DISCLAIMER AND FORWARD-LOOKING STATEMENTS This presentation and accompanying statements contain forward-looking statements that are subject to risks and uncertainties. All statements other than statements of historical facts or relating to present facts or current conditions included in this presentation are forward-looking statements. Forward-looking statements give Seaport Entertainment Group Inc.’s (“Seaport Entertainment,” the “Company,” “we,” “us” and “our”) current expectations relating to its financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “may,” “could,” “seek,” “potential,” “likely,” “believe,” “will,” “expect,” “anticipate,” “estimate,” “plan,” “intend,” “forecast,” “aim,” “objectives,” “target,” “transform,” “project,” “realize” or variations of these terms and similar expressions, or the negative of these terms or similar expressions, although not all forward-looking statements contain these identifying words. Forward-looking statements include statements related to: the anticipated spin-off of the Company by Howard Hughes Holdings Inc.; the timing and method of the spin-off; the anticipated benefits of the spin-off; the expected financial and operational performance, liquidity and capitalization of, and future opportunities for, the Company following the spin-off; the tax treatment of the spin-off; the leadership of the Company following the separation; future or expected growth, growth potential, forward momentum, performance, cash flows, balance sheet strengths, debt or financial condition of the Company; and the Company’s anticipated rights offering. The forward-looking statements contained in this presentation are based on information currently available to the Company and assumptions the Company has made in light of management’s experience and perceptions of historical trends, current conditions, expected future developments and other factors that management believes are appropriate. These statements are not guarantees of performance or results. The assumptions underlying these forward-looking statements and the Company’s future performance or results involve risks and uncertainties including, but not limited to: the timing, anticipated size, and terms of the proposed rights offering; risks related to the proposed spin-off; macroeconomic conditions; changes in discretionary consumer spending patterns or consumer tastes or preferences; risks associated with our investments in real estate assets and trends in the real estate industry; our ability to obtain operating and development capital on favorable terms, or at all, including our ability to obtain or refinance debt capital our ability to renew our leases or re-lease available space; our ability to compete effectively; our ability to successfully identify, acquire, develop and manage properties on terms that are favorable to us; the impact of uncertainty around, and disruptions to, our supply chain, including labor shortages and shipping delays; risks related to the concentration of our properties in Manhattan and the Las Vegas area; extreme weather conditions or climate change that may cause property damage or interrupt business; the impact of water and electricity shortages on our business; the contamination of our properties by hazardous or toxic substances; catastrophic events or geopolitical conditions that may disrupt our business; actual or threatened terrorist activity and other acts of violence, or the perception of a heightened threat of such events; losses that are not insured or that exceed the applicable insurance limits; risks related to disruption or failure of information technology networks and related systems—both ours and those operated and managed by third parties—including data breaches and other cybersecurity attacks; our ability to attract and retain key personnel; our inability to control certain of our properties due to the joint ownership of such property and our inability to successfully attract desirable strategic partners, including joint venture partners; and other risks set forth under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s registration statement on Form S-1 filed with the Securities and Exchange Commission (the “SEC”). Additional factors or events that could cause the Company’s actual performance to differ from these forward-looking statements may emerge from time to time, and it is not possible for the Company to predict all of them. Should one or more of these risks or uncertainties materialize, or should any of the Company’s assumptions prove incorrect, the Company’s actual financial condition, results of operations, future performance and business may vary in material respects from the performance projected in these forward-looking statements. All forward-looking statements in this presentation are made as of (i) the date hereof, in the case of information about the Company, and (ii) the date of such information, in the case of information from persons other than the Company. While management believes the information underlying any estimates and projections forms a reasonable basis for the statements in this presentation, such information may be limited or incomplete and should not be read to indicate that the Company has conducted an exhaustive inquiry into, or review of, all potentially available relevant information. The Company undertakes no obligation to update any forward-looking statement, except as may be required by law. The Company has filed a registration statement (including a prospectus) on Form S-1 with the SEC for the rights offering. You should read the prospectus, including the risk factors set forth therein, completely and with the understanding that our actual future results may be materially different from what we expect. You can obtain copies of the prospectus for free by visiting EDGAR on the SEC's website at www.sec.gov. Alternatively, copies of the prospectus may be obtained from Wells Fargo Securities, LLC 375 Park Avenue, New York, New York 10152, Attn: Equity Syndicate Department, telephone: (800) 326-5897. A registration statement related to the rights offering has been filed with the SEC but has not yet become effective. These securities may not be sold, nor may offers to buy be accepted, prior to the time the registration statement becomes effective. This presentation and related discussion shall not constitute an offer to sell, or the solicitation of an offer to buy, these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. Sales and offers to sell our securities will only be made in accordance with the Securities Act of 1933, as amended, and applicable SEC regulations, including written prospectus requirements. This presentation is not intended to form the basis of any investment decision by the recipient and does not constitute investment, tax or legal advice. All trademarks and logos depicted in this presentation are the property of their respective owners and are displayed solely for purposes of illustration. Such use should not be construed as an endorsement of the products or services of the Company. 2

Spin-off overview Howard Hughes (NYSE: HHH) expects to spin-off Seaport Entertainment into a publicly-traded company that is expected to be listed on the NYSE under the ticker symbol SEG in a distribution that is intended to be tax-free to HHH stockholders for U.S. federal income tax purposes except for cash received in lieu of fractional shares. Seaport Entertainment will own and operate hospitality and entertainment-related assets, primarily located in New York City and Las Vegas. Immediately following the spin-off, the Company expects to have more than $25 million of cash and cash equivalents on its balance sheet, and just over $100 million of outstanding debt and no near-term debt maturities. Following the spin, the Company intends to launch a $175 million Rights Offering that is expected to include a backstop provided by investment funds managed by Pershing Square Capital Management, L.P., which the Company believes will provide ample liquidity to execute its business plan when combined with its other sources of available liquidity. The spin-off is anticipated to occur in the third quarter of 2024 and the Rights Offering is expected to be launched following the spin-off. 3 NYC

Creating two distinct companies Building a brand at the intersection of entertainment and real estate Leading master planned community developer and operator 4 organizational efficiencies Each enterprise can focus on its core business Dedicated management teams with relevant industry experience are positioned to seek operational efficiencies The new structure is expected to drive asset-level value and financial performance at each organization Financial flexibility Each platform expected to have ample liquidity Enhanced strategic focus and financial flexibility for targeted growth and capital allocation strategies Clarity for the investment community Provides greater transparency Better highlights the differentiated investment opportunities provided by each company Long-Term Growth Allows each company to execute on its long-term value creation and growth strategies Opportunity to pursue accretive transactions and seek partnerships that are specific to their respective business models

