|

| OMB APPROVAL | ||

|

| OMB Number: | 3235-0570 | |

|

| Expires: | April 30, 2008 | |

| UNITED STATES | Estimated average burden hours per response. . . . . . . . . . . . . . . . .19.4 | ||

| SECURITIES AND EXCHANGE COMMISSION |

| ||

| Washington, D.C. 20549 |

| ||

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-1879 | ||||||||

| |||||||||

Janus Investment Fund | |||||||||

(Exact name of registrant as specified in charter) | |||||||||

| |||||||||

151 Detroit Street, Denver, Colorado |

| 80206 | |||||||

(Address of principal executive offices) |

| (Zip code) | |||||||

| |||||||||

Stephanie Grauerholz-Lofton, 151 Detroit Street, Denver, Colorado 80206 | |||||||||

(Name and address of agent for service) | |||||||||

| |||||||||

Registrant’s telephone number, including area code: | 303-333-3863 |

| |||||||

| |||||||||

Date of fiscal year end: | 10/31 |

| |||||||

| |||||||||

Date of reporting period: | 4/30/07 |

| |||||||

Item 1 - Reports to Shareholders

2007 Semiannual Report

Janus Growth Funds

Growth

Janus Fund

Janus Enterprise Fund

Janus Orion Fund

Janus Research Fund

Janus Triton Fund

Janus Twenty Fund

Janus Venture Fund

Specialty Growth

Janus Global Life Sciences Fund

Janus Global Technology Fund

Look Inside. . .

• Portfolio management perspective

• Investment strategy behind your fund

• Fund performance, characteristics and holdings

Table of Contents

Janus Growth Funds

| Co-Chief Investment Officers' Letter to Shareholders | 1 | ||||||

| Useful Information About Your Fund Report | 4 | ||||||

| Management Commentaries and Schedules of Investments | |||||||

| Janus Fund | 5 | ||||||

| Janus Enterprise Fund | 13 | ||||||

| Janus Orion Fund | 21 | ||||||

| Janus Research Fund | 29 | ||||||

| Janus Triton Fund | 37 | ||||||

| Janus Twenty Fund | 45 | ||||||

| Janus Venture Fund | 51 | ||||||

| Janus Global Life Sciences Fund | 59 | ||||||

| Janus Global Technology Fund | 66 | ||||||

| Statements of Assets and Liabilities | 74 | ||||||

| Statements of Operations | 76 | ||||||

| Statements of Changes in Net Assets | 78 | ||||||

| Financial Highlights | 82 | ||||||

| Notes to Schedules of Investments | 87 | ||||||

| Notes to Financial Statements | 91 | ||||||

| Additional Information | 102 | ||||||

| Explanations of Charts, Tables and Financial Statements | 105 | ||||||

Please consider the charges, risks, expenses and investment objectives carefully before investing. For a prospectus containing this and other information, please call Janus at 1-800-525-3713 or download the file from www.janus.com. Read it carefully before you invest or send money.

Co–Chief Investment Officers' Letter to the Shareholders

Jonathan Coleman

Co-Chief Investment Officer

Gibson Smith

Co-Chief Investment Officer

Dear Shareholders,

We would like to thank you for your investment in the Janus Funds. Your support is what drives us in our quest to deliver strong, consistent fund performance.

Major Market Themes

Equity markets delivered healthy gains during the six months ended April 30, 2007, amid continued evidence of strong U.S. economic growth with modest inflation. Despite a brief bout of market volatility in late February and early March, markets rebounded quickly on hopes of monetary easing by the Federal Reserve (Fed). While U.S. corporate profit growth showed signs of slowing, robust mergers and acquisitions (M&A) and private equity transactions continued to provide valuation support to equities in the U.S. and around the globe.

Continued Strong Performance

We are pleased to report that several fund managers continued to deliver strong performance compared to their peers. For the one-year period ended April 30, 2007, 81% of Janus' retail funds ranked within Lipper's top two quartiles based on total returns. For the three-year period, 68% of our retail funds achieved first- or second- quartile Lipper rankings, and 67% ranked in Lipper's top two quartiles for the five-year period. (See complete rankings on page 3).

Investment Team Depth

We're proud of the depth we've built in our investment team over the past few years. Recently, we said farewell to several long-term Janus portfolio managers who announced their retirements. In transitioning the leadership of their portfolios, we're confident that our investment team bench strength will ensure smooth transitions.

Management of Janus Global Life Sciences Fund will reside in the capable hands of Andy Acker. Barney Wilson will assume sole portfolio management responsibilities for Janus Global Technology Fund. In addition, Gibson Smith and Darrell Watters, with more than 33 years of combined investment experience, will co-manage Janus Flexible Bond Fund. Jason Groom, a seasoned fixed-income professional with 13 years of investment experience, will assume co-portfolio management responsibilities with Darrell Watters for Janus Short-Term Bond Fund, previously managed by Gibson Smith. Lastly, Craig Jacobson will join Eric Thorderson as Co-Portfolio Manager of all Janus money market funds, with the exception of Janus Tax-Exempt Money Market Fund, for which he will be sole Portfolio Manager.

It's important to note that we will continue to focus on the same investment objectives and employ the same in-depth, fundamental analysis and company-by-company approach to portfolio construction that are Janus hallmarks. We believe all of these individuals possess the skills and experience necessary to lead your Funds to strong performance.

Outlook

Looking ahead, with most U.S. equity indexes near all-time highs at the end of the period, we will closely monitor several fundamental factors for directional cues. First, despite the weakness in the U.S. housing sector and the associated credit quality issues in the subprime mortgage market, the U.S. unemployment rate was near historic lows. We intend to watch the labor market closely for any sign of a slowdown that could impact consumer sentiment and economic growth. Similarly, we plan to monitor the higher-quality prime mortgage market and other areas of consumer lending for any indication of credit quality deterioration.

Second, U.S. corporate profit growth has experienced double-digit gains for several years, which, combined with strong liquidity from corporate M&A and private equity transactions, has supported higher equity valuations. We will continue to watch both the future path of corporate earnings and the overall liquidity in the markets to determine whether current valuations can be sustained.

In summary, while there are both positive and negative factors that could influence the markets in the coming months, we view the fundamental economic outlook as positive. While inflationary concerns and questions about the strength of consumer spending abound, we feel valuations for equities are reasonable by historic standards. In fact, as overall economic growth slows, investors could place an increasing premium on the shares of companies with strong growth prospects. We believe Janus' fundamental research can be beneficial in such an environment. Regardless of the macroeconomic

Janus Growth Funds April 30, 2007 1

Continued

climate, we remain dedicated to rewarding your confidence in Janus with strong, consistent fund performance.

Sincerely,

Jonathan Coleman

Co-Chief Investment Officer

Gibson Smith

Co-Chief Investment Officer

2 Janus Growth Funds April 30, 2007

Lipper Rankings (unaudited)

| Lipper Rankings – Based on total return as of 4/30/07 | |||||||||||||||||||||||||||||||||||||||||||||||

| ONE YEAR | THREE YEAR | FIVE YEAR | TEN YEAR | SINCE INCEPTION | |||||||||||||||||||||||||||||||||||||||||||

| LIPPER CATEGORY | PERCENTILE RANK (%) | RANK/ TOTAL FUNDS | PERCENTILE RANK (%) | RANK/ TOTAL FUNDS | PERCENTILE RANK (%) | RANK/ TOTAL FUNDS | PERCENTILE RANK (%) | RANK/ TOTAL FUNDS | PERCENTILE RANK (%) | RANK/ TOTAL FUNDS | |||||||||||||||||||||||||||||||||||||

| Janus Investment Fund | |||||||||||||||||||||||||||||||||||||||||||||||

| (Inception Date) | |||||||||||||||||||||||||||||||||||||||||||||||

| Janus Fund (2/70) | Large-Cap Growth Funds | 5 | 34/723 | 19 | 117/620 | 29 | 147/506 | 38 | 74/195 | 10 | 2/20 | ||||||||||||||||||||||||||||||||||||

| Janus Enterprise Fund(1) (9/92) | Mid-Cap Growth Funds | 5 | 26/628 | 11 | 53/499 | 6 | 21/393 | 45 | 72/161 | 34 | 17/49 | ||||||||||||||||||||||||||||||||||||

| Janus Orion Fund (6/00) | Multi-Cap Growth Funds | 13 | 62/497 | 2 | 5/395 | 5 | 13/317 | N/A | N/A | 29 | 66/232 | ||||||||||||||||||||||||||||||||||||

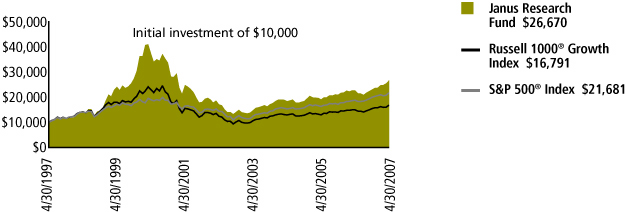

| Janus Research Fund(1)(2) (5/93) | Large-Cap Growth Funds | 1 | 1/723 | 2 | 9/620 | 3 | 11/506 | 1 | 1/195 | 2 | 1/81 | ||||||||||||||||||||||||||||||||||||

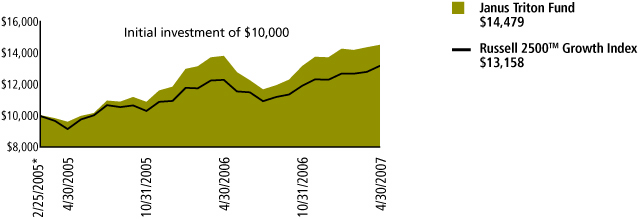

| Janus Triton Fund(1) (2/05) | Small-Cap Growth Funds | 33 | 178/536 | N/A | N/A | N/A | N/A | N/A | N/A | 4 | 21/476 | ||||||||||||||||||||||||||||||||||||

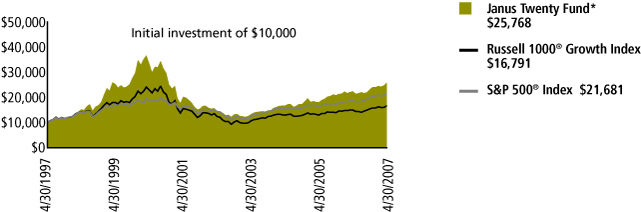

| Janus Twenty Fund* (4/85) | Large-Cap Growth Funds | 2 | 9/723 | 1 | 3/620 | 1 | 3/506 | 3 | 4/195 | 3 | 1/40 | ||||||||||||||||||||||||||||||||||||

| Janus Venture Fund* (4/85) | Small-Cap Growth Funds | 3 | 11/536 | 7 | 29/437 | 10 | 33/364 | 27 | 39/147 | 10 | 1/10 | ||||||||||||||||||||||||||||||||||||

| Janus Global Life Sciences Fund (12/98) | Health/Biotechnology Funds | 79 | 134/169 | 50 | 75/151 | 56 | 74/132 | N/A | N/A | 38 | 18/47 | ||||||||||||||||||||||||||||||||||||

| Janus Global Technology Fund (12/98) | Science & Technology Funds | 33 | 94/287 | 32 | 83/260 | 52 | 125/241 | N/A | N/A | 27 | 20/75 | ||||||||||||||||||||||||||||||||||||

| Janus Balanced Fund(1) (9/92) | Mixed-Asset Target Allocation Moderate Funds | 25 | 102/423 | 17 | 53/319 | 39 | 81/212 | 6 | 6/113 | 4 | 1/29 | ||||||||||||||||||||||||||||||||||||

| Janus Contrarian Fund (2/00) | Multi-Cap Core Funds | 1 | 2/897 | 1 | 1/661 | 1 | 2/479 | N/A | N/A | 11 | 31/323 | ||||||||||||||||||||||||||||||||||||

| Janus Fundamental Equity Fund(1) (6/96) | Large-Cap Core Funds | 90 | 713/795 | 1 | 10/670 | 7 | 41/567 | 1 | 2/255 | 1 | 1/212 | ||||||||||||||||||||||||||||||||||||

| Janus Growth and Income Fund(1) (5/91) | Large-Cap Core Funds | 97 | 772/795 | 12 | 79/670 | 28 | 159/567 | 4 | 9/255 | 6 | 4/76 | ||||||||||||||||||||||||||||||||||||

| INTECH Risk-Managed Stock Fund (2/03) | Multi-Cap Core Funds | 49 | 434/897 | 22 | 144/661 | N/A | N/A | N/A | N/A | 32 | 172/548 | ||||||||||||||||||||||||||||||||||||

