Washington, D.C. 20549

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $134,634,077

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: November 8, 2018 - 23,764,098

The information required by Part III is incorporated by reference from the registrant’s definitive proxy statement for the Annual Meeting of Shareholders to be held in January 2019, which will be filed with the SEC within 120 days of the close of the fiscal year ended August 31, 2018.

Statements that are not historical facts contained in this Annual Report on Form 10-K, or incorporated by reference into this Annual Report on Form 10-K, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The words “anticipate,” “seek,” “project,” “future,” “likely,” “believe,” “may,” “should,” “could,” “will,” “estimate,” “expect,” “plan,” “intend” and similar expressions, as they relate to us, are intended to identify forward-looking statements. Forward-looking statements include statements relating to, among other things:

Forward-looking statements reflect our current views with respect to future events and are subject to certain risks, uncertainties and assumptions. We cannot assure you that any of our expectations will be realized. Our actual results could differ materially from those in such statements. Factors that could cause actual results to differ from those contemplated by such forward-looking statements include, without limitation:

We undertake no obligation, and disclaim any obligation, to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. All forward-looking statements are expressly qualified by this cautionary statement.

The following terms are commonly used in the water industry and are used throughout our annual report:

Pure Cycle Corporation, a Colorado corporation (“we,” “us” or “our”), is a vertically integrated water company that:

As a vertically integrated water company, we own or control substantially all assets necessary to provide wholesale water and wastewater services to our customers. We own or control the water rights that we use to provide domestic and irrigation water to our wholesale customers (including surface water, groundwater, reclaimed water rights and water storage rights). We own the infrastructure required to (i) withdraw, treat, store and deliver water (such as wells, diversion structures, pipelines, reservoirs and treatment facilities); (ii) collect, treat, store and reuse wastewater; and (iii) treat and deliver reclaimed water for irrigation use. We are principally targeting the “I-70 corridor,” a largely undeveloped area located east of downtown Denver and south of Denver International Airport along Interstate 70, as we expect the I-70 corridor to experience substantial growth over the next 30 years.

We provide wholesale water and wastewater services predominantly to two local governmental entities that in turn provide residential and commercial water and wastewater services to communities along the eastern slope of Colorado in the area referred to as the “Front Range,” extending essentially from Fort Collins on the north to Colorado Springs on the south. Our largest customer is the Rangeview Metropolitan District (the “Rangeview District”), which is a quasi-municipal political subdivision of the State of Colorado. We have the exclusive right to provide wholesale water and wastewater services to the Rangeview District and its end-use customers pursuant to the “Rangeview Water Agreements” and the “Off-Lowry Service Agreement” (each as defined below). Through the Rangeview District, we currently provide wholesale service to 391 SFE water connections and 157 SFE wastewater connections located in the Rangeview District’s service area of southeastern metropolitan Denver in an area called the Lowry Range and other nearby areas where we have acquired service rights.

We supply untreated water to industrial customers for various purposes and to oil and gas companies for hydraulic fracturing on properties located within or adjacent to our service areas. Oil and gas operators have leased more than 135,000 acres within and adjacent to our service areas to explore and develop oil and gas interests in the oil-rich Niobrara and other formations. We have capitalized on the need for significant water supplies for hydraulic fracturing in proximity to our existing water supplies and infrastructure.

Pure Cycle Corporation was incorporated in Delaware in 1976 and reincorporated in Colorado in 2008. Unless otherwise specified or the context otherwise requires, all references to “we,” “us,” or “our” are to Pure Cycle Corporation and its subsidiaries on a consolidated basis. Pure Cycle’s common stock trades on The NASDAQ Stock Market under the ticker symbol “PCYO.”

The $36.7 million of capitalized water costs on our balance sheet represents the costs of the water rights we own or have the exclusive right to use and the related infrastructure developed to provide wholesale water and wastewater services. Our water assets are as follows:

We believe we can serve approximately 60,000 SFEs.

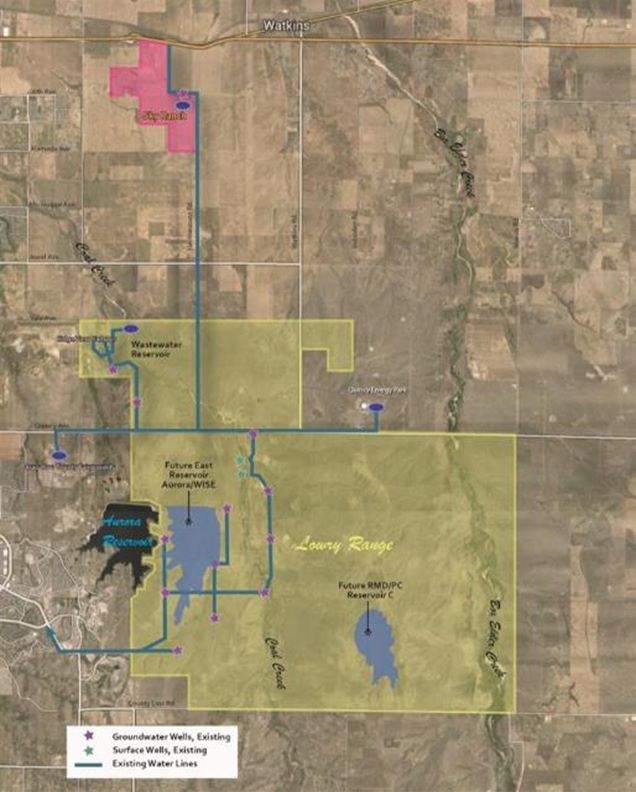

Our service areas and water and land assets are described in greater detail in the maps and discussion that follow.

The map below indicates the location of our Denver area assets.

Additionally, in 1997 we entered into a Wastewater Service Agreement (the “Lowry Wastewater Agreement”) with the Rangeview District to provide wastewater service to the Rangeview District’s customers on the Lowry Range.

The Lease, the Export Agreement, the Lowry Service Agreement and the Lowry Wastewater Agreement are collectively referred to as the “Rangeview Water Agreements.”

Of the approximately 26,985 acre feet of water comprising our Rangeview Water Supply, we own 11,650 acre feet of Export Water, which consists of 10,000 acre feet of groundwater and 1,650 acre feet of average yield surface water, pending completion by the Land Board of documentation related to the exercise of our right to substitute 1,650 acre feet of our groundwater for a comparable amount of surface water. Additionally, assuming the completion of the substitution of groundwater for surface water, we hold the exclusive right to develop and deliver through the year 2081 the remaining 13,685 acre feet of groundwater and approximately 1,650 acre feet of average yield surface water to customers either on or off of the Lowry Range. The Rangeview Water Agreements also grant us the right to use surface reservoir capacity to provide water service to customers both on and off the Lowry Range.

We are also required to pay the Land Board a minimum annual water production fee of $45,600 per year, which is to be credited against future royalties.

The amounts charged by the Rangeview District to its end-use customers off the Lowry Range are determined pursuant to the Rangeview District’s service agreements with such customers and such rates may vary. In exchange for providing water service to the Rangeview District’s customers off the Lowry Range, we receive 98% of the usage charges received by the Rangeview District relating to water services after deducting any required royalty to the Land Board. The royalty to the Land Board is required for water service provided utilizing our Rangeview Water Supply, which includes most of our current customers off the Lowry Range except those at Wild Pointe.

In addition to the tiered water usage pricing structure, we currently charge a hydrant rate of $10.50 per thousand gallons for commercial and industrial customers. We also collect other immaterial fees and charges from customers and other users to cover miscellaneous administrative and service expenses, such as application fees, review fees and permit fees.

In exchange for providing wastewater services, we receive 90% of the Rangeview District’s monthly wastewater treatment fees, as well as the right to use or sell the reclaimed water.