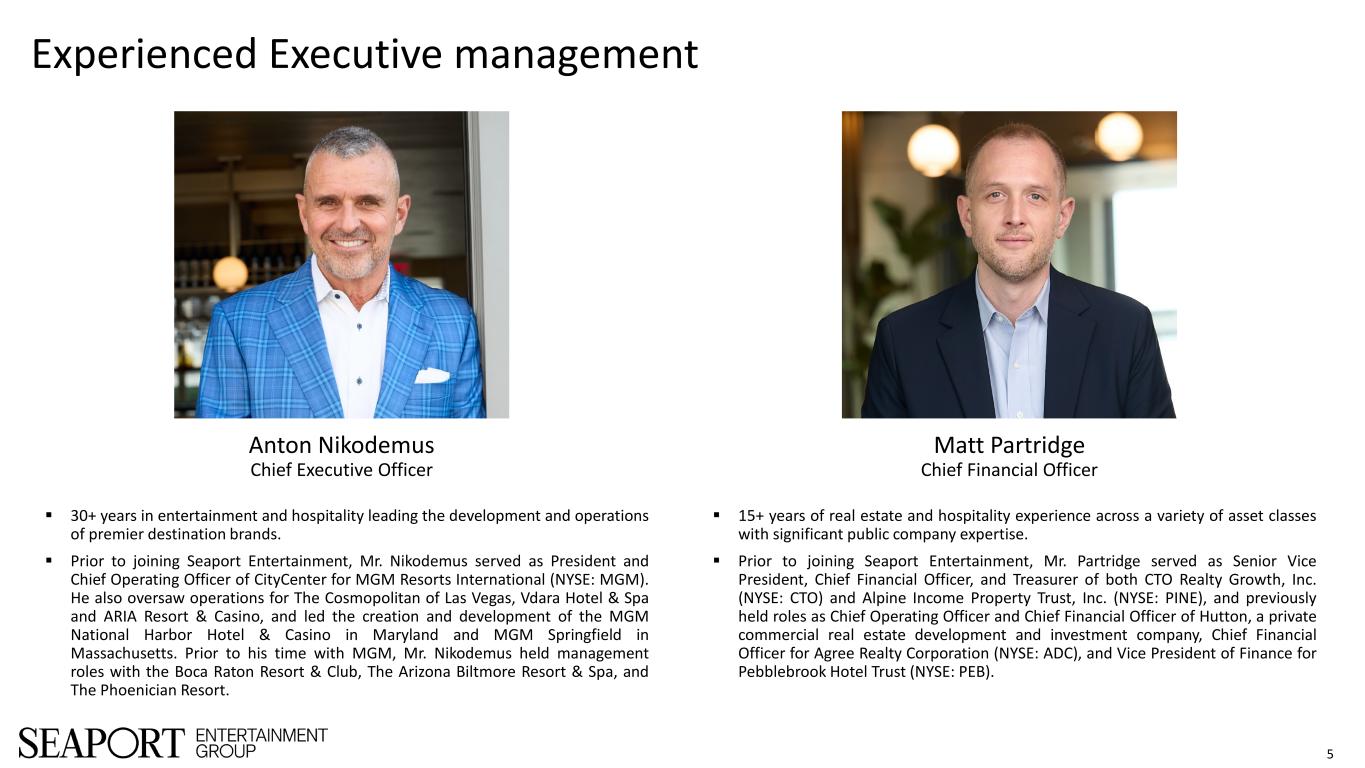

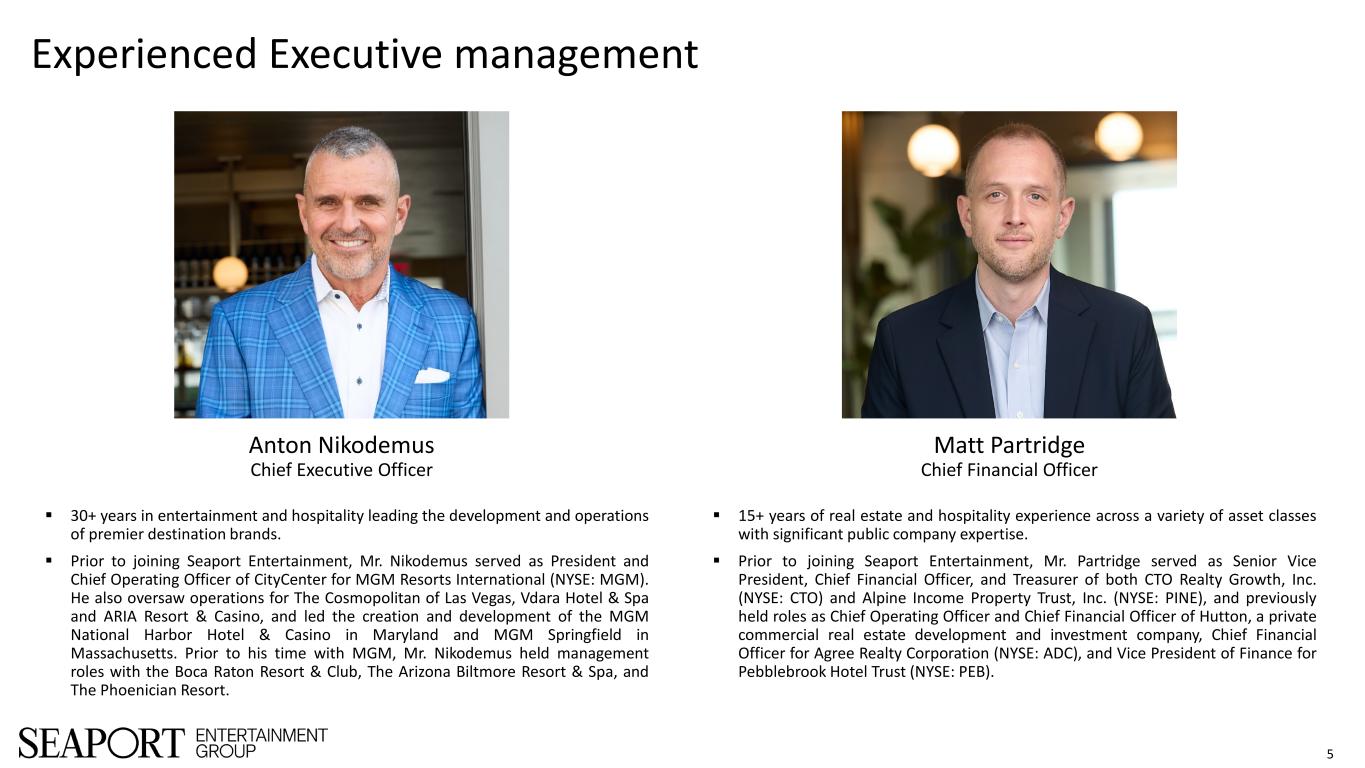

Experienced Executive management 5 Anton Nikodemus Chief Executive Officer 30+ years in entertainment and hospitality leading the development and operations of premier destination brands. Prior to joining Seaport Entertainment, Mr. Nikodemus served as President and Chief Operating Officer of CityCenter for MGM Resorts International (NYSE: MGM). He also oversaw operations for The Cosmopolitan of Las Vegas, Vdara Hotel & Spa and ARIA Resort & Casino, and led the creation and development of the MGM National Harbor Hotel & Casino in Maryland and MGM Springfield in Massachusetts. Prior to his time with MGM, Mr. Nikodemus held management roles with the Boca Raton Resort & Club, The Arizona Biltmore Resort & Spa, and The Phoenician Resort. Matt Partridge Chief Financial Officer 15+ years of real estate and hospitality experience across a variety of asset classes with significant public company expertise. Prior to joining Seaport Entertainment, Mr. Partridge served as Senior Vice President, Chief Financial Officer, and Treasurer of both CTO Realty Growth, Inc. (NYSE: CTO) and Alpine Income Property Trust, Inc. (NYSE: PINE), and previously held roles as Chief Operating Officer and Chief Financial Officer of Hutton, a private commercial real estate development and investment company, Chief Financial Officer for Agree Realty Corporation (NYSE: ADC), and Vice President of Finance for Pebblebrook Hotel Trust (NYSE: PEB).

Differentiated investment opportunity 6 Unique, Premier real estate High-Quality entertainment AND HOSPITALITY brands and assets Multiple internal and external growth opportunities Experienced management and board with strong corporate governance Expected Financial Flexibility to Support Existing Business and future Growth

Premier real estate & iconic experiences 7 hospitality Retail sports Growth opportunities Live entertainment

New York city tourism a tailwind 8 New York City is the largest city in the United States by population with over 8.3 million residents2 Food and Beverage, Retail and Arts, Culture and Entertainment represent more than 50% of historical visitor spending3 Popular annual events such as New Year’s Eve In Times Square, Macy’s Thanksgiving Day Parade, St. Patrick’s Day Parade, Tribeca Film Festival and Fourth of July Fireworks expected to continue to drive activity New York is expected to significantly benefit from several near-term events, such as: Eight FIFA World Cup 26 matches 2026 World Cup Final set to be played nearby at the Meadowlands in New Jersey United States Semiquincentennial celebration 1 Source: New York City Tourism + Conventions. 2 As of May 2024. 3 For the year 2023. Source: Office of the New York State Comptroller, The Tourism Industry in New York City. 62 Million Visitors in 20231 9.1% Growth in Visitors in 20231 $74 Billion Economic Impact in 2023 from Visitors1

The seaport district NYC 9 Pier 17 Historic district 250 water street Tin building One of the few multi-block neighborhoods in New York City largely under private management, creating a multifaceted, customer-centric destination. 478k SF of Entertainment, Dining, Community and Cultural Experiences 20+ Owned & Operated Restaurant and Entertainment Concepts 66% Occupancy as of March 31, 2024 200K+ Attendees to the 2023 Summer Concert Series Across 63 Shows Note: Shading of buildings is intended to be representative and not meant to depict control or ownership by floor of each building. 250 Water Street Pier 17 The Tin Building by Jean-Georges Fulton Market Building Schermerhorn Row One Seaport Plaza Seaport Translux Museum Block 117 Beekman Street 85 South St. John St. Service Building

Unparalleled programming & engagement 10 Robust calendar of events and programming to provide New Yorkers and tourists a year-round destination. kids The Arts The fit The Sounds The cinema The Winter Wonderland Garden Bar Hester Street Fair The Court at Seaport Summer Concert Series 4th of July at the Seaport Seaport Beachfest Match Point Rooftop Tennis Taste of the Seaport Seaport Halloween Seaport Food Lab Holiday Tree Lighting

