP’s head office is located at 420 – 730 View Street, Victoria, BC V8W 3Y7 and its registered office is located at 800 – 885 West Georgia Street, Vancouver, BC V6C 3H1. Our main telephone number is 778-600-0509.

Emerging Growth Company Status

As a company with less than $1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or JOBS Act, enacted in April 2012, and may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| | ● | being permitted to present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations in our SEC filings; |

| | | |

| | ● | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act; |

| | | |

| | ● | reduced disclosure obligations regarding executive compensation in periodic reports, proxy statements and registration statements; and |

| | | |

| | ● | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval. |

7 Sharma, D., Misba, L. & Khan, A.U. 2019. Antibiotics versus biofilm: an emerging battleground in microbial communities. Antimicrob. Resist. Infect. Control 8, 76.

8 VanEpps J.S. & Younger J.G. 2016. Implantable device related infection. Shock. 46(6):597-608.

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the date of the first sale of our common equity securities pursuant to an effective registration statement under the Securities Act of 1933, as amended (the “Securities Act”). However, if certain events occur before the end of such five-year period, including if we become a “large accelerated filer,” our annual gross revenues exceed $1.235 billion or we issue more than $1.00 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company before the end of such five-year period.

In addition, Section 107 of the JOBS Act provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. We have elected to take advantage of the extended transition period for complying with new or revised accounting standards and acknowledge such election is irrevocable pursuant to Section 107 of the JOBS Act.

We have elected to take advantage of certain of the reduced disclosure obligations regarding executive compensation in this prospectus and, as long as we continue to qualify as an emerging growth company, we may elect to take advantage of this and other reduced burdens in future filings. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

Competitive Market Conditions

The pharmaceutical and biotechnology industries are intensely competitive. We compete directly and indirectly with other pharmaceutical companies, biotechnology companies and academic and research organizations in developing therapies to treat diseases and antibiotic resistance. There is no strong evidence that any of our competitors in the therapeutics space are developing products that work against a broad spectrum of bacterial biofilms or have conjoint anti-inflammatory activity. As for the sepsis diagnostics, our competitive edge lies in the timeframe required to identify patients who might develop severe sepsis as well as our ability to provide a binary (sepsis or not) risk assessment. As mentioned earlier, conventional sepsis diagnoses can take approximately 13 to 48 hours whereas SepsetER results should be available within approximately 1 hour.

Foreign Private Issuer Status

We are a “foreign private issuer,” as defined in Rule 405 under the Securities Act and Rule 3b-4(c) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As a result, we are not subject to the same requirements as U.S. domestic issuers. Under the Exchange Act, we will be subject to reporting obligations that, to some extent, are more lenient and less frequent than those of U.S. domestic reporting companies. For example, we will not be required to issue quarterly reports or proxy statements. We will not be required to disclose detailed individual executive compensation information. Furthermore, our directors and executive officers will not be required to report equity holdings under Section 16 of the Exchange Act and will not be subject to the insider short-swing profit disclosure and recovery regime.

As an exempted Canadian company to be listed on The Nasdaq Stock Market (“Nasdaq”), we will be subject to Nasdaq’s corporate governance listing standards. However, Nasdaq rules permit a foreign private issuer like us to follow the corporate governance practices of its home country. Certain corporate governance practices in Canada, which is our home country, may differ significantly from Nasdaq corporate governance listing standards.

