As filed with the Securities and Exchange Commission on August 8, 2024.

Registration No. 333-[•]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

_____________________________

MEGAN HOLDINGS LIMITED

(Exact name of registrant as specified in its charter)

_____________________________

Cayman Islands | | 0273 | | Not Applicable |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (IRS. Employer

Identification Number) |

B-01-07, Gateway Corporate Suites

Gateway Kiaramas

No.1, Jalan Desa Kiara

50480 Mont Kiara

Kuala Lumpur, Malaysia

+60 3 6420 1071

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

_____________________________

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

(212) 947-7200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

_____________________________

With a Copy to: |

William S. Rosenstadt, Esq.

Mengyi “Jason” Ye, Esq.

Yarona L. Yieh, Esq.

Ortoli Rosenstadt LLP

366 Madison Avenue, 3rd Floor

New York, NY 10017

212-588-0022 | | Angela Dowd, Esq.

Xiaoqin “Sherry” Li, Esq.

Loeb & Loeb LLP

345 Park Avenue

New York, NY 10154

Phone: (212) 407-4000

Fax: (212) 407-4990 |

_____________________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed or supplemented. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

PRELIMINARY PROSPECTUS | | SUBJECT TO COMPLETION, DATED AUGUST 8, 2024 |

Megan Holdings Limited

1,250,000 Ordinary Shares

This is the initial public offering of 1,250,000 ordinary shares, par value US$0.0001 per share (the “Ordinary Shares”) of Megan Holdings Limited, a Cayman Islands exempted company. This offering is being conducted on a firm commitment basis. We expect that the offering price of our Ordinary Shares in this offering will be between US$4.00 and US$6.00 per share. Prior to this offering, there has been no public market for our Ordinary Shares.

We have applied to list our Ordinary Shares on the Nasdaq Capital Market under the symbol “MGN”. It is a condition to the closing of this offering that our Ordinary Shares qualify for listing on a national securities exchange, though our application might not be approved, and this offering may not be completed. There is no established public trading market for the Ordinary Shares, and such a market might never develop.

We are an “emerging growth company” and a “foreign private issuer,” each as defined under the U.S. federal securities laws, and, as such, are eligible for reduced public company reporting requirements for this and future filings.

Upon completion of this offering, our controlling shareholder, Mr. Darren Hoo, will be the beneficial owner of an aggregate of 10,845,000 Ordinary Shares, which will represent 66.7% of the then total issued and outstanding Ordinary Shares (or 66.0% of the then total issued and outstanding Ordinary Shares if the underwriters exercise their option to purchase additional Ordinary Shares in full). As a result, we will meet the definition of a “controlled company” under the corporate governance standards for Nasdaq listed companies. As a “controlled company,” we will be eligible to utilize certain exemptions from the corporate governance requirements of the Nasdaq Stock Market. Although we do not currently intend to rely on the “controlled company” exemptions under the Nasdaq listing rules, we could elect to rely on these exemptions in the event that we no longer qualify as a foreign private issuer.

Investing in our Ordinary Shares involves a high degree of risk. Before buying any Ordinary Shares, you should carefully read the discussion of the material risks of investing in our Ordinary Shares under the heading “Risk Factors” beginning on page 8 of this prospectus.

| | Per Share | | Total |

Initial public offering price | | US$ | 4.00 | | US$ | 5,000,000 |

Underwriting Discounts and Commissions(1) | | US$ | 0.28 | | US$ | 350,000 |

Proceeds to us, before expenses | | US$ | 3.72 | | US$ | 4,650,000 |

We have granted the underwriters an option exercisable within 45 days from the date of this prospectus to purchase up to an additional fifteen percent (15%) of the Ordinary Shares offered in this offering on the same terms solely to cover over-allotments, if any.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expects to deliver the Ordinary Shares to purchasers against payment therefor on or about , 2024.

[ ]

Sole Book-Running Manager

Prospectus dated , 2024.

Table of Contents

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized anyone to provide you with information different from what is contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We and the underwriters are not, making an offer to sell securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus is accurate only as of the date on the front of this prospectus, regardless of the time of delivery of this prospectus or any sale of the securities. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside of the United States, neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our Ordinary Shares and the distribution of this prospectus outside of the United States.

Until and including [•], 2024 (the 25th day after the date of this prospectus), all dealers that buy, sell or trade our Ordinary Shares, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

i

Table of Contents

ABOUT THIS PROSPECTUS

Neither we nor any of the underwriters have authorized anyone to provide you with any information or to make any representations other than as contained in this prospectus or in any related free writing prospectus. Neither we nor the underwriters take responsibility for, and provide no assurance about the reliability of, any information that others may give you. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the securities. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the Ordinary Shares and the distribution of this prospectus outside the United States.

We obtained statistical data, market data and other industry data and forecasts used in this prospectus from market research, publicly available information and industry publications.

ii

Table of Contents

PRESENTATION OF FINANCIAL INFORMATION

Basis of Presentation

Unless otherwise indicated, all financial information contained in this prospectus is prepared and presented in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP” or “GAAP”).

Certain amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Accordingly, amounts, percentages and other figures shown as totals in certain tables or charts may not be the arithmetic aggregation of those that precede them and amounts and figures expressed as percentages in the text may not total 100% or, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

Our financial year ends on December 31 of each year. References in this prospectus to a financial year, such as “financial year 2023”, relate to our financial year ended December 31 of that calendar year.

Financial Information in U.S. Dollars

Our reporting currency is the Malaysian Ringgit. Fees generated from our services are denominated in Malaysian Ringgit or “RM”. This prospectus also contains translations of certain foreign currency amounts into U.S. dollars for the convenience of the reader. Assets and liabilities denominated in foreign currencies are translated at year-end exchange rates, income statement accounts are translated at average rates of exchange for the year and equity is translated at historical exchange rates. Any translation gains or losses are recorded in foreign currency translation reserve. Gains or losses resulting from foreign currency transactions are included in net income.

This prospectus contains translations of certain RM amounts into U.S. dollar amounts at specified rates solely for the convenience of the reader. All reference to “US dollars”, “USD” or “US$” are to U.S. dollars. The relevant exchange rates are listed below:

| | December 31,

2023 | | December 31,

2022 | | December 31,

2021 |

Period Ended USD:RM exchange rate | | 4.5903 | | 4.4002 | | 4.1750 |

iii

Table of Contents

MARKET AND INDUSTRY DATA

Certain market data and forecasts used throughout this prospectus were obtained from internal company surveys, market research, consultant surveys, reports of governmental and international agencies and industry publications and surveys including the Protégé Associates Report, a third-party global research organization, commissioned by our Company. Industry publications and third-party research, surveys and reports generally indicate that their information has been obtained from sources believed to be reliable. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus.

iv

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that relate to our current expectations and views of future events. These forward-looking statements are contained principally in the sections entitled “Prospectus Summary”, “Risk Factors”, “Use of Proceeds”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, “Industry Overview” and “Business”. These statements relate to events that involve known and unknown risks, uncertainties, and other factors, including those listed under “Risk Factors”, which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, these forward-looking statements can be identified by words or phrases such as “is/are likely to,” “believe,” “plan,” “expect,” “intend,” “should,” “seek,” “estimate,” “will,” “aim,” “may,” “might,” “could” and “anticipate,” or other similar expressions, but these are not the exclusive means of identifying such statements. All statements other than statements of historical facts included in this document, including those regarding future financial position and results, business strategy, plans and objectives of management for future operations (including development plans and dividends) and statements on future industry growth are forward-looking statements.

These forward-looking statements are subject to risks, uncertainties, and assumptions, some of which are beyond our control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect results. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under the heading “Risk Factors” and elsewhere in this prospectus. If one or more of these risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual events or results may vary significantly from those implied or projected by the forward-looking statements. No forward-looking statement is a guarantee of future performance.

