UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | | | | |

| | | |

| ☑ | | Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

for the quarterly period ended March 31, 2024

or

| | | | | | | | |

| | | |

| ☐ | | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from to |

Commission file number 1-3215

Johnson & Johnson

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| New Jersey | | 22-1024240 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

One Johnson & Johnson Plaza

New Brunswick, New Jersey 08933

(Address of principal executive offices)

Registrant’s telephone number, including area code (732) 524-0400

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☑ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☑ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☑ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| Emerging growth company | ☐ | | |

If an emerging growth company, indicated by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☑ No

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, Par Value $1.00 | JNJ | New York Stock Exchange |

| 0.650% Notes Due May 2024 | JNJ24C | New York Stock Exchange |

| 5.50% Notes Due November 2024 | JNJ24BP | New York Stock Exchange |

| 1.150% Notes Due November 2028 | JNJ28 | New York Stock Exchange |

| 1.650% Notes Due May 2035 | JNJ35 | New York Stock Exchange |

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

On April 25, 2024, 2,406,679,183 shares of Common Stock, $1.00 par value, were outstanding.

JOHNSON & JOHNSON AND SUBSIDIARIES

Table of contents

Cautionary note regarding forward-looking statements

This Quarterly Report on Form 10-Q and Johnson & Johnson’s other publicly available documents contain “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Management and representatives of Johnson & Johnson and its subsidiaries (the Company) also may from time to time make forward-looking statements. Forward-looking statements do not relate strictly to historical or current facts and reflect management’s assumptions, views, plans, objectives and projections about the future. Forward-looking statements may be identified by the use of words such as “plans,” “expects,” “will,” “anticipates,” “estimates,” and other words of similar meaning in conjunction with, among other things: discussions of future operations, expected operating results, financial performance; impact of planned acquisitions and dispositions; impact and timing of restructuring initiatives including associated cost savings and other benefits; the Company’s strategy for growth; product development activities; regulatory approvals; market position and expenditures.

Because forward-looking statements are based on current beliefs, expectations and assumptions regarding future events, they are subject to uncertainties, risks and changes that are difficult to predict and many of which are outside of the Company’s control. Investors should realize that if underlying assumptions prove inaccurate, or known or unknown risks or uncertainties materialize, the Company’s actual results and financial condition could vary materially from expectations and projections expressed or implied in its forward-looking statements. Investors are therefore cautioned not to rely on these forward-looking statements. Risks and uncertainties include, but are not limited to:

Risks related to product development, market success and competition

•Challenges and uncertainties inherent in innovation and development of new and improved products and technologies on which the Company’s continued growth and success depend, including uncertainty of clinical outcomes, additional analysis of existing clinical data, obtaining regulatory approvals, health plan coverage and customer access, and initial and continued commercial success;

•Challenges to the Company’s ability to obtain and protect adequate patent and other intellectual property rights for new and existing products and technologies in the United States and other important markets;

•The impact of patent expirations, typically followed by the introduction of competing generic, biosimilar or other products and resulting revenue and market share losses;

•Increasingly aggressive and frequent challenges to the Company’s patents by competitors and others seeking to launch competing generic, biosimilar or other products and increased receptivity of courts, the United States Patent and Trademark Office and other decision makers to such challenges, potentially resulting in loss of market exclusivity and rapid decline in sales for the relevant product sooner than expected;

•Competition in research and development of new and improved products, processes and technologies, which can result in product and process obsolescence;

•Competition to reach agreement with third parties for collaboration, licensing, development and marketing agreements for products and technologies;

•Competition based on cost-effectiveness, product performance, technological advances and patents attained by competitors; and

•Allegations that the Company’s products infringe the patents and other intellectual property rights of third parties, which could adversely affect the Company’s ability to sell the products in question and require the payment of money damages and future royalties.

Risks related to product liability, litigation and regulatory activity

•Product efficacy or safety concerns, whether or not based on scientific evidence, potentially resulting in product withdrawals, recalls, regulatory action on the part of the United States Food and Drug Administration (U.S. FDA) (or international counterparts), declining sales, reputational damage, increased litigation expense and share price impact;

•The impact, including declining sales and reputational damage, of significant litigation or government action adverse to the Company, including product liability claims and allegations related to pharmaceutical marketing practices and contracting strategies;

•The impact of an adverse judgment or settlement and the adequacy of reserves related to legal proceedings, including patent litigation, product liability, personal injury claims, securities class actions, government investigations, employment and other legal proceedings;

•Increased scrutiny of the healthcare industry by government agencies and state attorneys general resulting in investigations and prosecutions, which carry the risk of significant civil and criminal penalties, including, but not limited to, debarment from government business;

•Failure to meet compliance obligations in compliance agreements with governments or government agencies, which could result in significant sanctions;

•Potential changes to applicable laws and regulations affecting United States and international operations, including relating to: approval of new products; licensing and patent rights; sales and promotion of healthcare products; access to, and reimbursement and pricing for, healthcare products and services; environmental protection; and sourcing of raw materials;

•Compliance with local regulations and laws that may restrict the Company’s ability to manufacture or sell its products in relevant markets, including requirements to comply with medical device reporting regulations and other requirements such as the European Union’s Medical Devices Regulation;

•Changes in domestic and international tax laws and regulations, increasing audit scrutiny by tax authorities around the world and exposures to additional tax liabilities potentially in excess of existing reserves; and

•The issuance of new or revised accounting standards by the Financial Accounting Standards Board and regulations by the Securities and Exchange Commission.

Risks related to healthcare market trends and the realization of benefits from the Company's strategic initiatives

•Pricing pressures resulting from trends toward healthcare cost containment, including the continued consolidation among healthcare providers and other market participants, trends toward managed care, the shift toward governments increasingly becoming the primary payors of healthcare expenses, significant new entrants to the healthcare markets seeking to reduce costs and government pressure on companies to voluntarily reduce costs and price increases;

•Restricted spending patterns of individual, institutional and governmental purchasers of healthcare products and services due to economic hardship and budgetary constraints;

•Challenges to the Company’s ability to realize its strategy for growth including through externally sourced innovations, such as development collaborations, strategic acquisitions, licensing and marketing agreements, and the potential heightened costs of any such external arrangements due to competitive pressures;

•The potential that the expected strategic benefits and opportunities from any planned or completed acquisition or divestiture by the Company may not be realized or may take longer to realize than expected;

•The potential that the expected benefits and opportunities related to past and ongoing restructuring actions may not be realized or may take longer to realize than expected;

•The Company’s ability to divest the Company’s remaining ownership interest in Kenvue Inc. (Kenvue) and realize the anticipated benefits from the separation; and

•Kenvue's ability to succeed as a standalone publicly traded company.

Risks related to economic conditions, financial markets and operating internationally

•The risks associated with global operations on the Company and its customers and suppliers, including foreign governments in countries in which the Company operates;

•The impact of inflation and fluctuations in interest rates and currency exchange rates and the potential effect of such fluctuations on revenues, expenses and resulting margins;

•Potential changes in export/import and trade laws, regulations and policies of the United States and other countries, including any increased trade restrictions or tariffs and potential drug reimportation legislation;

•The impact on international operations from financial instability in international economies, sovereign risk, possible imposition of governmental controls and restrictive economic policies, and unstable international governments and legal systems;

•The impact of global public health crises and pandemics;

•Changes to global climate, extreme weather and natural disasters that could affect demand for the Company’s products and services, cause disruptions in manufacturing and distribution networks, alter the availability of goods and services within the supply chain, and affect the overall design and integrity of the Company’s products and operations;

•The impact of global or economic changes or events, including global tensions and war; and

•The impact of armed conflicts and terrorist attacks in the United States and other parts of the world, including social and economic disruptions and instability of financial and other markets.

Risks related to supply chain and operations

•Difficulties and delays in manufacturing, internally, through third-party providers or otherwise within the supply chain, that may lead to voluntary or involuntary business interruptions or shutdowns, product shortages, withdrawals or suspensions of products from the market, and potential regulatory action;

•Interruptions and breaches of the Company’s information technology systems or those of the Company’s vendors, which could result in reputational, competitive, operational or other business harm as well as financial costs and regulatory action;

•Reliance on global supply chains and production and distribution processes that are complex and subject to increasing regulatory requirements that may adversely affect supply, sourcing and pricing of materials used in the Company’s products; and

•The potential that the expected benefits and opportunities related to restructuring actions may not be realized or may take longer to realize than expected, including due to any required approvals from applicable regulatory authorities.

Investors also should carefully read the Risk Factors described in Item 1A of the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2023, for a description of certain risks that could, among other things, cause the Company’s actual results to differ materially from those expressed in its forward-looking statements. Investors should understand that it is not possible to predict or identify all such factors and should not consider the risks described above to be a complete statement of all potential risks and uncertainties. The Company does not undertake to publicly update any forward-looking statement that may be made from time to time, whether as a result of new information or future events or developments.

