OMB APPROVAL

OMB Number: 3235-0570

Expires: September 30, 2007

Estimated average burden

hours per response: 19.4

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-1879

Janus Investment Fund

(Exact name of registrant as specified in charter)

151 Detroit Street, Denver, Colorado 80206

(Address of principal executive offices) (Zip code)

Kelley Abbott Howes, 151 Detroit Street, Denver, Colorado 80206

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-333-3863

Date of fiscal year end: 10/31

Date of reporting period: 4/30/06

Item 1 - Reports to Shareholders

2006 Semiannual Report

Janus Growth Funds

Growth

Janus Fund

Janus Enterprise Fund

Janus Mercury Fund

Janus Olympus Fund

Janus Orion Fund

Janus Triton Fund

Janus Twenty Fund

Janus Venture Fund

Specialty Growth

Janus Global Life Sciences Fund

Janus Global Technology Fund

Look Inside. . .

• Portfolio manager perspective

• Investment strategy behind your fund

• Fund performance, characteristics and holdings

Table of Contents

Janus Growth Funds

| President and CEO Letter to Shareholders | 1 | ||||||

| Portfolio Managers' Commentaries and Schedules of Investments | |||||||

| Janus Fund | 6 | ||||||

| Janus Enterprise Fund | 14 | ||||||

| Janus Mercury Fund | 21 | ||||||

| Janus Olympus Fund | 28 | ||||||

| Janus Orion Fund | 35 | ||||||

| Janus Triton Fund | 41 | ||||||

| Janus Twenty Fund | 47 | ||||||

| Janus Venture Fund | 52 | ||||||

| Janus Global Life Sciences Fund | 59 | ||||||

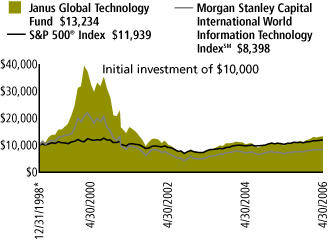

| Janus Global Technology Fund | 65 | ||||||

| Statements of Assets and Liabilities | 72 | ||||||

| Statements of Operations | 74 | ||||||

| Statements of Changes in Net Assets | 76 | ||||||

| Financial Highlights | 80 | ||||||

| Notes to Schedules of Investments and Securities Sold Short | 85 | ||||||

| Notes to Financial Statements | 89 | ||||||

| Additional Information | 97 | ||||||

| Explanations of Charts, Tables and Financial Statements | 101 | ||||||

| Shareholder Meeting | 104 | ||||||

Please consider the charges, risks, expenses and investment objectives carefully before investing. For a prospectus containing this and other information, please call Janus at 1-800-525-3713 or download the file from www.janus.com. Read it carefully before you invest or send money.

CEO's Letter

Gary Black

President and Chief Executive Officer

Dear Shareholders,

Before offering my perspective on the economy, the markets and the progress we've made at Janus during the six months ended April 30, 2006, I'd like to thank you for your continued confidence and investment in Janus' funds. Your unwavering support is the driving force behind our desire to deliver the strong, consistent fund performance that you've come to expect from Janus.

As you'll read on the following pages, our fund managers continued to deliver excellent performance – for the one-year period ended April 30, 2006, 68% of Janus' retail funds ranked within Lipper's top two quartiles based on total returns. For the five years ended April 30, 2006, 57% of our retail funds earned first- or second-quartile Lipper rankings – up from 30% a year ago. Over the past three years, Janus' U.S. equity funds have gained an average of 21% annually, versus a 12% gain for the Russell 1000® Growth Index and a 15% gain for the S&P 500® Index. (See performance and complete ranking figures on pages 3-4).

Staying Focused on Consistent Performance

While we're pleased to report solid performance across different time periods, our goal is to ensure consistency in our investment returns across different market cycles as well. We employ several tools to help us meet this goal, beginning with detailed research processes that help us single out what we feel are the best investments for our funds. The very talented and experienced individuals at the heart of these processes – our research analysts and portfolio managers – are what distinguish Janus from its asset management peers. Additionally, our robust risk management tools and disciplined buy/sell strategies help in our efforts to deliver consistent performance over full market cycles.

...our goal is to ensure consistency in our investment returns across different market cycles...

We recently appointed Chief Investment Officers to oversee our various investment disciplines. Jonathan Coleman and David Decker oversee our U.S. Growth and Core funds, Jason Yee is responsible for our Global and International funds, and Gibson Smith has oversight of our Fixed-Income and Money Market funds. In their respective roles, these individuals serve as player-coaches with the portfolio managers and analysts who work with them and focus on driving performance of the products they oversee.

Combined, we believe these elements of our research process will help us as we strive to deliver strong fund performance in all market environments.

Corporate Profits Remained Strong

On that note, I'd like to summarize the environment we – and other investors – operated in during the past six months. Stronger-than-expected economic data and growing anticipation of a possible conclusion to monetary tightening by the Federal Reserve drove U.S. equity markets higher during the period. Notwithstanding a sharp spike in energy prices in early 2006 and clear signs of a slowdown in the U.S. housing market, corporate profits continued to grow at a healthy clip and consumer spending remained robust. Financial markets observed a smooth transition in leadership at the Federal Reserve Board after Chairman Alan Greenspan's long tenure, and investors appeared to conclude that incoming Chairman Ben Bernanke would pursue a similar course to that of his predecessor, namely, to contain inflation and promote long-term economic growth. Perhaps the biggest risk, in our opinion, is that the Federal Reserve could increase short-term r ates too aggressively to curb potential inflation, which could cause longer-term growth to stall.

Areas of particular strength in the market included economically sensitive sectors such as financial services, industrials and energy, all of which benefited from continued evidence of strong U.S. economic growth. Overseas markets also delivered healthy returns, with Japan's economic recovery reawakening domestic Japanese investors to the Japanese equity market, and rapid industrialization and growing consumer wealth driving significant gains in emerging equity markets like Brazil, China and India.

Greater Diversification Sought by Investors

It was encouraging to see equity markets worldwide climb higher during the period. And yet, if there's one thing that all investors can consistently count on, it's that there is no consistency in the markets. This year's gains could be next year's losses. With this in mind, more and more investors seem to be making a concerted effort to maintain a

Janus Growth Funds April 30, 2006 1

Continued

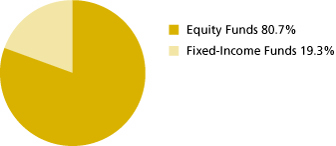

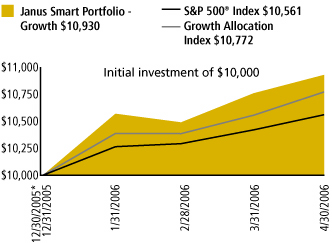

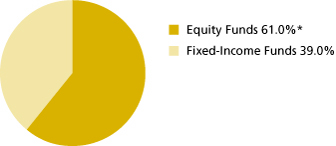

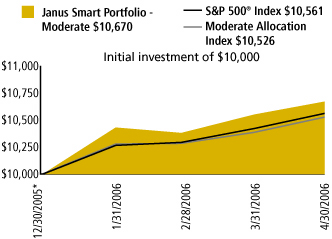

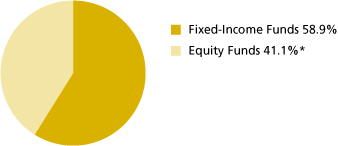

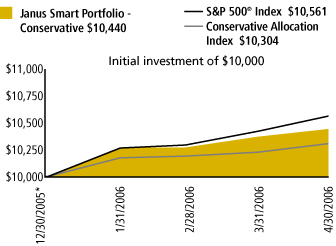

diversified portfolio. In recognition of this, we launched Janus Smart Portfolios in late December 2005. These Portfolios are geared toward investors who may not have the time to allocate their assets according to their specific goals and risk tolerance.

Janus Smart Portfolios invest in a combination of funds that leverage the fundamental research approach of Janus with funds supported by the risk-managed, mathematical investment process of INTECH (a Janus subsidiary). We believe the unique combination of these two different investment styles, assembled with the view of providing long-term diversification and market opportunity, will be of great benefit to shareholders as they invest toward their goals. And with three different portfolios to choose from – Growth, Moderate and Conservative – investors can choose the level of risk they are willing to take in pursuit of their goals.

A Compelling Case for Growth

In summary, the economic outlook appears positive to us, and we find valuations for U.S. equities attractive. The combination of those two factors continues to make a solid case for growth investing. Although future interest rate increases are becoming less likely, we will continue to closely monitor the actions of the Federal Reserve. Regardless of the macroeconomic climate ahead, we remain dedicated to rewarding your trust and confidence in Janus with strong, consistent fund performance.

Sincerely,

Gary Black

Chief Executive Officer and

Chief Investment Officer

2 Janus Growth Funds April 30, 2006

Lipper Rankings

| Lipper Rankings – Based on total return as of 4/30/06 | |||||||||||||||||||||||||||||||||||||||||||||||

| ONE YEAR | THREE YEAR | FIVE YEAR | TEN YEAR | SINCE INCEPTION | |||||||||||||||||||||||||||||||||||||||||||

| LIPPER CATEGORY | PERCENTILE RANK (%) | RANK/ TOTAL FUNDS | PERCENTILE RANK (%) | RANK/ TOTAL FUNDS | PERCENTILE RANK (%) | RANK/ TOTAL FUNDS | PERCENTILE RANK (%) | RANK/ TOTAL FUNDS | PERCENTILE RANK (%) | RANK/ TOTAL FUNDS | |||||||||||||||||||||||||||||||||||||

| Janus Investment Funds | |||||||||||||||||||||||||||||||||||||||||||||||

| (Inception Date) | |||||||||||||||||||||||||||||||||||||||||||||||

| Janus Fund (2/70) | Large-Cap Growth Funds | 43 | 296/698 | 48 | 280/590 | 79 | 374/474 | 44 | 72/165 | 5 | 1/19 | ||||||||||||||||||||||||||||||||||||

| Janus Enterprise Fund(1) (9/92) | Mid-Cap Growth Funds | 58 | 324/563 | 30 | 134/461 | 72 | 257/357 | 69 | 88/128 | 40 | 20/49 | ||||||||||||||||||||||||||||||||||||

| Janus Mercury Fund(1) (5/93) | Large-Cap Growth Funds | 31 | 210/698 | 9 | 53/590 | 65 | 306/474 | 11 | 18/165 | 2 | 1/84 | ||||||||||||||||||||||||||||||||||||

| Janus Olympus Fund(1) (12/95) | Multi-Cap Growth Funds | 44 | 186/423 | 53 | 190/359 | 66 | 188/288 | 27 | 25/95 | 15 | 13/88 | ||||||||||||||||||||||||||||||||||||

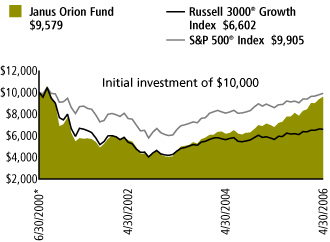

| Janus Orion Fund (6/00) | Multi-Cap Growth Funds | 3 | 11/423 | 1 | 3/359 | 3 | 8/288 | N/A | N/A | 27 | 61/230 | ||||||||||||||||||||||||||||||||||||

