Issuer Free Writing Prospectus dated 22 November 2024

Filed Pursuant to Rule 433 of the Securities Act of 1933, as amended

Relating to Preliminary Prospectus dated 20 November 2024

Registration Statement No. 333-282876

Hong Kong Pharma Digital Technology Holdings Limited Issuer Free Writing Prospectus dated 22 November 2024 Filed Pursuant to Rule 433 of the Securities Act of 1933, as amended Relating to Preliminary Prospectus dated 20 November 2024 Registration Statement No. 333 - 282876 November 2024 Investor Presentation

Forward - Looking Statements and Disclaimer T h i s p r e s e n t a t i o n r e l a t e s t o t h e p r o p o s e d p u b l i c o f f e r i n g o f o r d i n a r y s h a r e s o f H o n g K o n g P h a r m a D i g i t a l T e c h n o l o g y H o l d i n g s L i m i t e d ( “ w e ” , “ u s ” o r t h e “ C o m p a n y ” ) . T h i s p r e s e n t a t i o n i n c l u d e s s t a t e m e n t s t h a t a r e , o r m a y b e d e e m e d , “ f o r w a r d - l o o k i n g s t a t e m e n t s . ” I n s o m e c a s e s , t h e s e f o r w a r d - l o o k i n g s t a t e m e n t s c a n b e i d e n t i f i e d b y t h e u s e o f f o r w a r d - l o o k i n g t e r m i n o l o g y , i n c l u d i n g t h e t e r m s “ b e l i e v e s , ” “ e s t i m a t e s , ” “ a n t i c i p a t e s , ” “ e x p e c t s , ” “ p l a n s ” , “ i n t e n d s ” , “ m a y , ” “ c o u l d , ” “ m i g h t , ” “ wi l l , ” “ s h o u l d , ” “ a p p r o x i m a t e l y , ” “ p o t e n t i a l , ” o r i n e a c h c a s e , t h e i r n e g a t i v e o r o t h e r v a r i a t i o n s t h e r e o n a l t h o u g h n o t a l l f o r w a r d - l o o k i n g s t a t e m e n t s c o n t a i n t h e s e w o r d s . T h e y a p p e a r i n s e v e r a l p l a c e s t h r o u g h o u t t h i s p r e s e n t a t i o n a n d i n c l u d e s t a t e m e n t s r e g a r d i n g o u r i n t e n t i o n s , b e l i e f s , p r o j e c t i o n s , o u t l o o k , a n a l y s e s o r c u r r e n t e x p e c t a t i o n s c o n c e r n i n g , a m o n g o t h e r t h i n g s , O T C p h a r m a c e u t i c a l c r o s s - b o r d e r b u s i n e s s m a r k e t i n C h i n a a n d t h e p r o s p e c ts o f o u r e - c o m m e r c e S u p p l y C h a i n S e r v i c e s a n d P r o c u r e m e n t & D i s t r i b u t i o n s e r v i c e s a s s t a t e d h e r e i n . B y t h e i r n a t u r e , f o r w a r d - l o o k i n g s t a t e m e n t s i n v o l v e r i s k s a n d u n c e r t a i n t i e s b e c a u s e t h e y r e l a t e t o e v e n t s , c o m p e t i t i v e d y n a m i c s , and r e g u l a t o r y d e v e l o p m e n t s a n d d e p e n d o n t h e e c o n o m i c c i r c u m s t a n c e s t h a t m a y o r m a y n o t o c c u r i n t h e f u t u r e o r m a y o c c u r o n l o n g e r o r s h o r t e r t i m e l i n e s t h a t a n t i c i p a t e d . A l t h o u g h w e b e l i e v e t h a t w e h a v e a r e a s o n a b l e b a s i s f o r e a c h f o r w a r d - l o o k i n g s t a t e m e n t c o n t a i n e d i n t h i s p r e s e n t a t i o n , we c a u t i o n y o u t h a t f o r wa r d - l o o k i n g s t a t e m e n t s a r e n o t g u a r a n t e e s o f f u t u r e p e r f o r ma n c e a n d t h a t o u r a c t u a l r e s u l t s o f o p e r a t i o n , f i n a n c i a l c o n d i t i o n a n d l i q u i d i t y , a n d t h e d e v e l o p m e n t o f t h e i n d u s t r y w e o p e r a t e m a y d i f f e r m a t e r i a l l y f r o m t h e f o r w a r d - l o o k i n g s t a t e m e n t s i n t h i s p r e s e n t a t i o n a s a r e s u l t o f , a m o n g o t h e r f a c t o r s , t h e f a c t o r s r e f e r e n c e d i n t h e “ R i s k F a c t o r s ” s e c t i o n o f t h e p r o s p e c t u s c o n t a i n e d i n o u r R e g i s t r a t i o n S t a t e m e n t f i l e d w i t h t h e S e c u r i t i e s a n d E x c h a n g e C o m m i s s i o n ( “ S E C ” ) , a s a m e n d e d ( F i l e N o . 333 - 2 8 2 8 7 6 ) , f o r o u r p r o p o s e d i n i t i a l p u b l i c o f f e r i n g ( t h e “ R e g i s t r a t i o n S t a t e m e n t ” ) . I n a d d i t i o n , e v e n i f o u r r e s u l t o f o p e r a t i o n , f i n a n c i a l c o n d i t i o n s a n d l i q u i d i t y , a n d t h e d e v e l o p m e n t o f t h e i n d u s t r y i n w h i c h w e o p e r a t e a r e c o n s i s t e n t w i t h t h e f o r w a r d - l o o k i n g s t a t e m e n t s c o n t a i n e d i n t h i s p r e s e n t a t i o n , t h e y m a y n o t b e p r e d i c t i v e o f r e s u l t s o r d e v e l o p m e n t s i n f u t u r e p e r i o d s . A n y f o r w a r d - l o o k i n g s t a t e m e n t t h a t w e m a k e i n t h i s p r e s e n t a t i o n s p e a k s o n l y a s o f t h e d a t e o f s u c h s t a t e m e n t , a n d w e u n d e r t a k e n o o b l i g a t i o n t o u p d a t e s u c h s t a t e m e n t s t o r e f l e c t e v e n t s o r c i r c u m s t a n c e s a f t e r t h e d a t e o f t h i s p r e s e n t a t i o n . T h i s p r e s e n t a t i o n h i g h l i g h t s b a s i c i n f o r m a t i o n a b o u t u s a n d t h e o f f e r i n g . B e c a u s e i t i s a s u m m a r y , i t d o e s n o t c o n t a i n a l l o f t h e i n f o r ma t i o n t h a t y o u s h o u l d c o n s i d e r b e f o r e i n v e s t i n g . Y o u s h o u l d r e a d c a r e f u l l y t h e f a c t o r s d e s c r i b e d i n t h e “ R i s k F a c t o r s ” s e c t i o n o f t h e p r o s p e c t u s c o n t a i n e d i n t h e R e g i s t r a t i o n S t a t e m e n t t o b e t t e r u n d e r s t a n d t h e r i s k s a n d u n c e r t a i n t i e s i n h e r e n t i n o u r b u s i n e s s and a n y f o r w a r d - l o o k i n g s t a t e m e n t s . W e h a v e f i l e d a R e g i s t r a t i o n S t a t e m e n t ( i n c l u d i n g a p r o s p e c tu s ) w i t h t h e S E C f o r t h e o f f e r i n g t o w h i c h t h i s p r e s e n t a t i o n r e l a t e s . T h e R e g i s t r a t i o n S t a t e m e n t h a s n o t b e c o m e e f f e c t i v e y e t . B e f o r e y o u i n v e s t , y o u s h o u l d r e a d t h e p r o s p e c t u s i n t h e R e g i s t r a t i o n S t a t e m e n t ( i n c l u d i n g t h e r i s k f a c to r s d e s c r i b e d t h e r e i n ) a n d o t h e r d o c u m e n t s we h a v e f i l e d wi t h t h e S E C f o r m o r e c o m p l e t e i n f o r ma t i o n a bou t u s a n d t h e o f f e r i n g . Y o u m a y g e t t h e s e d o c u m e n t s f o r f r e e b y v i s i t i n g E D G A R o n t h e S E C w e b s i t e a t h t t p : // w w w . s e c . g o v . T h e p r e l i m i n a r y p r o s p e c t u s , d a t e d 2 0 N o v e m b e r 2 0 2 4 a v a i l a b l e o n S E C W e b s i t e a t : h t t p s : // w w w . s e c . g o v / A r c h i v e s / e d g a r / d a t a / 2 0 0 7 7 0 2 / 0 0 0 1 2 1 3 9 0 0 2 4 1 0 0 6 7 4 / e a 0 2 2 1 4 9 6 - f 1 a 1 _ h o n g k o n g . h t m 2

Forward - Looking Statements and Disclaimer A l t e rnat i vel y, we o r ou r un derwr i ter s wil l a rr a nge t o s en d yo u t h e p r o spect us i f yo u c on tac t B an cr oft C a p i ta l , LL C b y c a ll ing ( + 1 ) 48 4 - 54 6 - 800 , o r e m a i l ing t o I n ve s t ment Bank ing@banc rof t4vet s .com , o r c on tact E d did S e c ur i t ies US A I n c . b y c a ll ing ( + 1 ) 212 - 363 - 6888 , o r e m a i ling t o e c m @eddidusa. com o r c on tact ou r C o m pany b y c a ll ing ( + 852 ) 26 18 - 9289 , o r e m a i ling t o s a m wong@9zt .hk . T h e s e c ur i t ies o f t h e C o m pany ha ve no t be en r e g i s ter ed un der t h e S e c ur i t ies A c t o f 19 33 , a s a m ended, o r an y o t h er ap p l i cable s e c u r i t ies l a w. T h e C o m pany' s s e c u r i t ies ha ve no t be en ap pr oved o r d i s appr oved b y t h e SE C o r an y o t h er r e gu la tor y o r go ve r n m ental au t hor i t y, no r ha ve an y o f t h e f o r egoi ng pa s sed up on t h e a cc u rac y o r ad equac y o f t h e i n f or mation p r e sented. A n y p r e sentat ion t o t h e c on t rar y i s a c r im inal o f f ense. T h e p r e sentat ion s h a l l no t c o ns t i tut e a n o f f er t o s e l l o r t h e s o li c i tat ion o f a n o f f er t o bu y, no r s ha l l t he r e b e an y s a l e o f t he se s e c ur i t ies i n an y s t a t e o r o t her j u r i sdi ct ion i n wh i c h s u c h o f f er, s o li c i tati on o r s a l e wou l d b e un lawf u l p r i or t o r e g i s t rat ion o r qua l i f i c ation un der t h e s e c ur i t ies l a ws o f s u c h s t a t e o r o t her j u r i sdi ct ion. T h e c o m pany' s s e c u r i t ies m a y on l y b e s o l d pu r suant t o a n e f f ect i ve r e g i s t r ation s t a t em ent f il ed wi t h t h e SE C . T h i s p r e s ent ation c on ta ins p r o pr ie tar y i n f orm at ion t ha t i s t h e p r o per t y o f t h e C o m pany. N e i t her t h i s p r e sentat ion no r t h e p r o pr ie tar y i n f orm at ion c on ta ined he r e in s ha l l b e pub lished, r ep r oduc ed, c o p i ed, d i sc l osed o r u s e d f o r an y o t h er pu r pose, o t h er t ha n t h e r e v i e w an d c on s ider at ion o f t h i s p r e sentat ion. T h e f o r war d - look ing s t a t em ents m a de i n t h i s p r e sentat ion r e l a te on l y t o e ve nt s o r i n f orm at ion a s o f t h e da t e o n wh i c h t h e s t a t em ent s a r e m a de i n t h i s p r e s ent ation. E xc ep t a s r e qu i r ed b y l a w, we un der take n o ob l igat ion t o up dat e o r r e v i s e pu b l i c l y an y f o r wa rd - looking s t a t em ent s, whe t her a s a r e s u l t of ne w i n f orm ation, f u t ure e ven t s , o r o t h er wi se, a f t er t h e da t e o n wh i c h t h e s t a t em ent s a r e m a de o r t o r e f lec t t h e o cc u r rence o f un anti c ipated e ve nt s. Yo u s h ould r ea d ou r p r o spect us an d t h e do cum ents t ha t we r e f er t o i n t h i s p r e s ent ation an d ha ve f il ed a s e xh i b i t s t o t h e R e g i st r ation S t a tem ent c o m p le te l y an d wi t h t h e un der s tanding t ha t ou r a c t ual f u t ure r e s u l t s m a y b e m a ter ia l l y d i f f er ent f r o m wha t we e xpe ct . 3

