| | | /s/ Paul W. Graves | | | /s/ Pierre Brondeau | |

| | | Paul W. Graves | | | Pierre Brondeau | |

| | | President and Chief Executive Officer | | | Chairman of the Board |

| | | /s/ Paul W. Graves | | | /s/ Pierre Brondeau | |

| | | Paul W. Graves | | | Pierre Brondeau | |

| | | President and Chief Executive Officer | | | Chairman of the Board |

| 1. | Livent Transaction Agreement Proposal. To adopt the Transaction Agreement, dated as of May 10, 2023, as amended by the Amendment to Transaction Agreement, dated as of August 2, 2023 and the Second Amendment to Transaction Agreement, dated as of November 5, 2023 (and as may be further amended from time to time, the “Transaction Agreement”), by and among Livent Corporation (“Livent”), Allkem Limited, an Australian public company limited by shares (“Allkem”), Arcadium Lithium plc, a public limited company incorporated under the laws of the Bailiwick of Jersey (originally incorporated as Lightning-A Limited, a private limited company incorporated under the laws of the Bailiwick of Jersey and f/k/a Allkem Livent plc) (“NewCo”) and Lightning-A Merger Sub, Inc., a Delaware company (“Merger Sub”), pursuant to which, among other transactions, Merger Sub will merge with and into Livent, with Livent surviving the merger as a wholly owned subsidiary of NewCo (the “merger”), and each share of common stock, par value $0.001 per share, of Livent (the “Livent Shares”), other than certain excluded shares, will be converted into the right to receive 2.406 ordinary shares, par value $1.00 per share, of NewCo (the “NewCo Shares”), and approve the transactions contemplated by the Transaction Agreement, including the merger (the “Livent Transaction Agreement Proposal”). |

| 2. | Livent Advisory Compensation Proposal. To approve, in a non-binding, advisory vote, the compensation that may be paid or become payable to Livent’s named executive officers in connection with the transactions contemplated by the Transaction Agreement (the “Livent Advisory Compensation Proposal”). |

| 3. | NewCo Advisory Governance Documents Proposals. To approve, in non-binding, advisory votes, certain provisions of the articles of association of NewCo (the “NewCo Advisory Governance Documents Proposals”). |

| 4. | Livent Adjournment Proposal. To approve one or more adjournments of the Livent Special Meeting to a later date or dates for any purpose if necessary or appropriate, including if necessary or appropriate to solicit additional proxies if there are insufficient votes to adopt the Transaction Agreement and approve the transactions contemplated thereby, including the merger, at the time of the Livent Special Meeting (the “Livent Adjournment Proposal”). |

| | | | | BY ORDER OF THE BOARD OF DIRECTORS, | ||

| | | | | |||

| | | | | /s/ Sara Ponessa | ||

Dated: | | | November 20, 2023 | | | Sara Ponessa |

| | | Philadelphia, Pennsylvania | | | Vice President, General Counsel and Secretary |

| • | “Allkem” refers to Allkem Limited, an Australian public company limited by shares; |

| • | “Allkem Board” refers to the board of directors of Allkem; |

| • | “Allkem Shareholder Approval” refers to the approval of the scheme at the scheme meeting by the Allkem shareholders in accordance with the Australian Corporations Act by (i) a majority in number of Allkem shareholders that are present and voting at the scheme meeting (either in person or by proxy or by corporate representative) and (ii) 75% or more of the votes cast on the resolution; and in the case of (i), such other threshold as approved by the Court; |

| • | “Allkem Shares” refers to the ordinary shares of Allkem; |

| • | “Antitrust Division” refers to the Antitrust Division of the U.S. Department of Justice; |

| • | “ASIC” refers to the Australian Securities and Investments Commission; |

| • | “ASX” refers to the ASX Limited (ABN 98 008 624 691) and where the context requires, the securities exchange that it operates; |

| • | “ATO” refers to the Australian Taxation Office; |

| • | “ATO Class Ruling” refers to a class ruling from the ATO in relation to rollover relief for Allkem shareholders who are Australian tax residents who are receiving the scheme consideration in connection with the scheme; |

| • | “Australian Accounting Standards” refers to the Australian Accounting Standards, consistently applied; |

| • | “Australian Corporations Act” refers to the Australian Corporations Act 2001 (Cth); |

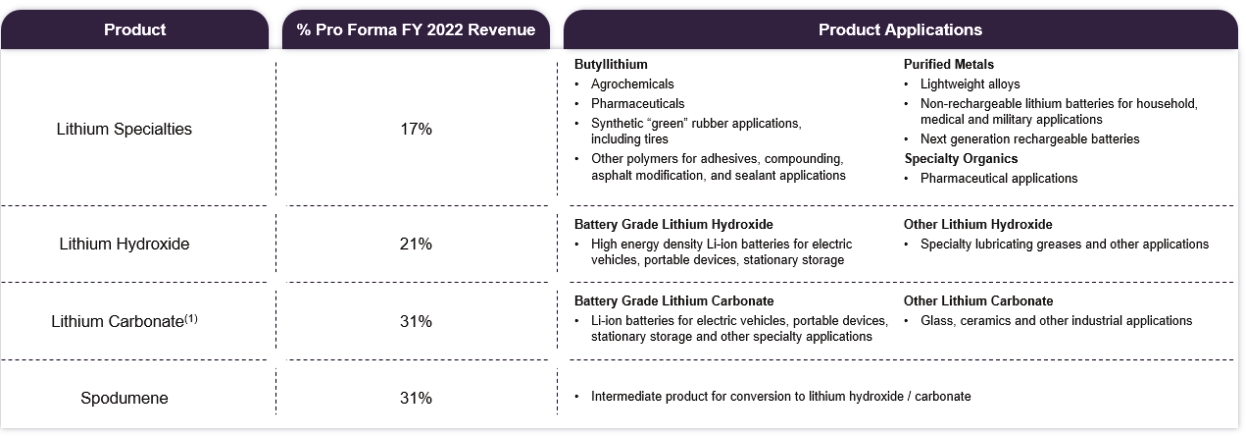

| • | “butyllithium” refers to an organolithium compound which is used to initiate polymerization in the manufacturing of synthetic rubber and other polymers and as a chemical reagent in the synthesis of certain organic compounds; |

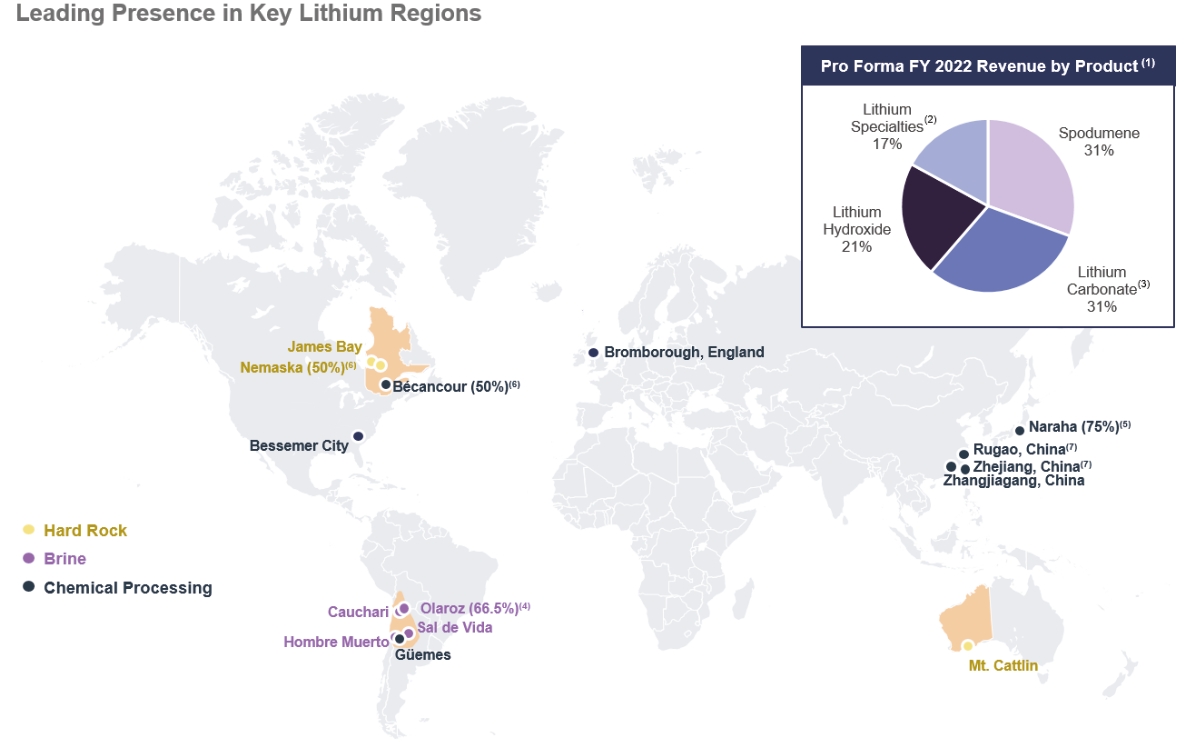

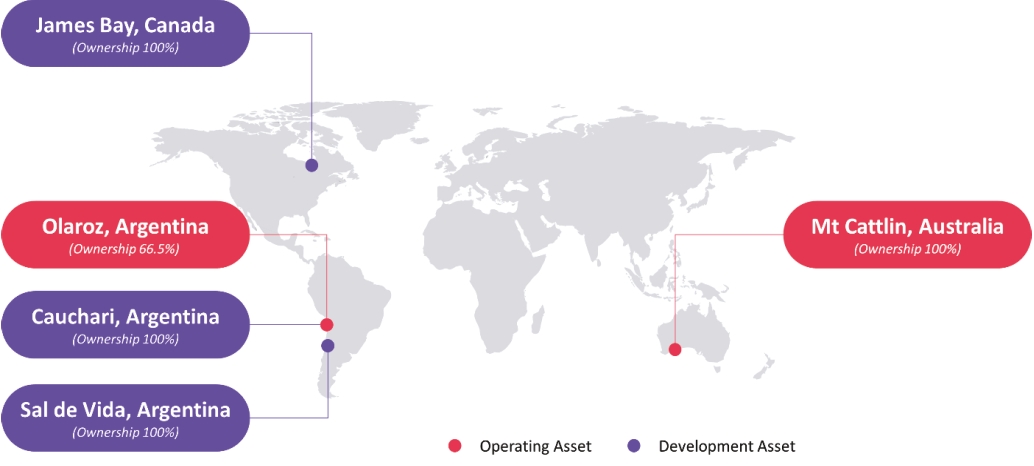

| • | “Cauchari” refers to Allkem’s Cauchari lithium brine project in Jujuy Province, Argentina; |

