EVERSOURCE ENERGY Q3 2022 RESULTS November 3, 2022 2022 Third Quarter Results Exhibit 99.3

EVERSOURCE ENERGY Q3 2022 RESULTS Safe Harbor Statement 1 All per - share amounts in this presentation are reported on a diluted basis. The only common equity securities that are publicly traded are common shares of Eversource Energy. The earnings and EPS of each business do not represent a direct legal interest in the assets and liabilities of such business, bu t r ather represent a direct interest in Eversource Energy's assets and liabilities as a whole. EPS by business is a financial measure not recognized under generally accepted accounting pr inciples (non - GAAP) that is calculated by dividing the net income or loss attributable to common shareholders of each business by the weighted average diluted Eversource Energy com mon shares outstanding for the period. Earnings discussions also include non - GAAP financial measures referencing 2022 and 2021 earnings and EPS excluding certain transaction an d transition costs, and our 2021 earnings and EPS excluding charges at CL&P related to an October 2021 settlement agreement that included credits to customers and funding of various customer assistance initiatives and a 2021 storm performance penalty imposed on CL&P by the PURA. Eversource Energy uses these non - GAAP financial measures to evaluate and provide details of earnings results by business and to more fully compare and explain 2022 and 2021 results without including these items. This information is amon g t he primary indicators management uses as a basis for evaluating performance and planning and forecasting of future periods. Management believes the impacts of transaction and tr ansition costs, the CL&P October 2021 settlement agreement, and the 2021 storm performance penalty imposed on CL&P by the PURA, are not indicative of Eversource Energy’s ongo ing costs and performance. Due to the nature and significance of the effect of these items on net income attributable to common shareholders and EPS, management believes tha t the non - GAAP presentation is a more meaningful representation of Eversource Energy’s financial performance and provides additional and useful information to read ers in analyzing historical and future performance of the business. These non - GAAP financial measures should not be considered as alternatives to Eversource Energy’s reported net in come attributable to common shareholders or EPS determined in accordance with GAAP as indicators of Eversource Energy’s operating performance. This document includes statements concerning Eversource Energy’s expectations, beliefs, plans, objectives, goals, strategies, as sumptions of future events, future financial performance or growth and other statements that are not historical facts. These statements are “forward - looking statements” with in the meaning of the Private Securities Litigation Reform Act of 1995. Generally, readers can identify these forward - looking statements through the use of words or phrases such a s “estimate,” “expect,” “anticipate,” “intend,” “plan,” “project,” “believe,” “forecast,” “should,” “could” and other similar expressions. Forward - looking statements involve r isks and uncertainties that may cause actual results or outcomes to differ materially from those included in the forward - looking statements. Forward - looking statements are based on the current expectations, estimates, assumptions or projections of management and are not guarantees of future performance. These expectations, estimates, assumptions or project ions may vary materially from actual results. Accordingly, any such statements are qualified in their entirety by reference to, and are accompanied by, the following important factors that may cause our actual results or outcomes to differ materially from those contained in our forward - looking statements, including, but not limited to: cyberattack s or breaches, including those resulting in the compromise of the confidentiality of our proprietary information and the personal information of our customers; disruptions i n t he capital markets or other events that make our access to necessary capital more difficult or costly; the negative impacts of the novel coronavirus (COVID - 19) pandemic, includi ng any new or emerging variants, on our customers, vendors, employees, regulators, and operations; changes in economic conditions, including impact on interest rates, tax polic ies , and customer demand and payment ability; ability or inability to commence and complete our major strategic development projects and opportunities; acts of war or terrorism, phys ica l attacks or grid disturbances that may damage and disrupt our electric transmission and electric, natural gas, and water distribution systems; actions or inaction of local, st ate and federal regulatory, public policy and taxing bodies; substandard performance of third - party suppliers and service providers; fluctuations in weather patterns, including extreme weat her due to climate change; changes in business conditions, which could include disruptive technology or development of alternative energy sources related to our current or fut ure business model; contamination of, or disruption in, our water supplies; changes in levels or timing of capital expenditures; changes in laws, regulations or regulatory polic y, including compliance with environmental laws and regulations; changes in accounting standards and financial reporting regulations; actions of rating agencies; and other prese ntl y unknown or unforeseen factors. Other risk factors are detailed in Eversource Energy’s reports filed with the Securities and Exchange Commission (SEC). They ar e updated as necessary and available on Eversource Energy’s website at www.eversource.com and on the SEC’s website at www.sec.gov. All such factors are difficult to predict an d c ontain uncertainties that may materially affect Eversource Energy’s actual results, many of which are beyond our control. You should not place undue reliance on the forward - lo oking statements, as each speaks only as of the date on which such statement is made, and, except as required by federal securities laws, Eversource Energy undertakes no obl iga tion to update any forward - looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of una nticipated events.

