Issuer Free Writing Prospectus dated August 28, 2024

Filed Pursuant to Rule 433 of the Securities Act of 1933, as amended

Relating to Preliminary Prospectus dated August 7, 2024

Registration Statement No. 333-278521

Springview Holdings Ltd Nasdaq Proposed Ticker: SPHL (Pending Approval) Investor Presentation Issuer Free Writing Prospectus dated August 28, 2024 Filed Pursuant to Rule 433 of the Securities Act of 1933, as amended Relating to Preliminary Prospectus dated August 7, 2024 Registration Statement No. 333 - 278521

DISCLAIMER This presentation has been prepared by Springview Holdings Ltd (the “Company”) solely for informational purposes . The information included herein in this presentation has not been independently verified . No representations, warranties,or undertakings, express or implied, are made by the Company or any of its affiliates, advisers or representatives, or the underwriters as to, and no reliance should be placed upon, the accuracy, fairness, completeness or correctness of the information or opinions presented or contained in this presentation . By viewing or accessing the information contained in this presentation, you acknowledge and agree that none of the Company or any of its affiliates, advisers or representatives, or the underwriters accept any responsibility whatsoever (in negligence or otherwise) for any loss howsoever arising from any information presented or contained in this presentation orotherwise arising in connection with the presentation . The information presented or contained in this presentation is subject to change without notice, and its accuracy is not guaranteed . None of the Company or any of its affiliates, advisers or representatives, or the underwriters make any undertaking to update any such information subsequent to the date hereof . This presentation should not be construed as legal, tax, investment, or other advice . 2 The Company has filed a registration statement on Form F - 1 with the SEC relating to the proposed public offering of its securities in the United States, but the registration statement has not yet become effective . The proposed offering of the Company’s securities to be made in the United States will be made solely on the basis of the information contained in the prospectus included in such registration statement, as amended . Any decision to purchasethe Company’s securities in the proposed offering should be made solely on the basis of the information contained in the prospectus . This presentation contains statements that reflect the Company’s intent, beliefs, or current expectations about the future . These statements can be recognized by the use of words such as “expects,” “plans,” “will,” “estimates,”“projects,” “intends,” or words of similar meaning . These forward - looking statements are not guarantees of future performance and are based on a number of assumptions about the Company’s operations and other factors, many of which are beyond the Company’s control, and accordingly, actual results may differ materially from these forward - looking statements . Caution should be taken with respect to such statements, and you should not place undue reliance on any such forward - looking statements . The Company or any of its affiliates, advisers or representatives, or the underwriters has no obligation and does not undertake to revise forward - looking statements to reflect newly available information, future events, or circumstances . This presentation does not constitute an offer to sell or an invitation to purchase or subscribe for any securities of the Company for sale in the United States or anywhere else . No part of this presentation shall form the basis of or be relied upon in connection with any contract or commitment whatsoever . Specifically, these materials do not constitute a “prospectus” within the meaning of the U . S . Securities Act of 1933 , as amended, and the regulations enacted thereunder . This presentation does not contain all relevant information relating to the Company or its securities, particularly with respect to the risks and special considerations involved with an investment in the securities of the Company and is qualified in its entirety by reference to the detailed information in the prospectus relating to the proposed offering . Any decision to purchase the Company’s securities in the proposed offering should be made solely on the basis of the information contained in the prospectus relating to the proposed offering . In evaluating its business, the Company uses or may use certain non - GAAP measures as supplemental measures to review and assess its operating and financial performance . These non - GAAP financial measures have limitations as analytical tools, and when assessing the Company’s operating and financial performances, investors should not consider them in isolation, or as a substitute for any consolidated statement of operations data prepared inaccordance with U . S . GAAP . THE INFORMATION CONTAINED IN THIS DOCUMENT IS HIGHLY CONFIDENTIAL AND IS BEING GIVEN SOLELY FOR YOUR INFORMATION AND ONLY FOR YOUR USE IN CONNECTION WITH THIS PRESENTATION . THE INFORMATION CONTAINED HEREIN MAY NOT BE COPIED, REPRODUCED, REDISTRIBUTED, OR OTHERWISE DISCLOSED, IN WHOLE OR IN PART, TO ANY OTHER PERSON IN ANY MANNER . Any forwarding, distribution, or reproduction of this presentation in whole or in part is unauthorized . The issuer has filed a registration statement (including a prospectus) on Form F - 1 (File No . 333 - 278521 ) with the SEC https : //www . sec . gov/Archives/edgar/data/ 2002236 / 000121390024066076 /ea 0201033 - 05 . htm for the offering to which this communication relates . Before you invest, you should read the prospectus, registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering . You may get these documents for free by visiting EDGAR on the SEC Website www . sec . gov . Alternatively, the Company and any underwriter or dealer participating in the offering will arrange to send you the prospectus if you request it by contacting AC Sunshine Securities LLC, 200 E . Robinson Street, Suite 295 , Orlando, FL 32801 at + 1 689 - 867 - 6218 or by email at ib @acsunshine . com or contacting the Company via email : ir@springviewggl . com .

Offering Summary 3 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Springview Holdings Ltd Issuer Class A Ordinary Shares, par value US$0.0001 per share Securities Initial Public Offering Offering Type Nasdaq Capital Market: SPHL Proposed Listing/Symbol 1,250,000 Class A Ordinary Shares Securities Offered 11,250,000 Class A Ordinary Shares and 10,000,000 Class B Ordinary Shares. Shares Outstanding Immediately After This Offering Expected to be between $4.00 to $5.00 per Class A Ordinary Share Offering Price $5.0 million (based upon an assumed initial public offering price of $4.00 per Class A Ordinary Share) Gross Proceeds • 30 % will be used for business development and marketing activities to attract new clients and secure more projects . • 30 % will be used for hiring and training skilled workers can help design and build contractors expand their workforce and enhance their capabilities . • 40 % will be used as working capital to support day - to - day operations, manage cash flow, and cover project - related expenses . Additionally, funds will also be used to ensure efficient project execution and manage any unforeseen costs . Use of Proceeds AC Sunshine Securities LLC Underwriter

Company Overview We design and construct residential and commercial buildings in Singapore. 4 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Operating since 2002 Our Services New Construction Additions and Alterations (“A&A”) Reconstruction Other General Contracting Services Established a positive reputation in the busy Singapore real estate development market through customer relationships . Our projects are carried out in either: Design and Build Mode Provide design input and also serve as the main contractor Construction Mode Act only in the role of a contractor