| • | “CDIs” refers to NewCo CHESS Depositary Instruments, each representing a beneficial ownership interest (but not legal title) in one NewCo Share; |

| • | “CHESS” refers to the Clearing House Electronic Subregister System; |

| • | “closing” refers to the closing of the transaction; |

| • | “Code” refers to the Internal Revenue Code of 1986, as amended; |

| • | “Competing Proposal” refers to, in the case of Livent and Allkem, as applicable, any inquiry, contract, proposal, offer or indication of interest from any third party relating to any transaction or series of related transactions (other than transactions only with the other of Allkem or Livent, respectively, or any of such other party’s subsidiaries) involving, directly or indirectly: (a) any acquisition (by asset purchase, equity purchase, merger, scheme of arrangement (solely in the case of Allkem) or otherwise) by any person or “group” (within the meaning of Section 13(d) of the Exchange Act) of any business or assets of such party or any of its subsidiaries (including capital stock of or ownership interest in any subsidiary) that constitute 20% or more of such party’s and its subsidiaries’ consolidated assets (by fair market value), or generated 20% or more of such party’s and its subsidiaries’ net revenue or earnings for the preceding 12 months, or any license, lease or long-term supply agreement having a similar economic effect, (b) any acquisition of beneficial ownership by any person or “group” (within the meaning of Section 13(d) of the Exchange Act) of 20% or more of the outstanding Livent Shares or Allkem Shares, respectively, or any other securities entitled to vote on the election of directors or any tender or exchange offer that if consummated would result in any person or “group” (within the meaning of Section 13(d) of the Exchange Act) beneficially owning 20% or more of the outstanding Livent Shares or Allkem Shares, respectively, entitled to vote on the election of directors or (c) any merger, consolidation, share exchange, business combination, scheme of arrangement (solely in the case of Allkem), recapitalization, liquidation, dissolution or similar |

| • | “Court” refers to the Federal Court of Australia (Western Australian registry), or such other court of competent jurisdiction under the Australian Corporations Act as may be agreed to in writing by Livent and Allkem; |

| • | “deed poll” refers to the deed poll under which NewCo covenants in favor of the Allkem shareholders to perform the obligations attributed to NewCo under the scheme provided for under the Transaction Agreement; |

| • | “DGCL” refers to the Delaware General Corporation Law, as amended; |

| • | “effective time” refers to the effective time of the merger; |

| • | “end date” refers to February 10, 2024 (subject to extension by either party until May 10, 2024 in order to obtain required antitrust, investment screening or other regulatory approvals); |

| • | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended; |

| • | “First Court Hearing” refers to the hearing of the Court pursuant to Section 411(4)(a) of the Australian Corporations Act to consider and, if thought fit, approve the mailing of the scheme booklet (with or without amendment) and convene the scheme meeting; |

| • | “fiscal year 2023” refers, when used with respect to Livent, to Livent’s fiscal year ending December 31, 2023 and, when used with respect to Allkem, to Allkem’s fiscal year ending June 30, 2023; |

| • | “fiscal year 2024” refers, when used with respect to Livent, to Livent’s fiscal year ending December 31, 2024 and, when used with respect to Allkem, to Allkem’s fiscal year ending June 30, 2024; |

| • | “FTC” refers to the U.S. Federal Trade Commission; |

| • | “GAAP” refers to U.S. generally accepted accounting principles, consistently applied; |

| • | “HSR Act” refers to the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and the rules and regulations promulgated thereunder; |

| • | “IER” refers to a report, including any update or supplementary report, of the Independent Expert setting out whether or not the scheme is in the best interests of the Allkem shareholders; |

| • | “IFRS” refers to the International Financial Reporting Standards as issued by the International Accounting Standards Board, consistently applied; |

| • | “Independent Expert” refers to the independent expert appointed by Allkem to prepare the IER, which is Kroll Australia Pty Ltd; |

| • | “Intervening Event” refers to, in the case of Livent and Allkem, as applicable, an effect that is material to such party that occurs or arises after the date of the Transaction Agreement that was not known to or reasonably foreseeable by such party’s board of directors as of the date of the Transaction Agreement (or, if known or reasonably foreseeable, the magnitude or material consequences of which were not known or reasonably foreseeable by such party’s board of directors as of the date of the Transaction Agreement); provided, however, that in no event shall the following constitute an Intervening Event: (a) the receipt, existence or terms of an actual or possible Competing Proposal or Superior Proposal of such party, (b) any change, in and of itself, in the price or trading volume of Livent Shares or Allkem Shares, respectively (it being understood that the underlying facts giving rise or contributing to such change may be taken into account in determining whether there has been an Intervening Event, to the extent otherwise permitted by this definition), (c) any effect relating to such party or any of its subsidiaries that does not amount to a material adverse effect, individually or in the aggregate, (d) conditions (or changes in such conditions) in the lithium mining and chemicals industry (including changes in general market prices for lithium chemicals, lithium spodumene concentrate and related products (including pricing under futures contracts) and political or regulatory changes affecting the industry or any changes in applicable law), (e) any opportunity to acquire (by merger, joint venture, partnership, consolidation, scheme of arrangement (solely |

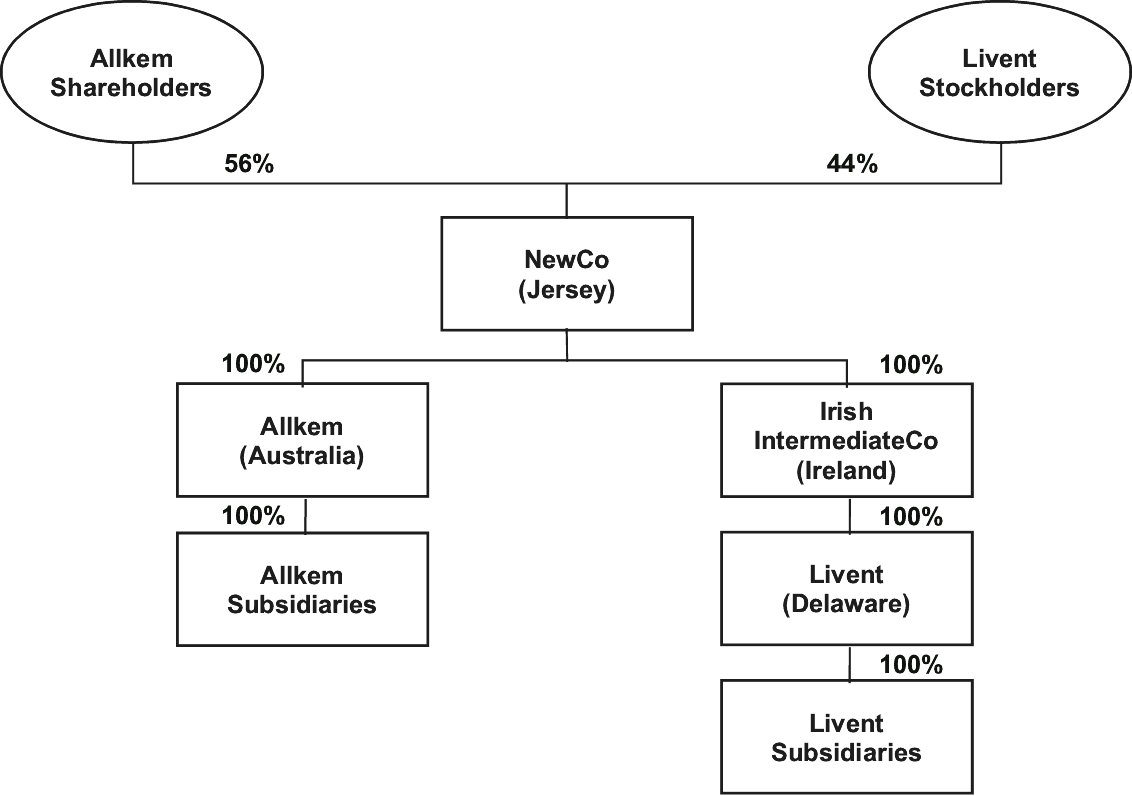

| • | “Irish IntermediateCo” refers to an Irish private company limited by shares that will be formed in connection with the transaction; |

| • | “IRS” refers to the U.S. Internal Revenue Service; |

| • | “James Bay” refers to Allkem’s James Bay lithium spodumene project in Québec, Canada; |

| • | “Jersey Companies Law” refers to the Companies (Jersey) Law 1991; |

| • | “Jersey law” refers to the laws of the Bailiwick of Jersey; |

| • | “kMT” refers to a thousand metric tons; |

| • | “LCE” refers to lithium carbonate equivalent; |

| • | “lithium carbonate” refers to an inorganic compound, derived mainly from lithium brine reservoirs or spodumene-bearing ores; |

| • | “lithium hydroxide” refers to an inorganic compound, derived mainly from spodumene-bearing ores or lithium carbonate, that is used mainly in lithium-ion batteries for energy storage applications; |

| • | “Livent” refers to Livent Corporation, a Delaware corporation; |

| • | “Livent Adjournment Proposal” refers to the proposal to approve one or more adjournments of the Livent Special Meeting to a later date or dates for any purpose if necessary or appropriate, including if necessary or appropriate to solicit additional proxies if there are insufficient votes to adopt the Transaction Agreement and approve the transactions contemplated thereby, including the merger, at the time of the Livent Special Meeting; |