Part I — Financial information

Item 1 — Financial statements

Johnson & Johnson and subsidiaries consolidated balance sheets

(Unaudited; Dollars in Millions Except Share and Per Share Data)

| | | | | | | | | | | | | | |

| | March 31, 2024 | | December 31, 2023 |

| Assets |

| Current assets: | | | | |

| Cash and cash equivalents (Note 4) | | $25,473 | | 21,859 |

| | | | |

| Marketable securities | | 745 | | 1,068 |

| Accounts receivable, trade, less allowances $162 (2023, $166) | | 14,946 | | 14,873 |

| Inventories (Note 2) | | 11,383 | | 11,181 |

| Prepaid expenses and other | | 4,455 | | 4,514 |

| | | | |

| Total current assets | | 57,002 | | 53,495 |

| Property, plant and equipment at cost | | 47,585 | | 47,776 |

| Less: accumulated depreciation | | (27,953) | | (27,878) |

| Property, plant and equipment, net | | 19,632 | | 19,898 |

| Intangible assets, net (Note 3) | | 34,286 | | 34,175 |

| Goodwill (Note 3) | | 36,616 | | 36,558 |

| Deferred taxes on income (Note 5) | | 10,305 | | 9,279 |

| Other assets | | 14,125 | | 14,153 |

| | | | |

| Total assets | | $171,966 | | 167,558 |

| Liabilities and shareholders’ equity |

| Current liabilities: | | | | |

| Loans and notes payable | | $8,550 | | 3,451 |

| Accounts payable | | 8,174 | | 9,632 |

| Accrued liabilities | | 10,323 | | 10,212 |

| Accrued rebates, returns and promotions | | 16,182 | | 16,001 |

| Accrued compensation and employee related obligations | | 2,178 | | 3,993 |

| Accrued taxes on income (Note 5) | | 3,318 | | 2,993 |

| | | | |

| Total current liabilities | | 48,725 | | 46,282 |

| Long-term debt (Note 4) | | 25,082 | | 25,881 |

| Deferred taxes on income (Note 5) | | 3,172 | | 3,193 |

| Employee related obligations (Note 6) | | 7,019 | | 7,149 |

| Long-term taxes payable (Note 5) | | 2,881 | | 2,881 |

| Other liabilities | | 15,067 | | 13,398 |

| | | | |

| Total liabilities | | $101,946 | | 98,784 |

| Commitments and Contingencies (Note 11) | | | | |

| Shareholders’ equity: | | | | |

| Common stock — par value $1.00 per share (authorized 4,320,000,000 shares; issued 3,119,843,000 shares) | | $3,120 | | 3,120 |

| Accumulated other comprehensive income (loss) (Note 7) | | (10,768) | | (12,527) |

| Retained earnings and Additional paid-in capital | | 153,378 | | 153,843 |

| Less: common stock held in treasury, at cost (713,120,000 and 712,765,000 shares) | | 75,710 | | 75,662 |

| Total shareholders’ equity | | $70,020 | | 68,774 |

| Total liabilities and shareholders’ equity | | $171,966 | | 167,558 |

See Notes to Consolidated Financial Statements

Johnson & Johnson and subsidiaries consolidated statements of earnings

(Unaudited; Dollars & Shares in Millions Except Per Share Amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fiscal First Quarter Ended |

| | March 31,

2024 | | Percent

to Sales | | April 2,

2023 | | Percent

to Sales |

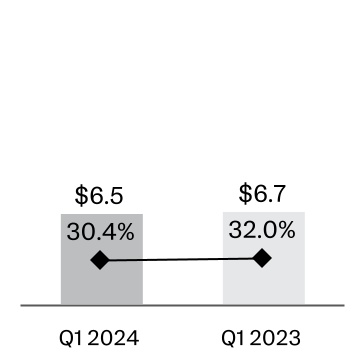

| Sales to customers (Note 9) | | $21,383 | | 100.0 | % | | $20,894 | | 100.0 | % |

| Cost of products sold | | 6,511 | | | 30.4 | | | 6,687 | | 32.0 | |

| Gross profit | | 14,872 | | | 69.6 | | | 14,207 | | 68.0 | |

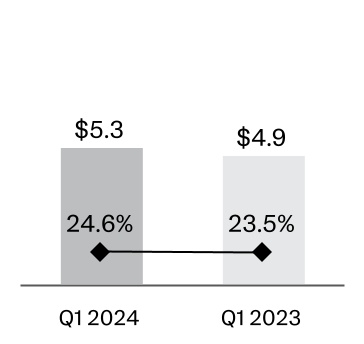

| Selling, marketing and administrative expenses | | 5,257 | | | 24.6 | | | 4,906 | | 23.5 | |

| Research and development expense | | 3,542 | | | 16.6 | | | 3,455 | | 16.6 | |

| In-process research and development impairments | | — | | | — | | | 49 | | 0.2 | |

| Interest income | | (364) | | | (1.7) | | | (198) | | (0.9) | |

| Interest expense, net of portion capitalized | | 155 | | | 0.7 | | | 212 | | 1.0 | |

| Other (income) expense, net | | 2,404 | | | 11.2 | | | 6,940 | | 33.2 | |

| Restructuring (Note 12) | | 164 | | | 0.8 | | | 130 | | 0.6 | |

| Earnings (loss) before provision for taxes on income | | 3,714 | | | 17.4 | | | (1,287) | | (6.2) | |

| Provision for (benefit from) taxes on income (Note 5) | | 459 | | | 2.2 | | | (796) | | (3.9) | |

| Net earnings (loss) from continuing operations | | 3,255 | | | 15.2 | % | | (491) | | (2.3) | % |

| Net earnings from discontinued operations, net of tax | | — | | | | | 423 | | |

| Net earnings (loss) | | $3,255 | | | | | $(68) | | |

| Net earnings (loss) per share (Note 8) | | | | | | | | |

| Continuing operations - basic | | $1.35 | | | | | $(0.19) | | |

| Discontinued operations - basic | | — | | | | | 0.16 | | |

| Total net earnings (loss) per share - basic | | $1.35 | | | | | $(0.03) | | |

| Continuing operations - diluted | | $1.34 | | | | | $(0.19) | | |

| Discontinued operations - diluted | | — | | | | | 0.16 | | |

| Total net earnings (loss) per share - diluted | | $1.34 | | | | | $(0.03) | | |

| Avg. shares outstanding | | | | | | | | |

| Basic | | 2,408.2 | | | | | 2,605.5 | | |

| Diluted | | 2,430.1 | | | | | 2,605.5 | * | |

See Notes to Consolidated Financial Statements

* Basic shares used when in a loss position from continuing operations

Prior year results have been recast to reflect the continuing operations of Johnson & Johnson

Johnson & Johnson and subsidiaries consolidated statements of comprehensive income

(Unaudited; Dollars in Millions)

| | | | | | | | | | | | | | | | | |

| | | Fiscal First Quarter Ended |

| | | | | March 31, 2024 | | April 2, 2023 |

| | | | | | | |

| Net earnings / (Loss) | | | | | $3,255 | | (68) |

| | | | | | | |

| Other comprehensive income (loss), net of tax | | | | | | | |

| Foreign currency translation | | | | | 2,123 | | (181) |

| | | | | | | |

| Securities: | | | | | | | |

| Unrealized holding gain (loss) arising during period | | | | | 2 | | 17 |

| Reclassifications to earnings | | | | | — | | — |

| | | | | | | |

| Net change | | | | | 2 | | 17 |

| | | | | | | |

| Employee benefit plans: | | | | | | | |

| Prior service cost amortization during period | | | | | (238) | | (35) |

| Gain (loss) amortization during period | | | | | 290 | | (33) |

| | | | | | | |

| Net change | | | | | 52 | | (68) |

| | | | | | | |

| Derivatives & hedges: | | | | | | | |

| Unrealized gain (loss) arising during period | | | | | (167) | | 570 |

| Reclassifications to earnings | | | | | (251) | | 3 |

| Net change | | | | | (418) | | 573 |

| | | | | | | |

| Other comprehensive income (loss) | | | | | 1,759 | | 341 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Comprehensive income | | | | | $5,014 | | 273 |

| | | | | | | |

See Notes to Consolidated Financial Statements

Amounts presented have not been recast to exclude discontinued operations.

| | |

|

|

| The tax effects in other comprehensive income/(loss) for the fiscal first quarter were as follows for 2024 and 2023, respectively: Foreign Currency Translation: $619 million and $234 million; Securities: $1 million and $5 million; Employee Benefit Plans: $42 million and $22 million; Derivatives & Hedges: $111 million and $154 million. |

Johnson & Johnson and subsidiaries consolidated statements of equity

(Unaudited; Dollars in Millions)

Fiscal First Quarter Ended March 31, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total | | Retained Earnings and Additional Paid-in Capital | | Accumulated

