STRICTLY CONFIDENTIAL – DO NOT DUPLICATE 1 Pearl Diver Credit Company Inc. (NYSE: PDCC) - Initial Public Offering Pearl Diver Credit Company Filed Pursuant to Rule 433 Issuer Free Writing Prospectus dated June 24, 2024 Registration No. 333 - 275147

STRICTLY CONFIDENTIAL – DO NOT DUPLICATE 2 Disclaimer This document should be read with a preliminary prospectus of Pearl Diver Credit Company Inc. (the “Company”). Investors are advised to carefully consider the investment objective, risks and charges and expenses of the Company before investing. A registration statement, which has been filed with the Securities and Exchange Commission (the “SEC”), and which is publicly available on EDGAR, contains this and other information about the Company and should be read carefully before investing. Copies of the registration statement and preliminary prospectus may be obtained for free by visiting EDGAR on the SEC website at www.sec.gov or from Kingswood Capital Partners, LLC, Attention: Capital Markets , 126 E 56 th Street, Suite 22S, New York, NY 10022, or by calling: 212 - 487 - 1080. An investment in the Company is speculative and involves a high degree of risk. There can be no guarantee that the Company’s investment objectives will be achieved. The Company may engage in other investment practices that may increase the risk of investment loss. An investor could lose all or substantially all of his or her investment. Please see th e “Risk Factors” section of the Company’s registration statement. The information herein and in the registration statement is not complete and may be changed. A registration statement relating to these securities has been filed with the SEC, but has not yet become effective. These securities may not be sold until the registration statement filed with the SEC is effective. These materials are not an offer to sell these securities and are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted or would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. These materials are not advice, a recommendation or an offer to enter into any transaction with the Company or any of its affiliates. This document does not purport to be complete and no obligation to update or otherwise revise such information is being assumed. Nothing shall be relied upon as a promise or representation as to the future performance of the Company. Such information is qualified in its entirety by reference to the more detailed discussions contained elsewhere in the preliminary prospectus and the Company’s registration statement. The Company’s securities do not represent a deposit or obligation of, and are not guaranteed or endorsed by, any bank or other insured depository institution, and are not insured by the FDIC, the Federal Reserve Board or any other government agency. You or your clients may lose money by investing in the Company. The Company is not intended to be a complete investment program and, due to the uncertainty inherent in all investments, there can be no assurance that the Company will achieve its investment objectives. Past performance is not indicative of, or a guarantee of, future performance. Nothing shall be relied upon as a promise or representation as to the future performance of the Company. Such information is qualified in its entirety by reference to the more detailed discussions contained elsewhere in the Company’s registration statement.

STRICTLY CONFIDENTIAL – DO NOT DUPLICATE 3 Forward - Looking Statements The following presentation includes certain forward - looking statements of the Company’s management . Forward - looking statements are statements that estimate the happening of future events and are not based on historical fact. Forward - looking statements may be identified by the use of forward - looking terminology, such as “may”, “shall”, “could”, “expect”, “estimate”, “anticipate”, “predict”, “probable”, “possible”, “should”, “continue”, or similar terms, variations of those term s o r the negative of those terms. Forward - looking statements should not be read as a guarantee of future performance or results and may not be accurate indications of when such performance or results will be achieved. Forward - looking statements are based on information the Company has when those statements are made or management’s good faith belief as of that time with respect to future events and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward - looking statements. The forward - looking statements specified in the following information have been compiled by the Company’s management on the basis of assumptions made by management and considered by management to be reasonable. The Company’s future operating results, however, are impossible to predict, and no representation, guaranty, or warranty is to be inferred from those forward - looking statements. You are cautioned not to place undue reliance on these forward - looking statements. Forward - looking statements include, but are not limited to, the following: • Statements relating to the Company’s future business and financial performance; • Statements relating to the Company’s competitive position; and • Other material future developments that you may take into consideration. Actual results of the Company’s operations may differ materially from information contained in the forward - looking statements as a result of risk factors described in the Company’s registration statement.

STRICTLY CONFIDENTIAL – DO NOT DUPLICATE 4 Preliminary Offering Overview ¹ Issuer: Pearl Diver Credit Company Inc. ("PDCC") Security Type / Exchange / Ticker: Common Stock / NYSE / PDCC ² Offering Price: $20.00 per share Base Offering Size: 2.00 million shares (100% primary); plus 15% over - allotment option (100% primary) Indications of Interest: Certain institutional investors as well as officers, employees, business associates and related persons of Pearl Diver have expressed an indication of interest to purchase up to the full size of the IPO Seed Portfolio: $87.8 million ³ Use of Proceeds: To acquire investments in accordance with investment objectives and strategies described in the PDCC prospectus and for gener al working capital purposes Lock - Up: Pre - IPO shares released after 2 years; Institutional IPO shares released after 180 days Initial Target Dividend per Share: Initial target dividend of $0.20 - 0.23; paid monthly ($2.40 - 2.80 annualized ) subject to approval and declaration by the Board⁴ Management Structure: Externally managed by Pearl Diver Capital, LLP; Base Management Fee: 1.5% per year of the total equity base; Incentive Fee: 15% of the pre - incentive fee net investment income over a 2% quarterly hurdle (8% annualized) with full catch - up Offering Expenses: Pearl Diver and its affiliates plan to pay all organizational and underwriting expenses Lead Bookrunner & Structuring Agent: Kingswood Capital Partners, LLC Expected Pricing: Q3 2024 1: PDCC has no operating history. There is no guarantee that the offering price, indication of interest amounts, or the initi al target dividend will be achieved. Please see important information on Pg. 2 and 3 regarding projections and forward - looking stat ements. 2: The Fund intends to list the common stock on the New York Stock Exchange under the trading or “ticker” symbol of “PDCC”. 3: Unaudited as of 4/30/2024. Value estimated using third - party pricing provider Markit mid - price. 4: If distributions exceed PDCC’s investment company taxable income in a tax year, such excess will represent a return of cap ita l, which is in effect a partial return of the amount a stockholder invested in PDCC securities. See the PDCC prospectus for f urt her detail.

