As filed with the U.S. Securities and Exchange Commission on February 13, 2025

Registration No. 333-281225

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Pre-Effective Amendment No. 4

to

FORM F-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

RYOJBABA CO., LTD.

(Exact name of registrant as specified in its charter)

Not Applicable

(Translation of registrant’s name into English)

| Japan | | 8742 | | Not Applicable |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

RYOJBABA CO., LTD.

4-3-1, Ohashi, Minami-Ku

Fukuoka-Shi, Fukuoka, 815-0033, Japan

Telephone: +81 (92) 553-0344

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

Telephone: (800) 221-0102

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Laura Anthony, Esq. Craig D. Linder, Esq. Anthony, Linder & Cacomanolis, PLLC 1700 Palm Beach Lakes Blvd., Suite 820 West Palm Beach, Florida 33401 Telephone: (561) 514-0936 | | Louis A. Bevilacqua, Esq.

Bevilacqua PLLC

1050 Connecticut Avenue, NW, Suite 500

Washington, DC 20036

Telephone: (202) 869-0888 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant files a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement becomes effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This preliminary prospectus does not constitute an offer to sell or a solicitation of an offer to purchase securities in any jurisdiction where offer or sale is not authorized.

| PRELIMINARY PROSPECTUS | | SUBJECT TO COMPLETION | | DATED FEBRUARY 13, 2025 |

RYOJBABA CO., LTD.

1,250,000 Common Shares

We are offering 1,250,000 common shares, no par value. This is our initial public offering. Prior to the offering, there has been no public market for our common shares. We expect the initial public offering price to be between $4.00 and $5.00 per share. For purposes of this prospectus, the assumed initial public offering price per share is $4.00, the low-end of the anticipated price range.

We are also seeking to register (i) warrants to purchase 87,500 common shares (or warrants to purchase 100,625 common shares if the underwriters exercise the over-allotment option in full) (the “Representative’s Warrants”), being issued to the representative of the underwriters (the “Representative”) in connection with the offering, as well as (ii) 87,500 common shares (or 100,625 common shares if the underwriters exercise the over-allotment option in full) issuable upon exercise of the Representative’s Warrants at an exercise price of $4.00 per share (100% of the assumed initial public offering price).

We intend to apply to list our common shares on the NYSE American (the “NYSE American”) or The Nasdaq Capital Market (the “Nasdaq”) under the symbol “RYOJ”. We believe that upon the completion of the offering contemplated by this prospectus, we will meet the standards for listing on the NYSE American or the Nasdaq. We cannot guarantee that we will be successful in listing our common shares on the NYSE American or the Nasdaq; however, we will not complete this offering unless we are so listed.

Currently, Ryoji Baba, our Chief Executive Officer and a member of our board of directors, beneficially owns a total of 8,024,000 common shares, which represents approximately 80.2% of the voting power of our outstanding common shares, directly and indirectly through Miracle Exploration Technologies Limited. Following this offering, Mr. Baba will control approximately 71.3% of the voting power of our outstanding common shares if all the common shares in this offering are sold (or 70.2% of our outstanding voting power if the underwriters’ option to purchase additional shares is exercised in full). As a result of his voting power, he will be able to control any action requiring the general approval of our shareholders, including the election of our board of directors, the adoption of amendments to our articles of incorporation and the approval of any merger or sale of substantially all of our assets. If we are approved to list our common shares on the NYSE American or the Nasdaq, we will be a “controlled company” as defined in Section 801(a) of the NYSE American or Rule 5615(c)(1) of the Nasdaq listing standards because more than 50% of our voting power will be held by Mr. Baba after the offering. As a “controlled company,” we are exempt by Section 801(a) of the NYSE American or Rule 5615(c)(2) of the Nasdaq listing standards from the requirements of Sections 802(a), 804, and 805 of the NYSE American or Rule 5605(b), (d) and (e) of the Nasdaq listing standards that would otherwise require us to have (i) a majority of the board of directors consist of “independent” directors under the listing standards of the NYSE American or the Nasdaq, (ii) a nominating/corporate governance committee composed entirely of independent directors and a written nominating/corporate governance committee charter meeting the requirements of the NYSE American or the Nasdaq, and (iii) a compensation committee composed entirely of independent directors and a written compensation committee charter meeting the requirements of the NYSE American or the Nasdaq. Consequently, we are exempt from independent director requirements of Sections 802(a), 804, and 805 of the NYSE American or Rule 5605(b), (d) and (e) of the Nasdaq listing standards, except for the requirements under Section 802(c) of the NYSE American or Rule 5605(b)(2) of the Nasdaq thereof pertaining to executive sessions of independent directors and those under Section 803(B)(2) of the NYSE American or Rule 5605(c)(2)(A) of the Nasdaq pertaining to the Audit Committee. Accordingly, you may not have the same protections afforded to stockholders of companies that are subject to all of the corporate governance requirements of the NYSE American or the Nasdaq. See “Prospectus Summary—Implications of Being a Controlled Company.”

We are an “emerging growth company” under the federal securities laws and, as such, we have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings. See “Prospectus Summary— Implications of Being an Emerging Growth Company and a Foreign Private Issuer.”

Investing in our common shares involves a high degree of risk. Before purchasing any shares, potential investors should carefully read the discussion of the material risks of investing in our common shares under the heading “Risk Factors” beginning on page 13 of this prospectus.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or recognized the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| | | Per share | | | Total | |

| Public offering price | | $ | [●] | | | $ | [●] | |

| Underwriting discounts and commissions (1) | | $ | [●] | | | $ | [●] | |

| Proceeds, before expenses, to us | | $ | [●] | | | $ | [●] | |

| (1) | Does not include a non-accountable expense allowance equal to 1% of the gross proceeds of this offering payable to Webull Financial LLC, the Representative of the underwriters. We have also agreed to issue warrants to the Representative. We have also agreed to reimburse the Representative for certain accountable expenses. See “Underwriting” beginning on page 127 of this prospectus for additional information regarding the compensation payable to the underwriters. |

We have granted a 45-day option to the underwriters to purchase up to 187,500 additional common shares solely to cover over-allotments, if any. If the underwriters exercise the option in full, the total underwriting cash discounts and commissions payable by us will be $402,500, and the total proceeds to us, before expenses, will be $4,597,500.

Delivery of the common shares is expected to be made on or about [●], 2025.

The date of this prospectus is , 2025

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by us. Neither we nor the underwriters have authorized anyone to provide you with information that is different, and neither we nor the underwriters take any responsibility for, and provide any assurance as to the reliability of, any information, other than the information in this prospectus and any free writing prospectus prepared by us. We are offering to sell our common shares, and seeking offers to buy our common shares, only in jurisdictions where such offers and sales are permitted. This prospectus is not an offer to sell, or a solicitation of an offer to buy, our common shares in any jurisdiction where, or under any circumstances under which, the offer, sale, or solicitation is not permitted. The information in this prospectus and in any free writing prospectus prepared by us is accurate only as of the date on its respective cover, regardless of the time of delivery of this prospectus or any free writing prospectus or the time of any sale of our common shares. Our business, results of operations, financial condition, or prospects may have changed since those dates.

Before you invest in our common shares, you should read the registration statement (including the exhibits thereto and the documents incorporated by reference therein) of which this prospectus forms a part.

For investors outside of the United States: Neither we nor the underwriters have done anything that would permit this offering, or the possession or distribution of this prospectus, in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about, and observe any restrictions relating to, this offering and the distribution of this prospectus.

Notice to prospective investors in Japan: Our common shares have not been and will not be registered pursuant to Article 4, Paragraph 1 of the Financial Instruments and Exchange Act. Accordingly, none of our common shares nor any interest therein may be offered or sold, directly or indirectly, in Japan or to, or for the benefit of, any “resident” of Japan (which term as used herein means any person resident in Japan, including any corporation or other entity organized under the laws of Japan), or to others for re-offering or resale, directly or indirectly, in Japan or to or for the benefit of a resident of Japan, except pursuant to an exemption from the registration requirements of, and otherwise in compliance with, the Financial Instruments and Exchange Act and any other applicable laws, regulations, and ministerial guidelines of Japan in effect at the relevant time.

