|

|

As filed with the Securities and Exchange Commission on June 8, 2020

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 /X/

Pre-Effective Amendment //

Post-Effective Amendment No. //

(Check appropriate box or boxes)

T. ROWE PRICE INTERNATIONAL FUNDS, INC.

Exact Name of Registrant as Specified in Charter

100 East Pratt Street, Baltimore, Maryland 21202

Address of Principal Executive Offices

410-345-2000

Registrant’s Telephone Number, Including Area Code

David Oestreicher

100 East Pratt Street, Baltimore, Maryland 21202

Name and Address of Agent for Service

Approximate Date of Proposed Public Offering: As soon as practicable after this registration statement becomes effective under the Securities Act of 1933

It is proposed that this filing will become effective on July 24, 2020 pursuant to Rule 488.

Calculation of Registration Fee under the Securities Act of 1933:

Title of Securities Being Registered: Shares of common stock (par value $0.01 per share) of the Registrant.

Amount Being Registered:

Proposed Maximum Offering Price per Unit:

Proposed Maximum Aggregate Offering Price:

Amount of Registration Fee:

The Registrant has registered an indefinite amount of securities pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended; accordingly, no filing fee is payable herewith in reliance upon Section 24(f).

|

|

T. ROWE PRICE INSTITUTIONAL INTERNATIONAL CORE EQUITY FUND

T. ROWE PRICE INSTITUTIONAL INTERNATIONAL GROWTH EQUITY FUND

July 21, 2020

Dear Shareholder:

We are writing to inform you about reorganizations that will affect your investment in T. Rowe Price Institutional International Core Equity Fund and T. Rowe Price Institutional International Growth Equity Fund (each, an “Institutional Fund” and together, the “Institutional Funds”). As provided in an Agreement and Plan of Reorganization (each, a “Plan” and together, the “Plans”), each Institutional Fund will be reorganized (each, a “Reorganization” and together, the “Reorganizations”) into a corresponding mutual fund advised by T. Rowe Price Associates, Inc. (“T. Rowe Price”), the same investment adviser to each Institutional Fund, as set out in the table below under the heading “Acquiring Funds” (each, an “Acquiring Fund,” together, the “Acquiring Funds,” and collectively with the Institutional Funds, the “Funds”).

Institutional Funds | Acquiring Funds | Expected |

T. Rowe Price Institutional International Core Equity Fund | T. Rowe Price Overseas Stock Fund | September 21, 2020 |

T. Rowe Price Institutional International Growth Equity Fund | T. Rowe Price International Stock Fund | October 5, 2020 |

Each Reorganization will be consummated on or about the date indicated in the above table (each, a “Closing Date”). The Plans were approved by the Funds’ Boards of Directors (the “Boards”).

Under each Plan, shareholders of each Institutional Fund will become shareholders of the I Class of the corresponding Acquiring Fund (each, an “I Class” and together, the “I Classes”). The value of an account in an I Class will be the same as it was in the Institutional Fund on the Closing Date of a Reorganization. The accompanying combined information statement and prospectus contains detailed information on the transactions and comparisons of the Funds.

Each Institutional Fund and its corresponding Acquiring Fund have identical investment objectives and substantially similar investment programs. The primary difference between the Funds is that the Acquiring Funds are offered in multiple share classes, including an Investor Class, I Class, Advisor Class, Z Class and with respect to the International Stock Fund, an R Class, each of which is available to a variety of

investors and has a different investment minimum. Each Institutional Fund is generally only available to institutional investors and requires an initial investment of $1,000,000, which is the same as each Acquiring Fund I Class’s investment minimum.

As discussed in more detail in the accompanying combined information statement and prospectus, the net expense ratios of the Acquiring Funds’ I Classes were lower than their corresponding Institutional Funds as of the six-month period ended April 30, 2020 (including the effects of any expense limitation agreements that are currently in place).

Since each Acquiring Fund invests in a substantially similar portfolio as its corresponding Institutional Fund, and since each I Class has a lower net expense ratio than that of its corresponding Institutional Fund, it is not a financial benefit to a high account balance shareholder to choose an Institutional Fund over the I Class of an Acquiring Fund. Accordingly, the Boards and fund management believe that offering a single fund with each investment program to a wide variety of investors will allow all shareholders to take advantage of potential economies of scale and reduce inefficiencies that can result from offering two substantially similar funds. Shares of each Institutional Fund will automatically be canceled and redeemed for I Class shares of equal value on the applicable Closing Date.

The Reorganizations are not taxable events, but redeeming or exchanging your shares prior to the Closing Date may be a taxable event, depending on your individual tax situation. The cost basis and holding periods of the Institutional Funds shares will carry over to the I Class shares that you will receive in connection with the Reorganization.

NO SHAREHOLDER ACTION IS REQUIRED WITH RESPECT TO THE REORGANIZATIONS.

We are not asking you for a proxy and you are not requested to send us a proxy. However, if you have any questions regarding the enclosed combined information statement and prospectus, please call T. Rowe Price at 1-800-638-8790.

Sincerely,

Robert W. Sharps

Head of Investments & Group Chief Investment Officer

July 21, 2020

COMBINED INFORMATION STATEMENT AND PROSPECTUS

Transfer of the Assets of each of the:

T. ROWE PRICE INSTITUTIONAL INTERNATIONAL CORE EQUITY FUND

(a series of T. Rowe Price Global Funds, Inc.)

By and in Exchange for I Class Shares of the

T. ROWE PRICE OVERSEAS STOCK FUND

(a series of T. Rowe Price International Funds, Inc.)

T. ROWE PRICE INSTITUTIONAL INTERNATIONAL GROWTH EQUITY FUND

(a series of T. Rowe Price Global Funds, Inc.)

By and in Exchange for I Class Shares of the

T. ROWE PRICE INTERNATIONAL STOCK FUND

(a series of T. Rowe Price International Funds, Inc.)

100 East Pratt Street

Baltimore, MD 21202

This Combined Information Statement and Prospectus (“Statement”) will be delivered to shareholders on or about July 21, 2020.

This Statement is being furnished to shareholders of the T. Rowe Price Institutional International Core Equity and T. Rowe Price Institutional International Growth Equity Funds, each a series of T. Rowe Price Global Funds, Inc. (formerly T. Rowe Price Institutional International Funds, Inc.) (each, an “Institutional Fund” and together, the “Institutional Funds”). As provided in an Agreement and Plan of Reorganization (each, a “Plan” and together, the “Plans”), each Institutional Fund will be reorganized (each, a “Reorganization” and together, the “Reorganizations”) into a corresponding mutual fund advised by T. Rowe Price Associates, Inc. (“T. Rowe Price”), the same investment adviser to each Institutional Fund, as set out in the table below under the heading “Acquiring Funds” (each, an “Acquiring Fund,” together, the “Acquiring Funds,” and collectively with the Institutional Funds, the “Funds”).

Institutional Funds | Acquiring Funds | Expected |

T. Rowe Price Institutional International Core Equity Fund | T. Rowe Price Overseas Stock Fund, a series of T. Rowe Price International Funds, Inc. | September 21, 2020 |

T. Rowe Price Institutional International Growth Equity Fund | T. Rowe Price International Stock Fund, a series of T. Rowe Price International Funds, Inc. | October 5, 2020 |

Each Reorganization will be consummated on or about the date indicated in the above table (each, a “Closing Date”). Each Plan provides for the transfer of substantially all of the assets and liabilities of each Institutional Fund to its corresponding Acquiring Fund, in exchange for I Class shares of the applicable Acquiring Fund (each, an “I Class” and together the “I Classes”). Following the transfer, the I Class shares received in the exchange will be distributed to each Institutional Fund’s shareholders in complete liquidation of the Institutional Funds. Shareholders of the Institutional Funds will receive I Class shares of the applicable Acquiring Fund having an aggregate net asset value equal to the aggregate net asset value of their Institutional Fund shares on the business day immediately preceding the closing date of the Reorganization. All issued and outstanding shares of the Institutional Funds will then be simultaneously redeemed.

Shares of each Institutional Fund will automatically be canceled and redeemed for I Class shares of equal value on the closing dates indicated in the table above and you will become a shareholder in the applicable Acquiring Fund. The value of the share balance in your account will be the same as it was in your Institutional Fund(s) on the business day preceding the day of the Reorganization.

Each Institutional Fund and its corresponding Acquiring Fund have identical investment objectives and substantially similar investment programs.