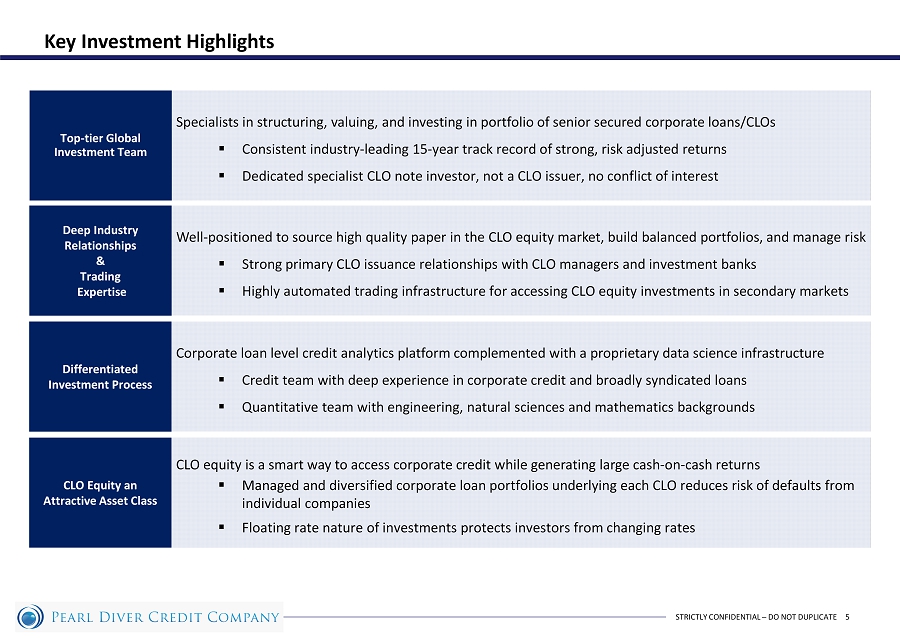

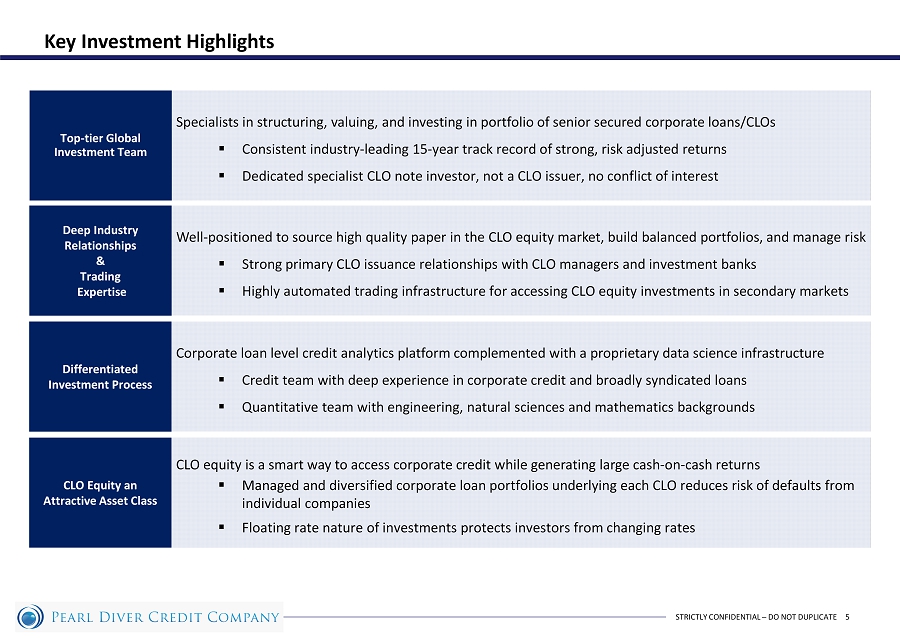

STRICTLY CONFIDENTIAL – DO NOT DUPLICATE 5 Specialists in structuring, valuing, and investing in portfolio of senior secured corporate loans/CLOs ▪ Consistent industry - leading 15 - year track record of strong, risk adjusted returns ▪ Dedicated specialist CLO note investor, not a CLO issuer, no conflict of interest Top - tier Global Investment Team Deep Industry Relationships & Trading Expertise Well - positioned to source high quality paper in the CLO equity market, build balanced portfolios, and manage risk ▪ Strong primary CLO issuance relationships with CLO managers and investment ba nks ▪ Highly automated trading infrastructure for accessing CLO equity investments in secondary markets Differentiated Investment Process Corporate loan level credit analytics platform complemented with a proprietary data science infrastructure ▪ Credit team with deep experience in corporate credit and broadly syndicated loans ▪ Quantitative team with engineering, natural sciences and mathematics backgrounds CLO Equity an Attractive Asset Class CLO equity is a smart way to access corporate credit while generating large cash - on - cash returns ▪ Managed and diversified corporate loan portfolios underlying each CLO reduces risk of defaults from individual companies ▪ Floating rate nature of investments protects investors from changing rates Key Investment Highlights

STRICTLY CONFIDENTIAL – DO NOT DUPLICATE 6 Leadership Team Formed in 2008 by Indranil “Neil” Basu and Chandrajit “CJ” Chakraborty Deep expertise in credit, structured finance, and investment business management 22 Years Experience 32 Years Experience Indranil “Neil” Basu CEO, Managing Partner Chandrajit “CJ” Chakraborty CIO, Managing Partner Tim Carroll Business Development, Partner Matthew Layton Head of Europe, Co - Head Credit, Partner Michael Brown Head of Structuring, Partner Kelvin Ho COO, CCO, Partner Kerrill Gaffney Co - Head Credit, Partner 16 Firm Tenure 16 Firm Tenure 26 Years Experience 15 Firm Tenure 6 Firm Tenure 21 Years Experience 13 Years Experience 13 Firm Tenure 16 Years Experience 11 Firm Tenure 15 Years Experience 8 Firm Tenure Pak Sum Chan Quantitative Analytics, Partner 9 Years Experience 9 Firm Tenure As of June 2024. “Years Experience” denotes years - of - experience in the financial industry. “Firm Tenure” denotes years - of - employ ment by Pearl Diver Capital LLP . All rights to trademarks and/or logos herein belong to their respective owners and Pearl Diver’s use thereof does not imply an affiliation with, or an endorsement by, the owners of these trademarks and/or logos .