Cautionary Note Regarding Forward-Looking Statements

This prospectus contains forward-looking statements that reflect our current expectations and views of future events, all of which are subject to risks and uncertainties. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. You can find many (but not all) of these statements by the use of words such as “approximates,” “believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,” “intends,” “plans,” “will,” “would,” “should,” “could,” “may” or other similar expressions in this prospectus. These statements are likely to address our growth strategy, financial results, and product and development programs. You must carefully consider any such statements and should understand that many factors could cause actual results to differ from our forward-looking statements. These factors may include inaccurate assumptions and a broad variety of other risks and uncertainties, including some that are known and some that are not. No forward-looking statement can be guaranteed, and actual future results may vary materially. Factors that could cause actual results to differ from those discussed in the forward-looking statements include, but are not limited to:

| | ● | the size and growth potential of the markets for our products or services, and our ability to serve those markets; |

| | | |

| | ● | the rate and degree of market acceptance of our products or services; |

| | | |

| | ● | our ability to expand our sales organization to address effectively existing and new markets that we intend to target; |

| | | |

| | ● | impact from future regulatory, judicial, and legislative changes or developments in the U.S. and foreign countries; |

| | | |

| | ● | our ability to compete effectively in a competitive industry; |

| | | |

| | ● | our ability to obtain funding for our operations and our future financial performance; |

| | | |

| | ● | our ability to attract collaborators and strategic partnerships; |

| | | |

| | ● | our ability to continue to meet the NYSE American or the Nasdaq requirements; |

| | | |

| | ● | our ability to meet our other financial operating objectives; |

| | | |

| | ● | the availability of qualified employees for our business operations; |

| | | |

| | ● | general business and economic conditions; |

| | | |

| | ● | our ability to meet our financial obligations as they become due; |

| | | |

| | ● | positive cash flows and financial viability of our operations and new business opportunities; |

| | | |

| | ● | ability to secure intellectual property rights over our proprietary services; |

| | | |

| | ● | our ability to be successful in new markets; |

| | | |

| | ● | ability to respond and adapt to changes in technology and customer behavior; |

| | | |

| | ● | ability to develop, maintain and enhance a strong brand; |

| | | |

| | ● | our ability to avoid infringement of intellectual property rights; and |

| | | |

| | ● | other risks and uncertainties indicated in this prospectus, including those under “Risk Factors.” |

We describe certain material risks, uncertainties, and assumptions that could affect our business, including our financial condition and results of operations, under “Risk Factors.” We base our forward-looking statements on our management’s beliefs and assumptions based on information available to our management at the time the statements are made. We caution you that actual outcomes and results may, and are likely to, differ materially from what is expressed, implied, or forecast by our forward-looking statements. Accordingly, potential investors should be careful about relying on any forward-looking statements. Except as required under the federal securities laws, we do not have any intention or obligation to update publicly any forward-looking statements after the distribution of this prospectus, whether as a result of new information, future events, changes in assumptions, or otherwise.

ABOUT THIS PROSPECTUS

As used in this prospectus, unless the context otherwise requires or otherwise states, references to the “Company,” “we,” “us,” “our,” and similar references refer to rYojbaba Co., Ltd., a joint stock corporation with limited liability organized under the laws of Japan, and its subsidiaries.

Our functional currency is the Japanese yen (which we refer to as “¥”). Our reporting currency is the U.S. dollar. The terms “$” refer to U.S. dollars, the legal currency of the United States. Consistent with ASC 830, the reporting currency is converted at the following rates:

| ($1 = ¥) | | December 31, 2023 | | | December 31, 2022 | | | December 31, 2021 | | June 30, 2023 | | June 30, 2024 |

| Current JPY: US$1 exchange rate | | ¥ | 141.83 | | | ¥ | 132.70 | | | ¥ | 115.17 | | ¥ | 144.99 | | ¥ | 161.07 |

| Average JPY: US$1 exchange rate | | ¥ | 140.67 | | | ¥ | 131.62 | | | ¥ | 109.90 | | ¥ | 135.00 | | ¥ | 152.36 |

We make no representation that the Japanese yen or U.S. dollar amounts referred to in this prospectus could have been or could be converted into U.S. dollars or Japanese yen, as the case may be, at any particular rate or at all.

Our financial statements are prepared in accordance with U.S. generally accepted accounting principles (which we refer to as “U.S. GAAP”). Our fiscal year ends on December 31 of each year as does our reporting year. Therefore, any references to 2023 and 2022 are references to the fiscal and reporting years ended December 31, 2023 and 2022, respectively. Our most recent fiscal year ended on December 31, 2023. See Note 2 in our audited consolidated financial statements as of and for the years ended December 31, 2023 and 2022, included elsewhere in this prospectus for a discussion of the basis of presentation of financial statements.

We have made rounding adjustments to some of the figures included in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that precede them.

NON-GAAP FINANCIAL MEASURES

In addition to U.S. GAAP measures, we also use EBITDA and EBITDA Margin, as described under “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Non-GAAP Financial Measures”, in various places in this prospectus. These financial measures are presented as supplemental disclosure and should not be considered in isolation of, as a substitute for, or superior to, the financial information prepared in accordance with U.S. GAAP, and should be read in conjunction with our consolidated financial statements and the notes thereto included elsewhere in this prospectus. EBITDA and EBITDA Margin may differ from similarly titled measures presented by other companies.

In preparing the consolidated financial statements in conformity with U.S. GAAP, management makes estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. These estimates are based on information as of the date of the consolidated financial statements. Significant estimates required to be made by management include, but are not limited to, the valuation of accounts receivable, useful lives of property and equipment, the recoverability of long-lived assets, provision necessary for contingent liabilities and implicit interest rate of operating leases and financing leases. Actual results could differ from those estimates.

Please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Operating Results” for a reconciliation of non-GAAP financial measures to the most directly comparable financial measure calculated in accordance with U.S. GAAP.

MARKET AND INDUSTRY DATA

This prospectus contains references to market data and industry forecasts and projections, which were obtained or derived from publicly available information, reports of governmental agencies, market research reports, and industry publications and surveys. These sources generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of that information is not guaranteed. Although we believe such information to be accurate, we have not independently verified the data from these sources. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and additional uncertainties and risks regarding the other forward-looking statements in this prospectus due to a variety of factors, including those described in the section entitled “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” and elsewhere in this prospectus. These and other factors could cause results to differ materially from those expressed in the forecasts and estimates.

TRADEMARKS AND COPYRIGHTS

We own or have rights to trademarks or trade names that we use in connection with the operation of our business, including our corporate names, logos, and website names. In addition, we own or have the rights to copyrights, trade secrets and other proprietary rights that protect the content of our products and the formulations for such products. This prospectus may also contain trademarks, service marks and trade names of other companies, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this prospectus is not intended to, and should not be read to, imply a relationship with or endorsement or sponsorship of us. Solely for convenience, some of the copyrights, trade names and trademarks referred to in this prospectus are listed without their ©, ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our copyrights, trade names and trademarks. All other trademarks are the property of their respective owners.

PROSPECTUS SUMMARY

This summary highlights certain information about us, this offering, and selected information contained in this prospectus and is qualified in its entirety by the more detailed information and financial statements and related notes included elsewhere in this prospectus. This summary is not complete and does not contain all of the information that potential investors should consider before deciding whether to invest in our common shares. For a more complete understanding of us and this offering, we encourage you to read and consider the more detailed information in this prospectus, including “Risk Factors,” Management’s Discussion and Analysis of Financial Condition and Results of Operation” and the financial statements and related notes. Unless the context otherwise requires, “rYojbaba,” the “Company,” “we,” “us,” and “our,” refer to rYojbaba Co., Ltd., a Japanese corporation, and its subsidiary, Sakai Seikotsuin Nishi Co., Ltd., a Japanese corporation (“Sakai”).

Company Overview

Our primary mission is to improve and restore physical and mental health diminished by work related stress through our consulting and health services. We believe that work-induced stress is a serious and growing problem as profits over people dominate all sectors of contemporary business culture.