In accordance with each Fund’s operative documents, and applicable Maryland state and U.S. federal law (including Rule 17a-8 under the Investment Company Act of 1940, as amended (the “1940 Act”)), each Reorganization may be effected without the approval of shareholders of any Fund.

NO SHAREHOLDER ACTION IS REQUIRED WITH RESPECT TO THE REORGANIZATIONS.

This Statement concisely sets forth the information you should know about the Acquiring Funds, their I Classes and the Plans. Please read this Statement and keep it for future reference. It is both an information statement for each of the Institutional Funds and a prospectus for the Acquiring Funds.

The following documents have been filed with the Securities and Exchange Commission (“SEC”) and are incorporated into this Statement by reference:

· The Statement of Additional Information dated July 21, 2020 relating to the Reorganization (“SAI”) (SEC File Nos. [X])

· The prospectuses of the Institutional International Core Equity and Institutional International Growth Equity Funds, each dated March 1, 2020, as supplemented to date (SEC File No. 033-29697)

· The prospectuses of the Overseas Stock and International Stock Funds, each dated March 1, 2020, as supplemented to date (SEC File No. 002-65539)

· The Statement of Additional Information of the Institutional International Core Equity and Institutional International Growth Equity Funds dated May 1, 2020 (SEC File No. 033-29697)

· The Statement of Additional Information of the Overseas Stock and International Stock Funds dated May 1, 2020 (SEC File No. 002-65539)

· The annual shareholder reports of the Institutional International Core Equity and Institutional International Growth Equity Funds, each dated October 31, 2019 (SEC File No. 033-29697)

· The annual shareholder reports of the Overseas Stock and International Stock Funds, each dated October 31, 2019 (SEC File No. 002-65539)

· The semiannual shareholder reports of the Institutional International Core Equity and Institutional International Growth Equity Funds, each dated April 30, 2020 (SEC File No. 033-29697)

· The semiannual shareholder reports of the Overseas Stock and International Stock Funds, each dated April 30, 2020 (SEC File No. 002-65539)

The prospectuses include the Funds’ investment objectives, risks, fees, expenses, and other information that you should read and consider carefully. Each Statement of Additional Information, which contains additional detailed information about the relevant Fund, is not a prospectus but should be read in conjunction with the prospectus.

Each shareholder report contains information about Fund investments, including a review of market conditions and the portfolio manager’s recent investment strategies and their impact on performance. Copies of prospectuses, annual and semiannual shareholder reports, Statements of Additional Information for the Acquiring and Institutional Funds and the SAI relating to these Reorganizations are all available at no cost by calling 1-800-225-5132; by writing to T. Rowe Price, Three Financial Center, 4515 Painters Mill Road, Owings Mills, Maryland 21117; or by visiting our website at troweprice.com. All of the above-referenced documents are also on file with the SEC and available through its website at http://www.sec.gov. Copies of this information

may be obtained, after paying a duplicating fee, by electronic request at publicinfo@sec.gov.

THE SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED UPON THE ADEQUACY OF THIS COMBINED INFORMATION STATEMENT AND PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

TABLE OF CONTENTS

Comparison of Investment Objectives, Policies, and Restrictions | |

No person has been authorized to give any information or to make any representations other than what is in this Statement or in the materials expressly incorporated herein by reference. Any such other information or representation should not be relied upon as having been authorized by the Institutional Funds or Acquiring Funds.

The information contained in this summary is qualified by reference to the more detailed information appearing elsewhere in this Statement, and in the Plans, which are included as Exhibit A to this Statement.

Why are the Reorganizations taking place?

At a meeting held on May 4, 2020, the Boards of Directors of the Funds (the “Boards”), including a majority of the independent directors, approved the Plans under which each Institutional Fund is to be reorganized into its corresponding Acquiring Fund.

What do the Plans provide for?

Each Plan provides for the transfer of substantially all the assets and liabilities of an Institutional Fund to its corresponding Acquiring Fund in exchange for I Class shares of the Acquiring Fund. Following the transfer, the I Class shares received in the exchange will be distributed to shareholders of the Institutional Fund in complete liquidation of each Institutional Fund. All issued and outstanding shares of the Institutional Funds will then be simultaneously redeemed. As a result of the transaction: (1) you will cease being a shareholder of the Institutional Fund(s); (2) instead you will become an owner of I Class shares of the Acquiring Fund(s); and (3) the value of your account in the Acquiring Fund(s) will equal the value of your account in the Institutional Fund(s) as of the close of the business day immediately preceding the closing date of the transaction.

Do I need to vote for the Reorganizations?

No. No vote of shareholders will be taken with respect to the Reorganizations. THE FUNDS ARE NOT ASKING FOR A PROXY AND YOU ARE NOT REQUESTED TO SEND A PROXY TO THE FUNDS WITH RESPECT TO THE REORGANIZATIONS.

Do I need to take any action in connection with the Reorganizations?

No. Your shares of an Institutional Fund will automatically be canceled and redeemed for I Class shares of the Acquiring Fund on the Closing Date of the applicable Reorganization.

Will I have to pay any sales charge, commission, redemption or other similar fee in connection with the applicable Reorganizations?

No, you will not have to pay any sales charge, commission, redemption or other similar fee in connection with the applicable Reorganizations. The I Class does not impose sales charges and does not make any administrative fee payments or 12b-1 fee payments to financial intermediaries. However, you may incur brokerage commissions and other charges when buying or selling I Class shares through a financial intermediary.

1

Who will pay for the Reorganizations?

The expenses incurred to execute the Reorganizations, including all direct and indirect expenses, will be paid by the Funds and their shareholders since each Reorganization is expected to benefit the Funds. The total estimated expenses associated with each Reorganization are as follows:

Funds | Estimated Reorganization Expenses | Estimated Transaction Costs* |

Institutional International Core Equity Fund | $15,000 | $13,000 |

Overseas Stock Fund | 27,000 | 12,000 |

Total | 42,000 | 25,000 |

* Includes estimated brokerage commissions and other transaction costs.

Funds | Estimated Reorganization Expenses | Estimated Transaction Costs* |

Institutional International Growth Equity Fund | $25,000 | $12,000 |

International Stock Fund | 41,000 | 29,000 |

Total | 66,000 | 41,000 |

* Includes estimated brokerage commissions and other transaction costs.

Will there be any tax consequences to the Institutional Funds or their shareholders?

The Reorganizations will each be structured to have no adverse tax consequences to the Institutional Funds or their shareholders. Each Reorganization is conditioned upon the receipt of an opinion of tax counsel to the Funds that, for federal income tax purposes:

· no gain or loss will be recognized by an Institutional Fund, an Acquiring Fund, or their shareholders as a result of a Reorganization;

· the holding period and adjusted basis of the I Class shares received by a shareholder will have the same holding period and adjusted basis of the shareholder’s shares of an Institutional Fund; and

· each Acquiring Fund will assume the holding period and adjusted basis of each asset (with certain exceptions) of its corresponding Institutional Fund that is transferred to the Acquiring Fund that the asset had immediately prior to the Reorganization.

The Institutional Funds may sell certain nontransferable international securities which will result in a net capital gain (or loss) and the Acquiring Funds may buy similar positions in the same securities prior to a Reorganization which will incur transaction expenses.

See “Information About the Reorganizations—Tax Considerations” for more information.

2

What if I redeem my shares before the applicable Reorganization takes place?

If you choose to redeem your shares before the Reorganizations take place, then the redemption will be treated as a normal sale of shares and, generally, will be a taxable transaction.

What are the investment objectives and policies of the Acquiring Funds and the Institutional Funds?

Each Acquiring Fund and its corresponding Institutional Fund have identical investment objectives. The Funds, in substantive part, seek long-term growth of capital through investments in the common stocks of non-U.S. companies.

Each Acquiring Fund and its corresponding Institutional Fund have substantially similar investment programs. The Institutional International Core Equity Fund and its Acquiring Fund, the Overseas Stock Fund, expect to invest significantly outside the U.S. and to diversify broadly among developed markets and, to a lesser extent, emerging market countries throughout the world. Both Funds normally invests at least 80% of its net assets (including any borrowings for investment purposes) in non-U.S. stocks and at least 65% of its net assets in stocks of large-cap companies. Both Funds take a core approach to investing, which provides some exposure to both growth and value styles of investing.