EVERSOURCE ENERGY Q3 2022 RESULTS Agenda 2 Joe Nolan President & CEO ▪ Business Update ▪ Winter Energy Pricing ▪ Offshore Wind Update ▪ Q3 2022 Financial Results ▪ Regulatory Update ▪ Financing Activity Update John Moreira CFO & Treasurer

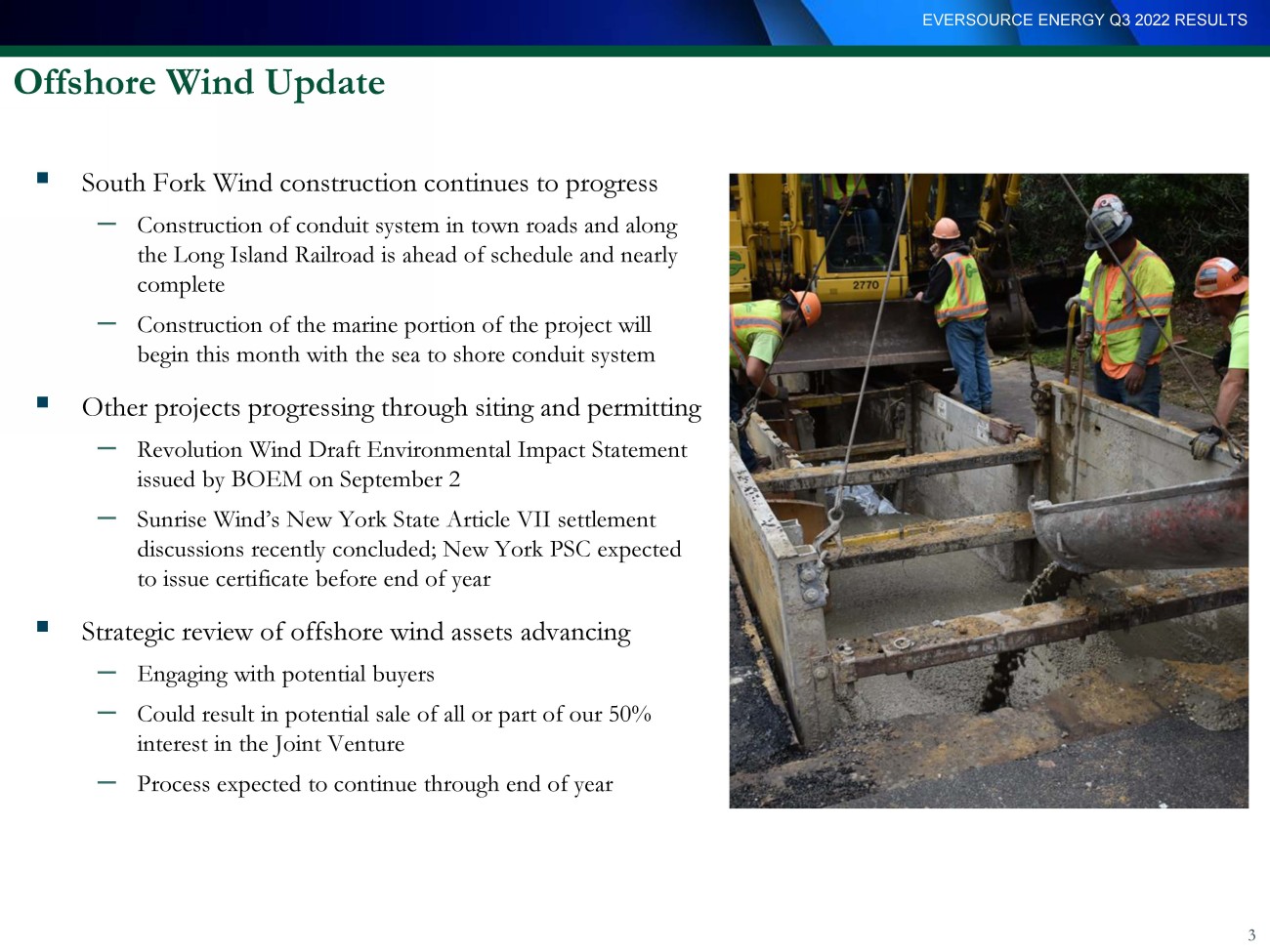

EVERSOURCE ENERGY Q3 2022 RESULTS ▪ South Fork Wind construction continues to progress – Construction of conduit system in town roads and along the Long Island Railroad is ahead of schedule and nearly complete – Construction of the marine portion of the project will begin this month with the sea to shore conduit system ▪ Other projects progressing through siting and permitting – Revolution Wind Draft Environmental Impact Statement issued by BOEM on September 2 – Sunrise Wind’s New York State Article VII settlement discussions recently concluded; New York PSC expected to issue certificate before end of year ▪ Strategic review of offshore wind assets advancing – Engaging with potential buyers – Could result in potential sale of all or part of our 50% interest in the Joint Venture – Process expected to continue through end of year 3 Offshore Wind Update