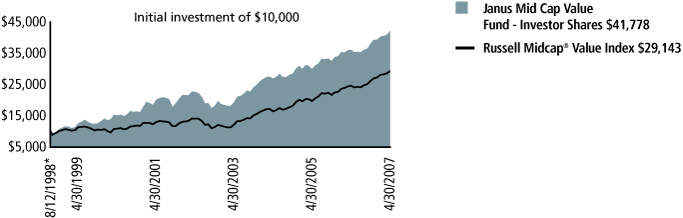

| Janus Mid Cap Value Fund - Inv(1)(3) (8/98) | Mid-Cap Value Funds | 43 | 128/300 | 63 | 147/232 | 41 | 73/178 | N/A | N/A | 6 | 4/68 | ||||||||||||||||||||||||||||||||||||

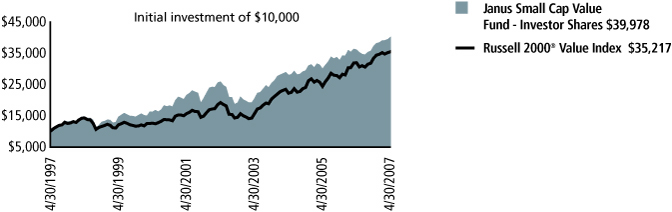

| Janus Small Cap Value Fund - Inv*(3) (10/87) | Small-Cap Core Funds | 14 | 98/713 | 74 | 410/556 | 81 | 350/432 | 11 | 16/145 | 16 | 21/132 | ||||||||||||||||||||||||||||||||||||

| Janus Federal Tax-Exempt Fund(1) (5/93) | General Municipal Debt Funds | 56 | 135/241 | 71 | 164/230 | 72 | 155/216 | 79 | 109/137 | 80 | 55/68 | ||||||||||||||||||||||||||||||||||||

| Janus Flexible Bond Fund(1) (7/87) | Intermediate Investment Grade Debt Funds | 38 | 198/530 | 52 | 226/442 | 18 | 65/380 | 31 | 54/174 | 24 | 6/24 | ||||||||||||||||||||||||||||||||||||

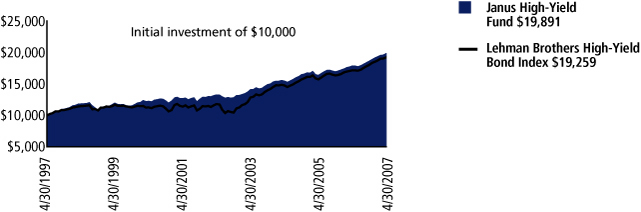

| Janus High-Yield Fund(1) (12/95) | High Current Yield Funds | 40 | 174/443 | 39 | 146/378 | 68 | 209/308 | 16 | 20/127 | 5 | 5/99 | ||||||||||||||||||||||||||||||||||||

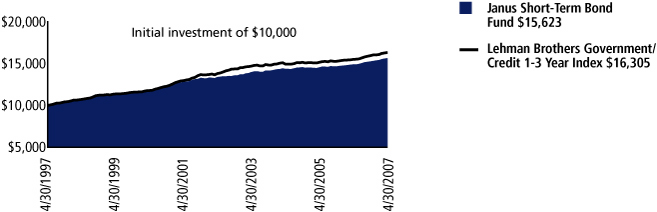

| Janus Short-Term Bond Fund(1) (9/92) | Short Investment Grade Debt Funds | 53 | 126/237 | 51 | 101/199 | 46 | 65/142 | 41 | 32/79 | 54 | 13/24 | ||||||||||||||||||||||||||||||||||||

| Janus Global Opportunities Fund(1) (6/01) | Global Funds | 33 | 132/399 | 94 | 281/301 | 85 | 198/234 | N/A | N/A | 24 | 49/209 | ||||||||||||||||||||||||||||||||||||

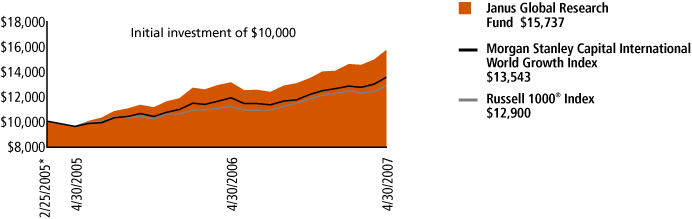

| Janus Global Research Fund(1)(4) (2/05) | Multi-Cap Growth Funds | 4 | 15/497 | N/A | N/A | N/A | N/A | N/A | N/A | 1 | 4/424 | ||||||||||||||||||||||||||||||||||||

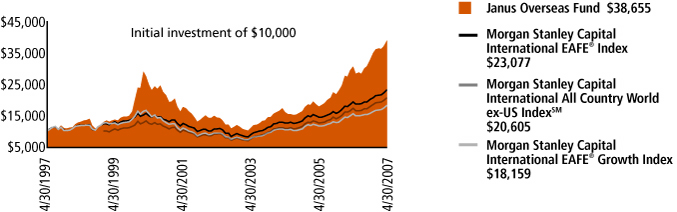

| Janus Overseas Fund(1) (5/94) | International Funds | 1 | 1/987 | 1 | 1/803 | 2 | 12/661 | 4 | 11/280 | 1 | 1/117 | ||||||||||||||||||||||||||||||||||||

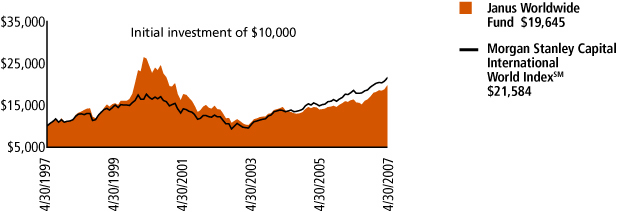

| Janus Worldwide Fund(1) (5/91) | Global Funds | 7 | 25/399 | 90 | 270/301 | 96 | 225/234 | 69 | 66/96 | 32 | 5/15 | ||||||||||||||||||||||||||||||||||||

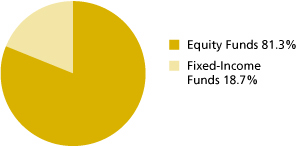

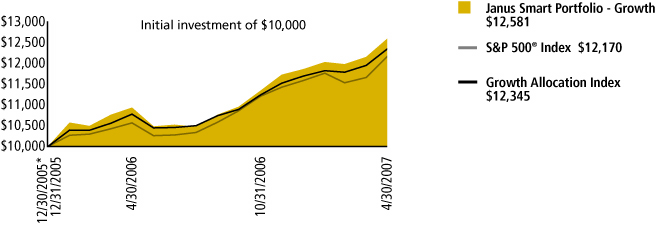

| Janus Smart Portfolio - Growth (12/05) | Mixed-Asset Target Allocation Growth Funds | 11 | 64/609 | N/A | N/A | N/A | N/A | N/A | N/A | 7 | 41/598 | ||||||||||||||||||||||||||||||||||||

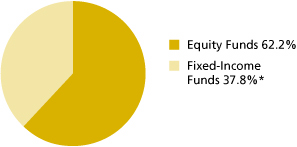

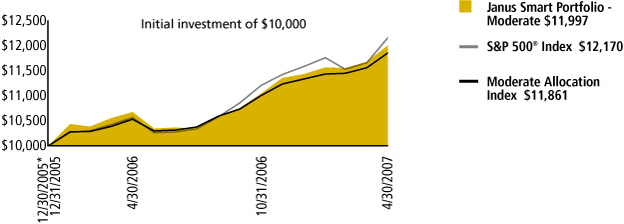

| Janus Smart Portfolio - Moderate (12/05) | Mixed-Asset Target Allocation Moderate Funds | 18 | 73/423 | N/A | N/A | N/A | N/A | N/A | N/A | 9 | 35/417 | ||||||||||||||||||||||||||||||||||||

| Janus Smart Portfolio - Conservative (12/05) | Mixed-Asset Target Allocation Conservative Funds | 8 | 28/365 | N/A | N/A | N/A | N/A | N/A | N/A | 4 | 11/344 | ||||||||||||||||||||||||||||||||||||

(1)The date of the Lipper ranking is slightly different from when the Fund began operations since Lipper provides fund rankings as of the last day of the month or the first Thursday after fund inception.

(2)Formerly named Janus Mercury Fund.

(3)Rating is for the Investor Share class only; other classes may have different performance characteristics.

(4)Formerly named Janus Research Fund.

*Closed to new investors.

Data presented represents past performance, which is no guarantee of future results.

There is no assurance that the investment process will consistently lead to successful investing.

Lipper Inc. - A Reuters Company, is a nationally recognized organization that ranks the performance of mutual funds within a universe of funds that have similar investment objectives. Rankings are historical with capital gains and dividends reinvested.

Janus Growth Funds April 30, 2007 3

Useful Information About Your Fund Report

Management Commentaries

The Management Commentaries in this report include valuable insight from the Funds' managers as well as statistical information to help you understand how your Fund's performance and characteristics stack up against those of comparable indices.

Please keep in mind that the opinions expressed by the Funds' managers in the Management Commentaries are just that: opinions. They are a reflection of their best judgment at the time this report was compiled, which was April 30, 2007. As the investing environment changes, so could their opinions. These views are unique to each manager and aren't necessarily shared by their fellow employees or by Janus in general.

Fund Expenses

We believe it's important for our shareholders to have a clear understanding of Fund expenses and the impact they have on investment return.

The following is important information regarding each Fund's Expense Example, which appears in each Fund's Management Commentary within this Semiannual Report. Please refer to this information when reviewing the Expense Example for each Fund.

Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including redemption fees (where applicable) (and any related exchange fees) and (2) ongoing costs, including management fees and other Fund expenses. The example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the six-month period from November 1, 2006 to April 30, 2007.

Actual Expenses

The first line of the table in each example provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During the Period" to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The second line of the table in each example provides information about hypothetical account values and hypothetical expenses based upon the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Janus Capital Management LLC ("Janus Capital") has contractually agreed to waive Janus Triton Fund's total operating expenses, excluding brokerage commissions, interest, taxes and extraordinary expenses, to certain limits until at least March 1, 2008. Expenses in the example reflect the application of this waiver. Had the waiver not been in effect, your expenses would have been higher. More information regarding the waiver is available in the Funds' prospectuses.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as redemption fees (where applicable). These fees are fully described in the prospectus. Therefore, the second line of each table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

4 Janus Growth Funds April 30, 2007

Janus Fund (unaudited)

Ticker: JANSX

Fund Snapshot

For more than 36 years, this traditional growth fund has exemplified Janus' research and stock-picking abilities.

David Corkins

portfolio manager

Let me begin by emphasizing how much I value this opportunity to speak directly with my fellow Janus Fund shareholders. I am pleased to report that performance continued to improve. It was particularly satisfying to see that last year's actions – shrinking the names in the portfolio, leveraging the full resources of the research team and diversifying the portfolio more broadly among sectors – began to have a positive impact on performance.

Performance Overview

Equity markets delivered healthy gains during the period amid continued evidence of strong U.S. economic growth with modest inflation. After a brief period of market volatility in late February and early March, markets rebounded quickly on hopes of monetary easing by the Federal Reserve (Fed). While U.S. corporate profit growth showed signs of slowing, robust mergers and acquisitions (M&A) and private equity transactions continued to provide key valuation support to equities in the U.S. and around the globe.

