Filed Pursuant to Rule 433 Registration Statement No. 333 - 276517 Issuer Free Writing Prospectus dated March 11, 2024 Relating to Preliminary Prospectus dated January 31, 2024 Rectitude Holdings Limited 2,000,000 Ordinary Shares This free writing prospectus relates to the proposed initial public offering of the ordinary shares (the “Ordinary Shares”), par value of $0.0001 per share, of Rectitude Holdings Ltd (“Rectitude”, or the “Company”) which are being registered on the Registration Statement and should be read together with the preliminary prospectus included in the Registration Statement filed by the Company with the U.S. Securities and Exchange Commission (the "SEC") for the offering to which this presentation relates, and may be accessed through the following web link: sec.gov/Archives/edgar/data/1995116/000121390024008394/ff12024a1_rectitudehold.htm This presentation (the “Presentation”) highlights basic information about the Company and the offering to which this presentation relates. Because it is a summary, it does not contain all of the information that you should consider before investing in our securities. The Company has filed the Registration Statement (including a preliminary prospectus) with the SEC for the proposed offering to which this communication relates. The Registration Statement has not yet become effective. By accepting this Presentation, the recipient agrees to keep confidential the information contained herein or made available in connection with any further inquiry of the Company. This Presentation may not be photocopied, reproduced, or distributed to others at any time without the prior written consent of the Company. Upon request, the recipient will promptly return all materials received from the Company (including this Presentation). The Registration Statement has not yet become effective. Before you invest, you should read the prospectus in the Registration Statement (including the risk factors described therein) and other documents we have filed with the SEC in their entirety for more complete information about us and the proposed offering. You may obtain these documents for free by visiting EDGAR on the SEC website at www.sec.gov . This Presentation has been prepared for informational purposes relating to this transaction only and upon the express understanding that it will be used only for the purposes set forth above. The Company makes no express or implied representation or warranty as to the accuracy or completeness of the information contained herein or made available in connection with any further investigation of the Company and to the certainty or assurance that any proposed acquisition contained in this Presentation will be completed. The Company expressly disclaims any and all liability which may be based on such information, errors therein or omissions therefrom. The recipient shall be entitled to rely solely on the representations and warranties made to it in any definitive agreement and the due diligence that recipient conducts. In furnishing this Presentation, the Company undertakes no obligation to provide the recipient with access to any additional information. This Presentation shall neither be deemed an indication of the state of affairs of the Company nor constitute an indication that there has not been any change in the Company or affairs of the Company since the date hereof. This Presentation does not constitute an offer to sell or solicitation of an offer to buy securities in any jurisdiction where, or to any person to whom, it is unlawful to make such offer or solicitation in such jurisdiction. Investments in private placements may be illiquid, highly speculative and you may lose your entire investment. Alternatively, we or the representative of the underwriters will arrange to send you the prospectus if you contact Karen Mu via e - mail at kmu@allianceg.com , or contact Rectitude Holdings Ltd, via e - mail at Chin_fo@rectitude.com.sg . 1

Forward - looking Statements This presentation contains forward - looking statements. All statements contained in this presentation other than statements of historical fact, including statements regarding our future results of operations and financial position, our business strategy and plans, and our objectives for future operations, are forward - looking statements. These forward - looking statements relate to events that involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from those expressed or implied by these statements. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” and similar expressions are intended to identify forward - looking statements. In addition, from time to time, we or our representatives may make forward - looking statements orally or in writing. We have based these forward - looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short - term and long - term business operations and objectives, and financial needs. These forward - looking statements are subject to a number of risks, uncertainties and assumptions, including those described in the “Risk Factors” section of the Company’s preliminary prospectus filed on Form F - 1. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward - looking statements we may make. In light of these risks, uncertainties and assumptions, the future events and trends discussed in the preliminary prospectus filed on form F - 1 may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward - looking statements. In evaluating these forward - looking statements, you should consider various factors, including: our ability to change the direction of the Company; our ability to keep pace with new technology and changing market needs; and the competitive environment of our business. These and other factors may cause our actual results to differ materially from any forward - looking statement. Forward - looking statements are only predictions. Thus, you should not rely upon forward - looking statements as predictions of future events. The events and circumstances reflected in the forward - looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward - looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. Except as required by applicable law, we undertake no duty to update any of these forward - looking statements after the date of the Presentation or to conform these statements to actual results or revised expectations. 2