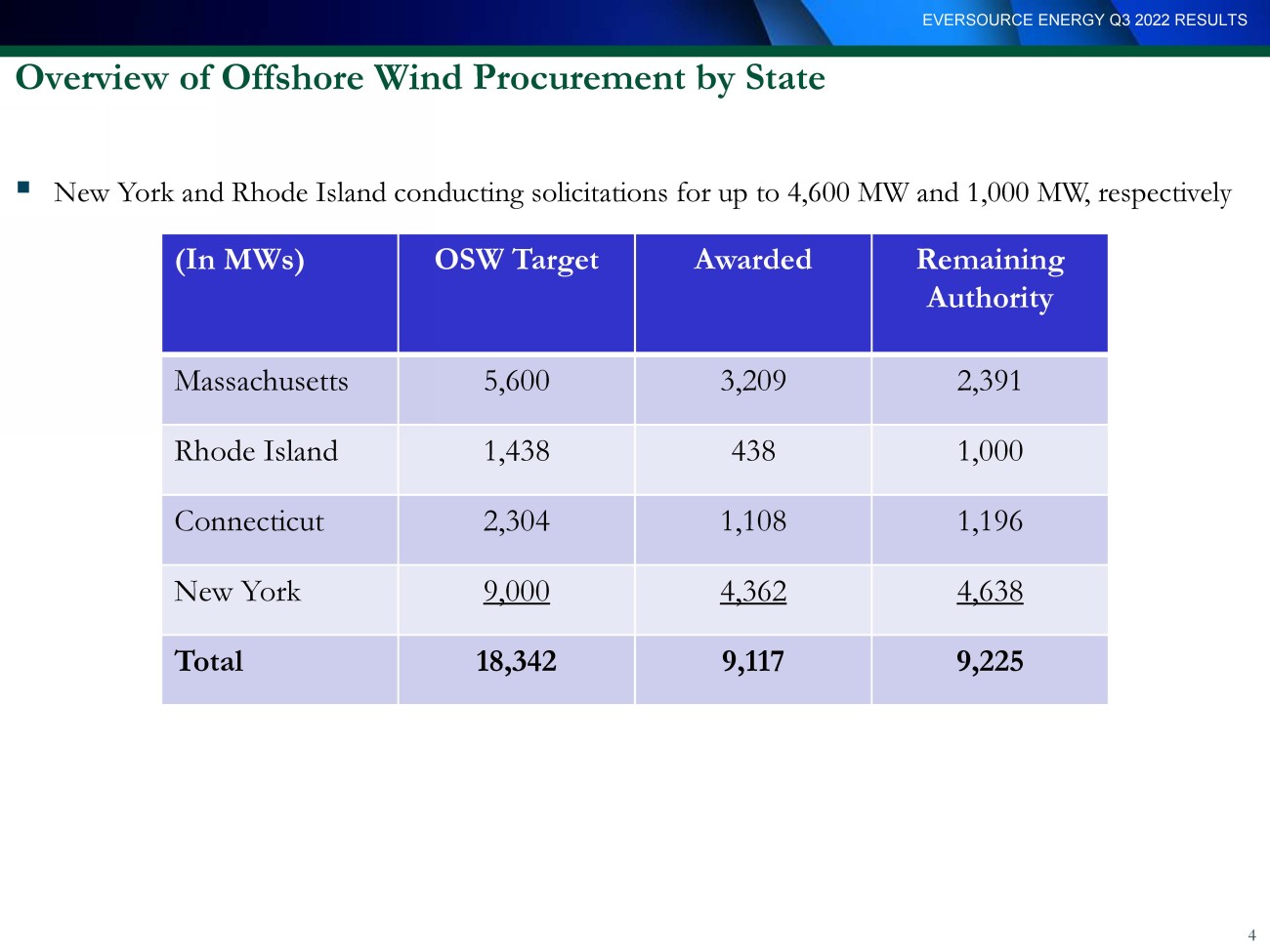

EVERSOURCE ENERGY Q3 2022 RESULTS 4 Overview of Offshore Wind Procurement by State (In MWs) OSW Target Awarded Remaining Authority Massachusetts 5,600 3,209 2,391 Rhode Island 1,438 438 1,000 Connecticut 2,304 1,108 1,196 New York 9,000 4,362 4,638 Total 18,342 9,117 9,225 ▪ New York and Rhode Island conducting solicitations for up to 4,600 MW and 1,000 MW, respectively