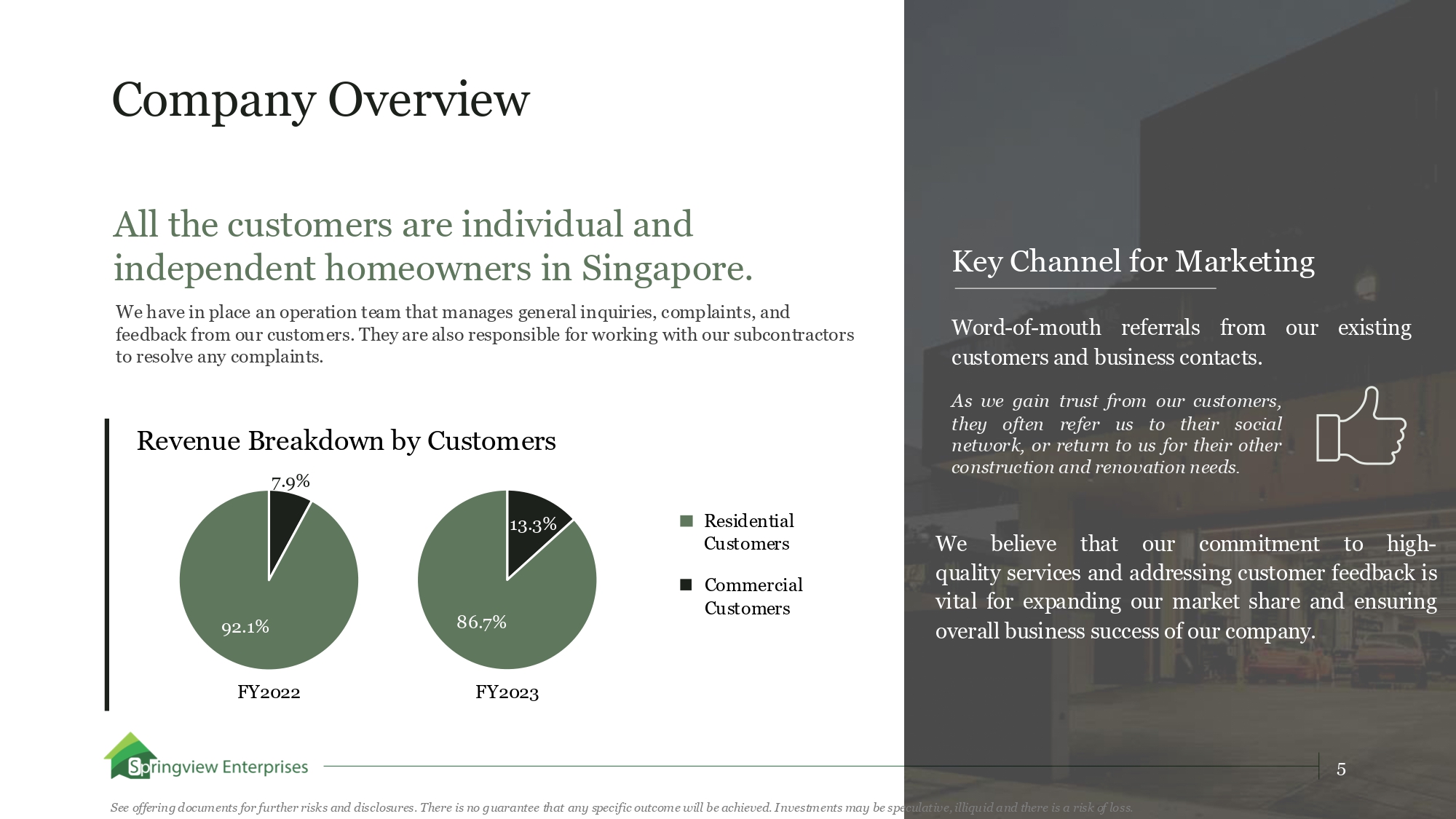

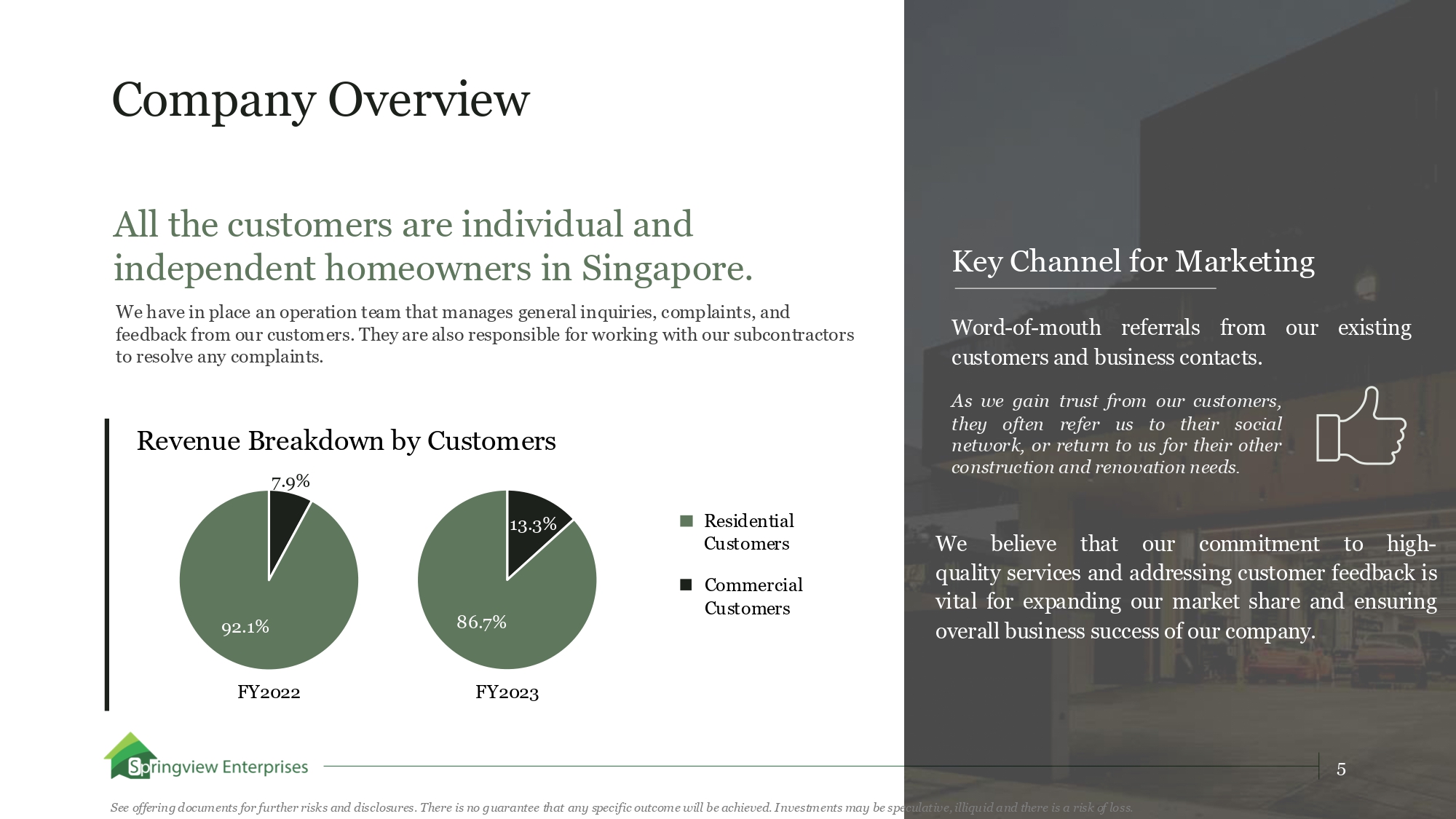

Company Overview 92.1% 13.3% 86.7% our existing Word - of - mouth referrals from customers and business contacts. As we gain trust from our customers, they often refer us to their social network, or return to us for their other construction and renovation needs . Key Channel for Marketing Revenue Breakdown by Customers 7.9% FY2022 FY2023 All the customers are individual and independent homeowners in Singapore. We have in place an operation team that manages general inquiries, complaints, and feedback from our customers. They are also responsible for working with our subcontractors to resolve any complaints. Residential Customers Commercial Customers We believe that our commitment to high - quality services and addressing customer feedback is vital for expanding our market share and ensuring overall business success of our company . 5 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.

