Issuer Free Writing Prospectus dated April 25th, 2024

Filed Pursuant to Rule 433 of the Securities Act of 1933, as amended

Relating to Preliminary Prospectus dated April 16th, 2024

Registration Statement No. 333-274667

Armlogi Holding Corp. Investor Presentation April 2024 DELIVERING THE WORLD TO YOUR DOORSTEP Issuer Free Writing Prospectus dated April 25th, 2024 Filed Pursuant to Rule 433 of the Securities Act of 1933, as amended Relating to Preliminary Prospectus dated April 16th, 2024 Registration Statement No. 333 - 274667

2 FREE WRITING PROSPECTUS STATEMENT This free writing prospectus relates to the proposed public offering of shares of common stock of Armlogi Holding Corp . (“we”, “us”, or “our”) and should be read together with the Registration Statement we filed with the U . S . Securities and Exchange Commission (the “SEC”) for the offering to which this presentation relates and may be accessed through the following web link : https : //www . sec . gov/Archives/edgar/data/ 1972529 / 000121390024033321 /ea 0200161 - 04 . htm The Registration Statement has not yet become effective . Before you invest, you should read the prospectus in the Registration Statement (including the risk factors described therein) and other documents we have with the SEC in their entirety for more complete information about us and the offering . You may get these documents for free by visiting EDGAR on the SEC website at http : // www . sec . gov . Alternatively, we or our underwriter will arrange to send you the prospectus if you contact EF Hutton LLC, 590 Madison Avenue, 39 th Floor, New York, NY 10022 , or by calling ( 212 ) 970 - 5150 , or contact Armlogi Holdings Corp . via email : ir@armlogi . com . This presentation does not constitute an offer or invitation for the sale or purchase of securities or to engage in any other transaction with the Company or its affiliates . The information in this presentation is not targeted at the residents of any particular country or jurisdiction and is not intended for distribution to, or use by, any person in any jurisdiction or country where such distribution or use would be contrary to local law or regulation . This presentation should not be construed as legal, tax, investment or other advice .

SPECIAL NOTE REGARDING FORWARD - LOOKING STATEMENTS AND INDUSTRY DATA This presentation contains forward - looking statements that reflect our current expectations and views of future events . Known and unknown risks, uncertainties and other factors, including those listed under “Risk Factors,” may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward - looking statements . You can identify some of these forward - looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,” “continue” or other similar expressions . We have based these forward - looking statements largely on our current expectations and projections about future events that we believe may affect our financial condition, results of operations, business strategy and financial needs . These forward - looking statements include statements relating to our goals and strategies ; our future business development, financial condition and results of operations ; the expected growth of the U . S . third - party logistics market for cross - border e - commerce ; our expectations regarding demand for and market acceptance of our products and services ; our expectations regarding our bases of customers ; our plans to invest in our products and services ; competition in our industry ; and relevant government policies and regulations relating to our industry . These forward - looking statements involve various risks and uncertainties . Although we believe that our expectations expressed in these forward - looking statements are reasonable, our expectations may later be found to be incorrect . The forward - looking statements made in this presentation relate only to events or information as of the date on which the statements are made in this presentation . Except as required by law, we undertake no obligation to update or revise publicly any forward - looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events . You should thoroughly read this presentation and the documents that we refer to herein with the understanding that our actual future results may be materially different from and worse than what we expect . We qualify all of our forward - looking statements by these cautionary statements . This presentation contains certain data and information that we obtained from various government and private publications . Statistical data in these publications also include projections based on a number of assumptions . The global cross - border e - commerce industry may not grow at the rate projected by market data, or at all . Failure of this industry to grow at the projected rate may have a material and adverse effect on our business and the market price of our ordinary shares . In addition, the highly - fragmented and rapidly changing nature of the third - party logistics industry results in significant uncertainties for any projections or estimates relating to the growth prospects or future condition of our industry . Furthermore, if any one or more of the assumptions underlying the market data are later found to be incorrect, actual results may differ from the projections based on these assumptions . You should not place undue reliance on these forward - looking statements . None of the Company or any of its affiliates, advisers or representatives or the underwriters make any undertaking to update any such information subsequent to the date hereof . 3