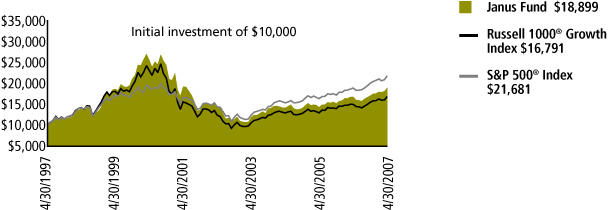

My goal for the Fund is to provide superior long-term returns for shareholders. In practice, these potential long-term returns begin with positive absolute performance and follow with consistent execution in up and down markets. For the six months ending April 30, 2007, Janus Fund returned 10.98%. By comparison, the Fund's primary benchmark, the Russell 1000® Growth Index returned 8.42% and our secondary benchmark the S&P 500® Index returned 8.60%.

Utilities and Industrials Boosted Performance

Within the Fund, holdings within the industrial, consumer discretionary and utilities sectors made positive contributions to performance during the period.

Among the utility holdings, wholesale power provider, NRG Energy, generated significant gains and was the largest individual contributor to performance for the six-month period. I was initially attracted to NRG last year due to what I saw as its reasonable valuation, high free cash generation, improving returns on capital and a management team that is focused on shareholder value-creation. A buy-out of Texas-based TXU, a smaller holding in the portfolio, which also contributed positively to performance, refocused investor attention on the utility industry and led to a revaluation of the group.

Within industrials, Precision Castparts, a supplier to Boeing and other aerospace manufacturers, benefited from Boeing's market share gains in the wide body commercial aircraft market. Precision Castparts also reported improved margins and returns in its specialty metals division. While remaining constructive on the outlook for the company, I trimmed back the position as the risk/reward profile changed due to the strong increase in the share price.

It should be noted that Boeing was also a top contributor to performance for the time period, driven in part by better-than-expected margins. The company has been able to gain market share at Airbus' expense, given operational difficulties by its competitor.

Looking within the healthcare sector, Coventry Health Care moved ahead after it reported improved financial results for 2007 based on market share gains in its Medicare business. Coventry has appealing membership growth, numerous opportunities to raise margins and an attractive valuation.

Information Technology (IT) and Consumer Staples Holdings Detract From Performance

The Fund holdings within the IT and consumer staples sectors detracted from performance during the time period.

The single largest detractor from performance was Advanced Micro Devices (AMD). Our initial thesis on AMD centered on its manufacturing advantages and the potential to improve margins and returns as the company captured market share from its competitor, Intel. However, AMD's fundamental outlook has been negatively impacted by the price war taking place between it and Intel, as well as industry oversupply issues. I also thought that the company's 2006 acquisition of ATI Technologies severely diluted returns on capital. For these reasons, I elected to exit the position during the period.

Another stock that negatively impacted performance was food retailer, Whole Foods Market, which declined after reporting that comparable store sales had moderated to an 8.6% level after posting years of double-digit gains. The company also guided down future comparable store expectations. I have maintained exposure to the name, given the continued robust

Janus Growth Funds April 30, 2007 5

Janus Fund (unaudited)

outlook for growth as Whole Foods seeks to expand its store base over the next few years.

While, in the aggregate, the Fund's healthcare investments made a positive contribution to performance, select holdings declined during the time period. Varian Medical Systems, a manufacturer and distributor of laser-guided radiation therapy instruments, reported inconsistent order growth from both their domestic and international businesses. From a macro perspective, I remain constructive on the outlook for the business, driven by higher rates of cancer, increases in the number of patients qualifying for radiation treatment and reasonable reimbursement rates.

Outlook

With most U.S. equity indexes near all-time highs at the end of the period, we will closely monitor several fundamental factors for directional cues. First, despite the weakness in the U.S. housing sector and the associated credit quality issues in the subprime mortgage market, the U.S. unemployment rate was near historic lows, mitigating the impact of the housing slowdown on consumer spending and the overall U.S. economy. We will watch the labor market closely for any sign of a slowdown that could impact consumer sentiment and economic growth. Similarly, we will monitor the higher-quality prime mortgage market and other areas of consumer lending for any indication of credit quality deterioration. Second, U.S. corporate profit growth experienced double-digit gains for several years, which, combined with strong liquidity from corporate M&A and private equity transacti ons, supported higher equity valuations.

We will continue to watch both the future path of corporate earnings and the overall liquidity in the markets to determine whether current valuations can be sustained. We will also watch market volatility, which in recent years has been well below average compared to the past 30 years. In my opinion, volatility will likely increase in the future and so my goal is for the Fund to capitalize on the situation.

In sum, I am honored to manage Janus Fund and I want to stress that I believe my investment and incentives are in alignment with yours. Lastly, I want to commend the entire investment team at Janus, who work very hard every day to seek attractive opportunities to grow our principal.

Janus Fund At a Glance

5 Largest Contributors to Performance – Holdings

| Contribution | |||||||

| NRG Energy, Inc. | 1.14 | % | |||||

| Precision Castparts Corp. | 0.83 | % | |||||

| Boeing Co. | 0.57 | % | |||||

| Coventry Health Care, Inc. | 0.42 | % | |||||

| JP Morgan Chase & Co. | 0.40 | % | |||||

5 Largest Detractors from Performance – Holdings

| Contribution | |||||||

| Advanced Micro Devices, Inc. | (0.50 | )% | |||||

| Whole Foods Market, Inc. | (0.30 | )% | |||||

| Varian Medical Systems, Inc. | (0.12 | )% | |||||

| SanDisk Corp. | (0.09 | )% | |||||

| Electronic Arts, Inc. | (0.08 | )% | |||||

5 Largest Contributors to Performance – Sectors

| Fund Contribution | Fund Weighting (% of Net Assets) | Russell 1000® Growth Index Weighting | |||||||||||||

| Industrials | 2.29 | % | 14.20 | % | 14.32 | % | |||||||||

| Consumer Discretionary | 1.71 | % | 10.57 | % | 14.20 | % | |||||||||

| Health Care | 1.62 | % | 13.15 | % | 17.46 | % | |||||||||

| Utilities | 1.22 | % | 3.86 | % | 1.43 | % | |||||||||

| Financials | 1.13 | % | 14.84 | % | 8.54 | % | |||||||||

5 Lowest Contributors to Performance – Sectors

| Fund Contribution | Fund Weighting (% of Net Assets) | Russell 1000® Growth Index Weighting | |||||||||||||

| Telecommunication Services | 0.26 | % | 3.02 | % | 0.90 | % | |||||||||

| Consumer Staples | 0.63 | % | 9.35 | % | 9.77 | % | |||||||||

| Energy | 0.86 | % | 5.95 | % | 4.01 | % | |||||||||

| Materials | 0.93 | % | 4.34 | % | 2.84 | % | |||||||||

| Information Technology | 1.10 | % | 20.73 | % | 26.54 | % | |||||||||

6 Janus Growth Funds April 30, 2007

(unaudited)

5 Largest Equity Holdings – (% of Net Assets)

| As of April 30, 2007 | |||||||

| JP Morgan Chase & Co. Finance - Investment Bankers/Brokers | 3.5 | % | |||||

| Boeing Co. Aerospace and Defense | 3.3 | % | |||||

| Procter & Gamble Co. Cosmetics and Toiletries | 3.1 | % | |||||

| Exxon Mobil Corp. Oil Companies - Integrated | 2.9 | % | |||||

| Roche Holding A.G. Medical - Drugs | 2.8 | % | |||||

| 15.6 | % | ||||||

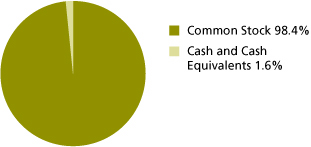

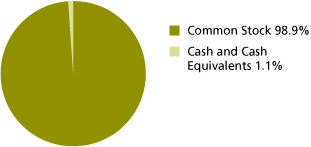

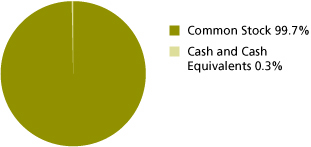

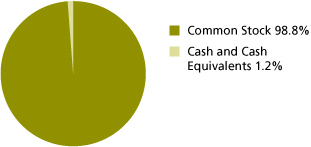

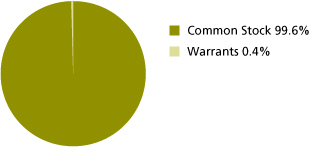

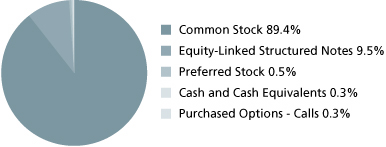

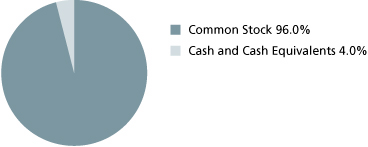

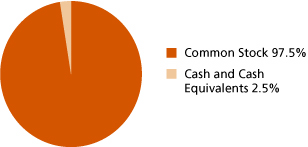

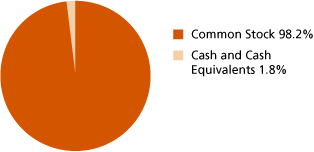

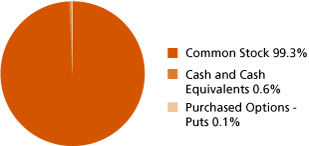

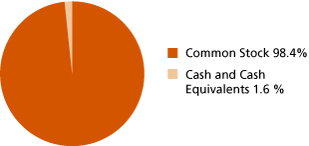

Asset Allocation – (% of Net Assets)

| As of April 30, 2007 | |||

Emerging markets comprised 1.0% of total net assets.

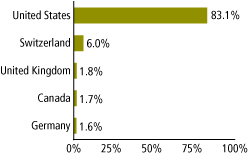

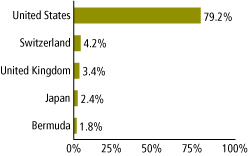

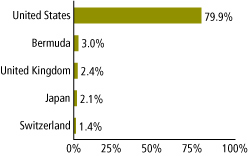

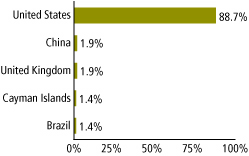

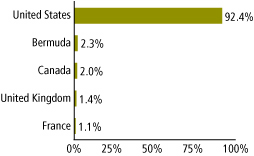

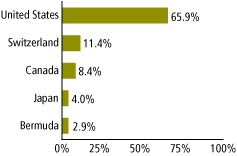

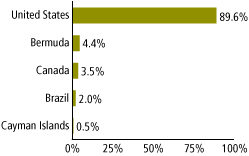

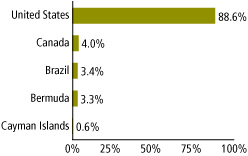

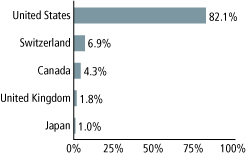

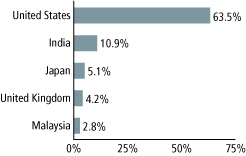

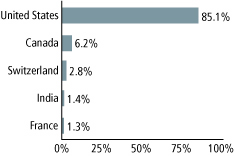

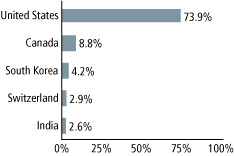

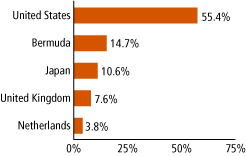

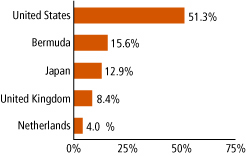

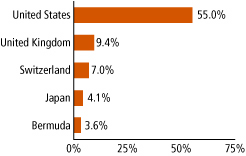

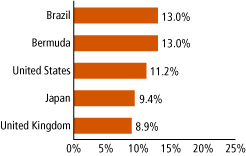

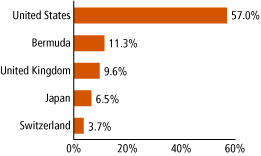

Top Country Allocations – Long Positions (% of Investment Securities)

| As of April 30, 2007 | As of October 31, 2006 | ||||||

|  | ||||||

Janus Growth Funds April 30, 2007 7

Janus Fund (unaudited)