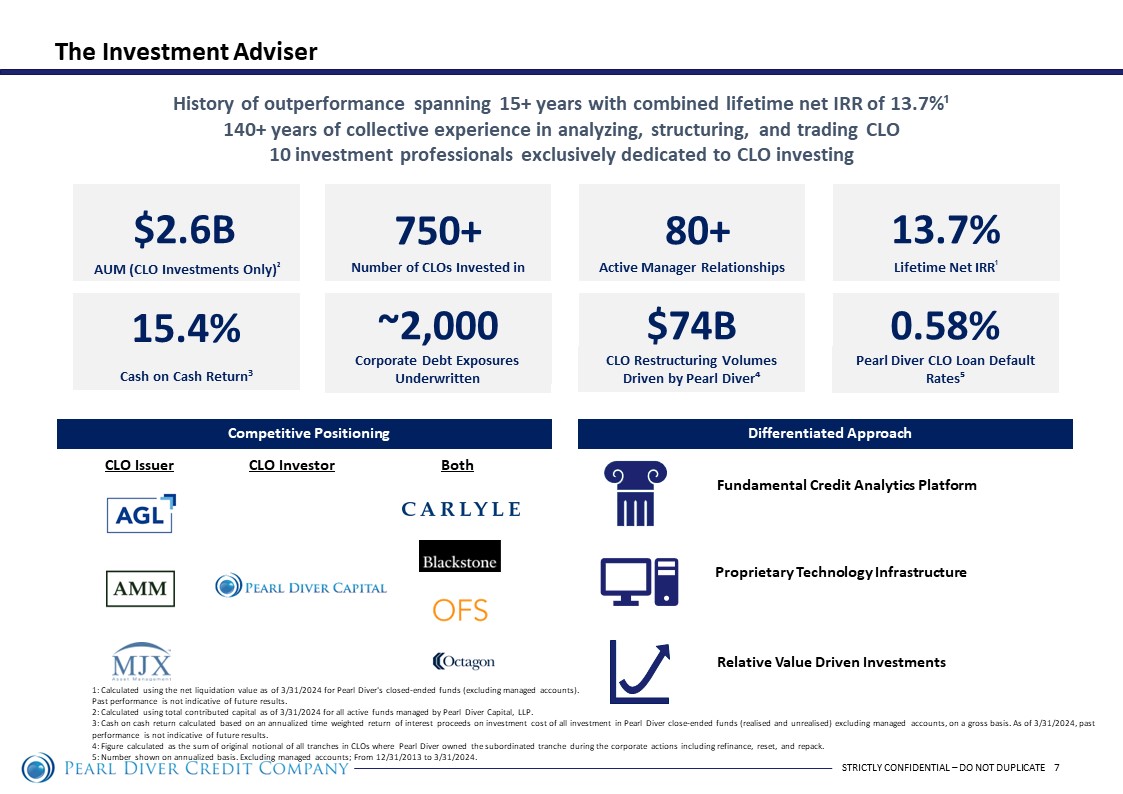

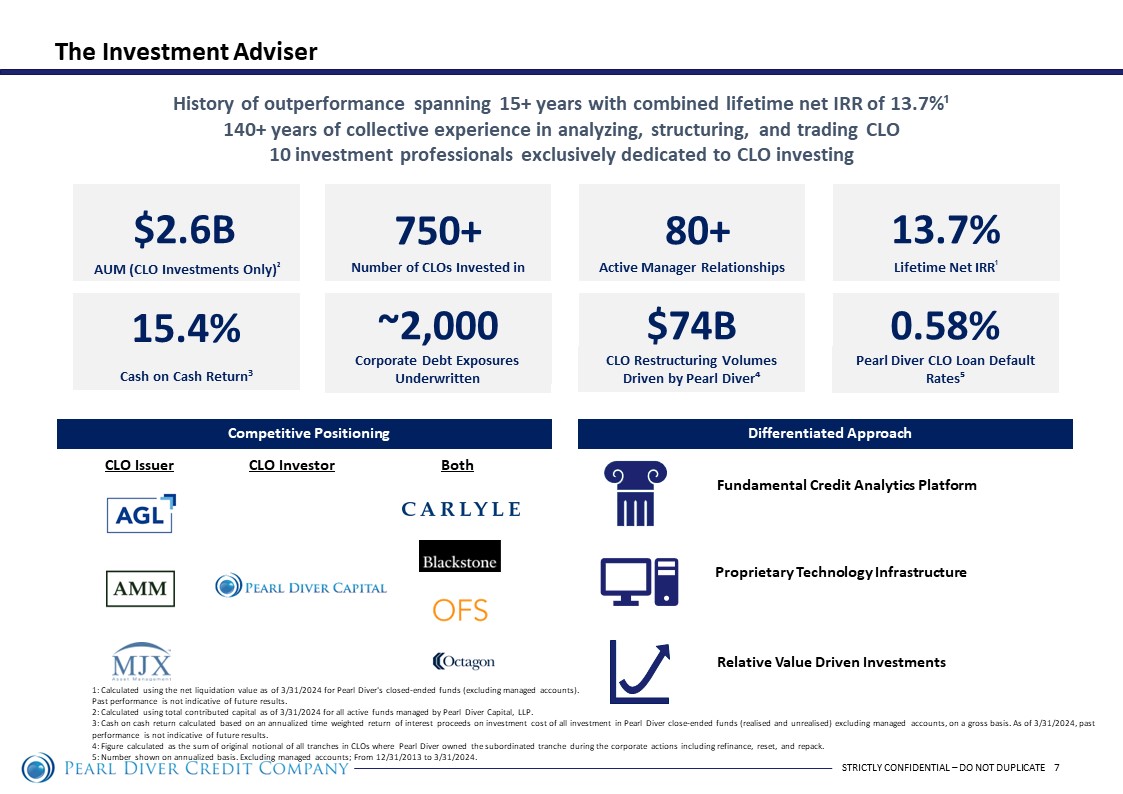

STRICTLY CONFIDENTIAL – DO NOT DUPLICATE 7 The Investment Adviser $2. 6 B $74B CLO Restructuring Volumes Driven by Pearl Diver⁴ 13.7% Lifetime Net IRR ¹ 750+ Number of CLOs Invested in ~2,000 Corporate Debt Exposures Underwritten 8 0+ Active Manager Relationships 15.4% Cash on Cash Return 3 0.58% Pearl Diver CLO Loan Default Rates⁵ AUM (CLO Investments Only) ² Competitive Positioning CLO Investor Both CLO Issuer Differentiated Approach Fundamental Credit Analytics Platform History of outperformance spanning 15+ years with combined lifetime net IRR of 13.7%¹ 140+ years of collective experience in analyzing, structuring, and trading CLO 10 investment professionals exclusively dedicated to CLO investing Proprietary Technology Infrastructure Relative Value Driven Investments 1 : Calculated using the net liquidation value as of 3/31/2024 for Pearl Diver's closed - ended funds (excluding managed accounts). Past performance is not indicative of future results. 2 : Calculated using total contributed capital as of 3/31/2024 for all active funds managed by Pearl Diver Capital, LLP. 3: Cash on cash return calculated based on an annualized time weighted return of interest proceeds on investment cost of all inv estment in Pearl Diver close - ended funds (realised and unrealised) excluding managed accounts, on a gross basis. As of 3/31/2024 , past performance is not indicative of future results. 4: Figure calculated as the sum of original notional of all tranches in CLOs where Pearl Diver owned the subordinated tranche du ring the corporate actions including refinance, reset, and repack. 5: Number shown on annualized basis. Excluding managed accounts; From 12/31/2013 to 3/31/2024.

STRICTLY CONFIDENTIAL – DO NOT DUPLICATE 8 PDCC Inc. Overview Focused on maximizing a diversified CLO equity portfolio’s total return while generating high current income Seed Portfolio ¹ Overview $87.8M Portfolio Fair Value 28 CLOs Highly Diverse Seed Portfolio 20 CLO Managers Diversified Across CLO Management Styles 1,200+ Unique Corporate Debt Exposures B+/B Average Credit Rating of Underlying Loans 12 - 14%² Initial Target Dividend ▪ Among the largest teams globally dedicated exclusively to CLO tranche investing ▪ Combined 140+ years of experience in analyzing, structuring, and trading CLOs ▪ Pearl Diver leverages its existing internally developed technology and trading infrastructure curated over 15+ years ▪ Actively - managed, agile, and relative value focused approach to investing and portfolio construction 1: Seed portfolio is as of 4/30/2024. 2: There is no guarantee that initial target dividend will be achieved. Please see important information on Pg. 2 and 3 regar din g projections and forward - looking statements. If distributions exceed PDCC’s investment company taxable income in a tax year, su ch excess will represent a return of capital, which is in effect a partial return of the amount a stockholder invested in PDCC securities. S ee the PDCC prospectus for further detail. Pearl Diver overview and seed portfolio overview are provided for illustrative purposes only and is not a promise or represen tat ion as to future portfolio construction and/or performance and is subject to change without notice.