Other

Comprehensive

Income (AOCI) | | Common Stock

Issued Amount | | Treasury

Stock

Amount | | | |

| Balance, December 31, 2023 | $68,774 | | 153,843 | | (12,527) | | 3,120 | | (75,662) | | | |

| Net earnings | 3,255 | | 3,255 | | — | | — | | — | | | |

| Cash dividends paid ($1.19 per share) | (2,869) | | (2,869) | | — | | — | | — | | | |

| Employee compensation and stock option plans | 577 | | (851) | | — | | — | | 1,428 | | | |

| Repurchase of common stock | (1,475) | | — | | — | | — | | (1,475) | | | |

| Other | (1) | | — | | — | | — | | (1) | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Other comprehensive income (loss), net of tax | 1,759 | | — | | 1,759 | | — | | — | | | |

| Balance, March 31, 2024 | $70,020 | | 153,378 | | (10,768) | | 3,120 | | (75,710) | | | |

| | | | | | | | | | | | |

Fiscal First Quarter Ended April 2, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

|

| Total | | Retained Earnings and Additional Paid-in Capital | | Accumulated

Other

Comprehensive

Income | | Common Stock

Issued Amount | | Treasury

Stock

Amount |

| Balance, January 1, 2023 | $76,804 | | 128,345 | | (12,967) | | 3,120 | | (41,694) |

| | | | | | | | | |

| Net earnings | (68) | | (68) | | — | | — | | — |

| Cash dividends paid ($1.13 per share) | (2,942) | | (2,942) | | — | | — | | — |

| Employee compensation and stock option plans | 295 | | (777) | | — | | — | | 1,072 |

| Repurchase of common stock | (3,537) | | — | | — | | — | | (3,537) |

| Other | (24) | | — | | — | | — | | (24) |

| Other comprehensive income (loss), net of tax | 341 | | — | | 341 | | — | | — |

| Balance, April 2, 2023 | $70,869 | | 124,558 | | (12,626) | | 3,120 | | (44,183) |

| | | | | | | | | |

See Notes to Consolidated Financial Statements

Johnson & Johnson and subsidiaries consolidated statements of cash flows

(Unaudited; Dollars in Millions)

| | | | | | | | | | | | | | |

| | | Fiscal Three Months Ended |

| | March 31,

2024 | | April 2,

2023 |

| Cash flows from operating activities | | | | |

| Net earnings/(Loss) | | $3,255 | | (68) |

| Adjustments to reconcile net earnings to cash flows from operating activities: | | | | |

| Depreciation and amortization of property and intangibles | | 1,815 | | 1,880 |

| Stock based compensation | | 302 | | 306 |

| | | | |

| | | | |

| Asset write-downs | | 185 | | 426 |

| | | | |

| | | | |

| | | | |

| Net gain on sale of assets/businesses | | — | | (8) |

| | | | |

| Deferred tax provision | | (1,562) | | (1,543) |

| Credit losses and accounts receivable allowances | | — | | 1 |

| Changes in assets and liabilities, net of effects from acquisitions and divestitures: | | | | |

| Increase in accounts receivable | | (279) | | (54) |

| Increase in inventories | | (348) | | (524) |

| Decrease in accounts payable and accrued liabilities | | (2,483) | | (2,572) |

| Decrease/(Increase) in other current and non-current assets | | 3,199 | | (915) |

| (Decrease)/Increase in other current and non-current liabilities | | (427) | | 6,328 |

| | | | |

| Net cash flows from operating activities | | 3,657 | | 3,257 |

| | | | |

| Cash flows from investing activities | | | | |

| Additions to property, plant and equipment | | (807) | | (863) |

| Proceeds from the disposal of assets/businesses, net (Note 10) | | 210 | | 40 |

| Acquisitions, net of cash acquired (Note 10) | | (1,811) | | — |

| Purchases of investments | | (630) | | (3,774) |

| Sales of investments | | 979 | | 7,766 |

| Credit support agreements activity, net | | 1,600 | | 158 |

| Other (including capitalized licenses and milestones) | | (5) | | (12) |

| | | | |

| Net cash (used by)/ from investing activities | | (464) | | 3,315 |

| | | | |

| Cash flows from financing activities | | | | |

| Dividends to shareholders | | (2,869) | | (2,942) |

| Repurchase of common stock | | (1,475) | | (3,537) |

| Proceeds from short-term debt | | 5,263 | | 11,094 |

| Repayment of short-term debt | | (890) | | (5,388) |

| Proceeds from long-term debt, net of issuance costs | | 2 | | 7,674 |

| Repayment of long-term debt | | (1) | | (500) |

| Proceeds from the exercise of stock options/employee withholding tax on stock awards, net | | 195 | | (11) |

| Credit support agreements activity, net | | 228 | | (13) |

| | | | |

| | | | |

| | | | |

| Other | | 93 | | (239) |

| | | | |

| Net cash flows from financing activities | | 546 | | 6,138 |

| | | | |

| | | | | | | | | | | | | | |

| | | Fiscal Three Months Ended |

| | March 31,

2024 | | April 2,

2023 |

| | | | |

| Effect of exchange rate changes on cash and cash equivalents | | (125) | | 28 |

| Increase in cash, cash equivalents and restricted cash | | 3,614 | | 12,738 |

| Cash and cash equivalents from continuing operations, beginning of period | | 21,859 | | 12,889 |

| Cash and cash equivalents from discontinued operations, beginning of period | | — | | 1,238 |

| Cash and Cash equivalents beginning of period | | 21,859 | | 14,127 |

| | | | |

| Cash and cash equivalents from continuing operations, end of period | | 25,473 | | 25,188 |

| Cash and cash equivalents from discontinued operations, end of period | | — | | 1,677 |

| Cash, cash equivalents and restricted cash, end of period | | $25,473 | | 26,865 |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Acquisitions | | | | |

| Fair value of assets acquired | | $1,899 | | — |

| Fair value of liabilities assumed | | (88) | | — |

| Net cash paid for acquisitions | | $1,811 | | — |

| | | | |

| | | | |

See Notes to Consolidated Financial Statements

Amounts presented have not been recast to exclude discontinued operations.

Notes to consolidated financial statements

Note 1 — The accompanying unaudited interim consolidated financial statements and related notes should be read in conjunction with the audited Consolidated Financial Statements of Johnson & Johnson and its subsidiaries (the Company) and related notes as contained in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023. The unaudited interim financial statements include all adjustments (consisting only of normal recurring adjustments) and accruals necessary in the judgment of management for a fair statement of the results for the periods presented.

Columns and rows within tables may not add due to rounding. Percentages have been calculated using actual, non-rounded figures.

New accounting standards

The Company assesses the adoption impacts of recently issued accounting standards by the Financial Accounting Standards Board on the Company's financial statements as well as material updates to previous assessments, if any, from the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

Recently adopted accounting standards

There were no new material accounting standards adopted in the fiscal first quarter of 2024.

Recently issued accounting standards

Not adopted as of March 31, 2024

ASU 2023-07: Segment Reporting (Topic 280) – Improvements to Reportable Segment Disclosures

This update requires expanded annual and interim disclosures for significant segment expenses that are regularly provided to the chief operating decision maker and included within each reported measure of segment profit or loss. This update will be effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024. This standard is to be applied retrospectively to all periods presented in the financial statements. Early adoption is permitted. As this accounting standard only impacts disclosures, it will not have a material impact on the Company’s Consolidated Financial Statements.

ASU 2023-09: Income Taxes (Topic 740) - Improvements to Income Tax Disclosures

This update standardizes categories for the effective tax rate reconciliation, requires disaggregation of income taxes and additional income tax-related disclosures. This update is required to be effective for the Company for fiscal periods beginning after December 15, 2024. As this accounting standard only impacts disclosures, it will not have a material impact on the Company’s Consolidated Financial Statements.

There were no new material accounting standards issued in the fiscal first quarter of 2024.

Supplier finance program obligations

The Company has agreements for supplier finance programs with third-party financial institutions. These programs provide participating suppliers the ability to finance payment obligations from the Company with the third-party financial institutions. The Company is not a party to the arrangements between the suppliers and the third-party financial institutions. The Company’s obligations to its suppliers, including amounts due, and scheduled payment dates (which have general payment terms of 90 days), are not affected by a participating supplier’s decision to participate in the program.

As of March 31, 2024, and December 31, 2023, $0.6 billion and $0.7 billion, respectively, were valid obligations under the program. The obligations are presented as Accounts payable on the Consolidated Balance Sheets.

