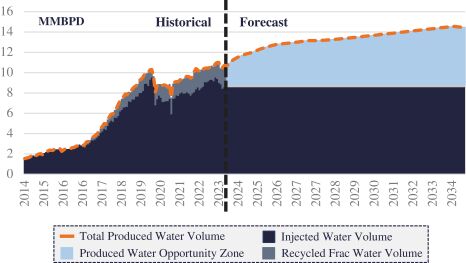

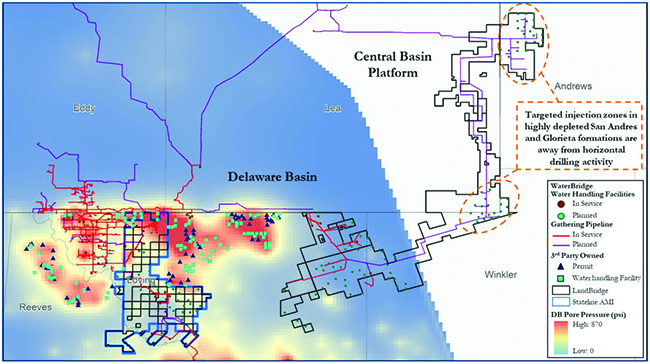

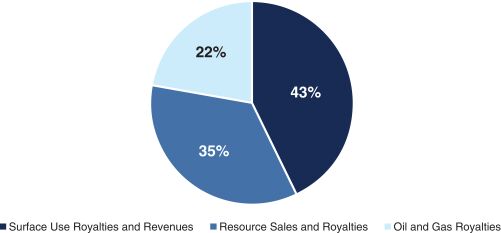

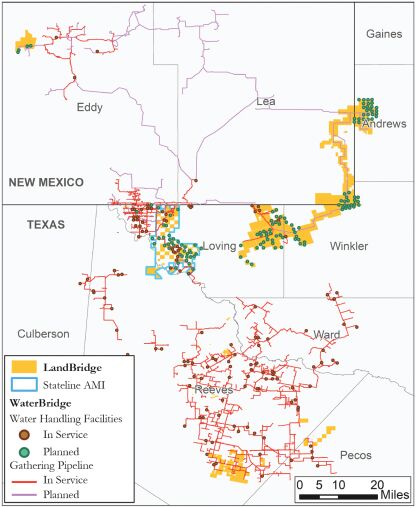

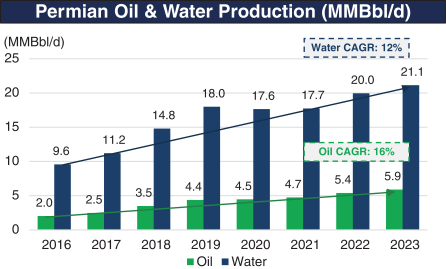

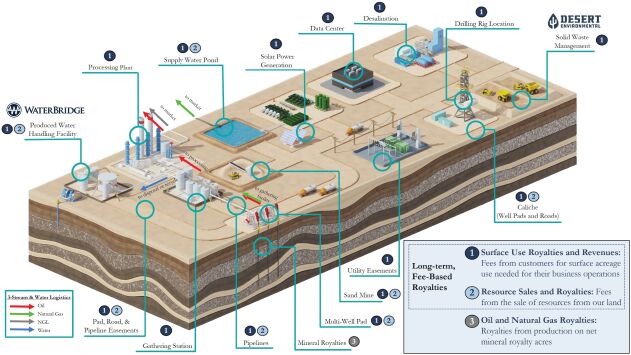

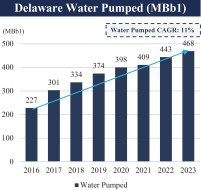

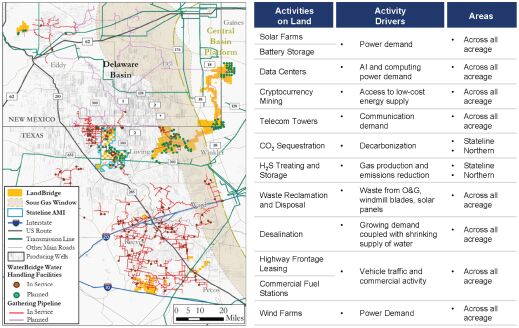

Surface use royalties. Surface use royalties increased by $5.5 million, or 72%, to $13.2 million for the year ended December 31, 2023, as compared to $7.7 million for the year ended December 31, 2022. The increase was primarily attributable to new produced water throughput agreements and increased WaterBridge produced water handling on our surface for the year ended December 31, 2023, as compared to the year ended December 31, 2022.

