UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________________________________________________

FORM 10-K

___________________________________________________________________

| |

| |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024 |

or |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______ to ______ |

Commission File Number: 001-41797

TKO GROUP HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| |

| |

Delaware | 92-3569035 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

200 Fifth Ave, 7th Floor

New York, NY 10010

(Address of principal executive offices)

(646) 558-8333

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

| | |

| | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Class A Common Stock, par value $0.00001 per share | TKO | The New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | |

Large Accelerated Filer ☒ | Accelerated Filer ☐ | Non-Accelerated Filer ☐ | Smaller Reporting Company ☐ | Emerging Growth Company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, based on the closing price of the shares of Class A common stock on the New York Stock Exchange on June 30, 2024, was $8,505,980,836. Solely for the purposes of this disclosure, shares of common stock held by the registrant's executive officers, directors and certain of its stockholders as of such date have been excluded because such holders may be deemed to be affiliates.

As of January 31, 2025, there were 81,553,818 shares of the Registrant’s Class A common stock outstanding and 89,616,891 shares of the Registrant’s Class B common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions of the registrant's Definitive Proxy Statement for the registrant's 2025 annual meeting of stockholders to be filed with the Securities and Exchange Commission no later than 120 days after the end of the fiscal year ended December 31, 2024 are incorporated herein by reference in Part III of this Annual Report on Form 10-K.

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (the “Annual Report”) contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended (the "Securities Act") and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). All statements other than statements of present and historical fact contained in this Annual Report, including without limitation, statements regarding the anticipated benefits of and costs associated with the Transactions (as defined below); our expectations surrounding the Transactions and our ability to grow our business and bolster our financial position; our expectations regarding strategic transactions, including the Endeavor Asset Acquisition; our expectation regarding actions under our capital return program, including the amount and frequency of share repurchases and dividends; our expectations about the issuance of Class B common stock; our expected contractual obligations and capital expenditures; our future results of operations and financial position; industry and business trends; the impact of market conditions and other macroeconomic factors on our business, financial condition and results of operations; our future business strategy, plans, market growth and our objectives for future operations; and our competitive market position within our industry are forward-looking statements.

Without limiting the foregoing, you can generally identify forward-looking statements by the use of forward-looking terminology, including the terms “aim,” “anticipate,” “believe,” “could,” “mission,” “may,” “will,” “should,” “expect,” “intend,” “plan,” “estimate,” “project,” “predict,” “potential,” “target,” “contemplate,” or, in each case, their negative, or other variations or comparable terminology and expressions. The forward-looking statements in this Annual Report are only predictions and are based on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition, and results of operations. These forward-looking statements speak only as of the date of this Annual Report and are subject to a number of known and unknown risks, uncertainties and assumptions, including but not limited to important risk factors included in Part I, Item 1A. “Risk Factors” in this Annual Report and our subsequent filings with the Securities and Exchange Commission (the “SEC”).

These risks could cause our actual results to differ materially from those implied by forward-looking statements in this Annual Report. Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. Even if our results of operations, financial condition and liquidity and the development of the industry in which we operate are consistent with the forward-looking statements contained in this Annual Report, those results or developments may not be indicative of results or developments in subsequent periods.

You should read this Annual Report and the documents that we reference herein completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements. Except as required by applicable law, we have no obligation to update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

DEFINITIONS

As used in this Annual Report, unless we state otherwise or the context otherwise requires:

•“we,” “us,” “our,” “TKO Group Holdings,” “TKO,” the “Company,” and similar references refer (1) prior to the consummation of the Transactions (as defined below) to Zuffa Parent, LLC, and (2) after the consummation of the Transactions to TKO Group Holdings, Inc. and its consolidated subsidiaries.

•“Board” refers to the board of directors of TKO Group Holdings.

•“business combination” refers to the combination of the businesses of WWE and TKO OpCo.

•“Class A common stock” refers to the Class A common stock, par value $0.00001 per share, of TKO.

•“Class B common stock” refers to the Class B common stock, par value $0.00001 per share, of TKO.

•“DGCL” refers to the General Corporation Law of the State of Delaware.

•“Endeavor” refers to Endeavor Group Holdings, Inc., a Delaware corporation.

•“Endeavor Asset Acquisition” refers to our agreement with Endeavor OpCo and IMG Worldwide, LLC (collectively, the "EDR Parties") to acquire the Professional Bull Riders (“PBR”), On Location and IMG businesses (including the IMG Media business and certain other businesses operating under the IMG brand).

•“Endeavor OpCo” refers to Endeavor Operating Company, LLC, a Delaware limited liability company and subsidiary of Endeavor.

•“Endeavor Take-Private” refers to the transactions contemplated by the Agreement and Plan of Merger, dated as of April 2, 2024, by and among Wildcat EGH Holdco, L.P., Wildcat OpCo Holdco, L.P., Wildcat PubCo Merger Sub, Inc., Wildcat Manager Merger Sub, L.L.C., Wildcat OpCo Merger Sub, L.L.C., Endeavor Executive Holdco, LLC, Endeavor Executive II Holdco, LLC, Endeavor Executive PIU Holdco, LLC, Endeavor Manager, LLC, Endeavor OpCo and Endeavor, pursuant to which affiliates of Silver Lake agreed to acquire 100% of the outstanding shares of Endeavor’s stock that Silver Lake does not already own (subject to certain exceptions).

•“fully-diluted basis” means on a basis calculated assuming the full cash exercise (and not net settlement but, for the avoidance of doubt, including the conversion of the Convertible Notes (to the extent not converted prior to closing of the Transaction)) of all outstanding options, warrants, restricted stock units, performance stock units, dividend equivalent rights and other rights and obligations (including any promised equity awards and assuming the full issuance of the shares underlying such awards) to acquire voting interests of TKO Group Holdings (without regard to any vesting provisions and, with respect to any promised awards whose issuance is conditioned in full or in part based on achievement of performance goals or metrics, assuming achievement at target performance) and the full conversion, exercise, exchange, settlement of all issued and outstanding securities convertible into or exercisable, exchangeable or settleable for voting interests of TKO Group Holdings, not including any voting interests of TKO Group Holdings reserved for issuance pursuant to future awards under any option, equity bonus, share purchase or other equity incentive plan or arrangement of TKO Group Holdings (other than promised awards described above), and any other interests or shares, as applicable, that may be issued or exercised. For the avoidance of doubt, this definition assumes no net settlement or other reduction in respect of withholding tax obligations in connection with the issuance, conversion, exercise, exchange or settlement of such rights or obligations to acquire interests of TKO Group Holdings as described in the foregoing.

•“NYSE” refers to the New York Stock Exchange.

•“TKO OpCo” refers to TKO Operating Company, LLC (f/k/a Zuffa Parent LLC), a Delaware limited liability company and our direct subsidiary.

•“TKO OpCo Units” refers to all of the existing equity interests in TKO OpCo.

•“Transactions” refer, collectively, to the transactions pursuant to the Transaction Agreement (defined below) pursuant to which: (i) WWE undertook certain internal restructuring steps; (ii) Whale Merger Sub Inc. (“Merger Sub”) merged with and into WWE (the “Merger”), with WWE surviving the Merger (the “Surviving Entity”) and becoming a direct wholly owned subsidiary of the Company; (iii) immediately following the Merger, the Company caused the Surviving Entity to be converted into a Delaware limited liability company (“WWE LLC”) and the Company became the sole managing member of WWE LLC (the “Conversion”); and (iv) following the Conversion, TKO Group Holdings, Inc. (x) contributed all of the equity interests of WWE LLC to TKO OpCo in exchange for 49% of the membership interests in TKO OpCo on a fully diluted basis, and (y) issued to Endeavor OpCo and certain of Endeavor’s other subsidiaries a number of shares of our Class B common stock representing, in the aggregate, approximately 51% of the total voting interests of the Company’s stock on a fully-diluted basis, in exchange for a payment equal to the par value of such Class B common stock.