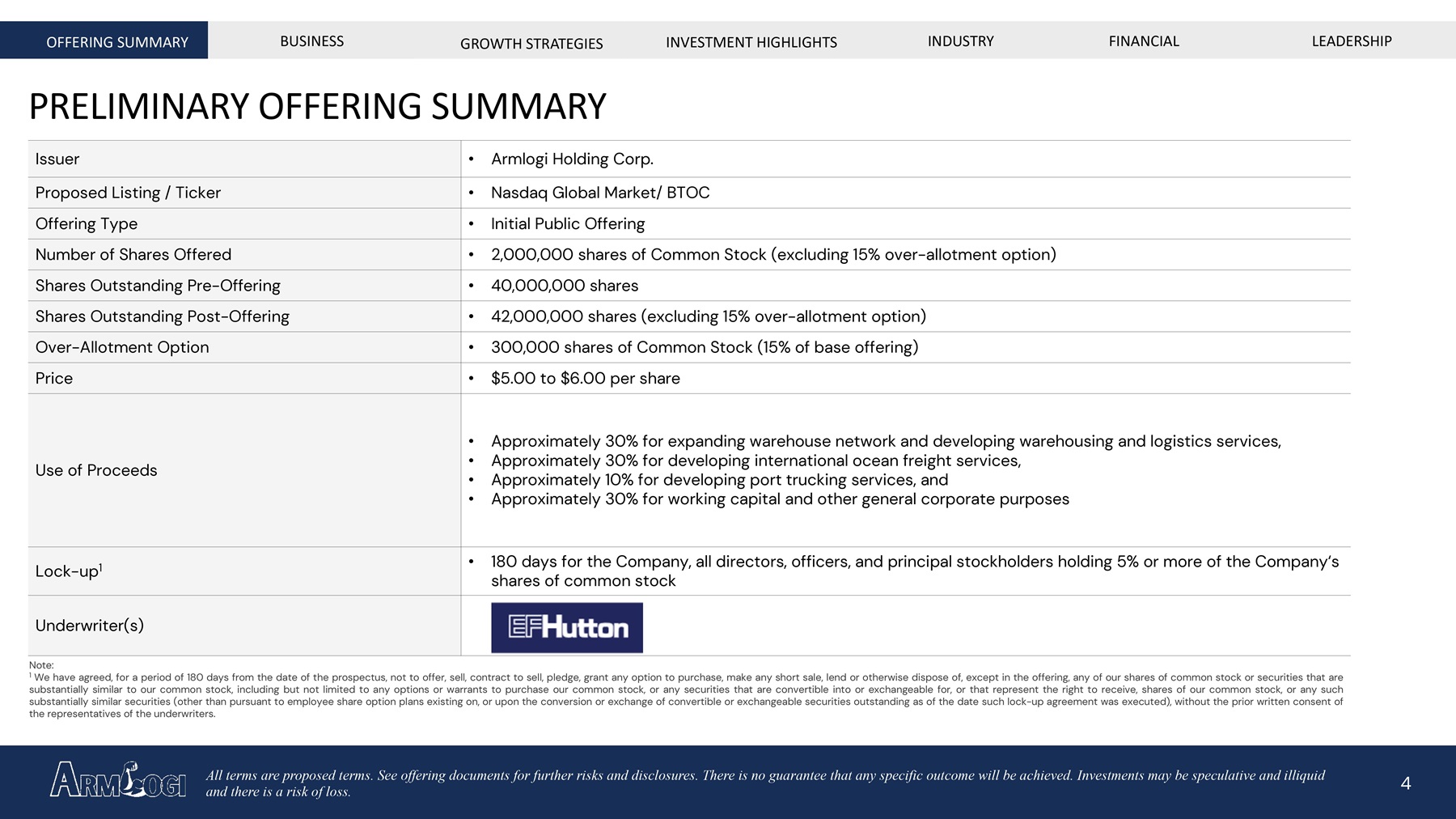

4 • Armlogi Holding Corp. Issuer • Nasdaq Global Market/ BTOC Proposed Listing / Ticker • Initial Public Offering Offering Type • 2,000,000 shares of Common Stock (excluding 15% over - allotment option) Number of Shares Offered • 40,000,000 shares Shares Outstanding Pre - Offering • 42,000,000 shares Shares Outstanding Post - Offering • 300,000 shares of Common Stock (15% of base offering) Over - Allotment Option • $5.00 to $6.00 per share Price • Approximately 30% for expanding warehouse network and developing warehousing and logistics services, • Approximately 30% for developing international ocean freight services, • Approximately 10% for developing port trucking services, and • Approximately 30% for working capital and other general corporate purposes Use of Proceeds • 180 days for all directors, officers, and principal stockholders holding 5% or more of the Company‘s shares of common stock Lock - up 1 Underwriter(s) Note : 1 We have agreed, for a period of 180 days from the date of the prospectus, not to offer, sell, contract to sell, pledge, grant any option to purchase, make any short sale, lend or otherwise dispose of, except in the offering, any of our shares of common stock or securities that are substantially similar to our common stock, including but not limited to any options or warrants to purchase our common stock, or any securities that are convertible into or exchangeable for, or that represent the right to receive, shares of our common stock, or any such substantially similar securities (other than pursuant to employee share option plans existing on, or upon the conversion or exchange of convertible or exchangeable securities outstanding as of the date such lock - up agreement was executed), without the prior written consent of the representatives of the underwriters . PRELIMINARY OFFERING SUMMARY OFFERING SUMMARY BUSINESS GROWTH STRATEGIES INVESTMENT HIGHLIGHTS INDUSTRY FINANCIAL LEADERSHIP All terms are proposed terms. See offering documents for further risks and disclosures. There is no guarantee that any specif ic outcome will be achieved. Investments may be speculative and illiquid and there is a risk of loss.

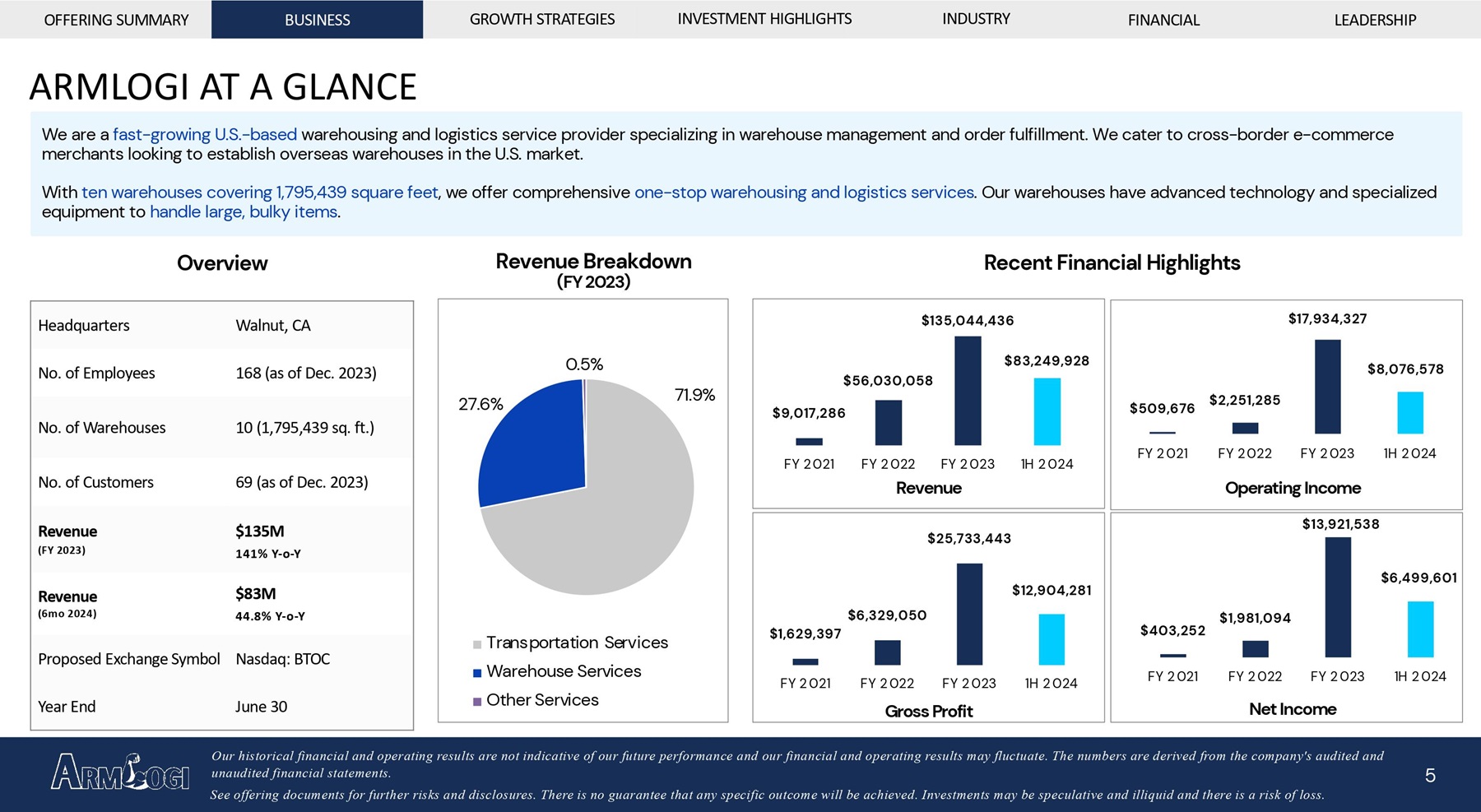

5 OFFERING SUMMARY BUSINESS GROWTH STRATEGIES INVESTMENT HIGHLIGHTS INDUSTRY FINANCIAL LEADERSHIP ARMLOGI AT A GLANCE We are a fast - growing U.S. - based warehousing and logistics service provider specializing in warehouse management and order fulfillment. We cater to cross - border e - commerce merchants looking to establish overseas warehouses in the U.S. market. With ten warehouses covering 1,795,439 square feet , we offer comprehensive one - stop warehousing and logistics services . Our warehouses have advanced technology and specialized equipment to handle large, bulky items . Walnut, CA Headquarters 168 (as of Dec. 2023) No. of Employees 10 (1,795,439 sq. ft.) No. of Warehouses 69 (as of Dec. 2023) No. of Customers $135M 141% Y - o - Y Revenue (FY 2023) $83M 44.8% Y - o - Y Revenue (6mo 2024) Nasdaq: BTOC Proposed Exchange Symbol June 30 Year End Overview Revenue Breakdown (FY 2023) 71.9% 27.6% 0.5% Transportation Services Warehouse Services Other Services Recent Financial Highlights $9,017,286 $56,030,058 $135,044,436 $83,249,928 FY 2021 FY 2022 FY 2023 1H 2024 Revenue $1,629,397 $6,329,050 $25,733,443 $12,904,281 FY 2021 FY 2022 FY 2023 1H 2024 Gross Profit $509,676 $2,251,285 $17,934,327 $8,076,578 FY 2021 FY 2022 FY 2023 1H 2024 $403,252 $1,981,094 $13,921,538 $6,499,601 FY 2021 FY 2022 FY 2023 1H 2024 Net Income Operating Income See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative and illiquid and there is a risk of loss. Our historical financial and operating results are not indicative of our future performance and our financial and operating r esu lts may fluctuate. T he numbers are derived from the company's audited and unaudited financial statements.