| • | “Livent Advisory Compensation Proposal” refers to the proposal to approve, in a non-binding, advisory vote, the compensation that may be paid or become payable to Livent’s named executive officers in connection with the transactions contemplated by the Transaction Agreement; |

| • | “Livent Board” refers to the board of directors of Livent; |

| • | “Livent Director RSUs” refers to any outstanding time-vested restricted stock unit held by any Livent non-employee directors; |

| • | “Livent Option” refers to any outstanding time-vested stock option with respect to Livent Shares; |

| • | “Livent Proposals” refers to, collectively, the Livent Transaction Agreement Proposal, the Livent Advisory Compensation Proposal, the NewCo Advisory Governance Documents Proposals and the Livent Adjournment Proposal; |

| • | “Livent PSUs” refers to the outstanding performance-based restricted stock units of Livent; |

| • | “Livent RSUs” refers to the outstanding time-vested restricted stock units of Livent; |

| • | “Livent Shares” refers to the shares of common stock of Livent, par value $0.001 per share; |

| • | “Livent Special Meeting” refers to the special meeting of Livent stockholders described in this proxy statement/prospectus; |

| • | “Livent Stockholder Approval” refers to the affirmative vote of a majority of the outstanding Livent Shares entitled to vote on the Livent Transaction Agreement Proposal, including the adoption of the Transaction Agreement and approval of the transactions contemplated thereby, at the Livent Special Meeting in favor of such adoption and approval, respectively; |

| • | “Livent Transaction Agreement Proposal” refers to the proposal to adopt the Transaction Agreement and approve the transactions contemplated thereby, including the merger; |

| • | “merger” refers to the merger of Merger Sub with and into Livent, with Livent as the surviving company, as part of the transaction; |

| • | “merger consideration” refers to the right to receive, with respect to each Livent Share (other than certain excluded shares), 2.406 NewCo Shares in the merger; |

| • | “Merger Exchange Ratio” refers to 2.406 NewCo Shares for each Livent Share; |

| • | “Merger Sub” refers to Lightning-A Merger Sub, Inc., a Delaware corporation; |

| • | “Mt Cattlin” refers to Allkem’s Mt Cattlin spodumene operation or project in Ravensthorpe, Western Australia; |

| • | “Naraha” refers to the lithium hydroxide plant in Naraha, Japan of which Allkem owns a 75% economic interest; |

| • | “NewCo” refers to Arcadium Lithium plc, a public limited company incorporated under the Laws of the Bailiwick of Jersey (originally incorporated as Lightning-A Limited, a private limited company incorporated under the laws of the Bailiwick of Jersey and f/k/a Allkem Livent plc); |

| • | “NewCo Advisory Governance Documents Proposals” refers to, collectively, the proposals to approve, in non-binding, advisory votes, certain provisions of the NewCo articles of association; |

| • | “NewCo articles of association” refers to the amended and restated articles of association of NewCo, which will become effective immediately prior to the scheme effectiveness, substantially in the applicable form attached as Annex B; |

| • | “NewCo memorandum of association” refers to the amended and restated memorandum of association of NewCo, which will become effective immediately prior to the scheme effectiveness, substantially in the applicable form attached as Annex B; |

| • | “NewCo Organizational Documents” refers to the NewCo articles of association and the NewCo memorandum of association; |

| • | “NewCo Parties” refers to NewCo, Merger Sub and, following the execution of a joinder agreement to the Transaction Agreement, Irish IntermediateCo; |

| • | “NewCo Shares” refers to ordinary shares, par value $1.00 per share, of NewCo; |

| • | “NYSE” refers to the New York Stock Exchange; |

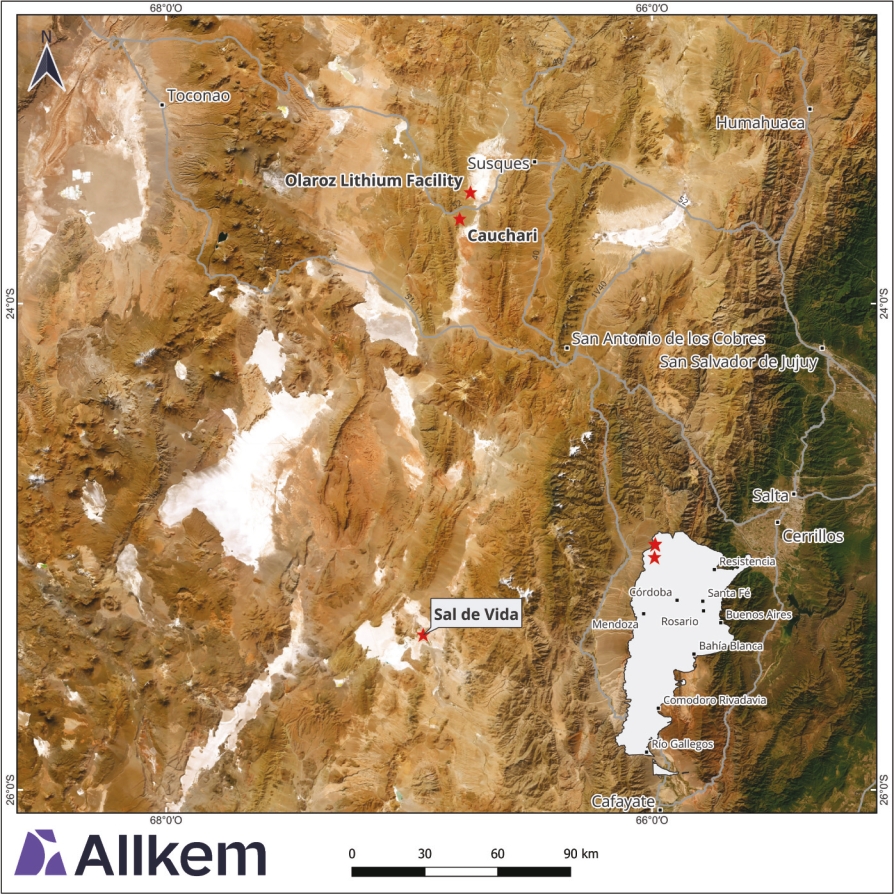

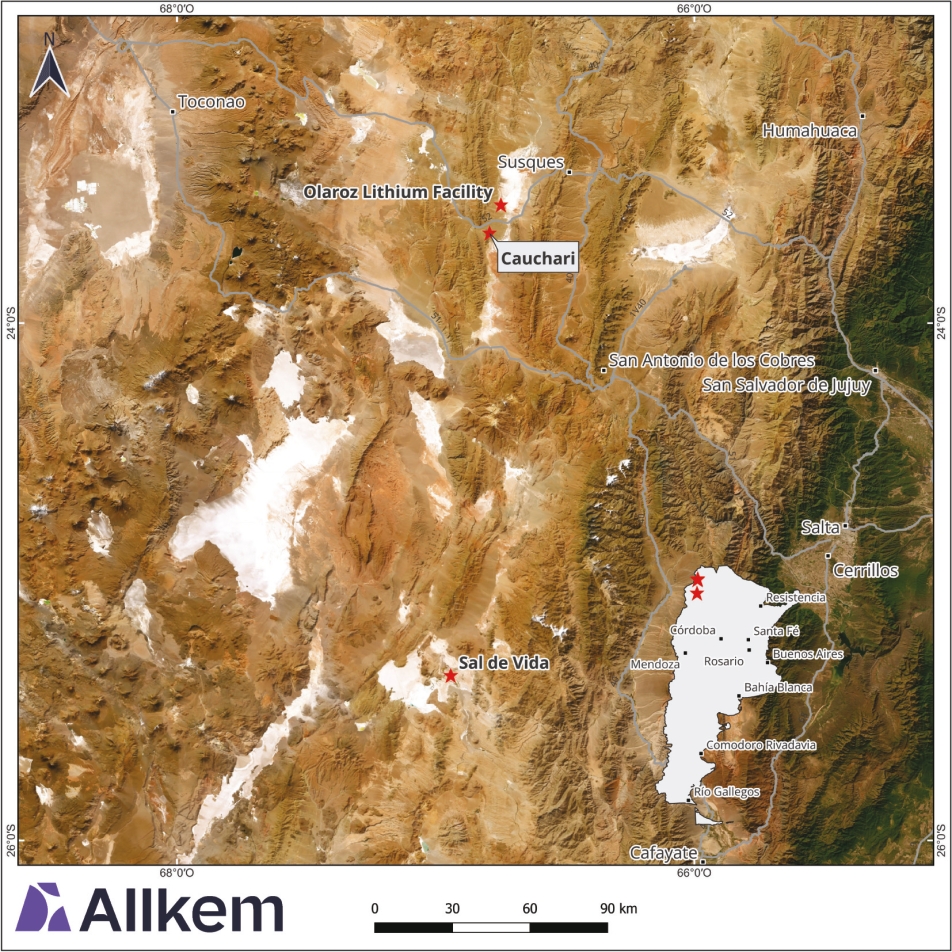

| • | “Olaroz” refers to the Olaroz lithium facility in Jujuy Province, Argentina of which Allkem owns a 66.5% equity interest; |

| • | “pegmatite,” which includes the mineral spodumene, refers to naturally occurring igneous, or magmatic, rock formations that typically have a coarse grained texture and are mined for rare earth commodities; |

| • | “Sal de Vida” refers to Allkem’s Sal de Vida lithium brine project or operation in Catamarca Province, Argentina; |

| • | “sanction date” refers to the first day on which the Court hears the application for an order under section 411(4)(b) of the Australian Corporations Act approving the scheme or, if the application is adjourned or subject to appeal for any reason, the first day on which the adjourned or appealed application is heard; |

| • | “Sarbanes-Oxley Act” refers to the Sarbanes-Oxley Act of 2002; |

| • | “scheme” refers to the scheme of arrangement provided for under the Transaction Agreement; |

| • | “scheme booklet” refers to a document prepared by Allkem in relation to the scheme explaining the effect of the scheme and setting out certain prescribed information including notice of the scheme meeting; |

