As filed with the Securities and Exchange Commission on June 3, 2024

Registration No. 333-275956

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM F-1/A

Amendment No. 6

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ENERGYS GROUP LIMITED

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

| Cayman Islands | 1731 | Not Applicable | ||

(State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

Franklyn House, Daux Road

Billingshurst, West Sussex

RH149SJ

United Kingdom

Telephone: +44 1403 786212

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, New York 10168

800-221-0102

(Telephone, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Henry F. Schlueter, Esq. Celia Velletri, Esq. Schlueter & Associates, P.C. 5655 South Yosemite Street, Suite 350 Greenwood Village, CO 80111 Telephone: (303) 292-3883 | Ross D. Carmel, Esq. Barry P. Biggar, Esq. Sichenzia Ross Ference Carmel LLP 1185 Avenue of the Americas, 31st Floor New York, NY 10036 Telephone: (212) 930-9700 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The term new or revised financial accounting standard refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement contains two prospectuses, as set forth below.

| ● | Public Offering Prospectus. A prospectus to be used for the initial public offering of 2,250,000 Ordinary Shares (the “Ordinary Shares”) of the Registrant (the “Public Offering Prospectus”) through the underwriters named in the Underwriting section of the Public Offering Prospectus. | |

| ● | Resale Prospectus. A prospectus to be used for the potential resale by the selling shareholders (collectively, the “Selling Shareholders”) of 2,000,000 Ordinary Shares of the Registrant held by them, collectively, that are not being sold pursuant to the Public Offering Prospectus (the “Resale Prospectus”). |

The Resale Prospectus is substantively identical to the Public Offering Prospectus, except for the following principal points:

| ● | they contain different front covers; | |

| ● | all references in the Public Offering Prospectus to “this offering” will be changed to “the IPO,” defined as the underwritten initial public offering of our Ordinary Shares, in the Resale Prospectus; | |

| ● | all references in the Public Offering Prospectus to “underwriters” will be changed to “underwriters of the IPO” in the Resale Prospectus; | |

| ● | they contain different “Use of Proceeds” sections; | |

| ● | the Resale Prospectus contains a “Selling Shareholders” section; | |

| ● | they contain different “Summary — The Offering” sections; | |

| ● | the section “Shares Eligible For Future Sale — Selling Shareholders Resale Prospectus” from the Public Offering Prospectus is deleted from the Resale Prospectus; | |

| ● | the Underwriting section from the Public Offering Prospectus is deleted from the Resale Prospectus and a Plan of Distribution section is inserted in its place; | |

| ● | the Legal Matters section in the Resale Prospectus deletes the reference to counsel for the underwriters; and | |

| ● | they contain different back covers. |

The Registrant has included in this Registration Statement a set of alternate pages after the back cover page of the Public Offering Prospectus (the “Alternate Pages”) to reflect the foregoing differences in the Resale Prospectus as compared to the Public Offering Prospectus. The Public Offering Prospectus will exclude the Alternate Pages and will be used for the public offering by the Registrant. The Resale Prospectus will be substantively identical to the Public Offering Prospectus except for the addition or substitution of the Alternate Pages and will be used for the resale offering by the Selling Shareholders of an aggregate 2,000,000 Ordinary Shares owned of record by them that are not being sold pursuant to the Public Offering Prospectus.

The information in this prospectus is not complete and may be changed or supplemented. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

Subject to Completion, dated June 3, 2024

PRELIMINARY PROSPECTUS

Energys Group Limited

2,250,000 Ordinary Shares

This is an initial public offering of our ordinary shares, US$0.0001 par value per share (the “Ordinary Shares”). We are offering on a firm commitment basis 2,250,000 Ordinary Shares. We anticipate that the initial public offering price of the Ordinary Shares will be in the range of US$4.50 and US$6.50 per Ordinary Share.

Prior to this offering, there has been no public market for our Ordinary Shares. We have applied for listing of our Ordinary Shares on the Nasdaq Capital Market under the symbol “ENGS”. This offering is contingent upon the listing of our Ordinary Shares on the Nasdaq Capital Market or another national securities exchange. There can be no assurance that we will be successful in listing our Ordinary Shares on the Nasdaq Capital Market or another national securities exchange.

In addition to the 2,250,000 Ordinary Shares being offered hereby, we have registered for resale 2,000,000 currently outstanding Ordinary Shares (the “Resale Shares”) that may be sold from time to time by the Selling Shareholders. Those 2,000,000 Ordinary Shares are not a part of this offering. The Selling Shareholders may offer Resale Shares for sale concurrently with this offering or at any time, or from time to time, thereafter. Any sales of Resale Shares by the Selling Shareholders until our Ordinary Shares are listed or quoted on an established public trading market will take place at a price per share that is equal to the initial public offering price of the Ordinary Shares we are selling in our initial public offering. Thereafter, any sales will occur at prevailing market prices or at privately negotiated prices.

Investing in our Ordinary Shares involves a high degree of risk, including the risk of losing your entire investment. See “Risk Factors” beginning on page 12 to read about factors you should consider before buying our Ordinary Shares.

Energys Group Limited is a holding company incorporated on July 5, 2022 in the Cayman Islands with no material operations of its own. We hold a 100% equity interest in Energys Group Holding Limited, incorporated on June 29, 2017 under the laws of the British Virgin Islands. EGHL is a holding company and holds 100% of the equity interest in our Operating Subsidiaries. As a holding company with no material operations of our own, our end-to-end customized lighting solutions were developed and are provided through our Operating Subsidiaries. Investors in this offering will not directly hold any equity interests in the Operating Subsidiaries.

We are an “Emerging Growth Company” and a “Foreign Private Issuer” under applicable U.S. federal securities laws and, as such, are eligible for reduced public company reporting requirements. Please see “Implications of Being an Emerging Growth Company” and “Implications of Being a Foreign Private Issuer” on page 8 of this prospectus for more information.

Upon completion of this offering, our issued and outstanding shares will consist of 14,250,000 Ordinary Shares, assuming the underwriters do not exercise their over-allotment option to purchase additional Ordinary Shares, or 14,587,500 Ordinary Shares, assuming the over-allotment option is exercised in full, and 2,575,250 shares of Series A convertible preferred stock (“Preferred Shares”). We will be a controlled company as defined under Rule 5615(c) of the Listing Rules of the Nasdaq Stock Market because, immediately after the completion of this offering, Moonglade Investment Limited (“Moonglade”), a holding company organized under the laws of the British Virgin Islands, which holds 80.4% of our Ordinary Shares prior to this offering and 4.2% of our issued and outstanding Preferred Shares, will hold 58.0% of the total voting power, assuming that the underwriters do not exercise their over-allotment option, or 56.9% of the total voting power, assuming that the over-allotment option is exercised in full. See “Prospectus Summary - Implications of Being a Controlled Company,” on page 8 of this prospectus.

Neither the United States Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total(4)(5) | |||||||

| Initial public offering price(1) | US$ | 5.50 | US$ | 12,375,000 | ||||

| Underwriting discounts and commissions(2) | US$ | 0.399 | US$ | 897,188 | ||||

| Proceeds to the Company before expenses(3) | US$ | 5.101 | US$ | 11,477,812 | ||||

(1) Initial public offering price per share is assumed to be US$5.50, being the mid-point of the initial public offering price range.

(2) We have agreed to pay the underwriters a discount equal to 7.25% of the gross proceeds of the offering. This table does not include a non-accountable expense allowance equal to 1.5% of the gross proceeds of this offering payable to the underwriters. For a description of the other compensation to be received by the underwriters, see “Underwriting” beginning on page 136.

(3) Excludes fees and expenses payable to the underwriters and other expenses of this offering. The total amount of underwriters’ expenses related to this offering is set forth in the section titled “Expenses Related to This Offering” on page 130.

(4) Assumes that the underwriters do not exercise any portion of their over-allotment option.