•“Transaction Agreement” refers to the transaction agreement, dated as of April 2, 2023, by and among Endeavor, Endeavor OpCo, TKO OpCo, WWE, the Company, and Merger Sub.

•“UFC” refers to the Ultimate Fighting Championship.

•“WWE” refers to World Wrestling Entertainment, Inc. (n/k/a World Wrestling Entertainment, LLC).

•“Zuffa” refers to Zuffa Parent, LLC (n/k/a TKO Operating Company, LLC or TKO OpCo).

RISK FACTOR SUMMARY

Our business is subject to numerous risks and uncertainties, including those described in Part I, Item 1A. “Risk Factors” in this Annual Report. You should carefully consider these risks and uncertainties when investing in our securities. Principal risks and uncertainties affecting our business include the following:

•our ability to generate revenue from discretionary and corporate spending on events, such as corporate sponsorships and advertising, is subject to many factors, including many that are beyond our control, such as general macroeconomic conditions;

•we depend on key relationships with television and cable networks, satellite providers, digital streaming partners and other distribution partners. Our failure to maintain, renew or replace key agreements could adversely affect our ability to distribute our media content, WWE Network and/or other of our goods and services, which could adversely affect our operating results;

•we may not be able to adapt to or manage new content distribution platforms or changes in consumer behavior resulting from new technologies;

•failure to complete the Endeavor Asset Acquisition could negatively impact our stock price, future business and financial results;

•the planned issuance of Class B common stock and TKO OpCo Units to the EDR Parties will dilute the ownership and voting interests;

•we may be unsuccessful in our strategic acquisitions, investments and commercial agreements, and we may pursue acquisitions, investments or commercial agreements for their strategic value in spite of the risk of lack of profitability;

•because our success depends substantially on our ability to maintain a professional reputation, adverse publicity concerning us, or our key personnel could adversely affect our business;

•the markets in which we operate are highly competitive, rapidly changing and increasingly fragmented, both within the United States and internationally, and we may not be able to compete effectively, which could adversely affect our operating results;

•failure to protect our IT Systems and Confidential Information (both terms as defined in Part I, Item 1A. "Risk Factors") against breakdowns, security breaches, and other cybersecurity risks could result in financial penalties, legal liability, and/or reputational harm, which would adversely affect our business, results of operations, and financial condition;

•we are subject to extensive U.S. and foreign governmental regulations, and our failure to comply with these regulations could adversely affect our business;

•we depend on the continued services of executive management and other key employees, and of our parent company, Endeavor. The loss or diminished performance of these individuals, or any diminished performance by Endeavor, could adversely affect our business;

•changes in public and consumer tastes and preferences and industry trends could reduce demand for our content offerings and adversely affect our business;

•owning and managing events for which we sell media and sponsorship rights, ticketing and hospitality exposes us to greater financial risk. Additionally, we may be prohibited from promoting and conducting our live events if we do not comply with applicable regulations. If our live events are not financially successful, our business could be adversely affected;

•our business and operating results may be affected by the outcome of pending and future litigation, investigations, claims and other disputes;

•we have a substantial amount of indebtedness, which could adversely affect our business, and we cannot be certain that additional financing will be available on reasonable terms when required, or at all;

•we are a holding company whose principal assets are the TKO OpCo Units we hold in TKO OpCo and, accordingly, we are dependent upon distributions from TKO OpCo to pay taxes and other expenses;

•we are currently controlled by Endeavor. The interests of Endeavor or, subject to the Endeavor Take-Private, Silver Lake, may differ from the interests of other stockholders of TKO Group Holdings;

•if Endeavor or its subsidiaries sell a controlling interest in us to a third party in a private transaction, we may become subject to the control of a presently unknown third party;

•we may fail to complete the Endeavor Asset Acquisition if certain required conditions, many of which are outside our control, are not satisfied;

•we may fail to realize the anticipated benefits of the Endeavor Asset Acquisition and may assume unanticipated liabilities, including in connection with termination of the Services Agreement;

•the market price of our Class A common stock may be volatile, and holders of our Class A common stock may be unable to resell their Class A common stock at or above their purchase price or at all;

•we cannot guarantee we will conduct share repurchases or pay dividends in any specified amounts or particular frequency;

•tax matters may cause significant variability in our financial results; and

•TKO OpCo may be required to pay additional taxes as a result of the partnership audit rules.

PART I

Item 1. Business

TKO Group Holdings is a premium sports and sports entertainment company that operates leading combat sport and sports entertainment companies. TKO owns and manages valuable sports and entertainment intellectual property, positioning the business in what we believe is one of the most attractive parts of the fast-growing global sports and entertainment ecosystem.

TKO is comprised of UFC, the world's premier mixed martial arts ("MMA") organization, and WWE, a renowned sports entertainment business. The merger of these two businesses in September 2023 united two complementary organizations in a single company.

We believe TKO’s companies are well-positioned among sports, media and entertainment peers given their large, diverse and global fanbases and the year-round nature of their content. UFC is among the most popular sports organizations in the world. As of December 31, 2024, UFC has more than 700 million fans who skew young and diverse, as well as approximately 300 million social media followers, and broadcasts its content to over 950 million households across more than 170 countries. As of the same period, WWE has over 700 million fans and approximately 380 million social media followers. WWE counts more than 100 million YouTube subscribers, making it one of the most viewed YouTube channels globally. In total, UFC and WWE produce approximately 300 live events that attract more than two million attendees on an annual basis and serve as the foundation of our global content distribution strategy.

