Issuer Free Writing Prospectus dated December 6, 2024

Filed Pursuant to Rule 433 of the Securities Act of 1933, as amended

Relating to Preliminary Prospectus dated November 13, 2024

Registration Statement No. 333-283186

OneConstruction Group Limited Proposed Nasdaq Ticker: ONEG Investor Presentation December 2024

Note: See offering documents for further risks and disclosures. There is no guarantee that only a specific outcome will be ac hie ved. Investments maybe speculative, illiquid and there is a risk of loss. PRESENTATION DISCLAIMER This presentation related to the proposed public offering of ordinary shares with par value US $ 0 . 0001 per share (“Ordinary Shares”) of OneConstruction Group Limited (“we”, “us” or “our” or the “Company”) and highlights basic information about us and the offering . Due to its summary nature, it does not contain all of the information that you should consider before investing in our Ordinary Shares and should be read together with the registration statement on Form F - 1 (“Registration Statement”) we filed with the U . S . Securities and Exchange Commission (“SEC”) for the offering to which this presentation relates and may be accessed through the following web link : https : //www . sec . gov/Archives/edgar/data/ 2030834 / 000121390024097080 /ea 0210012 - 06 . htm The Registration Statement has not yet become effective . Before you invest, you should read the prospectus that forms a part of the Registration Statement (including the risk factors described therein) and other documents we have filed with the SEC in their entirety for more complete information about us and the offering . You may get these documents for free by visiting EDGAR on the SEC website at www . sec . gov . This presentation does not constitute an offer or invitation for the sale or purchase of securities or to engage in any other transaction with the Company or its affiliates . The information in this presentation is not targeted at the residents of any particular country or jurisdiction and is not intended for distribution to, or use by, any person in any jurisdiction or country where such distribution or use would be contrary to local law or regulation . This presentation contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry . This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates . In addition, projections, assumptions, and estimates of the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk . We undertake no duty to update such estimates .

Note: See offering documents for further risks and disclosures. There is no guarantee that only a specific outcome will be ac hie ved. Investments maybe speculative, illiquid and there is a risk of loss. FORWARD - LOOKING STATEMENTS This presentation includes forward - looking statements . All statements contained in this presentation other than statements of historical fact, including statements regarding our future results of operations and financial position, our business strategy and plans, and our objectives for future operations, are forward - looking statements . The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect” and similar words are intended to identify forward - looking statements . We have based these forward - looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short - term and long - term business operations and objectives, and financial needs . These forward - looking statements are subject to a number of risks, uncertainties and assumptions, including those described in the “Risk Factors” section in the Registration Statement . Moreover, we operate in a very competitive and rapidly changing environment . New risks emerge from time to time . It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward - looking statements we may make . In light of these risks, uncertainties and assumptions, the future events and trends discussed in this presentation may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward - looking statements . You should not rely upon the forward - looking statements as predictions of future events . The events and circumstances reflected in the forward - looking statements may not be achieved or occur . Although we believe that the expectations reflected in the forward - looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements . Except as required by applicable law, we undertake no duty to update any of these forward - looking statements after the date of this presentation or to confirm these statements to actual results of revised expectations .

