UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

o ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended ______________.

OR

þ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from July 1, 2012 to December 31, 2012.

Commission File Number 000-10822

(Exact name of registrant as specified in its charter)

| Pennsylvania | | 25-1229323 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

| | | |

Weststrasse 1, Baar Switzerland | | CH6340 |

| (Address of principal executive offices) | | (Zip Code) |

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Name of each exchange on which registered |

| n/a | | n/a |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, Par Value $0.0001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes o No þ

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No þ

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | o | Accelerated filer | o |

| Non-accelerated filer | o | Smaller reporting company | þ |

| (Do not check if smaller reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

As of June 30, 2012, the aggregate market value of the 562,371,636 shares of voting and nonvoting common stock held by nonaffiliates of the issuer was $6,129,850.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. As of April 29, 2013, 18,879,848,155 shares of the registrant’s common stock, par value $0.0001, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

None.

| Item | | Description | | Page | |

| | | | | | 1 | |

| | | | | | 1 | |

| | | | | | | |

| | | Part I | | | | |

| | | | | 2 | |

| | | | | 10 | |

| | | | | 10 | |

| | | | | 10 | |

| | | | | 10 | |

| | | | | 10 | |

| | | | | | | |

| | | Part II | | | | |

| | | | | 11 | |

| | | | | 13 | |

| | | | | 13 | |

| | | | | 22 | |

| | | | | 22 | |

| | | | | 22 | |

| | | | | 22 | |

| | | | | 24 | |

| | | | | | | |

| | | Part III | | | | |

| | | | | 25 | |

| | | | | 27 | |

| | | | | 31 | |

| | | | | 32 | |

| | | | | 34 | |

| | | | | | | |

| | | Part IV | | | | |

| | | | | 35 | |

| | | | | | 38 | |

On November 30, 2012, the Company (then known as Intelligent Communication Enterprise Corporation (“ICE Corp.”)) and One Horizon Group PLC, a public limited company incorporated in England and Wales (“One Horizon UK”), consummated a share exchange (the “Share Exchange”), as a result of which One Horizon UK became a subsidiary of the Company, with former One Horizon UK shareholders holding approximately 96% of the issued and outstanding shares of ICE Corp. The Company’s name was subsequently changed to One Horizon Group, Inc. Prior to the Share Exchange, One Horizon UK had a June 30th fiscal year end, which, by virtue of One Horizon UK being deemed the accounting acquirer, became the fiscal year end of the Company. On February 13, 2013, the Company filed a Current Report on Form 8-K disclosing that the board of directors of the Company changed the Company's fiscal year end from June 30 to December 31. As a result of this change, this Transition Report on Form 10-KT (the “Report”) includes the financial information for the six-month transition period from July 1, 2012 to December 31, 2012 (the "Transition Period"). Prior to this Report, the Annual Reports on Form 10-K of the Company (formerly ICE Corp.) cover the fiscal year from January 1 to December 31.

Unless otherwise noted, references to the “Company” in this Report include One Horizon Group, Inc. and all of its subsidiaries.

The statements made in this Report, and in other materials that the Company has filed or may file with the Securities and Exchange Commission, in each case that are not historical facts, contain “forward-looking information” within the meaning of the Private Securities Litigation Reform Act of 1995, and Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, both as amended, which can be identified by the use of forward-looking terminology such as “may,” “will,” “anticipates,” “expects,” “projects,” “estimates,” “believes,” “seeks,” “could,” “should,” or “continue,” the negative thereof, and other variations or comparable terminology as well as any statements regarding the evaluation of strategic alternatives. These forward-looking statements are based on the current plans and expectations of management, and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those reflected in such forward-looking statements. Among these risks and uncertainties are the competition we face; our ability to adapt to rapid changes in the market for voice and messaging services; our ability to retain customers and attract new customers; our ability to establish and expand strategic alliances; governmental regulation and related actions and taxes in our international operations; increased market and competitive risks, including currency restrictions, in our international operations; risks related to the acquisition or integration of future businesses or joint ventures; our ability to obtain or maintain relevant intellectual property rights; intellectual property and other litigation that may be brought against us; failure to protect our trademarks and internally developed software; security breaches and other compromises of information security; our dependence on third party facilities, equipment, systems and services; system disruptions or flaws in our technology and systems; uncertainties relating to regulation of VoIP services; liability under anti-corruption laws; results of regulatory inquiries into our business practices; fraudulent use of our name or services; our ability to maintain data security; our dependence upon key personnel; our dependence on our customers' existing broadband connections; differences between our service and traditional phone services; our ability to obtain additional financing if required; our early history of net losses and our ability to maintain consistent profitability in the future. These and other matters the Company discusses in this Report, or in the documents it incorporates by reference into this Report, may cause actual results to differ from those the Company describes. The Company assumes no obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise.

PART I

We develop and license software to telecommunications operators through our indirect wholly-owned subsidiaries Horizon Globex GmbH and Abbey Technology GmbH, each incorporated under the laws of Switzerland (“Horizon Globex” and “Abbey Technology,” respectively). Specifically, Horizon Globex and Abbey Technology develop software application platforms that optimize mobile voice, instant messaging and advertising communications over the internet, collectively, the “Horizon Platform.” Both subsidiaries do this by using proprietary software techniques that use internet bandwidth more efficiently than other technologies that are unable to provide a low-bandwidth solution. The Horizon Platform is a bandwidth-efficient Voice Over Internet Protocol (“VoIP”) platform for smartphones and tablets, and also provides optimized data applications including messaging and mobile advertising. We license our software solutions to telecommunications network operators and service providers in the mobile, fixed line and satellite communications markets. We are an ISO 9001 and ISO 20000-1 certified company with assets and operations in Switzerland, the United Kingdom, China, India, Singapore and Hong Kong.

The Horizon Platform delivers a turnkey mobile VoIP solution to telecommunications operators. We believe that the technology underlying the Horizon Platform, which we call SmartPacket™, is the world’s most bandwidth-efficient VoIP technology. Our VoIP technology is able to transmit voice at 2kbps compared to around 8kbps offered by other VoIP platforms, thereby enabling voice communications over limited bandwidth and congested cellular telecom data networks including 2G, 3G and 4G.

Industry

The global telecommunication services market continues to experience growth. This growth is mainly being driven by the growth in the number of mobile subscribers. Although the mobile VoIP (or “mVoIP”) is a small percentage of the total revenue generated by mobile telecommunications providers, Visiongain, an independent business information provider for the telecommunications industry, among others, expects this market to grow significantly by 2016 as a number of commercial and technological factors alter mobile voice communications. These factors include innovative smartphone designs with improved user interfaces and acoustics, increased acceptance of VoIP and overall increases in broadband penetration.

According to Visiongain, mVoIP users are expected to increase to more than 180 million with total revenue of more than $36 billion by 2016. We expect consumer demand for all VoIP and mVoIP will continue to grow for a number of reasons including cheaper rates. The market will likely continue to broaden as VoIP is further incorporated into other mobile applications, including social networking applications. The major factors driving the growth of mVoIP include rise in the use of mobile smartphones, intense price competition and price regulations that are driving down voice revenues as a proportion of total mobile revenue and shifts in consumer behavior.

The growth of smartphones and tablets is a key driver for the Company in increasing the number of customers and revenue. According to estimates by the International Data Corporation, a provider of market intelligence in the industry, the number of smartphones globally will grow from 495 million in 2011 to 1.52 billion in 2015. Smartphones consume 24X more data than the “feature phones” that they replace due to higher usage of data, VoIP, and video services, creating a significant strain on existing carrier infrastructure and creating potentially severe network congestion issues particularly in high density, high population markets.