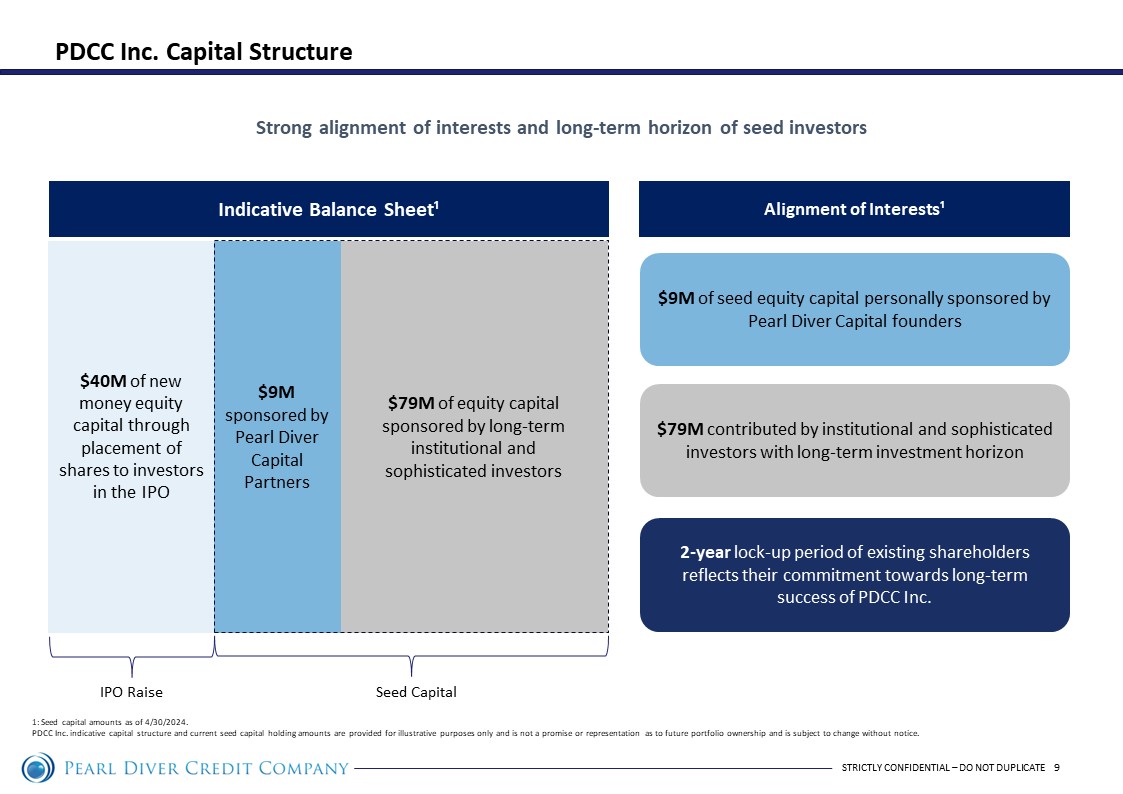

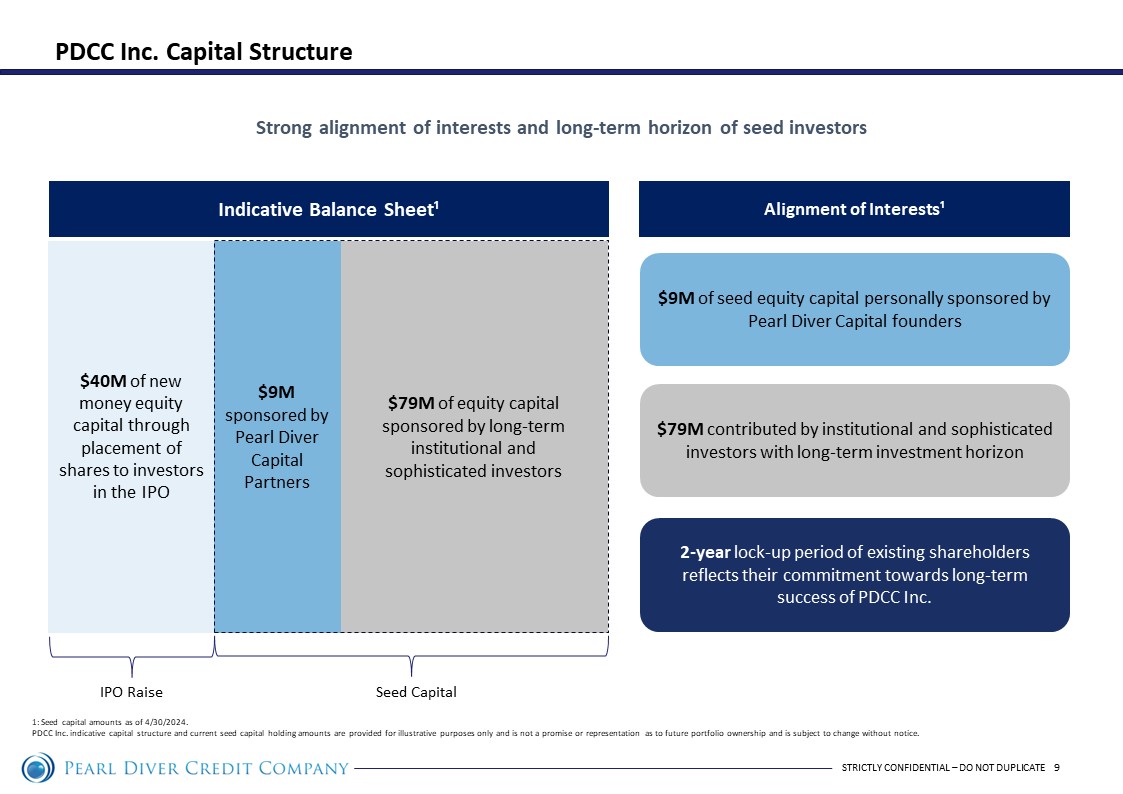

STRICTLY CONFIDENTIAL – DO NOT DUPLICATE 9 PDCC Inc. Capital Structure Strong alignment of interests and long - term horizon of seed investors $40M of new money equity capital through placement of shares to investors in the IPO Indicative Balance Sheet¹ $79M of equity capital sponsored by long - term institutional and sophisticated investors $9M sponsored by Pearl Diver Capital Partners Seed Capital IPO Raise Alignment of Interests¹ $9M of seed equity capital personally sponsored by Pearl Diver Capital founders $79M contributed by institutional and sophisticated investors with long - term investment horizon 2 - year lock - up period of existing shareholders reflects their commitment towards long - term success of PDCC Inc. 1: Seed capital amounts as of 4/30/2024. PDCC Inc. indicative capital structure and current seed capital holding amounts are provided for illustrative purposes only a nd is not a promise or representation as to future portfolio ownership and is subject to change without notice.

