UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3010

Fidelity Advisor Series VII

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Marc Bryant, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | July 31 |

Date of reporting period: | January 31, 2017 |

Item 1.

Reports to Stockholders

Fidelity Advisor Focus Funds® Fidelity Advisor® Biotechnology Fund Fidelity Advisor® Communications Equipment Fund Fidelity Advisor® Consumer Discretionary Fund Fidelity Advisor® Energy Fund Fidelity Advisor® Financial Services Fund Fidelity Advisor® Health Care Fund Fidelity Advisor® Industrials Fund Fidelity Advisor® Semiconductors Fund (formerly Fidelity Advisor® Electronics Fund) Fidelity Advisor® Technology Fund Fidelity Advisor® Utilities Fund Semi-Annual Report January 31, 2017 |

|

Contents

Fidelity Advisor® Biotechnology Fund | |

Fidelity Advisor® Communications Equipment Fund | |

Fidelity Advisor® Consumer Discretionary Fund | |

Fidelity Advisor® Energy Fund | |

Fidelity Advisor® Financial Services Fund | |

Fidelity Advisor® Health Care Fund | |

Fidelity Advisor® Industrials Fund | |

Fidelity Advisor® Semiconductors Fund | |

Fidelity Advisor® Technology Fund | |

Fidelity Advisor® Utilities Fund | |

Board Approval of Investment Advisory Contracts and Management Fees |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2017 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Funds nor Fidelity Distributors Corporation is a bank.

Note to Shareholders

Fidelity Advisor® Communications Equipment Fund:

On April 1, 2017, the fund’s industry benchmark will change from the S&P Custom Communications Equipment Index to the MSCI North America IMI + ADR Custom Communications Equipment 25/50 Index. Due to new international benchmark guidelines, S&P Dow Jones Indices has decided to stop offering its brand on custom benchmarks, effective March 31, 2017. Fidelity believes that the new MSCI index will continue to provide shareholders with meaningful performance comparisons.

Fidelity Advisor® Biotechnology Fund

Investment Summary (Unaudited)

Top Ten Stocks as of January 31, 2017

| % of fund's net assets | % of fund's net assets 6 months ago | |

| Amgen, Inc. | 10.7 | 0.2 |

| Celgene Corp. | 8.2 | 7.0 |

| Alexion Pharmaceuticals, Inc. | 7.2 | 5.9 |

| Biogen, Inc. | 7.0 | 7.0 |

| Regeneron Pharmaceuticals, Inc. | 4.6 | 7.7 |

| BioMarin Pharmaceutical, Inc. | 2.7 | 3.5 |

| TESARO, Inc. | 2.6 | 1.3 |

| Incyte Corp. | 2.6 | 2.7 |

| Vertex Pharmaceuticals, Inc. | 2.4 | 4.5 |

| Seattle Genetics, Inc. | 1.8 | 1.7 |

| 49.8 |

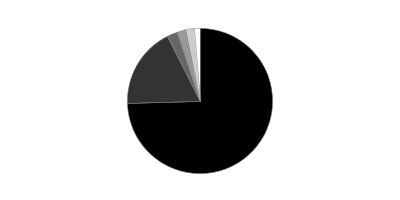

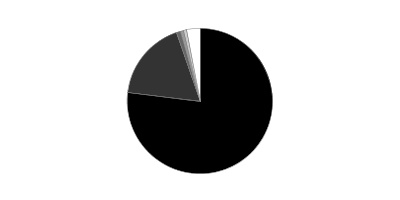

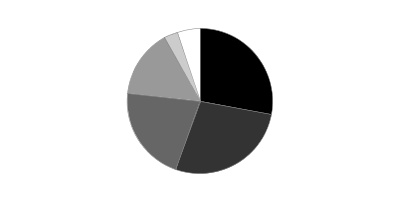

Top Industries (% of fund's net assets)