Currently, as a Canadian company, we intend to rely on home country practice with respect to our corporate governance. A description of the significant ways in which our governance practices currently differ from those followed by domestic companies pursuant to the Rule 5600 series of the Nasdaq Stock Market Rules is set out below:

| ● | Quorum Requirement —Nasdaq Listing Rule 5620(c) provides that the minimum quorum requirement for a meeting of shareholders is 33 1/3 % of the outstanding common voting shares. We do not follow this Nasdaq Listing Rule. Instead, we follow our articles which provide that the quorum for the transaction of business at a meeting of shareholders is one or more persons, present in person or by proxy. |

| | |

| ● | Shareholder Approval Requirements —In certain instances, Nasdaq Listing Rule 5635 requires each issuer to obtain shareholder approval before an issuance of securities in connection with: (i) the acquisition of the stock or assets of another company; (ii) equity-based compensation of officers, directors, employees or consultants; and (iii) transactions other than public offerings. We do not follow this Nasdaq Listing Rule. Instead, we comply with the laws, rules and regulations of Canada and the Province of British Columbia and the policies of the Canadian Securities Exchange, which have different requirements for shareholder approval (including, in certain instances, not requiring any shareholder approval) in connection with issuances of securities in the circumstances listed above. |

Risks Associated with Our Business

Our ability to execute our business strategy is subject to numerous risks, as more fully described in the section captioned “Risk Factors” immediately following this prospectus summary. You should read these risks before you invest in our securities. In particular, risks associated with our business include, but are not limited to, the following:

| | ● | We have a relatively limited operating history and have not generated revenue to date and thus are subject to risks of business development and you have no basis on which to evaluate our ability to achieve our business objective. |

| | ● | Future acquisitions or strategic investments could disrupt our business and harm our business, results of operations or financial condition. |

| | ● | We will require additional funding for our growth plans, and such funding may result in a dilution of your investment. |

| | ● | We may not have sufficient capital to fund our ongoing operations, effectively pursue our strategy or sustain our growth initiatives. |

| | ● | If we fail to keep up with technological developments, our business, results of operations and financial condition may be materially and adversely affected. |

| | ● | If we cannot continue to develop, acquire, market and offer new products and services or enhancements to existing products and services that meet customer requirements, our operating results could suffer. |

| | ● | We could make significant investments in new products and services that may not achieve expected returns. |

| | ● | Changes in laws or regulations, or a failure to comply with any laws and regulations, may adversely affect our business, investments and results of operations. |

| | ● | Public health epidemics or outbreaks, such as COVID-19, could materially and adversely impact our business. |

THE OFFERING

| Units offered | | Up to [__] Units, based on an assumed initial public offering price of $[ ] per Unit, the midpoint of the initial public offering price range reflected on the cover page. Each Unit consists of one common share (or a Pre-Funded Warrant to purchase one common share in lieu thereof) and one common warrant. The common shares and Pre-Funded Warrants, if any, can each be purchased in this offering only with the accompanying common warrant, as part of a Unit, but the components of the Units are immediately separable and will be issued separately in this offering. |

| | | |

| Units, comprising Pre-Funded Warrants, offered by us in this offering | | We are offering to each purchaser whose purchase of Units consisting of common shares in this offering would result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common shares immediately following the consummation of this offering, the opportunity to purchase, if the purchaser so chooses, Units, that include Pre-Funded Warrants, in lieu of common shares. Subject to limited exceptions, a holder of a Pre-Funded Warrant will not have the right to exercise any portion of its Pre-Funded Warrant if the holder, together with its affiliates, would beneficially own in excess of 4.99% (or, at the election of the holder, 9.99%) of the number of common shares outstanding immediately after giving effect to such exercise. Each Pre-Funded Warrant will be exercisable for one common share. The purchase price of each Unit that includes a Pre-Funded Warrant will equal the price per Unit which comprises a common share and a common warrant, minus $0.0001, and the exercise price of each Pre-Funded Warrant will be $0.0001 per share. The Pre-Funded Warrants are immediately exercisable and may be exercised at any time until all the Pre-Funded Warrants are exercised in full. This offering also relates to the common shares issuable upon exercise of any Pre-Funded Warrants sold in this offering. For each Pre-Funded Warrant we sell, the number of common shares we are offering will be decreased on a one-for-one basis. See “Description of Securities” in this prospectus for more information. |