Forward-looking statements include, but are not limited to, statements about: the following:

• our business and operating strategies and our various measures to implement such strategies;

• our operations and business prospects, including development and capital expenditure plans for our existing business;

• changes in policies, legislation, regulations or practices in the industry and those countries or territories in which we operate that may affect our business operations;

• our financial condition, results of operations and dividend policy;

• changes in political and economic conditions and competition in the area in which we operate, including a downturn in the general economy;

• the regulatory environment and industry outlook in general;

• future developments in the supply of manpower and cleaning services, competition in our industry and actions of our competitors;

• catastrophic losses from man-made or natural disasters, such as fires, floods, windstorms, earthquakes, diseases, epidemics, other adverse weather conditions or natural disasters, war, international or domestic terrorism, civil disturbances and other political or social occurrences;

• the loss of key personnel and the inability to replace such personnel on a timely basis or on terms acceptable to us;

• the overall economic environment and general market and economic conditions in the jurisdictions in which we operate;

• our ability to execute our strategies;

• changes in the need for capital and the availability of financing and capital to fund those needs;

v

Table of Contents

• our ability to anticipate and respond to changes in the markets in which we operate, and in customer demands, trends and preferences;

• exchange rate fluctuations, including fluctuations in the exchange rates of currencies that are used in our business;

• changes in interest rates or rates of inflation; and

• legal, regulatory and other proceedings arising out of our operations.

The forward-looking statements made in this prospectus relate only to events or information as of the date on which the statements are made in this prospectus. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this prospectus and the documents that we reference in this prospectus and have filed as exhibits to the registration statement, of which this prospectus is a part, completely and with the understanding that our actual future results or performance may be materially different from what we expect.

This prospectus also contains certain data and information, which we obtained from various government and private publications. Although we believe that the publications and reports are reliable, we have not independently verified the data. Statistical data in these publications includes projections that are based on a number of assumptions. If any one or more of the assumptions underlying the market data is later found to be incorrect, actual results may differ from the projections based on these assumptions.

vi

Table of Contents

DEFINITIONS

Except where the context otherwise requires and for purposes of this prospectus only, references to:

“Amended and Restated Memorandum of Association” means the amended and restated memorandum of association of our Company adopted on January 8, 2024 and as supplemented, amended or otherwise modified from time to time.

“Amended and Restated Articles of Association” means the amended and restated articles of association of our Company adopted on January 8, 2024, as amended from time to time.

“Business Day” means a day (other than a Saturday, Sunday or public holiday in the U.S.) on which licensed banks in the U.S. are generally open for normal business to the public.

“CAGR” means compound annual growth rate.

“Company” or “our Company” means Megan Holdings Limited, an exempted company incorporated in the Cayman Islands on December 7, 2022.

“Companies Act” means the Companies Act (2023 Revision) of the Cayman Islands.

“COVID-19” means the Coronavirus Disease 2019.

“Directors” means the directors of our Company as at the date of this prospectus, unless otherwise stated.

“ECGL” means Eternity Capital Group Limited, a private limited liability company incorporated in Hong Kong on May 10, 2023.

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended.

“Executive Directors” means the executive directors of our Company who are also employees of either our Company or MMSB as at the date of this prospectus, unless otherwise stated.

“Executive Officers” means the executive officers of our Company as at the date of this prospectus, unless otherwise stated.

“Group,” “our Group,” “we,” “us,” or “our” means our Company and its subsidiaries or any of them, or where the context so requires, in respect of the period before our Company becoming the holding company of its present subsidiaries, such subsidiaries as if they were subsidiaries of our Company at the relevant time or the businesses which have since been acquired or carried on by them or as the case may be their predecessors.

“Independent Directors Nominees” means the independent non-executive Directors of our Company as at the date of this prospectus, unless otherwise stated.

“KBSB” means Kheng Builders Sdn Bhd, a private company limited by shares incorporated in Malaysia on January 16, 2023.

“KLSB” means Kapiti Latino Sdn Bhd, a private company limited by shares incorporated in Malaysia on July 1, 2022.

“Malama” means Malama Sdn Bhd, a private company limited by shares incorporated in Malaysia on March 6, 2023.

“MHL” means Megan Holdings Limited, an exempted company incorporated in the Cayman Islands on December 7, 2022.

“MMSB” means Megan Mezanin Sdn Bhd, a private company limited by shares incorporated in Malaysia on February 13, 2020.

“Mr. Darren Hoo” means Hoo Wei Sern, our executive director, Chairman and Chief Executive Officer (“CEO”).

“MTSB” means Megan Technologies Sdn Bhd, a private company limited by shares incorporated in Malaysia on March 18, 2024.

“RM” means Malaysian ringgit, the lawful currency of Malaysia.

“SEC” or “Securities and Exchange Commission” means the United States Securities and Exchange Commission.

vii

Table of Contents

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“Share Swap Agreement” means the share swap agreement dated July 31, 2024 entered into between SSL, USSB, YHCML, ECGL, KLSB, KBSB, Malama and SJCC with MHL for the acquisition by MHL of the entire issued shares in MMSB.

“SJCC” means SJCC Holdings Sdn Bhd, a private company limited by shares incorporated in Malaysia on January 31, 2023.

“Smart Farming System” means the farm management system that MMSB that plans to develop and is expected to leverage on Information Technology (IT) infrastructure for data collection, farm monitoring and analysis.

“SSL” means Star Sprite Limited, a company incorporated in the BVI on November 30, 2022 and wholly owned by Mr. Darren Hoo.

“US$” or “USD” or “U.S. Dollars” means U.S. dollar(s), the lawful currency of the United States of America.

“USSB” means Usaha Sedava Sdn Bhd, a private company limited by shares incorporated in Malaysia on June 8, 2022.

“YHCML” means Yat Ho Construction Materials Limited, a private limited liability company incorporated in Hong Kong on October 3, 2023.

viii

Table of Contents

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary may not contain all of the information that may be important to you, and we urge you to read this entire prospectus carefully, including the “Risk Factors,” “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections and our consolidated financial statements and notes to those statements, included elsewhere in this prospectus, before deciding to invest in our Ordinary Shares. This prospectus includes forward-looking statements that involve risks and uncertainties. See “Special Note Regarding Forward-Looking Statements.”

Overview

We are a company principally engaged in the development, construction and maintenance of aquaculture farms and related works. Our operations are based in Malaysia. Since our inception in 2020, we have strived to establish ourselves as a trusted and experienced provider of shrimp farm related maintenance services in Malaysia. As of the date of this prospectus, we have been carrying out a series of upgrading and maintenance works for aquaculture farms, all of which are located in Tawau, Sabah, Malaysia. This constitutes 71.8%, 43.7% and 15.5% of our revenue for the financial years ended December 31, 2021, 2022 and 2023, respectively. Besides that, we also carried out upgrading works for a pineapple plantation farm located at Kota Tinggi, Johor, Malaysia in 2022 and 2023. This constituted nil, 25.3% and 22.6% of our revenue for the financial years ended December 31, 2021, 2022 and 2023, respectively.

Complementary to our upgrading and maintenance services, we also assist customers with the design and development of new farms. As of the date of this prospectus, we are currently involved in the development and construction of a shrimp hatchery center in Semporna, Sabah, Malaysia, where we have been engaged to undertake the construction of hatchery buildings and related functional facilities. We are also assisting in the development of a 111-acre shrimp farm at Tawau, Sabah, Malaysia. The design and development of new farms comprised 22.2%, 16.4% and 61.7% of our revenue for the financial years ended December 31, 2021, 2022 and 2023, respectively. From time to time, we also assist our customers in sourcing for building materials and machineries available for rental for use on their farms. This comprised 6.0%, 14.6% and 0.2% of our revenue for the financial years ended December 31, 2021, 2022 and 2023, respectively.

With our wide suite of services and diverse revenue streams, we are well-positioned to serve customers as a one-stop center for their aquaculture and agriculture needs.

