Filed Pursuant to Rule 424(b)(4)

Registration No. 333-278416

1,500,000 Shares

LAKESIDE HOLDING LIMITED

Common Stock

__________________________________________

This is an initial public offering of common stock of Lakeside Holding Limited. We are offering 1,500,000 shares of our common stock, par value $0.0001 per share.

Prior to this offering there has been no public market for our common stock.

Our common stock has been approved for listing on the Nasdaq Capital Market (the “Nasdaq”) under the symbol “LSH.”

We are an “emerging growth company” and a “smaller reporting company” under the U.S. federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements for this prospectus and future filings after the closing of this offering. See the section titled “Prospectus Summary — Implications of Being an Emerging Growth Company and a Smaller Reporting Company.”

__________________________________________

Investing in our common stock involves risks. See the section titled “Risk Factors” beginning on page 7 of this prospectus to read about factors you should consider before deciding to invest in shares of our common stock.

__________________________________________

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | Per Share | | Total without

Over-Allotment

Option | | Total with

Over-Allotment

Option |

Initial public offering price | | $ | 4.50 | | $ | 6,750,000 | | $ | 7,762,500 |

Underwriting discounts and commissions(1) | | $ | 0.295 | | $ | 441,900 | | $ | 508,185 |

Proceeds, before expenses, to us | | $ | 4.205 | | $ | 6,308,100 | | $ | 7,254,315 |

We have granted the underwriters an option for a period of 30 days to purchase up to 225,000 additional shares of our common stock at the initial public offering price less the underwriting discounts and commissions.

Delivery of the shares is expected to be made on or about July 1, 2024.

__________________________________________

THE BENCHMARK COMPANY, LLC | | AXIOM CAPITAL MANAGEMENT, INC. |

Prospectus dated June 27, 2024

Table of Contents

Table of Contents

Table of Contents

Table of Contents

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus, any amendment or supplement to this prospectus or any free writing prospectus in connection with the sale of the shares offered hereby that we may authorize to be delivered or made available to you. We and the underwriters have not, authorized anyone to provide any information or to make any representations other than those contained in this prospectus, any amendment or supplement to this prospectus or any such free writing prospectuses prepared by us or on our behalf. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus, any amendment or supplement to this prospectus or any applicable free writing prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus, any amendment or supplement to this prospectus or any applicable free writing prospectus is current only as of its date, regardless of the time of delivery of this prospectus, any amendment or supplement to this prospectus or any applicable free writing prospectus or any sale of the shares offered hereby. Our business, financial condition, results of operations and prospects may have changed since such date.

For investors outside the United States: we have not, and the underwriters have not, done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States.

i

Table of Contents

PROSPECTUS SUMMARY

This summary highlights information included elsewhere in this prospectus. This summary does not contain all the information you should consider before investing in our common stock. You should read and consider this entire prospectus carefully, including the sections titled “Risk Factors,” “Special Note Regarding Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes included elsewhere in this prospectus, before making any investment decision. Unless the context otherwise requires, the terms “Lakeside,” “the Company,” “we,” “us” and “our” refer to Lakeside Holding Limited, together with its consolidated subsidiaries.