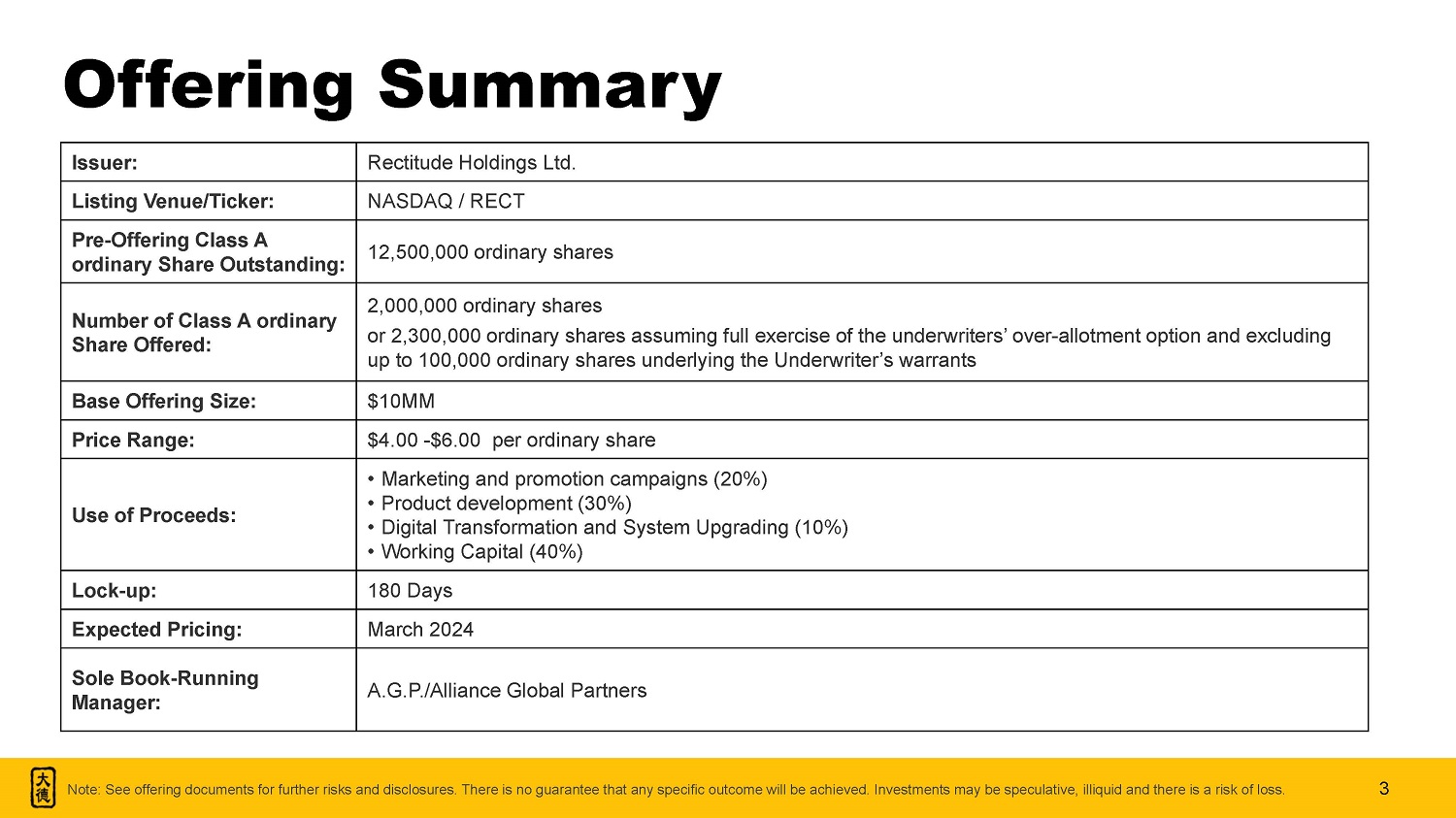

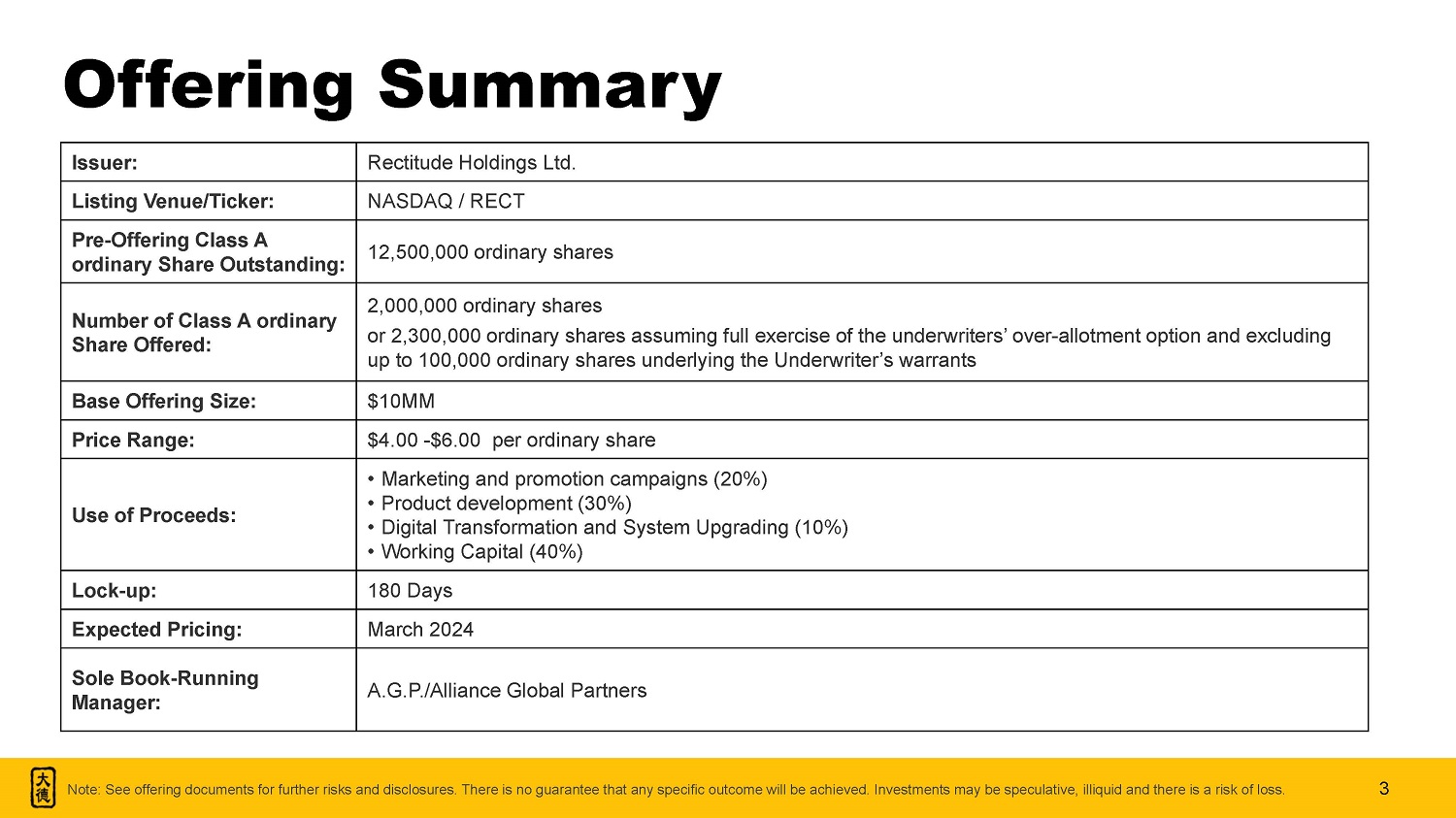

Rectitude Holdings Ltd. Issuer: NASDAQ / RECT Listing Venue/Ticker: 12,500,000 ordinary shares Pre - Offering Class A o rdinary Share Outstanding: 2 , 0 00,000 ordinary shares or 2,300,000 ordinary shares assuming full exercise of the underwriters’ over - allotment option and excluding up to 100,000 ordinary shares underlying the Underwriter’s warrants Number of Class A ordinary Share Offered: $ 10 MM Base Offering Size: $ 4 .00 - $ 6 .00 per ordinary share Price Range: • Marketing and promotion campaigns (20%) • Product development (30%) • Digital Transformation and System Upgrading (10%) • Working Capital (40%) Use of Proceeds: 180 Days Lock - up: March 202 4 Expected Pricing: A.G.P./Alliance Global Partners Sole Book - Running Manager : Note: See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achie ved . Investments may be speculative, illiquid and there is a risk of loss. Offering Summary 3

Who We Are Rectitude Holdings Ltd. is a Singapore - based provider of safety equipment and other industrial products, selling goods and providing solutions through a wide array of distributor networks and end markets. Our distribution network spans Singapore and is increasing throughout the Southeast Asian region including Brunei, Cambodia, Malaysia, Indonesia and Vietnam. 98 Employees 8 Strategically Located Branches Across Singapore 20+ Years of Operating History 4