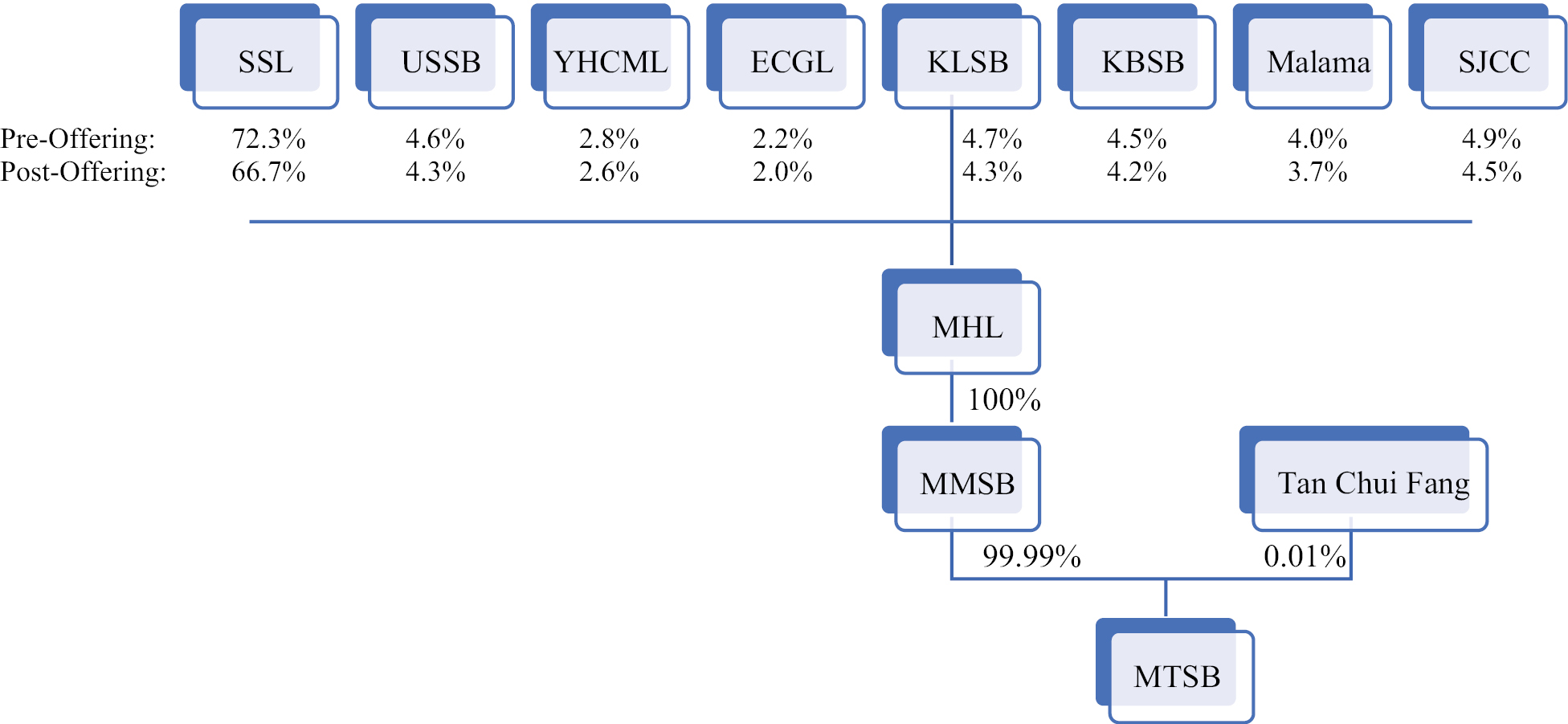

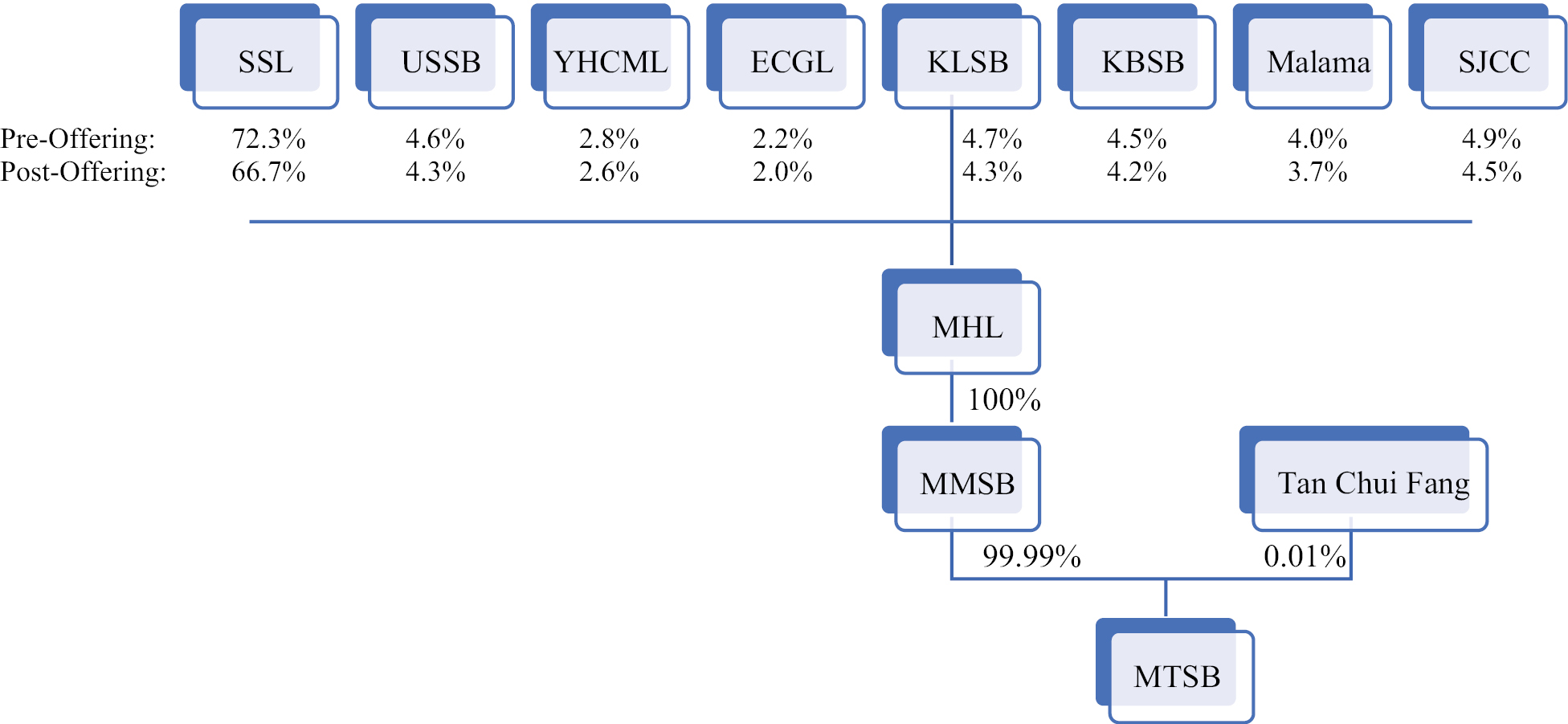

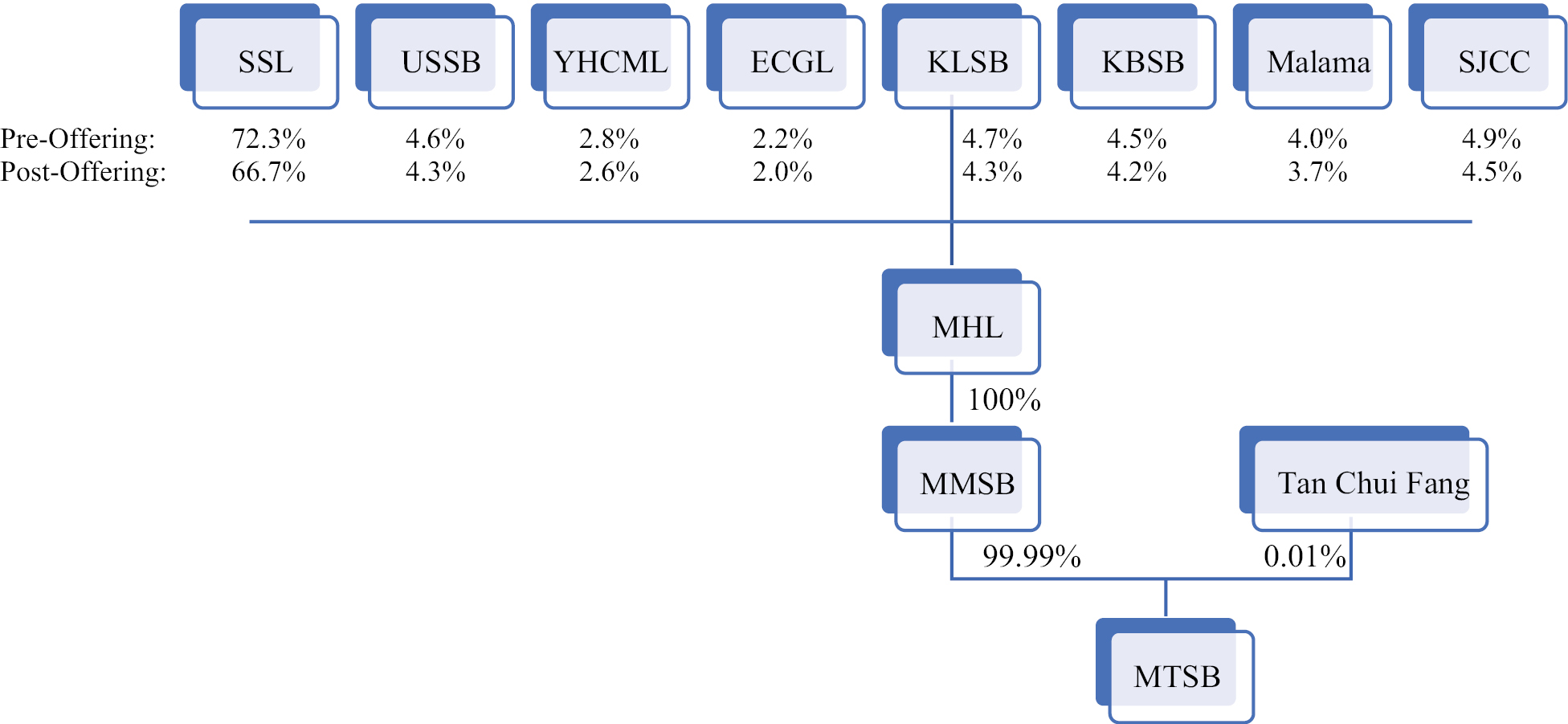

Corporate Structure

Below is a chart illustrating our post re-organization corporate structure:

1

Table of Contents

The re-organization, which was to enable MMSB to become a wholly owned subsidiary of MHL (the intended listing entity), was completed on July 31, 2024, each of SSL, USSB, YHCML, ECGL, KLSB, KBSB, Malama and SJCC, being the shareholders of MMSB as of the date of the Share Swap Agreement, transferred their respective shares in MMSB, representing in aggregate 100% of the issued share capital of MMSB, to MHL. The consideration for the share transfers was satisfied by the allotment and issuance of 14,999,999 Ordinary Shares in aggregate to SSL, USSB, YHCML, ECGL, KLSB, KBSB, Malama and SJCC, each credited as fully paid, in proportion to their respective shareholdings in MMSB. Following the completion of the Share Swap Agreement on July 31, 2024, MHL is now the holding company of MMSB, whereas SSL, USSB, YHCML, ECGL, KLSB, KBSB, Malama and SJCC are now the shareholders of MHL.

Holding Company Structure

MHL is a holding company incorporated in the Cayman Islands with no material operations of its own. We conduct our operations primarily in Malaysia via MMSB.

Competitive Strengths

• Cost effective solutions. Our company offers shrimp farmers a comprehensive suite of services encompassing consultancy, design, construction, maintenance, and repair. This all-inclusive approach affords our customers the convenience of a single point of contact for all their shrimp farming requirements, streamlining their operations, and delivering tangible cost and time savings.

• Strong relationships. We have established strong and stable relationships with key suppliers and customers in Malaysia over the last three years.

• We have an experienced management team. We have an experienced management team, led by Mr. Darren Hoo, our Chairman and CEO, who has been instrumental in spearheading the growth of our company. He has over 10 years of experience in the aquaculture and agriculture industries in Malaysia and is primarily responsible for the planning and execution of our Company’s business strategies and managing our Company’s customer relationships.

Growth Strategy

• Market Development. We are actively exploring new customers in Malaysia, and international markets, beginning with Indonesia, leveraging our reputation and customer base to build new relationships and increase market share for continued success in the industry.

• Strategic growth initiatives. As our customer base grows, we aim to identify potential partners for equity participation, creating recurring revenue streams and mutually beneficial relationships to drive our industry success.