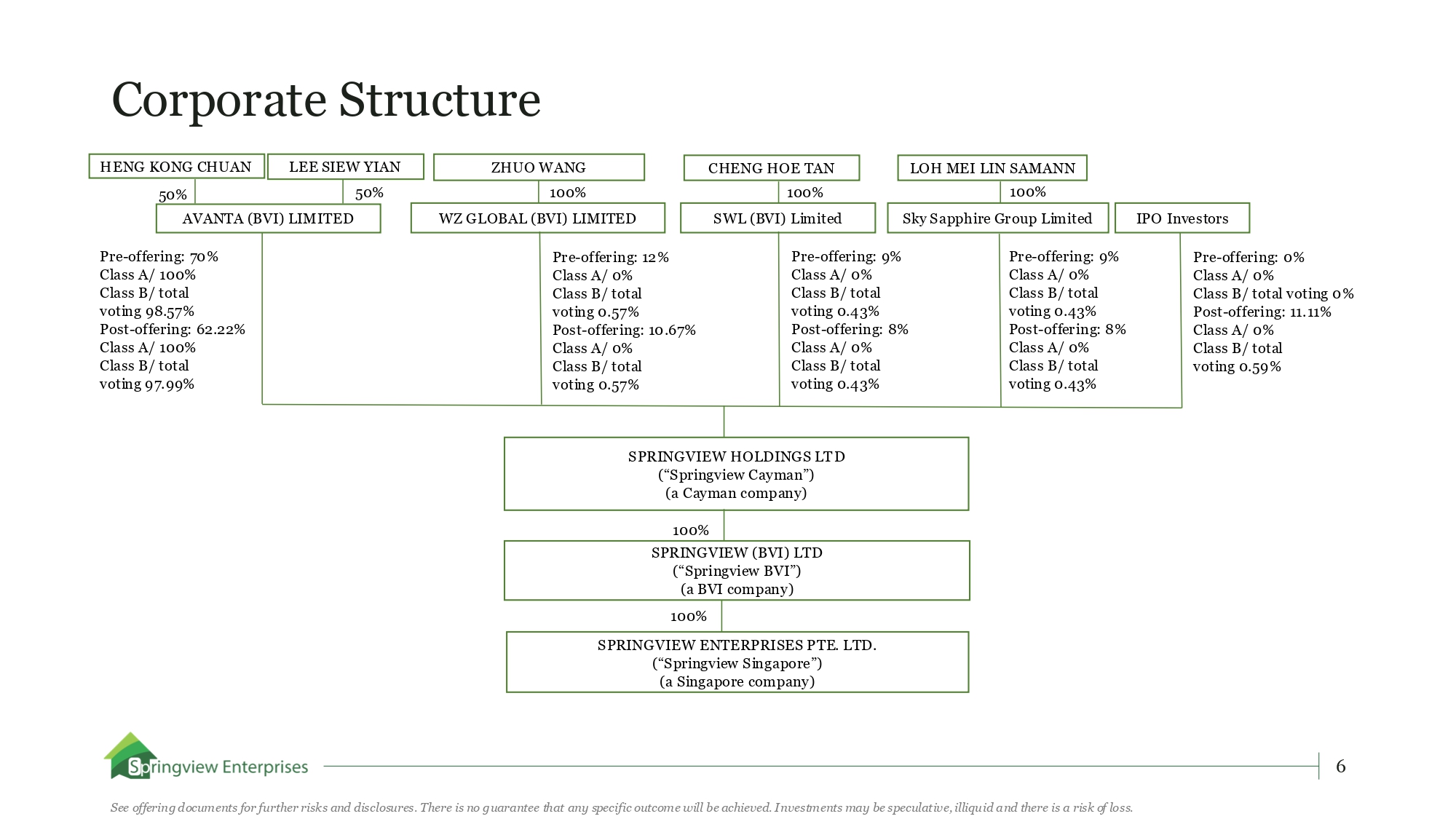

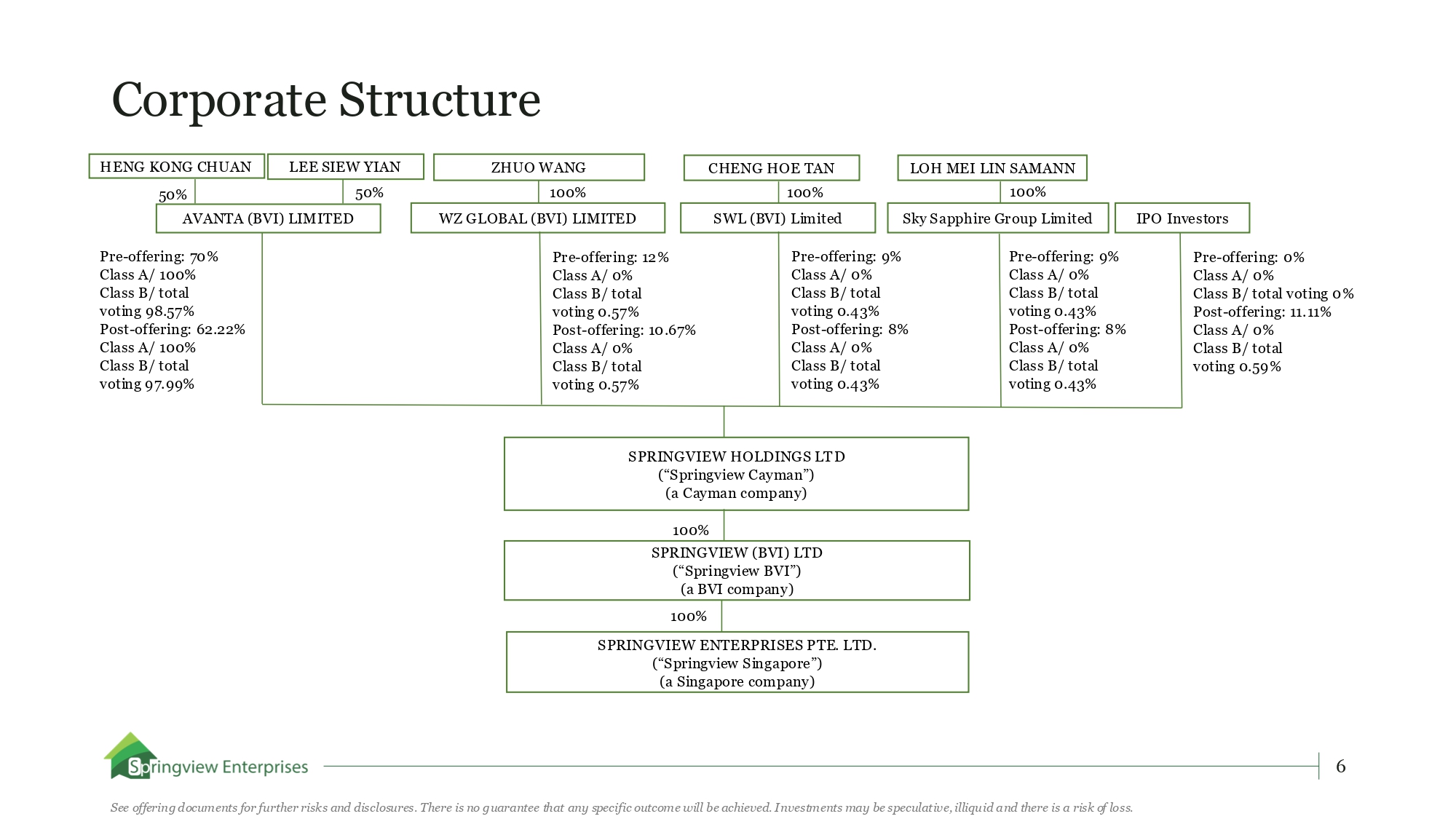

Corporate Structure CHENG HOE TAN ZHUO WANG LEE SIEW YIAN LOH MEI LIN SAMANN AVANTA (BVI) LIMITED SPRINGVIEW HOLDINGS LTD (“Springview Cayman”) (a Cayman company) 100% SPRINGVIEW (BVI) LTD (“Springview BVI”) (a BVI company) 100% SPRINGVIEW ENTERPRISES PTE. LTD. (“Springview Singapore”) (a Singapore company) IPO Investors HENG KONG CHUAN 100% 100% 100% SWL (BVI) Limited WZ GLOBAL (BVI) LIMITED Sky Sapphire Group Limited Pre - offering: 12% Class A/ 0% Class B/ total voting 0.57% Post - offering: 10.67% Class A/ 0% Class B/ total voting 0.57% 6 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Pre - offering: 9% Class A/ 0% Class B/ total voting 0.43% Post - offering: 8% Class A/ 0% Class B/ total voting 0.43% Pre - offering: 9% Class A/ 0% Class B/ total voting 0.43% Post - offering: 8% Class A/ 0% Class B/ total voting 0.43% Pre - offering: 0% Class A/ 0% Class B/ total voting 0% Post - offering: 11.11% Class A/ 0% Class B/ total voting 0.59% Pre - offering: 70% Class A/ 100% Class B/ total voting 98.57% Post - offering: 62.22% Class A/ 100% Class B/ total voting 97.99% 50% 50%

Investment Highlights Our experienced management team • Led by Mr. Zhuo Wang, our Chief Executive Officer, and Ms. Siew Yian Lee, an executive director of our company. • Mr. Wang has extensive experience in sales and marketing and the management of companies. • Ms. Lee has substantial experience in the construction design services and building contractors industry. 7 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Our seamless solutions • A comprehensive range of services, such as design, construction, furniture customization and project management. • Skilled in - house team of experts providing a one - stop solution that fosters strong customer relationships, potentially resulting in more projects and referrals. • Post - project services further enhance our customer engagement and future project opportunities. 1/ 2/ 3/ Our supplier and subcontractor relationships • Enabling us to secure raw materials supply with consistent quality, timely delivery and competitive pricing from our materials and consumables suppliers. • Better enforcing our work quality requirements and progress timeframe with our subcontractors.

Our Seamless Solutions New Construction We possess extensive experience in assisting customers with the demolition and reconstruction of their homes, realizing their dream designs. • Clients often opt for a fresh start, enabling the creation of thoughtfully designed spaces. • We ensure a quick and clean demolition process. Dealing with deteriorating structures • We conceptualize clients’ design plans. • We also offer our customers our own customized design plans, blending practicality with aesthetic appeal. Rebuilding process An existing house will be demolished and a new house will be rebuilt. 8 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.