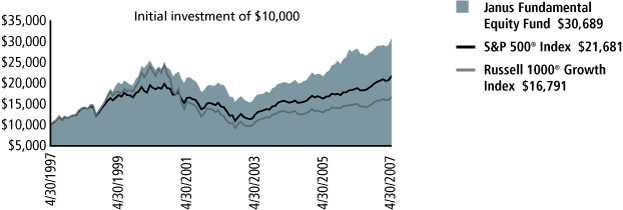

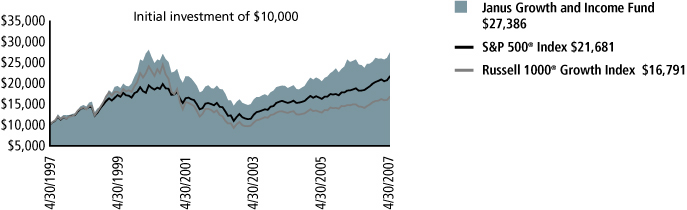

Performance

| Average Annual Total Return – for the periods ended April 30, 2007 | Expense Ratios – for the fiscal year ended October 31, 2006 | ||||||||||||||||||||||||||

| Fiscal Year-to-Date | One Year | Five Year | Ten Year | Since Inception* | Total Annual Fund Operating Expenses | ||||||||||||||||||||||

| Janus Fund | 10.98 | % | 12.79 | % | 5.82 | % | 6.57 | % | 13.83 | % | 0.91 | % | |||||||||||||||

| Russell 1000® Growth Index | 8.42 | % | 12.25 | % | 6.22 | % | 5.32 | % | 11.97 | %** | |||||||||||||||||

| S&P 500® Index | 8.60 | % | 15.24 | % | 8.54 | % | 8.05 | % | 11.51 | % | |||||||||||||||||

| Lipper Quartile | – | 1 | st | 2 | nd | 2 | nd | 1 | st | ||||||||||||||||||

| Lipper Ranking - based on total return for Large-Cap Growth Funds | – | 34/723 | 147/506 | 74/195 | 2/20 | ||||||||||||||||||||||

Visit janus.com to view current performance

and characteristic information

Data presented reflects past performance, which is no guarantee of future results. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, current performance may be higher or lower than the performance shown. Call 800.525.3713 or visit www.janus.com for performance current to the most recent month-end.

The Fund's expense ratios were determined based on average net assets as of the fiscal year ended October 31, 2006. Detailed information is available in the prospectus. All expenses are shown without the effect of expense offset arrangements. Pursuant to such arrangements, credits realized as a result of uninvested cash balances are used to reduce custodian and transfer agent expenses.

The Fund's performance may be affected by risks that include those associated with non-diversification, non-investment grade debt securities, undervalued or overlooked companies, investments in specific industries or countries and potential conflicts of interest with Janus Smart Portfolios. Additional risks to the Fund may include those associated with investing in foreign securities, emerging markets, initial public offerings ("IPO"s), derivatives and companies with relatively small market capitalizations. Please see a Janus prospectus or www.janus.com for more information about risk, portfolio holdings and details.

Total return includes reinvestment of dividends, distributions and capital gains. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Lipper Inc. - A Reuters Company, is a nationally recognized organization that ranks the performance of mutual funds within a universe of funds that have similar investment objectives. Rankings are historical with capital gains and dividends reinvested.

There is no assurance that the investment process will consistently lead to successful investing.

See Notes to Schedules of Investments for index definitions.

The Fund's portfolio may differ significantly from the securities held in the indices. The indices are not available for direct investment; therefore their performance does not reflect the expenses associated with the active management of an actual portfolio.

See "Explanations of Charts, Tables and Financial Statements."

*The Fund's inception date – February 5, 1970

**The Russell 1000® Growth Index's since inception returns are calculated from December 31, 1978.

8 Janus Growth Funds April 30, 2007

(unaudited)

Fund Expenses

The example below shows you the ongoing costs (in dollars) of investing in your Fund and allows you to compare these costs with those of other mutual funds. Please refer to the section Useful Information About Your Fund Report for a detailed explanation of the information presented in these charts.

| Expense Example | Beginning Account Value (11/1/06) | Ending Account Value (4/30/07) | Expenses Paid During Period (11/1/06-4/30/07)* | ||||||||||||

| Actual | $ | 1,000.00 | $ | 1,109.80 | $ | 4.60 | |||||||||

| Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,020.43 | $ | 4.41 | |||||||||

*Expenses are equal to the annualized expense ratio of 0.88%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Janus Growth Funds April 30, 2007 9

Janus Fund

Schedule of Investments (unaudited)

As of April 30, 2007

| Shares or Principal Amount | Value | ||||||||||

| Common Stock - 98.4% | |||||||||||

| Aerospace and Defense - 4.8% | |||||||||||

| 7,834,454 | BAE Systems PLC** | $ | 71,104,166 | ||||||||

| 4,152,015 | Boeing Co.** | 386,137,395 | |||||||||

| 1,173,760 | Lockheed Martin Corp.**,# | 112,845,286 | |||||||||

| 570,086,847 | |||||||||||

| Agricultural Chemicals - 2.8% | |||||||||||

| 2,773,380 | Monsanto Co.# | 163,601,686 | |||||||||

| 820,225 | Syngenta A.G.# | 163,149,973 | |||||||||

| 326,751,659 | |||||||||||

| Agricultural Operations - 0.6% | |||||||||||

| 1,947,565 | Archer-Daniels-Midland Co.# | 75,370,766 | |||||||||

| Audio and Video Products - 0.6% | |||||||||||

| 1,420,200 | Sony Corp.** | 75,646,521 | |||||||||

| Automotive - Cars and Light Trucks - 1.1% | |||||||||||

| 2,044,576 | BMW A.G.**,# | 126,644,657 | |||||||||

| Beverages - Non-Alcoholic - 0.4% | |||||||||||

| 976,155 | Coca-Cola Co.# | 50,945,529 | |||||||||

| Building - Residential and Commercial - 0.5% | |||||||||||

| 66,445 | NVR, Inc.*,# | 54,750,680 | |||||||||

| Casino Hotels - 1.8% | |||||||||||

| 1,415,475 | Harrah's Entertainment, Inc. | 120,740,018 | |||||||||

| 1,132,040 | Station Casinos, Inc. | 98,487,480 | |||||||||

| 219,227,498 | |||||||||||

| Cellular Telecommunications - 1.0% | |||||||||||

| 2,226,110 | America Movil S.A. de C.V. - Series L (ADR) | 116,937,558 | |||||||||

| Chemicals - Diversified - 0.6% | |||||||||||

| 1,068,600 | Shin-Etsu Chemical Company, Ltd.** | 69,150,272 | |||||||||

| Commercial Services - Finance - 0.9% | |||||||||||

| 826,385 | Moody's Corp.# | 54,640,576 | |||||||||

| 2,554,860 | Western Union Co. | 53,779,803 | |||||||||

| 108,420,379 | |||||||||||

| Computers - 3.2% | |||||||||||

| 1,975,165 | Apple, Inc.*,** | 197,121,467 | |||||||||

| 3,083,050 | Hewlett-Packard Co.# | 129,919,727 | |||||||||

| 418,570 | Research In Motion, Ltd. (U.S. Shares)* | 55,075,441 | |||||||||

| 382,116,635 | |||||||||||

| Computers - Memory Devices - 1.8% | |||||||||||

| 13,692,385 | EMC Corp.*,# | 207,850,404 | |||||||||

| Consumer Products - Miscellaneous - 1.1% | |||||||||||

| 1,779,455 | Kimberly-Clark Corp. | 126,643,812 | |||||||||

| Containers - Metal and Glass - 0.8% | |||||||||||

| 1,843,442 | Ball Corp. | 93,444,075 | |||||||||

| Cosmetics and Toiletries - 4.1% | |||||||||||

| 2,743,548 | Avon Products, Inc.# | 109,193,210 | |||||||||

| 5,808,380 | Procter & Gamble Co. | 373,536,917 | |||||||||

| 482,730,127 | |||||||||||

| Data Processing and Management - 0.8% | |||||||||||

| 2,388,592 | Paychex, Inc.# | 88,616,763 | |||||||||

| Distribution/Wholesale - 0.7% | |||||||||||

| 7,139,500 | Esprit Holdings, Ltd. | 86,402,649 | |||||||||

| Diversified Operations - 2.7% | |||||||||||

| 8,798,325 | General Electric Co. | 324,306,260 | |||||||||

| Shares or Principal Amount | Value | ||||||||||

| E-Commerce/Services - 0.8% | |||||||||||

| 2,293,993 | eBay, Inc.*,# | $ | 77,858,122 | ||||||||

| 553,632 | IAC/InterActiveCorp*,# | 21,104,452 | |||||||||

| 98,962,574 | |||||||||||

| Electric - Integrated - 1.6% | |||||||||||

| 2,820,780 | TXU Corp. | 184,986,752 | |||||||||

| Electric Products - Miscellaneous - 0.5% | |||||||||||

| 1,347,030 | Emerson Electric Co. | 63,296,940 | |||||||||

| Electronic Components - Semiconductors - 2.3% | |||||||||||

| 7,987,059 | Texas Instruments, Inc.# | 274,515,218 | |||||||||

| Electronic Forms - 0.7% | |||||||||||

| 2,104,745 | Adobe Systems, Inc.*,# | 87,473,202 | |||||||||

| Enterprise Software/Services - 1.6% | |||||||||||

| 6,094,540 | Oracle Corp.*,# | 114,577,352 | |||||||||

| 1,618,235 | SAP A.G. (ADR)**,# | 77,675,280 | |||||||||

| 192,252,632 | |||||||||||

| Entertainment Software - 1.3% | |||||||||||

| 3,095,341 | Electronic Arts, Inc.*,** | 156,036,140 | |||||||||

| Finance - Consumer Loans - 0.8% | |||||||||||

| 1,863,695 | SLM Corp.# | 100,322,702 | |||||||||

| Finance - Credit Card - 1.3% | |||||||||||

| 2,590,390 | American Express Co. | 157,158,961 | |||||||||

| Finance - Investment Bankers/Brokers - 7.1% | |||||||||||

| 7,859,760 | JP Morgan Chase & Co. | 409,493,495 | |||||||||

| 1,828,110 | Merrill Lynch & Company, Inc. | 164,950,365 | |||||||||

| 2,121,572 | UBS A.G.# | 137,503,265 | |||||||||

| 1,926,370 | UBS A.G. (U.S. Shares) | 125,021,413 | |||||||||

| 836,968,538 | |||||||||||

| Finance - Mortgage Loan Banker - 1.3% | |||||||||||

| 2,692,175 | Fannie Mae# | 158,622,951 | |||||||||

| Finance - Other Services - 0.7% | |||||||||||

| 158,412 | Chicago Mercantile Exchange Holdings, Inc.# | 81,859,401 | |||||||||

| Food - Retail - 0.5% | |||||||||||

| 1,277,315 | Whole Foods Market, Inc.# | 59,765,569 | |||||||||

| Food - Wholesale/Distribution - 0.4% | |||||||||||

| 1,420,975 | Sysco Corp.# | 46,522,722 | |||||||||

| Independent Power Producer - 2.6% | |||||||||||

| 3,862,770 | NRG Energy, Inc.*,# | 305,004,319 | |||||||||

| Internet Infrastructure Software - 0.5% | |||||||||||

| 1,280,940 | Akamai Technologies, Inc.*,# | 56,463,835 | |||||||||

| Investment Management and Advisory Services - 0.3% | |||||||||||

| 767,370 | T. Rowe Price Group, Inc. | 38,122,942 | |||||||||

| Medical - Biomedical and Genetic - 1.9% | |||||||||||

| 2,868,856 | Celgene Corp.* | 175,459,233 | |||||||||

| 672,078 | Genentech, Inc.* | 53,759,519 | |||||||||

| 229,218,752 | |||||||||||

| Medical - Drugs - 4.5% | |||||||||||

| 3,870,030 | Merck & Company, Inc. | 199,074,343 | |||||||||

| 1,786,843 | Roche Holding A.G. | 337,070,252 | |||||||||

| 536,144,595 | |||||||||||

| Medical - HMO - 2.0% | |||||||||||

| 4,044,475 | Coventry Health Care, Inc.* | 233,891,989 | |||||||||

| Medical - Wholesale Drug Distributors - 0.9% | |||||||||||

| 1,559,125 | Cardinal Health, Inc.# | 109,060,794 | |||||||||

See Notes to Schedules of Investments and Financial Statements.