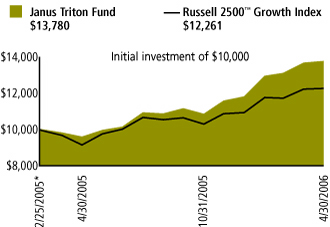

| Janus Triton Fund (2/05) | Small-Cap Growth Funds | 12 | 59/533 | N/A | N/A | N/A | N/A | N/A | N/A | 3 | 14/520 | ||||||||||||||||||||||||||||||||||||

| Janus Twenty Fund* (4/85) | Large-Cap Growth Funds | 6 | 36/698 | 2 | 6/590 | 12 | 56/474 | 2 | 2/165 | 3 | 1/40 | ||||||||||||||||||||||||||||||||||||

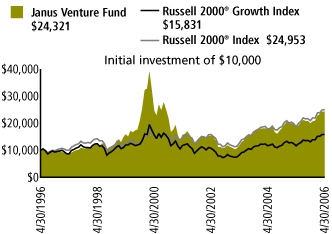

| Janus Venture Fund* (4/85) | Small-Cap Growth Funds | 59 | 311/533 | 10 | 45/453 | 20 | 70/363 | 38 | 44/117 | 10 | 1/10 | ||||||||||||||||||||||||||||||||||||

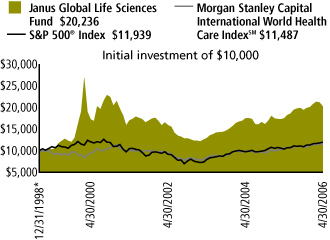

| Janus Global Life Sciences Fund (12/98) | Health/Biotechnology Funds | 33 | 57/176 | 25 | 39/161 | 43 | 55/127 | N/A | N/A | 31 | 15/48 | ||||||||||||||||||||||||||||||||||||

| Janus Global Technology Fund (12/98) | Science & Technology Funds | 33 | 94/292 | 43 | 113/265 | 58 | 132/230 | N/A | N/A | 23 | 17/76 | ||||||||||||||||||||||||||||||||||||

| Janus Balanced Fund(1) (9/92) | Mixed-Asset Target Allocation Moderate Funds | 13 | 49/395 | 52 | 140/271 | 39 | 81/210 | 3 | 2/81 | 4 | 1/27 | ||||||||||||||||||||||||||||||||||||

| Janus Contrarian Fund (2/00) | Multi-Cap Core Funds | 1 | 3/834 | 1 | 3/588 | 3 | 11/421 | N/A | N/A | 9 | 29/332 | ||||||||||||||||||||||||||||||||||||

| Janus Core Equity Fund(1) (6/96) | Large-Cap Core Funds | 2 | 9/864 | 3 | 20/746 | 3 | 16/618 | N/A | N/A | 2 | 3/248 | ||||||||||||||||||||||||||||||||||||

| Janus Growth and Income Fund(1) (5/91) | Large-Cap Core Funds | 5 | 35/864 | 9 | 65/746 | 15 | 90/618 | 3 | 5/240 | 6 | 5/96 | ||||||||||||||||||||||||||||||||||||

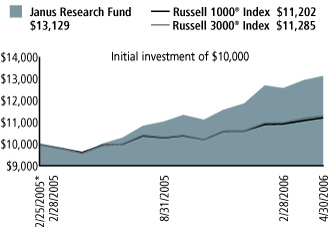

| Janus Research Fund (2/05) | Multi-Cap Growth Funds | 8 | 31/423 | N/A | N/A | N/A | N/A | N/A | N/A | 7 | 26/410 | ||||||||||||||||||||||||||||||||||||

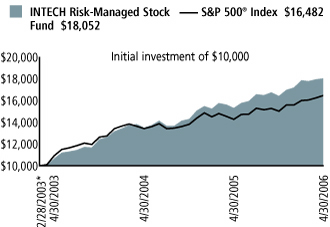

| INTECH Risk-Managed Stock Fund (2/03) | Multi-Cap Core Funds | 58 | 483/834 | 22 | 129/588 | N/A | N/A | N/A | N/A | 26 | 150/586 | ||||||||||||||||||||||||||||||||||||

| Janus Mid Cap Value Fund - Inv(1)(2) (8/98) | Mid-Cap Value Funds | 75 | 201/267 | 53 | 114/216 | 35 | 51/146 | N/A | N/A | 5 | 4/81 | ||||||||||||||||||||||||||||||||||||

| Janus Small Cap Value Fund - Inv*(2) (10/87) | Small-Cap Core Funds | 97 | 612/633 | 91 | 456/504 | 65 | 243/373 | N/A | N/A | N/A | N/A | ||||||||||||||||||||||||||||||||||||

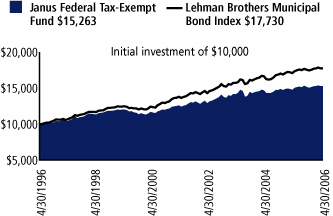

| Janus Federal Tax-Exempt Fund (5/93) | General Municipal Debt Funds | 60 | 155/260 | 89 | 221/249 | 71 | 156/221 | 86 | 122/142 | 83 | 64/77 | ||||||||||||||||||||||||||||||||||||

| Janus Flexible Bond Fund(1) (7/87) | Intermediate Investment Grade Debt Funds | 37 | 172/473 | 36 | 146/406 | 24 | 74/320 | 24 | 35/147 | 24 | 6/25 | ||||||||||||||||||||||||||||||||||||

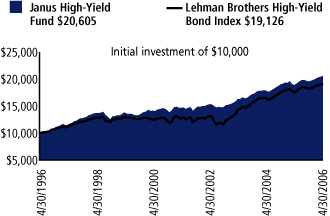

| Janus High-Yield Fund (12/95) | High Current Yield Funds | 38 | 164/439 | 72 | 276/385 | 55 | 169/311 | 9 | 10/111 | 3 | 3/104 | ||||||||||||||||||||||||||||||||||||

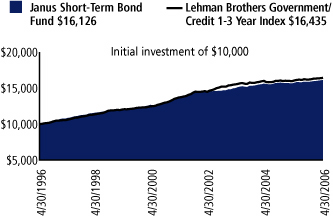

| Janus Short-Term Bond Fund(1) (9/92) | Short Investment Grade Debt Funds | 30 | 68/228 | 21 | 38/181 | 49 | 63/129 | 20 | 13/66 | 43 | 11/25 | ||||||||||||||||||||||||||||||||||||

| Janus Global Opportunities Fund(1) (6/01) | Global Funds | 100 | 360/362 | 54 | 154/286 | N/A | N/A | N/A | N/A | 23 | 50/224 | ||||||||||||||||||||||||||||||||||||

| Janus Overseas Fund(1) (5/94) | International Funds | 1 | 2/910 | 1 | 2/770 | 19 | 114/599 | 4 | 8/230 | 2 | 2/120 | ||||||||||||||||||||||||||||||||||||

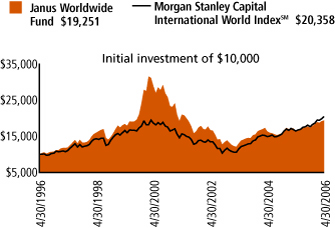

| Janus Worldwide Fund(1) (5/91) | Global Funds | 94 | 339/362 | 98 | 279/286 | 99 | 217/220 | 68 | 56/82 | 28 | 5/17 | ||||||||||||||||||||||||||||||||||||

(1)The date of the Lipper ranking is slightly different from when the Fund began operations since Lipper provides fund rankings as of the last day of the month or the first Thursday after fund inception.

(2)Rating is for the Investor share class only; other classes may have different performance characteristics.

*Closed to new investors.

Data presented represents past performance, which is no guarantee of future results.

There is no assurance that the investment process will consistently lead to successful investing.

Lipper Inc. - A Reuters Company, is a nationally recognized organization that ranks the performance of mutual funds within a universe of funds that have similar investment objectives. Rankings are historical with capital gains and dividends reinvested.

Janus Growth Funds April 30, 2006 3

Performance

| Average Annual Total Return for the periods ended 4/30/06 | |||||||||||||||||||||||

| ONE YEAR | THREE YEAR | FIVE YEAR | 10 YEAR | SINCE INCEPTION | |||||||||||||||||||

| Fund/Index | |||||||||||||||||||||||

| (Inception Date) | |||||||||||||||||||||||

| Janus Fund (2/70) | 17.28 | % | 11.85 | % | (2.62 | )% | 6.67 | % | 13.86 | % | |||||||||||||

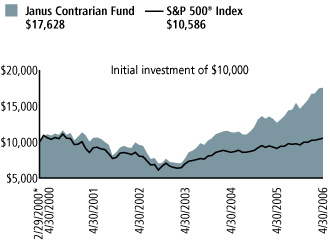

| Janus Contrarian Fund(1)(2)(3) (2/00) | 38.81 | % | 31.63 | % | 10.68 | % | N/A | 9.63 | % | ||||||||||||||

| Janus Core Equity Fund(3) (6/96) | 31.00 | % | 19.14 | % | 5.74 | % | N/A | 13.43 | % | ||||||||||||||

| Janus Enterprise Fund (9/92) | 29.21 | % | 22.74 | % | 1.87 | % | 6.69 | % | 11.63 | % | |||||||||||||

| Janus Growth and Income Fund (5/91) | 25.82 | % | 16.82 | % | 3.44 | % | 12.02 | % | 13.80 | % | |||||||||||||

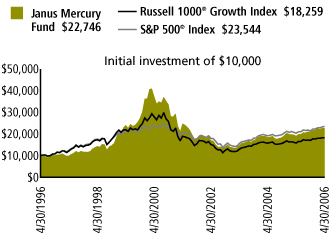

| Janus Mercury Fund (5/93) | 19.00 | % | 15.42 | % | (1.74 | )% | 8.56 | % | 12.70 | % | |||||||||||||

| Janus Mid Cap Value Fund - Investor Shares(3)(4) (8/98) | 20.64 | % | 23.27 | % | 12.45 | % | N/A | 17.97 | % | ||||||||||||||

| Janus Olympus Fund (12/95) | 26.44 | % | 16.83 | % | 0.45 | % | 9.78 | % | 11.77 | % | |||||||||||||

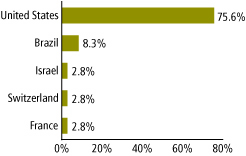

| Janus Orion Fund(1)(5)(6)(7) (6/00) | 41.50 | % | 27.95 | % | 10.72 | % | N/A | (0.73 | )% | ||||||||||||||

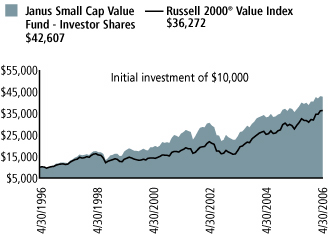

| Janus Small Cap Value Fund - Investor Shares* (10/87) | 20.30 | % | 20.76 | % | 10.80 | % | 15.60 | % | N/A | ||||||||||||||

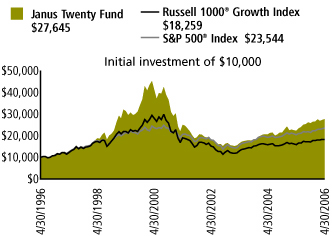

| Janus Twenty Fund*(4)(6) (4/85) | 24.20 | % | 19.02 | % | 2.05 | % | 10.70 | % | 13.48 | % | |||||||||||||

| Janus Venture Fund*(8) (4/85) | 32.58 | % | 27.53 | % | 9.14 | % | 9.29 | % | 13.88 | % | |||||||||||||

| INTECH Risk-Managed Stock Fund(3) (2/03) | 17.81 | % | 19.16 | % | N/A | N/A | 20.50 | % | |||||||||||||||

| S&P 500® Index | 15.42 | % | 14.68 | % | 2.70 | % | 8.94 | % | N/A | ||||||||||||||

| Russell 1000® Growth Index | 15.18 | % | 12.05 | % | (0.76 | )% | 6.21 | % | N/A | ||||||||||||||

Data presented reflects past performance, which is no guarantee of future results. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, current performance may be higher or lower than the performance shown. Call 800.525.3713 or visit www.janus.com for performance current to the most recent month-end.