The increase in mobile data consumption has been driven by the availability of cheap GSM (global system for mobile communications) data and the massive uptake of smartphones and tablets, devices on which our mobile application, Horizon Call, was designed to run.

In its paper titled “Cisco Visual Networking Index: Global Mobile Data Traffic Forecast Update, 2012–2017,” Cisco projects global mobile data traffic to increase 13-fold between 2012 and 2017. According to Cisco, at the end of 2012, the number of mobile-connected devices exceeded the number of people on earth, and by 2017, it is expected that there will be 1.4 mobile devices per capita. According to Cisco, in 2017, it is expected that 4G will account for ten percent of connections, but 45 percent of total traffic. Horizon Call addresses the need for efficient data on the next generation networks while tackling the need for efficient data usage on legacy networks in the world’s most populous countries.

Our Technology

Our technology enables greater bandwidth efficiency by reducing IP overhead and optimizing packet flow, delivery and playback. It is also extremely efficient in the way it handles silence. Traditional VoIP calls send the same amount of data in both directions, regardless of whether someone is speaking or not. SmartPacket™ detects silence and sends “heartbeats” so it does not sound like the line has been dropped. These heartbeats get sent at only 0.25kbps compared to approximately 8kbps on other VoIP platforms. In addition to low-bandwidth VoIP, our technology can also be utilized to enhance data applications for personal computers (i.e., email, web browsing and instant messaging) which give the user total visibility and control over how much data they consume on pay-as-you-use internet connections such as satellite data connections.

The Horizon Platform has been developed entirely in-house and is fully compatible with digital telecommunications standards. It is capable of interconnecting any phone system over IP – on mobile, fixed and satellite networks.

The Horizon Platform was initially developed for the mobile satellite market by Abbey Technology to make the best use of the limited wireless bandwidth available, minimize the amount of data consumed and ultimately reduce costs for the end-user.

The Company further developed the Horizon Platform for the broader telecommunications market, while focusing on the mobile data sector. This sector also benefits from the Company’s optimized mobile VoIP software that allows voice calls over new and legacy cellular telecom data networks. With the explosive growth in smartphone sales and increased usage of mobile data services, mobile operators face the challenge of dealing with increasingly congested networks, more dropped calls and rising levels of churn. Since the wireless spectrum is a finite resource it is not always possible, or can be cost prohibitive, to increase network capacity. For these reasons, we believe that the demand for solutions which optimize the use of IP bandwidth will inevitably increase.

Our Strategy

We have developed a mobile application, “Horizon Call,” that enables highly bandwidth-efficient VoIP calls over a smartphone using a 2G/EDGE, 3G, 4G/LTE, WiFi or WiMax connection. Our Horizon Call application is currently available for the iPhone and for Android handsets.

Unlike the majority of mobile VoIP applications, Horizon Call creates a business-to-business solution for mobile operators. Telecommunications operators are able to license, brand and deploy on a “white-labeled” basis that they can optimize to their business strategies. The operators decide how to integrate it within their portfolio, how to offer it commercially and can customize the application according to their own branding. Our solution helps them to manage rising traffic volumes while also combating the competitive threat to their voice telephony revenues from other mobile VoIP applications by giving its mobile data customers a more efficient mobile VoIP solution that adds value to their mobile data network.

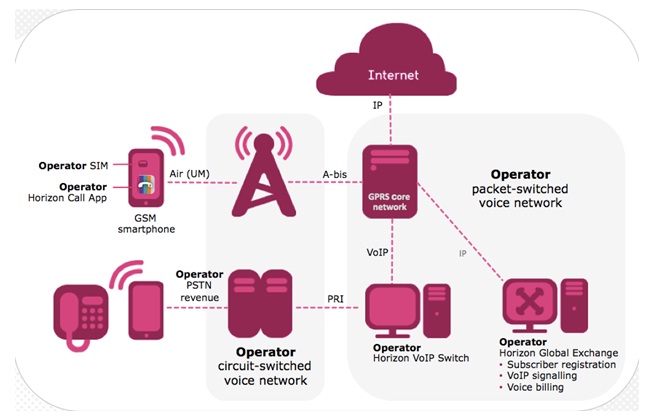

We are positioning ourselves as an operator-enabler by licensing our technology to the operator in a manner that can be fully customized to the needs of their subscribers. As shown below, operators are able to offer our platform to deliver branded smartphone applications to their existing customers to help reduce lost Voice/Text revenue and minimize customer churn.

By offering Horizon Call to their existing customer base, our telecommunications operator customers can offer innovative data-based voice and data services that differentiate themselves from the existing Over The Top (“OTT”) data applications running on their networks. OTT refers to voice and messaging services that are delivered by a third party to an end user’s smartphone, leaving the mobile network provider responsible only for transporting Internet data packets and not the value-added content. The Horizon Call voice services allow the mobile operators’ customers to make VoIP calls under the mobile operators’ call plans, thereby allowing the mobile operator to capture the value-added content, including voice calls, text messaging, voice messaging, group messaging, multimedia messaging, and advertising, that would have otherwise gone to the providers of other OTT services.

Horizon Call runs on both smartphone and tablet devices and, as networks become more congested, software services such as Horizon Call become ever more relevant. We believe that although more network capacity will eventually come on stream with 4G/LTE, it, like all other highways, will quickly become congested and this is why we believe that Horizon Call is ideally placed to add value to mobile data networks.

Incumbent mobile operators are suffering a reduction in revenue per user due to the OTT software services on mobile devices. These OTT applications, such as Skype, Viber, WeChat, and WhatsApp, can negatively impact mobile operators’ traditional revenue streams of voice and SMS (short message service). As shown below, the Horizon Platform positions the Company to enable mobile operators to operate their own OTT solution branded in their image allowing use on all mobile data networks.

In addition to delivering new data services to their existing customers, the mobile operators can offer their brand of Horizon Call on any other operators’ handsets. Because the Horizon Call application can be installed on the smartphone from the Internet, the potential customer base for the operators’ data application surpasses the customer base that they can reach through traditional mobile phone SIM card distribution. We believe that this service innovation, coupled with the fact that the Horizon Call application can also use existing mobile operator pre-paid credit redemption and distribution services, presents a very compelling service offering from the operator compared to OTT services.

We believe that emerging markets represent a key opportunity for Horizon Call because these are significant markets with high population density, high penetration of mobile phones, congested mobile cellular networks and high growth in the adoption of smartphones. These factors will put increased pressure on mobile operators to manage their network availability.

In this context, where necessary, we are forming a number of joint ventures with local partners in regions of various emerging markets to seize upon this opportunity, including one in China in which the Company has invested $1.5 million for a 75% equity stake. Our joint venture partner, ZTE Corporation, is the second largest mobile handset manufacturer in the world and the fourth largest telecommunications equipment supplier in the world. The Company is not a guarantor of any debt related to the joint venture. The investment is held in a subsidiary, One Horizon Hong Kong Limited.

Marketing

Our marketing objective is to become a broadly adopted solution in the regions of the world with the largest concentrations of smartphone users and highest network congestion by becoming the preferred solution for carriers who wish to deploy branded VoIP solutions that enable them to minimize revenue erosion, reduce churn, increase the effective capacity of their network infrastructure and improve user experience. We employ an integrated multi-channel approach to marketing, whereby we evaluate and focus our efforts on selling through Tier 1 and Tier 2 telecommunications companies to enable them to provide the Horizon Platform to their customers. We regularly evaluate the success of our marketing efforts and try to reallocate budgets to identify more effective media mixes.

