Revenue

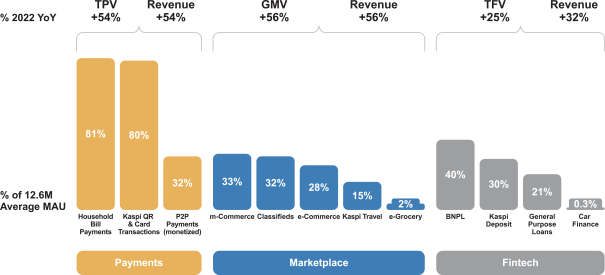

Our total revenue increased by 44% to ₸1,270,592 million for the year ended December 31, 2022 from ₸884,822 million for the year ended December 31, 2021, due to growth in revenue across all our platforms and a reduction in rewards.

Net fee revenue. Net fee revenue increased by 45% to ₸679,782 million for the year ended December 31, 2022 from ₸467,493 million for the year ended December 31, 2021, due to a 40% increase in fee revenue, as a result of growth in fee revenue of all platforms and a reduction in rewards by 14%, primarily as a result of a reduction of accruals of bonuses on certain transactions and purchases that matured or were not prioritized, including transactions using plastic cards.

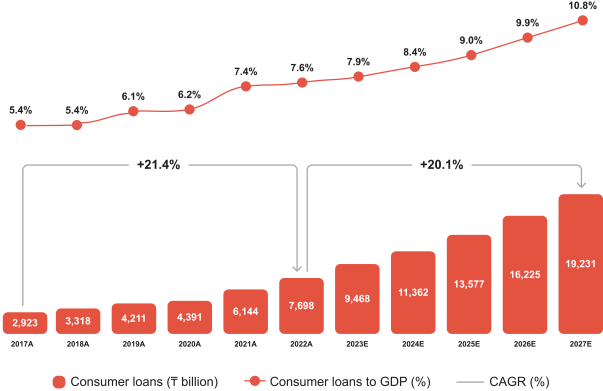

Interest revenue. Interest revenue increased by 36% to ₸574,426 million for the year ended December 31, 2022 from ₸422,075 million for the year ended December 31, 2021, mainly as a result of a 45% increase in our Average Net Loan Portfolio, which was partly offset by a decrease in average yield on loans to customers to 18.0% for the year ended December 31, 2022 from 18.4% for the year ended December 31, 2021.

Other gains/(losses). Our other gains for the year ended December 31, 2022 of ₸16,384 million and other losses for the year ended December 31, 2021 of ₸4,746 million primarily represented foreign exchange transactions, with the change primarily as a result of changes in the currency exchange rate of the tenge to the U.S. dollar, as well as changes in gains/(losses) on derivative financial instruments.

Costs and Operating Expenses

Costs and operating expenses increased by 54% to ₸550,018 million for the year ended December 31, 2022 from ₸356,020 million for the year ended December 31, 2021, and costs and operating expenses as a percentage of revenue increased to 43% for the year ended December 31, 2022 from 40% for the year ended December 31, 2021, in each case, primarily due to growth in interest expenses.

Interest expenses. Interest expenses increased by 63% to ₸278,676 million for the year ended December 31, 2022 from ₸171,491 million for the year ended December 31, 2021, mainly as a result of an increase in the average interest rates on customer accounts to 7.9% for the year ended December 31, 2022 from 6.0% for the year ended December 31, 2021 and a 35% increase in the number of Fintech Active Consumers (deposits).

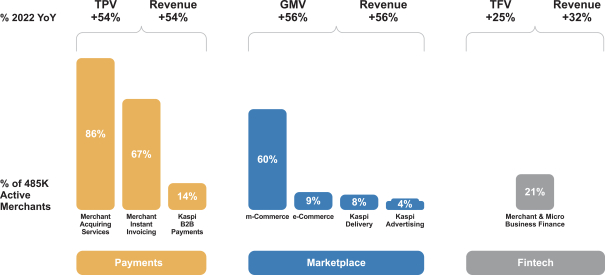

Transaction expenses. Transaction expenses increased by 34% to ₸22,188 million for the year ended December 31, 2022 from ₸16,542 million for the year ended December 31, 2021, primarily due to a 54% increase in the number of TPV Payments Transactions, partially offset by a growing share of proprietary network transactions where we do not pay third-party providers.

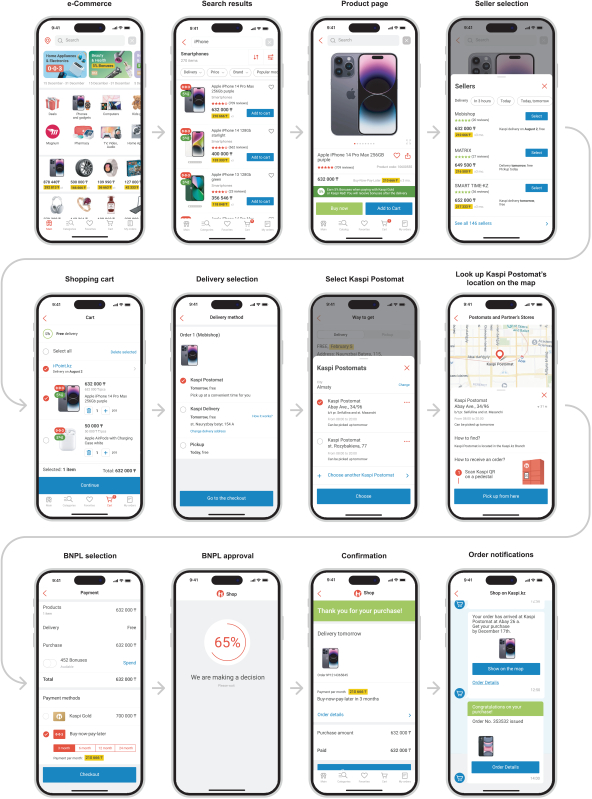

Cost of goods and services. Cost of goods and services increased by 46% to ₸82,747 million for the year ended December 31, 2022 from ₸56,829 million for the year ended December 31, 2021, mainly due to a 142% increase in the number of e-Commerce purchases and growth in delivery expenses, a 16% increase in the number of Payments Active Consumers and a 15% increase in the number of Fintech Active Consumers (loans).

Technology and product development. Technology and product development expenses increased by 37% to ₸60,807 million for the year ended December 31, 2022 from ₸44,388 million for the year ended December 31, 2021, mainly as a result of increased expenses to support the growth of our technology and delivery infrastructure, such as Kaspi POS, Postomats and data storage, as well as higher compensation expenses due to growth in the number of technology personnel and higher remuneration.

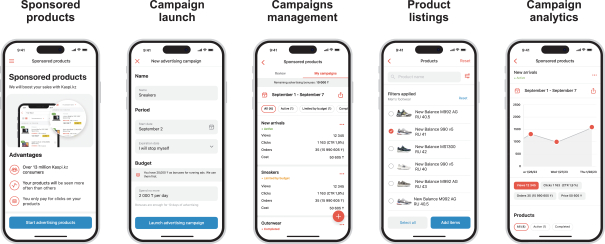

Sales and marketing. Sales and marketing expenses increased by 194% to ₸25,618 million for the year ended December 31, 2022 from ₸8,702 million for the year ended December 31, 2021,

114