The Rangeview District’s 2018 water tap fees are $24,974, and its wastewater tap fees are $4,659.

In exchange for providing water service to the Rangeview District’s customers on the Lowry Range, we receive 100% of the Rangeview District’s tap fees after deducting the two percent royalty to the Land Board described above. If water taps are sold to customers not located on the Lowry Range that are to be serviced utilizing the Rangeview Water Supply (other than taps to Sky Ranch, which are exempt), the two percent royalty to the Land Board would be deducted from the amount we receive. In exchange for providing wastewater services, whether to customers on or off the Lowry Range, we receive 100% of the Rangeview District’s wastewater tap fees.

Construction fees are fees we receive, typically in advance, from developers for us to build certain infrastructure such as Special Facilities, which are normally the responsibility of the developer.

| (iii) | Consulting Fees – Consulting fees are fees we receive, typically on a monthly basis, from municipalities and area water providers along the I-70 corridor, for systems with respect to which we provide contract operations services. |

| Arapahoe County Fairgrounds Agreement for Water Service | |

|

| | |

In 2005, we entered into an Agreement for Water Service (the “County Agreement”) with Arapahoe County to design, construct, operate and maintain a water system for, and provide water services to, the county for use at the Arapahoe County fairgrounds (the “Fairgrounds”), which are located west of the Lowry Range. Pursuant to the County Agreement, we purchased 321 acre feet of water from the county in 2008. Further details of the arrangements with the county are described in Note 4 – Water and Land Assets to the accompanying financial statements. | |

| | |

| Pursuant to the County Agreement, we constructed and own a deep water well, a 500,000-gallon water tank and pipelines to transport water to the Fairgrounds. The construction of these items was completed in our fiscal 2006, and we began providing water service to the county in 2006. | |

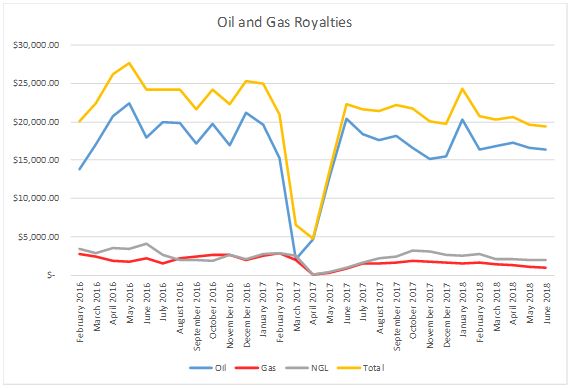

Water Sales for Fracking

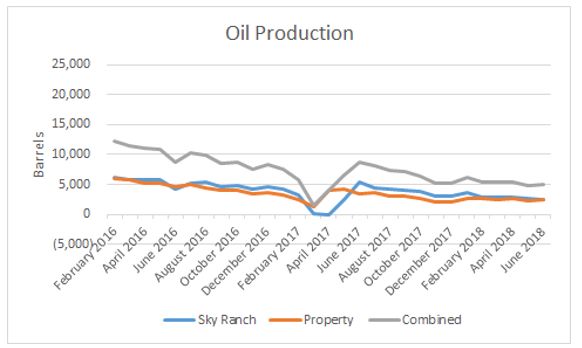

We provide water for hydraulic fracturing (“fracking”) of oil and gas wells being developed in the Niobrara Formation to and around the Land Board’s Lowry Range property and our Sky Ranch property. Oil and gas drilling in our area is affected by the price of oil, and the number of wells drilled and fracked can vary from year to year. Each well developed in the Niobrara Formation utilizes between 10 and 20 million gallons of water to drill and frack, which equates to selling water to between approximately 100 and 200 homes for an entire year.

Water revenues from sales of water for the construction of well sites, drilling and fracking wells developed in the Niobrara Formation were approximately $4,044,300 and $478,500 during the fiscal years ended August 31, 2018 and 2017, respectively. With a large percentage of the acreage surrounding the Lowry Range in Arapahoe, Adams, Elbert, and portions of Douglas Counties already leased by oil companies, we anticipate providing additional water for drilling and fracking of oil and gas wells in the future. Previously, nearly all oil and gas development was attributable to our largest fracking customer ConocoPhillips Company (“ConocoPhillips”). However, in the past year, there have been three other oil and gas companies acquiring lease interests in the area, and each of these companies has drilled and fracked wells. We anticipate continued development of oil and gas wells at the Lowry Range, Sky Ranch and the surrounding area by multiple operators. See “Sales to the fracking industry can fluctuate significantly” in Item 1A – Risk Factors of this Annual Report on Form 10-K.

Service to Customers Not on the Lowry Range

Since January 2017, we have had an agreement with the Rangeview District to be the Rangeview District’s exclusive provider of water and wastewater services to the Rangeview District’s customers located outside of its Lowry Range service area. This agreement was confirmed in the Export Service Agreement, dated June 16, 2017 (the “Off-Lowry Service Agreement”), between us and the Rangeview District. Pursuant to the Off-Lowry Service Agreement, we design, construct, operate and maintain the Rangeview District’s water and wastewater systems and the systems of other communities that have service contracts with the Rangeview District to provide water and wastewater services to the Rangeview District’s customers that are not on the Lowry Range (currently, Wild Pointe and Sky Ranch). In exchange for providing water and wastewater services to the Rangeview District’s customers that are not on the Lowry Range, we receive 100% of water and wastewater tap fees, 98% of the water usage fees, and 90% of the monthly wastewater service and usage fees received by the Rangeview District from its customers that are not located on the Lowry Range, after deduction of royalties due to the Land Board, if applicable. See Rangeview Water Supply and Lowry Range – Land Board Royalties above. The water usage fees to be collected for service at Sky Ranch are the only fees that would currently be subject to the Land Board royalty.

Wild Pointe – Elbert & Highway 86 Commercial Metropolitan District – In 2017, we entered into an agreement with the Rangeview District, which had entered into an agreement with Elbert & Highway 86 Commercial Metropolitan District (the “Elbert 86 District”) to operate and maintain a water system for residential and commercial customers at the Wild Pointe development in Elbert County. The water system includes two deep water wells, a pump station, treatment facility, storage facility, over eight miles of transmission lines, and approximately 457 acre feet of water rights serving the development. We provided $1.6 million in funding to acquire the exclusive rights to operate and maintain all the water facilities in exchange for payment of the remaining residential and commercial tap fees and annual water use fees. Service to Wild Pointe is governed by the Off-Lowry Service Agreement.

Sky Ranch Water and Wastewater Service – As described in more detail below, we are developing 931 acres of land we own as a master planned community known as Sky Ranch. Pursuant to the Sky Ranch Water and Wastewater Service Agreement, dated June 19, 2017, between PCY Holdings, LLC, our wholly owned subsidiary and the owner of the Sky Ranch property (“PCY Holdings”), and the Rangeview District, PCY Holdings agreed to construct certain facilities necessary to provide water and wastewater service to Sky Ranch, and the Rangeview District agreed to provide water and wastewater services for the Sky Ranch development. Pursuant to the Off-Lowry Service Agreement, we are the exclusive provider of water and wastewater services to future residents of the Sky Ranch development.

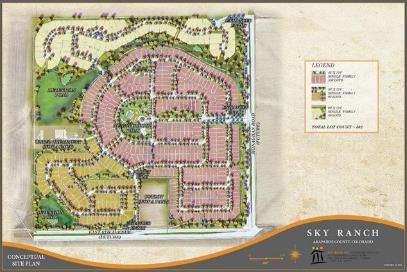

Sky Ranch Development

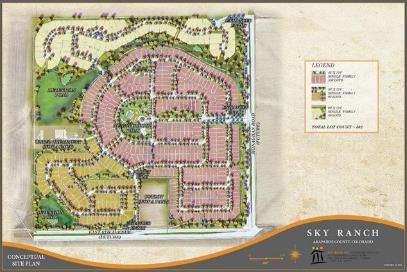

In 2010, we purchased approximately 931 acres of undeveloped land located in unincorporated Arapahoe County known as Sky Ranch. Sky Ranch is located directly adjacent to I-70, 16 miles east of downtown Denver, four miles north of the Lowry Range, and four miles south of Denver International Airport.