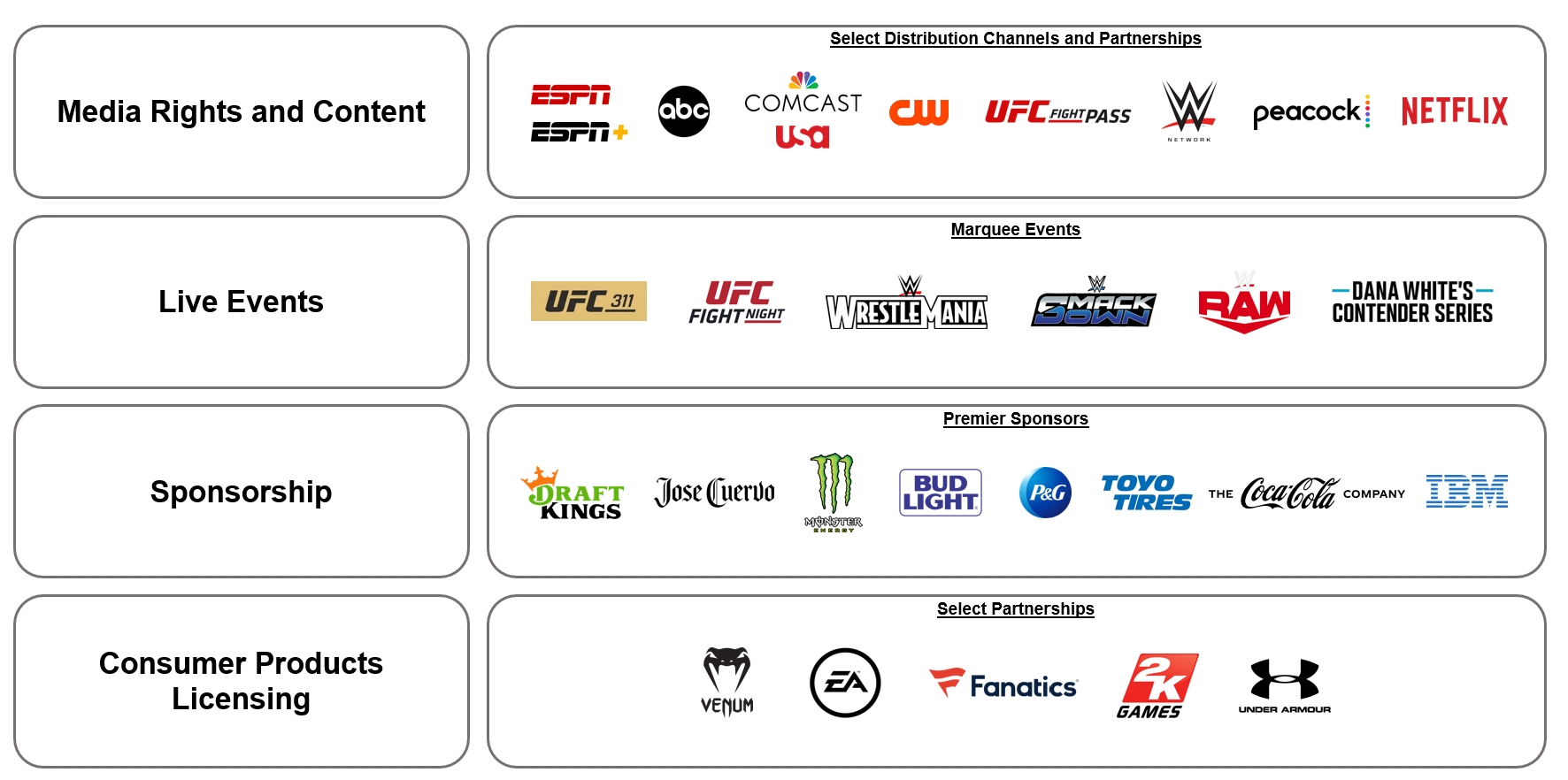

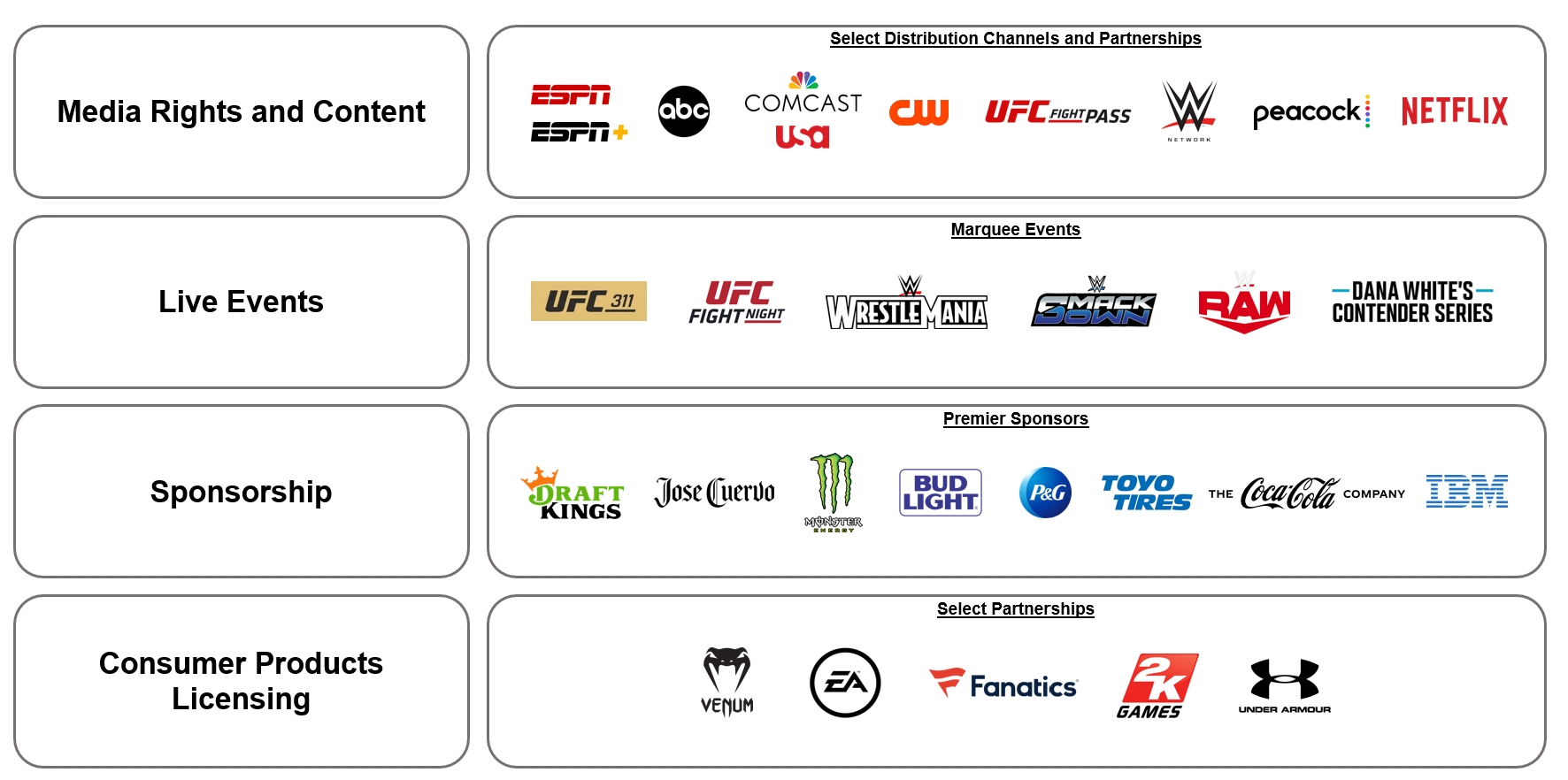

TKO distributes content and monetizes our intellectual property primarily through four principal activities: Media Rights and Content, Live Events, Sponsorship and Consumer Products Licensing, which are covered in greater detail in the “Overview of Revenue Sources” section of this document. A summary of our principal activities is presented in the table below:

The popularity of our companies makes us attractive to media distribution and sponsorship partners. Across our portfolio, we have agreements with leading distributors, including Disney’s ESPN, Netflix, NBCUniversal, the CW, Rogers, Foxtel and DAZN, enabling UFC and WWE content to reach audiences around the globe. We have advertising and sponsorship agreements with a wide variety of leading brands including Anheuser-Busch, IBM, Procter & Gamble, Monster Energy, Cuervo, DraftKings, Toyo Tires, Slim Jim, and others across multiple categories. Our track record building our properties is driven by the quality and quantity of our program offerings and the favorable demographic profile of our core and growing fanbases.

We utilize a multitude of social media platforms to promote our properties, market and distribute our content, engage our fans, and generate advertising revenue. Our social media accounts and websites consistently attract a high volume of views and engagements on various platforms. Across our portfolio of owned brand accounts, we boast approximately 300 million social media followers at UFC and approximately 380 million social media followers at WWE as of December 31, 2024. With over 100 million subscribers, WWE is the 13th most viewed channel across all categories on YouTube.

We believe our companies are well positioned for the future of media. We have the flexibility to deliver our content across channels to meet our fans where they are consuming media. Our multichannel distribution model enables TKO to capitalize on increased

competition for premium live sports rights and sports entertainment programming across digital and linear services. We license our media rights under long-term contracts to leading distributors globally. The contractual, recurring nature of our revenue base provides our business with good visibility into revenue growth, which supports further investment in our products and adjacent content reinforcing the value of our properties to our fans and partners.

Our management team has deep expertise in sports, media, and live events. Ariel Emanuel serves as CEO and Executive Chair and Mark Shapiro serves as President and COO at TKO. They each have decades of experience founding, acquiring, and scaling sports and entertainment businesses, including UFC, which Endeavor acquired in 2016 and subsequently executed a strategy that drove substantial value creation for shareholders. Dana White serves as CEO and President of UFC and Nick Khan serves as President of WWE. Each brings deep institutional and operational knowledge to our business. We believe our leadership team’s proven track record of performance positions us to successfully execute organic and inorganic growth opportunities at TKO. We view this as a key competitive advantage within the dynamic sports and entertainment landscape.

In October 2024, we entered into an agreement with Endeavor to acquire PBR, On Location and IMG businesses (including IMG's media business and certain other businesses operating under the IMG brand) (the "Endeavor Asset Acquisition”). We expect to close this acquisition in the first quarter of 2025.

