UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 000-09165

STRYKER CORPORATION

(Exact name of registrant as specified in its charter)

| | |

| Michigan | | 38-1239739 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| |

| 2825 Airview Boulevard, Kalamazoo, Michigan | | 49002 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (269) 385-2600

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange on which registered |

| Common Stock, $.10 par value | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

YES x NO ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities and Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of large “accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | |

Large accelerated filer x | | Accelerated filer ¨ |

| Non-accelerated filer ¨ | | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

YES ¨ NO x

Based on the closing sales price of June 30, 2010, the aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $18,806,045,091.

The number of shares outstanding of the registrant’s common stock, $.10 par value, was 391,246,163 at January 31, 2011.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the proxy statement to be filed with the U.S Securities and Exchange Commission relating to the 2011 Annual Meeting of Shareholders (the 2011 proxy statement) are incorporated by reference into Part III.

FORWARD-LOOKING STATEMENTS

This report contains information that includes or is based on forward-looking statements within the meaning of the federal securities law that are subject to various risks and uncertainties that could cause actual results of Stryker Corporation (the Company) to differ materially from those expressed or implied in such statements. Such factors include, but are not limited to: weakening of economic conditions that could adversely affect the level of demand for the Company’s products; pricing pressures generally, including cost-containment measures that could adversely affect the price of or demand for the Company’s products; changes in foreign exchange markets; legislative and regulatory actions; unanticipated issues arising in connection with clinical studies and otherwise that affect U.S. Food and Drug Administration approval of new products; changes in reimbursement levels from third-party payors; a significant increase in product liability claims; unfavorable resolution of tax audits; changes in financial markets; changes in the competitive environment; and the Company’s ability to integrate acquisitions.

While the Company believes the assumptions underlying such forward-looking statements are reasonable, there can be no assurance that future events or developments will not cause such statements to be inaccurate. All forward-looking statements contained in this report are qualified in their entirety by this cautionary statement.

REGISTERED TRADEMARKS AND TRADEMARKS

Stryker Corporation or its divisions or other corporate affiliated entities own, use or have applied for the following trademarks in this Report: 3-Chip, ABG, Accolade, ADM, Ascent Healthcare Solutions, Asnis, AxSOS, AVS, BackSmart, Big Wheel, CentPillar, CerviCore, Chaperone, Colorado, Dall-Miles, Dynatran, Exeter, FlexiCore, Formula, Flyte, Gamma3, GMRS, Hoffmann, Howmedica, HydroSet, iBed, IDEAL EYES, iSuite, Leibinger, LFIT, Maestro, Mantis, Mobile Bearing Hip, Monotube, NRG, OASYS, Omnifit, OP-1, OtisKnee, PainPump, Power-PRO, PureFix, Radius, Reflex, Rejuvenate, RemB, Restoration, S3, Scorpio, Scorpio ClassiQ, Secur-Fit, Sightline, Simplex, Sonopet, SpineCore, Stair-PRO, Stair-TREAD, Stryker, Stryker Orthopaedics, Switchpoint Infinity, System 6, T2, TenXor, THOR, TMZF, Triathlon, Trident, Tritanium, UHR, VariAx, VLIFT, WiSe, X3, Xia, Zoom. Cormet is a registered trademark of Corin Limited. All other trademarks or service marks are trademarks or service marks of their respective owners or holders.

Not all products referenced in this report are approved or cleared for sale, distribution or use in the United States.

TABLE OF CONTENTS

PART I

GENERAL

Stryker Corporation (the Company or Stryker) is one of the world’s leading medical technology companies and is dedicated to helping healthcare professionals perform their jobs more efficiently while enhancing patient care. The Company provides innovative orthopaedic implants as well as state-of-the-art medical and surgical equipment to help people lead more active and more satisfying lives. The Company’s products include implants used in joint replacement, trauma and spinal surgeries; surgical equipment and surgical navigation systems; endoscopic and communications systems; patient handling and emergency medical equipment as well as other medical device products used in a variety of medical specialties. Stryker was incorporated in Michigan in 1946 as the successor company to a business founded in 1941 by Dr. Homer H. Stryker, a leading orthopaedic surgeon and the inventor of several orthopaedic products.

Stryker’s filings with the U.S. Securities and Exchange Commission (SEC), including its annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, are accessible free of charge at www.stryker.com within the “Investor—SEC Filings & Ownership Reports” link.

In 2010 the Company completed several acquisitions in all cash transactions, including the Sonopet Ultrasonic Aspirator assets from Mutoh Co., Ltd. and Synergetics USA, Inc., Gaymar Industries, Inc. and the bioimplantable implants product line and related assets from Porex Surgical, Inc. In December 2009 the Company acquired Ascent Healthcare Solutions, Inc. (Ascent), also in an all cash transaction.

In December 2010 the Company announced a definitive agreement to sell its OP-1 product family for use in orthopaedic bone applications and its manufacturing facility based in West Lebanon, NH. This transaction was completed on February 1, 2011 for total consideration of $60.0 million.

In October 2010 the Company announced a definitive agreement to acquire the assets of the Neurovascular division of Boston Scientific Corporation (Neurovascular) in an all cash transaction of up to $1.5 billion. This transaction was completed on January 3, 2011 for $1.45 billion in cash plus an additional $50.0 million to be paid upon the completion of certain milestones. The acquisition of Neurovascular is expected to substantially enhance the Company’s presence in the neurovascular market, allowing it to offer a comprehensive portfolio of products in both neurosurgical and neurovascular devices.

PRODUCT SALES

The Company segregates its operations into two reportable business segments: Orthopaedic Implants and MedSurg Equipment. The Orthopaedic Implants segment sells orthopaedic reconstructive (hip and knee), trauma and spinal implant systems and other related products. The MedSurg Equipment segment sells surgical equipment and surgical navigation systems; endoscopic and communications systems; patient handling and emergency medical equipment; as well as other medical device products used in a variety of medical specialties.

1

The following amounts and percentages represent domestic/international and business segment net sales during each of the three years ended December 31 (dollars in millions):

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2010 | | | 2009 | | | 2008 | |

| | | $ | | | % | | | $ | | | % | | | $ | | | % | |

Domestic/international sales: | | | | | | | | | | | | | | | | | | | | | | | | |

Domestic | | $ | 4,792.8 | | | | 65 | % | | $ | 4,317.4 | | | | 64 | % | | $ | 4,282.2 | | | | 64 | % |

International | | | 2,527.2 | | | | 35 | % | | | 2,405.7 | | | | 36 | % | | | 2,436.0 | | | | 36 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total net sales | | $ | 7,320.0 | | | | 100 | % | | $ | 6,723.1 | | | | 100 | % | | $ | 6,718.2 | | | | 100 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Business segment sales: | | | | | | | | | | | | | | | | | | | | | | | | |

Orthopaedic Implants | | $ | 4,308.4 | | | | 59 | % | | $ | 4,119.7 | | | | 61 | % | | $ | 3,967.5 | | | | 59 | % |

MedSurg Equipment | | | 3,011.6 | | | | 41 | % | | | 2,603.4 | | | | 39 | % | | | 2,750.7 | | | | 41 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total net sales | | $ | 7,320.0 | | | | 100 | % | | $ | 6,723.1 | | | | 100 | % | | $ | 6,718.2 | | | | 100 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Additional financial information regarding the Company’s operating segments and geographic areas can be found under the captionResults of Operations in Item 7 of this report and Note 13 to the Consolidated Financial Statements in Item 8 of this report.

Approximately 76% of the Company’s sales in 2010, 77% in 2009 and 74% in 2008 consisted of products with short lives, such as reconstructive, trauma, craniomaxillofacial (CMF) and spinal implant systems (while implants have a long useful life to the patient, they have a one-time use to the hospital); disposables and expendable tools; and parts and service revenues, including service and repair charges. The balance of sales in each of the years came from products that could be considered capital equipment, having useful lives in excess of one year.

The Company’s backlog of firm orders is not considered material to an understanding of its business.