| | | |

| Common Warrants being offered by us | | Each Unit being offered includes one common share, or one Pre-Funded Warrant in lieu of one common share, and a common warrant. Each common warrant is exercisable at a price of $ per share, or pursuant to an alternate cashless exercise option. The common warrants will be immediately exercisable upon issuance and will expire five (5) years from the closing date of this offering. This prospectus also relates to the offering of the common shares issuable upon exercise of the common warrants. See “Description of Securities” in this prospectus for more information. |

| | | |

Over-allotment Option to purchase additional common shares from us | | We have granted the underwriter an option, exercisable for forty-five (45) days after the closing of this offering, to purchase up to an additional [__] common shares and/or Pre-Funded Warrants and [ ] common warrants (equal to fifteen percent (15%) of the total number of Units to be offered by us in this offering) on the same terms as the other Units being purchased by the underwriter from us. |

| | | |

| Common shares outstanding before this offering | | 76,059,147 common shares. |

| | | |

| Common shares outstanding after this offering | | [__] common shares (assuming no sale of any Pre-Funded Warrants and assuming none of the common warrants issued in this offering are exercised). |

| | | |

| Use of Proceeds | | We intend to use the proceeds from this offering for working capital and general corporate purpose. Additionally, we may use a portion of the net proceeds from this offering to acquire or invest in complementary products or assets. However, we have no current plans, commitments or obligations to do so. See “Use of Proceeds” for more information. |

| | | |

| Underwriter | | Aegis Capital Corp. |

| | | |

| Underwriter’s Warrants | | We have agreed to issue to Aegis warrants to purchase up to a total of [__] common shares (equal to five percent (5%) of the aggregate number of common shares included in the Units and issuable upon exercise of the Pre-Funded Warrants sold in this offering, excluding the exercise of the over-allotment option), which are exercisable at a price per share of [__] (equal to 125% of the offering price) during the four- year-and-six-month period commencing six months after the commencement of sales in the offering. |

| | | |

| Lockup Agreements | | Our executive officers, directors, employees and shareholders holding ten percent (10%) or more of our common shares prior to the offering, collectively, have agreed with the underwriter not to sell, transfer or dispose of any common shares or similar securities for a period of 90 days following the closing of this offering. |

| | | |

| Trading symbol | | We have applied for listing of our common shares on The Nasdaq Stock Market under the symbol “SEPS.” The offering will not proceed unless the Company is accepted for listing on Nasdaq. |

| | | |

Listing of Pre-Funded Warrants and common warrants | | We do not intend to list the Pre-Funded Warrants or the common warrants on any securities exchange or nationally recognized trading system. Without a trading market, the liquidity of the Pre-Funded Warrants and common warrants will be extremely limited. |

| | | |

| Risk Factors | | Investing in these securities involves a high degree of risk. As an investor, you should be able to bear a complete loss of your investment. You should carefully consider the information set forth in the “Risk Factors” section of this prospectus before deciding to invest in our common shares. |

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables summarize our historical financial data. The summary consolidated statements of operation for the year ended December 31, 2023 and the summary consolidated balance sheets as of December 31, 2023 have been derived from our consolidated financial statements included elsewhere in this prospectus. The following summary financial data should be read in conjunction with the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results that may be expected in the future.

The following table presents our summary consolidated statements of operation for the year ended December 31, 2023:

| | | For the year ended December 31, 2023 | |

| Revenue | | $ | 21,140 | |

| Total revenue | | | 21,140 | |

| Expenses | | | | |

| Amortization | | | 1,294,266 | |

| Board advisory fees | | | 230,673 | |

| Compensation | | | 782,301 | |

| Consulting | | | 514,478 | |

| General and administrative | | | 222,903 | |

| Investor relations | | | 1,110,409 | |

| Patent fees | | | 134,880 | |

| Professional fees | | | 760,006 | |

| Research and development costs | | | 678,543 | |

| Share-based compensation | | | 1,952,054 | |

| Transfer agent and filing fees | | | 61,890 | |

| Total expenses | | | 7,742,403 | |

| Operating loss | | | (7,721,263 | ) |

| Other income (expenses) | | | | |

| Borrowing costs | | | (270 | ) |

| Foreign exchange loss | | | (4,116 | ) |

| Loss on debt settlement | | | (429,864 | ) |

| SafeCoat Medical Inc. acquisition expense | | | (1,275,000 | ) |

| Net loss and comprehensive loss for period | | $ | (9,430,513 | ) |

| Net loss attributable to: | | | | |

| Shareholders of ASEP | | $ | (8,227,328 | ) |

| Non-controlling interest | | | (1,203,185 | ) |

| | | $ | (9,430,513 | ) |

| Loss per share – basic and fully diluted | | $ | (0.13 | ) |

| Weighted average number of common shares outstanding – basic and fully diluted | | | 62,235,372 | |

The following table presents our summary consolidated balance sheet data as of December 31, 2023:

| | | December 31, 2023 | |

| ASSETS | | | | |

| Current assets | | | | |

| Cash | | $ | 64,721 | |

| GST receivable | | | 25,423 | |

| Prepaids and deposits | | | 160,799 | |

| | | | 250,943 | |

| Non-current assets | | | | |

| Equipment | | | 37,183 | |

| Intangible assets | | | 27,949,560 | |

| Investment in Hunan Sanway Sepsmart Ltd. | | | 2,375,000 | |

| | | | 25,361,743 | |

| TOTAL ASSETS | | $ | 25,612,686 | |

| LIABILITIES | | | | |

| Current liabilities | | | | |

| Accounts payable and accrued liabilities | | $ | 677,731 | |

| Deferred revenue | | | 297,586 | |

| Loan payable | | | 20,270 | |

| | | | 995,587 | |

| Non-current liabilities | | | | |

| Deferred revenue | | | 2,056,274 | |

| TOTAL LIABILITIES | | | 3,051,861 | |

| EQUITY | | | | |

| Share capital | | | 24,045,616 | |

| Other components of equity | | | 3,550,141 | |

| Deficit | | | (14,983,767 | ) |

| Total equity attributable to ASEP shareholders | | | 12,611,990 | |

| Non-controlling interest | | | 9,948,835 | |

| TOTAL EQUITY | | | 22,560,825 | |

| TOTAL LIABILITIES AND EQUITY | | $ | 25,612,686 | |

RISK FACTORS

Investing in our securities is speculative and involves a high degree of risk. You should consider carefully the following risk factors, as well as the other information in this prospectus, including our consolidated financial statements and notes thereto, before you decide to purchase our securities. If any of the following risks actually occur, our business, financial condition, results of operations and prospects could be materially adversely affected, the value of our common shares could decline, and you may lose all or part of your investment. This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of a number of factors, including the risks described below. See “Cautionary Note Regarding Forward-Looking Statements.”

Risks Related to Our Business

If ABT or Sepset experience delays or difficulties in the enrollment of volunteers or patients in the clinical trials, receipt of necessary regulatory approvals could be delayed or prevented.

Clinical trials for treatment candidates require identification and enrollment of a large number of volunteers or eligible patients. ABT or Sepset may not be able to enroll sufficient volunteers or eligible patients to complete clinical trials in a timely manner or at all. Patient enrollment is a function of many factors, including the following: design of the protocol, size of the patient population, eligibility criteria for the study in question, perceived risks and benefits of the product under study, availability of competing therapies, efforts to facilitate timely enrollment in clinical trials, patient referral practices of physicians, and availability of clinical trial sites. If ABT or Sepset have difficulty enrolling sufficient volunteers or patients to conduct its clinical trials as planned, they may need to delay, forego or terminate ongoing clinical trials, which could have a material adverse effect on the Company’s financial condition or results of operations.