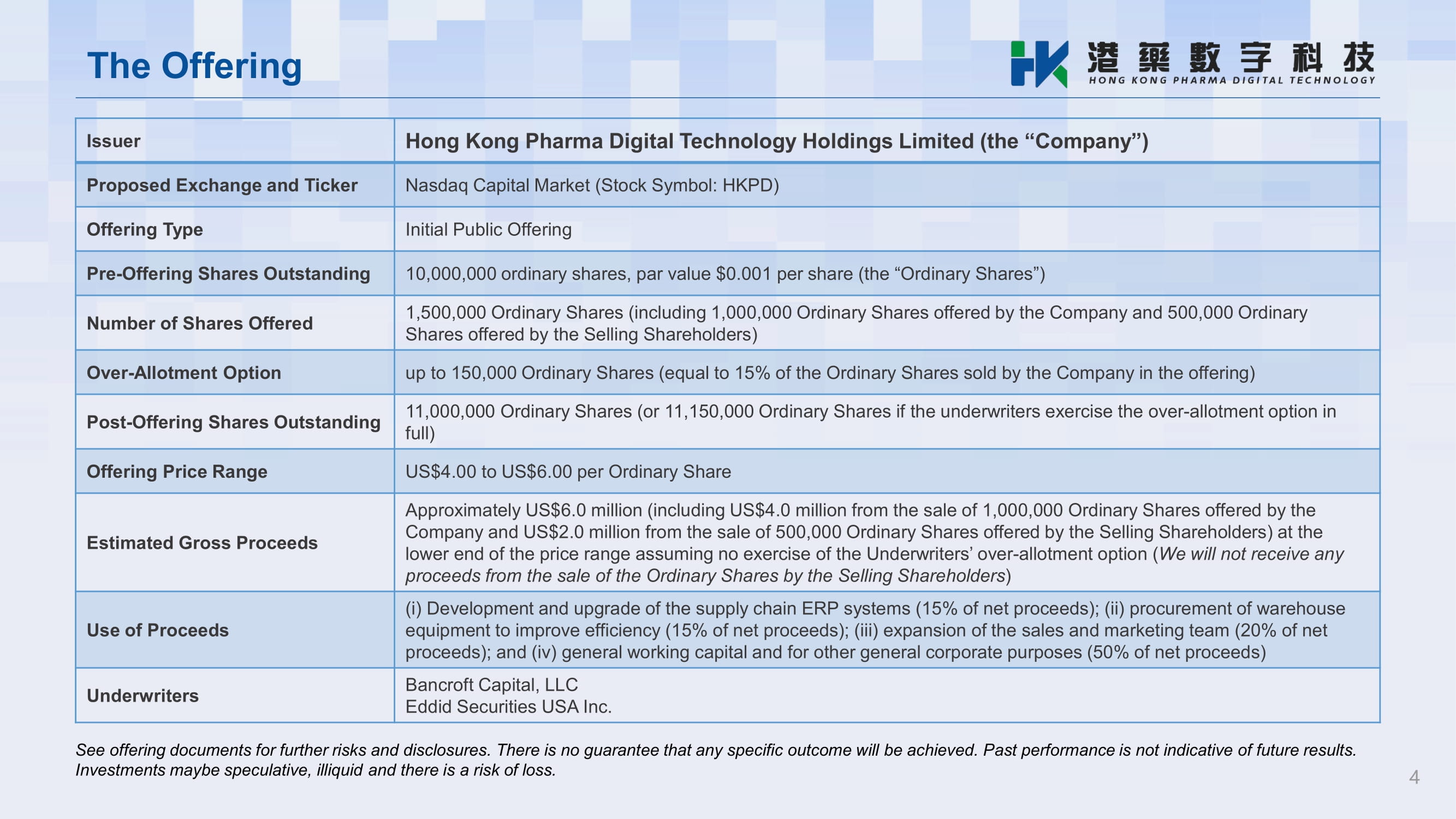

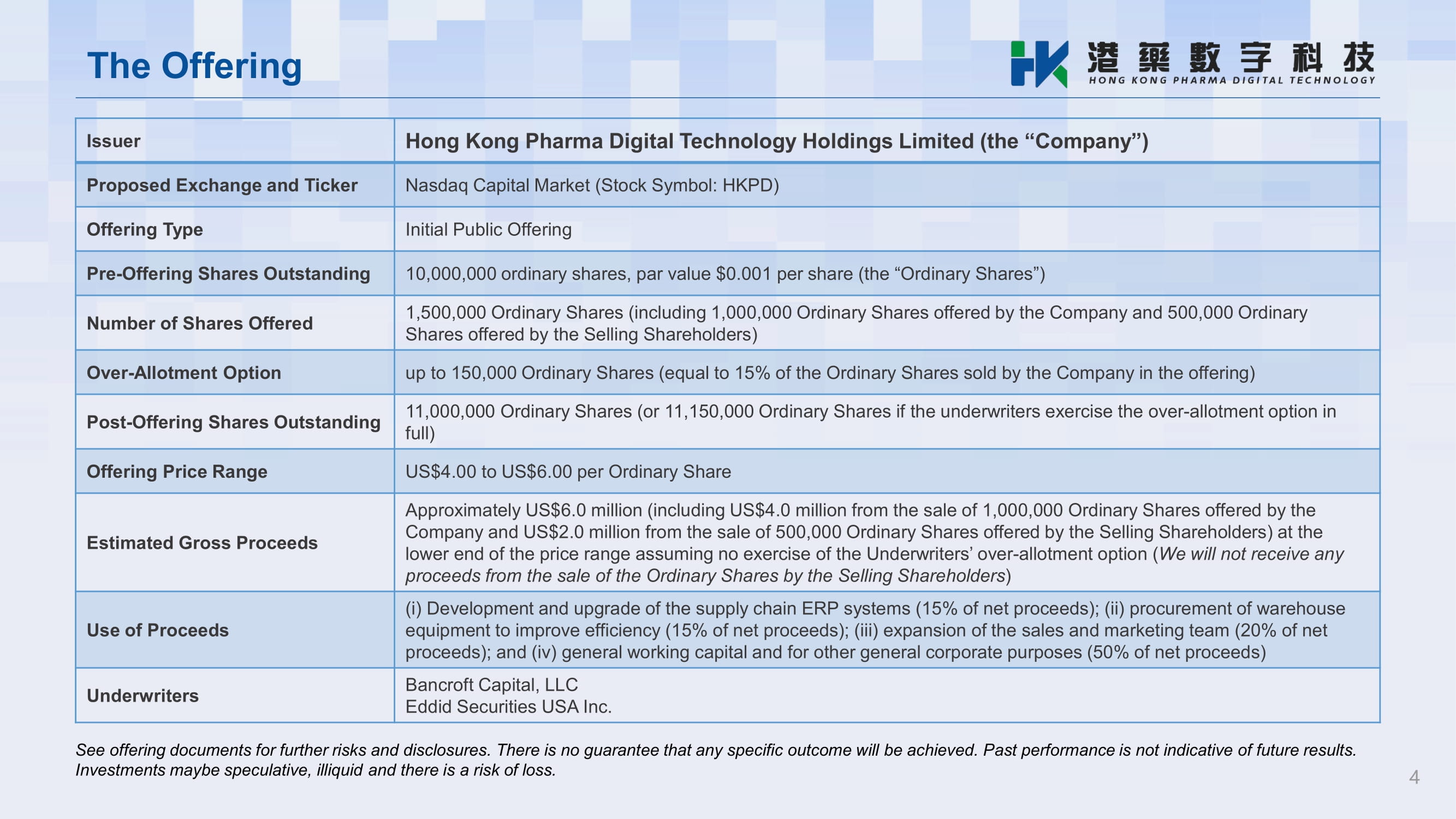

The Offering See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Past performance is not indicative of future results. Investments maybe speculative, illiquid and there is a risk of loss. Hong Kong Pharma Digital Technology Holdings Limited (the “Company”) Issuer Nasdaq Capital Market (Stock Symbol: HKPD) Proposed Exchange and Ticker Initial Public Offering Offering Type 10,000,000 ordinary shares, par value $0.001 per share (the “Ordinary Shares”) Pre - Offering Shares Outstanding 1,500,000 Ordinary Shares (including 1,000,000 Ordinary Shares offered by the Company and 500,000 Ordinary Shares offered by the Selling Shareholders) Number of Shares Offered up to 150,000 Ordinary Shares (equal to 15% of the Ordinary Shares sold by the Company in the offering) Over - Allotment Option 11,000,000 Ordinary Shares (or 11,150,000 Ordinary Shares if the underwriters exercise the over - allotment option in full) Post - Offering Shares Outstanding US$4.00 to US$6.00 per Ordinary Share Offering Price Range Approximately US$6.0 million (including US$4.0 million from the sale of 1,000,000 Ordinary Shares offered by the Company and US$2.0 million from the sale of 500,000 Ordinary Shares offered by the Selling Shareholders) at the lower end of the price range assuming no exercise of the Underwriters’ over - allotment option ( We will not receive any proceeds from the sale of the Ordinary Shares by the Selling Shareholders ) Estimated Gross Proceeds (i) Development and upgrade of the supply chain ERP systems (15% of net proceeds); (ii) procurement of warehouse equipment to improve efficiency (15% of net proceeds); (iii) expansion of the sales and marketing team (20% of net proceeds); and (iv) general working capital and for other general corporate purposes (50% of net proceeds) Use of Proceeds Bancroft Capital, LLC Eddid Securities USA Inc. Underwriters 4