The property includes rights to approximately 830 acre feet of water and approximately 640 acres of oil and gas mineral rights and has been zoned for residential, commercial and retail uses that may include up to 4,850 SFEs. Sky Ranch is zoned for 4,400 homes and 1.6 million square feet of commercial, retail and light industrial development. Sky Ranch will develop in multiple phases over a number of years. Our first phase of 151 acres is platted for 506 detached single-family residential lots. We have entered into purchase and sale agreements (described in more detail below) with three national home builders pursuant to which the Company agreed to sell, and the builders agreed to purchase, the initial 506 residential lots at the property. We began construction of 250 residential lots for entry-level housing (houses costing in the $300,000 range) on March 1, 2018, with model homes scheduled for construction in late 2018. We expect to phase the development of our initial 506 lots beginning with delivery of approximately 150 finished lots in early 2019, delivering an additional 100 lots in mid-2019 and the balance of the lots to each builder depending on home sales. We estimate that build out of our initial 506 lots will take between three and four years. We have leased the oil and gas minerals underlying the land to a major independent exploration and production company.

In June 2017, we entered into purchase and sale agreements (collectively, the “Purchase and Sale Contracts”) with three separate home builders pursuant to which we agreed to sell, and each builder agreed to purchase, a certain number (totaling 506) of single-family, detached residential lots at Sky Ranch. We will be developing finished lots for each of the three home builders (which are lots on which homes are ready to be built that include roads, curbs, wet and dry utilities, storm drains and other improvements). Each builder is required to purchase water and sewer taps for the lots from the Rangeview District, the cost of which depends on the size of the lot, the size of the house, and the amount of irrigated turf. Pursuant to the Off-Lowry Service Agreement, we will receive all of the water tap fees and wastewater tap fees. We will receive the monthly service fees and usage fees for wastewater services received by the Rangeview District from customers at Sky Ranch net of a 10% fee retained by the Rangeview District. We will also receive the usage fees for water services received by the Rangeview District from customers at Sky Ranch, after deduction, in most instances, of the royalty to the Land Board related to the use of the Rangeview Water Supply, net of a 2% fee retained by the Rangeview District.

In November 2017, each builder completed its due diligence under the Purchase and Sale Contracts, at which time certain earnest money deposits by each builder became non-refundable. In July 2018, we obtained final approval of the entitlements for the property and achieved the first payment milestone for 150 platted lots to two of our builders. We received a payment of $2,500,000, and the two builders posted letters of credit for an additional $7,775,000. We are working to complete construction of finished lots in fiscal year 2019 and will receive two additional payments, to be distributed from the escrowed funds, from each of these builders. The first additional payment will be distributed upon completion of construction of wet utilities, and the final payment will be distributed upon completion of finished lots. Additionally, we will receive payment from our third builder upon completion of finished lots.

We are obligated pursuant to the Purchase and Sale Contracts, or separate Lot Development Agreements (the “Lot Development Agreements” and, together with the Purchase and Sale Contracts, the “Builder Contracts”), to construct infrastructure and other improvements, such as roads, curbs and gutters, park amenities, sidewalks, street and traffic signs, water and sanitary sewer mains and stubs, storm water management facilities, and lot grading improvements for delivery of finished lots to each builder. Pursuant to the Builder Contracts, we must cause the Rangeview District to install and construct off-site infrastructure improvements (i.e., a wastewater reclamation facility and wholesale water facilities) for the provision of water and wastewater service to the property. In conjunction with our approvals with Arapahoe County for the Sky Ranch project, we and/or the Rangeview District and the Sky Ranch Districts or the CAB (each as defined and described in more detail below) are obligated to deposit into an account the anticipated costs to install and construct substantially all the off-site infrastructure improvements (which include drainage, wholesale water and wastewater facilities, and entry roadway), which we estimate will be approximately $10.2 million.

The improvements, such as roads, parks, and water and sanitary sewer mains, that will be shared by all homeowners in the development and not specific to a finished lot will ultimately be owned by the Sky Ranch Districts or the CAB. Upon completion of the improvements and acceptance by the Sky Ranch Districts or the CAB, we will be entitled to reimbursement for the verified costs incurred with respect to such improvements. We estimate that the total capital required to develop lots in the first phase (506 lots) of Sky Ranch will be approximately $35 million, which includes estimated reimbursable costs of approximately of $27 million that will be reimbursable to us by the CAB, and that lot sales to home builders will generate approximately $36 million in revenues, providing a margin on lots of approximately $1 million prior to receipt of reimbursable expenses. The Company and the CAB have agreed that no payment is required by the CAB with respect to reimbursable costs unless and until the CAB and/or the Sky Ranch Districts issue bonds in an amount sufficient to reimburse us for all or a portion of advances provided, or expenses incurred for reimbursables. Due to this contingency, the reimbursable costs will be included in lot development capitalized costs until the point in time when bonding is obtained. At that point, all reimbursable costs will be reversed and recorded as a note receivable and will reduce any remaining capitalized costs. Any excess will be recognized as other income from CAB reimbursement.

Utility revenues will be derived from tap fees (which vary depending on lot size, house size, and amount of irrigated turf) and usage fees (which are monthly water usage and wastewater treatment fees). Our current Sky Ranch water tap fees are $26,650 (per SFE), and wastewater taps fees are $4,659 (per SFE).

We have begun design and preliminary engineering for our second phase, which will include approximately 320 acres of residential development and 160 acres of commercial, retail, and industrial development along the I-70 frontage. We expect to have multiple phases being developed concurrently and would expect the development of the Sky Ranch project to occur over 10–14 years, depending on demand.

Sky Ranch Metropolitan District Nos. 1, 3, 4, and 5 – The Sky Ranch Metropolitan District Nos. 1, 3, 4 and 5 are quasi-municipal corporations and political subdivisions of Colorado formed in 2004 for the purpose of providing service to the approximately 930 acres of the Sky Ranch property (the “Sky Ranch Districts”). The Sky Ranch Districts are governed by an elected board of directors. Eligible voters and persons eligible to serve as directors of the Sky Ranch Districts must own an interest in property within the boundaries of the district. We own certain rights and real property interests which encompass the current boundaries of the districts. The current directors of the districts are Mark W. Harding (our President, Chief Financial Officer and a director), Scott E. Lehman (a Pure Cycle employee), and Dirk Lashnits (a Pure Cycle employee), and one independent board member. Pursuant to Colorado law, directors may receive $100 for each board meeting they attend, up to a maximum of $1,600 per year. Mr. Harding, Mr. Lehman, and Mr. Lashnits have all elected to forego these payments.

Sky Ranch Community Authority Board

Pursuant to a certain Community Authority Board Establishment Agreement, as the same may be amended from time to time, Sky Ranch Metropolitan District No. 1 and Sky Ranch Metropolitan District No. 5 formed the CAB to, among other things, design, construct, finance, operate and maintain certain public improvements for the benefit of the property within the boundaries and/or service area of the Sky Ranch Districts. In order for the public improvements to be constructed and/or acquired, it is necessary for each Sky Ranch District, directly or through the CAB, to be able to fund the improvements and pay its ongoing operations and maintenance expenses related to the provision of services that benefit the property. We have entered into agreements, first with Sky Ranch Metropolitan District No. 5 in 2014, and later with the CAB in November 2017 and June 2018, requiring us to fund expenses related to the construction of an agreed upon list of improvements for the Sky Ranch property.