We believe that work-related stress not only affects the health and well-being of individual employees, but also reduces employee productivity. This negative impact of work-related stress occurs when work demands exceed a person’s capacity and ability to meet those demands. We believe that the main work-related stressors include corporate culture, bad management practices, job content and demands, physical work environment, relationships at work, changes in management, lack of support, role conflict and trauma. Some of the factors that commonly cause work-related stress include long hours, heavy workload, changes within the company, tight deadlines, changes to duties, job insecurity, insufficient compensation, lack of autonomy, boring work, insufficient skills for the job, over-supervision, inadequate working environment, lack of proper resources, lack of equipment, few promotional opportunities, harassment, discrimination, and poor relationships with colleagues or bosses.

The signs or symptoms of work-related stress can be physical, psychological, and behavioral. Physical symptoms include fatigue, muscular tension, headaches, heart palpitations, sleeping difficulties, such as insomnia, gastrointestinal upsets, such as diarrhea or constipation, and dermatological disorders. Psychological symptoms include depression, anxiety, discouragement, irritability, pessimism, feelings of being overwhelmed and unable to cope, and cognitive difficulties, such as a reduced ability to concentrate or make decisions. Behavioral symptoms include an increase in sick days or absenteeism, aggression, diminished creativity and initiative, a decline in work performance, problems with interpersonal relationships, mood swings and irritability, lower tolerance of frustration and impatience, disinterest, and isolation.

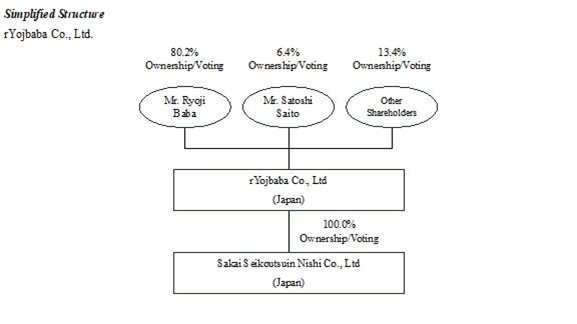

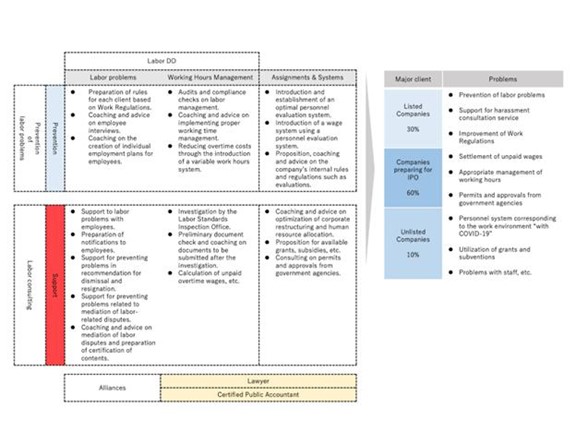

We are engaged in two primary businesses in Japan:

| | (1) | Consulting Services. We provide labor and corporate consulting services to foster constructive employment relationships between companies and their employees. More specifically, we provide consulting services to labor unions as well as to companies wishing to build constructive relationships with labor unions. We provide consulting services to (i) labor unions to increase their membership rate, (ii) companies to support the practice of whistleblowing and stress checks, and (iii) both companies and labor unions to resolve disputes in a constructive manner. |

| | | |

| | (2) | Health Services. As of February 13, 2025, we provide health services through 28 osteopathic clinics and two osteopathic beauty salons to alleviate physical ailments primarily created by work related stress. We directly operate all of our clinics and salons (no clinics or salons are franchised as of the date of this prospectus). |

For the fiscal years ended December 31, 2023 and 2022, we generated revenues of $10,963,365 (87% attributable to health services and 13% attributable to consulting services) and $10,486,584 (96% attributable to health services and 4% attributable to consulting services), respectively, we reported net income of $770,571 and net loss of ($452,546), respectively, and cash flow from operating activities of $388,989 and $1,166,433, respectively. For the six months ended June 30, 2024, we generated revenues of $5,196,844 (81% attributable to health services and 19% attributable to consulting services), net income of $398,528, and net cash provided in operating activities of $411,823. As stated in the unaudited consolidated financial statements, as of June 30, 2024, we had retained earnings of $693,728.

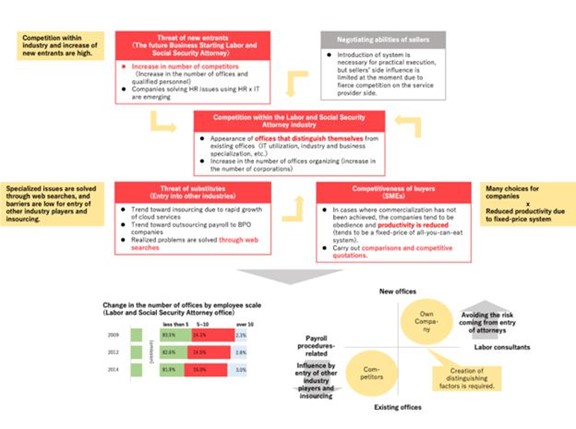

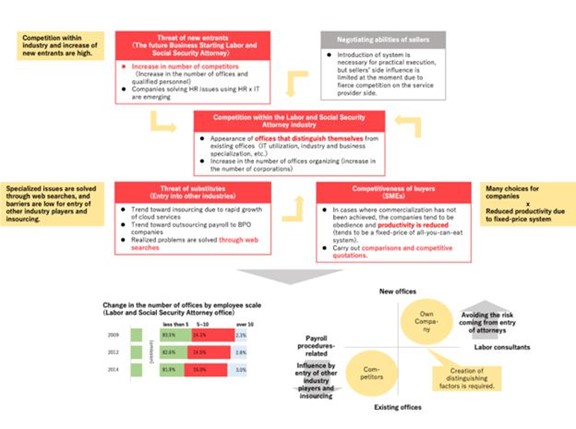

Labor Industry

Labor rights are an important social issue due to the historical vulnerability of the status and authority of the labor class. Labor unions strive to bring economic justice to the workplace by representing the collective interests of workers in negotiations with employers. However, labor unions in Japan have struggled with a gradual decline in membership in the past few decades. The overall unionization rate hit a low of 16.3% in 2023, with membership at 12.4% for women and 8.4% for part-time workers. We believe Japan’s labor unions have not been successful because they do not have enough members, legislators have not passed effective laws, and the Japanese courts have historically supported the business owners.

The results of an online survey on labor unions, conducted by the Japanese Trade Union Confederation (Rengō) in late October 2022, implicitly shows that a majority of working people in Japan do not view labor unions as organizations that can help them. The online survey was based on 2,000 valid responses from individuals aged 15 or older nationwide. In response to the survey’s question about work-related dissatisfaction, the most common problem cited was low wages (32.9%), followed by poor coworker relations (18.1%) and uncertainty about the future of one’s company (16.0%). Approximately two out of three respondents were dissatisfied with their jobs in some way, while 32.0% said they had no particular complaint. When those who were dissatisfied with their workplace or job were asked what they had done to resolve the problem, the majority of them, at 58.9%, said they had done nothing. In other words, we believe that most continue to work with a sense of dissatisfaction. Among those who took action, 20.3% consulted with a family member and 15.1% consulted with the human resource department or a supervisor, while just 3.0% consulted a labor union.

In Japan, the term “black corporation,” which is a Japanese term for an exploitative employment system, began to be used in the late 2000s to refer collectively to companies that engage in activities that violate compliance with Labor Standards Act in Japan, such as extremely long working hours, nonpayment of overtime wages and salaries. This has now become a well-established term in Japanese society. Depression due to overtime work, death from overwork, nonpayment of overtime wages, various types of harassment in the workplace, and other such problems caused by harsh working environments and working conditions have become major social problems in Japan in recent years.

In 2018, the Japanese government passed an initiative entitled “Work Style Reform” aimed at “reducing long working hours”, “improving work efficiency”, “securing workforce” and “enabling flexible ways of working.” Pursuant to “Work Style Reform,” employees cannot be required to perform overtime exceeding 100 hours in any one month, or 80 hours or more averaged over a reference period of two to six months, or 720 hours a year.

