As filed with the Securities and Exchange Commission on June 21, 2024

Registration No. 333-279440

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM F-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SPECIALTY COPPER LISTCO PLC

(Exact Name of Registrant as Specified in Its Charter)

| England and Wales | | 3440 | | Not Applicable |

(State or Other Jurisdiction of

Incorporation or Organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) |

1 Vine Street, 5th Floor, London

United Kingdom, W1J 0AH

+1 (212) 488-5509

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

1 Vine Street, 5th Floor, London

United Kingdom, W1J 0AH

+1 (212) 488-5509

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Lorenzo Corte, Esq.

Maria Protopapa, Esq.

Skadden, Arps, Slate, Meagher & Flom (UK) LLP

22 Bishopsgate

London EC2N 4BQ

+44 20 7519 7025 | | J. David Stewart, Esq. Dr. Ingo Strauss

Latham & Watkins (London) LLP 99 Bishopsgate

London EC2M 3XF

+44 20 7710 1000 | | Dr. Florian Harder

Dr. Veronika Montes

Morgan, Lewis & Bockius LLP

Königinstr. 9

80539 Munich

+49 89 189 51 6000 |

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after this registration statement is declared effective and all other conditions to the Business Combination described in the enclosed proxy statement/prospectus have been satisfied or waived.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration for the share offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ |

| | | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary proxy statement/prospectus is not complete and may be changed. The registrant may not sell the securities described in this preliminary proxy statement/prospectus until the registration statement filed with the U.S. Securities and Exchange Commission is declared effective. This preliminary proxy statement/prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JUNE 21, 2024

PROXY STATEMENT FOR EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

AND EXTRAORDINARY GENERAL MEETING OF WARRANT HOLDERS OF

SDCL EDGE ACQUISITION CORPORATION

60 East 42nd Street, Suite 1100,

New York, NY 10165

PROSPECTUS FOR ORDINARY SHARES, WARRANTS AND ORDINARY SHARES

ISSUABLE UPON EXERCISE OF WARRANTS OF

SPECIALTY COPPER LISTCO PLC

(THE COMBINED PUBLIC LIMITED COMPANY AFTER THE

BUSINESS COMBINATION DESCRIBED HEREIN)

Dear Shareholders and Warrant Holders of SDCL EDGE Acquisition Corporation:

As a shareholder (“SEDA shareholder”) of SDCL Edge Acquisition Corporation, a Cayman Islands exempted company (together with its successors, “SEDA,” “we,” “us” or “our”), you are cordially invited to attend the Extraordinary General Meeting of SEDA shareholders (the “SEDA General Meeting”), to be held on , 2024, at , Eastern Time, at the offices of Skadden, Arps, Slate, Meagher & Flom LLP, located at One Manhattan West, New York, NY 10001, United States, or at such other time, on such other date and at such other place to which the meeting may be postponed or adjourned, or to attend virtually via the Internet.

As a warrant holder of SEDA (“SEDA warrant holder”), you are cordially invited to attend the Extraordinary General Meeting of SEDA warrant holders (the “SEDA Warrant Holders Meeting” and, together with the SEDA General Meeting, the “SEDA General Meetings”), to be held on , 2024, at , Eastern Time, at the offices of Skadden, Arps, Slate, Meagher & Flom LLP, located at One Manhattan West, New York, NY 10001, United States, or at such other time, on such other date and at such other place to which the meeting may be postponed or adjourned, or to attend virtually via the Internet.

You will be able to attend the SEDA General Meeting online, vote, and submit your questions during the SEDA General Meeting by visiting https:// . While shareholders are encouraged to attend the meeting virtually, you will be permitted to attend the SEDA General Meeting in person at the offices of Skadden, Arps, Slate, Meagher & Flom LLP, located at One Manhattan West, New York, NY 10001, United States. The virtual meeting format allows attendance from any location in the world.

You will be able to attend the SEDA Warrant Holders Meetings online, vote, and submit your questions during the SEDA Warrant Holders Meetings by visiting https:// . While warrant holders are encouraged to attend the meeting virtually, you will be permitted to attend the SEDA Warrant Holders Meetings in person at the offices of Skadden, Arps, Slate, Meagher & Flom LLP, located at One Manhattan West, New York, NY 10001, United States. The virtual meeting format allows attendance from any location in the world.

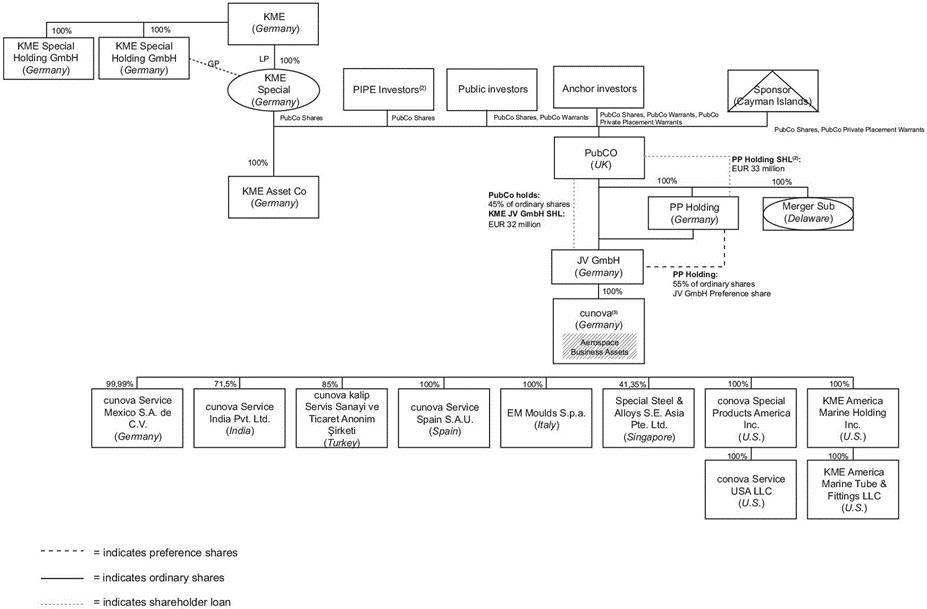

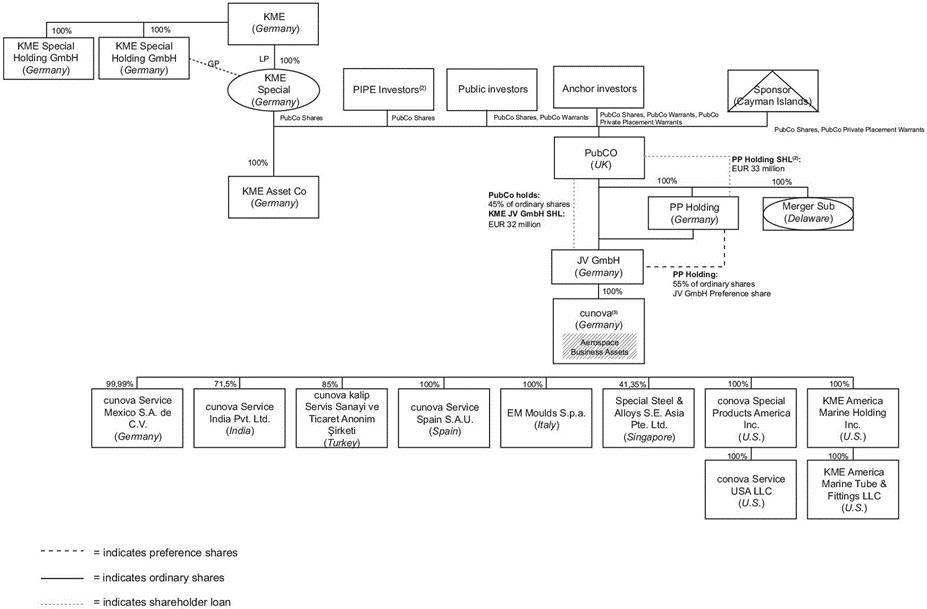

On February 20, 2024, (i) SEDA, (ii) Specialty Copper Listco Plc, a public limited company registered in England and Wales with registered number 15395590 (“PubCo”), (iii) SEDA Magnet LLC, a Delaware limited liability company (the “Merger Sub”), (iv) MAGNET Joint Venture GmbH, a limited liability company organized under the laws of Germany, registered with the commercial register of the local court of Osnabrück under registration number HRB 217397 (“JV GmbH”), (v) PP S&C Holding GmbH, a limited liability company organized under the laws of Germany, registered with the commercial register of the local court of Munich under registration number HRB 275474, (vi) cunova GmbH, a limited liability company organized under the laws of Germany, registered with the commercial register of the local court of Osnabrück under registration number HRB 216155 (“cunova”), (vii) KME SE, a stock corporation organized under the laws of Germany, registered with the commercial register of the local court of Osnabrück under registration number HRB 213357 (“KME”), (viii) Creature Kingdom Limited, a private limited company registered in England and Wales with registered number 06799429, (ix) The Paragon Fund III GmbH & Co. geschlossene Investment KG, a limited partnership organized under the laws of Germany, registered with the commercial register of the local court of Munich under registration number HRB 110100 (“Paragon” and together with KME, the “Shareholders”) and (x) Mr. Edward Wilson Davis, solely in the capacity as the representative for the shareholders of SEDA, entered into a business combination agreement (as amended from time to time, the “Business Combination Agreement”), pursuant to which several transactions relating to the special product business of cunova, which is a wholly owned subsidiary of JV GmbH, and certain assets of KME comprising the KME Specialty Aerospace Business (the “KME Aerospace Business” and, together with cunova, the “Target”) will occur, and in connection therewith, PubCo will become the ultimate parent company of Merger Sub, JV GmbH and the Target (the “Business Combination”).