On September 18, 2018, the parties entered into a series of agreements, including a Facilities Funding and Acquisition Agreement with an effective date of November 13, 2017 (the “2018 FFAA”), which supersedes and consolidates the previous agreements and pursuant to which

| ● | the CAB agreed to repay the amounts owed by Sky Ranch Metropolitan District No. 5 to Pure Cycle, and the previous Facilities Funding and Acquisition Agreement entered into between Pure Cycle and Sky Ranch Metropolitan District No. 5 in 2014 was terminated; |

| ● | the November 2017 Project Funding and Reimbursement Agreement and the June 2018 Funding Acquisition Agreement between the CAB and Pure Cycle were terminated; |

| ● | the CAB acknowledged all amounts owed to Pure Cycle under the terminated agreements, as well as amounts we incurred to finance the formation of the CAB; and |

| ● | Pure Cycle agreed to fund expenses related to the construction of an agreed upon list of improvements to be constructed by the CAB with an estimated cost of $30 million (including improvements already funded) on an as-needed basis for calendar years 2018–2023. |

Advances and verified costs expended by us for expenses related to the construction of the agreed upon improvements are reimbursable to us by the CAB. All amounts owed under the terminated agreements and each reimbursable expense incurred under the 2018 FFAA accrues interest at a rate of 6% per annum from the time funds are advanced by us to the CAB or costs are incurred by us for expenses related to the construction of improvements, as applicable. No repayment is required of the CAB for advances made to the CAB or expenses incurred related to the construction of improvements unless and until the CAB and/or Sky Ranch Districts issue bonds in an amount sufficient to reimburse us for all or a portion of advances or other expenses incurred. The CAB agrees to exercise reasonable efforts to issue bonds to reimburse us subject to certain limitations. In addition, the CAB agrees to utilize any available moneys not otherwise pledged to payment of debt, used for operation and maintenance expenses, or otherwise encumbered, to reimburse us. Any advances or expenses not paid or reimbursed by the CAB by December 31, 2058, shall be deemed forever discharged and satisfied in full. We have funded reimbursable expenses for improvements, including improvements with respect to earthwork, erosion control, streets, drainage, and landscaping, at an estimated cost of $2.3 million and expect to fund an additional estimated $25 million in reimbursable buildout costs.

The current directors of the CAB are Mark W. Harding (our President, Chief Financial Officer and a director), Scott E. Lehman (a Pure Cycle employee), and Dirk Lashnits (a Pure Cycle employee), and one independent board member. Pursuant to Colorado law, directors may receive $100 for each board meeting they attend, up to a maximum of $1,600 per year. Mr. Harding, Mr. Lehman, and Mr. Lashnits have all elected to forego these payments.

| Oil and Gas Leases | | |

| | | |

| | In 2011, we entered into a three-year Oil and Gas Lease (the “O&G Lease”) and Surface Use and Damage Agreement (the “Surface Use Agreement”) and received an up-front payment of $1,243,400 ($1,900 per mineral acre) and a 20% of gross proceeds royalty (less certain taxes) from the sale of any oil and gas produced from the approximately 634 acres of mineral estate we own at Sky Ranch. In 2014, the O&G Lease was extended for an additional two (2) years, and we received an additional up-front payment of $1,243,400 for the extension. The O&G Lease is now held by production, and we have been receiving royalties from the oil and gas production from two wells drilled within our mineral interest. During the fiscal year ended August 31, 2018, we received $191,300 in royalties attributable to these two wells. |

| | |

| | In 2015, we received an up-front payment of $72,000, pursuant to a lease (which expired in fiscal 2017) for the purpose of exploring for, developing, producing, and marketing oil and gas of 40 acres of mineral estate we own adjacent to the Lowry Range (the “Rangeview Lease”). In September 2017, we entered into a three-year Paid-Up Oil and Gas Lease with Bison Oil and Gas, LLP (the “Bison Lease”) for this 40-acre mineral estate, and we received an up-front payment of $167,200. |

Arkansas River Land and Minerals

We own three farms totaling 700 acres in the Arkansas River Valley. The farms were acquired in order to correct dry-up covenant issues related to water-only farms, and we currently lease all three farms for dry land grazing. We intend to sell the farms in due course and have classified the farms as long-term investments. We also own approximately 13,900 acres of mineral interests in the Arkansas River Valley, which have an estimated value of approximately $1.4 million. We currently have no plans to sell our mineral interests.

Well Enhancement and Recovery Systems

In 2007, we, along with two other parties, formed Well Enhancement and Recovery Systems LLC (“Well Enhancement LLC”), to develop a new deep water well enhancement tool and process that we believe will increase the efficiency of wells completed into the Denver Basin groundwater formations. According to results from studies performed by an independent hydro-geologist, the well enhancement tool effectively increased the production of the two test wells by 80% and 83% when compared to that of nearby wells developed in similar formations at similar depths. Based on the positive results of the test wells, we continue to refine the process of enhancing deep water wells and are marketing the tool to area water providers. We currently hold a 50% interest in Well Enhancement LLC. We have not drilled any new wells in the past three years and have not used the tool during this period, but we intend to continue to use the tool when we drill new water wells.

Significant Customers

Water and Wastewater

Our wholesale water and wastewater sales to the Rangeview District pursuant to the Rangeview Water Agreements accounted for 6%, 26% and 67% of our total water revenues for the fiscal years ended August 31, 2018, 2017 and 2016, respectively. The Rangeview District has one significant customer, the Ridgeview Youth Services Center (“Ridgeview”). Pursuant to our Rangeview Water Agreements, we are providing water and wastewater services to Ridgeview on behalf of the Rangeview District. Ridgeview accounted for 4%, 21% and 55% of our total water revenues for the fiscal years ended August 31, 2018, 2017 and 2016, respectively.

Our industrial water sales (i) directly and indirectly to ConocoPhillips accounted for approximately 68%, 30% and less than 1% and (ii) to other oil and gas operators accounted for approximately 21%, 25%, and nil, of our total water revenues for the fiscal years ended August 31, 2018, 2017 and 2016, respectively.

Land Development

Revenues from two customers represented 98% of the Company’s land development revenues for the fiscal year ended August 31, 2018. Richmond America Homes of Colorado, Inc. represented 66% and Taylor Morrison of Colorado, Inc. represented 32% of the Company’s land development revenues for the fiscal year ended August 31, 2018. No revenues were recognized from the Company’s land development activities for the fiscal years ended August 31, 2017 and 2016.

Our Projected Operations

This section should be read in conjunction with Item 1A – Risk Factors.

Along the Colorado Front Range, there are over 70 water providers with varying needs for replacement and new water supplies. We believe that we are well positioned to assist certain of these providers in meeting their current and future water needs.

We design, construct and operate our water and wastewater facilities using advanced water treatment and wastewater treatment technologies, which allow us to use our water supplies in an efficient and environmentally sustainable manner. We plan to develop our water and wastewater systems in stages to efficiently meet demands in our service areas, thereby reducing the amount of up-front capital costs required for construction of facilities. We use third-party contractors to construct our facilities as needed. We employ licensed water and wastewater operators to operate our water and wastewater systems. As our systems expand, we expect to hire additional personnel to operate our systems, which include water production, treatment, testing, storage, distribution, metering, billing, and operations management.

Our water and wastewater systems conjunctively use surface and groundwater supplies and storage of raw water and highly treated effluent supplies to provide a balanced sustainable water supply for our wholesale customers and their end-use customers. Integrating conservation practices and incentives together with effective water reuse demonstrates our commitment to providing environmentally responsible and sustainable water and wastewater services. Water supplies and water storage reservoirs are competitively sought throughout the west and along the Front Range of Colorado. We believe that regional cooperation among area water providers in developing new water supplies, water storage, and transmission and distribution systems provides the most cost-effective way of expanding and enhancing service capacities for area water providers. We continue to discuss developing water supplies and water storage opportunities with area water providers.