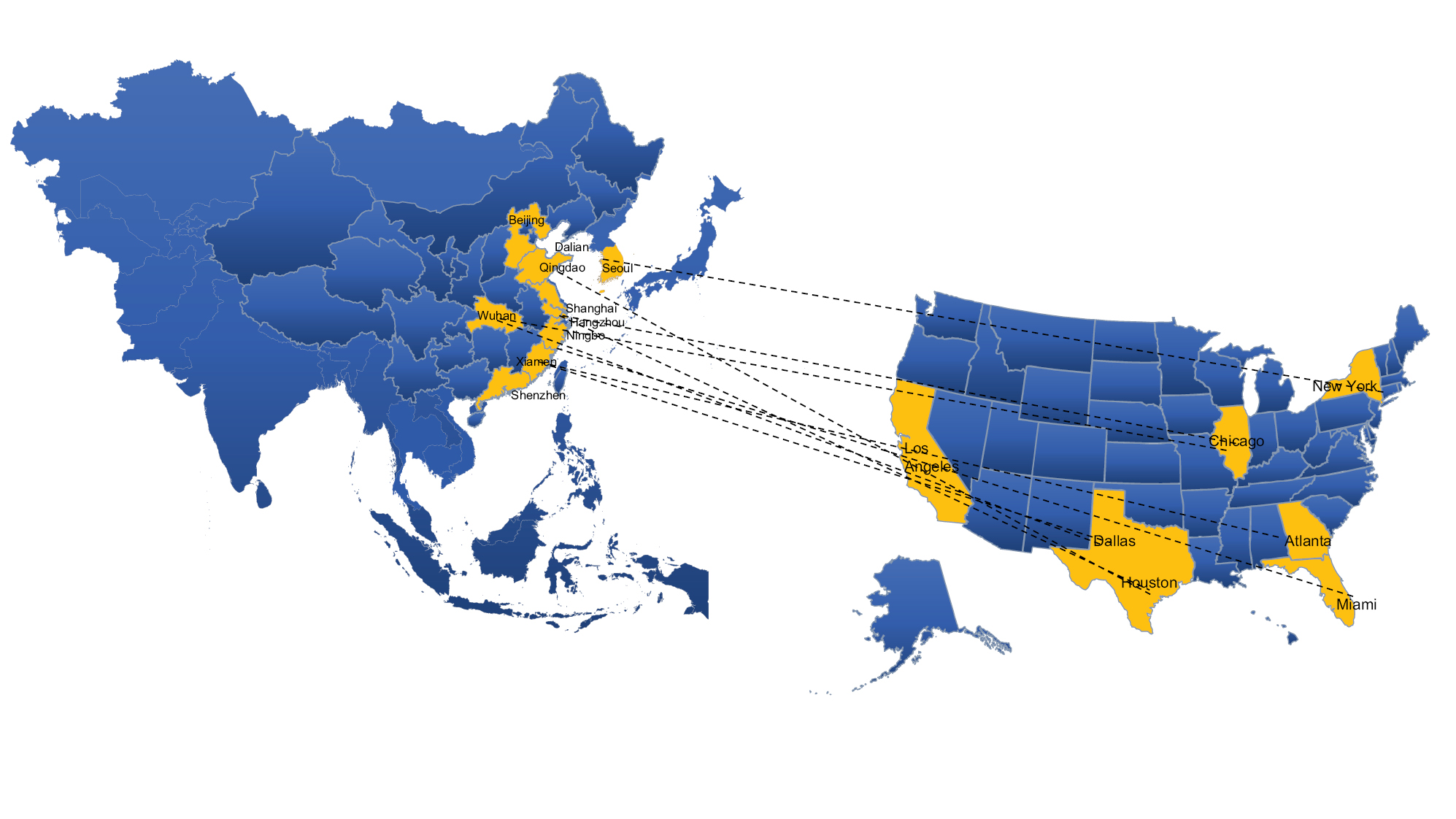

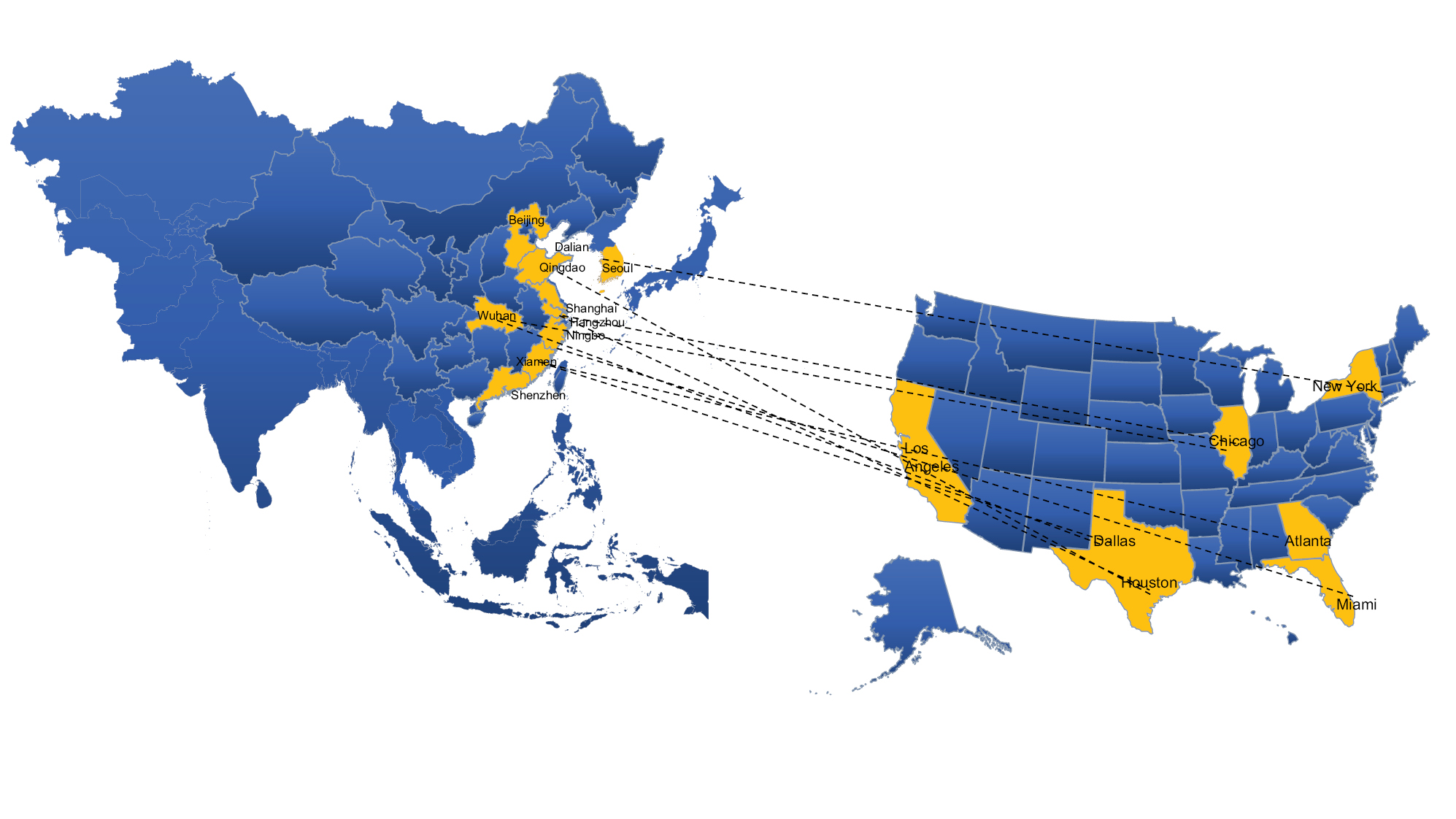

Mission

We aspire to become a U.S.-backed cross-border supply chain corridor that connects Asia and North America with efficiency, reliability, and affordability.

Overview

We are a U.S.-based integrated cross-border supply chain solution provider with a strategic focus on the Asian market including China and South Korea. We primarily provide customized cross-border ocean freight solutions and airfreight solutions in the U.S. that specifically cater to our customers’ requirements and needs in transporting goods into the U.S. We offer a wide variety of integrated services under our cross-border ocean freight solutions and cross-border airfreight solutions, including (i) cross-border freight consolidation and forwarding services, (ii) customs clearance services, (iii) warehousing and distribution services and (iv) U.S. domestic ground transportation services.

Founded in Chicago, Illinois in 2018, we are an Asian American-owned business rooted in the U.S. with in-depth understanding of both the U.S. and Asian international trading and logistics service markets. Our customers are typically Asia- and U.S.-based logistics service companies serving large e-commerce platforms, social commerce platforms and manufacturers to sell and transport consumer and industrial goods made in Asia into the U.S. Since inception and as of March 31, 2024, we had served over 300 customers to fulfill over 37,000 cross-border supply chain solution orders.

We have established an extensive collaboration network of service providers, including global freight carriers for our cross-border freight consolidation and forwarding services as well as domestic ground transportation carriers for our U.S. domestic transportation services. Since inception and as of March 31, 2024, we had collaborated with almost all major global ocean and air carriers to forward over 29,800 twenty-foot equivalent unit, or TEU, of container loads and 41,800 tons of air cargo. As of March 31, 2024, we had also cooperated with over 200 domestic ground transportation carriers, including almost all major U.S. domestic ground transportation carriers, on a long-term, short-term or order basis, as the case may be.

We operate two massive and hyper-busy regional warehousing and distribution centers in the U.S., in Illinois and Texas. With an aggregate gross feet area of approximately 75,014 square feet and 34 docks, our regional warehousing and distribution centers have an aggregate daily floor load of up to 3,000 cubic meters of freight. In addition to our regional centers, we maintain close contact with over 150 warehouses and distribution terminals in almost all transportation hubs in the U.S. which we have cooperated in the past to support the warehousing and distributing services of our cross-border freight in case such freight requires storage, fulfilment, transloading, palletizing, packaging or distribution in states other than Illinois and Texas. Further, we collaborate with licensed customs brokerage experts to help our customers clear shipments importing into the U.S. As of March 31, 2024, we had assisted with the customs clearance of cross-border freight of an aggregate assessed value of over $34.4 million.

Leveraging our strong cross-border supply chain service capabilities, extensive service provider network of cross-border freight carriers and U.S. domestic ground transportation carriers, massive and hyper-busy regional warehousing and distribution centers as well as deep understanding of the Asian markets, we have been able to build up our brand and reputation and have achieved fast growth since our inception. For the fiscal years ended June 30, 2022 and 2023 and the nine months ended March 31, 2023 and 2024, our revenues amounted to $9.6 million, $12.9 million, $8.8 million and $13.5 million, respectively, and our gross profit amounted to $1.8 million, $2.6 million, $1.7 million and $2.7 million during the same periods, respectively. As of March 31, 2024, we had fulfilled over 37,000 cross-border supply chain solution orders for freight of an aggregate assessed value of $1.0 billion, delivered to thousands of business and residential addresses in approximately 48 U.S. states.

1

Table of Contents

Solutions and Services

We primarily offer cross-border ocean freight solutions and airfreight solutions in the U.S. that are specifically tailored to our customers’ requirements and needs in transporting goods into the U.S.

Services under our cross-border ocean freight solutions and cross-border airfreight solutions typically include (i) cross-border freight consolidation and forwarding services, (ii) customs clearance services, (iii) warehousing and distribution services and (iv) U.S. domestic ground transportation services.

Our Strengths

We believe the following strengths contribute to our success and differentiate us from our competitors:

• Fast-growing U.S.-based cross-border supply chain solution provider with a unique focus on the Asian market;

• Extensive network of global freight consolidation and forwarding and U.S. ground transportation service providers;

• Symbiotic relationships with a large base of customers with high demand for supply chain solutions;

• Persistent focus on providing superior service efficiency and quality; and

• Visionary and accomplished young management team with strong industry expertise and in-depth understanding of Asian markets.

Growth Strategies

We believe that we have a significant opportunity before us, both to further our mission and to strengthen our business and grow our revenues. We are focused on the following strategies to drive our growth:

• Solidify our competitive edge and further grow customer base;

• Expand our global footprints more extensively;

• Diversify and increase the breadth and depth of our service offerings through an organic growth and/or mergers and acquisitions;

• Optimize operational efficiency and maintain premier service quality; and

• Continue to invest in and advance our technologies.

Market Opportunity

The cross-border supply chain solutions industry is highly fragmented with thousands of companies of various sizes competing in domestic and international markets. The overall opportunities in the cross-border supply chain solutions sector are significant. According to McKinsey & Company(1), the cross-border supply chain solutions sector is expected to see a significant growth in the coming years. It is estimated that the market size of cross-border e-commerce will expand to around $1 trillion in merchandise value by 2030, from a current value of approximately $300 billion.