| As of January 31, 2017 | ||

| Biotechnology | 88.8% | |

| Pharmaceuticals | 10.0% | |

| Health Care Equipment & Supplies | 0.2% | |

| Health Care Technology | 0.1% | |

| Health Care Providers & Services | 0.1% | |

| All Others* | 0.8% | |

| As of July 31, 2016 | ||

| Biotechnology | 88.3% | |

| Pharmaceuticals | 10.2% | |

| Health Care Equipment & Supplies | 0.2% | |

| Health Care Technology | 0.2% | |

| Health Care Providers & Services | 0.1% | |

| All Others* | 1.0% | |

Prior period industry classifications reflect the categories in place as of the date indicated and have not been adjusted to reflect current industry classifications.

* Includes short-term investments and net other assets (liabilities).

Fidelity Advisor® Biotechnology Fund

Investments January 31, 2017 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks - 97.7% | |||

| Shares | Value | ||

| Biotechnology - 87.5% | |||

| Biotechnology - 87.5% | |||

| AbbVie, Inc. (a) | 64,935 | $3,968,178 | |

| AC Immune SA (b) | 180,038 | 2,164,057 | |

| AC Immune SA | 101,250 | 1,156,174 | |

| ACADIA Pharmaceuticals, Inc. (b)(c) | 499,986 | 17,294,516 | |

| Acceleron Pharma, Inc. (c) | 662,346 | 16,081,761 | |

| Achillion Pharmaceuticals, Inc. (c) | 211,384 | 881,471 | |

| Acorda Therapeutics, Inc. (c) | 316,553 | 6,489,337 | |

| Adamas Pharmaceuticals, Inc. (b)(c) | 910,248 | 14,445,636 | |

| Adaptimmune Therapeutics PLC sponsored ADR (c) | 823,742 | 3,550,328 | |

| ADMA Biologics, Inc. (c) | 48,000 | 245,280 | |

| Aduro Biotech, Inc. (b)(c) | 138,318 | 1,639,068 | |

| Aduro Biotech, Inc. (a)(c) | 345,762 | 4,097,280 | |

| Advanced Accelerator Applications SA sponsored ADR (c) | 80,100 | 2,592,837 | |