However, as Japanese labor-related laws and regulations are complex and have a wide scope of application, and are frequently revised, dealing with these labor-related issues is getting more difficult for companies and labor unions. As such, we believe that the need for consulting services like ours, that provide appropriate knowledge on and solutions for labor problems and related laws, is expected to continue.

Our consulting services are led by our Chief Executive Officer, Ryoji Baba, a skilled and experienced Japanese Labor and Social Security Attorney and a Certified Administrative Procedures Legal Specialist. A Certified Administrative Procedures Legal Specialist is a person with national qualification who can file government licenses and permits, draft documents, and provide legal advice around such interactions as well as assist foreign nationals in all aspects of their lives in Japan, including residence, naturalization, study abroad, employment, marriage, and setting up a business. Mr. Baba specializes in various social insurance systems and administrative laws, with knowledge of Labor Laws in Japan. We believe that Mr. Baba’s knowledge and experience in labor laws gives us an advantage over other consulting companies.

Since October 2021, our Company has provided insightful and prompt consulting services to labor unions aiming to reach solutions that we believe are beneficial to labor unions, companies, and their employees. Ryoji Baba, our Chief Executive Officer, has been providing consulting services since January 2009. Accordingly, we believe that we have significant experience with the potential causes of problems that could occur among laborers. Furthermore, this experience has led to an increase in the number of customers seeking our corporate consulting services. As a result, we are able to assist in efforts to prevent and resolve problems between laborers and companies and contribute to the resulting improved productivity of our clients. We believe we have established a good reputation and maintain a strong relationship with the top executives of our clients due to the effectiveness of our consulting services to such clients, which in turn has led to high unit price consulting contracts (representative of the type of contracts found in our consulting service business) such as 300,000 yen per month.

Sometimes we receive “spot revenues” from clients (while we did not receive any spot revenues during years ended December 31, 2023 and 2022, we received $715,042 during the six months ended June 30, 2024) which are subsidies paid by the government to clients that have applied for subsidies upon the occurrence of social problems impacting the clients. The social problems that the Japanese government subsidies are targeting are the same problems as the labor rights our consulting services specialize in.

The types of Japanese government subsidies include: (1) a “career-up” subsidy targeted at addressing the disparity between permanent employees and temporary employees in their wages and treatment; (2) an employment adjustment subsidy targeted at helping companies maintain their employment levels during a business downturn due to economic crises, natural disasters, and pandemics; (3) a human resource development support subsidy targeted at addressing the lack of employees’ skills and knowledge and decreasing the inconsistency between employees’ skills and employers’ expectation; and (4) a business restructuring subsidy targeted at helping companies transform their business models in response to economic shifts and the impact of the COVID-19.

By supporting our customers and utilizing these subsidies, our clients can promote temporary employees and ensure stabilized employment, maintain employment levels even during a business downturn, enhance their employees’ skills and restructure their business models, with limited costs. We believe this ultimately leads to constructive employment relationships between companies and their employees, which is one of the main goals in our consulting services.

In addition to the application support and our advice on how to utilize them, we provide comprehensive strategies to solve the labor and management issues that our customers face. This allows our customers to improve their working environment, strengthen their competitiveness, and aim for sustainable growth.

The process through which our clients apply for and obtain Japanese government subsidies is as follows: (1) we assist our client in preparing and submitting an application to the government for such subsidy, (2) if the application is approved, the government notifies the client of the approval and sends the client the subsidy payment, (3) we submit an invoice to the client for our consulting services, and (4) the client pays remuneration for our service.

We believe the significant difference between our Company and our competitors is our ability to provide impartial services that are not tailored specifically to the employer or the employee. For example, typically a hired professional is expected to solve the issue only for its client, rather than provide a solution that addresses the concerns of all the parties involved, which only protects the rights of one party, the employee or the employer. Based on this understanding, we have developed consulting and other services that are beneficial for both the employer side (companies) and the employee side (labor unions). In other words, we believe we have substantial experience in providing consulting services to both employers and employees rather than specializing in either side. To clarify further, we do not provide consulting services to both parties at the same time as that would be a conflict of interest.

Osteopathic Industry

Osteopathy medicine is a system of medical practice that emphasizes a holistic and comprehensive approach to patient care and utilizes the manipulation of musculoskeletal tissues along with other therapeutic measures to prevent and treat injury and disease. Judo therapy is a form of osteopathic medicine practiced in Japan.

According to a 2022 survey by the Yano Economic Research Institute, the judo therapy, acupuncture, moxibustion and massage market is estimated to increase by 5.3% year-over-year to 968 billion yen in 2021, and the number of patients visiting osteopathic clinics has almost returned to the level before the COVID-19 pandemic.

The number of osteopathic clinics in Japan exceeded 50,000 in 2023; in 2000, the number was 24,500, and in just 20 years, the number of osteopathic clinics has almost doubled. In recent years, the number of osteopathic clinics increased by 287 clinics (0.6%) from 50,077 at the end of 2018 to 50,364 at the end of 2020. The reason for the increase in the number of osteopathic clinics is that the number of training schools for judo therapists increased from 25 in 2000 to 109 in 2015, which increased the number of fields in which nationally certified therapists could work.

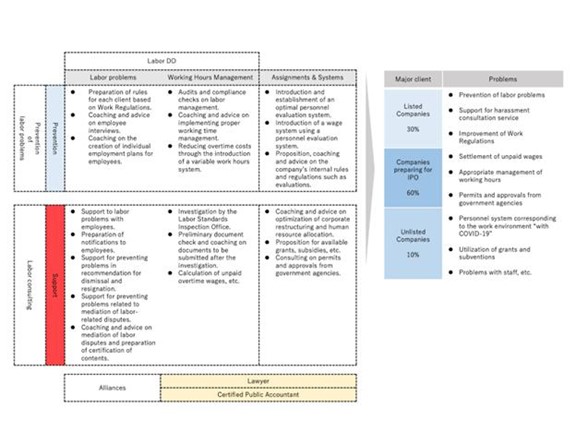

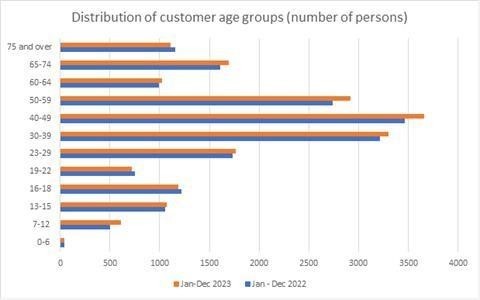

With the increase in the number of osteopathic clinics, differentiation has become important to attract customers. Since most of the customers attending osteopathic clinics are over 30 years old, we believe osteopathic clinic companies have been offering homogenized products according to their customer’s age, namely “posture improvement” menus. This product homogenization offered by our competitors is favorable to our Company, as we are providing tailor-made treatment menus to suit each individual and each individual symptom based on our knowledge and experience that we have accumulated over many years.

On January 5, 2015, Sakai Enterprise Co., Ltd. was founded by Masataka Sakai in Japan. The name of Sakai Enterprise Co., Ltd. was changed to Sakai Seikotsuin Co., Ltd. on October 1, 2019 and the name of Sakai Seikotsuin Co., Ltd. was changed to rYojibaba Co., Ltd. on October 22, 2021. On October 23, 2021, Ryoji Baba and other existing shareholders acquired all the issued and outstanding shares of rYojibaba Co., Ltd. from Mr. Sakai and the Company commenced its consulting business operations. In January 2022, rYojibaba Co., Ltd. acquired Sakai Seikotsuin Nishi Co., Ltd., which operates osteopathic clinics, from Mr. Sakai, who founded Sakai Seikotsuin Nishi Co., Ltd. in Japan on August 26, 2010. The name of rYojibaba Co., Ltd. was changed to rYojbaba Co., Ltd. on March 31, 2022. We currently directly operate 28 Sakai Seikotsuin osteopathic clinics and two Speed Kogao osteopathic beauty salons. We provide an extensive menu of treatments to alleviate pain and have gained a large number of individual clients. We also offer services to treat injuries and pain suffered by athletes. As a result, the range of client ages and the types of pain that can be addressed are wide, which we believe is different from the client groups of competitive companies. Of the 28 Sakai Seikotsuin osteopathic clinics currently operated by our wholly owned subsidiary Sakai Seikotsuin Nishi Co., Ltd., (i) four branch osteopathic clinics commenced operations during the period of 1989 to 2008, (ii) 15 branch osteopathic clinics commenced operations during the period of 2009 to 2018, and (iii) eight branch osteopathic clinics commenced operations during the period of 2019 to present. We believe the significant difference between our Company and other competitive companies is that we are able to serve a wide range of patients, from young to old, and from amateur athletes to professional athletes, because of the wealth of knowledge we have developed from integrative medicine.