At the SEDA General Meeting, SEDA shareholders will be asked to consider and vote upon a proposal, as an ordinary resolution, to adopt the Business Combination Agreement and approve the terms thereto, or the “Business Combination Proposal” or “Proposal No. 1,” attached to the accompanying proxy statement/prospectus as Annex A.

In addition to the Business Combination Proposal, SEDA shareholders will be asked to consider and vote upon a proposal, as a special resolution, to approve the Merger (as defined below) and the plan of merger between SEDA and Merger Sub in the form tabled at the SEDA General Meeting, or the “Merger Proposal” or “Proposal No. 2,” and such plan the “Plan of Merger,” which will be substantially in the form attached to this proxy statement/prospectus as Annex B.

As further described in the accompanying proxy statement/prospectus, subject to the terms and conditions of the Business Combination Agreement, upon consummation of the Business Combination in each case as described in the Business Combination Agreement, among other things:

| (i) | SEDA will merge with and into Merger Sub, a wholly owned subsidiary of PubCo (the “Merger”), with Merger Sub being the surviving entity in the merger (the time at which the Merger becomes effective, the “Merger Effective Time”); |

| (ii) | in connection with the Merger, (a) each outstanding SEDA Class B ordinary share, par value $0.0001 per share (the “SEDA Class B Shares”) will be converted (unless otherwise agreed in writing) into 0.893 SEDA Class A ordinary shares, par value $0.0001 per share (the “SEDA Class A Shares,” and together with the SEDA Class B Shares, the “SEDA Shares”), (b) each outstanding SEDA Class A Share will be automatically cancelled and converted into PubCo ordinary shares at an exchange ratio of 1.119375, each such PubCo ordinary share having a par value of $0.0001 per share (the “PubCo Shares”), and (c) each outstanding warrant of SEDA will be automatically adjusted to entitle the holder to purchase one whole PubCo Share at a price of $11.50 per PubCo Share (the “SEDA Adjusted Warrants”); |

| (iii) | on the Exchange Date (as defined below) (and, if applicable, immediately after the closing contemplated of any Financing (as defined below)), PubCo will (a) redeem the redeemable preference share in PubCo held by Creature Kingdom, and (b) purchase from Creature Kingdom the ordinary share in PubCo held by Creature Kingdom in exchange for the release of the undertaking to pay the subscription price of such redeemable share; and |

| (iv) | on the Exchange Date (as defined below), (a) Paragon will transfer its shares in PP Holding and a certain shareholder loan to PubCo in exchange for cash and a vendor loan agreement by and between Paragon, PubCo and cunova, (b) cunova will redeem the preference share of cunova with the number 25,001 (the “cunova Preference Share”) in consideration for the transfer of the preference share of KME AssetCo GmbH (“KME AssetCo”) with the number 25,001 (the “KME AssetCo Preference Share”) by cunova to KME Special Products GmbH & Co. KG (“KME Special”), and (c) KME will cause (i) KME Germany GmbH (“KME Germany”), KME Mansfeld GmbH (“KME Mansfeld”) and KME America Inc. (“KME America” and, together with KME Germany and KME Mansfeld, the “Aerospace Business Sellers”) to transfer to cunova the KME Specialty Aerospace Business in exchange for a vendor loan debt instrument issued by cunova (the “Aerospace VLN”) and which the Aerospace Business Sellers will transfer to KME Special and KME Special, in turn, will contribute the Aerospace VLN to PubCo in exchange for PubCo Shares; and (ii) KME Special to transfer its shares in JV GmbH and a certain shareholder loan between KME Special and JV GmbH to PubCo in exchange for PubCo Shares and cash ((a)-(c) the “Exchange” and the date on which the Exchange occurs, the “Exchange Date”). |

In addition to the Business Combination Proposal and the Merger Proposal, SEDA shareholders are being asked to consider and vote on the following proposals:

| ● | to consider and vote upon the following separate proposals, or the “Organizational Documents Proposals,” and together, “Proposal No. 3,” to be approved by an ordinary resolution, upon the following six separate resolutions to approve material differences between the existing Amended and Restated Memorandum and Articles of Association of SEDA and the Amended and Restated Articles of Association of PubCo to be in effect following the Business Combination (the “PubCo Proposed Governing Documents”), a copy of which is attached to this proxy statement/prospectus as Annex E (the “Form of PubCo Articles of Association”): |

| (i) | the name of the new public entity, PubCo, will be “Specialty Copper Listco Plc” as opposed to “SDCL Edge Acquisition Corporation” (the “Organizational Documents Proposal 3A,” or, “Proposal No. 3A”); |

| (ii) | PubCo will be a public company limited by shares incorporated under the laws of England and Wales, governed by the laws of England and Wales, as opposed to a Cayman Islands exempted company, governed by the laws of the Cayman Islands (the “Organizational Documents Proposal 3B,” or, “Proposal No. 3B”); |

| (iii) | PubCo will have, and the PubCo Proposed Governing Documents will provide for, one class of ordinary shares as opposed to the two classes of ordinary shares provided for in the Amended and Restated Memorandum and Articles of Association of SEDA (the “Organizational Documents Proposal 3C,” or, “Proposal No. 3C”); |

| (iv) | PubCo’s corporate existence is perpetual as opposed to SEDA’s corporate existence terminating if a business combination is not consummated within a specified period of time (the “Organizational Documents Proposal 3D,” or, “Proposal No. 3D”); |

| (v) | the PubCo Proposed Governing Documents will not include the various provisions applicable only to special purpose acquisition corporations that are contained in the Amended and Restated Memorandum and Articles of Association of SEDA (the “Organizational Documents Proposal 3E,” or, “Proposal No. 3E”); |

| (vi) | a special resolution, which is required for (among other things) any amendment to the articles of association, will (in the case of PubCo) require the support of 75% of the votes cast, as opposed to (in the case of SEDA) two-thirds of the votes cast (the “Organizational Documents Proposal 3F,” or, “Proposal No. 3F”). |

| ● | to consider and vote upon a proposal, or the “Adjournment Proposal” or “Proposal No. 4,” to approve by an ordinary resolution, the adjournment of the SEDA General Meeting to a later date or dates (A) to the extent necessary to ensure that any required supplement or amendment to the accompanying proxy statement/prospectus is provided to SEDA shareholders or, if as of the time for which the SEDA General Meeting is scheduled, there are insufficient SEDA Shares represented (either in person or by proxy) to constitute a quorum necessary to conduct business at the SEDA General Meeting, (B) in order to solicit additional proxies from SEDA shareholders in favour of one or more of the Proposals at the SEDA General Meeting, or (C) if SEDA shareholders redeem an amount of SEDA Class A Shares such that the condition to each party’s obligation to consummate the Business Combination that the amount of cash in the Trust Account (as defined in the accompanying proxy statement/prospectus) (net of the aggregate amount of cash required to satisfy any exercise by SEDA shareholders of their right to have SEDA redeem their SEDA Class A Shares in connection with the Business Combination, or the “Cash Redemption Amount”) (the “Minimum Cash Condition”), together with the proceeds from certain debt financing obtained prior to the Closing Date (as defined in the accompanying proxy statement/prospectus), any PIPE Investment (as defined in the accompanying proxy statement/prospectus), any other equity or debt financing obtained on or prior to the Closing Date, is not at least $140,000,000. The Adjournment Proposal will only be presented to SEDA shareholders in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Business Combination Proposal, or in the event that SEDA shareholders redeem an amount of SEDA Class A Shares such that the Minimum Cash Condition would not be satisfied. |

Each of these Proposals is more fully described in this proxy statement/prospectus, which each shareholder is encouraged to read carefully.

