UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| | | | | |

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition period from_____ to _____

Commission File No. 001-05672

ITT INC.

| | | | | | | | |

| Indiana | | 81-1197930 |

| (State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

100 Washington Boulevard

6th Floor, Stamford, CT 06902

(Address of Principal Executive Offices) (Zip Code)

(914) 641-2000

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $1.00 per share | ITT | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | |

| ☑ | Large accelerated filer | ☐ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company |

| ☐ | Emerging growth company | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes þ No ¨

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No þ

The aggregate market value of common stock of the registrant held by non-affiliates of the registrant on June 30, 2024 was approximately $10.5 billion. As of February 7, 2025, there were 81.4 million shares of the registrant's common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Definitive Proxy Statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A for its 2025 Annual Meeting of Shareholders are incorporated by reference in Part III of this Form 10-K.

TABLE OF CONTENTS

| | | | | | | | |

| ITEM | PAGE |

| PART I |

| 1 | | |

| 1A | | |

| 1B | | |

| 1C | Cybersecurity | |

| 2 | | |

| 3 | | |

| 4 | | |

| * | Information About Our Executive Officers | |

| | |

| PART II |

| 5 | | |

| 6 | | |

| 7 | | |

| 7A | | |

| 8 | | |

| 9 | | |

| 9A | | |

| 9B | | |

| 9C | | |

| | |

| PART III |

| 10 | | |

| 11 | | |

| 12 | | |

| 13 | | |

| 14 | | |

| | |

| PART IV |

| 15 | | |

| 16 | | |

| |

| |

| | |

| * | Included pursuant to the General Instruction to Item 401 of Regulation S-K. | |

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the U.S. Securities and Exchange Commission (the SEC). The SEC maintains a website at www.sec.gov on which you may access our SEC filings. In addition, we make available free of charge at investors.itt.com copies of materials we file with, or furnish to, the SEC as soon as reasonably practical after we electronically file or furnish these reports, as well as other important information that we disclose from time to time. In addition, in certain sections of this Annual Report on Form 10-K we refer readers to additional information that is contained on our website, or that can be accessed through our website. The information on our website, including the materials we are specifically referencing, do not constitute a part of this Annual Report on Form 10-K. We have included our website address only as an inactive textual reference and do not intend it to be an active link to our website.

Our corporate headquarters is located at 100 Washington Boulevard, 6th Floor, Stamford, Connecticut 06902 and the telephone number of this location is (914) 641-2000.

FORWARD-LOOKING AND CAUTIONARY STATEMENTS

Some of the information included herein includes forward-looking statements within the meaning of the Securities Exchange Act of 1933, and the Securities Exchange Act of 1934, as amended. We intend such forward-looking statements to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements are not historical facts, but rather represent only a belief regarding future events based on current expectations, estimates, assumptions and projections about our business, future financial results and, the industry in which we operate, and other legal, regulatory and economic developments. These forward-looking statements include, but are not limited to, future strategic plans and other statements that describe the company’s business strategy, outlook, objectives, plans, intentions or goals, and any discussion of future events and future operating or financial performance.

We use words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “future,” “guidance,” “intend,” “may,” “plan,” “potential,” “project,” “should,” “target,” “will,” “would,” and other similar expressions to identify such forward-looking statements. Forward-looking statements are uncertain and, by their nature, many are inherently unpredictable and outside of ITT’s control, and involve known and unknown risks, uncertainties and other important factors that could cause actual results to differ materially from those expressed or implied in, or reasonably inferred from, such forward-looking statements.

Where in any forward-looking statement we express an expectation or belief as to future results or events, such expectation or belief is based on current plans and expectations of our management, expressed in good faith and believed to have a reasonable basis. However, we cannot provide any assurance that the expectation or belief will occur or that anticipated results will be achieved or accomplished.

Among the factors that could cause our results to differ materially from those indicated by forward-looking statements are risks and uncertainties inherent in our business including, without limitation:

•uncertain global economic and capital markets conditions, which have been influenced by heightened geopolitical tensions, inflation, changes in monetary policies, the threat of a possible regional or global economic recession, trade disputes between the U.S. and its trading partners, political and social unrest, and the availability and fluctuations in prices of energy and commodities, including steel, oil, copper and tin;

•fluctuations in interest rates and the impact of such fluctuations on customer behavior and on our cost of debt;

•fluctuations in foreign currency exchange rates and the impact of such fluctuations on our revenues, customer demand for our products and on our hedging arrangements;

•volatility in raw material prices and our suppliers’ ability to meet quality and delivery requirements;

•impacts and risk of liabilities from recent mergers, acquisitions, or venture investments, and past divestitures and spin-offs;

•our inability to hire or retain key personnel;

•failure to compete successfully and innovate in our markets;

•failure to manage the distribution of products and services effectively;

•failure to protect our intellectual property rights or violations of the intellectual property rights of others;

•the extent to which there are quality problems with respect to manufacturing processes or finished goods;

•the risk of cybersecurity breaches or failure of any information systems used by the Company, including any flaws in the implementation of any enterprise resource planning systems;

•loss of or decrease in sales from our most significant customers;

•risks due to our operations and sales outside the U.S. and in emerging markets, including the imposition of tariffs and trade sanctions;

•fluctuations in demand or customers’ levels of capital investment, maintenance expenditures, production, and market cyclicality;

•the risk of material business interruptions, particularly at our manufacturing facilities;

•risks related to government contracting, including changes in levels of government spending and regulatory and contractual requirements applicable to sales to the U.S. government;

•fluctuations in our effective tax rate, including as a result of changing tax laws and other possible tax reform legislation in the U.S. and other jurisdictions;

•changes in environmental laws or regulations, discovery of previously unknown or more extensive contamination, or the failure of a potentially responsible party to perform;

•failure to comply with the U.S. Foreign Corrupt Practices Act (or other applicable anti-corruption legislation), export controls and trade sanctions; and

•risk of product liability claims and litigation.

Refer to Item 1A, Risk Factors for more information on factors that could cause actual results or events to differ materially from those anticipated and disclosed within this Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and in other documents we file from time to time with the SEC. The forward-looking statements included in this Annual Report on Form 10-K speak only as of the date of this report. We undertake no obligation (and expressly disclaim any obligation) to update any forward-looking statements, whether written or oral or as a result of new information, future events or otherwise.

PART I

| | | | | |

| ITEM 1. | DESCRIPTION OF BUSINESS |

(Amounts reported in this Annual Report on Form 10-K, except per share amounts, are stated in millions unless otherwise specified. References herein to "ITT," "the Company," and such words as "we," "us," and "our" include ITT Inc. and its subsidiaries on a consolidated basis, unless the context otherwise indicates.)