10 Janus Growth Funds April 30, 2007

Schedule of Investments (unaudited)

As of April 30, 2007

| Shares or Principal Amount | Value | ||||||||||

| Medical Instruments - 0.3% | |||||||||||

| 237,478 | Intuitive Surgical, Inc.* | $ | 30,791,397 | ||||||||

| Medical Products - 0.4% | |||||||||||

| 1,031,070 | Varian Medical Systems, Inc.*,# | 43,521,465 | |||||||||

| Metal Processors and Fabricators - 2.1% | |||||||||||

| 2,347,085 | Precision Castparts Corp.# | 244,355,019 | |||||||||

| Multi-Line Insurance - 1.0% | |||||||||||

| 1,665,050 | American International Group, Inc. | 116,403,646 | |||||||||

| Multimedia - 1.3% | |||||||||||

| 4,276,175 | News Corporation, Inc. - Class A | 95,743,559 | |||||||||

| 3,396,816 | Publishing & Broadcasting, Ltd. | 57,523,286 | |||||||||

| 153,266,845 | |||||||||||

| Networking Products - 0.5% | |||||||||||

| 2,353,870 | Cisco Systems, Inc.* | 62,942,484 | |||||||||

| Oil and Gas Drilling - 0.7% | |||||||||||

| 2,499,635 | Nabors Industries, Ltd.* | 80,288,276 | |||||||||

| Oil Companies - Exploration and Production - 1.0% | |||||||||||

| 770,665 | Apache Corp.# | 55,873,213 | |||||||||

| 1,205,280 | EnCana Corp. (U.S. Shares) | 63,216,936 | |||||||||

| 119,090,149 | |||||||||||

| Oil Companies - Integrated - 3.5% | |||||||||||

| 4,366,860 | Exxon Mobil Corp.# | 346,641,346 | |||||||||

| 1,205,330 | Hess Corp. | 68,402,478 | |||||||||

| 415,043,824 | |||||||||||

| Oil Refining and Marketing - 0.8% | |||||||||||

| 1,396,435 | Valero Energy Corp. | 98,071,630 | |||||||||

| Reinsurance - 0.9% | |||||||||||

| 27,981 | Berkshire Hathaway, Inc. - Class B* | 101,515,068 | |||||||||

| Retail - Apparel and Shoe - 2.7% | |||||||||||

| 2,171,841 | Industria de Diseno Textil S.A.** | 133,133,991 | |||||||||

| 3,488,650 | Nordstrom, Inc. | 191,596,658 | |||||||||

| 324,730,649 | |||||||||||

| Retail - Consumer Electronics - 0.8% | |||||||||||

| 1,995,625 | Best Buy Company, Inc.# | 93,095,906 | |||||||||

| Retail - Drug Store - 1.8% | |||||||||||

| 5,985,029 | CVS/Caremark Corp. | 216,897,451 | |||||||||

| Retail - Office Supplies - 1.2% | |||||||||||

| 5,554,802 | Staples, Inc. | 137,759,090 | |||||||||

| Savings/Loan/Thrifts - 0.8% | |||||||||||

| 3,980,575 | Hudson City Bancorp, Inc.# | 53,021,259 | |||||||||

| 3,033,949 | NewAlliance Bancshares, Inc.# | 47,359,944 | |||||||||

| 100,381,203 | |||||||||||

| Semiconductor Components/Integrated Circuits - 0.3% | |||||||||||

| 2,227,685 | Marvell Technology Group, Ltd.* | 35,932,559 | |||||||||

| Soap and Cleaning Preparations - 1.3% | |||||||||||

| 2,837,113 | Reckitt Benckiser PLC** | 155,462,896 | |||||||||

| Telecommunication Equipment - Fiber Optics - 0.8% | |||||||||||

| 3,899,530 | Corning, Inc.* | 92,496,852 | |||||||||

| Telecommunication Services - 0.6% | |||||||||||

| 2,449,085 | NeuStar, Inc. - Class A* | 70,435,685 | |||||||||

| Telephone - Integrated - 0.5% | |||||||||||

| 11,038,880 | Level 3 Communications, Inc.*,**,# | 61,376,173 | |||||||||

| Therapeutics - 1.9% | |||||||||||

| 1,799,760 | Amylin Pharmaceuticals, Inc.*,# | 74,384,081 | |||||||||

| 1,860,404 | Gilead Sciences, Inc.* | 152,032,215 | |||||||||

| 226,416,296 | |||||||||||

| Shares or Principal Amount | Value | ||||||||||

| Tobacco - 0.5% | |||||||||||

| 930,745 | Altria Group, Inc. | $ | 64,146,945 | ||||||||

| Transportation - Railroad - 1.4% | |||||||||||

| 1,923,680 | Canadian National Railway Co. (U.S. Shares) | 96,645,683 | |||||||||

| 612,905 | Union Pacific Corp.# | 70,024,396 | |||||||||

| 166,670,079 | |||||||||||

| Transportation - Services - 1.2% | |||||||||||

| 2,662,595 | C.H. Robinson Worldwide, Inc.# | 142,342,329 | |||||||||

| Web Portals/Internet Service Providers - 3.2% | |||||||||||

| 303,565 | Google, Inc. - Class A*,# | 143,094,470 | |||||||||

| 8,531,825 | Yahoo!, Inc.*,# | 239,232,373 | |||||||||

| 382,326,843 | |||||||||||

| Wireless Equipment - 3.0% | |||||||||||

| 3,143,975 | Crown Castle International Corp.*,# | 107,964,102 | |||||||||

| 2,803,700 | Nokia Oyj (ADR)**,# | 70,793,425 | |||||||||

| 3,943,320 | QUALCOMM, Inc. | 172,717,416 | |||||||||

| 351,474,943 | |||||||||||

| Total Common Stock (cost $8,681,555,849) | 11,679,930,321 | ||||||||||

| Money Markets - 1.5% | |||||||||||

| 45,177,295 | Janus Institutional Cash Management Fund - Institutional Shares, 5.32% | 45,177,295 | |||||||||

| 128,903,700 | Janus Institutional Money Market Fund - Institutional Shares, 5.26% | 128,903,700 | |||||||||

| Total Money Markets (cost $174,080,995) | 174,080,995 | ||||||||||

| Other Securities - 6.6% | |||||||||||

| 2,345,164 | Foreign Government Bonds† | 2,345,164 | |||||||||

| 734,966,045 | State Street Navigator Securities Lending Prime Portfolio† | 734,966,045 | |||||||||

| 43,116,592 | U.S. Treasury Notes/Bonds† | 43,116,592 | |||||||||

| Total Other Securities (cost $780,427,801) | 780,427,801 | ||||||||||

| Total Investments (total cost $9,636,064,645) – 106.5% | 12,634,439,117 | ||||||||||

| Liabilities, net of Cash, Receivables and Other Assets** – (6.5)% | (771,018,543 | ) | |||||||||

| Net Assets – 100% | $ | 11,863,420,574 | |||||||||

Summary of Investments by Country – (Long Positions)

| Country | Value | % of Investment Securities | |||||||||

| Australia | $ | 57,523,286 | 0.5 | % | |||||||

| Bermuda | 202,623,484 | 1.6 | % | ||||||||

| Canada | 214,938,060 | 1.7 | % | ||||||||

| Finland | 70,793,425 | 0.6 | % | ||||||||

| Germany | 204,319,937 | 1.6 | % | ||||||||

| Japan | 144,796,793 | 1.1 | % | ||||||||

| Mexico | 116,937,558 | 0.9 | % | ||||||||

| Spain | 133,133,991 | 1.1 | % | ||||||||

| Switzerland | 762,744,903 | 6.0 | % | ||||||||

| United Kingdom | 226,567,062 | 1.8 | % | ||||||||

| United States†† | 10,500,060,618 | 83.1 | % | ||||||||

| Total | $ | 12,634,439,117 | 100.0 | % | |||||||

††Includes Short-Term Securities and Other Securities (75.6% excluding Short-Term Securities and Other Securities).

See Notes to Schedules of Investments and Financial Statements.

Janus Growth Funds April 30, 2007 11

Janus Fund

Schedule of Investments (unaudited)

As of April 30, 2007

Forward Currency Contracts, Open

| Currency Sold and Settlement Date | Currency Units Sold | Currency Value in $U.S. | Unrealized Gain/(Loss) | ||||||||||||

| British Pound 10/17/07 | 18,300,000 | $ | 36,522,093 | $ | (1,203,093 | ) | |||||||||

| Euro 6/8/07 | 69,900,000 | 95,530,323 | (4,095,531 | ) | |||||||||||

| Euro 10/18/07 | 8,500,000 | 11,665,288 | (79,958 | ) | |||||||||||

| Japanese Yen 10/18/07 | 3,000,000,000 | 25,670,960 | (46,141 | ) | |||||||||||

| Total | $ | 169,388,664 | $ | (5,424,723 | ) | ||||||||||

| Value | |||||||

| Schedule of Written Options - Calls | |||||||

| Apple, Inc. expires May 2007 992 contracts exercise price $110.00 | $ | (9,920 | ) | ||||

| Apple, Inc. expires May 2007 1,588 contracts exercise price $115.00 | (7,940 | ) | |||||

| Boeing Co. expires May 2007 1,587 contracts exercise price $100.00 | (11,109 | ) | |||||

| Electronic Arts, Inc. expires May 2007 398 contracts exercise price $55.00 | (13,930 | ) | |||||

| Electronic Arts, Inc. expires May 2007 795 contracts exercise price $60.00 | (3,975 | ) | |||||

| Level 3 Communications, Inc. expires May 2007 3,970 contracts exercise price $7.50 | (19,850 | ) | |||||

| Lockheed Martin Corp. expires May 2007 795 contracts exercise price $105.00 | (7,950 | ) | |||||

| Total Written Options - Calls | |||||||

| 10,125 contracts (Premiums received $229,431) | $(74,674) | ||||||

| Schedule of Written Options - Puts | |||||||

| Best Buy Company, Inc. expires May 2007 1,586 contracts exercise price $45.00 | $ | (49,166 | ) | ||||

| Total Written Options - Puts | |||||||

| 1,586 contracts (Premiums received $30,134) | $(49,166) | ||||||

See Notes to Schedules of Investments and Financial Statements.

12 Janus Growth Funds April 30, 2007

Janus Enterprise Fund (unaudited)

Ticker: JAENX

Fund Snapshot

This growth fund pursues companies that have grown large enough to be well established but are small enough to still have room to grow.