We have granted the underwriters an option, exercisable from time to time in whole or in part, to purchase up to 337,500 additional Ordinary Shares from us at the initial public offering price, less underwriting discounts and commissions, within 45 days from the date of this prospectus to cover over-allotments, if any. If the underwriters exercise the option in full, the total underwriting discounts payable will be US$1,031,766 and the total proceeds to us, before expenses, will be US$13,199,484.

If we complete this offering, net proceeds will be delivered to us on the closing date.

The underwriters expect to deliver the Ordinary Shares to the purchasers against payment on or about [●], 2024.

You should not assume that the information contained in the registration statement of which this prospectus is a part is accurate as of any date other than the date hereof, regardless of the time of delivery of this prospectus or of any sale of the Ordinary Shares being registered in the registration statement of which this prospectus is a part.

No dealer, salesperson or any other person is authorized to give any information or make any representations in connection with this offering other than those contained in this prospectus and, if given or made, the information or representations must not be relied upon as having been authorized by us. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any security other than the securities offered by this prospectus, or an offer to sell or a solicitation of an offer to buy any securities by anyone in any jurisdiction in which the offer or solicitation is not authorized or is unlawful.

Joseph Stone Capital, LLC

The date of this prospectus is [●], 2024.

TABLE OF CONTENTS

Until ______, 2024 (the 25th day after the date of this prospectus), all dealers that effect transactions in these Ordinary Shares, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as an underwriter and with respect to their unsold allotments or subscriptions.

| i |

Neither we nor any of the underwriters have authorized anyone to provide you with any information or to make any representations other than as contained in this prospectus or in any related free writing prospectus. Neither we nor the underwriters take responsibility for, or provide any assurance about the reliability of, any information that others may give you. This prospectus is an offer to sell only the securities offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the securities. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the Ordinary Shares and the distribution of this prospectus outside the United States.

PRESENTATION OF FINANCIAL INFORMATION

Basis of Presentation

Unless otherwise indicated, all financial information contained in this prospectus is prepared and presented in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP” or “GAAP”).

Certain amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Accordingly, amounts, percentages and other figures shown as totals in certain tables or charts may not be the arithmetic aggregation of those that precede them, and amounts and figures expressed as percentages in the text may not total 100% or, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

For the purpose of undertaking a public offering of its Ordinary Shares, effective February 23, 2023, the Company engaged in a reorganization pursuant to which the shareholders of EGHL transferred all of their EGHL shares, constituting 100% of its issued and outstanding shares, to the Company in exchange for the issuance by the Company of 12,000,000 Ordinary Shares to the Company’s current shareholders. Per share financial data contained in this prospectus has been retroactively restated to the beginning of the first financial period presented herein to reflect this transaction.

Exchange Rate Information

Our main operations and head office are located in the United Kingdom, and our revenues are primarily denominated in GBP. The Company uses GBP as its reporting currency. The functional currency of the Company and its subsidiaries incorporated in the Cayman Islands and British Virgin Islands is the US dollar (“US$”). The functional currency of the Company’s United Kingdom subsidiaries is the GBP, and the functional currency of its Hong Kong subsidiaries is the Hong Kong dollar (“HK$”). Capital accounts in our financial statements are translated into U.S. dollars from GBP at their historical exchange rates when the capital transactions occurred. Unless otherwise noted, all translations from GBP to U.S. dollars and from U.S. dollars to GBP in this prospectus were calculated at the noon buying rate of US$1 = GBP0.7847 on December 31, 2023, US$1 = GBP0.7868 on June 30, 2023 and US$1 = GBP0.8222 on June 30, 2022 as published in H.10 statistical release of the Board of Governors of the Federal Reserve System. The Company makes no representation that the GBP or U.S. dollar amounts referred to in this prospectus could have been or could be converted into U.S. dollars or GBP, as the case may be, at any particular rate or at all.

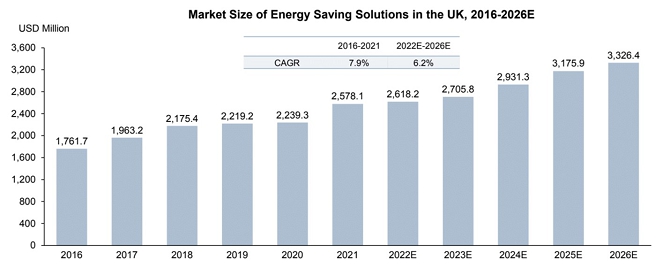

Certain market data and forecasts used throughout this prospectus were obtained from internal company surveys, market research, consultant surveys, reports of governmental and international agencies and industry publications and surveys, including the Report of Frost & Sullivan, a third-party global research organization commissioned by the Company. Industry publications and third-party research, surveys and reports generally indicate that their information has been obtained from sources believed to be reliable. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that relate to our current expectations and views of future events. These forward-looking statements are contained principally in the sections entitled “Prospectus Summary,” “Risk Factors,” “Use of Proceeds,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Industry Review” and “Business.” These statements relate to events that involve known and unknown risks, uncertainties and other factors, including those listed under “Risk Factors,” which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

| ii |

In some cases, these forward-looking statements can be identified by words or phrases such as “believe,” “plan,” “expect,” “intend,” “should,” “seek,” “estimate,” “will,” “aim” and “anticipate” or other similar expressions, but these are not the exclusive means of identifying such statements. All statements other than statements of historical facts included in this document, including those regarding future financial position and results, business strategy, plans and objectives of management for future operations (including development plans and dividends) and statements on future industry growth are forward-looking statements. In addition, we and our representatives may from time to time make other oral or written statements which are forward-looking statements, including in our periodic reports that we will file with the SEC, other information sent to our shareholders and other written materials.

These forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual outcomes may differ materially from the information contained in the forward-looking statements as a result of a number of factors, including, without limitation, the risk factors set forth in “Risk Factors” and the following:

| ● | the deterioration of market conditions, including our dependence on customers’ capital budgets for sales of our energy-saving products and services, and adverse impacts on costs and the demand for our energy-saving products as a result of factors; | |

| ● | our ability to manage general economic, business and geopolitical conditions; | |

| ● | our ability to successfully launch, manage and maintain our refocused business strategy to successfully bring to market new and innovative energy-saving products and service offerings; | |

| ● | price fluctuations (including as a result of tariffs), shortages or interruptions of component supplies and raw materials used to manufacture our products; | |

| ● | the availability of additional debt financing and/or equity capital to pursue our evolving strategy and sustain our growth initiatives; | |

| ● | our risk of potential loss related to single or focused exposure within our current customer base and product offerings; | |

| ● | our ability to manage our inventory and avoid inventory obsolescence in a rapidly evolving LED market; | |

| ● | our reliance on third parties for the manufacture of product components, as well as the provision of certain services; | |

| ● | our increasing emphasis on selling more of our products through third-party distributors and sales agents, including our ability to attract and retain effective third-party distributors and sales agents to execute our sales model; | |

| ● | the reduction or elimination of investments in, or incentives to adopt, LED lighting or the elimination of, or changes in, policies, incentives or rebates in certain jurisdictions that encourage the use of LEDs over some traditional lighting technologies; | |

| ● | our failure to comply with the covenants in any of our or our Operating Subsidiaries’ credit or loan agreements; | |

| ● | the cost to comply with, and the effects of, any current and future industry and government regulations, laws and policies; and | |

| ● | potential warranty claims in excess of our reserve estimates, including legal, regulatory and other proceedings arising out of our operations. |

The forward-looking statements made in this prospectus relate only to events or information as of the date on which the statements are made in this prospectus. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this prospectus and the documents that we reference in this prospectus and have filed as exhibits to the registration statement, of which this prospectus is a part, completely and with the understanding that our actual future results or performance may be materially different from what we expect.