COMPANY OVERVIEW

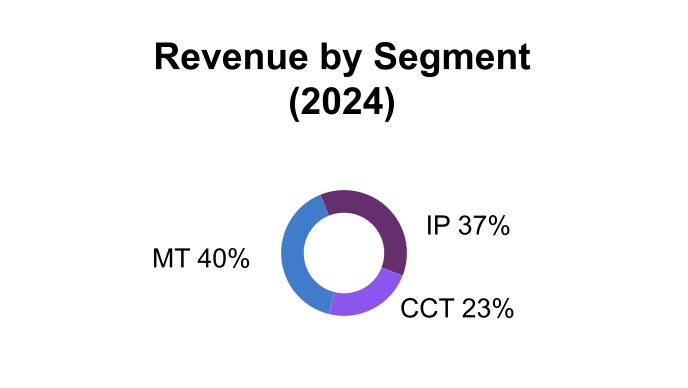

ITT is a diversified manufacturer of highly engineered critical components and customized technology solutions primarily for the transportation, industrial and energy markets. We manufacture components that are integral to the operation of equipment, systems and manufacturing processes in these key markets. Our products enable functionality for applications where reliability and performance are critically important to our customers and the users of their products. We operate through three primary segments: Motion Technologies (MT), Industrial Process (IP), and Connect & Control Technologies (CCT).

| | | | | |

| 2024 COMPANY SNAPSHOT |

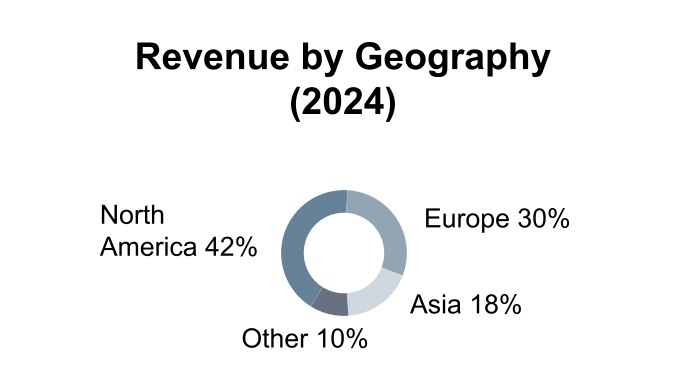

| • $3.6 billion of sales across approx. 125 countries | • Approx. 11,700 employees in 39 countries |

| • Global presence with 67% of revenue outside the U.S. | • Balanced and diversified portfolio |

MT is a global manufacturer of highly engineered brake pads, shock absorbers and damping technologies for the automotive and rail markets. IP is a global manufacturer of industrial pumps, valves, and monitoring and control systems, and provides aftermarket services for the energy, chemical and petrochemical, pharmaceutical, general industrial, marine, mining, pulp and paper, food and beverage, power generation and biopharmaceutical markets. CCT is a global designer and manufacturer of harsh-environment interconnect solutions and critical energy absorption and flow control components, primarily for the aerospace, defense and industrial markets. For additional segment information, see Segment Information section.

Business Model and Strategy

Our businesses share a common, repeatable operating model centered on our engineering capabilities. Each business applies its technology and engineering expertise to solve our customers' most pressing challenges. Our technological applications foster an ongoing business relationship with our customers which provides us with unique insight into our customers' requirements thus enabling us to develop solutions to better assist our customers achieve their business goals. Our technology and customer intimacy together provide opportunities to capture recurring revenue streams, aftermarket opportunities and content on long-lived platforms from original equipment manufacturers (OEMs).

We create long-term stakeholder value through our four strategic priorities of customer centricity, operational excellence, effective capital deployment, and sustainability and innovation. Our strategy is designed to achieve premier financial performance by combining profitable growth with operational improvements, while keeping our customers at the center of everything we do.

Our operational focus centers on safety, quality, delivery and cost. This is the foundation of the improvements we make in each of our businesses. We are establishing a higher performance culture that goes beyond the factory floor to improve the efficiency and effectiveness of all critical processes in the value chain. These initiatives encompass not only continuous improvement principles, but also leadership, talent and cultural aspects. For additional information, refer to Human Capital Management below. When value-generating opportunities arise, we seek to expand into new markets and invest in new products that leverage our deep engineering capabilities. We continue to evaluate investments that will enable us to strategically and efficiently deploy capital, including close-to-core acquisitions that have unique and differentiated products, services and technologies. Effective capital deployment, including resource optimization and a disciplined focus on cash flow management, are a major part of how we execute our strategy and continue to deliver strong shareholder returns.

Primary Businesses and Brands

Our brands have a strong international presence across many emerging markets, including China, India, Mexico, Brazil and Saudi Arabia. Below is a list of the key brands in each segment.

| | | | | | | | | | | |

| OUR KEY BRANDS |

| MT | • ITT Friction TechnologiesTM | • KONI® | • GALT.® |

| • Axtone® | • NovitekTM | |

| IP | • Goulds PumpsTM | • Bornemann® | • i-ALERT® |

| • PRO Services® | • C'treat® | • Svanehøj® |

| • Rheinhütte Pumpen® | • HabonimTM | • Hamworthy Pumps® |

| • Engineered Valves® | | |

| CCT | • Cannon® | • VEAM® | • BIW Connector Systems® |

| • Aerospace ControlsTM | • Enidine® | • Compact AutomationTM |

| • Neo-Dyn® Process Controls | • Conoflow® | • Micro-ModeTM |

| • kSARIA® | | |

Environmental, Social & Governance

Environmental, social & governance (ESG) practices play an essential role in our business and are firmly rooted in how we conduct our operations and in our daily decisions. Our products, manufacturing processes and innovations reflect our drive to help make the world and the communities we serve more sustainable. We believe ingraining ESG priorities into our strategy will drive long-term growth and shareholder value, help our customers meet their ESG goals and, furthermore, is simply the right thing to do.

Environmental

We recognize climate change is a global crisis and we are committed to doing our part to reduce the environmental impact of our operations. Our approach to environmental stewardship falls into three categories:

▪Development of innovative products that help customers reduce their greenhouse gas (GHG) emissions, achieve their sustainability goals and comply with emissions reduction regulations;

▪Investment in technologies and processes to reduce CO2 emissions, waste sent to landfills, water usage and increase our energy supply security through solar installations; and

▪Development of a credible path to carbon neutrality through our Reduce–Avoid–Offset framework, in which we seek to reduce our carbon footprint and commit to using renewable energy sources.

We partner with our customers to solve challenging problems and deliver best-in-class solutions. ITT's products enable our customers to operate more efficiently, reduce their total cost of ownership and produce sustainable, environmentally friendly technologies and processes.

At the same time, it is imperative for our business to ensure our operations are efficient, sustainable and environmentally conscious. In 2021, we launched our Reduce–Avoid–Offset framework as part of our development of a credible plan to carbon neutrality. After developing the framework, we announced a goal of reducing our global Scope 1 and 2 GHG emissions for all of ITT by 10% by the end of 2026, compared to 2021. In 2022, we launched a

pilot program at our three most energy-intensive locations geared towards more precise measurement and analysis of Scope 1 and 2 GHG emissions. In 2023, we expanded the program to include sites in Czechia and Mexico, and in 2024, we added our Italy and China sites to the program's scope. Additionally, in 2024, we continued our investments in solar energy by adding installations at our Orchard Park, New York, and Lancaster, Pennsylvania sites, with more efficiency projects planned.

