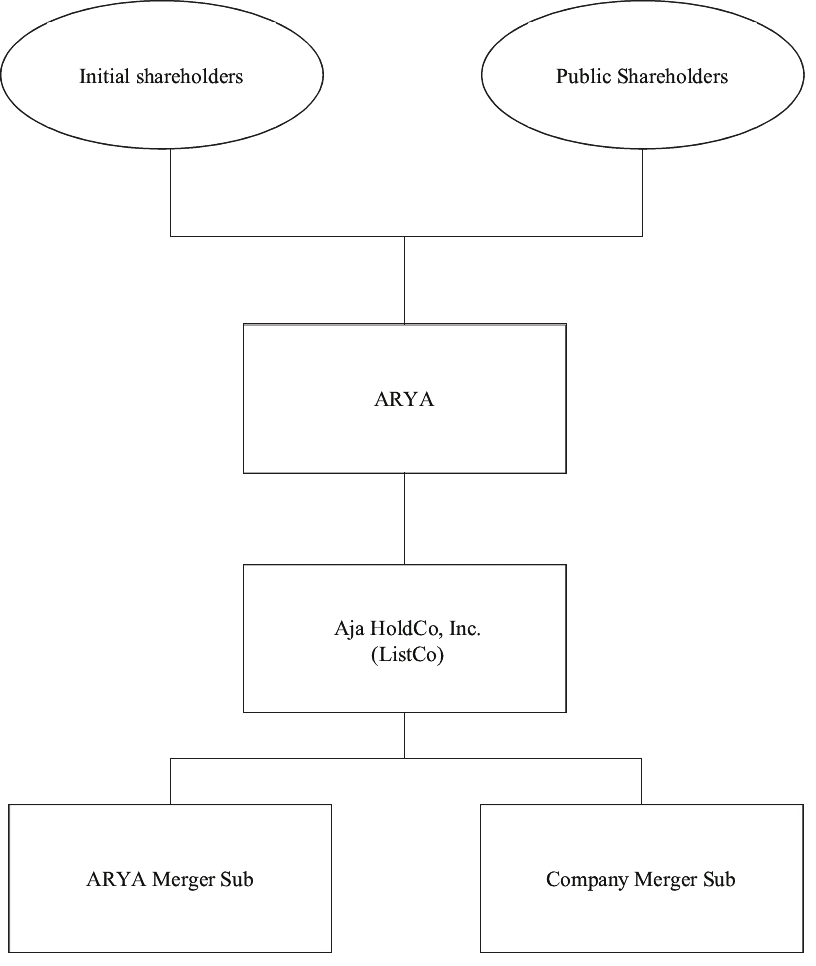

Prior to the ARYA Merger Effective Time, ARYA and ListCo will cause (A) ListCo to file with the Secretary of State of the State of Delaware an amended and restated certificate of incorporation of ListCo, substantially in the form attached to the accompanying proxy statement/prospectus as Annex C and (B) the board of directors of ListCo to approve and adopt amended and restated bylaws of ListCo, substantially in the form attached to the accompanying proxy statement/prospectus as Annex D. Following the Closing, ListCo’s name will be changed to “Adagio Medical, Inc.” (or such other name mutually agreed to by ARYA and Adagio).

On the Closing Date, prior to the ARYA Merger Effective Time, ARYA will cause each holder of Class A ordinary shares that has timely and validly made a redemption election to be redeemed on the terms and subject to the conditions set forth in the Existing Governing Documents and the other procedures described herein.

