|

| OMB APPROVAL | ||

|

| OMB Number: | 3235-0570 | |

|

| Expires: | September 30, 2007 | |

| UNITED STATES | Estimated average burden hours per response. . . . . . . . . . . . . . . .19.4 | ||

| SECURITIES AND EXCHANGE COMMISSION |

| ||

| Washington, D.C. 20549 |

| ||

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-1879 | ||||||

| |||||||

Janus Investment Fund | |||||||

(Exact name of registrant as specified in charter) | |||||||

| |||||||

151 Detroit Street, Denver, Colorado | 80206 | ||||||

(Address of principal executive offices) | (Zip code) | ||||||

| |||||||

Kelley Abbott Howes, 151 Detroit Street, Denver, Colorado 80206 | |||||||

(Name and address of agent for service) | |||||||

| |||||||

Registrant’s telephone number, including area code: | 303-333-3863 |

| |||||

| |||||||

Date of fiscal year end: | 10/31 |

| |||||

| |||||||

Date of reporting period: | 4/30/05 |

| |||||

Item 1 - Reports to Shareholders

2005 Semiannual Report

Janus Growth Funds

Growth

Janus Fund

Janus Enterprise Fund

Janus Mercury Fund

Janus Olympus Fund

Janus Orion Fund

Janus Triton Fund

Janus Twenty Fund

Janus Venture Fund

Specialty Growth

Janus Global Life Sciences Fund

Janus Global Technology Fund

Table of Contents

Janus Growth Funds

| President and CIO Letter to Shareholders | 1 | ||||||

| Portfolio Managers' Commentaries and Schedules of Investments | |||||||

| Janus Fund | 5 | ||||||

| Janus Enterprise Fund | 11 | ||||||

| Janus Mercury Fund | 17 | ||||||

| Janus Olympus Fund | 22 | ||||||

| Janus Orion Fund | 27 | ||||||

| Janus Triton Fund | 32 | ||||||

| Janus Twenty Fund | 36 | ||||||

| Janus Venture Fund | 40 | ||||||

| Janus Global Life Sciences Fund | 46 | ||||||

| Janus Global Technology Fund | 51 | ||||||

| Statements of Assets and Liabilities | 58 | ||||||

| Statements of Operations | 60 | ||||||

| Statements of Changes in Net Assets | 62 | ||||||

| Financial Highlights | 66 | ||||||

| Notes to Schedules of Investments | 71 | ||||||

| Notes to Financial Statements | 74 | ||||||

| Additional Information | 81 | ||||||

| Explanations of Charts, Tables and Financial Statements | 83 | ||||||

Please consider the charges, risks, expenses and investment objectives carefully before investing. For a prospectus containing this and other information, please call Janus at 1-800-525-3713 or download the file from www.janus.com. Read it carefully before you invest or send money.

Dear Shareholder,

Having served as Janus' Chief Investment Officer for full a year now, it seems an appropriate time to assess the progress we've made for our shareholders over the past 12 months.

Report Card

In my first letter to Janus shareholders last April, I spoke about our collective efforts to expand our coverage of stocks, improve our risk-management discipline and foster additional collaboration between portfolio managers and analysts.

I am pleased to report that we have made significant progress on all three fronts, and would like to share details with you.

First, we hired eight new equity analysts this past year, which brings the total equity analyst team to 36. On the fixed-income side, we hired three new credit analysts. The expanded research staff has enabled Janus to increase its coverage of domestic and international stocks, with the goal of keeping the portfolios fresh with current ideas.

Second, we improved our risk-management oversight by creating the position of Director of Risk Management and Performance, a role recently filled by Daniel Scherman, who brings with him more than 20 years of experience in the investment management industry. While Janus' heritage is built on a willingness to invest with conviction when we believe we have a research edge, adding this additional layer of risk oversight should ensure that exposures, whether intended or not, are properly analyzed.

The third initiative on which we have made progress is enhancing the quality of debate and dialogue within the investment team, which is a critical, yet intangible component of any successful investment management organization. There are multiple venues available for portfolio managers and analysts to come together and discuss or review key stocks in the news or new buy recommendations. The senior analysts that lead the global sector teams play an important part in driving this dialogue with the portfolio managers, resulting in a more robust exchange of ideas.

Also noteworthy is the contribution our team of 12 research associates has made to our overall research effort. Created two years ago, the team continues to make solid contributions by uncovering real-time demand trends in the marketplace in key consumer categories, ranging from travel and lodging to online music and wireless communications.

While we're pleased with our accomplishments to date, these and other initiatives would be irrelevant if there was no concurrent improvement in relative fund performance. In that regard, I am pleased to report a significant improvement in the relative performance of a number of our funds, as described below.

Performance

As of April, 30, 2005, 73% of Janus growth and core funds ranked in Lipper's top two quartiles for the one- and three-year periods, based on total returns. Longer-term relative performance is also impressive, with 100% of our growth and core funds ranking in Lipper's top two quartiles for the life-of-fund periods.

In my opinion, the improvement in relative performance for many of our funds tells me that our research effort continues to set us apart from our peers and that the portfolios are well positioned to outperform in all types of markets. The investment team is working together to ensure that, in its view, the most compelling risk/reward stocks are properly positioned in the portfolios.

New Fund Offerings

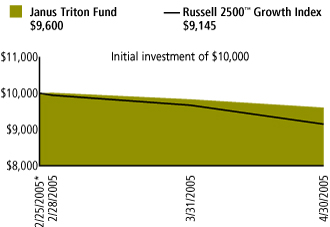

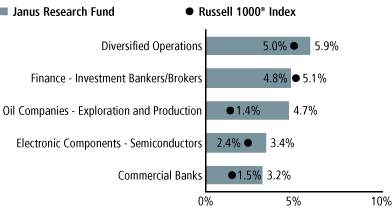

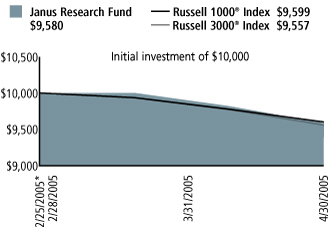

We are very excited to bring our investors two new mutual funds, which were launched this past winter: Janus Triton Fund and Janus Research Fund. Janus Triton Fund, managed by Ron Sachs, outpaced its benchmark index since inception (the two-month period ended April 30, 2005). We attribute these results to the success that Ron and team have had uncovering promising investment ideas in the small- and mid-cap growth space.

Gary Black

President and Chief

Investment Officer

Past performance is no guarantee of future results.

Janus Growth Funds April 30, 2005 1

Continued

Janus Research Fund is a unique collection of the top picks of each analyst at Janus, thereby resulting in a diversified, multicap portfolio of both growth and value stocks. It, too, is backed by a solid research effort, and by focusing on what we believe are the best prospects for the long haul, we hope to deliver Index-beating returns with relatively low risks.

Market Review and Outlook

After hitting 31/2 year highs in early March, equity markets encountered stiff headwinds in late-March and April. Record-high oil prices, sluggish retail sales, falling consumer confidence, and slowing earnings growth all conspired to stymie the markets.

General Motors' announcement in mid-March that it has scaled back its earnings expectations for the remainder of 2005 was a clear sign that higher oil prices and rising interest rates were finally having a negative impact on consumer spending. Subsequent updates by Wal-Mart, Harley-Davidson and IBM provided further confirmation of a slightly softer macroeconomic environment as the second quarter unfolded.

It appears that two opposing opinions have crystallized regarding the near-term outlook for the economy. One camp is forecasting a deceleration in the economy due to the lagging effect of higher energy prices and rising interest rates. This group is projecting that gross domestic product (GDP) growth will slow to 2% in the second half of the year.

The other camp argues that the U.S. economy is better equipped to handle higher energy prices and interest rates when compared to the 1980s, and what we may be witnessing in the current volatile market is the handoff in spending from consumers to businesses.

Taking a step back from the day-to-day noise of the markets, the most likely scenario to unfold will be that the economy continues to grow at an acceptable rate given this stage of the business cycle. While it is reasonable to expect some moderation in economic growth as the business cycle matures, we do not think that GDP growth will decelerate markedly in the second half of the year.

In support of that view, it is important to note that unemployment is declining, business spending is improving, merger and acquisition activity is picking up, jobs are still being created, and corporate earnings generally have been reasonable.

Risks to economic growth are well known – rising energy prices, eroding consumer confidence, job cuts, reduced business spending, and higher interest rates. We believe these concerns will likely remain in the forefront of the market for the near term.

While all investors get impatient with sideways markets, we at Janus believe that the market will always reward superior business models with improving fundamental outlooks. Our job is to identify those companies that are winning in the marketplace and own them in your funds.

Thank you for your confidence and trust.

Sincerely,

Gary Black

President and Chief Investment Officer

There is no assurance that the investment process will consistently lead to successful investing. There is no guarantee these trends will continue.

As of April 30, 2005, General Motors Acceptance Corp. was 0.9% of the Janus Short-Term Bond Fund, 0.4% of the Janus High-Yield Fund, 0.2% of the Janus Balanced Fund and 0.1% of the Janus Flexible Bond Fund.

As of April 30, 2005, Wal-Mart Stores, Inc. was 1.5% of the Janus Research Fund, 0.5% of the Janus Balanced Fund, 0.5% of the Janus Mercury Fund, 0.5% of the Janus Olympus Fund and 0.4% of the Janus Risk-Managed Stock Fund.

As of April 30, 2005, Harley-Davidson, Inc. was 0.5% of the Janus Olympus Fund, 0.3% of the Janus Flexible Bond Fund, 0.2% of the Janus Risk-Managed Stock Fund and 0.2% of the Janus Fund.

As of April 30, 2005, International Business Machines Corp. was 1.6% of the Janus Global Technology Fund, 1.0% of the Janus Core Equity Fund, 0.6% of the Janus Balanced Fund, 0.3% of the Janus Flexible Bond Fund and 0.1% of the Janus Risk-Managed Stock Fund. There is no assurance that any Janus fund currently holds these securities.