Orthopaedic Implants

Orthopaedic Implants consist of such products as implants used in joint replacement, trauma, craniomaxillofacial and spinal surgeries; bone cement; and the bone growth factor OP-1. Artificial joints are made of cobalt chromium, titanium alloys, ceramics or ultrahigh molecular weight polyethylene and are implanted in patients whose natural joints have been damaged by arthritis, osteoporosis, other diseases or injury. Many of Stryker’s technologically advanced reconstructive implants are suited to minimally invasive surgery (MIS) procedures that are intended to reduce soft-tissue damage and pain while hastening return to function. The Company supports surgeons with technology, procedural development and specialized instrumentation as they develop new MIS techniques.

Hip Implant Systems

The Company offers a variety of hip implant systems for the global reconstructive market. Total hip replacement surgeries involve the replacement of both the head of the femur as well as the acetabulum (socket) of the pelvis. Stryker offers hip replacement products to address first time (primary) hip surgeries as well as revision systems. The ABG Hip System, Partnership Hip System, Secur-Fit Hip System, Omnifit Hip System, Accolade Hip System, CentPillar Hip System, Trident Acetabular Hip System, ADM Mobile Bearing Hip System, Rejuvenate Modular Primary Hip System, Cormet Hip Resurfacing System and Restoration Hip System are all comprehensive systems of hip implants and associated instrumentation designed to provide physicians and patients with reliable clinical results across the continuum of care, while enhancing value and operating room efficiency for the hospital.

2

Stryker is committed to following clinical outcomes and recognizes that long-term clinical results are an important factor in the Company’s ability to market hip implants. Significant clinical milestones for the Company include more than 40 years of clinical history with the Exeter Hip System, more than 25 years of clinical history with the Dall-Miles Cable System, more than 20 years of clinical history with the Omnifit HA stem and more than 10 years clinical history with the Accolade TMZF Hip System.

Stryker was the first company to receive clearance from the U.S. Food and Drug Administration (the FDA) to commercially release for sale in the United States a hip implant with hydroxylapatite (HA) surface treatment. HA is a naturally occurring calcium phosphate material that demonstrates a high level of biocompatibility due to its resemblance to bone. The Company’s global clinical experience with HA-coated hip stems now extends over 20 years, and reported clinical performance continues to equal or exceed that of comparable hip stems reported in the scientific literature.

Primary Femoral Hip Systems:

In 2009 Stryker introduced the Rejuvenate Modular Primary Hip System, the latest evolution in the Company’s OmniFit and Secur-Fit hip systems. The Rejuvenate Modular Primary Hip System offers surgeons unparalleled options for personalizing the implant to each patient’s anatomy. The Rejuvenate System is designed to optimize anatomic restoration by providing options that offer enhanced stability, proven modularity and intraoperative flexibility. The modular design enables the surgeon to independently manage stem size, leg length and offset to recreate the patient’s anatomy, restore biomechanics and, consequently, minimize the risk of dislocation.

The Accolade TMZF Hip System has demonstrated strong clinical results for more than 10 years, with 2009 marking the first introduction of the product into Japan. The Accolade TMZF System is a tapered wedge implant, based on a broach only technique and is recognized for its simplicity and flexibility to accommodate all surgical approaches and navigation.

The ABG II Modular Hip System represents the next generation of design based on the ABG monolithic stem that has had positive clinical experience for more than 10 years. This modular primary hip stem provides the opportunity to recreate patient anatomy through independent sizing of the stem and neck. Versatile instrumentation also accommodates surgeon preference for a navigated procedure or direct anterior surgical approach.

The Company’s Exeter Total Hip System is based on a collarless, highly polished, double-tapered femoral design that reduces shear stresses and increases compression at the cement/bone interface.

Primary Acetabular Systems:

The Company’s advanced bearing system, Low Friction Ion Treatment (LFIT) Anatomic Femoral Heads with X3 polyethylene liners represents a significant advance in hip-bearing technology through the combination of Stryker’s LFIT technology and X3 advanced bearing technology. The femoral heads are anatomically sized for more natural hip performance. In 2010 the Company introduced the ADM X3 Mobile Bearing Acetabular System, a next-generation technology for hip replacement surgery designed to minimize the risk associated with total hip replacement surgery by offering a large diameter bearing without a metal-on-metal articulation. X3 advanced bearing technology is based on the Company’s highly crosslinked polyethylene, which demonstrates enhanced material characteristics in laboratory testing, including improved strength, reduced wear and oxidation resistance. This second generation bearing option offers a significant technological advance for both hip and knee replacements. The Company also offers the Biolox Delta Ceramic Anatomic head for further options to reduce wear and potentially increase implant longevity.

3

The Company has a premarket approval (PMA) from the FDA for its ceramic-on-ceramic hip replacement system, the Trident Ceramic Acetabular Insert, for patients in the United States. Stryker Orthopaedics has successfully launched the Trident ceramic insert in the United States, Europe, Australia and Canada. The Trident insert has demonstrated low wear clinically, and it is protected and strengthened by a patented titanium sleeve.

In 2009 the Company introduced the Tritanium Primary Acetabular System in Latin America, Australia, and Europe following a U.S. launch in 2008. This system is the only Advanced Fixation Technology manufactured from a commercially-pure Titanium matrix. Introduction of this highly porous surface into the primary hip market provides a biologically-inspired enhanced fixation acetabular solution that was previously not available for primary use.

Hip Fracture Hip Systems:

Stryker offers a broad array of femoral stem options and bearings to accommodate the hip fracture patient including the Accolade HFx stem and the UHR bipolar head.

Revision Hip Systems:

The Restoration Modular Revision Hip System offers surgeons performing revision surgeries flexibility in treating complex hip stem revisions and restoring patient biomechanics. The Restoration Modular Revision Hip System also takes advantage of Stryker’s long clinical history with HA by incorporating PureFix HA coating on many components. The Restoration Modular Revision Hip System complements the Company’s existing Restoration HA and Restoration plasma spray (PS) monolithic revision systems.

The Company’s Trident Tritanium Acetabular Shell contains a highly porous surface that closely resembles the structure of bone. This shell is designed for revision surgery and contains multiple screw holes to achieve bone fixation and initial stability.

Knee Implant Systems

The Company offers three major knee implant systems: Triathlon, Scorpio and the Global Modular Replacement System (GMRS).

The Triathlon Knee System utilizes the Company’s evolutionary design that more closely reproduces natural knee motion and provides mobility with stability through more than 150 degrees of flexion. In 2008, Stryker continued to expand the Triathlon brand with the Triathlon Partial Knee Resurfacing (PKR) offering in the uni-condylar market segment and the Triathlon Total Stabilizer (TS) offering in the fast growing revision knee market. Both products incorporate the single radius design to provide the potential for better ligament balancing. The Company also offers the X3 advanced bearing technology for use with the Triathlon Knee System.

The Scorpio knee implant design is based on Stryker’s patented single radius; this approach to total knee replacement addresses significant clinical issues, such as improved patient rehabilitation and midflexion stability. The Scorpio NRG is the high flexion evolution to the Scorpio line. This design includes increased rotational allowance, an articulating design for deeper flexion and greater extension allowance without impingement. The Scorpio NRG with X3 advanced bearing technology is designed to lower wear rates compared to standard inserts. Scorpio ClassiQ was developed for the emerging global markets and is based on the Scorpio System to offer a high-quality and clinically proven affordable technology.

The GMRS is a global product that offers a comprehensive solution for severe bone loss in oncology, trauma and revision surgery patients. GMRS has tibial and femoral components, including a total femur, and a modular rotating hinge knee. The system employs both titanium and cobalt chrome alloys for strength and lightness of weight, together with the superior flexibility of the hinge.

4

Bone Cement

Simplex bone cement, a material used to secure cemented implants to bone, was first approved for orthopaedic use in the United States in 1971 and is the most widely used bone cement in the world. The Company manufactures and provides several variations of Simplex bone cement to meet specific patient needs. Simplex has nearly 50 years of clinical history, the longest of any bone cement, with more than 600 published clinical papers.

Trauma Implant Systems

The Company develops, manufactures and markets trauma, extremities and deformity correction systems. These systems include Intramedullary (IM) and cephlomedullary nails, locked and non-locked plating, hip fracture solutions and external fixation systems, as well as bone substitutes that are used primarily for the treatment of traumatic injuries.