At the SEDA Warrant Holders Meeting, SEDA warrant holders will be asked to consider and vote upon (i) a proposal, which is referred to herein as the “Warrant Amendment Proposal,” or “Warrant Holder Proposal No. 1,” to approve and adopt the amendment to the Warrant Agreement (the “Warrant Amendment”), a copy of which is attached as Annex I to the accompanying proxy statement/prospectus, to provide that, following the Merger Effective Time, each of the then outstanding SEDA Warrants will be automatically adjusted to entitle the holder to purchase one whole PubCo Share at a price of $11.50 per PubCo Share (the “SEDA Adjusted Warrants”), and (ii) a proposal to approve the adjournment of the SEDA Warrant Holders Meeting to a later date or dates, if necessary, to permit the further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Warrant Holders Meeting, the Warrant Amendment Proposal would not be duly approved and adopted by the holders of the requisite amount of each of (a) the then outstanding SEDA Public Warrants and (b) the then outstanding SEDA Private Warrants (the “Warrant Holders Adjournment Proposal,” or “Warrant Holder Proposal No. 2”).

The SEDA Class A Shares, SEDA Units and SEDA Public Warrants are currently listed on the New York Stock Exchange, or “NYSE,” under the symbols “SEDA,” “SEDA.U” and “SEDA.WS,” respectively. Upon Closing of the Business Combination, the SEDA securities will be delisted from the NYSE. PubCo intends to apply to list the PubCo Shares and SEDA Adjusted Warrants on the NYSE under the symbols “CUNO” and “CUNO.WS,” respectively, upon the Closing of the Business Combination. SEDA cannot assure you that the PubCo Shares or SEDA Adjusted Warrants will be approved for listing on the NYSE.

Investing in PubCo’s securities involves a high degree of risk. The accompanying proxy statement/prospectus provides you with detailed information about the Business Combination and other matters to be considered at the SEDA General Meetings. Whether or not you plan to attend the SEDA General Meetings, we urge you to carefully read the accompanying proxy statement/prospectus, including the Annexes and the accompanying financial statements of SEDA, cunova Core Business and the KME Aerospace Business in their entirety. In particular, you should carefully read the section entitled “Risk Factors” beginning on page 71 of the accompanying proxy statement/prospectus.

With respect to SEDA and the holders of the SEDA Shares and SEDA Warrants, the accompanying proxy statement/prospectus serves as:

| (i) | a proxy statement for the SEDA General Meeting, where SEDA shareholders will vote on, among other things, the Business Combination Proposal, the Merger Proposal, the Organizational Documents Proposals and the Adjournment Proposal; |

| (ii) | a proxy statement for the SEDA Warrant Holders Meeting, where SEDA warrant holders will vote on, among other things, the Warrant Amendment Proposal and the Warrant Holders Adjournment Proposal; and |

| (iii) | a prospectus for the PubCo Shares and SEDA Adjusted Warrants that SEDA shareholders and public warrant holders will receive in the Business Combination. |

Pursuant to the SEDA Amended and Restated Memorandum and Articles of Association, SEDA is providing its Public Shareholders with the opportunity to redeem, immediately prior to the closing of the Business Combination, the SEDA Class A Shares then held by them for cash equal to their pro rata share of the aggregate amount on deposit (as of two business days prior to the Merger Date (as defined below in the accompanying proxy statement/prospectus)) in the Trust Account that holds the proceeds (including interest accrued thereon, which shall be net of taxes payable and expenses relating to the administration of the Trust Account), divided by the number of then issued and outstanding public shares, which redemption will completely extinguish Public Shareholders’ rights as shareholders (including the right to receive further liquidating distributions, if any). Redemptions referred to herein will take effect as repurchases under the SEDA Amended and Restated Memorandum and Articles of Association. The per-share amount SEDA will distribute to shareholders who properly redeem their SEDA Class A Shares will not be reduced by the transaction expenses incurred in connection with the Business Combination. For illustrative purposes, based on the funds held in the Trust Account as of June 10, 2024, the estimated per SEDA Class A Share redemption price would have been approximately $11.13. The redemption rights include the requirement that a holder must identify itself in writing as a beneficial holder and provide its legal name, phone number and address to Continental Stock Transfer & Trust, or the “SEDA Transfer Agent,” in order to validly redeem its shares. Public shareholders may elect to redeem their shares even if they vote for the Business Combination Proposal. SEDA has no specified maximum redemption threshold under its Amended and Restated Memorandum and Articles of Association, but SEDA is not permitted to redeem SEDA Class A Shares in an amount that would result in SEDA’s failure to have net tangible assets of at least $5,000,001. Each redemption of SEDA Class A Shares by SEDA’s Public Shareholders will reduce the amount in the Trust Account. The Business Combination Agreement provides that the obligation of JV GmbH, PP Holding and the Shareholders to consummate the Business Combination is conditioned on the amount of cash in the Trust Account (net of the Cash Redemption Amount) together with the proceeds from certain debt financings obtained prior to the Closing Date, any PIPE Investment, any other equity or debt financing obtained on or prior to the Closing Date being at least $140,000,000.

The conditions to closing in the Business Combination Agreement are for the sole benefit of the parties thereto and may be waived by such parties. If, as a result of redemptions of SEDA Class A Shares by SEDA’s Public Shareholders, the Minimum Cash Condition is not met or is not waived and SEDA has not raised sufficient proceeds through equity or debt financings to meet the Minimum Cash Condition, then each of JV GmbH, PP Holding and the Shareholders

may elect not to consummate the Business Combination. Holders of outstanding SEDA Public Warrants do not have redemption rights in connection with the Business Combination. Unless otherwise specified, the information in the accompanying proxy statement/prospectus assumes that none of SEDA’s Public Shareholders exercise their redemption rights with respect to their SEDA Class A Shares. For more information about the factors that affect the assumptions above, please see the section entitled “Security Ownership of Certain Beneficial Owners and Management of SEDA and PubCo.” As of the date of this proxy statement/prospectus, SEDA has not obtained any debt or equity financing or any subscriptions for any PIPE Investment or entered into any non-redemption agreements. In the event that SEDA obtains any such debt or equity financing or any such subscriptions or enters into any non-redemption agreements prior to the Closing, SEDA will disclose such debt and/or equity financing, such subscriptions and/or non-redemption agreements in an amendment or a supplement to the accompanying proxy statement/prospectus.

SEDA is providing the accompanying proxy statement/prospectus, a shareholder proxy card and a warrant holder proxy card to its shareholders and warrant holders, respectively, in connection with the solicitation of proxies to be voted at the SEDA General Meetings and at any adjournments or postponements of the SEDA General Meetings. Information about the SEDA General Meetings, the Business Combination and other related business to be considered by the SEDA shareholders and SEDA warrant holders at the SEDA General Meetings is included in the accompanying proxy statement/prospectus.

Upon consummation of the Business Combination and based on the assumptions laid out in the unaudited pro forma condensed combined financial information appearing elsewhere in this proxy statement/prospectus, KME is expected to hold 52.2% of the equity interest and voting power in PubCo assuming (i) no redemption rights are exercised, (ii) KME is not required to provide the Additional Financing and (iii) no warrants are exercised (and 36.0%, if all warrants were exercised), and 52.3% of the equity interest and voting power in PubCo assuming (i) the maximum redemption rights are exercised, (ii) KME is not required to provide the Additional Financing and (iii) no warrants are exercised (and 36.1% if all warrants were exercised). In the event KME provides the Additional Financing in the amount of $35 million, its equity stake in PubCo would be 60.1% assuming (i) no redemption rights are exercised and (ii) no warrants are exercised (and 41.5%, if all warrants were exercised), and 60.1% assuming (i) the maximum redemption rights are exercised and (ii) no warrants are exercised (and 41.5%, if all warrants were exercised). The foregoing scenarios are for illustrative purposes only, as the actual number of redemptions by SEDA’s Public Shareholders is unknowable prior to the SEDA shareholder vote with respect to the Business Combination Agreement and the calculations have been made based on certain assumptions. Please read the following section, “Unaudited Pro Forma Condensed Combined Financial Information — Notes To Unaudited Pro Forma Condensed Combined Financial Information — 2. Pro Forma Significant Assumptions — 2.2 Redemption scenarios”. As a result of KME’s ownership, upon consummation of the Business Combination, PubCo will be a “controlled company” within the meaning of the corporate governance rules of NYSE. Therefore, PubCo will have the option not to comply with certain requirements to which companies that are not controlled companies are subject, including the requirement that a majority of its board of directors shall consist of independent directors and the requirement that its nominating and corporate governance committee and compensation committee shall be composed entirely of independent directors. PubCo does not currently intend to take advantage of the controlled company exemption, however, it may do so in the future. Therefore, PubCo’s shareholders may not have the same protection afforded to shareholders of companies that are subject to these corporate governance requirements. See “Risk Factors — Risks Related to Being a Public Company — Upon the Closing of the Business Combination and based on the assumptions laid out in the unaudited pro forma condensed combined financial information appearing elsewhere in this proxy statement/prospectus, KME is expected to hold 52.2% of the equity interest and voting power in PubCo assuming (i) no redemption rights are exercised, (ii) KME is not required to provide the Additional Financing and (iii) no warrants are exercised (and 36.0%, if all warrants were exercised), and 52.3% of the equity interest and voting power in PubCo assuming (i) the maximum redemption rights are exercised, (ii) KME is not required to provide the Additional Financing and (iii) no warrants are exercised (and 36.1% if all warrants were exercised).”