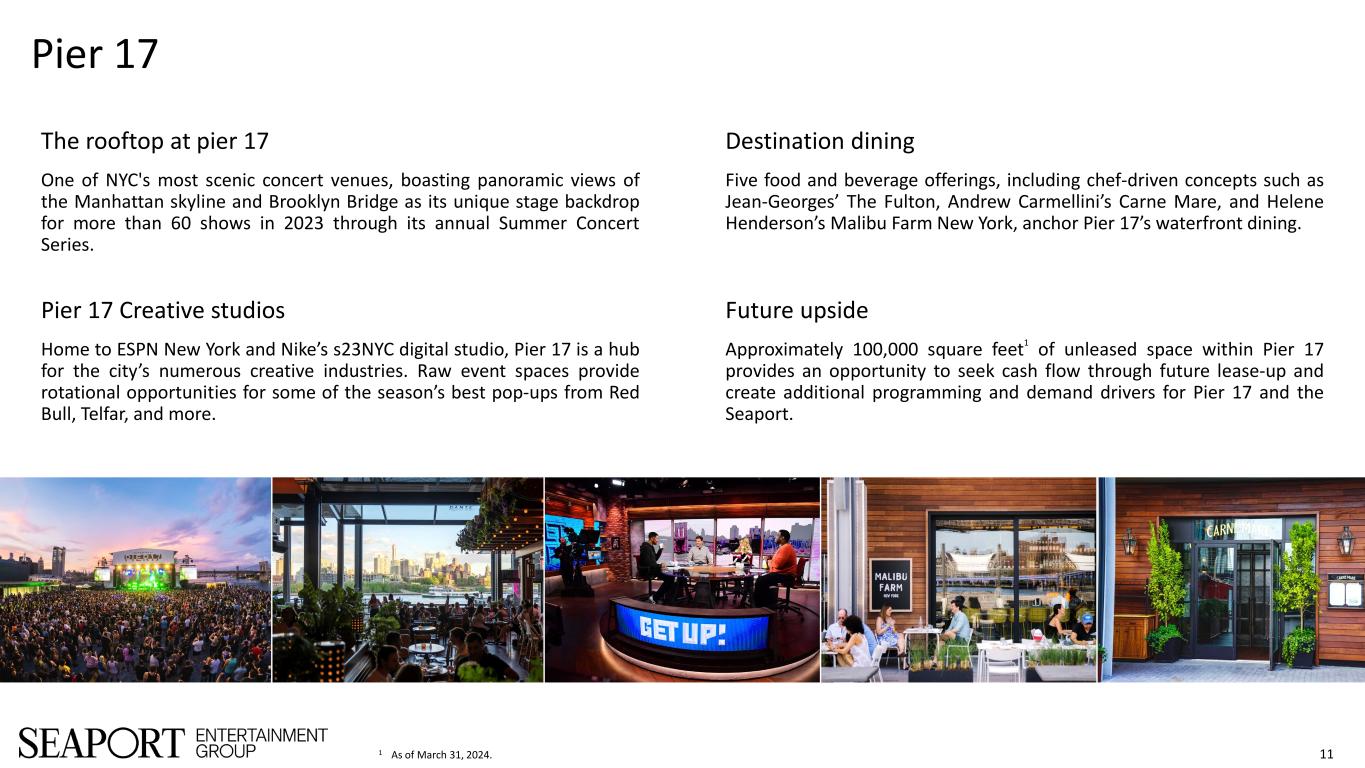

Pier 17 The rooftop at pier 17 One of NYC's most scenic concert venues, boasting panoramic views of the Manhattan skyline and Brooklyn Bridge as its unique stage backdrop for more than 60 shows in 2023 through its annual Summer Concert Series. Destination dining Five food and beverage offerings, including chef-driven concepts such as Jean-Georges’ The Fulton, Andrew Carmellini’s Carne Mare, and Helene Henderson’s Malibu Farm New York, anchor Pier 17’s waterfront dining. Future upside Approximately 100,000 square feet1 of unleased space within Pier 17 provides an opportunity to seek cash flow through future lease-up and create additional programming and demand drivers for Pier 17 and the Seaport. Pier 17 Creative studios Home to ESPN New York and Nike’s s23NYC digital studio, Pier 17 is a hub for the city’s numerous creative industries. Raw event spaces provide rotational opportunities for some of the season’s best pop-ups from Red Bull, Telfar, and more. 111 As of March 31, 2024.