We maintain a strong focus on the Asian market. According to McKinsey & Company(2), Asia is expected to account for 57% of the growth of the global e-commerce logistics market between 2020 and 2025, making it one of the most important regions for global trade and logistics activities going forward. Our concentration on the Asian market enables us to develop in-depth expertise in serving Asian countries such as China and South Korea and provides us an edge in understanding the nuances and demands in this rapidly evolving market.

2

Table of Contents

Summary of Risk Factors

Our business is subject to a number of risks of which you should be aware before making a decision to invest in our common stock. These risks are more fully described in the section titled “Risk Factors” beginning on page 7 of this prospectus. These risks include, among others, the following:

• Our business and growth are significantly affected by the development of international commerce, e-commerce and social commerce industries, as well as macroeconomic and other factors that affect demand for cross-border supply chain solutions and services, in the U.S. and globally.

• We face intense competition which could adversely affect our results of operations and market share.

• We face risks associated with our service providers and their personnel.

• COVID-19 significantly impacted worldwide economic conditions and global trade and may continue to have a disruptive effect on our operations, and the operations of our service providers and our customers, which may further impact our business.

• We rely on a variety of service providers, such as global ocean and air freight carriers as well as U.S. domestic ground transportation carriers, and if they become financially unstable or have reduced capacity to provide service because of COVID-19 or other factors, it may adversely impact our business, financial condition and results of operations.

• Global economic uncertainty impacted international trade and could affect demand for our services or the financial stability of our service providers and customers.

• Our historical results of operations and financial performance are not indicative of future performance.

• Failure to successfully implement our business strategies, effectively respond to changes in market dynamics or satisfactorily meet customer demands could materially and adversely affect our future financial results.

• We may not be familiar with new regions or markets we enter and may not be successful in maintaining our current growth in such regions or markets.

• The cross-border supply chain solution industry has its own set of risks, including operational inefficiencies, lack of digital culture and training, disruptive labor relations and operational costs. Our provision of integrated cross-border supply chain solutions and services to customers may be adversely impacted due to these factors.

• Our long-term growth and competitiveness are highly dependent on our ability to control costs.

• Any lack of requisite approvals, licenses or permits applicable to our business operation may have a material adverse impact on our business, financial condition and results of operations.

Recent Development

On March 29, 2024, we effected a forward stock split of our issued and outstanding common stock on a one (1) to one-hundred-and-twenty (120) basis (the “Stock Split”). The authorized number of shares and par value of our common stock did not change as a result of the Stock Split. Following the Stock Split, the total number of our issued and outstanding shares of common stock was increased to 6,000,000. Unless otherwise indicated, the share and per share information in this prospectus reflects such Stock Split.

Corporate Information

We commenced our operations in February 2018 through American Bear Logistics Corp., a corporation established under the laws of the State of Illinois. To facilitate our proposed initial public offering, we initiated a reorganization in August 2023 and completed such reorganization in September 2023. As part of our reorganization, we established our holding company, Lakeside Holding Limited, under the laws of the State of Nevada on August 28, 2023. Our principal executive offices are located at 1475 Thorndale Avenue, Suite A, Itasca, Illinois 60143, and our telephone number is (224) 446-9048.

3

Table of Contents

Our website address is www.americanbearlogistics.com. The information on, or that can be accessed through, our website is not part of this prospectus and is not incorporated by reference herein. We have included our website address as an inactive textual reference only.

Implications of Being an Emerging Growth Company and a Smaller Reporting Company

We qualify as an “emerging growth company” as defined in Section 2(a)(19) of the Securities Act of 1933, as amended, or the Securities Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements that are applicable to other companies that are not emerging growth companies.

Accordingly, in this prospectus, we (i) have presented only two years of audited financial statements; and (ii) have not included a compensation discussion and analysis of our executive compensation programs. In addition, for so long as we are an emerging growth company, among other exemptions, we will:

• not be required to engage an independent registered public accounting firm to report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act;

• not be required to comply with the requirement in Public Company Accounting Oversight Board Auditing Standard 3101, The Auditor’s Report on an Audit of Financial Statements When the Auditor Expresses an Unqualified Opinion, to communicate critical audit matters in the auditor’s report;

• be permitted to present only two years of audited financial statements and only two years of related “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our periodic reports and registration statements, including in this prospectus;

• not be required to disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the chief executive officer’s compensation to median employee compensation; or

• not be required to submit certain executive compensation matters to stockholder advisory votes, such as “say-on-pay,” “say-on-frequency,” and “say-on-golden parachutes.”

We will remain an “emerging growth company” until the earliest occurrence of:

• our reporting of $1.235 billion or more in annual gross revenue;

• our becoming a “large accelerated filer,” with at least $700 million of equity securities held by non-affiliates;

• our issuance, in any three year period, of more than $1.0 billion in non-convertible debt; and

• the fiscal year end following the fifth anniversary of the completion of this initial public offering.

The Jumpstart Our Business Startups Act of 2012, or the JOBS Act, also permits an emerging growth company such as us to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We have elected to use this extended transition period under the JOBS Act.

We also qualify as a “smaller reporting company,” meaning that the market value of our common stock is less than $700.0 million and our annual revenue is less than $100.0 million during the most recently completed fiscal year. We may continue to be a smaller reporting company after this offering if either (i) the market value of our common stock is less than $250.0 million or (ii) our annual revenue is less than $100.0 million during the most recently completed fiscal year and the market value of our common stock is less than $700.0 million. If we are a smaller reporting company at the time we cease to be an emerging growth company, we may continue to rely on exemptions from certain disclosure requirements that are available to smaller reporting companies. Specifically, as a smaller reporting company we may choose to present only the two most recent fiscal years of audited financial statements in our Annual Report on Form 10-K and, similar to emerging growth companies, smaller reporting companies have reduced disclosure obligations regarding executive compensation.

4

Table of Contents

THE OFFERING

Common stock offered by us | | 1,500,000 shares. |

Option to purchase additional shares | | The underwriters have a 30-day option to purchase up to 225,000 additional shares of our common stock at the initial public offering price less estimated underwriting discounts and commissions. |

Common stock to be outstanding after this offering | |

7,500,000 shares, or 7,725,000 shares if the underwriters exercise their option to purchase additional shares in full.

|

Use of proceeds | | We estimate that the net proceeds from this offering will be approximately $4.6 million (or approximately $5.5 million if the underwriters exercise their option to purchase additional shares in full) from the sale of the shares of common stock offered by us in this offering, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds from this offering for (i) investment in strengthening our cross-border supply chain capabilities, (ii) marketing activities to grow our customer base, (iii) strategic investments and potential mergers and acquisitions in the future, and (iv) general corporate purposes. See “Use of Proceeds” for additional information. |

Lock-up | | We, our executive officers, directors, and stockholders of our common stock prior to the offering, collectively, have agreed with the underwriters not to sell, transfer or dispose of any shares or similar securities for a period of 180 days following the closing of this offering. See “Shares Eligible for Future Sale” and “Underwriting.” |

Representatives’ Warrants | | Upon the closing of this offering, we will issue to The Benchmark Company, LLC (“Benchmark”) and Axiom Capital Management, Inc. (“Axiom”), as representatives of the underwriters, warrants entitling the representatives to purchase a total of 5% of the aggregate number of shares issued in this offering, including any shares to be exercised under the over-allotment option. The warrants shall be exercisable for a period of five years commencing six (6) months from the completion of this offering and shall be exercisable at a price per share equal to 100% of the initial public offering price. For additional information, please refer to the “Underwriting” section. |

Transfer Agent and Registrar | | Transhare Corporation |

Risk Factors | | You should carefully read and consider the information set forth in the section titled “Risk Factors,” together with all of the other information set forth in this prospectus, before deciding whether to invest in our common stock. |

Nasdaq trading symbol | | “LSH” |

The number of shares of our common stock that will be outstanding after this offering is based on 6,000,000 shares of common stock outstanding as of the date of this prospectus, after giving effect to the 1-for-120 forward stock split of our issued and outstanding common stock effected on March 29, 2024.