We are subject to stringent federal, state, local, and foreign environmental laws and regulations concerning air emissions, water discharges and waste disposal. In the U.S., these include, but are not limited to, the Federal Clean Air Act, the Clean Water Act, the Resource, Conservation and Recovery Act, and the Comprehensive Environmental Response, Compensation and Liability Act. We closely monitor our environmental responsibilities, together with trends in environmental laws. Separate from our Reduce–Avoid–Offset framework, we have established an internal program to assess compliance with applicable environmental requirements at our facilities. The program, which includes periodic audits of many of our locations, including our major operating facilities, is designed to identify problems in a timely manner, correct potential deficiencies and maintain continued regulatory compliance. ITT also implements a robust environmental due diligence process during mergers and acquisitions. As a result of ITT’s ongoing compliance and diligence efforts, ITT's environmental liabilities are, for the most part, not associated with current operating facilities (only two of ITT's 26 locations with current environmental obligations are associated with active operating sites). Additionally, ITT’s diligent remediation approach continues to effectively reduce the number of ongoing matters year after year.

Environmental laws and regulations are subject to change, and the nature and timing of such changes, if any, is difficult to predict. To minimize our exposure, we have purchased insurance protection against certain environmental risks arising from our business activities. As actual costs incurred at identified sites in future periods may vary from our current estimates given the inherent uncertainties in evaluating environmental exposures, it is not possible to reasonably predict the outcome of these uncertainties or any resulting impact on our financial statements.

Social

We recognize that sustainable performance and growth are made possible only through the efforts of our dynamic team of approximately 11,700 ITTers globally. Given this, one of our most important commitments as a company is to create an engaging, inspiring place to work and drive actions that enable every individual's full potential and performance. ITT provides an employee stock purchase program benefit to U.S. employees as an opportunity to invest in ITT stock at a discounted price and share in the company's success. Refer to the "Human Capital Management" section below for further information. Governance

Our Board of Directors (the “Board”) is composed of highly experienced and diverse individuals. The role of the Board is to oversee the affairs of the Company, including those pertaining to ESG, and to ensure the overall success of the business. ITT's Board believes in strong corporate governance and is committed to sound principles and practices. Meanwhile, our ethics and compliance and enterprise risk management programs, and ongoing shareholder engagement, help us to understand key risks and market trends as an organization and deploy resources appropriately to meet our current and future needs. ITT has been an early adopter of many of the most significant governance advances over the last two decades, including majority voting for uncontested director elections, proxy access bylaws, an independent Board Chair and shareholder rights to call a special meeting.

The growing complexity and frequency of cyber threats underscore the need for robust cybersecurity and data governance across all business areas. ITT is dedicated to enhancing our cybersecurity measures to safeguard employee, customer, and partner data against current and future threats. Protecting data integrity is essential for fostering a high-performance culture, meeting customer needs, and ensuring our ongoing growth and success. For additional details regarding cybersecurity matters, see "Cybersecurity" within Item 1C. We are proud of the strides we have made with respect to our ESG efforts to date, and will continue looking for ways to improve upon these efforts to help bring additional value to our employees, customers, communities and business. For further information regarding our ESG commitment, refer to our ITT 2024 Sustainability Report (the "2024 Sustainability Report"). It is available on our website at www.itt.com/sustainability.

Human Capital Management

We believe that sustainable performance and growth are made possible only through the efforts of our dynamic team of employees. In order to continue innovating in the industries and key end markets we serve, ITT remains committed to attracting and retaining top talent globally. We strive to make ITT an engaging and safe workplace for all, and to create a higher performance culture with opportunities and training for all employees to develop and grow professionally and personally. In addition, we offer competitive compensation, benefits, and health and wellness programs.

As of December 31, 2024, we had approximately 11,700 employees located in 39 countries, including approximately 3,400 employees in the U.S. As of December 31, 2024, approximately 13% of our U.S. employees are represented by unions. No one unionized facility in the U.S. accounted for more than 15% of ITT's total revenues. In addition, many of our employees outside the U.S. are covered by collective agreements or represented by works councils or other groups. We continually focus on building strong relationships with our employees. and we have not experienced any material strikes or work stoppages in the past several years.

Health, Safety and Well-being

At ITT, the health, safety, and well-being of our employees is our number one priority. Our Environmental, Safety, Health and Security Council drives the systemic control of workplace risks and continual improvement of environmental and occupational safety and health protocols at all of our sites. We challenge ourselves to continually reduce injury frequency and severity by engaging employees in our “Accept Only Zero” safety accountability system and fostering an environment where employees take responsibility for their actions and have access to tools and training to work safely together. Despite these comprehensive measures, accidents still occur. In such cases, we report the accident, its root cause and any corrective measures taken in ITT’s company-wide accident reporting and tracking tool. Accident reporting and analysis helps ITT gauge the effectiveness of our safety initiatives and procedures across all sites, and it helps us find creative solutions to mitigate risks to our employees at our sites.

Higher Performance Culture & Engaged Meritocracy

At ITT, fostering a high-performance culture and engaged meritocracy is core to our values and critical to our success as a company. We are committed to cultivating an environment where varied ideas and perspectives drive engagement, innovation, and better business outcomes. By creating a culture that supports our employees and recognizes merit, we positively impact the performance of our people and the global communities in which we operate. We align our efforts to our strategic workplace goals by building an environment where all ITTers feel empowered to fully engage, achieve their potential, and share ideas freely. We believe our success is fueled by variety of thought, collaboration, and continuous learning from each other’s ideas and experiences. By fostering an engaged meritocracy, we position ourselves for sustained success in the global marketplace and the creation of long-term value for all stakeholders. Our most recent Employment Information Report (EEO-1 report) is available at www.itt.com/our-people/eeo-1-report, where we will also post our 2024 EEO-1 report when it becomes available.

Talent Development

In order to foster a higher-performance culture, we are committed to maintaining effective strategies to support recruiting and hiring, onboarding and training, compensation planning, performance management and professional development. We invest significant resources to develop our talent to remain a global leader in the manufacturing of highly engineered customized products and solutions. We focus on providing meaningful, equitable career development pathways and support to help ITTers realize their career aspirations. Our development philosophy is built around a “know-do” framework which includes both formal training and experiential learning. Tailored learning programs, coaching and mentoring elevate both technical and other skills (the “know”) while challenging, well-planned work experiences and global assignments prepare ITTers for current and future roles (the “do”). Successful employee development is also supported by thoughtful plans built in partnership between employees and their managers. Our development planning tools and processes ensure targeted, concrete action planning, and we promote continuous feedback and regular check-ins.

Compensation and Benefits

We provide flexible compensation and benefits programs to help meet the needs of our employees and their families. In addition to base salaries, we offer numerous benefits for eligible employees, including annual bonuses, stock awards, an employee stock purchase plan for employees in the U.S., a 401(k) Plan, healthcare and insurance benefits, health savings and flexible spending accounts, paid time off, family leave, flexible work schedules, retirement benefits, employee assistance programs and tuition reimbursement. ITT’s pay and recognition practices leverage data to ensure our employees receive competitive, equitable salaries supported by evaluations of roles, experience, performance and union or works council agreements in select areas. Our variable incentive plans reinforce pay for performance and our strong belief in meritocracy. The majority of our employees are eligible for either a performance-based bonus or a statutory profit-sharing payment. The bonus plans align employee compensation with financial or operational results and individual performance. With respect to stock awards, we have used discretionary equity-based grants with time-based vesting conditions to facilitate the retention of key personnel, particularly those identified as high-performing talent.