Jonathan Coleman

portfolio manager

Performance Overview

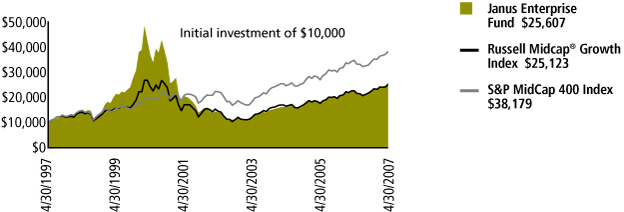

During the six months ended April 30, 2007, Janus Enterprise Fund gained 13.60%. By comparison, the Fund's primary benchmark, the Russell Midcap® Growth Index, and the Fund's secondary benchmark, the S&P MidCap 400 Index, returned 11.77% and 11.98%, respectively.

Economic Overview

Equity markets delivered healthy gains during the period amid continued evidence of strong U.S. economic growth with modest inflation. After a brief period of market volatility in late February and early March, markets rebounded quickly on hopes of monetary easing by the Federal Reserve (Fed). While U.S. corporate profit growth showed signs of slowing, robust mergers and acquisitions (M&A) and private equity transactions continued to provide key valuation support to equities in the U.S. and around the globe.

Materials Stocks Boost Performance

Fund performance for the period benefited from solid stock selection in the materials sector, where it held an above-benchmark weighting. Additionally, solid stock selection in the information technology (IT), consumer discretionary and healthcare sectors contributed positively to results.

Owens-Illinois, a materials holding, was our top contributor for the period. The glass manufacturer benefited from a change in management and investor optimism that new CEO Al Stroucken's focus on pricing and cost reduction could improve operating margins. This thesis gained credibility as the company put at least one high profile capital expenditure on hold in the first quarter. Over time, I think this new management focus on margin improvement could help this business become more predictable and, as a result, receive a higher valuation from investors.

Potash Corporation of Saskatchewan, Canada, also within the materials sector, was the second top-performing holding. Potash holds the world's largest excess supply of potash, a key ingredient in fertilizer. As such, the company has benefited from increasing global demand for agricultural land. Further boosting performance, the company's share of the global potash market increased with the flood of a competitor's mine late in 2006.

Financials Stocks Weigh on Results

On the downside, performance for the period was hindered by the Fund's overweight exposure to the financials sector. While the Fund did not have direct exposure to the subprime mortgage market, several individual financial services holdings were pressured by concerns that subprime mortgage delinquencies could lead to problems in other areas of consumer lending and the economy overall.

Advanced Micro Devices (AMD), an IT holding, was our largest detractor from performance in the period. AMD and rival Intel engaged in a series of price cuts that have taken a toll on margins, which undermined my confidence in the company's long-term outlook. As such, I eliminated the position in AMD.

Additionally, while the Fund's healthcare holdings generally performed well for the period, Varian Medical Systems, a maker of cancer-therapy systems, suffered. The company reported slowing order growth and longer sales cycles due to heightened competition affecting its oncology franchise. Given my concerns over changes in the company's competitive landscape, I trimmed my investment in Varian late in the period.

Outlook

With most U.S. equity indexes near all-time highs at the end of the period, I am closely monitoring several fundamental factors for directional cues. First, despite the weakness in the U.S. housing sector and the associated credit quality issues in the subprime mortgage market, the U.S. unemployment rate is near historical lows, mitigating the impact of the housing slowdown on consumer spending and the overall U.S. economy. I will be watching the labor market closely for any sign of a slowdown which could impact consumer sentiment and economic growth. Similarly, I will be monitoring the higher-quality prime mortgage market and other areas of consumer lending for any indication of a deterioration in credit quality. Second, U.S. corporate profit growth has experienced double-digit gains for several years, which, combined with strong liquidity from corporate M&A and private equity transactions, has supported higher equity valuations. I will continue to watch both the future path of corporate earnings and the overall liquidity in the markets to determine whether current valuations can be sustained.

Janus Growth Funds April 30, 2007 13

Janus Enterprise Fund (unaudited)

Going forward, I remain constructive on the market outlook, but caution that uncertainty over inflation pressures and the Fed policy could keep markets volatile in the near term. Such volatility could present me with attractive buying opportunities as I continue to rely on research-driven approaches to help identify promising investments.

As I always do in this space, I would like to reiterate to you that I am an investor alongside you in Janus Enterprise Fund. I invest a portion of every paycheck in the Fund and I have never sold a share of the Fund as long as I have managed it. I take the obligation of trust very seriously and work every day to support the trust you have placed in me and in Janus.

Thank you for your investment in Janus Enterprise Fund.

Janus Enterprise Fund At a Glance

5 Largest Contributors to Performance – Holdings

| Contribution | |||||||

| Owens-Illinois, Inc. | 1.23 | % | |||||

| Potash Corporation of Saskatchewan, Inc. (U.S. Shares) | 1.05 | % | |||||

| Precision Castparts Corp. | 0.62 | % | |||||

| Ball Corp. | 0.61 | % | |||||

| Cypress Semiconductor Corp. | 0.58 | % | |||||

5 Largest Detractors from Performance – Holdings

| Contribution | |||||||

| Advanced Micro Devices, Inc. | (0.30 | )% | |||||

| Varian Medical Systems, Inc. | (0.27 | )% | |||||

| Corporate Executive Board Co. | (0.18 | )% | |||||

| Jackson Hewitt Tax Service, Inc. | (0.17 | )% | |||||

| Office Depot, Inc. | (0.15 | )% | |||||

5 Largest Contributors to Performance – Sectors

| Fund Contribution | Fund Weighting (% of Net Assets) | Russell Midcap® Growth Index Weighting | |||||||||||||

| Materials | 3.11 | % | 7.44 | % | 4.09 | % | |||||||||

| Health Care | 2.62 | % | 17.13 | % | 14.85 | % | |||||||||

| Consumer Discretionary | 2.38 | % | 18.17 | % | 22.38 | % | |||||||||

| Information Technology | 2.25 | % | 17.84 | % | 18.49 | % | |||||||||

| Industrials | 1.48 | % | 12.25 | % | 14.62 | % | |||||||||

5 Lowest Contributors to Performance – Sectors

| Fund Contribution | Fund Weighting (% of Net Assets) | Russell Midcap® Growth Index Weighting | |||||||||||||

| Consumer Staples | 0.25 | % | 1.91 | % | 4.37 | % | |||||||||

| Telecommunication Services | 0.30 | % | 3.70 | % | 2.32 | % | |||||||||

| Utilities | 0.35 | % | 0.68 | % | 1.78 | % | |||||||||

| Energy | 0.40 | % | 4.82 | % | 7.74 | % | |||||||||

| Financials | 0.65 | % | 16.06 | % | 9.36 | % | |||||||||

14 Janus Growth Funds April 30, 2007

(unaudited)

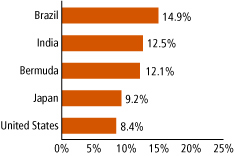

5 Largest Equity Holdings – (% of Net Assets)

| As of April 30, 2007 | |||||||

| EOG Resources, Inc. Oil Companies - Exploration and Production | 3.1 | % | |||||

| Lamar Advertising Co. Advertising Sales | 3.0 | % | |||||

| T. Rowe Price Group, Inc. Investment Management and Advisory Services | 3.0 | % | |||||

| Celgene Corp. Medical - Biomedical and Genetic | 2.9 | % | |||||

| Ball Corp. Containers - Metal and Glass | 2.9 | % | |||||

| 14.9 | % | ||||||

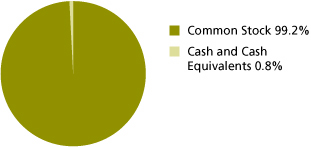

Asset Allocation – (% of Net Assets)

| As of April 30, 2007 | |||

Emerging markets comprised 1.1% of total net assets.

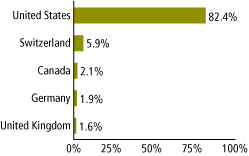

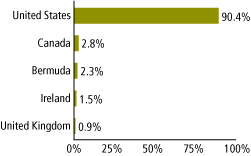

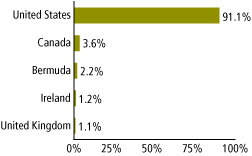

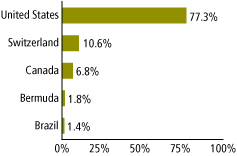

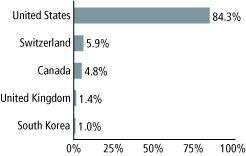

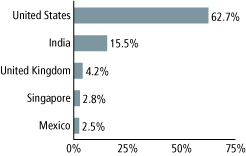

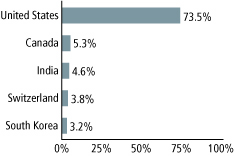

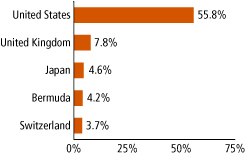

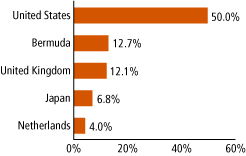

Top Country Allocations – Long Positions (% of Investment Securities)

| As of April 30, 2007 | As of October 31, 2006 | ||||||

|  | ||||||

Janus Growth Funds April 30, 2007 15

Janus Enterprise Fund (unaudited)

Performance

| Average Annual Total Return – for the periods ended April 30, 2007 | Expense Ratios – for the fiscal year ended October 31, 2006 | ||||||||||||||||||||||||||

| Fiscal Year-to-Date | One Year | Five Year | Ten Year | Since Inception* | Total Annual Fund Operating Expenses | ||||||||||||||||||||||

| Janus Enterprise Fund | 13.60 | % | 14.94 | % | 12.76 | % | 9.86 | % | 11.85 | % | 1.00 | % | |||||||||||||||

| Russell Midcap® Growth Index | 11.77 | % | 11.13 | % | 11.60 | % | 9.65 | % | 11.36 | % | |||||||||||||||||

| S&P MidCap 400 Index | 11.98 | % | 10.19 | % | 11.47 | % | 14.34 | % | 14.70 | % | |||||||||||||||||

| Lipper Quartile | – | 1 | st | 1 | st | 2 | nd | 2 | nd | ||||||||||||||||||

| Lipper Ranking - based on total return for Mid-Cap Growth Funds | – | 26/628 | 21/393 | 72/161 | 17/49 | ||||||||||||||||||||||

Visit janus.com to view current performance

and characteristic information

Data presented reflects past performance, which is no guarantee of future results. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, current performance may be higher or lower than the performance shown. Call 800.525.3713 or visit www.janus.com for performance current to the most recent month-end.

The Fund's expense ratios were determined based on average net assets as of the fiscal year ended October 31, 2006. Detailed information is available in the prospectus. All expenses are shown without the effect of expense offset arrangements. Pursuant to such arrangements, credits realized as a result of uninvested cash balances are used to reduce custodian and transfer agent expenses.

The Fund's performance may be affected by risks that include those associated with non-diversification, non-investment grade debt securities, undervalued or overlooked companies, investments in specific industries or countries and potential conflicts of interest with Janus Smart Portfolios. Additional risks to the Fund may include those associated with investing in foreign securities, emerging markets, initial public offerings ("IPO"s), derivatives and companies with relatively small market capitalizations. Please see a Janus prospectus or www.janus.com for more information about risk, portfolio holdings and details.

Total return includes reinvestment of dividends, distributions and capital gains. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Lipper Inc. - A Reuters Company, is a nationally recognized organization that ranks the performance of mutual funds within a universe of funds that have similar investment objectives. Rankings are historical with capital gains and dividends reinvested.

September 3, 1992 is the date used to calculate the since-inception Lipper ranking, which is slightly different from when the Fund began operations since Lipper provides fund rankings as of the last day of the month or the first Thursday after fund inception.

There is no assurance that the investment process will consistently lead to successful investing.

See Notes to Schedules of Investments for index definitions.

The Fund's portfolio may differ significantly from the securities held in the indices. The indices are not available for direct investment; therefore their performance does not reflect the expenses associated with the active management of an actual portfolio.

See "Explanations of Charts, Tables and Financial Statements."