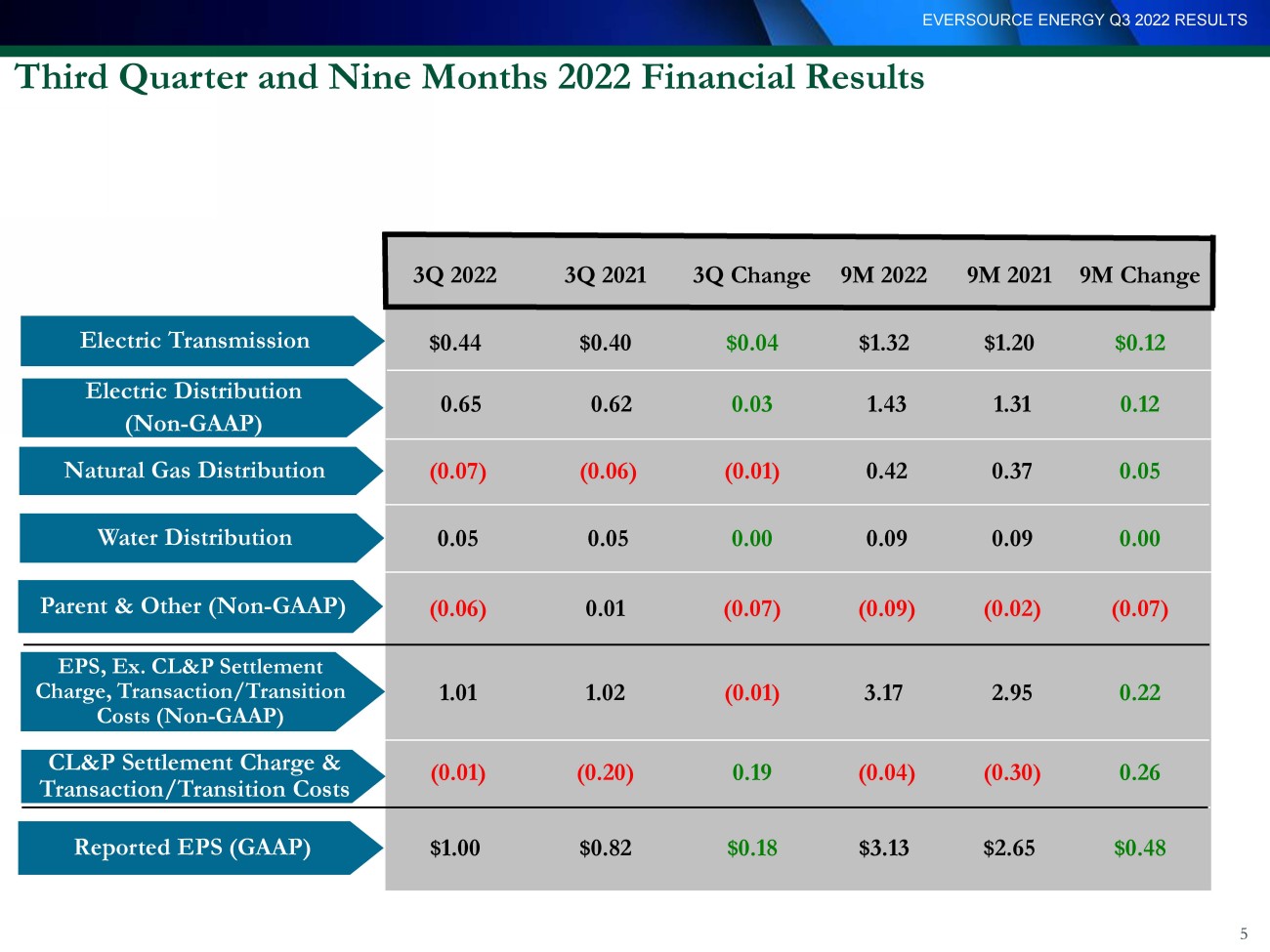

EVERSOURCE ENERGY Q3 2022 RESULTS 5 3Q 2022 3Q 2021 3Q Change 9M 2022 9M 2021 9M Change $0.44 $0.40 $0.04 $1.32 $1.20 $0.12 0.65 0.62 0.03 1.43 1.31 0.12 (0.07) (0.06) (0.01) 0.42 0.37 0.05 0.05 0.05 0.00 0.09 0.09 0.00 (0.06) 0.01 (0.07) (0.09) (0.02) (0.07) 1.01 1.02 (0.01) 3.17 2.95 0.22 (0.01) (0.20) 0.19 (0.04) (0.30) 0.26 $1.00 $0.82 $0.18 $3.13 $2.65 $0.48 Electric Transmission Electric Distribution (Non - GAAP) Natural Gas Distribution Parent & Other (Non - GAAP) Water Distribution EPS, Ex. CL&P Settlement Charge, Transaction/Transition Costs (Non - GAAP) CL&P Settlement Charge & Transaction/Transition Costs Reported EPS (GAAP) Third Quarter and Nine Months 2022 Financial Results