The Company’s internal fixation portfolio includes a full array of IM & cephlomedullary nails; hip fracture solutions, including compression hip screws, cannulated screws as well as anatomically designed plates and screws in both titanium and stainless steel. These products provide a possible restorative option prior to joint reconstruction. These products are marketed worldwide as: Gamma3, Asnis III, AxSOS, VariAx, HydroSet, and T2.

The Company’s external fixation portfolio includes products such as Hoffmann II MRI, Hoffmann Xpress, Monotube Triax mono-lateral, as well as the Hoffmann II Hybrid (TenXor) circular fixation systems. These systems are used to construct frames for bone stabilization that are either definitive or as a temporary step in the treatment process associated with damage control orthopaedics. Hoffmann systems have been defined by their ease of assembly with “snap-fit” couplers. The use of a proprietary Vectran coating on the bars makes Hoffmann II MRI an MRI conditional solution.

The Company also offers a product portfolio for the treatment of fractures and injuries of the extremities. These products include fracture specific locked plating for the wrist, shoulder, elbow, fibula and foot, as well as bone substitutes and external fixation systems. These are all designed to treat the unique nature of upper extremity and foot and ankle injuries. These products are marketed worldwide under the brands VariAx, AxSOS and Hoffmann. New products launched in 2010 include the VariAx Fibula and VariAx Elbow Systems.

Spinal Implant Systems

The Company develops, manufactures and markets spinal implant products including cervical, thoracolumbar and interbody systems used in spinal injury, deformity and degenerative therapies. Spinal implant products include plates, rods, screws, connectors, spacers and cages, along with proprietary implant instrumentation.

In 2009 the Company introduced the Xia 3 Sacral Iliac system that completes the thoracolumbar system and makes it one of the most comprehensive platforms on the market. Also in 2009, the Company introduced the Dynatran-Dynamic/Translational Anterior Cervical Plate, which expands the Company’s presence in the cervical space with its unique locking mechanism. In 2008 the Company introduced the Radius Thoracolumbar Spinal Implant System. The Radius system provides a non-threaded wedgelock locking mechanism designed to reduce the potential for false locking and cross-threading and to increase the speed, ease and reliability of connecting rods to screws. Also in 2008, the Company launched Xia 3, the next generation of its thoracolumbar spinal implant system, and THOR, its anterior lumbar plating system that incorporates a proprietary screw locking technology. The Company also offers the Mantis minimally invasive access system for posterior instrumented spinal fusion and the Reflex Zero Profile anterior cervical plating system. In addition the Company offers the VLIFT vertebral body replacement system consisting of a preassembled, cylindrically shaped titanium

5

cage with a distractible or retractable center. The hollow core of the cage allows for packing bone graft. The Company’s AVS AS and AL Spacers are used as vertebral body support devices in anterior procedures. Other product lines include the OASYS fixation system that serves the posterior cervical fusion market, the Reflex Hybrid anterior cervical plate and the AVS PL and TL vertebral spacer systems.

Craniomaxillofacial (CMF) Implant Systems

The Company develops, manufactures and markets plating systems and related implants and products for craniomaxillofacial surgery, including dura substitutes, bone substitutes, electrosurgical microdissection needles and surgical instruments. They are primarily used in the fixation of fractures due to sudden injury as well as in the correction of congenital deformities. These products are marketed under such names as the Universal Fixation System, Colorado Needle, DuraMatrix-Onlay, Leibinger Instruments and HydroSet.

In 2010 the Company acquired the bioimplantable porous polyethylene (PPE) product line from Porex Surgical, Inc. for use primarily in reconstructive surgery of the head and face. These PPE products have a long history with considerable clinical data that is supported by over 350 references in peer-reviewed journals.

OP-1/BMP-7

Stryker’s OP-1 Implant is composed of recombinant human OP-1 and a bioresorbable collagen matrix. Stryker has received two approvals for a Humanitarian Device Exemption (HDE) from the FDA. An HDE, as defined by the FDA, is for a product intended to benefit patients by treating or diagnosing a disease or condition that affects fewer than 4,000 individuals per year in the United States. OP-1 is currently used for orthopaedic bone applications, including the use of OP-1 Implant as an alternative to autograft in recalcitrant long-bone nonunions where use of autograft is not feasible and alternative treatments have failed. A second application is for revision posterolateral spine fusion using a new formulation of OP-1 known as OP-1 Putty. In 2010 the Company announced that it had entered into a definitive agreement with Olympus Corporation for the sale of its OP-1 product family as used in orthopaedic bone applications and completed this transaction on February 1, 2011.

The Company continues to conduct research and development efforts directed toward exploring the cartilage regeneration properties of BMP-7 for potential use in osteoarthritis as well as other non-orthopaedic applications. The Company has successfully completed preclinical studies showing that BMP-7 can stimulate new cartilage formation and increase disc height in animal models of degenerative disc disease. In 2008 the Company completed enrollment in a Phase I dose-ranging clinical safety study for the first time use of BMP-7 to treat the disc. Stryker has also filed an Investigational New Drug application with the FDA to treat osteoarthritis in the knee with the injectable form of BMP-7. Following FDA concurrence in 2007, the Company proceeded with patient enrollment in the Phase I clinical study, which was completed in 2008. Based on the results of that study, a Phase II protocol was submitted to and approved by the FDA. The Company began enrollment in the Phase II study in 2010. Given the early stage of these clinical efforts and the expected scope of data to be required by the FDA, commercialization of BMP-7 is not expected for at least five years.

MedSurg Equipment

MedSurg Equipment products include surgical equipment and surgical navigation systems; endoscopic and communications systems; patient handling and emergency medical equipment; as well as other medical device products used in a variety of medical specialties.

Surgical Equipment and Surgical Navigation Systems

The Company offers a broad line of surgical, neurologic, ENT and interventional spine equipment that is used in surgical specialties for drilling, burring, rasping or cutting bone in small-bone orthopaedic, neurosurgical, spine and ENT procedures; wiring or pinning bone fractures; and preparing hip or knee surfaces for the placement of artificial implants. Stryker also manufactures an array of different attachments and cutting accessories for use by orthopaedic, neurologic and small-bone specialists.

6

In 2010 the Company acquired the assets used to produce the Sonopet Ultrasonic Aspirator control consoles, handpieces and accessories. The Sonopet Ultrasonic Aspirator is used in the fields of neurosurgery as well as for orthopedic, general, laparoscopic and plastic surgeries. The device is used by surgeons to fragment soft and hard tissue and for tumor removal and bone cutting.

The System 6 heavy duty, large-bone power system represents the Company’s primary heavy-duty, cordless product offering. The System 6 Rotary Handpieces provide multiple options to surgeons by allowing both high-speed drilling and high-torque reaming in one handpiece.

In 2009 Stryker introduced the RemB micro electric system, combining the Company’s Consolidated Operating Room Equipment (CORE) platform with lightweight, specialized handpieces, allowing surgeons to work effectively with greater precision and control. This versatile system is an evolution in the Company’s offering of powered surgical instruments designed to remove and reshape bone in a wide variety of medical specialties including hand surgery, podiatry, orthopaedic foot and ankle surgery and extremity trauma surgery. The Maestro drill represents Stryker’s line of micro powered instruments for spine, neurology and ENT applications. The Maestro drill leverages the Company’s Total Performance System (TPS) and CORE platforms by using the same cutting attachments. The Stryker Bone Mill, launched in 2008, further leverages the CORE platform and is designed for use in spine, orthognathic and orthopaedic primary and revision joint procedures.

To promote safety for patients and medical staff, Stryker works closely with hospitals and other healthcare organizations to develop a broad product portfolio. In 2009 the Company introduced the Flyte personal protection system, the latest version of Stryker’s Sterishield line of personal protection products combining improved comfort and support with higher levels of protection against contamination, exposure to infectious bodily fluids and transfer of microorganisms and particulate matter. Additionally, Flyte’s integrated helmet with illumination represents enhancements aimed towards improving the surgical environment.

The Company also offers a broad line of surgical navigation systems that give surgeons in several specialties the ability to use electronic imaging to see more clearly, better align instruments and more accurately track where the instruments are relative to a patient’s anatomy during surgical procedures. The Company offers the Navigation System II Cart, the eNlite suitcase system and the Navigation iSuite. All of these product offerings are either image based or imageless platforms, incorporating intuitive Smart hardware and software functionality, and a highly accurate digital infrared camera that result in greater ease of use and less invasive procedures.