This prospectus contains certain data and information that we obtained from various research and other publications. Statistical data in these publications also include projections based on a number of assumptions. The markets for LED products and associated products and software technology may not grow at the rate projected by such market data, or at all. Failure of our industry to grow at the projected rate may have a material and adverse effect on our business and the market price of our Ordinary Shares. Furthermore, if any one or more of the assumptions underlying the market data are later found to be incorrect, actual results may differ from the projections based on these assumptions. You should not place undue reliance on these forward-looking statements.

| iii |

“AGL” means Advance Gallant Limited, a private company established under the laws of Hong Kong.

“AI” means artificial intelligence, or the capacity of computers and other machines to exhibit or simulate intelligent behavior.

“BRE” means the “Building Research Establishment,” a profit-for-purpose organization that provides independent research to create products, standards and qualifications for efficient and sustainable buildings, homes and communities in the United Kingdom.

“BUS” means the Boiler Upgrade Scheme.

“Business Day” means a day (other than a Saturday, Sunday or public holiday in the U.S.) on which licensed banks in the U.S. are generally open for normal business to the public.

“China” or the “PRC” means the People’s Republic of China.

“Climate Change Act 2008” means the regulatory measure enacted by the government of the United Kingdom that set 2050 as the target date for the United Kingdom to reach an 80% reduction (amended in 2019 to 100%) in its net emissions of carbon dioxide and other greenhouse gases as compared to 1990 levels, thereby reducing the UK’s impact on the environment as well as requiring preparation for climate change risks.

“CLL” means China Light Limited, a private company established under the laws of Hong Kong.

“Company,” “we,” “us” or “our” means Energys Group Limited, a company with limited liability established on July 5, 2022 under the laws of the Cayman Islands, and/or its consolidated subsidiaries.

“Companies Act” means the Companies Act (2023 Revision) of the Cayman Islands.

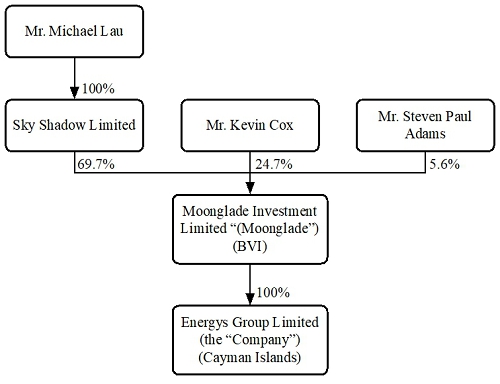

“Controlling Shareholder” means Moonglade Investment Limited, which is owned as to 69.7% by Sky Shadow Limited, 24.7% by Kevin Cox and 5.6% by Steven Paul Adams. Sky Shadow Limited is 100% owned by Michael Lau.

“COVID-19” means the Coronavirus Disease 2019.

“ECSL” means Energy Conservation Solutions Limited, a private company established under the laws of England and Wales.

“EGHL” means Energys Group Holding Limited, a holding company organized under the laws of the British Virgin Islands.

“EGL(HK)” means Energys Group Limited, a limited liability company established under the laws of Hong Kong.

“EGL(UK)” means Energys Group Limited, a holding company incorporated under the laws of England and Wales.

“ESCO” means energy service companies.

“ESL” means Energys Services Limited, a company organized and registered under the laws of England and Wales.

“EU” means the European Union.

“Exchange Act” means the United States Securities Exchange Act of 1934, as amended.

| iv |

“FCA” means the Financial Conduct Authority.

“Frost & Sullivan Report” means the report dated September 2022 prepared by Frost & Sullivan, a third-party global research organization, commissioned by the Company.

“GAI” means Grand Alliance International Limited, a limited liability company established under the laws of Hong Kong.

“GBP” or “£” means the Great Britain Pound Sterling.

“Goji” means Goji Group Ltd., a company established under the laws of England and Wales.

“Group,” “our Group,” “we,” “us” or “our” means our holding companies and their subsidiaries or any of them, or where the context so requires, in respect of the period before our Company became the holding company of its present subsidiaries, such subsidiaries as if they were subsidiaries of our Company at the relevant time or the businesses which have since been acquired or carried on by them or as the case may be their predecessors.

“HIC” means Harvest Idea Consultant Limited, a company established under the laws of the British Virgin Islands.

“HID” means high intensity discharge lighting products.

“Hong Kong dollars” or “HKD” or “HK$” means Hong Kong dollars.

“Hong Kong Subsidiaries” means Grand Alliance International Limited, New Vision Lighting Limited, Energys Group Limited (HK), Advance Gallant Limited, China Light Limited, Leading Prosper Limited and Peace Master Limited.

“IAQ” means indoor air quality.

“ICO” means Information Commissioner’s Office.

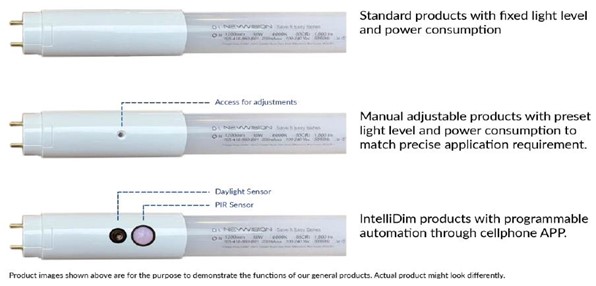

“IntelliDim” means the IntelliDim lighting controller.

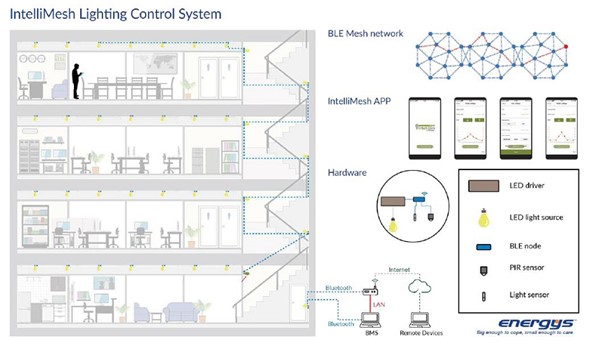

“IntelliMesh” means the IntelliMesh lighting control network.

“IoT” means Internet of Things, or the network of physical objects that are embedded with sensors, software and other technologies for the purpose of connecting and exchanging data with other devices and systems over the internet.

“IT” means information technology, or the use of computers and telecommunications to store, retrieve, transmit or send data.

“Kelvin” means is the primary unit of temperature in the International System of Units used alongside the degree Celsius (1 Kelvin = -272.15 Celsius), and is an absolute thermodynamic temperature scale using absolute zero as its null (zero) point.

“kWh” means Kilo Watt Hour, which is a unit of energy that measures how much electricity is used. One kilowatt hour is the amount of energy used in a 1,000 watt appliance running for an hour.

“LED” means a light emitting diode lighting system.

“LPL” means Leading Prosper Limited, a private company established under the laws of Hong Kong.

“Lux” is the unit of illuminance or luminous flux per unit area in the International System of Units, and is equal to one lumen per square meter.

| v |

“Memorandum and Articles of Association” means the memorandum and articles of association of our Company adopted on July 5, 2022, and as further supplemented, amended or otherwise modified from time to time, a copy of which is filed as Exhibit 3.1 to our Registration Statement filed with the SEC on December 8, 2023.

“MQTT” means a telemetry transport, which is lightweight, publish-subscribe, machine to machine network protocol designed for connections with remote locations that have devices with resource constraints or limited network bandwidths.

“Nasdaq Capital Market” means an online global electronic marketplace for buying and selling securities, which operates 25 markets, 1 clearinghouse and 5 central securities depositories in the United States and Europe.

“NHS” means the United Kingdom national health service.

“NVL” means New Vision Lighting Limited, a limited liability company established under the laws of Hong Kong.

“OEM” means original equipment manufacturer.

“OFGEM” means the United Kingdom’s Office of Gas and Electricity Markets.