We make use of marketing research to gain consumer insights into brand, product, and service performance, and utilize those findings to improve our messaging and media plans. Market research is also leveraged in the areas of testing, retention marketing, and product marketing to ensure we bring compelling products and services to market for our customers.

Sales

Direct Sales. Our primary sales channel for the products and services of Horizon Platform is by selling Horizon Platforms to Tier 1 and Tier 2 telecommunications companies to enable them to provide the product and services to their customers. We continue our efforts to develop new customers in Europe, the Middle East, Asia, Africa, South America, and, in the near future, North America.

Joint Ventures. In addition to our direct sales channel, we also offer increased sales through our joint venture channel. In this context, we are forming a number of joint ventures in areas where regulatory issues require local representation.

Target Markets. The markets for our primary and joint venture channels will have high population density, high penetration of mobile phones, congested mobile cellular networks and high growth in the adoption of smartphones.

Competition

The Company’s direct competitors for its technology primarily consist of systems integrators that combine various elements of SIP (Session Initiation Protocol) dialers and media gateways. Other dial-back solutions exist but are not IP-based. Because SIP dialers and media gateways currently are unable to provide a low bandwidth solution, they do not currently compete with the Company’s technology in those markets in which their high bandwidth needs are unsupported by the existing cellular networks. They do, however, compete in those markets where the cellular networks are accessible by those SIP dialers and gateways.

The Company licenses the Horizon Platform to mobile operators, who in turn may offer the application to their end-user subscribers. The Company’s principal competitors for the mobile operators’ end-users are Skype, Viber, WeChat, and WhatsApp. Having a mobile operator’s subscriber opt to use the operator’s (branded) Horizon Call service instead of existing OTT services means that the mobile operator will gain market share of some of the OTT voice and messaging traffic. We are unaware of any other companies that seek to license VoIP technology directly to the mobile operators.

One of the Company’s key competitive advantages is that it is not a threat to the mobile operators. Rather, the Company’s Horizon Platform is a tool that can be used by the mobile operator to compete against the OTT provider’s applications that are running on the networks of the mobile operators. Through the Horizon Platform, the mobile operators are able to compete directly with OTT services that, by their design, divert voice and messaging services away from the mobile operators. The solution is delivered complete and is easy to install and operate. This means that the mobile operator has a turnkey mobile voice and messaging solution to deploy to its customer (i.e., the end-user).

The Horizon Global Exchange complete software platform, a central processing service, and the Horizon SmartPacket™ technology give us a competitive advantage by managing credit, routing, rating, security, performance, billing and monitoring. Horizon SmartPacket™ is the world’s lowest bandwidth voice compression and transmission protocol and is 100% developed and owned by the Company. Other software companies can offer part of this solution space but we believe none offer it in such a complete and integrated fashion. We believe that to copy/replicate the Horizon Platform in its entirety would take a substantial number of years, by which time we believe the Horizon Platform will have improved and further distanced itself from potential competition.

Intellectual Property

Our strategy with respect to our intellectual property is to patent our core software concepts wherever possible. The Company’s current software patent application, which is pending in Switzerland, reflects this strategy and protects the Horizon Platform and the central processing service of the Horizon Platform.

The Company endeavors to protect its internally developed systems and technologies. All of our software is developed “in-house,” and then licensed to our customers. We take steps, including by contract, to ensure that any changes, modifications or additions to the Horizon Platform requested by our customers remain the sole intellectual property of the Company.

Research and Development and Software Products

The Company has spent approximately $7.5 million on research and development during the period from July 1, 2010 to December 31, 2012. In the period ended June 30, 2012, the R&D has developed the VoIP Application, encompassing VoIP signaling (global exchange), billing, VoIP servers (App-App/App-PSTN/PSTN-App) and VoIP clients (VoIP PBX and Horizon Call smartphone application for iPhone and Android), together with voicemail messaging and customer registration and assistance portal. The Horizon Call application is currently for sale through iTunes and Google Play. In the six months ended December 31, 2012, additional R&D has been focused on advertising and bulk messaging applications for the Horizon Platform. Future projects currently underway include the development of Microsoft Lync Software (“MS Lync”) as a service to enable MS Lync accredited distributors to license a mobile client application that works as part of their Lync “software as a service” offering. The MS Lync development project is in the research phase and early prototyping phase. Other than the costs of software developed and capitalized, the Company incurred no research and development costs in the six months ended December 31, 2012 and years ended June 30, 2012 and 2011.

Employees

As of December 31, 2012, we had 20 employees, all of whom were full-time employees.

Background

On November 30, 2012, the Company (then known as Intelligent Communication Enterprise Corporation (“ICE Corp.”)), and One Horizon Group PLC, a public limited company incorporated in the United Kingdom (“One Horizon UK”), consummated a share exchange (the “Share Exchange”), pursuant to which ICE Corp. will acquire all of the issued and outstanding shares of One Horizon UK from One Horizon UK’s then existing shareholders in exchange for 17,853,476,138 shares of ICE Corp.’s common stock. To date, the Company has acquired 99% of the outstanding shares of One Horizon UK pursuant to the Share Exchange. Under the terms of the Share Exchange, each One Horizon UK shareholder received 175.14 shares of ICE Corp.’s common stock for each issued and outstanding share of One Horizon UK stock. As a result of the Share Exchange, One Horizon UK is now a subsidiary of the Company, with former One Horizon UK shareholders holding approximately 96% of the issued and outstanding shares of ICE Corp. Having received share exchange acceptances in excess of 90% of the One Horizon UK shares, the Company intends to exercise its rights in accordance with Sections 974 to 991 (inclusive) of the Companies Act 2006 to acquire compulsorily the remaining One Horizon UK shares in respect of which acceptances have not been received to date. The transaction has been accounted for as a reverse acquisition, whereby ICE Corp. is the legal acquirer and One Horizon UK is the legal acquiree and accounting acquirer. On December 27, 2012, the Company changed its name to One Horizon Group, Inc.

To record the accounting effects of the reverse acquisition, the assets and liabilities of One Horizon UK (the accounting acquirer) are recognized and measured at their precombination carrying amounts. The assets and liabilities of ICE Corp. (the accounting acquiree) are recognized and measured consistent with accounting for business combinations, including recognition of fair values, effective as of November 30, 2012, the date of the Share Exchange transaction.

The Company was incorporated in Pennsylvania in 1972 as Coratomic, Inc. It changed its name to Biocontrol Technology, Inc. in 1986; BICO, Inc. in 2000; Mobiclear Inc. in 2006; and Intelligent Communication Enterprise Corporation in 2009.

The Company effected a 1-for-250 share reverse stock split on July 21, 2008, and the outstanding shares were reduced to 6,757,803.

The Company effected a 1-for-600 share reverse stock split on October 20, 2009, and the outstanding shares were reduced to 521,519.

The Company effected a 3-for-1 share forward stock split on February 5, 2010, and the outstanding shares were increased to 92,375,841.

The Company effected a 7-for-1 share forward stock split on December 30, 2010, and the outstanding shares were increased to 640,023,118.

On March 5, 2012, the Company obtained control of all the issued and outstanding shares of Global Integrated Media Limited (“GIM”), a contract publishing entity with operations in Hong Kong and the Philippines, for 61,471,814 shares of our common stock with a fair value of $1,383,000. Although the Company had announced the closing of this transaction on December 12, 2011, based upon the delivery and execution of the transaction documents by the parties, the Company did not obtain control of GIM and did not deliver the consideration to the seller at that time. On March 5, 2012, the Company completed the acquisition of GIM and issued 61,471,814 shares of common stock, with a fair value of $1,383,000, as full consideration for the acquisition. On December 31, 2012, the Company sold all of the issued and outstanding shares of GIM and all of the assets and operations of the Company’s Modizo business (discussed below, under “Pre-Share Exchange Business of ICE Corp.”) for the return of 42,000,000 shares of our common stock held by the purchaser, which had a fair value of $420,000. After giving effect to the Share Exchange transaction consummated on November 30, 2012, as described in the Company’s Form 8-K filed December 6, 2012, at the time of the sale, the GIM and Modizo businesses were less than 10% of the Company’s assets and are expected to be less than 10% of the Company’s sales and profits in future fiscal years.