The average performance of Janus' U.S. equity funds over the past three years was calculated using the three-year total returns of the 13 funds contained in the performance chart above. The 13 funds reflected in the performance chart above are those which Janus categorizes as U.S. equity funds and which have performance histories of three or more years.

*Closed to new investors

(1)This Fund may have significant exposure to emerging markets. In general, emerging market investments have historically been subject to significant gains and/or losses. As such, the Fund's returns and NAV may be subject to such volatility.

(2)The Fund has experienced significant gains due, in part, to its investments in India. While holdings are subject to change without notice, the Fund's returns and NAV may be affected to a large degree by fluctuations in currency exchange rates or political or economic conditions in India.

(3)The Fund will invest at least 80% of its net assets in the type of securities described by its name.

(4)Due to certain investment strategies, the Fund may have an increased position in cash.

(5)The Fund has experienced significant gains due, in part, to its investments in Brazil. While holdings are subject to change without notice, the Fund's returns and NAV may be affected to a large degree by fluctuations in currency exchange rates or political or economic conditions in Brazil.

(6)Returns have sustained significant gains due to market volatility in the healthcare sector.

(7)Returns have sustained significant gains due to market volatility in the financials sector.

(8)This Fund has been significantly impacted, either positively or negatively, by investing in initial public offerings (IPOs).

Total return includes reinvestment of dividends, distributions and capital gains.

A fund's performance may be affected by risks that include those associated with non-diversification, investments in foreign securities and emerging markets, non-investment grade debt securities, undervalued or overlooked companies, companies with relatively small market capitalizations and investments in specific industries or countries. Please see a Janus prospectus or janus.com for more information about fund holdings and details.

The proprietary mathematical process used by Enhanced Investment Technologies LLC ("INTECH") may not achieve the desired results. Since the portfolio is regularly balanced, this may result in a higher portfolio turnover rate, higher expenses and potentially higher net taxable gains or losses compared to a "buy and hold" or index fund strategy.

There is no assurance that the investment process will consistently lead to successful investing.

Returns shown for Janus Mid Cap Value Fund prior to 4/21/03 are those of Berger Mid Cap Value Fund.

Returns shown for Janus Small Cap Value Fund prior to 4/21/03 are those of Berger Small Cap Value Fund.

Effective 2/1/06, Blaine Rollins is no longer the portfolio manager of Janus Fund, and David Corkins is now the Fund manager.

Effective 2/1/06, David Corkins is no longer the portfolio manager of Janus Mercury Fund. A research team now selects the investments for Janus Mercury Fund led by the Director of Research, Jim Goff.

Effective 2/28/06, Janus Risk-Managed Stock Fund changed its name to INTECH Risk-Managed Stock Fund.

Janus Capital Group Inc. has a 30% ownership stake in the investment advisory business of Perkins, Wolf, McDonnell and Company, LLC.

INTECH is a subsidiary of Janus Capital Group Inc.

A Fund's portfolio may differ significantly from the securities held in the indices. The indices are not available for direct investment; therefore their performance does not reflect the expenses associated with the active management of an actual portfolio.

The S&P 500® Index is the Standard & Poor's composite index of 500 stocks, a widely recognized, unmanaged index of common stock prices.

The Russell 1000® Growth Index measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values.

4 Janus Growth Funds April 30, 2006

Useful Information About Your Fund Report

Portfolio Manager Commentaries

The portfolio manager commentaries in this report include valuable insight from the portfolio managers as well as statistical information to help you understand how your Fund's performance and characteristics stack up against those of comparable indices.

Please keep in mind that the opinions expressed by the portfolio managers in their commentaries are just that: opinions. They are a reflection of their best judgment at the time this report was compiled, which was April 30, 2006. As the investing environment changes, so could their opinions. These views are unique to each manager and aren't necessarily shared by their fellow employees or by Janus in general.

Fund Expenses

We believe it's important for our shareholders to have a clear understanding of Fund expenses and the impact they have on investment return.

The following is important information regarding each Fund's Expense Example, which appears in each Fund's Portfolio Manager Commentary within this Semiannual Report. Please refer to this information when reviewing the Expense Example for each Fund.

Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including redemption fees (where applicable) (and any related exchange fees) and (2) ongoing costs, including management fees and other Fund expenses. The example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the six-month period from November 1, 2005 to April 30, 2006.

Actual Expenses

The first line of the table in each example provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During the Period" to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The second line of the table in each example provides information about hypothetical account values and hypothetical expenses based upon the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Janus Capital Management LLC ("Janus Capital") has contractually agreed to waive Janus Triton Fund's total operating expenses, excluding brokerage commissions, interest, taxes and extraordinary expenses, to certain limits until at least March 1, 2007. Expenses in the example reflect the application of this waiver. Had the waiver not been in effect, your expenses would have been higher. More information regarding the waiver is available in the Funds' prospectuses.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as redemption fees (where applicable). These fees are fully described in the prospectus. Therefore, the second line of each table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Janus Growth Funds April 30, 2006 5

Janus Fund (unaudited)

Ticker: JANSX

Fund Snapshot

For more than 35 years, this traditional growth fund has exemplified Janus' research and stock-picking abilities.

David Corkins

portfolio manager

Performance Overview

I very much appreciate the opportunity to speak directly with you for the first time since taking over management of Janus Fund effective February 1, 2006. My hope with this letter is to review the Fund's performance over the last 6 months, further explain our investment process so that all shareholders understand what we do, and finally, share our outlook for the Fund going forward.

Performance Review

Our goal with the Fund is superior long-term returns for shareholders. What does that mean in practice? These potential long-term returns start with positive absolute performance and follow with consistent execution in up and down markets. For the six months ending April 30, 2006, Janus Fund returned 10.51%. By comparison, our primary benchmark the Russell 1000® Growth Index returned 7.06% and our secondary benchmark the S&P 500® Index returned 9.64%.

Our Investment Process

Some of the best advice I ever received about managing investments was succinct: "Know your companies." We believe that understanding the leverage points in a company's business model allows you to properly assess risk as well as calculate the free cash flow and returns on invested capital that drive value creation. Knowing your companies also allows you to potentially take advantage of the inherent volatility in the market. You are more likely to be able to buy when others are fearful and sell when others are greedy. Most importantly, knowing my companies helps me invest with conviction (more concentrated and with lower turnover) and hold on for the long-run.

Likewise, I believe it is imperative that investors in Janus Fund understand our investment process and strategy. I believe in the classic Janus investment style that I learned from previous portfolio managers, the most influential being Tom Bailey, Jim Craig, Tom Marsico and Helen Young Hayes. For me, this style means fundamental, grass-roots growth investing which is a combination of qualitative and quantitative analysis. The quantitative aspect means in-depth, detailed, financial modeling of a company to understand the leverage points in the business, the free cash flow, and the returns on capital. This model allows me to move onto the qualitative focus, which is using the financial information to speak with management, competitors and suppliers to gain a more complete understanding of the company. The next piece of the investment mosaic is to understand the valuation , risk and reward for this investment given the current price of the security and the macro-economic factors impacting it. Finally, the last part of the puzzle is to consider overall portfolio construction, risk and return in addition to the sum of each of the individual securities.

What I've learned over the last 10 years managing money is that this investment method must be iterative – it's a never-ending process of building a deeper and deeper knowledge base about a company. The better your model, the more information you can extract; the more information you get the better your model. Like most businesses, at the end of the day, the harder you work, the better your results.

I also believe it is imperative to think like a partner – I would like my fellow investors to have a good appreciation for their manager's investment in the Fund, as well as how I am compensated for managing the Fund. In that vein, I have made a 7-figure investment in the Fund because I believe in the team and our investment process. I am eating our cooking. In terms of compensation, I am strongly incented with pay for performance: my incentive pay is primarily based on how well the Fund performs relative to its peers over a three-year basis, as well as whether the return is positive on an absolute basis.

What Went Right?

An eclectic group of securities performed quite strongly, and the Fund performed well within the pharmaceutical, semiconductor, financial and capital goods sectors. Since our primary focus is on individual company selection, rather than large sector trading bets, one measure of health for the Fund is whether the winners were from diverse areas of the economy.

The largest single contributor to the Fund's results was Boeing. Boeing is an excellent example of what we look for in a stock: strong competitive positioning, attractive industry dynamics, improving free cash flow and returns on invested capital and management focused on shareholder value. As the leading American aerospace manufacturer, Boeing has benefited from a

6 Janus Growth Funds April 30, 2006

(unaudited)

continued expansion of the aerospace cycle as demand from emerging markets, like China, India and the Middle East, accelerates for fuel-efficient planes given high commodity input costs. Low-cost carriers have also started to spend on next generation planes given the change in domestic networks from hub-and-spoke to point-to-point. Legacy carriers such as United are emerging from bankruptcy and we believe will likely extend the cycle towards 2010 as they pull in orders to remain competitive with the lower-cost carriers. At the same time, a major competitor Airbus has stumbled in next generation product design with a poorly received A350. Finally, we believe a new CEO at Boeing will likely bring a much needed focus on costs, production and return on capital.

We have done extensive research on Boeing and the aerospace industry. We've met with management at various levels of the company as well as interviewed numerous competitors and suppliers, both domestically and overseas. Primary analyst Jeremiah Buckley and the rest of the team continue to build our financial model of the company and gain a deeper knowledge base of the industry. One area of caution remains the defense business, which we believe is seeing a possible slowdown in orders as the U.S. defense cycle wanes from previous years' strength.

Other contributors to the Fund's strong performance were financial companies such as JP Morgan Chase, which is beginning to show the fruits of its waste-cutting and renewed focus on revenue growth and returns. Analyst Gabe Bodhi has done excellent work on this company, which holds a particular interest for me since I worked at its predecessor for seven years before I joined Janus. We hope new leadership at the company will drive returns on capital and free cash flow on a sustainable basis.

I believe our healthcare team does exceptional fundamental research under the aegis of Tom Malley. Analyst Tony Yao helped lead the effort on Celgene which gained over 50% for shareholders due to strong clinical trials for Revlimid. Final product launch for the drug implies long-term success in multiple myeloma (a bone marrow-based cancer) and myelodysplastic syndromes (MDS – a blood-borne cancer) indications, as well as possible success in chronic lymphocytic leukemia (CLL), another blood cancer. Celgene also has a deep pipeline behind current products in the areas of sickle-cell and inflammatory disease.

What Went Wrong?

It's usually more productive to focus on what went wrong rather than over-emphasizing those areas and stocks that performed well. Learning from one's mistakes is a key to longevity in this business.

Two sectors in particular caused relative weakness in the Fund's performance: healthcare services and media. The biggest underperformers in these areas were UnitedHealth Group and Comcast. We have cut our position in UnitedHealth Group meaningfully and sold our position in Comcast.