PBR is the world’s premier bull riding organization. More than 800 bull riders compete in more than 200 events annually across the PBR Unleash The Beast tour, which features the top bull riders in the world; the PBR Pendleton Whisky Velocity Tour; the PBR Touring Pro Division; and the PBR business’ international circuits in Australia, Brazil, and Canada. In 2022, PBR launched the PBR Team Series — eight teams of the world’s best bull riders competing for a new championship expanding to 10 teams in 2024 — as well as the PBR Challenger Series with more than 60 annual events nationwide. PBR Teams League and Unleash The Beast events are broadcast on CBS Television Network, reaching nearly 40 million viewers each year.

On Location is a global leader in premium experiential hospitality, offering ticketing, curated guest experiences, live event production and travel management across sports and entertainment. On Location provides unrivaled access for corporate clients and fans looking for official, immersive experiences at marquee events, including the 2024, 2026 and 2028 Summer and Winter Olympic and Paralympic Games, FIFA World Cup 2026, Super Bowl, NCAA Final Four, and more.

IMG is an industry-leading global sports marketing agency, specializing in media rights management and sales, multi-channel content production and distribution, brand partnerships, digital services, and events management. It powers growth of revenues, fanbases and IP for more than 200 federations, associations, events, and teams, including the National Football League, English Premier League, International Olympic Committee, National Hockey League, Major League Soccer, ATP and WTA Tours, the All England Lawn Tennis & Croquet Club (Wimbledon), EuroLeague Basketball, DP World Tour, and The R&A, as well as UFC, WWE, and PBR.

Overview of Revenue Sources

Media Rights and Content

We generate revenue from the licensing of our live events and original programming to domestic and international broadcasters and distributors that carry our programming on digital and linear channels and via pay-per-view (“PPV”). Original programming includes long and short-form content, reality series and other filmed entertainment.

License agreements with broadcasters and distributors have various terms typically ranging from three to five years, although certain of our most significant agreements are longer and range from seven to 10 years. We negotiate agreements with a renewal horizon that reflects the growing popularity of our programming. In 2019, UFC established a seven-year partnership with ESPN to become the exclusive broadcaster of UFC live events in the U.S., including PPV events. UFC’s live events appear on Disney’s ABC broadcast channel, ESPN, ESPN2, and ESPN+. We have also signed new international license agreements at UFC that have bolstered growth in audience reach and revenues. For WWE, media rights fees consist primarily of licensing revenues from the distribution of Raw, SmackDown, NXT and Premium Live Events ("PLEs"). WWE has entered partnerships with major distribution networks, such as Netflix, NBCUniversal/USA Network, and the CW, to distribute content across the U.S. Since January 2025, Netflix is the exclusive global home to Raw. Additionally, since January 2025 and as rights become available globally, distribution for all WWE content outside the U.S., including PLEs, is available on Netflix. The agreement has an initial 10-year term, with an option for Netflix to extend for an additional 10 years and to opt out after the initial five years.

In addition to the rights we sell to distributors, we offer a direct-to-consumer streaming product, UFC FIGHT PASS, that addresses consumer demand for premium, live and on-demand events. This direct-to-consumer streaming product provides fans globally with access to live and video-on-demand events, as well as vast libraries of original content.

UFC FIGHT PASS provides UFC fans an expansive library of content directly to audiences in regions where it has an existing rights deal. UFC FIGHT PASS also allows UFC to distribute its content directly to audiences in markets where a direct customer relationship is economically favorable when compared to a third-party broadcast, digital or pay-per-view licensing deal. One such

example is Brazil, where UFC elected to take its content to fans directly via a fully localized version of UFC FIGHT PASS, recognizing that 96% of the Brazil fan base consumes UFC content through digital service offerings.

WWE Network provides WWE fans an expansive library of archived content and non-live original content per year, including second runs of in-ring television programming, exclusive original programming, documentaries, reality shows, and specials. In March 2021, Peacock became the exclusive U.S. home to WWE Network in connection with a multi-year license agreement. WWE Network content is also licensed in certain international markets. As mentioned previously, since January 2025 and as rights become available globally, distribution for all WWE content outside the U.S., including PLEs, is available on Netflix.

Live Events

We deliver compelling, year-round events around the world that showcase a talented roster of UFC athletes and WWE Superstars. Live events generate revenue through the sale of tickets, site fees, travel packages and VIP experiences.

Across UFC and WWE, TKO hosts approximately 300 annual live events in multiple countries and marquee venues, including New York’s Madison Square Garden, London’s O2 Arena, and Las Vegas' T-Mobile Arena. Our tentpole live events include UFC numbered events, WrestleMania, and SummerSlam, among others. These events regularly sell out. In 2024, UFC set 10 new, all-time-highest-grossing event records at several arenas in key markets, including Scotiabank Arena in Toronto, Canada (UFC 297); Honda Center in Anaheim, Calif. (UFC 298); Kaseya Center in Miami, Fla. (UFC 299); Co-op Live in Manchester, England (UFC 304); RAC Arena in Perth, Australia (UFC 305); and Sphere in Las Vegas (UFC 306). In the same year, WrestleMania XL became the most successful and highest-grossing event in history, with over 145,000 attendees over the course of the two-day event, while our Money in the Bank event became the highest-grossing WWE arena event in Canada.

Sponsorship

TKO generates advertising and sponsorship revenue from the sale of in-venue and in-broadcast advertising assets, content product integration and digital impressions across both UFC and WWE. Advertising revenues are also driven by original content on third-party social media platforms. With complete ownership and control over our properties' production, we believe our programming and format provide compelling sports and entertainment opportunities for advertisers. We are able to create unique brand integration opportunities for partners across existing programming.

Sponsorship revenues are generated from partners who promote their products utilizing the broad reach of TKO’s premium properties. Our global salesforce has established sponsor relationships with major brands worldwide across a variety of industries. The unique but complementary nature of our properties enables us to offer a differentiated sponsorship product to partners, providing access to scaled promotion, as well as more targeted audiences across our entire portfolio, to meet the unique needs of our sponsorship partners. We continue to expand the categories and volume of our partnerships with major brands, such as Anheuser-Busch, IBM, Procter & Gamble, Monster Energy, Cuervo, DraftKings, Toyo Tires and Slim Jim. We are also able to create new sponsorship assets and inventory through our innovative approach to new technology, including UFC’s high-definition LED Fight Clock and Fight Deck displays and WWE’s innovative in-ring product activations, which provide additional, unique opportunities for our partners.

Consumer Products Licensing

TKO merchandises UFC and WWE across a diverse range of branded products, including video games, apparel, equipment, trading cards, memorabilia, digital goods, and toys. We partner with major global companies to sell branded merchandise through licensing arrangements and direct-to-consumer sales. Revenues principally consist of royalties and license fees related to branded products and sales of merchandise distributed at live events and through eCommerce platforms.

We have licensing partnerships with major retailers and brands worldwide. Video games and toys are among the largest components of our licensing programs. UFC has multi-year licensing agreements with EA Sports to produce and sell UFC-branded console video games and with Fanatics to produce and sell event merchandise. Similarly, WWE has a multi-year licensing agreement with Take-Two Interactive Software to produce and sell WWE-branded console video games. WWE also has a multi-year licensing agreement with Mattel, Inc., its exclusive toy licensee, covering all global territories and, beginning July 2022, WWE launched an exclusive, multi-year partnership with Fanatics that includes WWE Shop, a premier e-commerce and mobile destination. WWE also distributes its products through major retail holders such as Walmart, Target, GameStop, Barnes & Noble, Topps, Hot Topic, and ASDA Stores. Similarly, UFC maintains licensing partnerships with over 40 premium brands, including EA Sports, Project Rock by Under Armour, Timex, and Venum.