Our Products • Personal protective clothing • Hand gloves • Safety footwear • Personal fall arrest systems 1 Essential Safety Equipment Items Portable Fire Extinguishers • Rubber speed humps wheel stops • Wheel chocks Traffic Products • Industrial hardware tools and electrical hardware required for construction sites Auxiliary Products 65% Safety Equipment, Extinguishers, Traffic Products 35% Auxiliary Products SALES FOR THE FISCAL YEAR ENDED MARCH 31, 2023 (1) A system used to arrest an employee in a fall from a walking - working surface, usually consisting of a body harness, anchora ge and connector 5

Our Brands 6 The D&D brand represents our core product line featuring a variety of safety footwear designed with sturdy toecaps. The SkyHawk brand is our product line committed to providing reliable travel restraint and fall arrest equipment, specifically designed to ensure the safety of workers operating at heights. The Super Sun brand covers our range of industrial graded hardware and traffic products. The STRIKERS brand covers our wide range of firefighting equipment. The Osprey brand covers our fall arrest equipment, safety gloves and step platform ladders. The HORNET brand covers our fall arrest equipment for workers working at heights. The DADE brand covers our range of industrial hardware tools, electrical products and accessories.

Our Customers 7 Our customers, who are located throughout Southeast Asia, can be categorized into (i) wholesalers and distributers and (ii) end users of our products. For the financial years ended March 31, 2023, our top five customers accounted for 33% of total sales, with three of our top five customers having more than 10 years of business with us. Purchase products with economics of scale to markup and sell to end users. Wholesalers & Distributers Operate in various industries which range from infrastructure, building construction, marine, oil and gas industries, as well as general industrial markets. End - user Customers

Sales and Marketing 8 Our sales and marketing team consists of 14 full - time employees based in Singapore, led by Executive Director Huang Dong. The sales team consist of individuals who specialize in handling wholesale ordering and those who specialize in handling end user markets. We also have stationed staff at our distribution branches who are trained on up selling and our large product offering to advise the customer on their tailored needs. One of our other key channels for marketing is through word - of - mouth referrals from our long - term existing customers and business contacts. Sales and marketing team with 14 full - time employees ONLINE OFFLINE • Shopee • Lazada • Dade.sg • Safety + Health Asia Singapore • MetalTech and AutoMex 2023 Kuala Lumpur • Exyte Singapore Safety Week