The commercialization of certain technology is dependent on the Hancock License Agreement and the UBC License Agreement.

The SepsetER technology is covered by two separate filed and issued patents. The first patent is owned by Dr. Robert E.W. Hancock together with other inventors. Dr. Robert E.W. Hancock is also one of three inventors for the technology underlying the second patent. However, the second patent has been assigned to UBC, who provided an exclusive license to Sepset. Sepset has been granted an exclusive and worldwide license for the use and sublicense of the Sepset technology as well as any improvements, variations, updates, modifications, and enhancements made and/or acquired thereon, and to manufacture, have made, distribute and sell products made from or based upon the Sepset technology pursuant to the terms of the Hancock License Agreement. In the event the Hancock License Agreement is terminated prior to the expiration of its term, the ability of Sepset to achieve its stated business objectives and milestones would be severely impacted.

UBC has licensed to ABT pursuant to the terms and conditions of the University of British Columbia License Agreement the patents found in “Business- Intellectual Property- ABT Innovations Inc” of this prospectus. UBC may, at its option, immediately terminate the UBC License Agreement by giving notice to ABT under certain circumstances, including insolvency, breach of contract, winding up, liquidation or other termination of the existence of ABT. Either party may terminate this Agreement for any breach which is not remedied after proving notice to the party in breach. In the event the UBC License Agreement is terminated prior to the expiration of its term, the ability of ABT to achieve its stated business objectives and milestones could be impacted.

Probable lack of business diversification.

Because the Company will be focused on developing its business ancillary to the life sciences industry, and potentially directly in the life sciences industry, the prospects for the Company’s success will be dependent upon the future performance and market acceptance of the Company’s intended products, processes, and services. Unlike certain entities that have the resources to develop and explore numerous product lines, operating in multiple industries or multiple areas of a single industry, the Company does not anticipate the ability to immediately diversify or benefit from the possible spreading of risks or offsetting of losses. Again, the prospects for the Company’s success may become dependent upon the development or market acceptance of a very limited number of products, processes or services.

The Company’s officers and directors may be engaged in a range of business activities that could result in conflicts of interest.

Certain of the directors and officers of the Company may also serve as directors and/or officers of other companies involved in the industries in which the Company may operate and consequently there exists the possibility for such directors and officers to be in a position of conflict. For example, Dr. Hancock currently holds a position as a faculty member at UBC, where he runs a research and development laboratory. Additionally, Dr. Hancock holds 23% of ABT, 31.5% of Sepset and holds several other positions with other life sciences companies. Dr. Hancock is one of the non-waiving University of British Columbia (UBC) inventors of the technology in-licensed by SafeCoat Medical. He was not involved in any of the discussions regarding the licencing. However, as a result of his involvement as an inventor, he will receive one quarter of the inventor’s shares, representing 12.5% of the SafeCoat shares to be issued to UBC and Inventors. He will receive 1.5% of total SafeCoat shares. Any decision made by any of such directors and officers will be made in accordance with their duties and obligations to deal fairly and in good faith with a view to the best interests of the Company and its shareholders. In addition, each director is required to declare and refrain from voting on any matter in which such director may have a conflict of interest in accordance with the procedures set forth in applicable laws.

Competition.

An increase in other companies competing in the industry could limit the ability of the Company’s potential of expanding its operations. Current and new competitors may have better capitalization, a longer operating history, more expertise and able to develop higher quality equipment or products, at the same or a lower cost. The Company will not be able to provide assurances that we will be able to compete successfully against current and future competitors. Competitive pressures that the Company may face could have a material adverse effect on our business, operating results and financial condition.

Risks Related to Government Regulation

If the Company fails to comply with extensive regulations of United States and foreign regulatory agencies, the commercialization of our products could be delayed or prevented entirely.