We expect the development of our Rangeview Water Supply to require a significant number of high capacity deep water wells. We anticipate drilling separate wells into each of the three principal aquifers located beneath the Lowry Range. Each well is intended to deliver water to central water treatment facilities for treatment prior to delivery to customers. Development of our Lowry Range surface water supplies will require facilities to divert surface water to storage reservoirs to be located on the Lowry Range and treatment facilities to treat the water prior to introduction into our distribution systems. Surface water diversion facilities will be designed with capacities to divert the surface water when available (particularly during seasonal events such as spring run-off and summer storms) for storage in reservoirs to be constructed on the Lowry Range. Based on preliminary engineering estimates, the full build-out of water facilities (including diversion structures, transmission pipelines, reservoirs, and water treatment facilities) on the Lowry Range will cost in excess of $750 million, based on estimated costs, and will accommodate water service to customers located on and outside the Lowry Range. We expect this build out to occur in phases over an extended period of at least 50 years, and we expect that tap fees will be sufficient to fund the infrastructure costs.

Our Denver-based supplies are a valuable, locally available resource located near the point of use. This enables us to incrementally develop infrastructure to produce, treat and deliver water to customers based on their growing demands.

During fiscal 2018, we invested approximately $1.8 million to construct pipelines that interconnect the Rangeview District, WISE, and Sky Ranch water systems. We expect to continue to invest in pipelines at the Sky Ranch property in anticipation of the first phase of development. We also expect to add additional wells as demand for water grows.

The Rangeview District is a participant in the WISE project. This project is developing infrastructure to interconnect providers’ water systems and to extend renewable water sources owned by Denver Water and Aurora Water to participating South Metro water providers, including the Rangeview District and, through our agreements with the Rangeview District, us. This system will diversify our sources of water and will enable providers to move water among themselves, which will increase the reliability of our and others’ water systems. Through the WISE Financing Agreement, we funded the Rangeview District’s purchase of certain rights to use existing water transmission and related infrastructure acquired and constructed by the WISE project. We have invested approximately $3.1 million into the WISE water supply to date. We anticipate that we will be spending approximately $3.0 million on this system during fiscal 2019 and $3.8 million during the next four years to fund the Rangeview District’s purchase of its share of the water transmission line and additional facilities, water and related assets for WISE and to fund operations and water deliveries related to WISE. Timing of the investment will vary depending on the schedule of projects within WISE and the amount of water purchased.

We are in the process of developing our Sky Ranch property, including building finished lots for home builders and building the water and wastewater infrastructure for residential and commercial development of the property. In March 2018, we began construction of improvements for finished lots and will phase the construction of finished lots consistent with builder purchases of finished lots as defined in our agreements. The timing for us to develop the remaining phases of the property will be largely dependent on the Denver real estate market and the interest we receive from home builders and developers. During fiscal 2018, we invested approximately $5.3 million in our Sky Ranch property, which consisted of planning, preliminary and final engineering designs, grading, erosion, sediment control, drainage design, water and wastewater facility designs, and construction of approximately 10 miles of new transmission lines.

We plan to develop additional water assets within the Denver area and are exploring opportunities to utilize our water assets in areas adjacent to our existing water supplies.

Water and Growth in Colorado

Colorado has experienced a robust housing market over the past 24 months. The key drivers to housing in the area are:

| ● | Housing Starts – From September 2017 to September 2018, annual housing starts increased by 13.3%. From September 2016 to September 2017, annual housing starts increased by 6%. |

| ● | Unemployment – The unemployment rate in Colorado was 2.9% at August 31, 2018, compared to a national unemployment rate of 3.9%. |

| ● | Population – The Denver Regional Council of Governments, a voluntary association of over 50 county and municipal governments in the Denver metropolitan area, estimates that the Denver metropolitan area population will increase by about 38% from today’s 3.4 million people to 4.7 million people by the year 2040. A Statewide Water Supply Initiative report by the Colorado Water Conservation Board estimates that the South Platte River basin, which includes the Denver metropolitan region, will grow from a current population of 3.9 million to 4.9 million by the year 2030, while the state’s population will increase from 5.7 million to 7.2 million. |

| ● | Demand – Approximately 70% of the state’s projected population increase is anticipated to occur within the South Platte River basin. Significant increases in Colorado’s population, particularly in the Denver metro region and other areas in the water-short South Platte River basin, together with increasing agricultural, recreational, and environmental water demands, will intensify competition for water supplies. The estimated population increases are expected to result in demands for water services in excess of the current capabilities of municipal service providers, especially during drought conditions. |

| ● | Supply – The Statewide Water Supply Initiative estimates that population growth in the Denver region and the South Platte River basin could result in additional water supply demands of over 400,000 acre feet by the year 2030. |

| ● | Development – Colorado law requires property developers to demonstrate that they have sufficient water supplies for their proposed projects before rezoning applications will be considered. These factors indicate that water and availability of water will continue to be critical to growth prospects for the region and the state, and that competition for available sources of water will continue to intensify. We focus the marketing of our water supplies and services to developers and home builders that are active along the Colorado Front Range as well as other area water providers in need of additional supplies. |

Colorado’s future water supply needs will be met through conservation, reuse and the development of new supplies. The Rangeview District’s rules and regulations for water and wastewater service call for adherence to strict conservation measures, including low-flow water fixtures, high efficiency appliances, and advanced irrigation control devices. Additionally, our systems are designed and constructed using a dual-pipe water distribution system to segregate the delivery of high quality potable drinking water to our local governmental entities and their end-use customers through one system and a second system to supply raw or reclaimed water for irrigation demands. About one-half of the water used by a typical Denver-area residential water customer is used for outdoor landscape and lawn irrigation. We believe that raw or reclaimed water supplies provide the lowest cost, most environmentally sustainable water for outdoor irrigation. We expect our systems to include an extensive water reclamation system in which essentially all effluent water from wastewater treatment plants will be reused to meet non-potable water demands. Our dual-distribution systems demonstrate our commitment to environmentally responsible water management policies in our water-short region.

Labor and Raw Materials

We competitively bid contracts for infrastructure improvements (grading, utilities, roads, water and wastewater) at Sky Ranch. Contractors enter into fixed priced contracts where the contractor is at risk for cost overruns prior to completion of improvements. Under these fixed-price contracts, the contract prices that we agree to are established in part based on fixed, firm subcontractor quotes on contracts and on cost and scheduling estimates. These quotes or estimates may be based on a number of assumptions, including assumptions about prices and availability of labor, equipment and materials, and other issues. Increased costs or shortages of skilled labor and/or concrete, steel, pipe and other materials could cause increases in property development costs and delays. These shortages and delays may result in delays in the delivery of the residential lots under development, reduced gross margins from lot sales, or both. While we contract with third parties for our labor and materials at a fixed price, which should allow us to mitigate the risks associated with increases in the cost of labor and building materials, other variables may arise which would increase lot delivery costs.