One Horizon UK

One Horizon Group, PLC (“One Horizon UK”), a subsidiary of the Company (formerly ICE Corp.), was incorporated in the United Kingdom on March 8, 2004, and has three wholly-owned subsidiaries, Horizon Globex and Abbey Technology, both incorporated in Switzerland, and One Horizon Hong Kong Limited, which is incorporated in Hong Kong. On October 25, 2012, One Horizon UK sold a group of wholly-owned subsidiaries referred to as the Satcom Global business. The Satcom Global business was a satellite communication distribution business comprised of multiple entities located throughout Europe, Asia and the United States. As a result of the downturn in U.S. government expenditure in satellite communication, the Satcom Global business became unprofitable and One Horizon Group UK decided to sell the business for nominal cash consideration and the assumption of debt so that it could focus its efforts on the Horizon Globex business (discussed above). Also on October 25, 2012, Abbey Technology sold certain satellite billing software utilized in the Satcom Global business to the purchaser of the Satcom Global business. The entire purchase price for the software was paid by means of an offset against amounts owed by Abbey Technology and its affiliates to Satcom Global FZE, an entity acquired by the purchaser in connection with the purchase of the Satcom Global business.

Prior to the Share Exchange, the consolidated financial statements of One Horizon UK for its fiscal years ended June 30, 2012 and 2011 consisted of two main business segments, the Horizon Globex business segment and the Satcom Global business. In those historical financial statements, the financial results of the Horizon Globex business segment consisted of the financial results of the One Horizon UK and two of its subsidiaries, Abbey Technology and Horizon Globex. The Satcom Global business was sold in October 2012, prior to the Share Exchange. In the historical financial statement presentation of the UK Operating Company for its fiscal years ended June 30, 2012 and 2011, the operations of Satcom Global have been retrospectively restated for treatment as discontinued operations.

Satcom Global was maintained in separate legal entities, all of which were sold in their entirety prior to the Share Exchange transaction. The Satcom Global distribution business represented a dissimilar business from the Horizon Globex software business. As a distribution business, Satcom Global had a different revenue and expense model (high volume and low gross margin), included different products and product marketing strategies, sold to different customers, purchased from different vendors, and had different management and operational personnel. The results of the Satcom Global business is not an indicator of Company management’s past performance as all of the operational staff and management of the Satcom Global business remained with that business and are now employed by the purchasers of the Satcom Global business.

One Horizon Hong Kong is a subsidiary of One Horizon UK, and was formed in 2012. One Horizon Hong Kong currently holds the Company’s equity interest in the Chinese joint venture.

Abbey Technology is a software development company that was founded in 1999 by our director and Chief Technology Officer, Brian Collins, and licenses proprietary software solutions for the banking sector. The Horizon software platform was invented/developed in Abbey Technology by Brian Collins and Claude Dziedzic with One Horizon UK (formerly Satcom Group Holdings) as its first customer for the solution (phase 1 – satellite networks). It is the named company on the filed patent for the Horizon Platform. Abbey Technology was subsequently acquired by One Horizon UK (formerly Satcom Group Holdings) in September 2010.

Unless otherwise noted, references to “we” or “us” in this Report include the Company (post-Share Exchange) and all of its subsidiaries.

Pre-Share Exchange Business of ICE Corp.

Prior to the Share Exchange, the Company had two operational businesses: Modizo, and Global Integrated Media Limited (GIM). The Modizo business consisted of a celebrity blogging application, while the GIM business consisted of custom publishing, advertising design, brand building, media representation, website design and development and market research programs. As the GIM and Modizo businesses did not fit within the Company’s business plan after the Share Exchange, both businesses were sold on December 31, 2012.

Not applicable.

Not applicable.

We do not currently own any real property. Our principal executive offices consist of approximately 2,600 square feet of leased space in Baar, Switzerland, for which we pay $5,600 a month. We also have an office consisting of approximately 500 square feet in London, United Kingdom, for which we pay $4,000 a month.

We are not a party to any material legal proceedings and no material legal proceedings have been threatened by us or, to the best of our knowledge, against us.

Not applicable.

PART II

Our common stock is quoted on the OTC under the symbol OHGI. Prior to January 31, 2013, our common stock was quoted under the symbol ICMC.

The following table sets forth the high and low bid information, as reported by Nasdaq on its website, www.nasdaq.com, for our common stock for each quarterly period in 2011 and 2012, as well as 2013 to date. Prior to November 30, 2012, the bid information reflects bid information of the Company prior to the Share Exchange. The information reflects inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

| | | Low | | | High | |

| | | | | | | |

| Fiscal year ending December 31, 2013: | | | | | | |

| Quarter ended March 31 | | $ | 0.006 | | | $ | 0.036 | |

| | | | | | | | | |

| Fiscal year ended December 31, 2012: | | | | | | | | |

| Quarter ended December 31 | | $ | 0.0052 | | | $ | 0.06 | |

| Quarter ended September 30 | | | 0.0051 | | | | 0.0199 | |

| Quarter ending June 30 | | | 0.00 | | | | 0.028 | |

| Quarter ended March 31 | | | 0.01 | | | | 0.03 | |

| | | | | | | | | |

| Fiscal year ended December 31, 2011: | | | | | | | | |

| Quarter ended December 31 | | | 0.01 | | | | 0.037 | |

| Quarter ended September 30 | | | 0.02 | | | | 0.04 | |

| Quarter ending June 30 | | | 0.02 | | | | 0.0697 | |

| Quarter ended March 31 | | | 0.0303 | | | | 0.11 | |

| | | | | | | | | |

As of April 29, 2013, we had approximately 6,925 stockholders of record.

Dividend Policy

The payment of cash dividends by us is within the discretion of our board of directors and depends in part upon our earnings levels, capital requirements, financial condition, any restrictive loan covenants, and other factors our board considers relevant. Since our inception, we have not declared or paid any dividends on our common stock and we do not anticipate paying such dividends in the foreseeable future. We intend to retain earnings, if any, to finance our operations and expansion.

Issuer Sales of Unregistered Equity Securities

On November 30, 2012, the Company (previously, ICE Corp.) and One Horizon UK, a United Kingdom-based company, consummated a share exchange (the “Share Exchange”), pursuant to which ICE Corp. will acquire all of the issued and outstanding shares of One Horizon UK in exchange for 17,853,476,138 shares of the Company’s common stock, or 175.14 shares of the Company’s common stock for each issued and outstanding share of One Horizon UK stock. To date, the Company has acquired 99% of the outstanding shares of One Horizon UK. The Company also issued options to purchase an aggregate 216,132,393 shares of the Company’s common stock to holders of One Horizon UK options in exchange for such options, which are exercisable at prices ranging from $0.16 to $0.59, reflecting their current exercise prices converted to US dollars using the 175.14 to one ratio, and created a pool of an additional 1,120,896,000 shares of the Company’s common stock reserved for the issuance of such shares upon the exercise of options and warrants that One Horizon UK has agreed to issue in the future to certain employees. On the date of closing, more than 98.9% of One Horizon UK shareholders’ offers of exchange had been received. Following the closing, additional One Horizon UK shareholders have offered their shares for exchange, and as of April 29, 2013, the Company owned approximately 99% of the outstanding shares of One Horizon UK. Having received share exchange acceptances in excess of 90% of the One Horizon UK shares, the Company intends to exercise its rights in accordance with Sections 974 to 991 (inclusive) of the Companies Act 2006 to acquire compulsorily the remaining One Horizon UK shares in respect of which acceptances have not been received to date. Upon such act, One Horizon UK will be a wholly-owned subsidiary of the Company.