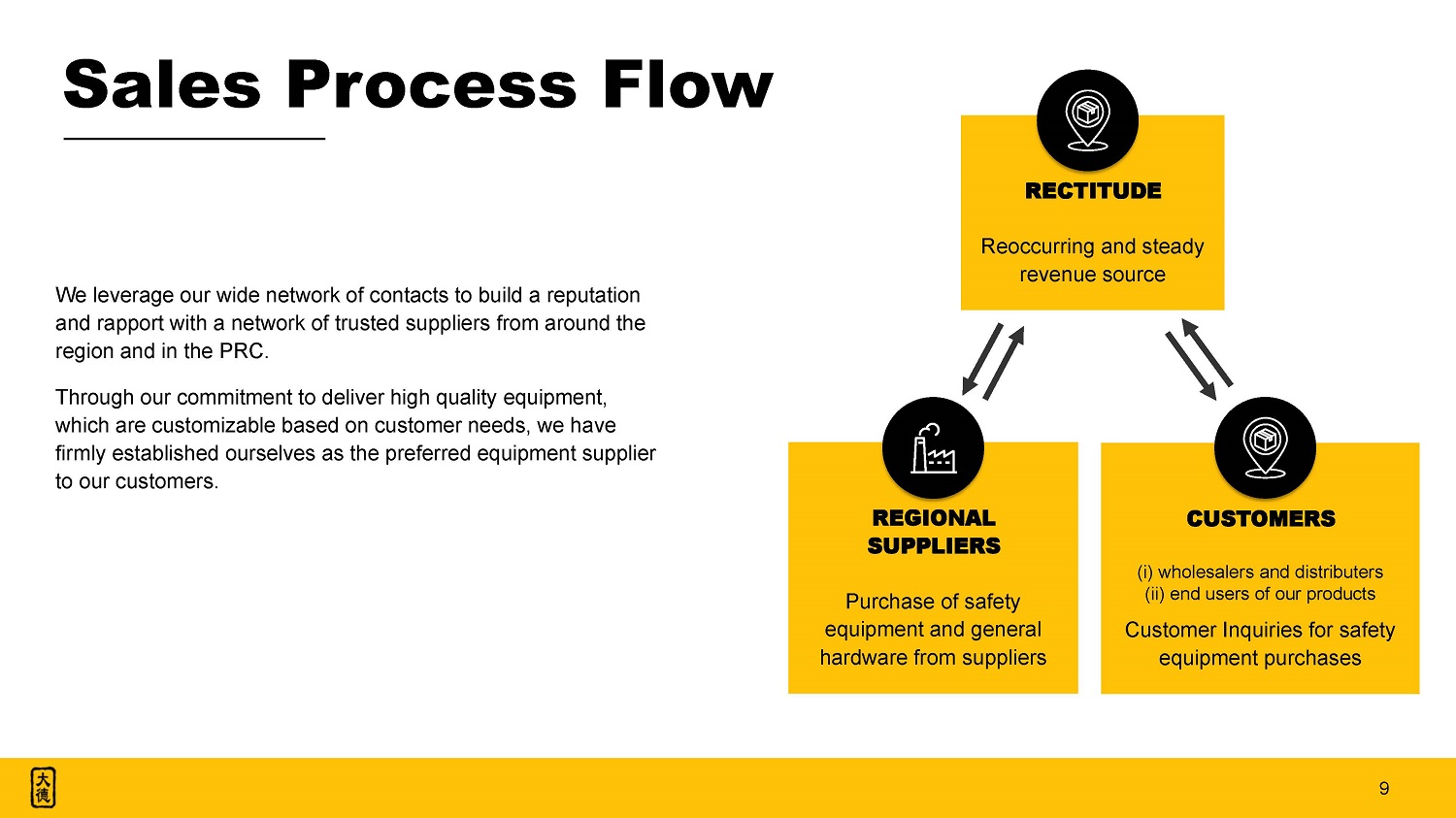

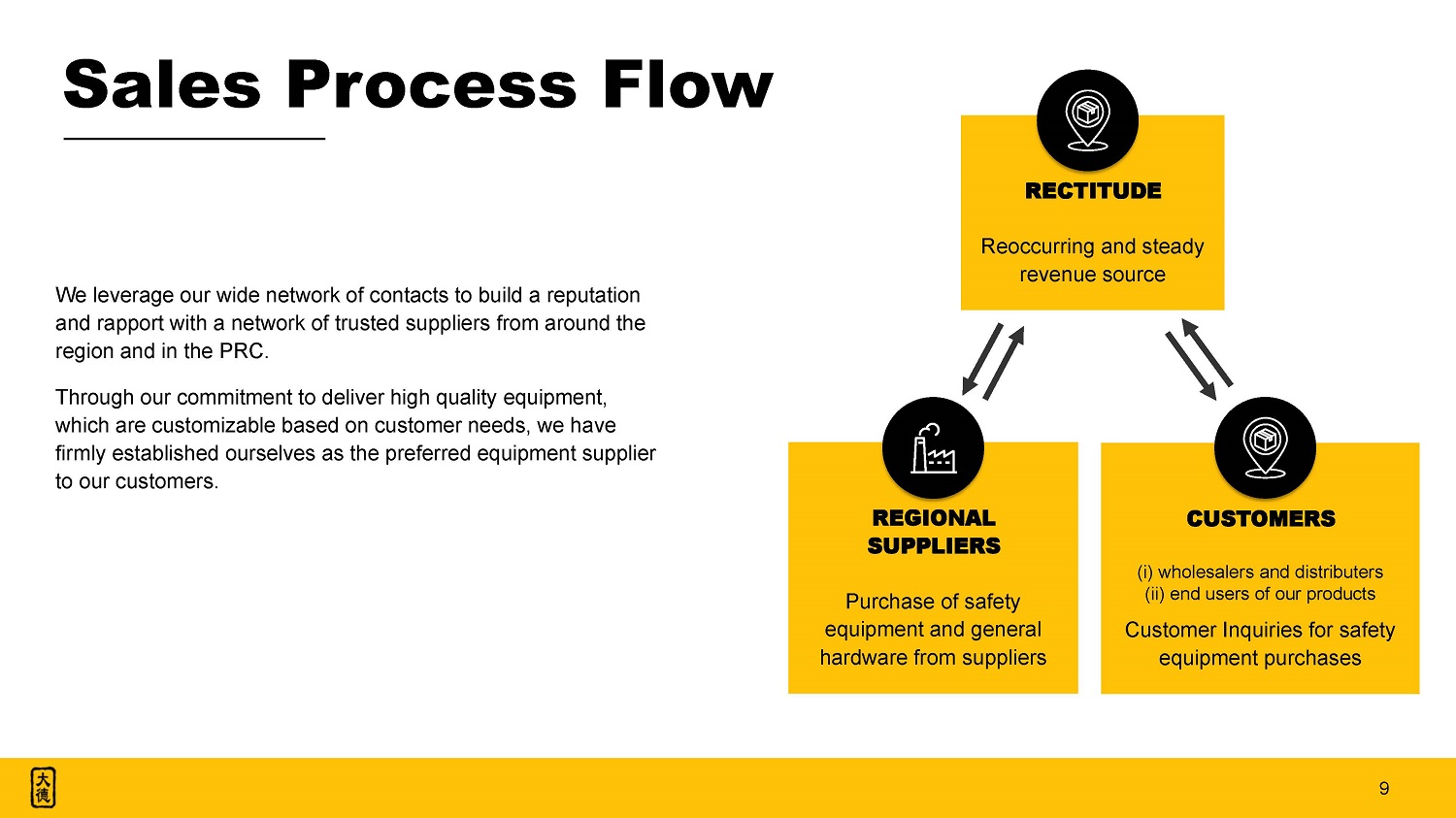

Sales Process Flow We leverage our wide network of contacts to build a reputation and rapport with a network of trusted suppliers from around the region and in the PRC. Through our commitment to deliver high quality equipment, which are customizable based on customer needs, we have firmly established ourselves as the preferred equipment supplier to our customers. REGIONAL SUPPLIERS Purchase of safety equipment and general hardware from suppliers RECTITUDE Reoccurring and steady revenue source CUSTOMERS (i) wholesalers and distributers (ii) end users of our products Customer Inquiries for safety equipment purchases 9

Industry Overview 10 Personal Protection Equipment (“PPE”) Industry Overview PPE encompasses an array of equipment designed to curtail exposure to safety and health risks in the workplace that have the potential to cause injuries or illnesses. These risks could manifest in various forms, including contact with chemicals, corrosive materials, biohazards, electrical perils, contaminated air, extreme temperature conditions, and more. Given the nature of uses for this equipment, PPE plays a pivotal role in diverse industries spanning from construction, oil & gas, and manufacturing to food & beverage, healthcare, and others. DISTINCT TYPES OF PPE Head - to - Neck Protection Respiratory Protection Hand Protection Protective Attire Workwear Foot Protection Fall Prevention Gas Detection