2 Janus Growth Funds April 30, 2005

Lipper Rankings

| Lipper Rankings - Based on total return as of 4/30/05 | |||||||||||||||||||||||||||||||||||||||||||||||

| ONE YEAR | THREE YEAR | FIVE YEAR | TEN YEAR | SINCE INCEPTION | |||||||||||||||||||||||||||||||||||||||||||

| LIPPER CATEGORY | PERCENTILE RANK (%) | RANK/ TOTAL FUNDS | PERCENTILE RANK (%) | RANK/ TOTAL FUNDS | PERCENTILE RANK (%) | RANK/ TOTAL FUNDS | PERCENTILE RANK (%) | RANK/ TOTAL FUNDS | PERCENTILE RANK (%) | RANK/ TOTAL FUNDS | |||||||||||||||||||||||||||||||||||||

| Janus Investment Funds | |||||||||||||||||||||||||||||||||||||||||||||||

| (Inception Date) | |||||||||||||||||||||||||||||||||||||||||||||||

| Janus Fund (2/70) | Large-Cap Growth Funds | 53 | 348/659 | 52 | 280/544 | 67 | 278/420 | 41 | 56/137 | 5 | 1/19 | ||||||||||||||||||||||||||||||||||||

| Janus Enterprise Fund(1) (9/92) | Mid-Cap Growth Funds | 22 | 115/537 | 10 | 39/426 | 92 | 264/289 | 58 | 65/112 | 38 | 19/50 | ||||||||||||||||||||||||||||||||||||

| Janus Mercury Fund(1) (5/93) | Large-Cap Growth Funds | 19 | 119/659 | 10 | 53/544 | 82 | 344/420 | 7 | 9/137 | 2 | 1/85 | ||||||||||||||||||||||||||||||||||||

| Janus Olympus Fund(1) (12/95) | Multi-Cap Growth Funds | 37 | 155/421 | 71 | 250/354 | 80 | 192/242 | – | – | 15 | 13/90 | ||||||||||||||||||||||||||||||||||||

| Janus Orion Fund (6/00) | Multi-Cap Growth Funds | 10 | 38/421 | 10 | 33/354 | – | – | – | – | 37 | 93/252 | ||||||||||||||||||||||||||||||||||||

| Janus Twenty Fund* (4/85) | Large-Cap Growth Funds | 3 | 19/659 | 1 | 2/544 | 73 | 305/420 | 1 | 1/137 | 6 | 2/38 | ||||||||||||||||||||||||||||||||||||

| Janus Venture Fund* (4/85) | Small-Cap Growth Funds | 25 | 125/510 | 15 | 62/418 | 62 | 190/310 | 37 | 31/83 | 10 | 1/9 | ||||||||||||||||||||||||||||||||||||

| Janus Balanced Fund(1) (9/92) | Balanced Funds | 38 | 228/601 | 58 | 257/447 | 58 | 208/362 | 7 | 10/162 | 4 | 3/76 | ||||||||||||||||||||||||||||||||||||

| Janus Core Equity Fund(1) (6/96) | Large-Cap Core Funds | 5 | 38/917 | 28 | 214/783 | 26 | 153/600 | – | – | 2 | 5/291 | ||||||||||||||||||||||||||||||||||||

| Janus Growth and Income Fund(1) (5/91) | Large-Cap Core Funds | 6 | 52/917 | 28 | 217/783 | 62 | 371/600 | 3 | 5/230 | 5 | 5/110 | ||||||||||||||||||||||||||||||||||||

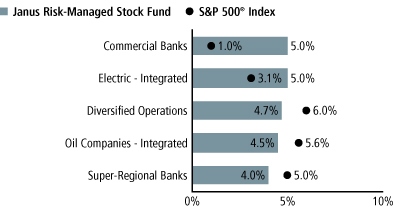

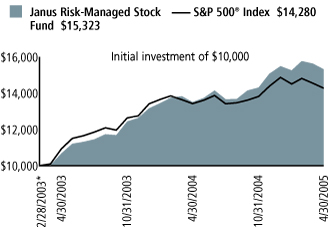

| Janus Risk-Managed Stock Fund (2/03) | Multi-Cap Core Funds | 3 | 22/739 | – | – | – | – | – | – | 16 | 96/616 | ||||||||||||||||||||||||||||||||||||

| Janus Contrarian Fund(4) (2/00) | Multi-Cap Core Funds | 7 | 46/739 | 5 | 23/527 | 26 | 95/367 | – | – | 22 | 76/351 | ||||||||||||||||||||||||||||||||||||

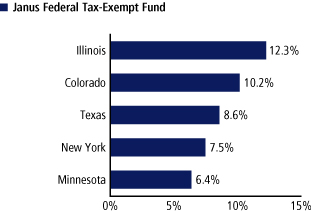

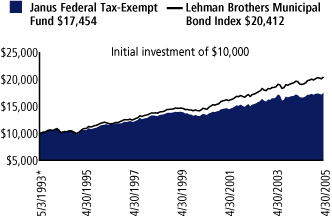

| Janus Federal Tax-Exempt Fund (5/93) | General Municipal Debt | 78 | 219/280 | 73 | 188/257 | 85 | 191/224 | 71 | 102/143 | 83 | 69/83 | ||||||||||||||||||||||||||||||||||||

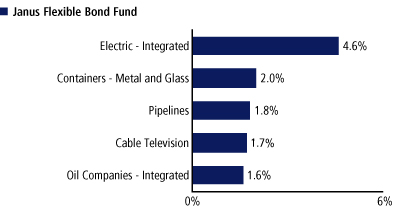

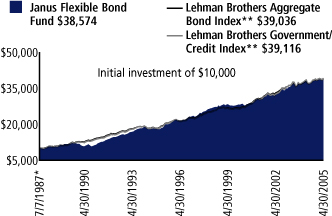

| Janus Flexible Bond Fund(1)(2) (7/87) | Intermediate Inv Grade Debt Funds | 68 | 308/453 | 14 | 51/383 | 58 | 153/265 | 8 | 10/135 | 12 | 3/24 | ||||||||||||||||||||||||||||||||||||

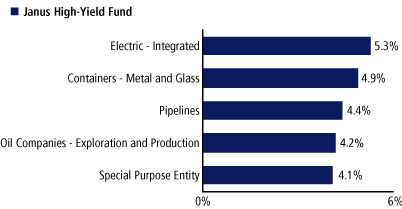

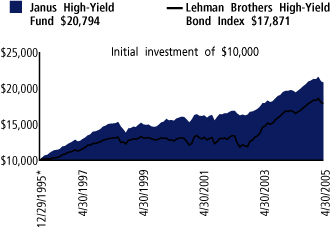

| Janus High-Yield Fund (12/95) | High Current Yield Funds | 36 | 150/418 | 80 | 280/350 | 38 | 108/285 | – | – | 3 | 3/104 | ||||||||||||||||||||||||||||||||||||

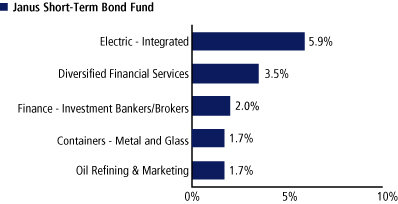

| Janus Short-Term Bond Fund(1) (9/92) | Short Investment Grade Debt | 62 | 129/208 | 46 | 64/139 | 44 | 46/105 | 25 | 14/56 | 44 | 11/24 | ||||||||||||||||||||||||||||||||||||

| Janus Global Life Sciences Fund (12/98) | Health/Biotechnology Funds | 53 | 96/181 | 53 | 83/157 | 83 | 64/77 | – | – | 32 | 16/49 | ||||||||||||||||||||||||||||||||||||

| Janus Global Opportunities Fund(1) (6/01) | Global Funds | 83 | 266/321 | 52 | 134/260 | – | – | – | – | 10 | 22/234 | ||||||||||||||||||||||||||||||||||||

| Janus Global Technology Fund (12/98) | Science and Technology Funds | 59 | 172/292 | 58 | 158/275 | 54 | 81/149 | – | – | 22 | 18/83 | ||||||||||||||||||||||||||||||||||||

| Janus Overseas Fund(1) (5/94) | International Funds | 80 | 674/851 | 58 | 405/706 | 83 | 423/513 | 5 | 8/171 | 6 | 7/123 | ||||||||||||||||||||||||||||||||||||

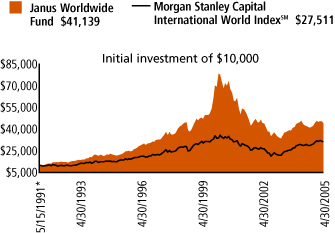

| Janus Worldwide Fund(1) (5/91) | Global Funds | 96 | 306/321 | 99 | 256/260 | 94 | 183/194 | 36 | 22/61 | 32 | 6/18 | ||||||||||||||||||||||||||||||||||||

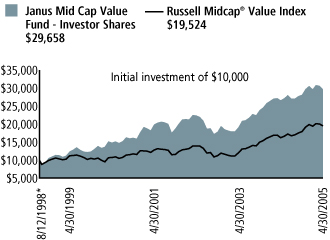

| Janus Mid Cap Value Fund - Inv(1)(3) (8/98) | Mid-Cap Value Funds | 51 | 120/235 | 31 | 57/184 | 14 | 14/100 | – | – | 5 | 4/79 | ||||||||||||||||||||||||||||||||||||

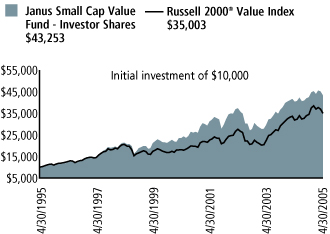

| Janus Small Cap Value Fund - Inv*(3) (10/87) | Small-Cap Core Funds | 50 | 293/591 | 68 | 320/474 | 17 | 53/324 | N/A | N/A | N/A | N/A | ||||||||||||||||||||||||||||||||||||

(1)The date of the Lipper ranking is slightly different from when the fund began operations since Lipper provides fund rankings as of the last day of the month or the first Thursday after fund inception.

(2)Effective February 28, 2005, Janus Flexible Income Fund changed its name to Janus Flexible Bond Fund and added to its investment policy to state that at least 80% of its net assets (plus borrowings for investment purposes) will be invested in bonds.

(3)Rating is for the investor share class only; other classes may have different performance characteristics.

(4)Janus Contrarian Fund buys stock in overlooked or underappreciated companies of any size, in any sector. Overlooked and underappreciated stocks present special risks.

*Closed to new investors.

Data presented represents past performance, which is no guarantee of future results.

Janus Contrarian Fund, Janus Overseas Fund, Janus Global Technology Fund and Janus Orion Fund may have significant exposure to emerging markets which may lead to greater price volatility.

A fund's performance may be affected by risks that include those associated with non-diversification, investments in foreign securities, non-investment grade debt securities, undervalued companies or companies with a relatively small market capitalization. Please see a Janus prospectus for more detailed information.

There is no assurance that the investment process will consistently lead to successful investing.

Growth and value investing each have their own unique risks and potential for rewards, and may not be suitable for all investors. A growth investing strategy typically carries a higher risk of loss and a higher potential for reward than a value investing strategy. A growth investing strategy emphasizes capital appreciation; a value investing strategy emphasizes investments in companies believed to be undervalued.