Our Seamless Solutions A&A Work We specialize in providing A&A work for existing structures, tailored to our customers’ requests. 9 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Whether it is the replacement or addition of columns, our A&A work ensures that modifications remain below 50%, preserving the essence of the original building while accommodating desired changes. We prioritize our customers’ needs and align our efforts with the uniqueness of their homes. Minor modifications to existing structures within an existing building’s requirements.

Our Seamless Solutions Reconstruction We specialize in rejuvenating a building’s aesthetics through the modernization of existing fixtures and amenities. Replacement of typically 50%+ of gross floor area, of a residence Certain undertakings of a less extensive nature • Replacement of an entire floor. • Addition of an extra story. • Comprehensive refurbishment of the entire edifice. • Augmenting the overall building story height. • Incorporating alterations or replacement of the existing roof (partial/full). • Culminating in a new story addition. • A metamorphosis in the configuration of landed housing. Replacement of a substantial part of a house. 10 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.

Our Seamless Solutions Other General Contracting Services We work with our customers on their vision and budget constraints, collaborating to develop a feasible design concept. Comprehensive suite of other general contracting services: • Renovation and design consultation. • Space planning. • Bespoke carpentry as well as project management. 11 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.

Our Experienced Management Team Mr. Zhuo Wang Chairman and Chief Executive Officer • Mr. Wang is responsible for the overall business management of Springview Holdings Ltd. • Mr. Wang is an independent director and the audit committee chair of Metal Sky Star Acquisition Corporation (Nasdaq: MSSA) since June 2021. • Mr. Wang was appointed as a director of Mingzhu Logistics Holdings Limited (Nasdaq: YGMZ) in April 2018. • Mr. Wang served as the marketing manager of Springview Enterprises Pte. Ltd. from August 2011 to October 2012, and from June 2018 to present. • Mr. Wang obtained a Bachelor of Science degree in business management from Babson College in 2007. Mr. Jordan Yi Chun Tse Chief Financial Officer • Mr. Tse was appointed as Chief Financial Officer on November 15, 2023. • Mr. Tse is an experienced professional with extensive experience in the field of accounting and auditing. • Mr . Tse currently serves as an investment manager at Alpha (Shenzhen) Management Consulting Limited . • Mr . Tse was a co - founder at 24 Seasons (Shenzhen) Supply Chain Management Company Limited from November 2021 to September 2022 . • Mr . Tse worked as a Senior Associate in Core Assurance Services at PricewaterhouseCoopers, Hong Kong from December 2018 to September 2020 . • Mr. Tse obtained a Bachelor of Commerce degree in 2016 from the University of New South Wales. 12 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.