The Company’s future product candidates and research and development activities are subject to extensive government regulations related to its development, testing, manufacturing and commercialization in the United States and other countries. The determination of when and whether a product is ready for large-scale purchase and potential use in the United States will be made by the United States government through consultation with a number of governmental agencies, including the Food and Drug Administration (“FDA”), the National Institutes of Health and the Centers for Disease Control and Prevention. The Company’s products have not received regulatory approval from the FDA, or any foreign regulatory agencies, to be commercially marketed and sold. The process of obtaining and complying with FDA and other governmental regulatory approvals and regulations in the United States and in foreign countries is costly, time consuming, uncertain and subject to unanticipated delays. Obtaining such regulatory approvals, if any, can take several years. Despite the time and expense exerted, regulatory approval is never guaranteed. The Company is also subject to the following risks and obligations, among others:

| | ● | the FDA (and/or other competent regulatory agency, as applicable) may refuse to approve an application if it believes that applicable regulatory criteria are not satisfied; |

| | | |

| | ● | the FDA (and/or other regulatory authority) may require additional testing for safety and effectiveness; |

| | | |

| | ● | the FDA (and/or other regulatory authority) may not agree with the Company’s interpretation of data from pre-clinical testing and clinical trials; |

| | | |

| | ● | if regulatory approval of a product is granted, the approval may be limited to specific indications or limited with respect to its distribution; and |

| | | |

| | ● | the FDA (and/or other regulatory authority) may change its approval policies and/or adopt new regulations. |

Failure to comply with these or other regulatory requirements may subject the Company to administrative or judicially imposed sanctions, including:

| | ● | warning letters, untitled letters or other written notice of violations; |

| | | |

| | ● | civil penalties; |

| | | |

| | ● | criminal penalties; |

| | | |

| | ● | injunctions; |

| | | |

| | ● | product seizure or detention; |

| | | |

| | ● | product recalls; and |

| | | |

| | ● | total or partial suspension of productions. |

Obtaining and maintaining regulatory approval of our product candidates in one jurisdiction does not mean that we will be successful in obtaining regulatory approval of our product candidates in other jurisdictions.

Obtaining and maintaining regulatory approval of our product candidates in one jurisdiction does not guarantee that we will be able to obtain or maintain regulatory approval in any other jurisdiction, but a failure or delay in obtaining regulatory approval in one jurisdiction may have a negative effect on the regulatory approval process in others. For example, even if the FDA grants marketing approval of a product candidate, comparable regulatory authorities in other jurisdictions must also approve the manufacturing, marketing and promotion of the product candidate in those countries. Approval procedures vary among jurisdictions and can involve requirements and administrative review periods different from those in the United States, including additional preclinical studies or clinical trials as clinical trials conducted in one jurisdiction may not be accepted by regulatory authorities in other jurisdictions. In many jurisdictions outside the United States, a product candidate must be approved for reimbursement before it can be approved for sale in that jurisdiction. In some cases, the price that we intend to charge for our products is also subject to approval.

Obtaining foreign regulatory approvals and compliance with foreign regulatory requirements could result in significant delays, difficulties and costs for us and could delay or prevent the introduction of our products in certain countries. If we fail to comply with the regulatory requirements in international markets and/or to receive applicable marketing approvals, our future target market could be reduced and our ability to realize the full market potential of our future product candidates could be harmed.

If the Company fails to comply with laws and regulations, it could be subject to regulatory actions, which could affect its ability to develop, market and sell its product candidates and any other future product candidates and may harm its reputation.