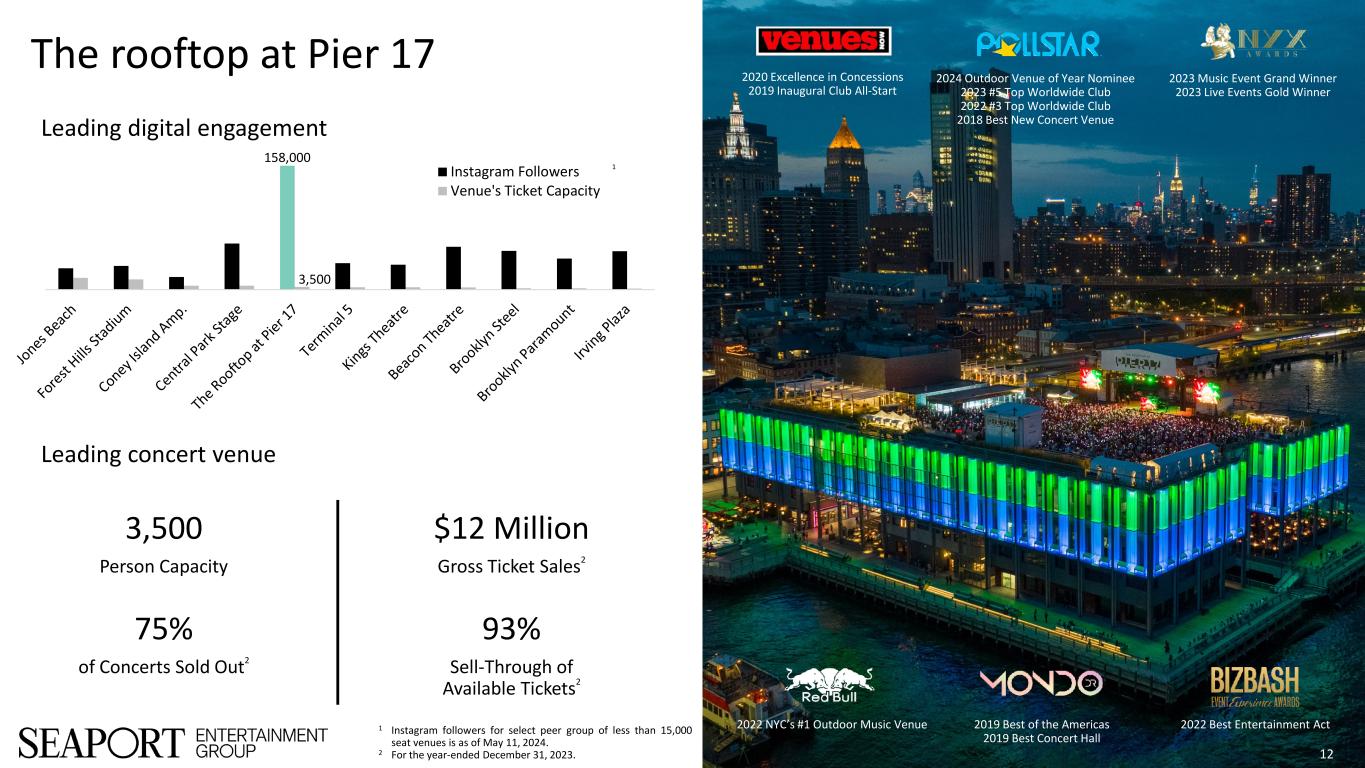

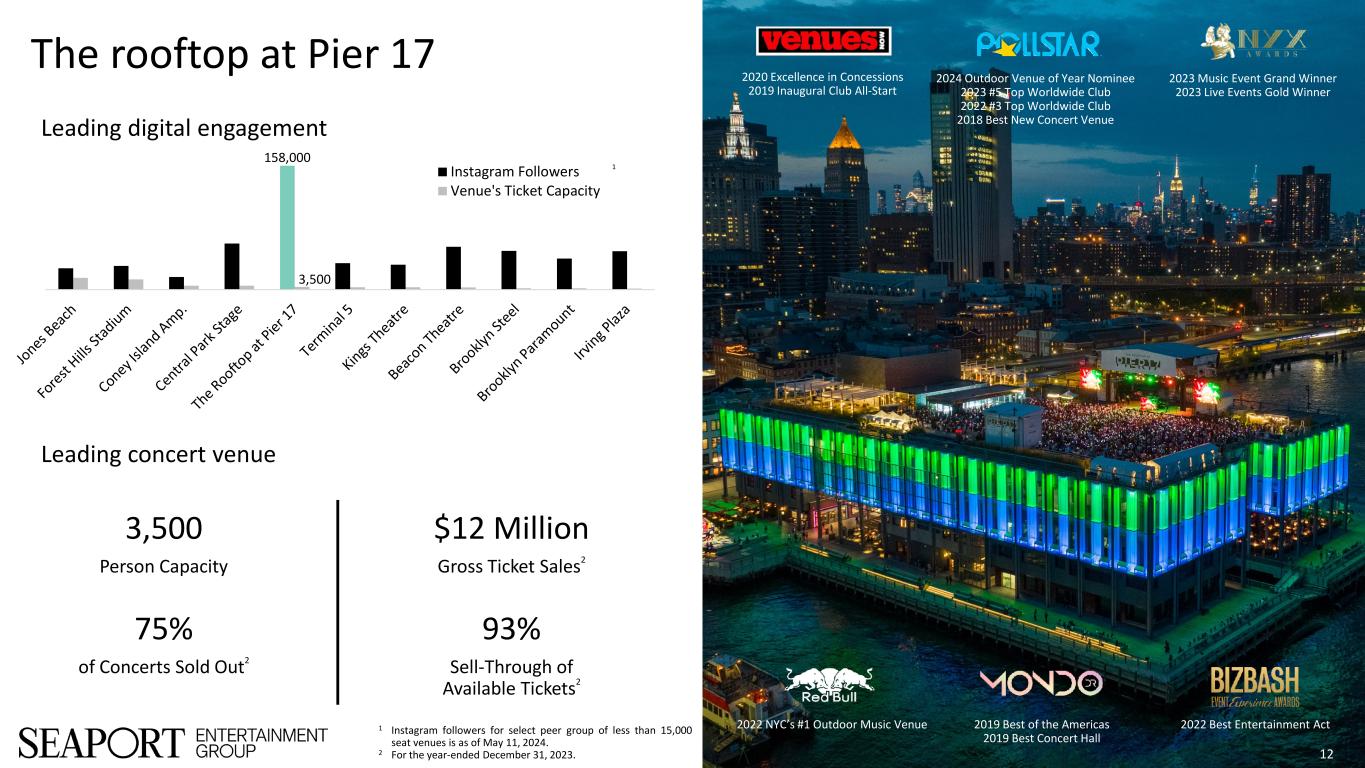

The rooftop at Pier 17 Leading digital engagement Leading concert venue 12 2024 Outdoor Venue of Year Nominee 2023 #5 Top Worldwide Club 2022 #3 Top Worldwide Club 2018 Best New Concert Venue 2019 Best of the Americas 2019 Best Concert Hall 2020 Excellence in Concessions 2019 Inaugural Club All-Start 2023 Music Event Grand Winner 2023 Live Events Gold Winner 2022 NYC’s #1 Outdoor Music Venue 2022 Best Entertainment Act 158,000 3,500 Instagram Followers Venue's Ticket Capacity 1 Instagram followers for select peer group of less than 15,000 seat venues is as of May 11, 2024. 2 For the year-ended December 31, 2023. 3,500 Person Capacity 93% Sell-Through of Available Tickets2 $12 Million Gross Ticket Sales2 75% of Concerts Sold Out2 1

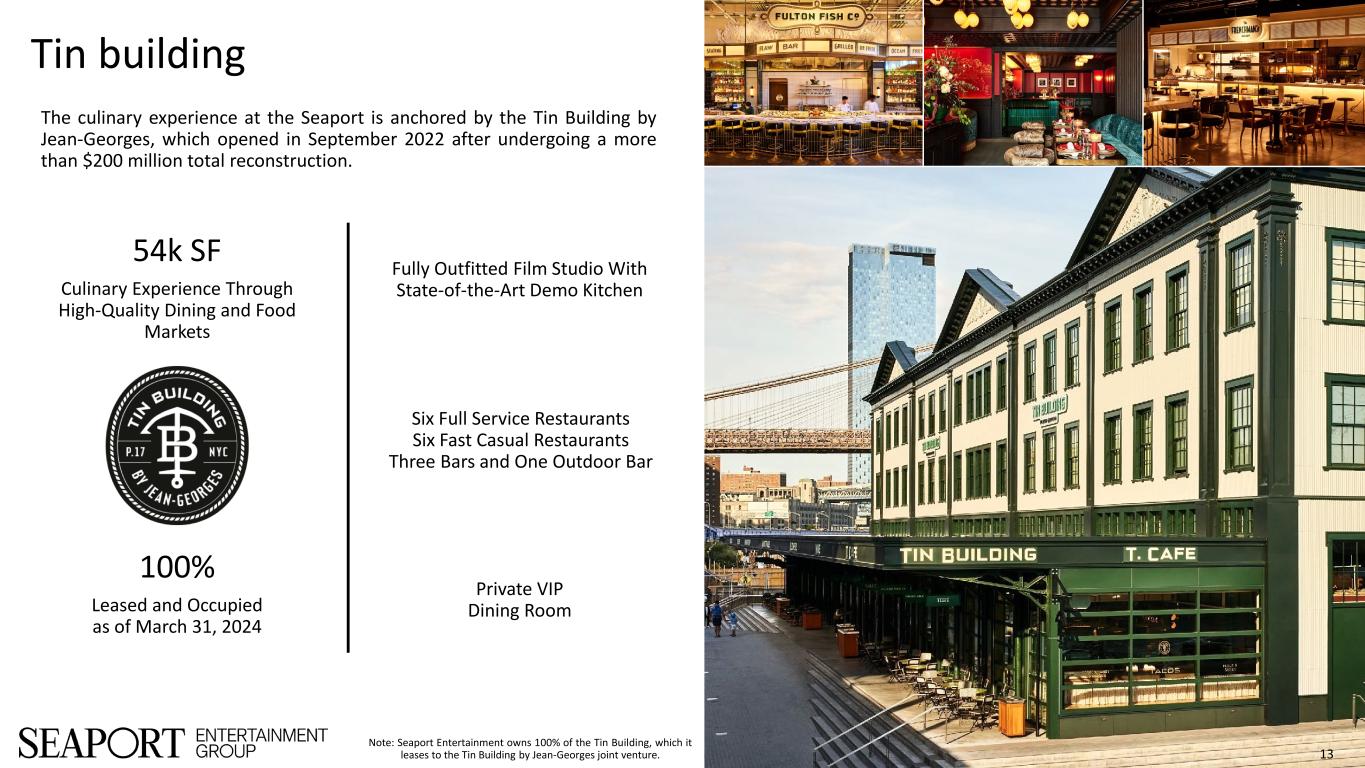

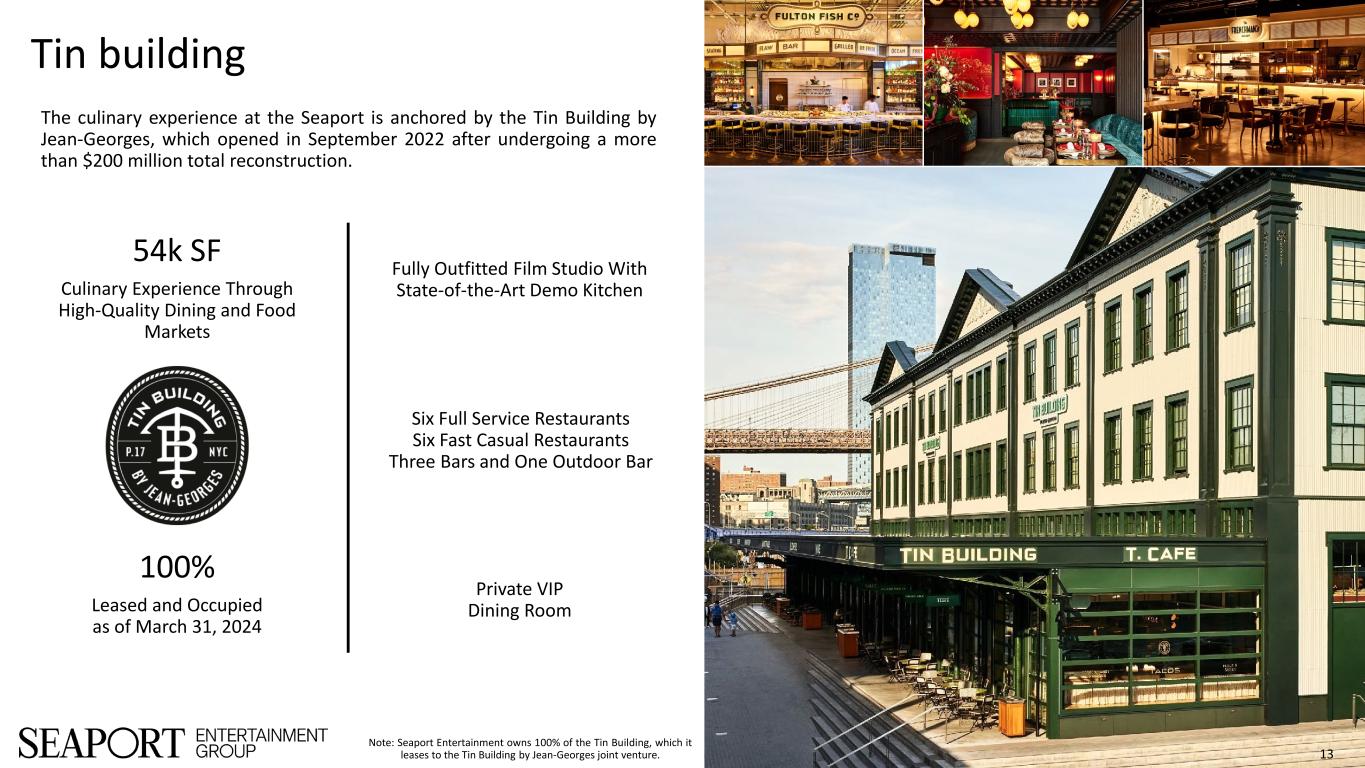

Tin building 13 The culinary experience at the Seaport is anchored by the Tin Building by Jean-Georges, which opened in September 2022 after undergoing a more than $200 million total reconstruction. 54k SF Culinary Experience Through High-Quality Dining and Food Markets Fully Outfitted Film Studio With State-of-the-Art Demo Kitchen Six Full Service Restaurants Six Fast Casual Restaurants Three Bars and One Outdoor Bar Private VIP Dining Room 100% Leased and Occupied as of March 31, 2024 Note: Seaport Entertainment owns 100% of the Tin Building, which it leases to the Tin Building by Jean-Georges joint venture.