| • | “scheme consideration” refers to the right to receive, with respect to each Allkem Share, one CDI or, in certain cases, one NewCo Share, in the scheme; |

| • | “scheme effectiveness” refers to the scheme becoming effective under the Australian Corporations Act, which will occur on the date on which the Court order approving the scheme is filed with ASIC; |

| • | “Scheme Exchange Ratio” refers to one NewCo Share or CDI for each Allkem Share; |

| • | “scheme implementation” refers to the issue of the scheme consideration (comprising NewCo Shares and CDIs) to former Allkem shareholders followed by the transfer of all of the Allkem Shares to NewCo, each in accordance with the terms and conditions of the scheme; |

| • | “scheme meeting” refers to the meeting of Allkem shareholders (and any adjournment thereof) ordered by the Court to be convened under subsection 411(1) of the Australian Corporations Act to consider and vote on the scheme; |

| • | “Scheme Record Date” refers to 7:00 pm (Sydney time) on the second ASX trading day after scheme effectiveness, or such other date and time as may be agreed to in writing by Allkem and Livent; |

| • | “SEC” refers to the Securities and Exchange Commission; |

| • | “Second Court Hearing” refers to the hearing of the Court pursuant to Section 411(4)(b) of the Australian Corporations Act to approve the scheme; |

| • | “Securities Act” refers to the Securities Act of 1933, as amended; |

| • | “spodumene” or “lithium bearing spodumene” refers to a naturally occurring lithium bearing ore, derived mainly from mining of lithium-bearing pegmatite formations. Spodumene is typically used in concentrated form as feedstock for lithium carbonate or hydroxide production, and valued based on its lithium content among other factors; |

| • | “Superior Proposal” refers to, in case of Livent or Allkem, as applicable, a bona fide written proposal that is not solicited after the date of the Transaction Agreement in breach of the Transaction Agreement and is made after the date of the Transaction Agreement by any person or “group” (within the meaning of Section 13(d) of the Exchange Act) (other than the other party or any of its affiliates) to acquire, directly or indirectly, (a) businesses or assets of Livent or Allkem, respectively, or any of their subsidiaries, as applicable (including capital stock of or ownership interest in any subsidiary) that account for all or substantially all of the fair market value of such party and its subsidiaries’ assets or that generated all or substantially all of such party and its subsidiaries’ net revenue or earnings for the preceding 12 months, respectively, or (b) all or substantially all of the outstanding Livent Shares or Allkem Shares, respectively, in each case whether by way of merger, amalgamation, scheme of arrangement (solely in the case of Allkem), share exchange, tender offer, exchange offer, recapitalization, consolidation, sale of equity or assets or otherwise, that in the good-faith determination of such party’s board of directors, after consultation with its financial and legal advisors, if consummated, would result in a transaction more favorable to such party’s stockholders than the transaction (after taking into account the time likely to be required to consummate such proposal, the sources, availability and terms of any financing, financing market conditions and the existence of a financing contingency, the likelihood of termination, the timing or certainty of closing, the identity of the person or persons making the proposal and any adjustments or revisions to the terms of the Transaction Agreement offered by the other party in response to such proposal or otherwise), after considering all factors such party’s board of directors deems relevant; |

| • | “tantalum” refers to tantalum pentoxide (Ta2O5) and tantalum pentoxide bearing ore; |

| • | “transaction” refers to the collective transactions contemplated by the Transaction Agreement, including the merger and the scheme; |

| • | “Transaction Agreement” refers to the Transaction Agreement, dated as of May 10, 2023, as amended by the Amendment to Transaction Agreement, dated as of August 2, 2023 and the Second Amendment to Transaction Agreement, dated as of November 5, 2023, and as may be further amended from time to time, among Livent, Allkem, NewCo and Merger Sub; |

| • | “transaction consideration” refers to the merger consideration and the scheme consideration, collectively; |

| • | “Treasury Regulations” refers to the U.S. Treasury regulations promulgated under the Code; |

| • | “TSX” refers to the Toronto Stock Exchange; |

| • | “U.K.” refers to the United Kingdom of Great Britain and Northern Ireland; and |

| • | “U.S.” refers to the United States of America. |

| Q: | Why am I receiving this proxy statement/prospectus and proxy card? |

| Q: | How does the Livent Board recommend that I vote at the Livent Special Meeting? |

| A: | The Livent Board unanimously recommends that Livent stockholders vote “FOR” the Livent Transaction Agreement Proposal, “FOR” the Livent Advisory Compensation Proposal, “FOR” the NewCo Advisory Governance Documents Proposals and “FOR” the Livent Adjournment Proposal. See the section entitled “The Transaction—Recommendation of the Livent Board; Livent’s Reasons for the Transaction” beginning on page 98 of this proxy statement/prospectus. |

| Q: | What is the vote required to approve each proposal at the Livent Special Meeting? |

| A: | Approval of the Livent Transaction Agreement Proposal requires the affirmative vote of the holders of a majority of the outstanding Livent Shares entitled to vote on the proposal. Because the affirmative vote required to approve the Livent Transaction Agreement Proposal is based upon the total number of outstanding Livent Shares, if you fail to submit a proxy or vote virtually at the Livent Special Meeting, you abstain or you do not provide your bank, broker or other nominee with instructions, as applicable, this will have the same effect as a vote “AGAINST” the Livent Transaction Agreement Proposal. |

| Q: | Does my vote matter? |

| A: | Yes. The transaction cannot be completed unless the Livent Transaction Agreement Proposal is approved by the Livent stockholders. For Livent stockholders, if you fail to submit a proxy or vote virtually at the Livent Special Meeting, or vote to abstain, or you do not provide your bank, broker or other nominee with instructions, as applicable, this will have the same effect as a vote “AGAINST” the Livent Transaction Agreement Proposal. |

| Q: | What will I receive if the transaction is completed? |

| A: | If the transaction is completed, each outstanding Livent Share (other than Livent Shares held as treasury stock by Livent or Livent Shares held by any of its subsidiaries) will be converted into the right to receive 2.406 NewCo Shares. The issuance of the NewCo Shares to holders of Livent Shares will be registered with the SEC and the NewCo Shares are expected to be listed and traded on the NYSE under the symbol “ALTM.” See the section entitled “The Transaction Agreement—Merger Consideration” beginning on page 146 of this proxy statement/prospectus. |

| Q: | What equity stakes will former Livent stockholders and former Allkem shareholders hold in NewCo? |

| A: | Under the Transaction Agreement and based on the Merger Exchange Ratio of Livent Shares for NewCo Shares, the Scheme Exchange Ratio of Allkem Shares for NewCo Shares or CDIs, and Allkem’s and Livent’s respective fully diluted shares as of the date of the Transaction Agreement, it is expected that Livent stockholders will own approximately 44%, and Allkem shareholders will own approximately 56%, respectively, of NewCo immediately following the effective time. |

| Q: | What is the value of a NewCo Share? |

| A: | Prior to the effective time, there has not been and will not be an established public trading market for NewCo Shares, and the market price of NewCo Shares will be unknown until the commencement of trading following the effective time. The NewCo Shares will reflect the combination of Livent and Allkem based upon the respective exchange ratios for Allkem Shares and Livent Shares, which, in the case of Allkem is one NewCo Share or one CDI for each Allkem Share, and in the case of Livent is 2.406 NewCo Shares for each Livent Share. The exchange ratios are fixed and will not fluctuate up or down based on the market price of Livent Shares, the market price of Allkem Shares or changes in currency exchange rates prior to the completion of the transaction. |

| Q: | After the transaction, where can I trade my NewCo Shares? |

| A: | At and as of the closing of the transaction, it is expected that the NewCo Shares will be listed and traded on the NYSE under the symbol “ALTM.” |

| Q: | What will holders of Livent equity awards receive in the transaction? |

| A: | Upon completion of the merger, outstanding Livent equity awards will be treated as follows: |

| • | Livent RSUs. At the effective time, each Livent RSU will be assumed by NewCo and will be subject to substantially the same terms and conditions as applied to the related Livent RSU immediately prior to the effective time, except that the Livent Shares subject to such Livent RSUs will be converted into the right to receive, upon vesting, a number of NewCo Shares equal to the product of (A) the number of Livent Shares underlying such Livent RSUs immediately prior to the effective time, multiplied by (B) 2.406. Following such assumption, each assumed Livent RSU that is unvested and outstanding as of the date of signing of the Transaction Agreement will vest on a pro rata basis and, to the extent of such vesting, will be exchanged into the right to receive the merger consideration at the effective time or as soon as practicable thereafter. |

| • | Livent PSUs. At the effective time, each Livent PSU will fully vest, with the number of Livent Shares subject to such Livent PSUs determined based on the achievement of the higher of target and actual performance. At the effective time or as soon as practicable thereafter, each Livent PSU will be canceled in exchange for the right to receive the merger consideration. |

| • | Livent Options. At the effective time, each Livent Option will be assumed by NewCo and will be subject to substantially the same terms and conditions as applied to the related Livent Option immediately prior to the effective time, except that (x) each such assumed Livent Option will be converted into a stock option to acquire a number of NewCo Shares equal to the product of (A) the number of Livent Shares underlying such assumed Livent Options immediately prior to the effective time, multiplied by (B) 2.406; and (y) the exercise price per NewCo Share will be equal to the product of (A) the original exercise price per Livent Share when such assumed Livent Option was granted, divided by (B) 2.406. |

| • | Livent Director RSUs. Immediately prior to the effective time, any Livent Director RSUs will vest in full and be cancelled and converted into the right to receive an amount in cash equal to (A) the number of Livent Shares subject to such Livent Director RSUs immediately prior to the effective time, multiplied by (B) the higher of (i) the first available closing price of the merger consideration and (ii) the closing price per Livent Share as reported in the New York Stock Exchange, on the last trading day preceding the closing date. |

| Q: | Do any of the Livent directors or executive officers have interests in the transaction that may differ from or be in addition to my interests as a Livent stockholder? |

| A: | Livent’s directors and executive officers have certain interests in the transaction that may be different from, or in addition to, the interests of Livent stockholders generally. These interests include, among other things: |