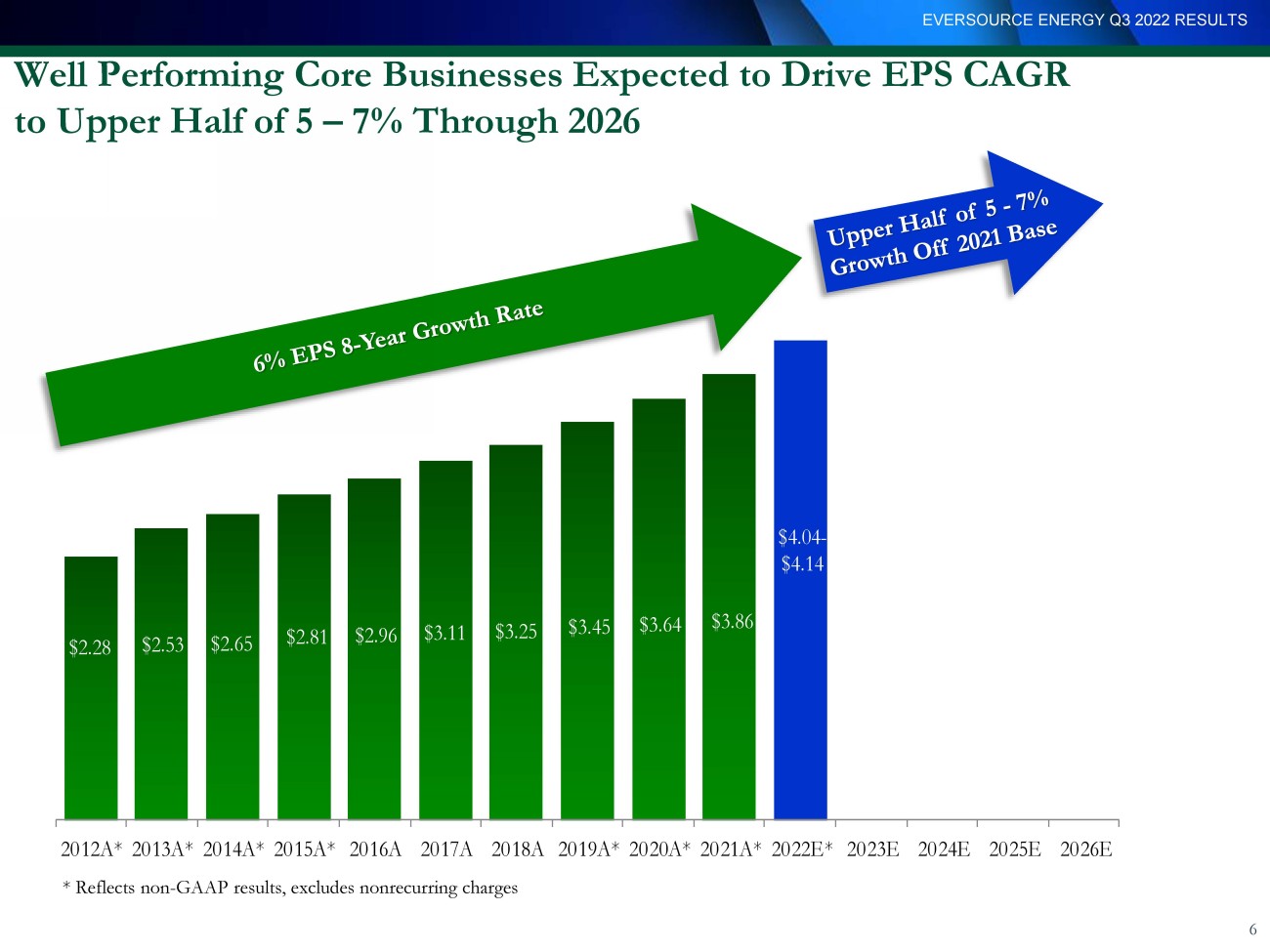

EVERSOURCE ENERGY Q3 2022 RESULTS 6 Well Performing Core Businesses Expected to Drive EPS CAGR to Upper Half of 5 – 7% Through 2026 $2.28 $2.53 $2.65 $2.81 $2.96 $3.11 $3.25 $3.45 $3.64 $3.86 $4.04 - $4.14 2012A* 2013A* 2014A* 2015A* 2016A 2017A 2018A 2019A* 2020A* 2021A* 2022E* 2023E 2024E 2025E 2026E * Reflects non - GAAP results, excludes nonrecurring charges

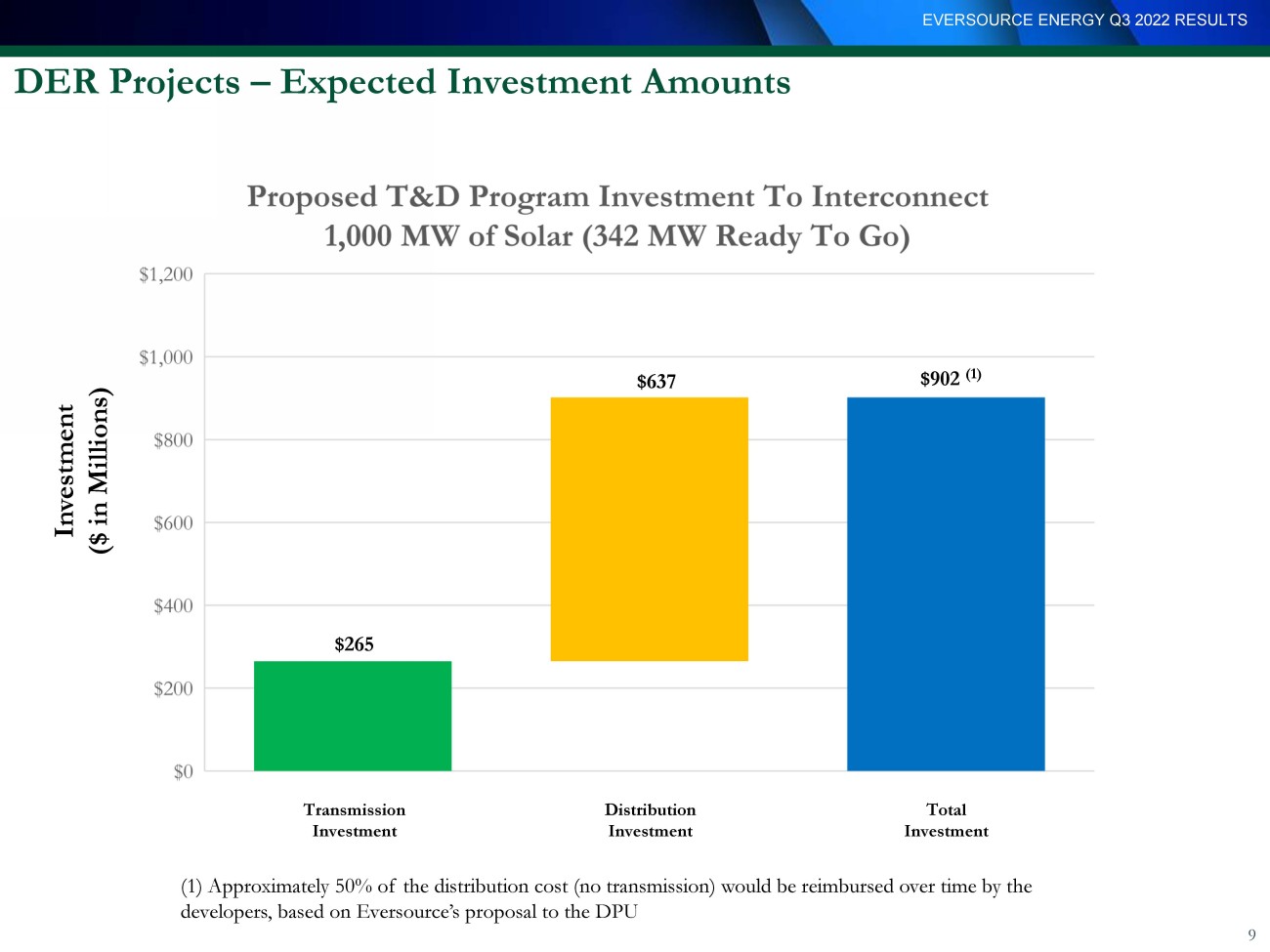

EVERSOURCE ENERGY Q3 2022 RESULTS 7 Proposed Capital Investments Needed to Unlock Renewable Distributed Energy Resources (DER) in Massachusetts ▪ Interconnection upgrades needed to deliver additional clean energy into our system – Current proposal would enable up to 1 GW of solar ▪ Proposal establishes fixed construction schedule, fixed fee and fixed enabled capacity for DER customers ▪ Portion of costs recovered from local transmission and distribution customers, and portion from developers ▪ Six NSTAR Electric solar cluster proposals are now under DPU review ▪ Eversource targeting completion of these projects over the next 4 - 5 years ▪ Investments not currently included in our capital investment forecast