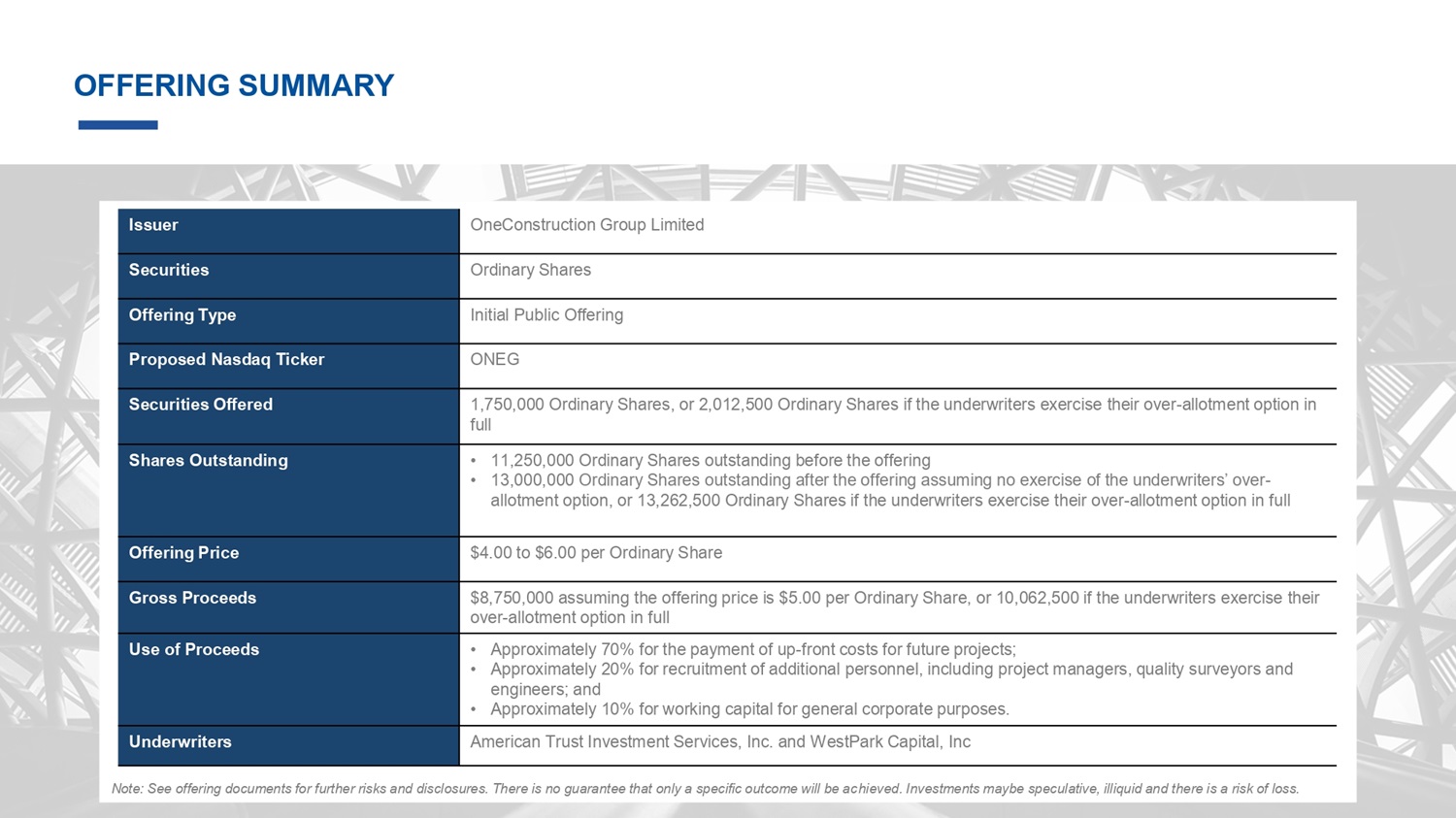

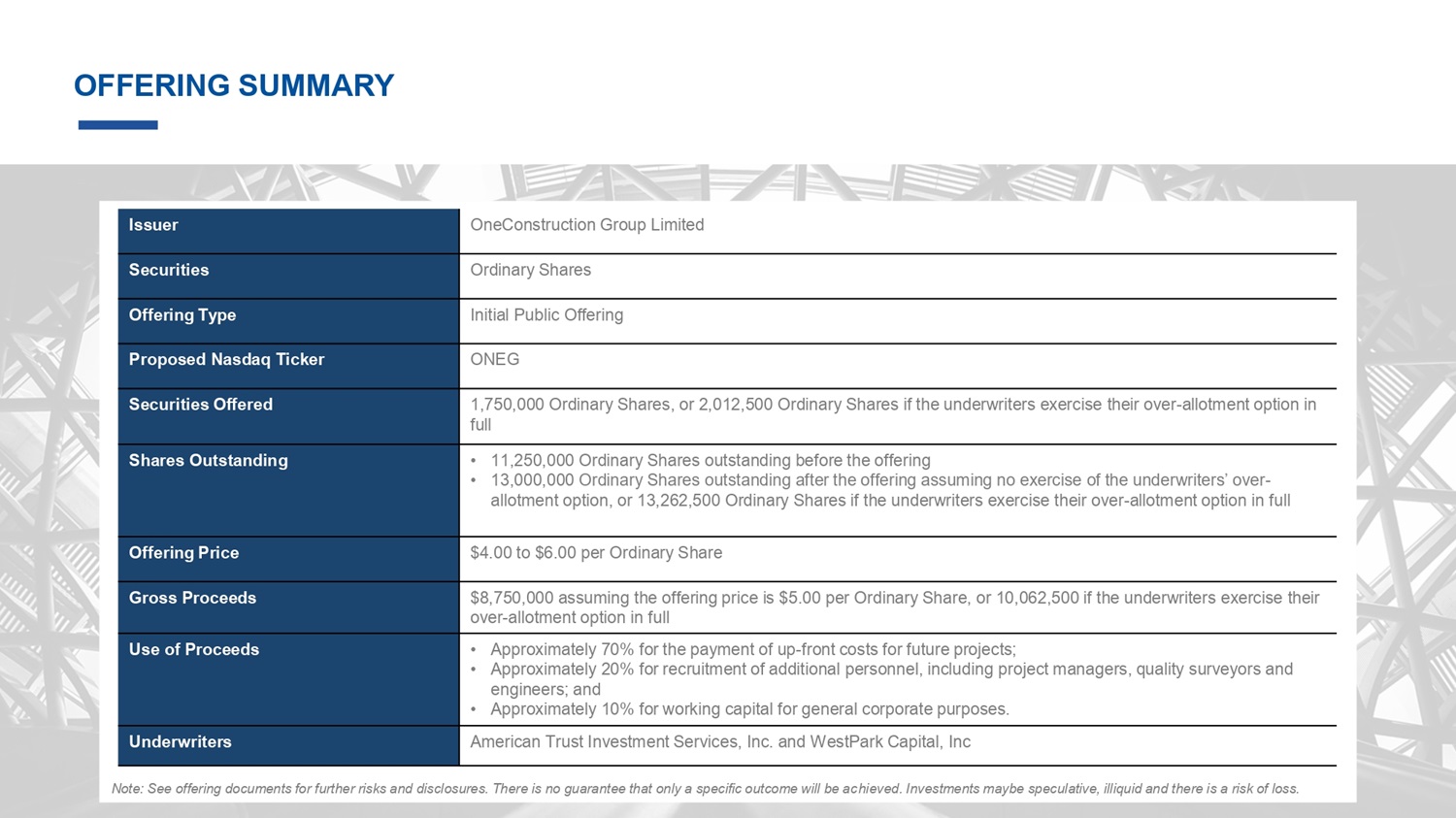

Note: See offering documents for further risks and disclosures. There is no guarantee that only a specific outcome will be ac hie ved. Investments maybe speculative, illiquid and there is a risk of loss. OFFERING SUMMARY OneConstruction Group Limited Issuer Ordinary Shares Securities Initial Public Offering Offering Type ONEG Proposed Nasdaq Ticker 1,750,000 Ordinary Shares, or 2,012,500 Ordinary Shares if the underwriters exercise their over - allotment option in full Securities Offered • 11,250,000 Ordinary Shares outstanding before the offering • 13,000,000 Ordinary Shares outstanding after the offering assuming no exercise of the underwriters’ over - allotment option, or 13,262,500 Ordinary Shares if the underwriters exercise their over - allotment option in full Shares Outstanding $4.00 to $6.00 per Ordinary Share Offering Price $8,750,000 assuming the offering price is $5.00 per Ordinary Share, or 10,062,500 if the underwriters exercise their over - allotment option in full Gross Proceeds • Approximately 70% for the payment of up - front costs for future projects; • Approximately 20% for recruitment of additional personnel, including project managers, quality surveyors and engineers; and • Approximately 10% for working capital for general corporate purposes. Use of Proceeds American Trust Investment Services, Inc. and WestPark Capital, Inc Underwriters