Growth Vectors

We believe TKO is well-positioned to benefit from secular tailwinds in both sports and entertainment. Live sports and sports entertainment remain important for both traditional linear platform providers as well as streamers and technology entrants. As a result, the value of media rights for unique assets, such as UFC and WWE, have appreciated consistently. We anticipate realizing growth in media rights content agreements upon contract renewals that materialize over the coming years, reflecting the increased value of our

premium content to linear and streaming channels, as well as the broader trend of premium live sports and entertainment content rights generally increasing in value across renewal cycles. We believe we can generate more content in various formats to acquire and engage new and existing fans, generate license fees from distribution partners, and drive increased adoption of our direct-to-consumer offerings, UFC FIGHT PASS and WWE Network. TKO drives economic benefits to the cities that host WWE and UFC events, which we believe will lead to growth in site fees as jurisdictions vie to bring premium events to their market. For example, WrestleMania in April 2024 generated $200 million in economic impact for the Philadelphia region, UFC 307 in Salt Lake City generated nearly $27 million in economic impact in October 2024 and TKO's takeover of Anaheim, California with UFC 298 and Raw combined to generate over $30 million in February 2024.

International

As of December 31, 2024, approximately 93% of UFC and WWE fans are from international markets. We see a significant opportunity to further monetize and grow in existing international markets through traditional distribution partnerships, direct-to-consumer offerings, live events, consumer products, and sponsorship partnerships.

In addition to further monetizing our existing international markets, we are also focused on the international expansion of our content and programming distribution, with efforts across Europe, Asia Pacific and the Middle East offering significant growth potential. We believe our success to date through our live events, extensive international distribution infrastructure, and international talent demonstrates our ability to sustain future international growth of our properties. UFC content reaches over 950 million households across 50 broadcast partners in over 50 languages in more than 170 countries. As of December 31, 2024, WWE content reached more than one billion households in 24 languages in more than 150 countries.

Live Events

We believe we can grow Live Events revenue by increasing ticket sales and expanding premium VIP offerings to drive higher per event revenues to drive monetization across events. Compelling, live experiences are at the core of TKO, driving the strength of our companies and fan engagement.

Through our partnership with Endeavor’s On Location business, which curates premium live event experiences, we plan to bring sports and lifestyle events even closer to consumers. Events such as UFC X, which include open workouts, interactive attendee experiences, meet and greets, concerts and parties, and athlete panels, are opportunities to drive growth in site fees as the sport continues to gain in popularity and attract a young and diverse fan base in large cities and countries throughout the world.

Over UFC's history, we have successfully held events in more than 150 cities internationally, and in 2024 visited Abu Dhabi, London, Macau, Mexico City, Riyadh, Perth, and Paris, among other major destinations. During 2024, WWE produced several international events, including PLEs in international markets including Australia, France, Scotland, and Canada, in addition to two events produced through our partnership with the General Entertainment Authority of the Kingdom of Saudi Arabia.

Moreover, live events have the potential to drive significant economic output for host cities from new job creation, salaries and wages, taxes, and other economic activity. Consequently, as the popularity of TKO live events grows, we expect to have a greater ability to secure site fees from local governments or tourism organizations in certain jurisdictions.

Sponsorships

TKO is also distinguished by the attractive fan demographics of its brands. The multicultural foundation of the fighting styles incorporated in MMA and the ubiquitous nature of wrestling resonates with audiences from diverse cultural and demographic backgrounds all over the world. As of December 31, 2024, we estimate that the fan bases of UFC and WWE are approximately 36% and 38% female, respectively. UFC and WWE fans also skew younger on average than those of traditional U.S. sports leagues with a median age of 37 years old and 35 years old, respectively, compared to a range of 39 to 46 years old for the latter.

We believe the differentiated fanbases of our companies make TKO a valued partner for sponsors looking to access this attractive demographic. Our unified global partnership team provides brands with access to one of the most formidable sports marketing portfolios in the world. We expect to increase product activations across platforms and formats, expand and monetize additional staple sponsorship categories, provide additional inventory and assets through innovative new sponsorship offerings, and improve sell-through, particularly in international markets. As such, we anticipate the acceleration of our properties and talent placement across sponsorships, as well as greater cross-selling opportunities with our product licensing partners by leveraging technology, thus driving incremental revenue from new on-screen graphics assets.

Consumer Products

Product licensing and merchandising is a growing category for TKO. We believe there is an opportunity to continue to scale our consumer products division through opportunities in many product categories, including apparel, casual games, and online betting platforms, in addition to expanding direct-to-retail channels in the U.S. and globally.

As such, we continually seek exclusive, multi-year partnerships with leading organizations to develop new products and further expand our licensing business. For example, UFC’s partnership with EA Sports and WWE’s partnership with Take-Two Interactive Software allows us to remain agile as content can be updated for new characters, game modes, and story plots for enhanced game play. Additionally, both UFC and WWE have exclusive, multi-year partnerships with Fanatics across a variety of product categories.

Structural Advantages

Based on our organizational structure, we believe we are well-positioned to effectively and efficiently navigate the rapidly evolving sports and entertainment landscape relative to other sports and entertainment offerings. UFC and WWE’s governance structures do not involve a franchise system with multiple owner-operators as is common in team sports. Importantly, UFC does not rely on an independent promoters network as found in other combat sports. These structural advantages allow UFC and WWE to make decisions unilaterally and to react swiftly and nimbly to changes in consumption habits and fan preferences and to address customer needs. We also have autonomy and oversight over our content production and intellectual property, including domestic and international media rights, which we believe enables us to optimize distribution and production quality.

Unlike traditional sports leagues, we host live events year-round and are not constrained by a seasonal format. In the year ended December 31, 2024, UFC and WWE hosted approximately 300 live events in locations around the world. We maintain the flexibility to scale the number of events hosted each year to meet consumer demand. We also determine the location of each event, which helps us acquire new fans across geographies globally and strengthen our brand reach.

Competition

The entertainment industry is highly competitive and subject to fluctuations in popularity, which are not easy to predict. For our live event and media content audiences, we face competition from professional and college sports (including other MMA promotions), scripted wrestling promotions, other live, filmed, televised, and streamed entertainment, as well as other leisure activities. We continue to face increased competition from websites, mobile, and other internet-connected apps delivering paid and free content as streamed media offerings continue to expand. For purchases of our merchandise, we compete with entertainment companies, professional and college sports leagues, and other makers of branded apparel and merchandise. In addition, our properties compete respectively for talent with other live combat sports and sports entertainment platforms, and work to develop and discover emerging talent.

Talent Discovery and Development

UFC Athletes

Essential to the success of UFC and the sport of MMA is the ability to discover and promote athletes globally. UFC athletes are independent contractors. As of December 31, 2024, there were approximately 650 UFC athletes representing more than 70 countries, of which nearly 20% were female and 60% originated from outside of the U.S.

UFC discovers new athletes via multiple methods, including staging talent discovery shows such as The Ultimate Fighter, Dana White's Lookin’ for a Fight, Dana White’s Contender Series, and Road to UFC. UFC also discovers and evaluates talent through its UFC Academy in Asia, which provides younger MMA athletes with a platform to develop their skills and abilities while competing in local promotions ahead of a potential career in UFC.

To advance the sport of MMA, UFC established the UFC Performance Institutes, which are designed to accelerate knowledge and understanding of MMA by delivering interdisciplinary services, evidence-based science, sports medicine, innovation, and technology, while sharing best practices for performance optimization with athletes and coaches around the world. The first Performance Institute opened in Las Vegas in 2017. The second location opened in Shanghai in 2019. A third location opened in Mexico City in February 2024.

WWE Superstars

The success of WWE is due primarily to the continuing popularity of its Superstars. WWE Superstars are independent contractors. As of December 31, 2024, there were approximately 230 WWE Superstars under contract from more than 20 countries, of which approximately 40% were female. Contracts for WWE Superstars range from multi-year guaranteed contracts with established Superstars to developmental contracts with our Superstars in training.