Note 2 — Inventories

| | | | | | | | | | | |

| (Dollars in Millions) | March 31, 2024 | | December 31, 2023 |

| Raw materials and supplies | $2,331 | | 2,355 |

| Goods in process | 2,172 | | 1,952 |

| Finished goods | 6,880 | | 6,874 |

| Total inventories | $11,383 | | 11,181 |

Note 3 — Intangible assets and goodwill

Intangible assets that have finite useful lives are amortized over their estimated useful lives. The latest annual impairment assessment of goodwill and indefinite lived intangible assets was completed in the fiscal fourth quarter of 2023. Future impairment tests for goodwill and indefinite lived intangible assets will be performed annually in the fiscal fourth quarter, or sooner, if warranted.

| | | | | | | | | | | |

| (Dollars in Millions) | March 31, 2024 | | December 31, 2023 |

| Intangible assets with definite lives: | | | |

| Patents and trademarks — gross | $39,198 | | 40,417 |

| Less accumulated amortization | (24,826) | | (24,808) |

| Patents and trademarks — net | 14,372 | | 15,609 |

| Customer relationships and other intangibles — gross | 19,930 | | 20,322 |

| Less accumulated amortization | (12,742) | | (12,685) |

Customer relationships and other intangibles — net(1) | 7,188 | | 7,637 |

| Intangible assets with indefinite lives: | | | |

| Trademarks | 1,649 | | 1,714 |

| Purchased in-process research and development | 11,077 | | 9,215 |

| Total intangible assets with indefinite lives | 12,726 | | 10,929 |

| Total intangible assets — net | $34,286 | | 34,175 |

(1)The majority is comprised of customer relationships

Goodwill as of March 31, 2024 was allocated by segment of business as follows:

| | | | | | | | | | | | | | | | | | | |

| (Dollars in Millions) | | | Innovative Medicine | | MedTech | | Total |

| Goodwill at December 31, 2023 | | | $10,407 | | 26,151 | | 36,558 |

| Goodwill, related to acquisitions | | | 290 | | — | | 290 |

| Goodwill, related to divestitures | | | — | | — | | — |

| Currency translation/Other | | | (145) | | (87) | | (232) |

| Goodwill at March 31, 2024 | | | $10,552 | | 26,064 | | 36,616 |

The weighted average amortization period for patents and trademarks is approximately 11 years. The weighted average amortization period for customer relationships and other intangible assets is approximately 18 years. The amortization expense of amortizable intangible assets included in the cost of products sold was $1.1 billion and $1.1 billion for the fiscal first quarters ended March 31, 2024 and April 2, 2023, respectively. Intangible asset write-downs are included in Other (income) expense, net.

The estimated amortization expense for approved products, before tax, for the five succeeding years is approximately:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in Millions) | | | | | | |

| 2024 | | 2025 | | 2026 | | 2027 | | 2028 |

| $4,300 | | 3,500 | | 2,900 | | 2,300 | | 1,600 |

See Note 10 to the Consolidated Financial Statements for additional details related to acquisitions and divestitures.

Note 4 — Fair value measurements

The Company uses forward foreign exchange contracts to manage its exposure to the variability of cash flows, primarily related to the foreign exchange rate changes of future intercompany product and third-party purchases of materials denominated in a foreign currency. The Company uses cross currency interest rate swaps to manage currency risk primarily related to borrowings. Both types of derivatives are designated as cash flow hedges.

Additionally, the Company uses interest rate swaps as an instrument to manage interest rate risk related to fixed rate borrowings. These derivatives are designated as fair value hedges. The Company uses cross currency interest rate swaps and forward foreign exchange contracts designated as net investment hedges. Additionally, the Company uses forward foreign exchange contracts to offset its exposure to certain foreign currency assets and liabilities. These forward foreign exchange contracts are not designated as hedges, and therefore, changes in the fair values of these derivatives are recognized in earnings, thereby offsetting the current earnings effect of the related foreign currency assets and liabilities.

The Company does not enter into derivative financial instruments for trading or speculative purposes, or that contain credit risk related contingent features. The Company maintains credit support agreements (CSA) with certain derivative counterparties establishing collateral thresholds based on respective credit ratings and netting agreements. As of March 31, 2024, the cumulative amount of cash collateral paid by the Company under the CSA amounted to $2.2 billion net, related to net investment and cash flow hedges. On an ongoing basis, the Company monitors counter-party credit ratings. The Company considers credit non-performance risk to be low, because the Company primarily enters into agreements with commercial institutions that have at least an investment grade credit rating. Refer to the table on significant financial assets and liabilities measured at fair value contained in this footnote for receivables and payables with these commercial institutions. As of March 31, 2024, the Company had notional amounts outstanding for forward foreign exchange contracts, cross currency interest rate swaps and interest rate swaps of $43.2 billion, $39.6 billion and $10.0 billion, respectively. As of December 31, 2023, the Company had notional amounts outstanding for forward foreign exchange contracts, cross currency interest rate swaps and interest rate swaps of $42.9 billion, $39.7 billion and $10.0 billion, respectively.

All derivative instruments are recorded on the balance sheet at fair value. Changes in the fair value of derivatives are recorded each period in current earnings or other comprehensive income, depending on whether the derivative is designated as part of a hedge transaction, and if so, the type of hedge transaction.

The designation as a cash flow hedge is made at the entrance date of the derivative contract. At inception, all derivatives are expected to be highly effective. Foreign exchange contracts designated as cash flow hedges are accounted for under the forward method and all gains/losses associated with these contracts will be recognized in the income statement when the hedged item impacts earnings. Changes in the fair value of these derivatives are recorded in accumulated other comprehensive income until the underlying transaction affects earnings and are then reclassified to earnings in the same account as the hedged transaction.

Gains and losses associated with interest rate swaps and changes in fair value of hedged debt attributable to changes in interest rates are recorded to interest expense in the period in which they occur. Gains and losses on net investment hedges are accounted for through the currency translation account within accumulated other comprehensive income. The portion excluded from effectiveness testing is recorded through interest (income) expense using the spot method. On an ongoing basis, the Company assesses whether each derivative continues to be highly effective in offsetting changes of hedged items. If and when a derivative is no longer expected to be highly effective, hedge accounting is discontinued.

The Company designated its Euro denominated notes with due dates ranging from 2024 to 2035 as a net investment hedge of the Company's investments in certain of its international subsidiaries that use the Euro as their functional currency in order to reduce the volatility caused by changes in exchange rates.

As of March 31, 2024, the balance of deferred net loss on derivatives included in accumulated other comprehensive income was $795 million after-tax. For additional information, see the Consolidated Statements of Comprehensive Income and Note 7. The Company expects that substantially all of the amounts related to forward foreign exchange contracts will be reclassified into earnings over the next 12 months as a result of transactions that are expected to occur over that period. The maximum length of time over which the Company is hedging transaction exposure is 18 months, excluding interest rate contracts and net investment hedge contracts. The amount ultimately realized in earnings may differ as foreign exchange rates change. Realized gains and losses are ultimately determined by actual exchange rates at maturity of the derivative.

The following table is a summary of the activity related to derivatives and hedges for the fiscal first quarters ended March 31, 2024 and April 2, 2023, net of tax:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2024 | | April 2, 2023 |

| (Dollars in Millions) | Sales | Cost of Products Sold | R&D Expense | Interest (Income) Expense | Other (Income) Expense | | Sales | Cost of Products Sold | R&D Expense | Interest (Income) Expense | Other (Income) Expense |

| | | | | | | | | | | |

| | | | | | | | | | | |

| The effects of fair value, net investment and cash flow hedging: | | | | | | | | | | | |

| Gain (Loss) on fair value hedging relationship: | | | | | | | | | | | |

| Interest rate swaps contracts: | | | | | | | | | | | |

| Hedged items | $— | — | — | 8 | — | | — | — | — | 169 | — |

| Derivatives designated as hedging instruments | — | — | — | (8) | — | | — | — | — | (169) | — |

| | | | | | | | | | | |

| Gain (Loss) on net investment hedging relationship: | | | | | | | | | | | |

| Cross currency interest rate swaps contracts: | | | | | | | | | | | |

| Amount of gain or (loss) recognized in income on derivative amount excluded from effectiveness testing | — | — | — | 34 | — | | — | — | — | 34 | — |

| Amount of gain or (loss) recognized in AOCI | — | — | — | 34 | — | | — | — | — | 34 | — |

| | | | | | | | | | | |

| Gain (Loss) on cash flow hedging relationship: | | | | | | | | | | | |

| Forward foreign exchange contracts: | | | | | | | | | | | |

| Amount of gain or (loss) reclassified from AOCI into income | 1 | 165 | 4 | — | (2) | | 12 | (146) | (13) | — | 2 |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Amount of gain or (loss) recognized in AOCI | (3) | (19) | 22 | — | 4 | | 24 | 145 | (36) | — | (14) |

| | | | | | | | | | | |

| Cross currency interest rate swaps contracts: | | | | | | | | | | | |

| Amount of gain or (loss) reclassified from AOCI into income | — | — | — | 49 | — | | — | — | — | 108 | — |

| | | | | | | | | | | |

| Amount of gain or (loss) recognized in AOCI | $— | — | — | (205) | — | | — | — | — | 417 | — |

| | | | | | | | | | | |

As of March 31, 2024, and December 31, 2023, the following amounts were recorded on the Consolidated Balance Sheet related to cumulative basis adjustment for fair value hedges:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Line item in the Consolidated Balance Sheet in which the hedged item is included | | Carrying Amount of the Hedged Liability

| | Cumulative Amount of Fair Value Hedging Gain/ (Loss) Included in the Carrying Amount of the Hedged Liability |

| | |

| (Dollars in Millions) | | March 31, 2024 | | December 31, 2023 | | March 31, 2024 | | December 31, 2023 |

| | | | | | | | |

| Long-term Debt | | $8,871 | | 8,862 | | (1,205) | | (1,216) |

| | | | | | | | |

The following table is the effect of derivatives not designated as hedging instruments for the fiscal first quarters ended 2024 and 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | | | | Gain/(Loss)

Recognized In

Income on Derivative | |

| (Dollars in Millions) | | Location of Gain /(Loss) Recognized in Income on Derivative | | | | Fiscal First Quarter Ended | |

| Derivatives Not Designated as Hedging Instruments | | | | | | | | March 31, 2024 | | April 2, 2023 | |

| Foreign Exchange Contracts | | Other (income) expense | | | | | | 25 | | (31) | |

The following table is the effect of net investment hedges for the fiscal first quarters ended in 2024 and 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| | Gain/(Loss)

Recognized In

Accumulated OCI | | Location of Gain or (Loss) Reclassified from Accumulated Other Comprehensive Income Into Income | | Gain/(Loss) Reclassified From

Accumulated OCI

Into Income |

| (Dollars in Millions) | | March 31, 2024 | | April 2, 2023 | | | | March 31, 2024 | | April 2, 2023 |

| Debt | | $84 | | (77) | | Interest (income) expense | | — | | — |

| Cross Currency interest rate swaps | | $728 | | 690 | | Interest (income) expense | | — | | — |

The Company holds equity investments with readily determinable fair values and equity investments without readily determinable fair values. The Company has elected to measure equity investments that do not have readily determinable fair values at cost minus impairment, if any, plus or minus changes resulting from observable price changes in orderly transactions for the identical or a similar investment of the same issuer.