In addition, following consummation of the Business Combination, PubCo will be considered a “foreign private issuer” under the securities laws of the United States and the rules of the NYSE and will therefore be exempt from certain provisions of the securities rules and regulations in the United States that are applicable to U.S. domestic issuers, including (i) the rules under the Exchange Act requiring the filing of quarterly reports on Form 10-Q and current reports on Form 8-K with the SEC; (ii) the sections of the Exchange Act regulating the solicitation of proxies, consents, or authorizations in respect of a security registered under the Exchange Act; (iii) the sections of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and (iv) the selective disclosure rules by issuers of material

nonpublic information under Regulation FD. In addition, as a “foreign private issuer”, PubCo will be permitted to follow certain home-country corporate governance practices in lieu of certain NYSE requirements. A foreign private issuer must disclose in its Annual Reports filed with the SEC each NYSE requirement with which it does not comply followed by a description of its applicable home country practice. PubCo’s established practices in the area of corporate governance will be in line with the spirit of the NYSE standards and provide adequate protection to our shareholders. PubCo does not expect that there will be any significant differences between PubCo’s corporate governance practices and the NYSE standards applicable to listed U.S. companies. PubCo cannot give any assurances that it will continue to follow such corporate governance requirements in the future, and may therefore in the future, rely on available NYSE exemptions that would allow PubCo to follow its home country practice. Unlike the requirements of NYSE, PubCo is not required, under the corporate governance practice and requirements in England and Wales, to have its board consist of a majority of independent directors, nor is PubCo required to have a compensation committee or a nominating or corporate governance committee consisting entirely of independent directors, or have regularly scheduled executive sessions with only independent directors each year. Such home country practices may afford less protection to holders of PubCo’s securities. PubCo does not currently intend to take advantage of the home country corporate governance exemptions outlined above. For additional information regarding the home country practices PubCo intends to follow, see the section of this proxy statement/prospectus entitled “Management of PubCo After the Business Combination — Foreign Private Issuer.” See also “Risk Factors — Risks Related to Being a Public Company — As a “foreign private issuer” under the rules and regulations of the SEC, PubCo is permitted to file less or different information with the SEC than a company incorporated in the United States or otherwise subject to these rules and is permitted to follow certain home-country corporate governance practices in lieu of certain NYSE requirements applicable to U.S. issuers.”

After careful consideration, the SEDA Board has unanimously approved the Business Combination Agreement and the Business Combination, and recommends that SEDA shareholders vote “FOR” the Business Combination Proposal, “FOR” the Merger Proposal, “FOR” the Organizational Documents Proposals, and “FOR” the Adjournment Proposal, in each case, if presented to the SEDA General Meeting. Further, the SEDA Board has unanimously approved the Warrant Amendment, and recommends that the SEDA warrant holders vote “FOR” the Warrant Amendment Proposal and “FOR” the Warrant Holders Adjournment Proposal, in each case, if presented to the SEDA Warrant Holders Meeting. When you consider the SEDA Board’s recommendation of these proposals, you should keep in mind that certain of SEDA’s directors and officers have interests in the Business Combination that may conflict with your interests as a shareholder or warrant holder. Please see the section entitled “Proposal No. 1 — The Business Combination Proposal — Interests of the Sponsor and SEDA’s Directors and Officers in the Business Combination” in the accompanying proxy statement/prospectus for additional information.

Approval of the Business Combination Proposal requires the affirmative vote of holders of a majority of the SEDA Shares that are entitled to vote and are voted at the SEDA General Meeting. Approval of the Merger Proposal requires the affirmative vote of holders of at least two-thirds of the SEDA Shares that are entitled to vote and are voted at the SEDA General Meeting. Approval of the Organizational Documents Proposals requires the affirmative vote of holders of a majority of the SEDA Shares that are entitled to vote and are voted at the SEDA General Meeting. Approval of the Adjournment Proposal requires the affirmative vote of holders of a majority of the SEDA Shares that are entitled to vote and are voted at the SEDA General Meeting.

Approval of the Warrant Amendment Proposal requires the affirmative vote of the holders of at least 65% of each of (i) the outstanding SEDA Public Warrants and (ii) the outstanding SEDA Private Warrants (as defined below), each voting separately as a class. Approval of the Warrant Holders Adjournment Proposal requires the affirmative vote of the holders of at least 50% of the SEDA Warrants present in person, online or represented by proxy at the SEDA Warrant Holders Meeting, with such votes cast by SEDA warrant holders present or represented by proxy and entitled to vote at the SEDA Warrant Holders Meeting.

Your vote is very important. Whether or not you plan to attend the SEDA General Meetings, please vote as soon as possible by following the instructions in the accompanying proxy statement/prospectus to ensure that your shares and/or warrants are represented at the SEDA General Meetings. If you hold your shares and/or warrants in “street name” through a bank, broker or other nominee, you will need to follow the instructions provided to you by your bank, broker or other nominee to ensure that your shares and/or warrants are represented and voted at the SEDA General Meetings. The transactions contemplated by the Business Combination Agreement will be consummated only if the Business Combination Proposal and the Merger Proposal (collectively, the “Condition Precedent Proposals”) are approved at the SEDA General Meeting. The closing of the Business

Combination is conditioned upon the approval of the Business Combination Proposal and the Merger Proposal. The Business Combination Proposal and the Merger Proposal are cross-conditioned on the approval of each other, while the Organizational Documents Proposals and the Adjournment Proposal are not conditioned on the approval of any other proposal set forth in the accompanying proxy statement/prospectus.

The SEDA board has fixed the close of business on , 2024 as the record date for the SEDA General Meetings (the “SEDA Record Date”). Only SEDA shareholders and SEDA warrant holders of record on , 2024 are entitled to notice of and to vote at the SEDA General Meetings or any postponement or adjournment thereof. Further information regarding voting rights and the matters to be voted upon is presented in the accompanying proxy statement/prospectus.

If you sign, date and return your shareholder proxy card without indicating how you wish to vote, your shareholder proxy will be voted “FOR” each of the proposals presented at the SEDA General Meeting. If you fail to return your shareholder proxy card or fail to instruct your bank, broker or other nominee or intermediary how to vote, and do not attend the SEDA General Meeting in person or virtually, the effect will be, among other things, that your shares will not be counted for purposes of determining whether a quorum is present at the SEDA General Meeting and will not be voted. An abstention or broker non-vote will be counted towards the quorum requirement but will not count as a vote cast at the SEDA General Meeting. If you are a SEDA shareholder of record and you attend the SEDA General Meeting and wish to vote in person or virtually, you may withdraw your proxy and vote in person.

If you sign, date and return your warrant holder proxy card without indicating how you wish to vote, your warrant holder proxy will be voted “FOR” each of the proposals presented at the SEDA Warrant Holders Meeting. In general, if your SEDA Warrants are held in “street” name and you do not instruct your broker, bank or other nominee or intermediary on a timely basis on how to vote your SEDA Warrants, your broker, bank or other nominee or intermediary, in its sole discretion, may either leave your SEDA Warrants unvoted or vote your SEDA Warrants on routine matters, but not on any non-discretionary matters. Proxies that are marked “abstain” and proxies relating to “street name” SEDA Warrants that are returned to SEDA but marked by brokers as “not voted” will be treated as SEDA Warrants present for purposes of determining the presence of quorum on all matters, but they will not be treated as SEDA Warrants voted on the matter and will, therefore, have the effect of an “AGAINST” vote on the Warrant Amendment Proposal. If you are a SEDA warrant holder of record and you attend the SEDA Warrant Holders Meeting and wish to vote in person or virtually, you may withdraw your proxy and vote in person.