Competition

Water and Wastewater Services

We negotiate individual service agreements with our governmental customers and with their developers and/or home builders to design, construct and operate water and wastewater systems and to provide services to end-use customers of governmental entities and to commercial and industrial customers. These service agreements seek to address all aspects of the development of the water and wastewater systems, including:

| (i) | the purchase of water and wastewater taps in exchange for our obligation to construct certain Wholesale Facilities; |

| (ii) | the establishment of payment terms, timing, capacity and location of Special Facilities (if any); and |

| (iii) | specific terms related to our provision of ongoing water and wastewater services to our local governmental customers as well as the governmental entities’ end-use customers. |

Although we have exclusive long-term water and wastewater service contracts for 24,000 acres of the 27,000-acre Lowry Range pursuant to the Lowry Service Agreement, providing water and wastewater services to areas other than Wild Pointe, Sky Ranch and a portion of the Lowry Range is subject to competition. Alternate sources of water are available, principally from other private parties, such as farmers or others owning water rights that have historically been used for agriculture, and from municipalities seeking to annex new development areas in order to increase their tax base. Our principal competition in areas close to the Lowry Range is the City of Aurora. Principal factors affecting competition for potential purchasers of our Export Water include the availability of water for the particular purpose, the cost of delivering the water to the desired location (including the cost of required taps), and the reliability of the water supply during drought periods. We estimate that the water assets we own and have the exclusive right to use have a supply capacity of approximately 60,000 SFE units, and we believe that they provide us with a significant competitive advantage along the Front Range. Our legal rights to the Rangeview Water Supply have been confirmed for municipal use, and our water supply is close to Denver area water users. We believe that our pricing structure is competitive and that our water portfolio is well balanced with senior surface water rights, groundwater rights, storage capacity and reclaimed water supplies.

Land Development

Land development is a highly competitive business. There are numerous land developers, as well as properties and development projects, in the same geographic area in which Sky Ranch is located. Competition among land developers and development projects is determined by the location of the real estate, the market appeal of the development plan, and the developer’s ability to build, market and deliver projects on a timely basis. Many of our land development competitors have greater financial resources than we do, and most if not all of our land development competitors have more development experience than we do. Residential developers sell to home builders, who in turn compete based on location, price, market segmentation, product design and reputation. Commercial, retail, and industrial developers sell to and/or compete with other developers, owners and operators of real estate.

Environmental, Health and Safety Regulation

Provision of water and wastewater services is subject to regulation under the federal Safe Drinking Water Act, the Clean Water Act, related state laws, and federal and state regulations issued under these laws. These laws and regulations establish criteria and standards for drinking water and for wastewater discharges. In addition, we are subject to federal and state laws and other regulations relating to solid waste disposal and certain other aspects of our operations.

Environmental compliance issues may arise in the normal course of operations or as a result of regulatory changes. We attempt to align capital budgeting and expenditures to address these issues in a timely manner.

Safe Drinking Water Act – The Safe Drinking Water Act establishes criteria and procedures for the U.S. Environmental Protection Agency to develop national quality standards for drinking water. Regulations issued pursuant to the Safe Drinking Water Act and its amendments set standards on the amount of certain microbial and chemical contaminants and radionuclides allowable in drinking water. The State of Colorado has assumed primary responsibility for enforcing the standards established by the Safe Drinking Water Act and has adopted the Colorado Primary Drinking Water Standards (Code of Colorado Regulations 5 CCR 1003-1). Current requirements for drinking water are not expected to have a material impact on our financial condition or results of operations as we have made and are making investments to meet existing water quality standards. In the future, we might be required to change our method of treating drinking water and make additional capital investments if additional regulations become effective.

The federal Groundwater Rule became effective December 1, 2009. This rule requires additional testing of water from well sources and under certain circumstances requires demonstration and maintenance of effective disinfection. In 2009, Colorado adopted Article 13 to the Colorado Primary Drinking Water Standards to establish monitoring and compliance criteria for the Groundwater Rule. We have implemented measures to comply with the Groundwater Rule.

Clean Water Act – The Clean Water Act regulates wastewater discharges from drinking water and wastewater treatment facilities and storm water discharges into lakes, rivers, streams, and wetlands. The State of Colorado has assumed primary responsibility for enforcing the standards established by the federal Clean Water Act for wastewater discharges from domestic water and wastewater treatment facilities and has adopted the Colorado Water Quality Control Act and related regulations, which also regulate discharges to groundwater. It is our policy to obtain and maintain all required permits and approvals for discharges from our water and wastewater facilities and to comply with all conditions of those permits and other regulatory requirements. A program is in place to monitor facilities for compliance with permitting, monitoring and reporting for wastewater discharges. From time to time, discharge violations might occur which might result in fines and penalties, but we have no reason to believe that any such fines or penalties are pending or will be assessed.

In the future, we anticipate changing our method of treating wastewater, which will require future additional capital investments, as additional regulations become effective. In 2016, we invested $368,600 to design, permit and construct a 13 million gallon effluent storage reservoir at our wastewater treatment facility and have converted our facility to a zero discharge treatment facility. We are storing the treated effluent water and expect to use the water for agricultural and irrigation uses.

Solid Waste Disposal – The handling and disposal of residuals and solid waste generated from water and wastewater treatment facilities is governed by federal and state laws and regulations. We have a program in place to monitor our facilities for compliance with regulatory requirements, and we do not anticipate that costs associated with our handling and disposal of waste material from our water and wastewater operations will have a material impact on our business or financial condition.

Employees

We currently have 19 full-time employees.

Available Information and Website Address

Our website address is www.purecyclewater.com. We make available free of charge through our website our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to these reports as soon as reasonably practicable after filing with the Securities and Exchange Commission (the “SEC”).

These reports and all other material we file with the SEC may be obtained directly from the SEC’s website, www.sec.gov/edgar/searchedgar/companysearch.html, under CIK code 276720. The contents of our website are not incorporated by reference into this report. You may also read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. Operating information for the Public Reference Room is available by calling the SEC at 1-800-SEC-0330.

The following section describes the material risks and uncertainties that management believes could have a material adverse effect on our business, financial condition, results of operations, and the market price of our common stock. The risks discussed below include forward-looking statements, and our actual results may differ materially from those discussed in these forward-looking statements. These risks should be read in conjunction with the other information set forth in this report, including the accompanying financial statements and notes thereto.

Our net losses may continue, and we may not have sufficient cash flows from operations or other capital resources to pursue our business objectives. While we generated net income in fiscal 2018, we have a long history of losses. Our cash flows from operations have not been sufficient to fund our operations in the past; and we have been required to raise debt and equity capital and sell assets to remain in operation. Since 2004, we have obtained $76.3 million through (i) the issuance of $25.3 million of common stock (including the issuance of stock pursuant to the exercise of options, net of expenses), (ii) the issuance of $5.2 million of convertible debt, which was converted to common stock on January 11, 2011, and (iii) the sale of our Arkansas River water and land for approximately $45.8 million in cash. Our development of the first 250 homes in the first phase of Sky Ranch requires significant cash expenditures of approximately $18 million before we will generate positive cash flows from the sale of lots and water and sewer tap fees. We expect to fund such expenditures with cash on hand and cash flows from operations. At August 31, 2018, we had approximately $20 million of cash and marketable securities on hand. We currently have a limited number of customers. If our cash on hand and future cash flows from operations are not sufficient to fund our operations and the significant capital expenditure requirements to build our water delivery systems and develop Sky Ranch, we may be forced to seek to obtain additional debt or equity capital. Economic conditions and disruptions have previously caused substantial volatility in capital markets, including credit markets and the banking industry, increasing the cost and significantly reducing the availability of financing, which may reoccur in the future. There can be no assurance that financing will be available on acceptable terms or at all.

The rates the Rangeview District is allowed to charge customers on the Lowry Range are limited by the Lease with the Land Board and our contract with the Rangeview District and may not be sufficient to cover our costs of construction and operation. The prices charged by the Rangeview District for water service on the Lowry Range are subject to pricing regulations set forth in the Lease with the Land Board. Both the tap fees and usage rates and charges are capped at the average of the rates of three nearby water providers. Annually the Rangeview District surveys the tap fees and rates of the three nearby providers, and the Rangeview District may adjust tap fees and rates and charges for water service on the Lowry Range based on the average of those charged by this group, and we receive 100% of tap fees and 98% of water usage fees charged by the Rangeview District to its customers after the deduction of royalties owed to the Land Board. Our costs associated with the construction of water delivery systems and the production, treatment and delivery of water are subject to market conditions and other factors, which may increase at a significantly higher rate than that of the fees we receive from the Rangeview District. Factors beyond our control and which cannot be predicted, such as government regulations, insurance and labor markets, drought, water contamination and severe weather conditions, like tornadoes and floods, may result in additional labor and material costs that may not be recoverable under the current rate structure. Both increased customer demand and increased water conservation may also impact the overall cost of our operations. If the costs for construction and operation of our wholesale water services, including the cost of extracting our groundwater, exceed our revenues, we would be providing service to the Rangeview District for use at the Lowry Range at a loss. The Rangeview District may petition the Land Board for rate increases; however, there can be no assurance that the Land Board would approve a rate increase request. Further, even if a rate increase were approved, it might not be granted in a timely manner or in an amount sufficient to cover the expenses for which the rate increase was sought.