As of February 13, 2025, our osteopathic clinics have a repeat customer rate of over 80%. During the fiscal year ended December 31, 2023, (i) the annual average number of visits is 22.1 times per customer (i.e., the aggregate number of annual visits of 457,376 divided by medical records of 20,738) and (ii) the number of unique customers who visited our osteopathic clinics only once (i.e., one-off customers) and were not repeat customers is 1,571. During the fiscal year ended December 31, 2022, (i) the annual average number of visits is 22.3 times per customer (i.e., the aggregate number of annual visits of 477,229 divided by medical records of 21,432) and (ii) the number of unique customers who visited our osteopathic clinics only once (i.e., one-off customers) and were not repeat customers is 1,786.

As of February 13, 2025, our beauty salons have a repeat customer rate of over 10%. During the fiscal year ended December 31, 2023, (i) the period average number of visits is 5.5 times per customer (i.e., the aggregate number of annual visits of 26,635 divided by medical records of 4,827) and (ii) the number of unique customers who visited our beauty salons only once (i.e., one-off customers) and were not repeat customers is 3,061. During the period from September 2022 (acquisition of the beauty salons) through December 31, 2022, (i) the period average number of visits is 4.5 times per customer (i.e., the aggregate number of annual visits of 10,699 divided by medical records of 2,390) and (ii) the number of unique customers who visited our beauty salons only once (i.e., one-off customers) and were not repeat customers is 948.

Although we have no franchisee osteopathic clinics or franchisee beauty salons as of February 13, 2025, we intend to develop a franchise business as to osteopathic clinics and beauty salons in the future.

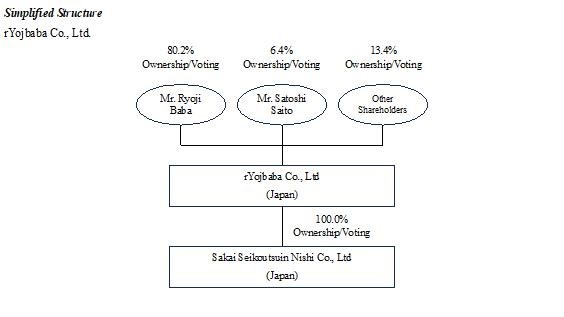

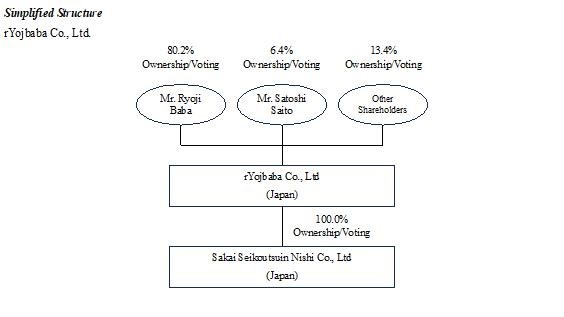

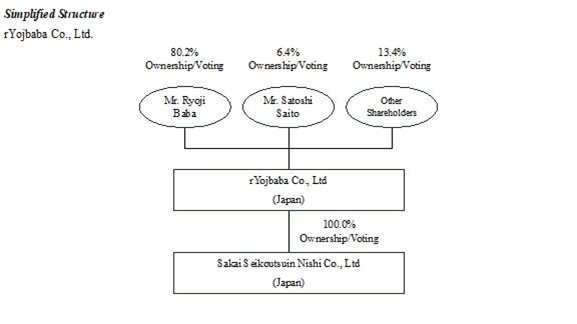

Organizational Structure

The following diagram reflects our current organizational structure as of the date of this prospectus:

* “Other Shareholders” include 27 other existing shareholders. Mr. Baba, Mr. Saito, and the Other Shareholders own 8,024,000 common shares, 640,000 common shares and 1,336,000 common shares, shares, respectively.

Strengths

Labor and Consulting Services

We believe our strengths within our labor and corporate consulting services business are as follows:

(1) Our profitable labor consulting services has a high customer retention rate, which reduces our advertising and other costs;

(2) Our strong relationship with CEOs, CFOs or the other upper management level employees of each client;

(3) Our knowledge of and experience in identifying the causes of potential problems among laborers, results in consulting contracts at higher unit prices;

(4) We assist in the formation of labor unions without union dues, which reduces the financial burden on the members, resulting in higher membership rates;

(5) We developed and launched new consulting services, through which we consult on whistleblower systems and conduct stress checks; and

(6) We provide services that contribute to the activities of both companies and labor unions.

Osteopathic Services

We believe our strengths within our osteopathic services business are as follows:

(1) Long standing business;

(2) Multifaceted approach to medical treatment; and

(3) Applying osteopathic techniques to beauty treatments.

Our Strategies

Consulting Services

We are pursuing the following strategies to grow our consulting services business:

(1) Offering more consulting services to employers and employees;

(2) Growing our customer base;

(3) Expanding our consulting business through IT platform implementation;

(4) Strengthening our foundation to serve more customers by hiring additional consultants and administrative staff; and

(5) Opportunistically pursuing strategic acquisitions.

Osteopathic Services

We are pursuing the following strategies to grow our osteopathic services business:

(1) Expanding stores nationwide;

(2) Promoting franchising and overseas expansion through business packaging;

(3) Managing cost optimization through operations improvement; and

(4) Selectively pursuing acquisitions.

Implications of Being an Emerging Growth Company and a Foreign Private Issuer

We are an “emerging growth company”, as defined in Section 2(a) of the Securities Act of 1933, as amended (which we refer to as the “Securities Act”), as modified by the Jumpstart Our Business Startups Act of 2012 (which we refer to as the “JOBS Act”). As such, we are eligible to take advantage of specified reduced reporting and other requirements that are otherwise applicable generally to reporting companies that make filings with the U.S. Securities and Exchange Commission (which we refer to as the “SEC”). For so long as we remain an emerging growth company, we will not be required to, among other things:

| | ● | present more than two years of audited financial statements and two years of related selected financial data and management’s discussion and analysis of financial condition and results of operations disclosure in our registration statement of which this prospectus forms a part; |

| | | |

| | ● | have an auditor report on our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002 (which we refer to as the “Sarbanes-Oxley Act”); |

| | | |

| | ● | disclose certain executive compensation related items; and |

| | | |

| | ● | seek shareholder non-binding advisory votes on certain executive compensation matters and golden parachute arrangements, to the extent applicable to our Company as a foreign private issuer. |

The JOBS Act also permits emerging growth companies to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(2) of the JOBS Act. This election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result, our financial statements may not be comparable to companies that comply with public company effective dates.

We will remain an emerging growth company until the earlier of (i) the last day of the fiscal year following the fifth anniversary of the completion of this offering, (ii) the last day of the fiscal year during which we have total annual gross revenue of at least $1.235 billion, (iii) the date on which we are deemed to be a “large accelerated filer” under the Securities Exchange Act of 1934, as amended (which we refer to as the “Exchange Act”), which means the market value of our common shares that are held by non-affiliates exceeds $700.0 million as of the last business day of our most recently completed second fiscal quarter, and (iv) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three- year period.