5 Company Overview Revenue from Mainland China’s Over - the - Counter pharmaceutical (“OTC”) cross - border e - commerce supply chain services in Hong Kong (“HK”), as per Frost & Sullivan report The number of HK Department of Health (“HKDOH”) - enlisted OTC products cataloged in our system, a significant head start against competitors Year ended 31 Mar. 2024 (“FY2024”) vs. FY2023 Hong Kong Pharma Digital Technology Holdings Limited (Cayman Islands) 100% 100% Joint Cross Border Logistics Company Limited (Hong Kong) (“ JCBL ”) V - Alliance Technology Supplies Limited (Hong Kong) (“ VATS ”) OTC pharmaceutical cross - border e - commerce supply chain services (“Supply Chain Services”) Market supply leader in one - stop chain solution for Mainland Chinese customers to access OTC products from overseas OTC pharmaceutical cross - border procurement and distribution (“Procurement & Distribution”) Leveraging on supply chain sell procure and OTC products data, we overseas directly to merchants on Chinese e - commerce platforms and pharmaceutical distributors Our business segments Based in Hong Kong, we has established ourself as a leading provider of third - party supply chain services in Mainland China's OTC pharmaceutical cross - border e - commerce market Our corporate structure * As of May 31, 2024 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Past performance is not indicative of future results. Investments maybe speculative, illiquid and there is a risk of loss.

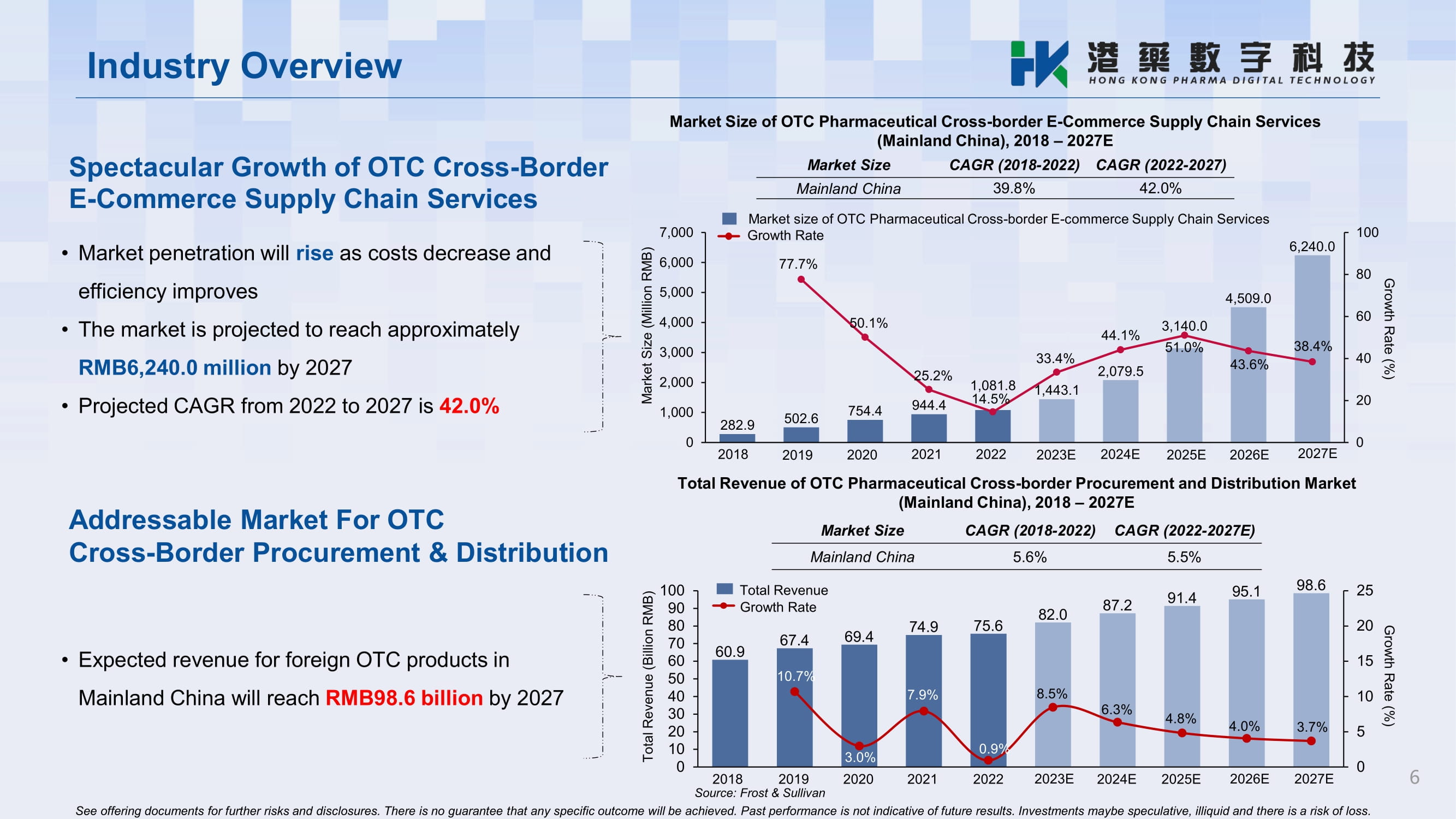

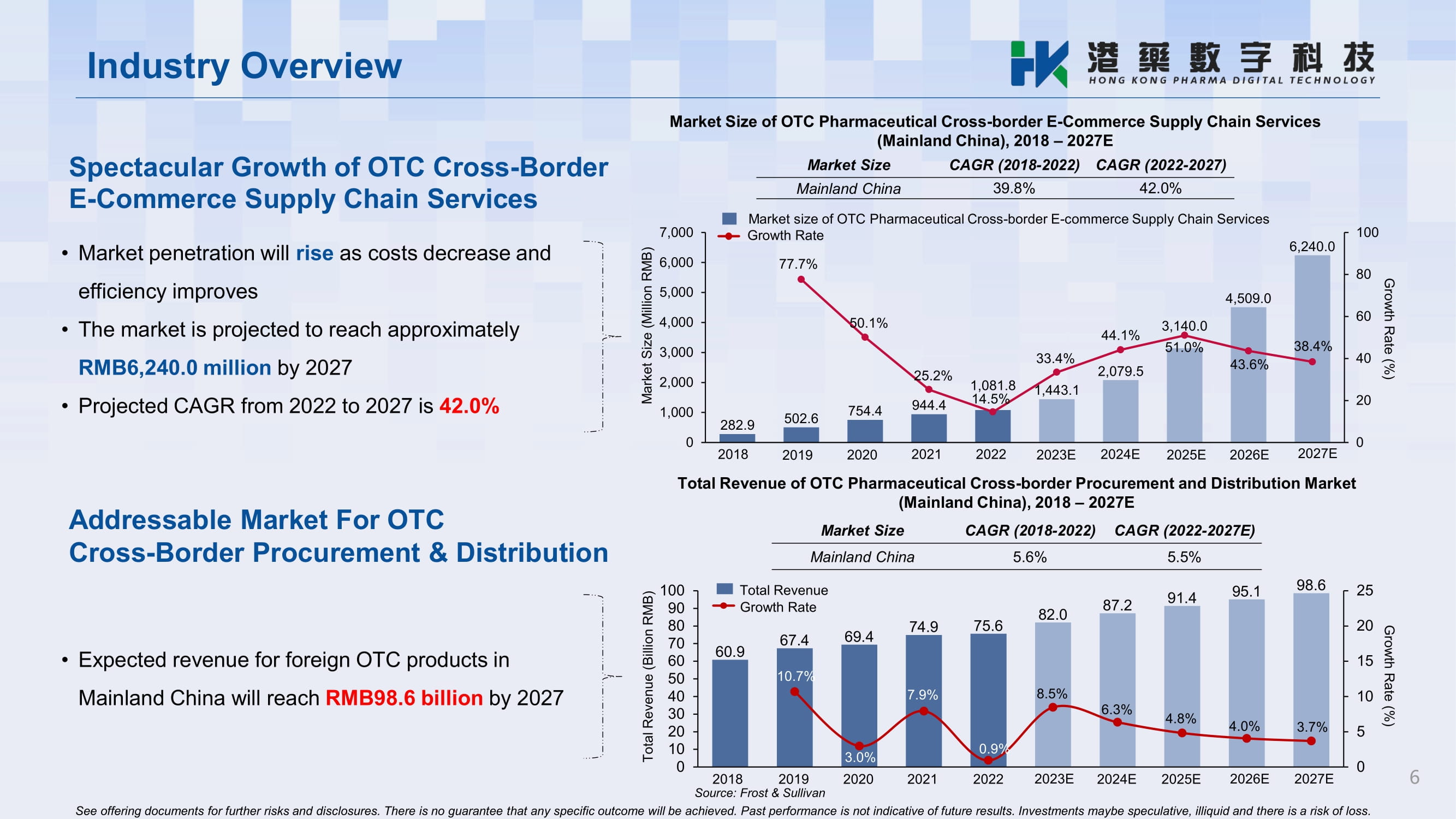

Industry Overview 6 Total Revenue of OTC Pharmaceutical Cross - border Procurement and Distribution Market (Mainland China), 2018 – 2027E Market Size of OTC Pharmaceutical Cross - border E - Commerce Supply Chain Services (Mainland China), 2018 – 2027E CAGR (2022 - 2027) CAGR (2018 - 2022) Market Size 42.0% 39.8% Mainland China CAGR (2022 - 2027E) CAGR (2018 - 2022) Market Size 5.5% 5.6% Mainland China • Market penetration will rise as costs decrease and efficiency improves • The market is projected to reach approximately RMB6,240.0 million by 2027 • Projected CAGR from 2022 to 2027 is 42.0% • Expected revenue for foreign OTC products in Mainland China will reach RMB98.6 billion by 2027 Market Size (Million RMB) 282.9 502.6 754.4 944.4 1,443.1 2,079.5 3,140.0 4,509.0 6,240.0 0 20 40 60 80 100 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 2018 2019 2020 2021 2022 2023E 2024E 2025E 2026E 2027E 77.7% 50.1% 25.2% 1,081.8 14.5% 33.4% 44.1% 51.0% 43.6% 38.4% Market size of OTC Pharmaceutical Cross - border E - commerce Supply Chain Services Growth Rate Growth Rate (%) 60.9 67.4 69.4 74.9 75.6 82.0 87.2 91.4 95.1 98.6 0 5 10 15 20 25 100 90 80 70 60 50 40 30 20 10 0 2018 2019 Source: Frost & Sullivan 2020 2021 2022 2023E 2024E 2025E 2026E 2027E 10.7% 3.0% 7.9% 0.9% 8.5% 6.3% 4.8% 4.0% 3.7% Total Revenue Growth Rate Growth Rate (%) See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Past performance is not indicative of future results. Investments maybe speculative, illiquid and there is a risk of loss. Total Revenue (Billion RMB) Addressable Market For OTC Cross - Border Procurement & Distribution Spectacular Growth of OTC Cross - Border E - Commerce Supply Chain Services