Note: See offering documents for further risks and disclosures. There is no guarantee that only a specific outcome will be ac hie ved. Investments maybe speculative, illiquid and there is a risk of loss. COMPANY OVERVIEW Who we are : • We, through the operating subsidiary, OneConstruction Engineering Projects Limited, are a structural steelwork contractor in Hong Kong , specializing in the procurement and installation of structural steel for construction projects in Hong Kong . Our operating subsidiary has been undertaking structural steelwork projects in the role of subcontractor since incorporation in 2021 and has conducted all of our business activities in Hong Kong, where all of our clients and suppliers are located . • Our revenue generated from : Private Sector Projects mostly private commercial, residential and industrial developments Public Sector Projects including infrastructure, public facilities and public residential developments

Note: See offering documents for further risks and disclosures. There is no guarantee that only a specific outcome will be ac hie ved. Investments maybe speculative, illiquid and there is a risk of loss. CORPORATE STRUCTURE Upon completion of this offering (assuming no exercise of the underwriters’ over - allotment option) :

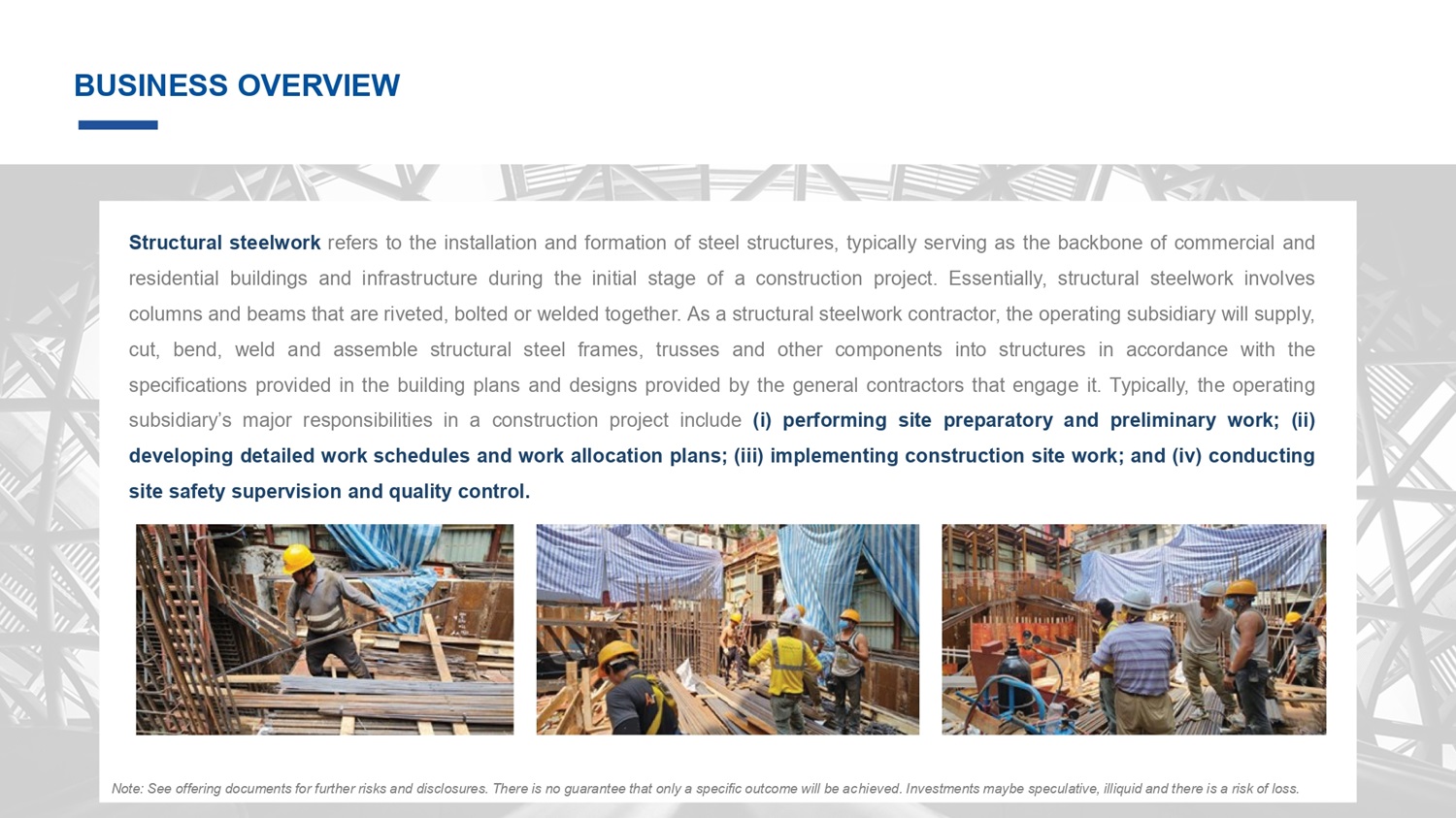

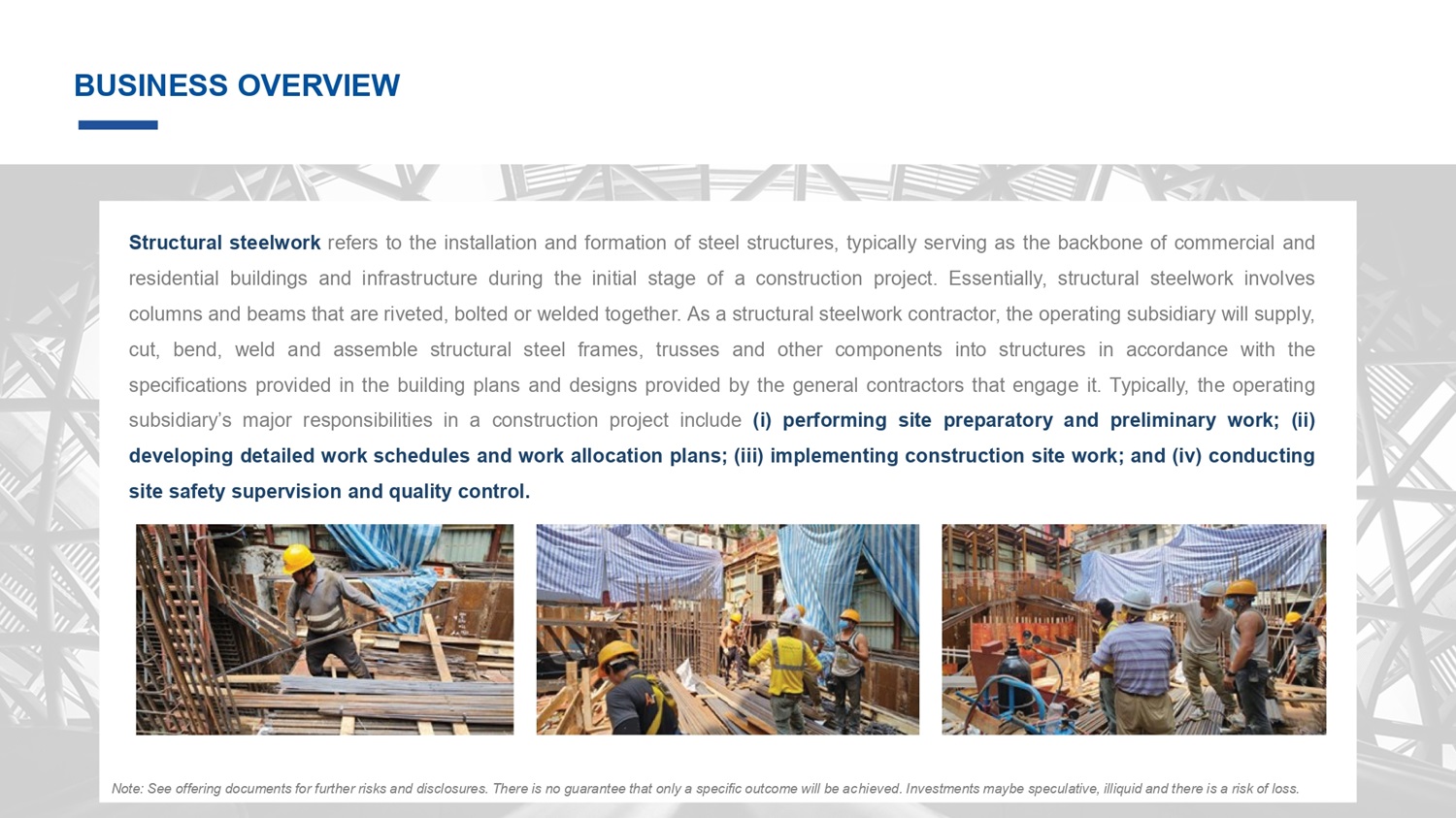

Note: See offering documents for further risks and disclosures. There is no guarantee that only a specific outcome will be ac hie ved. Investments maybe speculative, illiquid and there is a risk of loss. BUSINESS OVERVIEW Structural steelwork refers to the installation and formation of steel structures, typically serving as the backbone of commercial and residential buildings and infrastructure during the initial stage of a construction project . Essentially, structural steelwork involves columns and beams that are riveted, bolted or welded together . As a structural steelwork contractor, the operating subsidiary will supply, cut, bend, weld and assemble structural steel frames, trusses and other components into structures in accordance with the specifications provided in the building plans and designs provided by the general contractors that engage it . Typically, the operating subsidiary’s major responsibilities in a construction project include ( i ) performing site preparatory and preliminary work ; (ii) developing detailed work schedules and work allocation plans ; (iii) implementing construction site work ; and (iv) conducting site safety supervision and quality control .