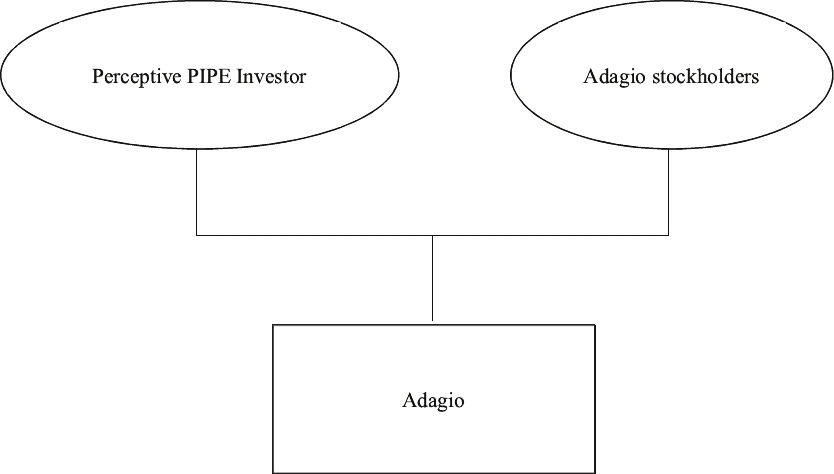

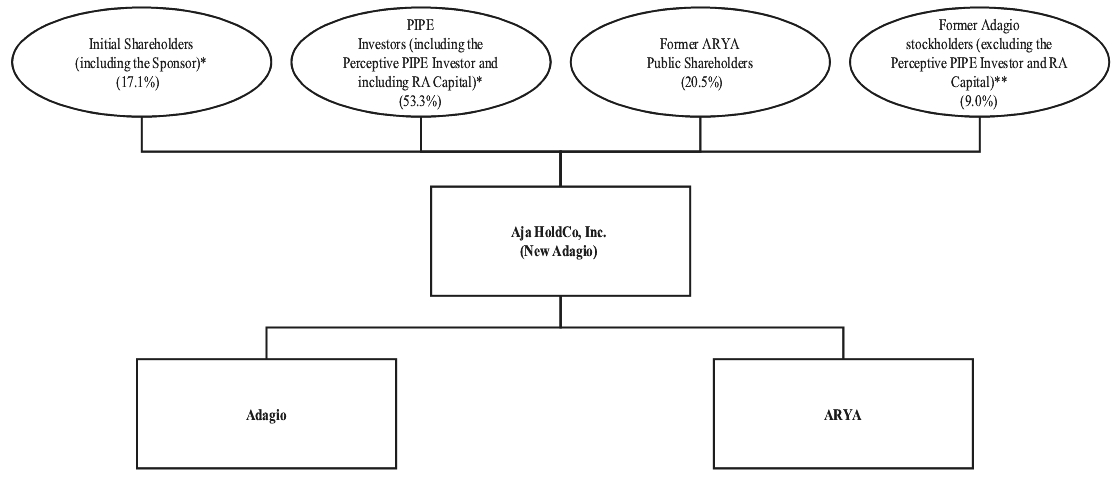

As described above, in connection with the execution of the Business Combination Agreement, ListCo and ARYA entered into Subscription Agreements (the “Subscription Agreements”) with the Perceptive PIPE Investor and certain other investors (the “Other PIPE Investors,” and, together with the Perceptive PIPE Investor, the “PIPE Investors”), pursuant to which the PIPE Investors committed financing valued at approximately $45,000,000, which includes (i) commitments by certain investors to subscribe for and purchase Class A ordinary shares in the open market and not to redeem such shares prior to the Closing Date, (ii) non-redemption commitments by certain investors that are shareholders of ARYA, (iii) agreements to subscribe for and purchase shares of New Adagio Common Stock, (iv) the contribution of $23,000,000 of 2023 Bridge Financing Notes to ListCo pursuant to the terms of the Subscription Agreement executed by the Perceptive PIPE Investor, and (v) an additional cash investment by the Perceptive PIPE Investor of approximately $8,070,575 (which amount may be reduced by up to approximately $1,070,575 subject to Additional Financing being raised prior to Closing) (together, the “PIPE Financing”). In connection with the PIPE Financing, the PIPE Investors will also subscribe for (i) Base Warrants or (ii) a combination of Base Warrants and Pre-Funded Warrants. As provided for in the Subscription Agreements, the number of shares of New Adagio Common Stock and Base Warrants issuable to the PIPE Investors will depend on the redemption value of the Class A ordinary shares at Closing, the average per share price of the Class A ordinary shares purchased by certain PIPE Investors in the open market and the amount of interest on the Bridge Financing Notes that will have accrued and be unpaid at Closing and be contributed to ListCo in exchange for shares of New Adagio Common Stock. The shares of New Adagio Common Stock and PIPE Warrants to be issued pursuant to the Subscription Agreements have not been registered under the Securities Act of 1933, as amended (the “Securities Act”), and will be issued in reliance upon the exemption provided in Section 4(a)(2) of the Securities Act. ListCo will grant the PIPE Investors certain registration rights in connection with the PIPE Financing. The PIPE Financing is contingent upon, among other things, the substantially concurrent closing of the Business Combination. For additional information on the calculation of the number of shares that will be issued pursuant to each Subscription Agreement, please see “Proposal 1: Business Combination Proposal—Certain Agreements Related to the Business Combination—PIPE Financing.”

Further, in connection with the execution of the Business Combination Agreement, certain investors (“Convert Investors”) executed a securities purchase agreement, dated February 13, 2024, with ListCo (the “Convertible Security Subscription Agreement”), pursuant to which ListCo will issue on the Closing Date to the Convert Investors $20,000,000 of 13% senior secured convertible notes (the “New Adagio Convertible Notes”), which will be convertible into shares of New Adagio Common Stock at a conversion price of $10.00 per share, subject to adjustment, and 1,500,000 warrants (the “Convert Warrants”), each Convert Warrant being exercisable on a cashless basis or for cash at a price of $24.00 per share, subject to adjustment (the “Base Convert Financing”). Such $20,000,000 of financing in the form of New Adagio Convertible Notes includes the Perceptive Convertible Note Commitment (as defined below) and includes the conversion of the 2024 Bridge Financing Notes into New Adagio Convertible Notes at Closing, subject in each case to Additional Financing being raised prior to Closing, as further described below. The New Adagio Convertible Notes will have a maturity of three years and nine months after Closing and interest will be payable in cash or compound as additional principal outstanding. Concurrently with the execution of the Convertible Security Subscription Agreement, the Perceptive PIPE Investor also purchased a $7,000,000 convertible promissory note of Adagio (the “2024 Bridge Financing Note”) pursuant to a note purchase agreement, dated February 13, 2024, by and among the Perceptive PIPE Investor, Adagio and ListCo (the “2024 Bridge Financing Note Subscription Agreement”). On the Closing Date, pursuant to the terms of the 2024 Bridge Financing Note and the 2024 Bridge Financing Note Subscription Agreement, the 2024 Bridge Financing Note will convert into $7,000,000 of New Adagio Convertible Notes and 525,000 Convert Warrants, and the Perceptive PIPE Investor will subscribe for an additional $5,500,000 of New Adagio Convertible Notes and 412,500 Convert Warrants, for a total of $12,500,000 of New Adagio Convertible Notes and 937,500 Convert Warrants, on the same terms as the Convert Investors executing the Convertible Security Subscription Agreement (such additional $5,500,000 commitment by the Perceptive PIPE Investor to purchase New Adagio Convertible Notes and Convert Warrants, the “Perceptive Convertible Note Commitment,” and the conversion of the 2024 Bridge Financing Note and purchase of New Adagio Convertible Notes and Convert Warrants pursuant to the Perceptive Convertible Note Commitment as part of the Base Convert Financing, the “Convertible Security Financing”). Subject to ARYA and New Adagio receiving any new financing or commitment for financing, whether in the form of equity, debt or convertible debt, before the Closing Date (any such financing, an “Additional Financing”), the Perceptive PIPE Investor may request that on the Closing Date the 2024 Bridge Financing Note is repaid, the Perceptive Convertible Note Commitment is reduced or a combination of both. The New Adagio Convertible Notes and the Convert Warrants issuable in connection with the Convertible Security Financing have not been registered under the Securities Act and will be issued in reliance upon the exemption provided in Section 4(a)(2) of the Securities Act. ListCo will grant the Convert Investors certain registration rights in connection with the Convertible Security Financing. The Convertible Security Financing is contingent upon, among other things, the substantially concurrent closing of the Business Combination. As set forth in the Convertible Security Subscription Agreement, the closing of $7,500,000 of financing by a Convert Investor in the Convertible Security Financing is conditioned on New Adagio having a certain amount of available unrestricted cash on the Closing Date.