Except as otherwise indicated, all information in this prospectus reflects and/or assumes no exercise by the underwriters of their option to purchase additional shares of common stock from us in this offering.

5

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The following summary of historical financial and operating data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the accompanying notes included elsewhere in this prospectus. We have derived the summary consolidated statements of operations data for the fiscal years ended June 30, 2023 and 2022 and consolidated balance sheet data as of June 30, 2023 from our audited consolidated financial statements included elsewhere in this prospectus. The following summary consolidated statements of operations data for the three and nine months ended March 31, 2024 and 2023, and summary consolidated balance sheet data as of March 31, 2024, have been derived from our unaudited interim condensed consolidated financial statements included elsewhere in this prospectus and have been prepared on the same basis as our audited consolidated financial statements and include all adjustments, consisting only of normal and recurring adjustments, that we consider necessary for a fair statement of our financial position and results of operations for the periods presented. Our historical results are not necessarily indicative of the results that may be expected in the future.

| | For the Nine

Months Ended

March 31,

2024

(unaudited) | | For the Nine

Months Ended

March 31,

2023

(unaudited) | | For the Three

Months Ended

March 31,

2024

(unaudited) | | For the Three

Months Ended

March 31,

2023

(unaudited) | | For the Fiscal

Year Ended

June 30,

2023 | | For the Fiscal

Year Ended

June 30,

2022 |

Summary Consolidated Statements of Operations Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Revenues | | $ | 13,525,342 | | | $ | 8,777,930 | | | $ | 4,460,763 | | | $ | 3,300,976 | | | $ | 12,872,891 | | | $ | 9,605,536 | |

Gross profit | | | 2,687,615 | | | | 1,722,872 | | | | 975,564 | | | | 538,732 | | | | 2,564,289 | | | | 1,808,905 | |

Operating expenses | | | 2,898,660 | | | | 1,814,341 | | | | 935,088 | | | | 827,220 | | | | 2,317,392 | | | | 1,926,665 | |

Income (loss) from operations | | | (211,045 | ) | | | (91,469 | ) | | | 40,476 | | | | (288,488 | ) | | | 246,897 | | | | (117,760 | ) |

Other income (expense),

net | | | 111,487 | | | | 594,678 | | | | 76,902 | | | | 408,317 | | | | 761,901 | | | | 114,871 | |

Income taxes expense | | | (130,735 | ) | | | (32,457 | ) | | | (104,610 | ) | | | (7,729 | ) | | | (65,068 | ) | | | — | |

Net income (loss) | | $ | (230,293 | ) | | $ | 470,752 | | | $ | 12,768 | | | $ | 112,100 | | | $ | 943,730 | | | $ | (2,889 | ) |

Earnings (loss) per share, basic and diluted | | $ | (0.04 | ) | | $ | 0.08 | | | $ | 0.00 | | | $ | 0.02 | | | $ | 0.16 | | | $ | — | |

Weighted average Ordinary Shares outstanding

(basic) | | | 6,000,000 | | | | 6,000,000 | | | | 6,000,000 | | | | 6,000,000 | | | | 6,000,000 | | | | 6,000,000 | |

Summary Consolidated Balance Sheet Data:

| | As of

March 31,

2024

(unaudited) | | As of

June 30,

2023 | | As of

June 30,

2022 |

Current assets | | $ | 3,125,006 | | $ | 2,435,814 | | $ | 1,574,327 |

Total assets | | | 6,436,587 | | | 5,471,946 | | | 5,154,464 |

Current liabilities | | | 4,598,403 | | | 2,774,366 | | | 2,532,944 |

Total liabilities | | | 5,798,811 | | | 4,617,186 | | | 5,075,994 |

Total equity | | $ | 637,776 | | $ | 854,760 | | $ | 78,470 |

6

Table of Contents

RISK FACTORS

Investing in the common stock involves a high degree of risk. You should carefully consider the following risks, as well as other information contained in this prospectus, before making an investment in our company. The risks discussed below could materially and adversely affect our business, prospects, financial condition, results of operations, cash flows, ability to pay dividends and the trading price of our common stock. We may face additional risks and uncertainties aside from the ones mentioned below. There may be risks and uncertainties that we are unaware of, or that we currently do not consider material, that may become important factors that adversely affect our business in the future. Any of the following risks and uncertainties could have a material adverse effect on our business, financial condition, results of operations and ability to pay dividends. In such case, the market prices of the common stock could decline and you may lose part or all of your investment.

Risks Related to Our Business and Industry

Our business and growth are significantly affected by the development of international commerce, e-commerce and social commerce industries, as well as macroeconomic and other factors that affect demand for cross-border supply chain solutions and services, in the U.S. and globally.

We are a U.S.-based integrated cross-border supply chain solution provider with a strategic focus on the Asian market including China and South Korea. Our customers are typically Asia- and U.S.-based logistics service companies serving large e-commerce platforms, social commerce platforms and manufacturers to sell and transport consumer and industrial goods made in Asia into the U.S. As such, our business and growth are highly dependent on the viability and prospects of international commerce, as well as the domestic and international e-commerce and social commerce industries. Any uncertainties relating to the growth, profitability and regulatory oversight of international commerce, e-commerce or social commerce industries could have a significant impact on us. The developments of international commerce, e-commerce and social commerce industries are affected by a number of factors, most of which are beyond our control. These factors include, but are not limited to:

• the consumption power and disposable income of consumers, as well as changes in demographics and consumer tastes and preferences;

• the potential impact of the COVID-19 and other pandemics on our business operations and the economy in the U.S. and elsewhere in the world generally;

• the growth of broadband and mobile Internet penetration and usage;

• the availability, reliability and security of e-commerce and social commerce platforms;

• the selection, price and popularity of products offered on e-commerce and social commerce platforms;

• the emergence of alternative channels or business models that better suit the needs of consumers;

• the development of logistics, payment and other ancillary services associated with international commerce, e-commerce and social commerce; and

• changes in laws and regulations, as well as government policies that govern international commerce, trade, e-commerce and social commerce industries.

International commerce, e-commerce and social commerce industries are highly sensitive to the changes of macroeconomic conditions, and consumers’ e-commerce and social commerce spending tends to decline during recessionary periods. Many factors beyond our control, including economic recessions, downturns in business cycles, inflation and deflation, fluctuation of currency exchange rate, volatility of stock and property markets, changes in interest rates, tax rates and other government policies, and increases in unemployment rates, can adversely affect international commerce, consumer confidence and spending behavior on e-commerce and social commerce platforms, which could in turn materially and adversely affect our growth and profitability. In addition, unfavorable changes in domestic and international politics, including military conflicts, political turmoil and social instability, may also adversely affect consumer confidence and spending behavior, which could in turn negatively impact our growth and profitability.

7

Table of Contents

Further, the cross-border supply chain solution industry has historically experienced cyclical fluctuations in operational and financial performance due to economic recessions, reductions in per capita disposable income and levels of consumer spending, downturns in the business cycles of customers, interest rate fluctuations and economic factors beyond our control. During economic downturns, whether in the U.S. or globally, reduced overall demand for cross-border supply chain services will likely result in decreased demand for our solutions and services and may exert downward pressures on our rates and margins. As we provide a significant portion of our supply chain solutions and logistics services for the international commerce, e-commerce and social commerce industries, if the online and offline retail channel integration trend or any other trend required for the development of international commerce, e-commerce or social commerce industry does not develop as we expect, our business prospects may be adversely affected. In periods of strong economic growth, demand for limited transportation resources can also result in increased network congestion and operational inefficiencies.