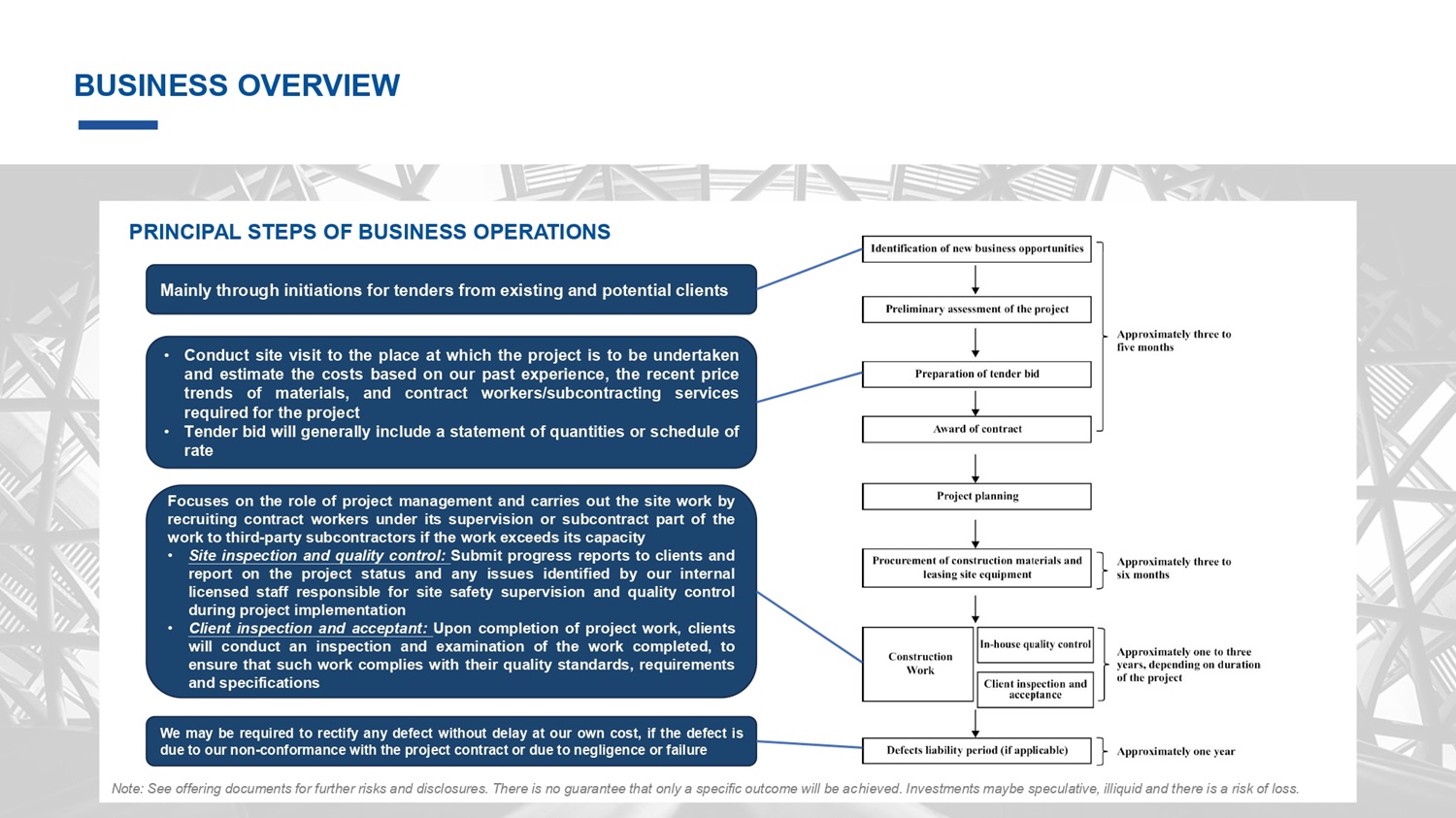

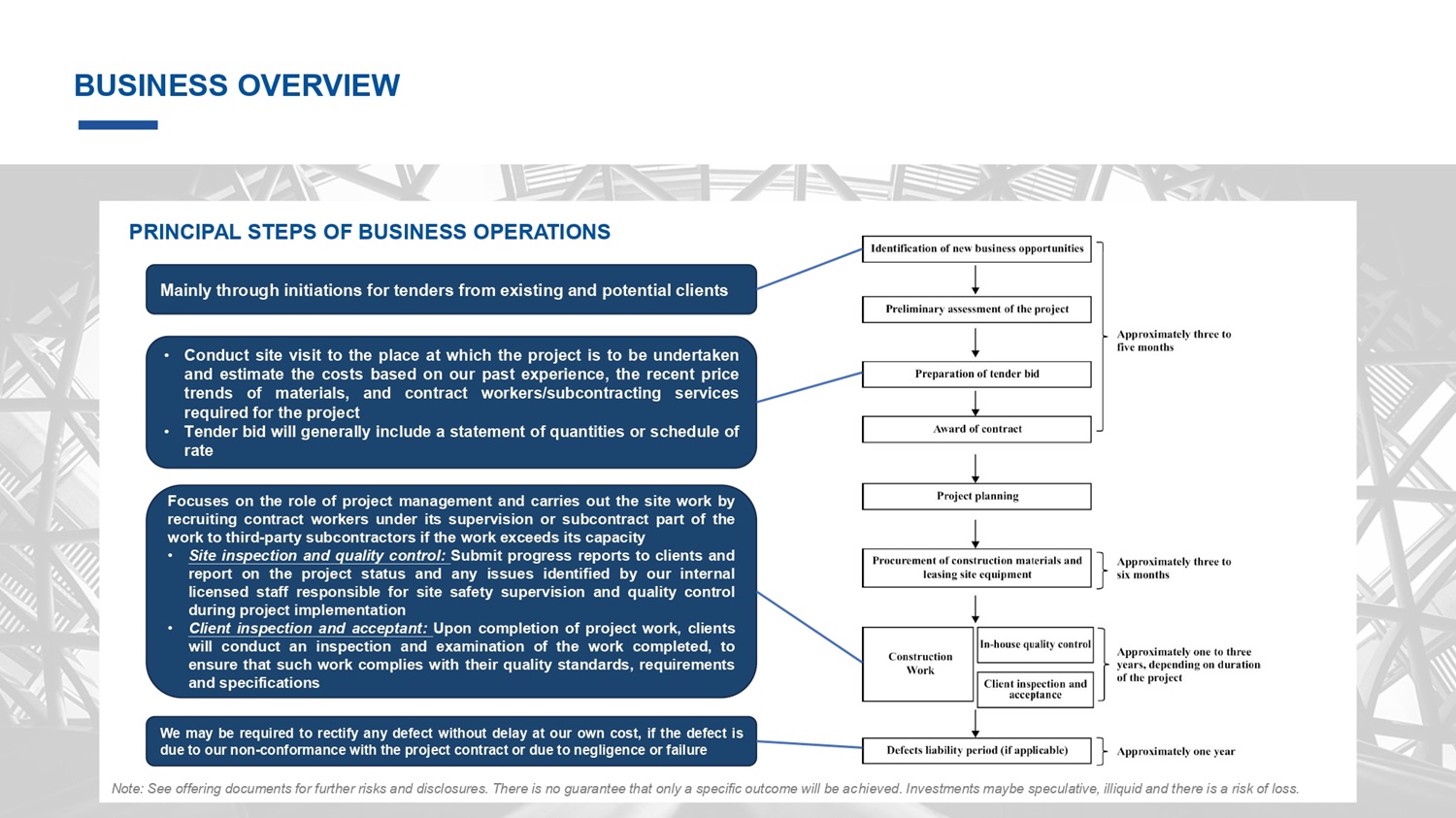

Note: See offering documents for further risks and disclosures. There is no guarantee that only a specific outcome will be ac hie ved. Investments maybe speculative, illiquid and there is a risk of loss. BUSINESS OVERVIEW PRINCIPAL STEPS OF BUSINESS OPERATIONS Mainly through initiations for tenders from existing and potential clients Focuses on the role of project management and carries out the site work by recruiting contract workers under its supervision or subcontract part of the work to third - party subcontractors if the work exceeds its capacity • Site inspection and quality control : Submit progress reports to clients and report on the project status and any issues identified by our internal licensed staff responsible for site safety supervision and quality control during project implementation • Client inspection and acceptant : Upon completion of project work, clients will conduct an inspection and examination of the work completed, to ensure that such work complies with their quality standards, requirements and specifications We may be required to rectify any defect without delay at our own cost, if the defect is due to our non - conformance with the project contract or due to negligence or failure • Conduct site visit to the place at which the project is to be undertaken and estimate the costs based on our past experience, the recent price trends of materials, and contract workers/subcontracting services required for the project • Tender bid will generally include a statement of quantities or schedule of rate

Note: See offering documents for further risks and disclosures. There is no guarantee that only a specific outcome will be ac hie ved. Investments maybe speculative, illiquid and there is a risk of loss. INVESTMENT HIGHLIGHTS One of the top service providers in the Hong Kong structural steelwork industry with an established reputation and proven track record Visionary and experienced management team with strong technical and operational expertise x Engaged in the structural steelwork segment for 21 , 024 public residential units for certain public residential projects, which account for 29 % of the Hong Kong Housing Bureau’s forecasted total of 73 , 000 residential units in the public sector in 2024 to 2026 x Awarded “outstanding contractor” under the category of Domestic Sub - contractors (Reinforcement Bar Fixing) by the Hong Kong Housing Authority x Under the leadership of our management, i . e . Mr . Kam Cheung Cheung , our executive director, and Mr . Ka Chun Gordon Li, our general manager, with over 25 years and ten years of experience in this industry, respectively, we established a strong and dedicated execution team to work with our existing and potential clients to meet their needs and market trends

Note: See offering documents for further risks and disclosures. There is no guarantee that only a specific outcome will be ac hie ved. Investments maybe speculative, illiquid and there is a risk of loss. INVESTMENT HIGHLIGHTS Offering tailored solutions in structural steelwork service for clients Effective and stringent quality control systems in place x Well - equipped to handle tight timelines and supplemental orders, due to its established network and relationships with suppliers x Can respond to unforeseen demand quickly and adjust the supply and installation schedules accordingly, which reinforces our appeal to clients x Closely monitor each stage of the structural steelwork, to ensure strict compliance with necessary standards and quality requirements established by us and/or our clients