The Institutional International Growth Equity Fund and its Acquiring Fund, the International Stock Fund, expect to primarily invest in stocks outside the U.S. and to diversify broadly among developed and emerging countries throughout the world. Normally, at least 80% of each Fund’s net assets (including any borrowings for investment purposes) will be invested in stocks. The Acquiring Fund normally invests in at least five countries and may purchase the stocks of companies of any size, but its focus will typically be on large companies. The Institutional Fund may purchase the stocks of companies of any size, but its focus will typically be on large companies and, to a lesser extent, medium-sized companies. Security selection for both Funds reflect a growth style.

The Funds have identical fundamental investment restrictions and policies and operating policies which are described below and in more detail in the Statement of Additional Information.

Each post-Reorganization Fund (each, a “Combined Fund”) will continue to follow the current investment program that is shared by each Institutional Fund and its corresponding Acquiring Fund.

See “Comparison of Investment Objectives, Policies, and Restrictions.”

What are the Funds’ management arrangements?

All of the Funds are advised and managed by T. Rowe Price Associates, Inc. (“T. Rowe Price”), an SEC-registered investment adviser that, among others, sponsors and serves as adviser and subadviser to registered investment companies.

3

With respect to the Institutional International Growth Equity and International Stock Funds, T. Rowe Price has entered into subadvisory agreements with T. Rowe Price International Ltd (“T. Rowe Price International”) under which T. Rowe Price International is authorized to trade securities and make discretionary investment decisions on behalf of the Funds. T. Rowe Price International is registered with the SEC as an investment adviser and is authorized or licensed by the United Kingdom Financial Conduct Authority and other global regulators. T. Rowe Price International sponsors and serves as adviser to foreign collective investment schemes and provides investment management services to registered investment companies and other institutional investors. T. Rowe Price International is headquartered in London and has several branch offices around the world. T. Rowe Price International is a direct subsidiary of T. Rowe Price and its address is 60 Queen Victoria Street, London EC4N 4TZ, United Kingdom.

Oversight of the portfolio and specific decisions regarding the purchase and sale of fund investments are made by each Fund’s portfolio manager(s). Each Fund’s investment adviser and subadviser (if applicable) have established an Investment Advisory Committee with respect to each Fund, whose chairman (or cochairmen) have day-to-day responsibility for managing the portfolio and work with the committee in developing and executing each Fund’s investment program.

Both the Institutional International Core Equity and Overseas Stock Funds are managed by Raymond A. Mills, Ph.D., who serves as Chairman to each Fund’s investment advisory committee. Mr. Mills has been chairman of the committee of the Institutional International Core Equity Fund since the fund’s inception in 2010 and of the Overseas Stock Fund since the fund’s inception in 2006. He joined the firm in 1997 and his investment experience dates from that time. He has served as a portfolio manager with the firm throughout the past five years.

Both the Institutional International Growth Equity and International Stock Funds are managed by Richard N. Clattenburg, who serves as Chairman to each Fund’s investment advisory committee. Mr. Clattenburg has been chairman of the committee of both funds since 2015. He joined the firm in 2005 and his investment experience dates from 2003. He has served as a portfolio manager with the firm throughout the past five years.

Each Fund’s Statement of Additional Information provides additional information about the portfolio managers’ compensation, other accounts managed by the portfolio managers, and the portfolio managers’ ownership of the Funds’ shares.

Will the Reorganizations result in higher fund expenses?

None of the Reorganizations are expected to result in higher net expenses. Both the gross and net annual fund operating expense ratios for the Acquiring Funds are expected to be lower than that of the corresponding Institutional Funds. As of the six-month period ended April 30, 2020, the annualized gross and net expense ratios for each Acquiring Fund was lower than that of the corresponding Institutional Fund.

4

Institutional International Core Equity Fund | Overseas Stock Fund | |

Gross expense ratio | 1.38% | 0.66% |

Net expense ratio* | 0.75% | 0.66% |

*Includes the effects of any contractual expense limitation currently in place.

Institutional International Growth Equity Fund | International Stock Fund | |

Gross expense ratio | 1.23% | 0.66% |

Net expense ratio* | 0.75% | 0.66% |

*Includes the effects of any contractual expense limitation currently in place.

Each Institutional Fund pays T. Rowe Price a management fee of 0.65% for the Institutional International Core Equity Fund and 0.70% for the Institutional International Growth Equity Fund based on the fund’s average daily net assets.

Each Acquiring Fund pays T. Rowe Price a management fee that consists of two components—an “individual fund fee,” which reflects the fund’s particular characteristics, and a “group fee.” The group fee, which is designed to reflect the benefits of the shared resources of T. Rowe Price, is calculated daily based on the combined net assets of all T. Rowe Price mutual funds (except the funds-of-funds, T. Rowe Price Reserve Funds, Multi-Sector Account Portfolios, and any index or private-label mutual funds). The group fee schedule is graduated, declining as the combined assets of the T. Rowe Price Funds rise, so shareholders benefit from the overall growth in mutual fund assets. On April 30, 2020, the annual group fee rate was 0.29%. The individual fund fee, also applied to the fund’s average daily net assets, is 0.35%. Based on the group fee rate and individual fund fee rate, each Acquiring Fund’s overall management fee as of April 30, 2020 was 0.64%.

In addition to the management fee, each Institutional Fund pays its operating expenses, and the I Class of each Acquiring Fund pays its pro-rata portion of fund operating expenses and class-specific operating expenses. The net annual operating expense ratio takes into account the effect of any expense limitation agreement in place for the Fund. With respect to each Institutional Fund, T. Rowe Price has agreed (through February 28, 2021 for the Institutional International Core Equity Fund and February 28, 2022 for the Institutional International Growth Equity Fund) to waive its fees and/or bear any expenses (excluding interest; expenses related to borrowings, taxes, and brokerage; nonrecurring, extraordinary expenses; and acquired fund fees and expenses) that would cause the Fund’s ratio of expenses to average daily net assets to exceed 0.75%.

The I Class of each Acquiring Fund also has an expense limitation agreement in place, although it is currently operating below its expense limitation. With respect to the I Class, T. Rowe Price has contractually agreed (through February 28, 2022) to pay the operating expenses of the fund’s I Class excluding management fees; interest; expenses related to borrowings, taxes, and brokerage; nonrecurring, extraordinary expenses; and acquired fund fees and expenses (“I Class Operating Expenses”), to the extent the I Class Operating Expenses exceed 0.05% of the class’ average daily net assets. The

5

agreement may only be terminated at any time after February 28, 2022 with approval by the fund’s Board of Directors. Any expenses paid under this agreement (and a previous limitation of 0.05%) are subject to reimbursement to T. Rowe Price by the fund whenever the fund’s I Class Operating Expenses are below 0.05%. However, no reimbursement will be made more than three years from the date such amounts were initially waived or reimbursed. The fund may only make repayments to T. Rowe Price if such repayment does not cause the I Class Operating Expenses (after the repayment is taken into account) to exceed the lesser of: (1) the limitation on I Class Operating Expenses in place at the time such amounts were waived; or (2) the current expense limitation on I Class Operating Expenses.

As of April 30, 2020, the I Class’ operating expenses for each Acquiring Fund was 0.02%, which is below the operating expense limitation of 0.05%.

Because the management fee of the Acquiring Fund could increase if the group fee component increased due to a significant decrease in the combined net assets of all T. Rowe Price mutual funds, effective September 1, 2020, T. Rowe Price will permanently limit the Acquiring Fund’s overall management fee to the same rate of the Institutional Fund’s current management fee (0.65% for the Overseas Stock Fund and 0.70% for the International Stock Fund of the fund’s average daily net assets). These arrangements may only be terminated with approval by the Acquiring Fund’s shareholders. Fees waived under this agreement will not be subject to reimbursement to T. Rowe Price by the fund. In addition, effective September 1, 2020, T. Rowe Price will waive its fees and/or bear any expenses (excluding interest; expenses related to borrowings, taxes, and brokerage; nonrecurring, extraordinary expenses; and acquired fund fees and expenses) that would cause the I Class’s ratio of expenses to average daily net assets to exceed 0.75% of the I Class’ daily net assets (through February 28, 2021 for the Overseas Stock Fund and through February 28, 2022 for the International Stock Fund), the current expense limit for the Institutional Funds.

After taking into account the effect of each Institutional Fund’s contractual expense limitation, each Acquiring Fund’s I Class’ net annual operating expense ratio is expected to be 0.09% lower than the corresponding Institutional Fund’s net annual operating expense ratio after the Reorganization (0.66% compared to 0.75%, respectively).