| • | for Livent’s non-employee directors, the treatment of outstanding Livent Director RSUs, which will vest in full and be cancelled and converted into the right to receive an amount in cash. The estimated amount that would be realized by each of Livent’s eight non-employee directors in respect of his or her unvested outstanding Livent Director RSUs if the transaction were to be completed on November 30, 2023 is $127,535. Livent’s non-employee directors only hold Livent Director RSUs and do not hold any other types of equity incentive awards; |

| • | for Livent’s executive officers, the treatment of outstanding equity awards described in the section entitled “The Transaction—Interests of Livent’s Directors and Executive Officers in the Transaction—Treatment of Livent Equity Awards” beginning on page 149 of this proxy statement/prospectus; based on the assumptions described thereunder, the estimated aggregate value of accelerated equity awards that would be realized by each of Messrs. Paul W. Graves and Gilberto Antoniazzi and Ms. Sara Ponessa is $6,165,407, $1,607,455 and $1,171,701, respectively; for a detailed breakdown of each executive officer’s holding of the equity awards, please see the tabular disclosure under such section; |

| • | for each of Livent’s executive officers, the entitlement to receive certain severance benefits under their individual executive severance agreements with Livent upon a termination of employment by Livent without “cause” or by such individual for “good reason,” in each case within the 24-month period following a “change in control” of Livent; the estimated aggregate value of severance benefits that would be provided to each of Messrs. Graves and Antoniazzi and Ms. Ponessa in connection with such a termination is $12,938,249, $5,200,467 and $3,133,436, respectively; |

| • | for each of Mr. Antoniazzi and Ms. Ponessa, the entitlement to receive a cash retention bonus payment in the amount of $250,000 under a retention program established in connection with the transaction, as described in the section entitled “The Transaction—Interests of Livent’s Directors and Executive Officers in the Transaction—Livent Retention Program” beginning on page 118 of this proxy statement/prospectus; |

| • | for each of Livent’s executive officers, the entitlement to receive a transaction bonus upon the closing of the merger (subject to continued service through such event) of $500,000 for Mr. Graves and $200,000 for each of Mr. Antoniazzi and Ms. Ponessa, as described in the section entitled “The Transaction—Interests of Livent’s Directors and Executive Officers in the Transaction—Livent Transaction Bonus Program” beginning on page 118 of this proxy statement/prospectus; and |

| • | continued indemnification and directors’ and officers’ liability insurance. |

| Q: | Will my NewCo Shares acquired in the transaction receive a dividend? |

| A: | Once you exchange your Livent Shares after the closing of the transaction, as a holder of NewCo Shares, you will receive the same dividends on NewCo Shares that all other holders of NewCo Shares or CDIs will receive with any dividend record date that occurs after the transaction is completed. Any dividend payments will be made at the discretion of the board of directors of NewCo and will depend upon many factors, including the |

| Q: | Will dividends paid by NewCo be subject to tax withholding? |

| A: | Dividend Withholding Tax (“DWT”) (which is currently 25%) must be deducted from dividends paid by an Irish tax resident company such as NewCo, unless a shareholder is entitled to an exemption and has submitted a properly completed exemption form to NewCo’s registrar, Computershare Investor Services (Jersey) Limited. |

| Q: | What are the material U.S. federal income tax consequences of the transaction to U.S. holders of Livent Shares? |

| A: | In connection with the filing of the registration statement of which this proxy statement/prospectus forms a part, Davis Polk & Wardwell LLP (“Davis Polk”) has rendered to NewCo its opinion, dated October 30, 2023, to the effect that, based upon and subject to the assumptions, exceptions, limitations and qualifications set forth herein and in the federal income tax opinion filed as an exhibit to the registration statement of which this proxy statement/prospectus forms a part (including, for the avoidance of doubt, the assumption that market conditions between the date of such opinion and the effective time do not impact the relative valuation of Livent and Allkem for purposes of Treasury Regulations Section 1.367(a)-3(c) and Section 7874(a)(2)(B) of the Code), and representations from Livent, Allkem, and NewCo, (i) either (A) the merger will qualify as a reorganization under Section 368(a) of the Code, or (B) the merger and the scheme, taken together, will qualify as an exchange described in Section 351(a) of the Code, (ii) the transfer of Livent Shares, other than certain excluded shares, by Livent stockholders pursuant to the merger (other than by any Livent stockholder who is a U.S. person and would be a “five-percent transferee shareholder” (within the meaning of Treasury Regulations Section 1.367(a)-3(c)(5)(ii)) of NewCo following the merger that does not enter into a five year gain recognition agreement in the form provided in Treasury Regulations Section 1.367(a)-8(c)) should qualify for an exception to Section 367(a)(1) of the Code (the tax treatment described in clauses (i) and (ii) together, the “Intended U.S. Shareholder Tax Treatment”) and (iii) the merger and scheme will not result in NewCo being treated as a “surrogate foreign corporation” within the meaning of Section 7874(a)(2)(B) of the Code or a “domestic corporation” pursuant to Section 7874(b) of the Code (the tax treatment described in this clause (iii), the “Intended Section 7874 Tax Treatment”, and together with the Intended U.S. Shareholder Tax Treatment, the “Intended U.S. Tax Treatment”). |

| Q: | When is the transaction expected to be completed? |

| A: | Subject to the satisfaction or waiver of the closing conditions described under the section entitled “The Transaction Agreement—Conditions That Must Be Satisfied or Waived for the Transaction to Occur” beginning on page 167 of this proxy statement/prospectus, including the approval of the Livent Transaction Agreement Proposal by Livent stockholders at the Livent Special Meeting, Livent and Allkem expect that the transaction will be completed by the end of calendar year 2023. However, it is possible that factors outside the control of one or both companies could result in the transaction being completed at a different time or not at all. |

| Q: | Who will serve on the NewCo board of directors following the transaction? |

| A: | Upon the closing of the transaction, the board of directors of NewCo will be comprised of 12 members. Under the Transaction Agreement, the composition of the NewCo board of directors will be as follows: |

| • | six current Allkem directors (each of whom will be nominated by Allkem prior to the scheme effectiveness, and including Mr. Peter Coleman, the current Chairman of the Allkem Board); and |

| • | six current Livent directors (each of whom will be nominated by Livent prior to the scheme effectiveness, and including Mr. Paul W. Graves, the current Chief Executive Officer of Livent). |

| Q: | Where will NewCo be located, where will NewCo be domiciled and who will serve in senior leadership roles following the transaction? |

| A: | Following the transaction, NewCo and its subsidiaries will maintain a critical presence in the same locations from which Livent and Allkem currently operate and NewCo’s headquarters will be in North America in a location mutually determined by Livent and Allkem prior to the scheme effectiveness. NewCo is incorporated in the Bailiwick of Jersey, and is a resident of Ireland for tax purposes and expects to continue to be an Irish tax resident following the transaction. Pursuant to the Transaction Agreement, the current Chairman of the Allkem Board, Mr. Peter Coleman, will assume the role of Chair of NewCo after the transaction, and Livent’s current Chief Executive Officer, Mr. Paul W. Graves, and its current Chief Financial Officer, Mr. Gilberto Antoniazzi, will assume the roles of Chief Executive Officer and Chief Financial Officer, respectively, of NewCo after the transaction. Pursuant to the Transaction Agreement, the other executive leadership of NewCo as of the effective time were contemplated to be mutually determined by Livent and Allkem prior to the scheme effectiveness and the parties have since made this determination, including that Livent’s current General Counsel, Ms. Sara Ponessa, will assume the role of General Counsel of NewCo, as well as determining the rest of the broader senior management team of NewCo as of the effective time, consisting of an approximately equal split of employees from each of Allkem and Livent. For additional information on NewCo’s directors and executive officers, see “Management and Corporate Governance of NewCo” beginning on page 289 of this proxy statement/prospectus. |

| Q: | How will my rights as a holder of NewCo Shares following the transaction differ from my current rights as a holder of Livent Shares? |

| A: | Pursuant to the terms of the Transaction Agreement, immediately prior to the closing of the transaction, NewCo’s articles of association will be amended to be in substantially the applicable form attached as Annex B to this proxy statement/prospectus. As a result, the rights of Livent stockholders who become shareholders of NewCo following the transaction will be governed by the laws of the Bailiwick of Jersey and the NewCo Organizational Documents. For more information, see the section entitled “Comparison of the Rights of Holders of Livent Shares and NewCo Shares” beginning on page 269 of this proxy statement/prospectus. |

| Q: | Who can vote at the Livent Special Meeting? |

| A: | All holders of record of Livent Shares as of the close of business on November 14, 2023 (the “Merger Record Date”), the record date for the Livent Special Meeting, are entitled to receive notice of, and to vote at, the Livent Special Meeting. Each holder of Livent Shares is entitled to cast one vote on each matter properly brought before the Livent Special Meeting for each Livent Share that such holder owned of record as of the Merger Record Date. |

| Q: | When and where is the Livent Special Meeting? |

| A: | The Livent Special Meeting of Livent stockholders will be a virtual meeting conducted exclusively via live webcast online starting at 9:00 a.m. Eastern time (with log-in beginning at 8:45 a.m. Eastern time) on December 19, 2023. Livent stockholders will be able to attend the Livent Special Meeting online only and vote shares electronically at the meeting by going to www.virtualshareholdermeeting.com/LTHM2023SM and entering the 16-digit control number included on the proxy card that Livent stockholders received. Because the Livent Special Meeting is completely virtual and being conducted via live webcast, Livent stockholders will not be able to attend the meeting in person. On or about November 20, 2023, Livent commenced mailing this proxy statement/prospectus and the enclosed form of proxy card to its stockholders entitled to vote at the Livent Special Meeting. For additional information about the Livent Special Meeting, see the section entitled “Information About the Livent Special Meeting” beginning on page 75 of this proxy statement/prospectus. |

| Q: | Why am I being asked to consider and vote on a proposal to approve, in a non-binding, advisory vote, the compensation that may be paid or become payable to Livent’s named executive officers in connection with the transactions contemplated by the Transaction Agreement? |