Note: See offering documents for further risks and disclosures. There is no guarantee that only a specific outcome will be ac hie ved. Investments maybe speculative, illiquid and there is a risk of loss. BOARD AND MANAGEMENT TEAM Mr . Kam Cheung Cheung Executive Director Mr . Cheung has been our executive director since July 2024 . He worked at Sun Hung Kai Properties Limited, one of the largest property developers in Hong Kong (SEHK : 016 ), from 2005 until July 2024 , and his last position was senior project manager . Mr . Cheung is an authorized person on the registered list of architects maintained by the Building Authority of Hong Kong, a registered architect under the Architects Registration Board of Hong Kong and a member of the Hong Kong Institute of Architects . Mr . Cheung was also an executive director of Rainbow Foundation Limited, a Hong Kong charity organization, and a member of the advisory committee nominated by the Hong Kong Government for Ma Wan Park Limited (a government - funded organization) . Mr . Ka Chun Gordon Li General Manager Mr . Li has been our general manager since June 2024 . He has also served as the executive director of Hope Life International Holdings Limited (SEHK : 1683 ) since April 2024 as well as the independent non - executive director of Royal Century Resources Holdings Limited (SEHK : 8125 ) since December 2023 and HSC Resources Group Limited (SEHK : 1850 ) since March 2022 . From 2015 to 2021 , Mr . Li was the project manager and assistant general manager of Kam Fung Engineering Limited, a construction company, where he was responsible for project management and management of daily operations .

Note: See offering documents for further risks and disclosures. There is no guarantee that only a specific outcome will be ac hie ved. Investments maybe speculative, illiquid and there is a risk of loss. BOARD AND MANAGEMENT TEAM Ms . Hau Wai Tsang Chief Financial Officer Ms . Tsang has been our CFO since June 2024 . She has also served as the independent non - executive director of Royal Century Resources Holdings Limited (SEHK : 8125 ) since October 2023 . From 2011 to 2020 , Ms . Tsang served as the chief financial officer of Long Well International Holdings Limited (SEHK : 850 ) . Ms . Tsang is a certified public accountant of the Hong Kong Institute of Certified Public Accountants and a member of The Institute of Chartered Accountants in England and Wales . Mr . Man Kit Chan Independent Director Mr . Chan has served as our independent director since June 2024 . He has also served as the independent non - executive director of New Sparkle Roll International Group Limited (SEHK : 970 ) since April 2024 . Mr . Chan has been a partner at Nortik Partners & Co . since 2019 and the sole proprietor of Chan Man Kit CPA since 2018 , where he is responsible for audit and accounting services . Mr . Chan is a practicing certified public accountant of the Hong Kong Institute of Certified Public Accountants and a member of the Association of Chartered Certified Accountants .