EVERSOURCE ENERGY Q3 2022 RESULTS DER – Area Map of Six Solar Cluster Proposals Plymouth Cape Marion/ Fairhaven Dartmouth/ Westport Freetown I - 90 CT MA Plainfield - Blandford I - 91 8

EVERSOURCE ENERGY Q3 2022 RESULTS 9 DER Projects – Expected Investment Amounts Investment ($ in Millions) Transmission Investment Distribution Investment Total Investment $902 (1) (1) Approximately 50% of the distribution cost (no transmission) would be reimbursed over time by the developers, based on Eversource’s proposal to the DPU $637 $265

EVERSOURCE ENERGY Q3 2022 RESULTS Rate Review Summary NSTAR Electric ▪ Expected decision date of December 1, 2022 ▪ Rates effective on January 1, 2023 ▪ Revenue deficiency of $93M ▪ Requested return on equity of 10.5% ▪ Requested capital structure of 53.21% common equity Aquarion Connecticut ▪ Rate review filed on August 29, 2022 ▪ First rate review in nearly a decade ▪ Expected decision date of March 15, 2023 ▪ Revenue deficiency requested: – $27.5M in Year 1, or 13.9% – $22.4M over 2 subsequent rate years 10

EVERSOURCE ENERGY Q3 2022 RESULTS 11 Equity Issuance Update New Shares ▪ $1.2 billion At - The - Market Program has issued 2.17M shares at a weighted average price of $92.31 through October with proceeds of approximately $200 million Treasury Shares ▪ Dividend reinvestment, employee equity programs continue with approximately 810,000 shares issued YTD through October

EVERSOURCE ENERGY Q3 2022 RESULTS APPENDIX 12

EVERSOURCE ENERGY Q3 2022 RESULTS Inflation Reduction Act Impact on Offshore Wind Review ▪ Tax credits extended to 2032 ▪ Additional 10% if qualified for domestic content ▪ More seamless transferability of tax benefits to 3 rd parties 13 Impact on Regulated Businesses ▪ Lower cost for customers related to regulated business investments in solar and battery storage ▪ Near term cash benefit ▪ No material impact expected from the Alternative Minimum Tax provision