The following table is a summary of the activity related to equity investments:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2023 | | | | | | March 31, 2024 |

| (Dollars in Millions) | | Carrying Value | | Changes in Fair Value Reflected in Net Income (1) | | Sales/ Purchases/Other (2) | | Carrying Value | | Non Current Other Assets |

| Equity Investments with readily determinable value* | | $4,473 | | 30 | | (17) | | 4,486 | | 4,486 |

| | | | | | | | | | |

| Equity Investments without readily determinable value | | $696 | | 23 | | (12) | | 707 | | 707 |

(1)Recorded in Other (income)/expense, net

(2)Other includes impact of currency

* Includes the 9.5% remaining stake in Kenvue and the unfavorable change in the fair value of the investment.

Fair value is the exit price that would be received to sell an asset or paid to transfer a liability. Fair value is a market-based measurement determined using assumptions that market participants would use in pricing an asset or liability. In accordance with ASC 820, a three-level hierarchy was established to prioritize the inputs used in measuring fair value. The levels within the hierarchy are described below with Level 1 inputs having the highest priority and Level 3 inputs having the lowest.

The fair value of a derivative financial instrument (i.e., forward foreign exchange contracts, interest rate contracts) is the aggregation by currency of all future cash flows discounted to its present value at the prevailing market interest rates and subsequently converted to the U.S. Dollar at the current spot foreign exchange rate. The Company does not believe that fair values of these derivative instruments materially differ from the amounts that could be realized upon settlement or maturity, or that the changes in fair value will have a material effect on the Company’s results of operations, cash flows or financial position. The Company also holds equity investments which are classified as Level 1 and debt securities which are classified as Level 2. The Company holds acquisition related contingent liabilities based upon certain regulatory and commercial events, which are classified as Level 3, whose values are determined using discounted cash flow methodologies or similar techniques for which the determination of fair value requires significant judgment or estimations.

The following three levels of inputs are used to measure fair value:

Level 1 — Quoted prices in active markets for identical assets and liabilities.

Level 2 — Significant other observable inputs.

Level 3 — Significant unobservable inputs.

The Company’s significant financial assets and liabilities measured at fair value as of March 31, 2024 and December 31, 2023 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | March 31, 2024 | | | | December 31, 2023 |

| (Dollars in Millions) | | Level 1 | | Level 2 | | Level 3 | | Total | | Total(1) |

| Derivatives designated as hedging instruments: | | | | | | | | | | |

| Assets: | | | | | | | | | | |

| Forward foreign exchange contracts | | $— | | 499 | | — | | 499 | | 539 |

Interest rate contracts(2) | | — | | 1,202 | | — | | 1,202 | | 988 |

| | | | | | | | | | |

| Total | | — | | 1,701 | | — | | 1,701 | | 1,527 |

| Liabilities: | | | | | | | | | | |

| Forward foreign exchange contracts | | — | | 401 | | — | | 401 | | 624 |

Interest rate contracts(2) | | — | | 3,543 | | — | | 3,543 | | 5,338 |

| | | | | | | | | | |

| Total | | — | | 3,944 | | — | | 3,944 | | 5,962 |

| Derivatives not designated as hedging instruments: | | | | | | | | | | |

| Assets: | | | | | | | | | | |

| Forward foreign exchange contracts | | — | | 21 | | — | | 21 | | 64 |

| Liabilities: | | | | | | | | | | |

| Forward foreign exchange contracts | | — | | 36 | | — | | 36 | | 75 |

| Other Investments: | | | | | | | | | | |

Equity investments(3) | | 4,486 | | — | | — | | 4,486 | | 4,473 |

Debt securities(4) | | — | | 9,346 | | — | | 9,346 | | 8,874 |

| Other Liabilities | | | | | | | | | | |

Contingent consideration(5) | | $— | | — | | 1,114 | | 1,114 | | 1,092 |

| | | | | | | | | | | | | | |

| Gross to Net Derivative Reconciliation | | March 31, 2024 | | December 31, 2023 |

| (Dollars in Millions) | | | | |

| Total Gross Assets | | $1,722 | | 1,591 |

| Credit Support Agreement (CSA) | | (1,681) | | (1,575) |

| Total Net Asset | | 41 | | 16 |

| | | | |

| Total Gross Liabilities | | 3,980 | | 6,037 |

| Credit Support Agreement (CSA) | | (3,882) | | (5,604) |

| Total Net Liabilities | | $98 | | 433 |

| | | | |

Summarized information about changes in liabilities for contingent consideration for the fiscal first quarters ended March 31, 2024 and April 2, 2023 is as follows:

| | | | | | | | | | | | | | |

| | |

| | March 31, 2024 | | April 2, 2023 |

| (Dollars in Millions) | | | | |

| Beginning Balance | | $1,092 | | 1,120 |

Changes in estimated fair value(6) | | 22 | | 23 |

| Additions | | — | | — |

| Payments | | — | | (1) |

| Ending Balance | | $1,114 | | 1,142 |

(1)2023 assets and liabilities are all classified as Level 2 with the exception of equity investments of $4,473 million, which are classified as Level 1 and contingent consideration of $1,092 million, classified as Level 3.

(2)Includes cross currency interest rate swaps and interest rate swaps.

(3)Classified as non-current other assets.

(4)Classified within cash equivalents and current marketable securities.

(5)Classified as non-current other liabilities as of March 31, 2024 and December 31, 2023, respectively.

(6)Ongoing fair value adjustment amounts are primarily recorded in Research and Development expense.

The Company's cash, cash equivalents and current marketable securities as of March 31, 2024 comprised:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in Millions) | Carrying Amount | | Unrealized Gain | | | | Estimated Fair Value | | Cash & Cash Equivalents | | Current Marketable Securities |

| Cash | $3,410 | | — | | | | 3,410 | | 3,410 | | — |

| U.S. Gov't securities | 96 | | — | | | | 96 | | 96 | | — |

| Non-U.S. sovereign securities | 324 | | — | | | | 324 | | 324 | | — |

| U.S. reverse repurchase agreements | 7,892 | | — | | | | 7,892 | | 7,892 | | — |

| | | | | | | | | | | |

Corporate debt securities(1) | 702 | | — | | | | 702 | | 588 | | 114 |

| Money market funds | 3,822 | | — | | | | 3,822 | | 3,822 | | — |

Time deposits(1) | 626 | | — | | | | 626 | | 626 | | — |

| Subtotal | 16,872 | | — | | | | 16,872 | | 16,758 | | 114 |

| | | | | | | | | | | |

| | | | | | | | | | | |

| U.S. Gov’t securities | 9,064 | | — | | | | 9,064 | | 8,665 | | 399 |

| U.S. Gov’t Agencies | 41 | | 2 | | | | 43 | | — | | 43 |

| Other sovereign securities | 2 | | — | | | | 2 | | — | | 2 |

| Corporate debt securities | 237 | | — | | | | 237 | | 50 | | 187 |

Subtotal available for sale debt(2) | $9,344 | | 2 | | | | 9,346 | | 8,715 | | 631 |

| Total cash, cash equivalents and current marketable securities | $26,216 | | 2 | | | | 26,218 | | 25,473 | | 745 |

(1)Held to maturity investments are reported at amortized cost and gains or losses are reported in earnings.

(2)Available for sale debt securities are reported at fair value with unrealized gains and losses reported net of taxes in other comprehensive income.

As of the fiscal year ended December 31, 2023, the carrying amount was approximately the same as the estimated fair value.

Fair value of government securities and obligations and corporate debt securities was estimated using quoted broker prices and significant other observable inputs.

The Company classifies all highly liquid investments with stated maturities of three months or less from date of purchase as cash equivalents and all highly liquid investments with stated maturities of greater than three months from the date of purchase as current marketable securities. Available for sale securities with stated maturities of greater than one year from the date of purchase are available to fund current operations and are classified as either cash equivalents or current marketable securities.