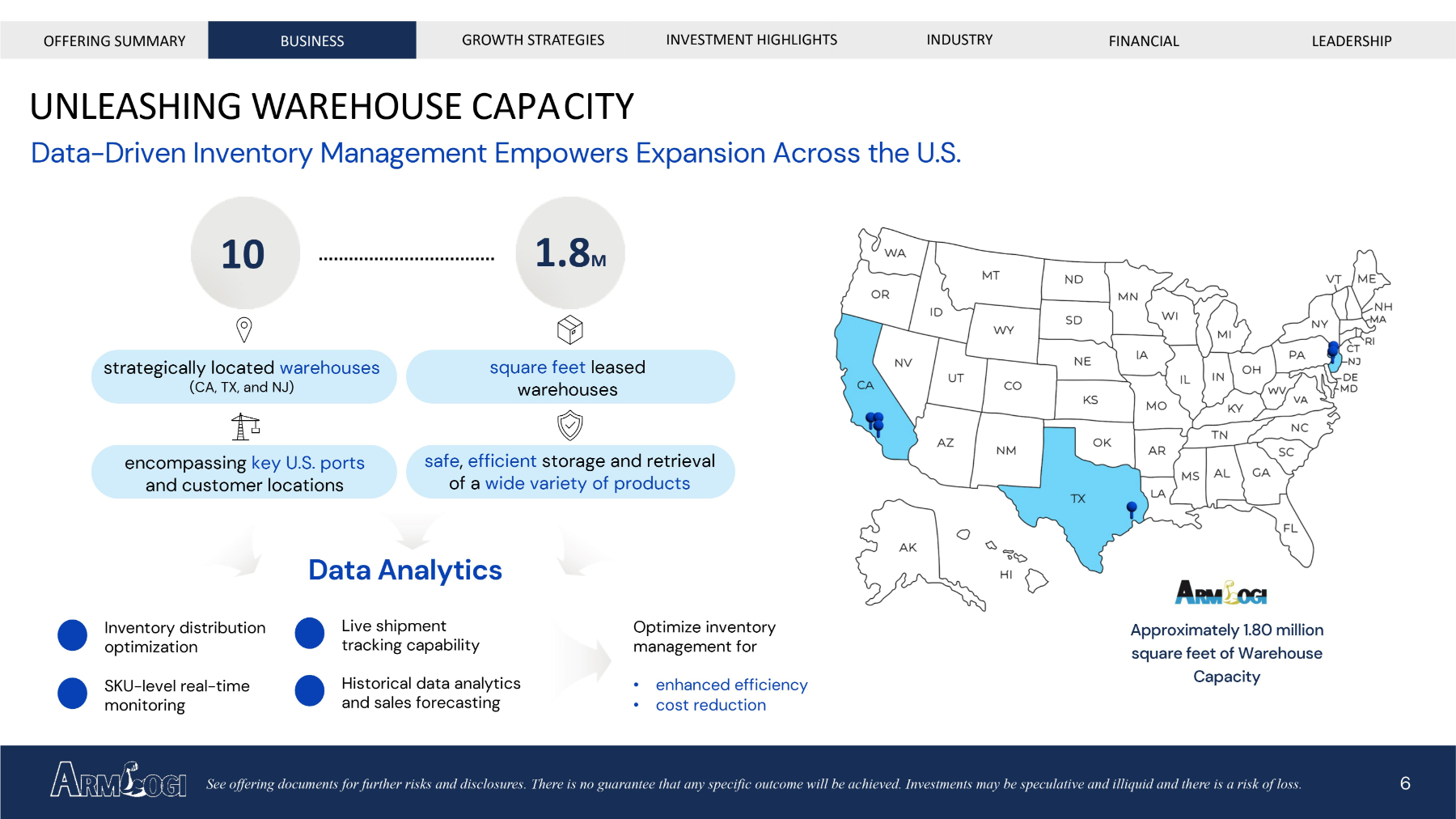

6 Inventory distribution optimization SKU - level real - time monitoring Live shipment tracking capability Historical data analytics and sales forecasting Optimize inventory management for • enhanced efficiency • cost reduction Approximately 1.80 million square feet of Warehouse Capacity OFFERING SUMMARY BUSINESS GROWTH STRATEGIES INVESTMENT HIGHLIGHTS INDUSTRY FINANCIAL LEADERSHIP UNLEASHING WAREHOUSE CA PA CITY Data - Driven Inventory Management Empowers Expansion Across the U.S. 10 encompassing key U.S. ports and customer locations 1.8 M square feet leased warehouses safe , efficient storage and retrieval of a wide variety of products strategically located warehouses (CA, TX, and NJ) Data Analytics See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative and illiquid and there is a risk of loss.

7 UNLOCKING MULTIPLE REVENUE STREAMS A Comprehensive Solution for Cross - Border Warehousing and Logistics OFFERING SUMMARY BUSINESS GROWTH STRATEGIES INVESTMENT HIGHLIGHTS INDUSTRY FINANCIAL LEADERSHIP Revenue Streams: Reselling third - party carrier services to our customers Transportation Services 1 Inventory management and storage offerings Other services primarily include customs brokerage services Collaboratively assist customers in diligently completing: - documentation and - fulfilling tax and duty obligations Brokerage service fees range from $20 to $200 per service, depending on the number of items to be declared Other Services 3 Warehouse Services 2 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative and illiquid and there is a risk of loss.