WWE’s talent development system, including the NXT division, has produced more than 80% of WWE’s current active main roster stars, such as Roman Reigns, Bianca Belair, Sami Zayn, Asuka, Chad Gable, and Alexa Bliss. NXT has evolved into WWE’s third brand after Raw and SmackDown and has transitioned into a weekly live television series. More than 20% of WWE’s developmental talent come from countries outside the U.S., including Nigeria, Japan, England, Chile, Australia, Canada, Ukraine, Haiti, Singapore and Switzerland. Women comprise over 40% of WWE’s developmental talent. NXT talent train at the WWE Performance Center in Orlando, Florida, which was designed to cultivate the next generation of talent and has become the center of WWE’s talent development program.

In 2021, WWE launched a major comprehensive recruiting initiative for in-ring competitors called Next In Line (“NIL”). This program serves to recruit and develop potential future Superstars, and it further enhances WWE’s talent development process through collaborative partnerships with select athletes from diverse athletic backgrounds. In October 2024, following the success of the NIL program, WWE launched a developmental program called WWE Independent Development ("WWE ID") to provide up-and-coming independent wrestlers a pathway to a potential career in WWE. The WWE ID program provides prominent independent wrestling schools with the WWE ID official designation, with the goal of providing new trainees and existing talent at these select institutions with enhanced developmental opportunities. Additionally, WWE ID will identify top independent wrestling prospects with an official designation and support their developmental journey by providing financial opportunity and assisting with training, mentorship and development, including access to world-class facilities, best-in-class ring training, and athletic trainers.

Intellectual Property and Other Proprietary Rights

We consider intellectual property to be very important to the operation of our business and to driving growth in our revenues, particularly with respect to sponsorships, licensing rights, and media distribution agreements. Our intellectual property includes the “UFC” and “WWE” brands and other trademarks and copyrights associated with us and our events, and the rights to use the intellectual property of our commercial partners. Substantially all our intellectual property and owned assets that we create or acquire associated with our content and events are protected by trademarks and copyrights, whether registered or unregistered.

Human Capital Resources

General

We believe the strength of our workforce is critical to our long-term success. Our human capital management objectives include attracting, retaining, and developing high performing and diverse talent.

As of December 31, 2024, we had over 1,300 employees in 12 countries. We have invested and focused extensively on the training and development of our employees, from both a personnel and technology perspective. We believe that our relations with our employees are good.

Talent Development

We recognize nurturing talent and embracing the constant evolution that leadership requires is crucial to our success. We have invested in learning and development opportunities that strengthen the role of leaders, as well as offer all employees opportunities for professional growth and skill development through access to a broad range of learning solutions on varying industry topics.

We strive to create a work environment that is reflective of the communities in which we work and recognize inclusion and belonging are intrinsically linked to business success and as such have taken part in efforts to ensure our global workforce is comprised of qualified individuals of all backgrounds. In 2024, we expanded on talent development initiatives including providing training and developmental opportunities to all employees through mentorship and other programs.

Regulation and Legislation

We are subject to federal, state and local laws, both domestically and internationally, and at the state level by athletic commissions, governing matters such as:

•licensing laws for athletes;

•operation of our venues;

•licensing, permitting, and zoning;

•health, safety, and sanitation requirements;

•the service of food and alcoholic beverages;

•working conditions, labor, minimum wage and hour, citizenship, immigration, visas, harassment and discrimination, and other labor and employment laws and regulations;

•compliance with the U.S. Foreign Corrupt Practices Act of 1977, as amended (the “FCPA”);

•the U.K. Bribery Act 2010 (the “Bribery Act”) and similar regulations in other countries, as described in more detail below;

•antitrust and fair competition;

•data privacy and information security;

•environmental protection regulations;

•imposition by the U.S. or foreign countries of tariffs or trade restrictions, restrictions on the manner in which content is currently licensed and distributed, ownership restrictions, or currency exchange controls;

•licensure and other regulatory requirements for the supply of sports betting data and software to gambling operators;

•licensing laws for the promotion and operation of MMA events; and

•government regulation of the entertainment and sports industry.

We monitor changes in these laws and believe that we are in material compliance with applicable laws. See “Risk Factors—Risks Related to Our Business—We are subject to extensive U.S. and foreign governmental regulations, and our failure to comply with these regulations could adversely affect our business.”

Many of the events produced or promoted by us are presented in venues which are subject to building and health codes and fire regulations imposed by the state and local governments in the jurisdictions in which the venues are located. These venues are also subject to zoning and outdoor advertising regulations and require a number of licenses in order for us to operate, including occupancy permits, exhibition licenses, food and beverage permits, liquor licenses, and other authorizations. In addition, these venues are subject to the U.S. Americans with Disabilities Act of 1990 and the U.K.’s Disability Discrimination Act 1995, which require us to maintain certain accessibility features at each of the facilities.

In various states in the United States and some foreign jurisdictions, we are required to obtain licenses for promoters, medical clearances and other permits or licenses for our athletes, and permits for our live events in order to promote and conduct those events. Generally, we or our employees hold promoters and matchmakers licenses to organize and hold our live events. We or our employees hold these licenses in a number of states, including California, Nevada, New Jersey and New York.

We are required to comply with the anti-corruption laws of the countries in which we operate, including the FCPA and the Bribery Act. These regulations make it illegal for us to pay, promise to pay, or receive money or anything of value to, or from, any government or foreign public official for the purpose of directly or indirectly obtaining or retaining business. This ban on illegal payments and bribes also applies to agents or intermediaries who use funds for purposes prohibited by the statute.

Our business is also subject to certain regulations applicable to our web sites and mobile applications. We maintain various web sites and mobile applications that provide information and content regarding our business and offer merchandise and tickets for sale. The operation of these web sites and applications may be subject to a range of federal, state and local laws.

The marketplace for audio-visual programming (including cable television and internet programming) in the United States and internationally is substantially affected by government regulations applicable to, as well as social and political influences on, television stations, television networks and cable and satellite television systems and channels. Certain FCC regulations are imposed directly on us and/or indirectly through our distributors.

Gaming laws in the jurisdictions in which we operate are established by statute and are administered by regulatory agencies with broad authority to interpret gaming laws, to promulgate gaming regulations, and to regulate gaming activities. Regulatory requirements vary among jurisdictions, but a number of jurisdictions in which we operate require licenses, permits, or findings of suitability for us, our individual officers, directors, major stockholders and key employees. Regulatory agencies from time to time may modify their interpretation of gaming laws and regulations and the regulatory requirements imposed on operators under such laws and regulations. We believe we hold all of the licenses and permits necessary to conduct our business in this space.

Available Information and Website Disclosure

We are required to file annual, quarterly and current reports, proxy statements and other information with the SEC. Our filings with the SEC are also available to the public through the SEC’s website at www.sec.gov.

You also can find more information about us online at our investor relations website located at investor.tkogrp.com. Filings we make with the SEC and any amendments to those reports are available free of charge on our website as soon as reasonably practicable

after we electronically file such material with the SEC. The information posted on or accessible through our website is not incorporated into this Annual Report.

Investors and others should note that we announce material financial and operational information to our investors using press releases, SEC filings and public conference calls and webcasts, and by postings on our investor relations site at investor.tkogrp.com. We may also use our website as a distribution channel of material Company information. In addition, you may automatically receive email alerts and other information about TKO, UFC and WWE when you enroll your email address by visiting the “Investor Email Alerts” option under the Resources tab on investor.tkogrp.com.

Item 1A. Risk Factors

Investing in our Class A common stock involves substantial risks. You should carefully consider the following factors, together with all of the other information included in this Annual Report on Form 10-K, including under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the related notes included elsewhere in this Annual Report on Form 10-K before investing in our Class A common stock. Any of the risk factors we describe below could adversely affect our business, financial condition or results of operations. The market price of our Class A common stock could decline if one or more of these risks or uncertainties develop into actual events, causing you to lose all or part of your investment. We cannot assure you that any of the events discussed below will not occur. Please also see “Forward-Looking Statements” for more information.