“Operating Subsidiaries” means Grand Alliance International Limited, New Vision Lighting Limited, Energys Group Limited (HK), Advance Gallant Limited, China Light Limited, Leading Prosper Limited and Peace Master Limited, all of which are incorporated in Hong Kong, and Energy Conservation Solutions Limited, which is incorporated in the United Kingdom.

“PIR” means passive infrared sensor, which detects motion by measuring changes in body heat differential in the space.

“PM” means atmospheric particulate matter that has a diameter of less than 2.5 micrometers and is so small that they can only be seen with a microscope; PM2.5 is about 3% the diameter of a human hair and smaller than their counterpart PM10, which are also called fine particles.

“PML” means Peace Master Limited, a private company established under the laws of Hong Kong.

“PSDS” means the Public Sector Decarbonization Scheme.

“Reorganization” means the reorganization arrangements undertaken by our Group in preparation for the listing on the Nasdaq Capital Market, which are described in more detail in “History and Corporate Structure” in this prospectus.

“Resale Prospectus” means the prospectus to be used by the Selling Shareholders for future offers and sales of the Ordinary Shares owned by them that have been registered by the Registration Statement of which this prospectus and the Resale Prospectus are parts.

“Resale Shares” means the 2,000,000 Ordinary Shares that may be sold by the Selling Shareholders under the Resale Prospectus.

“RFID” means radio frequency identification, denoting technologies that use radio waves to identify people or objects carrying encoded microchips.

“Save it Easy®” means a patented plug-in converter that allows replacement of fluorescent T8 tubes with energy-efficient T5 tubes in existing light fittings.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“SEC” or “Securities and Exchange Commission” means the United States Securities and Exchange Commission.

“Selling Shareholders” means Jumbo Tiger Global Limited, Bright Forever Investments Limited and Talent Linkage Limited, all of which own Ordinary Shares of the Company that are being registered for resale in conjunction with this offering but that are not offered as part of this offering.

“Sky Shadow” means Sky Shadow Limited, a company with limited liability established under the laws of the British Virgin Islands, which is 100% owned by Mr. Michael Lau.

“TVOC” means total volatile organic compounds.

“UK” means the United Kingdom.

“US$,” “$” or “USD” means United States dollar(s).

| vi |

This summary highlights information contained elsewhere in this prospectus. This summary may not contain all of the information that may be important to you, and we urge you to read this entire prospectus carefully, including the “Risk Factors,” “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections and our consolidated financial statements and notes to those statements, included elsewhere in this prospectus, before deciding to invest in our Ordinary Shares. This prospectus includes forward-looking statements that involve risks and uncertainties. See “Special Note Regarding Forward-Looking Statements.” Unless otherwise stated, all references to “us,” “our,” “we,” the “Company” and similar designations refer to Energys Group Limited, a Cayman Islands exempted company limited by shares, and/or its consolidated subsidiaries.

Overview

We are an energy service company based in the United Kingdom with over 23 years of experience in deploying energy-saving technologies and services. We principally provide end-to-end customized solutions and services that involve retrofitting existing infrastructures to help public and private organizations reduce their CO2 emissions and save money.

Our headquarters is located in the United Kingdom. We also have offices located in Hong Kong from which EGL(HK) conducts research and development and GAI and NVL engage in the procurement of lighting and other products, which are then sold to ECSL, our United Kingdom Operating Subsidiary. ECSL provides innovative LED lighting systems and turnkey project implementation, including installation and commissioning of fixtures, controls and IoT systems, as well as ongoing system maintenance and program management primarily within the United Kingdom. AGL, CLL, LPL and PML hold real estate located in Hong Kong for investment purposes. Goji, which is 43% owned by EGHL, is engaged in the distribution of air purification solutions. ESL and HIC are currently dormant.

Corporate History

Our Group’s history began in 1998 when ECSL was established as an energy consulting firm. In 2000, GAI, one of our key Operating Subsidiaries, was incorporated in Hong Kong as a technology company resulting from the procurement by its then affiliate of the patent on an invention called Save It Easy®. Save It Easy® is a simple, do-it-yourself conversion unit which enables the use of high-efficiency T5 and T8 fluorescent tubes in conventional fluorescent lighting fixtures. Mr. Michael Lau, an executive director and Chief Technology Officer of the Company, was one of the founding members of GAI and worked closely with the inventors of Save It Easy® in the commercialization of the product and in its patent registrations. In 2008, ECSL became an exclusive distributor of Save It Easy® in the United Kingdom, shifting from a consulting services provider to a product and solution provider.

Due to the evolution of lighting technology from fluorescent tubes to LED lamps, in 2015, the Group started designing its own LED lighting products and building its own brand of high-quality, competitively priced LED products that could be customized to suit specific on-site requirements. With management’s combined experience, know-how and track record, we believe that the Company has differentiated itself from competitors by offering a comprehensive total solution that manages the entire project.

The Group helps its customers achieve their sustainability, energy savings and carbon footprint reduction goals through innovative technology and exceptional service. Its target market is “retrofitting,” which refers to the upgrade or replacement of existing equipment in existing infrastructure. Its principal customers are large national accounts, including various United Kingdom governmental departments, universities, schools, hospitals, military and telecommunications companies. The majority of our business (revenue) is derived from the sale of bundled products and services to direct end-users. However, the Group also provides product-only or service-only support to direct end-users, contractors and wholesalers.

| 1 |

Reorganization

Effective February 23, 2023, our Group underwent a reorganization (the “Reorganization”) to consolidate our businesses in the United Kingdom and Hong Kong into an offshore corporate holding structure in anticipation of our listing on the Nasdaq Capital Market.

Prior to the Reorganization, each of Moonglade and EGHL were owned, of record and beneficially, by Sky Shadow, which is wholly owned by Mr. Michael Lau, (73%), Mr. Kevin Cox (22%) and Mr. Steven Paul Adams (5%). EGHL owned all of the issued and outstanding shares of its five current, direct, wholly owned subsidiaries, 43.12% of its current, non-wholly owned subsidiary and 100% of the issued and outstanding shares of its six current, indirect subsidiaries.

On January 31, 2023, Sky Shadow transferred five shares and six shares of EGHL owned by it to Mr. Siu Chung Lee and Mr. Ka Lok To, respectively. On the same date, Sky Shadow transferred 1,350 and 300 shares in Moonglade owned by it to Mr. Cox and Mr. Adams, respectively. After these transfers, EGHL was owned 62% by Sky Shadow, 5% by Mr. Lee, 6% by Mr. To, 22% by Mr. Cox and 5% by Mr. Adams, and Moonglade was owned 69.7% by Sky Shadow, 24.7% by Mr. Cox and 5.6% by Mr. Adams.

Pursuant to the Reorganization, Sky Shadow, Mr. Cox, Mr. Adams, Mr. Lee and Mr. To, collectively, transferred 100% of the issued and outstanding shares of EGHL to the Company in exchange for the issuance by the Company of 10,680,000 Ordinary Shares to Moonglade, 600,000 Ordinary Shares to Mr. Lee and 720,000 Ordinary Shares to Mr. To. As a result, the Company became the holding company of the Group, with Mr. Michael Lau, through his 100% ownership of Sky Shadow, indirectly controlling 89% of the outstanding Ordinary Shares of the Company.

For more detailed information regarding the Reorganization, see “History and Corporate Structure – Reorganization,” below.