In the issuance above, no general solicitation was used and the transactions were negotiated directly with our existing shareholders. The securities were issued in reliance upon the exemption from registration afforded by Regulation S and Section 4(a)(2) of the Securities Act of 1933, as amended, which exempts transactions by an issuer not involving any public offering. In support thereof, the recipients of the common stock made certain written representations, acknowledged that the securities constituted restricted securities, and consented to a restrictive legend on the certificates to be issued.

Issuer Purchases of Equity Securities

The Company was a party to the Share Exchange described above under “Issuer Sales of Unregistered Equity Securities,” pursuant to which shares of One Horizon UK were exchanged for shares of ICE Corp. The shares that were the subject of such Share Exchange are not reflected in the table below.

ISSUER PURCHASES OF EQUITY SECURITIES

| Period | (a) Total Number of Shares Purchased | (b) Average Price Paid per Share | (c) Total Number of Shares Purchased as Part of Publicly Announced Plans | (d) Maximum Number of Shares (or Approximate Dollar Value) that May Yet Be Purchased Under the Plans |

| October 1 – October 31, 2012 | 0 | 0 | 0 | 0 |

| November 1 – November 30, 2012 | 0 | 0 | 0 | 0 |

| December 1 – December 31, 2012 | 42,000,000 | $0.01 (A) | 0 | 0 |

| Total | 42,000,000 | $0.01 | 0 | 0 |

| (A) | On December 31, 2012, the Company entered into an Acquisition Agreement with a shareholder pursuant to which the Company sold to such shareholder all of the shares of its subsidiary, Global Integrated Media, Ltd., and all of the assets and operations of its Modizo business, a celebrity blogging platform (“Modizo”) in exchange for 42,000,000 shares of the Company’s common stock held by the shareholder. For purposes of the Company’s financial statements included herewith, the Company recognized an aggregate of $420,000 for the sale of the shares of GIM and the assets and operations of Modizo. |

Not applicable.

The following discussion and analysis should be read in conjunction with our financial statements and notes thereto included elsewhere in this Report. Management’s discussion and analysis includes a comparison of the six months ended December 31, 2012 to the comparable period of 2011, which comparison is derived from unaudited financial statements of the Company (for the six months ended December 31, 2011) consistent with the reporting entity for such six-month period. The financial statements and Management’s Discussion and Analysis of Financial Condition and Results of Operations include information of One Horizon UK for the relevant periods, except for the period following the Share Exchange, for which period the information presented is that of the combined Company.

Overview

Operating through our indirect wholly-owned subsidiaries, Horizon Globex GmbH and Abbey Technology GmbH, our operations include the licensing of software to telecommunications operators and the development of software application platforms (the “Horizon Platform”) that optimize mobile voice, instant messaging and advertising communications over the Internet. Both subsidiaries do this by using proprietary software techniques that use internet bandwidth more efficiently than other technologies that are unable to provide a low-bandwidth solution. The Horizon Platform is a bandwidth-efficient Voice over Internet Protocol (“VoIP”) platform for smartphones and also provides optimized data applications including messaging and mobile advertising. We license our software solutions to telecommunications network operators and service providers in the mobile, fixed line and satellite communications markets. We are an ISO 9001 and ISO 20000-1 certified company with assets and operations in Switzerland, the United Kingdom, China, India, Singapore and Hong Kong.

We have developed a mobile application, “Horizon Call,” which enables highly bandwidth-efficient VoIP calls over a smartphone using a 2G/EDGE, 3G, 4G/LTE, WiFi or WiMax connection. Our Horizon Call application is currently available for the iPhone and for Android handsets.

Unlike other mobile VoIP applications, Horizon Call creates a business-to-business solution for mobile operators. It is a software solution that telecommunications operators license, brand and deploy. They decide how to integrate it within their portfolio and how to offer it commercially, and it can be customized according to their own branding. It helps them to manage rising traffic volumes while also combating the competitive threat to their voice telephony revenues from other mobile VoIP applications by giving its mobile data customers a more efficient mobile VoIP solution that adds value to their mobile data network.

We believe that emerging markets represent a key opportunity for Horizon Call because there are significant markets with high population density, high penetration of mobile phones, congested mobile cellular networks and high growth in the adoption of smartphones. These factors will put increased pressure on mobile operators to manage their network availability.

In this context, the Company is forming a number of joint ventures with local partners in the region to seize upon this opportunity.

We plan to continue to develop our products in areas with high population density, high penetration of mobile phones, congested mobile cellular networks and high growth in the adoption of smartphones. We expect to form joint ventures when local regulations prevent us from accessing a particular market directly.

We plan to fund this proposed expansion through debt financing, cash from operations and potential equity financing. However, we may not be able to obtain additional financing at acceptable terms, or at all, and, as a result, our ability to continue to improve and expand our software products and to expand our business could be adversely affected.

Critical Accounting Policies and Estimates

Our discussion and analysis of our financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States, or GAAP. Our significant accounting policies are described in notes accompanying the consolidated financial statements. The preparation of the consolidated financial statements requires our management to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues, expenses, and related disclosure of contingent assets and liabilities. Estimates are based on information available as of the date of the financial statements, and accordingly, actual results in future periods could differ from these estimates. Significant judgments and estimates used in the preparation of the consolidated financial statements apply critical accounting policies described in the notes to our consolidated financial statements.

We consider our recognition of revenues, accounting for the consolidation of operations, accounting for stock-based compensation, accounting for intangible assets and related impairment analyses, accounting for equity transactions, and accounting for acquisitions to be most critical in understanding the judgments that are involved in the preparation of our consolidated financial statements.

Additionally, we consider certain judgments and estimates to be significant, including those relating to a determination of vendor specific objective evidence (“VSOE”) for purposes of revenue recognition, useful lives for amortization of intangibles, determination of future cash flows associated with impairment testing of long-lived assets, determination of the fair value of stock options and other assessments of fair value. We base our estimates on historical experience, current conditions and on other assumptions that we believe to be reasonable under the circumstances. Actual results may differ materially from these estimates and assumptions.

Our significant accounting policies are summarized in Note 2 of our audited financial statements for the six months ended December 31, 2012. We believe the following critical accounting policies affect our more significant judgments and estimates used in the preparation of our financial statements.