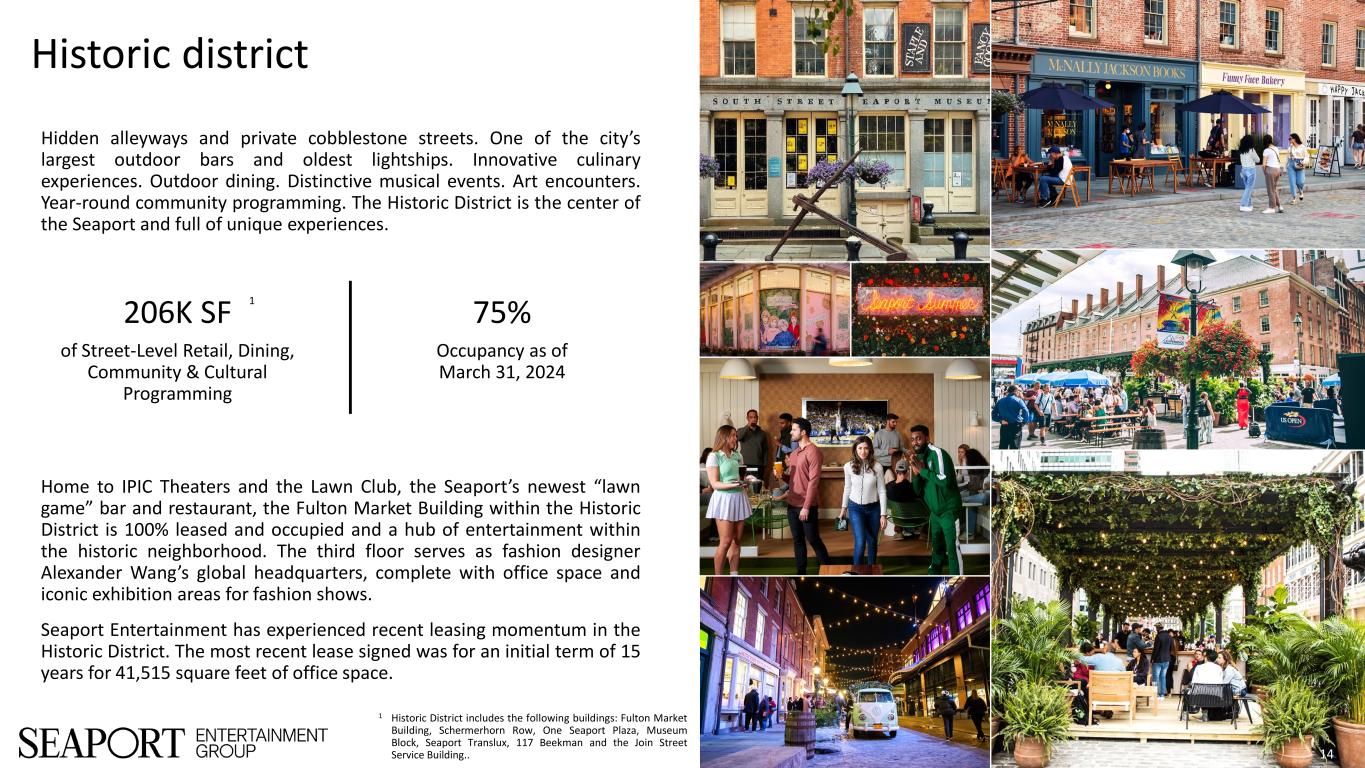

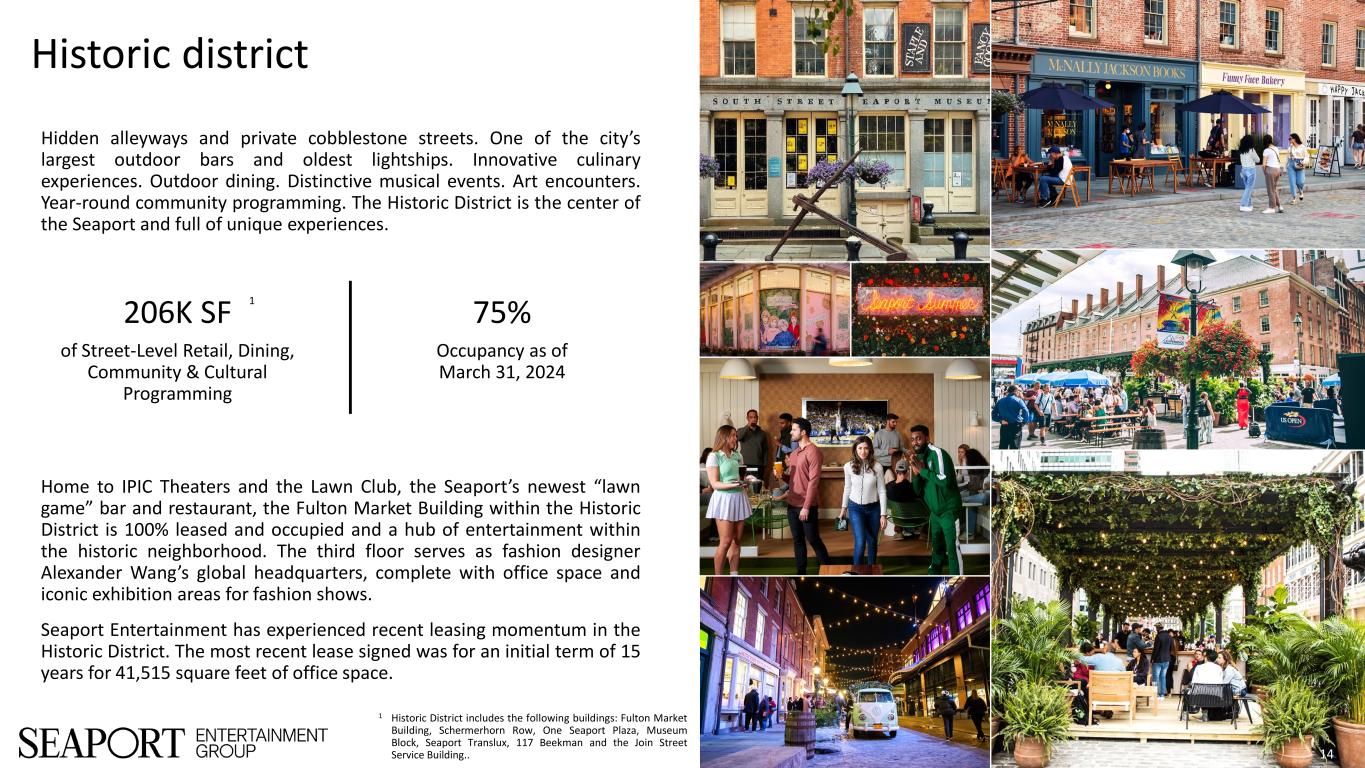

Historic district 14 Hidden alleyways and private cobblestone streets. One of the city’s largest outdoor bars and oldest lightships. Innovative culinary experiences. Outdoor dining. Distinctive musical events. Art encounters. Year-round community programming. The Historic District is the center of the Seaport and full of unique experiences. Home to IPIC Theaters and the Lawn Club, the Seaport’s newest “lawn game” bar and restaurant, the Fulton Market Building within the Historic District is 100% leased and occupied and a hub of entertainment within the historic neighborhood. The third floor serves as fashion designer Alexander Wang’s global headquarters, complete with office space and iconic exhibition areas for fashion shows. Seaport Entertainment has experienced recent leasing momentum in the Historic District. The most recent lease signed was for an initial term of 15 years for 41,515 square feet of office space. 206K SF of Street-Level Retail, Dining, Community & Cultural Programming 75% Occupancy as of March 31, 2024 1 1 Historic District includes the following buildings: Fulton Market Building, Schermerhorn Row, One Seaport Plaza, Museum Block, Seaport Translux, 117 Beekman and the Join Street Service Building..

