Confidential Treatment Requested by BBB Foods Inc.

Pursuant to 17 CFR 200.83

Net Cash Used in Investing Activities

Net cash used in investing activities generally consists of expenses and capital expenditures to expand our number of stores and distribution centers, investments in our supply chain, including purchase and sale of property and equipment, and maintenance of existing stores.

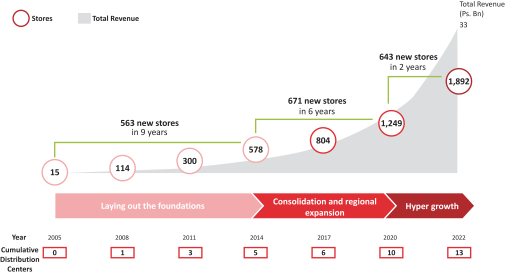

Net cash used in investing activities was Ps.901,193 thousand and Ps.773,984 thousand for the nine months ended September 30, 2023 and 2022, respectively. Net cash used in investing activities increased by Ps.127,209 thousand for the nine months ended September 30, 2023 as compared to the nine months ended September 30, 2022, mainly as we expanded our store count by 395 net new store openings between October 1, 2022 and September 30, 2023 and three new distribution centers, leading to increased purchases of property and equipment and of cold rooms.

Net cash used in investing activities was Ps.1,111,350 thousand, Ps.524,080 thousand and Ps.296,497 thousand for the years ended December 31, 2022, 2021 and 2020, respectively. Net cash used in investing activities increased by Ps.587,270 thousand for the year ended December 31, 2022 as compared to the year ended December 31, 2021, mainly as we expanded our store count by 392 net new store openings and three new distribution centers, leading to increased purchases of property and equipment and of cold rooms. Net cash used in investing activities increased by Ps.227,583 thousand for the year ended December 31, 2021 as compared to the year ended December 31, 2020, mainly as a result of the purchase of property and equipment, and acquisitions of cold rooms due to the opening of 251 new stores and two new distribution centers. We expect to continue to use cash to make expenditures to open new stores, renovate existing stores and distribution centers, acquire store equipment and transportation equipment and invest in software.

Net Cash Used in Financing Activities

Net cash used in financing activities generally consists of transactions related to our short-term and long-term debt and financing obligations. Transactions with non-controlling interest shareholders are also classified as cash flows from financing activities.

Net cash used in financing activities was Ps.1,027,374 thousand and Ps.743,306 thousand for the nine months ended September 30, 2023 and 2022, respectively. Net cash used in financing activities increased by Ps.284,068 thousand for the nine months ended September 30, 2023 as compared to the nine months ended September 30, 2022, mainly driven by an increase of lease payments due to our 395 net new store openings between October 1, 2022 and September 30, 2023 and the opening of three new distribution center, offset by an increase in transactions under our reverse factoring arrangement with Santander and HSBC.

Net cash used in financing activities was Ps.1,027,115 thousand, Ps.450,241 thousand and Ps.446,643 thousand for the years ended December 31, 2022, 2021 and 2020, respectively. Net cash used in financing activities increased by Ps.576,874 thousand for the year ended December 31, 2022 as compared to the year ended December 31, 2021, mainly driven by an increase of lease payments due to 392 net new store openings and the opening of three distribution centers, offset by an increase in transactions under our reverse factoring arrangement with Santander. Net cash used in financing activities increased by Ps.3,598 thousand for the year ended December 31, 2021 as compared to the year ended December 31, 2020, mainly driven by an increase of lease payments due to our 251 net new store openings and the opening of two new distribution centers, which was partially offset by the interest payable at the maturity of the Promissory Notes and an increase in transactions under our reverse factoring arrangement with Santander.

Capital Expenditures

We make, and expect to continue to make, capital expenditures for store openings, renovation of existing stores and distribution centers, acquisitions of store equipment and transportation equipment, and investments in software.

77