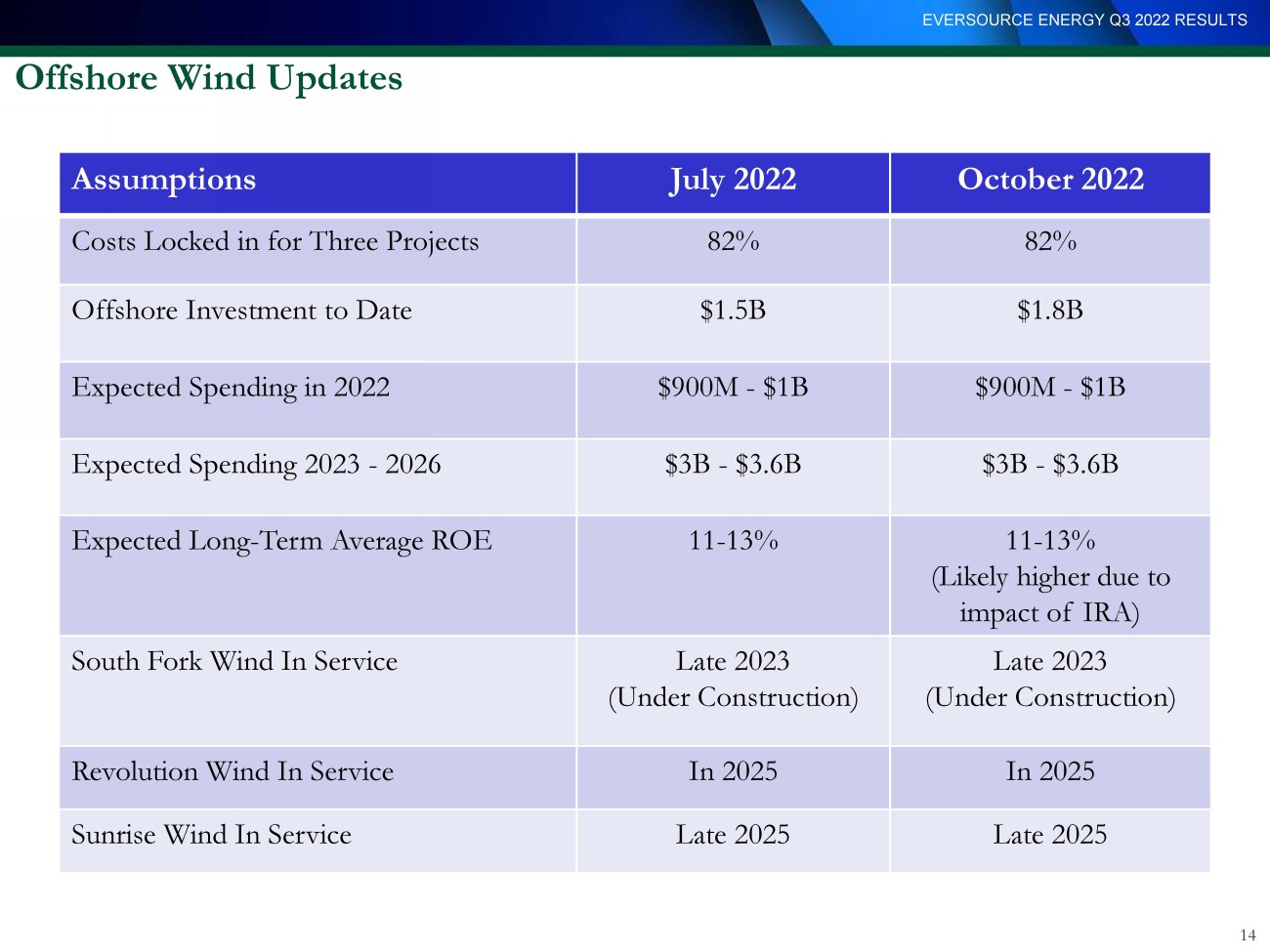

EVERSOURCE ENERGY Q3 2022 RESULTS 14 Assumptions July 2022 October 2022 Costs Locked in for Three Projects 82% 82% Offshore Investment to Date $1.5B $1.8B Expected Spending in 2022 $900M - $1B $900M - $1B Expected Spending 2023 - 2026 $3B - $3.6B $3B - $3.6B Expected Long - Term Average ROE 11 - 13% 11 - 13% (Likely higher due to impact of IRA) South Fork Wind In Service Late 2023 (Under Construction) Late 2023 (Under Construction) Revolution Wind In Service In 2025 In 2025 Sunrise Wind In Service Late 2025 Late 2025 Offshore Wind Updates