UnitedHealth Group has been a long-time holding in the Fund. The company is the leading HMO and specialty healthcare services provider in the United States. Operational tenets run deep within the company, pricing and margins remain attractive, demographics continue to drive demand and free cash flow generation is strong. Emerging specialty businesses diversify the business mix from more cyclical commercial underwriting trends. So with all those competitive strengths, what caused us to meaningfully reduce our position in the name? First, the company's outperformance caused its valuation to rise close to our fair value and meaningfully shifted the risk/reward profile; second, industry dynamics have resulted in an excess of capital and nascent signs of price competition; and third, serious questions have arisen regarding options grant timing. We realized profits in the name and reinvested the proceeds in other stocks with more attractive risk/r eward prospects.

Comcast was eliminated completely. Another long-time holding of the Fund, Comcast was sold as the company's business model continues to become more capital intensive and competitive threats from phone and satellite providers rise. Although cable systems offer an excellent gateway into the home, we believe the transition of the media business towards digital and Internet protocols (IP) threatens the primacy of the cable network model and implies lower returns in the future.

We are looking diligently in the media sector for attractive businesses as many of these leading franchises have been sold by disappointed investors looking for growth. Although valuations are becoming much more attractive, many of the high-margin business models are under assault from the move from analog to digital distribution as well as the emergence of the Internet as a media delivery vehicle. We have yet to make significant new investments in the sector.

We also remain cautious on the consumer discretionary areas of the economy in the short-run as a combination of rising energy prices, increased debt payments driven by interest rate increases, and higher healthcare costs squeezes the U.S. consumer. In the longer-term, we believe these areas are ripe for investment as the cyclical pressures ease.

Janus Growth Funds April 30, 2006 7

Janus Fund (unaudited)

Looking Forward

Our outlook remains cautious. Markets have performed strongly year-to-date due to a combination of very strong economic data as well as the anticipation of a conclusion to Federal Reserve monetary tightening. Small-cap stocks and emerging markets have led the way with strong performance coming in just a few months.

Yet clearly the market is in transition after three years of strong outperformance. This transition is driven by higher interest rates and a weaker U.S. dollar. We're cautiously watching several signs to better understand how this transition plays out. One area of focus is monetary liquidity and the U.S. dollar. Money supply growth has been slowing sequentially, Fed Repos have slowed dramatically, yet money flow into equities is quite strong and foreigners have been the driving force. Foreigners were huge beneficiaries of the dollar index, which rallied strongly throughout 2005. In 2006, however, the dollar index is beginning to roll over and the question remains how much of a rate increase or non-inflationary growth is necessary to keep foreigners in our currency and equity market.

Within Janus Fund, our response in general has been to transition from business models that are dependent on an economic tailwind to stronger franchises that have more control over their own sales and margins regardless of macro-economic conditions. In addition, we are cautiously watching the yield curve and U.S. dollar in anticipation of further transition as the economy continues to move forward.

In sum, I am honored with the opportunity to manage Janus Fund. My investment and incentives are aligned with yours. As a former English major, I can't finish this letter without a favorite quote from an old media hand like Samuel Goldwyn: "The harder I work, the luckier I get." It gives me comfort to know the entire investment team at Janus is working very hard every day to find attractive opportunities to grow our principal.

Thank you for your investment in Janus Fund.

Janus Fund At a Glance

5 Largest Contributors to Performance – Holdings

| Contribution | |||||||

| Boeing Co. Commercial jet aircraft company - U.S. | 0.93 | % | |||||

| JP Morgan Chase & Co. Financial products and services provider - U.S. | 0.46 | % | |||||

| Nokia Oyj (ADR) Telecommunications company - Finland | 0.44 | % | |||||

| Companhia Vale do Rio Doce (ADR) Iron ore producer/seller - Brazil | 0.44 | % | |||||

| Schlumberger, Ltd. (U.S. Shares) Oil services company - U.S. | 0.42 | % | |||||

5 Largest Detractors from Performance – Holdings

| Contribution | |||||||

| UnitedHealth Group, Inc. Organized health systems company - U.S. | (0.42 | %) | |||||

| Yahoo!, Inc. Global Internet media company - U.S. | (0.37 | %) | |||||

| Alcon, Inc. (U.S. Shares) Eye care company - U.S. | (0.32 | %) | |||||

| Juniper Networks, Inc. Internet infrastructure solutions provider - U.S. | (0.26 | %) | |||||

| Caremark Rx, Inc. Pharmaceutical services provider - U.S. | (0.23 | %) | |||||

5 Largest Contributors to Performance – Sectors

| Fund Contribution | Fund Weighting (% of Net Assets) | Primary Benchmark Weighting | |||||||||||||

| Capital Goods | 1.97 | % | 9.84 | % | 11.43 | % | |||||||||

| Diversified Financials | 1.52 | % | 6.47 | % | 3.65 | % | |||||||||

| Materials | 1.33 | % | 5.42 | % | 2.06 | % | |||||||||

| Energy | 1.28 | % | 5.69 | % | 3.69 | % | |||||||||

| Technology Hardware and Equipment | 1.20 | % | 8.81 | % | 10.64 | % | |||||||||

5 Lowest Contributors/Detractors to Performance – Sectors

| Fund Contribution | Fund Weighting (% of Net Assets) | Primary Benchmark Weighting | |||||||||||||

| Healthcare Equipment & Services | (1.33 | %) | 10.91 | % | 9.05 | % | |||||||||

| Food & Staples Retailing | (0.19 | %) | 2.07 | % | 3.47 | % | |||||||||

| Media | (0.10 | %) | 0.94 | % | 3.03 | % | |||||||||

| Food, Beverage & Tobacco | (0.01 | %) | 1.65 | % | 4.48 | % | |||||||||

| Commercial Services & Supplies | 0.00 | % | 0.00 | % | 1.03 | % | |||||||||

8 Janus Growth Funds April 30, 2006

(unaudited)

5 Largest Equity Holdings – (% of Net Assets)

| As of April 30, 2006 | |||

| Boeing Co. Aerospace and Defense | 3.3 | % | |||||

| Procter & Gamble Co. Cosmetics and Toiletries | 3.1 | % | |||||

| JP Morgan Chase & Co. Finance - Investment Bankers/Brokers | 2.8 | % | |||||

| Yahoo!, Inc. Web Portals/Internet Service Providers | 2.7 | % | |||||

| General Electric Co. Diversified Operations | 2.5 | % | |||||

| 14.4 | % | ||||||

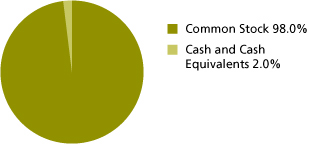

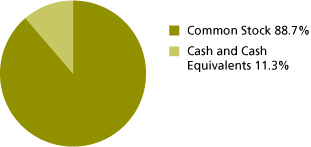

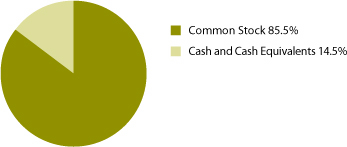

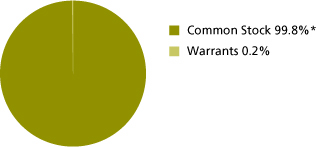

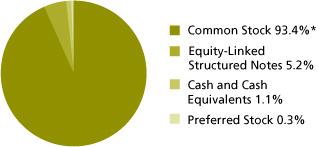

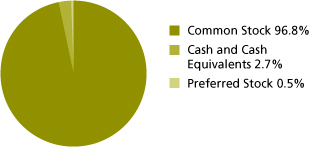

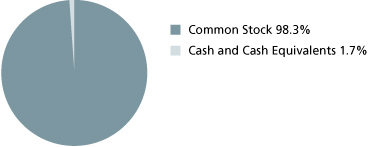

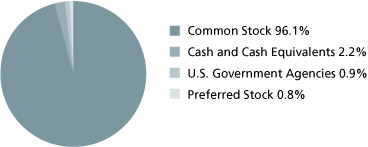

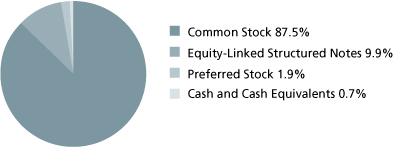

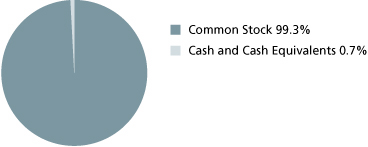

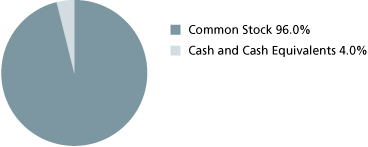

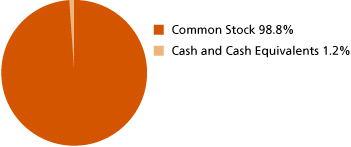

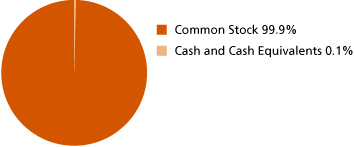

Asset Allocation – (% of Net Assets)

| As of April 30, 2006 | |||

Emerging markets comprised 3.7% of total net assets.

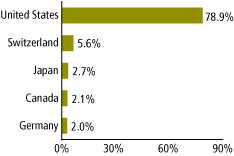

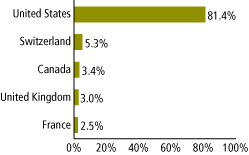

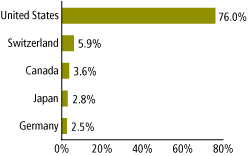

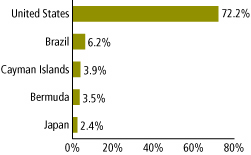

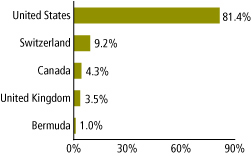

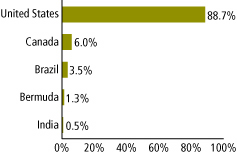

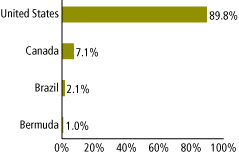

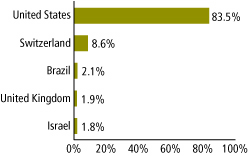

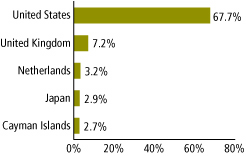

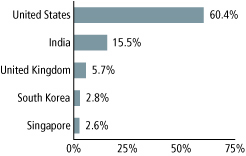

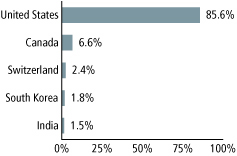

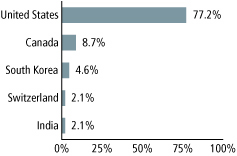

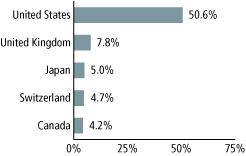

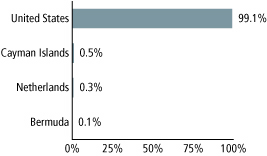

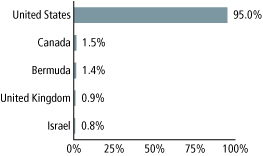

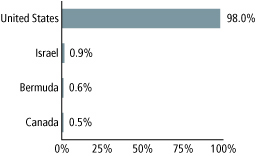

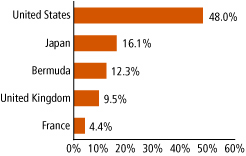

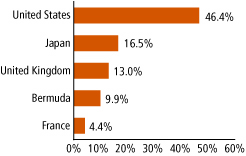

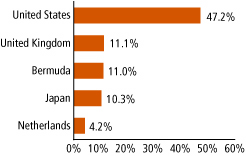

5 Largest Country Allocations – (% of Investment Securities)

| As of April 30, 2006 | As of October 31, 2005 | ||||||

|  | ||||||

Janus Growth Funds April 30, 2006 9

Janus Fund (unaudited)