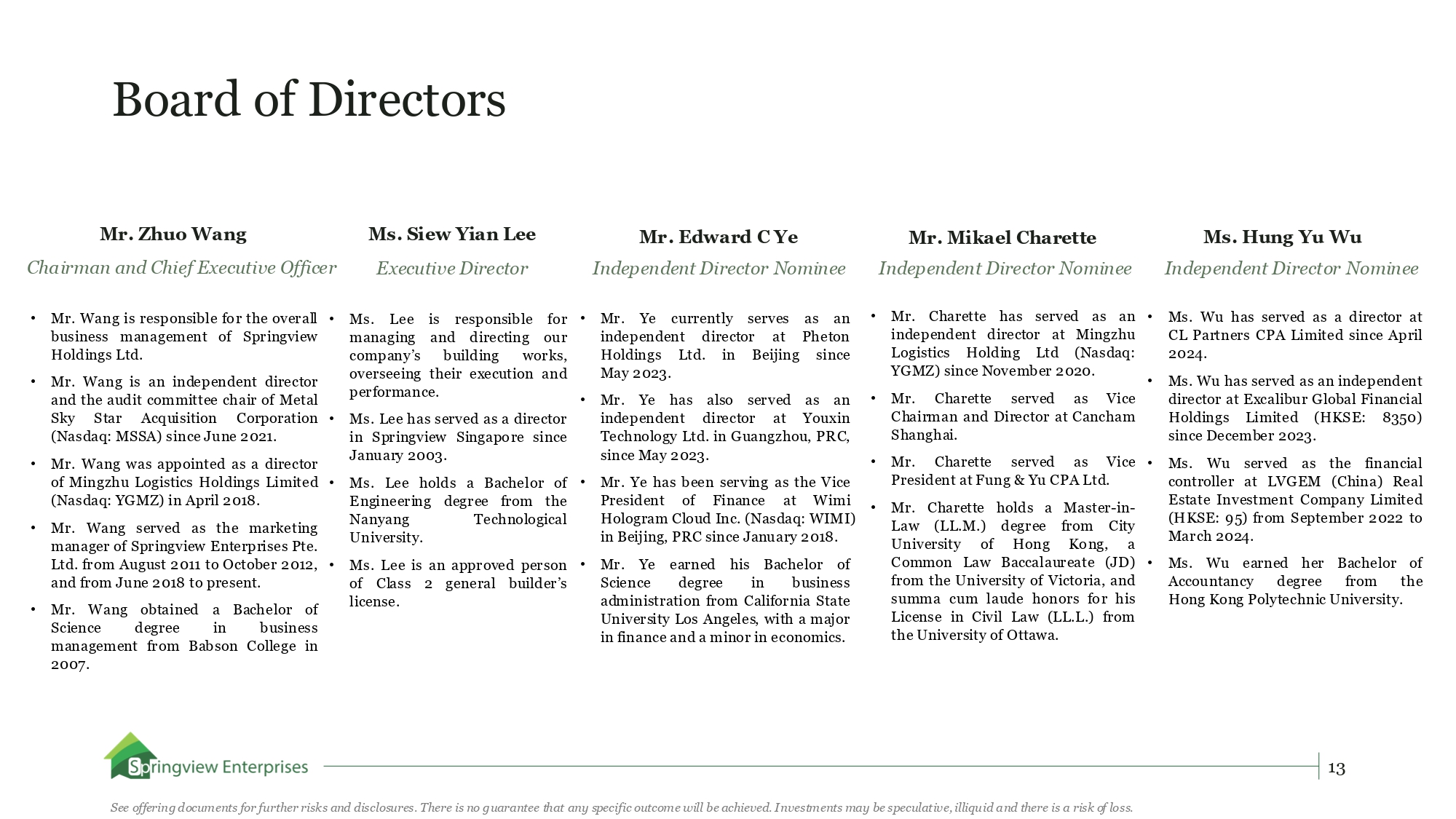

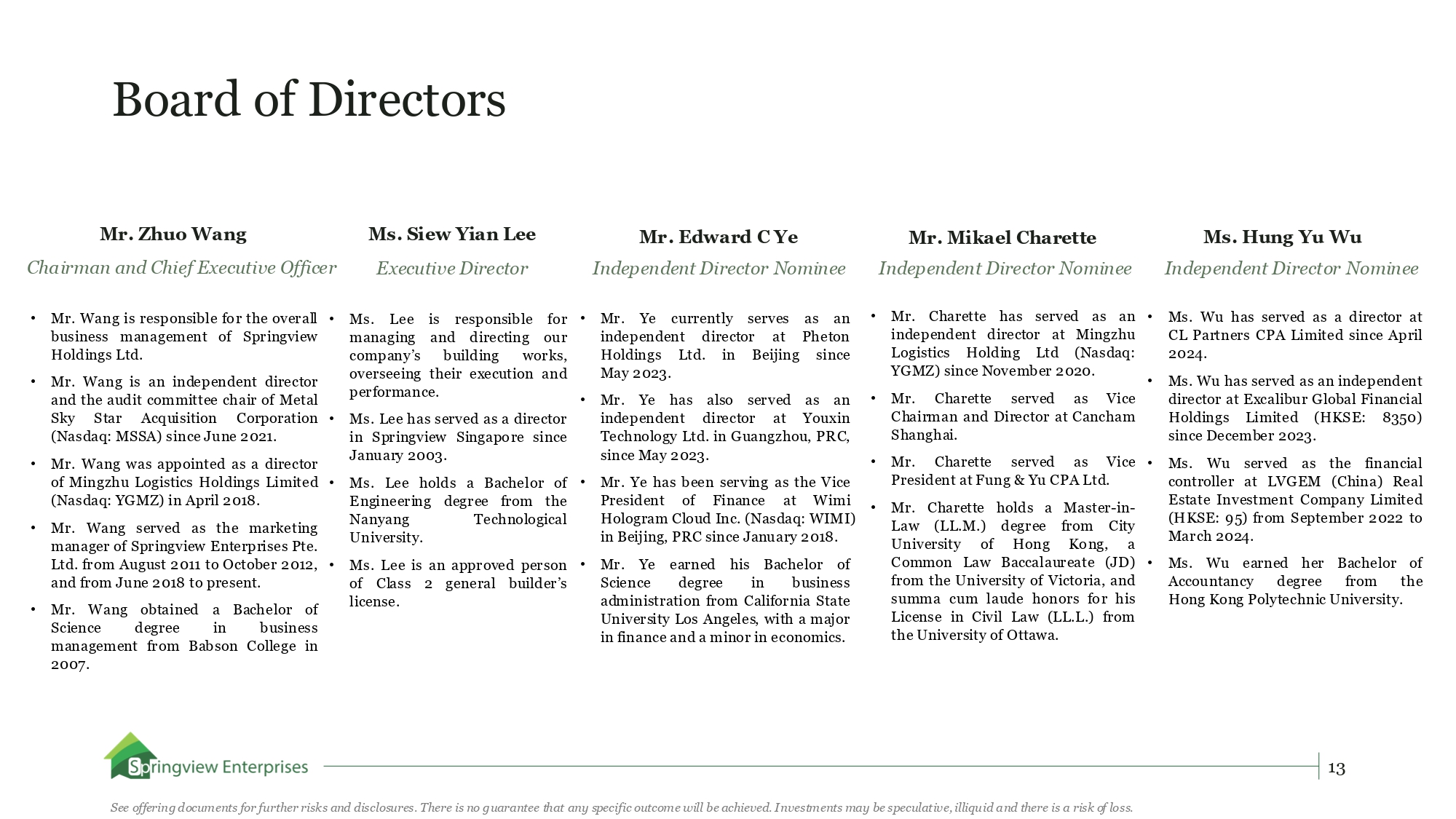

Board of Directors 13 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Ms. Siew Yian Lee Executive Director Mr. Edward C Ye Independent Director Nominee Mr. Mikael Charette Independent Director Nominee Ms. Hung Yu Wu Independent Director Nominee • Mr. Ye has also served as an independent director at Youxin Technology Ltd. in Guangzhou, PRC, since May 2023. • Mr. Ye has been serving as the Vice President of Finance at Wimi Hologram Cloud Inc. (Nasdaq: WIMI) in Beijing, PRC since January 2018. • Mr . Ye earned his Bachelor of Science degree in business administration from California State University Los Angeles, with a major in finance and a minor in economics . • Mr . Charette has served as an independent director at Mingzhu Logistics Holding Ltd (Nasdaq : YGMZ) since November 2020 . • Mr . Charette served as Vice Chairman and Director at Cancham Shanghai . • Mr. Charette served as Vice President at Fung & Yu CPA Ltd. • Mr. Charette holds a Law (LL.M.) degree University of Hong Master - in - from City Kong, a Common Law Baccalaureate (JD) from the University of Victoria, and summa cum laude honors for his License in Civil Law (LL . L . ) from the University of Ottawa . • Ms . Wu has served as a director at CL Partners CPA Limited since April 2024 . • Ms . Wu has served as an independent director at Excalibur Global Financial Holdings Limited (HKSE : 8350 ) since December 2023 . • Ms . Wu served as the financial controller at LVGEM (China) Real Estate Investment Company Limited (HKSE : 95 ) from September 2022 to March 2024 . • Ms . Wu earned her Bachelor of Accountancy degree from the Hong Kong Polytechnic University . • Ms. Lee is responsible managing and directing for • Mr. Ye currently serves as an our independent director at Pheton Holdings Ltd. in Beijing since May 2023. company’s building works, overseeing their execution and performance . • Ms . Lee has served as a director in Springview Singapore since January 2003 . • Ms. Lee holds a Bachelor of degree from the Technological Engineering Nanyang University. • Ms . Lee is an approved person of Class 2 general builder’s license . Mr. Zhuo Wang Chairman and Chief Executive Officer • Mr . Wang is responsible for the overall business management of Springview Holdings Ltd . • Mr . Wang is an independent director and the audit committee chair of Metal Sky Star Acquisition Corporation (Nasdaq : MSSA) since June 2021 . • Mr . Wang was appointed as a director of Mingzhu Logistics Holdings Limited (Nasdaq : YGMZ) in April 2018 . • Mr . Wang served as the marketing manager of Springview Enterprises Pte . Ltd . from August 2011 to October 2012 , and from June 2018 to present . • Mr . Wang obtained a Bachelor of Science degree in business management from Babson College in 2007 .