Lipper Inc. - A Reuters Company, is a nationally recognized organization that ranks the performance of mutual funds within a universe of funds that have similar investment objectives. Rankings are historical with capital gains and dividends reinvested.

Janus Growth Funds April 30, 2005 3

Useful Information About Your Fund Report

Portfolio Manager Commentaries

The portfolio manager commentaries in this report include valuable insight from the portfolio managers as well as statistical information to help you understand how your fund's performance and characteristics stack up against those of comparable indices.

Please keep in mind that the opinions expressed by the portfolio managers in their commentaries are just that: opinions. The commentary is a reflection of the portfolio manager's best judgment at the time this report was compiled, which was April 30, 2005. As the investing environment changes, so could the portfolio managers' opinions. These views are unique to each manager and aren't necessarily shared by their fellow employees or by Janus in general.

Fund Expenses

We believe it's important for our shareholders to have a clear understanding of fund expenses and the impact they have on investment return.

The following is important information regarding each Fund's Expense Example, which appears in each Fund's Portfolio Manager Commentary within this Semiannual Report. Please refer to this information when reviewing the Expense Example for each Fund.

Example

As a shareholder of a fund, you incur two types of costs: (1) transaction costs such as redemption fees (where applicable) (and any related exchange fees) and (2) ongoing costs, including management fees and other Fund expenses. The example is intended to help you understand your ongoing costs (in dollars) of investing in a fund and to compare these costs with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the six-month period from November 1, 2004 to April 30, 2005 for all Funds except Janus Triton Fund which is based on the period February 25, 2005 to April 30, 2005.

Actual Expenses

The first line of the table in each example provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During the Period" to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The second line of the table in each example provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses. This is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Janus Capital Management LLC ("Janus Capital") has contractually agreed to waive Janus Triton Fund's total operating expenses, excluding brokerage commissions, interest, taxes and extraordinary expenses to certain limits until at least March 1, 2006. Expenses in the example reflect the application of this waiver. Had the waiver not been in effect, your expenses would have been higher. More information regarding the waiver is available in the Funds' Prospectuses.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees (where applicable). These fees are fully described in the prospectus. Therefore, the second line of each table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

4 Janus Growth Funds April 30, 2005

Janus Fund (unaudited)

Fund Snapshot

For more than 30 years, this traditional growth fund has exemplified Janus' research and stock-picking abilities.

Blaine Rollins

portfolio manager

Performance Overview

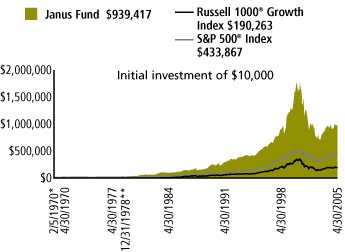

During the six-month period ended April 30, 2005, Janus Fund gained 1.54%, outpacing the Russell 1000® Growth Index's return of 1.14%. The Fund's secondary benchmark, the S&P 500® Index, returned 3.28% for the same time period. Investor sentiment shifted dramatically during the period, with confidence surging in the latter months of 2004 following the presidential election and then waning as concerns over interest rates, inflation, and rising commodity prices took hold in 2005. The environment was also challenging for us in that growth stocks continued to lag value stocks for the period.

We owe our outperformance of the Russell 1000® Growth Index to a range of factors, including strong stock selection across market sectors. Performance within the food and staples retailing, technology hardware and equipment, and retailing sectors was particularly strong. Conversely, the Fund's larger position than the Index in the weaker-performing semiconductor group held back our results during the period.

Strategy in This Environment

Over the past six months, we continued to perform in-depth, bottom-up research in pursuit of those leading growth companies we believe are taking market share from their peers and investing/deploying their profits wisely. We also took measures to reduce the Fund's risk profile by further diversifying assets across holdings – a strategy that worked to our advantage in a volatile period. Additionally, we continued to invest in new ideas that represent our expanded analyst team's best ideas. The result has been improved performance – a trend that we will be working to uphold as the year continues.

Portfolio Composition

As of April 30, 2005, the Fund was 94.4% invested in equities, with foreign stocks accounting for 17.2% of our net assets. The Fund's top 10 equity holdings represented 35.7% of its total net assets and we held a cash position of 5.5%.

Strong Performance from Select Holdings in Media, Healthcare, and Aerospace and Defense

Our strongest contribution during the semiannual period came from media leader Comcast, the nation's largest cable operator. We view Comcast as a defensive growth utility that is taking share away from competing single-service media companies. Throughout the semiannual period, Comcast benefited from its past investment in a high-speed, two-way plant, and consumers are finding additional value in Comcast's video, data and telephony services. Its digital video business continues to bring in new customers at a strong rate due to the growth of high-definition TV, digital video recorders and video-on-demand products. In March alone, Comcast's video-on-demand product, On Demand, registered 100 million viewings (or about 12 per digital cable household). Meanwhile, cable modem subscribers keep growing even as DSL pricing is falling, proving that cable is a speed- and service-differentiated product. We are also excited that while Comcast continues to invest in its own internal growth, the company is returning cash to shareholders via stock repurchases as well.

Other high-performing holdings could be found in healthcare. Our team identified a number of companies that provided 30-percent-plus upside during the period, including Alcon, Caremark, Patterson Dental, UnitedHealthcare, and Celgene. Although some clouds over the pharmaceutical industry remained, we were pleased with the Fund's outperformance in healthcare. Another noteworthy contributor was drugstore chain Walgreen Co., which is classified as a retail stock but in many ways is a

Top 10 Equity Holdings – (% of Net Assets)

| April 30, 2005 | October 31, 2004 | ||||||||||

| Comcast Corp. - Special Class A | 6.0 | % | 7.2 | % | |||||||

| Time Warner, Inc. | 5.9 | % | 7.0 | % | |||||||

| Cisco Systems, Inc. | 4.6 | % | 4.8 | % | |||||||

| Maxim Integrated Products, Inc. | 3.5 | % | 6.7 | % | |||||||

| Walgreen Co. | 3.3 | % | 2.8 | % | |||||||

| Procter & Gamble Co. | 2.7 | % | 1.3 | % | |||||||

| Linear Technology Corp. | 2.7 | % | 4.7 | % | |||||||

| Tyco International, Ltd. (New York Shares) | 2.6 | % | 2.4 | % | |||||||

| Lockheed Martin Corp. | 2.3 | % | 1.6 | % | |||||||

| McDonald's Corp. | 2.1 | % | 2.3 | % | |||||||

Janus Growth Funds April 30, 2005 5

Janus Fund (unaudited)

healthcare play. During the period, Walgreen benefited from an increase in prescriptions – a potential effect of the aging baby boomer demographic.

The Fund's outperformance can also be traced to our exposure to Boeing and other aerospace and defense names. In the case of Boeing, some investors were distracted by negative press regarding a competitor's new double-decker plane and issues surrounding senior management turnover at Boeing; however, we stayed focused on the fundamentals – namely orders for Boeing's 737 and 777 models, new business wins for producing the 787, and improving margins for all three of the company's main divisions. Our confidence was rewarded with strong performance from Boeing for the semiannual period.

Technology Names Detract

Our relative performance was hampered by some of the Fund's technology holdings. For example, semiconductor names Maxim Integrated Products and Linear Technology Company lagged other technology companies, despite their lower valuations and long-term potential for growth. Although I've trimmed our positions in both, Maxim and Linear have been defensible franchises that generate solid cash flow, which they're using to repurchase stock and increase their dividend payouts.

Other detractors were online auction house eBay and system networking giant Cisco Systems. In a sense, eBay was a victim of its own success in 2004. eBay's earnings and accomplishments were so stellar last year that it's been difficult to match investors' expectations in 2005. However, we believe eBay's business model is still sound. Turning to Cisco, performance was off potentially due to sluggish enterprise spending over the past six months. On the positive side, Cisco continues to aggressively repurchase its own stock, thereby shrinking the number of outstanding shares. This tactic typically helps companies succeed over time; with this in mind, we are willing to exercise patience with regard to Cisco.

Investment Strategy and Outlook

Looking ahead, we are optimistic about opportunities in the large-cap growth arena. Valuations for many high-quality names are at attractive levels, and at some point we believe we'll see an increase in companies' spending on new and better technology. In addition, we're confident that investors will be looking to redistribute assets into the fundamentally strong companies that we favor.

Thank you for your investment with Janus.

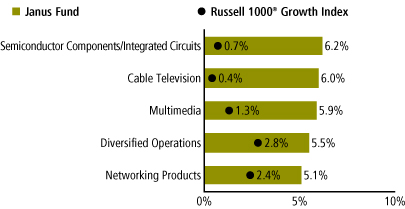

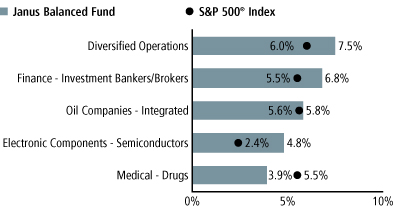

Significant Areas of Investment – Fund vs. Index (% of Net Assets)

6 Janus Growth Funds April 30, 2005

(unaudited)

Performance

Average Annual Total Return – for the periods ended April 30, 2005

| Fiscal Year-to-Date | One Year | Five Year | Ten Year | Since Inception* | |||||||||||||||||||

| Janus Fund | 1.54 | % | 0.92 | % | (10.87 | )% | 7.72 | % | 13.76 | % | |||||||||||||

| Russell 1000® Growth Index | 1.14 | % | 0.40 | % | (10.75 | )% | 7.71 | % | 11.84 | %** | |||||||||||||

| S&P 500® Index | 3.28 | % | 6.34 | % | (2.94 | )% | 10.26 | % | 11.30 | % | |||||||||||||

| Lipper Ranking - based on total returns for Large-Cap Growth Funds | N/A | 348/659 | 278/420 | 56/137 | 1/19 | ||||||||||||||||||

Data presented represents past performance, which is no guarantee of future results. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, current performance may be higher or lower than the performance shown. Call 1-800-525-3713 or visit www.janus.com for performance current to the most recent month-end.

See Notes to Schedules of Investments for index definitions.