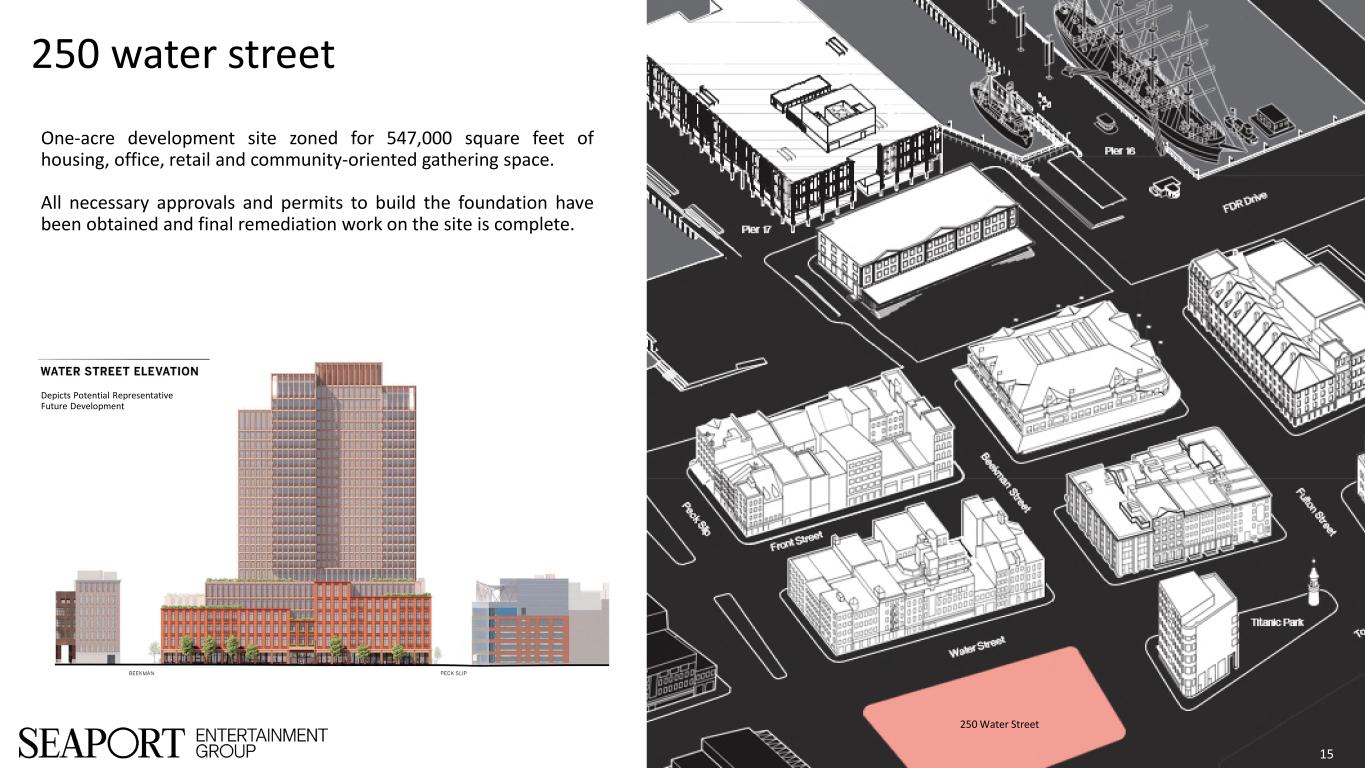

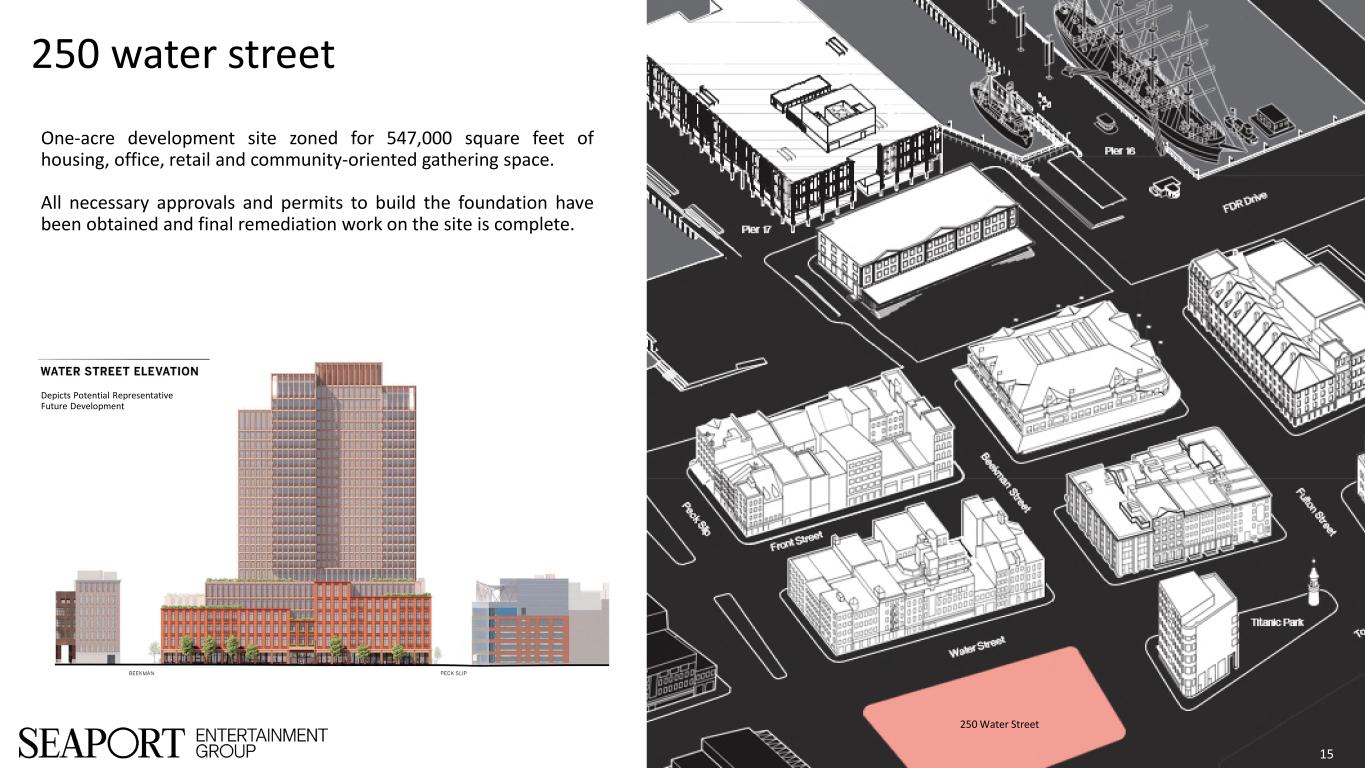

250 water street 15 One-acre development site zoned for 547,000 square feet of housing, office, retail and community-oriented gathering space. All necessary approvals and permits to build the foundation have been obtained and final remediation work on the site is complete. 250 Water Street Depicts Potential Representative Future Development

Jean-Georges restaurants 16 ownership alignment Seaport Entertainment owns a 25% interest in Jean-Georges Restaurants and Jean-Georges provides management services through its management arm, Creative Culinary Management Company, for multiple retail and food and beverage operations within the Seaport District NYC for Seaport Entertainment. Opportunities for growth Jean-Georges’ expertise and versatility allow him to serve the culinary needs of the customer rather than a specific type of cuisine. As a result, Seaport Entertainment believes there are numerous opportunities to open new restaurants, introduce different types of concepts, including franchising, and potentially offer private label wholesale products. Leading brand Jean-Georges Restaurants was formed by acclaimed Michelin-star chef Jean-Georges Vongerichten. Jean-Georges Restaurants has grown from 17 locations in 2013 to more than 40 high-end restaurant concepts across five continents, 13 countries and 24 distinct markets.