Fees and Expenses

The following table further describes the fees and expenses that you may pay if you buy and hold shares of the Funds. The fees and expenses of the Funds set forth below are annualized based on the fees and expenses for the six-month period ended April 30, 2020 and the pro forma fees and expenses reflect the expected fees and expenses of the Combined Fund as of April 30, 2020, assuming the Reorganizations takes place as proposed.

6

Fees and Expenses of the Institutional International Core Equity and Overseas Stock Funds

Institutional International Core Equity Fund | Overseas Stock Fund—I Class | Pro Forma Combined | ||||

Annual fund operating expenses | ||||||

Management fees | 0.65 | % | 0.64 | % | 0.64 | % |

Other expenses | 0.73 | 0.02 | 0.02 | |||

Total annual fund operating expenses | 1.38 | 0.66 | 0.66 | |||

Fee waiver/expense reimbursement | (0.63 | )a | — | b | — | |

Total annual fund operating expenses after fee waiver/expense reimbursement | 0.75 | a | 0.66 | b | 0.66 | |

a T. Rowe Price Associates, Inc., has contractually agreed (through February 28, 2021) to waive its fees and/or bear any expenses (excluding interest; expenses related to borrowings, taxes, and brokerage; nonrecurring, extraordinary expenses; and acquired fund fees and expenses) that would cause the ratio of expenses to exceed 0.75% of the class' average daily net assets. The agreement may only be terminated at any time after February 28, 2021, with approval by the fund’s Board of Directors. Fees waived and expenses paid under this agreement (and a previous limitation of 0.75%) are subject to reimbursement to T. Rowe Price Associates, Inc., by the fund whenever the expense ratio is below 0.75%. However, no reimbursement will be made more than three years from the date such amounts were initially waived or reimbursed. The fund may only make repayments to T. Rowe Price Associates, Inc., if such repayment does not cause the expense ratio (after the repayment is taken into account) to exceed the lesser of: (1) the expense limitation in place at the time such amounts were waived; or (2) the current expense limitation.

b Effective September 1, 2020, with respect to the I Class, T. Rowe Price has also agreed (through February 28, 2021) to waive its fees and/or bear any expenses (excluding interest; expenses related to borrowings, taxes, and brokerage; nonrecurring, extraordinary expenses; and acquired fund fees and expenses) that would cause the I Class’ ratio of expenses to average daily net assets to exceed 0.75%. The agreement may be terminated at any time beyond February 28, 2021, with approval by the fund’s Board of Directors. Fees waived and expenses paid under this agreement (or a separate agreement limiting I Class Operating Expenses to 0.05%) are subject to reimbursement to T. Rowe Price by the fund whenever the I Class’ expense ratio is below 0.75%. However, no reimbursement will be made more than three years from the date such amounts were initially waived or reimbursed. The fund may only make repayments to T. Rowe Price Associates, Inc., if such repayment does not cause the class’ expense ratio (after the repayment is taken into account) to exceed the lesser of: (1) any expense limitation in place at the time such amounts were waived; or (2) any current expense limitation related to the I Class.

Example This example is intended to help you compare the cost of investing in the Funds with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in each Fund for the time periods indicated and then redeem all of your shares at the end of those periods, that your investment has a 5% return each year, and that each Fund’s operating expenses remain the same. The example also assumes that an expense limitation arrangement currently in place is not renewed; therefore, the figures have been adjusted to reflect fee waivers or expense reimbursements only in the

7

periods for which the expense limitation arrangement is expected to continue. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

Fund | 1 year | 3 years | 5 years | 10 years |

Institutional International Core Equity Fund | $77 | $375 | $695 | $1,603 |

Overseas Stock Fund—I Class | 67 | 211 | 368 | 822 |

Pro Forma Combined | 67 | 211 | 368 | 822 |

Fees and Expenses of the Institutional International Growth Equity and International Stock Funds

Institutional International Growth Equity Fund | International Stock Fund—I Class | Pro Forma Combined | ||||

Annual fund operating expenses | ||||||

Management fees | 0.70 | % | 0.64 | % | 0.64 | % |

Other expenses | 0.53 | 0.02 | 0.02 | |||

Total annual fund operating expenses | 1.23 | 0.66 | 0.66 | |||

Fee waiver/expense reimbursement | (0.48 | )a | — | b | — | |

Total annual fund operating expenses after fee waiver/expense reimbursement | 0.75 | a | 0.66 | b | 0.66 | |

a T. Rowe Price Associates, Inc., has contractually agreed (through February 28, 2022) to waive its fees and/or bear any expenses (excluding interest; expenses related to borrowings, taxes, and brokerage; nonrecurring, extraordinary expenses; and acquired fund fees and expenses) that would cause the fund’s ratio of expenses to exceed 0.75% of the fund’s average daily net assets. The agreement may only be terminated at any time after February 28, 2022, with approval by the fund’s Board of Directors. Fees waived and expenses paid under this agreement (and a previous limitation of 0.75%) are subject to reimbursement to T. Rowe Price Associates, Inc., by the fund whenever the fund’s expense ratio is below 0.75%. However, no reimbursement will be made more than three years from the date such amounts were initially waived or reimbursed. The fund may only make repayments to T. Rowe Price Associates, Inc., if such repayment does not cause the fund’s expense ratio (after the repayment is taken into account) to exceed the lesser of: (1) the expense limitation in place at the time such amounts were waived; or (2) the fund’s current expense limitation.

b Effective September 1, 2020, with respect to the I Class, T. Rowe Price has also agreed (through February 28, 2022) to waive its fees and/or bear any expenses (excluding interest; expenses related to borrowings, taxes, and brokerage; nonrecurring, extraordinary expenses; and acquired fund fees and expenses) that would cause the I Class’ ratio of expenses to average daily net assets to exceed 0.75%. The agreement may be terminated at any time beyond February 28, 2022, with approval by the fund’s Board of Directors. Fees waived and expenses paid under this agreement (or a separate agreement limiting I Class Operating Expenses to 0.05%) are subject to reimbursement to T. Rowe Price by the fund whenever the I Class’ expense ratio is below 0.75%. However, no reimbursement will be made after February 29, 2024 or three years from the date such amounts were initially waived or reimbursed, whichever is sooner. The fund may only make repayments to T. Rowe Price Associates, Inc., if such repayment does not cause the class’ expense ratio (after the repayment is taken into account) to exceed

8

the lesser of: (1) any expense limitation in place at the time such amounts were waived; or (2) any current expense limitation related to the I Class.

Example This example is intended to help you compare the cost of investing in the Funds with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in each Fund for the time periods indicated and then redeem all of your shares at the end of those periods, that your investment has a 5% return each year, and that each Fund’s operating expenses remain the same. The example also assumes that an expense limitation arrangement currently in place is not renewed; therefore, the figures have been adjusted to reflect fee waivers or expense reimbursements only in the periods for which the expense limitation arrangement is expected to continue. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

Fund | 1 year | 3 years | 5 years | 10 years |

Institutional International Growth Equity Fund | $77 | $293 | $581 | $1,401 |

International Stock Fund—I Class | 67 | 211 | 368 | 822 |

Pro Forma Combined | 67 | 211 | 368 | 822 |

A discussion about the factors considered by the Board and its conclusions in approving the Funds’ investment management subadvisory agreements appear in the Funds’ semiannual report to shareholders for the period ended April 30.

What are the Funds’ policies for purchasing, redeeming, exchanging, and pricing shares?

The Acquiring Fund—I Classes and the Institutional Funds have substantially similar procedures for purchasing, redeeming, exchanging, and pricing shares. The I Classes and the Institutional Funds both generally require a $1 million minimum initial investment and there is no minimum for additional purchases, although the initial investment minimum for the I Class generally is waived for retirement plans, financial intermediaries, and certain client accounts for which T. Rowe Price or its affiliates have discretionary investment authority (the Institutional Funds may waive the investment minimum for certain types of accounts held through a retirement plan, financial adviser, or other financial intermediary). Shares of the Funds may be redeemed at their respective net asset values; however, large redemptions can adversely affect a portfolio manager’s ability to implement a Fund’s investment strategy by causing the premature sale of securities. Therefore, the Funds reserve the right (without prior notice) to pay all or part of redemption proceeds with securities from the Fund’s portfolio rather than in cash (redemption in-kind). The Funds’ procedures for pricing their shares are identical. Fund share prices are based on a Fund’s net asset value and is calculated at the close of the New York Stock Exchange (normally 4 p.m. ET) each day the exchange is open for business. The Funds also use the same calculation methodology.