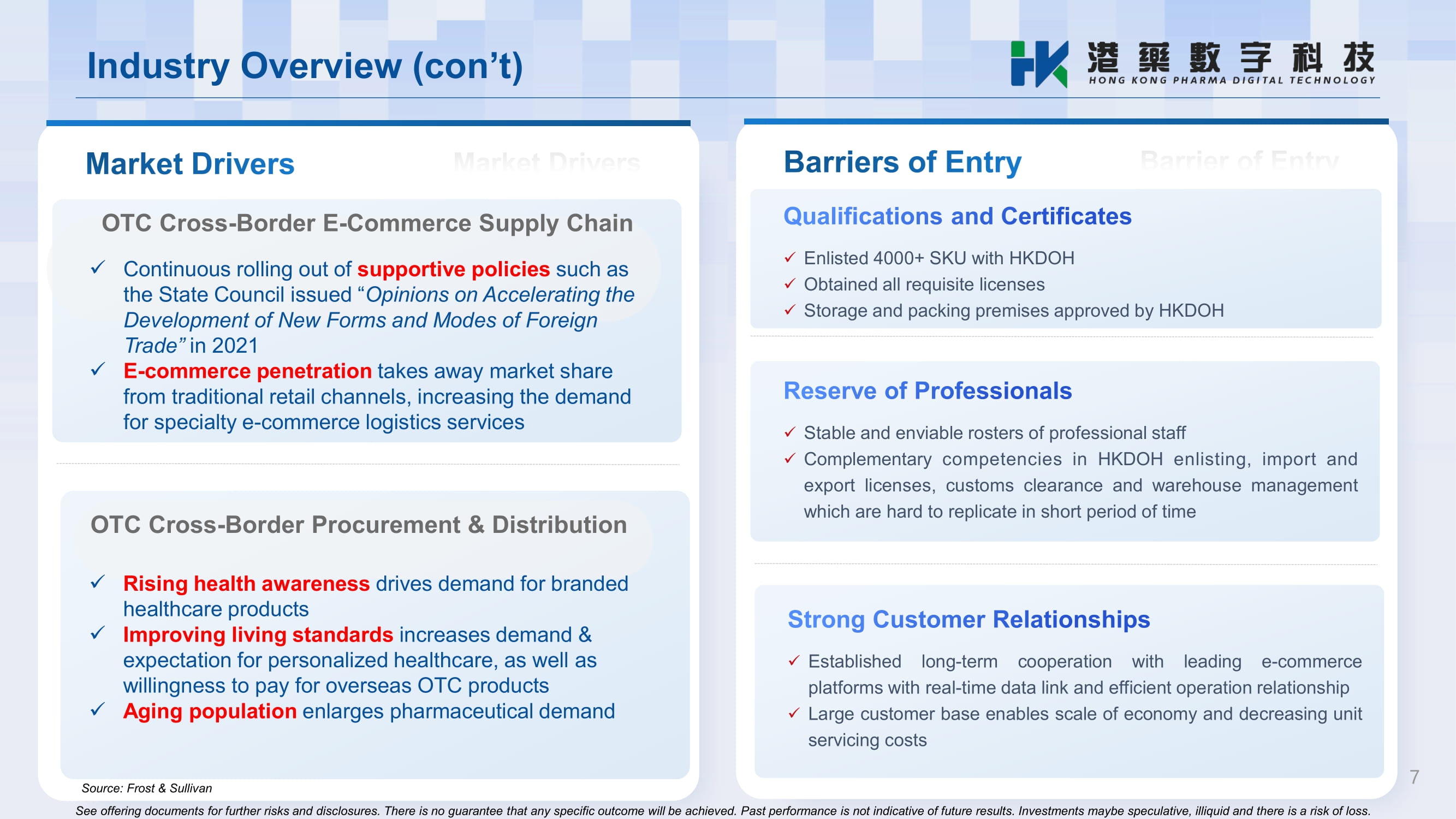

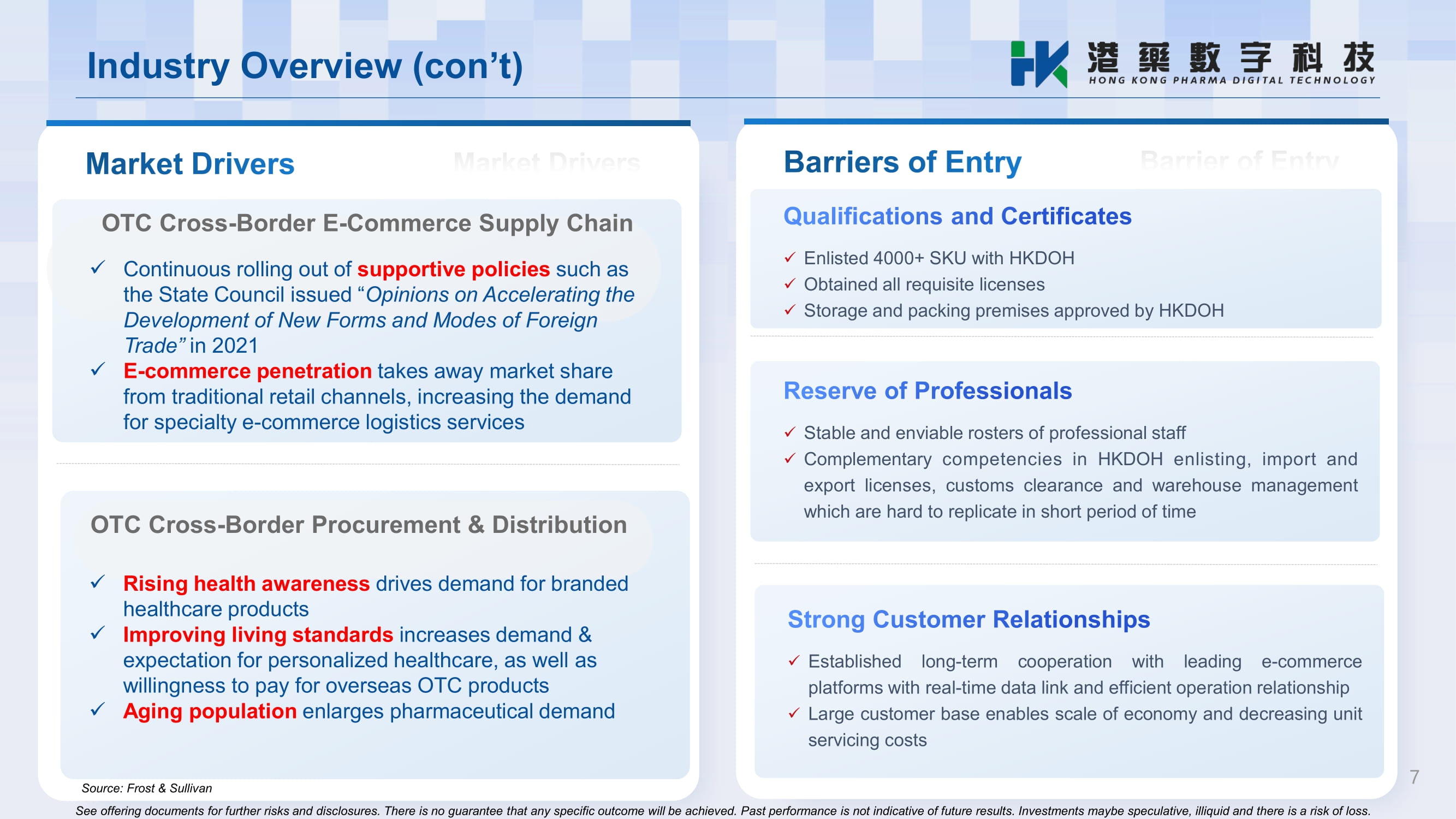

Industry Overview (con’t) x Enlisted 4000+ SKU with HKDOH x Obtained all requisite licenses x Storage and packing premises approved by HKDOH x Stable and enviable rosters of professional staff x Complementary competencies in HKDOH enlisting, import and export licenses, customs clearance and warehouse management which are hard to replicate in short period of time x Established long - term cooperation with leading e - commerce platforms with real - time data link and efficient operation relationship x Large customer base enables scale of economy and decreasing unit servicing costs 7 OTC Cross - Border E - Commerce Supply Chain x Continuous rolling out of supportive policies such as the State Council issued “ Opinions on Accelerating the Development of New Forms and Modes of Foreign Trade” in 2021 x E - commerce penetration takes away market share from traditional retail channels, increasing the demand for specialty e - commerce logistics services OTC Cross - Border Procurement & Distribution x Rising health awareness drives demand for branded healthcare products x Improving living standards increases demand & expectation for personalized healthcare, as well as willingness to pay for overseas OTC products x Aging population enlarges pharmaceutical demand See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Past performance is not indicative of future results. Investments maybe speculative, illiquid and there is a risk of loss. Source: Frost & Sullivan

