Fiscal Years Ended June 30, 2023 and June 30, 2024

Revenue and other operating income. We have not yet commenced natural gas production. Therefore, we did not realize any revenue and other operating income during fiscal years 2023 and 2024, respectively.

Compensation and benefits, including stock based compensation. Compensation and benefits, including stock based compensation, decreased by $0.9 million during fiscal year 2024, as compared to fiscal year 2023, due primarily to forfeiture of options during the period and, although the company increased headcount as compared to the prior period, the compensation of the majority of those employees has been capitalized to unproven properties.

Consultancy, legal and professional fees. Consultancy, legal and professional fees increased by $2.6 million during fiscal year 2024, as compared to fiscal year 2023, due to increased costs related to significant capital raising activities and related transactions including preparation for a U.S. initial public offering in addition to consulting costs related to government and community relations and midstream activities.

Loss on sale of assets classified as held for sale. Loss on sale of assets classified as held for sale decreased by $12.6 million during fiscal year 2024, as compared to fiscal year 2023, due to a write down of two rigs in the prior period which did not recur.

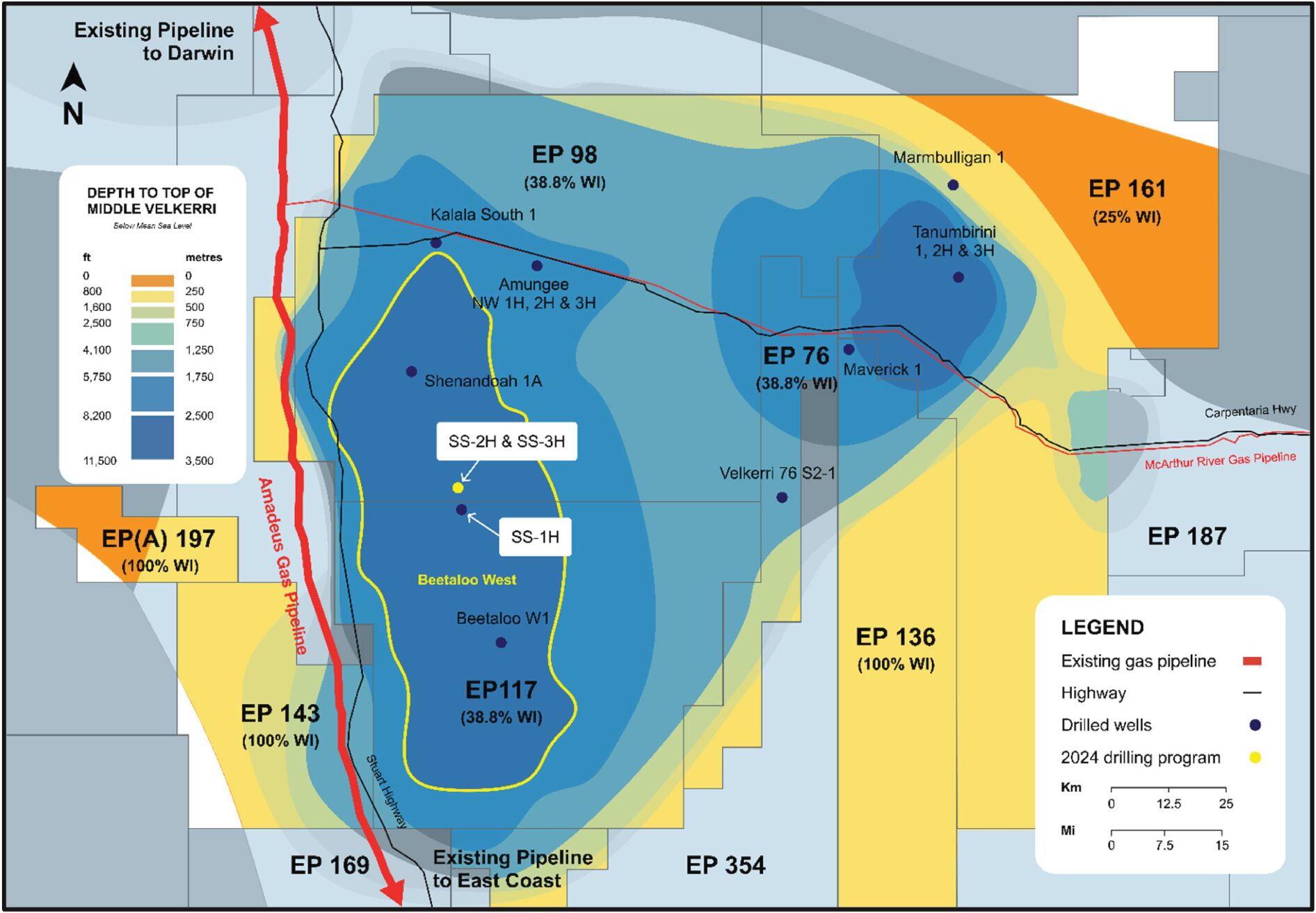

Accretion of asset retirement obligations expense. For fiscal year 2024, an expense for accretion of asset retirement obligations of $0.9 million was recognized. The recognition of such an expense was due to the accretion of asset retirement obligation liabilities in relation to all EPs, inclusive of EPs 76, 98, 117, 136 and 161, including for the two new wells drilled during the period.

Exploration expense. Exploration expense decreased by $0.6 million during fiscal year 2024, as compared to fiscal year 2023, due to the focus of the Company on drilling our SS1H and A3H wells. Our exploration expense consisted of costs related to topographical, geographical and geophysical studies and other indirect expenditure.

General and administrative. General and administrative costs decreased by $0.3 million during fiscal year 2024, as compared to fiscal year 2023 as a result of overhead allocations recovery from the joint venture. Our general and administrative expense consisted of the following during fiscal years 2023 and 2024: expenses related to travel, insurance, and office and administrative fees.

Interest Income, net. Interest income, net increased by $0.7 million during fiscal year 2024, as compared to fiscal year 2023, due to interest received from term deposits during the period.

Loss on extinguishment of debt. For fiscal year 2024, an expense for loss on extinguishment of debt of $3.9 million was recognized. The recognition of such an expense was due to the extinguishment of payables to H&P in exchange of the issuance of the 5.5% Convertible Senior Note due 2029 between Helmerich & Payne International Holdings, LLC, Tamboran Resources Corporation, and the guarantors thereto dated June 4, 2024 (the “Convertible Note” which was converted to common stock upon the IPO.

Foreign currency translation. In fiscal year 2024, we recognized a foreign currency translation loss of $0.4 million, primarily due to slight weakening of the Australian Dollar as of June 30, 2024, as compared to July 1, 2023. In fiscal year 2023, we recognized a foreign currency translation gain of $1.6 million, primarily due to the acquisition of assets from Origin amounting to A$81.9 million on November 9, 2023 and the strengthening of the Australian Dollar from that date to June 30, 2023. Foreign exchange gains and losses resulting from the settlement of foreign currency transactions and from the translation at fiscal year-end exchange rates of monetary assets and liabilities denominated in foreign currencies are recognized on our income statement.

Income Tax Expense. We have no income tax expense due to operating losses incurred for fiscal years 2023 and 2024. We have provided a full valuation allowance on our net deferred tax asset because management has

77