Endoscopic and Communications Systems

The Company develops, manufactures and markets medical video and communications equipment and instruments for arthroscopy, general surgery and urology. Stryker has established a position of leadership in the production of medical video technology and accessories for minimally invasive surgery, as well as communications equipment to facilitate local and worldwide sharing of medical information among operating rooms, doctors’ offices and teaching institutions. Products include medical video cameras, digital documentation equipment, arthroscopes, laparoscopes, powered surgical instruments, radio frequency ablation systems, irrigation fluid management systems, i-Suite operating room solutions and state-of-the-art equipment for telemedicine and enterprise-wide connectivity. Stryker’s line of rigid scopes, which range in diameter from 1.9 millimeters to 10 millimeters, contains a series of precision lenses as well as fiber optics that, when combined with Stryker’s high-definition (HD) camera systems, allow the physician to view internal anatomy with a high degree of clarity.

In 2010 Stryker continued to expand its wireless platform by launching the WiSe 1:3 Transmitter, which allows simultaneous transmission to three high-definition wireless WiSe monitors. The Switchpoint Infinity 3 video router provides surgeons and operating room staff with an integrated platform tailored specifically to each individual operating room. This router increases efficiency and flexibility during procedures.

7

In 2009 Stryker introduced the 1288 HD Camera, the next generation Stryker 3-Chip HD medical video camera. This latest version has HD 1080p resolution with wireless high definition transmission to the new Stryker WiSe wide screen monitor system. This new camera system provides superior image quality compared to previous camera systems and ease of use through customized programmable buttons. This product provides surgical teams with improved visibility during endoscopic procedures, which can improve overall surgical and patient outcomes. In conjunction with the launch of the 1288 HD Camera, Stryker also introduced the L-9000 lightsource. This new lightsource includes proprietary LED technology that provides the customer with a cooler and longer lasting bulb. Also introduced in 2009 was the IDEAL EYES line of HD arthroscopes and laparoscopes. To accommodate the recording of HD images, the Company offers the SDC HD digital documentation system. The Company also offers its Formula shaver system, which is small, light and equipped with radio frequency identification (RFID), facilitating communication between the blade and console.

Patient Handling and Emergency Medical Equipment

Stryker is a leader in the patient handling equipment segment, offering a wide variety of stretchers customized to fit the needs of acute care and specialty surgical care facilities with a focus on providing a safe and comfortable surface for patients while reducing the risk of back injury for hospital staff.

In 2010 the Company acquired Gaymar Industries, which specializes in support surfaces and pressure ulcer management solutions as well as the temperature management segment of the healthcare industry. The acquisition expands the Company’s product offerings while also providing a complementary product offering to its existing customer base through its temperature management technology platform.

In 2010 Stryker introduced the Prime series of stretchers, designed to ensure caregiver safety and efficiency while enhancing patient comfort. Patients can adjust their own positions without calling a caregiver for assistance. The Prime stretchers incorporate Glideaway siderails with Zero Transfer Gap; the Zoom Motorized Drive System, virtually eliminating push force; Big Wheel technology, reducing start-up force by up to 50 percent and increasing maneuverability; and a 700-pound weight capacity.

Stryker also develops and manufactures beds and accessories that are designed to meet the unique needs of specialty departments within the acute care environment. In 2008 the Company introduced the redesigned S3 Med/Surg Hospital Bed, the first redesign since its original 1994 introduction, combining a retractable frame with the Company’s BackSmart ergonomically designed side rails and featuring an open architecture to accept any standard support surface. The S3 offers the Chaperone center-of-gravity bed-exit system with Zone Control to help prevent patient falls, as well as iBed Awareness, an exclusive technology that monitors safe patient bed positions and alerts caregivers in the event that the desired safe bed configuration is altered. In 2009 the Company introduced the Impression non-powered support surface designed to improve pressure redistribution, enhance patient comfort and provide enhanced moisture management similar to that achieved by powered support surfaces. Stryker has a complete line of intensive care unit (ICU) beds for critical care and step-down units. The beds incorporate advanced features that facilitate patient care, such as in-bed scales that accurately weigh the patient regardless of bed position and a radiolucent surface that facilitates chest x-rays without moving the patient from the bed. Stryker’s XPRT support surface, with low air loss, percussion and rotational therapy, aids in the prevention and treatment of certain skin ulcers and pulmonary care.

To serve the worldwide pre-hospital market, the Company offers a line of manually operated and powered ambulance cots and cot-to-ambulance fastening systems. In addition, Stryker offers the Stair-PRO stair chairs with Stair-TREAD track systems that facilitate patient transport up and down stairs. The Company’s Power-PRO ambulance cot incorporates an advanced battery-powered hydraulic lift system that enables emergency medical professionals to raise and lower the cot with the press of a button. The use of Stair-PRO and the Power-PRO helps prevent caregiver back injuries. Stryker expanded the Power-PRO line with a version customized for streamlined incubator transport on both inter-facility and intra-facility transports and with a version customized for ambulances that use hydraulic tail lifts or ramps that are popular in the United Kingdom.

8

Medical Device Reprocessing

In December 2009 the Company acquired Ascent, the market leader in the medical device reprocessing industry. Ascent’s reprocessing of medical devices includes collecting recyclable medical devices from hospitals and cleaning, function testing and sterilizing the medical devices for reuse in subsequent procedures. The reprocessed medical device is equivalent to a new medical device in terms of function, quality and effectiveness. Extending the life of these medical devices beyond a single use enables the Company to partner with health care providers in managing costs without compromising the quality of patient care and diverts thousands of pounds of medical waste from landfills.

PRODUCT DEVELOPMENT

Most of the Company’s products and product improvements have been developed internally. The Company maintains close working relationships with physicians and medical personnel in hospitals and universities who assist in product research and development. New and improved products play a critical role in the Company’s sales growth. The Company continues to place emphasis on the development of proprietary products and product improvements to complement and expand its existing product lines. The Company has a decentralized research and development focus, with manufacturing locations responsible for new product development and product improvements. Research, development and engineering personnel at the various manufacturing locations maintain relationships with staff at distribution locations and with customers to understand changes in the market and product needs.

Total expenditures for product research, development and engineering were $393.9 million in 2010, $336.2 million in 2009 and $367.8 million in 2008. Research, development and engineering expenses represented 5.4% of sales in 2010, compared to 5.0% in 2009 and 5.5% in 2008. The spending level in 2010 increased due to the Company’s increased focus on new product development for anticipated future product launches and investments in new technologies. Recent new product introductions in the Orthopaedic Implants and MedSurg Equipment segments are more fully described under the captionProduct Sales.

In addition to internally developed products, the Company invests in technologies developed by third parties that have the potential to expand the markets in which the Company operates. In 2010 the Company acquired the Sonopet Ultrasonic Aspirator control consoles, handpieces and accessories from Mutoh Co., Ltd. and Synergetics USA, Inc., Gaymar Industries, a manufacturer of specialized support surface and pressure ulcer management solutions, and the bioimplantable porous polyethylene (PPE) product line from Porex Surgical, Inc. for use primarily in reconstructive surgery of the head and face. In December 2009 the Company acquired Ascent, the market leader in the reprocessing and remanufacturing of medical devices in the U.S. During 2010 and 2009, the Company acquired certain additional companies all of which are expected to enhance the Company’s product offerings to its customers within its Orthopaedic Implants and MedSurg Equipment business segments.

MARKETING

Domestic sales accounted for 65% of total revenues in 2010. Most of the Company’s products are marketed directly to doctors, hospitals and other healthcare facilities through dedicated sales forces for each of its principal product lines to provide focus and a high level of expertise to each medical specialty served. International sales accounted for 35% of total revenues in 2010. The Company’s products are sold in approximately 100 countries through local dealers and direct sales efforts. Additional information regarding the Company’s international and domestic operations and sales appears in Note 13 to the Consolidated Financial Statements in Item 8 of this report.

The Company’s business is generally not seasonal in nature; however, the number of orthopaedic implant surgeries is lower during the summer months.