TO EXERCISE YOUR REDEMPTION RIGHTS, YOU MUST DEMAND THAT SEDA REDEEM YOUR SHARES FOR A PRO RATA PORTION OF THE FUNDS HELD IN THE TRUST ACCOUNT AND TENDER YOUR SHARES TO THE SEDA TRANSFER AGENT AT LEAST TWO (2) BUSINESS DAYS PRIOR TO THE INITIALLY SCHEDULED VOTE AT THE SEDA GENERAL MEETING. THE REDEMPTION RIGHTS INCLUDE THE REQUIREMENT THAT A HOLDER MUST IDENTIFY HIMSELF, HERSELF OR ITSELF IN WRITING AS A BENEFICIAL HOLDER AND PROVIDE HIS, HER OR ITS LEGAL NAME, PHONE NUMBER AND ADDRESS TO THE SEDA TRANSFER AGENT IN ORDER TO VALIDLY REDEEM HIS, HER OR ITS SHARES. YOU MAY TENDER YOUR SHARES BY EITHER DELIVERING YOUR SHARE CERTIFICATE TO THE SEDA TRANSFER AGENT OR BY DELIVERING YOUR SHARES ELECTRONICALLY USING DEPOSITORY TRUST COMPANY’S DWAC (DEPOSIT WITHDRAWAL AT CUSTODIAN) SYSTEM. IF THE BUSINESS COMBINATION IS NOT COMPLETED, THEN THESE SHARES WILL NOT BE REDEEMED FOR CASH. IF YOU HOLD THE SHARES IN STREET NAME, YOU WILL NEED TO INSTRUCT THE ACCOUNT EXECUTIVE AT YOUR BANK OR BROKER TO WITHDRAW THE SHARES FROM YOUR ACCOUNT IN ORDER TO EXERCISE YOUR REDEMPTION RIGHTS.

On behalf of the SEDA Board, I would like to thank you for your support of SDCL EDGE Acquisition Corporation and look forward to a successful completion of the Business Combination.

| | Sincerely, |

| | |

| | |

| | Jonathan Maxwell

Co-Chief Executive Officer and Director |

, 2024

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES REGULATORY AGENCY HAS APPROVED OR DISAPPROVED THE TRANSACTIONS DESCRIBED IN

THIS PROXY STATEMENT/PROSPECTUS, PASSED UPON THE MERITS OR FAIRNESS OF THE BUSINESS COMBINATION OR RELATED TRANSACTIONS OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THE ACCOMPANYING PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY CONSTITUTES A CRIMINAL OFFENSE.

This is not a prospectus made under the EU Prospectus Regulation or the UK Prospectus Regulation.

The accompanying proxy statement/prospectus is dated , 2024, and is expected to be first mailed or otherwise delivered to SEDA shareholders and SEDA warrant holders on or about , 2024.

No person is authorized to give any information or to make any representation with respect to the matters that this proxy statement/prospectus describes other than those contained in this proxy statement/prospectus, and, if given or made, the information or representation must not be relied upon as having been authorized by PubCo, SEDA or the Target. This proxy statement/prospectus does not constitute an offer to sell or a solicitation of an offer to buy securities or a solicitation of a proxy in any jurisdiction where, or to any person to whom, it is unlawful to make such an offer or a solicitation. Neither the delivery of this proxy statement/prospectus nor any distribution of securities made under this proxy statement/prospectus will, under any circumstances, create an implication that there has been no change in the affairs of PubCo, SEDA or the Target since the date of this proxy statement/prospectus or that any information contained herein is correct as of any time subsequent to such date.

ADDITIONAL INFORMATION

The accompanying proxy statement/prospectus incorporates important business and financial information about SEDA and the Target from other documents that are not included in or delivered with the accompanying proxy statement/prospectus. This information is available to you without charge upon your written or oral request free of charge. You can obtain the documents incorporated by reference in this document through the SEC website at http://www.sec.gov or by requesting them in writing, by e-mail, or by telephone at the appropriate address below:

SDCL EDGE Acquisition Corporation

60 East 42nd Street, Suite 1100

New York, NY 10165

Telephone: (212) 488-5509

You may also obtain these documents by requesting them in writing or by telephone from SEDA’s proxy solicitation agent at the following address and telephone number:

Individuals call toll-free:

Banks and Brokerage Firms, please call:

Email:

In order to receive timely delivery of the documents in advance of the SEDA General Meeting, you must make your request for information no later than , 2024 ( business days prior to the date of the SEDA General Meeting).

SDCL EDGE ACQUISITION CORPORATION

60 East 42nd Street, Suite 1100,

New York, NY 10165

NOTICE OF EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON , 2024

TO THE SHAREHOLDERS OF SDCL EDGE ACQUISITION CORPORATION:

NOTICE IS HEREBY GIVEN that the extraordinary general meeting of SDCL EDGE Acquisition Corporation, a Cayman Islands exempted company, or “SEDA,” which will be held on , 2024 at , Eastern time, at https://www.cstproxy.com/ , and at the offices of Skadden, Arps, Slate, Meagher & Flom LLP located at One Manhattan West, New York, New York 10001, United States, or the “SEDA General Meeting.” For the purposes of Cayman Islands law and the Amended and Restated Memorandum and Articles of Association of SEDA, the physical location of the meeting shall be at the offices of Skadden, Arps, Slate, Meagher & Flom LLP at One Manhattan West, New York, New York 10001, United States. You are cordially invited to attend the SEDA General Meeting to conduct the following items of business and/or consider, and if thought fit, approve the following resolutions:

| ● | Proposal No. 1: The Business Combination Proposal — RESOLVED, as an ordinary resolution, or the “Business Combination Proposal” or “Proposal No. 1,” that SEDA’s entry into Business Combination Agreement, dated as of February 20, 2024 (as it may be amended from time to time), a copy of which is attached to the accompanying proxy statement/prospectus as Annex A, by and among, (i) SEDA, (ii) Specialty Copper Listco Plc, a public limited company registered in England and Wales with registered number 15395590 (“PubCo”), (iii) SEDA Magnet LLC, a Delaware limited liability company (the “Merger Sub”), (iv) MAGNET Joint Venture GmbH, a limited liability company organized under the laws of Germany, registered with the commercial register of the local court of Osnabrück under registration number HRB 217397 (“JV GmbH”), (v) PP S&C Holding GmbH, a limited liability company organized under the laws of Germany, registered with the commercial register of the local court of Munich under registration number HRB 275474, (vi) cunova GmbH, a limited liability company organized under the laws of Germany, registered with the commercial register of the local court of Osnabrück under registration number HRB 216155 (“cunova”), (vii) KME SE, a stock corporation organized under the laws of Germany, registered with the commercial register of the local court of Osnabrück under registration number HRB 213357 (“KME”), (viii) Creature Kingdom Limited, a private limited company registered in England and Wales with registered number 06799429, (ix) The Paragon Fund III GmbH & Co. geschlossene Investment KG, a limited partnership organized under the laws of Germany, registered with the commercial register of the local court of Munich under registration number HRB 110100 (“Paragon” and together with KME, the “Shareholders”) and (x) Mr. Edward Wilson Davis, solely in the capacity as the representative for the shareholders of SEDA, and the transactions contemplated therein, including the business combination pursuant to which (a) SEDA will merge with and into the Merger Sub, with the Merger Sub being the surviving entity in the merger, (b) acquisition of cunova by PubCo and (c) acquisition by cunova of certain assets of KME comprising the KME Specialty Aerospace Business (the “KME Aerospace Business” and, together with cunova, the “Target”), and in connection therewith PubCo will be the ultimate parent company of JV GmbH and the Target, be approved, ratified and confirmed in all respects, subject to the approval, by way of special resolution, of the Merger Proposal. |

| ● | Proposal No. 2: The Merger Proposal — RESOLVED, as a special resolution, or the “Merger Proposal” or “Proposal No. 2,” that (i) SEDA be authorized to merge with and into Merger Sub so that the Merger Sub be the surviving entity in the merger and all the undertakings, property and liabilities of SEDA vest in the Merger Sub by virtue of the merger pursuant to the Companies Act (As Revised) of the Cayman Islands and the Delaware Limited Liability Company Act; (ii) the Plan of Merger be approved, ratified and confirmed in all respects and SEDA be authorized to enter into the Plan of Merger in the form annexed to the accompanying proxy statement/prospectus in respect of the extraordinary general meeting as Annex B, or the “Plan of Merger.”; (iii) the Plan of Merger be executed by any director of SEDA for and on behalf of SEDA and any director of SEDA or Maples and Calder, on behalf of Maples Corporate Services Limited, be authorized to submit the Plan of Merger, together with any supporting documentation, for registration to the Registrar of Companies of the Cayman Islands and the Delaware Limited Liability Company Act; |

and (iv) all actions taken and any documents or agreements executed, signed or delivered prior to or after the date hereof by any director or officer of SEDA in connection with the transactions contemplated by the Plan of Merger be and are hereby approved, ratified and confirmed in all respects.