If the Company fails to comply with applicable federal, state or foreign laws or regulations, the Company could be subject to regulatory actions, which could affect its ability to successfully develop, market and sell any future product candidates under development and could harm its reputation and lead to reduced or non-acceptance of its proposed product candidates by the market. Technical recommendations or evidence provided by the FDA through letters, site visits, and overall recommendations to academia or biotechnology companies may also make the manufacturing of a clinical product extremely labor intensive or expensive, making the product candidate no longer viable to manufacture in a cost-efficient manner. The mode of administration or the required testing of the product candidate may make that candidate no longer commercially viable. The FDA, or a clinical trial site’s Institutional Review Board or Institutional Biosafety Committee, may not agree with the proposed clinical trials, which may delay or make impossible the clinical testing of a product candidate. For example, the Institutional Review Board for a clinical trial may request to stop a trial or deem a product candidate unsafe to continue testing. This would have a material adverse effect on the value of the product candidate and the Company’s business, results of operations and financial condition.

United States legislative or FDA regulatory reforms may make it more difficult and costly for the Company to obtain regulatory approval of its product candidates and to manufacture, market and distribute its products after approval is obtained.

From time to time, legislation is drafted and implemented that could significantly change the statutory provisions governing the regulatory approval, manufacture and marketing of regulated products or the reimbursement thereof. In addition, FDA regulations and guidance are often revised or reinterpreted by the FDA in ways that may significantly affect the Company’s business and its products. Any new regulations or revisions or reinterpretations of existing regulations may impose additional costs or lengthen review times of future products or impose changes on other products already on the market. It is impossible to predict whether legislative changes will be enacted, or FDA regulations, guidance or interpretations will be changed, and what the impact of such changes, if any, may be on the Company’s new product development efforts.

Current and future legislation may increase the difficulty and cost of commercializing our drug candidates and may affect the prices we may obtain if our drug candidates are approved for commercialization.

In the U.S. and some foreign jurisdictions, there have been a number of adopted and proposed legislative and regulatory changes regarding the healthcare system that could prevent or delay regulatory approval of our drug candidates, restrict or regulate post-marketing activities and affect our ability to profitably sell any of our drug candidates for which we obtain regulatory approval.

In the U.S., the Medicare Prescription Drug, Improvement, and Modernization Act of 2003, or the MMA, changed the way Medicare covers and pays for pharmaceutical products. Cost reduction initiatives and other provisions of this legislation could limit the coverage and reimbursement rate that we receive for any of our future approved products. While the MMA only applies to drug benefits for Medicare beneficiaries, private payors often follow Medicare coverage policy and payment limitations in setting their own reimbursement rates. Therefore, any reduction in reimbursement that results from the MMA may result in a similar reduction in payments from private payors.

In March 2010, the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act of 2010, collectively the PPACA, was enacted. The PPACA was intended to broaden access to health insurance, reduce or constrain the growth of healthcare spending, enhance remedies against healthcare fraud and abuse, add new transparency requirements for healthcare and health insurance industries, impose new taxes and fees on the health industry and impose additional health policy reforms. The PPACA increased manufacturers’ rebate liability under the Medicaid Drug Rebate Program by increasing the minimum rebate amount for both branded and generic drugs and revised the definition of “average manufacturer price,” or AMP, which may also increase the amount of Medicaid drug rebates manufacturers are required to pay to states. The legislation also expanded Medicaid drug rebates and created an alternative rebate formula for certain new formulations of certain existing products that is intended to increase the rebates due on those drugs. The Centers for Medicare & Medicaid Services, or CMS, which administers the Medicaid Drug Rebate Program, also has proposed to expand Medicaid rebates to the utilization that occurs in the territories of the U.S., such as Puerto Rico and the Virgin Islands. Further, beginning in 2011, the PPACA imposed a significant annual fee on companies that manufacture or import branded prescription drug products and required manufacturers to provide a discount, equal to 70% off, effective as of 2019, the negotiated price of prescriptions filled by beneficiaries in the Medicare Part D coverage gap, referred to as the “donut hole.” Legislative and regulatory proposals have been introduced at both the state and federal level to expand post-approval requirements and restrict sales and promotional activities for pharmaceutical products.