Revenue Recognition

The Company recognizes revenue when it is realized or realizable and earned. The Company establishes persuasive evidence of a sales arrangement for each type of revenue transaction based on a signed contract with the customer and that delivery has occurred or services have been rendered, price is fixed and determinable, and collectability is reasonably assured.

| ● | Revenue from sales of perpetual licenses to top-tier telecom entities is recognized at the inception of the arrangement, presuming all other relevant revenue recognition criteria are met. Revenue from sales of perpetual licenses to other entities is recognized over the agreed collection period. |

| ● | Revenue from software maintenance, technical support and unspecified upgrades is recognized pro rata over the period that these services are delivered. |

| ● | Revenues for user licenses purchased by customers is recognized when the user license is delivered. |

We enter into arrangements in which a customer purchases a combination of software licenses, maintenance services and post-contract customer support (“PCS”). As a result, judgment is sometimes required to determine the appropriate accounting, including how the price should be allocated among the deliverable elements if there are multiple elements. PCS may include rights to upgrades, when and if available, support, updates and enhancements. When vendor specific objective evidence (“VSOE”) of fair value exists for all elements in a multiple element arrangement, revenue is allocated to each element based on the relative fair value of each of the elements. VSOE of fair value is established by the price charged when the same element is sold separately. Accordingly, the judgments involved in assessing the fair values of various elements of an agreement can impact the recognition of revenue in each period. Changes in the allocation of the sales price between deliverables might impact the timing of revenue recognition, but would not change the total revenue recognized on the contract. When elements such as software and services are contained in a single arrangement, or in related arrangements with the same customer, we allocate revenue to each element based on its relative fair value, provided that such element meets the criteria for treatment as a separate unit of accounting. In the absence of fair value for a delivered element, revenue is first allocated to the fair value of the undelivered elements and then allocated to the residual delivered elements. In the absence of fair value for an undelivered element, the arrangement is accounted for as a single unit of accounting, resulting in a delay of revenue recognition for the delivered elements until the undelivered elements are fulfilled. No sales arrangements to date include undelivered elements for which VSOE does not exist.

For purposes of revenue recognition for perpetual licenses, the Company considers payment terms exceeding one year as a presumption that revenue is recognized pro rata over the collection period, typically over five years. For sales to top tier customers, this presumption is overcome by the customers’ commitment to pay, as demonstrated by its payment history and its ability to pay. Payment terms are extended to customers on an interest-free basis for master license sales. For revenue recognized in advance of payments due, the Company provides for a discount against the revenue recorded, which is adjusted to the net present value of the cash flows expected over the payment terms, when the terms exceed one year.

Divestiture

On October 25, 2012, One Horizon UK sold its Satcom Global business. Because the Satcom business was discontinued prior to the Share Exchange, the operations of Satcom Global have been excluded from the Company’s historical financial statement presentation its fiscal years ended June 30, 2012 and 2011, and for the six-month period ended December 31, 2012. The historical financial statements are presented on a “carve out” basis, as described more fully in the notes to the financial statements. The financial statements presented are of those companies that constituted the consolidated entity at the date of the consummation of the Share Exchange, consisting of three legal entities: One Horizon UK and its subsidiaries Abbey Technology, and Horizon Globex.

Change in Fiscal Year

On February 13, 2013, following the Share Exchange, the Company filed a Current Report on Form 8-K disclosing that the board of directors of the Company approved a change to the Company's fiscal year end from June 30 to December 31. As a result of this change, this Report includes the financial information for the six-month transition period from July 1, 2012 to December 31, 2012.

Results of Operations

The following table sets forth information from our statements of operations for the six months ended December 31, 2012 and 2011.

Comparison of six months ended December 31, 2012 and 2011 (in thousands)

| | | For the Six Months Ended December 31, | | | Year to Year Comparison | |

| | | 2012 | | | 2011 | | | Increase/ (decrease) | | | Percentage Change | |

| | | | | | | | | | | | | |

| Revenue | | $ | 11,709 | | | $ | 668 | | | $ | 11,041 | | | | 1,652 | % |

| | | | | | | | | | | | | | | | | |

| Cost of revenue | | | 121 | | | | 15 | | | | 106 | | | | 706 | % |

| | | | | | | | | | | | | | | | | |

| Gross margin | | | 11,588 | | | | 653 | | | | 10,935 | | | | 1,674 | % |

| | | | | | | | | | | | | | | | | |

| Operating Expenses | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| General and administrative | | | 4,022 | | | | 1,263 | | | | 2,759 | | | | 218 | % |

| Depreciation | | | 73 | | | | 66 | | | | 7 | | | | 10 | % |

| Amortization of Intangibles | | | 873 | | | | 612 | | | | 261 | | | | 43 | % |

| Total Operating Expenses | | | 4,968 | | | | 1,941 | | | | 3,027 | | | | 156 | % |

| | | | | | | | | | | | | | | | | |

| Income (loss) from Operations | | | 6,620 | | | | (1,288) | | | | (7,908) | | | | N/A | % |

| | | | | | | | | | | | | | | | | |

| Other Income(Expense) | | | | | | | | | | | | | | | | |

| Interest expense | | | (87) | | | | (53) | | | | (34) | | | | (64 | %) |

| Foreign Exchange gain , net | | | 16 | | | | 44 | | | | (28) | | | | (63 | %) |

| Interest income | | | 1 | | | | 0 | | | | (1 | ) | | | N/A | |

| | | | | | | | | | | | | | | | | |

| Income for continuing operations before income taxes | | | 6,550 | | | | (1,297) | | | | 7,847 | | | | N/A | |

| | | | | | | | | | | | | | | | | |

| Income taxes (recovery) | | | 1,169 | | | | 0 | | | | 1,169 | | | | N/A | |

| Net (Loss) Income for period | | | 5,381 | | | | (1,297) | | | | 6,678 | | | | N/A | |

Revenue: Our revenue for the six months ended December 31, 2012 was approximately $11.7 million as compared to approximately $0.7 million for the six months ended December 31, 2011, an increase of $11.0 million, or 1,652%. The increase in our revenue was significantly due to the growth in sales of the Horizon Platform following the development of the GSM application, Horizon Call, which was completed in November 2011. The Company expects sales to continue to grow as more companies sign up for the Horizon Platform.

Cost of Revenue: Cost of revenue was approximately $121,000 for the six months ended December 31, 2012, or 0.77% of sales, compared to cost of sales of $15,000, or 0.47% of sales for the six months ended December 31, 2011. Our cost of sales is primarily composed of the costs of ancillary hardware sold with the Horizon Platform.

Gross Profit: Gross profit for the six months ended December 31, 2012 was approximately $11.6 million as compared to $0.65 million for the six months ended December 31, 2011. Our gross profits increased by 1,674% from 2011 to 2012. The main reason for the increase in gross profit is the growth in business and the smartphone market globally, as well as the Company’s ability capitalize on market opportunities by entering areas with high population density, high penetration of mobile phones, congested mobile cellular networks and high growth in the adoption of smartphones.

Going forward, management believes that gross profit will improve if sales continue to increase, although there can be no assurance of such.

Operating Expenses: Operating expenses, including general and administrative expenses, depreciation, and amortization of intangibles, were approximately $4.97 million, or 42.4% of sales for the six months ended December 31, 2012 as compared to $1.94 million, or 29% of sales for the same period in 2011, an increase of approximately $3.03 million. The increase was due to costs related to adding resources to deal with the new customers in both data handling and the account management roles. Going forward, management expects these costs to rise due to various public company-related expenses including share-based compensation, and various legal, accounting and consulting services.

Net Income: Net income for the six months ended December 31, 2012 was approximately $5.4 million as compared to a loss of $1.3 million for the same period in 2011. The increase in net income reflected the growth in the business and in the smartphone market globally.

Going forward, management believes the Company will continue to grow the business and increase profitability if we are successful in selling the Horizon Platform solution to new telecommunications company customers globally.

Foreign Currency Translation Adjustment: Our reporting currency is the U.S. dollar. Our local currencies, Swiss Francs and British pounds, are our functional currencies. Results of operations and cash flow are translated at average exchange rates during the period, and assets and liabilities are translated at the unified exchange rate as quoted by http://www.oanda.com/currency/historical-rates/ at the end of the period. Translation adjustments resulting from this process are included in accumulated other comprehensive income in the statement of shareholders’ equity. Transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred.

Currency translation adjustments resulting from this process are included in accumulated other comprehensive income in the consolidated statement of shareholders' equity and amounted to approximately $16,000 for the six months ended December 31, 2012.