In addition, any deterioration in the economic environment subjects our business to various risks that may have a material impact on our operating results and future prospects. Any trade barriers, legal measures and exchange rate fluctuations may severely affect cross-border business activities or integrated supply chain solution providers that are highly sensitive to price changes. In such deteriorated economic environment, some of our customers may face difficulties in paying us, and some may go out of business. These customers may not complete their payments as quickly as they did in the past, if at all, which would have an adverse impact on our working capital. We may not be able to promptly adjust our expenses in response to changing market demands or match our staffing levels to our business needs, which may have an adverse impact on our profitability.

We face intense competition which could adversely affect our results of operations and market share.

We offer a wide variety of integrated services within cross-border ocean freight solutions and cross-border airfreight solutions, including (i) cross-border freight consolidation and forwarding services, (ii) customs clearance services, (iii) warehousing and distribution services and (iv) U.S. domestic ground transportation services. The industries we operate in are highly competitive and fragmented. As a result, we may compete with a broad range of companies, such as integrated supply chain solution and service providers, cross-border freight delivery service providers, customs clearance services providers, U.S. domestic ground transportation service providers and other bonded warehouses. Specifically, there are multiple existing market players that offer integrated supply chain solutions and logistics services, and there may be new entrants emerging in each of the markets we operate in, which compete to attract, engage, and retain consumers and merchants. These companies may have greater financial, technological, research and development, marketing, distribution, and other resources than we do. They may have longer operating histories, a larger customer base or broader and/or deeper market coverage. As a result, our competitors may be able to respond more quickly and effectively to new or evolving opportunities, technologies, standards, or user requirements than we do and may have the ability to initiate or withstand significant regulatory changes and industry evolvement. Furthermore, when we expand into other markets, we will face competition from new competitors, domestic or foreign, who may also enter markets where we currently operate or plan to operate.

Any significant increase in competition may have a material adverse effect on our revenues and profitability as well as on our operations and business prospects. We cannot assure you that we will be able to continuously distinguish our services from those of our competitors, preserve and improve our relationships with various participants in the supply chain solution industry, or increase or even maintain our existing market share. We may experience the loss of market share, and our financial condition and results of operations may deteriorate if we fail to compete effectively.

In addition, new partnerships and strategic alliances in the supply chain solution industry also can alter market dynamics and adversely impact our businesses and competitive positioning. Our current and potential competitors may also establish cooperative or strategic relationships amongst themselves or with third parties that may further enhance their resources and offerings. If we are unable to anticipate or react to these competitive challenges, our competitive position could be undermined, and we could experience a decline in growth which may adversely affect our business, financial condition, and results of operations.

8

Table of Contents

We face risks associated with our service providers and their personnel.

We have established an extensive and long-standing collaboration network of service providers. For example, since inception and as of March 31, 2024, we had collaborated with almost all major global ocean and air carriers to serve over 300 customers to forward cross-border shipments consisting of over 29,800 TEU of container loads and 41,800 tons of air cargo. In addition, as of March 31, 2024, we had cooperated with over 200 domestic ground transportation carriers, including almost all major U.S. domestic ground transportation carriers, on a long-term, short-term or order basis, as the case may be.

As the cross-border freight of our customers moves in the network of our service providers from pickup, transportation to delivery, the performance of our service providers may affect our brand image.

We do not directly supervise the day-to-day operations of our service providers. We typically manage our collaboration with them through contractual agreements, which provide for performance incentives along with periodic evaluations. We may not be able to manage such service providers, as well as their own employees, as effectively as if we had full ownership of them or operated their businesses directly. Although we have established and distributed service standards across our network of service providers from time to time, we may not be able to successfully monitor, maintain and improve them. Their failure to provide satisfactory services may adversely impact our reputation and brand image. Furthermore, our service providers may fail to implement sufficient control over the performance of pickup, transportation and delivery personnel, adherence to customer privacy standards and timely delivery of parcels. We and our service providers may suffer financial losses, incur liabilities and suffer reputational damages in the event of theft or late delivery of freight or mishandling of customer privacy.

Suspension or termination of the services of our service providers in a particular geographic area may cause interruption to or suspension of our services in the corresponding geographic area. Our service providers may suspend or terminate their services voluntarily or involuntarily due to various reasons, including disagreement or dispute with us, failure to make a profit, failure to maintain requisite approvals, licenses or permits or to comply with governmental regulations, and events beyond our or their control, such as inclement weather, natural disasters, transportation interruptions or labor unrest or shortage. Due to the intense competition in the cross-border supply chain solution industry, our existing service providers may also choose to discontinue their cooperation with us and work with our competitors instead. We may not be able to promptly replace our service providers or find alternative ways to provide relevant services in a timely, reliable and cost-effective manner, or at all. As a result of any service disruptions associated with our service providers, our customer satisfaction, reputation, operations and financial performance may be materially and adversely affected.

COVID-19 significantly impacted worldwide economic conditions and global trade and may continue to have a disruptive effect on our operations, and the operations of our service providers and our customers, which may further impact our business.

We may be impacted by residual effects of the COVID-19 pandemic or a new and similarly disruptive global health emergency. In early 2020, COVID-19 was declared a global health emergency and later declared a global pandemic by the World Health Organization, prompting governments around the world to mandate lockdowns and other restrictions that had direct impacts on international trade. The COVID-19 pandemic and various government reactions to it contributed to shortages of labor and capacity, and increased costs that continue to impact our operations. While many of the COVID-19 restrictions have been eased or discontinued entirely, various protocols and policies continue to be implemented or contemplated in 2023, as a resurgence of COVID-19 remains a possibility. There is no guarantee that a continuation or resurgence of COVID-19 or a variant, or a similarly disruptive health emergency, would not impact our operations. Any significant disruption on the scale of the COVID-19 pandemic over an extended period could negatively affect our business and our financial results. Such a disruption could also have the effect of heightening many of the other risks described below.

We rely on a variety of service providers, such as global ocean and air freight carriers as well as U.S. domestic ground transportation carriers, and if they become financially unstable or have reduced capacity to provide service because of COVID-19 or other factors, it may adversely impact our business, financial condition and results of operations.

As an integrated cross-border supply chain solution provider, we depend on a variety of service providers, including global ocean and air freight carriers, U.S. domestic ground transportation carriers and others. The quality and profitability of our integrated cross-border supply chain solutions and services depend upon effective selection and

9

Table of Contents

oversight of our service providers. For example, during the pandemic, airfreight carriers have been particularly affected, such as having to cancel flights due to travel restrictions resulting in dramatic drops in revenues, historical losses, high leverage and liquidity challenges. Delays and congestions at various ports as a result of COVID-19 restrictions during the pandemic also prolonged the delivery times for certain of our cross-border freight. Additionally, ocean freight carriers have undergone mergers and consolidations with the potential for more to occur in the future, which may result in reduced carrier capacity or availability. Disruptions such as COVID-19 place significant stress on our global ocean and air freight carriers, U.S. domestic ground transportation carriers as well as other service providers, which may result in reduced carrier capacity or availability, pricing volatility or more limited carrier transportation schedules and other services that we utilize, which could adversely impact our business, financial condition and results of operations.

Global economic uncertainty impacted international trade and could affect demand for our services or the financial stability of our service providers and customers.

The global economy entered a recession as a result of the pandemic, which could affect international trade and negatively affect demand for our cross-border supply chain solutions and services. Future unfavorable economic conditions, rising interest rates and high inflation could result in lower freight volumes, reduced sell rates, higher operating expenses and may adversely affect our revenues, operating results and cash flows. These conditions, should they occur for an extended period of time, could adversely affect our customers and service providers. Should our customers’ ability to pay deteriorate, additional credit losses may be incurred.

Our historical results of operations and financial performance are not indicative of future performance.