SEGMENT INFORMATION

See Note 3, Segment Information, to the Consolidated Financial Statements for financial information about each of our segments. Motion Technologies (MT)

The Motion Technologies segment is a manufacturer of brake pads, shock absorbers, energy absorption components and damping technologies primarily for the transportation industry, including passenger cars and trucks, light- and heavy-duty commercial and military vehicles, buses and trains. MT consists of the following primary business units: ITT Friction Technologies, KONI, and Axtone. In July 2024, we sold our Wolverine Advanced Materials (Wolverine) business. Wolverine will continue to act as a third-party supplier of high-performance shims and seals for ITT. The results of the Wolverine business are included in the consolidated statements of operations and cash flows until the date of divestiture.

ITT Friction Technologies (Friction)

Friction manufactures a range of brake pads installed as original equipment (OE) on passenger cars (both internal combustion engine vehicles, hybrids and electric vehicles) and light commercial vehicles for a variety of end customers and automotive platforms around the world. OE brake pads are sold directly to OEMs or to Tier-1 brake manufacturers. Our OE brake pads are designed to meet customer specifications and environmental regulations, and to satisfy an array of performance standards across multiple geographies. Most automotive OEM platforms (car models) require specific brake pad formulations and have demanding quality, delivery and volume schedules. Friction is a recognized industry leader in the paradigm shift towards new brake pad formulations that are designed, developed and tested specifically for electric vehicles (EVs). Success in developing brake pads for EVs has led Friction to win multiple hybrid and EV platform awards with established and new OEMs.

Friction also manufactures aftermarket brake pads designed for the automotive service and repairs market. This market consists of both OE dealers, also referred to as original equipment service (OES) networks, and independent aftermarket networks. Brake pads sold within the OES network generally match the specifications of an original auto platform OE brake pad and are sold either directly to OEMs or to Tier-1 brake manufacturers, such as Continental AG (Continental), or indirectly through independent distributor channels. Our catalog of pads sold in independent aftermarket networks features technology designed to provide a range of braking performance levels.

KONI

The KONI business services four main end markets: railway rolling stock for freight and passenger trains; car and racing; bus, truck and trailer; and defense.

Railway supplies a wide range of equipment for passenger rail, locomotives, freight cars, high speed trains and light rail. Offerings include customized energy absorption solutions, hydraulic shock absorbers (primary, lateral, and inter-car), yaw dampers, springs, visco-elastic and hydraulic buffers, coupler components and crash mitigation equipment. Revenue from our rail damping systems is balanced between OE and aftermarket customers. Sales are made either directly to train manufacturers and train operators carrying out scheduled train maintenance programs or indirectly through distributors.

Car and Racing features performance shock absorbers often using our Frequency Selective Damping (FSD) technology. FSD products generally are used by car and racing enthusiasts who desire to modify their cars for increased handling performance and comfort. KONI aftermarket car shock absorbers are sold around the world, directly to customers and through a distribution network that markets KONI products into specific geographies or customer groups. KONI shock absorbers are also incorporated into new OEM platform designs and sold to Tier-1 shock absorber manufacturers.

Bus, Truck and Trailer, and Defense manufactures hydraulic and hydro-pneumatic shock absorbers for sale to both OEM and aftermarket customers.

Axtone

The Axtone business specializes in impact energy absorption technology and push-pull components for passenger and freight rolling stock in rail, metro and trams and the production of springs applicable across multiple industries such as rail, industrial and defense applications. Axtone develops, manufactures and distributes components designed to meet the rigorous demands of rail transportation of the most demanding customers worldwide. With a commitment to serving a global customer base, the Axtone solutions adhere to international standards with the highest level of quality, performance and durability.

KONI and Axtone are lifetime partners of rail customers, also offering repair and overhauling capabilities for their products.

Other Information

MT has a global manufacturing footprint with advanced automation capabilities, with production facilities in Europe, China, and North America. MT competes in markets primarily served by large and well-established national and global companies. Key competitive drivers within the brake pad business include technical expertise, formulation development capabilities, scale production, product performance, high-quality standards, cost, customer intimacy, reputation and the ability to meet demanding delivery and volume schedules in a limited amount of time. We have well-established, long-term relationships with our OE and OES brake pad customers based on mutual trust, local proximity and a wide range of cooperative activities, ranging from design, to sampling, prototyping and testing phases of brake pads.

MT's sales to Continental, a supplier to the automotive industry and MT's largest customer, represented 17% of MT's revenue, and approximately 7% of ITT's total revenue in 2024. Automaker requests to use ITT brake pads in their Continental-produced braking systems (calipers) typically account for approximately half of MT's revenue from Continental. These automaker requests are generally formalized through supply agreements signed directly between MT and the automakers. The remainder of MT's sales to Continental is through a long-term agreement to supply Continental with aftermarket parts.

MT is a global leader in rail suspension components, freight coupling devices currently used in Europe and crash absorption systems. Competitive drivers in MT's rail business include customer intimacy, price, technical expertise and product performance. MT's rail products are considered critical components because of safety requirements and thus they are designed specifically for different train applications and must satisfy strict compliance requirements.

Industrial Process (IP)

The Industrial Process segment is an OEM and an aftermarket parts and service provider of industrial pumps, valves, plant optimization and remote monitoring systems and services. IP's products serve an extensive base of customers ranging from large multi-national companies and engineering, procurement and construction (EPC) firms to regional distributors and various other end-users. IP's customers operate in global infrastructure and natural resource markets such as energy, chemical and petrochemical, pharmaceutical, general industrial, marine, mining, pulp and paper, food and beverage, power generation and biopharmaceutical. IP's marketplace-recognized brands include Goulds PumpsTM, Bornemann®, Rheinhütte Pumpen®, Engineered Valves®, PRO Services®, C'treat®, i-ALERT® and, HabonimTM,

In January 2024, we acquired Svanehøj Group A/S (Svanehøj) incorporating the Svanehøj® and Hamworthy Pumps® brand pumps into IP's portfolio. Svanehøj is a Denmark-based supplier of pumps and related aftermarket services with leading positions in cryogenic applications for the marine sector. Svanehøj employs approximately 400 employees and has operations in Denmark, Singapore and France. Svanehøj had sales of approximately $148 in 2023. Svanehøj Tank Control Systems develops and produces technologies that enhance the safety of liquified natural gas (LNG), cryogenic and refrigerated storage – both onshore and offshore.

Industrial Pumps

Industrial pumps are used by a wide array of customers and applications primarily in the chemical, energy, marine, mining, general industrial, pharmaceutical and power generation markets. IP designs and manufactures configured-to-order and standards-based industrial pumps that are highly engineered and customized to customer needs. These products include a broad portfolio of centrifugal and twin-screw positive displacement pumps that meet the following industry-recognized standards: American Petroleum Institute (API), American National Standards Institute (ANSI), ATmosphere EXplosible, European Directive 2014/34/EC (ATEX), IEC standards (IECEx) and International Organization for Standardization (ISO). Our project pumps are generally part of larger and more complex capital projects, have longer lead times than baseline pumps and are generally managed by EPC firms.