Our Supplier and Subcontractor Relationships 14 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Based on the needs and situations of each project, we from time to time engage the subcontractors to help us handle the specialized parts of work. • Allows us to accomplish projects with minimal delay due to unsatisfactory work or a lack of material. • Hold our suppliers and subcontractors to the same high standards which we set for ourselves, ensuring a consistent and reliable product which our customers are satisfied with.

Industry Overview Competition We compete with contractors, interior designers, and other industry professionals for the same pool of potential customers . We believe that we are well positioned to compete in the industry because of our previously established track record . Factors of Market Competition Market Knowledge and Innovation Critical for adapting to fluctuations in market demand and sustaining a competitive advantage. Operational and Project Management Capabilities Ensuring initiatives are completed on schedule and within budget. Management of Customer Relationships and Cooperation Fostering positive customer relationships is crucial for generating recurring business and positive word - of - mouth. Brand Image Critical components in the process of acquiring consumers and expanding a company’s operations. 15 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.

Industry Overview 616.5 663.3 744.6 595.8 668.4 726.5 768.1 803.3 858.2 898.6 947.7 370.1 357.8 368.7 281.7 361.1 465.7 476.0 497.8 515.0 556.9 580.8 0 500 1,000 1,500 2,000 Million SGD 2017 2018 2019 2020 2021 2022 2023E 2024E 2025E 2026E 2027E 986.6 1,021.1 1,113.3 877.5 1,029.5 1,192.2 1,244.1 1,301.1 1,373.2 1,455.5 1,528.5 Market Size of Reconstruction Works by Revenue (Singapore), 2017 - 2027E CAGR 2017 - 2022 2023E - 2027E Residential 4.7% 5.1% Others 3.3% 5.4% Total 3.9% 5.3% Others Residential 8,000 12,000 3,664.3 9,768.9 3,262.2 9,309.7 3,280.3 9,904.9 2,865.5 8,909.1 3,211.2 9,154.3 4,248.5 10,850.0 4,217.7 11,024.0 4,428.5 Million SGD 16,000 4,579.5 12,212.0 4,952.7 11,575.0 12,945.0 5,222.9 13,692.1 2023E - 2027E 2017 - 2022 CAGR 5.5% 3.0% Residential 5.6% 1.6% Others 5.6% 2.1% Total Market Size of New Construction Works by Revenue (Singapore), 2017 - 2027E 8,469.2 4,000 7,992.3 7,632.5 7,146.5 6,806.3 6,624.6 6,601.5 6,104.6 6,047.5 6,043.6 5,943.1 0 2017 2018 2019 2020 2021 2022 2023E 2024E 2025E 2026E 2027E 16 Source: Frost & Sullivan See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.

Industry Overview 0 2,000 4,000 6,000 2017 2018 2019 2020 2021 2022 2023E 2024E 2025E 2026E 2027E 1,575.4 2,611.2 4,186.6 1,398.4 2,591.4 3,989.8 1,405.8 2,839.2 4,245.0 1,143.5 2,418.0 3,561.5 1,376.2 2,547.1 3,923.3 1,796.4 2,776.5 4,572.9 1,807.6 2,917.1 4,724.7 1,898.0 3,062.8 Million SGD 1,962.6 3,271.1 5,233.7 2,122.5 4,960.8 5,547.7 2,237.3 3,597.8 5,835.1 3,425.2 2023E - 2027E 2017 - 2022 CAGR 5.5% 2.7% Residential 5.4% 1.2% Others 5.4% 1.8% Total Market Size of A&A Works by Revenue (Singapore), 2017 - 2027E 2,000 4,000 6,000 1,285.5 3,400.5 1,288.4 3,648.5 1,293.4 3,905.4 1,048.2 3,264.9 1,256.9 3,583.3 1,638.7 4,179.5 1,677.5 4,378.2 1,771.5 Million SGD 1,847.5 4,919.7 1,988.0 4,630.2 5,177.9 2,048.5 5,378.5 2023E - 2027E 2017 - 2022 CAGR 5.1% 5.0% Residential 5.4% 3.7% Others 5.3% 4.2% Total Market Size of Renovation by Revenue (Singapore), 2017 - 2027E Others 3,330.0 3,189.9 3,072.2 2,858.7 2,612.0 2,700.7 2,540.8 2,360.1 2,326.4 2,216.7 2,115.0 0 2017 2018 2019 2020 2021 2022 2023E 2024E 2025E 2026E 2027E 17 Source: Frost & Sullivan See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Residential

Growth Strategies Enhance client relationships and reputation Plan to achieve this by delivering projects on time and within budget, providing excellent customer service, and ensuring customer satisfaction. Invest in technology and innovation Plan to adopt advanced construction management software, Building Information Modelling (BIM) technology, and other innovativ e tools. Enhance service capacity by expanding in - house teams of workers Plan to gradually recruit more qualified and experienced professionals to expand our service capabilities. Adopt a more aggressive marketing strategy Plan to carry out strong advertisement and marketing campaigns on both digital and traditional media channels to enhance customer awareness and attract new customers. Expand business and operations through joint ventures and/or strategic alliances Plan to explore opportunities to collaborate with suitable partners in these industries through strategic alliances, joint ve ntures and investments. 18 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.