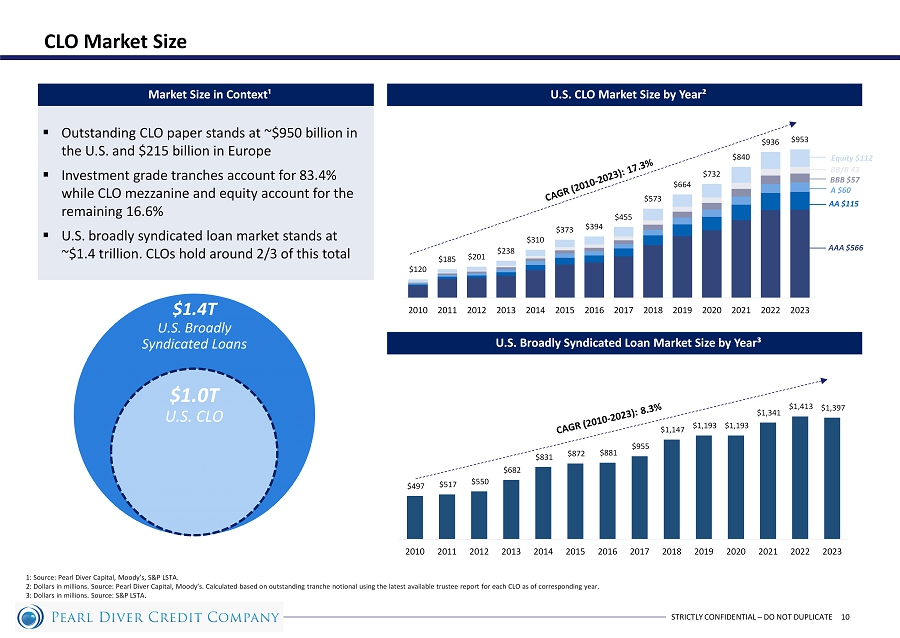

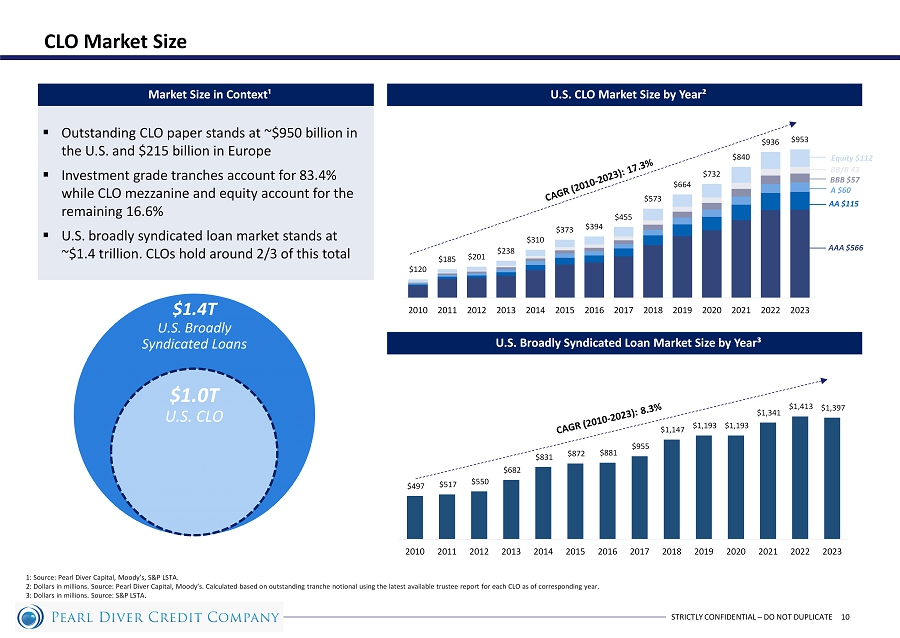

STRICTLY CONFIDENTIAL – DO NOT DUPLICATE 10 $120 $185 $201 $238 $310 $373 $394 $455 $573 $664 $732 $840 $936 $953 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 CLO Market Size $1.4T U.S. Broadly Syndicated Loans $1.0T U.S. CLO Market Size in Context¹ ▪ Outstanding CLO paper stands at ~$950 billion in the U.S. and $215 billion in Europe ▪ Investment grade tranches account for 83.4% while CLO mezzanine and equity account for the remaining 16.6% ▪ U.S. broadly syndicated loan market stands at ~$1.4 trillion. CLOs hold around 2/3 of this total U.S. CLO Market Size by Year² AAA $566 AA $115 A $60 BBB $57 BB/B 43 Equity $112 U.S. Broadly Syndicated Loan Market Size by Year³ $497 $517 $550 $682 $831 $872 $881 $955 $1,147 $1,193 $1,193 $1,341 $1,413 $1,397 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 1: Source: Pearl Diver Capital, Moody’s, S&P LSTA. 2: Dollars in millions. Source: Pearl Diver Capital, Moody’s. Calculated based on outstanding tranche notional using the late st available trustee report for each CLO as of corresponding year. 3: Dollars in millions. Source: S&P LSTA.

STRICTLY CONFIDENTIAL – DO NOT DUPLICATE 11 CLO Legal Structure CLO Summary² Structure: Simple bankruptcy remote trust structure (SPV) Assets: Senior secured corporate broadly syndicated loans Liabilities and Equity: CLO notes ▪ Usually, $500 million in balance sheet size ▪ 1500+ CLO vehicles of various vintages are outstanding currently ▪ $100 billion in annual new CLO issuance Sale of Loan Assets to the CLO SPV SPV Issues CLO Notes to Investors Broadly Syndicated Loans (Corporations) CLO SPV (~150 - 500 Corporate Debt Exposures) CLO Note Holders (Investors) Portfolio Manager (CLO Issuers) Cash Cash Portfolio Management Investment Grade Mezz / Equity ▪ Banks ▪ Insurance Companies ▪ Pension Funds ▪ Money Managers ▪ Hedge Funds ▪ Family Offices ▪ Private Equity Funds ▪ Specialty Credit Funds Illustrative Borrowers³ CLOs resemble the structure of a simplified bank and facilitate the flow of capital from investors to borrowers¹ 1: Reflects Pearl Diver’s Opinion as of the date of this presentation and is subject to change without notice. Information is pr ovided for illustrative purposes only and should not be considered a recommendation regarding the appropriateness of any particular investment or investments in CLOs generally. 2: Typical loan characteristics and CLO structural features are provided for illustrative purposes only and is a generalizati on of the structure of the CLOs in which PDCC will likely invest. The actual terms of any loan PDCC invests in may vary. Past pe rfo rmance is not indicative of future results. 3: The representative borrowers shown may not reflect a meaningful part of the portfolios of our CLO investments and have bee n s elected to provide context regarding the general types of borrowers of U.S. senior secured loans. Most of such borrowers are not as recognizable to the public as those shown. All rights to trademarks and/or logos herein belong to their respective owners and Pe arl Diver’s use thereof does not imply an affiliation with, or an endorsement by, the owners of those trademarks and/or logos .