Valves

Valves are manufactured to handle a wide variety of process conditions and solve unique challenges in the biopharmaceutical, chemical, mining, power generation, pulp and paper, and general industrial markets. Our portfolio of valve products includes knife-gate valves, ball valves, hygienic and industrial diaphragm valves, and valve actuators, marketed under the brand names EnviZion®, Cam-LineTM, Cam-Tite®, Dia-Flo®, Fabri-Valve®, Pure-Flo®, Skotch®, and HabonimTM. Also included within our portfolio is the Integrated Sensing Platform (ISP), which is a next-generation linear position sensing technology for EnviZion® and Pure-Flo® hygienic diaphragm valves, developed specifically for the toughest applications in the biopharmaceutical and sanitary industries.

Aftermarket

Our aftermarket solutions, which represented 43% of IP's revenue in 2024, provide customers with replacement parts, services and plant optimization solutions that reduce total cost of ownership of pumps and rotating equipment, and cryogenic applications for the marine sector. In addition to providing standard repairs, IP also develops engineered solutions for specific customer process issues. Examples include innovative technologies like PumpSmart® Control & Protection Technology and i-ALERT® Equipment Health Monitoring Devices, which remotely control and monitor pumps and other rotating equipment in an industrial environment.

Other Information

IP has a global manufacturing footprint with significant operations in the United States, South Korea, Saudi Arabia, Mexico, Germany, Denmark, and Singapore. IP markets its products via a global and diversified sales channel structure. Sales to independent distributors, who service end-users, account for approximately one-third of IP's revenue. We also sell directly to end-users through our customer-focused direct sales and service organization. In addition, we have focused channels dedicated to supporting EPC firms as their needs are often distinct from those of distribution and end-user customers.

The pump and valve markets we serve are highly competitive and fragmented. For most of our products, there are many regional competitors and a limited number of larger global peers. Primary customer purchase decision drivers include price, lead time and on-time performance, brand recognition, quality, breadth of product and service offerings, commercial terms, technical support and localization. Pricing can be very competitive for large projects because completed projects generate ongoing profitable aftermarket opportunities for the OE provider.

Connect & Control Technologies (CCT)

The Connect & Control Technologies segment designs and manufactures a range of highly-engineered connectors, cable assemblies, and specialized products for critical applications supporting various markets including aerospace and defense, industrial, transportation (including EVs), medical and energy. CCT’s products are often components on long-lived platforms that generate recurring aftermarket and replacement opportunities. CCT has organized its business around product offerings and end-user markets, with dedicated teams specializing in solutions for their specific markets, providing focused customer support and expertise.

Connector Products

The connector product portfolio includes high-performance connectors of the following types: Circular, Rectangular, Radio Frequency, Fiber Optic, D-sub Miniature and Micro-Miniature. Brands include Cannon®, VEAM®, Micro-ModeTM, and BIW Connector Systems®, which deliver solutions to enable the transfer of data, signals and power for various end-user markets including aerospace, defense, industrial, transportation, medical and energy. These brands are known for high-performance, high-reliability solutions which withstand high temperatures and pressure and are resistant to corrosive environments. In certain harsh environment markets, our connector products are considered market leaders because of our technological capabilities, cost performance and global footprint.

Products for the commercial aerospace and defense markets include industry standards-based connectors and late-stage customized solutions. These products are designed to withstand the extreme conditions in harsh environments that are typical in aviation and military applications where reliability and safety are critical factors.

Products for the industrial markets include connectors for industrial production and transportation equipment, industrial electronics and instruments, and other industrial and medical applications. Products for the transportation markets include connectors for electric vehicle charging station applications, passenger rail and heavy-duty vehicles.

Products for the energy markets include connectors that provide power for electric submersible pumps in oil wells and reservoir monitoring instruments. Specific product applications include electrical power penetrators for wellheads, packers and pods that are able to accommodate various sizes and provide for multiple sealing strategies and ratings.

Cable Assembly Products

In September 2024, ITT acquired kSARIA Parent, Inc. (kSARIA), a leading producer and supplier of mission-critical connectivity solutions for the defense and aerospace end markets. kSARIA produces highly engineered cable assemblies for avionics, sensors, communications and networking applications that are highly complementary to ITT’s existing connector portfolio. Headquartered in Hudson, New Hampshire, kSARIA has approximately 1,000 employees across six manufacturing sites in North America. The business generated approximately $175 in sales in 2023.

Control Products

The control product portfolio consists of highly engineered actuation, flow control, energy absorption, environmental control, and composite component solutions for the aerospace, defense and industrial markets.

Control products for the aerospace and defense markets include actuators, valves, pumps and switches for flow control applications, rate controls, seat recline locks and elastomer isolators for aircraft interiors, elastomeric bearings for rotorcraft vibration isolation, heaters, hoses, and composite ducting for environmental control systems. Brands include Aerospace Controls® and Enidine®.

Control products for the industrial markets include shock absorbers, wire ropes and actuators for factory and warehouse automation, regulators and switches for process control applications, seismic isolators and large bore shocks for protection of critical infrastructure, and regulators for natural gas vehicles. Brands include Enidine®, Compact AutomationTM, Turn-Act®, Neo-Dyn® and Conoflow®.

Other Information

CCT has a global production footprint, including facilities in the United States, Mexico, Germany, Italy, China and Japan, which provide close geographic proximity to key customers. CCT competes with a large number of companies in highly fragmented industries, ranging from large public multi-national corporations to small privately-held local firms, depending on the product line and region. CCT's ability to compete successfully depends upon numerous factors including quality, price, lead time, performance, brand recognition, customer service, innovation, application expertise and previous installation history. In addition, collaboration with customers to deliver a wide range of product offerings has allowed CCT to compete effectively, to cultivate and maintain strong customer relationships and to expand into new markets. CCT products are sold directly and indirectly through numerous channels, including distributors. CCT has long-lasting relationships with distributors, as many have been selling certain CCT products for decades. Sales to distributors represented approximately 30% of CCT's 2024 revenue.

OTHER COMPANY INFORMATION

Key Components and Raw Materials

All of our businesses require various manufactured components and raw materials, the availability and prices of which may fluctuate.

| | | | | |

| MANUFACTURED COMPONENTS ASSEMBLED INTO OUR PRODUCTS |

• Motors | • Castings |

• Mechanical Seals | • Machined Castings |

• Metal Fabrications | • Miscellaneous Metal, Plastic, and Electronic Components |

| | | | | | | | | | | |

| PRIMARY RAW MATERIALS |

• Steel | • Gold | • Copper | • Nickel |

| • Iron | • Aluminum | • Tin | • Rubber |

| • Specialty Alloys, including Titanium | | |

Raw materials are purchased in various forms, such as sheet, bar, rod and wire stock, pellets and metal powders. We also use various specialty resins and adhesives. Raw materials, supplies and product subassemblies are purchased from third-party suppliers, contract manufacturers and commodity dealers. For most of our products, we have alternate sources of supply or such materials are readily available. However, in some instances we depend on a single source of supply, manufacturing or assembly or participate in commodity markets that may be subject to a limited number of suppliers.