For more detailed information, please refer to section 3 of each Fund’s prospectus, entitled “Information About Accounts in T. Rowe Price Funds.”

9

What are the Funds’ policies on dividends and distributions?

The Funds’ policies on dividends and distributions are identical. Each Fund has a policy of distributing, to the extent possible, all of its net investment income and realized capital gains to its respective shareholders. Any dividends or capital gains are declared and paid annually, usually in December. Redemptions or exchanges of fund shares and distributions by the fund, whether or not you reinvest these amounts in additional fund shares, may be taxed as ordinary income or capital gains unless you invest through a tax-deferred account (in which case you will be taxed upon withdrawal from such account).

What are the principal risks of the Funds?

The Funds are subject to substantially similar risks. However, the disclosure in each Fund’s current prospectus describing the risk factors varies slightly. Below are the risk factors to which the Funds are exposed. These risks are not expected to materially change once the Funds are combined.

Market conditions The value of the fund’s investments may decrease, sometimes rapidly or unexpectedly, due to factors affecting an issuer held by the fund, particular industries, or the overall securities markets. A variety of factors can increase the volatility of the fund’s holdings and markets generally, including political or regulatory developments, recessions, inflation, rapid interest rate changes, war or acts of terrorism, natural disasters, and outbreaks of infectious illnesses or other widespread public health issues. Certain events may cause instability across global markets, including reduced liquidity and disruptions in trading markets, while some events may affect certain geographic regions, countries, sectors, and industries more significantly than others. These adverse developments may cause broad declines in market value due to short-term market movements or for significantly longer periods during more prolonged market downturns.

International investing Investing in the securities of non-U.S. issuers involves special risks not typically associated with investing in U.S. issuers. Non-U.S. securities tend to be more volatile and have lower overall liquidity than investments in U.S. securities and may lose value because of adverse local, political, social, or economic developments overseas, or due to changes in the exchange rates between foreign currencies and the U.S. dollar. In addition, investments outside the U.S. are subject to settlement practices and regulatory and financial reporting standards that differ from those of the U.S. The risks of investing outside the U.S. are heightened for any investments in emerging markets, which are susceptible to greater volatility than investments in developed markets.

Sector exposure At times, the fund may have a significant portion of its assets invested in securities of issuers conducting business in a broadly related group of industries within the same economic sector. Issuers in the same economic sector may be similarly affected by economic or market events, making the fund more

10

vulnerable to unfavorable developments in that economic sector than funds that invest more broadly.

Large-cap stocks Securities issued by large-cap companies tend to be less volatile than securities issued by smaller companies. However, larger companies may not be able to attain the high growth rates of successful smaller companies, especially during strong economic periods, and may be unable to respond as quickly to competitive challenges.

Stock investing Stocks generally fluctuate in value more than bonds and may decline significantly over short time periods. There is a chance that stock prices overall will decline because stock markets tend to move in cycles, with periods of rising and falling prices. The value of stocks held by the fund may decline due to general weakness or volatility in the stock markets in which the fund invests or because of factors that affect a particular company or industry.

Active management The fund’s overall investment program and holdings selected by the fund’s investment adviser may underperform the broad markets, relevant indices, or other funds with similar objectives and investment strategies.

For Institutional International Growth Equity and International Stock Funds which focus on growth investing, the following risk applies:

Growth investing The fund’s growth approach to investing could cause it to underperform other stock funds that employ a different investment style. Growth stocks tend to be more volatile than certain other types of stocks and their prices may fluctuate more dramatically than the overall stock market. A stock with growth characteristics can have sharp price declines due to decreases in current or expected earnings and may lack dividends that can help cushion its share price in a declining market.

For the Institutional International Core Equity, Institutional International Growth Equity and International Stock Funds that have a higher concentration in certain geographic regions, the following risks apply:

Investing in Europe The European financial markets have been experiencing increased volatility due to concerns over rising government debt levels of several European countries, and these events may continue to significantly affect all of Europe. European economies could be significantly affected by, among other things, rising unemployment, the imposition or unexpected elimination of fiscal and monetary controls by member countries of the European Economic and Monetary Union, uncertainty surrounding the euro, the success of governmental actions to reduce budget deficits, and ongoing uncertainties surrounding Brexit, the formal withdrawal by the United Kingdom from the European Union.

Investing in Asia Many Asian economies have at various times been negatively affected by inflation, currency devaluations, an over-reliance on international trade and exports, political and social instability, and less developed financial systems and

11

securities trading markets. Trade restrictions, unexpected decreases in exports, changes in government policies, or natural disasters could have a significant impact on companies doing business in Asia. The Asian region may be significantly affected by political unrest, military conflict, economic sanctions, and less demand for Asian products and services.

Emerging markets Investments in emerging market countries are subject to greater risk and overall volatility than investments in the U.S. and developed markets. Emerging market countries tend to have economic structures that are less diverse and mature, and political systems that are less stable, than those of developed countries. In addition to the risks associated with investing outside the U.S., emerging markets are more susceptible to governmental interference, political and economic uncertainty, local taxes and restrictions on the fund’s investments, less efficient trading markets with lower overall liquidity, and more volatile currency exchange rates.

For the Institutional International Core Equity Fund, due to a higher concentration in certain geographic regions, the following risks apply:

Investing in Japan The Japanese economy has at times been negatively affected by government intervention and protectionism, excessive regulation, an unstable financial services sector, a heavy reliance on international trade, and natural disasters. Some of these factors, as well as other adverse political developments, increases in government debt, and changes in fiscal, monetary, or trade policies, may affect the Japanese economy.

Investing in United Kingdom The risks of investing in the United Kingdom have been heightened as a result of Brexit, the formal steps taken by the United Kingdom to exit the European Union, which has resulted in increased volatility and triggered political, economic, and legal uncertainty. Despite a formal withdrawal deal, negotiations are ongoing and uncertainty remains as to the final terms and consequences of Brexit. Issuers in the United Kingdom may experience lower growth until negotiations and new agreements are finalized.

REASONS FOR THE REORGANIZATIONS

The Boards of each Fund, including a majority of the independent directors, have determined that the applicable Reorganization is in the best interests of the shareholders of each Fund and that the interests of shareholders of the Funds will not be diluted as a result of the Reorganizations.

In considering whether to approve the Reorganizations, the Boards reviewed the following matters and concluded that each Reorganization is in the best interest of the Funds for the reasons indicated below.

As explained in this Statement, each Institutional Fund and its corresponding Acquiring Fund offer a substantially similar investment program. As of April 30, 2020,

12

each Institutional Fund and its corresponding Acquiring Fund held a substantially similar set of securities. The I Class of each Acquiring Fund is available at a lower net expense ratio than the Institutional Fund. See “SUMMARY—Will the Reorganizations result in higher fund expenses?” This includes the effects of a contractual expense limitation for each Acquiring Fund’s I Class.

In addition, as explained in this Statement, each Institutional Fund and its corresponding Acquiring Fund have substantially similar investment strategies and identical fundamental investment restrictions and policies and operating policies. The Institutional Funds and the I Classes are offered to institutional shareholders (and, with respect to the I Class, high net worth individuals) with at least a $1 million initial investment minimum and waivers of the minimum for similar types of accounts. The Boards and fund management believe that offering a single fund with each investment program to a wide variety of investors will allow all shareholders to take advantage of potential economies of scale and reduce inefficiencies that can result from offering two substantially similar funds.