*The Fund's inception date – September 1, 1992

16 Janus Growth Funds April 30, 2007

(unaudited)

Fund Expenses

The example below shows you the ongoing costs (in dollars) of investing in your Fund and allows you to compare these costs with those of other mutual funds. Please refer to the section Useful Information About Your Fund Report for a detailed explanation of the information presented in these charts.

| Expense Example | Beginning Account Value (11/1/06) | Ending Account Value (4/30/07) | Expenses Paid During Period (11/1/06-4/30/07)* | ||||||||||||

| Actual | $ | 1,000.00 | $ | 1,136.00 | $ | 5.03 | |||||||||

| Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,020.08 | $ | 4.76 | |||||||||

*Expenses are equal to the annualized expense ratio of 0.95%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Janus Growth Funds April 30, 2007 17

Janus Enterprise Fund

Schedule of Investments (unaudited)

As of April 30, 2007

| Shares or Principal Amount | Value | ||||||||||

| Common Stock - 99.2% | |||||||||||

| Advertising Sales - 3.0% | |||||||||||

| 954,090 | Lamar Advertising Co.* | $ | 57,569,790 | ||||||||

| Aerospace and Defense - 1.5% | |||||||||||

| 348,265 | Embraer-Empresa Brasileira de Aeronautica S.A. (ADR) | 16,337,111 | |||||||||

| 384,870 | Spirit Aerosystems Holdings, Inc.*,# | 12,173,438 | |||||||||

| 28,510,549 | |||||||||||

| Aerospace and Defense - Equipment - 0.3% | |||||||||||

| 64,875 | Alliant Techsystems, Inc.*,# | 6,041,809 | |||||||||

| Agricultural Chemicals - 2.4% | |||||||||||

| 260,560 | Potash Corporation of Saskatchewan, Inc. (U.S. Shares) | 46,775,731 | |||||||||

| Airlines - 1.2% | |||||||||||

| 503,646 | Ryanair Holdings PLC (ADR)*,# | 23,505,159 | |||||||||

| Batteries and Battery Systems - 0.7% | |||||||||||

| 139,195 | Energizer Holdings, Inc.*,# | 13,526,970 | |||||||||

| Beverages - Wine and Spirits - 0.5% | |||||||||||

| 599,236 | C&C Group PLC | 10,061,510 | |||||||||

| Building - Mobile Home and Manufactured Homes - 0.4% | |||||||||||

| 172,055 | Thor Industries, Inc.# | 6,852,951 | |||||||||

| Building - Residential and Commercial - 1.1% | |||||||||||

| 25,410 | NVR, Inc.*,# | 20,937,840 | |||||||||

| Building and Construction Products - Miscellaneous - 0.6% | |||||||||||

| 228,925 | USG Corp.*,# | 10,564,889 | |||||||||

| Casino Hotels - 1.7% | |||||||||||

| 819,740 | Melco PBL Entertainment (Macau), Ltd. (ADR)*,# | 14,279,871 | |||||||||

| 217,190 | Station Casinos, Inc. | 18,895,530 | |||||||||

| 33,175,401 | |||||||||||

| Casino Services - 1.4% | |||||||||||

| 791,005 | Scientific Games Corp. - Class A*,# | 26,332,556 | |||||||||

| Cellular Telecommunications - 1.8% | |||||||||||

| 338,020 | MetroPCS Communications, Inc.*,# | 9,481,461 | |||||||||

| 318,905 | N.I.I. Holdings, Inc.*,# | 24,475,959 | |||||||||

| 33,957,420 | |||||||||||

| Commercial Banks - 0.5% | |||||||||||

| 183,970 | SVB Financial Group*,# | 9,422,943 | |||||||||

| Commercial Services - 1.0% | |||||||||||

| 698,517 | Iron Mountain, Inc.*,# | 19,628,328 | |||||||||

| Commercial Services - Finance - 1.9% | |||||||||||

| 113,030 | Equifax, Inc.# | 4,498,594 | |||||||||

| 429,780 | Jackson Hewitt Tax Service, Inc.# | 11,853,332 | |||||||||

| 311,723 | Moody's Corp.# | 20,611,125 | |||||||||

| 36,963,051 | |||||||||||

| Computer Services - 2.5% | |||||||||||

| 843,640 | Ceridian Corp.* | 28,481,286 | |||||||||

| 457,655 | IHS, Inc. - Class A*,# | 18,919,458 | |||||||||

| 47,400,744 | |||||||||||

| Computers - 1.1% | |||||||||||

| 210,702 | Apple, Inc.*,# | 21,028,060 | |||||||||

| Consulting Services - 1.2% | |||||||||||

| 117,795 | Corporate Executive Board Co.# | 7,496,474 | |||||||||

| 589,055 | Gartner Group, Inc.*,# | 14,861,857 | |||||||||

| 22,358,331 | |||||||||||

| Shares or Principal Amount | Value | ||||||||||

| Containers - Metal and Glass - 5.3% | |||||||||||

| 1,084,495 | Ball Corp. | $ | 54,973,051 | ||||||||

| 1,545,605 | Owens-Illinois, Inc.* | 46,507,254 | |||||||||

| 101,480,305 | |||||||||||

| Data Processing and Management - 2.3% | |||||||||||

| 324,247 | Global Payments, Inc.# | 12,314,901 | |||||||||

| 351,130 | NAVTEQ Corp.*,# | 12,415,957 | |||||||||

| 532,351 | Paychex, Inc.# | 19,750,222 | |||||||||

| 44,481,080 | |||||||||||

| Dental Supplies and Equipment - 0.7% | |||||||||||

| 394,555 | Sirona Dental Systems, Inc.*,# | 13,024,261 | |||||||||

| Diagnostic Kits - 1.8% | |||||||||||

| 701,180 | Dade Behring Holdings, Inc. | 34,434,950 | |||||||||

| Distribution/Wholesale - 1.2% | |||||||||||

| 1,223,000 | Esprit Holdings, Ltd. | 14,800,818 | |||||||||

| 2,701,600 | Li & Fung, Ltd. | 8,316,876 | |||||||||

| 23,117,694 | |||||||||||

| Diversified Operations - 0.6% | |||||||||||

| 35,394,279 | Polytec Asset Holdings, Ltd.§ | 10,856,498 | |||||||||

| E-Commerce/Services - 0.5% | |||||||||||

| 226,520 | IAC/InterActiveCorp*,# | 8,634,942 | |||||||||

| Electric Products - Miscellaneous - 1.2% | |||||||||||

| 606,857 | AMETEK, Inc. | 22,016,772 | |||||||||

| Electronic Components - Semiconductors - 1.5% | |||||||||||

| 445,695 | International Rectifier Corp.*,# | 15,724,119 | |||||||||

| 180,525 | Microchip Technology, Inc.# | 7,282,379 | |||||||||

| 196,710 | SiRF Technology Holdings, Inc.* | 4,772,185 | |||||||||

| 27,778,683 | |||||||||||

| Electronic Measuring Instruments - 1.0% | |||||||||||

| 647,690 | Trimble Navigation, Ltd.*,# | 18,575,749 | |||||||||

| Entertainment Software - 1.8% | |||||||||||

| 1,333,031 | Activision, Inc.*,# | 26,660,620 | |||||||||

| 148,480 | Electronic Arts, Inc.* | 7,484,877 | |||||||||

| 34,145,497 | |||||||||||

| Fiduciary Banks - 0.9% | |||||||||||

| 280,590 | Northern Trust Corp. | 17,663,141 | |||||||||

| Finance - Consumer Loans - 0.8% | |||||||||||

| 552,000 | Nelnet, Inc. - Class A# | 14,843,280 | |||||||||

| Finance - Investment Bankers/Brokers - 0.5% | |||||||||||

| 366,035 | optionsXpress Holdings, Inc.# | 9,033,744 | |||||||||

| Finance - Other Services - 1.4% | |||||||||||

| 51,920 | Chicago Mercantile Exchange Holdings, Inc.# | 26,829,660 | |||||||||

| Food - Canned - 0.9% | |||||||||||

| 582,729 | TreeHouse Foods, Inc.* | 17,563,452 | |||||||||

| Human Resources - 0.2% | |||||||||||

| 141,935 | Robert Half International, Inc. | 4,726,436 | |||||||||

| Independent Power Producer - 0.8% | |||||||||||

| 200,115 | NRG Energy, Inc.*,# | 15,801,080 | |||||||||

| Industrial Automation and Robotics - 0.4% | |||||||||||

| 130,122 | Rockwell Automation, Inc.# | 7,747,464 | |||||||||

| Instruments - Controls - 0.6% | |||||||||||

| 117,590 | Mettler-Toledo International, Inc.* | 11,479,136 | |||||||||

| Instruments - Scientific - 1.4% | |||||||||||

| 499,274 | Thermo Electron Corp.* | 25,992,204 | |||||||||

| Investment Management and Advisory Services - 3.6% | |||||||||||

| 272,665 | National Financial Partners Corp. | 12,561,677 | |||||||||

| 1,133,730 | T. Rowe Price Group, Inc.# | 56,323,705 | |||||||||

| 68,885,382 | |||||||||||

See Notes to Schedules of Investments and Financial Statements.

18 Janus Growth Funds April 30, 2007

Schedule of Investments (unaudited)

