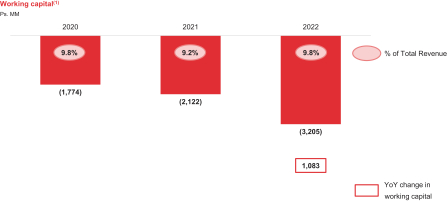

ifferences. Our working capital for 2021, 2022 and the nine months ended September 30, 2023 was Ps.(2,121,704) thousand, Ps.(3,205,200) thousand and Ps.(4,243,026) thousand, respectively. As of December 31, 2022 and 2021, our total current assets amounted to Ps.3,599,202 thousand and Ps.2,862,715 thousand, respectively. As of September 30, 2023, our total current assets amounted to Ps.4,020,750 thousand.

We have also used certain amounts of short-term and long-term debt with related parties and third parties to supplement our cash flows. As of December 31, 2022 and 2021, our long-term debt with unaffiliated third parties consisted of Ps.540,734 thousand and Ps.451,285 thousand, respectively. As of September 30, 2023, our long-term debt with unaffiliated third parties consisted of Ps.565,777 thousand. In addition to financing from third parties, we have issued several senior and junior, U.S. dollar-denominated pay-in-kind Promissory Notes that mature on December 31, 2026, most of which are held by related parties, including some of our shareholders. The aggregate principal amount and accrued interest outstanding on the Promissory Notes was US$224,387 thousand (Ps.4,344,461 thousand) as of December 31, 2022 and US$248,005 thousand (Ps.4,369,722 thousand) as of September 30, 2023. We have also issued Convertible Notes. The aggregate principal amount and accrued interest outstanding on the Convertible Notes was US$19,465 thousand (Ps.376,878 thousand) as of December 31, 2022 and US$21,689 thousand (Ps.382,149 thousand) as of September 30, 2023. See “—Indebtedness—Promissory Notes and Convertible Notes” for additional information.

In addition, we have entered into a reverse factoring arrangement with Banco Santander Mexico, S.A. (“Santander”) pursuant to which a participating supplier receives the original invoice amount discounted at an agreed rate, and we pay Santander the original amount of the invoice within 60 days after the supplier collects the invoice from Santander. The aggregate limit of amounts invoiced under this arrangement is Ps.350,000 thousand. Pursuant to the terms of this arrangement, we have created a trust, which is meant to be a source of payment in the case of a payment default, into which cash flows coming from 419 stores in a minimum aggregate amount of Ps.300,000 thousand are deposited and released so long as no payment default occurs. See Note 3.12 to our audited consolidated financial statements as of December 31, 2022 and 2021 and for the years ended December 31, 2022, 2021 and 2020 for more information about this arrangement.

On June 2, 2023, we and HSBC Mexico, S.A. (“HSBC”) entered into a reverse factoring transaction (the “HSBC Supplier Finance Agreement”) and a credit facility (the “HSBC Credit Line,” and together with the HSBC Supplier Finance Agreement, the “HSBC Agreement”). The aggregate principal amount financeable under the HSBC Agreement is Ps.450,000 thousand. Pursuant to the terms of the HSBC Supplier Finance Agreement, participating suppliers may discount their invoices with HSBC, and they will receive the original invoice amount discounted at an agreed rate and we will then pay HSBC the original amount by the earlier of: (x) the date HSBC pays the supplier plus the number of credit days originally agreed to with the supplier, and (y) 90 days after the supplier collects the invoice from HSBC. The supplier elects which invoices are entered into the factoring transaction. Once entered, such invoices are novated and the liability of the Company to cover such invoice is extinguished. Invoices that are not discounted with HSBC are payable to the supplier at the original maturity date. There are no commissions or interests payable to HSBC when invoices are discounted, and only an opening commission of Ps.2,250 thousand was paid for entering into the agreement, however, we receive a commission from HSBC for each factoring transaction and we must pay penalties in case of late payment. In addition, under the terms of the HSBC Agreement, the Company must comply with certain covenants, including restrictions on dividends. Additionally, pursuant to the terms of the HSBC Agreement, we have created a trust, which is meant to be a source of payment in the case of a payment default, into which Ps.540,000 thousand of cash flows have to be deposited each month and are released so long as no payment default occurs. Drawdowns on the HSBC Credit Facility are payable within 90 days and accrue interest at a rate of TIIE+3.25% and matures within 36 months.

We intend to increase our capital expenditures to support the growth in our business and operations. We believe that our existing cash and cash equivalents and the liquidity provided from other sources of funds (including the proceeds from this offering) will be sufficient to meet our anticipated cash needs for at least the next 12 months, considering our expected organic growth. Our future capital requirements and the adequacy of available funds will depend on many factors, including those described under “Risk Factors.” In addition, the

75