The following table sets forth information from our statements of operations for the years ended June 30, 2012 and 2011.

Comparison of years ended June 30, 2012 and 2011

| | | For the Year Ended June 30 | | | Year to Year Comparison | |

| | | 2012 | | | 2011 | | | Increase/ (decrease) | | | Percentage Change | |

| | | | | | | | | | | | | |

| Revenue | | $ | 5,222 | | | $ | 2,726 | | | $ | 2,496 | | | | 92 | % |

| | | | | | | | | | | | | | | | | |

| Cost of revenue | | | 80 | | | | 207 | | | | (127) | | | | (61 | %) |

| | | | | | | | | | | | | | | | | |

| Gross margin | | | 5,142 | | | | 2,519 | | | | 2,623 | | | | 104 | % |

| | | | | | | | | | | | | | | | | |

| Operating Expenses | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| General and administrative | | | 4,570 | | | | 1,911 | | | | 2,659 | | | | 139 | % |

| Depreciation | | | 884 | | | | 321 | | | | 563 | | | | 175 | % |

| Amortization of Intangibles | | | 1,655 | | | | 1,307 | | | | 303 | | | | 26 | % |

| Total Operating Expenses | | | 7,109 | | | | 3,539 | | | | 3,570 | | | | 101 | % |

| | | | | | | | | | | | | | | | | |

| Income from Operations | | | (1,967) | | | | (1,020) | | | | (947) | | | | (93) | % |

| | | | | | | | | | | | | | | | | |

| Other Income(Expense) | | | | | | | | | | | | | | | | |

| Interest expense | | | (218) | | | | (173) | | | | (45) | | | | (26 | %) |

| Foreign Exchange gain , net | | | 49 | | | | (2) | | | | 51 | | | | 100 | % |

| Gain on acquisition of subsidiary | | | 0 | | | | 476 | | | | (476 | ) | | | (100 | %) |

| | | | | | | | | | | | | | | | | |

| Loss for continuing operations before income taxes | | | (2,136) | | | | (719) | | | | (1,417) | | | | (197) | % |

| | | | | | | | | | | | | | | | | |

| Income taxes (recovery) | | | 69 | | | | (316) | | | | (385) | | | | | |

| Net Loss for period | | | (2,205) | | | | (403) | | | | (1,802) | | | | (447) | % |

Revenue: Our revenue for the year ended June 30, 2012 was approximately $5.2 million as compared to $2.7 million for the year ended June 30, 2011, an increase of $2.5 million, or 92%. The increase in our revenue was due to the growth in sales of the Horizon Platform following the development of the GSM application, Horizon Call, which was completed in November, 2011. We expect sales to continue to grow as more companies sign up for the Horizon Platform.

Cost of Revenue: Cost of revenue was approximately $80,000 for the year ended June 30, 2012, or 1.53% of sales, compared to cost of sales of $207,000, or 7.59% of sales for the year ended June 30, 2011. Our cost of sales is primarily composed of the costs of ancillary hardware sold with the Horizon Platform.

Gross Margin: Gross margin for the year ended June 30, 2012 was approximately $5.1 million as compared to $2.5 for the year ended June 30, 2011. Our gross margins increased by 104% from 2011 to 2012. The main reason for the increase in gross margin is the growth in business and the smartphone market globally, as well as the Company’s ability to capitalize on market opportunities by entering areas with high population density, high penetration of mobile phones, congested mobile cellular networks and high growth in the adoption of smartphones.

Going forward, management believes that gross margin will increase to the extent we are successful in our efforts to grow our sales.

Operating Expenses: Operating expenses, including general and administrative expenses, depreciation, and amortization of intangibles, were approximately $7.1 million, or 136% of sales for the year June 30, 2012, as compared to $3.5 million, or 130% of sales for the same period in 2011. Overall, operating expenses increased by approximately $3.6 million. The increase was due to costs related to adding additional resources to deal with the new customers in both data handling and the account management roles. Going forward, management expects overall costs to rise due to various public company-related expenses including share-based compensation, and various legal, accounting and consulting services.

Interest Expense: For the year ended June 30, 2012, interest expense was approximately $218,000 as compared to interest expense of approximately $173,000 for 2011. The increase of $35,000 or 20.2% in interest expense is mainly due to the increase in cost of capital charged by HSBC prior to the redemption of the facilities with the bank in October, 2012.

Net Income: Net loss for the year ended June 30, 2012 was approximately $2.2 million as compared to $0.4 million for the same period in 2011. The increase in losses reflected the increase in operating expenditures of the business.

Going forward, management believes the Company will continue to grow the business and increase profitability as the Horizon Platform solution is taken up by new telecommunications company customers globally.

Foreign Currency Translation Adjustment: Our reporting currency is the U.S. dollar. Our local currencies, Swiss Francs and British pounds, are our functional currencies. Results of operations and cash flow are translated at average exchange rates during the period, and assets and liabilities are translated at the unified exchange rate as quoted by http://www.oanda.com/currency/historical-rates/ at the end of the period. Translation adjustments resulting from this process are included in accumulated other comprehensive income in the statement of shareholders’ equity. Transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred.

Currency translation adjustments resulting from this process are included in accumulated other comprehensive income in the consolidated statement of shareholders' equity and amounted to approximately $49,000 for the year ended June 30, 2012 and $2,000 for the same period in 2011.

Liquidity and Capital Resources

Six Months Ended December 31, 2012 and December 31, 2011

The following table sets forth a summary of our approximate cash flows for the periods indicated:

| | | For the Six Months Ended December 31 (in thousands) | |

| | | 2012 | | | 2011 | |

| Net cash provided by (used in) operating activities | | | (833 | ) | | | (1,201 | ) |

| Net cash used in investing activities | | | (431 | ) | | | (850 | ) |

| Net cash provided by financing activities | | | 2,002 | | | | 1,640 | |

Net cash used by operating activities was approximately $833,000 for the six months ended December 31, 2012, as compared to $1,201,000 for the same period in 2011. The decrease in cash used by operations was primarily due to the increase in cash generated from sales, which offset (and reduced) the overall cash used by operating activities.

Net cash used in investing activities was approximately $431,000 and $850,000 for the six months ended December 31, 2012 and 2011, respectively. Net cash used in investing activities was primarily focused on acquisitions of intangible assets and property and equipment.

Net cash provided by financing activities amounted to $2.0 million for 2012 and $1.64 million for 2011. Cash provided by financing activities in 2012 was primarily due to the advances from related parties and proceeds from the sale of common stock. Cash used by financing activities in 2011 was primarily due to proceeds from sale of common stock and loan from related parties less the reduction in long term bank borrowing.

Our working capital, excluding the current portion of deferred income (attributable to licensing fees to be realized over time), as of December 31, 2012, was approximately $0.6 million, as compared to a working capital deficiency of approximately $6.0 million for the same period in 2011.

Year ended June 30, 2012 and 2011

The following table sets forth a summary of our approximate cash flows for the periods indicated:

| | | For the Year Ended June 30, (in thousands) | |

| | | 2012 | | | 2011 | |

| Net cash provided by (used in) operating activities | | | (2,895 | ) | | | 5,363 | |

| Net cash used in investing activities | | | (3,622 | ) | | | (2,661 | ) |

| Net cash provided by financing activities | | | 6,517 | | | | (2,702 | ) |

Net cash used by operating activities was approximately $2.9 million for the year ended June 30, 2012 as compared to net cash provided by operating activities of $5.4 million for the same period in 2011. The significant increase in cash used by operations was primarily due to increase in accounts receivable during the year.