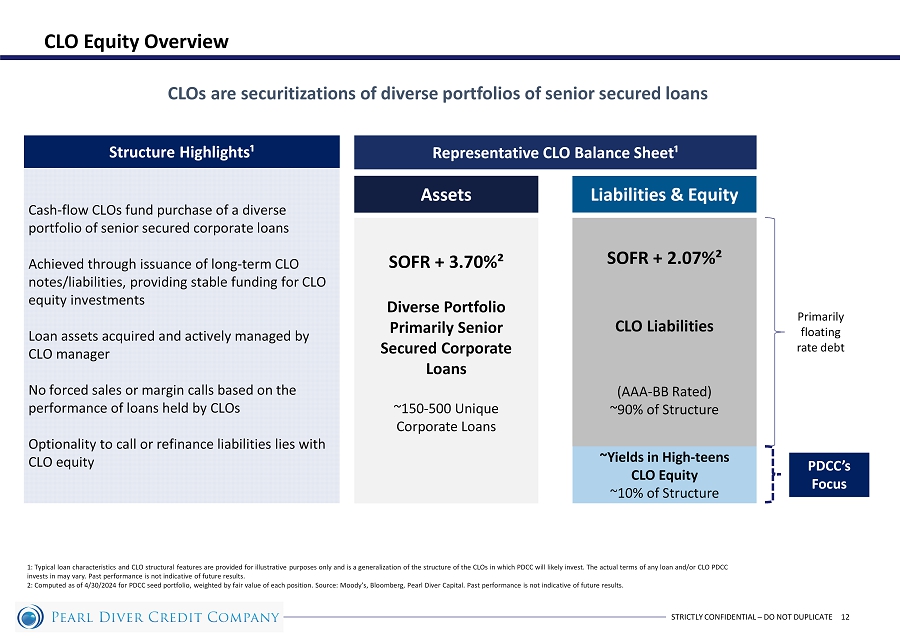

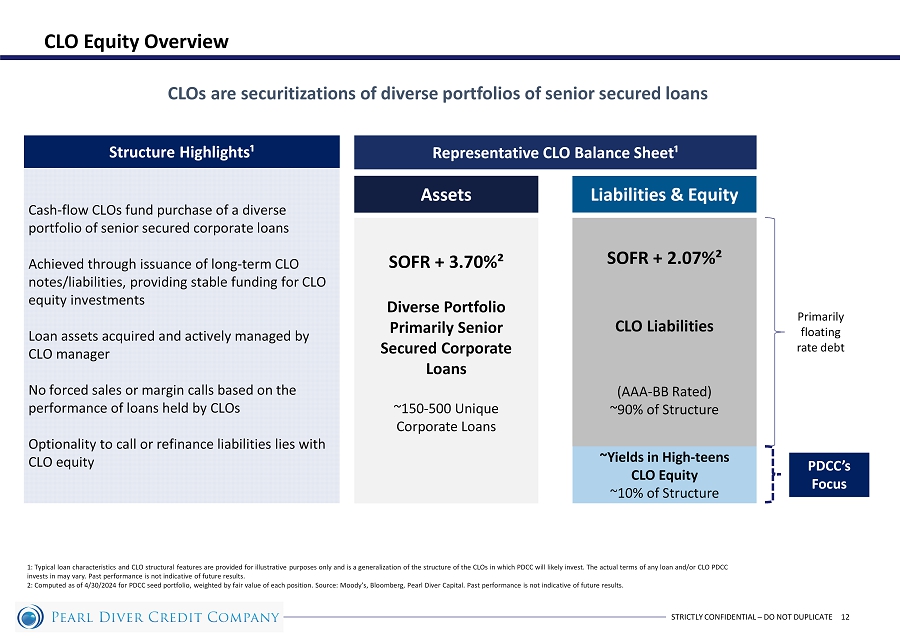

STRICTLY CONFIDENTIAL – DO NOT DUPLICATE 12 CLO Equity Overview SOFR + 2.07% ² CLO Liabilities (AAA - BB Rated) ~90% of Structure SOFR + 3.70% ² Diverse Portfolio Primarily Senior Secured Corporate Loan s ~150 - 500 Unique Corporate Loans ~ Yields in High - teens CLO Equity ~10% of Structure Primarily floating rate debt PDCC’s Focus Representative CLO Balance Sheet¹ Assets Liabilities & Equity Structure Highlights¹ Cash - flow CLOs fund purchase of a diverse portfolio of senior secured corporate loans Achieved through issuance of long - term CLO notes/liabilities, providing stable funding for CLO equity investments Loan assets acquired and actively managed by CLO manager No forced sales or margin calls based on the performance of loans held by CLOs Optionality to call or refinance liabilities lies with CLO equity CLOs are securitizations of diverse portfolios of senior secured loans 1: Typical loan characteristics and CLO structural features are provided for illustrative purposes only and is a generalizati on of the structure of the CLOs in which PDCC will likely invest. The actual terms of any loan and/or CLO PDCC invests in may vary. Past performance is not indicative of future results. 2: Computed as of 4/30/2024 for PDCC seed portfolio, weighted by fair value of each position. Source: Moody’s, Bloomberg, Pea rl Diver Capital. Past performance is not indicative of future results.

STRICTLY CONFIDENTIAL – DO NOT DUPLICATE 13 Historical U.S. Cash Flow CLOs – Quarterly distributions (2018Q1 - 2023Q4) ¹ 1: Presented numbers are annualized. Quarterly distributions were calculated by dividing total cash received by CLO Equity an d d ividing it by its notional amount, results were averaged over outstanding CLOs. Source: Moody’s, Pearl Diver Capital. There can be no assurance that the trends and/or performance illustrated will continue or that future investments in CLO equi ty will perform comparably. 2: The example cash flows presented above are for illustrative purposes only and do not represent a projection or prediction of the Company’s future results. Actual results may vary significantly. 0% 20% 40% 60% 80% Year 1 Year 2 Year 3 Year 4 Year 5 Projected Cash - on - Cash Interest Capital/Principal Illustrative Cash Flow Profile of CLO Equity ² Substantially all initial capital investment recouped by year 4 from interest payments Generated strong and stable historical returns A CLO equity typically offers a short payback period with high front - loaded quarterly cash flows CLO Equity Overview 0% 10% 20% 30% 2018 Q1 2018 Q2 2018 Q3 2018 Q4 2019 Q1 2019 Q2 2019 Q3 2019 Q4 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 2021 Q2 2021 Q3 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 2023 Q1 2023 Q2 2023 Q3 2023 Q4 U.S. CLO Equity averaged over 15% annualized cash distributions