| A: | Under SEC rules, Livent is required to seek a non-binding, advisory vote with respect to the compensation that may be paid or become payable to its named executive officers in connection with the transactions contemplated by the Transaction Agreement. |

| Q: | Why am I being asked to consider and vote on a proposal to approve, in non-binding, advisory votes, certain provisions of the NewCo articles of association? |

| A: | Under SEC rules, Livent is required to seek a non-binding, advisory vote with respect to certain provisions of the NewCo articles of association that represent a change from the corresponding provisions of Allkem’s current governing documents. |

| Q: | What will happen if Livent stockholders do not approve the transaction-related compensation or the amendments to the NewCo articles of association? |

| A: | Approval of the Livent Advisory Compensation Proposal and the NewCo Advisory Governance Documents Proposals is not a condition to completion of the transaction. Accordingly, you may vote against any or all of these proposals and vote in favor of the Livent Transaction Agreement Proposal. The Livent Advisory Compensation Proposal and the NewCo Advisory Governance Documents Proposals votes are each an advisory vote and will not be binding on Livent or NewCo following the transaction. If the transaction is completed, the transaction-related compensation may be paid to Livent’s named executive officers to the extent payable in accordance with the terms of their compensation agreements and arrangements even if Livent’s stockholders do not approve, in a non-binding, advisory vote, the Livent Advisory Compensation Proposal and the provisions of the NewCo articles of association will apply in accordance with their terms even if Livent’s stockholders do not approve, in non-binding, advisory votes, any or all of the NewCo Advisory Governance Documents Proposals. |

| Q: | What is the difference between holding shares as a shareholder of record and as a beneficial owner? |

| A: | If your Livent Shares are registered directly in your name with the transfer agent of Livent, EQ Shareowner Services, you are considered the shareholder of record with respect to those Livent Shares. As the shareholder of record, you have the right to vote, or to grant a proxy for your vote directly to Livent or to a third party to vote, at the Livent Special Meeting. |

| Q: | If my Livent Shares are held in “street name” by my bank, broker or other nominee, will my bank, broker or other nominee automatically vote those shares for me? |

| A: | No. If your Livent Shares are held in “street name” in a stock brokerage account or by a bank or other nominee, your broker, bank or other nominee will only be permitted to vote your Livent Shares if you instruct it how to vote. You must provide your broker, bank or other nominee with instructions on how to vote your Livent Shares in order to vote. Please follow the voting instructions provided by your broker, bank or other nominee. Please note that you may not vote Livent Shares held in street name by returning a proxy card directly to Livent, by voting by telephone or internet or by voting virtually at the Livent Special Meeting unless you obtain a “legal proxy,” which you must obtain from your broker, bank or other nominee. |

| Q: | How many votes do I have? |

| A: | Each Livent stockholder is entitled to one vote for each Livent Share held of record by such Livent stockholder as of the Merger Record Date. As of the close of business on the Merger Record Date, there were 179,812,100 outstanding Livent Shares. |

| Q: | What constitutes a quorum for the Livent Special Meeting? |

| A: | The representation, present virtually or by proxy, of a majority of the Livent Shares issued and outstanding on the Merger Record Date and entitled to vote is necessary to constitute a quorum. For purposes of the Livent Special Meeting, an abstention as to a particular matter occurs when either (a) a Livent stockholder affirmatively votes to “ABSTAIN” as to that matter or (b) a Livent stockholder attends the Livent Special Meeting and does not vote as to such matter. For purposes of the Livent Special Meeting, a failure to be represented as to particular Livent Shares and a particular matter occurs when either (a) the holder of record of such Livent Shares neither attends the virtual meeting nor returns a proxy with respect to such Livent Shares or (b) such Livent Shares are held in “street name” and the beneficial owner does not instruct the owner’s bank, broker or other nominee on how to vote such Livent Shares with respect to such matter (i.e., a broker non-vote). |

| How do I vote my shares? |

| A: | Stockholders of Record. |

| • | By Mail. Mark the enclosed proxy card, sign and date it, and return it in the postage-paid envelope you have been provided. To be valid, your proxy by mail must be received by 11:59 p.m. Eastern time on the day preceding the Livent Special Meeting. |

| • | By Telephone. The toll-free number for telephone proxy submission can be found on the enclosed proxy card. You will be required to provide your assigned control number located on the proxy card. Telephone proxy submission is available 24 hours a day. If you choose to submit your proxy by telephone, then you do not need to return the proxy card. To be valid, your telephone proxy must be received by 11:59 p.m. Eastern time on the day preceding the Livent Special Meeting. |

| • | By Internet. The web address and instructions for internet proxy submission can be found on the enclosed proxy card. You will be required to provide your assigned control number located on the proxy card. Internet proxy submission via the web address indicated on the enclosed proxy card is available 24 hours a day. If you choose to submit your proxy by internet, then you do not need to return the proxy card. To be valid, your internet proxy must be received by 11:59 p.m. Eastern time on the day preceding the Livent Special Meeting. |

| • | Online During the Meeting. Livent stockholders of record may attend the virtual Livent Special Meeting by entering your assigned control number located on the proxy card and voting online; attendance at the virtual Livent Special Meeting will not, however, in and of itself constitute a vote or a revocation of a prior proxy. Livent requests that Livent stockholders submit their proxies by telephone or over the internet or by completing and signing the accompanying proxy card and returning it to Livent in the enclosed postage-paid envelope as soon as possible. When the accompanying proxy card is returned properly executed, the Livent Shares represented by it will be voted at the Livent Special Meeting in accordance with the instructions contained on the proxy card. |

| Q: | How can I change or revoke my vote? |

| A: | You have the right to revoke or change your proxy before it is voted at the Livent Special Meeting by: (i) sending a written notice of revocation to Livent Corporation, 1818 Market Street, Suite 2550, Philadelphia, PA 19103, Attention: Corporate Secretary, that is received by Livent prior to 11:59 p.m. Eastern time on the day preceding |

| Q: | If a shareholder gives a proxy, how are the Livent Shares voted? |

| A: | Regardless of the method you choose to vote, the individuals named on the enclosed proxy card will vote your Livent Shares in the way that you indicate. When completing the internet or telephone processes or the proxy card, you may specify whether your Livent Shares should be voted for or against, or you may abstain from voting on, all, some or none of the specific items of business to come before the Livent Special Meeting. |

| Q: | What should I do if I receive more than one set of voting materials? |

| A: | If you hold Livent Shares in “street name” and also directly as a record holder or otherwise or if you hold Livent Shares in more than one brokerage account, you may receive more than one set of voting materials relating to the Livent Special Meeting. Please complete, sign, date and return each proxy card (or cast your vote by telephone or internet as provided on your proxy card) or otherwise follow the voting instructions provided in this proxy statement/prospectus in order to ensure that all of your Livent Shares are voted. If you hold your Livent Shares in “street name” through a bank, broker or other nominee, you should follow the procedures provided by your bank, broker or other nominee to vote your shares. |

| Q: | What happens if I sell my Livent Shares before the Livent Special Meeting? |

| A: | The Merger Record Date is earlier than both the date of the Livent Special Meeting and the effective time. If you transfer your Livent Shares after the Merger Record Date but before the Livent Special Meeting, you will, unless the transferee requests a proxy from you, retain your right to vote at the Livent Special Meeting but will transfer the right to receive the merger consideration to the person to whom you transfer your Livent Shares. In order to become entitled to receive the merger consideration you must hold your Livent Shares through the effective time, which Livent and Allkem expect will occur by the end of calendar year 2023, subject to satisfaction or waiver of closing conditions. |

| Q: | Who will solicit and pay the cost of soliciting proxies? |

| A: | Livent has engaged Morrow Sodali LLC to assist in the solicitation of proxies for the Livent Special Meeting. Livent will pay Morrow Sodali LLC a base fee of $35,000 plus reasonable out-of-pocket expenses. The cost of the solicitation of proxies from Livent stockholders will be borne by Livent. Livent will reimburse brokers and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy materials to the beneficial owners of Livent Shares. In addition to solicitations by mail, Livent’s directors, officers and employees may solicit proxies personally or by email or telephone without additional compensation. |

| Q: | What do I need to do now? |

| A: | After carefully reading and considering the information contained in this proxy statement/prospectus, please vote promptly to ensure that your shares are represented at the Livent Special Meeting. If you hold your Livent Shares in your own name as the shareholder of record, you may submit a proxy to have your Livent Shares voted at the Livent Special Meeting in one of four ways (described in detail in the response to the question “How do I vote my shares?”): |

| • | by mail; |

| • | by telephone; |

| • | via the internet; or |

| • | online during the Livent Special Meeting. |

| Q: | Where can I find the voting results of the Livent Special Meeting? |

| A: | The preliminary voting results will be announced at the Livent Special Meeting, if available. In addition, within four business days following certification of the final voting results, Livent will file the final voting results with the SEC on a Current Report on Form 8-K. |

| Q: | Am I entitled to exercise appraisal or dissenters’ rights instead of receiving the merger consideration for my Livent Shares? |

| A: | Under Section 262 of the DGCL, holders of Livent Shares are not entitled to exercise dissenters’ or appraisal rights in connection with the merger because Livent Shares are listed on the NYSE and holders of eligible Livent Shares are not required to receive consideration other than NewCo Shares, which are expected to be listed on the NYSE. |

| Q: | Are there any risks that I should consider in deciding whether to vote for the Livent Transaction Agreement Proposal? |

| A: | Yes. You should read and carefully consider the risks described in the section entitled “Risk Factors” beginning on page 37 of this proxy statement/prospectus. You also should read and carefully consider the risk factors relating to Livent contained in the documents filed with the SEC that are incorporated by reference into this proxy statement/prospectus, including Livent’s Annual Report on Form 10-K for the year ended December 31, 2022. |