Our business is subject to seasonal fluctuations and weather conditions that could affect demand for our water service and our revenues. We depend on an adequate water supply to meet the present and future demands of our customers and their end-use customers and to continue our expansion efforts. Conditions beyond our control may interfere with our water supply sources. Drought and overuse may limit the availability of water. These factors might adversely affect our ability to supply water in sufficient quantities to our customers, and our revenues and earnings may be adversely affected. Additionally, cool and wet weather, as well as drought restrictions and our customers’ conservation efforts, may reduce consumption demands, adversely affecting our revenue and earnings. Furthermore, freezing weather may contribute to water transmission interruptions caused by pipe and main breakage. If we experience an interruption in our water supply, it could have a material adverse effect on our financial condition and results of operations. Demand for our water during the warmer months is generally greater than during cooler months due primarily to additional requirements for water in connection with cooling systems, irrigation systems and other outside water use. Throughout the year, and particularly during typically warmer months, demand will vary with temperature and rainfall levels. If temperatures during the typically warmer months are cooler than expected or there is more rainfall than expected, the demand for our water may decrease and adversely affect our revenues.

Our water sales for the past two years have been highly concentrated to companies providing fracking services to the oil and gas industry, and such sales can fluctuate significantly. Our water sales have been historically highly concentrated directly and indirectly with one to three companies providing fracking services to the oil and gas industry on and around the Lowry Range and our Sky Ranch property. Generally, investment in oil and gas development is dependent on the price of oil and gas. While water sales for fracking represented 89% and 55% of our total water revenues during the fiscal years ended August 31, 2018 and 2017, respectively, we have no contractual commitment that will ensure these sales in the future. The oil and gas industry has periodically gone through periods when activity has significantly declined. For example, water sales for fracking represented less than 1% of our total water revenues during the fiscal year ended August 31, 2016.

Further sales to this customer base as well as renewals of our oil and gas leases, if any, in the future are impacted by statutory ballot initiatives, regulations, court interpretations of the statutory mandate of the Colorado Oil and Gas Conservation Commission, fracking technologies, the success of the wells and the price of oil and gas, among other things. For example, certain interest groups in Colorado opposed to oil and natural gas development generally, and hydraulic fracturing in particular, advanced a ballot initiative that would have resulted in oil and natural gas development in the state being significantly curtailed. The initiative was not approved by the voters of Colorado in the November 2018 election. The Colorado Oil and Gas Conservation Commission estimated that implementation of the proposed initiative would have made drilling unlawful on approximately 85% of the non-federal surface area of the state of Colorado. Although this initiative did not pass, these interest groups have declared that they will continue to seek restrictions on oil and gas development. There is also a case pending before the Colorado Supreme Court challenging the interpretation of the statute governing the standards applied by the Colorado Oil and Gas Conservation Commission in issuing drilling permits. The plaintiffs are seeking a ruling requiring the Commission to replace its current balancing test with a test that prioritizes health and environmental concerns. A favorable ruling for the plaintiffs could result in the issuance of fewer drilling permits. A significant decline in oil and gas drilling activities in and around the Lowry Range and our Sky Ranch property would have an adverse effect on our water sales to the fracking industry and our financial condition. Further, a significant decline in oil and gas activities throughout Colorado could negatively impact the Colorado economy, which could have an adverse effect on demand for new homes.

A significant portion of our water supplies come from non-renewable aquifers. A significant portion of our water supplies comes from non-renewable Denver Basin aquifers. The State of Colorado regulates development and withdrawal of water from the Denver Basin aquifers to a rate of 1 percent of the aggregate amount of water determined to be in storage each year, which means our supply should last approximately 100 years even if no efforts were made to conserve or recharge the supply. Nonetheless, we may need to seek additional water supplies as our non-renewable supplies are depleted. If we are unable to obtain sufficient replacement supplies, it would have a material adverse impact on our business and financial condition. Additionally, the cost of developing and withdrawing water from the aquifers will increase over time, and we may not be able to recover the increased costs through our rates and charges. Increased costs to develop water from the aquifers could have a significant negative impact on our business, results of operations, cash flows and financial condition.

We are dependent on the housing market and development in our targeted service areas for future revenues. Providing wholesale water service using our Colorado Front Range water supplies is our principal source of future revenue. The timing and amount of these revenues will depend in part on housing developments being built near our water assets. The development of the Lowry Range, Sky Ranch and other properties is subject to many factors that are not within our control. If wholesale water sales are not forthcoming or development on the Lowry Range, Sky Ranch or other properties in our targeted service areas is delayed or curtailed, we may need to use our capital resources, incur additional short or long-term debt obligations or seek to sell additional equity. We may not have sufficient capital resources or be successful in obtaining additional operating capital. After several years of significant declines in new home construction, there have been positive market gains in the Colorado housing market since 2013. However, if the downturn in the homebuilding or credit markets return or if the state or national economy weakens and economic concerns intensify, it could have a significant negative impact on our business and financial condition and our plans for future development of additional phases of Sky Ranch.

Although the Colorado economy has become increasingly diverse, the oil and gas industry remains an important segment of the Colorado economy. New statutes, regulations or other initiatives that would limit oil and gas exploration or increase the cost of exploration, as well as declines in the price of oil and gas, among other things, could lead to a downturn in the Colorado economy, including increased unemployment, which would likely have a negative impact on the housing market and our business and financial condition.

The homebuilding industry is cyclical and a deterioration in industry conditions or downward changes in general economic or other business conditions could adversely affect our business, results of operations, cash flows and financial condition. The residential homebuilding industry is cyclical and is highly sensitive to changes in general economic conditions such as levels of employment, consumer confidence and income, availability of mortgage financing for acquisitions, interest rate levels and inflation, among other factors. Beginning in 2006 and continuing through 2012, the U.S. and Colorado housing markets were unfavorably impacted by a severe weakness in new home sales attributable to, among other factors, weak consumer confidence, tightened mortgage standards, large supplies of foreclosure, resale and new homes and a more challenging appraisal environment. These conditions, combined with a prolonged economic downturn, high unemployment levels, increases in the rate of inflation and uncertainty in the U.S. economy, contributed to a decreased demand for housing, declining sales prices and increased pricing pressure. Additionally, the residential housing market is impacted by federal and state personal income tax rates and provisions, and government actions, policies, programs and regulations directed at or affecting the housing market, including the Tax Cuts and Jobs Act, the Dodd-Frank Wall Street Reform and Consumer Protection Act, tax benefits associated with purchasing and owning a home, and the standards, fees and size limits applicable to the purchase or insuring of mortgage loans by government-sponsored enterprises and government agencies. If the current recovery of the Colorado housing market stalls or reverses, we could experience declines in the market value of our inventory and demand for our lots, which could have a material adverse effect on our business, results of operations, cash flows and financial condition.