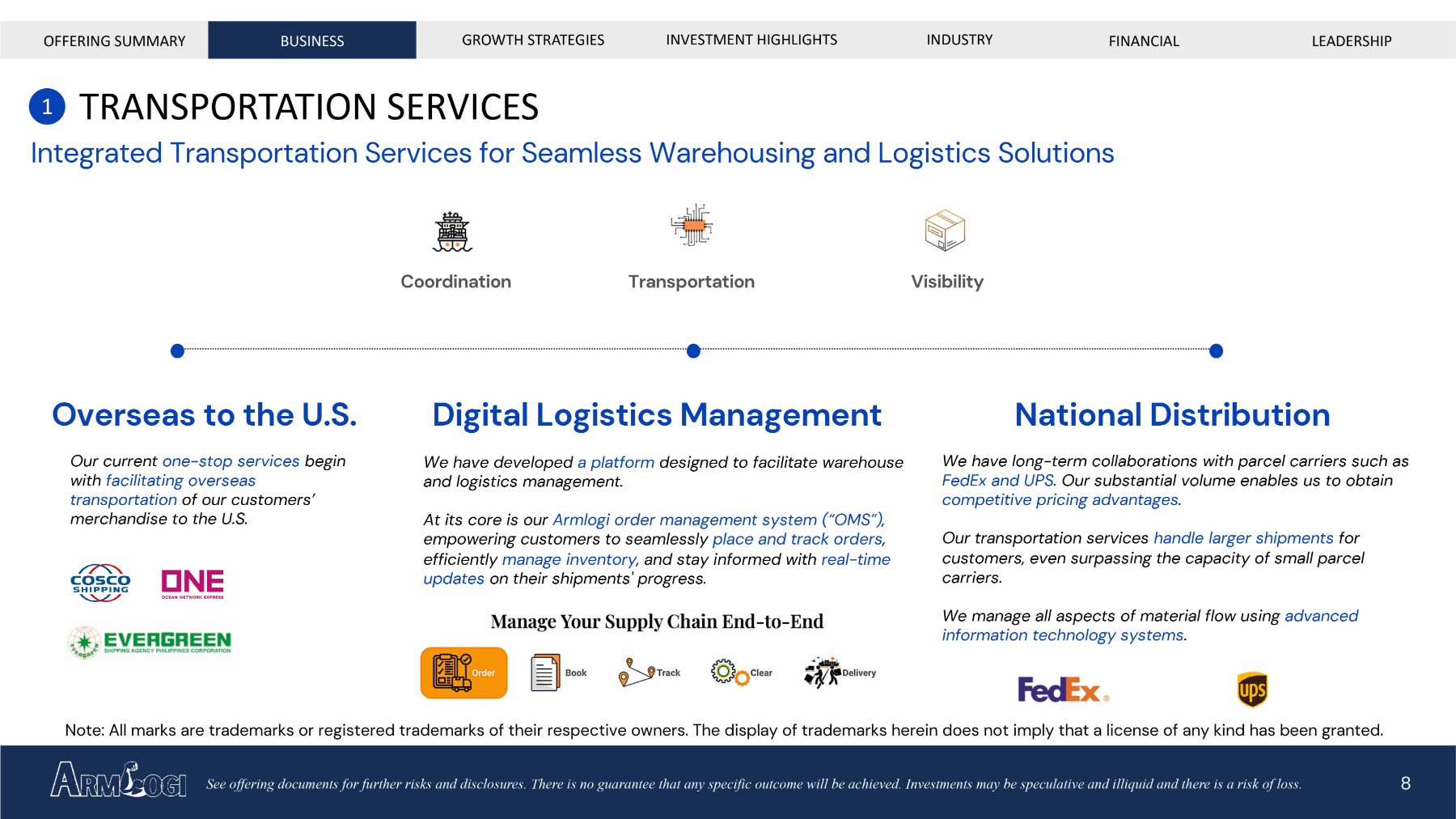

8 TRANSPORTATION SERVICES Integrated Transportation Services for Seamless Warehousing and Logistics Solutions 1 Our current one - stop services begin with facilitating overseas transportation of our customers’ merchandise to the U.S. We have developed a platform designed to facilitate warehouse and logistics management. At its core is our Armlogi order management system (“OMS”) , empowering customers to seamlessly place and track orders , efficiently manage inventory , and stay informed with real - time updates on their shipments' progress. We have long - term collaborations with parcel carriers such as FedEx and UPS . Our substantial volume enables us to obtain competitive pricing advantages . Our transportation services handle larger shipments for customers, even surpassing the capacity of small parcel carriers. We manage all aspects of material flow using advanced information technology systems . OFFERING SUMMARY BUSINESS GROWTH STRATEGIES INVESTMENT HIGHLIGHTS INDUSTRY FINANCIAL LEADERSHIP Overseas to the U.S. Digital Logistics Management National Distribution Coordination Transportation Visibility Note: All marks are trademarks or registered trademarks of their respective owners. The display of trademarks herein does not im ply that a license of any kind has been granted. See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative and illiquid and there is a risk of loss.

9 WAREHOUSING AND LOGISTICS SERVICES Delivering Specialized ISO 9001 - Certified Warehousing and Logistics Services with 24/7 Support and Accuracy 2 OFFERING SUMMARY BUSINESS GROWTH STRATEGIES INVESTMENT HIGHLIGHTS INDUSTRY FINANCIAL LEADERSHIP See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative and illiquid and there is a risk of loss. • High Inventory Accuracy : Achieved an average of 99.7% inventory accuracy, reducing stockouts and shrinkage, and ensuring quality control. • 24/7 Customer Support : Offers round - the - clock support in over 30 languages, facilitating global business operations and customer satisfaction. • Specialized in Bulky Items : Equipped with facilities and technology for handling and storing large items like furniture and appliances, suitable for e - commerce needs. • ISO 9001 Certified: Adherence to international quality management standards, demonstrating a commitment to continuous improvement and customer focus. • Strategic Warehouse Locations: Operations across the West Coast, Midwest, and East Coast with ten warehouses, including an eBay - certified third - party warehouse. • Competitive Service and Delivery Fees: Leverage high volume of goods and partnerships with third - party logistics providers like FedEx and UPS for cost - effective solutions. • Armlogi OMS Platform: Utilizes a comprehensive, cloud - based order management system for efficient, low - error warehousing and logistics, accessible anywhere with an Internet connection. • Continuous Improvement: Implementing ISO 9001 - compliant policies and procedures for managing inventory, goods handling, and customer feedback to enhance service quality. • Scalable Solutions: Ability to quickly respond to market demands and special circumstances due to flexible, technology - driven operations. • Cost - effective Shipping: Mitigating surge charges for oversized items and peak season fees, maintaining stable and reasonable transportation rates.

10 OTHER SERVICES Beyond Warehousing, Other Value - added Services to Simplify the Logistic Process 3 • Our subsidiary, ANDTECH Customs Broker LLC (“ Andtech ”) , guides customers through customs procedures, minimizing delays and penalties. • It handles documentation, fees, taxes, and monitors shipments , providing updates. • Andtech also assists with compliance programs , training, and trade consulting to enhance efficiency in customs regulations and procedures. • Our port trucking services transport shipping containers from ports to various destinations. • Equipped with advanced GPS tracking , our well - maintained fleet ensures safe and efficient operations. • We specialize in transporting customs - cleared goods to U.S. warehouses, streamlining logistics for enhanced supply chain efficiency. OFFERING SUMMARY BUSINESS GROWTH STRATEGIES INVESTMENT HIGHLIGHTS INDUSTRY FINANCIAL LEADERSHIP Customs Brokerage Services Port Trucking & Delivery See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative and illiquid and there is a risk of loss.

11 OFFERING SUMMARY BUSINESS GROWTH STRATEGIES INVESTMENT HIGHLIGHTS INDUSTRY FINANCIAL LEADERSHIP OUR GROWTH STRATEGIES Expand and Diversify Our Customer Base and Geographic Coverage Enhance Customers’ Supply Chain Efficiency by Expanding the Breadth and Depth of Our Solutions and Services Further Invest in Supply Chain Technologies to Drive Sustainable Growth Pursue Additional Strategic and Financially Attractive Acquisitions 1 2 3 4 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative and illiquid and there is a risk of loss.

12 OFFERING SUMMARY BUSINESS GROWTH STRATEGIES INVESTMENT HIGHLIGHTS INDUSTRY FINANCIAL LEADERSHIP CUSTOMER AND GEOGRAPHIC COVERAGE 1 Expand and Diversify Our Customer Base and Geographic Coverage Grow customer base Greater China Vietnam, Thailand, Indonesia, and Philippines Southeast Asia Develop infrastructure in Georgia, Tennessee, and Arizona Key U.S. Markets See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative and illiquid and there is a risk of loss.