Las Vegas growth driving success 17 Opportunity to benefit from growth of Las Vegas and its burgeoning professional sports industry Vegas Golden Knights were the 8th highest grossing revenue team in the National Hockey League2 Las Vegas Raiders were the 2nd highest grossing revenue team in the National Football League2 Las Vegas hosted Super Bowl LVIII in 2024 Formula 1 introduced the Las Vegas Grand Prix in 2023; Las Vegas Grand Prix will take place again in 2024, and Formula 1 is contracted to continue events in Las Vegas through 2032 Will also host WrestleMania 41 in 2025, the 2026 NCAA Division I Men’s Ice Hockey Championship and the 2028 NCAA Division I Men’s Basketball Final Four 1 Source: Las Vegas Convention and Visitors Authority Research Center. 2 For the year ended 2023; Source: Forbes. 40 Million Visitors in 20231 5.2% Growth in Visitors in 20231 $51 Billion in Direct Visitor Spending in 20231

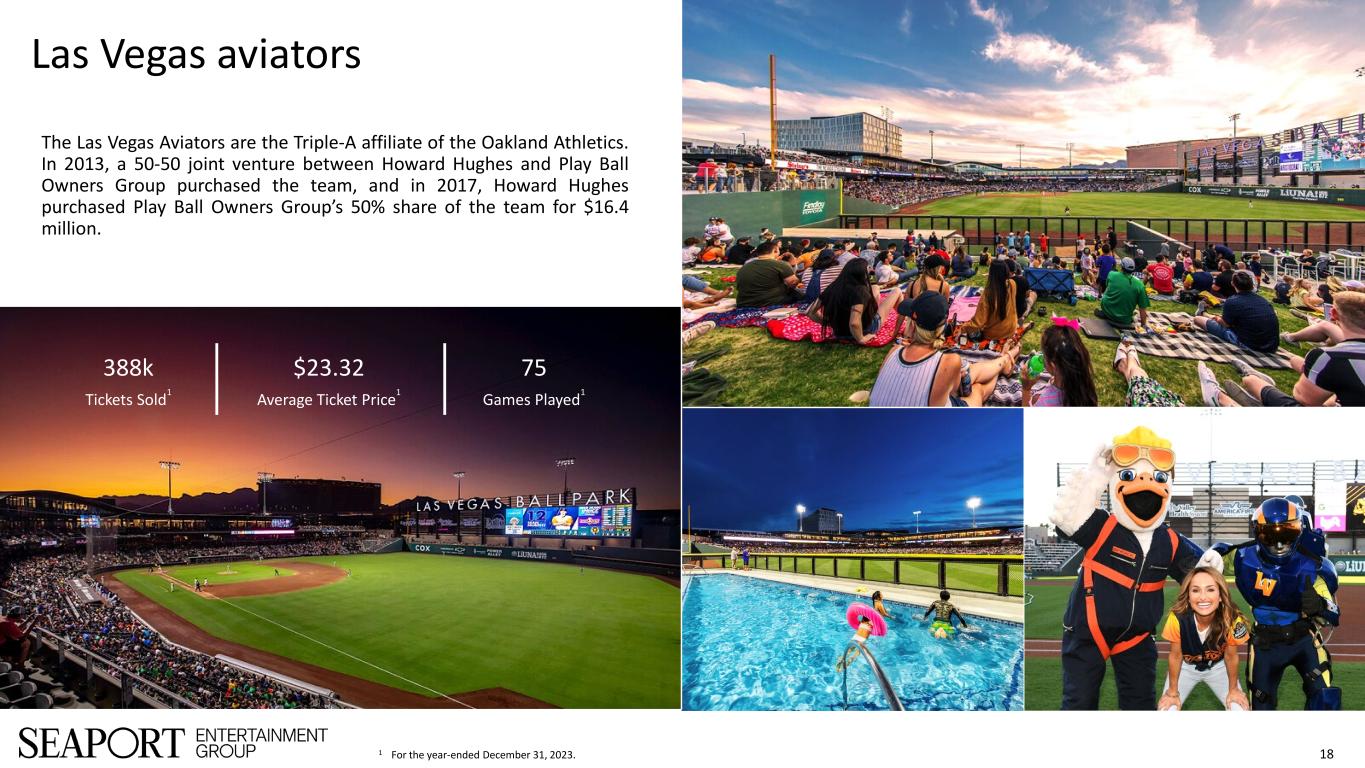

Las Vegas aviators 18 The Las Vegas Aviators are the Triple-A affiliate of the Oakland Athletics. In 2013, a 50-50 joint venture between Howard Hughes and Play Ball Owners Group purchased the team, and in 2017, Howard Hughes purchased Play Ball Owners Group’s 50% share of the team for $16.4 million. 388k Tickets Sold1 $23.32 Average Ticket Price1 75 Games Played1 1 For the year-ended December 31, 2023.

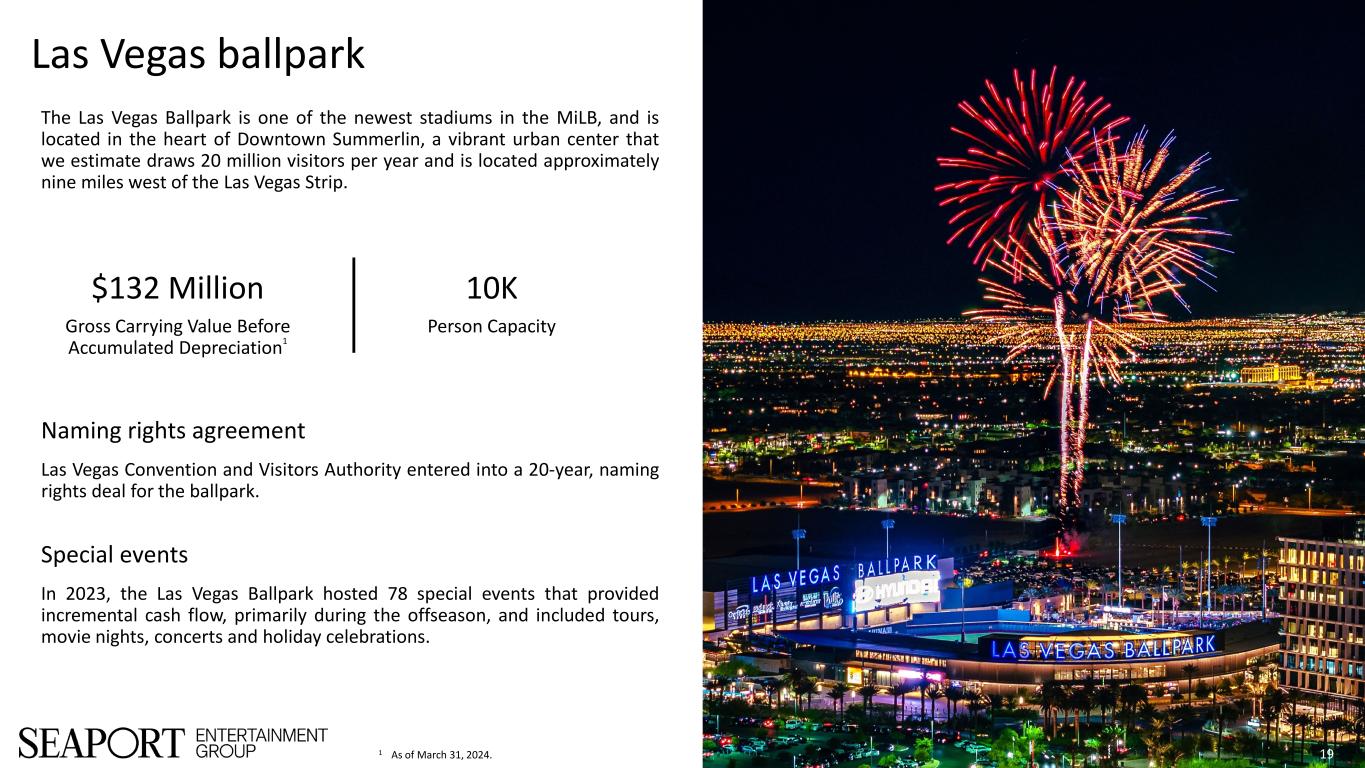

Las Vegas ballpark 19 Naming rights agreement Las Vegas Convention and Visitors Authority entered into a 20-year, naming rights deal for the ballpark. Special events In 2023, the Las Vegas Ballpark hosted 78 special events that provided incremental cash flow, primarily during the offseason, and included tours, movie nights, concerts and holiday celebrations. The Las Vegas Ballpark is one of the newest stadiums in the MiLB, and is located in the heart of Downtown Summerlin, a vibrant urban center that we estimate draws 20 million visitors per year and is located approximately nine miles west of the Las Vegas Strip. $132 Million Gross Carrying Value Before Accumulated Depreciation1 10K Person Capacity 1 As of March 31, 2024.

