CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO RULE 83

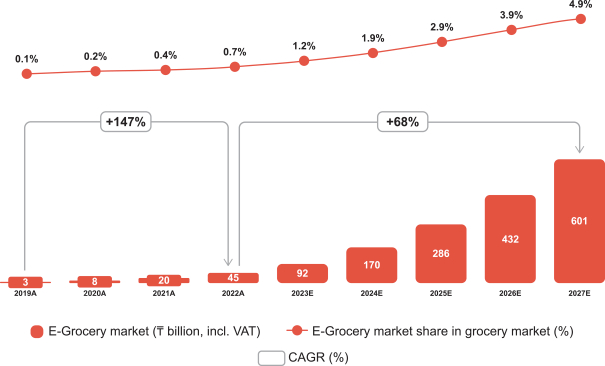

Retail revenue. Retail revenue was ₸21,106 million for the six months ended June 30, 2023, compared to nil in the prior year period, as a result of the transition of e-Grocery into a “first-party” business in February 2023.

Other gains. Our other gains of ₸12,263 million for the six months ended June 30, 2023 and ₸9,971 million for the six months ended June 30, 2022 primarily represented foreign exchange transactions, with the change primarily as a result of changes in the currency exchange rate of the tenge to the U.S. dollar, as well as changes in gains/(losses) on derivative financial instruments.

Costs and Operating Expenses

Costs and operating expenses increased by 56% to ₸392,961 million for the six months ended June 30, 2023 from ₸251,915 million for the six months ended June 30, 2022, primarily due to growth in interest expenses, and costs and operating expenses as a percentage of revenue were 47% for the six months ended June 30, 2023 and 2022.

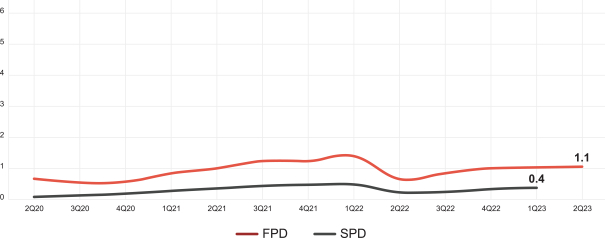

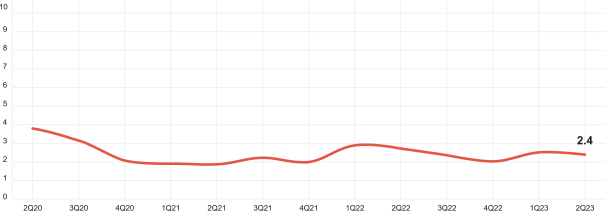

Interest expenses. Interest expenses increased by 91% to ₸220,474 million for the six months ended June 30, 2023 from ₸115,343 million for the six months ended June 30, 2022, mainly as a result of an increase in the average rates on customer deposits to 9.9% from 7.1% and a 32% increase in the number of Fintech Active Consumers (deposits).

Transaction expenses. Transaction expenses increased by 21% to ₸12,840 million for the six months ended June 30, 2023 from ₸10,632 million for the six months ended June 30, 2022, primarily due to a 46% increase in the number of TPV Payments Transactions, partially offset by a growing share of proprietary network transactions where we do not pay third-party providers.

Cost of goods and services. Cost of goods and services increased by 88% to ₸67,336 million for the six months ended June 30, 2023 from ₸35,757 million for the six months ended June 30, 2022, mainly due to an increase in cost of goods and services of Marketplace, primarily due to a 186% increase in the number of e-Commerce Purchases and growth in delivery expenses, as well as a 15% increase in the number of Payments Active Consumers, a 13% increase in the number of Fintech Active Consumers (loans) and the transition of e-Grocery into a “first-party” business in February 2023.

Technology and product development. Technology and product development expenses increased by 43% to ₸37,941 million for the six months ended June 30, 2023 from ₸26,608 million for the six months ended June 30, 2022, mainly as a result of increased expenses to support the growth of our technology and delivery infrastructure, such as Kaspi Postomats, which increased in number by 160% to 4,372, as well as higher compensation expenses due to growth in the number of technology personnel and higher remuneration.

Sales and marketing. Sales and marketing expenses decreased by 43% to ₸8,729 million for the six months ended June 30, 2023 from ₸15,356 million for the six months ended June 30, 2022, primarily due to the ₸10,000 million contribution made in the first half of 2022 to the public fund “Kazakhstan Halkyna” (see “Risk Factors—Risks Related to Kazakhstan—We are largely dependent on the economic, social and political conditions prevailing in Kazakhstan” for the description of the January 2022 events and related charitable contributions), while no similar contribution was made in the six months ended June 30, 2022.

General and administrative expenses. General and administrative expenses increased by 5% to ₸11,679 million for the six months ended June 30, 2023 from ₸11,084 million for the six months ended June 30, 2022, mainly due to growth in miscellaneous head office expenses.

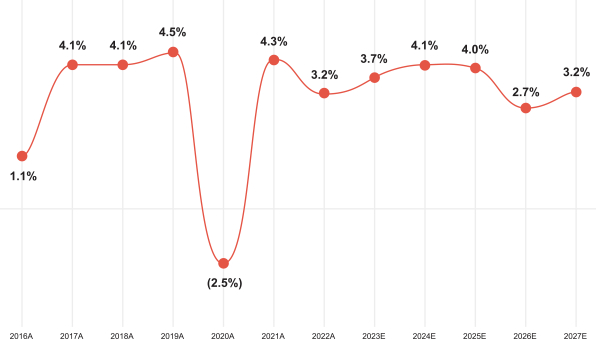

Provision expenses. Provision expenses decreased by 9% to ₸33,962 million for the six months ended June 30, 2023 from ₸37,135 million for the six months ended June 30, 2022, mainly as a result of additional provisioning for expected losses in the first half of 2022 due to a decrease in GDP forecasts, which impacted macroeconomic assumptions.

106