13 OFFERING SUMMARY BUSINESS GROWTH STRATEGIES INVESTMENT HIGHLIGHTS INDUSTRY FINANCIAL LEADERSHIP SUPPLY CHAIN EFFICIENCY 2 Enhance Customers’ Supply Chain Efficiency by Expanding the Breadth and Depth of Solutions and Services • Expand presence across the entire supply chain • Enhance and optimize international ocean freight services in the coming two years • Provide comprehensive value - added services , including sales forecasts and inventory planning, to customers • Develop modular solutions and services for easy customer adoption See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative and illiquid and there is a risk of loss.

14 OFFERING SUMMARY BUSINESS GROWTH STRATEGIES INVESTMENT HIGHLIGHTS INDUSTRY FINANCIAL LEADERSHIP INVESTMENTS IN SUPPLY CHAIN TECHNOLOGIES 3 Further Invest in Supply Chain Technologies to Drive Sustainable Growth Invest in smart systems for ocean freight tracking, automated sales forecasting, inventory management, and real - time data analysis Foster collaboration, innovation, and efficiency throughout the supply chain ecosystem Open technology platforms to customers and partners for enhanced integration and collaboration See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative and illiquid and there is a risk of loss.

15 OFFERING SUMMARY BUSINESS GROWTH STRATEGIES INVESTMENT HIGHLIGHTS INDUSTRY FINANCIAL LEADERSHIP STRATEGIC ACQUISITIONS 4 Pursue Additional Strategic and Financially Attractive Acquisitions Identify and acquire businesses that expand our warehousing and logistics operations within the supply chain Focus on achieving synergies and generating attractive returns that surpass the cost of capital Target strategically and financially attractive acquisition opportunities that offer new capabilities at favorable valuations See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative and illiquid and there is a risk of loss.

16 OFFERING SUMMARY BUSINESS GROWTH STRATEGIES INVESTMENT HIGHLIGHTS INDUSTRY FINANCIAL LEADERSHIP INVESTMENT HIGHLIGHTS Quality warehousing and logistics services that meet ISO 9001 standards Reasonable service fees and delivery fees due to the large volume The capability of providing efficient and low - error warehousing services by leveraging warehouse and order management technology An experienced management team with strong financial and operational expertise See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative and illiquid and there is a risk of loss.

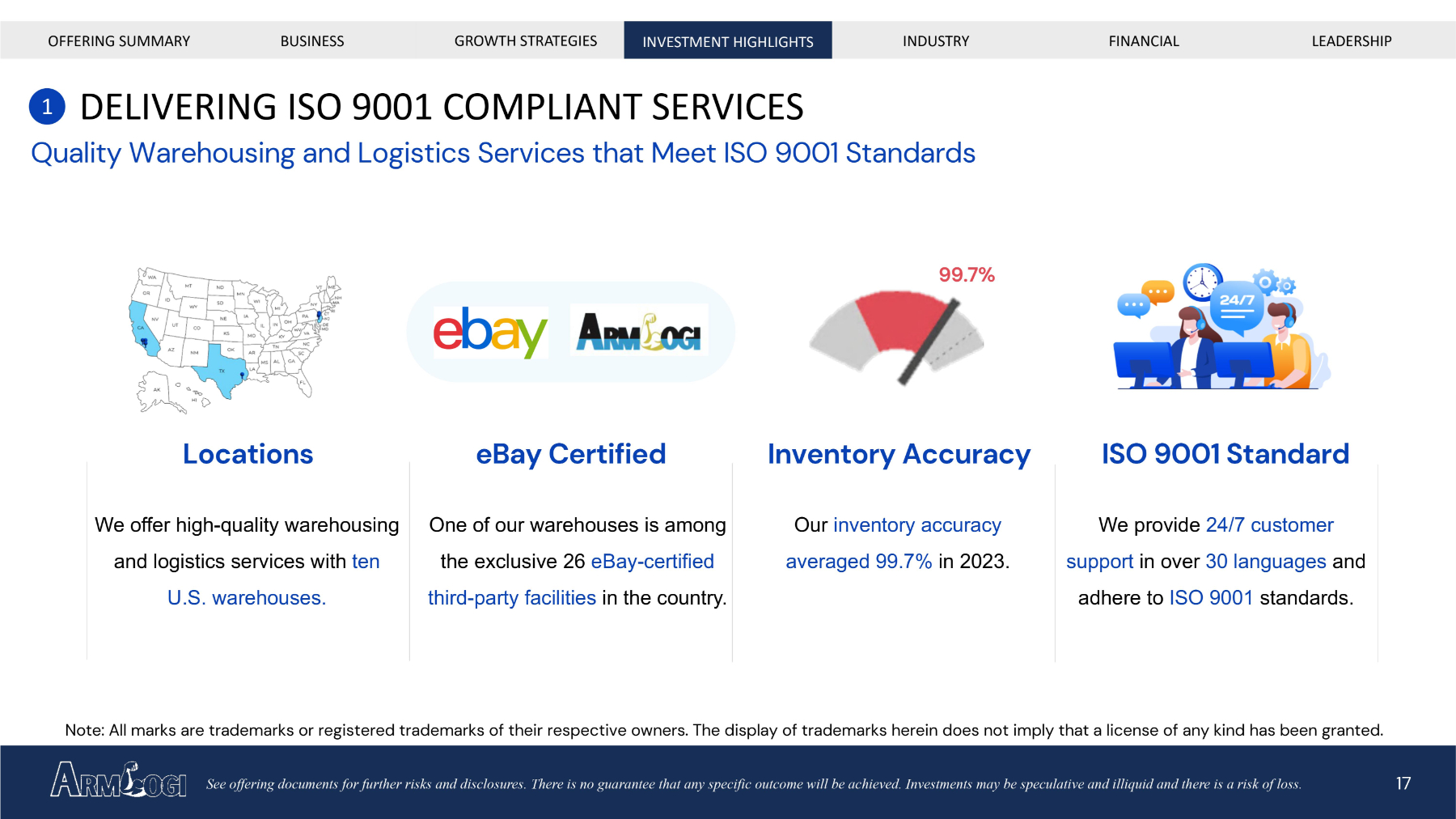

17 OFFERING SUMMARY BUSINESS GROWTH STRATEGIES INVESTMENT HIGHLIGHTS INDUSTRY FINANCIAL LEADERSHIP DELIVERING ISO 9001 COMPLIANT SERVICES 1 Quality Warehousing and Logistics Services that Meet ISO 9001 Standards We provide 24/7 customer support in over 30 languages and adhere to ISO 9001 standards. 99.7% We offer high - quality warehousing and logistics services with ten U.S. warehouses. One of our warehouses is among the exclusive 26 eBay - certified third - party facilities in the country. Our inventory accuracy averaged 99.7% in 2023. Locations eBay Certified Inventory Accuracy ISO 9001 Standard See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative and illiquid and there is a risk of loss. Note: All marks are trademarks or registered trademarks of their respective owners. The display of trademarks herein does not im ply that a license of any kind has been granted.

18 OFFERING SUMMARY BUSINESS GROWTH STRATEGIES INVESTMENT HIGHLIGHTS INDUSTRY FINANCIAL LEADERSHIP 2 MASSIVE VOLUMES, REASONABLE PRICES Reasonable Service and Delivery Fees Due to Handling Large Volumes Our large volume of goods and partnerships with third - party logistics providers, such as FedEx and UPS, enable us to offer affordable service and delivery fees. Efficient logistics management tools help us handle surge charges for oversized items and peak season fees, maintaining low freight charges. Long - term agreements and high shipping volumes with these providers result in significant discounts and reasonable transportation rates. See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative and illiquid and there is a risk of loss.