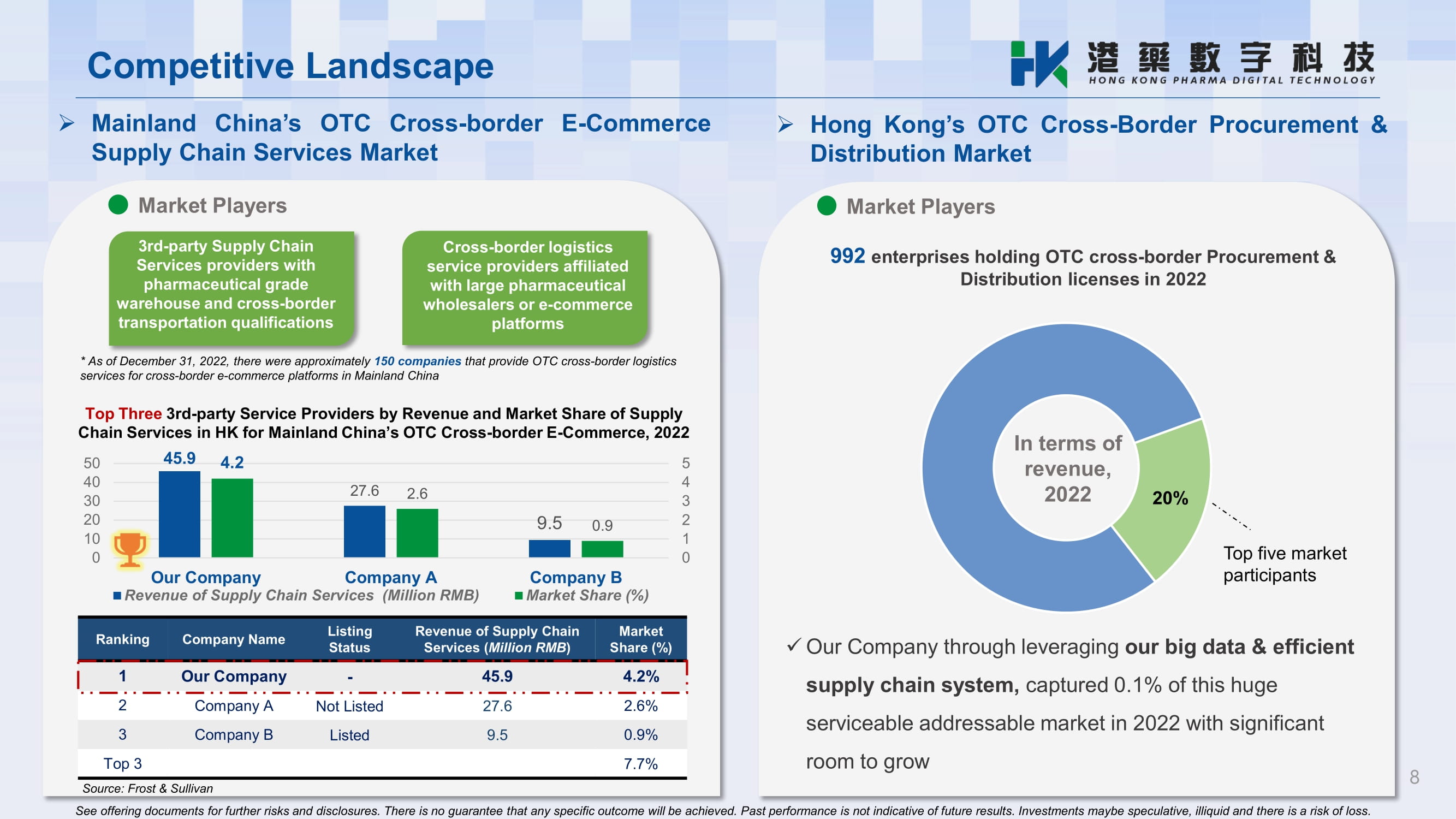

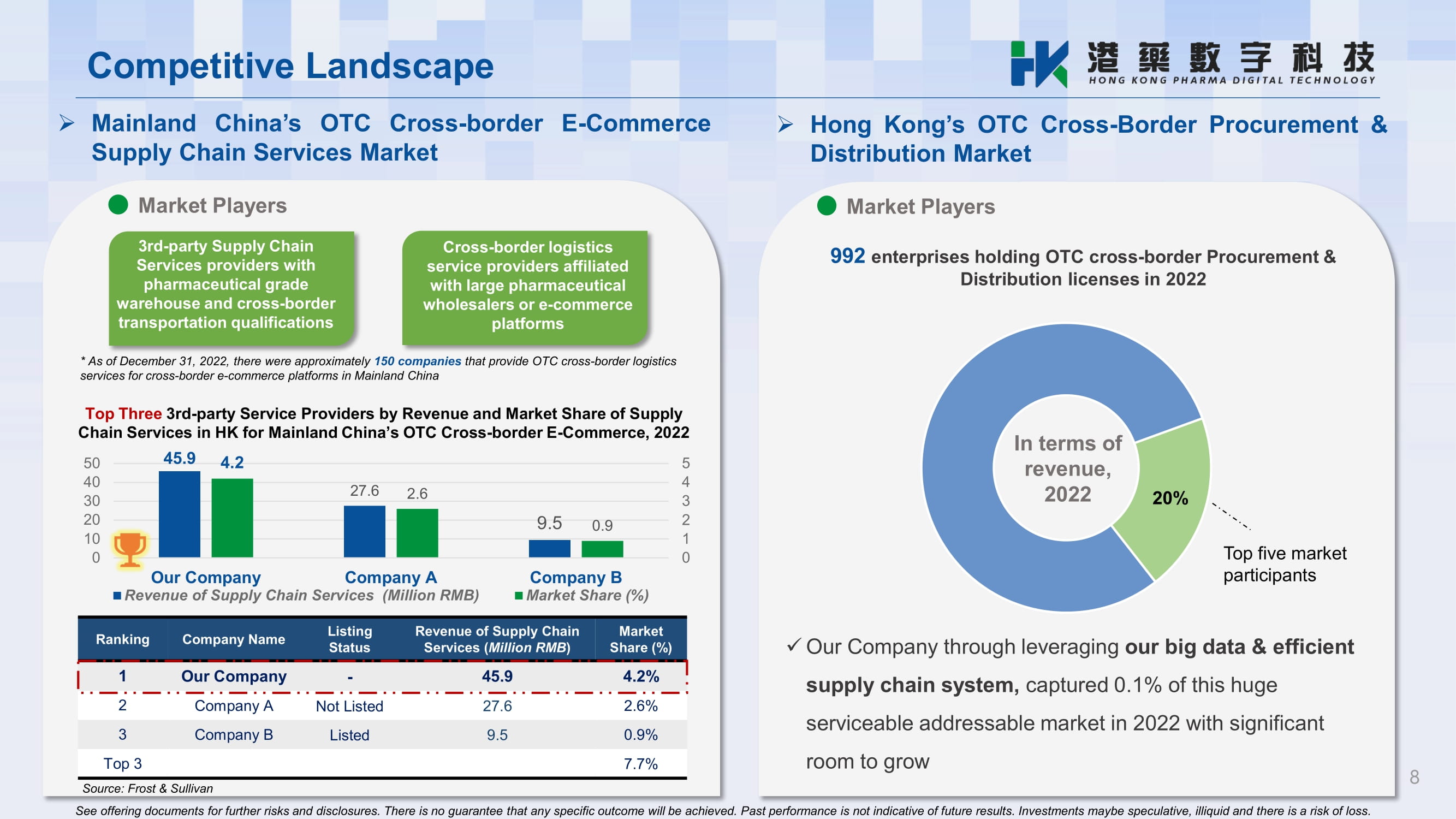

8 Competitive Landscape E - Commerce » Mainland China’s OTC Cross - border Supply Chain Services Market * As of December 31, 2022, there were approximately 150 companies that provide OTC cross - border logistics services for cross - border e - commerce platforms in Mainland China Market Players Top Three 3rd - party Service Providers by Revenue and Market Share of Supply Chain Services in HK for Mainland China’s OTC Cross - border E - Commerce, 2022 45.9 27.6 9.5 4.2 2.6 0.9 5 4 3 2 1 0 50 40 30 20 10 0 Our Company Company A Revenue of Supply Chain Services (Million RMB) Company B Market Share (%) » Hong Kong’s OTC Cross - Border Procurement & Distribution Market 20% In terms of revenue, 2022 Top five market participants 992 enterprises holding OTC cross - border Procurement & Distribution licenses in 2022 x Our Company through leveraging our big data & efficient supply chain system, captured 0.1% of this huge serviceable addressable market in 2022 with significant room to grow Market Players Cross - border logistics service providers affiliated with large pharmaceutical wholesalers or e - commerce platforms 3rd - party Supply Chain Services providers with pharmaceutical grade warehouse and cross - border transportation qualifications Market Share (%) Revenue of Supply Chain Services ( Million RMB ) Listing Status Company Name Ranking 4.2% 45.9 - Our Company 1 2.6% 27.6 Not Listed Company A 2 0.9% 9.5 Listed Company B 3 7.7% Top 3 Source: Frost & Sullivan See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Past performance is not indicative of future results. Investments maybe speculative, illiquid and there is a risk of loss.

Our Business Models Domestic Comprehensive e - commerce platforms Vertical pharmaceutical e - commerce platforms Overseas OTC Producers and OTC Distributors Overseas Cross - Border Supply Chain Services End Consumers Trading Companies Hospitals and Clinics Retail Stores Online Platforms On - sell to Downstream Business • Take principal ownership of goods in trade • Auxiliary services include product enlisting, obtaining import / export licenses etc. OTC Cross - Border Procurement & Distribution Mainland China and HK (through cross - border) Our position in the value chain in the Supply Chain Services market and Procurement & Distribution market respectively Supply Chain Services Procurement & Distribution See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Past performance is not indicative of future results. Investments maybe speculative, illiquid and there is a risk of loss. 9

First Business Segment — OTC Cross - Border E - Commerce Supply Chain Services Overseas OTC procurement Overseas OTC logistics arrangement Warehousing services Fulfillment services Customers • E - Commerce platform logistics partners • Merchants on established Chinese e - commerce platforms Suppliers • OTC pharma producers & suppliers • Logistics subcontractors • Labor service providers & packaging suppliers 10 Contributed 60.8% of our FY2024* Revenue Regulatory Authorities Hong Kong Department of Health (HKDOH); Hong Kong & Mainland China Customs Enlist drugs to the Hong Kong Department of Health, and obtain import and export permits and clearances * For the year ended 31 March 2024 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Past performance is not indicative of future results. Investments maybe speculative, illiquid and there is a risk of loss.

Seamless Cooperation with We provide » Warehousing, packaging, customs clearance, import compliance, compliance guidelines for online merchants, and product admission verification services for cross - border OTC products to CaiNiao We serve » Through CaiNiao, we serve the Alibaba Group’s online trading platforms, as well as other e - commerce platforms that utilize CaiNiao’s logistics services * CaiNiao, an affiliate to Alibaba (BABA.US), has a global smart logistics network covering, over 200 countries / regions, with over 1100 warehouses, 380 sorting centers, 170k “pick - up, drop - off” stations worldwide; approx.170 chartered flights and BSAs per week on average & over 2700 line - haul trucking routes globally Source: Cainiao.com website, 22 Nov 2024 » Started with CaiNiao*, who accounted for 47.5% of our FY2023 revenue, we have since diversified our customer base to merchants on other mega e - commerce platforms including JD, Meituan, Pinduoduo, etc. » In FY2024, revenue from Cainiao accounted for 15.5% of our total revenue, proving reducing dependence on CaiNiao We enter into » End - to - End Logistics Service Agreement & Warehouse Service Agreement with CaiNiao, renew annually (current ones up to 31 Mar 2025) 11 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Past performance is not indicative of future results. Investments maybe speculative, illiquid and there is a risk of loss.

Connecting to CaiNiao via real - time APIs we monitor key performance indicators including fulfillment accuracy, end - to - end fulfillment time, real - time inventory count & customer complaint etc. Seamless Cooperation with (con’t) Stable & stellar fulfillments led to designated services outsourcing partner status by CaiNiao Our reliable performance and years of track record in servicing CaiNiao have laid a solid foundation for long - term continuing cooperation . This stands as a hallmark of our quality services, helping us break into other e - commerce platforms , and serving as a cornerstone for our growth in this high growth, high market share sector. Detailed & quantifiable performance tracking enable granular performance measurements node by node for operation improvements 12 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Past performance is not indicative of future results. Investments maybe speculative, illiquid and there is a risk of loss.