The contractual maturities of the available for sale securities as of March 31, 2024 are as follows:

| | | | | | | | | | | | | | |

| (Dollars in Millions) | | Cost Basis | | Fair Value |

| Due within one year | | $9,331 | | 9,333 |

| Due after one year through five years | | 13 | | 13 |

| Due after five years through ten years | | — | | — |

| Total debt securities | | $9,344 | | 9,346 |

Financial instruments not measured at fair value

The following financial liabilities are held at carrying amount on the consolidated balance sheet as of March 31, 2024:

| | | | | | | | | | | | | | |

| (Dollars in Millions) | | Carrying Amount | | Estimated Fair Value |

| | | | |

| Financial Liabilities | | | | |

| | | | |

| Current Debt | | $8,550 | | 8,533 |

| | | | |

| Non-Current Debt | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| 0.55% Notes due 2025 | | 974 | | 940 |

| | | | |

| 2.46% Notes due 2026 | | 1,998 | | 1,917 |

| 2.95% Notes due 2027 | | 907 | | 958 |

| | | | |

| 0.95% Notes due 2027 | | 1,434 | | 1,337 |

| 2.90% Notes due 2028 | | 1,497 | | 1,422 |

| 1.150% Notes due 2028 (750MM Euro 1.0809) | | 807 | | 751 |

| 6.95% Notes due 2029 | | 298 | | 339 |

| 1.30% Notes due 2030 | | 1,633 | | 1,466 |

| 4.95% Debentures due 2033 | | 499 | | 523 |

| 4.375% Notes due 2033 | | 854 | | 848 |

| 1.650% Notes due 2035 (1.5B Euro 1.0809) | | 1,610 | | 1,430 |

| 3.587% Notes due 2036 | | 862 | | 893 |

| 5.95% Notes due 2037 | | 994 | | 1,110 |

| 3.625% Notes due 2037 | | 1,354 | | 1,333 |

| 3.40% Notes due 2038 | | 993 | | 858 |

| 5.85% Debentures due 2038 | | 697 | | 772 |

| 4.50% Debentures due 2040 | | 541 | | 530 |

| 2.10% Notes due 2040 | | 844 | | 688 |

| 4.85% Notes due 2041 | | 297 | | 301 |

| 4.50% Notes due 2043 | | 496 | | 481 |

| 3.73% Notes due 2046 | | 1,978 | | 1,675 |

| 3.75% Notes due 2047 | | 825 | | 829 |

| 3.50% Notes due 2048 | | 743 | | 598 |

| 2.25% Notes due 2050 | | 816 | | 629 |

| 2.45% Notes due 2060 | | 1,064 | | 743 |

| Other | | 67 | | 67 |

| Total Non-Current Debt | | $25,082 | | 23,438 |

The weighted average effective interest rate on non-current debt is 2.99%.

The excess of the carrying value over the estimated fair value of debt was $1.0 billion at December 31, 2023.

Fair value of the non-current debt was estimated using market prices, which were corroborated by quoted broker prices and significant other observable inputs.

The current debt balance as of March 31, 2024 includes $6.3 billion of commercial paper which has a weighted average interest rate of 5.25% and a weighted average maturity of approximately three months.

Note 5 — Income taxes

The worldwide effective income tax rates for the fiscal first quarters of 2024 and 2023 were 12.4% and 61.8%, respectively. The change in the consolidated tax rate as compared to the prior year fiscal first quarter is primarily due to a charge of $6.9 billion in the fiscal first quarter of 2023 and a charge of $2.7 billion in the fiscal first quarter of 2024, both for the talc settlement proposal. Both charges were recorded at an effective U.S. federal and state tax rate of approximately 23% (for further information see Note 11 to the Consolidated Financial Statements).

Additionally in the fiscal first quarter of 2024, the effective tax rate was impacted by legislative changes that went into effect for Pillar Two in some of the Company's foreign jurisdictions. The Company also had tax benefits received from stock-based compensation that were either exercised or vested during each of the fiscal first quarters, as well as a capital loss tax benefit in the fiscal first quarter of 2024.

As of March 31, 2024, the Company had approximately $2.5 billion of liabilities from unrecognized tax benefits. The Company conducts business and files tax returns in numerous countries and currently has tax audits in progress in a number of jurisdictions. With respect to the United States, the Internal Revenue Service has completed its audit for the tax years through 2016 and in the fiscal first quarter of 2024 has commenced the audit for tax years 2017 through 2020.

In other major jurisdictions where the Company conducts business, the years that remain open to tax audit go back to the year 2013. The Company believes it is possible that tax audits may be completed over the next twelve months by taxing authorities in some jurisdictions outside of the United States. However, the Company is not able to provide a reasonably reliable estimate of the timing of any other future tax payments relating to uncertain tax positions.

Note 6 — Pensions and other benefit plans

Components of net periodic benefit cost

Net periodic benefit costs for the Company’s defined benefit retirement plans and other benefit plans include the following components:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fiscal First Quarter Ended | | |

| | | Retirement Plans | | Other Benefit Plans | | | | |

| (Dollars in Millions) | | March 31, 2024 | | April 2, 2023 | | March 31, 2024 | | April 2, 2023 | | | | | | | | |

| Service cost | | $224 | | 210 | | 69 | | 68 | | | | | | | | |

| Interest cost | | 352 | | 352 | | 52 | | 54 | | | | | | | | |

| Expected return on plan assets | | (642) | | (668) | | (2) | | (1) | | | | | | | | |

Amortization of prior service cost/(credit) | | (46) | | (46) | | — | | — | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Recognized actuarial (gains)/losses | | 43 | | (50) | | 13 | | 6 | | | | | | | | |

| Curtailments and settlements | | — | | — | | — | | — | | | | | | | | |

| Net periodic benefit cost/(credit) | | $(69) | | (202) | | 132 | | 127 | | | | | | | | |

The service cost component of net periodic benefit cost is presented in the same line items on the Consolidated Statement of Earnings where other employee compensation costs are reported, including Cost of products sold, Research and development expense, Selling, marketing and administrative expenses, and in the fiscal first quarter of 2023, Net earnings from discontinued operations, net of taxes if related to the separation of Kenvue. All other components of net periodic benefit cost are presented as part of Other (income) expense, net on the Consolidated Statement of Earnings.

Company contributions

For the fiscal three months ended March 31, 2024, the Company contributed $29 million and $3 million to its U.S. and international retirement plans, respectively. The Company plans to continue to fund its U.S. defined benefit plans to comply with the Pension Protection Act of 2006. International plans are funded in accordance with local regulations.

Note 7 — Accumulated other comprehensive income

Components of other comprehensive income/(loss) consist of the following:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| (Dollars in Millions) | | Foreign Currency Translation | | Gain/ (Loss) On Securities | | Employee Benefit Plans | | Gain/ (Loss) On Derivatives & Hedges | | Total Accumulated Other Comprehensive Income/(Loss) |

| | | | |

| December 31, 2023 | | $(10,149) | | (1) | | (2,000) | | (377) | | (12,527) |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Net change | | 2,123 | | 2 | | 52 | | (418) | | 1,759 |

| March 31, 2024 | | (8,026) | | 1 | | (1,948) | | (795) | | | (10,768) |

Amounts in accumulated other comprehensive income are presented net of the related tax impact. Foreign currency translation is not adjusted for income taxes where it relates to permanent investments in international subsidiaries. For additional details on comprehensive income see the Consolidated Statements of Comprehensive Income.

Details on reclassifications out of Accumulated Other Comprehensive Income:

Gain/(Loss) On Securities - reclassifications released to Other (income) expense, net.

Employee Benefit Plans - reclassifications are included in net periodic benefit cost. See Note 6 for additional details.

Gain/(Loss) On Derivatives & Hedges - reclassifications to earnings are recorded in the same account as the underlying transaction. See Note 4 for additional details.

Note 8 — Earnings per share

The following is a reconciliation of basic net earnings per share to diluted net earnings per share:

| | | | | | | | | | | | | | | | | | | | |

| | | Fiscal First Quarter Ended | | |

| (Shares in Millions) | | March 31, 2024 | | April 2, 2023 | | | | |

| Basic net earnings (loss) per share from continuing operations | | $1.35 | | (0.19) | | | | |

| Basic net earnings per share from discontinued operations | | — | | | 0.16 | | | | |

| Total net earnings (loss) per share - basic | | 1.35 | | (0.03) | | | | |

| Average shares outstanding — basic | | 2,408.2 | | 2,605.5 | | | | |

| Potential shares exercisable under stock option plans | | 87.6 | | — | | | | |

| Less: shares which could be repurchased under treasury stock method | | (65.7) | | — | | | | |

| | | | | | | | |

| Average shares outstanding — diluted/basic* | | 2,430.1 | | 2,605.5 | | | | |

| Diluted net earnings (loss) per share from continuing operations | | 1.34 | | (0.19) | | | | |

| Diluted net earnings per share from discontinuing operations | | — | | | 0.16 | | | | |

| Total net earnings (loss) per share - diluted | | $1.34 | | (0.03) | | | | |

The diluted net earnings per share calculation for the fiscal first quarter ended March 31, 2024 excluded 44.2 million shares related to stock options, as the exercise price of these options was greater than the average market value of the Company’s stock.