• Product Development. We believe that our forthcoming Smart Farming System could serve as a pivotal driver for business growth and a transformative tool in aquaculture and agriculture. We are planning for our Smart Farming System to offer several features including (a) water quality monitoring, (b) feeding optimization, (c) disease prevention, (d) environmental monitoring and (e) data analytics. Overall, the hardware development for our Smart Farming System will require a combination of sensors, actuators, cameras, control systems, connectivity, and power supply, all working together to optimize yields, improve resource efficiency, and promote sustainable farming practices. Our system could closely monitor the operating parameters of each pond and alert customers to any irregularities, enabling them to take corrective action and improve yield. In addition, the system could capture data that our customers can use to analyze operational costs, estimate yields, and make informed decisions about their farm’s financial performance.

Transfers of Cash to and from Our Subsidiary

MHL is permitted under the laws of the Cayman Islands to provide funding to our subsidiary incorporated in Malaysia through loans or capital contributions without restrictions on the amount of the funds. Save for (a) when future financing arrangements between our subsidiary and its creditors may contain negative covenants that limit the ability of our

2

Table of Contents

subsidiary to declare or pay dividends or make distributions or (b) our subsidiary is restricted from declaring or paying such dividends or making such distributions under the Malaysian Companies Act, 2016, which stipulates that dividends are to be paid out of our subsidiary’s profits and that the dividends should not be paid if the payment of such dividends or making such distributions will cause our subsidiary to be insolvent (i.e. our subsidiary being unable to pay its debts as and when the debts become due within 12 months immediately after the payment distribution is made), there are no other restrictions on dividends transfers from Malaysia to the Cayman Islands. As of the date of this prospectus, all corporations in Malaysia are required to adopt a single-tier dividend. All dividends distributed by Malaysian resident companies under a single tier dividend are not taxable. Further, the Government of Malaysia does not levy withholding tax on dividends payment. Therefore, there is no withholding tax imposed on dividends paid to non-residents by Malaysian companies. For the transfer of assets from our subsidiary to the holding company, there are no governmental laws, decrees, regulations, or other legislations that may affect such transfer. However, such transfer of assets may be subject to withholding taxes (if any). The same applies to the transfer of cash from our subsidiary to the holding company upon the presentation of the necessary documentary evidence required by local banks or financial institutions. As of the date of this prospectus, there has not been any assets or cash transfer between the holding company and its subsidiary, and our subsidiary is not restricted from declaring any dividends as our subsidiary currently has sufficient profits and the payment of such dividends or making such distributions will not cause our subsidiary to be insolvent. We have not installed any cash management policies that dictate the amount of such funding.