9

COMPETITION

The Company is one of five leading competitors in the United States for orthopaedic reconstructive products. The four other leading competitors are DePuy Orthopaedics, Inc. (a subsidiary of Johnson & Johnson), Zimmer Holdings, Inc., Biomet, Inc., and Smith & Nephew plc. While competition abroad varies from area to area, the Company believes it is also a leading player in the international markets with these same companies as its principal competitors.

In the trauma implant segment, Stryker is one of five leaders competing principally with Synthes, Inc., Smith & Nephew Orthopaedics (a division of Smith & Nephew plc), Zimmer Holdings, Inc., and DePuy Orthopaedics, Inc.

In the spinal implant segment, the Company is one of four leaders, competing principally with Medtronic Sofamor Danek, Inc. (a subsidiary of Medtronic, Inc.), DePuy Spine, Inc. (a subsidiary of Johnson & Johnson), and Synthes, Inc.

In the craniomaxillofacial implant segment, Stryker is one of four leaders, competing principally with Synthes, Inc., Biomet Microfixation, LLC (a subsidiary of Biomet, Inc.), and KLS Martin L.P.

In the surgical equipment segment, Stryker is one of three leaders, competing principally with Medtronic, Inc. and Conmed Linvatec, Inc. (a subsidiary of CONMED Corporation). These companies are also competitors in the international segments, along with Aesculap-Werke AG (a division of B. Braun Melsungen AG), a large European manufacturer.

In the surgical navigation segment, Stryker is one of six principal competitors, including Medtronic Surgical Navigation Technologies (a division of Medtronic, Inc.), BrainLAB Inc. (a subsidiary of BrainLAB AG), AESCULAP AG & Co. KG (a division of B. Braun Melsungen AG), Radionics, Inc. (a subsidiary of Integra LifeSciences Corporation), and GE Medical Systems Navigation and Visualization, Inc. (a subsidiary of General Electric Company).

In the arthroscopy segment, the Company is one of four leaders, together with Smith & Nephew Endoscopy (a division of Smith & Nephew plc), ConMed Linvatec, Inc., and Arthrex, Inc. In the laparoscopic imaging products segment, the Company is one of three leaders, together with Karl Storz GmbH & Co. (a German company) and Olympus Optical Co. Ltd. (a Japanese company).

The Company’s primary competitor in the patient handling segment is Hill-Rom Holdings, Inc. In the specialty stretcher segment, the primary competitors are Hausted, Inc. (a subsidiary of STERIS Corporation), Hill-Rom Holdings, Inc., and Midmark Hospital Products Group (a subsidiary of Ohio Medical Instrument Company, Inc.). In the emergency medical services segment, Ferno-Washington, Inc. is the Company’s principal competitor.

The Company’s primary competitor in the U.S. market for reprocessing and remanufacturing of medical devices is SteriMed Inc.

The principal factors that the Company believes differentiate it in the highly competitive market segments in which it operates and enable it to compete effectively are innovation, reliability, service and reputation. The Company believes that its competitive position in the future will depend to a large degree on its ability to develop new products and make improvements to existing products. While the Company does not consider patents a major factor in its overall competitive success, patents and trademarks are significant to the extent that a product or an attribute of a product represents a unique design or process. Patent protection of such products restricts competitors from duplicating these unique designs and features. Stryker seeks to obtain patent protection on its products whenever appropriate for protecting its competitive advantage. As of December 31, 2010, the Company owns approximately 1,125 United States patents and 1,945 international patents.

10

MANUFACTURING AND SOURCES OF SUPPLY

The Company’s manufacturing processes consist primarily of precision machining, metal fabrication and assembly operations; the forging and investment casting of cobalt chrome; and the finishing of cobalt chrome and titanium. Approximately 12% of the Company’s cost of sales in 2010 represented finished products that were purchased complete from outside suppliers. The Company also purchases parts and components, such as forgings, castings, gears, bearings, casters and electrical components, and uses outside sources for certain finishing operations, such as plating, hardening and coating of machined components and sterilization of certain products. The principal raw materials used by the Company are stainless steel, aluminum, cobalt chrome and titanium alloys. In all, purchased parts and components from outside sources were approximately 38% of the total cost of sales in 2010.

While the Company relies on single sources for certain purchased materials and services, it believes alternate sources are available if needed. The Company has not experienced any significant difficulty in the past in obtaining the materials necessary to meet its production schedules.

Substantially all products manufactured by the Company are stocked in inventory, while certain products manufactured within the Company’s MedSurg Equipment segment are assembled to order.

REGULATION AND PRODUCT QUALITY

The Medical Device Amendments of 1976 to the federal Food, Drug and Cosmetic Act and the Safe Medical Devices Act of 1990, together with regulations issued or proposed thereunder, provide for regulation by the FDA of the design, manufacture and marketing of medical devices, including most of the Company’s products.

The FDA’s Quality System regulations set forth standards for the Company’s product design and manufacturing processes, require the maintenance of certain records and provide for inspections of the Company’s facilities by the FDA. There are also certain requirements of state, local and foreign governments that must be complied with in the manufacturing and marketing of the Company’s products.

In 2009 the Company received a warning letter from the FDA related to compliance issues for one of its CMF implant products that was previously sold through its CMF distribution facility in Portage, Michigan. In 2008 the Company received a warning letter from the FDA related to quality systems and compliance issues at its OP-1 implant manufacturing facility in Hopkinton, Massachusetts. In 2007 the Company received two warning letters from the FDA regarding compliance with certain quality system specifications at its reconstructive implant manufacturing facilities: one letter for its facility in Cork, Ireland and another for its facility in Mahwah, New Jersey. In October 2009, the FDA informed the Company that the warning letter related to its OP-1 implant manufacturing facility had been resolved following a productive reinspection earlier in 2009. In March 2010, the FDA informed the Company that the warning letter related to its Mahwah manufacturing facility had been resolved following a re-inspection in 2009 and additional corrective actions. In May 2010, the FDA informed the Company that the warning letters related to its Cork, Ireland and CMF facilities had been resolved following FDA re-inspection of the Cork, Ireland facility and additional corrective actions at both the Cork and CMF facilities.

Most of the Company’s new products fall into FDA classifications that require notification of and review by the FDA before marketing, submitted as a 510(k). Certain of the Company’s products require extensive clinical testing, consisting of safety and efficacy studies, followed by PMA applications for specific surgical indications.

Stryker also is subject to the laws that govern the manufacture and distribution of medical devices of each country in which the Company manufactures or sells products. The member states of the European Union (EU) have adopted the European Medical Device Directives, which create a single set of medical device regulations

11

for all EU member countries. These regulations require companies that wish to manufacture and distribute medical devices in EU member countries to obtain CE Marking for their products. Stryker has authorization to apply the CE Marking to substantially all of its products. The Company’s OP-1 product has been considered a drug under the regulations for Europe, Australia and Japan.

Initiatives sponsored by government agencies, legislative bodies and the private sector to limit the growth of healthcare expenses generally and hospital costs in particular, including price regulation and competitive pricing, are ongoing in markets where the Company does business. It is not possible to predict at this time the long-term impact of such cost-containment measures on the Company’s future business.

EMPLOYEES

At December 31, 2010, the Company had 20,036 employees worldwide. Certain international employees are covered by collective bargaining agreements that are updated annually. The Company believes that its employee relations are satisfactory.

EXECUTIVE OFFICERS OF THE REGISTRANT

Information regarding the executive officers of the Company appears under the caption “Directors, Executive Officers and Corporate Governance” in Item 10 of this report.

The following information discusses specific risks that could potentially impact the Company’s business, financial condition or operating results. The Company may be subject to additional risks that are not currently known to the Company or those which the Company deems immaterial that may also impact its business operations.

The Company’s operating results could be negatively impacted by economic, political or other developments in countries in which the Company does business.

The Company distributes its products throughout the world. As a result, the Company’s future operating results could be negatively impacted by unstable economic, political and social conditions, including but not limited to fluctuations in foreign currency exchange rates, political instability or changes in the interpretation or creation of laws and regulations, including tax laws and regulations, in each of the countries where the Company conducts business, including the United States.

Stricter pricing guidelines for the medical technology industry could have a negative impact on the Company’s future operating results.