In connection with the Closing and immediately prior to the ARYA Merger Effective Time, the Sponsor may elect to contribute the unsecured convertible promissory note, dated as of November 7, 2022, by and between the Sponsor and ARYA (the “First Convertible Promissory Note”), the unsecured convertible promissory note, dated as of February 28, 2023, by and between the Sponsor and ARYA (as amended on February 13, 2024, the “Second Convertible Promissory Note”), the amended and restated unsecured convertible promissory note, dated as of February 13, 2024, by and between the Sponsor and ARYA (the “A&R Third Promissory Note”) and the unsecured convertible promissory note, dated as of February 8, 2024, by and between the Sponsor and ARYA (the “Fourth Convertible Promissory Note,” and, together with the First Convertible Promissory Note, the Second Convertible Promissory Note and the A&R Third Promissory Note, the “ARYA Convertible Promissory Notes”) to ARYA in exchange for Class A ordinary shares, par value $0.0001 per share, of ARYA (the “Working Capital Shares”) at a conversion price of $10.00 per Class A ordinary share.

This prospectus covers 9,306,516 shares of New Adagio Common Stock. The number of shares of New Adagio Common Stock that this prospectus covers represents the maximum number of shares that may be issued to holders of shares of Adagio in connection with the Business Combination (as more fully described in this proxy statement/prospectus), together with the shares issued or issuable to the existing shareholders of ARYA in connection with the Business Combination, including the Share Trigger Price Vesting contemplated thereby.

ARYA’s Class A ordinary shares are currently listed on the Nasdaq Capital Market (“Nasdaq”) under the symbol “ARYD.” ListCo will apply for listing, to be effective at the time of the Business Combination, of the New Adagio Common Stock on Nasdaq under the proposed symbol “ADGM.” It is a condition of the consummation of the Business Combination that ARYA receive confirmation from Nasdaq that New Adagio has been conditionally approved for listing on Nasdaq, but there can be no assurance that such listing condition will be met or that ARYA will obtain such confirmation from Nasdaq. If such listing condition is not met or if such confirmation is not obtained, the Business Combination will not be consummated unless the Nasdaq condition set forth in the Business Combination Agreement is waived by the applicable parties.

The accompanying proxy statement/prospectus provides shareholders of ARYA with detailed information about the Business Combination and other matters to be considered at the annual general meeting of ARYA. We encourage you to read the entire accompanying proxy statement/prospectus, including the Annexes and other documents referred to therein, carefully and in their entirety. You should also carefully consider the risk factors described in “

Risk Factors” beginning on page

35 of the accompanying proxy statement/prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES REGULATORY AGENCY HAS APPROVED OR DISAPPROVED THE TRANSACTIONS DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT/PROSPECTUS, PASSED UPON THE MERITS OR FAIRNESS OF THE BUSINESS COMBINATION OR RELATED TRANSACTIONS OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THE ACCOMPANYING PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY CONSTITUTES A CRIMINAL OFFENSE.

The accompanying proxy statement/prospectus is dated [•], 2024, and

is first being mailed to ARYA’s shareholders on or about [•], 2024.