Note: See offering documents for further risks and disclosures. There is no guarantee that only a specific outcome will be ac hie ved. Investments maybe speculative, illiquid and there is a risk of loss. BOARD AND MANAGEMENT TEAM Mr . Hok Yu Law Independent Director Mr . Law has served as our independent director since June 2024 . He has been the executive director and company secretary of Hang Yick Holdings Company Limited (SEHK : 1894 ) since May and June 2024 , respectively, and the executive director and company secretary of Royal Century Resources Holdings Limited (SEHK : 8125 ) since May 2024 . Mr . Law served at LET Group Holdings Limited (SEHK : 1383 ) from 2021 to 2023 and his last position was assistant financial controller . Mr . Law worked as a manager at Ernst & Young from 2020 to 2021 and as an audit senior from 2018 to 2020 . Mr . Law is a member of the Hong Kong Institute of Certified Public Accountants . Ms . Wai Yan Chan Independent Director Ms . Chan has served as our independent director since June 2024 . She has been the independent non - executive director of Royal Century Resources Holdings Limited (SEHK : 8125 ) since May 2024 and of Hope Life International Holdings Limited (SEHK : 1683 ) since October 2023 . From 2017 to 2023 , Ms . Chan worked in the audit department at Y . S . Kwaan , W . L . Kwaan & Co . Ms . Chan is a member of the Hong Kong Institute of Certified Public Accountants .

Note: See offering documents for further risks and disclosures. There is no guarantee that only a specific outcome will be ac hie ved. Investments maybe speculative, illiquid and there is a risk of loss. INDUSTRY OVERVIEW 20.4 19.1 17.3 17.6 18.7 20.3 20.9 21.7 22.8 10 12 14 16 18 20 22 24 2019 2020 2021 2022 2023 2024 2025E 2026E 2027E Billion (US$) Expenditure in Hong Kong for building works in both the public and private sectors and civil works in the public sectors (i . e . the construction works that most involved the use of structural steel work) ( 2019 – 2027 E) Source : Construction Expenditure Forecast, Construction Industry Council of Hong Kong

Note: See offering documents for further risks and disclosures. There is no guarantee that only a specific outcome will be ac hie ved. Investments maybe speculative, illiquid and there is a risk of loss. GROWTH STRATEGIES Expand our workforce • By expanding the manpower resources, we believe that the operating subsidiary would have additional capacity to undertake more projects while maintaining project management efficiency and service quality simultaneously Improve our financial management to ensure optimal finance costs and capital sufficiency • By strengthening our available financial resources, it allows us to undertake more projects by using a portion of the net proceeds to satisfy our up - front costs for future projects Increase our market share • By expanding the operating subsidiary’s present scale of operation, it enables us to compete for additional and more sizeable projects to increase our market share by obtaining more resources, including available manpower and financial resource