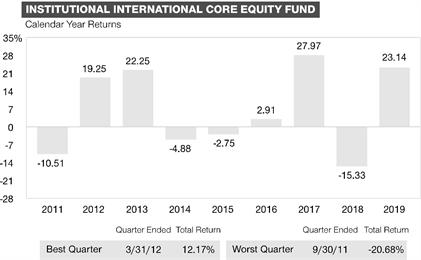

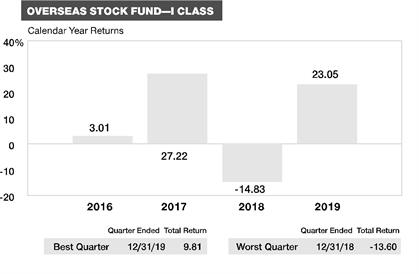

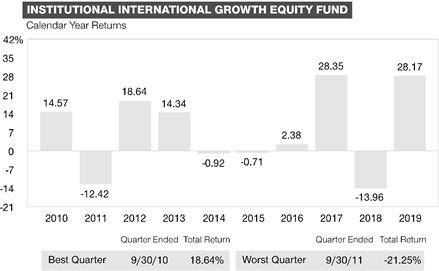

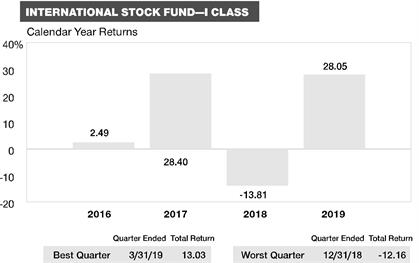

The Boards also considered the Funds’ performance. The average annual total returns of the Funds for the periods ended December 31, 2019 are set forth in the following tables.

Institutional International Core Equity Fund into Overseas Stock Fund—I Class

Average Annual Total Returns | |||||||||||||||||||||||||

| 1 Year | 5 Years | Since Inception | Since I Class Inception | Inception | ||||||||||||||||||||

| Institutional International Core Equity Fund | 10/27/2010 | |||||||||||||||||||||||

| Returns before taxes | 23.14 | % | 5.95 | % | 6.16 | % | 6.72 | % | ||||||||||||||||

| Returns after taxes on distributions | 22.66 | 5.48 | 5.75 | 6.17 | ||||||||||||||||||||

| Returns after taxes on distributions and sale of fund shares | 14.41 | 4.89 | 5.14 | 5.52 | ||||||||||||||||||||

Overseas Stock Fund—I Class | 08/28/2015 | ||||||||||||||||||||||||

Returns before taxes | 23.05 | — | 6.76 | — | |||||||||||||||||||||

Returns after taxes on distributions | 22.60 | — | 6.21 | — | |||||||||||||||||||||

Returns after taxes on distributions and sale of fund shares | 14.25 | — | 5.33 | — | |||||||||||||||||||||

13

Institutional International Growth Equity Fund into International Stock Fund—I Class

Average Annual Total Returns | ||||||||||||||||||||||

| 1 Year | 5 Years | 10 Years | Since Inception | Since I Class Inception | Inception Date | ||||||||||||||||

| Institutional International Growth Equity Fund | 09/07/1989 | ||||||||||||||||||||

| Returns before taxes | 28.17 | % | 7.55 | % | 6.85 | % | — | % | 8.56 | % | |||||||||||

| Returns after taxes on distributions | 26.77 | 6.43 | 6.19 | — | 7.26 | ||||||||||||||||

| Returns after taxes on distributions and sale of fund shares | 17.49 | 5.80 | 5.51 | — | 6.56 | ||||||||||||||||

International Stock Fund—I Class | 08/28/2015 | |||||||||||||||||||||

Returns before taxes | 28.05 | — | — | 8.64 | — | |||||||||||||||||

Returns after taxes on distributions | 27.16 | — | — | 7.54 | — | |||||||||||||||||

Returns after taxes on distributions and sale of fund shares | 17.11 | — | — | 6.63 | — | |||||||||||||||||

The performance of each Institutional Fund and its corresponding Acquiring Fund has been substantially similar over the periods for which they have both been in operation. Minor differences in Fund performance over the same period were primarily due to differences in fees and slight differences in position sizes as each Fund sold securities to meet redemption requests or bought securities as the Fund gained assets. The differences in performance do not reflect a difference in strategy.

The Boards also considered that the exchange of shares pursuant to the Reorganizations are not expected to create any tax liabilities for shareholders as the exchange of shares will not be a taxable event. The cost basis and holding periods of shares in an Institutional Fund will carry over to the I Class shares that a shareholder will receive as a result of a Reorganization. The Boards noted, however, that the Reorganizations will still have tax implications for shareholders in taxable accounts to the extent an Institutional Fund realizes gains before the Reorganization, because the Institutional Fund will need to distribute any net realized gains and taxable income before the Reorganization and these distributions will be taxable to shareholders.

In approving the Reorganization, the Board of each Institutional Fund also considered that Institutional Fund shareholders have the ability to redeem their shares at any time up to the date of the Reorganizations without redemption or other fees. (While none of the Funds currently assess a redemption fee, prior to April 1, 2019, the International

14

Stock Fund charged a 2.00% redemption fee, as a percentage of the amount redeemed on shares held for 90 days or less.)

The Boards considered that each of the Acquiring Fund’s service provider agreements, including, among others, their investment advisory, subadvisory, distribution, fund accounting, and custody agreements, will remain in place and will not be modified as a result of the Reorganizations. The Boards further considered that the service providers to each Fund are identical, and that each of the Acquiring Fund’s service provider agreements are substantially similar to those currently in place for each Institutional Fund (with the exception of the differences between each Fund’s management fee, which is discussed under the heading “SUMMARY—Will the Reorganizations result in higher fund expenses?”).

The Boards considered that the Funds share the same portfolio managers, and that the members of each Fund’s investment advisory committee are identical. No changes to the Acquiring Funds’ portfolio managers, investment advisory committee, or resources available to the Funds are expected as a result of the Reorganizations.

The Institutional Funds and Acquiring Funds use identical pricing methodologies to value their respective assets. The assets of the Institutional Funds will be transferred to the Acquiring Funds at their fair market value, determined as of the close of regular trading on the New York Stock Exchange on the business day immediately preceding the Closing Date. Each of these assets are securities already held by the applicable Acquiring Fund and are therefore valued using the same pricing sources and methodologies. Shares of each Acquiring Fund equal in value to the assets that will be received by each Institutional Fund in exchange. The expenses incurred to execute the Reorganizations will be paid by the Funds and their shareholders since each Reorganization is expected to benefit the Funds. For these reasons, the Boards believe that each Fund and its shareholders will not be diluted as a result of the Reorganization.

Therefore, in consideration of these factors, coupled with the fact the Funds have substantially similar portfolios, the Boards concluded that each Reorganization is in the best interests of the shareholders of the Institutional Funds and the Acquiring Funds. T. Rowe Price and the Boards believe that shareholders’ interests will be better served over time by completing this transaction.

INFORMATION ABOUT THE REORGANIZATIONS

The following summary of the terms and conditions of the Plans is qualified by reference to the Plans, which are included as Exhibit A to this Statement.

Plans of Reorganization

Each Reorganization will be consummated on or about the date indicated in the below table, or such other date as is agreed to by each Institutional Fund and its corresponding Acquiring Fund (“Closing Date”).

15

Institutional Funds | Acquiring Funds | Closing Date |

Institutional International Core Equity Fund | Overseas Stock Fund | September 21, 2020 |

Institutional International Growth Equity Fund | International Stock Fund | October 5, 2020 |

The parties to each Plan may postpone the Closing Date until a later date on which all of the conditions to the obligations of each party under the Plan are satisfied, provided that the Plan may be terminated by either party if the Closing Date does not occur on or before December 31, 2020. See “Conditions to Closing.”

On the Closing Date, each Institutional Fund will transfer substantially all of its assets to its corresponding Acquiring Fund in exchange for I Class shares of the Acquiring Fund having an aggregate net asset value equal to the aggregate value of the assets so transferred as of the close of regular trading on the New York Stock Exchange on the business day immediately preceding the Closing Date (“Valuation Date”). Each Acquiring Fund will assume or otherwise be responsible for any liabilities of the Institutional Fund existing on the Valuation Date. The number of I Class shares of the Acquiring Fund issued in the exchange will be determined by dividing the aggregate value of the assets of the Institutional Fund transferred (computed in accordance with the policies and procedures set forth in the current prospectus of the Acquiring Fund, subject to review and approval by the Institutional Fund) by the net asset value per share of the Acquiring Fund as of the close of regular trading on the Valuation Date. While it is not possible to determine the exact exchange ratio until the Valuation Date, due to, among other matters, market fluctuations and differences in the relative performance of each Institutional Fund and Acquiring Fund, the following table indicates the number of Acquiring Fund shares shareholders of each Institutional Fund would have received had the Reorganization taken place on the date indicated in the table.