Total return includes reinvestment of dividends, distributions and capital gains. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

* The Fund's inception date – February 5, 1970

** The Russell 1000® Growth Index's since inception returns calculated from December 31, 1978

Fund Expenses

The example below shows you the ongoing costs (in dollars) of investing in your fund and allows you to compare these costs with those of other mutual funds. Please refer to page 4 for a detailed explanation of the information presented in these charts.

| Expense Example | Beginning Account Value (11/1/04) | Ending Account Value (4/30/05) | Expenses Paid During Period (11/1/04-4/30/05)* | ||||||||||||

| Actual | $ | 1,000.00 | $ | 1,015.40 | $ | 4.45 | |||||||||

| Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,020.38 | $ | 4.46 | |||||||||

*Expenses are equal to the annualized expense ratio of 0.89%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

See "Explanations of Charts, Tables and Financial Statements."

The Fund's portfolio may differ significantly from the securities held in the index. The index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

There is no assurance that the investment process will consistently lead to successful investing.

Lipper Inc. - A Reuters Company, is a nationally recognized organization that ranks the performance of mutual funds within a universe of funds that have similar investment objectives. Rankings are historical with capital gains and dividends reinvested.

Effective February 25, 2005, Janus Fund changed its primary benchmark from S&P 500® Index to the Russell 1000® Growth Index. The new primary benchmark will provide a more appropriate comparison to the Fund's investment style. The Russell 1000® Growth Index measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. The Fund will retain the S&P 500® Index as a secondary index.

Janus Growth Funds April 30, 2005 7

Janus Fund

Schedule of Investments (unaudited)

As of April 30, 2005

| Shares or Principal Amount | Value | ||||||||||

| Common Stock - 94.4% | |||||||||||

| Advertising Sales - 0.3% | |||||||||||

| 949,545 | Lamar Advertising Co.* | $ | 35,493,992 | ||||||||

| Aerospace and Defense - 5.1% | |||||||||||

| 4,948,596 | BAE Systems PLC** | 24,162,126 | |||||||||

| 3,842,450 | Boeing Co.# | 228,702,624 | |||||||||

| 655,765 | General Dynamics Corp. | 68,888,113 | |||||||||

| 4,391,870 | Lockheed Martin Corp. | 267,684,476 | |||||||||

| 589,437,339 | |||||||||||

| Apparel Manufacturers - 0.7% | |||||||||||

| 5,848,713 | Burberry Group PLC** | 40,328,090 | |||||||||

| 1,375,130 | Coach, Inc.* | 36,853,484 | |||||||||

| 77,181,574 | |||||||||||

| Applications Software - 0.2% | |||||||||||

| 758,140 | NAVTEQ Corp.* | 27,611,459 | |||||||||

| Athletic Footwear - 0.2% | |||||||||||

| 362,455 | NIKE, Inc. - Class B | 27,840,169 | |||||||||

| Audio and Video Products - 0.5% | |||||||||||

| 1,721,315 | Sony Corp. (ADR)** | 63,189,474 | |||||||||

| Automotive - Cars and Light Trucks - 0.2% | |||||||||||

| 641,696 | BMW A.G.** | 27,197,261 | |||||||||

| Automotive - Truck Parts and Equipment - Original - 0.2% | |||||||||||

| 425,460 | Autoliv, Inc. | 18,826,605 | |||||||||

| Beverages - Non-Alcoholic - 0.7% | |||||||||||

| 1,512,250 | PepsiCo, Inc. | 84,141,590 | |||||||||

| Beverages - Wine and Spirits - 0.5% | |||||||||||

| 937,325 | Diageo PLC (ADR)**, # | 56,005,169 | |||||||||

| Building - Residential and Commercial - 1.2% | |||||||||||

| 1,759,738 | D.R. Horton, Inc. | 53,672,008 | |||||||||

| 55,685 | NVR, Inc.*, # | 40,001,320 | |||||||||

| 596,790 | Pulte Homes, Inc.# | 42,640,646 | |||||||||

| 136,313,974 | |||||||||||

| Building and Construction Products - Miscellaneous - 0.9% | |||||||||||

| 3,465,880 | Masco Corp. | 109,140,561 | |||||||||

| Cable Television - 6.0% | |||||||||||

| 21,917,161 | Comcast Corp. - Special Class A* | 695,431,519 | |||||||||

| Chemicals - Diversified - 0.3% | |||||||||||

| 1,365,715 | Lyondell Chemical Co.# | 34,265,789 | |||||||||

| Chemicals - Specialty - 0.2% | |||||||||||

| 1,049,465 | Syngenta A.G. (ADR)*, **, # | 21,755,409 | |||||||||

| Commercial Banks - 0.6% | |||||||||||

| 805,785 | UBS A.G. (ADR)**, # | 64,704,536 | |||||||||

| Commercial Services - Finance - 1.0% | |||||||||||

| 3,838,227 | Paychex, Inc.# | 117,449,746 | |||||||||

| Computer Services - 0% | |||||||||||

| 156,555 | Ceridian Corp.* | 2,641,083 | |||||||||

| Computers - 1.0% | |||||||||||

| 552,660 | Dell, Inc.* | 19,249,148 | |||||||||

| 1,572,855 | Research In Motion, Ltd. (New York Shares)* | 101,307,590 | |||||||||

| 120,556,738 | |||||||||||

| Computers - Memory Devices - 0.4% | |||||||||||

| 3,594,545 | EMC Corp.* | 47,160,430 | |||||||||

| Containers - Metal and Glass - 0.4% | |||||||||||

| 1,047,855 | Ball Corp. | 41,390,273 | |||||||||

| Shares or Principal Amount | Value | ||||||||||

| Cosmetics and Toiletries - 2.7% | |||||||||||

| 5,780,465 | Procter & Gamble Co. | $ | 313,012,180 | ||||||||

| Cruise Lines - 1.0% | |||||||||||

| 2,275,835 | Carnival Corp. (New York Shares) | 111,242,815 | |||||||||

| Dental Supplies and Equipment - 0.6% | |||||||||||

| 1,394,032 | Patterson Companies, Inc.*, # | 70,468,318 | |||||||||

| Distribution/Wholesale - 0.3% | |||||||||||

| 4,201,000 | Esprit Holdings, Ltd. | 31,448,455 | |||||||||

| Diversified Minerals - 1.4% | |||||||||||

| 6,070,255 | Companhia Vale do Rio Doce (ADR)# | 163,593,372 | |||||||||

| Diversified Operations - 5.5% | |||||||||||

| 3,124,720 | General Electric Co. | 113,114,864 | |||||||||

| 3,896,065 | Honeywell International, Inc. | 139,323,284 | |||||||||

| 887,875 | Pentair, Inc.# | 35,319,668 | |||||||||

| 2,629,429 | Smiths Group PLC** | 43,111,090 | |||||||||

| 9,793,825 | Tyco International, Ltd. (New York Shares) | 306,644,661 | |||||||||

| 637,513,567 | |||||||||||

| Diversified Operations - Commercial Services - 0.2% | |||||||||||

| 1,004,260 | ARAMARK Corp. - Class B# | 24,614,413 | |||||||||

| E-Commerce/Services - 1.1% | |||||||||||

| 2,405,889 | eBay, Inc.* | 76,338,858 | |||||||||

| 2,400,050 | IAC/InterActiveCorp*, # | 52,177,087 | |||||||||

| 128,515,945 | |||||||||||

| Electric - Generation - 0.3% | |||||||||||

| 1,869,750 | AES Corp.* | 30,065,580 | |||||||||

| Electronic Components - Miscellaneous - 0.7% | |||||||||||

| 3,290,505 | Koninklijke (Royal) Philips Electronics N.V. (New York Shares)**, # | 81,571,619 | |||||||||

| Electronic Components - Semiconductors - 1.2% | |||||||||||

| 1,963,010 | Intel Corp. | 46,169,995 | |||||||||

| 3,814,425 | Texas Instruments, Inc. | 95,208,048 | |||||||||

| 141,378,043 | |||||||||||

| Electronic Forms - 0.4% | |||||||||||

| 870,590 | Adobe Systems, Inc. | 51,773,987 | |||||||||

| Finance - Credit Card - 0.4% | |||||||||||

| 937,270 | American Express Co. | 49,394,129 | |||||||||

| Finance - Investment Bankers/Brokers - 1.4% | |||||||||||

| 1,441,555 | Citigroup, Inc. | 67,695,423 | |||||||||

| 1,040,685 | JPMorgan Chase & Co. | 36,933,911 | |||||||||

| 982,585 | Merrill Lynch & Company, Inc. | 52,990,809 | |||||||||

| 157,620,143 | |||||||||||

| Financial Guarantee Insurance - 0.3% | |||||||||||

| 634,285 | MBIA, Inc.# | 33,223,848 | |||||||||

| Food - Confectionary - 0.3% | |||||||||||

| 554,550 | Wm. Wrigley Jr. Co. | 38,336,042 | |||||||||

| Food - Retail - 0.8% | |||||||||||

| 950,510 | Whole Foods Market, Inc.# | 94,784,857 | |||||||||

| Food - Wholesale/Distribution - 0.5% | |||||||||||

| 1,560,535 | Sysco Corp.# | 53,994,511 | |||||||||

| Medical - Biomedical and Genetic - 0.8% | |||||||||||

| 978,465 | Celgene Corp.* | 37,093,608 | |||||||||

| 637,260 | Genentech, Inc.* | 45,207,225 | |||||||||

| 213,115 | Genzyme Corp.*, # | 12,490,670 | |||||||||

| 94,791,503 | |||||||||||

See Notes to Schedules of Investments and Financial Statements.