Recent Expansion Removed Bottleneck of Growth in Supply Chain Services Enhance sorting and packaging capability » 20+ sorting, packaging machines and forklifts added, with 12 new packaging staff hired Reduce end - to - end fulfillment time » Time from receiving order to package loaded on outgoing truck reduced and efficiency increased 13 * Measured by the actual inventory of 738,726 pieces at storage on 13 Nov 2024 divided by the new facility’s maximum storage capacity of 900,000 pieces See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Past performance is not indicative of future results. Investments maybe speculative, illiquid and there is a risk of loss. x Since mid Sep 2024 , we added over 20 % of our warehouse footage by leasing a new facility, which capacity utilization has already reached 82 % * on 13 Nov 2024 x It enables us to: Improve our efficiency of pharmaceuticals delivery » Larger freight elevators & loading docks

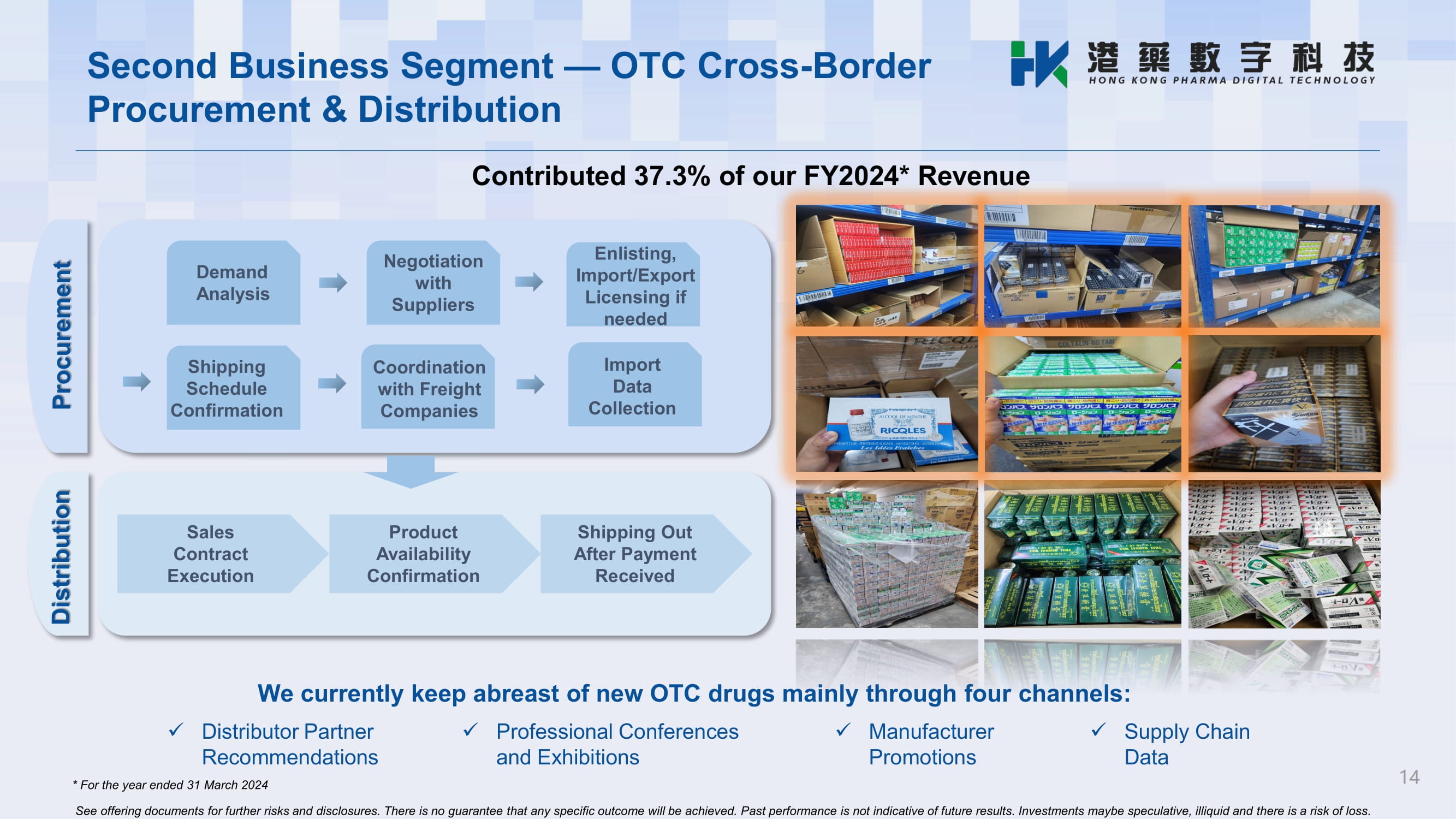

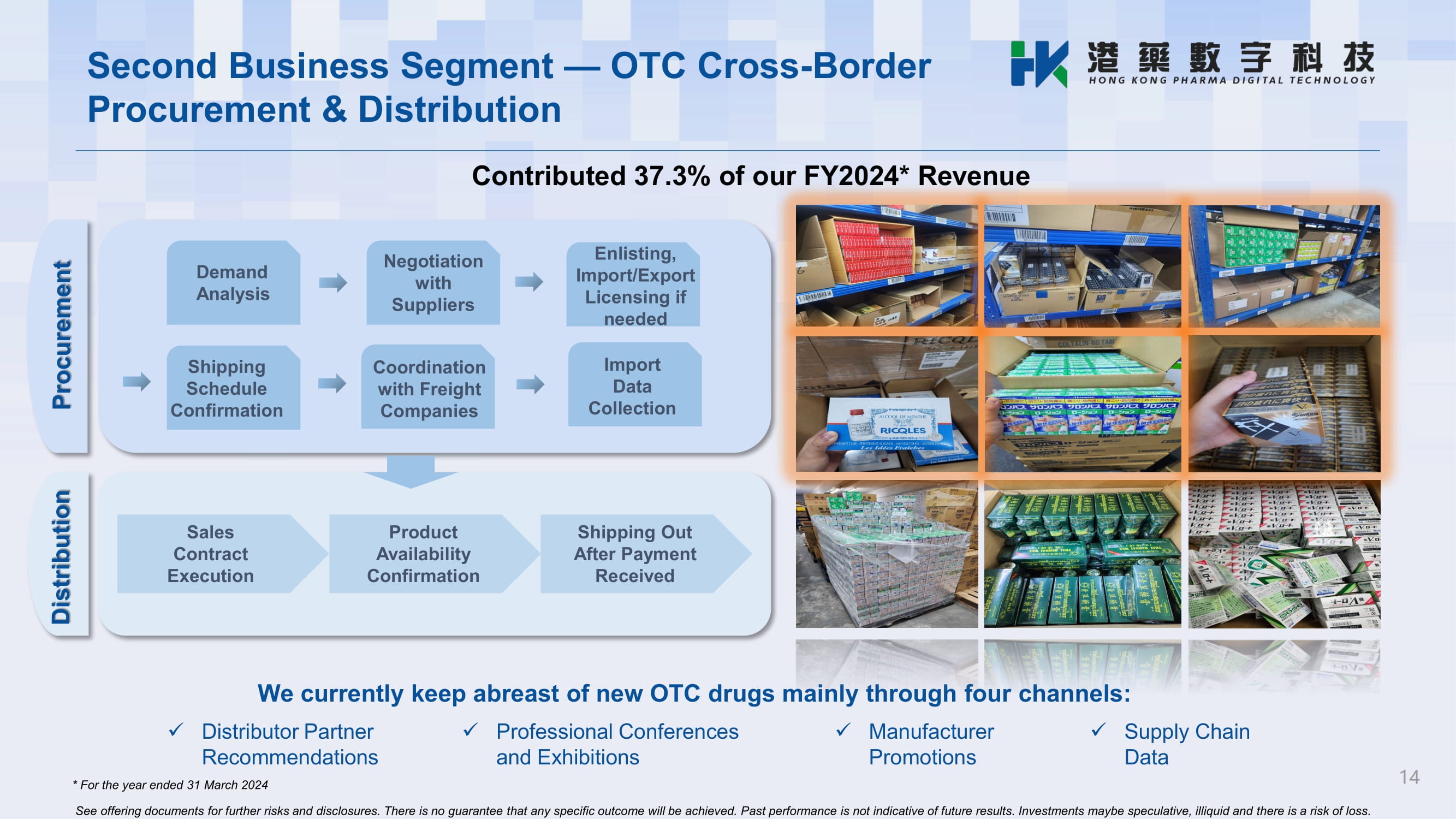

Second Business Segment — OTC Cross - Border Procurement & Distribution Demand Analysis Negotiation with Suppliers Shipping Schedule Confirmation Coordination with Freight Companies Procurement Sales Contract Execution Product Availability Confirmation Shipping Out After Payment Received Distribution Import Data Collection x Distributor Partner Recommendations x Professional Conferences and Exhibitions x Manufacturer Promotions We currently keep abreast of new OTC drugs mainly through four channels: x Supply Chain Data Enlisting, Import/Export Licensing if needed Contributed 37.3% of our FY2024* Revenue 14 * For the year ended 31 March 2024 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Past performance is not indicative of future results. Investments maybe speculative, illiquid and there is a risk of loss.

Company Awards and Certifications Awards and Accreditations Certifications, Licenses and Permits July 2024 Business Registration Ordinance (Chapter 310) – Business Registration Certificate January 2023 ISO 9001: 2015 Quality Management System July 2024 Chinese Medicine Ordinance (Chapter 549) – Wholesaler License in Proprietary Chinese Medicines October 2023 The Antibiotics Ordinance (Chapter 137) – Permit August 2021 Waste Disposal Ordinance (Chapter 354) – Registration of Waste Producer June 2024 Pharmacy and Poisons Ordinance (Chapter 138) – Wholesale Dealer License December 2023 Pesticides Ordinance (Chapter 133) – Pesticides License January 2023 Chinese Medicine Ordinance (Chapter 549) – Wholesaler License in Proprietary Chinese Medicines July 2023 Food Safety Ordinance (Chapter 612) – Registration as Food Importer/Food Distributor DIRECTOR HONG KONG CHINESE PREPARED MEDICINE TRADERS ASSOCIATION THE H.K. MEDICINE DEALERS’ GUILD MEMBER MEMBER PHARMACEUTI CAL DISTRIBUTORS ASSOCIATON OF HONG KONG CHINA MEDICAL PHARMACEUTICAL MATERIAL ASSOCIATION MEMBER 15 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Past performance is not indicative of future results. Investments maybe speculative, illiquid and there is a risk of loss.