Institutional Funds | Acquiring Funds | Number of Shares | Date |

Institutional International Core Equity Fund | Overseas Stock Fund | 1.1802 | April 30, 2020 |

Institutional International Growth Equity Fund | International Stock Fund | 1.2943 | April 30, 2020 |

As soon as practicable after the Closing Date, each Institutional Fund will distribute, in liquidation of the Institutional Fund, pro rata to its shareholders of record as of the close of business on the Valuation Date, the full and fractional shares of each Acquiring Fund received in the exchange. The Institutional Funds will accomplish this distribution by transferring the corresponding Acquiring Fund shares then credited to the account of the Institutional Fund on the books of the Acquiring Fund to open accounts on the share records of I Class shares of the Acquiring Fund in the names of the Institutional Fund’s shareholders, and representing the respective pro-rata number of the I Class shares of the Acquiring Fund due to such shareholders. All issued and outstanding shares of the Institutional Funds will then be simultaneously canceled and redeemed.

16

The stock transfer books of the Institutional Funds will be permanently closed as of the close of business on the Valuation Date. The Institutional Funds will only accept redemption requests received prior to the close of regular trading on the New York Stock Exchange on the Valuation Date. Redemption requests received thereafter will be deemed to be requests for redemption of the Acquiring Fund shares to be distributed to Institutional Fund shareholders pursuant to each Plan.

Conditions to Closing

The obligation of each Institutional Fund to transfer its assets to the Acquiring Fund pursuant to each Plan is subject to the satisfaction of certain conditions precedent, including performance by the Acquiring Fund in all material respects of its agreements and undertakings under each Plan, receipt of certain documents from the Acquiring Fund and receipt of a tax opinion of counsel to the Acquiring Fund. The obligation of each Acquiring Fund to consummate the Reorganization is subject to the satisfaction of certain conditions precedent, including performance by each Institutional Fund of its agreements and undertakings under each Plan, receipt of certain documents and financial statements from each Institutional Fund, and receipt of a tax opinion of counsel to each Institutional Fund.

The consummation of the Reorganization is subject to a number of conditions set forth in the Plans, some of which may be waived by the Boards of the Funds. The Plans may be terminated and the Reorganizations abandoned at any time prior to the Closing Date. See “Other Matters” below.

Expenses of Reorganization

The estimated expenses related to each Reorganization are set forth under the heading, “Who will pay for the Reorganizations?” These costs represent management’s estimate of professional services and fees, any costs related to printing, and mailing, the information statement, brokerage expenses and transaction costs (including taxes and stamps). The costs related to the Reorganizations will be borne by the Funds since each Reorganization is expected to benefit shareholders. It is anticipated that substantially all of the Institutional Funds’ portfolio holdings will transfer to the Acquiring Funds as part of the Reorganizations. Prior to the Reorganizations, any derivatives positions (if applicable) will generally be closed out, and any holdings that are deemed worthless will be disposed of.

Tax Considerations

Each Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization under Section 368(a)(1)(C) of the Internal Revenue Code of 1986, as amended (“IRC”, or “Code”), with no gain or loss recognized as a consequence of the Reorganization by each Acquiring Fund and Institutional Fund or their shareholders.

The consummation of the transaction contemplated under the Plans is conditioned upon receipt of an opinion from Willkie Farr & Gallagher LLP, counsel to both Funds, to the effect that, on the basis of certain representations of fact by officers of the

17

Institutional Funds and the Acquiring Funds, the existing provisions of the IRC, current administrative rules and court decisions, for federal income tax purposes:

· No gain or loss will be recognized by the Acquiring Funds or the Institutional Funds or their shareholders as a result of the Reorganization.

· Shareholders of each Institutional Fund will carry over the cost basis and holding periods of their Institutional Fund shares to their new I Class shares.

· The Acquiring Funds will assume the basis and holding periods of the Institutional Funds’ assets (other than certain assets, if any, subject to mark to market treatment under special tax rules).

To ensure that the transaction qualifies as a tax-free reorganization, it must meet certain requirements—the most important of which are that substantially all of the assets of the Institutional Funds are transferred and that the Acquiring Funds will maintain the historical business (as defined by the Internal Revenue Services (the “IRS”)) of the Institutional Fund. In the opinion of counsel and to the best knowledge of the Funds’ officers, the proposed transaction will comply with these and all other relevant requirements.

Other tax consequences to shareholders of the Institutional Funds are:

· Certain securities held by the Institutional Funds are expected to be sold prior to the transaction and not acquired by the Acquiring Funds. It is possible that any such sales will increase or decrease the expected distributions to shareholders of the Institutional Funds prior to the Reorganization. The exact amount of such sales and whether and to what extent they will result in taxable distributions to shareholders of the Institutional Funds will be influenced by a variety of factors and cannot be determined with certainty at this time.

· Since the cost basis of the Institutional Funds’ assets that are transferred will remain the same (other than certain assets, if any, subject to mark to market treatment under special tax rules), gains or losses on their subsequent sale by the Acquiring Funds will be shared with the shareholders of the Acquiring Funds. The potential shifting of tax consequences related to this is not expected to be significant.

· The Institutional Funds declare dividends annually (usually in December). Any taxable dividends of the Institutional Funds available for distribution prior to the Reorganizations will be distributed immediately prior to the Closing Date.

Based on the information available at the time of this Statement, it is anticipated that at the respective Closing Date, the Institutional Funds will not have any tax basis net realized capital losses. Any tax basis net realized capital losses of the Institutional Funds could be carried forward indefinitely to the applicable Acquiring Fund, although there may be certain limitations under the Code as to the amount that could be used

18

each year by the Combined Fund to offset future tax basis net realized capital gains. In addition, based on the information available at the time of this Statement, it is anticipated that any tax basis net capital losses of the Acquiring Fund at the respective Closing Date can be carried forward indefinitely without annual limitation as to the amount that can be used to offset future tax basis net realized capital gains of the Combined Fund. As of April 30, 2020, the Institutional International Core Equity and Overseas Stock Funds have tax basis capital loss carryforwards.

Both the Institutional International Core Equity and Institutional International Growth Equity Funds are expected to sell certain nontransferable international securities prior to each Institutional Fund’s Reorganization, which are expected to result in capital gains. Based on information as of April 30, 2020, T. Rowe Price estimates that these sales would result in a net capital gain position of approximately $2,443,000 (or $0.95 per share) for the Institutional International Growth Equity Fund and approximately $442,000 (or $0.23 per share) for the Institutional International Core Equity Fund. This amount does not take into account current year net realized capital gains (or losses). The Overseas Stock and International Stock Funds will, in turn, buy similar positions in the same securities prior to the Reorganizations. These transactions will result in brokerage expenses. T. Rowe Price estimates that the brokerage commission and other transaction costs (including taxes and stamps) relating to the sale and purchase of these nontransferable securities will be approximately $3,000 for replicating the positions of the Institutional International Core Equity Fund in the Overseas Stock Fund, and approximately $24,000 for replicating the positions of the Institutional International Growth Equity Fund in the International Stock Fund. In addition, the Institutional Funds will close out any derivatives positions (if applicable) and, although unlikely, sell any assets prior to the Reorganization that are deemed not acceptable to the applicable Acquiring Fund or inconsistent with the Acquiring Fund’s investment program, which could result in additional brokerage expenses and may affect the amount of income and capital gains that are required to be distributed. Because the Institutional International Growth Equity and Institutional International Core Equity Funds are expected to have realized gains at the time of the Reorganizations, it is anticipated that these Funds will distribute taxable income (including the realized gains) as a taxable dividend and taxable capital gains to shareholders prior to the Reorganization. The actual amount of capital gains (or losses) and brokerage commissions and other transaction costs resulting from the purchase and sale of any securities will differ from the amounts stated above due to changes in market conditions, portfolio composition, and market values at the time of sale. In addition, because the Acquiring Funds may have realized gains that are required to be distributed by the end of the year, Institutional Fund shareholders may, as shareholders of an Acquiring Fund, receive another taxable capital gain distribution in December (made by the Acquiring Fund) that they otherwise would not incur. In reporting tax information to their shareholders and the IRS, the Funds follow the IRS requirements.

19

Shareholders should recognize that an opinion of counsel is not binding on the IRS or on any court. The Funds do not expect to obtain a ruling from the IRS regarding the consequences of a Reorganization. Accordingly, if the IRS sought to challenge the tax treatment of a Reorganization and was successful, neither of which is anticipated, the Reorganizations would be treated as a taxable sale of assets of the Institutional Funds, followed by the taxable liquidation of the Institutional Funds.