8 Janus Growth Funds April 30, 2005

Schedule of Investments (unaudited)

As of April 30, 2005

| Shares or Principal Amount | Value | ||||||||||

| Medical - Drugs - 2.2% | |||||||||||

| 3,053,965 | Eli Lilly and Co. | $ | 178,565,334 | ||||||||

| 1,106,605 | Sanofi-Aventis (ADR)** | 49,100,064 | |||||||||

| 658,415 | Wyeth | 29,589,170 | |||||||||

| 257,254,568 | |||||||||||

| Medical - Generic Drugs - 0.5% | |||||||||||

| 1,924,355 | Teva Pharmaceutical Industries, Ltd. (ADR)# | 60,116,850 | |||||||||

| Medical - HMO - 1.2% | |||||||||||

| 1,509,440 | UnitedHealth Group, Inc. | 142,657,174 | |||||||||

| Medical - Hospitals - 0.5% | |||||||||||

| 951,010 | HCA, Inc. | 53,104,398 | |||||||||

| Medical Instruments - 0.8% | |||||||||||

| 931,580 | Medtronic, Inc. | 49,094,266 | |||||||||

| 1,004,805 | St. Jude Medical, Inc.* | 39,217,539 | |||||||||

| 88,311,805 | |||||||||||

| Medical Products - 3.0% | |||||||||||

| 2,540,125 | Johnson & Johnson | 174,328,779 | |||||||||

| 2,075,043 | Stryker Corp.# | 100,743,338 | |||||||||

| 276,216 | Synthes, Inc. | 31,322,104 | |||||||||

| 1,093,365 | Varian Medical Systems, Inc.*, # | �� | 36,890,135 | ||||||||

| 343,284,356 | |||||||||||

| Metal - Diversified - 0.3% | |||||||||||

| 1,103,825 | Inco, Ltd. (New York Shares) | 39,450,706 | |||||||||

| Metal Processors and Fabricators - 0.6% | |||||||||||

| 927,940 | Precision Castparts Corp.# | 68,352,060 | |||||||||

| Motorcycle and Motor Scooter Manufacturing - 0.2% | |||||||||||

| 596,870 | Harley-Davidson, Inc.# | 28,064,827 | |||||||||

| Multi-Line Insurance - 1.0% | |||||||||||

| 2,192,735 | American International Group, Inc. | 111,500,575 | |||||||||

| Multimedia - 5.9% | |||||||||||

| 40,875,994 | Time Warner, Inc.* | 687,125,459 | |||||||||

| Networking Products - 5.1% | |||||||||||

| 30,731,550 | Cisco Systems, Inc.* | 531,041,184 | |||||||||

| 2,787,905 | Juniper Networks, Inc.*, # | 62,978,774 | |||||||||

| 594,019,958 | |||||||||||

| Oil - Field Services - 1.6% | |||||||||||

| 1,229,280 | Halliburton Co. | 51,125,755 | |||||||||

| 1,950,915 | Schlumberger, Ltd. (New York Shares)**, # | 133,462,095 | |||||||||

| 184,587,850 | |||||||||||

| Oil and Gas Drilling - 0.6% | |||||||||||

| 1,451,870 | Transocean, Inc.*, # | 67,323,212 | |||||||||

| Oil Companies - Exploration and Production - 1.1% | |||||||||||

| 1,338,115 | Apache Corp. | 75,322,493 | |||||||||

| 1,060,830 | EOG Resources, Inc. | 50,442,467 | |||||||||

| 125,764,960 | |||||||||||

| Oil Companies - Integrated - 0.9% | |||||||||||

| 1,211,015 | Exxon Mobil Corp. | 69,064,186 | |||||||||

| 934,905 | Suncor Energy, Inc. (New York Shares) | 34,460,598 | |||||||||

| 103,524,784 | |||||||||||

| Optical Supplies - 1.8% | |||||||||||

| 2,182,125 | Alcon, Inc. (New York Shares)** | 211,666,125 | |||||||||

| Pharmacy Services - 1.3% | |||||||||||

| 3,703,525 | Caremark Rx, Inc.* | 148,326,176 | |||||||||

| Shares or Principal Amount | Value | ||||||||||

| Property and Casualty Insurance - 0.6% | |||||||||||

| 2,129,785 | W. R. Berkley Corp. | $ | 69,218,013 | ||||||||

| Retail - Apparel and Shoe - 1.6% | |||||||||||

| 1,664,230 | Abercrombie & Fitch Co. - Class A | 89,785,209 | |||||||||

| 1,929,170 | Foot Locker, Inc.# | 51,431,672 | |||||||||

| 2,314,235 | Gap, Inc. | 49,408,917 | |||||||||

| 190,625,798 | |||||||||||

| Retail - Building Products - 0.8% | |||||||||||

| 1,738,200 | Lowe's Companies, Inc.# | 90,577,602 | |||||||||

| Retail - Consumer Electronics - 0.6% | |||||||||||

| 1,325,510 | Best Buy Company, Inc. | 66,726,173 | |||||||||

| Retail - Discount - 0.2% | |||||||||||

| 676,714 | Costco Wholesale Corp.# | 27,461,054 | |||||||||

| Retail - Drug Store - 3.3% | |||||||||||

| 9,051,145 | Walgreen Co.# | 389,742,304 | |||||||||

| Retail - Major Department Stores - 0.8% | |||||||||||

| 1,873,740 | J.C. Penney Company, Inc. | 88,834,013 | |||||||||

| Retail - Office Supplies - 0.6% | |||||||||||

| 3,593,332 | Staples, Inc. | 68,524,841 | |||||||||

| Retail - Restaurants - 2.1% | |||||||||||

| 8,167,335 | McDonald's Corp. | 239,384,589 | |||||||||

| Schools - 0.3% | |||||||||||

| 564,710 | Apollo Group, Inc. - Class A* | 40,726,885 | |||||||||

| Semiconductor Components/Integrated Circuits - 6.2% | |||||||||||

| 8,695,895 | Linear Technology Corp. | 310,791,287 | |||||||||

| 11,000,520 | Maxim Integrated Products, Inc.£ | 411,419,449 | |||||||||

| 722,210,736 | |||||||||||

| Soap and Cleaning Preparations - 0.6% | |||||||||||

| 2,137,086 | Reckitt Benckiser PLC** | 69,383,965 | |||||||||

| Telecommunication Equipment - Fiber Optics - 1.3% | |||||||||||

| 11,072,470 | Corning, Inc.* | 152,246,463 | |||||||||

| Television - 2.2% | |||||||||||

| 4,460,443 | British Sky Broadcasting Group PLC** | 46,162,629 | |||||||||

| 8,119,782 | Univision Communications, Inc. - Class A* | 213,469,069 | |||||||||

| 259,631,698 | |||||||||||

| Therapeutics - 0.6% | |||||||||||

| 1,861,690 | Gilead Sciences, Inc.* | 69,068,699 | |||||||||

| Transportation - Railroad - 0.1% | |||||||||||

| 296,645 | Canadian National Railway Co. (New York Shares) | 16,971,060 | |||||||||

| Transportation - Services - 1.1% | |||||||||||

| 1,851,925 | United Parcel Service, Inc. - Class B | 132,060,772 | |||||||||

| Web Portals/Internet Service Providers - 1.1% | |||||||||||

| 3,611,265 | Yahoo!, Inc.* | 124,624,755 | |||||||||

| Wireless Equipment - 1.2% | |||||||||||

| 8,676,540 | Nokia Oyj (ADR)** | 138,651,109 | |||||||||

| Total Common Stock (cost $8,685,800,255) | 10,976,184,389 | ||||||||||

| Corporate Bonds - 0.1% | |||||||||||

| Advertising Sales - 0.1% | |||||||||||

| $13,850,000 | Lamar Advertising Co., 2.875% senior notes, due 12/31/10 (cost $13,832,507) | 12,516,937 | |||||||||

See Notes to Schedules of Investments and Financial Statements.

Janus Growth Funds April 30, 2005 9

Janus Fund

Schedule of Investments (unaudited)

As of April 30, 2005

| Shares or Principal Amount | Value | ||||||||||

| Other Securities - 2.3% | |||||||||||

| 265,987,247 | State Street Navigator Securities Lending Prime Portfolio† (cost $265,987,247) | $ | 265,987,247 | ||||||||

| Time Deposits - 5.1% | |||||||||||

| $ | 97,700,000 | Societe Generale, ETD 2.94%, 5/2/05 | 97,700,000 | ||||||||

| 500,000,000 | Rabobank Nederland N.V., ETD 2.94%, 5/2/05 | 500,000,000 | |||||||||

| Total Time Deposits (cost $597,700,000) | 597,700,000 | ||||||||||

| Total Investments (total cost $9,563,320,009) – 101.9% | 11,852,388,573 | ||||||||||

| Liabilities, net of Cash, Receivables and Other Assets – (1.9)% | (216,602,373 | ) | |||||||||

| Net Assets – 100% | $ | 11,635,786,200 | |||||||||

Summary of Investments by Country

| Country | Value | % of Investment Securities | |||||||||

| Bermuda | $ | 338,093,116 | 2.9 | % | |||||||

| Brazil | 163,593,372 | 1.4 | % | ||||||||

| Canada | 192,189,954 | 1.6 | % | ||||||||

| Cayman Islands | 67,323,212 | 0.6 | % | ||||||||

| Finland | 138,651,109 | 1.2 | % | ||||||||

| France | 49,100,064 | 0.4 | % | ||||||||

| Germany | 27,197,261 | 0.2 | % | ||||||||

| Israel | 60,116,850 | 0.5 | % | ||||||||

| Japan | 63,189,474 | 0.5 | % | ||||||||

| Netherlands | 215,033,714 | 1.8 | % | ||||||||

| Panama | 111,242,815 | 0.9 | % | ||||||||

| Switzerland | 298,126,070 | 2.5 | % | ||||||||

| United Kingdom | 279,153,069 | 2.4 | % | ||||||||

| United States†† | 9,849,378,493 | 83.1 | % | ||||||||

| Total | $ | 11,852,388,573 | 100.0 | % | |||||||

††Includes Short-Term Securities and Other Securities (75.8% excluding Short-Term Securities and Other Securities)

Forward Currency Contracts, Open

| Currency Sold and Settlement Date | Currency Units Sold | Currency Value in $ U.S. | Unrealized Gain/(Loss) | ||||||||||||

| British Pound 5/20/05 | 53,100,000 | $ | 101,158,213 | $ | (1,716,861 | ) | |||||||||

| British Pound 7/15/05 | 4,900,000 | 9,312,078 | (90,769 | ) | |||||||||||

| British Pound 8/19/05 | 26,900,000 | 51,055,061 | (536,861 | ) | |||||||||||

| Euro 7/15/05 | 74,300,000 | 95,825,659 | 269,295 | ||||||||||||

| Euro 9/9/05 | 8,500,000 | 10,986,254 | 230,347 | ||||||||||||

| Japanese Yen 7/15/05 | 2,160,000,000 | 20,746,469 | (489,506 | ) | |||||||||||

| Japanese Yen 9/9/05 | 1,505,000,000 | 14,537,586 | 90,211 | ||||||||||||

| Swiss Franc 7/15/05 | 16,400,000 | 13,792,468 | (70,634 | ) | |||||||||||

| Swiss Franc 8/19/05 | 14,300,000 | 12,057,674 | (101,153 | ) | |||||||||||

| Total | $ | 329,471,462 | $ | (2,415,931 | ) | ||||||||||

See Notes to Schedules of Investments and Financial Statements.

10 Janus Growth Funds April 30, 2005

Janus Enterprise Fund (unaudited)

Fund Snapshot

This growth fund pursues companies that have grown large enough to be well established but are small enough to still have room to grow.