| ● | Proposal No. 3: The Organizational Documents Proposal — RESOLVED, for each of the six separate proposals jointly forming the “Organizational Documents Proposals,” or “Proposal No. 3,” as an ordinary resolution, that: |

| (i) | Proposal No. 3A: The Organizational Documents Proposal 3A: the name of the new public entity, PubCo, will be “Specialty Copper Listco Plc” as opposed to “SDCL Edge Acquisition Corporation”; |

| (ii) | Proposal No. 3B: The Organizational Documents Proposal 3B: PubCo will be a public company limited by shares incorporated under the laws of England and Wales, governed by the laws of England and Wales, as opposed to a Cayman Islands exempted company, governed by the laws of the Cayman Islands; |

| (iii) | Proposal No. 3C: The Organizational Documents Proposal 3C: PubCo will have, and the PubCo Proposed Governing Documents will provide for, one class of ordinary shares as opposed to the two classes of ordinary shares provided for in the Amended and Restated Memorandum and Articles of Association of SEDA; |

| (iv) | Proposal No. 3D: The Organizational Documents Proposal 3D: PubCo’s corporate existence is perpetual as opposed to SEDA’s corporate existence terminating if a business combination is not consummated within a specified period of time; |

| (v) | Proposal No. 3E: The Organizational Documents Proposal 3E: the PubCo Proposed Governing Documents will not include the various provisions applicable only to special purpose acquisition corporations that are contained in the Amended and Restated Memorandum and Articles of Association of SEDA; and |

| (vi) | Proposal No. 3F: The Organizational Documents Proposal 3F: a special resolution, which is required for (among other things) any amendment to the articles of association, will (in the case of PubCo) require the support of 75% of the votes cast, as opposed to (in the case of SEDA) two-thirds of the votes cast. |

| ● | Proposal No. 4: Adjournment Proposal — RESOLVED, as an ordinary resolution, or the “Adjournment Proposal” or “Proposal No. 4,” that the adjournment of the SEDA General Meeting to a later date or dates, (i) to the extent necessary to ensure any required supplement or amendment to the accompanying proxy statement/prospectus is provided to SEDA shareholders or, if as of the time for which the SEDA General Meeting is scheduled, there are insufficient SEDA Shares represented (either in person or by proxy) to constitute a quorum necessary to conduct business at the SEDA General Meeting, (ii) in order to solicit additional proxies from SEDA shareholders in favour of the approval of one or more of the Proposals at the SEDA General Meeting, or (iii) if SEDA shareholders redeem an amount of SEDA Class A Shares such that the condition, or the “Minimum Cash Condition,” to each party’s obligation to consummate the Business Combination that the amount of cash in the Trust Account (net of the aggregate amount of cash required to satisfy any exercise by SEDA shareholders of their right to have SEDA redeem their SEDA Class A Shares in connection with the Business Combination) together with the proceeds from certain debt financing obtained prior to the Closing Date, any PIPE Investment, any other equity or debt financing obtained on or prior to the Closing Date is not at least $140,000,000, would not be satisfied, be hereby approved, ratified and confirmed in all respects. |

The record date for the SEDA General Meeting for SEDA shareholders that hold their shares in “street name” is , 2024. For SEDA shareholders holding their shares in “street name,” only shareholders at the close of business on that date may vote at the SEDA General Meeting or any adjournment thereof. For the avoidance of doubt, the record date does not apply to SEDA shareholders that hold their shares in registered form and are registered as shareholders in SEDA’s register of members. SEDA shareholders that hold their shares in registered form are entitled to one vote on each proposal presented at the SEDA General Meeting for each SEDA Share held on the date of the SEDA General Meeting.

As further described in the accompanying proxy statement/prospectus, subject to the terms and conditions of the Business Combination Agreement, upon consummation of the Business Combination in each case as described in the Business Combination Agreement, among other things:

| (i) | SEDA will merge with and into Merger Sub, a wholly owned subsidiary of PubCo (the “Merger”), with Merger Sub being the surviving entity in the merger (the time at which the Merger becomes effective, the “Merger Effective Time”); |

| (ii) | in connection with the Merger, (a) each outstanding SEDA Class B ordinary share, par value $0.0001 per share (the “SEDA Class B Shares”) will be converted (unless otherwise agreed in writing) into 0.893 SEDA Class A ordinary shares, par value $0.0001 per share (the “SEDA Class A Shares,” and together with the SEDA Class B Shares, the “SEDA Shares”), (b) each outstanding SEDA Class A Share will be automatically cancelled and converted into PubCo ordinary shares at an exchange ratio of 1.119375, each such PubCo ordinary share having a par value of $0.0001 per share (the “PubCo Shares”), and (c) each outstanding warrant of SEDA will be automatically adjusted to entitle the holder to purchase one whole PubCo Share at a price of $11.50 per PubCo Share (the “SEDA Adjusted Warrants”); |

| (iii) | on the Exchange Date (as defined below) (and, if applicable, immediately after the closing contemplated of any Financing (as defined below)), PubCo will (a) redeem the redeemable preference share in PubCo held by Creature Kingdom, and (b) purchase from Creature Kingdom the ordinary share in PubCo held by Creature Kingdom in exchange for the release of the undertaking to pay the subscription price of such redeemable share; and |

| (iv) | on the Exchange Date (as defined below), (a) Paragon will transfer its shares in PP Holding and a certain shareholder loan to PubCo in exchange for cash and a vendor loan agreement by and between Paragon, PubCo and cunova, (b) cunova will redeem the preference share of cunova with the number 25,001 (the “cunova Preference Share”) in consideration for the transfer of the preference share of KME AssetCo GmbH (“KME AssetCo”) with the number 25,001 (the “KME AssetCo Preference Share”) by cunova to KME Special Products GmbH & Co. KG (“KME Special”), and (c) KME will cause (i) KME Germany GmbH (“KME Germany”), KME Mansfeld GmbH (“KME Mansfeld”) and KME America Inc. (“KME America” and, together with KME Germany and KME Mansfeld, the “Aerospace Business Sellers”) to transfer to cunova the KME Specialty Aerospace Business in exchange for a vendor loan debt instrument issued by cunova (the “Aerospace VLN”) and which the Aerospace Business Sellers will transfer to KME Special and KME Special, in turn, will contribute the Aerospace VLN to PubCo in exchange for PubCo Shares; and (ii) KME Special to transfer its shares in JV GmbH and a certain shareholder loan between KME Special and JV GmbH to PubCo in exchange for PubCo Shares and cash ((a)-(c) the “Exchange” and the date on which the Exchange occurs, the “Exchange Date”). |

The above matters are more fully described in the accompanying proxy statement/prospectus, which also includes, as Annex A, a copy of the Business Combination Agreement, and as Annex B, a copy of the Plan of Merger. Whether or not you plan to attend the SEDA General Meeting, we urge you to read carefully, when available, the accompanying proxy statement/prospectus, including the Annexes, and accompanying financial statements of SEDA, cunova Core Business and the KME Aerospace Business. Please pay particular attention to risks described in the section entitled “Risk Factors.”

Pursuant to the SEDA Amended and Restated Memorandum and Articles of Association, SEDA is providing its Public Shareholders with the opportunity to redeem, immediately prior to the closing of the Business Combination, SEDA Class A Shares then held by them for cash equal to their pro rata share of the aggregate amount on deposit (as of two business days prior to the Merger Date) in the Trust Account that holds the proceeds (including interest accrued thereon, which shall be net of taxes payable and expenses relating to the administration of the trust account), divided by the number of then issued and outstanding public shares, which redemption will completely extinguish Public Shareholders’ rights as shareholders (including the right to receive further liquidating distributions, if any). Redemptions referred to herein will take effect as repurchases under the SEDA Amended and Restated Memorandum and Articles of Association. The per-share amount SEDA will distribute to shareholders who properly redeem their SEDA Class A Shares will not be reduced by the aggregate transaction expenses incurred in connection with the Business Combination. For illustrative purposes, based on the funds held in the Trust Account as of June 10, 2024, the estimated per SEDA Class A Share redemption price would have been approximately $11.13. The redemption rights include the requirement that a holder must identify himself, herself or itself in writing as a beneficial holder and provide

his, her or its legal name, phone number and address to the SEDA Transfer Agent in order to validly redeem his, her or its shares. Public shareholders may elect to redeem their shares even if they vote for the Business Combination Proposal. SEDA has no specified maximum redemption threshold under its Amended and Restated Memorandum and Articles of Association, but SEDA is not permitted to redeem SEDA Class A Shares in an amount that would result in SEDA’s failure to have net tangible assets of at least $5,000,001. Each redemption of SEDA Class A Shares by SEDA’s Public Shareholders will reduce the amount in the Trust Account. The Business Combination Agreement provides that the obligation of JV GmbH, PP Holding and the Shareholders to consummate the Business Combination is conditioned on the amount of cash in the Trust Account (net of the Cash Redemption Amount) together with the proceeds from certain debt financings obtained prior to the Closing Date, any PIPE Investment, any other equity or debt financing obtained on or prior to the Closing Date being at least $140,000,000.