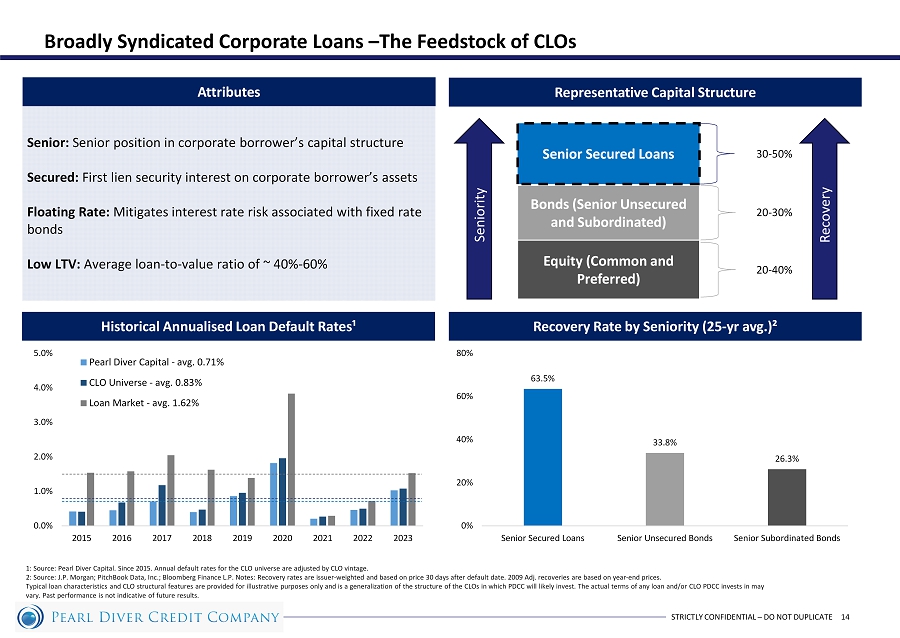

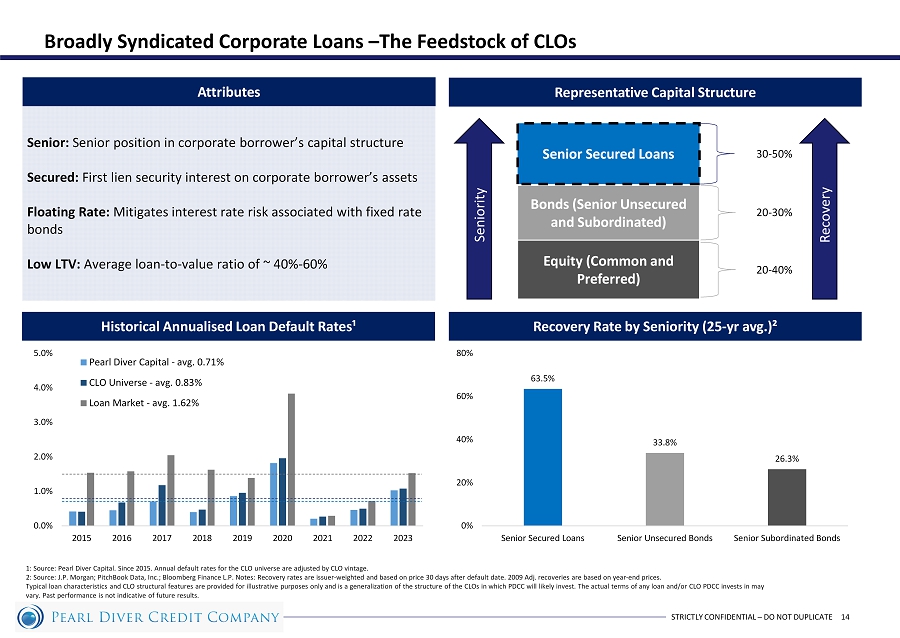

STRICTLY CONFIDENTIAL – DO NOT DUPLICATE 14 Broadly Syndicated Corporate Loans – The Feedstock of CLOs Attributes Representative Capital Structure Senior: Senior position in corporate borrower’s capital structure Secured: First lien security interest on corporate borrower’s assets Floating Rate: Mitigates interest rate risk associated with fixed rate bonds Low LTV: Average loan - to - value ratio of ~ 40% - 60% Bonds (Senior Unsecured and Subordinated) Senior Secured Loans Equity (Common and Preferred) 30 - 50% 20 - 30% 20 - 40% Recovery Recovery Rate by Seniority (25 - yr avg.) ² 63.5% 33.8% 26.3% 0% 20% 40% 60% 80% Senior Secured Loans Senior Unsecured Bonds Senior Subordinated Bonds 1: Source: Pearl Diver Capital. Since 2015. Annual default rates for the CLO universe are adjusted by CLO vintage. 2: Source: J.P. Morgan; PitchBook Data, Inc.; Bloomberg Finance L.P. Notes: Recovery rates are issuer - weighted and based on price 30 days after default date. 200 9 Adj. recoveries are based on year - end prices. Typical loan characteristics and CLO structural features are provided for illustrative purposes only and is a generalization of the structure of the CLOs in which PDCC will likely invest. The actual terms of any loan and/or CLO PDCC invests in may vary. Past performance is not indicative of future results. Historical Annualised Loan Default Rates ¹ 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 2015 2016 2017 2018 2019 2020 2021 2022 2023 Pearl Diver Capital - avg. 0.71% CLO Universe - avg. 0.83% Loan Market - avg. 1.62% Seniority

STRICTLY CONFIDENTIAL – DO NOT DUPLICATE 15 Investment Process and Risk Management Real - time Credit Risk Pricing ▪ We take a line - by - line approach to credit, assigning an in - house rating for each loan in every CLO ▪ A bespoke default vector is generated based on our internal loan - specific rating assumptions Relative Value Driven ▪ Analyze CLO trends to identify attractive opportunities within the CLO market ▪ Use advanced models to price and assess each investment, ensuring strong risk - adjusted returns Activist Investing ▪ We regularly monitor the performance of our holdings and aim to influence CLO manager decision - making through regular calls ▪ We seek to drive CLO corporate actions to maximize the value of our CLO equity holdings Portfolio Construction Balanced Approach: Mitigate risk through diversification across asset sectors, geographies, and CLO manager styles Capital Preservation: Investing in assets with strong fundamentals and downside protection mechanisms Opportunistic and Agile: Quick adjustments made in response to changing market conditions and opportunities Pearl Diver’s investment philosophy and portfolio management are fortified by our technology Information presented on this page reflects Pearl Diver’s opinion as of the date of this presentation and it is subject to ch ang e without notice. The information provided above is presented for illustrative purposes only and should not be considered a recommendation regarding the appropriateness of any particular investment or investments in CLOs generally nor should it be re lied upon as a promise or a representation as to future performance.