Jonathan Coleman

portfolio manager

Performance Overview

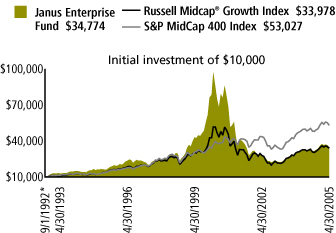

During the six months ended April 30, 2005, as mid-cap stocks modestly outpaced large-cap names, Janus Enterprise Fund advanced 3.53%. Meanwhile, the Fund's benchmark, the Russell Midcap® Growth Index, returned 4.07%. The Fund's secondary benchmark, the S&P MidCap 400 Index, returned 5.68% for the same time period.

Contributing to the Fund's underperformance versus its benchmark were select holdings in the consumer durables and apparel industry, as well as the media sector, which experienced setbacks during the period. Bolstering the Fund's performance, however, was a smaller position than the Index in the technology hardware and equipment industry, which, as a group, turned in weak results during the period. The Fund's relative results were also boosted by the strong performance of a number of stock picks within the energy sector.

Strategy in This Environment

The broader market experienced positive and negative swings as investors focused on stubbornly high oil prices and the health of consumer spending. To cushion the moves, we adhered to a diversified strategy, spreading our investments across a broad spectrum of companies in many industries. Regardless of where a company is located or what its business is, we employ a consistent investment thesis that we hope will be more fully recognized by the market over time through an improving stock price. In short, we are looking for companies we believe have exciting growth opportunities, predictable revenue streams, expanding profit margins, and disciplined management of balance sheets.

Portfolio Composition

As of April 30, 2005, the Fund was 97.9% invested in equities. The Fund's 10 largest equity positions represented 22.9% of its total net assets and we held 2.1% in cash.

Select Energy, Computer and Healthcare Stocks Fueled Gains

Reviewing the leading positive contributors, broad strength in the energy markets helped elevate two oil and natural gas exploration and production holdings – EOG Resources and Murphy Oil. EOG has a substantial ownership stake in the large Barnett Shale field in Texas, while Murphy has built an impressive portfolio of oil production sites ranging from North America to Malaysia. Clearly, both stocks have been helped by the underlying trends in energy prices and will be exposed to any drops, but we've long been attracted to each company's continued development potential regardless of the commodity markets.

Technology concern Apple Computer continued on an iPod-driven roll, accentuated by smaller, lower-priced versions of the digital music device. We also started to see evidence that Apple's personal computer sales are indeed benefiting from a carry-over effect among some iPod consumers who may have newly discovered the company's other products.

Health plan operator Coventry Health Care also rose, reflecting a growing confidence that it can effectively integrate First Health Group, a fee-for-service plan it announced it was acquiring in late 2004. Having had time to analyze what Coventry purchased and assess the potential cost savings, we believe the deal may prove more beneficial than originally hoped.

Top 10 Equity Holdings – (% of Net Assets)

| April 30, 2005 | October 31, 2004 | ||||||||||

| Nextel Partners, Inc. - Class A | 2.8 | % | 1.0 | % | |||||||

| EOG Resources, Inc. | 2.8 | % | 2.1 | % | |||||||

| Lamar Advertising Co. | 2.7 | % | 2.9 | % | |||||||

| Kinder Morgan, Inc. | 2.4 | % | 2.8 | % | |||||||

| Ball Corp. | 2.2 | % | 2.8 | % | |||||||

| Celgene Corp. | 2.1 | % | 1.6 | % | |||||||

| Fisher Scientific International, Inc. | 2.1 | % | 1.9 | % | |||||||

| Berkshire Hathaway, Inc. - Class B | 2.0 | % | 2.4 | % | |||||||

| T. Rowe Price Group, Inc. | 2.0 | % | 2.0 | % | |||||||

| Invitrogen Corp. | 1.8 | % | 1.3 | % | |||||||

Janus Growth Funds April 30, 2005 11

Janus Enterprise Fund (unaudited)

Beleaguered Biotech, Auto Component and Semiconductor Holdings Weighed on Returns

A pair of unexpected events undermined performance from the biotechnology portion of the Fund. Neurocrine Biosciences fell as a technical glitch forced to re-file a Food and Drug Administration application for its promising insomnia drug Indiplon. The oversight pushed a potential release date back by at least six months, which gives a competing treatment that's just being rolled out additional time to enjoy first-mover status. While we are frustrated with the delay, we believe Neurocrine, along with its marketing partner Pfizer, will ultimately carve out a strong market position for Indiplon.

We also experienced disappointing performance from Pharmion Corp, a biotech company with a focus on oncology treatments. Pharmion declined significantly in the period as investors became concerned with the growth of Vidaza, Pharmion's approved product which targets myelodysplastic syndrome. We trimmed the position late in the period as we became less certain of Vidaza's future growth.

Auto component supplier Harman International declined significantly during the period after delivering strong performance in the past. Investors became concerned with increased competition in Harman's lucrative navigation and infotainment segment. We believe navigation and infotainment penetration will continue in automobiles and that Harman is poised to benefit from that increased adoption. We trimmed the position during the period at prices we felt reflected fair value for the stock.

Elsewhere, semiconductor chip maker Advanced Micro Devices ("AMD") also disappointed, as its flash memory division suffered amid the industry's over-capacity issues and deteriorating pricing power. AMD showed its commitment to focusing on its core processor business in April when it announced that it was spinning off its flash memory division. We believe the core processor business could be undervalued as it has recently gained market share against industry behemoth Intel.

Investment Strategy and Outlook

Given the underlying pressures of elevated oil prices and increasing interest rates, the market may be range-bound during the next couple of quarters. Furthermore, considering the outperformance of small- and mid-cap stocks over the past five or so years, a rotation back into large-cap stocks could affect demand for smaller issues. At the same time, value stocks have outperformed growth names, and that cycle could be ready to shift as well. Regardless of the larger trends, we'll continue to invest in a wide array of industries in an effort to reduce the Fund's downside risk while maintaining exposure to an assortment of stocks we believe have the potential for price appreciation.

Thank you for your investment in Janus Enterprise Fund.

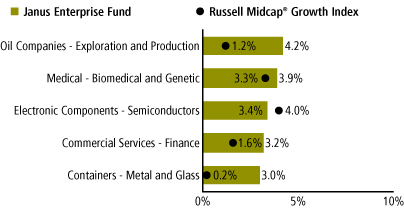

Significant Areas of Investment – Fund vs. Index (% of Net Assets)

12 Janus Growth Funds April 30, 2005

(unaudited)

Performance

Average Annual Total Return – for the periods ended April 30, 2005

| Fiscal Year-to-Date | One Year | Five Year | Ten Year | Since Inception* | |||||||||||||||||||

| Janus Enterprise Fund | 3.53 | % | 7.58 | % | (14.11 | )% | 7.98 | % | 10.34 | % | |||||||||||||

| Russell Midcap® Growth Index | 4.07 | % | 7.05 | % | (6.15 | )% | 9.38 | % | 10.14 | % | |||||||||||||

| S&P MidCap 400 Index | 5.68 | % | 9.74 | % | 6.78 | % | 14.46 | % | 14.08 | % | |||||||||||||

| Lipper Ranking - based on total returns for Mid-Cap Growth Funds | N/A | 115/537 | 264/289 | 65/112 | 19/50 | ||||||||||||||||||

Data presented represents past performance, which is no guarantee of future results. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, current performance may be higher or lower than the performance shown. Call 1-800-525-3713 or visit www.janus.com for performance current to the most recent month-end.

See Notes to Schedules of Investments for index definitions.

Total return includes reinvestment of dividends, distributions and capital gains. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The date of the Lipper ranking is slightly different from when the Fund began operations since Lipper provides fund rankings as of the last day of the month or the first Thursday after fund inception.

* The Fund's inception date – September 1, 1992

Fund Expenses

The example below shows you the ongoing costs (in dollars) of investing in your fund and allows you to compare these costs with those of other mutual funds. Please refer to page 4 for a detailed explanation of the information presented in these charts.

| Expense Example | Beginning Account Value (11/1/04) | Ending Account Value (4/30/05) | Expenses Paid During Period (11/1/04-4/30/05)* | ||||||||||||

| Actual | $ | 1,000.00 | $ | 1,035.30 | $ | 5.05 | |||||||||

| Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,019.84 | $ | 5.01 | |||||||||

*Expenses are equal to the annualized expense ratio of 1.00%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

See "Explanations of Charts, Tables and Financial Statements."

The Fund's portfolio may differ significantly from the securities held in the indices. The indices are not available for direct investment; therefore their performance does not reflect the expenses associated with the active management of an actual portfolio.

There is no assurance that the investment process will consistently lead to successful investing.

Lipper Inc. - A Reuters Company, is a nationally recognized organization that ranks the performance of mutual funds within a universe of funds that have similar investment objectives. Rankings are historical with capital gains and dividends reinvested.

Funds that emphasize investments in small-sized companies may experience greater price volatility.

Janus Growth Funds April 30, 2005 13

Janus Enterprise Fund

Schedule of Investments (unaudited)

As of April 30, 2005

| Shares or Principal Amount | Value | ||||||||||

| Common Stock - 97.9% | |||||||||||

| Advertising Agencies - 0.9% | |||||||||||

| 1,135,025 | Interpublic Group of Companies, Inc.# | $ | 14,596,422 | ||||||||

| Advertising Sales - 2.7% | |||||||||||

| 1,171,235 | Lamar Advertising Co.* | 43,780,763 | |||||||||

| Airlines - 1.0% | |||||||||||

| 411,223 | Ryanair Holdings PLC (ADR)*, # | 16,510,603 | |||||||||

| Apparel Manufacturers - 0.4% | |||||||||||

| 242,510 | Coach, Inc.* | 6,499,268 | |||||||||

| Applications Software - 1.4% | |||||||||||

| 314,705 | Citrix Systems, Inc.* | 7,080,863 | |||||||||

| 425,360 | NAVTEQ Corp.* | 15,491,611 | |||||||||

| 22,572,474 | |||||||||||

| Athletic Footwear - 0.6% | |||||||||||

| 43,451 | Puma A.G. Rudolf Dassler Sport | 10,018,694 | |||||||||

| Audio and Video Products - 1.3% | |||||||||||

| 270,825 | Harman International Industries, Inc. | 21,281,429 | |||||||||

| Automotive - Truck Parts and Equipment - Original - 0.2% | |||||||||||

| 82,885 | Lear Corp. | 2,808,973 | |||||||||

| Building - Mobile Home and Manufactured Homes - 0.7% | |||||||||||

| 407,325 | Thor Industries, Inc.# | 10,977,409 | |||||||||

| Building - Residential and Commercial - 1.6% | |||||||||||

| 35,030 | NVR, Inc.# | 25,163,801 | |||||||||

| Building Products - Air and Heating - 1.3% | |||||||||||

| 460,590 | American Standard Companies, Inc. | 20,592,979 | |||||||||

| Cable Television - 1.2% | |||||||||||

| 667,660 | EchoStar Communications Corp. - Class A* | 19,328,757 | |||||||||

| Casino Services - 0.3% | |||||||||||

| 258,290 | Scientific Games Corp. - Class A*, # | 5,545,486 | |||||||||

| Cellular Telecommunications - 2.8% | |||||||||||

| 1,937,478 | Nextel Partners, Inc. - Class A*, # | 45,569,482 | |||||||||

| Commercial Services - 0.5% | |||||||||||

| 291,987 | Iron Mountain, Inc.*, # | 8,672,014 | |||||||||

| Commercial Services - Finance - 3.2% | |||||||||||

| 522,455 | Jackson Hewitt Tax Service, Inc.# | 9,623,621 | |||||||||

| 204,098 | Moody's Corp. | 16,764,609 | |||||||||

| 828,716 | Paychex, Inc. | 25,358,709 | |||||||||

| 51,746,939 | |||||||||||

| Computer Services - 0.5% | |||||||||||

| 171,990 | Affiliated Computer Services, Inc. - Class A*, # | 8,198,763 | |||||||||