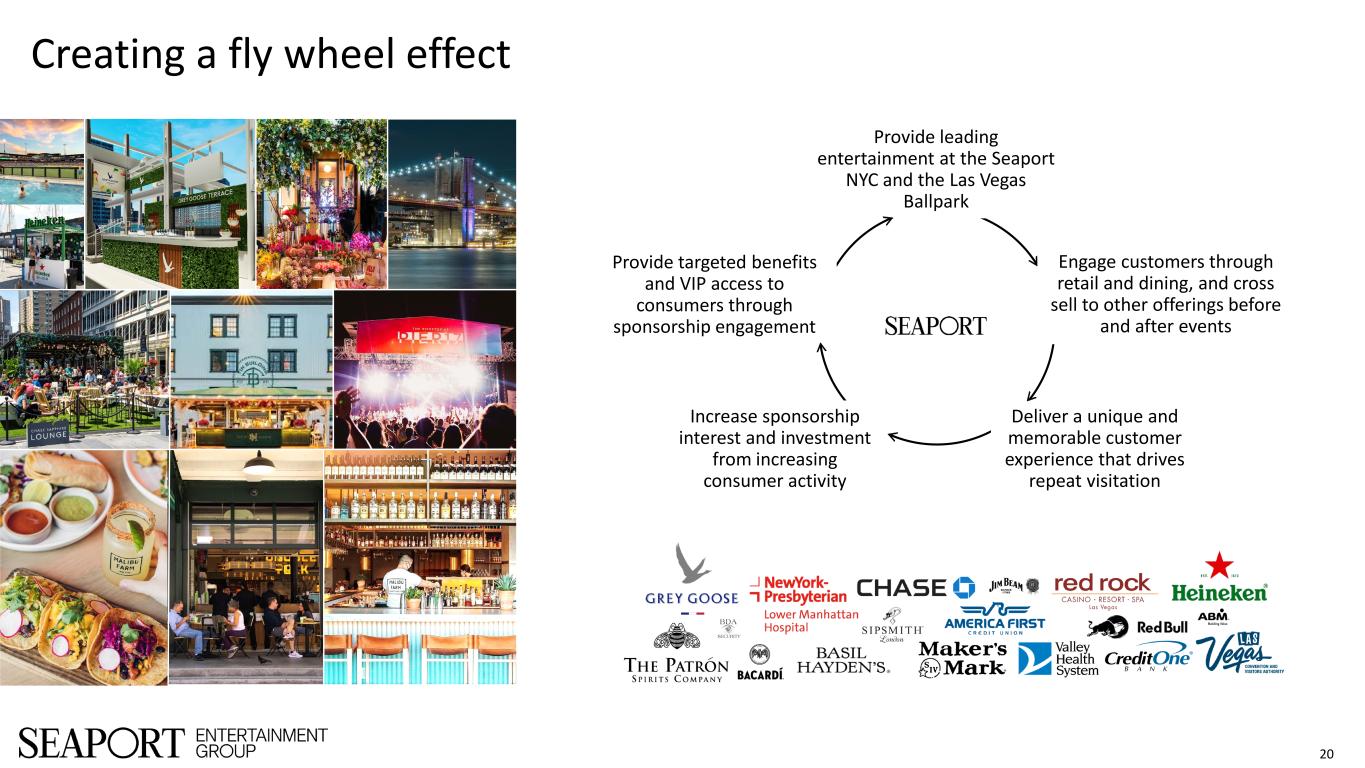

Creating a fly wheel effect 20 Provide leading entertainment at the Seaport NYC and the Las Vegas Ballpark Engage customers through retail and dining, and cross sell to other offerings before and after events Deliver a unique and memorable customer experience that drives repeat visitation Increase sponsorship interest and investment from increasing consumer activity Provide targeted benefits and VIP access to consumers through sponsorship engagement

Near-term focus 21 ~165K Square Feet of Unoccupied Space to Be Leased to Drive Seaport District NYC Cash Flow F&B Profitability Has Significant Room for Improvement and Optimization Ballpark Programming of Non-Baseball Events Has Opportunity to Meaningfully Increase Purchasing Programs Can Be Implemented Across All Operations to Seek to Improve Cost of Goods Improve Seaport NYC Programming to Drive Better Conversion of Visitors to Customers Covered Winter Concert Series Is an Option for The Rooftop at Pier 17, Representing an Opportunity for Additional Shows Increase average time In Destination to Increase Customer Engagement and Overall Spend Increase Number of Times to Destination by Providing Better Programming and Increased Experiences and Offerings Increase average spend Per Visitor by Providing New Offerings, Experiences and Programming Utilize Activity data to Drive Operating and Customer-Specific Insights that Allow for Improved Customer Experiences and Operating Efficiencies

Opportunities to create Long-Term value 22 Strategic partnerships to Help Drive Portfolio Growth and Expand Entertainment and Leisure Offerings 250 Water Street Could be Developed to Create Additional Residential, Retail and Office Fashion Show Air Rights1 Could Be Developed to Potentially Create a New Casino and Hotel Acquire New Assets to Grow the Overall Asset Base and Add Scale to the Company’s Managed Businesses 1 Seaport Entertainment has an interest in and to 80% of the air rights above the Fashion Show mall in Las Vegas, with Brookfield Properties having an interest in and to the remaining 20%..

Aligned institutional support 23 $19.0B 1 Source: Pershing Square Holding, Ltd. Monthly Net Asset Value and Performance Report for March 2024. Data as of March 31, 2024. Prior to forming PSCM, Mr. Ackman co-founded Gotham Partners Management Co., LLC. Mr. Ackman began his career in real estate investment banking at Ackman Brothers and Singer, Inc. Mr. Ackman received an MBA from the Harvard Business School and a Bachelor of Arts from Harvard College. Rights offering backstop Following the spin, the Company intends to launch a $175 million Rights Offering that is expected to include a backstop provided by investment funds managed by Pershing Square Capital Management, L.P., which the Company believes will provide ample liquidity to execute its business plan when combined with its other sources of available liquidity. Pershing Square is a concentrated research-intensive fundamental value investor in long and occasionally short investments in the public markets. Pershing Square investments: Pershing Square Total Assets Under Management William A. Ackman Pershing Square Chief Executive Officer

Expected Board of directors Expected corporate governance Annual elections for Board of Directors Code of ethics and business conduct Annual Board of Director evaluations Whistleblower policy No stockholder rights plan Corporate governance guidelines Insider trading policy Annual certification of adherence to company policies Internal and external privacy policies Committee charters for all committees Anthony Massaro Director Nominee Anthony currently serves as a Partner at Pershing Square Capital Management. Prior to his current role, Mr. Massaro served in various roles with Apollo Global Management (NYSE: APO) and Goldman Sachs (NYSE: GS). 24 David Hirsh Director Nominee David currently serves as Vice Chairman and Senior Advisor for Sterling Investors, as well as an advisory board member for Arialgo, Black Swan Real Estate, RXR Realty, Pace University and Madison Square Park Conservancy. Prior to his current roles, Mr. Hirsh served in senior leadership roles with Blackstone (NYSE: BX) and Salomon Smith Barney/Citigroup (NYSE: C). Monica Digilio Director Nominee Monica currently serves as Founder & CEO of Compass Advisors and as a Director for Sunstone Hotel Investors (NYSE: SHO), Venetian Resort Las Vegas, and Copperpoint Mutual Insurance Holding Co. Prior to her current roles, Ms. Digilio served in senior leadership roles with Caesars Entertainment (NASDAQ: CZR), Montage Hotels & Resorts, and Kerzner International. Mike Crawford Director Nominee Mike currently serves as Chairman, President and CEO of the Hall of Fame Resort & Entertainment Company and Pro Football Hall of Fame Village, Inc., as well as a Director for Texas Roadhouse (NASDAQ: TXRH). Prior to his current roles, Mr. Crawford served in senior leadership roles with Four Seasons Hotels and The Walt Disney Company (NYSE: DIS). Anton Nikodemus Chairman & Chief Executive Officer Anton currently serves as Chairman & Chief Executive officer for Seaport Entertainment Group, Inc. (NYSE: SEG). Prior to his current roles, Mr. Nikodemus served as President and Chief Operating Officer of CityCenter for MGM Resorts International (NYSE: MGM). He also oversaw operations for The Cosmopolitan of Las Vegas, Vdara Hotel & Spa and ARIA Resort & Casino.

Key terms and references References and terms used in this presentation that are in addition to the terms defined in the Disclaimer and Forward-Looking Statements section or not already defined in other areas of this presentation include: This presentation was published on May 23, 2024. “Aviators” refers to the Las Vegas Aviators Triple-A baseball team. “Company,” “Seaport Entertainment,” or “SEG” refers to Seaport Entertainment Group Inc. “Howard Hughes” or “HHH” refers to Howards Hughes Holdings Inc. “Jean-Georges,” “JGM,” or “JG” refers to Jean-Georges Restaurants. “NYSE” refers to the New York Stock Exchange. “Pershing Square” or “PSCM” refers to Pershing Square Capital Management, L.P. “Rights Offering” refers to the prospective $175 million rights offering transaction that is intended to be launched following the spin-off, of which $175 million will be backstopped by Pershing Square. “S” or “SOFR” refers to the Secured Overnight Financing Rate or “USD-SOFR” as defined in the 2006 ISDA Derivatives Definitions, as published by the International Swaps and Derivatives Association, Inc., as amended, supplemented or modified from time to time. “Seaport,” “Seaport District NYC,” “Seaport Neighborhood” or “Seaport District” refers to the approximately 478,000 square feet of restaurant, retail, office and entertainment properties and 21 residential units that makeup the Seaport in Lower Manhattan. “Spin-Off” refers to the pro rata distribution of the shares of Seaport Entertainment Group Inc. to the Seaport Entertainment Group Inc. shareholders in a distribution that is intended to be tax-free to HHH stockholders for U.S. federal income tax purposes except for cash received in lieu of fractional shares. 25

From New York City to the las Vegas strip. Built for excitement. Built to inspire.