Industry Overview Personal Protection Equipment (“PPE”) 11 The Asia Pacific market is expected to grow at the fastest growth rate at a CAGR of c.6.5% over the forecast period driven by the significant economic development and industrialization across the region. The SEA region is experiencing significant growth in the PPE market driven by stringent safety regulations, the region’s industrial expansion, as well as economic growth and urbanization. The PPE market in Southeast Asia (“SEA”) is poised for substantial growth with a projected CAGR of c.8% from 2022 to reach $5.0 billion in 2027. Singapore demonstrates the highest degree of adherence to the safety regulations outlined in the Workplace Safety and Health Act 2006. The PPE market in Singapore is projected to maintain this growth trajectory with an estimated CAGR of 8.3%, ultimately reaching a market size of $454 million by 2025.

Industry Overview Industry Outlook The PPE market encompasses a wide variety of safety gear designed to protect workers from workplace hazards. These hazards range from chemical exposure to electrical risks and extreme temperatures, making PPE a crucial component across industries like construction, manufacturing, healthcare, and oil & gas. The global PPE market is on a growth trajectory, projected to reach $125 billion by 2030 from $83 billion in 2023, with the Asia Pacific region leading this expansion at a robust CAGR of c.6.5%. Industry Growth Drivers Growth in Construction Industry • BCA foresees construction demand ranging from S$25 billion to S$32 billion per year from 2024 to 2027. This projection reflects the confidence in Singapore’s strong economic fundamentals and healthy investment commitments 12 Focus on Workplace Fatality • The increased workplace fatality rate in recent years, exemplified by a notable rise in 2022, has become a significant driver for the demand and emphasis on PPE. This push to lower fatality rates has led to heightened awareness of the importance of PPE across various industries, as it serves as a critical line of defense in safeguarding the well - being of workers

One - stop provider of an extensive range of products Strategically located branches across Singapore Experienced management team Strong and stable relationships with suppliers and customers • A one - stop provider for all clients’ safety needs by offering convenience and streamlining the procurement process • Provide customized products based on the needs of our customers • Network of suppliers allows for quick turnaround on all customer orders • 8 strategically located branches across Singapore • Fulfil customer product needs quickly and easily on short notice • Prompt and efficient delivery capabilities • A dedicated and experienced management team with a wealth of experience in the safety equipment industry in Singapore • 20+ years of operating history with strong and stable relationships with key suppliers and customers • Great reputation among suppliers and gain prospective customers from referral • A wide customer base from Singapore, Brunei, Cambodia, Indonesia, Malaysia and Vietnam Competitive Strengths 13

Business Strategies 14 Expand business and operations through acquisitions, joint ventures and/or strategic alliances Widen our product range Strengthen our local presence

Research and Development VR training service tailored to Singapore’s construction sites We are trying to optimize safety training with the integration of virtual reality (“VR”) technology and are aiming to provide our customers with the first iteration of our VR equipment in Q4’24. We have been developing VR technology that offers a transformative solution by immersing workers in realistic construction site scenarios, providing a firsthand experience of potential dangers and accidents. 15

Management Zhang Jian Chairman & Chief Executive Officer • Founder of Rectitude with 20+ years of experience in the safety equipment industry • Responsible for the overall business management of Rectitude, expanded the product range and established several successful brands, and opened eight branches across Singapore • Embarked on his entrepreneurial journey in 1997 by establishing a general hardware business before venturing into the supply of laboratory equipment • Received postgraduate diploma in Business Administration administered by the Society of Business Practitioners Chan Yong Xian Chief Financial Officer • Extensive knowledge of accounting and auditing with expertise in implementing business controls, streamlining processes, and providing counsel to executive teams • Previously worked at Pricewaterhouse Coopers (PwC) and other notable auditing firms where he audited listed companies in compliance with various accounting standards and was involved in IPO projects • Certified Public Accountant (CPA) from CPA Australia. • Received his Masters degree in Accounting from the Australian National University and a Bachelors degree in Electrical and Electronic Engineering Huang Dong Executive Director • 15 years of experience in marketing and wholesaling safety equipment products • Played a pivotal role in the rapid expansion of the company’s business and achieved outstanding performance and earning recognition as the top salesperson in the company • Successfully established a strong presence in Malaysia, Cambodia, Brunei, and China, cultivating excellent customer relationships and fostering prosperous business cooperation • Received a Bachelors degree in Science (Management) from the National University of Ireland Victor Aw Executive Director • 20+ years of experience in marketing and wholesaling safety equipment products, with excellence in general sales, logistics management, and supplier relations • Played an important role in driving sales growth, expanding client bases, maintaining excellent customer relationships, as well as helping the Company obtain certifications and implementing quality management systems • Graduated from Upper Aljunied Technical Secondary School with a GCE “O” Level certificate (technical stream) 16