| Computers - 1.1% | |||||||||||

| 505,230 | Apple Computer, Inc. | 18,218,594 | |||||||||

| Computers - Integrated Systems - 1.0% | |||||||||||

| 298,740 | National Instruments Corp.# | 6,434,860 | |||||||||

| 282,925 | NCR Corp.* | 9,336,525 | |||||||||

| 15,771,385 | |||||||||||

| Containers - Metal and Glass - 3.0% | |||||||||||

| 888,855 | Ball Corp. | 35,109,772 | |||||||||

| 504,060 | Owens-Illinois, Inc.* | 12,359,551 | |||||||||

| 47,469,323 | |||||||||||

| Cruise Lines - 1.0% | |||||||||||

| 363,690 | Royal Caribbean Cruises, Ltd. (New York Shares)# | 15,282,254 | |||||||||

| Shares or Principal Amount | Value | ||||||||||

| Disposable Medical Products - 0.5% | |||||||||||

| 111,750 | C.R. Bard, Inc. | $ | 7,953,248 | ||||||||

| Distribution/Wholesale - 0.8% | |||||||||||

| 298,315 | United Stationers, Inc.# | 12,582,927 | |||||||||

| Diversified Operations - 0.8% | |||||||||||

| 339,025 | Pentair, Inc. | 13,486,415 | |||||||||

| Diversified Operations-Commercial Services - 0.9% | |||||||||||

| 736,505 | Cendant Corp. | 14,663,815 | |||||||||

| Electric Products - Miscellaneous - 1.6% | |||||||||||

| 684,250 | AMETEK, Inc. | 25,912,548 | |||||||||

| Electronic Components - Semiconductors - 3.4% | |||||||||||

| 1,428,350 | Advanced Micro Devices, Inc.*, # | 20,325,420 | |||||||||

| 248,630 | Altera Corp.* | 5,154,100 | |||||||||

| 665,380 | ATI Technologies, Inc. (New York Shares)*, # | 9,847,624 | |||||||||

| 455,405 | International Rectifier Corp.*, # | 19,372,928 | |||||||||

| 54,700,072 | |||||||||||

| Electronic Design Automation - 0.6% | |||||||||||

| 740,670 | Cadence Design Systems, Inc.*, # | 10,369,380 | |||||||||

| Entertainment Software - 1.1% | |||||||||||

| 530,926 | Activision, Inc.* | 7,677,190 | |||||||||

| 181,835 | Electronic Arts, Inc.* | 9,708,171 | |||||||||

| 17,385,361 | |||||||||||

| Fiduciary Banks - 1.5% | |||||||||||

| 253,462 | Investors Financial Services Corp.# | 10,632,731 | |||||||||

| 280,590 | Northern Trust Corp. | 12,634,968 | |||||||||

| 23,267,699 | |||||||||||

| Finance - Other Services - 0.9% | |||||||||||

| 74,910 | Chicago Mercantile Exchange Holdings, Inc.# | 14,646,403 | |||||||||

| Food - Dairy Products - 1.7% | |||||||||||

| 780,772 | Dean Foods Co.* | 26,827,326 | |||||||||

| Hospital Beds and Equipment - 0.9% | |||||||||||

| 222,560 | Kinetic Concepts, Inc.* | 13,676,312 | |||||||||

| Hotels and Motels - 2.3% | |||||||||||

| 234,490 | Marriott International, Inc. - Class A | 14,714,248 | |||||||||

| 417,750 | Starwood Hotels & Resorts Worldwide, Inc. | 22,700,534 | |||||||||

| 37,414,782 | |||||||||||

| Human Resources - 1.7% | |||||||||||

| 540,525 | Manpower, Inc. | 20,837,239 | |||||||||

| 271,105 | Robert Half International, Inc. | 6,728,826 | |||||||||

| 27,566,065 | |||||||||||

| Independent Power Producer - 1.0% | |||||||||||

| 1,627,525 | Reliant Energy, Inc.* | 16,551,929 | |||||||||

| Industrial Audio and Video Products - 0.1% | |||||||||||

| 112,885 | Dolby Laboratories, Inc. - Class A* | 2,308,498 | |||||||||

| Industrial Automation and Robotics - 0.5% | |||||||||||

| 164,585 | Rockwell Automation, Inc. | 7,608,765 | |||||||||

| Instruments - Scientific - 2.1% | |||||||||||

| 555,127 | Fisher Scientific International, Inc.* | 32,963,441 | |||||||||

| Insurance Brokers - 0.5% | |||||||||||

| 220,520 | Willis Group Holdings, Ltd. | 7,376,394 | |||||||||

| Internet Infrastructure Software - 0.4% | |||||||||||

| 929,120 | TIBCO Software, Inc.* | 6,633,917 | |||||||||

See Notes to Schedules of Investments and Financial Statements.

14 Janus Growth Funds April 30, 2005

Schedule of Investments (unaudited)

As of April 30, 2005

| Shares or Principal Amount | Value | ||||||||||

| Internet Security - 0.7% | |||||||||||

| 511,180 | Check Point Software Technologies, Ltd. (New York Shares)* | $ | 10,709,221 | ||||||||

| Investment Management and Advisory Services - 2.0% | |||||||||||

| 566,865 | T. Rowe Price Group, Inc.# | 31,273,942 | |||||||||

| Leisure and Recreation Products - 0.7% | |||||||||||

| 268,405 | Brunswick Corp.# | 11,273,010 | |||||||||

| Machinery - Construction and Mining - 0.9% | |||||||||||

| 398,250 | Terex Corp. | 14,886,585 | |||||||||

| Medical - Biomedical and Genetic - 3.9% | |||||||||||

| 900,230 | Celgene Corp.* | 34,127,718 | |||||||||

| 384,380 | Invitrogen Corp.*, # | 28,163,523 | |||||||||

| 62,291,241 | |||||||||||

| Medical - Drugs - 0.9% | |||||||||||

| 119,655 | Merck KGaA | 9,130,535 | |||||||||

| 229,834 | Pharmion Corp.* | 5,309,165 | |||||||||

| 14,439,700 | |||||||||||

| Medical - Generic Drugs - 0.7% | |||||||||||

| 211,770 | Barr Pharmaceuticals, Inc.*, # | 10,982,392 | |||||||||

| Medical - HMO - 1.3% | |||||||||||

| 300,352 | Conventry Health Care, Inc.* | 20,553,087 | |||||||||

| Medical - Nursing Homes - 0.3% | |||||||||||

| 125,315 | Manor Care, Inc. | 4,179,255 | |||||||||

| Medical Instruments - 1.5% | |||||||||||

| 189,155 | Intuitive Surgical, Inc.*, # | 8,122,316 | |||||||||

| 407,665 | St. Jude Medical, Inc.* | 15,911,165 | |||||||||

| 24,033,481 | |||||||||||

| Medical Products - 1.1% | |||||||||||

| 89,000 | Synthes, Inc. | 10,092,345 | |||||||||

| 233,385 | Varian Medical Systems, Inc.*, # | 7,874,410 | |||||||||

| 17,966,755 | |||||||||||

| Miscellaneous Manufacturing - 0.9% | |||||||||||

| 8,504,360 | FKI PLC | 15,148,436 | |||||||||

| Motion Pictures and Services - 1.0% | |||||||||||

| 96,715 | DreamWorks Animation SKG, Inc. - Class A* | 3,626,813 | |||||||||

| 1,208,450 | Lions Gate Entertainment Corp.# (New York Shares)* | 11,673,627 | |||||||||