Implications of Our Being a “Controlled Company”

Upon completion of this offering, our controlling shareholder, Mr. Darren Hoo, will be the beneficial owner of an aggregate of 10,845,000 Ordinary Shares, which will represent 66.7% of the then total issued and outstanding Ordinary Shares (or 66.0% of the then total issued and outstanding Ordinary Shares if the underwriters exercise their option to purchase additional Ordinary Shares in full). As a result, we will remain a “controlled company” within the meaning of the Nasdaq Stock Market Rules, and therefore we are eligible for certain exemptions from the corporate governance listing requirements of the Nasdaq Stock Market Rules. For so long as we are a controlled company, we are permitted to elect to rely, and may rely, on certain exemptions from corporate governance rules, including:

• an exemption from the rule that certain committees be solely composed of independent directors;

• an exemption from the rule that the compensation of our directors and officers be determined or recommended solely by independent directors; and

• an exemption from the rule that our director nominees be selected or recommended solely by independent directors or a committee composed solely of independent directors.

Although we do not currently intend to rely on the “controlled company” exemptions under the Nasdaq listing rules, we could elect to rely on these exemptions in the event that we no longer qualify as a foreign private issuer.

As a result, you will not have the same protection afforded to shareholders of companies that are subject to these corporate governance requirements. See “Risk Factors — Risks Relating to this Offering and the Trading Market —

Additionally, pursuant to Nasdaq’s phase-in rules for newly listed companies, we have one year from the date on which we are first listed on Nasdaq to comply fully with the Nasdaq listing standards. We do not plan to rely on the phase-in rules for newly listed companies and will comply fully with the Nasdaq listing standards at the time of listing.

Implications of Being a Foreign Private Issuer

We are a foreign private issuer within the meaning of the rules under the Exchange Act. As such, we are exempt from certain provisions applicable to U.S. domestic public companies. For example:

• we are not required to provide as many Exchange Act reports, or as frequently, as a domestic public company;

• for interim reporting, we are permitted to comply solely with our home country requirements, which are less rigorous than the rules that apply to domestic public companies;

• we are not required to provide the same level of disclosure on certain issues, such as executive compensation;

3

Table of Contents

• we are exempt from the provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material information;

• we are not required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents, or authorizations in respect of a security registered under the Exchange Act; and

• we are not required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction.

Implications of Being an Emerging Growth Company

As a company with less than US$1.235 billion in revenues during our last financial year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An “emerging growth company” may take advantage of reduced reporting requirements that are otherwise applicable to larger public companies. In particular, as an emerging growth company, we:

• may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations, or “MD&A”;

• are not required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives, which is commonly referred to as “compensation discussion and analysis”;

• are not required to obtain an attestation and report from our auditors on our management’s assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002;

• are not required to obtain a non-binding advisory vote from our shareholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on frequency” and “say-on-golden-parachute” votes);

• are exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and chief executive officer pay ratio disclosure;

• are eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act; and

• will not be required to conduct an evaluation of our internal control over financial reporting.

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under §107 of the JOBS Act.

Summary of Risk Factors

Our business is subject to multiple risks and uncertainties, as more fully described in “Risk Factors” and elsewhere in this prospectus. We urge you to read “Risk Factors” and this prospectus in full. Our principal risks may be summarized as follows:

Risks Related to Our Business and Industry

Risks and uncertainties related to our business and industry include, but are not limited to, the following:

• As we from time to time engage subcontractors in our work, we may bear responsibilities for any non-performance, delayed performance, sub-standard performance, or non-compliance of our subcontractors.

• We are dependent on a small number of key customers for continued sale of our services.

4

Table of Contents

• The primary substantial portion of our revenues will be derived from Malaysia.

• We are a holding company, and we are accordingly dependent upon distributions from our subsidiary, MMSB, to service our debt and pay dividends, if any, taxes and other expenses.

• We depend on a small number of individuals who constitute our current management.

• We will need to grow the size and capabilities of our organization, and we may experience difficulties in managing this growth.

• Our business is subject to supply chain interruptions.

• Our business and operations may be materially and adversely affected in the event of a re-occurrence or a prolonged global pandemic outbreak of COVID-19.

• We may from time to time be subject to legal and regulatory proceedings and administrative investigations.

• Our business may be affected by technological changes and developments.

• We have a limited operating history in an evolving industry, which makes it difficult to evaluate our prospects and may increase the risk that we will not be successful.

• Our historical growth and performance may not be indicative of our future growth and performance.

• We may not be able to successfully implement our business strategies and future plans.

• We may not be able to successfully develop our Smart Farming System.

We are exposed to risks arising from fluctuations of foreign currency exchange rates.

• We do not have, and may be unable to obtain, sufficient insurance to insure against certain business risks. As a result, we may be exposed to significant costs and business disruption.

• We are currently operating in a period of economic uncertainty and capital markets disruption, which has been significantly impacted by geopolitical instability due to the ongoing military conflict between Russia and Ukraine. Our business, financial condition and results of operations may be materially and adversely affected by any negative impact on the global economy and capital markets resulting from the conflict in Ukraine, the conflict in Israel or any other geopolitical tensions.

• We are exposed to risks in respect of acts of war, terrorist attacks, epidemics, political unrest, adverse weather conditions and other uncontrollable events.

• Any adverse changes in the political, economic, legal, regulatory, taxation or social conditions in the jurisdictions that we operate in or intend to expand our business may have a material adverse effect on our operations, financial performance and future growth.

• You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are incorporated under Cayman Islands law.

• Certain judgments obtained against us or our auditor by our shareholders may not be enforceable.

• We have engaged in transactions with related parties, and such transactions present possible conflicts of interest that could have an adverse effect on our business and results of operations.

• We depend on a small number of key suppliers for continued provision of our services.

• We are exposed to the credit risks of some our customers.

• There may be potentially adverse impacts on our corporate governance because of the indemnification provisions in our articles of association pertaining to our directors and officers liability.

5

Table of Contents

Risks Relating to this Offering and the Trading Market

• If we fail to implement and maintain an effective system of internal controls, we may be unable to accurately or timely report our results of operations or prevent fraud, and investor confidence and the market price of our Ordinary Shares may be materially and adversely affected.

• An active trading market for our Ordinary Shares may not be established or, if established, may not continue and the trading price for our Ordinary Shares may fluctuate significantly.

• We may not maintain the listing of our Ordinary Shares on Nasdaq which could limit investors’ ability to make transactions in our Ordinary Shares and subject us to additional trading restrictions.

• The trading price of our Ordinary Shares may be volatile, which could result in substantial losses to investors.

• Certain recent initial public offerings of companies with public floats comparable to the anticipated public float of our Company have experienced extreme volatility that was seemingly unrelated to the underlying performance of the respective company. We may experience similar volatility. Such volatility, including any stock-run up, may be unrelated to our actual or expected operating performance and financial condition or prospects, making it difficult for prospective investors to assess the rapidly changing value of our Ordinary Shares.

• If securities or industry analysts do not publish research or reports about our business causing us to lose visibility in the financial markets or if they adversely change their recommendations regarding our Ordinary Shares, the market price for our Ordinary Shares and trading volume could decline.

• Short selling may drive down the market price of our Ordinary Shares.

• Because our public offering price per share is substantially higher than our net tangible book value per share, you will experience immediate and substantial dilution.

• You must rely on the judgment of our management as to the uses of the net proceeds from this offering, and such uses may not produce income or increase our share price.

• Our controlling shareholder has substantial influence over the Company. Its interests may not be aligned with the interests of our other shareholders, and it could prevent or cause a change of control or other transactions.

• As a company incorporated in the Cayman Islands, we are permitted to follow certain home country practices in relation to corporate governance matters in lieu of certain requirements under Nasdaq corporate governance listing standards. These practices may afford less protection to shareholders than they would enjoy if we complied fully with Nasdaq corporate governance listing standards.