Recent Events

Private Transfers of Ordinary Shares

On January 31, 2024, Moonglade sold 350,000 Ordinary Shares owned by it to Vibrant Sound Limited at $2.00 per share and on February 1, 2024, Moonglade sold 680,000 Ordinary Shares owned by it to Majestic Dragon Investment Co. Limited at $2.00 per share. Both Vibrant Sound Limited and Majestic Dragon Investment Co. Limited are independent third parties. These two sales reduced Moonglade’s ownership to 9,650,000 Ordinary Shares, or 80.4%, of our outstanding Ordinary Shares. In addition, on February 2, 2024, Mr. To sold 30,000 Ordinary Shares owned by him to Mr. Lee at $4.10 per share, reducing Mr. To’s ownership to 690,000 Ordinary Shares and increasing Mr. Lee’s ownership to 630,000 Ordinary Shares. All of the above sales were paid in full, in cash, in privately negotiated transactions. Subsequently, Mr. To contributed all of the Ordinary Shares owned by him to Jumbo Tiger Global Limited, a British Virgin Islands company wholly-owned by him, Mr. Lee contributed all of the Ordinary Shares owned by him to Talent Linkage Limited, a British Virgin Islands company wholly-owned by him, and Majestic Dragon Investment Co., Limited contributed all of the Ordinary Shares owned by it to Bright Forever Investments Limited, a British Virgin Islands company under common ownership with it.

Capital Restructure

In April 2024, the Company entered into a number of debt to equity transactions with existing debt holders to improve its total shareholder’s equity, and sold an aggregate of 120,000 Preferred Shares in order to improve its liquidity position and to satisfy the listing criteria for the Nasdaq Capital Market.

Preferred Shares exchanged for amounts due to related parties. As of December 31, 2023, the total amount due to related parties was GBP2,274,289 (USD2,898,126), GBP2,056,954 (USD2,621,176) of which was due to Michael Lau and GBP217,335 (USD276,950) of which was due to Kevin Cox. On April 25, 2024, Mr. Lau exchanged the debt owed to him for 1,048,470 of the Company’s Preferred Shares, or approximately GBP1.962 (US$2.50) per share, and Mr. Cox exchanged the debt owed to him for 110,780 Preferred Shares at the same price per share.

Preferred Shares exchanged for 8% Promissory Notes. During 2022 and 2023, the Company issued 36 8% Promissory Notes (the “Promissory Notes”) with a face value of US$60,000 each, or a total face value of US$2,160,000. The Promissory Notes accrued interest at 8% per annum and were entitled to a 50% premium in the event of a successful IPO by the Company. No interest has been paid on any of the Promissory Notes and the total aggregate value of the Promissory Notes as of December 31, 2023 was USD2,940,000 (GBP2,307,149).

In April 2024, all the Promissory Notes were exchanged for Preferred Shares issued by the Company. The Company calculated all accrued interest and the potential IPO premium to be US$1,080,000. The US$3,240,000 total value of the Promissory Notes, including principal, accrued interest and IPO premium, was exchanged for an aggregate of 1,296,000 Preferred Shares at US$2.50 per share.

Sale of Preferred Shares for cash. In April 2024, the Company offered its shareholders, pro rata, the right to acquire an aggregate of 120,000 Preferred Shares for cash at GBP1.962 (US$2.50) per share. Some shareholders declined to purchase the shares and the majority shareholder, Moonglade, purchased those shares. As a result, Moonglade acquired 106,900 Preferred Shares for GBP209,723 (USD267,250), Talent Linkage Limited acquired 6,300 Preferred Shares for GBP12,360 (USD15,750) and Majestic Dragon Investment Co. Limited acquired 6,800 Preferred Shares for GBP13,341 (USD17,000). Majestic Dragon Investment Co. Limited subsequently contributed its 6,800 Preferred Shares to Bright Forever Investments Limited, a British Virgin Islands company under common ownership with it.

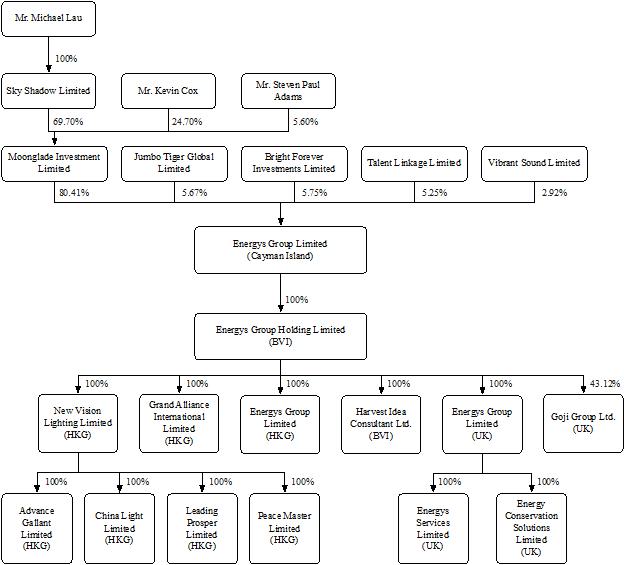

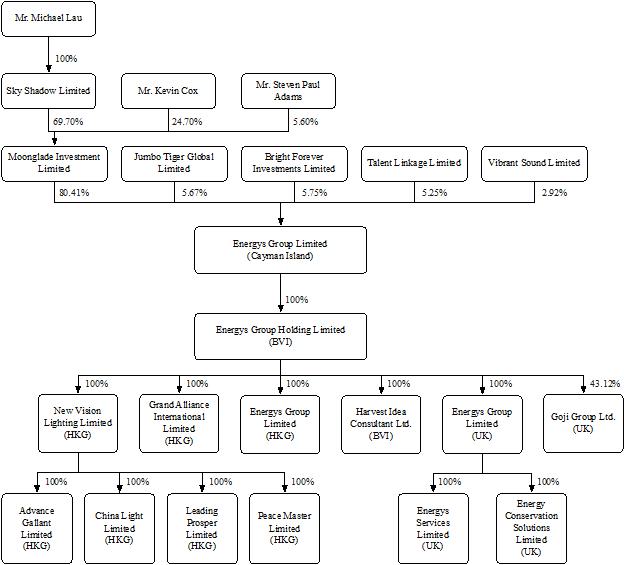

Corporate Structure

The following charts set forth our corporate structure as of the date of this prospectus and after completion of this offering.

As of the date of this Prospectus:

| 2 |

Post-Offering (assuming no exercise of the Underwriter’s over-allotment option)

| 3 |

Purchasers in this offering are buying shares of Energys Group Limited (“Company”), a Cayman Islands company, whereas all of our operations are conducted through our Operating Subsidiaries. At no time will the Company’s shareholders directly own shares of the Operating Subsidiaries.

We are and will be a “controlled company” as defined under the Nasdaq Stock Market Rules because, immediately after the completion of this offering, our Controlling Shareholder will own 68.9% of our total issued and outstanding Ordinary Shares and 4.2% of our issued and outstanding Preferred Shares, representing 58.0% of the total voting power, assuming that the underwriters do not exercise their over-allotment option, and 56.9% of the total voting power, if the over-allotment option is exercised in full.

Our Business

Our approach involves acquiring knowledge, specifying customized requirements, supplying and fitting appropriate solutions and ensuring exact performance and achievements for the project. Our business process entails: (i) consultancy and advice to clients; (ii) site selection, survey and real-time audit; (iii) data collection, analysis and benchmarking; (iv) technical and financial proposal; (v) project management and system design; (vi) product procurement and installation; (vii) measurement and verification; (viii) continued audit and performance reporting; (ix) technology and product upgrades; and (x) product warranty and maintenance. See “Business” on page 75 of this prospectus.

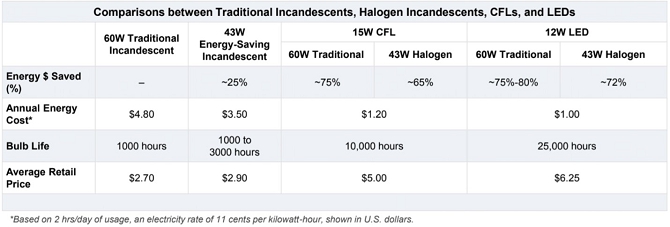

Our primary solution is lighting equipment upgrade, while the application focus is on ambient and task lighting. Our primary product, named IntelliDim, is a decentralized lighting controller that is incorporated into individual LED light fixtures. This enables each fixture to operate at its optimal performance without the need for re-wiring and networking. It sits at the entry level of smart lighting technology. We believe that energy-efficient lighting systems are cost-effective and environmentally responsible solutions, allowing end-users to reduce operating expenses and their carbon footprint.