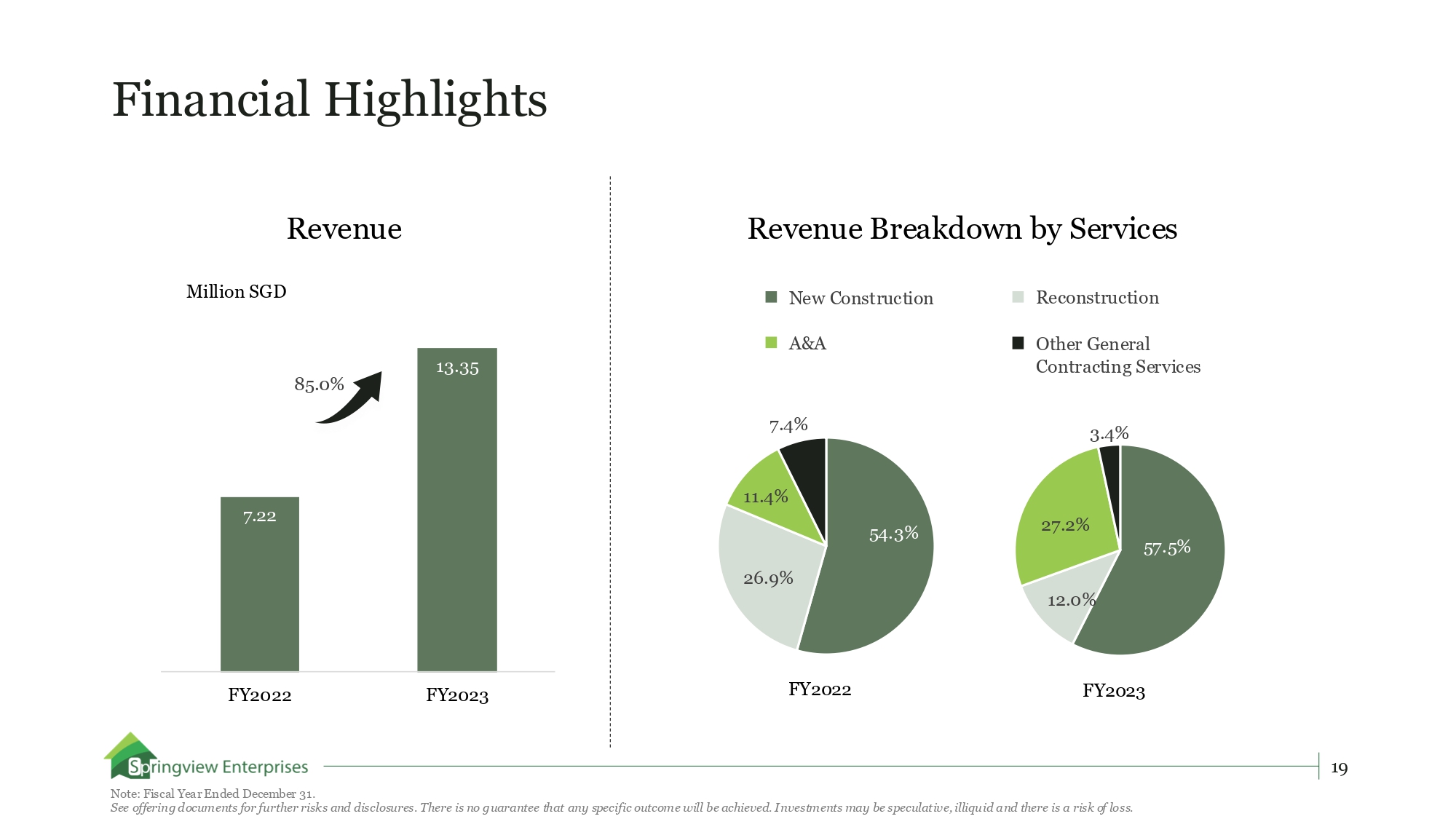

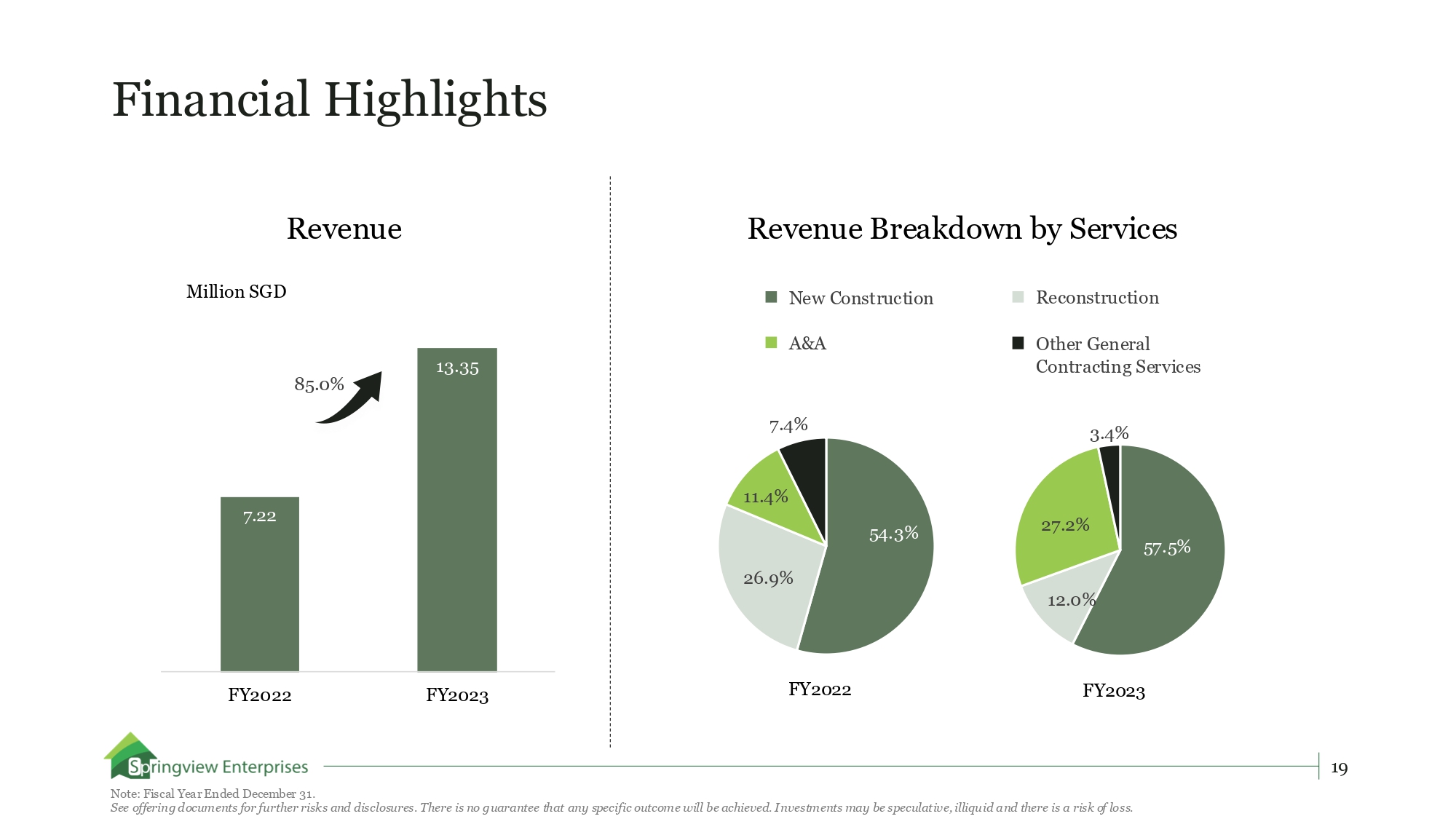

Financial Highlights 7.22 13.35 FY2022 FY2023 Revenue 85.0% Million SGD 54.3% 26.9% 11.4% 7.4% 57.5% 12.0% 27.2% 3.4% Revenue Breakdown by Services New Construction Reconstruction A&A Other General Contracting Services FY2022 FY2023 19 Note: Fiscal Year Ended December 31. See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.