• We are an emerging growth company within the meaning of the Securities Act and may take advantage of certain reduced reporting requirements applicable to other public companies that are not emerging growth companies.

• We are a foreign private issuer within the meaning of the Exchange Act, and as such we are exempt from certain provisions applicable to United States domestic public companies.

Corporate Information

Our principal executive office is located at B-01-07, Gateway Corporate Suites, Gateway Kiaramas, No.1, Jalan Desa Kiara, 50480 Mont Kiara, Kuala Lumpur, Malaysia. The telephone number of our principal executive office is +60 3 6420 1071. Our registered office in the Cayman Islands is located at Vistra (Cayman) Limited, P.O. Box 31119 Grand Pavilion, Hibiscus Way, 802 West Bay Road, Grand Cayman, KY1 – 1205 Cayman Islands. Our agent for service of process in the United States is Cogency Global Inc. located at 122 E. 42nd Street, 18th Floor, New York, New York 10168. We maintain a website at www.meganmezanin.com. We do not incorporate the information on our website into this prospectus and you should not consider any information on, or that can be accessed through, our website. It is included solely as an inactive textual reference.

6

Table of Contents

THE OFFERING

Shares Offered | | 1,250,000 Ordinary Shares, assuming an offering price of US$4.00, the low end of the price range included on the cover page of this prospectus (or 1,437,500 Ordinary Shares if the underwriters exercise their over-allotment option in full). |

Over-Allotment Option | | We have granted to the underwriters a 45-day option to purchase from us up to an additional 15% of the Ordinary Shares sold in this offering, solely to cover over-allotments, if any, at the initial public offering price less the underwriting discounts. |

Ordinary Shares outstanding prior to completion of this offering | | 15,000,000 Ordinary Shares. |

Ordinary Shares outstanding immediately after this offering | | 16,250,000 Ordinary Shares (or 16,437,500 Ordinary Shares if the underwriters exercise their over-allotment option in full). |

Voting Rights: | | Holders of Ordinary Shares are entitled to one (1) vote per share. Mr. Darren Hoo, through SSL, will beneficially own ordinary shares representing approximately 66.7% of the total votes, assuming that the underwriters do not exercise their over-allotment option, for our issued and outstanding share capital following the completion of this offering and will have the ability to control the outcome of matters submitted to our shareholders for approval, including the election of our directors and the approval of any change in control transaction. |

Lock-up: | | We, our directors, executive officers and all shareholders of the issued and outstanding Ordinary Shares are expected to enter into lock-up agreements with the underwriters not to sell, transfer or dispose of any Ordinary Shares for a period of one hundred and eighty (180) after this Offering is completed. |

Listing: | | We have applied to list our Ordinary Shares on the Nasdaq Capital Market. No assurance can be given that our application will be approved. |

Proposed Nasdaq Capital Market Symbol: | | “MGN.” |

Transfer Agent: | | VStock Transfer, LLC. |

Risk Factors: | | You should read the “Risk Factors” section of this prospectus for a discussion of factors that you should consider carefully before deciding to invest in our Ordinary Shares. |

Use of Proceeds: | | We intend to use the net proceeds to us from this offering for working capital and other general corporate purposes, including to finance the development of new products (including our Smart Farming System), sales and marketing activities, capital expenditures and the costs of operating as a public company. See “Use of Proceeds” for more information. |

Unless otherwise stated, all information in this prospectus assumes no exercise of the underwriters’ over-allotment option to purchase additional shares.

7

Table of Contents

RISK FACTORS

An investment in our securities carries a significant degree of risk. You should carefully consider the following risks before you decide to purchase the shares. Any one of these risks and uncertainties has the potential to cause material adverse effects on our business, prospects, financial condition and operating results which could cause actual results to differ materially from any forward-looking statements expressed by us and a significant decrease in the value of our Ordinary Shares.

We may not be successful in preventing the material adverse effects that any of the following risks and uncertainties may cause. These potential risks and uncertainties may not be a complete list of the risks and uncertainties facing us. There may be additional risks and uncertainties that we are presently unaware of, or presently consider immaterial, that may become material in the future and have a material adverse effect on us. You could lose all or a significant portion of your investment due to any of these risks and uncertainties.

Risks Related to Our Business and Industry

As we depend on subcontractors significantly in the course of our work, we may bear responsibilities for any non-performance, delayed performance, sub-standard performance, or non-compliance of our subcontractors.

We subcontract certain portions of our projects, such as the construction and maintenance of the aquaculture farms of our customers, to our subcontractors who are independent third parties. Subcontracting may expose us to risks associated with non-performance, delayed performance, or sub-standard performance by our subcontractors. As a result, we may experience deterioration in the quality or delivery of our work, incur additional costs due to the delays, suffer a higher price in sourcing the services, equipment or supplies in default, or be subject to liability under the relevant projects. Such events could impact upon our profitability, financial performance, and reputation, or result in litigation or damage claims.

There is no assurance that we would be able to monitor the performance of our subcontractors as directly and efficiently as with our own staff. If our subcontractors fail to meet our requirements, we may experience delay in project completion, quality issues concerning the work done, or non-performance by subcontractors. Consequently, we may incur significant time and costs to carry out remedial actions, which would in turn adversely affect the profitability and reputation of our business and result in litigation or damage claims against us. If our subcontractors violate any laws, rules, or regulations, we may also be held liable for their violations and be subject to claims for losses and damages if such violations result in any personal injuries and/or property damages.

In addition, our subcontractors may not always be readily available whenever we need to engage them, and there is no assurance that we would be able to maintain good working relationships with our sub-contractors in the future. As at the date of this prospectus, we had not entered into any long-term service agreement with our subcontractors. Further, there is no assurance that we would be able to find suitable alternative subcontractors that meet our project needs and requirements to complete the projects, which would in turn adversely affect our operations and financial results.

We are dependent on a small number of key customers for continued sale of our services.

Our revenue is concentrated among a small number of customers. In the financial years ended December 31, 2021, 2022, and 2023, our top 2 customers accounted for 77.8% and 70.1% and 77.8% of our revenue respectively. If any of these customers were to reduce or cease their business with the Company, it could have a material adverse impact on the Company’s financial condition and results of operations.

The Company has taken steps to mitigate its customer concentration risk by diversifying its customer base and developing long-term relationships with its key customers. However, the Company remains exposed to customer concentration risk, and any significant changes in the business of its key customers could have a material adverse impact on its business.

In addition, the Company’s business is dependent on the continued success of its customers. If any of the Company’s customers were to experience financial difficulties or cease operations, it could have a material adverse impact on the Company’s business.

8

Table of Contents

The Company is aware of the risks associated with customer concentration and is taking steps to mitigate these risks. However, investors should be aware of the potential for customer concentration to have a material adverse impact on the Company’s business.

The primary substantial portion of our revenues will be derived from Malaysia.

In the financial years ended December 31, 2021, 2022, and 2023, all our revenue derived from operations in Malaysia. We anticipate that sales of our services in Malaysia will represent the majority of our revenues in the near future. Any significant decline in the condition of the economy of Malaysia could adversely affect consumer demand for our services, among other things, which in turn would have a material adverse effect on our business and financial condition. Such a decline would occur from numerous factors outside of our control including geopolitical disputes, regional and global economic trends and climatic and environmental disasters.

We are a holding company, and we are accordingly dependent upon distributions from our subsidiary, MMSB, to service our debt and pay dividends, if any, taxes and other expenses.