Our operating results are generally exposed to fluctuations in the prices and supply constraints of raw materials and commodities due to inflation, supply chain disruptions, foreign currency fluctuations, and tariffs imposed by the U.S. and other countries. We continually monitor the business conditions of our supply chain to maintain our market position and to avoid potential supply disruptions. In 2024, supply disruptions for raw materials and component parts adversely affected our ability to deliver products to our customers. Because of the rising demand for raw materials globally, we have experienced increases in prices and delays in supply, particularly in the first half of the year, which impacted our financial results. We have been able to mitigate the impact of this inflation via fixed-price supply contracts with suppliers, price increases to customers and productivity savings. We typically acquire materials and components through a combination of blanket and scheduled purchase orders to support our materials requirements for an average of four to eight weeks, except for some specialty materials. In limited circumstances, we may have to obtain scarce components for higher prices on the spot market, which may have a negative impact on our results. We also acquire certain inventory in anticipation of supply constraints or enter into longer-term pricing commitments with vendors to improve the priority, price and availability of supply. We evaluate hedging opportunities to mitigate or minimize the risk of margin erosion resulting from the volatility of commodity prices. The challenges associated with supply chain disruptions, geopolitical disruptions, and inflation are expected to continue in 2025, and we are unable to reasonably predict when they will be resolved. As a result, we cannot provide assurance that we will not be adversely affected by materials price volatility or the availability of supplies to meet customer demand in the future.

Manufacturing Methods

Our businesses utilize two primary methods to fulfill demand for products: build-to-order and engineer-to-order.

•Build-to-order consists of assembling a group of products with the same pre-defined specifications, generally for our OEM customers. We employ build-to-order capabilities to maximize manufacturing and logistics efficiencies by producing high volumes of basic product configurations.

•Engineer-to-order consists of assembling a customized system according to a customer’s individual order specifications. Engineer-to-order permits the configuration of units to meet the customized requirements of our customers.

In both cases, we offer design, integration, test and other production value-added services. Our inventory management and distribution practices in both build-to-order and engineer-to-order seek to improve customer delivery performance and minimize inventory holding periods.

Intellectual Property

Where appropriate, we seek patent protection for inventions and improvements that are likely to be incorporated into our products or where proprietary rights are expected to improve our competitive position. The highly customized application engineering embedded within our products, our proprietary rights, our knowledge capabilities and our brand recognition all contribute to enhancing our competitive position.

Although we own and control a significant number of patents, trade secrets, confidential information, trademarks, trade names, copyrights and other intellectual property rights which, in the aggregate, are of material importance to our business, management believes that our Company, as a whole, as well as each of our core segments, is not materially dependent on any one intellectual property right or related group of such rights. Patents, patent applications and license agreements will expire or terminate over time by operation of law, in accordance with their terms or otherwise. As the portfolio of our patents, patent applications and license agreements has evolved over a long period of time, we do not expect the expiration of any specific patent or other intellectual property right to have a material adverse effect on our financial statements.

Research and Development

Research and Development (R&D) is key to our strategy and is generally focused on the design of highly engineered critical components. Our R&D teams develop competitive products to address our customers' needs in the markets we serve. In addition, we work closely with our customers to engineer solutions to fit their particular applications, thus enabling our customers to achieve their goals. For example, during 2024, we continued to invest in the Embedded Motor Drive (EMD), which is now in customer field trials. The EMD is a state-of-the-art variable speed motor that eliminates the need for mechanical controls, reduces energy consumption and CO₂ output and ensures that flow controls are more precise. Additionally, our Friction brake pad business, a global leader in R&D for braking technologies, continues to develop new brake pad formulations for electric and hybrid vehicles, as well as ground-breaking innovations for low-emission braking technology. We believe R&D is a source of competitive advantage and we continue to invest approximately 3% of revenue annually, in new product innovation and other R&D efforts.

Cyclicality and Seasonality

Many of the businesses in which we operate are subject to specific industry and general economic cycles. We consider our connector products in our CCT segment to be an early-cycle business, meaning it generally is impacted in the early portion of an economic cycle. Our automotive and aerospace components businesses tend to be impacted in the middle portion of the cycle, and our industrial pump business typically is impacted late in the economic cycle.

Our businesses experience limited seasonal variations. Revenue impacts from the limited seasonal variations are typically mitigated by our backlog of orders that allows us to adjust levels of production across different periods.

General Developments of the Business

Acquisitions and Divestitures

| | | | | | | | | | | | | | |

| Date of Transaction | Type | Segment | Business Acquired | Description |

| September 12, 2024 | Acquisition | CCT | kSARIA Parent, Inc. | Leading producer and supplier of mission-critical connectivity solutions for the defense and aerospace end markets. |

| July 22, 2024 | Divestiture | MT | Wolverine Advanced Materials | Manufacturer of automotive braking components and sealing solutions. |

| January 19, 2024 | Acquisition | IP | Svanehøj Group A/S | Supplier of pumps and related aftermarket services with leading positions in cryogenic applications for the marine sector. |

| December 29, 2023 | Divestiture | CCT | Matrix Composites, Inc.("Matrix") | Manufacturer of precision composite components in the aerospace and defense market. |

| May 2, 2023 | Acquisition | CCT | Micro-Mode Products, Inc. | Specialty designer and manufacturer of high-bandwidth radio frequency (RF) connectors for harsh environment defense and space applications. |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

We continue to grow our core businesses and enhance the ITT portfolio further through mergers and acquisitions. In 2024, we have taken a significant step in reshaping the ITT portfolio towards attractive pump applications and defense and aerospace interconnect markets, while reducing our automotive exposure. Other than as described herein, there have been no significant developments since our previous Form 10-K filing. See Note 21, Acquisitions, Investments, and Divestitures, to the Consolidated Financial Statements for additional information.

We are subject to a wide range of factors that could materially affect future developments and performance. Because of these factors, past performance may not be a reliable indicator of future results. You should carefully consider, together with the other information contained in this Annual Report on Form 10-K, the risks and uncertainties described below. These risks may have a material adverse effect on our reputation, business, results of operations, financial condition, or cash flows. In addition to these risks, there may be additional risks and uncertainties that adversely affect our business, performance or financial condition in the future that are not presently known, are not currently believed to be significant or are not identified below because they are common to most or all companies.

Business and Operating Risks

Our operating results have been, and may continue to be, adversely affected by unfavorable or uncertain global macroeconomic and capital market conditions.

Adverse global macroeconomic conditions, including due to heightened geopolitical tensions, inflation, slowing growth or a recession, currency fluctuations, new or increased tariffs or barriers to trade, tighter credit, higher interest rates, union strikes, and higher unemployment rates can negatively impact customer confidence, spending, and demand for our products and services. In addition, these conditions can negatively impact our customers and suppliers. A downturn in the economic environment can also lead to increased credit and collectability risk or slower collection on the Company's trade receivables, increased bankruptcy risk amongst our suppliers, the failure of derivative counterparties or other financial institutions, limitations on the ability of the Company to issue new debt, reduced liquidity, declines in the fair value of the Company's financial instruments, and increased impairment risk for the Company's goodwill and intangible assets. We have experienced and in the future may continue to experience volatility in revenues, operating results and profitability primarily as a result of these uncertain global macroeconomic conditions.