Moreover, payment methodologies may be subject to changes in healthcare legislation and regulatory initiatives. For example, CMS may develop new payment and delivery models, such as bundled payment models. In addition, recently there has been heightened governmental scrutiny over the manner in which manufacturers set prices for their marketed products, which has resulted in several U.S. Congressional inquiries and proposed and enacted federal and state legislation designed to, among other things, bring more transparency to drug pricing, reduce the cost of prescription drugs under government payor programs, and review the relationship between pricing and manufacturer patient programs. We also expect that additional U.S. federal healthcare reform measures will be adopted in the future, any of which could limit the amounts that the U.S. federal government will pay for healthcare products and services, which could result in reduced demand for our future drug candidates, if approved for commercialization.

In Europe, the United Kingdom withdrew from the European Union on January 31, 2020, and entered into a transition period that expired on December 31, 2020. A significant portion of the previous regulatory framework in the United Kingdom was derived from the regulations of the European Union. In 2021, the United Kingdom’s Medicines and Healthcare products Regulatory Agency, or MHRA, and the European Medicines Agency, or EMA, released guidance explaining the new regulatory framework. We cannot predict the consequences or impact that the new regulatory framework would have on our future operations, if any, in these jurisdictions.

In addition, on August 16, 2022, President Biden signed into law the Inflation Reduction Act of 2022, which, among other things, includes policies that are designed to have a direct impact on drug prices and reduce drug spending by the federal government, which shall take effect in 2023. Under the Inflation Reduction Act, Congress authorized Medicare beginning in 2026 to negotiate lower prices for certain costly single-source drug and biologic products that do not have competing generics or biosimilars. This provision is limited in terms of the number of pharmaceuticals whose prices can be negotiated in any given year and it only applies to drug products that have been approved for at least 9 years and biologics that have been licensed for 13 years. Drugs and biologics that have been approved for a single rare disease or condition are categorically excluded from price negotiation. Further, the new legislation provides that if pharmaceutical companies raise prices in Medicare faster than the rate of inflation, they must pay rebates back to the government for the difference. The new law also caps Medicare out-of-pocket drug costs at an estimated $4,000 a year in 2024 and, thereafter beginning in 2025, at $2,000 a year.

Our future clinical trials may fail to demonstrate substantial evidence of the safety and effectiveness of future product candidates that we may identify and pursue, which would prevent, delay or limit the scope of regulatory approval and commercialization.

In the United States, we would be able to begin marketing a product after we receive approval from the FDA, or, in any foreign countries, when we receive the requisite approval from those countries. Before obtaining regulatory approvals for the commercial sale of any product candidate for a target indication, we must demonstrate with evidence gathered in preclinical and well-controlled clinical trials, and, with respect to approval in the United States, to the satisfaction of the FDA and, with respect to approval in other countries, similar regulatory authorities in those countries, that the product candidate is safe and effective for use for that target indication and that the manufacturing facilities, processes and controls are adequate. Our failure to adequately demonstrate the safety and effectiveness of any of our products or product candidates for the treatment of particular diseases may delay or prevent our receipt of the FDA’s and foreign regulatory authorities’ approval and, ultimately, may prevent commercialization of our products and product candidates for those diseases. The FDA and foreign regulatory authorities have substantial discretion in deciding whether, based on the benefits and risks in a particular disease, any of our products or product candidates should be granted approval for the treatment of that particular disease. Even if we believe that a clinical trial or trials has demonstrated the safety and statistically significant efficacy of any of our products or product candidates for the treatment of a disease, the results may not be satisfactory to the FDA or foreign regulatory authorities. Preclinical and clinical data can be interpreted by the FDA and foreign regulatory authorities in different ways, which could delay, limit or prevent regulatory approval.

Additionally, clinical testing is expensive and can take many years to complete, and its outcome is inherently uncertain. Most product candidates that begin clinical trials are never approved by regulatory authorities for commercialization. We have limited experience in designing clinical trials and may be unable to design and execute a clinical trial to support marketing approval.