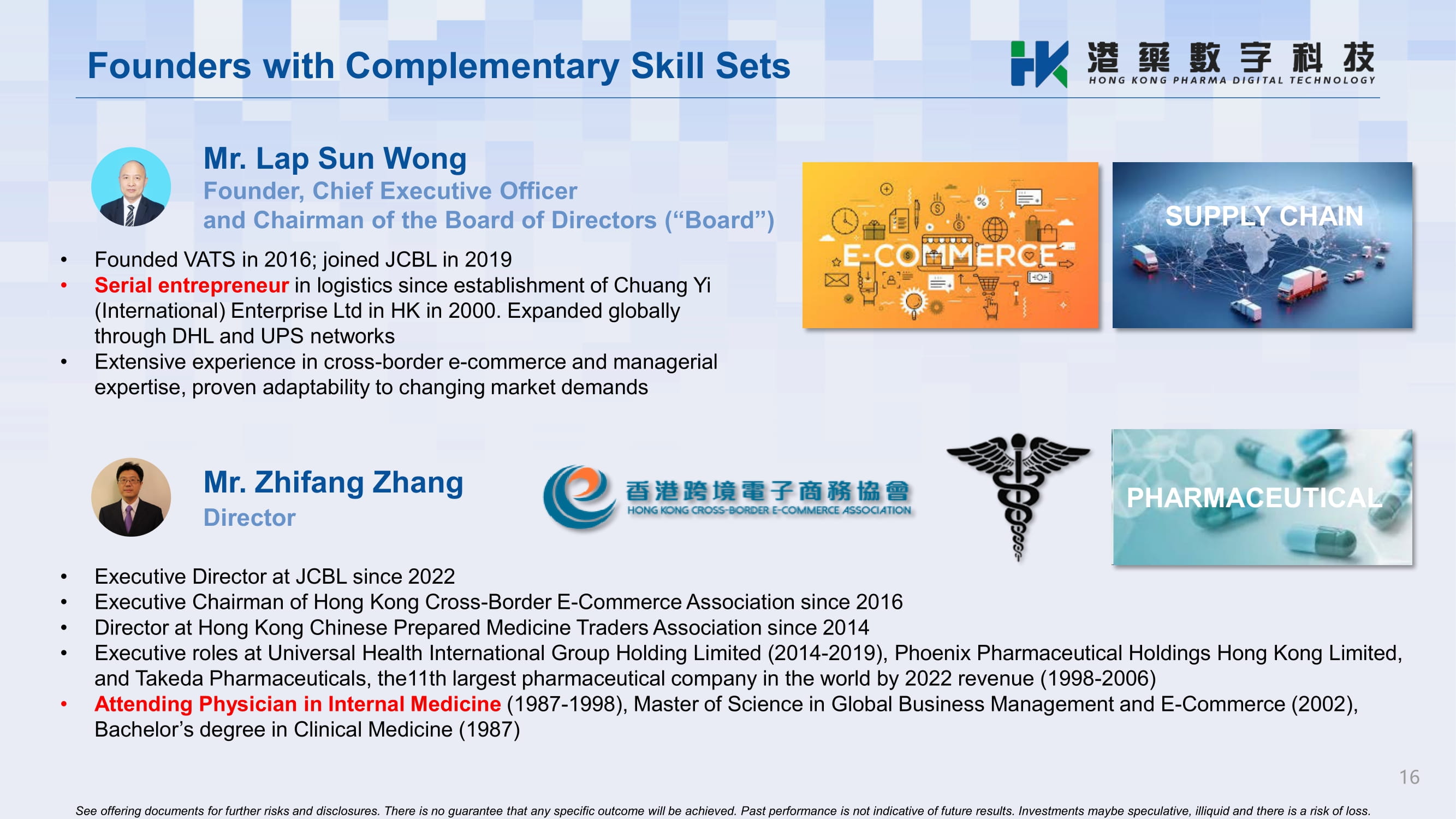

Founders with Complementary Skill Sets Mr. Lap Sun Wong Founder, Chief Executive Officer and Chairman of the Board of Directors (“Board”) • Founded VATS in 2016; joined JCBL in 2019 • Serial entrepreneur in logistics since establishment of Chuang Yi (International) Enterprise Ltd in HK in 2000. Expanded globally through DHL and UPS networks • Extensive experience in cross - border e - commerce and managerial expertise, proven adaptability to changing market demands • Executive Director at JCBL since 2022 • Executive Chairman of Hong Kong Cross - Border E - Commerce Association since 2016 • Director at Hong Kong Chinese Prepared Medicine Traders Association since 2014 • Executive roles at Universal Health International Group Holding Limited (2014 - 2019), Phoenix Pharmaceutical Holdings Hong Kong Limited, and Takeda Pharmaceuticals, the11th largest pharmaceutical company in the world by 2022 revenue (1998 - 2006) • Attending Physician in Internal Medicine (1987 - 1998), Master of Science in Global Business Management and E - Commerce (2002), Bachelor’s degree in Clinical Medicine (1987) Mr. Zhifang Zhang Director SUPPLY CHAIN PHARMACEUTICAL 16 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Past performance is not indicative of future results. Investments maybe speculative, illiquid and there is a risk of loss.

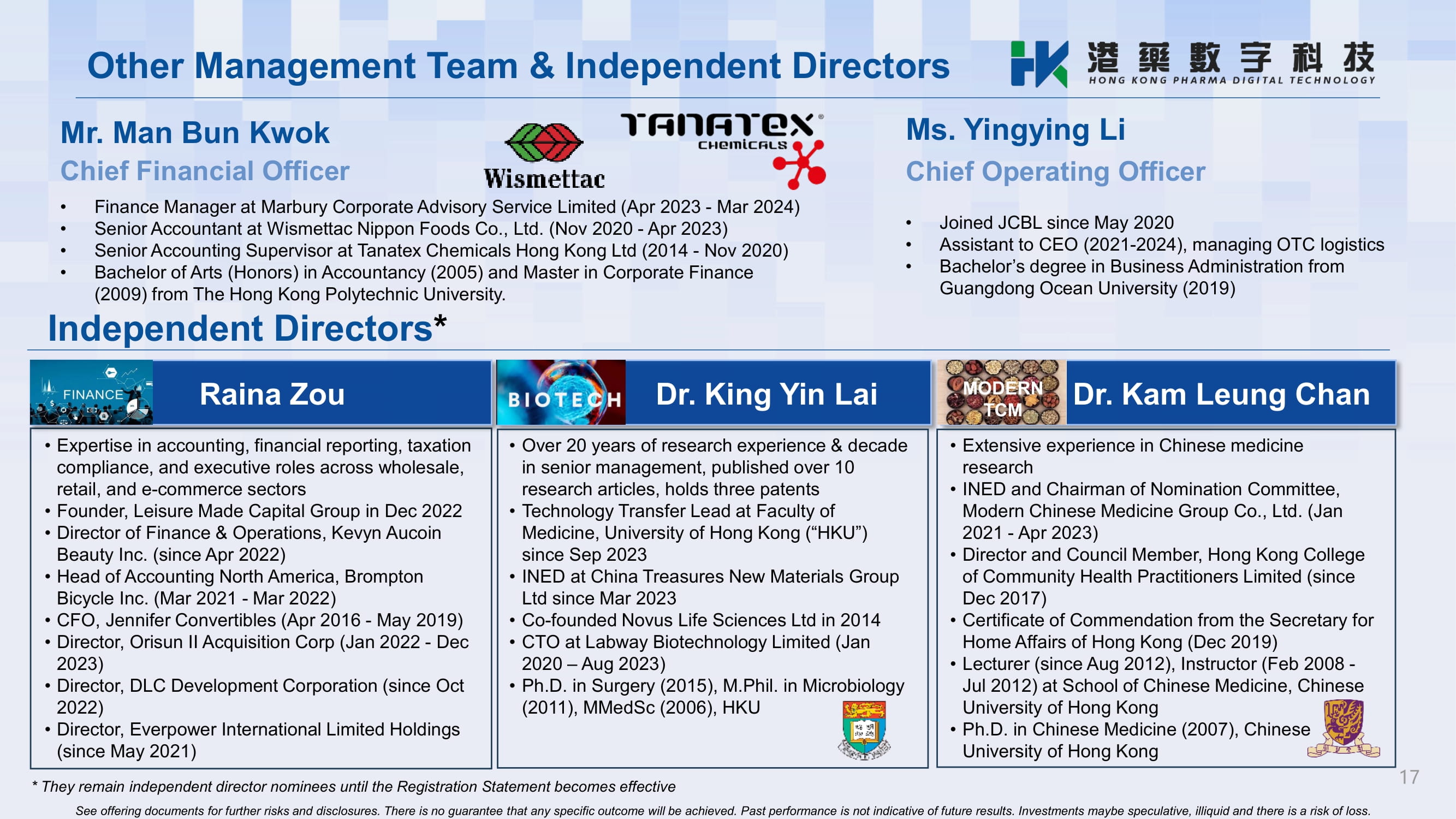

• Finance Manager at Marbury Corporate Advisory Service Limited (Apr 2023 - Mar 2024) • Senior Accountant at Wismettac Nippon Foods Co., Ltd. (Nov 2020 - Apr 2023) • Senior Accounting Supervisor at Tanatex Chemicals Hong Kong Ltd (2014 - Nov 2020) • Bachelor of Arts (Honors) in Accountancy (2005) and Master in Corporate Finance (2009) from The Hong Kong Polytechnic University. • Joined JCBL since May 2020 • Assistant to CEO (2021 - 2024), managing OTC logistics • Bachelor’s degree in Business Administration from Guangdong Ocean University (2019) Mr. Man Bun Kwok Chief Financial Officer Ms. Yingying Li Chief Operating Officer Independent Directors * Other Management Team & Independent Directors MODERN Dr. Kam Leung Chan TCM Dr. King Yin Lai Raina Zou • Extensive experience in Chinese medicine research • INED and Chairman of Nomination Committee, Modern Chinese Medicine Group Co . , Ltd . (Jan 2021 - Apr 2023 ) • Director and Council Member, Hong Kong College of Community Health Practitioners Limited (since Dec 2017) • Certificate of Commendation from the Secretary for Home Affairs of Hong Kong (Dec 2019) • Lecturer (since Aug 2012), Instructor (Feb 2008 - Jul 2012) at School of Chinese Medicine, Chinese University of Hong Kong • Ph.D. in Chinese Medicine (2007), Chinese University of Hong Kong • Over 20 years of research experience & decade in senior management, published over 10 research articles, holds three patents • Technology Transfer Lead at Faculty of Medicine, University of Hong Kong (“HKU”) since Sep 2023 • INED at China Treasures New Materials Group Ltd since Mar 2023 • Co - founded Novus Life Sciences Ltd in 2014 • CTO at Labway Biotechnology Limited (Jan 2020 – Aug 2023) • Ph.D. in Surgery (2015), M.Phil. in Microbiology (2011), MMedSc (2006), HKU • Expertise in accounting, financial reporting, taxation compliance, and executive roles across wholesale, retail, and e - commerce sectors • Founder, Leisure Made Capital Group in Dec 2022 • Director of Finance & Operations, Kevyn Aucoin Beauty Inc. (since Apr 2022) • Head of Accounting North America, Brompton Bicycle Inc. (Mar 2021 - Mar 2022) • CFO, Jennifer Convertibles (Apr 2016 - May 2019) • Director, Orisun II Acquisition Corp (Jan 2022 - Dec 2023) • Director, DLC Development Corporation (since Oct 2022) • Director, Everpower International Limited Holdings (since May 2021) 17 * They remain independent director nominees until the Registration Statement becomes effective See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Past performance is not indicative of future results. Investments maybe speculative, illiquid and there is a risk of loss.