| Advaxis, Inc. (b)(c) | 161,728 | 1,449,083 | |

| Adverum Biotechnologies, Inc. (c) | 125,129 | 362,874 | |

| Agenus, Inc. (b)(c) | 291,960 | 1,167,840 | |

| Agenus, Inc. warrants 1/9/18 (c) | 452,000 | 86 | |

| Agios Pharmaceuticals, Inc. (c) | 47,971 | 2,064,192 | |

| Aimmune Therapeutics, Inc. (b)(c) | 156,031 | 2,852,247 | |

| Aimmune Therapeutics, Inc. (a) | 460,107 | 8,410,756 | |

| Akebia Therapeutics, Inc. (c) | 152,477 | 1,529,344 | |

| Alder Biopharmaceuticals, Inc. (b)(c) | 693,513 | 14,251,692 | |

| Aldeyra Therapeutics, Inc. (c) | 561,259 | 3,058,862 | |

| Alexion Pharmaceuticals, Inc. (c) | 1,327,276 | 173,448,428 | |

| Alkermes PLC (c) | 393,503 | 21,292,447 | |

| Alnylam Pharmaceuticals, Inc. (c) | 236,835 | 9,471,032 | |

| AMAG Pharmaceuticals, Inc. (b)(c) | 632,677 | 15,247,516 | |

| Amarin Corp. PLC ADR (b)(c) | 381,894 | 1,134,225 | |

| Amgen, Inc. | 1,637,213 | 256,518,517 | |

| Amicus Therapeutics, Inc. (b)(c) | 892,770 | 4,910,235 | |

| Applied Genetic Technologies Corp. (c) | 143,136 | 1,037,736 | |

| Aptevo Therapeutics, Inc. (c) | 38,827 | 77,266 | |

| AquaBounty Technologies, Inc. (b)(c) | 1,394 | 19,237 | |

| Ardelyx, Inc. (c) | 728,401 | 8,740,812 | |

| Array BioPharma, Inc. (c) | 1,624,863 | 17,662,261 | |

| Ascendis Pharma A/S sponsored ADR (c) | 35,700 | 765,408 | |

| Asterias Biotherapeutics, Inc. (b) | 115,938 | 492,737 | |

| Asterias Biotherapeutics, Inc. warrants 2/15/17 (b)(c) | 23,187 | 3,246 | |

| Atara Biotherapeutics, Inc. (c) | 452,385 | 6,084,578 | |

| aTyr Pharma, Inc. (c) | 45,620 | 150,546 | |

| aTyr Pharma, Inc. (a)(c) | 55,238 | 182,285 | |

| Audentes Therapeutics, Inc. | 69,300 | 1,130,976 | |

| Axovant Sciences Ltd. (c) | 129,161 | 1,582,222 | |

| Bellicum Pharmaceuticals, Inc. (b)(c) | 264,791 | 3,542,904 | |

| BioCryst Pharmaceuticals, Inc. (b)(c) | 257,352 | 1,621,318 | |

| Biogen, Inc. (c)(d) | 612,341 | 169,765,419 | |

| BioMarin Pharmaceutical, Inc. (c) | 740,890 | 64,924,191 | |

| BioTime, Inc. warrants 10/1/18 (c) | 2 | 1 | |

| bluebird bio, Inc. (c) | 47,549 | 3,542,401 | |

| Blueprint Medicines Corp. (c) | 399,000 | 13,597,920 | |

| Calithera Biosciences, Inc. (b)(c) | 79,158 | 554,106 | |

| Cara Therapeutics, Inc. (b)(c) | 63,139 | 967,289 | |

| Catabasis Pharmaceuticals, Inc. (b)(c) | 138,100 | 556,543 | |

| Catalyst Pharmaceutical Partners, Inc.: | |||

| warrants 5/2/17 (c) | 8,557 | 432 | |

| warrants 5/30/17 (c) | 17,900 | 3,018 | |

| Celgene Corp. (c) | 1,695,294 | 196,908,398 | |

| Celldex Therapeutics, Inc. (b)(c) | 1,189,736 | 3,878,539 | |

| Chiasma, Inc. (b)(c) | 28,500 | 57,000 | |

| Chiasma, Inc. (a) | 325,192 | 650,384 | |

| Chiasma, Inc. warrants (c) | 81,298 | 34,726 | |

| Chimerix, Inc. (c) | 281,786 | 1,532,916 | |

| Cidara Therapeutics, Inc. (c) | 34,800 | 344,520 | |

| Cidara Therapeutics, Inc. (a)(c) | 223,967 | 2,217,273 | |