* Basic shares are used to calculate loss per share as use of diluted shares when in a loss position would be anti-dilutive.

.Note 9 — Segments of business and geographic areas

Following the separation of the Consumer Health business in the fiscal third quarter of 2023, the Company is now organized into two business segments: Innovative Medicine and MedTech. The segment results have been recast for all periods to reflect the continuing operations of the Company.

Sales by segment of business

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fiscal First Quarter Ended | | |

| (Dollars in Millions) | | March 31,

2024 | | April 2,

2023 | | Percent

Change | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| INNOVATIVE MEDICINE | | | | | | | | | | | | |

| Immunology | | | | | | | | | | | | |

| U.S. | | $2,453 | | 2,448 | | 0.2 | % | | | | | | |

| International | | 1,794 | | 1,664 | | 7.9 | | | | | | | |

| Worldwide | | 4,247 | | 4,112 | | 3.3 | | | | | | | |

| REMICADE | | | | | | | | | | | | |

| U.S. | | 266 | | 276 | | (3.9) | | | | | | | |

| U.S. Exports | | 27 | | 41 | | (32.7) | | | | | | | |

| International | | 141 | | 170 | | (17.2) | | | | | | | |

| Worldwide | | 434 | | 487 | | (10.9) | | | | | | | |

| SIMPONI / SIMPONI ARIA | | | | | | | | | | | | |

| U.S. | | 254 | | 271 | | (6.2) | | | | | | | |

| International | | 299 | | 266 | | 12.4 | | | | | | | |

| Worldwide | | 554 | | 537 | | 3.0 | | | | | | | |

| STELARA | | | | | | | | | | | | |

| U.S. | | 1,396 | | 1,451 | | (3.8) | | | | | | | |

| International | | 1,055 | | 993 | | 6.2 | | | | | | | |

| Worldwide | | 2,451 | | 2,444 | | 0.3 | | | | | | | |

| TREMFYA | | | | | | | | | | | | |

| U.S. | | 509 | | 406 | | 25.4 | | | | | | | |

| International | | 299 | | 234 | | 27.9 | | | | | | | |

| Worldwide | | 808 | | 640 | | 26.3 | | | | | | | |

| OTHER IMMUNOLOGY | | | | | | | | | | | | |

| U.S. | | 0 | | 3 | | * | | | | | | |

| International | | 0 | | 0 | | — | | | | | | | |

| Worldwide | | 0 | | 3 | | * | | | | | | |

| | | | | | | | | | | | |

| Infectious Diseases | | | | | | | | | | | | |

| U.S. | | 324 | | 392 | | (17.4) | | | | | | | |

| International | | 497 | | 1,193 | | (58.4) | | | | | | | |

| Worldwide | | 821 | | 1,586 | | (48.3) | | | | | | | |

| COVID-19 VACCINE | | | | | | | | | | | | |

| U.S. | | 0 | | 0 | | — | | | | | | | |

| International | | 25 | | 747 | | (96.6) | | | | | | | |

| Worldwide | | 25 | | 747 | | (96.6) | | | | | | | |

| EDURANT / rilpivirine | | | | | | | | | | | | |

| U.S. | | 8 | | 9 | | (10.9) | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fiscal First Quarter Ended | | |

| (Dollars in Millions) | | March 31,

2024 | | April 2,

2023 | | Percent

Change | | | | | | |

| International | | 315 | | 271 | | 16.6 | | | | | | | |

| Worldwide | | 323 | | 280 | | 15.7 | | | | | | | |

| PREZISTA / PREZCOBIX / REZOLSTA / SYMTUZA | | | | | | | | | | | | |

| U.S. | | 314 | | 378 | | (16.9) | | | | | | | |

| International | | 104 | | 99 | | 5.5 | | | | | | | |

| Worldwide | | 418 | | 477 | | (12.3) | | | | | | | |

| OTHER INFECTIOUS DISEASES | | | | | | | | | | | | |

| U.S. | | 2 | | 5 | | (68.8) | | | | | | | |

| International | | 52 | | 77 | | (32.8) | | | | | | | |

| Worldwide | | 53 | | 82 | | (35.1) | | | | | | | |

| | | | | | | | | | | | |

| Neuroscience | | | | | | | | | | | | |

| U.S. | | 1,054 | | 978 | | 7.8 | | | | | | | |

| International | | 749 | | 826 | | (9.3) | | | | | | | |

| Worldwide | | 1,803 | | 1,804 | | 0.0 | | | | | | |

| CONCERTA / methylphenidate | | | | | | | | | | | | |

| U.S. | | 41 | | 70 | | (41.2) | | | | | | | |

| International | | 136 | | 136 | | (0.1) | | | | | | | |

| Worldwide | | 177 | | 206 | | (14.1) | | | | | | | |

| INVEGA SUSTENNA / XEPLION / INVEGA TRINZA / TREVICTA | | | | | | | | | | | | |

| U.S. | | 765 | | 713 | | 7.2 | | | | | | | |

| International | | 292 | | 331 | | (11.8) | | | | | | | |

| Worldwide | | 1,056 | | 1,044 | | 1.2 | | | | | | | |

| SPRAVATO | | | | | | | | | | | | |

| U.S. | | 191 | | 111 | | 71.5 | | | | | | | |

| International | | 34 | | 20 | | 76.1 | | | | | | | |

| Worldwide | | 225 | | 131 | | 72.2 | | | | | | | |

| OTHER NEUROSCIENCE | | | | | | | | | | | | |

| U.S. | | 58 | | 84 | | (31.1) | | | | | | | |

| International | | 287 | | 339 | | (15.5) | | | | | | | |

| Worldwide | | 345 | | 423 | | (18.5) | | | | | | | |

| | | | | | | | | | | | |

| Oncology | | | | | | | | | | | | |

| U.S. | | 2,383 | | 1,889 | | 26.2 | | | | | | | |

| International | | 2,430 | | 2,223 | | 9.3 | | | | | | | |

| Worldwide | | 4,814 | | 4,112 | | 17.1 | | | | | | | |

| CARVYKTI | | | | | | | | | | | | |

| U.S. | | 140 | | 70 | | 99.8 | | | | | | | |

| International | | 16 | | 2 | | * | | | | | | |

| Worldwide | | 157 | | 72 | | * | | | | | | |

| DARZALEX | | | | | | | | | | | | |

| U.S. | | 1,464 | | 1,191 | | 22.9 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fiscal First Quarter Ended | | |

| (Dollars in Millions) | | March 31,

2024 | | April 2,

2023 | | Percent

Change | | | | | | |

| International | | 1,228 | | 1,072 | | 14.5 | | | | | | | |

| Worldwide | | 2,692 | | 2,264 | | 18.9 | | | | | | | |

| ERLEADA | | | | | | | | | | | | |

| U.S. | | 285 | | 249 | | 14.1 | | | | | | | |

| International | | 404 | | 293 | | 38.0 | | | | | | | |

| Worldwide | | 689 | | 542 | | 27.0 | | | | | | | |

| IMBRUVICA | | | | | | | | | | | | |

| U.S. | | 265 | | 270 | | (1.5) | | | | | | | |

| International | | 518 | | 557 | | (7.0) | | | | | | | |

| Worldwide | | 784 | | 827 | | (5.2) | | | | | | | |

TECVAYLI(1) | | | | | | | | | | | | |

| U.S. | | 101 | | 57 | | 76.7 | | | | | | | |

| International | | 33 | | 6 | | * | | | | | | |

| Worldwide | | 133 | | 63 | | * | | | | | | |

ZYTIGA / abiraterone acetate | | | | | | | | | | | | |

| U.S. | | 9 | | 16 | | (41.3) | | | | | | | |

| International | | 172 | | 229 | | (24.8) | | | | | | | |

| Worldwide | | 181 | | 245 | | (25.9) | | | | | | | |

| OTHER ONCOLOGY | | | | | | | | | | | | |

| U.S. | | 119 | | 35 | | * | | | | | | |

| International | | 60 | | 64 | | (6.1) | | | | | | | |

| Worldwide | | 178 | | 99 | | 80.2 | | | | | | | |

| | | | | | | | | | | | |

| Pulmonary Hypertension | | | | | | | | | | | | |

| U.S. | | 766 | | 600 | | 27.5 | | | | | | | |

| International | | 283 | | 272 | | 4.1 | | | | | | | |

| Worldwide | | 1,049 | | 872 | | 20.2 | | | | | | | |

| OPSUMIT | | | | | | | | | | | | |

| U.S. | | 356 | | 273 | | 30.4 | | | | | | | |

| International | | 169 | | 167 | | 0.8 | | | | | | | |

| Worldwide | | 524 | | 440 | | 19.1 | | | | | | | |

| UPTRAVI | | | | | | | | | | | | |

| U.S. | | 392 | | 304 | | 29.0 | | | | | | | |

| International | | 76 | | 58 | | 30.7 | | | | | | | |

| Worldwide | | 468 | | 362 | | 29.2 | | | | | | | |

| OTHER PULMONARY HYPERTENSION | | | | | | | | | | | | |

| U.S. | | 18 | | 23 | | (24.6) | | | | | | | |

| International | | 39 | | 47 | | (16.9) | | | | | | | |

| Worldwide | | 56 | | 70 | | (19.5) | | | | | | | |

| | | | | | | | | | | | |

| Cardiovascular / Metabolism / Other | | | | | | | | | | | | |

| U.S. | | 631 | | 715 | | (11.7) | | | | | | | |

| International | | 197 | | 212 | | (7.0) | | | | | | | |

| Worldwide | | 829 | | 927 | | (10.6) | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fiscal First Quarter Ended | | |