In addition, we report in accordance with SEC rules and regulations applicable to a “foreign private issuer.” As a foreign private issuer, we will take advantage of certain provisions under the rules that allow us to follow the laws of Japan for certain corporate governance matters. Even when we no longer qualify as an emerging growth company, as long as we continue to qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

| | ● | the sections of the Exchange Act regulating the solicitation of proxies, consents, or authorizations with respect to a security registered under the Exchange Act; |

| | | |

| | ● | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and other specified information, and current reports on Form 8-K upon the occurrence of specified significant events; and |

| | | |

| | ● | Regulation Fair Disclosure (which we refer to as “Regulation FD”), which regulates selective disclosures of material information by issuers. |

As a foreign private issuer, we have four months after the end of each fiscal year to file our annual report on Form 20-F with the SEC. In addition, our executive officers, directors, and principal shareholders are exempt from the requirements to report transactions in our equity securities and from the short-swing profit liability provisions contained in Section 16 of the Exchange Act.

Foreign private issuers, like emerging growth companies, are exempt from certain more stringent executive compensation disclosure rules. As such, even when we no longer qualify as an emerging growth company, as long as we continue to qualify as a foreign private issuer under the Exchange Act, we will continue to be exempt from the more stringent compensation disclosures required of public companies that are not a foreign private issuer.

We may take advantage of these exemptions until such time as we are no longer a foreign private issuer. We are required to determine our status as a foreign private issuer on an annual basis at the end of our second fiscal quarter. We would cease to be a foreign private issuer at such time as more than 50% of our outstanding voting securities are held by U.S. residents and any of the following three circumstances applies:

| | (i) | the majority of our executive officers or directors are U.S. citizens or residents; |

| | | |

| | (ii) | more than 50% of our assets are located in the United States; or |

| | | |

| | (iii) | our business is administered principally in the United States. |

In this prospectus, we have taken advantage of certain of the reduced reporting requirements as a result of being an emerging growth company and a foreign private issuer. Accordingly, the information that we provide in this prospectus may be different than the information you may receive from other public companies in which you hold equity interests. If some investors find our securities less attractive as a result, there may be a less active trading market for our securities and the prices of our securities may be more volatile.

Implications of Being a Controlled Company

The “controlled company” exception to rules of the NYSE American or the Nasdaq provides that a company of which more than 50% of the voting power is held by an individual, group or another company, a “controlled company,” need not comply with certain requirements of the corporate governance rules of the NYSE American or the Nasdaq. As of the date of this prospectus, Ryoji Baba, the Chief Executive Officer and a director of the Company, beneficially owned an aggregate of 8,024,000 common shares, which represents approximately 80.2% of the voting power of our outstanding common shares, directly and indirectly through Miracle Exploration Technologies Limited, a stock corporation incorporated in Micronesia. Following this offering, Mr. Baba will control approximately 71.3% of the voting power of our outstanding common shares if all the common shares in this offering are sold (or 70.2% of our outstanding voting power if the underwriters’ option to purchase additional shares is exercised in full). Accordingly, if we obtain listing on the NYSE American or the Nasdaq, we will be a “controlled company” within the meaning of the corporate governance rules of the NYSE American or the Nasdaq. Controlled companies are exempt from the corporate governance rules of the NYSE American or the Nasdaq requiring that listed companies have (i) a majority of the board of directors consist of “independent” directors under the listing standards of the NYSE American or the Nasdaq, (ii) a nominating/corporate governance committee composed entirely of independent directors and a written nominating/corporate governance committee charter meeting the requirements of the NYSE American or the Nasdaq, and (iii) a compensation committee composed entirely of independent directors and a written compensation committee charter meeting the requirements of the NYSE American or the Nasdaq. We currently utilize and presently intend to continue to utilize these exemptions. As a result, we may not have a majority of independent directors, our nomination and corporate governance committee and compensation committee may not consist entirely of independent directors and such committees may not be subject to annual performance evaluations. Accordingly, you may not have the same protections afforded to shareholders of companies that are subject to all of the corporate governance requirements of the NYSE American or the Nasdaq. See also “Management – Foreign Private Issuer Status and Controlled Company Exemption.”

Corporate Information

On January 5, 2015, Sakai Enterprise Co., Ltd. was founded by Masataka Sakai in Japan. The name of Sakai Enterprise Co., Ltd. was changed to Sakai Seikotsuin Co., Ltd. on October 1, 2019 and the name of Sakai Seikotsuin Co., Ltd. was changed to rYojibaba Co., Ltd. on October 22, 2021. On October 23, 2021, Ryoji Baba and other existing shareholders acquired all the issued and outstanding shares of rYojibaba Co., Ltd. from Mr. Sakai and the Company commenced its consulting business operations. In January 2022, rYojibaba Co., Ltd. acquired Sakai Seikotsuin Nishi Co., Ltd., which operates osteopathic clinics, from Mr. Sakai, who founded Sakai Seikotsuin Nishi Co., Ltd. in Japan on August 26, 2010. The name of rYojibaba Co., Ltd. was changed to rYojbaba Co., Ltd. on March 31, 2022. Of the 28 Sakai Seikotsuin osteopathic clinics currently operated by our wholly owned subsidiary Sakai Seikotsuin Nishi Co., Ltd., the oldest clinic was founded by Mr. Sakai in 1989 in Fukuoka City. Our agent for service of process in the United States is Cogency Global Inc. located at 122 East 42nd Street, 18th Floor, New York, NY 10168. Our principal place of business is located on the 4-3-1, Ohashi, Minami-Ku, Fukuoka-Shi, Fukuoka, 815-0033, Japan, and our telephone number is +81 (92) 553-0344. Our website is https://ryojbaba.com. Information on our website or accessible via our website is not reflected in this prospectus and is not part of this prospectus. Any information on our website should not be considered part of this prospectus. The address of our website is included in this prospectus for informational purposes only.

THE OFFERING

| Issuer: | | rYojbaba Co., Ltd. |

| | | |

| Securities offered by us: | | 1,250,000 common shares (or up to 1,437,500 shares if the underwriters exercise the over-allotment option in full) based on an assumed initial public offering price per share of $4.00, the low-end of the anticipated price range. |

| | | |

| Public offering price: | | For purposes of this prospectus, the assumed initial public offering price per common share is $4.00 (which is the low-end of the price range set forth on the cover page of this prospectus). The actual offering price per common share will be determined between the underwriters and us based on market conditions at the time of pricing. Therefore, the assumed public offering price used throughout this prospectus may not be indicative of the final offering price. |

| | | |

| Over-allotment option: | | We have granted to the underwriters an option to purchase up to an additional 187,500 common shares (15% of the number of common shares sold in this offering) exercisable solely to cover over-allotments, if any, at the applicable public offering price less the underwriting discounts and commissions shown on the cover page of this prospectus. The underwriters may exercise this option in full or in part at any time and from time to time until 45 days after the date of this prospectus. |

| | | |

| Common shares outstanding before this offering: | | 10,000,000 common shares(1) |

| | | |

| Common shares expected to be outstanding immediately after this offering: | | 11,250,000 common shares (or 11,437,500 common shares if the underwriters exercise in full their option to purchase additional common shares). |

| | | |

| Controlled Company: | | Following this offering, Ryoji Baba will control approximately 71.3% of the voting power of our outstanding capital stock if all the common shares being offered in this offering are sold (or 70.2% of our outstanding voting power if the underwriters’ option to purchase additional shares is exercised in full). As a result, if we obtain listing on the NYSE American or the Nasdaq, we will be a “controlled company” under the NYSE American or the Nasdaq corporate governance standards. Under these standards, a company of which more than 50% of the voting power is held by an individual, group or another company is a “controlled company” and may elect not to comply with certain corporate governance standards. See “Management – Board Committees and Director Independence - Controlled Company and Director Independence”. |

| | | |

| Representative’s Warrants: | | The registration statement of which this prospectus is a part also registers for sale warrants to purchase 87,500 common shares (7.0% of the common shares sold in this offering) to be issued to Webull Financial LLC as Representative of the underwriters (referred to in this prospectus as the Representative) and/or its affiliates (or warrants to purchase 100,625 common shares if the underwriters exercise the over-allotment option in full) and the common shares issuable upon exercise of such warrants, as a portion of the underwriting compensation payable in connection with this offering. The Representative’s Warrants will be exercisable at any time, and from time to time, in whole or in part, commencing from the closing of the offering and expiring five (5) years from the effectiveness of the registration statement, at an exercise price of $4.00 (100% of the assumed public offering price of the common shares). Please see “Underwriting— Representative’s Warrants” for a description of these warrants. |