We are a Cayman Islands holding company and have no material assets other than ownership of equity interests in our subsidiary. We have no independent means of generating revenue. We intend to cause our subsidiary to make distributions to their shareholders in an amount sufficient to cover all applicable taxes payable and dividends, if any, declared by us. Our ability to service our debt, if any, depends on the results of operations of our subsidiaries and upon the ability of our subsidiary to provide us with cash, whether in the form of dividends, loans or other distributions, to pay amounts due on our obligations. Future financing arrangements may contain negative covenants that limit the ability of our subsidiary to declare or pay dividends or make distributions. Our subsidiary is a separate and distinct legal entity; to the extent that we need funds, and our subsidiary is restricted from declaring or paying such dividends or making such distributions under applicable law or regulations or are otherwise unable to provide such funds (for example, due to restrictions in future financing arrangements that limit the ability of our subsidiary to distribute funds), our liquidity and financial condition could be materially harmed.

We depend on a small number of individuals who constitute our current management.

We highly depend on the services of our senior management team including Mr. Darren Hoo and Mr. Ng Kai Tie. The death, disability or other loss of members of our senior management team could result in us being unable to replace such member on reasonable economic terms or in a time period that meets our proposed plan of operations, if we are able to do so at all. We do not carry key-employee insurance to compensate us for the loss of any such individuals.

Our ability to recruit, retain, and motivate key employees may be hampered by market conditions. Competition for such employees can be intense, and the inability to attract and retain the additional qualified employees required to expand our activities, or the loss of current key employees could adversely affect our operating efficiency and financial condition. In addition, our growth strategy may place strains on our management who may become distracted from day-to-day duties.

We will need to grow the size and capabilities of our organization, and we may experience difficulties in managing this growth.

As our business strategies develop, we must add additional managerial, operational, financial, and other personnel. Future growth will impose significant added responsibilities on members of management, including:

• Identifying, recruiting, integrating, maintaining, and motivating additional personnel. We primarily focus on project management and outsource the physical groundwork to many sub-contractors. We rely on these sub-contractors to minimize our need to tackle issues relating to management of workers which allows us to focus on the execution of the projects and their progress. To ensure that the prices paid to the related party subcontractors are market prices, all our subcontractors undergo a fair tender process for the projects involved before we engage them;

• Managing our internal development efforts effectively, while complying with our contractual obligations to contractors and other third parties; and

• Improving our operational, financial, and management controls, reporting systems, and procedures.

9

Table of Contents

Our future financial performance will depend, in part, on our ability to effectively manage any future growth, which might be impacted by the COVID-19 outbreak, and our management may also have to divert a disproportionate amount of its attention away from day-to-day activities in order to devote a substantial amount of time to managing these growth activities. This lack of long-term experience working together may adversely impact our senior management team’s ability to effectively manage our business and growth.

We primarily focus on project management. As a result, we currently rely, and for the foreseeable future will continue to rely, in substantial part on various sub-contractors who undertake various on-site groundwork such as earthwork, building structural works, mechanical and electrical works, equipment supply and installation works. We rely on sub-contractors in order to minimize our need to tackle issues relating to man-management of workers, which allows us to focus on the execution of the projects and their progress. To ensure that the prices paid to the related party subcontractors are market prices, all our subcontractors undergo a fair tender process for the projects involved before we engage them. The services of these subcontractors might not continue to be available to us on a timely basis when needed, and we might not be able to find qualified replacements. In addition, if we are unable to effectively manage our outsourced activities or if the quality or accuracy of the services provided by consultants is compromised for any reason, we may not be able to advance our business. We might not be able to manage our existing subcontractors or find other competent outside contractors and consultants on economically reasonable terms, if at all. If we are not able to effectively expand our organization by hiring new employees and expanding our groups of subcontractors, we may not be able to successfully implement the tasks necessary to further develop our business initiatives and, accordingly, may not achieve our research, development, and commercialization goals. These risks may materially adversely affect our ability to attain or maintain profitable operations.

Our business is subject to supply chain interruptions.

We work with third-party logistic providers for the transportation of our aquaculture and agriculture related equipment and industrial-grade hardware. We rely on such third-party service providers’ abilities to deliver our equipment as part of the supply chain logistics. The factors that can adversely affect our operations include, but are not limited to:

• interruptions to our delivery capabilities;

• failure of third-party service providers to meet our standards or their commitments to us;

• increasing transportation costs, shipping constraint or other factors that could impact cost, such as having to find more expensive service providers which may or may not be readily available; and

• the COVID-19 and disruptions as a result of efforts to control or mitigate the pandemic (such as facility closures, governmental orders, outbreaks and/or transportation capacity).

Furthermore, any increased costs from delays, cancellations, and insurance, or disruption to, or inefficiency in, the supply chain network of our third-party service providers, whether due to geopolitical conflicts, COVID-19, outbreaks, or other factors, could affect our revenue and profitability. Please refer to the risk factors “Our business and operations may be materially and adversely affected in the event of a re-occurrence or a prolonged global pandemic outbreak of COVID-19” set out below in this prospectus, for details on how these recent events have caused interruptions to our supply chain and impacted our operations. If we fail to manage these risks effectively, we could experience a material adverse impact on our reputation, revenue, and profitability.

Our business and operations may be materially and adversely affected in the event of a re-occurrence or a prolonged global pandemic outbreak of COVID-19.

The global pandemic outbreak of COVID-19 announced by the World Health Organization in early 2020 has disrupted our operations, and the operations of our customers, suppliers, and/or sub-contractors. If the development of the COVID-19 outbreak becomes more severe and/or new variants of COVID-19 evolve to be more transmissible and virulent than the existing strains, this may result in a tightening of restrictions and regulations on businesses. If we or our customers, suppliers, and sub-contractors are forced to close their businesses with prolonged disruptions to their operations, we may experience a delay or shortage of supplies and/or services by our suppliers and sub-contractors, or termination of our orders and contracts by our customers. In addition, if any of our sub-contractors are suspected of having contracted COVID-19, some or all of our employees may be quarantined thus causing a shortage of labor and we will be required to disinfect our workplace and our production and processing facilities. In such event, our operations may be severely disrupted, which may have a material and adverse effect on our business, financial condition, and results of operations.

10

Table of Contents

In addition, we have also faced difficulties in engaging suitable subcontractors from overseas jurisdictions due to travel restrictions imposed by the Malaysian Government as a result of the COVID-19 pandemic during financial years 2021 and 2022. This has led to a stagnation in our ability to take on larger projects, thereby affecting our potential growth as we rely heavily on manual labor from our sub-contractors.

We may from time to time be subject to legal and regulatory proceedings and administrative investigations.

We may from time to time be subject to various legal and regulatory proceedings arising in the ordinary course of our business. Claims and complaints arising out of actual or alleged violations of laws and regulations or breach of contract could be asserted against us by contractors, customers, employees, ex-employees and other platforms, industry participants or governmental entities in administrative, civil or criminal investigations and proceedings or by other entities. These investigations, claims and complaints could be initiated or asserted under or on the basis of a variety of laws in different jurisdictions.

A substantial portion of our revenue is derived from services related to shrimp farming, which if done incorrectly can pollute nearby groundwater or coastal estuaries which may result in our customer being exposed to environmental claims whereby the customer may suffer claims and actions brought against them by the relevant governmental entities or other third parties. In the event of the above, the customer may be subject to an action by the relevant governmental entities for the contravention of the Malaysian Environmental Quality Act 1974 (“EQA 1974”) which is the principal law governing the prevention, abatement, control of pollution and enhancement of the environment in Malaysia, wherein if found guilty of such contravention, the customer may be liable to fines and/or imprisonment. The customer may also be subject to claims brought by third parties against the customer for damages suffered by such third party due to the customer’s negligence under common law. For clarity, any potential actions by the relevant governmental entities for any alleged violations of the EQA 1974 are primarily made against the customer as the owner/occupier of the subject premise. Any potential liability we may face is limited to the circumstance where the customer may commence legal proceedings against us for damages for breach of contract or claim against us for compensation if the damages suffered by the customer is a direct result of our action or negligence. As such, we believe that any violations of the EQA 1974 by the customer would not have any material impact to our operations. However, if the customer’s business is materially affected as a result of any actions by the relevant governmental entities for such violations, our business may be affected due to the customer concentration risk disclosed above. We are therefore actively taking steps to mitigate our customer concentration risk by diversifying our customer base.