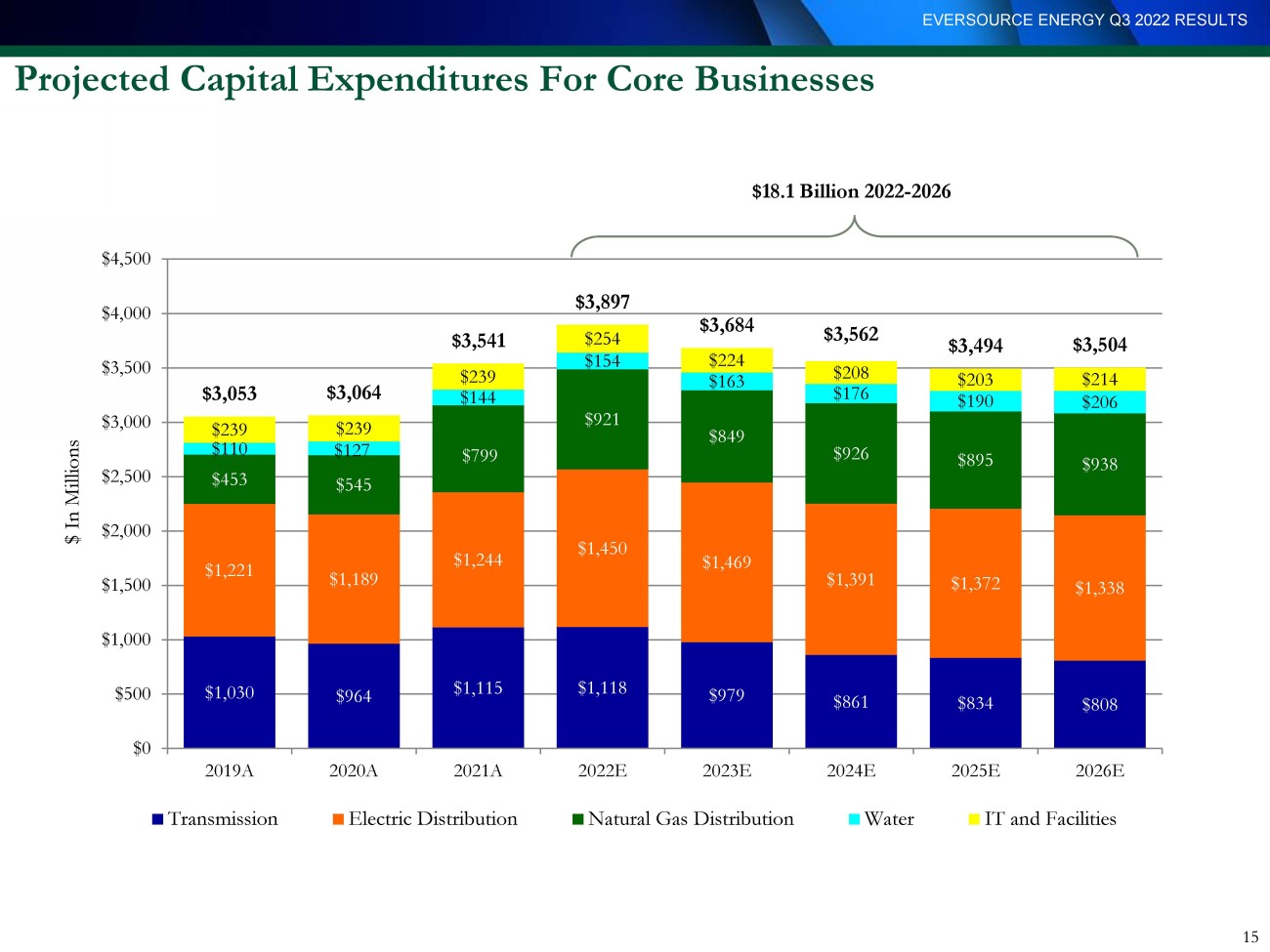

EVERSOURCE ENERGY Q3 2022 RESULTS Projected Capital Expenditures For Core Businesses $1,030 $964 $1,115 $1,118 $979 $861 $834 $808 $1,221 $1,189 $1,244 $1,450 $1,469 $1,391 $1,372 $1,338 $453 $545 $799 $921 $849 $926 $895 $938 $110 $127 $144 $154 $163 $176 $190 $206 $239 $239 $239 $254 $224 $208 $203 $214 $3,053 $3,064 $3,541 $3,897 $3,684 $3,562 $3,494 $3,504 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 2019A 2020A 2021A 2022E 2023E 2024E 2025E 2026E Transmission Electric Distribution Natural Gas Distribution Water IT and Facilities $ In Millions $18.1 Billion 2022 - 2026 15

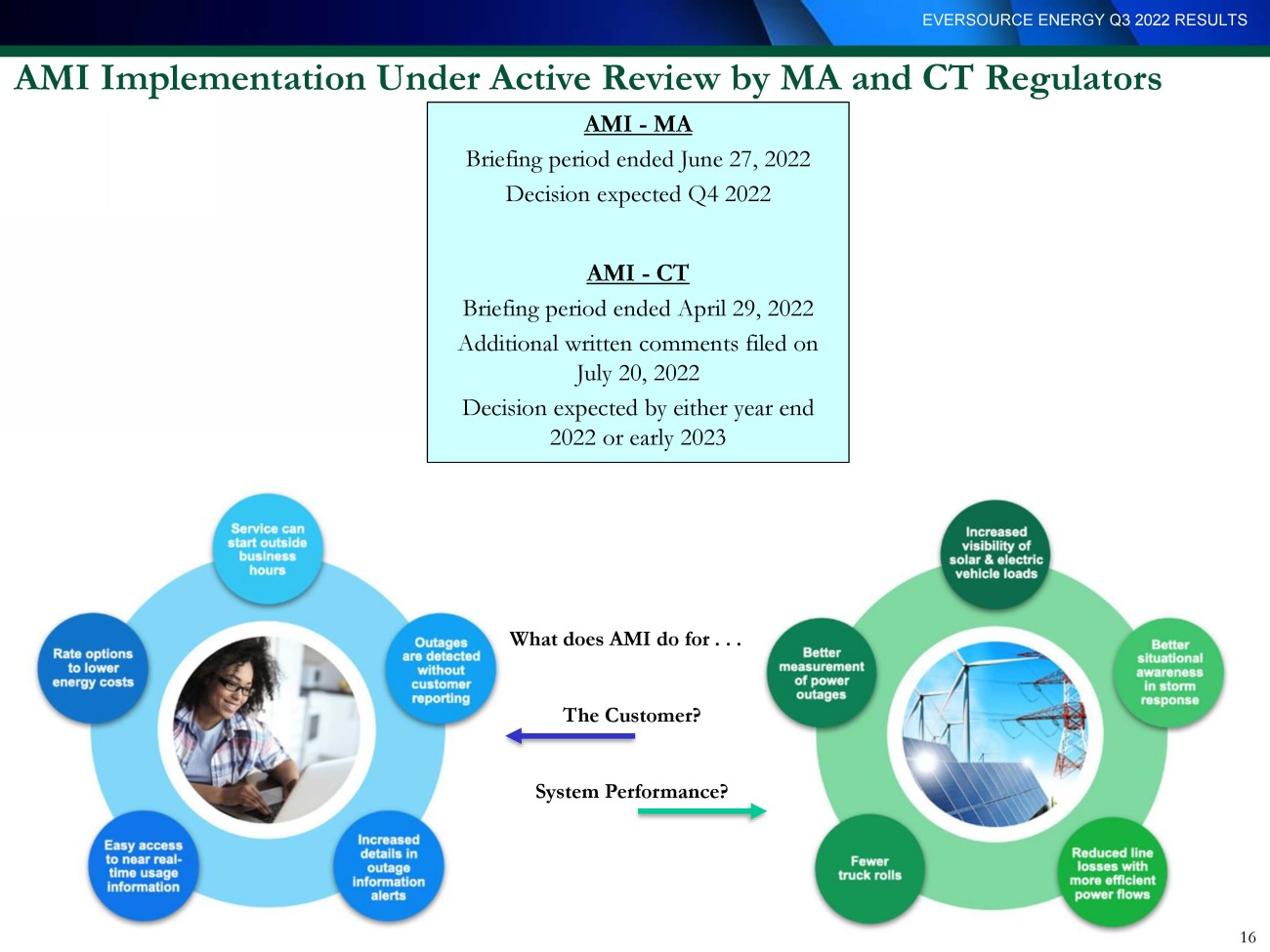

EVERSOURCE ENERGY Q3 2022 RESULTS 16 AMI Implementation Under Active Review by MA and CT Regulators AMI - MA Briefing period ended June 27, 2022 Decision expected Q4 2022 AMI - CT Briefing period ended April 29, 2022 Additional written comments filed on July 20, 2022 Decision expected by either year end 2022 or early 2023 What does AMI do for . . . The Customer? System Performance?