| Use of proceeds: | | We expect to receive net proceeds from this offering of $3,894,210 (or $4,584,210 if the underwriters exercise the over-allotment option in full) after deducting estimated underwriting discounts and commissions of $350,000 (or $402,500 if the underwriters exercise the over-allotment option in full) (7.0% of the gross proceeds of the offering) and after our offering expenses, estimated at $755,790 (or $763,290 if the underwriters exercise the over-allotment option in full). We intend to use the net proceeds from this offering to fund working capital and general corporate purposes, which may include implementation and development of an information technology (IT) platform for our labor consulting services, hiring of additional consultants and an expansion abroad of consulting business as well as an expansion of our osteopathic clinics and osteopathic beauty salons through mergers and acquisitions and franchising. See “Use of Proceeds.” |

| | | |

| Risk factors: | | See “Risk Factors” beginning on page 13 of this prospectus for a discussion of some of the factors you should carefully consider before deciding to invest in our common shares. |

| | | |

| Listing: | | We intend to apply to list our common shares on the NYSE American or the Nasdaq under the symbol “RYOJ”. There is no assurance that our listing application will be approved by the NYSE American or the Nasdaq. The approval of our listing on the NYSE American or the Nasdaq is a condition of closing. If our application to the NYSE American or the Nasdaq is not approved or we otherwise determine that we will not be able to secure the listing of the common shares on the NYSE American or the Nasdaq, we will not complete the offering. |

| | | |

| Lock-Ups: | | We, all of our directors and executive officers, and holders of our outstanding securities (or securities convertible into our common shares) have agreed not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our common shares or securities convertible into common shares without the prior written consent of the Representative for a period of twelve (12) months from the consummation of the offering, subject to certain limited exceptions. See “Underwriting—Lock-Up Agreements.” |

| | | |

| Dividend policy: | | We have not paid annual dividends to shareholders in the past. Following our public offering, the payment of future dividends on our common shares, if any, will be approved by our common shareholders at the annual meeting of the shareholders, or our board of directors only once during a business year, and will depend on many factors on which the common shareholders may determine not to do so. |

(1) Unless we indicate otherwise, all information in this prospectus:

| | ● | is based on 10,000,000 common shares issued and outstanding as of February 13, 2025; |

| | | |

| | ● | assumes no exercise by the underwriters of the option to purchase up to an additional 187,500 common shares to cover over-allotments, if any; |

| | | |

| | ● | excludes the number of common shares underlying 300,000 stock acquisition rights (with an exercise price of ¥1 ($0.01) per common share) equal to 3.0% of the issued and outstanding common shares on a fully diluted basis as of the day prior to the successful listing on the NYSE American or the Nasdaq, subject to adjustment as provided in the stock acquisition rights agreement; and |

| | | |

| | ● | excludes 100,625 common shares underlying the warrants to be issued to the Representative and/or its affiliates in connection with this offering (assuming the underwriters exercise the over-allotment option in full). |

SELECTED CONSOLIDATED FINANCIAL INFORMATION AND OPERATING DATA

The following tables set forth our selected consolidated financial information and operating data as of and for the years ended December 31, 2023 and 2022, and the six months ended June 30, 2024 and 2023. You should read the following selected consolidated financial information and operating data in conjunction with, and it is qualified in its entirety by reference to, our audited consolidated financial statements and the related notes thereto, and the sections entitled “Capitalization” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, each of which are included elsewhere in this prospectus.

Our selected consolidated statements of operations and comprehensive income information and operating data for the years ended December 31, 2023 and 2022, and our related selected consolidated balance sheets information as of December 31, 2023 and 2022, have been derived from our audited consolidated financial statements as of and for the years ended December 31, 2023 and 2022, prepared in accordance with U.S. GAAP, which are included elsewhere in this prospectus.

Our selected consolidated statements of operation and comprehensive income information and operating data for the six months ended June 30, 2024 and 2023, and our related selected consolidated balance sheets information as of June 30, 2024 have been derived from our unaudited consolidated financial statements for the six months ended June 30, 2024 and 2023, prepared in accordance with U.S. GAAP, which are included elsewhere in this prospectus.

Our historical results for the periods presented below are not necessarily indicative of the results to be expected for any future periods.

Consolidated statements of operations and comprehensive income information:

| | | Year Ended December 31, | |

| (In dollars) | | 2023($) | | | 2022($) | |

| | | | | | | |

| Revenues | | | 10,963,365 | | | | 10,486,584 | |

| Cost of revenues | | | 7,248,298 | | | | 8,415,630 | |

| Gross profit | | | 3,715,067 | | | | 2,070,954 | |

| | | | | | | | | |

| Operating expenses | | | | | | | | |

| Payroll expenses | | | 605,394 | | | | 745,005 | |

| General and administrative expenses | | | 1,695,164 | | | | 1,482,269 | |

| Depreciation and amortization | | | 39,320 | | | | 80,999 | |

| Rent and lease | | | 69,988 | | | | 63,333 | |

| Impairment on goodwill | | | - | | | | 245,667 | |

| Total operating expenses | | | 2,409,866 | | | | 2,617,273 | |

| | | | | | | | | |

| Income (loss) from operations | | | 1,305,201 | | | | (546,319 | ) |

| | | | | | | | | |

| Other income (expenses) | | | | | | | | |

| Interest income | | | 12,762 | | | | 8,268 | |

| Other income | | | 161,890 | | | | 69,290 | |

| Interest expenses | | | (92,930) | | | | (104,269 | ) |

| Total other income (expenses) | | | 81,722 | | | | (26,711 | ) |

| Loss before income taxes | | | 1,386,923 | | | | (573,030 | ) |

| Income tax benefit | | | 616,352 | | | | (120,484 | ) |

| Net income (loss) | | | 770,571 | | | | (452,546 | ) |

| Other comprehensive loss | | | (49,159) | | | | (167,960 | ) |

| Comprehensive income (loss) | | | 721,412 | | | | (620,506 | ) |

Consolidated balance sheets information:

| | | As of December 31, | |

| (In dollars) | | 2023($) | | | 2022($) | |

| | | | | | | |

| Cash and cash equivalents | | | 4,775,736 | | | | 5,433,190 | |

| Total assets | | | 18,001,363 | | | | 20,789,026 | |

| Working capital (1) | | | 1,910,026 | | | | 3,327,033 | |

| Total liabilities | | | 16,614,443 | | | | 20,123,518 | |

| Accumulated earnings (deficit) | | | 295,200 | | | | (475,371 | ) |

| Total shareholders’ equity | | | 1,386,920 | | | | 665,508 | |

Consolidated statements of operations and comprehensive income information:

| | | Six Months Ended June 30, (Unaudited) | |

| (In dollars) | | 2024($) | | | 2023($) | |

| | | | | | | |

| Revenues | | | 5,196,844 | | | | 5,951,953 | |

| Cost of revenues | | | 3,260,249 | | | | 3,643,110 | |

| Gross profit | | | 1,936,595 | | | | 2,308,843 | |

| | | | | | | | | |

| Operating expenses | | | | | | | | |

| Payroll expenses | | | 369,676 | | | | 330,781 | |

| General and administrative expenses | | | 911,057 | | | | 907,803 | |

| Depreciation and amortization | | | 13,460 | | | | 11,723 | |

| Rent and lease | | | 45,289 | | | | 45,738 | |

| Total operating expenses | | | 1,339,482 | | | | 1,296,045 | |

| | | | | | | | | |

| Income from operations | | | 597,113 | | | | 1,012,798 | |

| | | | | | | | | |

| Other income (expenses) | | | | | | | | |

| Interest income | | | 20 | | | | 23 | |

| Other income | | | 85,428 | | | | 134,007 | |

| Interest expenses | | | (40,812 | ) | | | (49,118 | ) |

| Total other income | | | 44,636 | | | | 84,912 | |

| Income before income taxes | | | 641,749 | | | | 1,097,710 | |

| Income tax expense | | | 243,221 | | | | 568,763 | |

| Net income | | | 398,528 | | | | 528,947 | |

| Other comprehensive loss | | | (187,222 | ) | | | (92,867 | ) |

| Comprehensive income | | | 211,306 | | | | 436,080 | |

Consolidated balance sheets information:

| | | Six Months Ended June 30, | |

| (In dollars) | | 2024($) | | | 2023($) | |

| | | | | | | |

| Cash and cash equivalents | | | 4,057,553 | | | | 4,383,164 | |

| Total assets | | | 15,361,184 | | | | 18,179,791 | |

| Working capital (1) | | | 1,271,506 | | | | 3,345,851 | |

| Total liabilities | | | 13,762,958 | | | | 17,078,203 | |

| Accumulated earnings | | | 693,728 | | | | 53,576 | |

| Total shareholders’ equity | | | 1,598,226 | | | | 1,101,588 | |

| (1) | Working capital (deficit) represents total current assets less total current liabilities. |