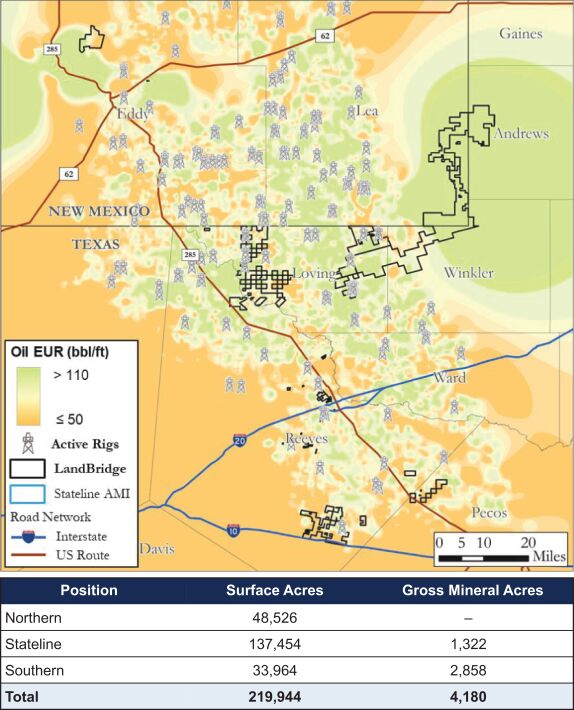

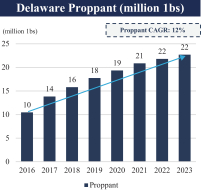

Resource royalties. Resource royalties increased by $5.2 million, or 433%, to $6.4 million for the year ended December 31, 2023, as compared to $1.2 million for the year ended December 31, 2022. The increase was primarily attributable to increased sand mine royalties. The sand mine commenced operations in September 2022 resulting in a full year of royalty revenue in 2023, as compared to four months for the year ended December 31, 2022.

Resource sales-related expenses. Resource sales related expenses decreased by $0.4 million, or 10% to $3.4 million for the year ended December 31, 2023, as compared to $3.8 million for the year ended December 31, 2022. The decrease was primarily attributable to lower utility expenses associated with sales of brackish water driven by the lower volumes sold during the year ended December 31, 2023, as compared to the year ended December 31, 2022.

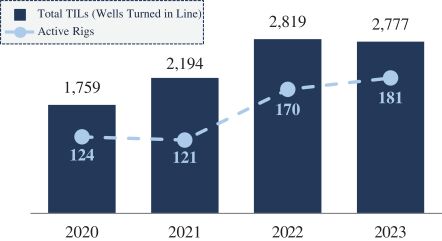

Other operating and maintenance expense. Other operating and maintenance expense increased by $0.1 million, or 3%, to $2.7 million for the year ended December 31, 2023, as compared to $2.6 million for the year ended December 31, 2022. The increase was primarily attributable to higher production taxes on oil and gas and skim oil royalties due to increased additional upstream production wells drilled and completed on our mineral acreage and increased produced water handling activity on our surface for the year ended December 31, 2023, as compared to the year ended December 31, 2022.

General and administrative expense. General and administrative expense, excluding share-based compensation expense, decreased by $0.3 million, or 5%, to $5.1 million for the year ended December 31, 2023, as compared to $5.4 million for the year ended December 31, 2022. The decrease was primarily attributable to lower professional services fees of $0.7 million for cancelled acquisitions and audit and tax services and lower employee compensation expense of $0.2 million related to short-term variable compensation offset by $0.6 million in increased corporate shared services allocation from WaterBridge. General and administrative expense, inclusive of share-based compensation, decreased by $53.9 million, or 129%, to income of $12.1 million for the year ended December 31, 2023, as compared to expense of $41.8 million for the year ended December 31, 2022. The decrease was primarily attributable to the change in share-based compensation expense of $53.6 million. Share-based compensation is associated with NDB LLC’s Incentive Units which are allocated to us. Such Incentive Units are classified as liability awards and primarily reflect the impacts of change in the liability remeasurement. See “Note 10—Share-Based Compensation” within the notes to our consolidated financial statements included elsewhere in this prospectus.

Depreciation, depletion, amortization and accretion. Depreciation, depletion, amortization and accretion increased by $2.0 million, or 30%, to $8.8 million for the year ended December 31, 2023, as compared to $6.7 million for the year ended December 31, 2022. The increase was primarily attributable to higher depletion expense of $1.4 million due to increased oil and gas royalty development activities and depreciation expense of $0.6 million related to capital expenditures associated with brackish water supply sales.

Interest expense, net. Interest expense, net increased by $3.9 million, or 126%, to $7.0 million for the year ended December 31, 2023, as compared to $3.1 million for the year ended December 31, 2022. The increase was primarily attributable to additional principal borrowings under our credit facility during the year ended December 31, 2023, as compared to the year ended December 31, 2022. See

111