The Company approved one-month extensions on June 2, 2023, July 2, 2023, August 2, 2023, September 2, 2023, October 2, 2023, November 2, 2023, December 2, 2023, January 2, 2024 and February 2, 2024. In connection with the extensions on June 2, 2023, July 2, 2023, August 2, 2023, and September 2, 2023, the Company drew an aggregate amount of $560,000 from the Second Convertible Promissory Note in the principal amount of up to $1,680,000. In connection with the extensions on October 2, 2023, November 2, 2023 and December 2, 2023, January 2, 2024 and February 2, 2024, the Company drew an aggregate amount of $900,000 from the Third Promissory Note (as defined below). The Company also drew additional funds under the Second Convertible Promissory Note and the Third Promissory Note in view of funding the Company’s ongoing working capital (for more information see Note 4).

As contemplated by the Amended and Restated Memorandum and Articles of Association, the holders of Public Shares were able to elect to redeem all or a portion of their Public Shares in exchange for their pro rata portion of the funds held in the Trust Account in connection with the First Extension Amendment Proposal. On February 28, 2023, the First Extension Amendment Proposal was adopted and 11,259,169 Public Shares were redeemed for an aggregate amount of $115,071,882. Following the adoption of the First Extension Amendment Proposal, the Company has 4,189,831 Class A ordinary shares, including 3,690,831 Public Shares and 499,000 Private Placement Shares, and 3,737,500 Class B ordinary shares issued and outstanding. See below for more information on additional redemptions in connection with the second amendment of the Amended and Restated Memorandum and Articles of Association to further extend the time period the Company has to consummate a Business Combination following March 2, 2024.

On February 27, 2024, the Company held an extraordinary general meeting of shareholders to approve an amendment to the Company’s Amended and Restated Memorandum and Articles of Association to extend the Termination Date by which the Company has to consummate a Business Combination from March 2, 2024 (the “Previous Termination Date”) to April 2, 2024 (the “Articles Extension Date”) and to allow the Company without another shareholder vote, to elect to extend the Termination Date to consummate a Business Combination on a monthly basis up to eleven times by an additional one month each time after the Articles Extension Date, by resolution of the Company’s board of directors, if requested by the Sponsor, and upon five days’ advance notice prior to the applicable Termination Date, until March 2, 2025, or a total of up to twelve months after the Previous Termination Date, unless the closing of a Business Combination shall have occurred prior thereto (the “Second Extension Amendment Proposal”). The Sponsor agreed that if the Second Extension Amendment Proposal (as defined below) was approved, it or one or more of its affiliates, members or third-party designees (the “Lender”) will contribute to the Company as a loan $111,000 to be deposited into the Trust Account. In addition, in the event the Company does not consummate a Business Combination by the Articles Extension Date, the Lender will contribute to the Company as a loan for an aggregate deposit of up to $1,221,000 in eleven equal installments to be deposited into the Trust Account for each of the eleven one-month optional extensions following the Articles Extension Date. On February 9, 2024, the Company drew on the unsecured convertible promissory note, dated February 8, 2024, by and between the Company and the Sponsor (the “Fourth Convertible Promissory Note”) in order to fund the $111,000 monthly deposits into the Trust Account and the Sponsor has the option to convert any amounts outstanding under the Fourth Convertible Promissory Note into Class A ordinary shares, at a conversion price equal to $10.00 per share, in connection with a Business Combination.

On February 27, 2024, the Second Extension Amendment Proposal was adopted and 390,815 Public Shares were redeemed for an aggregate amount of approximately $4,358,804. Following the adoption of the Second Extension Amendment Proposal, the Company had 3,799,016 Class A ordinary shares, including 3,300,016 Public Shares and 499,000 private placement shares, and 3,737,500 Class B ordinary shares issued and outstanding. Following the approval of the Second Extension Amendment Proposal, the ordinary shares held by the initial shareholders represented 56.2% of the issued and outstanding ordinary shares (including Private Placement Shares). For more information on the extensions that were approved to extend the Business Combination Period beyond April 2, 2024, see Note 9.

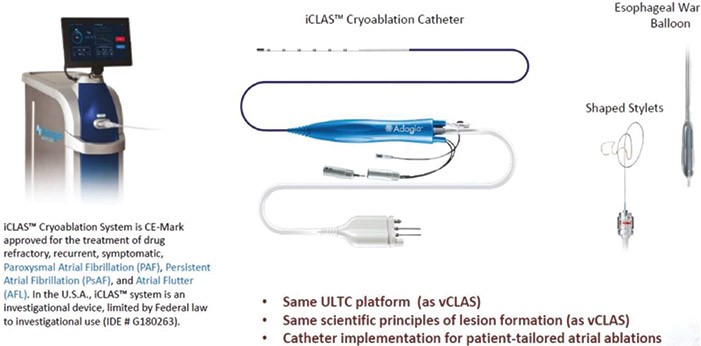

On February 26, 2024, the Company received a notice from the staff of the Listing Qualifications Department (the “Listing Department”) of The Nasdaq Stock Market LLC (“Nasdaq”) indicating that, unless the Company timely requested a hearing (the “Hearing”) before the Nasdaq Hearings Panel (the “Panel”), trading of the Company’s securities on The Nasdaq Capital Market would be suspended at the opening of business on March 6, 2024, due to the Company’s noncompliance with Nasdaq IM-5101-2, which requires that a special purpose acquisition company complete one or more business combinations within 36 months of the effectiveness of its Initial Public Offering registration statement. The Company timely requested the Hearing before the Panel to request sufficient time to complete the Company’s previously disclosed Proposed Adagio Business Combination. Subsequently, on March 26, 2024, the Company received an additional and separate notice from the staff of the Listing Department of Nasdaq formally notifying the Company that the deficiency under Nasdaq Listing Rule 5620(a) requiring the Company to hold an annual meeting of shareholders within twelve months of its fiscal year ended December 21, 2022, serves as an additional and separate basis for delisting. The Panel considered both matters at the hearing that was held on April 25, 2024. On May 13, 2024, the Panel issued written notice of its decision to grant the Company’s request for an exception to its listing deficiencies until August 23, 2024 in light of the progress the