SUMMARY OF RISK FACTORS

Below is a summary of material risks, uncertainties and other factors that could have a material effect on the Company and its operations:

Risks Related to Our Company

| | ● | We may need to raise additional capital to meet our business requirements in the future, and such capital raising may be costly or difficult to obtain and could dilute current shareholders’ ownership interests. |

| | | |

| | ● | There is a risk that we will be a passive foreign investment company (which we refer to as “PFIC”) for the current or any future taxable year, which could result in material adverse U.S. federal income tax consequences if you are a U.S. holder. |

| | | |

| | ● | It may not be possible for investors to effect service of process within the United States upon all of our directors (except for Ferdinand Groenewald), corporate auditors and executive officers, or to enforce against us or those persons judgments obtained in U.S. courts predicated upon the civil liability provisions of the federal securities laws of the United States. |

| | | |

| | ● | Rights of shareholders under Japanese law may be different from rights of shareholders in other jurisdictions. |

| | | |

| | ● | Substantially all of our revenues are generated in Japan, but an increase of our international presence could expose us to fluctuations in foreign currency exchange rates, or a change in monetary policy may harm our financial results. |

| | | |

| | ● | Risks related to our expansion into new geographic markets could adversely affect our business, financial condition, and operating results. |

| | | |

| | ● | As a “foreign private issuer” we are permitted, and intend, to follow certain home country corporate governance and other practices instead of otherwise applicable SEC and the NYSE American or the Nasdaq requirements, which may result in less protection than is accorded to investors under rules applicable to domestic U.S. issuers. |

| | | |

| | ● | If we fail to obtain necessary funds for our operations, we will be unable to maintain and improve our services, other businesses, and technology, and we will be unable to develop and commercialize our services, other businesses, and technologies. |

| | | |

| | ● | We are exposed to the risk of natural disasters, unusual weather conditions, pandemic outbreaks such as COVID-19, political events, war, and terrorism that could disrupt business and result in lower sales, increased operating costs and capital expenditures. |

| | | |

| | ● | The COVID-19 pandemic may continue to adversely impact our operations, demand for our services and our operating results. |

Risks Related to Our Labor Consulting Business

| | ● | Our inability to retain our senior management team would be detrimental to the success of our labor consulting business. |

| | | |

| | ● | Our inability to hire and retain talented people in the labor consultancy industry where there is great competition for talent could have a serious negative effect on our prospects and results of operations. |

| | | |

| | ● | If we are unable to manage the growth of our labor consulting business successfully, we may not be able to sustain profitability. |

| | | |

| | ● | Our financial results could suffer if we are unable to achieve or maintain adequate utilization and suitable billing rates for our labor consultants. |

| | | |

| | ● | A significant portion of our revenues are derived from a limited number of clients, and our engagement agreements for our labor consulting services, including those related to our largest clients, are non-recurring and can be terminated by our clients with little or no notice and without penalty, which may cause our operating results to be unpredictable. |

| | ● | Our ability to maintain and attract new business depends upon our reputation, the professional reputation of our labor consultants and the quality of our services. |

| | | |

| | ● | The consulting services industry is highly competitive, and we may not be able to compete effectively. |

| | | |

| | ● | Additional hiring of labor consultants and any acquisitions of groups of labor consultants could disrupt our operations, increase our costs or otherwise harm our business. |

| | | |

| | ● | The profitability of our fixed-fee engagements with clients for our consulting services may not meet our expectations if we underestimate the cost of these engagements. |

| | | |

| | ● | Revenues from our performance-based engagements for our labor consulting services are difficult to predict, and the timing and extent of recovery of our costs is uncertain. |

| | | |

| | ● | Conflicts of interest could preclude us from accepting engagements thereby causing decreased utilization and revenues. |

| | | |

| | ● | Expanding our service offerings or number of offices may not be profitable. |

| | | |

| | ● | Our engagements could result in professional liability, which could be very costly and hurt our reputation. |

| | | |

Risks Related to Our Osteopathic Clinic and Osteopathic Beauty Salon Business

| | ● | We may not achieve our development goals as to our osteopathic clinic business, which could adversely affect our operations and financial results. |

| | | |

| | ● | We are actively expanding in Japan and potentially will expand into overseas markets our osteopathic clinic business, and we may be adversely affected if Japanese and global economic conditions and financial markets deteriorate. |

| | | |

| | ● | Our system-wide osteopathic clinic and osteopathic beauty salon base is geographically concentrated in the Kyusyu area of Japan, especially in Fukuoka Prefecture, and we could be negatively affected by conditions specific to that region. |

| | | |

| | ● | Our success depends substantially on the value of our brands. |

| | | |

| | ● | The failure to enforce and maintain our trademarks and protect our other intellectual property could materially adversely affect our business, including our ability to establish and maintain brand awareness. |

| | | |

| | ● | Changes in regulatory requirements, or in application of current regulatory requirements, to our osteopathic clinics and osteopathic beauty salons may have an adverse effect on our business and results of operations. |

| | | |

| | ● | We may suffer losses from liability or other claims if our clinic services cause harm to customers. |

| | | |

| | ● | If we or our prospective franchisees face labor shortages or increased labor costs as to our osteopathic clinics and osteopathic beauty salons, our results of operations and our growth could be adversely affected. |

| | | |

| | ● | Substantially all of our revenues are generated in Japan, but an increase of our international presence could expose us to fluctuations in foreign currency exchange rates, or a change in monetary policy may harm our financial results. |

| | ● | Contracts with customers under the age of 18, who are considered minors, may be terminated if we cannot obtain a consent from their parents or guardians. |

Risks Related to the Osteopathic Services Industry

| | ● | We are vulnerable to changes in consumer preferences and economic conditions that could harm our osteopathic clinic and osteopathic beauty salon business, financial condition, results of operations and cash flow. |

| | | |

| | ● | We may not be able to compete successfully with other osteopathic clinic businesses, which could materially and adversely affect our results of operations. |

| | | |

| | ● | Negative publicity could reduce sales at some or all of our osteopathic clinics and osteopathic beauty salons. |

| | | |

| | ● | We conduct business in a heavily regulated industry, and if we fail to comply with applicable healthcare laws and government regulations, we could incur financial penalties, become excluded from participating in government healthcare programs, be required to make significant operational changes or experience adverse publicity, which could harm our business. |

| | | |

| | ● | We are potentially subject to government regulations, and we may experience delays in obtaining required regulatory approvals, if required, to market our proposed businesses. |

| | | |

| | ● | Legislative or governmental administrative reforms to the reimbursement systems in Japan in a manner that significantly reduces reimbursement for our services could have a material adverse effect on our business, financial condition or results of operation. |

| | | |

| | ● | We may suffer losses from liability or other claims if our clinic services cause harm to customers. |

Risks Related to Our Indebtedness

| | ● | Our level of indebtedness could materially and adversely affect our business, financial condition and results of operations. |

| | | |

| | ● | Our outstanding debt agreements may limit our flexibility in operating and expanding our business. |

General Risk Factors

| | ● | We may face strong competition from other providers in our service areas, which could materially and adversely affect our results of operations. |

| | | |

| | ● | Litigation involving our Company may occur and affect our operation. |

| | | |

| | ● | Third party claims with respect to intellectual property assets, if decided against us, may result in competing uses or require adoption of new, non-infringing intellectual property, which may in turn adversely affect sales and revenues. |