| Clovis Oncology, Inc. (b)(c) | 147,937 | 9,586,318 | |

| Corbus Pharmaceuticals Holdings, Inc. (b)(c) | 200,300 | 1,342,010 | |

| Corvus Pharmaceuticals, Inc. | 205,363 | 2,899,726 | |

| Cytokinetics, Inc. (c) | 420,327 | 4,392,417 | |

| Cytokinetics, Inc. warrants 6/25/17 (c) | 244,500 | 212,040 | |

| CytomX Therapeutics, Inc. (a) | 64,961 | 754,847 | |

| DBV Technologies SA sponsored ADR (c) | 258,000 | 8,906,160 | |

| Dicerna Pharmaceuticals, Inc. (b)(c) | 129,106 | 321,474 | |

| Dynavax Technologies Corp. (b)(c) | 222,919 | 913,968 | |

| Eagle Pharmaceuticals, Inc. (b)(c) | 67,784 | 4,691,331 | |

| Edge Therapeutics, Inc. (c) | 39,035 | 375,907 | |

| Editas Medicine, Inc. (b) | 212,057 | 3,694,033 | |

| Emergent BioSolutions, Inc. (c) | 47,755 | 1,445,544 | |

| Enanta Pharmaceuticals, Inc. (c) | 43,787 | 1,450,444 | |

| Epizyme, Inc. (c) | 2,443,973 | 25,661,717 | |

| Esperion Therapeutics, Inc. (b)(c) | 151,103 | 1,831,368 | |

| Exact Sciences Corp. (b)(c) | 234,107 | 4,436,328 | |

| Exelixis, Inc. (c) | 1,515,149 | 27,454,500 | |

| Fate Therapeutics, Inc. (b)(c) | 234,604 | 640,469 | |

| Fibrocell Science, Inc. (c) | 174,200 | 134,657 | |

| FibroGen, Inc. (c) | 361,122 | 8,179,413 | |

| Five Prime Therapeutics, Inc. (c) | 115,900 | 5,309,379 | |

| Foundation Medicine, Inc. (b)(c) | 12,112 | 236,790 | |

| Galapagos Genomics NV sponsored ADR (b)(c) | 253,629 | 16,511,248 | |

| Genmab A/S (c) | 178,793 | 34,468,872 | |

| Genomic Health, Inc. (c) | 25,920 | 712,282 | |

| GenSight Biologics SA | 105,964 | 913,961 | |

| Geron Corp. (b)(c) | 4,760,774 | 9,902,410 | |

| Gilead Sciences, Inc. | 91,201 | 6,607,512 | |

| Global Blood Therapeutics, Inc. (b)(c) | 576,467 | 9,309,942 | |

| Halozyme Therapeutics, Inc. (b)(c) | 1,247,231 | 14,405,518 | |

| Heron Therapeutics, Inc. (b)(c) | 475,742 | 6,184,646 | |

| Histogenics Corp. (c) | 597,234 | 949,602 | |

| Idera Pharmaceuticals, Inc. (b)(c) | 524,800 | 734,720 | |

| Ignyta, Inc. (c) | 157,472 | 771,613 | |

| Immune Design Corp. (c) | 68,300 | 385,895 | |

| ImmunoGen, Inc. (b)(c) | 161,351 | 377,561 | |

| Immunomedics, Inc. (c) | 224,184 | 1,008,828 | |

| Incyte Corp. (c) | 510,479 | 61,875,160 | |

| Insys Therapeutics, Inc. (b)(c) | 59,194 | 606,147 | |

| Intellia Therapeutics, Inc. (b)(c) | 226,137 | 2,921,690 | |

| Intercept Pharmaceuticals, Inc. (b)(c) | 175,060 | 19,212,835 | |

| Intrexon Corp. (b)(c) | 90,708 | 1,919,381 | |

| Ionis Pharmaceuticals, Inc. (c) | 403,938 | 17,975,241 | |

| Ironwood Pharmaceuticals, Inc. Class A (c) | 811,421 | 11,668,234 | |

| Juno Therapeutics, Inc. (b)(c) | 464,265 | 9,907,415 | |

| Karyopharm Therapeutics, Inc. (c) | 1,159,016 | 11,995,816 | |

| Keryx Biopharmaceuticals, Inc. (b)(c) | 396,439 | 1,978,231 | |

| Kite Pharma, Inc. (b)(c) | 196,252 | 10,002,964 | |