In addition to lighting solutions, the Group also provides other carbon reduction solutions such as boiler optimization, valve wrap, low carbon heating, combined heat and power, indoor air quality and 24/7 energy monitoring and reporting systems. With its expertise and know-how, the Group aims to offer cost-effective turnkey solutions.

Management believes that low-carbon heating and indoor air quality products will be a large and fast-growing market trend over the next two to five years. These products also align with the concepts of smart building and smart lighting. The Group’s mission is to offer innovative solutions that not only save energy but also improve wellness in infrastructures. The Group conducts research and development of new technologies to meet the changing needs and demands of the market.

The Group’s products are designed in its Hong Kong research and development facilities and manufactured in China by OEMs. As the smart building and IoT markets continue to evolve, the Group is increasingly shifting its focus to software and firmware development to add value to existing and new products. It believes that this will help diversify its product and solutions offerings and capture the upcoming trend.

We generally do not have long-term contracts with our customers for product or turnkey services. However, many of our clients are organizations that manage multiple sites and divisions. In addition, from time to time, the Group might engage multi-year framework agreements with major customers with sales completed on an individual purchase order basis. Substantially all of our revenue is generated from sales of lighting systems and related products, consultancy and related services on a project-by-project basis.

The majority of the Group’s sales occur within the United Kingdom, although its current plan is to geographically diversify over the next few years.

Competitive Advantages

| ● | We have a long and proven track record in retrofit lighting from initial site surveys and energy audits to installation of LED lighting and other products. | |

| ● | We have developed a large and growing national customer base and intend to expand into the United States and Europe. | |

| ● | We have developed an innovative portfolio of products featuring various elements of our LED and other products. | |

| ● | We are expanding our sales and distribution networks. | |

| ● | We believe that we possess several of the key success factors required for companies to thrive in a competitive and fragmented market. | |

| ● | We provide quality products and services. | |

| ● | We maintain a diversified customer base. | |

| ● | We have experienced and dedicated management teams. |

| 4 |

Growth strategies

During 2022 and 2023, we continued to capitalize on our status as a full service, turnkey provider of LED lighting and controls systems with design, build, installation and project management services, including being awarded large projects for major national accounts. To build on this success, we are evolving our business strategy to further leverage this unique capability, while making targeted technological features and additions to the scope and nature of our LED and other products and services to enhance the value we can provide to our customers. In particular, we are working to develop recurring revenue streams, including lighting as a service (LaaS) and electrical maintenance services, with an emphasis on utilizing control sensor technology to collect data and assist customers in the digitization of this data, along with other potential services. Our growth strategies include the following:

We intend to continue to focus on executing and marketing our LED retrofit capabilities to large national account customers.

We believe that one of our competitive advantages is our track record and portfolio with large national account customers. These customers require auditable results through full turnkey LED lighting projects, which start with energy audits and site assessments, and lead to custom engineering and manufacturing, through to fully managed installations. We believe that our rich experience and successful past projects provide our customers with comfort and confidence in working with us.

We intend to aggressively grow our market share in other low carbon and green tech technologies.

We believe that we are well placed to expand our range of low carbon offerings using our existing sales and delivery capabilities. We are already realizing growth in key technology areas, such as solar PV, which in the solar power industry represents photovoltaic, the name of the technology that makes solar panels possible (“Solar PF”), and low carbon (electric) heating solutions. Management expects this trend to accelerate.

We intend to continue to focus on product innovation.

We intend to continue to innovate, developing lighting fixtures and features and other products, including low carbon heating and IAQ related products, which address specific customer requirements while also working to maintain a leadership position in energy efficiency, smart product design and installation benefits. We also intend to continue to deepen our capabilities in the integration of smart lighting. Our goal is to provide state-of-the-art lighting products with modular plug-and-play designs to enable lighting system customization from basic controls to advanced AI and IoT capabilities.

We intend to incorporate additional technology into our products.

We believe we are ideally positioned to help customers to efficiently deploy AI-enabled lighting with tunable output, presence sensing and daylight harvesting. Tunable white lighting refers to LED lights manufactured with the ability to adjust the Kelvin temperature and wattage as required by the user. Tunable white light technology enables users to adjust the color temperature of a lamp in real-time to set the required mood and also to use algorithm to mimic the color temperature of the sun’s cycle to help sustain human circadian rhythm for the improvement of wellness. Our daylight harvesting systems use daylight to offset the amount of electric lighting needed to properly light a space in order to reduce energy consumption. This is accomplished using lighting control systems that are able to dim or switch electric lighting in response to changing daylight availability. Our daylight harvesting systems are typically designed to maintain a minimum recommended light level. This light level will vary according to the needs and use of the space. For example, the commonly recommended light level for offices is 500 Lux (or around 50 foot-candles on the desktop), but where the office is for tasks that are primarily computer based the recommended level is 300 lux, meaning that a system, such as ours, that can be dynamically adjusted results in a saving of 40%. AI or IoT capabilities can include the management and tracking of facilities, personnel, resources and customer behavior, driving both sales and lowering costs. As a result, these added capabilities provide customers an even greater return on investment from their lighting system and we believe make us an attractive partner, providing our customers with a path to digitization for their business operations.

| 5 |

Support success of our distribution sales channels.

We continue to focus on building our relationships and product and sales support for distribution channels.

We intend to expand into the United States and Europe.

We plan on expanding into the United States through developing relationships with strategic partners who already have complementary businesses in that country and into Europe by utilizing our sales team in the United Kingdom.

Risks and Challenges

Investing in our Ordinary Shares involves risks. You should carefully consider the risks set out in the section headed “Risk Factors” beginning on page 12 of this prospectus before making a decision to purchase Ordinary Shares. If any of these risks actually occurs, our business, financial condition or results of operations would likely be materially adversely affected. In such case, the trading price of our Ordinary Shares would likely decline, and you may lose all or part of your investment.

These risks include but are not limited to the following:

| ● | We will rely on dividends and other distributions on equity paid by our Operating Subsidiaries to fund our cash and financing requirements. | |

| ● | We may fail to implement and maintain an effective system of internal controls. | |

| ● | A downturn in the global economy or a change in economic and political policies could materially and adversely affect our business and financial condition. | |

| ● | Foreign currency fluctuations. | |

| ● | Risks associated with the United Kingdom’s withdrawal from the European Union on January 31, 2020 following a June 2016 referendum referred to as “Brexit.” | |

| ● | Our Operating Subsidiaries’ products use components and raw materials that may be subject to price fluctuations, shortages or interruptions of supply. | |

| ● | Our information technology systems’ security measures could be breached or fail or may need to be enhanced or updated. | |

| ● | The success of our business depends upon market acceptance and governmental support for our energy management products and services. | |

| ● | We rely on third-party manufacturers in China for the manufacture of our products and product components. | |

| ● | As we evolve our business strategy to increase our focus on new product and service offerings, our results of operations, financial condition and cash flows may be materially adversely affected. | |

| ● | The success of our LED lighting retrofit solutions depends, in part, on our ability to claim market share away from our competitors. |

| 6 |

| ● | Our Operating Subsidiaries may not be able to obtain or maintain all necessary licenses, permits and approvals, and to make all necessary registrations and filings for their business activities in multiple jurisdictions. | |

| ● | We do not have major sources of recurring revenue and we depend upon a limited number of customers in any given period to generate a substantial portion of our revenue. | |