Initiatives sponsored by government agencies, legislative bodies and the private sector to limit the growth of healthcare costs, including price regulation and competitive pricing, are ongoing in markets where the Company does business. The Company could experience a negative impact on its operating results due to increased pricing pressure in the United States, Europe, Japan and certain other markets. Governments, hospitals and other third party payers could reduce the amount of approved reimbursements for the Company’s products. Reductions in reimbursement levels or coverage or other cost-containment measures could unfavorably affect the Company’s future operating results.

The Company’s operating results could be negatively impacted by future product liability claims, unfavorable court decisions, regulatory compliance or legal settlements.

The Company is a defendant in various proceedings, legal actions and claims arising in the normal course of business, including product liability and other matters. Such matters are subject to many uncertainties and

12

outcomes are not predictable with assurance. In addition, the Company may incur significant legal expenses regardless of whether it is found to be liable. To partially mitigate losses arising from unfavorable outcomes in such matters, the Company purchases third-party insurance coverage subject to certain deductibles and loss limitations. While the Company believes its current insurance coverage is adequate to mitigate losses arising from such matters, its future operating results may be unfavorably impacted by any settlement payments or losses beyond the amounts of insurance carried. In addition, such product liability matters may negatively impact the Company’s ability to obtain cost-effective third-party insurance coverage in future periods.

Substantially all of the Company’s products are subject to regulation by the FDA and other governmental authorities both inside and outside of the United States. If the Company were to fail to comply with the applicable regulatory requirements, it may be subject to a range of sanctions including, but not limited to, warning letters, monetary fines, product recalls and the suspension of product manufacturing. Such sanctions, if implemented, could have a material unfavorable impact on the Company’s future operating results.

The Company’s inability to maintain adequate working relationships with healthcare professionals could have a negative impact on the Company’s future operating results.

The Company maintains close working relationships with respected physicians and medical personnel in hospitals and universities who assist in product research and development. The Company continues to place emphasis on the development of proprietary products and product improvements to complement and expand its existing product lines. If the Company is unable to maintain these good relationships, its ability to develop, market and sell new and improved products could decrease and future operating results could be unfavorably affected.

The Company’s operating results could be negatively impacted by future changes in the allocation of income to each of the income tax jurisdictions in which the Company operates.

The Company operates in multiple income tax jurisdictions both inside and outside the United States. Accordingly, management must determine the appropriate allocation of income to each of these jurisdictions based on current interpretations of complex income tax regulations. Income tax authorities in these jurisdictions regularly perform audits of the Company’s income tax filings. Income tax audits associated with the allocation of this income and other complex issues, including inventory transfer pricing and cost sharing, product royalty and foreign branch arrangements, may require an extended period of time to resolve and may result in significant income tax adjustments. If changes to the income allocation are required between jurisdictions with different income tax rates, such adjustments could have a material unfavorable impact on the Company’s income tax expense and net earnings in future periods.

The Company’s operating results could be negatively impacted if it is unable to capitalize on research and development spending.

The Company has spent a significant amount of time and resources on research and development projects in order to develop and validate new and innovative products. The Company believes these projects will result in the commercialization of new products and will create additional future sales. However, factors including regulatory delays, safety concerns or patent disputes could delay the introduction or marketing of new products. Additionally, unanticipated issues may arise in connection with current and future clinical studies that could delay or terminate a product’s development prior to regulatory approval. The Company may experience an unfavorable impact on its operating results if it is unable to capitalize on those efforts by attaining the proper FDA approval or to successfully market new products.

13

The Company’s operating results could be negatively impacted by changes in its excess and obsolete inventory reserves.

The Company maintains reserves for excess and obsolete inventory resulting from the potential inability to sell its products at prices in excess of current carrying costs. The markets in which the Company operates are highly competitive, and new products and surgical procedures are introduced on an ongoing basis. Such marketplace changes may cause some of the Company’s products to become obsolete. The Company makes estimates regarding the future recoverability of the costs of these products and records a provision for excess and obsolete inventories based on historical experience, expiration of sterilization dates and expected future trends. If actual product life cycles, product demand or acceptance of new product introductions are less favorable than projected by management, additional inventory write-downs may be required, which could unfavorably affect future operating results.

The Company’s operating results could be negatively impacted if it is unable to capitalize on previous or future acquisitions.

In addition to internally developed products, the Company relies upon investment in new technologies through acquisitions. Investments in medical technology are inherently risky and the Company cannot guarantee that any of its previous or future acquisitions will be successful or will not have a material unfavorable impact on the Company’s future operating results. Such risks include the activities required to integrate new businesses into the Company and may result in the need to allocate more resources to integration and product development activities than originally anticipated and involve significant amounts of management’s time, which could adversely affect management’s ability to focus on other projects and could have a material unfavorable impact on the Company’s financial condition, consolidated results of operations or cash flows. In addition, the Company cannot be certain that the businesses it acquires will become profitable or remain so, which may result in unexpected impairment charges.

The Company’s inability to continue to hire and retain key employees could have a negative impact on the Company’s future operating results.

The talent and drive of the Company’s employees are key factors in the success of its business. The Company’s sales, technical and other key personnel play an integral role in the development, marketing and selling of new and existing products. If the Company is unable to recruit, hire, develop and retain a talented, competitive work force, it may not be able to meet its strategic business objectives.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS. |

Not applicable.

14

The Company has the following properties as of December 31, 2010:

| | | | | | | | | | | | |

Location | | Segment | | Use | | Square

Feet | | | Owned/

Leased | |

Mahwah, New Jersey | | Orthopaedic Implants | | Manufacturing of reconstructive implants | | | 531,000 | | | | Owned | |

Limerick, Ireland | | Orthopaedic Implants | | Manufacturing of reconstructive implants and OP-1 | | | 130,000 | | | | Owned | |

Kiel, Germany | | Orthopaedic Implants | | Manufacturing of trauma implants | | | 174,000 | | | | Owned | |

Selzach, Switzerland | | Orthopaedic Implants | | Manufacturing of trauma implants | | | 78,000 | | | | Owned | |

Neuchâtel, Switzerland | | Orthopaedic Implants | | Manufacturing of spinal implants | | | 88,000 | | | | Owned | |

Bordeaux, France | | Orthopaedic Implants | | Manufacturing of spinal implants | | | 79,000 | | | | Owned | |

Bordeaux, France | | Orthopaedic Implants | | Manufacturing of spinal implants | | | 35,000 | | | | Leased | |

Carrigtwohill, Ireland | | Orthopaedic Implants and MedSurg Equipment | | Manufacturing of reconstructive implants and surgical equipment | | | 154,000 | | | | Owned | |

Freiburg, Germany | | Orthopaedic Implants and MedSurg Equipment | | Manufacturing of craniomaxillofacial implants and surgical navigation systems | | | 106,000 | | | | Owned | |

Stetten, Germany | | Orthopaedic Implants | | Manufacturing of craniomaxillofacial implants | | | 33,000 | | | | Owned | |

| West Lebanon, New Hampshire | | Orthopaedic Implants | | Manufacturing of OP-1 | | | 140,000 | | | | Owned | |

Hopkinton, Massachusetts | | Orthopaedic Implants | | Manufacturing of OP-1 | | | 69,000 | | | | Leased | |

Suzhou, China | | Orthopaedic Implants | | Manufacturing of reconstructive, trauma and spinal implants | | | 155,000 | | | | Owned | |

Newnan, Georgia | | Orthopaedic Implants | | Manufacturing of reconstructive implants | | | 54,000 | | | | Leased | |

Portage, Michigan | | MedSurg Equipment | | Manufacturing of surgical equipment and patient-handling and emergency medical equipment | | | 1,034,000 | | | | Owned | |

Arroyo, Puerto Rico | | MedSurg Equipment | | Manufacturing of surgical equipment and endoscopic systems | | | 220,000 | | | | Leased | |

San Jose, California | | MedSurg Equipment | | Manufacturing of endoscopic systems | | | 165,000 | | | | Leased | |

Flower Mound, Texas | | MedSurg Equipment | | Manufacturing of communications systems | | | 114,000 | | | | Leased | |

Lakeland, Florida | | MedSurg Equipment | | Reprocessing and remanufacturing of medical devices | | | 112,000 | | | | Leased | |

Phoenix, Arizona | | MedSurg Equipment | | Reprocessing and remanufacturing of medical devices | | | 51,000 | | | | Leased | |

Buffalo, New York | | MedSurg Equipment | | Manufacturing of pressure ulcer and temperature management products | | | 112,000 | | | | Owned | |

Kalamazoo, Michigan | | Other | | Corporate headquarters | | | 75,000 | | | | Owned | |

In addition to the above, the Company maintains administrative and sales offices and warehousing and distribution facilities in multiple countries. The Company believes that its properties are suitable and adequate for the manufacture and distribution of the Company’s products.