19 OFFERING SUMMARY BUSINESS GROWTH STRATEGIES INVESTMENT HIGHLIGHTS INDUSTRY FINANCIAL LEADERSHIP 3 WAREHOUSING FOR EFFICIENCY AND ACCURACY Providing Efficient Warehousing Services by Leveraging Warehouse and Order Management Technology The Armlogi OMS platform, built on the Amazon Web Services cloud computing infrastructure, provides a web - based interface for a comprehensive warehouse and logistics management solution. The platform manages end - to - end shipments, offers real - time tracking and updates, and provides tools for data input, log tracking, translations, and customer support. The platform reduces costs, boosts efficiency, streamlines workflow, minimizes errors, and enables seamless integration of new features. See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative and illiquid and there is a risk of loss. Note: All marks are trademarks or registered trademarks of their respective owners. The display of trademarks herein does not im ply that a license of any kind has been granted.

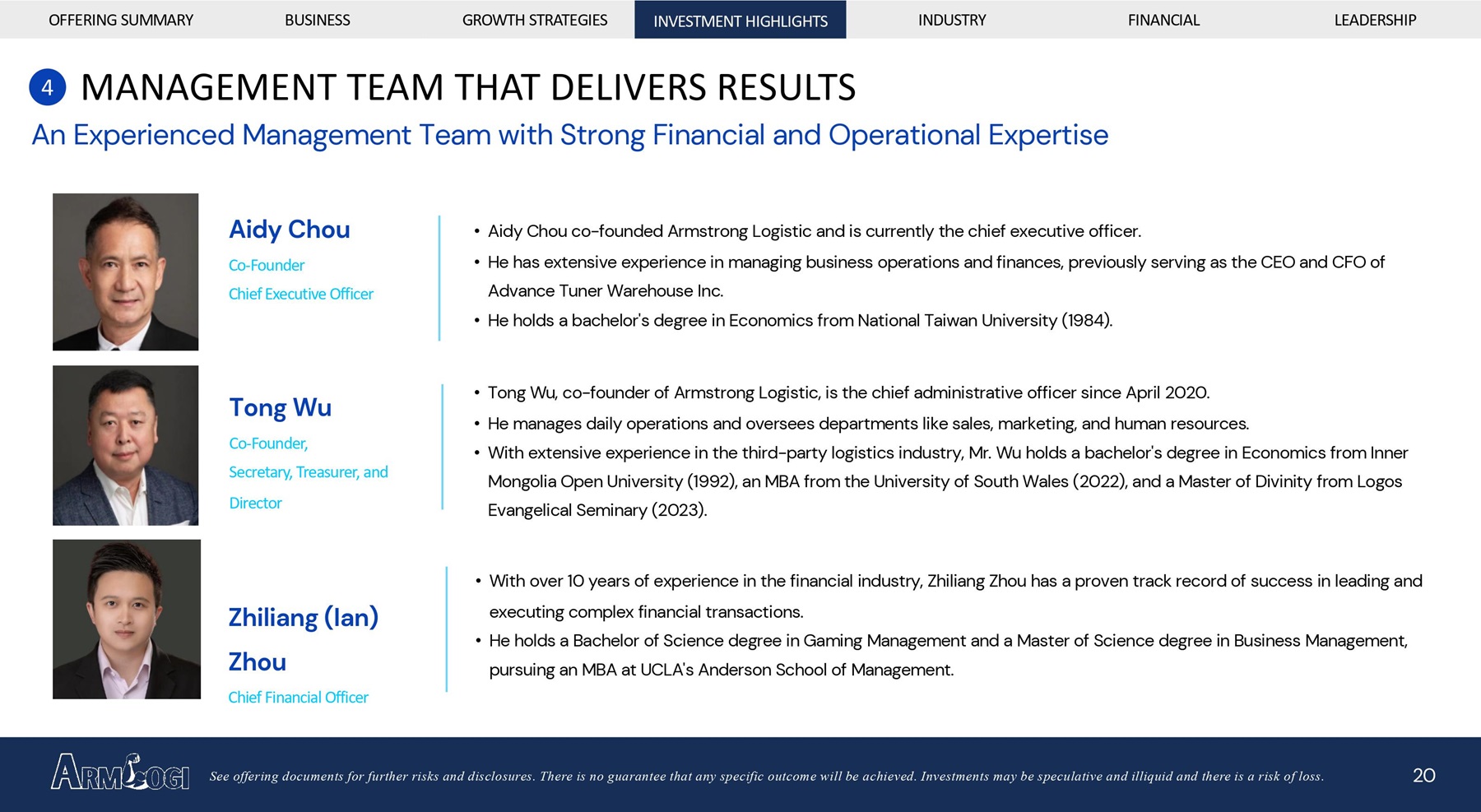

20 OFFERING SUMMARY BUSINESS GROWTH STRATEGIES INVESTMENT HIGHLIGHTS INDUSTRY FINANCIAL LEADERSHIP 4 MANAGEMENT TEAM THAT DELIVERS RESULTS An Experienced Management Team with Strong Financial and Operational Expertise Aidy Chou Co - Founder Chief Executive Officer • Aidy Chou co - founded Armstrong Logistic and is currently the chief executive officer. • He has extensive experience in managing business operations and finances, previously serving as the CEO and CFO of Advance Tuner Warehouse Inc. • He holds a bachelor's degree in Economics from National Taiwan University (1984). Tong Wu Co - Founder, Secretary, Treasurer, and Director • Tong Wu, co - founder of Armstrong Logistic, is the chief administrative officer since April 2020. • He manages daily operations and oversees departments like sales, marketing, and human resources. • With extensive experience in the third - party logistics industry, Mr. Wu holds a bachelor's degree in Economics from Inner Mongolia Open University (1992), an MBA from the University of South Wales (2022), and a Master of Divinity from Logos Evangelical Seminary (2023). Zhiliang (Ian) Zhou Chief Financial Officer • With over 10 years of experience in the financial industry, Zhiliang Zhou has a proven track record of success in leading and executing complex financial transactions. • He holds a Bachelor of Science degree in Gaming Management and a Master of Science degree in Business Management, pursuing an MBA at UCLA's Anderson School of Management. See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative and illiquid and there is a risk of loss.