Risks Related to Our Business

Our ability to generate revenue from discretionary and corporate spending on events, such as corporate sponsorships and advertising, is subject to many factors, including many that are beyond our control, such as general macroeconomic conditions.

Our business depends on discretionary consumer and corporate spending. Many factors related to corporate spending and discretionary consumer spending, including economic conditions affecting disposable consumer income such as unemployment levels, fuel prices, interest rates, changes in tax rates, tax laws that impact companies or individuals, and inflation, can significantly impact our operating results. While consumer and corporate spending may decline at any time for reasons beyond our control, the risks associated with our businesses become more acute in periods of a slowing economy or recession, which may be accompanied by reductions in corporate sponsorship and advertising, decreases in attendance at live events, and purchases of pay-per-view (“PPV”), among other things. There can be no assurance that consumer and corporate spending will not be adversely impacted by economic and geopolitical conditions, or by any future deterioration in economic conditions, thereby possibly impacting our operating results and growth. A prolonged period of reduced consumer or corporate spending, such as those that occurred during the COVID-19 pandemic, could have an adverse effect on our business, financial condition, and results of operations.

We depend on key relationships with television and cable networks, satellite providers, digital streaming partners and other distribution partners. Our failure to maintain, renew or replace key agreements could adversely affect our ability to distribute our media content, WWE Network and/or other of our goods and services, which could adversely affect our operating results.

A key component of our success is our relationships with television and cable networks, satellite providers, digital streaming and other distribution partners, as well as corporate sponsors. We are dependent on maintaining these existing relationships and expanding upon them so that we have a robust network with which we can work to arrange multimedia rights sales and sponsorship engagements, including distribution of our events and media content. Our television programming for our events is distributed by television and cable networks, satellite providers, PPV, digital streaming, and other media. We have depended on, and will continue to depend on, third parties for many aspects of the operations and distribution of WWE Network. We have an important relationship with ESPN as they are the exclusive domestic distributor of all UFC events. Because a large portion of our revenues are generated, directly and indirectly, from the distribution of our events, any failure to maintain or renew arrangements with distributors and platforms, the failure of distributors or platforms to continue to provide services to us, or the failure to enter into new distribution opportunities on terms favorable to us could adversely affect our business. We regularly engage in negotiations relating to substantial agreements covering the distribution of our television programming by carriers located in the United States and abroad. We have agreements with multiple PPV providers globally and distribute a portion of our events through PPV, including certain events that are sold exclusively through PPV. Beginning January 2025, Netflix became the exclusive global home to Raw. Additionally, since January 2025 and as rights become available globally, distribution for all WWE content outside the U.S., including premium live events, is on Netflix. Our agreement has an initial 10-year term, with an option for Netflix to extend for an additional 10 years and to opt out after the initial five years. Our failure to maintain the Netflix agreement, including through Netflix exercising its opt-out rights, could adversely affect our ability to distribute WWE content, which could adversely affect our operating results. We also have substantial relationships with NBCU, which carries SmackDown on USA Network, and The CW, which carries NXT on its cable network. WWE Network is distributed exclusively via Peacock in the domestic market. These relationships are expected to continue to constitute a significant percentage of our revenues. We anticipate that we will be involved in negotiations to renew or replace our domestic television distribution rights agreements for UFC content and WWE Network with our current licensee or others before their expiration in December 2025 and March 2026, respectively. These domestic licenses together account for a very significant portion of our media segment revenues and profitability. No assurances

can be provided as to the outcome of these negotiations and, if we are unable to renew existing agreements or find alternative streaming or distribution partners on at least as favorable terms, if at all, our results of operations could be adversely impacted.

There is also no guarantee that the growth in value of sports media licensing rights in the recent years will continue or can be maintained or that the current value of our sports media licensing rights will not diminish over time. Any adverse change in these relationships or agreements, including as a result of U.S., European Union and United Kingdom trade and economic sanctions and any counter-sanctions enacted by such sanctioned countries (e.g., Russia), or a deterioration in the perceived value of our sponsorships or these distribution channels, could have an adverse effect on our business, financial condition and results of operations.

We may not be able to adapt to or manage new content distribution platforms or changes in consumer behavior resulting from new technologies.

The manner in which audio/media content is distributed and viewed is constantly changing, and consumers have increasing options to access entertainment video. Changes in technology require resources including personnel, capital and operating expenses. Conversely, technology changes have also decreased the cost of video production and distribution for certain programmers (such as through social media), which lowers the barriers to entry and increases the competition for viewership and revenues. We must successfully adapt to and manage technological advances in our industry, including the emergence of alternative distribution platforms. If we are unable to adopt or are late in adopting technological changes and innovations, it may lead to a loss of consumers viewing our content, a reduction in revenues from attendance at our live events, a loss of ticket sales, or lower site fee revenue. Our ability to effectively generate revenue from new content distribution platforms and viewing technologies will affect our ability to maintain and grow our business. Emerging forms of content distribution may provide different economic models and compete with current distribution methods (such as television, film, and PPV) in ways that are not entirely predictable, which could reduce consumer demand for our content offerings.

We must also adapt to changing consumer behavior driven by advances that allow for time shifting and on-demand viewing, such as digital video recorders and video-on-demand, as well as internet-based and broadband content delivery and mobile devices. Cable and broadcast television distribution constitutes a large part of our revenues. The number of subscribers and ratings of television networks and advertising revenues in general have been impacted by viewers moving to alternative media content providers, a process known as “cord cutting” and “cord shaving”. Developments in technology may have added, and may continue to add, to this shift as consumers’ expectations relative to the availability of video content on demand, their willingness to pay to access content and their tolerance for commercial interruptions evolve. Many well-funded digital companies (such as Amazon, Apple, Facebook, Hulu, Netflix and YouTube) have been competing with the traditional television business model and, while it has been widely reported that they are paying significant amounts for media content, it is not clear that these digital distributors will replace the importance (in terms of money paid for content, viewer penetration and other factors) of television distribution to media content owners such as WWE and UFC. Our media partners’ businesses are affected by their sale of advertising and subscriptions for their services. If they are unable to sell advertising and/or subscriptions either with regard to WWE and UFC programming specifically or all of their programming generally, it could adversely affect our operating results. If we fail to adapt our distribution methods and content to emerging technologies and new distribution platforms, while also effectively preventing digital piracy and the dilution of the value of our content resulting from the creation of similar or fake content on artificial intelligence applications, our ability to generate revenue from our targeted audiences may decline and could result in an adverse effect on our business, financial condition, and results of operations.

We may fail to complete the Endeavor Asset Acquisition if certain required conditions, many of which are outside our control, are not satisfied.

The completion of the Endeavor Asset Acquisition is subject to various customary closing conditions, including, but not limited to, (i) the absence of any order, writ, judgment, injunction, decree, ruling, stipulation, directive, assessment, subpoena, verdict, determination or award issued, promulgated or entered, by or with any governmental entity that has the effect of making the Endeavor Asset Acquisition illegal or otherwise restraining or prohibiting the consummation of the Endeavor Asset Acquisition, (ii) subject to certain exceptions, the accuracy of the representations and warranties of the parties and (iii) compliance in all material respects by each party with its obligations under the transaction agreement. Despite the parties’ best efforts, we may not be able to satisfy or receive the various closing conditions and obtain the necessary approvals in a timely fashion or at all.

We may fail to realize the anticipated benefits of the Endeavor Asset Acquisition and may assume unanticipated liabilities, including in connection with termination of the Services Agreement.

The success of the Endeavor Asset Acquisition will depend on, among other things, our ability to integrate the transferred businesses in a manner that realizes the various benefits, growth opportunities and synergies that we have identified and are currently in the process of identifying. Our ability to achieve the anticipated benefits of the Endeavor Asset Acquisition is subject to a number of risks and uncertainties.

Failure to complete the Endeavor Asset Acquisition could negatively impact our stock price, future business and financial results.