| (Dollars in Millions) | | March 31,

2024 | | April 2,

2023 | | Percent

Change | | | | | | |

| XARELTO | | | | | | | | | | | | |

| U.S. | | 518 | | 578 | | (10.4) | | | | | | | |

| International | | — | | — | | — | | | | | | | |

| Worldwide | | 518 | | 578 | | (10.4) | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| OTHER | | | | | | | | | | | | |

| U.S. | | 114 | | 137 | | (17.1) | | | | | | | |

| International | | 197 | | 212 | | (7.0) | | | | | | | |

| Worldwide | | 311 | | 349 | | (11.0) | | | | | | | |

| | | | | | | | | | | | |

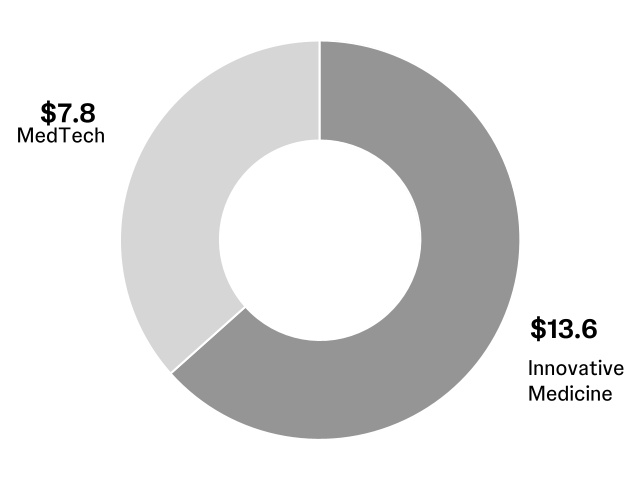

| TOTAL INNOVATIVE MEDICINE | | | | | | | | | | | | |

| U.S. | | 7,612 | | 7,023 | | 8.4 | | | | | | | |

| International | | 5,950 | | 6,390 | | (6.9) | | | | | | | |

| Worldwide | | 13,562 | | 13,413 | | 1.1 | | | | | | | |

| | | | | | | | | | | | |

| MEDTECH | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Cardiovascular(2) | | | | | | | | | | | | |

| U.S. | | 1,025 | | 863 | | 18.8 | | | | | | | |

| International | | 781 | | 640 | | 22.1 | | | | | | | |

| Worldwide | | 1,806 | | 1,503 | | 20.2 | | | | | | | |

| ELECTROPHYSIOLOGY | | | | | | | | | | | | |

| U.S. | | 692 | | 571 | | 21.3 | | | | | | | |

| International | | 652 | | 522 | | 24.9 | | | | | | | |

| Worldwide | | 1,344 | | 1,092 | | 23.0 | | | | | | | |

| ABIOMED | | | | | | | | | | | | |

| U.S. | | 303 | | 264 | | 15.0 | | | | | | | |

| International | | 67 | | 60 | | 12.4 | | | | | | | |

| Worldwide | | 371 | | 324 | | 14.5 | | | | | | | |

OTHER CARDIOVASCULAR(2) | | | | | | | | | | | | |

| U.S. | | 30 | | 28 | | 3.3 | | | | | | | |

| International | | 62 | | 58 | | 6.9 | | | | | | | |

| Worldwide | | 92 | | 87 | | 5.7 | | | | | | | |

| Orthopaedics | | | | | | | | | | | | |

| U.S. | | 1,448 | | 1,363 | | 6.2 | | | | | | | |

| International | | 892 | | 881 | | 1.3 | | | | | | | |

| Worldwide | | 2,340 | | 2,245 | | 4.3 | | | | | | | |

| HIPS | | | | | | | | | | | | |

| U.S. | | 270 | | 241 | | 12.1 | | | | | | | |

| International | | 152 | | 149 | | 1.7 | | | | | | | |

| Worldwide | | 422 | | 390 | | 8.1 | | | | | | | |

| KNEES | | | | | | | | | | | | |

| U.S. | | 242 | | 226 | | 6.9 | | | | | | | |

| International | | 160 | | 142 | | 12.3 | | | | | | | |

| Worldwide | | 401 | | 368 | | 9.0 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fiscal First Quarter Ended | | |

| (Dollars in Millions) | | March 31,

2024 | | April 2,

2023 | | Percent

Change | | | | | | |

| TRAUMA | | | | | | | | | | | | |

| U.S. | | 504 | | 491 | | 2.8 | | | | | | | |

| International | | 261 | | 267 | | (2.3) | | | | | | | |

| Worldwide | | 765 | | 757 | | 1.0 | | | | | | | |

| SPINE, SPORTS & OTHER | | | | | | | | | | | | |

| U.S. | | 432 | | 406 | | 6.5 | | | | | | | |

| International | | 320 | | 323 | | (0.9) | | | | | | | |

| Worldwide | | 752 | | 729 | | 3.2 | | | | | | | |

| Surgery | | | | | | | | | | | | |

| U.S. | | 987 | | 975 | | 1.2 | | | | | | | |

| International | | 1,429 | | 1,459 | | (2.0) | | | | | | | |

| Worldwide | | 2,416 | | 2,434 | | (0.7) | | | | | | | |

| ADVANCED | | | | | | | | | | | | |

| U.S. | | 446 | | 444 | | 0.2 | | | | | | | |

| International | | 641 | | 673 | | (4.7) | | | | | | | |

| Worldwide | | 1,087 | | 1,118 | | (2.8) | | | | | | | |

| GENERAL | | | | | | | | | | | | |

| U.S. | | 542 | | 531 | | 2.1 | | | | | | | |

| International | | 788 | | 785 | | 0.3 | | | | | | | |

| Worldwide | | 1,330 | | 1,316 | | 1.0 | | | | | | | |

| Vision | | | | | | | | | | | | |

| U.S. | | 547 | | 558 | | (1.8) | | | | | | | |

| International | | 710 | | 743 | | (4.4) | | | | | | | |

| Worldwide | | 1,258 | | 1,300 | | (3.3) | | | | | | | |

| CONTACT LENSES / OTHER | | | | | | | | | | | | |

| U.S. | | 438 | | 444 | | (1.4) | | | | | | | |

| International | | 472 | | 509 | | (7.4) | | | | | | | |

| Worldwide | | 910 | | 953 | | (4.6) | | | | | | | |

| SURGICAL | | | | | | | | | | | | |

| U.S. | | 110 | | 114 | | (3.7) | | | | | | | |

| International | | 238 | | 233 | | 2.2 | | | | | | | |

| Worldwide | | 348 | | 347 | | 0.3 | | | | | | | |

| | | | | | | | | | | | |

| TOTAL MEDTECH | | | | | | | | | | | | |

| U.S. | | 4,008 | | 3,759 | | 6.6 | | | | | | | |

| International | | 3,813 | | 3,722 | | 2.4 | | | | | | | |

| Worldwide | | 7,821 | | 7,481 | | 4.5 | | | | | | | |

| | | | | | | | | | | | |

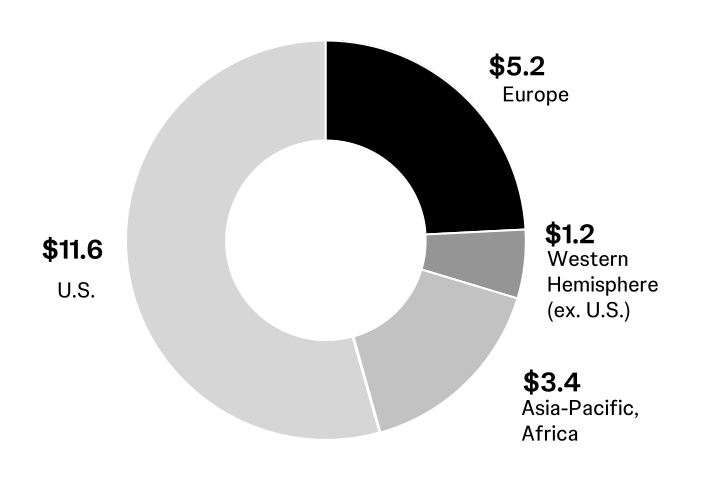

| WORLDWIDE | | | | | | | | | | | | |

| U.S. | | 11,620 | | 10,782 | | 7.8 | | | | | | | |

| International | | 9,763 | | 10,112 | | (3.4) | | | | | | | |

| Worldwide | | $21,383 | | 20,894 | | 2.3 | % | | | | | | |

* Percentage greater than 100% or not meaningful