| 15,300,440 | |||||||||||

| Multi-Line Insurance - 1.1% | |||||||||||

| 556,875 | Assurant, Inc.# | 18,426,994 | |||||||||

| Oil Companies - Exploration and Production - 4.2% | |||||||||||

| 955,220 | EOG Resources, Inc. | 45,420,710 | |||||||||

| 251,660 | Murphy Oil Corp. | 22,420,389 | |||||||||

| 67,841,099 | |||||||||||

| Optical Supplies - 0.7% | |||||||||||

| 115,250 | Alcon, Inc. (New York Shares) | 11,179,250 | |||||||||

| Pipelines - 2.4% | |||||||||||

| 498,086 | Kinder Morgan, Inc. | 38,083,655 | |||||||||

| Property and Casualty Insurance - 0.8% | |||||||||||

| 397,800 | W. R. Berkley Corp. | 12,928,500 | |||||||||

| Publishing - Newspapers - 0.5% | |||||||||||

| 112,880 | McClatchy Co. - Class A# | 7,980,616 | |||||||||

| Publishing - Periodicals - 0.5% | |||||||||||

| 320,115 | Dex Media, Inc.# | 7,010,519 | |||||||||

| Shares or Principal Amount | Value | ||||||||||

| Radio - 0.1% | |||||||||||

| 62,495 | Westwood One, Inc. | $ | 1,143,659 | ||||||||

| Recreational Vehicles - 0.7% | |||||||||||

| 197,885 | Polaris Industries, Inc.# | 11,390,261 | |||||||||

| Reinsurance - 2.0% | |||||||||||

| 11,441 | Berkshire Hathaway, Inc. - Class B* | 32,012,032 | |||||||||

| Respiratory Products - 0.9% | |||||||||||

| 230,815 | Respironics, Inc.* | 14,585,200 | |||||||||

| Retail - Apparel and Shoe - 1.1% | |||||||||||

| 212,420 | Abercrombie & Fitch Co. - Class A# | 11,460,059 | |||||||||

| 132,745 | Urban Outfitters, Inc.*, # | 5,880,604 | |||||||||

| 17,340,663 | |||||||||||

| Retail - Auto Parts - 0.9% | |||||||||||

| 279,216 | Advance Auto Parts, Inc.* | 14,896,174 | |||||||||

| Retail - Office Supplies - 1.3% | |||||||||||

| 1,118,815 | Staples, Inc. | 21,335,802 | |||||||||

| Retail - Restaurants - 1.6% | |||||||||||

| 562,796 | Yum! Brands, Inc. | 26,428,900 | |||||||||

| Schools - 1.8% | |||||||||||

| 263,784 | Apollo Group, Inc. - Class A* | 19,024,102 | |||||||||

| 90,535 | Strayer Education, Inc.# | 9,712,595 | |||||||||

| 28,736,697 | |||||||||||

| Semiconductor Components/Integrated Circuits - 2.1% | |||||||||||

| 352,845 | Linear Technology Corp. | 12,610,680 | |||||||||

| 617,665 | Marvell Technology Group, Ltd.* | 20,679,425 | |||||||||

| 33,290,105 | |||||||||||

| Semiconductor Equipment - 1.3% | |||||||||||

| 258,550 | KLA-Tencor Corp. | 10,088,621 | |||||||||

| 433,920 | Novellus Systems, Inc.* | 10,166,746 | |||||||||

| 20,255,367 | |||||||||||

| Telecommunication Services - 1.0% | |||||||||||

| 611,140 | Amdocs, Ltd. (New York Shares)* | 16,323,549 | |||||||||

| Television - 0.9% | |||||||||||

| 571,573 | Univision Communications, Inc. - Class A*, # | 15,026,654 | |||||||||

| Textile-Home Furnishings - 1.0% | |||||||||||

| 200,485 | Mohawk Industries, Inc.*, # | 15,599,738 | |||||||||

| Therapeutics - 1.9% | |||||||||||

| 366,228 | Gilead Sciences, Inc.* | 13,587,059 | |||||||||

| 486,527 | Neurocrine Biosciences, Inc.* | 17,008,984 | |||||||||

| 30,596,043 | |||||||||||

| Toys - 1.3% | |||||||||||

| 1,044,122 | Marvel Enterprises, Inc.* | 20,464,791 | |||||||||

| Transportation - Marine - 0.5% | |||||||||||

| 186,805 | Alexander & Baldwin, Inc.# | 7,608,568 | |||||||||

| Transportation - Railroad - 0.7% | |||||||||||

| 183,385 | Canadian National Railway Co. (New York Shares) | 10,491,456 | |||||||||

| Transportation - Services - 0.7% | |||||||||||

| 226,860 | Expeditors International of Washington, Inc.# | 11,141,095 | |||||||||

| Total Common Stock (cost $1,155,848,142) | 1,569,656,041 | ||||||||||

See Notes to Schedules of Investments and Financial Statements.

Janus Growth Funds April 30, 2005 15

Janus Enterprise Fund

Schedule of Investments (unaudited)

As of April 30, 2005

| Shares or Principal Amount | Value | ||||||||||

| Other Securities - 7.6% | |||||||||||

| 122,311,744 | State Street Navigator Securities Lending Prime Portfolio† (cost $122,311,744) | $ | 122,311,744 | ||||||||

| Repurchase Agreement - 0.3% | |||||||||||

| $ | 4,600,000 | Bear Stearns & Company, Inc., 3.00% dated 4/29/05, maturing 5/2/05 to be repurchased at $4,601,150 collateralized by $5,308,047 in U.S. Government Agencies 0% - 7.00%, 2/1/11 - 4/20/35 with a value of $4,692,028 (cost $4,600,000) | 4,600,000 | ||||||||

| Time Deposit - 1.8% | |||||||||||

| 29,300,000 | Societe Generale, ETD 2.94%, 5/2/05 (cost $29,300,000) | 29,300,000 | |||||||||

| Total Investments (total cost $(1,312,059,886) – 107.6% | 1,725,867,785 | ||||||||||

| Liabilities, net of Cash, Receivables and Other Assets – (7.6)% | (122,576,769 | ) | |||||||||

| Net Assets – 100% | $ | 1,603,291,016 | |||||||||

Summary of Investments by Country

| Country | Value | % of Investment Securities | |||||||||

| Bermuda | $ | 28,055,819 | 1.6 | % | |||||||

| Canada | 32,012,707 | 1.9 | % | ||||||||

| Germany | 19,149,229 | 1.1 | % | ||||||||

| Ireland | 16,510,603 | 1.0 | % | ||||||||

| Israel | 10,709,221 | 0.6 | % | ||||||||

| Liberia | 15,282,254 | 0.9 | % | ||||||||

| Switzerland | 11,179,250 | 0.6 | % | ||||||||

| United Kingdom | 31,471,985 | 1.8 | % | ||||||||

| United States†† | 1,561,496,717 | 90.5 | % | ||||||||

| Total | $ | 1,725,867,785 | 100.0 | % | |||||||

††Includes Short-Term Securities and Other Securities (81.4% excluding Short-Term Securities and Other Securities)

See Notes to Schedules of Investments and Financial Statements.

16 Janus Growth Funds April 30, 2005

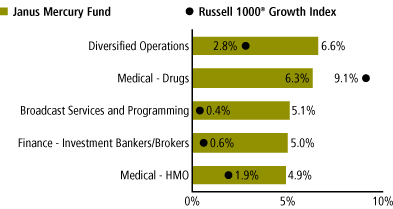

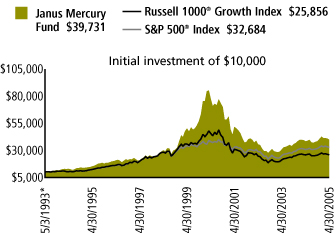

Janus Mercury Fund (unaudited)

Fund Snapshot

This diversified growth fund typically pursues larger companies believed to be well-positioned for future growth.

David Corkins

portfolio manager

Performance Overview

Over the course of the six-month period ended April 30, 2005, investors' optimism, stemming from a quick resolution to the U.S. presidential election, diminished in the wake of steeper energy prices and higher interest rates. Amid the resulting downward pressure on stocks, Janus Mercury Fund posted a 3.48% gain, topping the 1.14% return generated by its benchmark, the Russell 1000® Growth Index. The Fund's secondary benchmark, the S&P 500®, returned 3.28% for the same time period.

The Fund's outperformance versus its benchmark is largely due to our research team's ability to uncover a diverse group of opportunities in a variety of different market sectors.

Strategy in This Environment

During a period characterized by economic uncertainty and market volatility, one of my goals in managing the Fund remained finding good investment opportunities across many different areas of the market. What's more, I remain confident in the current mix of companies held in the Fund, as our rigorous, research-driven investing process suggests the market will ultimately recognize their value.

Portfolio Composition

As of April 30, 2005, equities accounted for 94.6% of the Fund's total net assets, including 20.6% of total net assets in foreign holdings. The Fund's 10 largest equity holdings represented 30.3% of its total net assets and a cash position comprised 5.4% of total net assets.

Strong Performers Found in Media, Biotech and Manufacturing Sectors

Generally, I'll commit about a quarter of the Fund's resources to so-called "fallen-growth" names – former growth companies that are either restructuring or refocusing their businesses. By definition, these stocks require considerable patience, but can generate significant rewards. An example is Liberty Media, which was among the Fund's strongest positive contributors to performance. The media conglomerate, which owns stakes in hot cable properties such as News Corp., QVC and Starz Encore, long proved too difficult to value due to its myriad assets and ownership structures. The stock got a lift late in the period when management announced plans to spin off Ascent Media and 50% of Discovery Communications. Liberty remains committed to creating value for its shareholders by continuing to focus on its core businesses. Because of this we are confident the company will continue to reward us in the future.

While one quarter of the Fund is invested in "fallen-growth" names, the remaining three quarters of the Fund is typically invested in more traditional growth names. One such example is biopharmaceutical firm Celgene, another strong contributor for the period. Its stock moved ahead in January on news that the company's fourth-quarter profits more than doubled due to increased sales of Thalomid, a treatment used to help heal skin lesions caused by leprosy and more recently approved for the treatment of multiple myeloma, a common cancer of the blood. An added bounce occurred after Celgene disclosed that its new drug Revlimid, another multiple myeloma therapy, exceeded expectations in Phase III clinical trials.

Top 10 Equity Holdings – (% of Net Assets)

| April 30, 2005 | October 31, 2004 | ||||||||||

| Liberty Media Corp. - Class A | 4.2 | % | 4.5 | % | |||||||

| Berkshire Hathaway, Inc. - Class B | 3.3 | % | 3.8 | % | |||||||

| Roche Holding A.G. | 3.2 | % | 3.7 | % | |||||||

| Tyco International, Ltd. (New York Shares) | 3.1 | % | 4.0 | % | |||||||

| Yahoo!, Inc. | 3.1 | % | 3.2 | % | |||||||

| UnitedHealth Group, Inc. | 3.1 | % | 3.0 | % | |||||||

| JP Morgan Chase & Co. | 2.9 | % | 2.9 | % | |||||||

| Texas Instruments, Inc. | 2.6 | % | 2.4 | % | |||||||

| Time Warner, Inc. | 2.4 | % | 3.0 | % | |||||||

| Canadian National Railway Co. (New York Shares) | 2.4 | % | 3.2 | % | |||||||

Janus Growth Funds April 30, 2005 17

Janus Mercury Fund (unaudited)

Likewise, Starwood Hotels & Resorts rallied as supply constraints in the hotel sector, in combination with the increased demand from foreigners traveling to the United States and an improving economy, had led to an imbalance and allowed operators to raise prices. We are pleased to see that Starwood's 700-plus hotels, operated under several brand names including St. Regis, Sheraton and Westin, are benefiting from the increasingly higher room rates that these factors have created.

Additionally, diversified manufacturer American Standard performed well. Best known for its bathroom and kitchen fixtures, the company also produces air conditioning equipment and vehicle control systems. A stock we view as a "later-cycle" play, or a name that performs favorably when the economy is well into a recovery, American Standard's significant exposure to the commercial real estate market positions it well to continue to benefit in a healthy economy.

Pullback in Consumer Interests Weighed, as did Drug Sector Disappointment

It's worth noting that we haven't found anything fundamentally wrong with the Fund's laggards. Rather, certain holdings that were recent strong contributors to the Fund's performance experienced pullbacks while the market focused on shorter-term issues.