For the fiscal year ended June 30, 2023, our total revenues increased by 34.0% to $12.9 million from $9.6 million for the fiscal year ended June 30, 2022, and our gross profits increased by 41.8% to $2.6 million from $1.8 million for the fiscal year ended June 30, 2022. For the nine months ended March 31, 2024, our total revenues increased by 54.1% to $13.5 million from $8.8 million for the nine months ended March 31, 2023, and our gross profits increased by 56.0% to $2.7 million from $1.7 million for the nine months ended March 31, 2023. Although our business has grown rapidly, our historical results of operations and financial performance may not be indicative of our future performance. In addition, we cannot assure you that we can continue to operate under our existing business models successfully. As the market and our business evolve, we may modify our operations, data and technology, sales and marketing as well as solutions and services. These changes may not achieve expected results and may have a material and adverse impact on our results of operations and financial condition. We expect our expenses to continue to increase in the future as we expand our business. Our expenses may grow faster than our revenues, and our expenses may be greater than we expected. We cannot assure you that we will be able to achieve similar results or grow at the same speed as we did in the past or at all. Rather than relying on our historical operating and financial results to evaluate us, you should consider our business prospects in light of the risks and difficulties we may encounter as a company in its ramp-up stage of development and operating in emerging and dynamic industries, including, among other factors, our ability to attract and retain customers; our ability to create value propositions for our service providers; our ability to navigate in the evolving regulatory environment; our ability to provide high-quality and satisfactory integrated cross-border supply chain services; our ability to build up our reputation and promote our brand; and our ability to anticipate and adapt to changing market conditions. We may not be able to successfully address these risks and difficulties, which could significantly harm our business, results of operations and financial condition.

Failure to successfully implement our business strategies, effectively respond to changes in market dynamics or satisfactorily meet customer demands could materially and adversely affect our future financial results.

We may make significant investments and other decisions in connection with our long-term business strategies such as to expand the breadth and depth of our solution and service offerings and to further upgrade the supply chain technologies that we utilize. Such initiatives and enhancements may require us to make significant capital expenditures. Additionally, in developing business strategies, we make certain assumptions including, but not limited to, those related to customer demand and preferences, competition landscape as well as the economy in the U.S., Asia and globally. However, the actual market, economic and other conditions may be different from our assumptions. As technologies, customer behaviors and market conditions continue to evolve, it is important that we maintain the relevance of our brand as well as our solution and service offerings to our customers. If we are not able to successfully implement our business strategies and effectively respond to changes in market dynamics, our future financial results may be materially and adversely affected. We have also incurred, and may continue to incur, increased operating expenses in connection with certain changes to our business strategies.

10

Table of Contents

In addition, our planning and spending decisions, including capacity expansion, procurement commitments, personnel needs, and other resource requirements, are primarily made based on our estimate of customer demands. We may not always be able to estimate such demands accurately. For example, if we underestimate our customer demands during our peak periods, we may experience capacity and resource shortages in fulfilling customer orders during such periods. Failure to meet customer demands in a timely fashion or at all will adversely affect our competitive position, financial condition and results of operations.

We may not be familiar with new regions or markets we enter and may not be successful in maintaining our current growth in such regions or markets.

We are a U.S.-based integrated cross-border supply chain solution provider with a current strategic focus on the Asian market including China and South Korea, while we intend to further expand our business footprint and enter into new regions and markets. Our revenue grew by 34.0% in the fiscal year ended June 30, 2023 from the fiscal year ended June 30, 2022 and by 54.1% in the nine months ended March 31, 2024 from the nine months ended March 31, 2023. However, we may be unable to replicate our current success in new markets. In expanding our business, we may enter markets in which we may have limited or no experience. We may fail to attract a sufficient number of customers due to our limited presence in that region. In addition, competitive conditions in new markets may be different from those in our existing markets and may make it difficult or impossible for us to generate high income in these new markets. If we are unable to manage such difficulties in our expansion into other regions or markets, our business, financial condition, results of operations and prospects may be adversely affected.

The cross-border supply chain solution industry has its own set of risks, including operational inefficiencies, lack of digital culture and training, disruptive labor relations and operational costs. Our provision of integrated cross-border supply chain solutions and services to customers may be adversely impacted due to these factors.

The cross-border supply chain solution industry has its own set of risks, including operational efficiencies, lack of digital culture and training, labor relations and operational costs. We dedicate to providing integrated cross-border supply chain solutions and services to our customers. The provision of these integrated cross-border supply chain solutions and services may also depend on various industry-inherent factors such as our ability to coordinate with our service providers and customers, the services and labor relations of our service providers, the operational efficiencies at our facilities, our ability to hire qualified personnel, our development of digital integration, and our ability to control and manage costs. If we are unable to manage any of such industry-inherent factors, our provision of cross-border supply chain solutions and services may be adversely affected.

Our long-term growth and competitiveness are highly dependent on our ability to control costs.

Our long-term growth, competitiveness and results of operations are affected by our ability to control costs including labor and lease costs, which may be subject to factors, including, among other things, fluctuations in wage rates and leasing costs. Any unexpected increase in our costs due to factors beyond our control, could adversely impact our profitability. Effective cost control measures have a direct impact on our financial condition and results of operations. We have adopted and expect to adopt additional cost control measures. However, the measures we have adopted or will adopt in the future may not always be as effective as expected. If we are not able to effectively control our costs and adjust the level of fee rates of our integrated cross-border supply chain solutions and services based on varied operating costs and market conditions, our profitability and cash flow may be adversely affected.

Any lack of requisite approvals, licenses or permits applicable to our business operation may have a material adverse impact on our business, financial condition and results of operations.

Our business is subject to certain regulations, and we are required to hold or complete a number of licenses, permits and filings in connection with our business operation, including, but not limited to, container freight station, non-vessel operating common carrier (“NVOCC”), indirect air carrier certification, Freight Broker License, and Standard Carrier Alpha Code. We must also obtain a license from the Federal Maritime Commission (“FMC”) by filing Form FMC-18. Failure to satisfy these requirements may result in penalties, orders to rectify, fines, or suspension of business for remediation. We hold or complete, as applicable, all material licenses, permits and filings for our current operation and will apply for certain permits and filings with the government authorities if needed

11

Table of Contents

in the future. Please see “Business — Government Regulations” for more information regarding the licenses and permits we have obtained and filings we have made. However, we cannot assure you that we will be able to complete such filings in a timely manner, or at all, due to complex procedural requirements and the expansion of our business.

As an integrated cross-border supply chain solution provider, a substantial portion of our business operations consist of freight forwarding, particularly international freight forwarding. According to FMC, all international freight forwarding agencies and their branches must be filed with or licensed by the Bureau of Certification and Licensing of FMC. Air freight forwarders should operate as indirect air carriers and hold indirect air carrier numbers, overseen by the Transportation Security Administration. Companies may file a Form FMC-18 in either paper or electronic format to complete the license application. Entities engaging in international freight forwarding operations who do not complete or maintain the filing will be subject to fines, denial, revocation or suspension of an ocean transportation intermediary license. In addition, we, as an integrated cross-border supply chain solution provider, also provide our service as an NVOCC. Under FMC, a U.S.-based NVOCC shall obtain a license from the FMC by filing form FMC-18.

The information contained in the licenses, permits, records or filings that we possessed may not be updated in a timely manner due to changes in any registered information of our subsidiaries, such as their domicile address, registered capital and type of entity, company name (including additions or removals of trade names), business structure change, and we will apply for these changes of registration as required. However, we cannot guarantee that we will complete such change of registration in time or at all and any failure to complete the change of registration in a timely manner may result in fines and penalties.

New laws and regulations may be enforced from time to time to require additional licenses and permits other than those we currently have or provide additional requirements on the operation of our business. If we do not receive, complete or maintain necessary approvals or filings, or we inadvertently conclude that such approvals or filings are not required, or there is a change in the applicable laws, regulations, or interpretations such that we need to make filings or obtain approvals in the future, we may be subject to (i) investigations by competent regulatory authorities, (ii) fines or penalties, (iii) orders to suspend our operations and to rectify any non-compliance, or (iv) prohibitions from engaging in relevant businesses and even securities offerings. These risks could result in material adverse changes in our operations, significantly limit or completely hinder our ability to offer or continue to offer securities to investors, or cause such securities to significantly decline in value or become worthless.