Our business has been, and may continue to be, adversely affected by raw material price volatility, a limited number of suppliers and the inability of suppliers to meet quality and delivery requirements.

Our business relies on third-party suppliers for raw materials, components and contract manufacturing services to produce our products. Commodity prices and the prices for other raw materials necessary for production have fluctuated, and may continue to fluctuate, and in 2024 increases in raw material costs negatively impacted our financial results. We are not always able to pass along raw material and component price increases to our customers which has impacted, and may continue to impact, our sales growth and profitability.

In addition, the supply of raw materials to ITT and to its component parts suppliers has been, and may continue to be, interrupted for a variety of reasons affecting our suppliers, including congested shipping ports around the world, production interruptions, heightened geopolitical tensions, including related to the Russia-Ukraine and the Middle East conflicts, global pandemics, the impaired financial condition of a particular supplier, capacity constraints, labor disputes or shortages, the ability to meet regulatory requirements and commitments to other purchasers. For most of our products, we have existing alternate sources of supply, or the required materials have historically been readily available. In limited instances, we depend on a single source of supply, manufacturing or assembly, or participate in commodity markets that may be subject to a limited number of suppliers. Although we believe we could obtain and qualify alternative sources for most sole and limited source supplier materials if necessary, the transition to an alternative source could be complex, costly, and protracted, especially if the change requires us to redesign our systems or re-qualify our products. In 2024, decreased availability of raw materials and component parts adversely affected our ability to deliver products to our customers and resulted in increased backlog.

Any further delay in our suppliers’ abilities to provide us with sufficient quality or flow of materials or any supplier price increases, or any decreased availability of raw materials or commodities, could further impair our ability to deliver products to our customers and may impact our profitability.

Recent mergers, acquisitions or venture investments could present operational challenges and past divestitures and spin-offs may expose us to potential liabilities, all of which could adversely affect our results of operations and financial position.

We regularly review our portfolio of businesses and pursue growth through the acquisition of other companies, assets and product lines that either complement or expand our existing businesses. In addition, from time to time, we make minority investments in other early-stage companies, and we risk losing part or all of our capital in any such investment. Refer to Note 21, Acquisitions, Investments, and Divestitures, for further information regarding acquisitions and investments made during the year. Although we conduct what we believe to be a prudent level of investigation regarding the operating and financial condition of the businesses we acquire, a level of risk remains regarding the actual operating condition of these businesses. Until we actually assume operating control of these businesses and their operations, we may not be able to ascertain the actual value or understand the potential liabilities of, or challenges facing, the acquired businesses and their operations. Acquisitions involve a number of risks and present financial, managerial and operational challenges that could have a material adverse effect on our reputation, financial results and business. These include the possibility that: •an acquired business could under-perform relative to our expectations;

•we could fail to realize the expected synergies of an acquisition;

•we could experience difficulties in the integration of technology, operations, personnel and financial and other systems;

•we could have acquired substantial undisclosed liabilities;

•there could be insufficient internal controls over financial activities or financial reporting at an acquired company that could impact us on a consolidated basis;

•management attention could be diverted from other businesses;

•an acquired business may have been impacted by a previous security breach where system/data integrity was compromised, or data was stolen without the seller's awareness;

•we could lose key employees of the acquired businesses;

•we could experience increased capital requirements; and

•the acquisition could result in customer dissatisfaction.

We have divested a number of businesses, including as part of spin-offs in 1995, 2011, our sale of InTelCo Management LLC (InTelCo), the entity holding asbestos-related assets and liabilities in 2021, and Wolverine in 2024. With respect to some of these former businesses, we have contractually agreed to indemnify the counterparties against, or otherwise retain, certain liabilities including certain product liability claims and environmental matters. Even without ongoing contractual indemnification obligations, we could be exposed to liabilities arising out of such divestitures. Although the counterparties to those divestitures may have agreed to indemnify us or assume certain liabilities relating to those divestitures, there can be no assurance that the indemnity or assumption of liability by the counterparties will be sufficient to protect us against the full amount of these liabilities or that a counterparty will be able to fully satisfy its obligations. Third parties also could seek to hold us responsible for any of the liabilities that a counterparty agreed to assume. Even if we ultimately succeed in recovering any amounts for which we were initially held liable, we may be temporarily required to bear these losses ourselves.

The industries in which we operate are experiencing a skilled labor shortage and if we are unable to hire and retain key personnel, including engineering talent and senior management talent, our ability to operate or grow our business could be negatively impacted.

The manufacturing industry is currently experiencing a skilled labor shortage. This shortage has created difficulties for the Company in attracting and retaining factory employees, in meeting customer demand and in controlling labor costs. We currently have a significant number of open positions, and we expect this to remain so in 2025. A failure to attract or retain engineering and other highly skilled personnel could adversely affect our operating results, our ability to deliver products and services to our customers and our ability to grow our business. Our future success will continue to depend, to a significant extent, on our ability to attract or retain engineers, senior management, our skilled labor source and other key personnel, which will depend on our ability to offer competitive compensation, training, flexibility and other benefits that our current and prospective employees desire.

Failure to provide high quality and reliable products, innovate or respond to competitors in our markets or protect our intellectual property rights could adversely impact our business and financial results.

We believe product performance, reliability and innovation, application expertise, enforcement of intellectual property rights, brand reputation, and price are principal points of competition in our markets.

We manufacture key components that are integral to the operation of systems and manufacturing processes in the markets we serve. The reliability and performance of our products are critically important to our customers and the users of their products. Accordingly, quality is extremely important to us and our customers due to the potentially costly consequences of product failure. Our quality certifications, including products manufactured to military specifications, are critical to the marketing success of our goods and services. Our success in part depends on our ability to attract and retain skilled engineers and to manufacture to exact tolerances precision-engineered components, subassemblies and finished devices from multiple materials. If our components fail to meet these standards or fail to adapt to evolving standards, it could damage our reputation as a manufacturer of high-quality components, which could hurt our ability to remain competitive and result in a loss of customers, market share or product sales.

Maintaining and improving our competitive position will require our continued investment in manufacturing, research and development, engineering, marketing, customer service and support, and our distribution networks. Insufficient investment in these areas may result in a failure to maintain our competitive position. In addition, our existing competitors, or potential new competitors, may develop products that are cheaper and/or superior to our products, develop more efficient or effective methods of providing products and services, or adapt more quickly than we do to new technologies or evolving customer requirements. These pressures may result in us having to take actions, such as adjusting the prices of certain products, in order to stay competitive.

Obtaining, maintaining and enforcing our proprietary rights is another factor that is critical to the success of our business and our ability to remain competitive. For certain products and manufacturing processes, we rely on patents, trademarks, trade secrets, non-disclosure agreements and other contracts to protect these rights. These contracts may be breached, or may not prevent competitors from independently developing or selling similar products. In addition, during the normal course of business, we could unintentionally infringe or violate the proprietary rights of others. Intellectual property litigation could be time consuming for management and could result in significant legal expenses to either pursue claims against others, or to defend ourselves. If we are unable to protect our patents, trademarks, or other proprietary rights, or if we infringe or violate the rights of others, our ability to remain competitive could be adversely impacted.

If we are unable to maintain our competitive position, our business, results of operations or financial condition could be materially adversely affected.