| Q: | What are the conditions to the completion of the transaction? |

| A: | In addition to approval of the Livent Transaction Agreement Proposal by Livent stockholders as described above, completion of the transaction is subject to the satisfaction of a number of other conditions, including conditions relating to receipt of the Allkem Shareholder Approval for the scheme under the Australian Corporations Act, expiration or earlier termination of any applicable waiting period and receipt of governmental consents, approvals and clearances, in each case, under antitrust and investment screening laws in certain applicable jurisdictions, approval of the Court under the Australian Corporations Act, approval from the NYSE of the listing of NewCo Shares to be issued in the transaction, approval from the ASX for the admission of NewCo as a foreign exempt listing and the approval for quotation of the CDIs to be issued in the transaction, accuracy of representations and warranties in the Transaction Agreement, compliance with covenants in the Transaction Agreement, confirmation (verbal or otherwise) from the ATO that either (i) there are no material impediments to or material issues to be resolved which may prevent the ATO from issuing the ATO Class Ruling or (ii) the ATO is prepared to issue the ATO Class Ruling, in a form and substance satisfactory to Allkem (acting reasonably), confirming that qualifying Australian resident Allkem shareholders will be eligible to choose |

| Q: | Is consummation of the transaction contingent upon any future approval by the holders of Allkem Shares? |

| A: | Yes. In accordance with the terms of the Transaction Agreement and applicable law, Allkem must obtain shareholder approval for the scheme under the Australian Corporations Act. See “The Transaction—Regulatory Approvals” beginning on page 130 of this proxy statement/prospectus. |

| Q: | What happens if the transaction is not completed? |

| A: | If the Livent Transaction Agreement Proposal is not approved by Livent stockholders or if the transaction is not completed for any other reason, Livent stockholders will not receive NewCo Shares for their Livent Shares. Instead, Livent will remain an independent public company, Livent Shares will continue to be listed and traded on the NYSE and registered under the Exchange Act and Livent will continue to file periodic reports with the SEC. If the Transaction Agreement is terminated, under specified circumstances, Livent may be required to pay Allkem a termination fee of $64.6 million and, under specified circumstances, Allkem may be required to pay Livent a termination fee of $64.6 million. See the section entitled “The Transaction Agreement—Termination Fee” beginning on page 172 of this proxy statement/prospectus. |

| Q: | Who can help answer any other questions I have? |

| A: | If you have additional questions about the transaction, need assistance in submitting your proxy or voting your Livent Shares or need additional copies of this proxy statement/prospectus or the enclosed proxy card, please contact Morrow Sodali, LLC, Livent’s proxy solicitor, by calling toll-free at (800) 662-5200 or via email at Livent@info.morrowsodali.com. |

| • | the occurrence of any change, effect, event, development, matter, state of facts, series of events or circumstances that could give rise to the termination of the Transaction Agreement, including a termination of the Transaction Agreement under circumstances that could require Livent to pay a termination fee to Allkem or require Allkem to pay a termination fee to Livent; |

| • | uncertainties related to the timing of the required regulatory approvals for the transaction and the possibility that Livent and Allkem may be required to accept conditions that could reduce the anticipated benefits of the transaction as a condition to obtaining such regulatory approvals; |

| • | the inability to complete the transaction due to the failure to obtain Livent Stockholder Approval of the transaction; |

| • | the inability to complete the transaction due to the failure to obtain Allkem Shareholder Approval of the scheme or approval of the Court under the Australian Corporations Act; |

| • | the failure of the transaction to close for any other reason; |

| • | the ability to implement integration plans for NewCo and the ability to recognize the anticipated growth and cost savings and other benefits of the transaction, and to do so at the cost, within the time and with the effort anticipated; |

| • | the ability to effectively manage the newly combined business, including with respect to implementing the anticipated strategies and obtaining the estimated cost savings, value of certain tax assets, synergies and growth; |

| • | the failure to realize expected synergies, efficiencies and cost savings from the transaction within the expected time period, if at all; |

| • | the inability to meet expectations regarding the timing, completion and accounting and tax treatments with respect to the transaction; |

| • | the transaction and requirements under the Transaction Agreement that could disrupt Allkem’s and Livent’s current or future plans, operations and relationships with customers; |

| • | the potential difficulties in retention of any members of senior management of Livent and Allkem and any other key employees that NewCo intends to retain after the closing of the transaction; |

| • | the outcome of any legal proceedings that may be instituted against NewCo, Allkem, Livent and/or others relating to the Transaction Agreement or the transactions contemplated thereby; |

| • | diversion of the attention of Livent’s and Allkem’s respective management from ongoing business concerns; |

| • | limitations placed by the Transaction Agreement on the ability of Livent and Allkem to operate their respective businesses; |

| • | the effect of the announcement of the transaction on Livent’s and Allkem’s business relationships, employees, suppliers, vendors, other partners, standing with local communities, regulators and other government officials, operating results and businesses generally; |

| • | the value of NewCo Shares and CDIs to be issued in the transaction, including risks relating thereto that have historically not affected the market price for Livent Shares or Allkem Shares individually; |

| • | the amount of any costs, fees, expenses, impairments and charges relating to the transaction; |

| • | factors that affect demand for, or the prices of, lithium and other commodities; |

| • | physical risks inherent in Allkem’s and Livent’s businesses and the mining industry generally, including those related to natural disasters, climate change and other environmental hazards; |

| • | competitive pressures in and unanticipated changes relating to competitive factors in the industries in which Livent and Allkem operate or in related industries, including industries that utilize lithium products; |

| • | the ability to reach the anticipated levels of production capacity at the respective operating assets and achieve steady state production at the development assets owned by Livent or Allkem or in which they have a financial interest; |

| • | shortages or changes in availability, or increases in costs of, key supplies; |

| • | changes in tax laws or interpretations that could increase the consolidated tax liabilities of Livent and Allkem, or that could affect the operations or financial performance of Livent and Allkem; |

| • | NewCo’s financial controls and reporting systems, especially given the different legislation, governmental regulations and standards that Allkem and Livent are subject to; |

| • | the impact of current future geo-political tensions, instability and events on Livent’s, Allkem’s and NewCo’s businesses and results; |

| • | the potential challenges relating to compliance with the differing legal, political, social and regulatory requirements in the many jurisdictions in which Livent and Allkem operate and in which NewCo will operate; |

| • | the impact of acquisitions and investments Livent, Allkem and NewCo have made or may make; |

| • | changes in legislation or governmental regulations affecting Livent, Allkem, NewCo or any of their properties; |

| • | NewCo’s governance, including in relation to its organization under Jersey law, as well as NewCo being an Irish tax resident; |

| • | the parties’ international operations, which are subject to the risks of currency fluctuations and foreign exchange controls; and |

| • | financial market conditions, including in the stock and credit markets, and international, national or local economic, social or political conditions that could adversely affect Livent, Allkem or NewCo, or their respective customers, suppliers and vendors. |

| • | Mt Cattlin lithium spodumene mine in Ravensthorpe, Western Australia; |

| • | Olaroz lithium facility in Jujuy Province, Argentina (of which Allkem owns a 66.5% equity interest); |

| • | Cauchari lithium brine project in Jujuy Province, Argentina; |

| • | Sal de Vida lithium brine project in Catamarca Province, Argentina; |

| • | James Bay lithium spodumene project in Québec, Canada; and |

| • | Naraha lithium hydroxide plant in Naraha, Japan (of which Allkem owns a 75% economic interest). |

| • | “FOR” the adoption of the Transaction Agreement and approval of the transactions contemplated thereby, including the merger; |

| • | “FOR” the approval of, in a non-binding, advisory vote, the compensation that may be paid or become payable to Livent’s named executive officers in connection with the transactions contemplated by the Transaction Agreement; |

| • | “FOR” the approval of, in non-binding, advisory votes, certain provisions of the NewCo articles of association; and |

| • | “FOR” the approval to adjourn the Livent Special Meeting. |

| • | the Livent Transaction Agreement Proposal; |

| • | the Livent Advisory Compensation Proposal; |

| • | the NewCo Advisory Governance Documents Proposals; and |

| • | the Livent Adjournment Proposal. |

| • | Livent RSUs. At the effective time, each Livent RSU will be assumed by NewCo and will be subject to substantially the same terms and conditions as applied to the related Livent RSU immediately prior to the effective time, except that the Livent Shares subject to such Livent RSUs will be converted into the right to receive, upon vesting, a number of NewCo Shares equal to the product of (A) the number of Livent Shares underlying such Livent RSUs immediately prior to the effective time, multiplied by (B) 2.406. Following such assumption, each assumed Livent RSU that is unvested and outstanding as of the date of signing of the Transaction Agreement will vest on a pro rata basis and, to the extent of such vesting, will be exchanged into the right to receive the merger consideration at the effective time or as soon as practicable thereafter. |

| • | Livent PSUs. At the effective time, each Livent PSU will fully vest, with the number of Livent Shares subject to such Livent PSUs determined based on the achievement of the higher of target and actual performance. At the effective time or as soon as practicable thereafter, each Livent PSU will be canceled in exchange for the right to receive the merger consideration. |

| • | Livent Options. At the effective time, each Livent Option will be assumed by NewCo (each, a “Livent Assumed Option”). Each Livent Assumed Option (whether vested or unvested) will be subject to substantially the same terms and conditions as applied to the related Livent Option immediately prior to the effective time, except that (x) each such Livent Assumed Option will be converted into a stock option to acquire a number of NewCo Shares equal to the product of (A) the number of Livent Shares underlying such Livent Assumed Options immediately prior to the effective time, multiplied by (B) 2.406; and (y) the exercise price per NewCo Share will be equal to the product of (A) the original exercise price per Livent Share when such Livent Assumed Option was granted, divided by (B) 2.406. |

| • | Livent Director RSUs. Immediately prior to the effective time, any Livent Director RSU will vest in full and be cancelled and converted into the right to receive an amount in cash equal to (A) the number of Livent Shares subject to such Livent Director RSUs immediately prior to the effective time, multiplied by (B) the higher of (i) the first available closing price of the merger consideration and (ii) the closing price per Livent Share as reported in the NYSE on the last trading day preceding the closing date. |