If the Endeavor Asset Acquisition is not completed, we will be subject to several risks, including the following:

•payment for certain costs relating to the Endeavor Asset Acquisition, whether or not the Endeavor Asset Acquisition is completed, such as legal, accounting, financial advisor and printing fees;

•negative reactions from the financial markets, including potential declines in the price of our Class A common stock due to the fact that current prices may reflect a market assumption that the Endeavor Asset Acquisition will be completed; and

•diverted attention of our management to the Endeavor Asset Acquisition rather than to our operations and pursuit of other opportunities that could have been beneficial to us.

The planned issuance of Class B common stock and TKO OpCo Units to the EDR Parties will dilute the ownership and voting interests.

If the Endeavor Asset Acquisition is completed, the Company expects to issue approximately 26.1 million TKO OpCo Units and corresponding shares of Class B common stock (subject to certain customary purchase price adjustments to be settled at the closing in equity and cash) to the EDR Parties, who beneficially hold approximately 53.9% of the Company’s total outstanding shares of common stock as of the date of this Annual Report. The issuance of the TKO OpCo Units and Class B common stock to the EDR Parties will cause a reduction in the relative percentage interest of the Company’s other current stockholders in the earnings of TKO OpCo, and in the voting interests of the Company. The issuance will result in (i) an approximate 6% reduction of equity ownership and (ii) an approximate 6% reduction in the total voting interests of the Company’s Class A common stock.

If we complete the Endeavor Asset Acquisition, the Services Agreement dated as of September 12, 2023, by and among Endeavor Group Holdings, Inc. and TKO Operating Company, LLC (“Services Agreement”) will terminate. TKO OpCo cannot be assured that the services previously provided under the Services Agreement will be sustained at the same level, or that TKO OpCo will be able to replace these services in a timely manner or on comparable terms. TKO OpCo’s costs of procuring those services from third parties may increase. The Services Agreement also contains terms and provisions that may be more favorable to TKO OpCo than terms and provisions TKO OpCo will be able to obtain in arm’s-length negotiations with unaffiliated third parties.

Because our success depends substantially on our ability to maintain a professional reputation, adverse publicity concerning us, or our key personnel could adversely affect our business.

Our professional reputation is essential to our continued success and any decrease in the quality of our reputation could impair our ability to, among other things, recruit and retain qualified and experienced personnel, or enter into multimedia, licensing, and sponsorship engagements. Our overall reputation may be negatively impacted by a number of factors, including negative publicity concerning Endeavor or us, members of our or Endeavor’s management or other key personnel or the athletes that participate in our events. Many athletes that participate in our events are public personalities with large social media followings whose actions generate significant publicity and public interest. Any adverse publicity relating to such individuals or individuals that we employ or previously employed or have a contractual relationship with, or that otherwise occur at our locations or events, including from reported or actual incidents or allegations of illegal or improper conduct, such as harassment, discrimination, or other misconduct, have resulted and may in the future result in significant media attention, even if not directly relating to or involving us, and could have a negative impact on our professional reputation. This could result in termination of media rights agreements, licensing, sponsorship or other contractual relationships, or our ability to attract new sponsorship or other business relationships, or the loss or termination of such employees’ or contractors’ services, all of which could adversely affect our business, financial condition, and results of operations.

The markets in which we operate are highly competitive, rapidly changing and increasingly fragmented, both within the United States and internationally, and we may not be able to compete effectively, which could adversely affect our operating results.

We face competition from a variety of other domestic and foreign companies. We also face competition from alternative providers of the content and events that we offer. For UFC, these providers include, but are not limited to, M-1 Global, Professional Fighters League, Combate Global, Invicta FC, Cage Warriors, AMC Fight Nights, ONE Championship, Rizin Fighting Federation, Absolute Championship Akhmat, Pancrase, Caged Steel, Eagle Fighting Championship, KSW and Extreme Fighting Championship. For WWE, these providers include, but are not limited to, All Elite Wrestling, Impact Wrestling, Ring of Honor and New Japan Pro-Wrestling. Additionally, competition exists from other forms of media, entertainment and leisure activities in a rapidly changing and increasingly fragmented environment. Other new and existing professional wrestling leagues also compete with our goods and services. For the sale of our consumer products, we compete with entertainment companies, professional and college sports leagues and other makers of branded apparel and merchandise. Any increased competition, which may not be foreseeable, or our failure to adequately address any competitive factors, could result in reduced demand for our content, live events, or brand, which could have an adverse effect on our business, financial condition, and results of operations.

We depend on the continued services of executive management and other key employees, and of our parent company, Endeavor. The loss or diminished performance of these individuals, or any diminished performance by Endeavor, could adversely affect our business.

Our performance is substantially dependent on the continued services of executive management and other key employees as well as our relationship with our parent company, Endeavor, with whom we have various service agreements. Upon the consummation of the Endeavor Take-Private, we expect to continue utilizing Endeavor's services for a specified period of time. We cannot be sure that any adverse effect on Endeavor’s business would not also have an adverse effect on our business, financial condition, and results of operations. Further, members of our or Endeavor’s executive management may not remain with Endeavor or us and may compete with us in the future. The loss of any member of our or Endeavor’s executive management teams could impair our ability to execute our business plan and growth strategy, have a negative impact on our business, financial condition, and results of operations, or cause employee morale problems or the loss of additional key employees.

Changes in public and consumer tastes and preferences and industry trends could reduce demand for our content offerings and adversely affect our business.

Our ability to generate revenues is highly sensitive to rapidly changing consumer preferences and industry trends, as well as the popularity of our brand, events, and the athletes that participate in our events. Our success depends on our ability to offer premium content through popular channels of distribution that meet the changing preferences of the broad consumer market and respond to competition from an expanding array of choices facilitated by technological developments in the delivery of content. Our operations and revenues are affected by consumer tastes and entertainment trends, including the market demand for the distribution rights to live events, which are unpredictable and may be affected by factors such as changes in the social and political climate, global epidemics such as the COVID-19 pandemic or general macroeconomic factors. Changes in consumers’ tastes or a change in the perceptions of our brand and business partners, whether as a result of the social and political climate or otherwise, could adversely affect our operating results. Our failure to avoid a negative perception among consumers, or anticipate and respond to changes in consumer preferences, could result in reduced demand for our events and content offerings, which could have an adverse effect on our business, financial condition and results of operations.

Consumer tastes change frequently, and it can be challenging to anticipate what offerings will be successful at any point in time. We may invest in our content and events before learning the extent to which we will achieve popularity with consumers. A lack of popularity of our content offerings, as well as labor disputes, unavailability of a star athlete, cost overruns, disputes with production teams, or severe weather conditions, could have an adverse effect on our business, financial condition and results of operations.

Owning and managing events for which we sell media and sponsorship rights, ticketing and hospitality exposes us to greater financial risk. Additionally, we may be prohibited from promoting and conducting our live events if we do not comply with applicable regulations. If our live events are not financially successful, our business could be adversely affected.

We act as a principal by owning and managing live events for which we sell media and sponsorship rights, ticketing and hospitality. Organizing and operating a live event involves significant financial risk as we bear all or most event costs, including a significant amount of up-front costs. In addition, we typically book our live events many months in advance of holding the event and often incur expenses prior to receiving any related revenue. Accordingly, if a planned event fails to occur or there is any disruption in our ability to live stream or otherwise distribute, whether as a result of technical difficulties or otherwise, we could lose a substantial amount of these costs, fail to generate the anticipated revenue, and could be forced to issue refunds for ticket or PPV sales and generate lower than expected media rights, sponsorship and licensing fees. If we are forced to postpone a planned event, we could incur substantial additional costs in order to stage the event on a new date, may have reduced attendance and revenue, and may have to refund fees. We could be compelled to cancel or postpone all or part of an event for many reasons, including severe weather conditions, issues with obtaining permits or government regulation, athletes failing to participate, as well as operational challenges caused by extraordinary incidents, such as terrorist or other security incidents, mass-casualty incidents, natural disasters, public health concerns including pandemics, or similar events. Such incidents have been shown to cause a nationwide and global disruption of commercial and leisure activities.