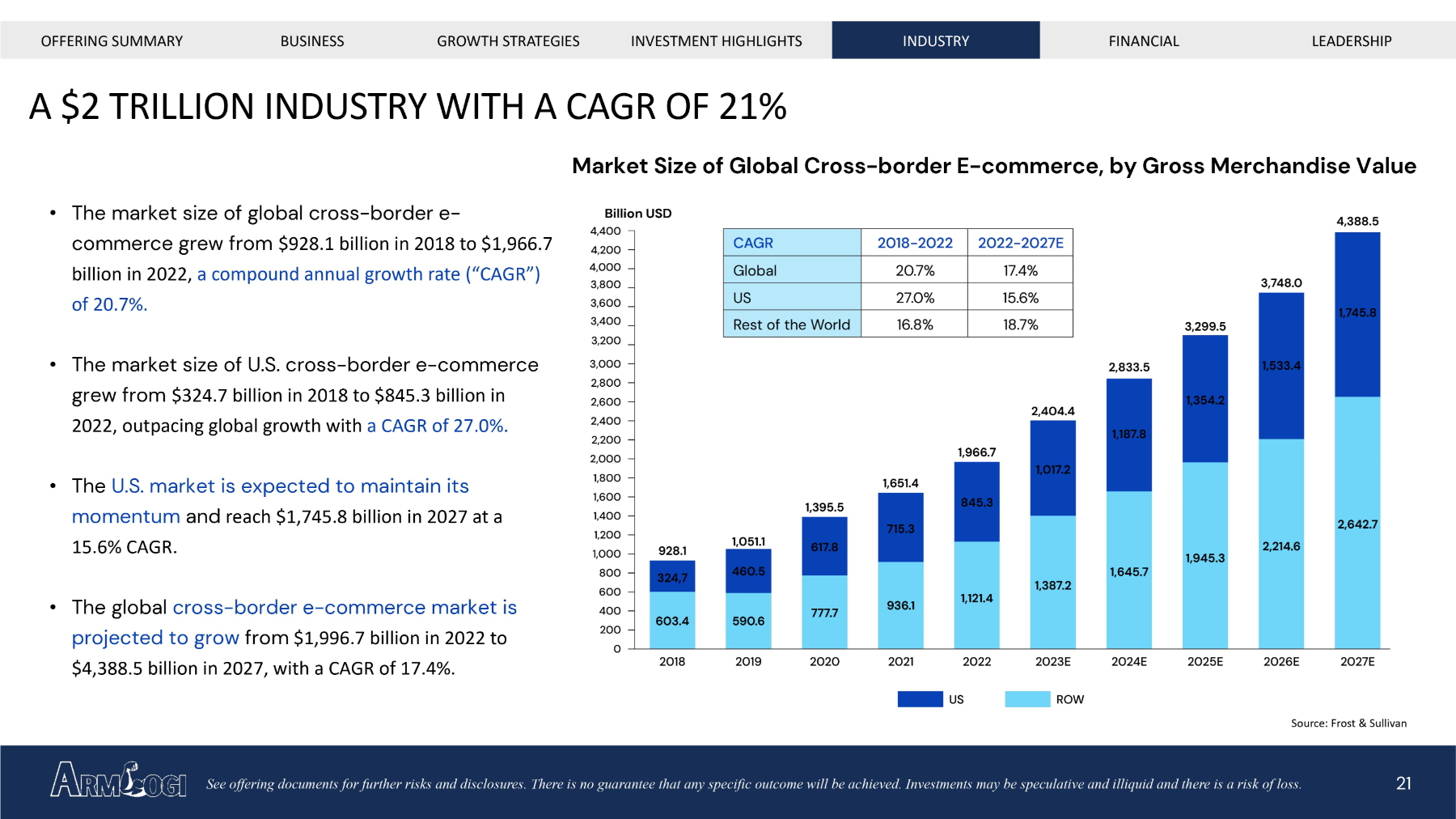

21 OFFERING SUMMARY BUSINESS GROWTH STRATEGIES INVESTMENT HIGHLIGHTS INDUSTRY FINANCIAL LEADERSHIP A $2 TRILLION INDUSTRY WITH A CAGR OF 21% Source: Frost & Sullivan Market Size of Global Cross - border E - commerce, by Gross Merchandise Value • The market size of global cross - border e - commerce grew from $928.1 billion in 2018 to $1,966.7 billion in 2022, a compound annual growth rate (“CAGR”) of 20.7%. • The market size of U.S. cross - border e - commerce grew from $324.7 billion in 2018 to $845.3 billion in 2022, outpacing global growth with a CAGR of 27.0%. • The U.S. market is expected to maintain its momentum and reach $1,745.8 billion in 2027 at a 15.6% CAGR. • The global cross - border e - commerce market is projected to grow from $1,996.7 billion in 2022 to $4,388.5 billion in 2027, with a CAGR of 17.4%. See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative and illiquid and there is a risk of loss.

22 STRONG INDUSTRY GROWTH DRIVERS FOR U.S. & GLOBAL MARKETS Source: Frost & Sullivan • Increased online shopping trend over brick - and - mortar stores due to COVID - 19 pandemic • U.S. e - commerce sales grew from $465 billion in 2019 to $617.8 billion in 2020 (32.4% YoY growth). • Global e - commerce sales grew from $1,051.1 billion in 2019 to $1,395.5 billion in 2020 (32.8% YoY growth). • U.S., being a large consumer country, imports most commodities, promoting cross - border e - commerce industry. Changes in Consumption Habits Post COVID - 19 • Businesses shifted to online platforms for new revenue growth post - pandemic. • Walmart launched its online business in 2013 and became the second - largest retailer in the U.S. in 2021. Retail Moving Online • Frost & Sullivan’s market research indicated average prices for household utensils sold in the U.S. were two to five times higher than those sold in China. • Popular categories in the U.S. e - commerce market in 2022 were clothing, toys, and consumer electronics, mostly imported from China. • Typically, e - commerce platforms offer a more transparent price comparison mechanism, allowing customers to choose from competitively priced products. Cross - border E - comm Offering Value - for - money Merchandise OFFERING SUMMARY BUSINESS GROWTH STRATEGIES INVESTMENT HIGHLIGHTS INDUSTRY FINANCIAL LEADERSHIP See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative and illiquid and there is a risk of loss.