Other Matters

To the extent permitted by law, the Boards of the Funds may amend the Plans without shareholder approval or may waive any default by the Institutional Funds or the Acquiring Funds or the failure to satisfy any of the conditions of their obligations, provided that no such amendment or waiver may be made if it would adversely affect shareholders of the Institutional Funds or the Acquiring Funds. The Plans may be terminated and the Reorganizations abandoned at any time by action of the Boards. The Boards may, at their election, terminate the Plans in the event that a Reorganization has not closed on or before December 31, 2020.

Description of I Class Shares

Full and fractional I Class shares of each Acquiring Fund will be issued to shareholders of the Institutional Funds in accordance with the procedures under the Plans as previously described. Each Acquiring Fund share will be fully paid and nonassessable when issued, will have no preemptive or conversion rights, and will be transferrable on its books. Ownership of I Class shares of an Acquiring Fund by former shareholders of an Institutional Fund will be recorded electronically and the Acquiring Funds will issue a confirmation to such shareholders relating to those shares acquired as a result of the Reorganizations.

The voting rights of the Institutional Funds and the Acquiring Funds are the same. As shareholders of an Acquiring Fund, former shareholders of an Institutional Fund will have the same voting rights with respect to the Acquiring Fund as they currently have with respect to their Institutional Fund. Neither the Institutional Funds nor the Acquiring Funds routinely hold meetings of shareholders. Both the Institutional Funds and the Acquiring Funds are organized as series of a Maryland corporation. To hold a shareholders’ meeting for a Maryland corporation, one-third of the corporation’s shares entitled to be voted must have been received by proxy or be present in person at the meeting.

Accounting Survivor and Performance Reporting

Each Acquiring Fund will be the surviving fund for accounting, tax, and performance reporting purposes. The Acquiring Fund’s historical financial statements will be utilized for all financial reporting after each Reorganization and the performance of each Institutional Fund will no longer be used.

Capitalization

The following tables show the unaudited capitalization of each Institutional Fund and Acquiring Fund (as of each period indicated in the table), and on a pro forma basis as

20

of that date giving effect to the proposed acquisition of fund assets. The actual net assets of the Institutional Funds and Acquiring Funds on the Valuation Date will differ due to fluctuations in net asset values, subsequent purchases, and redemptions of shares.

Institutional International Core Equity Fund into Overseas Stock Fund—I Class

| Fund | Net Assets | Net Asset | Shares | |||

| |||||||

| Institutional International Core Equity Fund | $20,213 | $10.75 | 1,881 | |||

Overseas Stock Fund | |||||||

Investor Class | 2,818,154 | 9.10 | 309,763 | ||||

I Class | 3,024,801 | 9.10 | 332,392 | ||||

Advisor Class | 45,234 | 8.99 | 5,032 | ||||

Z Class | 8,725,780 | 9.11 | 958,048 | ||||

Pro Forma Adjustments** | (42 | ) | 339 | ||||

Pro Forma Combined | |||||||

Investor Class | 2,818,154 | 9.10 | 309,763 | ||||

I Class | 3,044,972 | 9.10 | 334,612 | ||||

Advisor Class | 45,234 | 8.99 | 5,032 | ||||

Z Class | 8,725,780 | 9.11 | 958,048 | ||||

* Information is as of April 30, 2020.

** Pro forma adjustments include the estimated one-time fees and expenses and other costs associated with the securities transfer incurred by the funds in connection with the consummation of the Reorganization, including the estimated other fees and expenses described in “Expenses of Reorganization” under “Information About the Reorganization.”

21

Institutional International Growth Equity Fund into International Stock Fund—I Class

| Fund | Net Assets | Net Asset | Shares | |||

| |||||||

| Institutional International Growth Equity Fund | $52,856 | $20.52 | 2,576 | |||

International Stock Fund | |||||||

Investor Class | 3,289,264 | 15.84 | 207,640 | ||||

I Class | 964,785 | 15.85 | 60,878 | ||||

Advisor Class | 15,396 | 15.85 | 5,032 | ||||

R Class | 7,982 | 15.63 | 958,048 | ||||

Z Class | 8,191,745 | 15.85 | 516,723 | ||||

Pro Forma Adjustments** | (66 | ) | 758 | ||||

Pro Forma Combined | |||||||

Investor Class | 3,289,264 | 15.84 | 207,640 | ||||

I Class | 1,017,575 | 15.85 | 64,212 | ||||

Advisor Class | 15,396 | 15.85 | 5,032 | ||||

R Class | 7,982 | 15.63 | 958,048 | ||||

Z Class | 8,191,745 | 15.85 | 516,723 | ||||

* Information is as of April 30, 2020.

** Pro forma adjustments include the estimated one-time fees and expenses and other costs associated with the securities transfer incurred by the funds in connection with the consummation of the Reorganization, including the estimated other fees and expenses described in “Expenses of Reorganization” under “Information About the Reorganization.”

The Financial Highlights tables, which provide information about the financial history for each Institutional Fund and Acquiring Fund—I Class, are based on a single share outstanding throughout the periods shown.

The tables are part of each Fund’s financial statements, which are included in each Fund’s respective semiannual report. Except for the information for the semiannual period ended April 30, 2020, the information has been audited by each Fund’s independent registered public accounting firm, [X], whose report, along with each Fund’s financial highlights, is included in the Fund’s annual report, which is incorporated by reference into each Fund’s Statement of Additional Information and available upon request.

22

INSTITUTIONAL INTERNATIONAL CORE EQUITY FUND | |

Unaudited | |

FINANCIAL HIGHLIGHTS | For a share outstanding throughout each period |

6 Months Ended | Year | 10/31/18 | 10/31/17 | 10/31/16 | 10/31/15 | ||||||||||||||||||||

NET ASSET VALUE | |||||||||||||||||||||||||

Beginning of period | $ | $ | 12.50 | $ | 13.96 | $ | 11.22 | $ | 11.71 | $ | 12.33 | ||||||||||||||

| |||||||||||||||||||||||||

Investment activities | |||||||||||||||||||||||||

Net investment | 0.27 | 0.40 | 0.27 | 0.26 | 0.27 | ||||||||||||||||||||

Net realized and | 0.91 | (1.61 | ) | 2.73 | (0.51 | ) | (0.50 | ) | |||||||||||||||||

Total from investment | 1.18 | (1.21 | ) | 3.00 | (0.25 | ) | (0.23 | ) | |||||||||||||||||

| |||||||||||||||||||||||||

Distributions | |||||||||||||||||||||||||

Net investment income | (0.91 | ) | (0.25 | ) | (0.26 | ) | (0.23 | ) | (0.39 | ) | |||||||||||||||

Net realized gain | – | – | – | (0.01 | ) | – | |||||||||||||||||||

Total distributions | (0.91 | ) | (0.25 | ) | (0.26 | ) | (0.24 | ) | (0.39 | ) | |||||||||||||||

| |||||||||||||||||||||||||

NET ASSET VALUE | $ | $ | 12.77 | $ | 12.50 | $ | 13.96 | $ | 11.22 | $ | 11.71 | ||||||||||||||

Ratios/Supplemental Data | |||||||||||||||||||||||||

Total return(2)(3) | % | 10.63 | % | (8.84 | )% | 27.35 | % | (2.09 | )% | (1.79 | )% | ||||||||||||||

Ratios to average net assets:(2) | |||||||||||||||||||||||||

Gross expenses before waivers/ payments | % | 1.38 | % | 0.86 | % | 0.84 | % | 0.86 | % | 0.88 | % | ||||||||||||||

Net expenses after | % | 0.75 | % | 0.75 | % | 0.75 | % | 0.75 | % | 0.75 | % | ||||||||||||||

Net investment income | 2.25 | % | 2.85 | % | 2.13 | % | 2.37 | % | 2.20 | % | |||||||||||||||

Portfolio turnover rate | % | 32.9 | % | 32.3 | % | 11.5 | % | 22.1 | % | 18.0 | % | ||||||||||||||

Net assets, end of period (in thousands) | $ | $ | 32,574 | $ | 46,930 | $ | 182,208 | $ | 128,268 | $ | 163,071 | ||||||||||||||

(1) Per share amounts calculated using average shares outstanding method.

(2) Includes the impact of expense-related arrangements with Price Associates.

(3) Total return reflects the rate that an investor would have earned on an investment in the fund during each period, assuming reinvestment of all distributions, and payment of no redemption or account fees, if applicable.

23

OVERSEAS STOCK FUND—I CLASS | |

Unaudited | |