The conditions to closing in the Business Combination Agreement are for the sole benefit of the parties thereto and may be waived by such parties. If, as a result of redemptions of SEDA Class A Shares by SEDA’s Public Shareholders, the Minimum Cash Condition is not met or is not waived and SEDA has not raised sufficient proceeds through equity or debt financings to meet the Minimum Cash Condition, then each of JV GmbH, PP Holding and the Shareholders may elect not to consummate the Business Combination. Holders of outstanding SEDA Public Warrants do not have redemption rights in connection with the Business Combination. Unless otherwise specified, the information in the accompanying proxy statement/prospectus assumes that none of SEDA’s Public Shareholders exercise their redemption rights with respect to their SEDA Class A Shares. For more information about the factors that affect the assumptions above, please see the section entitled “Security Ownership of Certain Beneficial Owners and Management of SEDA and PubCo.” As of the date of the accompanying proxy statement/prospectus, SEDA has not obtained any debt or equity financing or any subscriptions for any PIPE Investment or entered into any non-redemption agreements. In the event that SEDA obtains any such debt or equity financing or any such subscriptions or enters into any non-redemption agreements prior to the Closing, SEDA will disclose such debt and/or equity financing, such subscriptions and/or non-redemption agreements in an amendment or a supplement to the accompanying proxy statement/prospectus.

The closing of the Business Combination is conditioned upon the approval of the Business Combination Proposal and the Merger Proposal. The Business Combination Proposal and the Merger Proposal are cross-conditioned on the approval of each other, while the Organizational Documents Proposals and the Adjournment Proposal are not conditioned on the approval of any other proposal set forth in the accompanying proxy statement/prospectus.

Approval of the Business Combination Proposal requires the affirmative vote of holders of a majority of the SEDA Shares that are entitled to vote and are voted at the SEDA General Meeting. Approval of the Merger Proposal requires the affirmative vote of holders of at least two-thirds of the SEDA Shares that are entitled to vote and are voted at the SEDA General Meeting. Approval of the Organizational Documents Proposals requires the affirmative vote of holders of a majority of the SEDA Shares that are entitled to vote and are voted at the SEDA General Meeting. Approval of the Adjournment Proposal requires the affirmative vote of holders of a majority of the SEDA Shares that are entitled to vote and are voted at the SEDA General Meeting.

After careful consideration, the SEDA Board has unanimously approved the Business Combination Agreement and the Business Combination, and recommends that SEDA shareholders vote “FOR” the Business Combination Proposal, “FOR” the Merger Proposal, “FOR” the Organizational Documents Proposals, and “FOR” the Adjournment Proposal, in each case, if presented to the SEDA General Meeting. When you consider the SEDA Board’s recommendation of these proposals, you should keep in mind that certain SEDA’s directors and officers have interests in the Business Combination that may conflict with your interests as a shareholder.

The existence of financial and personal interests of one or more of SEDA’s directors may result in a conflict of interest on the part of such director(s) between what he, she or they may believe is in the best interests of SEDA and SEDA shareholders and what he, she or they may believe is best for himself, herself or themselves in determining to recommend that SEDA shareholders vote for these proposals. In addition, SEDA’s directors, executive officers and the Sponsor and its affiliates may have interests in the Business Combination that may conflict with your interests as a SEDA shareholder. Please see the section entitled “Proposal No. 1 — The Business Combination Proposal — Interests of the Sponsor and SEDA’s Directors and Officers in the Business Combination” for a further discussion of these considerations.

Your vote is important regardless of the number of shares you own. Whether you plan to attend the SEDA General Meeting or not, please sign, date and return the proxy card accompanying the proxy statement/prospectus as soon as possible in the envelope provided. If your shares are held in “street name” or are in a margin or similar account, you should contact your broker to ensure that votes related to the shares you beneficially own are properly counted. If you have any questions or need assistance voting your shares, please contact , our proxy solicitor, by calling , or banks and brokers can call collect at , or by emailing .

Thank you for your participation. We look forward to your continued support.

| | By | Order of the Board of Directors |

| | | |

| | | |

| | | Jonathan Maxwell |

| | | Co-Chief Executive Officer and Director |

, 2024

TO EXERCISE YOUR REDEMPTION RIGHTS, YOU MUST DEMAND THAT SEDA REDEEM YOUR SHARES FOR A PRO RATA PORTION OF THE FUNDS HELD IN THE TRUST ACCOUNT AND TENDER YOUR SHARES TO THE SEDA TRANSFER AGENT AT LEAST TWO (2) BUSINESS DAYS PRIOR TO THE INITIALLY SCHEDULED VOTE AT THE SEDA GENERAL MEETING. THE REDEMPTION RIGHTS INCLUDE THE REQUIREMENT THAT A HOLDER MUST IDENTIFY HIMSELF, HERSELF OR ITSELF IN WRITING AS A BENEFICIAL HOLDER AND PROVIDE HIS, HER OR ITS LEGAL NAME, PHONE NUMBER AND ADDRESS TO THE SEDA TRANSFER AGENT IN ORDER TO VALIDLY REDEEM HIS, HER OR ITS SHARES. YOU MAY TENDER YOUR SHARES BY EITHER DELIVERING YOUR SHARE CERTIFICATE TO THE SEDA TRANSFER AGENT OR BY DELIVERING YOUR SHARES ELECTRONICALLY USING DEPOSITORY TRUST COMPANY’S DWAC (DEPOSIT WITHDRAWAL AT CUSTODIAN) SYSTEM. IF THE BUSINESS COMBINATION IS NOT COMPLETED, THEN THESE SHARES WILL NOT BE REDEEMED FOR CASH. IF YOU HOLD THE SHARES IN STREET NAME, YOU WILL NEED TO INSTRUCT THE ACCOUNT EXECUTIVE AT YOUR BANK OR BROKER TO WITHDRAW THE SHARES FROM YOUR ACCOUNT IN ORDER TO EXERCISE YOUR REDEMPTION RIGHTS.

ADDITIONAL INFORMATION

The accompanying proxy statement/prospectus incorporates important business and financial information about SEDA and the Target from other documents that are not included in or delivered with the accompanying proxy statement/prospectus. This information is available to you without charge upon your written or oral request free of charge. You can obtain the documents incorporated by reference in this document through the SEC website at http://www.sec.gov or by requesting them in writing, by e-mail, or by telephone at the appropriate address below:

SDCL EDGE Acquisition Corporation

60 East 42nd Street, Suite 1100

New York, NY 10165

Telephone: (212) 488-5509

You may also obtain these documents by requesting them in writing or by telephone from SEDA’s proxy solicitation agent at the following address and telephone number:

Individuals call toll-free:

Banks and Brokerage Firms, please call:

Email:

In order to receive timely delivery of the documents in advance of the SEDA General Meeting, you must make your request for information no later than , 2024 ( business days prior to the date of the SEDA General Meeting).

SDCL EDGE ACQUISITION CORPORATION

60 East 42nd Street, Suite 1100,

New York, NY 10165

NOTICE OF EXTRAORDINARY GENERAL MEETING OF WARRANT HOLDERS

TO BE HELD ON , 2024

TO THE WARRANT HOLDERS OF SDCL EDGE ACQUISITION CORPORATION:

NOTICE IS HEREBY GIVEN that the extraordinary general meeting of the warrant holders of SDCL EDGE Acquisition Corporation, a Cayman Islands exempted company, or “SEDA,” which will be held on , 2024 at , Eastern time, at https://www.cstproxy.com/ and at the offices of Skadden, Arps, Slate, Meagher & Flom LLP located at One Manhattan West, New York, New York 10001, United States, or the “SEDA Warrant Holders Meeting.” For the purposes of Cayman Islands law and the Amended and Restated Memorandum and Articles of Association of SEDA, the physical location of the meeting shall be at the offices of Skadden, Arps, Slate, Meagher & Flom LLP at One Manhattan West, New York, New York 10001, United States. You are cordially invited to attend the SEDA Warrant Holders Meeting which will be held for the following purposes:

| ● | Warrant Holder Proposal No. 1: The Warrant Amendment Proposal — to consider and vote upon an amendment to the warrant agreement that governs all of SEDA’s outstanding warrants (the “Warrant Agreement”). The Warrant Amendment proposes to amend the Warrant Agreement to provide that, following the Merger Effective Time, each of the then outstanding warrants of SEDA (“SEDA Warrants”) will be automatically adjusted to entitle the holder to purchase one whole PubCo ordinary share having a par value of $0.0001 per share (“PubCo Shares”) at a price of $11.50 per PubCo Share (the “SEDA Adjusted Warrants”). |

| ● | Warrant Holder Proposal No. 2: The Warrant Holders Adjournment Proposal — to consider and vote upon a proposal to approve the adjournment of the Warrant Holders Meeting to a later date or dates, if necessary, to permit the further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Warrant Holders Meeting, the Warrant Amendment Proposal would not be duly approved and adopted by the holders of the requisite amount of each of (i) the then outstanding SEDA Public Warrants and (ii) the then outstanding SEDA Private Warrants (the “Warrant Holders Adjournment Proposal” and, together with the Warrant Amendment Proposal, the “Warrant Holder Proposals”). |

The above matters are more fully described in the accompanying proxy statement/prospectus, which also includes, as Annex I, a copy of the Warrant Amendment. We will provide you with the accompanying proxy statement/prospectus and a warrant holder proxy card in connection with the solicitation of proxies to be voted at the SEDA Warrant Holders Meeting and at any adjournment of the SEDA Warrant Holders Meeting. Whether or not you plan to attend the SEDA Warrant Holders Meeting, we urge you to read carefully, when available, the accompanying proxy statement/prospectus, including the Annexes, and accompanying financial statements of SEDA, cunova Core Business and the KME Aerospace Business. Please pay particular attention to risks described in the section entitled “Risk Factors.”