Development on the Lowry Range is not within our control and is subject to obstacles. Development on the Lowry Range is controlled by the Land Board, which is governed by a five-person citizen board of commissioners representing education, agriculture, local government and natural resources, plus one at-large commissioner, each appointed for a four-year term by the Colorado governor and approved by the Colorado Senate. The Land Board’s focus with respect to issues such as development and conservation on the Lowry Range tends to change as membership on the Land Board changes. In addition, there are often significant delays in the adoption and implementation of plans with respect to property administered by the Land Board because the process involves many constituencies with diverse interests. In the event water sales are not forthcoming or development of the Lowry Range is delayed or abandoned, we may need to use our capital resources, incur additional short or long-term debt obligations or seek to sell additional equity. We may not have sufficient capital resources or be successful in obtaining additional operating capital.

Because of the prior use of the Lowry Range as a military facility, environmental clean-up may be required prior to development, including the removal of unexploded ordnance. The U.S. Army Corps of Engineers has been conducting unexploded ordnance removal activities at the Lowry Range for more than 30 years. Continued activities are dependent on federal appropriations, and the Army Corps of Engineers has no assurance from year to year of such appropriations for its activities at the Lowry Range.

We do not have experience with the development of real property. While we have experience designing and constructing water and wastewater facilities and maintaining and operating these facilities, we do not have experience developing real property. We may underestimate the capital expenditures required to develop the first phase of Sky Ranch, including the costs of certain infrastructure improvements. We lack experience in managing property development activities, including the permitting and other approvals required, which may result in delays in obtaining the necessary permits and government approvals.

Significant competition from other development projects could adversely affect our results. Land development is a highly competitive business. There are numerous land developers, as well as properties and development projects, in the same geographic area in which Sky Ranch is located. Many of our land development competitors may have advantages over us, such as more favorable locations, which may provide more desirable schools and easier access to roads and shopping, or amenities that we may not offer, as well as greater financial resources. If other development projects are found to be more attractive to homebuyers, home builders or other developers or operators of real estate based on location, price, or other factors, then we may be pressured to reduce our prices or delay further development, either of which could materially adversely affect our business, results of operations, cash flows and financial condition.

Our construction of water and wastewater projects may expose us to certain completion, performance and financial risks. We expect to rely on independent contractors to construct our water and wastewater facilities and Sky Ranch lot improvements. These construction activities may involve risks, including shortages of materials and labor, work stoppages, labor relations disputes, injuries to third parties, damages to property, weather interference, engineering, environmental, permitting or geological problems and unanticipated cost increases. These issues could give rise to delays, cost overruns or performance deficiencies, or otherwise adversely affect the construction or operation of our water and wastewater delivery systems and the construction and delivery of residential lots pursuant to our Builder Contracts. In addition, we may experience quality problems in the construction of our systems and facilities, including equipment failures. We may not meet the required deadlines under our Builder Contracts. We may face claims from customers or others regarding product quality and installation of equipment placed in service by contractors.

The Builder Contracts for Sky Ranch and for the water facilities that we design and construct are fixed-price contracts, in which we bear all or a significant portion of the risk for cost overruns. Under these fixed-price contracts, contract prices are established in part based on fixed, firm subcontractor quotes on contracts and on cost and scheduling estimates. These quotes or estimates may be based on a number of assumptions, including assumptions about prices and availability of labor, equipment and materials, and other issues. If these subcontractor quotations or cost estimates prove inaccurate, or if circumstances change, cost overruns may occur, and our financial results would be negatively impacted. In many cases, the incurrence of these additional costs would not be within our control.

Pursuant to our Builder Contracts for Sky Ranch, we guarantee project completion of water and wastewater delivery systems and lot improvements by a scheduled date. We also guarantee that the project, when completed, will achieve certain performance standards, meet certain quality specifications and satisfy certain requirements for governmental approvals. If we fail to complete the project as scheduled, meet guaranteed performance standards or quality specifications, or obtain the required governmental approvals, we may be held responsible for cost impacts and/or penalties to the customer resulting from any delay or for the costs to alter the project to achieve the performance standards and the quality specifications and to obtain the required government approvals. To the extent that these events occur and are not due to circumstances for which the customer accepts responsibility or cannot be mitigated by performance bonds or the provisions of our agreements with contractors, the total costs of the project would exceed our original estimates and our financial results would be negatively impacted.

We are required to secure, or to have our subcontractors secure, performance and completion bonds for certain contracts and projects. The market environment for surety companies has become increasingly risk averse. We and our subcontractors secure performance and completion bonds for our contracts from these surety companies. To the extent we or our subcontractors are unable to obtain bonds, we may breach existing agreements and/or not be awarded new contracts. We may not be able to secure performance and completion bonds when required.

We may be subject to significant potential liabilities as a result of warranty and liability claims made against us. Design, construction or system failures related to our water and wastewater delivery systems could result in injury to third parties or damage to property. In addition, as a property developer, we are subject in the ordinary course of our business to warranty claims. We are also subject to claims for injuries that occur in the course of our property development activities. We plan to record warranty and other reserves for the residential lots we sell based on historical trends in our market and our judgment of the qualitative risks associated with the type of lots we sell. We have, and many of our subcontractors have, general liability, property, workers’ compensation and other business insurance. These insurance policies are intended to protect us against a portion of our risk of loss from claims, subject to certain self-insured retentions, deductibles and coverage limits. However, it is possible that this insurance will not be adequate to address all warranty and liability claims to which we are subject. Additionally, the coverage offered and the availability of general liability insurance for construction defects are currently limited and policies that can be obtained are costly and often include exclusions based upon past losses insurers suffered as a result of use of defective materials used by other property developers. As a result, our subcontractors may be unable to obtain insurance, and we may have to waive our customary insurance requirements, which increases our and our insurers’ exposure to claims and increases the possibility that our insurance will not be adequate to protect us for all the costs we incur. Any losses that exceed claims against our contractors, the performance bonds and our insurance limits at such facilities could result in claims against us. In addition, if there is a customer dispute regarding performance of our services, the customer may decide to delay or withhold payment to us.

We may not be able to manage the increasing demands of our expanded operations. We have historically depended on a limited number of employees to administer our existing operations, interface with applicable governmental bodies, market our services and plan for the construction and development of our assets. The execution of the Builder Contracts for Sky Ranch has increased the size and complexity of our business. The success of our current business and future business development and our ability to capitalize on growth opportunities depends on our ability to attract and retain additional experienced and qualified persons to operate and manage our business. We may not be able to maximize the value of our assets if we are unable to attract and retain qualified personnel and to manage the demands of a workforce that has tripled in the past two years. State regulations set the training, experience and qualification standards required for our employees to operate specific water and wastewater facilities. Failure to find state-certified and qualified employees to support the operation of our facilities could put us at risk for, among other things, regulatory penalties (including fines and suspension of operations), operational errors at the facilities, improper billing and collection processes, claims for personal injury and property damage, and loss of contracts and revenues. We may be unsuccessful in managing our operations and growth.

We are dependent on the services of a key employee. Our success largely depends on the continuing services of our President and Chief Financial Officer, Mark W. Harding. We believe that Mr. Harding possesses valuable knowledge, experience and leadership abilities that would be difficult in the short term to replicate. Mr. Harding also serves on the boards of the Rangeview District, the Sky Ranch Districts, and the CAB. The loss of Mr. Harding as a key employee and as a director of these boards would cause a significant interruption of our operations.

Supply shortages and risks related to the demand for skilled labor and building materials could increase costs and delay closings. The property development industry is highly competitive for skilled labor and materials. Labor shortages in the Colorado Front Range have become more acute in recent years as the supply chain adjusts to uneven industry growth. Increased costs or shortages of skilled labor and/or concrete, steel, pipe and other materials could cause increases in property development costs and delays. We are unable to pass on increases in property development costs to home builders with whom we have already entered into purchase and sale contracts for residential lots, as our contracts fix the price of the lots at the time the contracts are signed, which will be well in advance of property development. Sustained increases in development costs may, over time, erode our margins.