Shirley Tan Independent Director Nominee • 18+ years of experience in corporate secretarial work and compliance advisory for private and publicly listed companies, SMEs, foreign companies, and academic institutions in Singapore • Expertise includes corporate secretarial due diligence exercises for initial public offering (IPO), dual listing in Singapore and Hong Kong, M&A, company restructuring, etc. • Member of Chartered Secretaries Institute of Singapore, the CSIS secretarial practice sub - committee, the Singapore Institute of Directors • Received MS in Management with distinction from the National University of Ireland, Dublin Clive Ho Yip Seng Independent Director Nominee • 25+ years of experience in business operation, sales, and marketing • Served as Business Advisor at SMECentre@SICCI, aiding local businesses in growth, internationalization, and leveraging government resources • Previously served in a leading role in sales and marketing, business operations with an outstanding track record • Received a Bachelor of Business Administration degree from the University of South Australia Fok Chee Khuen Independent Director Nominee • 22 years of experience in audit, accounting, and inspection, specializing in audits of listed corporations in Singapore and the United States • Co - founder and Managing Director of Quality Accountants Pte Ltd and FE Advisory Pte Ltd • Served as the Head of the Practice Monitoring Department at the Accounting & Corporate Regulatory Authority (ACRA). • Chartered Accountant of Singapore and a member of the Institute of Singapore Chartered Accountants • Received Bachelor of Accountancy Degree (1st Class Honors) from Nanyang Technological University in Singapore Independent Board Members 17

$29.8 $37.6 $0 $5 $10 $15 $20 $25 $30 $35 $40 2022 2023 Millions Revenue (S$) Fiscal Years Ended March 31, 2022 and 2023 65% 35% Revenue (S$) by sales categories For the Fiscal Years ended March 31,2022 and 2023 During the years ended March 31, 2023, sale of safety equipment and auxiliary products accounted for approximately 65.0% and 35.0% of the total revenue, respectively. Total revenues increased by S$7,830,085, or 26.3%, from S$29,813,611 for the year ended March 31, 2022, to S$37,643,696 for the year ended March 31, 2023, primarily due to an approximately 42.9% increase in the sale of safety equipment. Overall, our revenue increase was driven by higher demand by our customers, such as those in the construction sectors driven by new construction projects and resumption of previously delayed activities. Financials 18

Net income for the year increased by S$1,849,813, or approximately 89.1%, from S$2,077,008 for the year ended March 31, 2022, to S$3,926,821 for the year ended March 31, 2023. For the years ended March 31, 2022 and 2023, our gross profits were S$8,743,878 and S$12,140,670, respectively, and our gross profit margins were approximately 29.3% and 32.2%, respectively. Our gross profit increased by S$3,396,792, or approximately 38.8% primarily due to the increase in the sale of safety equipment. Our gross profit margin improved by approximately 2.9% primarily due to lower procurement costs and a better product mix. Financials 19 $2.08 $3.93 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 $4.0 $4.5 2022 2023 Millions Net income and comprehensive income (S$) For the Years Ended March 31, 2022 and 2023

I ssuer Rectitude Holdings Limited Email: Chin_fo@rectitude.com.sg Tel: +(65) 6749 6647 Address: 35 Tampines Industrial Avenue 5 T5@Tampines Underwriter A.G.P./Alliance Global Partners Karen Mu Email: kmu@allianceg.com Address: 590 Madison Ave 28th Floor, New York, NY 10022 20