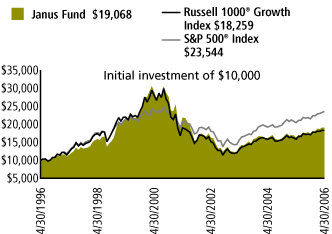

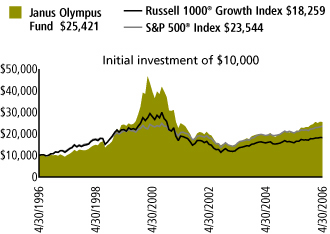

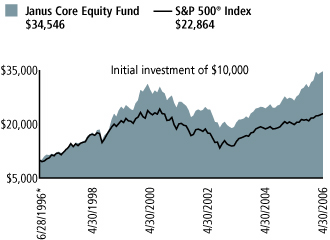

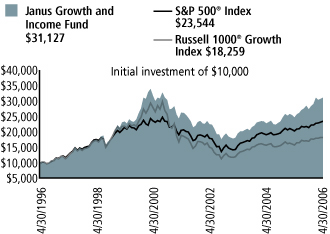

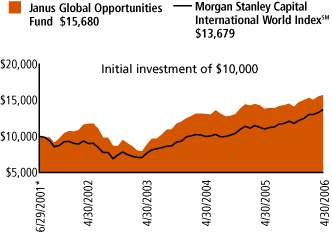

Performance

Average Annual Total Return – for the periods ended April 30, 2006

| Fiscal Year-to-Date | One Year | Five Year | Ten Year | Since Inception* | |||||||||||||||||||

| Janus Fund | 10.51 | % | 17.28 | % | (2.62 | )% | 6.67 | % | 13.86 | % | |||||||||||||

| Russell 1000® Growth Index | 7.06 | % | 15.18 | % | (0.76 | )% | 6.21 | % | 11.96 | %** | |||||||||||||

| S&P 500® Index | 9.64 | % | 15.42 | % | 2.70 | % | 8.94 | % | 11.41 | % | |||||||||||||

| Lipper Quartile | N/A | 2 | nd | 4 | th | 2 | nd | 1 | st | ||||||||||||||

| Lipper Ranking - based on total return for Large-Cap Growth Funds | N/A*** | 296/698 | 374/474 | 72/165 | 1/19 | ||||||||||||||||||

Visit janus.com to view up to date performance and characteristic information

Data presented represents past performance, which is no guarantee of future results. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, current performance may be higher or lower than the performance shown. Call 800.525.3713 or visit www.janus.com for performance current to the most recent month-end.

See Notes to Schedules of Investments for index definitions.

Total return includes reinvestment of dividends, distributions and capital gains. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

*The Fund's inception date – February 5, 1970

**The Russell 1000® Growth Index's since inception returns calculated from December 31, 1978

***The Fund's fiscal year-to-date Lipper ranking is not available.

See "Explanations of Charts, Tables and Financial Statements."

The Fund's portfolio may differ significantly from the securities held in the indices. The indices are not available for direct investment; therefore their performance does not reflect the expenses associated with the active management of an actual portfolio.

There is no assurance that the investment process will consistently lead to successful investing.

Lipper Inc. - A Reuters Company, is a nationally recognized organization that ranks the performance of mutual funds within a universe of funds that have similar investment objectives. Rankings are historical with capital gains and dividends reinvested.

Effective 2/1/06, Blaine Rollins is no longer the portfolio manager of Janus Fund, and David Corkins is now the Fund manager.

Fund Expenses

The example below shows you the ongoing costs (in dollars) of investing in your Fund and allows you to compare these costs with those of other mutual funds. Please refer to page 5 for a detailed explanation of the information presented in these charts.

| Expense Example | Beginning Account Value (11/1/05) | Ending Account Value (4/30/06) | Expenses Paid During Period (11/1/05-4/30/06)* | ||||||||||||

| Actual | $ | 1,000.00 | $ | 1,105.10 | $ | 4.75 | |||||||||

| Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,020.28 | $ | 4.56 | |||||||||

*Expenses are equal to the annualized expense ratio of 0.91%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

10 Janus Growth Funds April 30, 2006

Janus Fund

Schedule of Investments (unaudited)

As of April 30, 2006

| Shares or Principal Amount | Value | ||||||||||

| Common Stock - 98.0% | |||||||||||

| Aerospace and Defense - 4.7% | |||||||||||

| 5,401,628 | BAE Systems PLC** | $ | 41,124,397 | ||||||||

| 4,658,990 | Boeing Co. | 388,792,715 | |||||||||

| 1,494,360 | Lockheed Martin Corp. | 113,421,924 | |||||||||

| 543,339,036 | |||||||||||

| Agricultural Chemicals - 1.8% | |||||||||||

| 1,386,690 | Monsanto Co. | 115,649,946 | |||||||||

| 648,568 | Syngenta A.G.* | 90,471,105 | |||||||||

| 206,121,051 | |||||||||||

| Apparel Manufacturers - 0.5% | |||||||||||

| 1,617,560 | Coach, Inc.* | 53,411,831 | |||||||||

| Applications Software - 1.9% | |||||||||||

| 9,041,305 | Microsoft Corp. | 218,347,516 | |||||||||

| Automotive - Cars and Light Trucks - 1.5% | |||||||||||

| 2,375,506 | BMW A.G.**,# | 129,318,586 | |||||||||

| 3,368,400 | Nissan Motor Company, Ltd.** | 44,284,853 | |||||||||

| 173,603,439 | |||||||||||

| Automotive - Truck Parts and Equipment - Original - 0.1% | |||||||||||

| 694,895 | Lear Corp.# | 16,385,624 | |||||||||

| Beverages - Non-Alcoholic - 0.8% | |||||||||||

| 1,549,975 | PepsiCo, Inc. | 90,270,544 | |||||||||

| Broadcast Services and Programming - 0.5% | |||||||||||

| 7,548,271 | Liberty Media Corp. - Class A* | 63,028,063 | |||||||||

| Building - Residential and Commercial - 0.3% | |||||||||||

| 51,365 | NVR, Inc.*,# | 38,780,575 | |||||||||

| Building and Construction Products - Miscellaneous - 0.3% | |||||||||||

| 1,172,145 | Masco Corp. | 37,391,426 | |||||||||

| Building Products - Cement and Aggregate - 0.6% | |||||||||||

| 1,093,265 | Cemex S.A. de C.V. (ADR)# | 73,817,253 | |||||||||

| Casino Hotels - 0.7% | |||||||||||

| 1,053,425 | Harrah's Entertainment, Inc. | 86,001,617 | |||||||||

| Cellular Telecommunications - 0.7% | |||||||||||

| 2,077,100 | America Movil S.A. de C.V. - Series L (ADR) | 76,665,761 | |||||||||

| Chemicals - Diversified - 0.5% | |||||||||||

| 1,068,600 | Shin-Etsu Chemical Company, Ltd.** | 61,751,969 | |||||||||

| Commercial Banks - 0.6% | |||||||||||

| 8,504 | Mizuho Financial Group, Inc.** | 72,519,071 | |||||||||

| Commercial Services - Finance - 1.3% | |||||||||||

| 893,515 | Moody's Corp. | 55,406,865 | |||||||||

| 2,408,627 | Paychex, Inc. | 97,284,445 | |||||||||

| 152,691,310 | |||||||||||

| Computers - 2.1% | |||||||||||

| 2,061,165 | Apple Computer, Inc.* | 145,085,405 | |||||||||

| 1,309,440 | Research In Motion, Ltd. (U.S. Shares)* | 100,342,387 | |||||||||

| 245,427,792 | |||||||||||

| Computers - Memory Devices - 2.1% | |||||||||||

| 13,063,415 | EMC Corp.* | 176,486,737 | |||||||||

| 1,016,710 | SanDisk Corp.* | 64,896,599 | |||||||||

| 241,383,336 | |||||||||||

| Containers - Metal and Glass - 0.6% | |||||||||||

| 1,596,965 | Ball Corp. | 63,846,661 | |||||||||

| Shares or Principal Amount | Value | ||||||||||

| Cosmetics and Toiletries - 3.1% | |||||||||||

| 6,249,985 | Procter & Gamble Co. | $ | 363,811,627 | ||||||||

| Dental Supplies and Equipment - 0.5% | |||||||||||

| 1,886,277 | Patterson Companies, Inc.*,# | 61,454,905 | |||||||||

| Distribution/Wholesale - 0.5% | |||||||||||

| 7,139,500 | Esprit Holdings, Ltd. | 56,999,607 | |||||||||

| Diversified Minerals - 1.0% | |||||||||||

| 2,258,405 | Companhia Vale do Rio Doce (ADR) | 116,353,026 | |||||||||

| Diversified Operations - 2.5% | |||||||||||

| 8,492,190 | General Electric Co. | 293,744,852 | |||||||||

| E-Commerce/Services - 1.5% | |||||||||||

| 2,214,603 | eBay, Inc.* | 76,204,489 | |||||||||

| 3,356,212 | IAC/InterActiveCorp* | 96,893,841 | |||||||||

| 173,098,330 | |||||||||||

| Electric - Generation - 0.5% | |||||||||||

| 3,510,260 | AES Corp.* | 59,569,112 | |||||||||

| Electric Products - Miscellaneous - 0.6% | |||||||||||

| 766,410 | Emerson Electric Co. | 65,106,530 | |||||||||

| Electronic Components - Semiconductors - 3.8% | |||||||||||

| 6,626,115 | Advanced Micro Devices, Inc.* | 214,354,820 | |||||||||

| 6,601,680 | Texas Instruments, Inc. | 229,144,312 | |||||||||

| 443,499,132 | |||||||||||

| Electronic Forms - 0.8% | |||||||||||

| 2,421,850 | Adobe Systems, Inc.* | 94,936,520 | |||||||||

| Enterprise Software/Services - 2.3% | |||||||||||

| 2,238,595 | CA, Inc. | 56,770,769 | |||||||||

| 6,886,240 | Oracle Corp.* | 100,470,242 | |||||||||

| 2,069,110 | SAP A.G. (ADR)** | 113,035,479 | |||||||||

| 270,276,490 | |||||||||||

| Entertainment Software - 1.6% | |||||||||||

| 3,255,821 | Electronic Arts, Inc.* | 184,930,633 | |||||||||

| Finance - Credit Card - 1.6% | |||||||||||

| 2,210,720 | American Express Co. | 118,958,844 | |||||||||

| 1,167,700 | Credit Saison Company, Ltd.** | 61,223,106 | |||||||||

| 180,181,950 | |||||||||||

| Finance - Investment Bankers/Brokers - 6.2% | |||||||||||

| 7,197,950 | JP Morgan Chase & Co. | 326,642,971 | |||||||||

| 1,759,205 | Merrill Lynch & Company, Inc. | 134,156,973 | |||||||||

| 2,449,000 | Mitsubishi UFJ Securities Company, Ltd.** | 38,585,219 | |||||||||

| 1,060,786 | UBS A.G.# | 125,734,190 | |||||||||

| 823,125 | UBS A.G. (ADR) | 96,182,156 | |||||||||

| 721,301,509 | |||||||||||

| Finance - Mortgage Loan Banker - 1.1% | |||||||||||

| 2,474,885 | Fannie Mae | 125,229,181 | |||||||||

| Finance - Other Services - 0.5% | |||||||||||

| 137,307 | Chicago Mercantile Exchange Holdings, Inc.# | 62,886,606 | |||||||||

| Food - Dairy Products - 0.7% | |||||||||||

| 2,051,140 | Dean Foods Co.* | 81,245,655 | |||||||||

| Food - Retail - 1.0% | |||||||||||

| 1,843,510 | Whole Foods Market, Inc. | 113,154,644 | |||||||||

| Food - Wholesale/Distribution - 0.5% | |||||||||||

| 2,048,465 | Sysco Corp. | 61,228,619 | |||||||||

| Independent Power Producer - 0.5% | |||||||||||

| 1,312,855 | NRG Energy, Inc.* | 62,478,769 | |||||||||

See Notes to Schedules of Investments and Financial Statements.