Our business and results of operations may be materially and adversely affected if we or our service providers become unable to provide relevant services in a timely, reliable, safe and secure manner.

The success of our business largely depends on our ability to maintain and further enhance the quality of our supply chain solutions and services. Together with our service providers such as cross-border freight forwarding carriers, customs brokerage experts and U.S. domestic ground transportation carriers, we provide integrated cross-border supply chain solutions and services to our customers. If we, or our service providers become unable to provide relevant services in a timely, reliable, safe and secure manner, our reputation and customer loyalty could be negatively affected. In addition, if our customer service personnel fail to satisfy customer needs or respond effectively to customer complaints, we may not be able to retain our existing customers or attract prospective customers and may experience a decrease in our supply chain solution orders, which could have a material adverse effect on our business, financial condition and results of operations. See also “— We face risks associated with our service providers and their personnel.”

As substantially all of the container loads and air cargo space we source are non-committed purchases, there can be no assurance that we will be able to obtain sufficient container loads or air cargo space on routes that meet our customers’ specific demands, or at all.

Since our inception, substantially all of the container loads and air cargo space we source from our cross-border freight forwarding carriers such as ocean shipping carriers, airlines as well as other sizable ocean and air freight forwarders for our cross-border freight consolidation and forwarding services are on a non-committed basis and are subject to the availability of their shipping vessels and aircrafts. There can be no assurance that we will be able to source sufficient container loads or air cargo space on all routes upon our customers’ requests. If we cannot obtain sufficient container loads and air cargo space from our service providers to meet our customers’ specific demands, in particular during peak periods, our reputation within the network of industry players and our results of operations could be adversely affected.

12

Table of Contents

Fluctuations in the rates of container loads and air cargo space could adversely impact our business, financial condition and results of operations.

The rates of container loads and air cargo space for our cross-border freight consolidation and forwarding services may fluctuate based on market conditions. If we cannot adjust the corresponding rates that we charge our customers in time to reflect such fluctuations accordingly, the number of our supply chain solution orders and/or our gross profit may decrease, and our business, financial condition and results of operations may be materially and adversely affected. In addition, we generally enter into block space agreements with our freight forwarding service carriers such as ocean shipping carriers, airlines as well as other sizable ocean and air freight forwarders, whereby we are committed to purchasing a fixed number of containers or amount of cargo space at pre-determined rates regardless of the actual volume that we utilize and resell to our customers. Although we have not experienced any situations where we cannot fully utilize the pre-determined containers or cargo space, we cannot assure you that we will not encounter any of such situations in the future. If at the time when we fix our terms with our customers, the prevailing market rates of container loads or air cargo space fall below the pre-determined rates provided under the block space agreements, we may not be able to charge our customers at rates higher than the ones provided under our block space agreements, and our gross profit may be materially and adversely affected.

If we cannot utilize the container loads or air cargo space allocated to us under the block space agreements with our freight forwarding service providers, we may not be able to fully recover the costs of the relevant container loads or air cargo space, and our results of operations may be adversely impacted.

For our cross-border freight consolidation and forwarding services, we generally enter into block space agreements with our freight forwarding service providers such as ocean shipping carriers, airlines as well as other sizable ocean and air freight forwarders in order to ensure we obtain an assured level of container loads and air cargo space at a relatively fixed price. However, we may not be able to fully utilize the container loads or air cargo space that we purchase from such freight forwarding service providers under the block space agreements at all times. If we cannot resell the container loads and air cargo space allocated to us under the block space agreements to our customers in full, we may not be able to fully recover the costs of the relevant container loads and air cargo space, and our financial condition and results of operations may be adversely impacted.

Any disruption to the operation of our regional warehousing and distribution centers could have a material adverse effect on our business, financial condition and results of operations.

We operate two massive and hyper-busy regional warehousing and distribution centers in Illinois and Texas with an aggregate gross feet area of approximately 75,014 square feet. Natural disasters or other unanticipated catastrophic events, including power interruptions, water shortage, storms, fires, environmental pollution, earthquakes, terrorist attacks and wars, as well as changes in governmental planning for the land underlying these regional warehousing and distribution centers, could damage or destroy our cross-border freight at these facilities that requires storage, fulfilment, transloading, palletizing, packaging or distribution, and significantly impair our business operations. We may not be able to identify suitable replacement warehousing and logistics facilities that meet our requirements in a timely manner, should any of the foregoing occur. If we are unable to identify suitable replacement warehousing and logistics facilities, we may not be able to offer the warehousing and distribution services that can meet our customers’ demand and our financial condition and results of operations may be adversely impacted.

If we are unable to utilize our regional warehousing and distribution centers effectively, our business, financial condition and results of operations may be adversely affected.

As part of our integrated cross-border supply chain solutions, we offer warehousing and distribution services at our two regional warehousing and distribution centers in Illinois and Texas. The continued growth of our integrated cross-border supply chain solution business depends in part on our ability to maintain efficient and effective operation of these regional warehousing and distribution centers, including to: (i) obtain adequate funding for development and improvement of these centers; (ii) accurately estimate the customer demand in new centers; (iii) successfully promote these centers; and (iv) hire and retain skilled management and employees, especially qualified warehousing and distribution managers through our training and promotion, on commercially reasonable terms. Adverse changes in the economic conditions and any material decline in demand of our warehousing and distribution services may lead to excess capacity at our warehousing and distribution centers. If we are unable to utilize excess capacity on hand, we may incur losses which could materially and adversely affect our business, financial condition and results of operations.

13

Table of Contents

If we are unable to manage the expansion of our supply chain infrastructure successfully, our business prospects and results of operations may be materially and adversely affected.

As of March 31, 2024, we had a workforce of 49 full-time employees across various functions. We may expand our supply chain infrastructure to increase our operational capacity and to restructure and reorganize the workflow and processes therein. We may also establish centers in additional cities, states and countries to further enhance our warehousing and distribution capacity. As we continue to enhance capability, our supply chain infrastructure may become increasingly complex and challenging to operate. We cannot assure you that we will be able to set up additional warehousing and distribution centers or lease suitable facilities on commercially acceptable terms or at all. Moreover, we may not be able to recruit a sufficient number of qualified employees in connection with the expansion of such supply chain infrastructure. In addition, the expansion of our supply chain infrastructure may strain our managerial, financial, operational and other resources. If we fail to manage such expansion successfully, our growth potential, business and results of operations may be materially and adversely affected. Even if we manage to expand our supply chain infrastructure successfully, we may not obtain the competitive advantage that we expect.

We face risks associated with the cross-border freight that we handle, including real or perceived quality or health issues, and risks inherent in the supply chain industry, including personal injury, product damage, and transportation-related incidents.

We handle a large volume of freight during the provision of our integrated cross-border supply chain services and face challenges with respect to the protection and examination of such freight. Freight that we and/or our service providers handle may be delayed, stolen, damaged or lost during the transportation due to various reasons beyond our control, and we may be perceived or found liable for such incidents. In addition, we may not be able to fully screen and detect unsafe, prohibited or restricted items within the freight that we handle. Unsafe items, such as flammables and explosives, toxic or corrosive items and radioactive materials, may damage other freight, harm the personnel and facilities of us or our service providers, or even injure the recipients. Furthermore, if we fail to prevent prohibited or restricted items from entering into our cross-border supply chain network and if we participate in the transportation and delivery of such items unknowingly, we may be subject to administrative penalties, and if any personal injury or property damage is concurrently caused, we may also be liable for civil compensation.