Net cash used in investing activities was approximately $3.6 million and $2.7 million for the years ended June 30, 2012 and 2011, respectively. Net cash used in investing activities was primarily focused on acquisitions of intangible assets and property and equipment, and in 2011 the acquisition of Abbey Technology GmbH.

Net cash provided by financing activities amounted to approximately $6.5 million for year ended June 30, 2012 and cash used of $2.7 million for year ended June 30, 2011. Cash provided by financing activities in 2012 was primarily due to the advances from related parties and proceeds from the sale of common stock. Cash used by financing activities in 2011 was primarily due to repayment of long term debt and payment of dividends.

Our working capital deficiency, excluding the current portion of deferred income (attributable to licensing fees to be realized over time), as of June 30, 2012, was approximately $7.3 million, as compared to a working capital deficiency of approximately $6.1 million for the same period in 2011.

As of June 30, 2012 we had retained losses of $10.0 million and stockholders’ equity of approximately $9.6 million. Total stockholders’ equity as of June 30, 2011 was approximately $5.6 million with retained losses of $7.8 million.

Going forward, we intend to rely on the sales of our products and services, as well as on the sale of securities to, and loans from, existing stockholders and new investors, to meet our cash requirements.

On January 22, 2013, Messrs. White and Collins each made a loan to the Company of $250,000 (each, a “Loan”). In exchange for each Loan, the Company issued to each of Messrs. White and Collins a promissory note, in the initial principal amount of each Loan. Each Loan bears interest at the rate of 0.21% per annum, must be repaid in one year, and is prepayable without penalty at the option of the Company at any time following its issuance in cash or in shares of its common stock, at the rate of $0.0086 per share.

On February 18, 2013, the Company entered into a Subscription Agreement with a non-U.S. shareholder of the Company (the “Investor”), pursuant to which it sold an aggregate of 483,870,968 shares of the Company’s common stock for an aggregate consideration of $6,000,000, or $0.0124 per share. The Company also issued a common stock purchase warrant to the Investor exercisable for three years to purchase 241,935,483 shares of the Company’s common stock at an exercise price of $0.0124 per share. Pursuant to the Subscription Agreement, the initial installment of the investment of $2,790,000 was paid, with two additional installments totaling $3,210,000 to be made by September 30, 2013. Such installments accrued interest at a rate of three percent (3%) per annum and are secured by a pledge by the Investor to the Company of the shares pro rata.

We may seek to sell common or preferred stock in private placements. We have no commitments from anyone to purchase our common or preferred stock or to loan funds. We cannot assure that we will be able to raise additional funds or to do so at a cost that will be economically viable.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that have, or are reasonably likely to have, a current or future effect on its financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Not applicable.

Our combined financial statements, including the independent registered public accounting firm’s report on our combined financial statements, are included beginning at page F-1 immediately following the signature page of this report.

None.

Evaluation of Disclosure Controls and Procedures

Disclosure controls are procedures that are designed with the objective of ensuring that information required to be disclosed in our reports filed under the Exchange Act, such as this Report, is recorded, processed, summarized, and reported within the time periods specified in the SEC’s rules and forms. Disclosure controls are also designed with the objective of ensuring that such information is accumulated and communicated to our management, including the chief executive officer and chief financial officer, as appropriate to allow timely decisions regarding required disclosure. Our management evaluated, with the participation of our current chief executive officer and chief financial officer (our “Certifying Officers”), the effectiveness of our disclosure controls and procedures as of December 31, 2012, pursuant to Rule 13a-15(b) under the Exchange Act. Based upon that evaluation, our Certifying Officers concluded that, because of the material weaknesses in our internal control over financial reporting described below and the Company’s failure to file all Current Reports on Form 8-K required under the Exchange Act within their required time periods, as of December 31, 2012, our disclosure controls and procedures were not effective.

Management’s Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting (as such term is defined in Exchange Act Rules 13a-15(f) and 15d-15(f)). Our internal control over financial reporting is a process designed under the supervision of our Certifying Officers to provide reasonable assurance regarding the reliability of financial reporting and the preparation of our financial statements for external purposes in accordance with accounting principles generally accepted in the United States of America.

Management, under the supervision and with the participation of our Certifying Officers, evaluated the effectiveness of our internal control over financial reporting using the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal Control-Integrated Framework.

Based on our evaluation and the material weaknesses described below, management concluded that we did not maintain effective internal control over financial reporting as of December 31, 2012. This Report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Because we are a smaller reporting company, management’s report was not subject to attestation by our registered public accounting firm.

Material Weaknesses Identified

In connection with the preparation of our financial statements for the year ended December 31, 2012, certain significant deficiencies in internal control over financial reporting became evident to management that, in the aggregate, represent material weaknesses, including:

(i) Lack of sufficient independent directors to form an audit committee. We currently have two independent directors on our board, which is comprised of five directors. These two independent directors, however, would not currently be deemed independent under NASDAQ for audit committee purposes. Although there is no requirement that we have an audit committee, we intend to have a majority of independent directors as soon as we are reasonably able to do so.

(ii) Insufficient corporate governance policies. Although we have a code of ethics that provides broad guidelines for corporate governance, our corporate governance activities and processes are not always formally documented. Specifically, decisions made by the board to be carried out by management should be documented and communicated on a timely basis to reduce the likelihood of any misunderstandings regarding key decisions affecting our operations and management.

(iii) Insufficient segregation of duties in our finance and accounting functions due to limited personnel. During the six months ended December 31, 2012, we had one person on staff who performed nearly all aspects of our financial reporting process, including access to the underlying accounting records and systems, the ability to post and record journal entries, and responsibility for the preparation of the financial statements. This creates certain incompatible duties and a lack of review over the financial reporting process that would likely result in a failure to detect errors in spreadsheets, calculations, or assumptions used to compile the financial statements and related disclosures as filed with the Securities and Exchange Commission. These control deficiencies could result in a material misstatement to our interim or annual consolidated financial statements that would not be prevented or detected.

(iv) Accounting for Technical Matters. Our current accounting personnel perform adequately in the basic accounting and recordkeeping function. However, our operations and business practices include complex technical accounting issues that are outside the routine basic functions. The complex areas in 2012 included accounting for the Share Exchange and disposal of the business. These technical accounting issues are complex and require significant expertise to ensure that the accounting and reporting are accurate and in accordance with generally accepted accounting principles. This is especially important for periodic interim reporting that is not subject to audit.

(v) Lack of in-house US GAAP Expertise. Currently we do not have sufficient in-house expertise in US GAAP reporting. Instead, we rely very much on the expertise and knowledge of external financial advisors in US GAAP conversion.

(vi) Maintenance of Accounting Records. We did not maintain a comprehensive set of financial records for the six months ended December 31, 2012. Certain receipts, disbursements and other transactions were recorded in the general ledger; however account reconciliations, journal entry forms or other supporting schedules were either missing or incomplete. Without adequate financial records, we may be unable to provide timely financial reporting and/or report inaccurate information.

As part of the communications respecting its audit procedures for the year ended December 31, 2012, our independent registered accountants, Peterson Sullivan, LLP (“Peterson Sullivan”), informed the board that these deficiencies constituted material weaknesses, as defined by Auditing Standard No. 5, “An Audit of Internal Control Over Financial Reporting that is Integrated with an Audit of Financial Statements and Related Independence Rule and Conforming Amendments,” established by the Public Company Accounting Oversight Board.

Plan for Remediation of Material Weaknesses

We intend to take appropriate and reasonable steps to make the necessary improvements to remediate these deficiencies. We intend to consider the results of our remediation efforts and related testing as part of our year-end 2013 assessment of the effectiveness of our internal control over financial reporting.