Janus Growth Funds April 30, 2006 11

Janus Fund

Schedule of Investments (unaudited)

As of April 30, 2006

| Shares or Principal Amount | Value | ||||||||||

| Insurance Brokers - 0.5% | |||||||||||

| 1,928,360 | Marsh & McLennan Companies, Inc. | $ | 59,142,801 | ||||||||

| Internet Infrastructure Software - 0.4% | |||||||||||

| 1,429,260 | Akamai Technologies, Inc.*,# | 48,151,769 | |||||||||

| Machinery - Construction and Mining - 0.3% | |||||||||||

| 434,950 | Joy Global, Inc. | 28,571,866 | |||||||||

| Medical - Biomedical and Genetic - 2.3% | �� | ||||||||||

| 1,463,595 | Amgen, Inc.* | 99,085,382 | |||||||||

| 2,783,120 | Celgene Corp.* | 117,336,339 | |||||||||

| 646,288 | Genentech, Inc.* | 51,515,616 | |||||||||

| 267,937,337 | |||||||||||

| Medical - Drugs - 5.0% | |||||||||||

| 2,834,040 | Abbott Laboratories | 121,126,870 | |||||||||

| 5,398,875 | Merck & Company, Inc. | 185,829,277 | |||||||||

| 1,786,843 | Roche Holding A.G.# | 274,754,845 | |||||||||

| 581,710,992 | |||||||||||

| Medical - Generic Drugs - 1.1% | |||||||||||

| 3,143,006 | Teva Pharmaceutical Industries, Ltd. (ADR)# | 127,291,743 | |||||||||

| Medical - HMO - 2.8% | |||||||||||

| 638,063 | Aetna, Inc. | 24,565,426 | |||||||||

| 3,616,950 | Coventry Health Care, Inc.* | 179,653,906 | |||||||||

| 2,424,730 | UnitedHealth Group, Inc. | 120,606,070 | |||||||||

| 324,825,402 | |||||||||||

| Medical - Wholesale Drug Distributors - 1.0% | |||||||||||

| 1,732,795 | Cardinal Health, Inc. | 116,703,743 | |||||||||

| Medical Instruments - 1.2% | |||||||||||

| 3,732,975 | Boston Scientific Corp.* | 86,754,339 | |||||||||

| 425,575 | Intuitive Surgical, Inc.* | 54,048,025 | |||||||||

| 140,802,364 | |||||||||||

| Medical Products - 0.5% | |||||||||||

| 1,031,070 | Varian Medical Systems, Inc.*,# | 54,007,447 | |||||||||

| Metal Processors and Fabricators - 1.2% | |||||||||||

| 2,269,510 | Precision Castparts Corp. | 142,933,740 | |||||||||

| Networking Products - 0.8% | |||||||||||

| 4,616,155 | Cisco Systems, Inc.* | 96,708,447 | |||||||||

| Oil - Field Services - 2.5% | |||||||||||

| 2,093,520 | Halliburton Co. | 163,608,588 | |||||||||

| 1,783,380 | Schlumberger, Ltd. (U.S. Shares)**,# | 123,302,893 | |||||||||

| 286,911,481 | |||||||||||

| Oil Companies - Exploration and Production - 1.9% | |||||||||||

| 943,615 | Apache Corp. | 67,034,410 | |||||||||

| 1,452,895 | EnCana Corp. (U.S. Shares)# | 72,717,395 | |||||||||

| 1,128,900 | EOG Resources, Inc.# | 79,282,646 | |||||||||

| 219,034,451 | |||||||||||

| Oil Companies - Integrated - 2.5% | |||||||||||

| 407,740 | Amerada Hess Corp. | 58,416,910 | |||||||||

| 3,761,455 | Exxon Mobil Corp. | 237,272,581 | |||||||||

| 295,689,491 | |||||||||||

| Oil Refining and Marketing - 0.3% | |||||||||||

| 451,895 | Valero Energy Corp. | 29,255,682 | |||||||||

| Optical Supplies - 0.8% | |||||||||||

| 854,800 | Alcon, Inc. (U.S. Shares) | 86,941,708 | |||||||||

| Pharmacy Services - 1.1% | |||||||||||

| 2,683,925 | Caremark Rx, Inc. | 122,252,784 | |||||||||

| Shares or Principal Amount | Value | ||||||||||

| Real Estate Management/Services - 0.4% | |||||||||||

| 2,020,000 | Mitsubishi Estate Company, Ltd.** | $ | 44,173,363 | ||||||||

| Reinsurance - 0.7% | |||||||||||

| 27,981 | Berkshire Hathaway, Inc. - Class B* | 82,599,912 | |||||||||

| Retail - Apparel and Shoe - 1.2% | |||||||||||

| 2,171,841 | Industria de Diseno Textil S.A.** | 88,365,301 | |||||||||

| 1,302,815 | Nordstrom, Inc. | 49,936,899 | |||||||||

| 138,302,200 | |||||||||||

| Retail - Building Products - 0.7% | |||||||||||

| 1,302,775 | Lowe's Companies, Inc. | 82,139,964 | |||||||||

| Retail - Office Supplies - 1.3% | |||||||||||

| 5,628,642 | Staples, Inc. | 148,652,435 | |||||||||

| Savings/Loan/Thrifts - 0.3% | |||||||||||

| 2,111,534 | NewAlliance Bancshares, Inc.# | 30,490,551 | |||||||||

| Semiconductor Components/Integrated Circuits - 0.5% | |||||||||||

| 967,845 | Marvell Technology Group, Ltd.* | 55,254,271 | |||||||||

| Soap and Cleaning Preparations - 0.9% | |||||||||||

| 2,837,113 | Reckitt Benckiser PLC** | 103,420,783 | |||||||||

| Steel - Producers - 0.3% | |||||||||||

| 2,509,858 | Tata Steel, Ltd. | 35,448,251 | |||||||||

| Telecommunication Services - 0.4% | |||||||||||

| 1,432,795 | NeuStar, Inc. - Class A* | 50,291,105 | |||||||||

| Telephone - Integrated - 0.4% | |||||||||||

| 8,382,820 | Level 3 Communications, Inc.*,# | 45,267,228 | |||||||||

| Television - 0.2% | |||||||||||

| 751,618 | Univision Communications, Inc. - Class A*,# | 26,825,246 | |||||||||

| Therapeutics - 1.7% | |||||||||||

| 1,603,410 | Amylin Pharmaceuticals, Inc.*,# | 69,828,506 | |||||||||

| 2,287,100 | Gilead Sciences, Inc.* | 131,508,250 | |||||||||

| 201,336,756 | |||||||||||

| Transportation - Railroad - 1.3% | |||||||||||

| 1,923,680 | Canadian National Railway Co. (U.S. Shares) | 86,392,468 | |||||||||

| 667,665 | Union Pacific Corp. | 60,897,725 | |||||||||

| 147,290,193 | |||||||||||

| Transportation - Services - 2.1% | |||||||||||

| 2,532,595 | C.H. Robinson Worldwide, Inc. | 112,320,588 | |||||||||

| 1,559,300 | United Parcel Service, Inc. - Class B | 126,412,451 | |||||||||

| 238,733,039 | |||||||||||

| Web Portals/Internet Service Providers - 3.7% | |||||||||||

| 303,565 | Google, Inc. - Class A* | 126,871,956 | |||||||||

| 9,409,395 | Yahoo!, Inc.* | 308,439,968 | |||||||||

| 435,311,924 | |||||||||||

| Wireless Equipment - 3.3% | |||||||||||

| 2,381,030 | Crown Castle International Corp.* | 80,121,660 | |||||||||

| 6,938,865 | Nokia Oyj (ADR)** | 157,234,680 | |||||||||

| 2,938,305 | QUALCOMM, Inc. | 150,852,579 | |||||||||

| 388,208,919 | |||||||||||

| Total Common Stock (cost $9,245,435,979) | 11,388,890,960 | ||||||||||

| Money Markets - 1.6% | |||||||||||

| 165,000,000 | Janus Institutional Cash Reserves Fund 4.83% | 165,000,000 | |||||||||

| 25,000,000 | Janus Money Market Fund 4.77% | 25,000,000 | |||||||||

| Total Money Markets (cost $190,000,000) | 190,000,000 | ||||||||||

See Notes to Schedules of Investments and Financial Statements.

12 Janus Growth Funds April 30, 2006

Schedule of Investments (unaudited)

As of April 30, 2006

| Shares or Principal Amount | Value | ||||||||||

| Other Securities - 4.5% | |||||||||||

| 522,862,639 | State Street Navigator Securities Lending Prime Portfolio† (cost $522,862,639) | $ | 522,862,639 | ||||||||

| Time Deposit - 0.1% | |||||||||||

| $ | 11,900,000 | ING Financial, ETD 4.86%, 5/1/06 (cost $11,900,000) | 11,900,000 | ||||||||

| Total Investments (total cost $9,970,198,618) – 104.2% | 12,113,653,599 | ||||||||||

| Liabilities, net of Cash, Receivables and Other Assets – (4.2)% | (488,270,828 | ) | |||||||||

| Net Assets – 100% | $ | 11,625,382,771 | |||||||||

Summary of Investments by Country

| Country | Value | % of Investment Securities | |||||||||

| Bermuda | $ | 112,253,878 | 0.9 | % | |||||||

| Brazil | 116,353,026 | 1.0 | % | ||||||||

| Canada | 259,452,250 | 2.1 | % | ||||||||

| Finland | 157,234,680 | 1.3 | % | ||||||||

| Germany | 242,354,065 | 2.0 | % | ||||||||

| India | 35,448,251 | 0.3 | % | ||||||||

| Israel | 127,291,743 | 1.1 | % | ||||||||

| Japan | 322,537,581 | 2.7 | % | ||||||||

| Mexico | 150,483,014 | 1.2 | % | ||||||||

| Netherlands | 123,302,893 | 1.0 | % | ||||||||

| Spain | 88,365,301 | 0.7 | % | ||||||||

| Switzerland | 674,084,004 | 5.6 | % | ||||||||

| United Kingdom | 144,545,180 | 1.2 | % | ||||||||

| United States†† | 9,559,947,733 | 78.9 | % | ||||||||

| Total | $ | 12,113,653,599 | 100.0 | % | |||||||

††Includes Short-Term Securities and Other Securities (72.9% excluding Short-Term Securities and Other Securities)

Forward Currency Contracts, Open

| Currency Sold and Settlement Date | Currency Units Sold | Currency Value in $ U.S. | Unrealized Gain/(Loss) | ||||||||||||

| British Pound 10/19/06 | 20,700,000 | $ | 37,843,245 | $ | (787,968 | ) | |||||||||

| Euro 6/28/06 | 88,900,000 | 112,579,871 | (2,560,788 | ) | |||||||||||

| Euro 8/24/06 | 8,500,000 | 10,800,699 | (495,299 | ) | |||||||||||

| Japanese Yen 8/24/06 | 9,000,000,000 | 80,376,886 | (2,372,173 | ) | |||||||||||

| Total | $ | 241,600,701 | $ | (6,216,228 | ) | ||||||||||

See Notes to Schedules of Investments and Financial Statements.