15

| ITEM 3. | LEGAL PROCEEDINGS. |

The Company is involved in various proceedings, legal actions and claims arising in the normal course of business, including proceedings related to product, labor and intellectual property, and other matters that are more fully described in Note 17 to the Consolidated Financial Statements in Item 8 of this report. The outcomes of these matters will generally not be known for prolonged periods of time. In certain of the legal proceedings, the claimants seek damages, as well as other compensatory relief, which could result in the payment of significant claims and settlements. In legal matters for which management has sufficient information to reasonably estimate the Company’s future obligations, a liability representing management’s best estimate of the probable cost, or the minimum of the range of probable losses when a best estimate within the range is not known, for the resolution of these legal matters is recorded. The estimates are based on consultation with legal counsel, previous settlement experience and settlement strategies.

PART II

| ITEM 5. | MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

The Company’s common stock is traded on the New York Stock Exchange under the symbol SYK. Quarterly stock prices and dividend information for the years ended December 31, 2010 and 2009 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2010 Quarter Ended | | | 2009 Quarter Ended | |

| | | Mar. 31 | | | June 30 | | | Sept. 30 | | | Dec. 31 | | | Mar. 31 | | | June 30 | | | Sept. 30 | | | Dec. 31 | |

Dividends declared per share of common stock | | $ | 0.15 | | | $ | 0.15 | | | $ | 0.15 | | | $ | 0.18 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 0.25 | |

Market price of common stock: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

High | | | 58.49 | | | | 59.72 | | | | 53.29 | | | | 55.00 | | | | 44.46 | | | | 41.73 | | | | 48.10 | | | | 52.66 | |

Low | | | 49.85 | | | | 48.76 | | | | 42.74 | | | | 48.13 | | | | 30.96 | | | | 32.34 | | | | 37.14 | | | | 42.74 | |

The Company’s Board of Directors considers payment of a cash dividend at each of its quarterly meetings.

In the fourth quarter of 2010, the Company issued 230 shares of common stock as performance incentive awards to certain employees. The shares were not registered under the Securities Act of 1933 (the Act) based on the conclusion that the awards would not be events of sale within the meaning of Section 2(a)(3) of the Act.

On January 31, 2011, there were 4,748 shareholders of record of the Company’s common stock.

In December 2010 the Company announced that its Board of Directors had authorized the Company to purchase up to $500.0 million of its common stock from time to time in the open market, in privately negotiated transactions or otherwise. The Company did not make any repurchase pursuant to the $500.0 million repurchase program in 2010.

16

In December 2009 the Company announced that its Board of Directors had authorized the Company to repurchase up to $750.0 million of its common stock from time to time in the open market, in privately negotiated transactions or otherwise. During the fourth quarter of 2010, the Company repurchased 6.1 million shares of its common stock in the open market at a cost of $314.5 million, as follows (in millions, except per share amounts):

| | | | | | | | | | | | | | | | |

Period | | (a)

Total Number

of Shares

Purchased | | | (b)

Average Price

Paid

Per Share | | | (c)

Total Number of

Shares Purchased as

Part of Publicly

Announced Plans | | | (d)

Maximum

Dollar Value

of Shares that may

yet be Purchased

Under the Plans | |

$750.0 million repurchase program | | | | | | | | | | | | | | | | |

Month #1 | | | | | | | | | | | | | | | | |

October 1, 2010—October 31, 2010 | | | — | | | $ | — | | | | — | | | $ | — | |

Month #2 | | | | | | | | | | | | | | | | |

November 1, 2010—November 30, 2010 | | | 3.9 | | | $ | 51.53 | | | | 3.9 | | | $ | 478.7 | |

Month #3 | | | | | | | | | | | | | | | | |

December 1, 2010—December 31, 2010 | | | 2.2 | | | $ | 51.19 | | | | 2.2 | | | $ | 324.4 | |

| | | | | | | | | | | | | | | | |

Total | | | 6.1 | | | $ | 51.41 | | | | 6.1 | | | | | |

| | | | | | | | | | | | | | | | |

$500.0 million repurchase program | | | | | | | | | | | | | | | | |

Month #3 | | | | | | | | | | | | | | | | |

December 1, 2010—December 31, 2010 | | | — | | | $ | — | | | | — | | | $ | 500.0 | |

| | | | | | | | | | | | | | | | |

Total | | | — | | | $ | — | | | | — | | | | | |

| | | | | | | | | | | | | | | | |

17

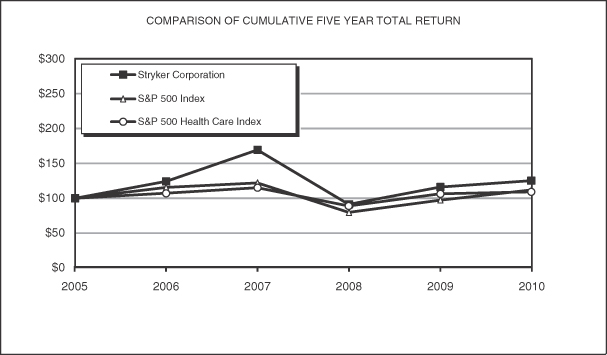

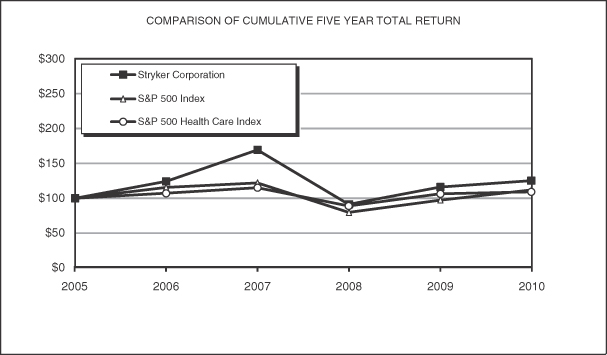

PERFORMANCE GRAPH (UNAUDITED)

Set forth below is a graph comparing the total returns (including reinvestments of dividends) of the Company, the Standard & Poor’s (S&P) 500 Composite Stock Price Index and the S&P Health Care (Medical Products and Supplies) Index. The graph assumes $100 invested on December 31, 2005 in the Company’s Common Stock and each of the indices.

| | | | | | | | | | | | | | | | | | | | | | | | |

Company / Index | | 2005 | | | 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2010 | |

Stryker Corporation | | | 100 | | | | 124.53 | | | | 169.59 | | | | 91.58 | | | | 116.04 | | | | 125.20 | |

S&P 500 Index | | | 100 | | | | 115.79 | | | | 122.16 | | | | 76.96 | | | | 97.33 | | | | 111.99 | |

S&P 500 Health Care Index | | | 100 | | | | 107.53 | | | | 115.22 | | | | 88.94 | | | | 106.46 | | | | 109.55 | |

18

| ITEM 6. | SELECTED FINANCIAL DATA. |

The financial information for each of the five years in the period ended December 31, 2010 is set forth below (dollars in millions, except per share amounts):

| | | | | | | | | | | | | | | | | | | | |

| | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

Net sales | | $ | 7,320.0 | | | $ | 6,723.1 | | | $ | 6,718.2 | | | $ | 6,000.5 | | | $ | 5,147.2 | |

Cost of sales | | | 2,285.7 | | | | 2,183.7 | | | | 2,131.4 | | | | 1,865.2 | | | | 1,616.6 | |

| | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 5,034.3 | | | | 4,539.4 | | | | 4,586.8 | | | | 4,135.3 | | | | 3,530.6 | |

| | | | | |

Research, development and engineering expenses | | | 393.9 | | | | 336.2 | | | | 367.8 | | | | 375.3 | | | | 324.6 | |