Our Competitive Strengths Advanced Proprietary Technology Infrastructure We utilize systematic order management, seamlessly integrated with warehouse management Scalability We secure and collaborate with major platform logistics partners and top - tier merchants Flexibility of Our Offerings We tailor our comprehensive offerings and holistic one - stop solution to meet customers’ unique needs Regulatory Compliance We work closely with government authorities to ensure compliance and efficiency of logistics operations Seasoned and Visionary Management Team and Established Market Presence We have management team with extensive and complementary industry experience 18 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Past performance is not indicative of future results. Investments maybe speculative, illiquid and there is a risk of loss.

Our Growth Strategies Improve accuracy by implementing smart shipping and receiving equipment for automatic identification and counting of goods and packages, automate the assembly line to reduce manual operations and labor costs, and design storage facilities tailored to pharmaceutical products to enhance warehouse space utilization Continuously Upgrade Our Technology Infrastructure Plan to establish a sales team in Mainland China, primarily for acquiring more merchants, and further expanding into fast growing new customer segments such as internet hospitals who need access to new drugs overseas (e.g. American drugs, Indian drugs) Expand Our Sales Team Improving accounts receivable turnover rates, establishing a robust credit management system, assessing and managing customer credit, reducing inventory turnover times, optimizing procurement plans, and minimizing inventory retention times Optimize Working Capital and Operations 19 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Past performance is not indicative of future results. Investments maybe speculative, illiquid and there is a risk of loss.

Financial Highlights 998 1,330 FY2023 FY2024 8,052 10,146 4,481 6,218 23 325 FY2024 Procurement and Distribution FY2023 Consignment sales and other revenue Supply Chain Services 12,556 16,688 Net Profit (USD’000) Total Revenue (USD’000) For the years ended March 31, 2024 For the years ended March 31, 2023 (USD’000, except for %) 16,688 12,556 Total Revenue 3,559 2,739 Gross profit 21.3% 21.8% Gross Margin (%) 1,526 1,021 Profit before income taxes (196) (23) Income tax expense 1,330 998 Net profit Selected Income Statement Data (audited) Selected Cash Flow Data (audited) For the years ended March 31, 2024 For the years ended March 31, 2023 (USD’000) (394) 1,727 Cash Flows provided by (used in) operating activities (41) (132) Cash Flows used in investing activities 537 (1,156) Cash Flows provided by (used in) financing activities 20 32.9% 33.2% See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Past performance is not indicative of future results. Investments maybe speculative, illiquid and there is a risk of loss.

Financial Highlights (con’t) 4000+ Number of HKDOH - enlisted OTC products As of October 1, 2024 Diversification and enlargement of customer base x Supply Chain Services’ dependency on CaiNiao has reduced, and total number of supply chain customers increased from 176 in FY2023 to 218 in FY2024 6000+ Number of SKUs operated 300+ Number of retailers 100+ Number of suppliers Stable gross margin amid growth x Gross margin maintained at 21.3% in FY2024 vs 21.8% in FY2023 Twin growth engines x Procurement & Distribution revenue grew by 38.8% from FY2023 to FY2024 (vs 26% for Supply Chain Services), proving our ability to leverage on our supply chain data & customer reach to accelerate Procurement & Distribution x Approx. 50% IPO proceeds would be used to fund general working capital and corporate purposes, lifting a key bottleneck in Procurement & Distribution 21 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Past performance is not indicative of future results. Investments maybe speculative, illiquid and there is a risk of loss.

Investment Highlights Operational efficiency and synergy iii. i. Interface with multiple platforms such as Tmall, Pinduoduo, Meituan and JD.com, enable merchants to engage us as their centralized procurement, storage & shipping post across their stores in multiple platforms ii. Twin growth engines facilitate the conversion and synergy between the customers in Supply Chain Services sector and Procurement & Distribution sector Systematic order management seamlessly integrated with warehouse management system which optimize picking, packing and shipment by SKU, shipment destinations and quantities to streamline workflows, reduce employee disruption & thereby drive efficiency 1 Robust industry growth i. Driven by favorable government policies, increasing e - commerce penetration, rising health awareness, improving living standards, aging population ii. We believe today we are the largest one - stop services provider in Hong Kong for Chinese cross - border OTC e - Commerce Supply Chain Services, which would ride on the 42% CAGR market growth from 2022 - 2027 2 Formidable barrier of entry i. 4000+ SKUs enlisted up to date; enviable rosters of professional staff with complementary competencies ii. Established long - term cooperation with leading e - commerce platforms & efficient operation relationship iii. Industry growth and large customer base will enable us to further capitalize on economies of scale, enable us to offer competitive prices and decreasing unit servicing costs 3 22 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Past performance is not indicative of future results. Investments maybe speculative, illiquid and there is a risk of loss.

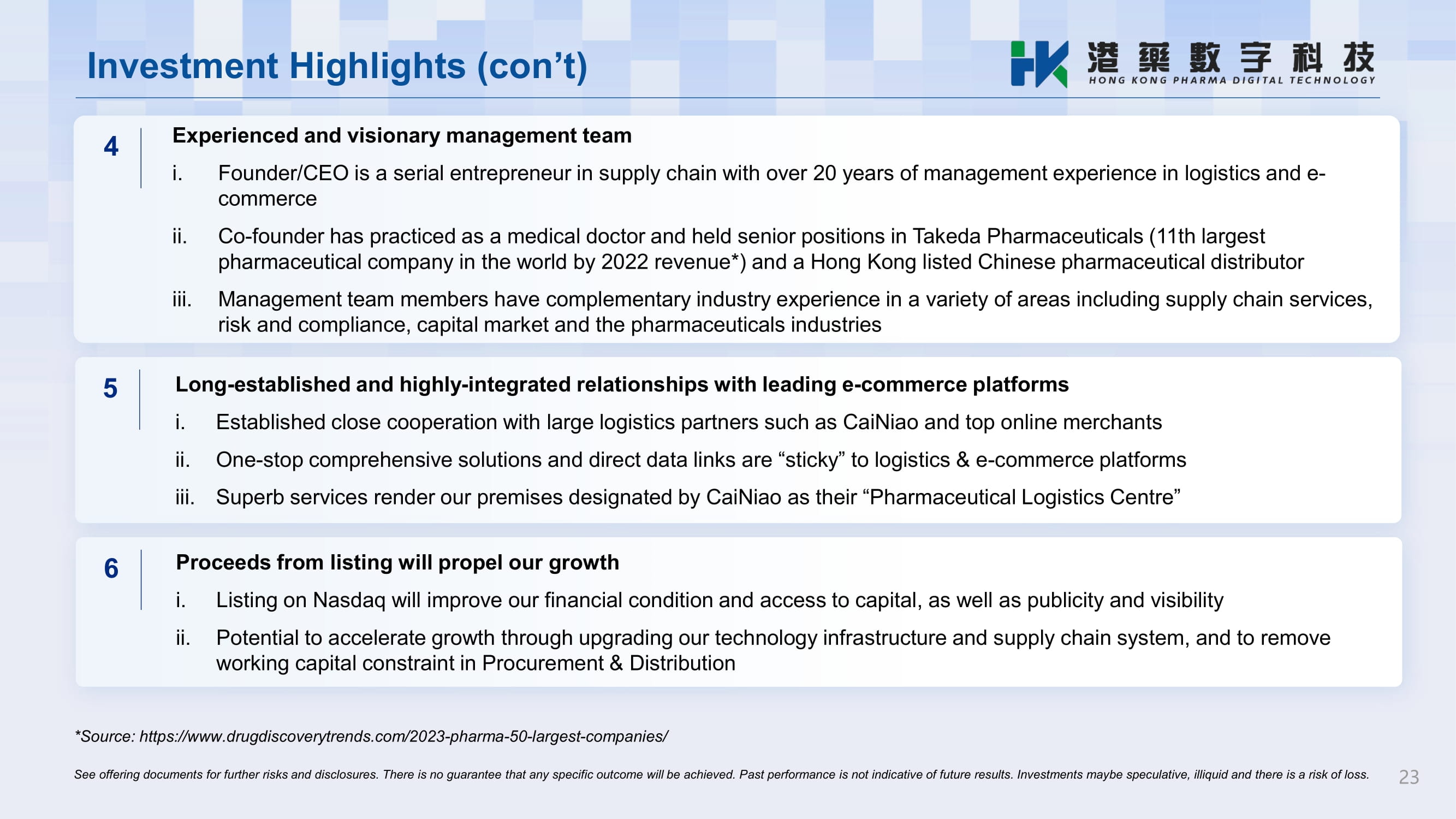

Investment Highlights (con’t) 23 Experienced and visionary management team iii. i. Founder/CEO is a serial entrepreneur in supply chain with over 20 years of management experience in logistics and e - commerce ii. Co - founder has practiced as a medical doctor and held senior positions in Takeda Pharmaceuticals (11th largest pharmaceutical company in the world by 2022 revenue*) and a Hong Kong listed Chinese pharmaceutical distributor Management team members have complementary industry experience in a variety of areas including supply chain services, risk and compliance, capital market and the pharmaceuticals industries 4 Long - established and highly - integrated relationships with leading e - commerce platforms i. Established close cooperation with large logistics partners such as CaiNiao and top online merchants ii. One - stop comprehensive solutions and direct data links are “sticky” to logistics & e - commerce platforms iii. Superb services render our premises designated by CaiNiao as their “Pharmaceutical Logistics Centre” 5 Proceeds from listing will propel our growth i. Listing on Nasdaq will improve our financial condition and access to capital, as well as publicity and visibility ii. Potential to accelerate growth through upgrading our technology infrastructure and supply chain system, and to remove working capital constraint in Procurement & Distribution 6 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Past performance is not indicative of future results. Investments maybe speculative, illiquid and there is a risk of loss. *Source: https:// www.drugdiscoverytrends.com/2023 - pharma - 50 - largest - companies/

Thank you Hong Kong Pharma Digital Technology Holdings Limited Sam Wong (+852) 2618 - 9289 samwong@9zt.hk Bancroft Capital, LLC Robert L. Malin (+1) 646 - 510 - 4455 rmalin@bancroft4vets.com Eddid Securities USA Inc. Tom Li (+1) 212 - 363 - 6888 ecm@eddidusa.com Contact Information