Janus Growth Funds April 30, 2006 13

Janus Enterprise Fund (unaudited)

Ticker: JAENX

Fund Snapshot

This growth fund pursues companies that have grown large enough to be well established but are small enough to still have room to grow.

Jonathan Coleman

portfolio manager

Performance Overview

During the six months ended April 30, 2006, as mid-cap stocks continued to outpace large-cap stocks, Janus Enterprise Fund advanced 14.29%. Meanwhile, the Fund's primary benchmark, the Russell Midcap® Growth Index returned 15.18%. The Fund's secondary benchmark, the S&P MidCap 400 Index, returned 15.27% for the same time period. While this short-term underperformance is disappointing, rest assured that we will not change our investment philosophy to chase momentary hot trends. In short, we look for companies with strong competitive barriers to entry, diverse and predictable revenue streams, an ability to expand profit margins over time, a strong stewardship of investors' capital, and appropriate valuations which we believe provide a reasonable risk and reward tradeoff.

As the performance of the market would suggest, the prior six months have been a strong period, particularly for small- and mid-sized companies. While deciphering the exact reasons for market strength (or weakness) in any period can be perilous, let me offer a few suggestions. First, the six-month period captures a significant rebound from the hurricane-related malaise that plagued the market last October. Consumer confidence, and therefore consumer spending, accelerated after a brief slowdown. As a result, GDP and corporate earnings have grown faster than expected. Additionally, the market has anticipated that the Federal Reserve may be close to ending the series of rate hikes it began in mid-2004. Finally, while energy prices remain elevated, the economy has so far proved to be much more resilient than in the 1970s, the last such period of sustained high energy prices.

Market strength has also been relatively concentrated, with certain groups experiencing very significant price moves in short periods of time. Of particular strength were the capital goods, materials, and telecommunications services industries. These industries are experiencing accelerating demand for their products and services, driven in large part by a surge in capital spending after several years of retrenchment. Given my long-standing investment philosophy that we should have exposure to a broad array of industries rather than a highly concentrated portfolio, there are inevitably periods when our breadth of holdings works against us. This certainly occurred during the last six months. Nevertheless, I do believe that over an entire cycle of up and down markets the approach has considerable merit.

Investment Strategy

As always, there were certain sectors which were positive and negative contributors to performance. I am pleased to report that given the strong market performance, we had positive absolute returns in every sector except for utilities, where we sustained a small loss. Contributing to the Fund's underperformance versus its benchmark were holdings in the materials, healthcare equipment and services, and energy sectors. While we made money in these sectors on an absolute basis, we were either underweight in a strong group or did a poor job of stock selection within the group during the six-month period. We did a better job with our picks in the automobiles and components, media, and pharmaceuticals and biotechnology sectors. Of particular strength was long time holding Celgene, which I have written about in past letters. The company received Federal Drug Administration approval for its cancer-fighting agent Revlimid and the early market uptake appears positive.

Heavy Equipment and RV Manufacturer Boosted Performance

I'd like to discuss a couple of stocks that worked well for us during the period and give you some context on how they fit into our investment philosophy. Industrial heavy equipment manufacturer Terex produced very strong results during the period, aided by increasing demand for its mining, crane and aerial lift businesses. We became interested in Terex after meeting with the company in early 2005 and spending time understanding the company's strategic priorities. Several years ago Terex undertook a strategic review of the business, deciding to de-emphasize acquisitions and instead focus on driving returns on invested capital higher. The company has been able to do this by improving operating margins and reducing its working capital such as inventories and accounts receivable, which unnecessarily tie up cash. Our investment philosophy has consistently been predicated on investing in companies which are growing revenues and earnings while also increasing returns on invested capital. Terex has done just that, showing impressive operating leverage in recent quarters. To be more specific, revenue increased 27% in 2005 versus 2004, while operating profit increased 75% when compared to the prior year. Importantly, returns on invested capital have also increased more than five percentage points over the prior year. These factors led to very strong share price performance. As Terex has become more fairly valued by the market, we have used the opportunity to trim back our holdings.

Towable recreational vehicle (RV) manufacturer Thor Industries is perhaps best known for its iconic Airstream trailer brand. Thor is run by CEO Wade Thompson, who purchased a loss-making Airstream from conglomerate Beatrice International Holdings in 1980. Mr. Thompson is a manager who thinks like an owner, because he in fact owns 30% of the company. As a result, he allocates capital with the care that we value in our core holdings and rewards his managers who expand market share and do so profitably. The proof is in the numbers. Thor has been profitable every year since going public in 1987 and boasts returns on invested capital of greater than 30% in an industry when many competitors struggle with profitability. We believe that Thor can capitalize on a demographic tailwind as baby boomers enter their retirement years. The propensity to purchase an RV increases dramatically after the age of 50 and we believe Thor has the product breadth to s erve the demand. Thor's business has held up very well in spite of the increases in gasoline prices, in part because the majority of its sales are in towable RVs, as opposed to larger more expensive motorized RVs. Consumers have traded down to the cheaper product, which has benefited Thor at the expense of some competitors. While we admire Thor and its management tremendously, we have used the strength in the stock to lighten our position.

Healthcare Industry Holdings Detracted from Performance

I'd also like to discuss some of our losers in the period, explain our investment rationale, and tell you what we have done in response to the disappointments. Several of our most significant losses in the

14 Janus Growth Funds April 30, 2006

(unaudited)

period came in the healthcare industry. Implantable cardiac device manufacturer St. Jude Medical has been a holding in the Fund for over 4 years and has delivered good returns over that period. St. Jude has proven very adept at developing new products with large addressable end markets. This product innovation has driven compounded annual growth in sales of greater than 20% over the last 4 years. Nevertheless, the company has recently experienced a slowing growth rate for its products as the potential patient population for its devices has become more fully penetrated by St. Jude and its competitors. While we believe St. Jude has an enviable franchise, we have become increasingly concerned that the market slowdown could last for an extended period of time. As a result, we have trimmed the position considerably. We continue to monitor market trends closely and, for now, hold our remaining St. Jude shares given their reasonable current valuation.

We also experienced disappointing performance from a more recent purchase, Patterson Companies. Established in 1877, Patterson is a dental and veterinary supply distributor that has an enviable long-term track record of earnings growth, most recently having compounded earnings growth of 21% over the last 9 years. Additionally, the company boasts very high returns on its capital, with returns on equity of 16% or higher each of the last 5 years. As the numbers suggest, this is not the proverbial flash in the pan. I have long admired the company, but I had not owned the stock in the past. In the last 4 quarters the company's growth rate has slowed, causing the stock to underperform sharply. We believe this slowing growth rate is a temporary phenomenon and we initiated a position. In retrospect, we started purchasing too soon, as the stock has continued to perform poorly rel ative to the market since our purchase. Over the long-term we like the opportunity for Patterson to continue to gain share in the very fragmented dental and veterinary markets. We are impressed with the company's 12% operating margins, which are quite strong for a distributor. We have modestly added to our position, as our research suggests signs of better financial results in future periods.

Summary

As I always do in this space, I would like to reiterate to you that I am an investor alongside you in Janus Enterprise Fund. I invest a portion of every paycheck in the Fund and I have never sold a share of the Fund as long as I have managed it. I take the obligation of trust very seriously and work every day to support the trust you have placed in me and in Janus.

Thank you for your investment in Janus Enterprise Fund.

Janus Enterprise Fund At a Glance

5 Largest Contributors to Performance – Holdings

| Contribution | |||||||

| Celgene Corp. Biopharmaceutical company - U.S. | 1.44 | % | |||||

| Terex Corp. Diversified global manufacturer - U.S. | 0.87 | % | |||||

| Thor Industries, Inc. Recreation vehicle producer/seller - U.S. | 0.81 | % | |||||

| Advanced Micro Devices, Inc. Integrated circuits provider - U.S. | 0.79 | % | |||||

| Lamar Advertising Co. Outdoor advertising company - U.S. | 0.74 | % | |||||

5 Largest Detractors from Performance – Holdings

| Contribution | |||||||

| Reliant Energy, Inc. Electricity and energy services provider - U.S. | (0.28 | %) | |||||

| St. Jude Medical, Inc. Cardiovascular medical devices servicer - U.S. | (0.25 | %) | |||||

| Patterson Companies, Inc. Dental, veterinary and rehabilitation supplies distributor - U.S. | (0.24 | %) | |||||

| Alcon, Inc. (U.S. Shares) Eye care company - U.S. | (0.22 | %) | |||||

| Coventry Health Care, Inc. Managed company - U.S. | (0.14 | %) | |||||

5 Largest Contributors to Performance – Sectors

| Fund Contribution | Fund Weighting (% of Net Assets) | Primary Benchmark Weighting | |||||||||||||

| Semiconductor & Semiconductor Equipment | 1.79 | % | 7.67 | % | 7.46 | % | |||||||||

| Pharmaceuticals & Biotechnology | 1.78 | % | 8.35 | % | 5.58 | % | |||||||||

| Capital Goods | 1.61 | % | 4.27 | % | 7.58 | % | |||||||||

| Diversified Financials | 1.51 | % | 6.82 | % | 4.80 | % | |||||||||

| Media | 1.02 | % | 5.17 | % | 3.82 | % | |||||||||

5 Lowest Contributors/Detractors to Performance – Sectors

| Fund Contribution | Fund Weighting (% of Net Assets) | Primary Benchmark Weighting | |||||||||||||

| Utilities | (0.28 | %) | 0.01 | % | 0.91 | % | |||||||||

| Banks | 0.00 | % | 0.19 | % | 1.65 | % | |||||||||

| Food & Staples Retailing | 0.00 | % | 0.00 | % | 0.52 | % | |||||||||

| Household & Personal Products | 0.00 | % | 0.40 | % | 0.61 | % | |||||||||

| Materials | 0.01 | % | 3.77 | % | 2.98 | % | |||||||||

Janus Growth Funds April 30, 2006 15

Janus Enterprise Fund (unaudited)