The transportation of cross-border freight also involves inherent risks. The insurance maintained by us or our service providers may not fully cover the liabilities caused by transportation-related injuries or losses during the cross-border freight forwarding or the U.S. domestic ground transportation. From time to time, the shipping vessels, aircrafts, vehicles or personnel of our service providers may be involved in transportation accidents, and freight carried by them may be lost or damaged. In addition, frictions or disputes may occasionally arise during the pickup or delivery of freight. Personal injuries or property damages may arise if such incidents escalate.

Any of the foregoing could disrupt our solutions and services, cause us to incur substantial expenses and divert the time and attention of our management. We may face claims and incur significant liabilities if found liable or partially liable for any of injuries, damages or losses. Furthermore, if the services by us or our service providers are perceived to be insecure or unsafe by our customers, the volume of our integrated cross-border supply chain solutions orders may be significantly reduced, and our business, financial condition and results of operations may be materially and adversely affected.

We may fail to make necessary acquisitions or investments or enter desirable strategic alliances, and we may not be able to achieve the anticipated benefits from such acquisitions, investments or strategic alliances.

Our strategy for long-term growth, productivity and profitability depends in part on our ability to make prudent decisions to make strategic acquisitions or investments or enter desirable alliances and to realize the benefits we expect when we make those investments or acquisitions. We may evaluate and consider strategic acquisitions and investments or enter strategic alliances to develop new services or solutions, with an aim to enhance our competitive position and achieve long-term growth, productivity and profitability. However, we cannot assure you that we will make prudent decisions on such acquisitions, investments, strategic alliances at all times. In addition, investments or acquisitions involve numerous risks, including (i) potential failure to achieve the expected benefits of the integration or acquisition, (ii) difficulties in, and the cost of, integrating operations, technologies, services and personnel, (iii) potential write-offs of acquired assets or investments and (iv) downward effect on our operating results. These transactions will also divert management’s time and resources from our normal course of operations, and we may have to incur unexpected liabilities or expenses. Strategic alliances with third parties could also subject us to a

14

Table of Contents

number of risks, including risks associated with potential leakage of proprietary information, non-performance by the counterparty and an increase in expenses incurred in establishing new strategic alliances, any of which may materially and adversely affect our business.

If we cannot successfully execute or effectively operate, integrate, leverage and grow the acquired businesses or strategic alliances, our financial results and reputation may be materially and adversely affected. While we expect our future acquisitions, investments or strategic alliances to further enhance our value propositions to customers and improve our long-term profitability, there can be no assurance that we will realize our expectations within the time frame we envisage, if at all, or that we can continue to support the values we allocate to these acquired, invested or alliance businesses, including their goodwill or other intangible assets.

We may not be able to obtain additional capital when desired, on favorable terms or at all.

We may require additional capital resources to fund future growth and the development of our businesses, including investments in equipment, land, facilities and technological systems to remain competitive. If our capital resources are insufficient to satisfy our cash requirements, we may seek to issue additional equity or debt securities or obtain new or expanded credit facilities. Our ability to obtain external financing in the future is subject to a variety of uncertainties, including our future financial condition, results of operations, cash flows, stock price performance, liquidity of domestic and international capital and lending markets, governmental regulations over foreign investment and the cross-border supply chain industry. In addition, incurring indebtedness would subject us to increased debt service obligations and could result in operating and financing covenants that would restrict our operations. There can be no assurance that financing will be available in a timely manner or in amounts or on terms acceptable to us, or at all. Any failure to raise needed funds on terms favorable to us, or at all, could severely restrict our liquidity as well as have a material adverse effect on our business, financial condition and results of operations. Moreover, issuance of equity or equity-related securities could result in significant dilution to our existing stockholders.

Failure to renew our current leases or locate desirable premises for our facilities, or challenges on the use of certain leased properties by us or our service providers, could materially and adversely affect our business, financial condition and results of operations.

We lease properties for our facilities including offices and regional warehousing and distribution centers. Some of our service providers also lease properties for operation facilities such as offices, pickup and delivery outlets and service stations. We are mindful that such lease agreements are subject to local real estate laws and regulations, which, along with market conditions, may impact our ability and/or the ability of our such service providers to extend or renew such leases upon expiration of the current term on commercially reasonable terms or at all, and we and/or our service providers may therefore be forced to relocate the affected operations. This could disrupt our operations and result in significant relocation expenses, which could adversely affect our business, financial condition and results of operations. Even if we are able to extend or renew our leases, rental payments may significantly increase as a result of the high demand for the leased properties. In addition, as our operations further scale, we may need to expand our existing regional warehousing and distribution centers or establish new centers to meet our increased operational demands. We may compete with other businesses for premises at certain locations of desirable sizes, and it can be difficult for us to find suitable premises or locate desirable alternative sites that meet all of our requirements, and such failure in relocating our affected operations could adversely affect our business, financial condition and results of operations.

If our customers reduce their expenditures on outsourcing cross-border supply chain services or increase utilization of their internal solutions, our business, financial condition and operating results may be materially and adversely affected.

Our customers are typically Asia- and U.S.-based logistics service companies serving large e-commerce platforms, social commerce platforms and manufacturers to sell and transport consumer and industrial goods made in Asia into the U.S. Our growth strategy is partially based on the assumption that their outsourcing of all or part of their cross-border supply chain services will continue. Third-party cross-border supply chain solution providers like us are generally able to provide such services more efficiently than otherwise could be provided “in-house,” primarily as a result of our expertise, technology and lower and more flexible employee cost structure. However, many factors could cause a reversal in such trend. For example, our customers may see risks in relying on and outsourcing all or part of their cross-border supply chain services to third-party providers, or they may begin to define these activities as within their own core competencies and decide to perform relevant supply chain operations on their own. If our customers are able to improve the cost structure of their in-house activities related to integrated cross-border supply chain solutions and services, including in particular labor-related costs, our solutions

15

Table of Contents

and services may no longer be deemed an attractive alternative to meet their cross-border supply chain needs. In addition, if our customers reduce expenditures on outsourcing cross-border supply chain services and switch to performing significant aspects of their supply chain operations in-house, or if our prospective customers who may have conducted cross-border supply chain activities on their own have no further demands for outsourcing, our business, financial condition and results of operations may be materially and adversely affected.

Our business is in part dependent upon our customers’ business performance and their continuing outsourcing and demand of cross-border supply chain solutions and services.

As an integrated cross-border supply chain solution provider, we primarily provide customized cross-border ocean freight solutions and airfreight solutions in the U.S. that specifically cater to our customers’ requirements and needs in transporting goods into the U.S., and our customers are typically Asia- and U.S.-based logistics service companies serving large e-commerce platforms, social commerce platforms and manufacturers to sell and transport consumer and industrial goods made in Asia into the U.S. Our business is therefore in part dependent upon the business performance and developments of our customers and the end customers that our customers serve in their markets and industries. Any decline in the business performance and developments of our customers or the end customers that they serve, or any adverse change in their decisions to outsource cross-border supply chain solutions and services, could lead to a corresponding decrease in demand for our solutions and services and may therefore adversely affect our business, financial condition and results of operations.

Increased inspection procedures and tighter import and export controls could increase our costs and disrupt our business.

Cross-border freight is subject to various security and customs inspections and related procedures in countries of origin, destination, and trans-shipment points. As a U.S.-based integrated cross-border supply chain solution provider that primarily provides customized cross-border ocean freight solutions and airfreight solutions in the U.S. that specifically cater to customers’ requirements and needs in transporting goods into the U.S., we adhere to and maintain compliance with U.S. customs and border protection regulations. Increased inspection procedures may result in the seizure of the freight for which we provide cross-border supply chain services, delays in the trans-loading, transportation or delivery of such freight and levying of customs duties, fines, or other penalties against us, our service providers or our customers, in certain cases, rendering the cross-border forwarding or U.S. domestic transportation of certain freight uneconomical or impractical. Further, inspection-related delays or incidents may subject us to additional costs of operations as well as financial and legal obligations to our customers and may adversely impact our reputation.

If we are unable to collect our receivables from our existing customers, our results of operations and cash flows could be adversely affected.