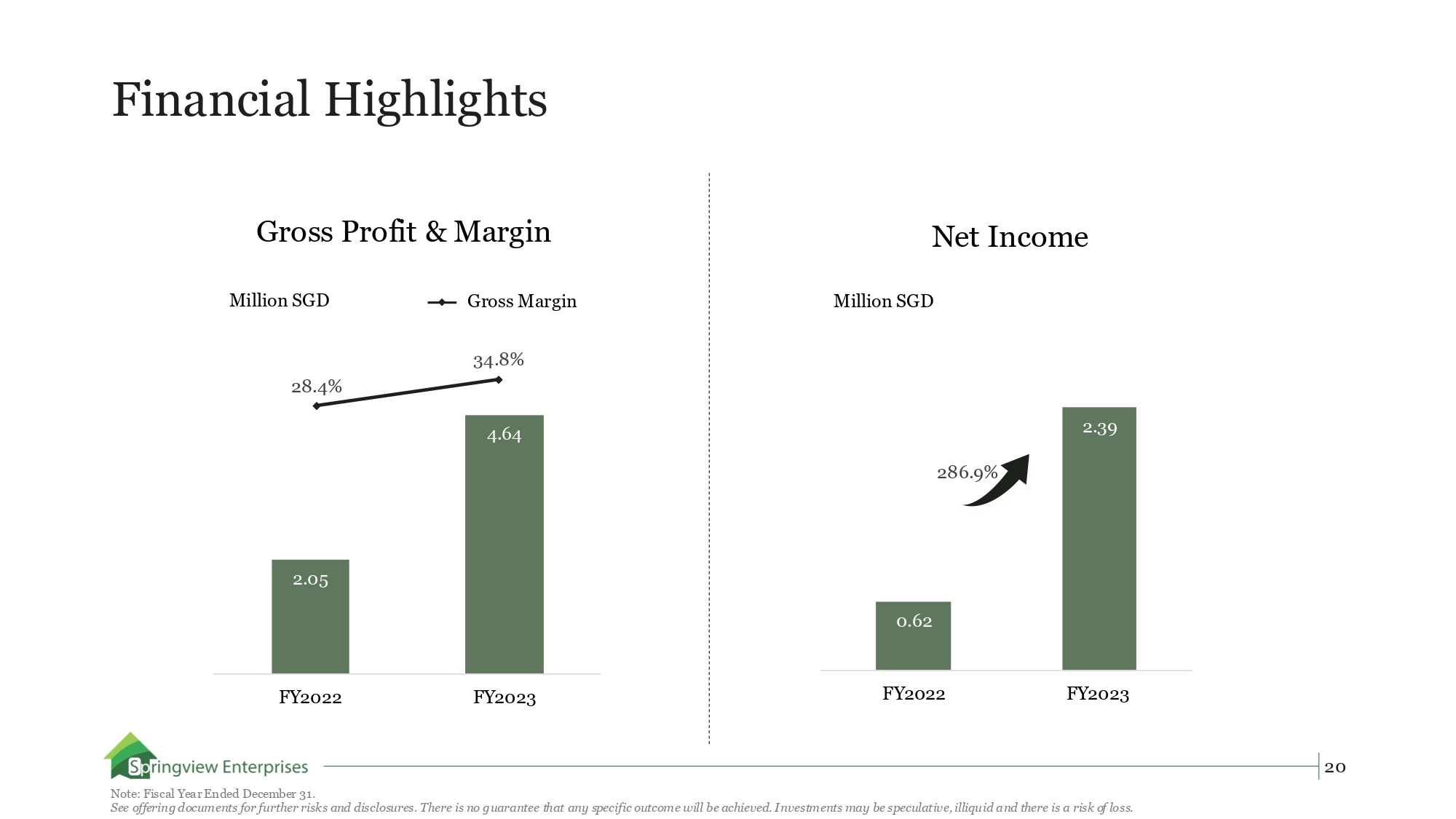

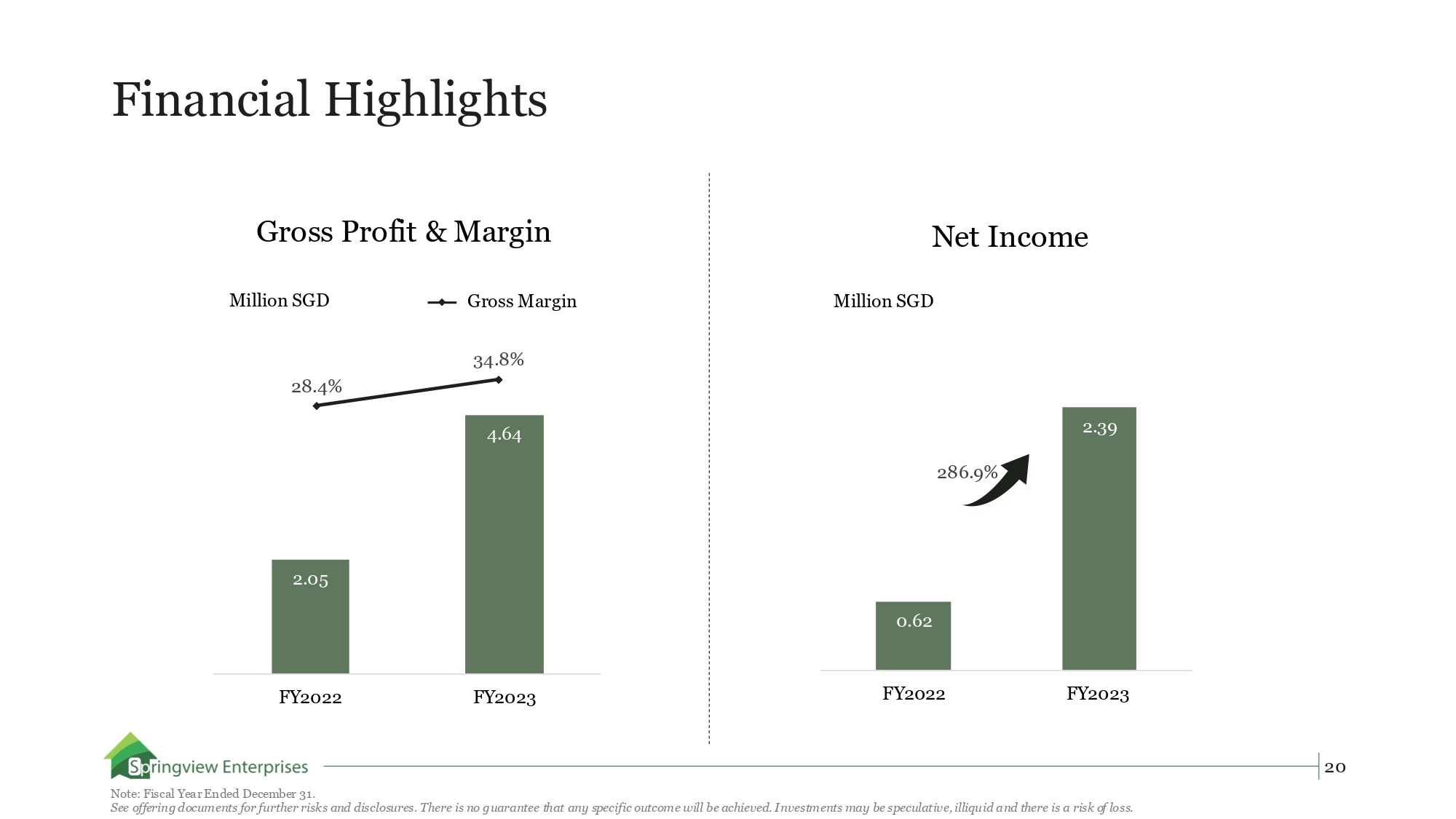

Financial Highlights 2.05 4.64 FY2022 FY2023 Gross Profit & Margin 0.62 2.39 FY2022 FY2023 Net Income Million SGD 28.4% 34.8% Gross Margin 286.9% Million SGD 20 Note: Fiscal Year Ended December 31. See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.

Contacts AC Sunshine Securities LLC Email: ib @acsunshine.com Tel: +1 - 689 - 867 - 6218 Address: 200 E. Robinson Street, Suite 295, Orlando, FL 32801 Underwriter Issuer Springview Holdings Ltd Email: ir@springviewggl.com Tel: +65 - 6271 - 2282 Address: 203 Henderson Road #06 - 01, Henderson Industrial Park Singapore 159546 21 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.