Only holders of record of SEDA Warrants at the close of business on , 2024 are entitled to notice of and to vote and have their votes counted at the SEDA Warrant Holders Meeting and any adjournment of the SEDA Warrant Holders Meeting.

All SEDA warrant holders are cordially invited to attend the SEDA Warrant Holders Meeting. To ensure your representation at the SEDA Warrant Holders Meeting, however, you are urged to complete, sign, date and return the proxy card accompanying the proxy statement/prospectus as soon as possible. If you are a SEDA warrant holder of record holding one or more SEDA Warrants on , 2024, you may also cast your vote in person at the SEDA Warrant Holders Meeting. If your SEDA Warrants are held in an account at a brokerage firm or bank, you must instruct your broker or bank on how to vote your SEDA Warrants or, if you wish to attend the SEDA Warrant Holders Meeting and vote in person, obtain a proxy from your broker or bank.

If you sign, date and return your warrant holder proxy card without indicating how you wish to vote, your warrant holder proxy will be voted “FOR” each of the proposals presented at the SEDA Warrant Holders Meeting. In general, if your SEDA Warrants are held in “street” name and you do not instruct your broker, bank or other nominee or intermediary

on a timely basis on how to vote your SEDA Warrants, your broker, bank or other nominee or intermediary, in its sole discretion, may either leave your SEDA Warrants unvoted or vote your SEDA Warrants on routine matters, but not on any non-discretionary matters. Proxies that are marked “abstain” and proxies relating to “street name” SEDA Warrants that are returned to SEDA but marked by brokers as “not voted” will be treated as SEDA Warrants present for purposes of determining the presence of quorum on all matters, but they will not be treated as SEDA Warrants voted on the matter and will, therefore, have the effect of an “AGAINST” vote on the Warrant Amendment Proposal. If you are a SEDA warrant holder of record and you attend the SEDA Warrant Holders Meeting and wish to vote in person or virtually, you may withdraw your proxy and vote in person.

Approval of the Warrant Amendment Proposal requires the affirmative vote of the holders of at least 65% of each of (i) the outstanding SEDA Public Warrants and (ii) the outstanding SEDA Private Warrants, each voting separately as a class. Approval of the Warrant Holders Adjournment Proposal requires the affirmative vote of the holders of at least 50% of the SEDA Warrants present in person, online or represented by proxy at the SEDA Warrant Holders Meeting, with such votes cast by SEDA warrant holders present or represented by proxy and entitled to vote at the SEDA Warrant Holders Meeting.

After careful consideration, the SEDA Board has unanimously approved the Warrant Amendment, and recommends that the SEDA warrant holders vote “FOR” the Warrant Amendment Proposal and “FOR” the Warrant Holders Adjournment Proposal, in each case, if presented to the SEDA Warrant Holders Meeting. When you consider the SEDA Board’s recommendation of these proposals, you should keep in mind that certain SEDA’s directors and officers have interests in the Business Combination that may conflict with your interests as a warrant holder.

The existence of financial and personal interests of one or more of SEDA’s directors may result in a conflict of interest on the part of such director(s) between what he, she or they may believe is in the best interests of SEDA and SEDA warrant holders and what he, she or they may believe is best for himself, herself or themselves in determining to recommend that SEDA warrant holders vote for the Warrant Holder Proposals. In addition, SEDA’s directors, executive officers and the Sponsor and its affiliates may have interests in the Business Combination that may conflict with your interests as a SEDA warrant holder. Please see the section entitled “Proposal No. 1 — The Business Combination Proposal — Interests of the Sponsor and SEDA’s Directors and Officers in the Business Combination” for a further discussion of these considerations.

Your vote is important regardless of the number of SEDA Warrants you own. Whether you plan to attend the SEDA Warrant Holders Meeting or not, please sign, date and return the warrant holder proxy card accompanying the proxy statement/prospectus as soon as possible in the envelope provided. If your SEDA Warrants are held in “street name” or are in a margin or similar account, you should contact your broker to ensure that votes related to the SEDA Warrants you beneficially own are properly counted.

If you have any questions or need assistance voting your SEDA Warrants, please contact , our proxy solicitor, by calling , or banks and brokers can call collect at , or by emailing .

Thank you for your participation. We look forward to your continued support.

| | By | Order of the Board of Directors |

| | | |

| | | |

| | | Jonathan Maxwell |

| | | Co-Chief Executive Officer and Director |

, 2024

ADDITIONAL INFORMATION

The accompanying proxy statement/prospectus incorporates important business and financial information about SEDA and the Target from other documents that are not included in or delivered with the accompanying proxy statement/prospectus. This information is available to you without charge upon your written or oral request free of charge. You can obtain the documents incorporated by reference in this document through the SEC website at http://www.sec.gov or by requesting them in writing, by e-mail, or by telephone at the appropriate address below:

SDCL EDGE Acquisition Corporation

60 East 42nd Street, Suite 1100

New York, NY 10165

Telephone: (212) 488-5509

You may also obtain these documents by requesting them in writing or by telephone from SEDA’s proxy solicitation agent at the following address and telephone number:

Individuals call toll-free:

Banks and Brokerage Firms, please call:

Email:

In order to receive timely delivery of the documents in advance of the SEDA Warrant Holders Meeting, you must make your request for information no later than , 2024 ( business days prior to the date of the SEDA Warrant Holders Meeting).

TABLE OF CONTENTS

ANNEXES

ABOUT THIS PROXY STATEMENT/PROSPECTUS

This document, which forms part of a registration statement on Form F-4 filed with the U.S. Securities and Exchange Commission, or the “SEC,” by Specialty Copper Listco Plc, or “PubCo,” which constitutes a prospectus of PubCo under Section 5 of the U.S. Securities Act of 1933, as amended, or the “Securities Act,” with respect to the PubCo Shares to be issued to SEDA shareholders, the SEDA Adjusted Warrants to be issued to SEDA Warrant holders and the PubCo Shares underlying such SEDA Adjusted Warrants if the Business Combination described herein is consummated. This document also constitutes a notice of the extraordinary general meeting and a proxy statement under Section 14(a) of the U.S. Securities Exchange Act of 1934, as amended, or the “Exchange Act,” with respect to (i) the extraordinary general meeting of SEDA at which SEDA shareholders will be asked to consider and vote upon a proposal to approve the Business Combination by the adoption of the Business Combination Agreement, among other matters, and (ii) the extraordinary general meeting of SEDA at which SEDA warrant holders will be asked to consider and vote upon the Warrant Amendment Proposal, among other matters.

Unless otherwise indicated, references to a particular “fiscal year” refers to the fiscal year ended December 31 of that year. Fiscal quarters end on March 31, June 30 and September 30. After the Business Combination, PubCo’s financial year will end on December 31 each year and its fiscal quarters will be on March 31, June 30 and September 30.

References to a year other than a “Fiscal” or “fiscal year” are to the calendar year ended December 31. References to “U.S. Dollars” and “$” in this proxy statement/prospectus are to United States dollars, the legal currency of the United States. References to “Euro” or “€” and “Pound Sterling” or “£” in this proxy statement/prospectus, are to each of the legal currency of the European Union, or the “EU,” and the United Kingdom, respectively. Any discrepancies in any table between totals and sums of the amounts listed are due to rounding. Certain amounts and percentages have been rounded; consequently, certain figures may add up to be more or less than the total amount and certain percentages may add up to be more or less than 100% due to rounding. In particular and without limitation, amounts expressed in millions contained in this proxy statement/prospectus have been rounded to a single decimal place for the convenience of readers.

This proxy statement/prospectus does not constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction or to any person to whom it would be unlawful to make such offer.

The securities are not intended to be offered, sold or otherwise made available to, and should not be offered, sold or otherwise made available to, any persons in member states of the European Economic Area except (i) to persons who are qualified investors for the purposes of the EU Prospectus Regulation or (ii) in any other circumstances falling within Article 1(4) of the EU Prospectus Regulation, and no person in member states of the European Economic Area that is not a qualified investor or otherwise falling within Article 1(4) of the EU Prospectus Regulation may act or rely on this document or any of its contents.