Selling, general and administrative expenses | | | 2,707.3 | | | | 2,506.3 | | | | 2,625.1 | | | | 2,391.5 | | | | 2,047.0 | |

Intangibles amortization | | | 58.2 | | | | 35.5 | | | | 40.0 | | | | 41.4 | | | | 42.7 | |

Other (a) | | | 123.5 | | | | 67.0 | | | | 34.9 | | | | 19.8 | | | | 52.7 | |

| | | | | | | | | | | | | | | | | | | | |

| | | 3,282.9 | | | | 2,945.0 | | | | 3,067.8 | | | | 2,828.0 | | | | 2,467.0 | |

| | | | | | | | | | | | | | | | | | | | |

Operating income | | | 1,751.4 | | | | 1,594.4 | | | | 1,519.0 | | | | 1,307.3 | | | | 1,063.6 | |

Other income (expense) | | | (21.8 | ) | | | 29.5 | | | | 61.2 | | | | 62.8 | | | | 30.2 | |

| | | | | | | | | | | | | | | | | | | | |

Earnings from continuing operations before income taxes | | | 1,729.6 | | | | 1,623.9 | | | | 1,580.2 | | | | 1,370.1 | | | | 1,093.8 | |

Income taxes | | | 456.2 | | | | 516.5 | | | | 432.4 | | | | 383.4 | | | | 322.4 | |

| | | | | | | | | | | | | | | | | | | | |

Net earnings from continuing operations | | | 1,273.4 | | | | 1,107.4 | | | | 1,147.8 | | | | 986.7 | | | | 771.4 | |

Net earnings and gain on sale of discontinued operations | | | — | | | | — | | | | — | | | | 30.7 | | | | 6.3 | |

| | | | | | | | | | | | | | | | | | | | |

Net earnings | | $ | 1,273.4 | | | $ | 1,107.4 | | | $ | 1,147.8 | | | $ | 1,017.4 | | | $ | 777.7 | |

| | | | | | | | | | | | | | | | | | | | |

Net earnings from continuing operations per share of common stock: | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | 3.21 | | | $ | 2.79 | | | $ | 2.81 | | | $ | 2.41 | | | $ | 1.90 | |

Diluted | | $ | 3.19 | | | $ | 2.77 | | | $ | 2.78 | | | $ | 2.37 | | | $ | 1.87 | |

| | | | | |

Net earnings per share of common stock: | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | 3.21 | | | $ | 2.79 | | | $ | 2.81 | | | $ | 2.48 | | | $ | 1.91 | |

Diluted | | $ | 3.19 | | | $ | 2.77 | | | $ | 2.78 | | | $ | 2.44 | | | $ | 1.89 | |

| | | | | |

Dividends declared per share of common stock | | $ | 0.63 | | | $ | 0.25 | | | $ | 0.40 | | | $ | 0.33 | | | $ | 0.22 | |

| | | | | |

Average number of shares outstanding—in millions: | | | | | | | | | | | | | | | | | | | | |

Basic | | | 396.4 | | | | 397.4 | | | | 408.1 | | | | 409.7 | | | | 406.5 | |

Diluted | | | 399.5 | | | | 399.4 | | | | 413.6 | | | | 417.2 | | | | 411.8 | |

| (a) | Includes restructuring charges, property, plant and equipment impairment, intangible asset impairment and purchased in-process research and development charges. |

19

FINANCIAL AND STATISTICAL DATA

| | | | | | | | | | | | | | | | | | | | |

| | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

Cash and current marketable securities | | | 4,380.1 | | | | 2,954.8 | | | | 2,195.6 | | | | 2,410.8 | | | | 1,414.8 | |

Working capital | | | 6,026.4 | | | | 4,410.2 | | | | 3,517.2 | | | | 3,571.9 | | | | 2,182.8 | |

Current ratio | | | 4.8 | | | | 4.1 | | | | 3.4 | | | | 3.7 | | | | 2.6 | |

Property, plant and equipment—net | | | 798.3 | | | | 947.6 | | | | 963.8 | | | | 991.6 | | | | 914.9 | |

Capital expenditures | | | 182.1 | | | | 131.3 | | | | 155.2 | | | | 187.7 | | | | 209.4 | |

Depreciation and amortization | | | 410.2 | | | | 385.3 | | | | 387.6 | | | | 366.6 | | | | 324.1 | |

Total assets | | | 10,895.1 | | | | 9,071.3 | | | | 7,603.3 | | | | 7,354.0 | | | | 5,873.8 | |

Long-term debt, including current maturities | | | 1,021.8 | | | | 18.0 | | | | 20.5 | | | | 16.8 | | | | 14.8 | |

Shareholders’ equity | | | 7,173.6 | | | | 6,595.1 | | | | 5,406.7 | | | | 5,378.5 | | | | 4,191.0 | |

Return on average equity | | | 18.5 | % | | | 18.5 | % | | | 21.3 | % | | | 21.3 | % | | | 20.8 | % |

Net cash provided by operating activities | | | 1,547.4 | | | | 1,460.7 | | | | 1,175.9 | | | | 1,028.3 | | | | 867.3 | |

Number of shareholders of record | | | 4,586 | | | | 4,607 | | | | 4,500 | | | | 4,373 | | | | 4,091 | |

Number of employees | | | 20,036 | | | | 18,582 | | | | 17,594 | | | | 16,026 | | | | 18,806 | |

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

Throughout this discussion, references are made to the following financial measures: “constant currency,” “adjusted net earnings,” “adjusted basic net earnings per share,” and “adjusted diluted net earnings per share.” These financial measures are an alternative representation of Stryker Corporation’s (the Company or Stryker) past and potential future operational performance and do not replace the presentation of the Company’s reported financial results under U.S. generally accepted accounting principles (GAAP). The Company has provided these supplemental non-GAAP financial measures because they provide meaningful information regarding the Company’s results on a consistent and comparable basis for the periods presented. Management uses these non-GAAP financial measures for reviewing the operating results of its business segments, for analyzing potential future business trends in connection with its budget process and bases certain annual bonus plans on these non-GAAP financial measures. In order to measure the Company’s sales performance on a constant currency basis, it is necessary to remove the impact of changes in foreign currency exchange rates which affects the comparability and trend of sales. Constant currency results are calculated by translating current year results at prior year average foreign currency exchange rates. In order to measure earnings performance on a consistent and comparable basis, the Company excludes the impairment of property, plant and equipment and gain on sale of certain assets recorded in 2010, the patent litigation gain recorded in 2009, the income tax effect associated with the repatriation of foreign earnings recorded in 2010 and 2009 and the restructuring charges recorded in 2009 and 2008, each of which affects the comparability of operating results and the trend of earnings. Additional details regarding the nature, determination and financial statement impact of these items are included inResults of Operations. In addition, the Company believes investors will utilize this information to evaluate period-to-period results on a comparable basis and to better understand potential future operating results. The Company encourages investors and other users of these financial statements to review its Consolidated Financial Statements and other publicly filed reports in their entirety and not to rely solely on any single financial measure.

Executive Level Overview

Stryker is one of the world’s leading medical technology companies and is dedicated to helping healthcare professionals perform their jobs more efficiently while enhancing patient care. The Company provides innovative orthopaedic implants as well as state-of-the-art medical and surgical equipment to help people lead more active and more satisfying lives. The Company’s products include implants used in joint replacement, trauma and spinal surgeries; surgical equipment and surgical navigation systems; endoscopic and communications systems; patient handling and emergency medical equipment as well as other medical device products used in a variety of medical specialties.

20

Domestic sales accounted for 65% of total revenues in 2010. Most of the Company’s products are marketed directly to doctors, hospitals and other healthcare facilities by approximately 4,600 sales and marketing personnel in the United States. Stryker primarily maintains separate and dedicated sales forces for each of its principal product lines to provide focus and a high level of expertise to each medical specialty served.

International sales accounted for 35% of total revenues in 2010. The Company’s products are sold in approximately 100 countries through Company-owned sales subsidiaries and branches as well as third-party dealers and distributors.

The Company’s business is generally not seasonal in nature; however, the number of orthopaedic implant surgeries is lower during the summer months.