As of April 30, 2007

| Shares or Principal Amount | Value | ||||||||||

| Machinery - General Industrial - 0.2% | |||||||||||

| 10,832,000 | Shanghai Electric Group Company, Ltd. | $ | 4,618,930 | ||||||||

| Machinery - Pumps - 0.5% | |||||||||||

| 252,575 | Graco, Inc.# | 9,976,713 | |||||||||

| Medical - Biomedical and Genetic - 2.9% | |||||||||||

| 913,148 | Celgene Corp.* | 55,848,131 | |||||||||

| Medical - HMO - 2.0% | |||||||||||

| 649,733 | Coventry Health Care, Inc.* | 37,574,059 | |||||||||

| Medical - Nursing Homes - 1.3% | |||||||||||

| 373,885 | Manor Care, Inc. | 24,261,398 | |||||||||

| Medical Instruments - 0.9% | |||||||||||

| 46,420 | Intuitive Surgical, Inc.* | 6,018,817 | |||||||||

| 254,595 | Kyphon, Inc.*,# | 11,866,673 | |||||||||

| 17,885,490 | |||||||||||

| Medical Labs and Testing Services - 0.4% | |||||||||||

| 131,200 | Covance, Inc.*,# | 7,937,600 | |||||||||

| Medical Products - 0.5% | |||||||||||

| 235,110 | Varian Medical Systems, Inc.* | 9,923,993 | |||||||||

| Metal Processors and Fabricators - 1.4% | |||||||||||

| 258,200 | Precision Castparts Corp. | 26,881,202 | |||||||||

| Multi-Line Insurance - 1.3% | |||||||||||

| 425,345 | Assurant, Inc.# | 24,470,098 | |||||||||

| Networking Products - 0.5% | |||||||||||

| 401,950 | Juniper Networks, Inc.*,# | 8,987,602 | |||||||||

| Oil and Gas Drilling - 0.6% | |||||||||||

| 380,810 | Nabors Industries, Ltd.* | 12,231,617 | |||||||||

| Oil Companies - Exploration and Production - 3.9% | |||||||||||

| 256,350 | Chesapeake Energy Corp.# | 8,651,813 | |||||||||

| 798,985 | EOG Resources, Inc.# | 58,677,457 | |||||||||

| 210,155 | Forest Oil Corp.* | 7,405,862 | |||||||||

| 74,735,132 | |||||||||||

| Physician Practice Management - 0.8% | |||||||||||

| 262,115 | Pediatrix Medical Group, Inc.* | 14,953,661 | |||||||||

| Property and Casualty Insurance - 0.6% | |||||||||||

| 346,367 | W. R. Berkley Corp. | 11,253,464 | |||||||||

| Racetracks - 0.9% | |||||||||||

| 347,775 | Penn National Gaming, Inc.* | 16,811,444 | |||||||||

| Real Estate Management/Services - 0.7% | |||||||||||

| 388,500 | CB Richard Ellis Group, Inc.*,# | 13,150,725 | |||||||||

| Real Estate Operating/Development - 0.9% | |||||||||||

| 313,435 | St. Joe Co.# | 17,749,824 | |||||||||

| Recreational Vehicles - 0.6% | |||||||||||

| 230,255 | Polaris Industries, Inc.# | 11,634,785 | |||||||||

| Reinsurance - 1.8% | |||||||||||

| 9,399 | Berkshire Hathaway, Inc. - Class B* | 34,099,572 | |||||||||

| REIT - Mortgages - 1.1% | |||||||||||

| 812,335 | CapitalSource, Inc.# | 20,933,873 | |||||||||

| Respiratory Products - 1.5% | |||||||||||

| 726,720 | Respironics, Inc.*,# | 29,621,107 | |||||||||

| Retail - Apparel and Shoe - 2.4% | |||||||||||

| 302,230 | Abercrombie & Fitch Co. - Class A# | 24,680,102 | |||||||||

| 170,800 | J. Crew Group, Inc.*,# | 6,915,692 | |||||||||

| 253,315 | Nordstrom, Inc.# | 13,912,060 | |||||||||

| 45,507,854 | |||||||||||

| Retail - Gardening Products - 0.7% | |||||||||||

| 246,055 | Tractor Supply Co.*,# | 12,730,886 | |||||||||

| Shares or Principal Amount | Value | ||||||||||

| Retail - Office Supplies - 2.0% | |||||||||||

| 299,625 | Office Depot, Inc.*,# | $ | 10,073,393 | ||||||||

| 1,118,815 | Staples, Inc.# | 27,746,612 | |||||||||

| 37,820,005 | |||||||||||

| Schools - 0.5% | |||||||||||

| 201,754 | Apollo Group, Inc. - Class A*,# | 9,542,964 | |||||||||

| Semiconductor Components/Integrated Circuits - 2.8% | |||||||||||

| 1,582,555 | Cypress Semiconductor Corp.* | 36,113,905 | |||||||||

| 1,038,310 | Marvell Technology Group, Ltd.* | 16,747,940 | |||||||||

| 52,861,845 | |||||||||||

| Telecommunication Equipment - 0.6% | |||||||||||

| 240,200 | CommScope, Inc.*,# | 11,205,330 | |||||||||

| Telecommunication Services - 1.8% | |||||||||||

| 562,260 | Amdocs, Ltd. (U.S. Shares)*,# | 20,663,055 | |||||||||

| 625,400 | Time Warner Telecom, Inc. - Class A*,# | 12,820,700 | |||||||||

| 33,483,755 | |||||||||||

| Therapeutics - 1.9% | |||||||||||

| 283,827 | Gilead Sciences, Inc.* | 23,194,342 | |||||||||

| 605,415 | MannKind Corp.*,# | 8,802,734 | |||||||||

| 91,860 | United Therapeutics Corp.* | 5,135,893 | |||||||||

| 37,132,969 | |||||||||||

| Toys - 0.8% | |||||||||||

| 488,092 | Marvel Entertainment, Inc.* | 14,413,357 | |||||||||

| Transportation - Equipment and Leasing - 0.4% | |||||||||||

| 170,715 | GATX Corp.# | 8,366,742 | |||||||||

| Transportation - Marine - 0.4% | |||||||||||

| 146,215 | Alexander & Baldwin, Inc.# | 7,815,192 | |||||||||

| Transportation - Railroad - 0.9% | |||||||||||

| 325,590 | Canadian National Railway Co. (U.S. Shares) | 16,357,642 | |||||||||

| Transportation - Services - 0.8% | |||||||||||

| 358,795 | Expeditors International of Washington, Inc.# | 14,997,631 | |||||||||

| Transportation - Truck - 0.8% | |||||||||||

| 327,920 | Landstar System, Inc.# | 15,841,815 | |||||||||

| Web Hosting/Design - 0.9% | |||||||||||

| 211,176 | Equinix, Inc.*,# | 17,626,861 | |||||||||

| Wireless Equipment - 2.0% | |||||||||||

| 1,091,990 | Crown Castle International Corp.*,# | 37,498,937 | |||||||||

| Total Common Stock (cost $1,198,584,951) | 1,892,469,647 | ||||||||||

| Money Markets - 0.8% | |||||||||||

| 11,772,399 | Janus Institutional Cash Management Fund - Institutional Shares, 5.32% | 11,772,399 | |||||||||

| 4,252,600 | Janus Institutional Money Market Fund - Institutional Shares, 5.26% | 4,252,600 | |||||||||

| Total Money Markets (cost $16,024,999) | 16,024,999 | ||||||||||

| Other Securities - 17.0% | |||||||||||

| 324,530,053 | State Street Navigator Securities Lending Prime Portfolio† | 324,530,053 | |||||||||

| 745,249 | U.S. Treasury Notes/Bonds† | 745,249 | |||||||||

| Total Other Securities (cost $325,275,302) | 325,275,302 | ||||||||||

| Total Investments (total cost $1,539,885,252) – 117.0% | 2,233,769,948 | ||||||||||

| Liabilities, net of Cash, Receivables and Other Assets – (17.0)% | (325,363,850 | ) | |||||||||

| Net Assets – 100% | $ | 1,908,406,098 | |||||||||

See Notes to Schedules of Investments and Financial Statements.

Janus Growth Funds April 30, 2007 19

Janus Enterprise Fund

Schedule of Investments (unaudited)

As of April 30, 2007

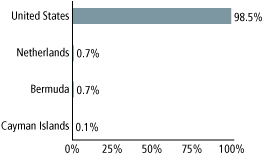

Summary of Investments by Country – (Long Positions)

| Country | Value | % of Investment Securities | |||||||||

| Bermuda | $ | 52,097,251 | 2.3 | % | |||||||

| Brazil | 16,337,111 | 0.7 | % | ||||||||

| Canada | 63,133,373 | 2.8 | % | ||||||||

| Cayman Islands | 10,856,498 | 0.5 | % | ||||||||

| China | 4,618,930 | 0.2 | % | ||||||||

| Hong Kong | 14,279,871 | 0.7 | % | ||||||||

| Ireland | 33,566,669 | 1.5 | % | ||||||||

| United Kingdom | 20,663,055 | 0.9 | % | ||||||||

| United States†† | 2,018,217,190 | 90.4 | % | ||||||||

| Total | $ | 2,233,769,948 | 100.0 | % | |||||||

††Includes Short-Term Securities and Other Securities (75.1% excluding Short-Term Securities and Other Securities).

See Notes to Schedules of Investments and Financial Statements.

20 Janus Growth Funds April 30, 2007

Janus Orion Fund (unaudited)

Ticker: JORNX

Fund Snapshot

This focused growth fund invests in a small number of well-researched companies, hand-picked for their upside potential.

Ron Sachs

portfolio manager

Investment Strategy

In keeping with Janus' core investment approach, I focus on individual stocks and company fundamentals. Company fundamentals are often greatly influenced by the macroeconomic environment in which businesses operate. Therefore, I closely monitor the macroeconomic backdrop that feeds the assumptions and expectations I have for each of the companies in the Fund.

At period end, I thought U.S. and global equity markets were reasonably valued based on the fact that I was able to find numerous compelling investment opportunities with what I believed to be attractive risk/reward tradeoffs. That belief was further confirmed by looking at the valuation multiples of the broad market indexes in developed markets relative to the growth expectations for gross domestic product (GDP) and corporate profits. Market participants seemed very cognizant of risk and reacted appropriately as fundamental risks changed.

Within that environment, I continued to find what I believed were great businesses with attractive valuations for the Fund. When I am able to find those types of businesses, I truly enjoy my job. My challenge as Portfolio Manager is less about discovering new attractive investment opportunities and more focused on selecting from a list of attractive risk/reward opportunities uncovered by the research analysts and portfolio managers at Janus. More compelling stock ideas should lead to fewer stocks in the portfolio. Rather than struggling to fill the Fund with many small positions with a reasonably attractive risk/reward tradeoff, I would rather cull what I believe to be great ideas that merit larger position sizes. As of period end, I believed even some of the best-performing positions in the Fund over the past six, 12 and 24 months remained compelling investment opportunities because the business fundamentals had improved in step with or ahe ad of the stock prices. By focusing on the long-term competitive position of a company, I was able to decide whether to hold or sell a stock based on whether its business executed and grew as I had anticipated.

Market Overview

Notwithstanding the strong recent performance of the stocks in Janus Orion Fund, I think the fact that stock indexes across the globe and in most every segment of the market, including commodities and real estate, have performed well should be a cause for concern. Therefore, I have begun to focus on possible risks, such as the existence of "bubbles," stemming from this positive environment. Unfortunately, bubbles are usually only identifiable in hindsight.

While I don't believe the overall stock market is in such a bubble, I do believe there are pockets of the investment universe that have exhibited irrational confidence. For example, real estate in Dublin sold at over 30 times rental costs and the Chinese stock market mirrored the Internet sector of the late 1990s with individual investors opening new accounts at an unprecedented rate.

These developments prompted numerous questions for me. Have other asset classes been pulled into higher valuation ranges by those bubbles? Will a collapse of any small bubble have spillover effects? Historically, bubbles have driven great fundamentals for businesses but I intend to exit early from companies in the Fund that I believe are enjoying the benefits of a market bubble.

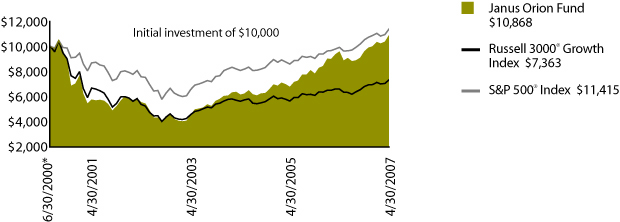

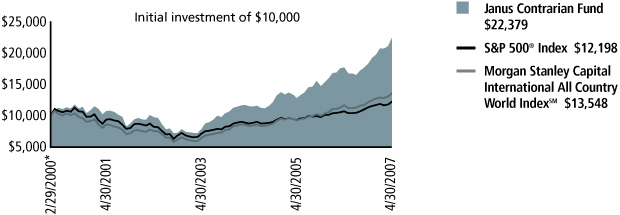

Fund Performance

The Fund was up 13.33% during the six-month period ended April 30, 2007, versus a return of 8.34% for the Fund's primary benchmark, the Russell 3000® Growth Index, and a return of 8.60% for the S&P 500® Index, the Fund's secondary benchmark. A number of the top contributors to the Fund over the period were holdings where the company's business model met or exceeded my expectations.

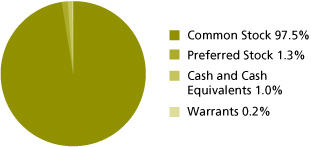

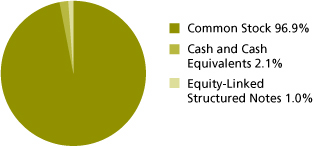

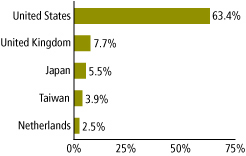

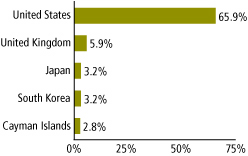

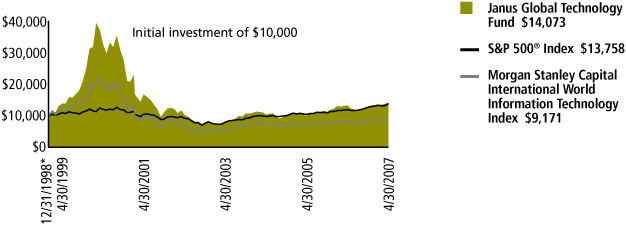

Dade Behring and ABB Were Important Contributors