| ● | Adverse conditions in the global economy have negatively impacted us, and could in the future negatively impact our customers, suppliers and business. | |

| ● | We may not be able to obtain equity capital or debt financing necessary to effectively pursue our evolving strategy and sustain our growth initiatives. | |

| ● | Our retrofitting process frequently involves responsibility for the removal and disposal of components containing hazardous materials. | |

| ● | Government tariffs and other actions may adversely affect our business. | |

| ● | Any future reduction or elimination of investments in or incentives to adopt LED lighting or the elimination of or changes in policies, could cause the growth in demand for our LED products to slow. | |

| ● | Product liability claims could adversely affect our business, results of operations and financial condition. | |

| ● | Our inability to protect our intellectual property or our involvement in damaging and disruptive intellectual property litigation, could adversely affect our results of operations, financial condition and cash flows or result in the loss of use of the related product or service. | |

| ● | The costs of compliance with environmental laws and regulations and any related environmental liabilities could adversely affect our results of operations, financial condition and cash flows. | |

| ● | Our Operating Subsidiaries operate in a highly fragmented and competitive industry and failure to compete over other industry players could materially and adversely affect their business. | |

| ● | An active trading market for our Ordinary Shares may not be established or, if established, may not continue and the trading price for our Ordinary Shares may fluctuate significantly. | |

| ● | We may not maintain the listing of our Ordinary Shares on the Nasdaq Capital Market, which could limit investors’ ability to make transactions in our Ordinary Shares and subject us to additional trading restrictions. | |

| ● | Registration of the 2,000,000 Resale Shares could adversely affect the market price of our Ordinary Shares following completion of this offering. | |

| ● | We expect our quarterly revenue and operating results to fluctuate. | |

| ● | Short selling may drive down the market price of our Ordinary Shares. | |

| ● | Because we do not expect to pay dividends in the foreseeable future, you must rely on price appreciation of our Ordinary Shares for a return on your investment. | |

| ● | Because our public offering price per share is substantially higher than our net tangible book value per share, you will experience immediate and substantial dilution. | |

| ● | You must rely on the judgment of our management as to the uses of the net proceeds from this offering, and such uses may not produce income or increase our share price. |

| 7 |

| ● | You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are incorporated under Cayman Islands law. | |

| ● | We are an emerging growth company within the meaning of the Securities Act and may take advantage of certain reduced reporting requirements. | |

| ● | We are a foreign private issuer within the meaning of the rules under the Exchange Act, and as such we are exempt from certain provisions applicable to United States domestic public companies. | |

| ● | As a “controlled company” within the meaning of Rule 5615(c) of the, we may rely on exemptions from certain corporate governance requirements that provide protection to shareholders of other companies and our controlling shareholder can control the actions of the Company. | |

| ● | The enactment of the Law of the PRC on Safeguarding National Security in the Hong Kong Special Administrative Region (the “Hong Kong National Security Law”) could impact our Hong Kong subsidiaries. | |

| ● | The Chinese government may exercise significant oversight and discretion over the conduct of our business in Hong Kong and may intervene in or influence our operations in Hong Kong at any time. | |

| ● | Hong Kong and China’s political and legal systems are evolving and include inherent uncertainties. | |

| ● | Changes in the policies, rules and regulations, and enforcement of laws of the PRC government may be implemented quickly with little or no advance notice and could have a significant impact upon our Hong Kong Operating Subsidiaries’ ability to operate profitably. | |

| ● | The enforcement of contractual, intellectual property and other property rights in the PRC, where our products are manufactured through OEM arrangements, may be difficult and expensive, and it may be difficult and expensive to effect service of process in the PRC. | |

| ● | Increases in costs, disruption of supply chain or shortage of materials for production of our LED products could harm our business. | |

| ● | Investing in real estate involves certain risks, and our Operating Subsidiaries in Hong Kong have each invested in and own commercial real property located in Hong Kong. | |

| ● | If our business plan is not successful, we may not be able to continue operations as a going concern and our shareholders may lose their entire investment in the Company. |

Corporate Information

We were incorporated in the Cayman Islands on July 5, 2022 for the purpose of being a holding company for listing on the Nasdaq Capital Market. Our registered office and agent for service of process in the Cayman Islands is at c/o Quality Corporation Services Ltd., Suite 102, Cannon Place, P.O. Box 712, North Sounds Road, George Town, Cayman Islands, KYI-9006. Our principal executive office is at the Frankly House, Daux Road, Billingshurst, West Sussex RH149JS. Our telephone number at this location is +44 (0) 1403 786212. Our website address is http://www.energysgroup.com. The information contained on our website does not form part of this prospectus. Our agent for service of process in the United States is Cogency Global Inc., 122 E. 42nd Street, 18th Floor, New York, New York 10168.

Because we are incorporated under the laws of the Cayman Islands, you may encounter difficulty protecting your interests as a shareholder, and your ability to protect your rights through the U.S. federal court system may be limited. Please refer to the sections entitled “Risk Factors – Risks Related to our Securities and the Offering”“ and “Enforceability of Civil Liabilities” for more information.

We have subsidiaries conducting operations in Hong Kong, and we face various legal and operational risks and uncertainties relating to the operations of those subsidiaries. Although our products are manufactured in China under OEM agreements, we do not have any business operations in mainland China, either directly or through Variable Interest Entity (“VIE”) arrangements. Therefore, we consider that the current laws and regulations of the PRC applicable in mainland China have no material impact on our business or on the businesses, financial condition or results of operations of our Hong Kong subsidiaries. However, since Hong Kong is a special administrative region of China, the legal and operational risks associated with operating in China also apply to operations in Hong Kong. See “Risk Factors - Risks Related to Doing Business in Hong Kong and to Having Our Products Manufactured in China” commencing on page 30 of this prospectus.

Permission Required from Chinese Authorities

As our only nexus with China is that our products are manufactured in the PRC under OEM arrangements and some of our subsidiaries are located in Hong Kong, which is a Special Administrative Region of the PRC, management of the Company does not believe that either we or our Operating Subsidiaries are required to obtain any permissions or approvals from PRC authorities to operate our business, other than the standard business licenses and registrations required from the government of Hong Kong, or that we are required to obtain permissions or approvals from any PRC authorities, including the China Securities Regulatory Commission (the “CSRC”) or the Cyberspace Administration of China (the “CAC”), before listing in the U.S. or to issue our Ordinary Shares to foreign investors. We have received all requisite permissions and approvals for our subsidiaries to operate in Hong Kong and we have not been denied any such permissions or approvals.

However, if we (i) do not receive or maintain required permissions or approvals from Chinese authorities; (ii) have erroneously concluded that these permission requirements do not apply to us; (iii) or if applicable laws, regulations or interpretations change, and it is determined in the future that the permission requirements become applicable to us, we may be subject to review, may face challenges in addressing these requirements and may incur substantial costs in complying with these requirements, which could result in material adverse changes in our business operations and financial position. In addition, if we are not able to fully comply with the Measures for Cybersecurity Review (2021 version) or if the “Opinions on Severely Cracking Down on Illegal Securities Activities According to Law,” recently issued by the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council, are determined to be applicable to us, our ability to offer or to continue to offer securities to investors may be significantly limited or completely hindered, and our securities may significantly decline in value or become worthless.