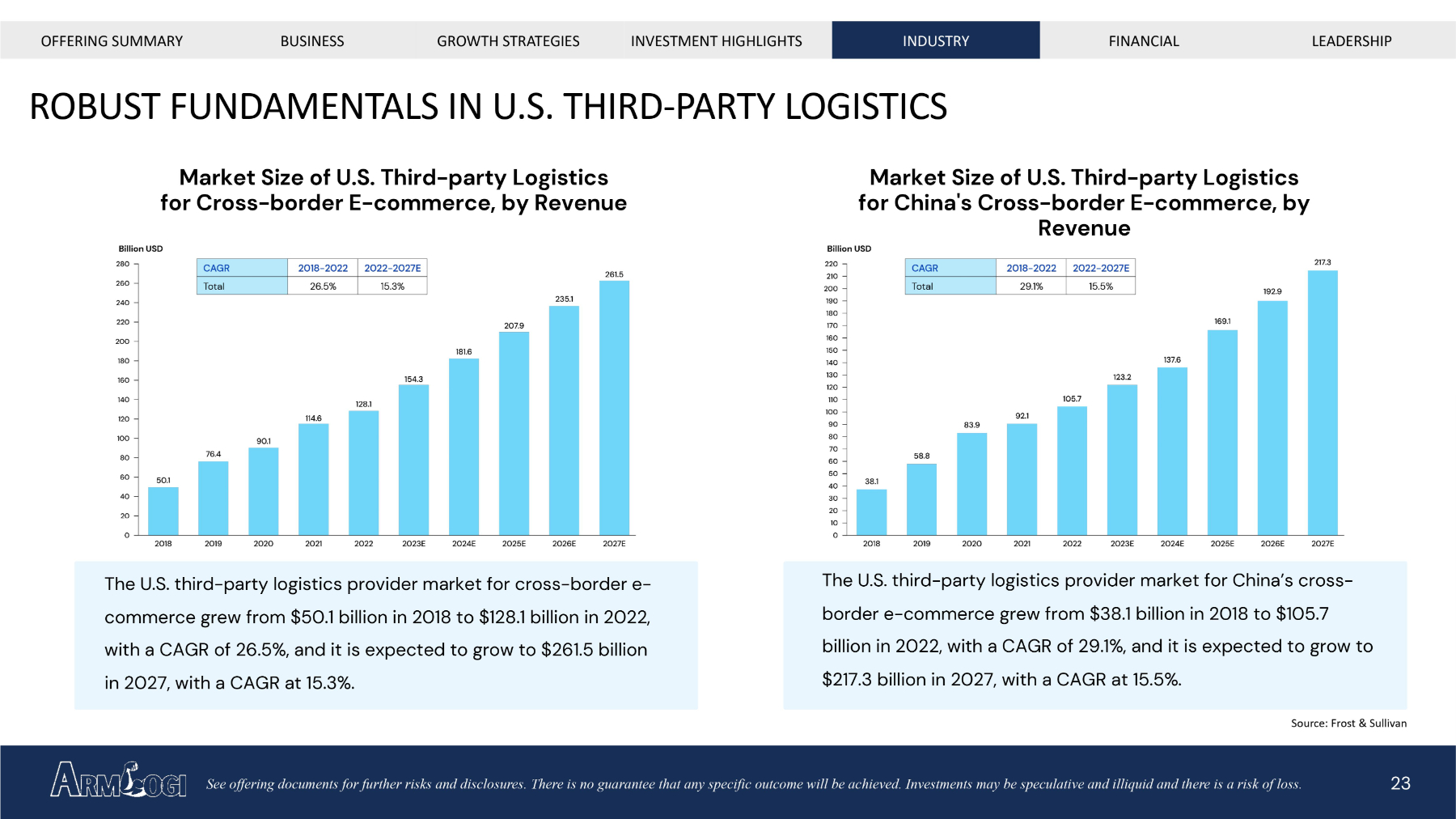

23 ROBUST FUNDAMENTALS IN U.S. THIRD - PARTY LOGISTICS Source: Frost & Sullivan Market Size of U.S. Third - party Logistics for Cross - border E - commerce, by Revenue Market Size of U.S. Third - party Logistics for China's Cross - border E - commerce, by Revenue The U.S. third - party logistics provider market for cross - border e - commerce grew from $50.1 billion in 2018 to $128.1 billion in 2022, with a CAGR of 26.5%, and it is expected to grow to $261.5 billion in 2027, with a CAGR at 15.3%. The U.S. third - party logistics provider market for China’s cross - border e - commerce grew from $38.1 billion in 2018 to $105.7 billion in 2022, with a CAGR of 29.1%, and it is expected to grow to $217.3 billion in 2027, with a CAGR at 15.5%. OFFERING SUMMARY BUSINESS GROWTH STRATEGIES INVESTMENT HIGHLIGHTS INDUSTRY FINANCIAL LEADERSHIP See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative and illiquid and there is a risk of loss.

24 SUCCESS BY NUMBERS The Path of Our Financial Growth OFFERING SUMMARY BUSINESS GROWTH STRATEGIES INVESTMENT HIGHLIGHTS INDUSTRY FINANCIAL LEADERSHIP See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative and illiquid and there is a risk of loss. Our historical financial and operating results are not indicative of our future performance and our financial and operating r esu lts may fluctuate. T he numbers are derived from the company's audited and unaudited financial statements.

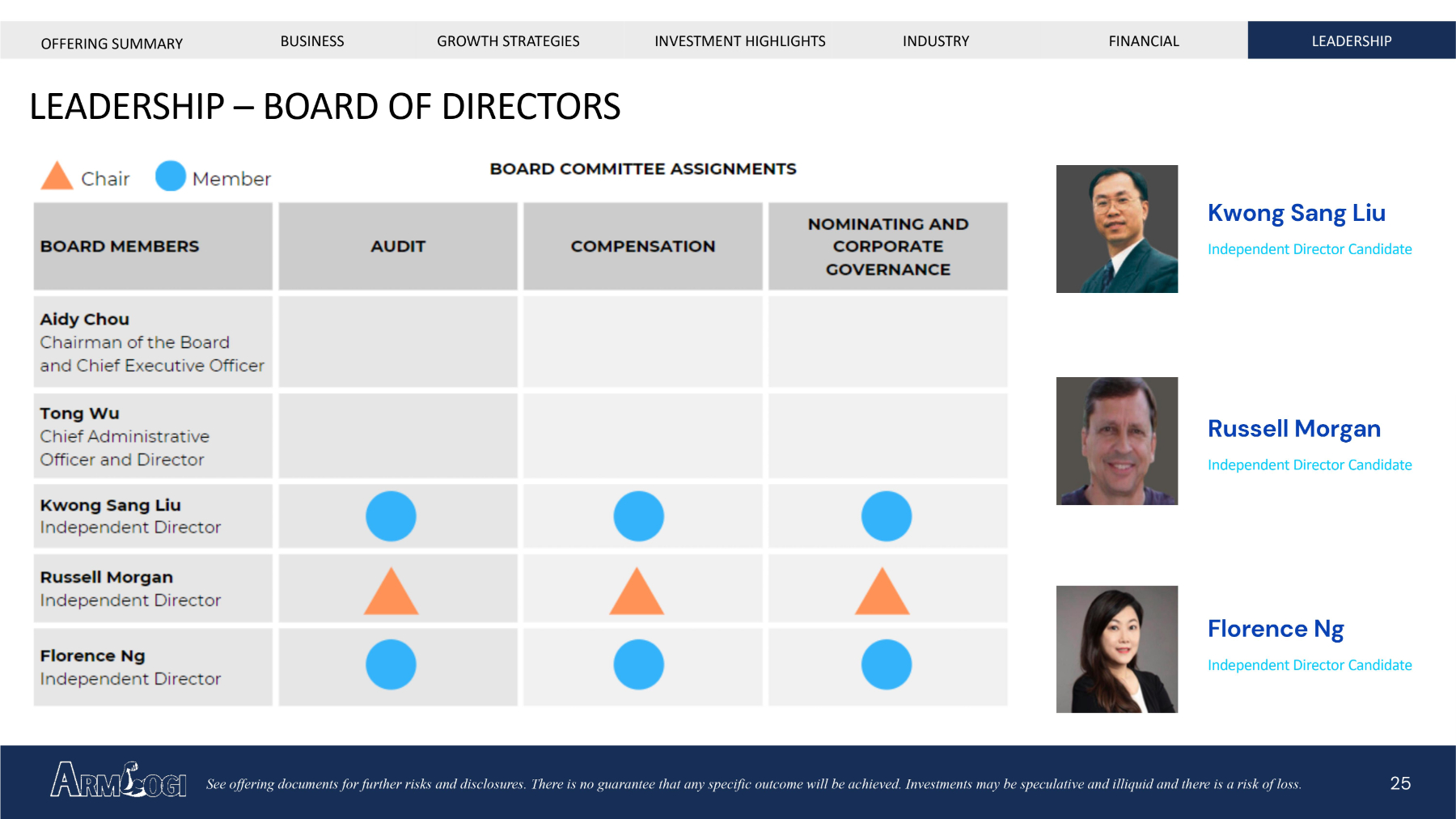

25 OFFERING SUMMARY BUSINESS GROWTH STRATEGIES INVESTMENT HIGHLIGHTS INDUSTRY FINANCIAL LEADERSHIP LEADERSHIP – BOARD OF DIRECTORS Kwong Sang Liu Independent Director Candidate Russell Morgan Independent Director Candidate Florence Ng Independent Director Candidate See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative and illiquid and there is a risk of loss.

Company Contact: 20301 East Walnut Drive North Walnut, California, 91789 (888) 691 - 2911 ir@armlogi.com www.armlogi.com CONTACT US May 2023 Investor Relations Contact: Strategic Investor Relations, Inc. Matthew Abenante IRC, President (347) 947 - 2093 matthew@strategic - ir.com