Our operations could be disrupted, and our business could be materially and adversely affected by our inability to prevent, detect or adequately respond to cybersecurity breaches.

The efficient operation of our business is dependent on information technology (IT) systems, some of which are owned or managed by third parties. In the ordinary course of business, we collect and store confidential information, including proprietary business information belonging to us, our customers, suppliers, business partners and other third parties, as well as personally identifiable information of our employees and others.

Our information technology systems and those of our third-party service providers may be susceptible to damage, disruptions or shutdowns due to power outages, hardware failures, telecommunication failures, cybersecurity incidents and user errors that may affect our operations. Although we actively manage the risks to our information technology systems that are within our control, we can provide no assurance that our actions or those of our third-party service providers will always be successful in eliminating or mitigating risks to our systems, networks or data. Even the most well-protected information technology systems could be vulnerable to internal and external cybersecurity incidents including, but not limited to, those by employees and by computer hackers and other threat actors utilizing techniques such as phishing, ransomware or denial of service attacks. We have experienced cybersecurity incidents in the past which have not had a material impact on our operations or financial results. If we experience a future disruption in our information technology systems, it could result in the loss of sales and customers and significant incremental costs, which could materially adversely affect our business. In addition, as a provider of products and services to government and commercial customers, and particularly as a government contractor, we are subject to a heightened risk of cybersecurity incidents caused by computer viruses, illegal break-ins or hacking, sabotage, or acts of vandalism, including by foreign governments, hackers and cyber terrorists. Furthermore, information technology security threats are increasing in sophistication, intensity and frequency. A cybersecurity incident may occur, including breaches that we may be unable to detect in a timely manner. The

unavailability of our information technology systems, the failure of these systems to perform as anticipated for any reason, or any significant breach of security could cause significant disruption to our business or could result in decreased performance and increased costs.

We continue to monitor data security regulations in the jurisdictions in which we operate. The processing and storage of certain information is increasingly subject to privacy and data security regulations, and many such regulations are country-specific. The interpretation and application of data protection laws in the U.S., Europe, China, and elsewhere are uncertain, evolving and may be inconsistent across jurisdictions. Compliance with these various laws may be onerous and require us to incur substantial costs or to change our business practices in a manner that adversely affects our business, while failure to comply with such laws may subject us to substantial penalties.

If we are unable to protect sensitive information, our customers or governmental authorities could question the adequacy of our security processes and procedures and our compliance with evolving privacy and data security regulations and government cybersecurity requirements for government contractors, potentially causing us to lose business. A breach could also result in the loss of our intellectual property, potentially impacting our long-term capability to compete for sales of affected products. In addition, a breach of security of our information technology systems could result in litigation, regulatory action and potential liability, as well as increased costs to implement further information security measures. If we are unable to prevent, detect or adequately respond to cybersecurity incidents, our operations could be disrupted, our reputation could be harmed, and our business and financial condition could be materially and adversely affected.

The Company’s ability to manage its business and monitor results is highly dependent upon information and communication systems, and a failure of these systems, including flaws in the implementation of any business system, could adversely impact our business or financial results.

The Company is dependent upon a variety of information technology IT systems, including business systems and communication systems, to operate its business. Over the past several years, we have been implementing new business systems at many of our sites, including within our shared services subsidiary, and we expect these implementations to continue for the next several years. These implementations have required and will continue to require significant investment in capital and deployment of human resources. Potential flaws in implementing business systems or in the failure of any portion or module of the business system(s) may pose risks to our ability to operate successfully and efficiently. In addition, failure to implement the appropriate internal controls with respect to new business systems may result in the business systems producing inaccurate or unreliable information. Any disruptions, delays or deficiencies in the design or implementation of the new business systems or related internal controls, or in the performance of legacy IT systems, could adversely affect the Company’s ability to effectively manage its business, which could adversely affect the Company’s reputation, competitive position and financial results.

A significant portion of our revenue is derived from a single customer. Loss of this customer, a loss of business with this customer, or a reduction in this customer's market share, could adversely impact our financial results.

Sales to Continental, a supplier to the automotive industry and ITT's largest customer, were approximately 7% of our total revenue in 2024. Requests by automakers to use ITT brake pads in their Continental-produced braking systems (calipers) typically account for approximately half of MT's revenue from Continental. These automaker requests are generally formalized through supply agreements signed directly between MT and the automakers. The remainder of MT's sales to Continental in 2024 was generated from a 10-year agreement to supply Continental with aftermarket parts, which is effective through December 31, 2033, although there can be no assurance that we are able to retain this customer's business in the future. The loss of this customer, or a reduction in this customer's market share could have a material adverse effect on our business, results of operations or financial condition.

Due to our operations and sales outside of the U.S., we are subject to inherent business risks, including the imposition of tariffs, which may adversely affect our financial results.

Our international operations, including U.S. exports, comprise a growing portion of our operations and are a strategic focus for continued future growth. Our sales in emerging markets such as Mexico, South America, China, and the Middle East have been increasing. In both 2024 and 2023, approximately 67% of our total sales were to customers operating outside of the United States. Our sales from international operations and export sales are subject to varying degrees of risks inherent in doing business outside of the United States. These risks include the following:

•war or geopolitical instability in regions where we operate;

•fluctuations in foreign exchange rates;

•possibility of unfavorable circumstances arising from host country laws or regulations;

•restrictions, regulations, or tax liabilities on currency repatriation;

•potential negative consequences from changes to taxation policies;

•the disruption of operations from labor and political disturbances; and

•our ability to hire and maintain qualified staff in these regions.

Our operations in emerging markets could involve additional uncertainties such as challenges in our ability to protect our intellectual property, pressure on the pricing of our products, and risks of political instability. Governments of emerging market countries may also impose limitations or prohibitions on our ability to repatriate funds, impose or increase withholding or other taxes on remittances and other payments to us, seek to nationalize our assets, or impose or increase investment barriers or other restrictions that may adversely affect our business.

Because a significant portion of our sales are to customers operating outside the U.S., our financial results have been, and may continue to be, adversely impacted by foreign currency fluctuations, which are influenced by changes in global macroeconomic conditions. The primary foreign currencies to which we have exposure are the Euro, Chinese renminbi, Czech koruna, Danish krone, Singapore dollar, Polish zloty, South Korean won, Saudi riyal, Mexican peso, and Israeli new shekel. Any significant change in the value of currencies of the countries in which we do business relative to the value of the U.S. dollar could reduce our revenue, impact our ability to sell products and control costs, thus our financial results have been, and may continue to be, adversely affected upon translation. In addition, our international subsidiaries report their results of operations and financial position in their respective local currencies (i.e., functional currencies), which are then translated into U.S. dollars for financial reporting purposes. From time to time, we enter into derivative contracts to hedge some of our foreign currency exposures. However, our hedging strategy may fail to reduce our exposure and could even result in an unfavorable impact on our financial results. Refer to Note 20, Derivative Financial Instruments, for further information. The cost of compliance with increasingly complex and often conflicting regulations worldwide can also impair our flexibility in modifying product, marketing, pricing or other strategies for growing our businesses, as well as our ability to improve productivity and maintain acceptable profit margins.