There may be additional exposure under including intellectual property laws, data protection and privacy laws, labor and employment laws, securities laws, finance services laws, tort laws and contract laws. There is no guarantee that we will be successful in defending ourselves in legal and administrative actions or in asserting our rights under various laws. If we fail to defend ourselves in these actions, we may be subject to restrictions, fines or penalties that will materially and adversely affect our business, prospects, financial condition and results of operations. Even if we are successful in our defense, the process of communicating with relevant regulators, defending ourselves and enforcing our rights against the various parties involved may be expensive, time-consuming and ultimately futile. These actions could expose us to negative publicity, substantial monetary damages and legal defense costs, injunctive relief and criminal and civil fines and penalties, including but not limited to suspension or revocation of licenses necessary for our business operation. Under such circumstances, our business, prospects, financial condition and results of operations would be negatively and adversely impacted.

Our business may be affected by technological changes and developments.

We may be affected by rapid changes in technology, changing market trends and evolving industry standards across all areas of our business. The risks we may face include but are not limited to:

(a) not being able to anticipate and adapt to new technology and developing technology trends in the aquaculture and agriculture sector;

(b) our competitors developing more innovative and efficient solutions as compared to us; and

(c) not being able to expand our suite of agriculture and aquaculture solutions and resources quickly enough to keep up with demand.

11

Table of Contents

Accordingly, our success depends on our ability to innovate and adapt our solutions to meet evolving industry standards and our customers’ expectations. We have invested, and expect to continue to invest, substantial time, capital, and other resources in understanding the needs of our customers and developing technologies, tools, features, and service offerings to meet those needs. Our current and future offerings might not be satisfactory to or broadly accepted by customers, or competitive with the offerings of our competitors. If our current or future offerings are unable to meet industry and customer expectations in a timely and cost-effective manner, our business, prospects, financial condition, and results of operations may be adversely affected.

Furthermore, technological development is inherently challenging, time-consuming, and expensive, and the nature of development cycles may result in delays between the time we incur expenses and the time we make available new offerings and generate revenue, if any, from those investments. Anticipated customer demand for an offering we are developing could also decrease after the development cycle has commenced, and we would not be able to recoup substantial costs we incurred. In addition, we might not be able to identify, design, develop, implement, and utilize, in a timely and cost-effective manner, technology necessary for us to compete effectively, that such technology will be commercially successful, or that products and services developed by others will not render our offerings non-competitive or obsolete. If we do not achieve the desired outcome from our technological investments, our business, prospects, financial condition, and results of operations may be adversely affected.

We have a limited operating history in an evolving industry, which makes it difficult to evaluate our prospects and may increase the risk that we will not be successful.

We have a limited operating history of less than 4 years since our inception in 2020 on which to base an evaluation of its business and prospects. We are subject to all the risks inherent in a small company seeking to develop, market and distribute new services, particularly companies in evolving markets. The likelihood of our success must be considered, in light of the problems, expenses, difficulties, complications and delays frequently encountered in connection with the development, introduction, marketing and distribution of new products and services in a competitive environment.

Such risks include, but are not limited to, dependence on the success and acceptance of our services and the management of growth. In view of our limited operating history, we believe that period-to-period comparisons of our operating results are not necessarily meaningful and should not be relied upon as an indication of future performance.

We are subject to many of the risks common to early-stage enterprises, including under-capitalization, cash shortages, limitations with respect to personnel, financial, and other resources and lack of revenues.

Our historical growth and performance may not be indicative of our future growth and performance.

Although we have experienced growth in operating our services in terms of a 17.9% growth in revenue and a 0.9% growth in profits from financial year 2022 to financial year 2023, we may fail to continue our growth or maintain our historical growth rates. You should not consider our historical growth and profitability as indicative of our future financial performance. You should consider our future operations in light of the challenges and uncertainties that we may encounter, which include our ability to, among other things:

(a) successfully increase our market share, brand recognition and reputation;

(b) adapt our operations to new policies, regulations and measures that may come into effect from time to time;

(c) deliver compelling value propositions to our customers with our services; and

(d) expand our service offerings and expand into new jurisdictions and/or businesses.

We may not be successful in our efforts to do any of the foregoing, in which case, our business, prospects, financial condition and results of operations could be materially and adversely affected.

We may not be able to successfully implement our business strategies and future plans.

As part of our business strategies and future plans, we intend to strengthen our market position in the Southeast Asian region by identifying potential business opportunities or through joint ventures or mergers and acquisitions. While we have planned such expansion based on our outlook regarding our business prospects, such expansion plans might not be commercially successful, and the actual outcome of those expansion plans might not match our expectations. The

12

Table of Contents

success and viability of our expansion plans depend upon our ability to obtain the proper financing, favorable market conditions, hire and retain skilled employees to carry out our business strategies and future plans and implement strategic business development and marketing plans effectively and upon an increase in demand for our services by existing and new customers in the future. While we are actively looking to strengthen our market position, we have not as of the date of this prospectus identified any specific target and therefore do not have any detailed plans for any joint ventures or mergers and acquisitions.

Further, the implementation of our business strategies and future plans may require substantial capital expenditure and additional financial resources and commitments. There is no assurance that these business strategies and future plans will achieve the expected results or outcome such as an increase in revenue that will be commensurate with our investment costs or the ability to generate any costs savings, increased operational efficiency and/or productivity improvements to our operations. We might not be able to obtain financing on terms that are favorable, if at all. If the results or outcome of our future plans do not meet our expectations, if we fail to achieve a sufficient level of revenue or if we fail to manage our costs efficiently, we may not be able to recover our investment costs and our business, financial condition, results of operations and prospects may be adversely affected.

We may not be able to successfully develop our Smart Farming System.

We intend to allocate approximately 30% of our net proceeds from this offering to develop a sophisticated Smart Farming System tailored for shrimp farming. The intricate nature of this technology introduces specific challenges, including the complexity of integrating real-time monitoring for temperature and pH levels. Technical hurdles such as integration issues, data accuracy concerns, and the need for continuous optimization pose potential obstacles to the successful development and implementation of the Smart Farming System. Furthermore, navigating evolving regulatory landscapes and ensuring compliance with industry standards present additional challenges, while the recruitment and retention of skilled personnel to develop such proprietary technology adds another layer of complexity to the project. These challenges may impact the timeline and effectiveness of implementing our Smart Farming System initiative, potentially adversely influencing our business, financial condition, and results of operations.

We are exposed to risks arising from fluctuations of foreign currency exchange rates.

Our reporting currency is the Malaysian Ringgit and fees generated from our services is denominated in Malaysian Ringgit. The exchange rates between foreign currencies in recent years have fluctuated significantly and may continue to do so in the future. Therefore, we may be exposed to foreign currency exchange gains or losses arising from transactions in currencies other than our reporting currency. Given the volatility of exchange rates, we might not be able to effectively manage our currency transaction risks, and volatility in currency exchange rates might have a material adverse effect on our business, financial condition or results of operations.

We do not have, and may be unable to obtain, sufficient insurance to insure against certain business risks. As a result, we may be exposed to significant costs and business disruption.

We do not currently maintain insurance coverage for business interruption, liability, or litigation insurance coverage for our operations in Malaysia. Our lack of insurance coverage or reserves with respect to business-related risks may expose us to substantial losses. As to those risks for which we have insurance coverage, the insurance payouts we are entitled to in case of an insured event are subject to deductibles and other customary conditions and limitations.

We are currently operating in a period of economic uncertainty and capital markets disruption, which has been significantly impacted by geopolitical instability due to the ongoing military conflict between Russia and Ukraine. Our business, financial condition and results of operations may be materially and adversely affected by any negative impact on the global economy and capital markets resulting from the conflict in Ukraine, the conflict in Israel or any other geopolitical tensions.