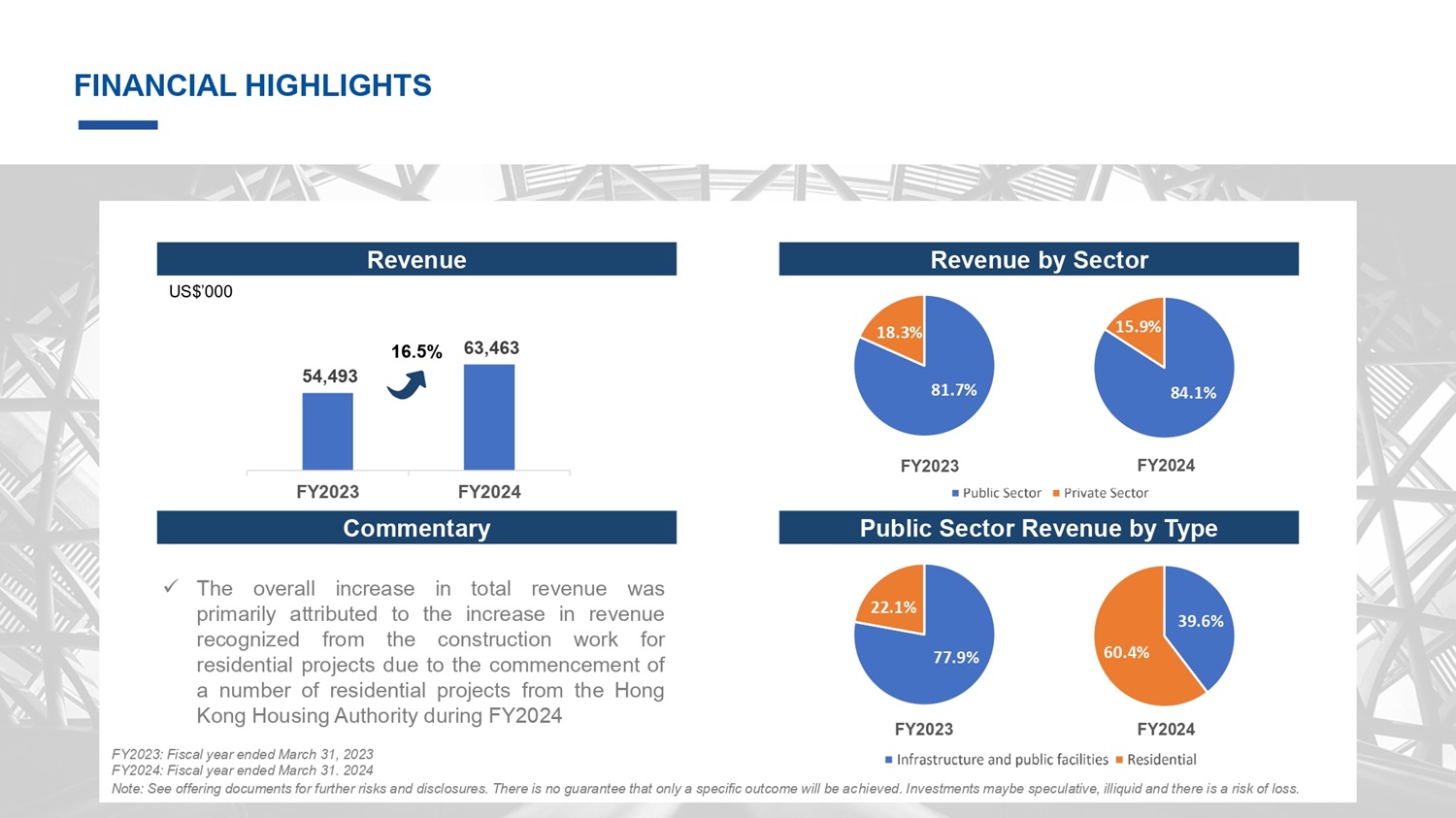

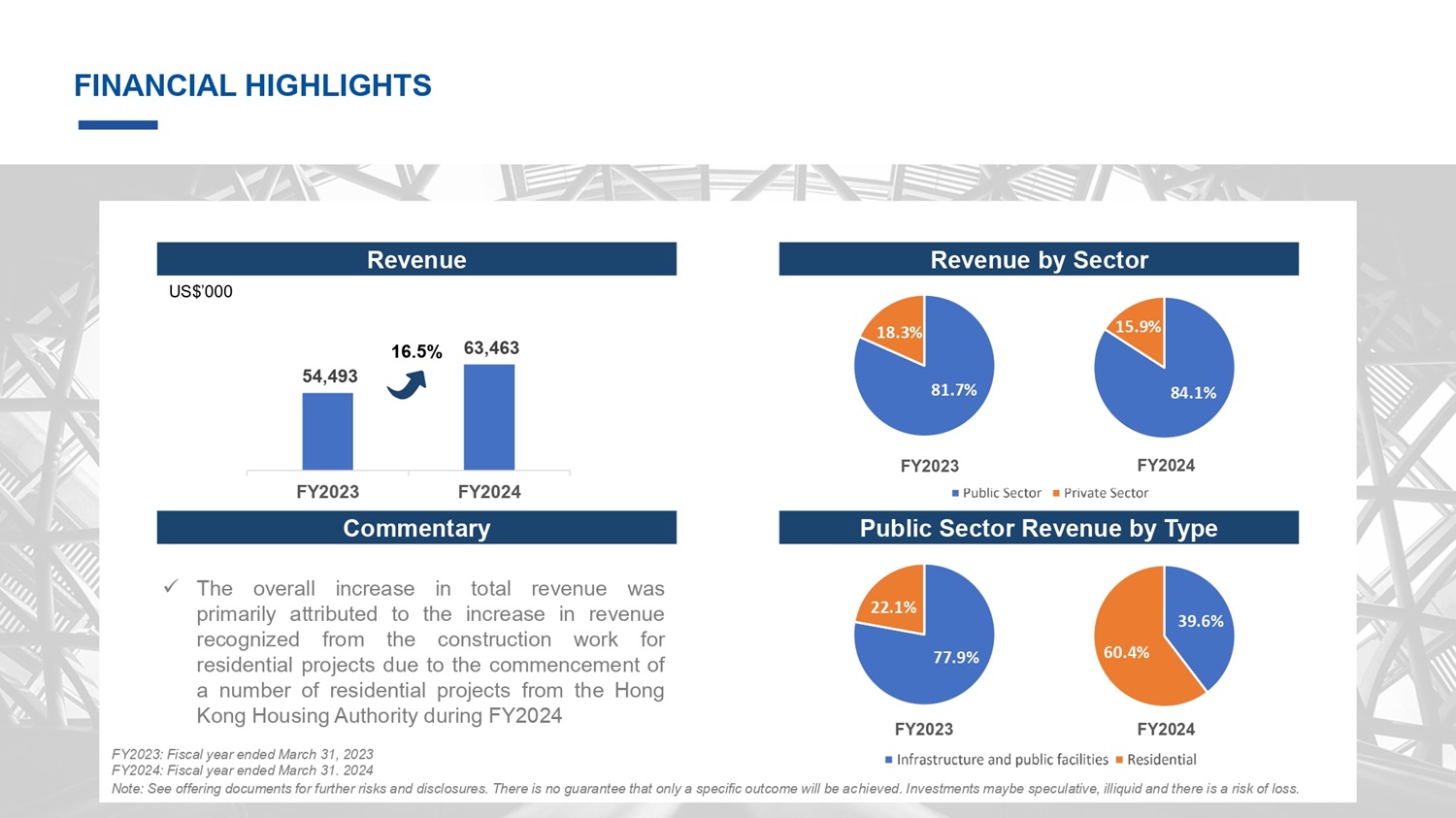

Note: See offering documents for further risks and disclosures. There is no guarantee that only a specific outcome will be ac hie ved. Investments maybe speculative, illiquid and there is a risk of loss. FINANCIAL HIGHLIGHTS Revenue Revenue by Sector Commentary Public Sector Revenue by Type 54,493 63,463 FY2023 FY2024 US$’000 16.5% 81.7% 18.3% 84.1% 15.9% FY2023 FY2024 77.9% 22.1% FY2023 39.6% 60.4% x The overall increase in total revenue was primarily attributed to the increase in revenue recognized from the construction work for residential projects due to the commencement of a number of residential projects from the Hong Kong Housing Authority during FY 2024 FY2024 FY 2023 : Fiscal year ended March 31 , 2023 FY 2024 : Fiscal year ended March 31 . 2024

Note: See offering documents for further risks and disclosures. There is no guarantee that only a specific outcome will be ac hie ved. Investments maybe speculative, illiquid and there is a risk of loss. FINANCIAL HIGHLIGHTS Gross Profit Profit from Operations Profit attributable to shareholders 2,826 4,443 5.2% 7.0% 2023 2024 US$’000 Gross Margin % 2,201 2,232 2023 2024 1,670 1,769 2023 2024 US$’000 US$’000

Note: See offering documents for further risks and disclosures. There is no guarantee that only a specific outcome will be ac hie ved. Investments maybe speculative, illiquid and there is a risk of loss. CONTACT Issuer OneConstruction Group Limited Email: gli@oneconstruction.com.hk Tel: +852 2123 8410 Address: Room 6808A, 68/F, Central Plaza, 18 Harbor Road, Wanchai , Hong Kong Thank You