5 Largest Equity Holdings – (% of Net Assets)

| As of April 30, 2006 | |||

| Lamar Advertising Co. Advertising Sales | 3.4 | % | |||||

| Celgene Corp. Medical - Biomedical and Genetic | 3.4 | % | |||||

| EOG Resources, Inc. Oil Companies - Exploration and Production | 3.0 | % | |||||

| T. Rowe Price Group, Inc. Investment Management and Advisory Services | 2.5 | % | |||||

| Nextel Partners, Inc. - Class A Cellular Telecommunications | 2.4 | % | |||||

| 14.7 | % | ||||||

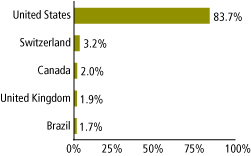

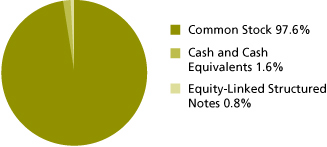

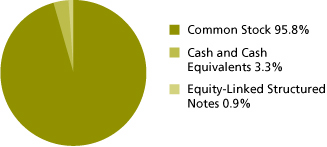

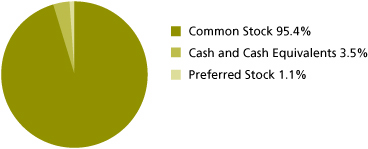

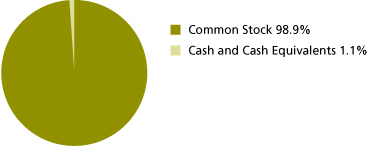

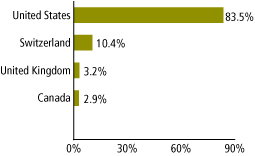

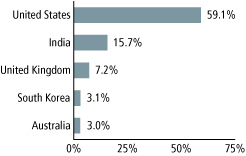

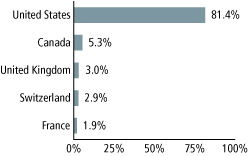

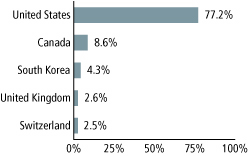

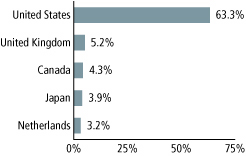

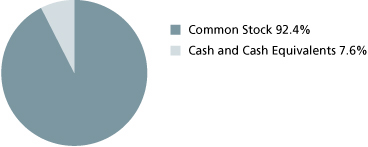

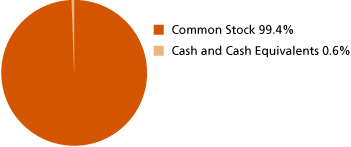

Asset Allocation – (% of Net Assets)

| As of April 30, 2006 | |||

Emerging markets comprised 0.4% of total net assets.

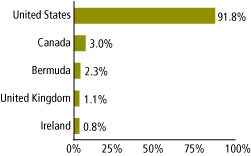

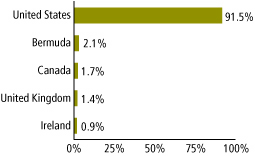

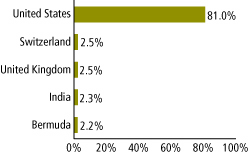

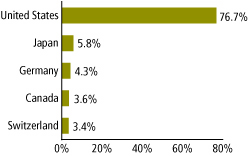

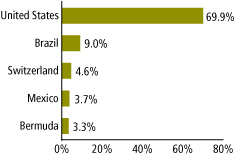

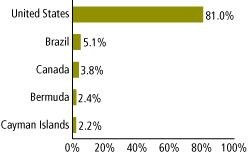

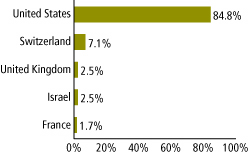

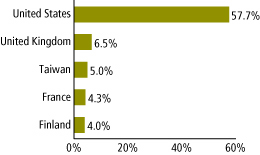

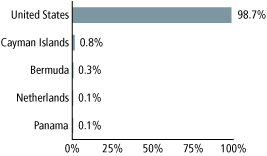

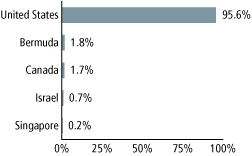

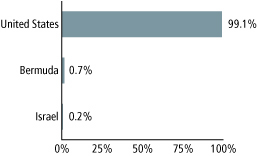

5 Largest Country Allocations – (% of Investment Securities)

| As of April 30, 2006 | As of October 31, 2005 | ||||||

|  | ||||||

16 Janus Growth Funds April 30, 2006

(unaudited)

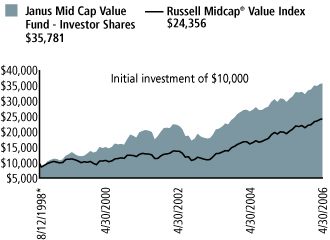

Performance

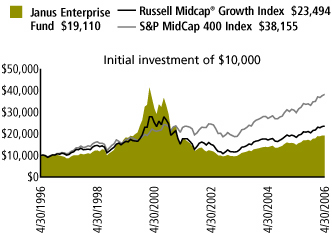

Average Annual Total Return – for the periods ended April 30, 2006

| Fiscal Year-to-Date | One Year | Five Year | Ten Year | Since Inception* | |||||||||||||||||||

| Janus Enterprise Fund | 14.29 | % | 29.21 | % | 1.87 | % | 6.69 | % | 11.63 | % | |||||||||||||

| Russell Midcap® Growth Index | 15.18 | % | 28.27 | % | 5.77 | % | 8.92 | % | 11.38 | % | |||||||||||||

| S&P MidCap 400 Index | 15.27 | % | 28.32 | % | 10.73 | % | 14.33 | % | 15.07 | % | |||||||||||||

| Lipper Quartile | N/A | 3 | rd | 3 | rd | 3 | rd | 2 | nd | ||||||||||||||

| Lipper Ranking - based on total return for Mid-Cap Growth Funds | N/A** | 324/563 | 257/357 | 88/128 | 20/49 | ||||||||||||||||||

Visit janus.com to view up to date performance and characteristic information

Data presented represents past performance, which is no guarantee of future results. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, current performance may be higher or lower than the performance shown. Call 800.525.3713 or visit www.janus.com for performance current to the most recent month-end.

See Notes to Schedules of Investments for index definitions.

Total return includes reinvestment of dividends, distributions and capital gains. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The date of the Lipper ranking is slightly different from when the Fund began operations since Lipper provides fund rankings as of the last day of the month or the first Thursday after fund inception.

*The Fund's inception date – September 1, 1992

**The Fund's fiscal year-to-date Lipper ranking is not available.

See "Explanations of Charts, Tables and Financial Statements."

The Fund's portfolio may differ significantly from the securities held in the indices. The indices are not available for direct investment; therefore their performance does not reflect the expenses associated with the active management of an actual portfolio.

There is no assurance that the investment process will consistently lead to successful investing.

Lipper Inc. - A Reuters Company, is a nationally recognized organization that ranks the performance of mutual funds within a universe of funds that have similar investment objectives. Rankings are historical with capital gains and dividends reinvested.

Funds that emphasize investments in small-sized companies may experience greater price volatility.

Fund Expenses

The example below shows you the ongoing costs (in dollars) of investing in your Fund and allows you to compare these costs with those of other mutual funds. Please refer to page 5 for a detailed explanation of the information presented in these charts.

| Expense Example | Beginning Account Value (11/1/05) | Ending Account Value (4/30/06) | Expenses Paid During Period (11/1/05-4/30/06)* | ||||||||||||

| Actual | $ | 1,000.00 | $ | 1,142.90 | $ | 5.21 | |||||||||

| Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,019.93 | $ | 4.91 | |||||||||

*Expenses are equal to the annualized expense ratio of 0.98%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Janus Growth Funds April 30, 2006 17

Janus Enterprise Fund

Schedule of Investments (unaudited)

As of April 30, 2006

| Shares or Principal Amount | Value | ||||||||||

| Common Stock - 97.6% | |||||||||||

| Advertising Sales - 3.4% | |||||||||||

| 1,167,170 | Lamar Advertising Co.* | $ | 64,182,677 | ||||||||

| Agricultural Chemicals - 1.3% | |||||||||||

| 268,530 | Potash Corporation of Saskatchewan, Inc. (U.S. Shares) | 25,424,420 | |||||||||

| Airlines - 0.9% | |||||||||||

| 372,978 | Ryanair Holdings PLC (ADR)*,# | 17,559,804 | |||||||||

| Apparel Manufacturers - 0.8% | |||||||||||

| 445,600 | Coach, Inc.* | 14,713,712 | |||||||||

| Applications Software - 0.5% | |||||||||||

| 221,060 | Citrix Systems, Inc.* | 8,824,715 | |||||||||

| Batteries and Battery Systems - 0.4% | |||||||||||

| 139,195 | Energizer Holdings, Inc.*,# | 7,119,824 | |||||||||

| Broadcast Services and Programming - 0.4% | |||||||||||

| 545,665 | CKX, Inc.*,# | 7,699,333 | |||||||||

| Building - Mobile Home and Manufactured Homes - 1.2% | |||||||||||

| 433,475 | Thor Industries, Inc. | 21,881,818 | |||||||||

| Building - Residential and Commercial - 1.0% | |||||||||||

| 25,410 | NVR, Inc.*,# | 19,184,550 | |||||||||

| Casino Services - 0.8% | |||||||||||

| 391,190 | Scientific Games Corp. - Class A*,# | 14,900,427 | |||||||||

| Cellular Telecommunications - 2.4% | |||||||||||

| 1,609,163 | Nextel Partners, Inc. - Class A*,# | 45,603,679 | |||||||||

| Coal - 0.5% | |||||||||||

| 401,000 | Alpha Natural Resources, Inc.*,# | 10,069,110 | |||||||||

| Commercial Banks - 0.5% | |||||||||||

| 183,970 | SVB Financial Group*,# | 9,340,157 | |||||||||

| Commercial Services - 0.9% | |||||||||||

| 420,962 | Iron Mountain, Inc.*,# | 16,459,614 | |||||||||

| Commercial Services - Finance - 3.4% | |||||||||||

| 456,910 | Jackson Hewitt Tax Service, Inc.# | 13,652,471 | |||||||||

| 337,111 | Moody's Corp. | 20,904,253 | |||||||||

| 716,691 | Paychex, Inc. | 28,947,149 | |||||||||

| 63,503,873 | |||||||||||

| Computer Services - 1.6% | |||||||||||

| 689,225 | Ceridian Corp.* | 16,699,921 | |||||||||

| 457,655 | IHS, Inc. - Class A*,# | 12,960,790 | |||||||||

| 29,660,711 | |||||||||||

| Computers - 1.0% | |||||||||||

| 257,287 | Apple Computer, Inc.* | 18,110,432 | |||||||||

| Computers - Memory Devices - 0.3% | |||||||||||

| 98,490 | SanDisk Corp.* | 6,286,617 | |||||||||

| Containers - Metal and Glass - 3.0% | |||||||||||

| 888,855 | Ball Corp. | 35,536,423 | |||||||||

| 1,180,980 | Owens-Illinois, Inc.* | 21,588,314 | |||||||||

| 57,124,737 | |||||||||||

| Data Processing and Management - 0.7% | |||||||||||

| 307,850 | NAVTEQ Corp.*,# | 12,781,932 | |||||||||

| Dental Supplies and Equipment - 0.8% | |||||||||||

| 481,330 | Patterson Companies, Inc.*,# | 15,681,731 | |||||||||

| Diagnostic Kits - 1.5% | |||||||||||

| 721,650 | Dade Behring Holdings, Inc. | 28,144,350 | |||||||||

| Shares or Principal Amount | Value | ||||||||||

| Distribution/Wholesale - 0.7% | |||||||||||

| 886,500 | Esprit Holdings, Ltd. | $ | 7,077,548 | ||||||||

| 2,278,000 | Li & Fung, Ltd. | 5,406,111 | |||||||||

| 12,483,659 | |||||||||||