| • | as at 8:00 a.m. AWST on the sanction date, each of the conditions set out below (other than the conditions in the second and third bullets below) has been satisfied or waived (where permitted); |

| • | the approval by the Court (or any court of competent jurisdiction on appeal therefrom) (without material modification) of the scheme pursuant to Section 411(4)(b) of the Australian Corporations Act; |

| • | the lodging by Allkem of an office copy of the Court orders approving the scheme under Section 411(4)(b) of the Australian Corporations Act with ASIC; |

| • | the closing of the merger being capable of occurring, and would reasonably be expected to occur, as promptly as practicable following implementation of the scheme, meaning no applicable impediments under the terms of the Transaction Agreement exist or are foreseen such that there is any possibility that the scheme implementation and the merger closing do not occur around the same time, noting that the only condition to the merger occurring is the occurrence of the scheme implementation; |

| • | the Allkem Shareholder Approval being duly obtained at the scheme meeting (or at any adjournment or postponement thereof, in each case at which a vote on such approval was taken); |

| • | the Livent Stockholder Approval being duly obtained at the Livent Special Meeting (or at any adjournment or postponement thereof, in each case at which a vote on such approval was taken); |

| • | (i) the NYSE having approved the listing of the NewCo Shares to be issued to the holders of Livent Shares and the NewCo Shares, including the NewCo Shares underlying the CDIs, to be issued to holders of Allkem Shares pursuant to the transaction, subject to official notice of issuance, and (ii) the ASX having provided approval for the admission of NewCo as a foreign exempt listing to the official list of ASX and the approval for official quotation of the CDIs, whether or not such approval is subject to conditions; |

| • | all applicable governmental consents under specified antitrust and investment screening laws, in each case on any terms described in the Transaction Agreement (as the list may be amended with the written consent of Livent and Allkem) must have been obtained or made (as applicable) and remain in full force and effect and all applicable waiting periods (including any extensions by agreement or operation of law) applicable to the scheme and the merger with respect thereto must have expired, lapsed or been terminated (as applicable); |

| • | the registration statement on Form S-4 of which this proxy statement/prospectus forms a part must have become effective under the Securities Act and must not be the subject of any stop order (which has not been withdrawn) or proceedings initiated by the SEC seeking any stop order; |

| • | (i) no governmental entity of a competent jurisdiction will have issued any order (whether temporary, preliminary or permanent) that is in effect and restrains, enjoins or otherwise prohibits the consummation of the transaction and (ii) no governmental entity having jurisdiction over any party shall have adopted any law that is in effect and makes consummation of the transaction illegal or otherwise prohibited (it being understood that if any such law arises out of or relates to antitrust laws or investment screening laws, the presence of such law will only be a failure to meet a condition to the scheme implementation to the extent the violation or contravention of such law as in effect would reasonably be expected to result in criminal liability to any person, personal liability to any director or officer of Allkem, Merger Sub, NewCo, Livent or any of their respective subsidiaries, or a material adverse effect on NewCo and its subsidiaries following the effective time); and |

| • | at 8:00 a.m. AWST on the sanction date, neither the Transaction Agreement nor the deed poll having been terminated in accordance with its terms. |

| • | the representations and warranties of Livent are true and correct to the extent required by, and subject to the applicable materiality standards set forth in, the Transaction Agreement, together with the receipt by Allkem of a certificate executed by Livent’s Chief Executive Officer to such effect; |

| • | each of Livent and the NewCo Parties have in all material respects performed the obligations and complied with the covenants required to be performed or complied with by it under the Transaction Agreement, together with the receipt by Allkem of a certificate executed by Livent’s Chief Executive Officer to such effect; |

| • | there has been no material adverse effect with respect to Livent; |

| • | the Independent Expert will have issued the IER, which concludes that the scheme is in the best interest of Allkem shareholders and the Independent Expert does not change, withdraw or qualify its conclusion in any written update to its IER or withdraw the IER; and |

| • | Allkem will have received confirmation (verbal or otherwise) from the ATO that either (i) there are no material impediments to or material issues to be resolved which may prevent the ATO from issuing the ATO Class Ruling or (ii) the ATO is prepared to issue the ATO Class Ruling, in a form and substance satisfactory to Allkem (acting reasonably), confirming that qualifying Australian resident Allkem shareholders will be eligible to choose rollover relief to the extent to which they receive NewCo Shares or CDIs in exchange for their Allkem Shares in connection with the scheme. Should an ATO Class Ruling not be available for all qualifying Australian resident Allkem shareholders, an ATO Class Ruling that includes (or would include, when issued) a confirmation that qualifying Australian resident shareholders who hold their shares on capital account are eligible to claim rollover relief will be deemed acceptable to Allkem. |

| • | the representations and warranties of Allkem are true and correct to the extent required by, and subject to the applicable materiality standards set forth in, the Transaction Agreement, together with the receipt by Livent of a certificate executed by Allkem’s Chief Executive Officer to such effect; |

| • | Allkem has in all material respects performed the obligations and complied with the covenants required to be performed or complied with by it under the Transaction Agreement, together with the receipt by Livent of a certificate executed by Allkem’s Chief Executive Officer to such effect; |

| • | there has been no material adverse effect with respect to Allkem; and |

| • | Livent shall have sought and received an opinion of Davis Polk, or, if Davis Polk is unable or unwilling to provide such opinion, Sidley Austin, dated as of the sanction date, in form and substance reasonably satisfactory to Livent, to the effect that, on the basis of facts, representations and assumptions set forth or referred to in such opinion and as of the date thereof, (i) either (A) the merger should qualify as a “reorganization” under Section 368(a) of the Code or (B) the merger and the scheme, taken together, should qualify as an exchange described in Section 351(a) of the Code, and (ii) the transfer of Livent Shares (other than certain excluded shares) by Livent stockholders pursuant to the merger (other than by any Livent stockholder who is a U.S. person and would be a “five-percent transferee shareholder” (within the meaning of Treasury Regulations Section 1.367(a)-3(c)(5)(ii)) of NewCo following the merger that does not enter into a five-year gain recognition agreement in the form provided in Treasury Regulations Section 1.367(a)-8(c)) should qualify for an exception to Section 367(a)(1) of the Code. |

| • | change, withhold, withdraw, qualify or modify, or publicly propose or announce any intention to change, withhold, withdraw, qualify or modify in a manner adverse to the other party, its recommendation to its stockholders that they approve the Transaction Agreement (in the case of Livent) and vote in favor of the scheme (in the case of Allkem) (in the case of Livent, the “Livent Board Recommendation,” and in the case of Allkem, the “Allkem Board Recommendation,” and each as applicable, a “Board Recommendation”); |

| • | fail to include its Board Recommendation in this proxy statement/prospectus, in the case of Livent, or the scheme booklet, in the case of Allkem; |

| • | approve, adopt, endorse or recommend, or publicly propose or announce any intention to approve, adopt, endorse or recommend, any Competing Proposal; |

| • | publicly agree or propose to enter into, any agreement in principle, letter of intent, memorandum of understanding, term sheet, merger agreement, acquisition agreement, option agreement, joint venture agreement, partnership agreement or other agreement, in each case of the foregoing relating to a Competing Proposal (other than a confidentiality agreement as provided for in the Transaction Agreement); |

| • | in the case of Livent only, in the case of a Competing Proposal that is structured as a tender offer or exchange offer pursuant to the Exchange Act for outstanding Livent Shares (other than by Allkem or an affiliate of Allkem), fail to recommend, in a Solicitation/Recommendation Statement on Schedule 14D-9, against acceptance of such tender offer or exchange offer by its stockholders on or prior to the earlier of (A) three business days prior to the date the Livent Special Meeting is held, including adjournments (or promptly after commencement of such tender offer or exchange offer if commenced on or after the third business day prior to the date the Livent Special Meeting is held, including adjournments) or (B) ten business days (as such term is used in Rule 14d-9 of the Exchange Act) after commencement of such tender offer or exchange offer; or |

| • | cause or permit it to enter into an alternative acquisition agreement (together with any of the actions set forth in the first through fourth bullets above and, only in the case of Livent, the fifth bullet above, a “Change of Recommendation”). |

| • | by either Livent or Allkem: |

| • | if the Allkem Shareholder Approval is not obtained at the scheme meeting, or at any adjournment or postponement thereof, in each case at which a vote on such approval was taken (the “Allkem Shareholder Approval Failure Termination Right”); |

| • | if the Livent Stockholder Approval is not obtained at the Livent Special Meeting, or at any adjournment or postponement thereof, in each case at which a vote on such approval was taken (the “Livent Stockholder Approval Failure Termination Right”); or |

| • | if the Court declines or refuses to make any orders directing Allkem to convene the scheme meeting or declines or refuses to approve the scheme, and either (x) no appeal of the Court’s decision is made, or (y) on appeal, a court of competent jurisdiction issues a final and non-appealable ruling upholding the declination or refusal (as applicable) of the Court, and such outcome was not principally caused by a material breach of any representation, warranty, covenant or agreement set forth in the Transaction Agreement by the party seeking to terminate the Transaction Agreement. |

| • | by Allkem: |

| • | if Livent or a NewCo Party has breached or failed to perform any of its representations, warranties, covenants or other agreements contained in the Transaction Agreement, such that the conditions to Allkem’s obligation to consummate the transaction would not be satisfied (subject to Livent’s right to cure, and provided that Allkem is not then in breach) (the “Allkem Material Breach Termination Right”); |

| • | prior to the receipt of the Allkem Shareholder Approval, if there has occurred an Allkem Change of Recommendation in connection with a Superior Proposal; provided that prior to or concurrently with such termination Allkem pays or causes to be paid to Livent the Allkem Termination Fee (as defined below) (the “Allkem Change of Recommendation Termination Right”); |

| • | prior to the receipt of the Allkem Shareholder Approval, if there has occurred an Allkem Change of Recommendation in response to an Intervening Event; provided that prior to or concurrently with such termination Allkem pays or causes to be paid to Livent the Allkem Termination Fee (the “Allkem Intervening Event Termination Right”); |