Implications of Being a Holding Company - Transfers of Cash to and from Our Operating Subsidiaries

As a holding company, we will rely on dividends and other distributions on equity paid by our Operating Subsidiaries for our cash and financing requirements. We are permitted under the laws of the Cayman Islands and our Memorandum and Articles of Association (as amended from time to time) to provide funding to our subsidiaries incorporated in the United Kingdom and Hong Kong, through loans or capital contributions. Our United Kingdom and Hong Kong Operating Subsidiaries are permitted under the laws of their respective jurisdictions to provide funding to us through dividend distribution without restriction on the amount of the funds, other than as limited by the amount of their distributable earnings. However, to the extent cash is in our Hong Kong Operating Subsidiaries, there is a possibility that the funds may not be available to fund our operations or for other uses outside Hong Kong due to possible future interventions or the imposition of restrictions and limitations by the PRC government on their ability to transfer cash. In addition, if any of our subsidiaries incurs debt on its own behalf in the future, the instruments governing such debt may restrict their ability to pay dividends to us. See “Risk Factors – Risks Related to the Company and Our Corporate Structure – We will rely on dividends and other distributions on equity paid by our Operating Subsidiaries to fund our cash and financing requirements, and any limitation on the ability of our Operating Subsidiaries to make payments to us could have a material adverse effect on our ability to conduct our business” on page 21.

| 8 |

Implications of Being a “Controlled Company”

Upon completion of this offering, Moonglade will be the beneficial owner of 9,650,000 Ordinary Shares, which will represent 67.7% of the then total issued and outstanding Ordinary Shares (or 66.2% of the then total issued and outstanding Ordinary Shares if the underwriters exercise their over-allotment option in full). In addition, Moonglade is the beneficial owner of 106,900 Preferred Shares; therefore, Moonglade’s voting power after the offering will be 58.0% if the underwriters do not exercise their over-allotment option and 56.9% of the total voting power if the over-allotment option is exercised in full. As a result, we will remain a “controlled company” within the meaning of Rule 5615(c) of the Listing Rules of the Nasdaq Stock Market and therefore we are eligible for, and, in the event we no longer qualify as a foreign private issuer, we may rely on, certain exemptions from the corporate governance listing requirements of the Nasdaq Stock Market including (i) the requirement that a majority of our board of directors must be independent directors; (ii) the requirement that our director nominees must be selected or recommended solely by either a Nomination Committee comprised solely of independent directors or by a majority of the independent directors; and (iii) the requirement that we have a formal written charter or board resolution, as applicable, addressing the nominations process and such related matters as may be required under the federal securities laws.

In addition, Mr. Michael Lau, our Executive Director and Chief Technology Officer, through his 100% ownership of Sky Shadow, which owns 89% of the issued and outstanding shares of Moonglade, could control the outcome of any corporate transaction or other matter submitted to our shareholders for approval, including mergers, consolidations, the election of directors and other significant corporate actions, including the power to prevent or cause a change in control.

Implications of Being an Emerging Growth Company

As a company with less than US$1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other requirements that are otherwise applicable generally to public companies. These provisions include:

| ● | being permitted to provide only two years of audited financial statements (rather than three years), in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; and | |

| ● | an exemption from compliance with the auditor attestation requirement of the Sarbanes-Oxley Act, on the effectiveness of our internal control over financial reporting. |

We may take advantage of these reporting exemptions until we are no longer an emerging growth company. We will remain an emerging growth company until the earliest of (1) the last day of the fiscal year in which the fifth anniversary of the completion of this offering occurs; (2) the last day of the fiscal year in which we have total annual gross revenue of at least US$1.235 billion; (3) the date on which we are deemed to be a “large accelerated filer” under the Exchange Act, which means the market value of our Ordinary Shares that are held by non-affiliates exceeds US$700.0 million as of the prior June 30; and (4) the date on which we have issued more than US$1.0 billion in non-convertible debt during the prior three-year period. We may choose to take advantage of some, but not all, of the available exemptions.. Accordingly, the information contained herein may be different from the information you receive from other public companies in which you hold stock.

Implications of Being a Foreign Private Issuer

Upon completion of this offering, we will report under the Exchange Act as a non-U.S. company with foreign private issuer status. Even after we no longer qualify as an emerging growth company, as long as we qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

| ● | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; | |

| ● | the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and | |

| ● | the rules under the Exchange Act requiring the filing with the Securities and Exchange Commission, or the SEC, of quarterly reports on Form 10-Q containing unaudited financial and other specified information, or current reports on Form 8-K, upon the occurrence of specified significant events. |

| 9 |

Both foreign private issuers and emerging growth companies are also exempt from certain more stringent executive compensation disclosure rules. Thus, even if we no longer qualify as an emerging growth company but remain a foreign private issuer, we will continue to be exempt from the more stringent compensation disclosures required of companies that are neither emerging growth companies nor foreign private issuers.

Further, as an exempted company incorporated in the Cayman Islands, we are permitted to adopt certain home country practices in relation to corporate governance matters that differ significantly from the corporate governance requirements of the Nasdaq Stock Market. These practices would afford less protection to shareholders than they would enjoy if we comply fully with corporate governance listing requirements of the Nasdaq Stock Market, such as not requiring that a majority of our directors be independent directors, that our audit committee have a minimum of three members and that our compensation committee and our nomination committee be comprised entirely of independent directors. In addition, the Listing Rules of the Nasdaq Stock Market require that every company listed on Nasdaq hold an annual general meeting of shareholders. We intend to comply with the corporate governance requirements of the Nasdaq Stock Market in lieu of following home country practice after the closing of this offering.

| Offering Price | We estimate that the initial public offering price will be in the range of US$4.50 to US$6.50 per Ordinary Share. | |

Ordinary Shares offered by us | 2,250,000 Ordinary Shares (or 2,587,500 Ordinary Shares if the underwriters exercise the over-allotment option in full). | |

Ordinary Shares issued and outstanding prior to this offering | 12,000,000 Ordinary Shares. | |

| Ordinary Shares to be issued and outstanding immediately after this offering | 14,250,000 Ordinary Shares (or 14,587,500 Ordinary Shares if the underwriters exercise the over-allotment option in full). | |

| Over-allotment option | We have granted to the underwriters an option, exercisable for 45 days from the date of this prospectus, to purchase up to an aggregate of 337,500 Ordinary Shares at the initial public offering price, less underwriting discounts and commissions, solely for the purpose of covering over-allotments. See “Underwriting” on page 136 of this prospectus. |

| 10 |

| Use of proceeds | We currently intend to use the net proceeds from this offering: (i) to expand our Operating Subsidiaries’ network in the United Kingdom to increase market penetration; (ii) for inventory procurement in order to counter the global supply chain pressures and improve economies of scale and reduce logistics expenses; (iii) to establish operating subsidiaries in the United States and European marketplaces; (iv) to identify and pursue merger and acquisition opportunities to expand vertically and horizontally; (iv) to expand our research and development division’s human resources; (v) to repay bank loans in order to reduce interest expenses; (vi) to repay certain promissory notes issued by the Company; and (vii) to use as general working capital and for other general corporate purposes, including $300,000 to be held in the indemnification escrow account described below. See “Use of Proceeds” on page 35 of this prospectus. | |

| Indemnification escrow | Net proceeds of this offering in the amount of $300,000 shall be used to fund an escrow account for a period of 18 months following the closing date of this offering, which account shall be used for indemnification purposes by the Company and the underwriters. | |

| Dividend policy | We do not intend to pay any dividends on our Ordinary Shares in the foreseeable future. Instead, we anticipate that all of our earnings, if any, will be used for the operation and growth of our business. See “Dividends and Dividend Policy” for more information. | |

Lock-up

| We and our directors, executive officers and affiliates have agreed, subject to certain exceptions, for a period of 12 months, and our 5% shareholders, other than any Selling Shareholders, have agreed, subject to certain exceptions, for a period of six months after the closing of this offering, not to offer, pledge, sell, grant any option, right or warrant to purchase, lend or otherwise transfer or dispose of, directly or indirectly, any Ordinary Shares or any other securities convertible into or exercisable or exchangeable for Ordinary Shares, or enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of Ordinary Shares. In addition, all holders of Preferred Shares have agreed for a period of six months after the closing of this offering to a similar lock-up in respect of their Preferred Shares. See “Shares Eligible for Future Sale - Lock-Up Agreements” and “Underwriting—Lock-Up Agreements.” | |