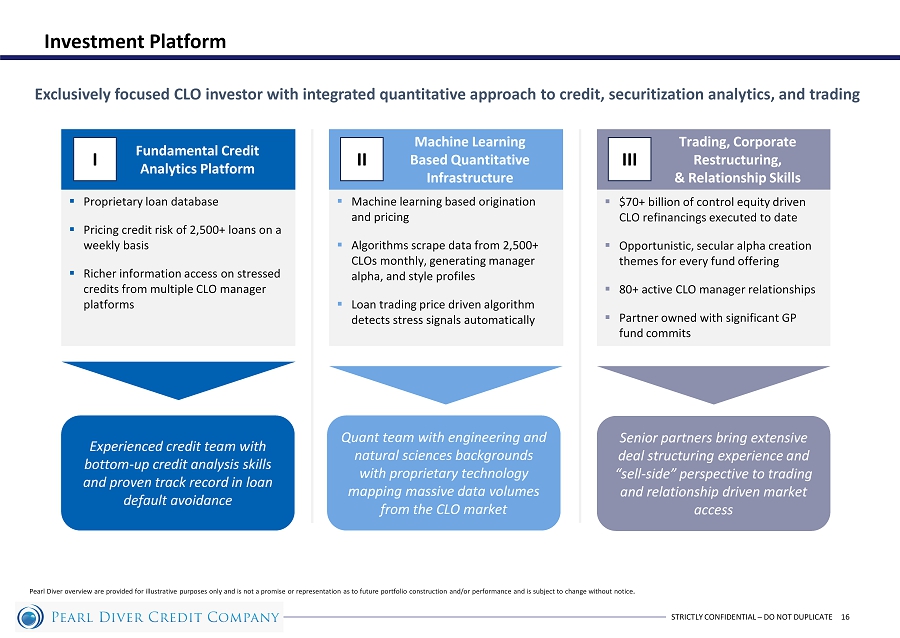

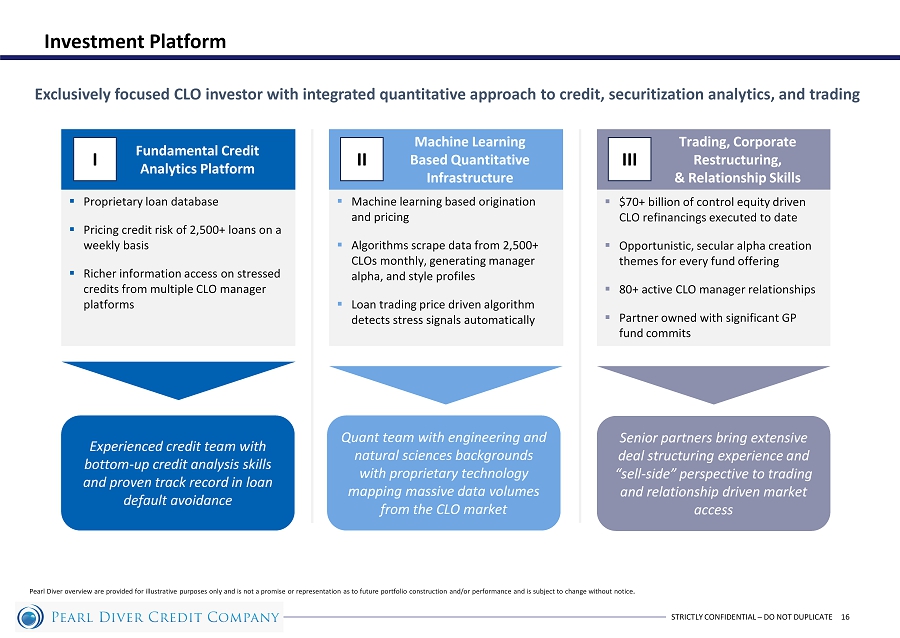

STRICTLY CONFIDENTIAL – DO NOT DUPLICATE 16 Investment Platform Exclusively focused CLO investor with integrated quantitative approach to credit, securitization analytics, and trading ▪ Proprietary loan database ▪ Pricing credit risk of 2,500+ loans on a weekly basis ▪ Richer information access on stressed credits from multiple CLO manager platforms ▪ Machine learning based origination and pricing ▪ Algorithms scrape data from 2,500+ CLOs monthly, generating manager alpha, and style profiles ▪ Loan trading price driven algorithm detects stress signals automatically ▪ $70+ billion of control equity driven CLO refinancings executed to date ▪ Opportunistic, secular alpha creation themes for every fund offering ▪ 80+ active CLO manager relationships ▪ Partner owned with significant GP fund commits Fundamental Credit Analytics Platform Machine Learning Based Quantitative Infrastructure Trading, Corporate Restructuring , & Relationship Skills I II III Experienced credit team with bottom - up credit analysis skills and proven track record in loan default avoidance Quant team with engineering and natural sciences backgrounds with proprietary technology mapping massive data volumes from the CLO market Senior partners bring extensive deal structuring experience and “sell - side” perspective to trading and relationship driven market access Pearl Diver overview are provided for illustrative purposes only and is not a promise or representation as to future portfoli o c onstruction and/or performance and is subject to change without notice .

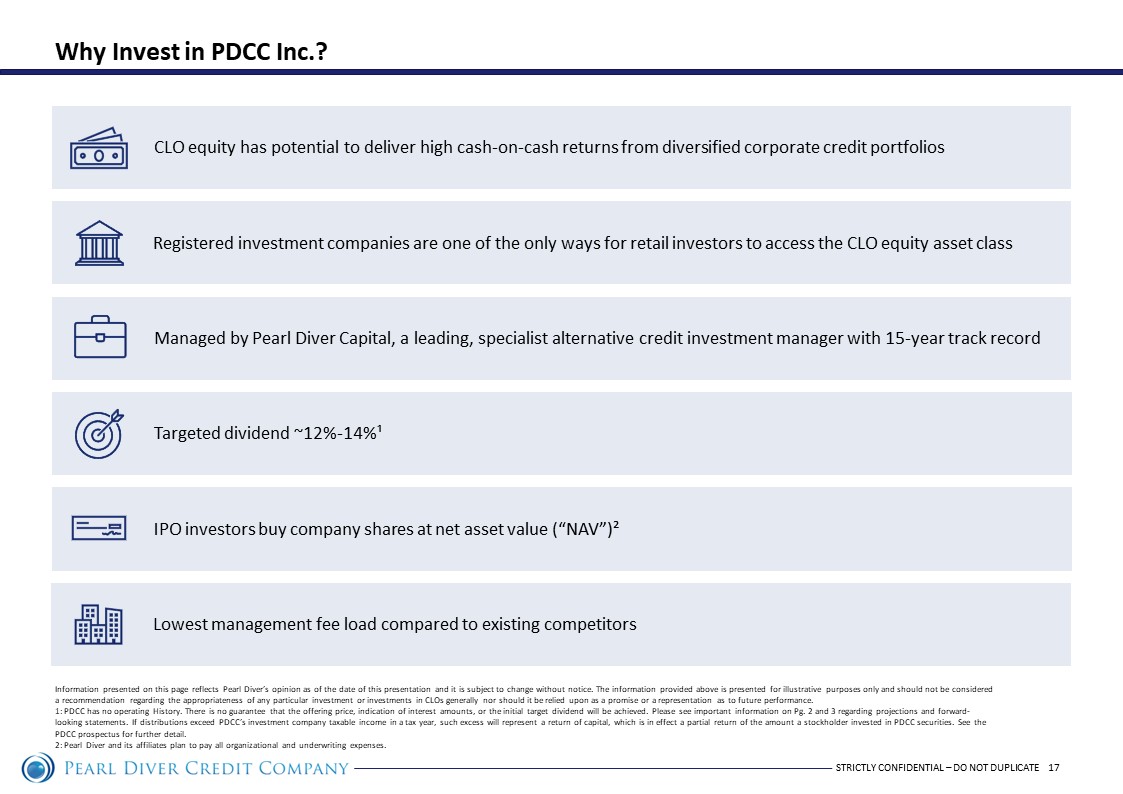

STRICTLY CONFIDENTIAL – DO NOT DUPLICATE 17 Why Invest in PDCC Inc.? Information presented on this page reflects Pearl Diver’s opinion as of the date of this presentation and it is subject to ch ang e without notice. The information provided above is presented for illustrative purposes only and should not be considered a recommendation regarding the appropriateness of any particular investment or investments in CLOs generally nor should it be re lied upon as a promise or a representation as to future performance. 1: PDCC has no operating History. There is no guarantee that the offering price, indication of interest amounts, or the initi al target dividend will be achieved. Please see important information on Pg. 2 and 3 regarding projections and forward - looking statements. If distributions exceed PDCC’s investment company taxable income in a tax year, such excess will represen t a return of capital, which is in effect a partial return of the amount a stockholder invested in PDCC securities. See the PDCC prospectus for further detail. 2: Pearl Diver and its affiliates plan to pay all organizational and underwriting expenses. CLO equity has potential to deliver high cash - on - cash returns from diversified corporate credit portfolios Registered investment companies are one of the only ways for retail investors to access the CLO equity asset class Managed by Pearl Diver Capital, a leading, specialist alternative credit investment manager with 15 - year track record Targeted dividend ~ 12 % - 14 % ¹ IPO investors buy company shares at net asset value (“NAV”)² Lowest management fee load compared to existing competitors