| Kura Oncology, Inc. (c) | 921,702 | 5,760,638 | |

| La Jolla Pharmaceutical Co. (c) | 290,700 | 5,654,115 | |

| Lexicon Pharmaceuticals, Inc. (b)(c) | 747,366 | 10,709,755 | |

| Ligand Pharmaceuticals, Inc. Class B (b)(c) | 54,712 | 5,800,019 | |

| Lion Biotechnologies, Inc. (c) | 255,946 | 1,855,609 | |

| Loxo Oncology, Inc. (c) | 491,681 | 19,288,646 | |

| Macrogenics, Inc. (c) | 566,002 | 10,454,057 | |

| MediciNova, Inc. (b)(c) | 388,780 | 2,161,617 | |

| Merrimack Pharmaceuticals, Inc. (b)(c) | 642,119 | 1,996,990 | |

| MiMedx Group, Inc. (b)(c) | 12,313 | 99,489 | |

| Minerva Neurosciences, Inc. (b)(c) | 1,660,580 | 17,602,148 | |

| Mirna Therapeutics, Inc. (b)(c) | 28,200 | 60,912 | |

| Momenta Pharmaceuticals, Inc. (c) | 140,425 | 2,654,033 | |

| NantKwest, Inc. (b)(c) | 102,878 | 551,426 | |

| Neurocrine Biosciences, Inc. (c) | 669,028 | 28,707,991 | |

| NewLink Genetics Corp. (c) | 157,192 | 1,913,027 | |

| Novavax, Inc. (b)(c) | 2,050,216 | 2,685,783 | |

| Novelion Therapeutics, Inc. (c) | 195,070 | 1,845,362 | |

| OncoMed Pharmaceuticals, Inc. (b)(c) | 148,170 | 1,223,884 | |

| Opko Health, Inc. (b)(c) | 243,812 | 2,118,726 | |

| Oragenics, Inc. (c) | 108,608 | 76,026 | |

| Osiris Therapeutics, Inc. (b)(c) | 8,014 | 45,039 | |

| OvaScience, Inc. (b)(c) | 119,045 | 188,091 | |

| Portola Pharmaceuticals, Inc. (c) | 697,858 | 19,016,631 | |

| Progenics Pharmaceuticals, Inc. (b)(c) | 533,608 | 4,759,783 | |

| ProQR Therapeutics BV (c) | 237,916 | 921,925 | |

| Protagonist Therapeutics, Inc. | 155,823 | 2,811,047 | |

| Proteostasis Therapeutics, Inc. | 2,300 | 33,925 | |

| Prothena Corp. PLC (c) | 128,634 | 6,297,921 | |

| PTC Therapeutics, Inc. (c) | 205,857 | 2,696,727 | |

| Puma Biotechnology, Inc. (b)(c) | 306,694 | 9,936,886 | |

| Radius Health, Inc. (b)(c) | 926,101 | 40,303,916 | |

| Regeneron Pharmaceuticals, Inc. (c) | 311,396 | 111,881,469 | |

| REGENXBIO, Inc. (c) | 333,286 | 6,165,791 | |

| Regulus Therapeutics, Inc. (c) | 265,221 | 318,265 | |

| Repligen Corp. (c) | 160,227 | 4,813,219 | |

| Retrophin, Inc. (b)(c) | 389,310 | 7,638,262 | |

| Sage Therapeutics, Inc. (c) | 278,968 | 13,384,885 | |

| Sangamo Therapeutics, Inc. (c) | 237,552 | 831,432 | |

| Sarepta Therapeutics, Inc. (b)(c) | 237,311 | 7,370,880 | |

| Seattle Genetics, Inc. (c) | 722,220 | 43,506,533 | |

| Selecta Biosciences, Inc. | 58,800 | 823,200 | |

| Seres Therapeutics, Inc. (b)(c) | 237,191 | 2,345,819 | |

| Seres Therapeutics, Inc. (a)(c) | 352,270 | 3,483,950 | |

| Spark Therapeutics, Inc. (b)(c) | 314,145 | 19,809,984 | |

| Spectrum Pharmaceuticals, Inc. (c) | 105,647 | 492,315 | |

| Stemline Therapeutics, Inc. (c) | 506,193 | 5,163,169 | |

| Syndax Pharmaceuticals, Inc. | 252,699 | 1,920,512 | |

| Syros Pharmaceuticals, Inc. | 61,578 | 668,121 | |

| Syros Pharmaceuticals, Inc. (a) | 62,568 | 678,863 | |

| TESARO, Inc. (b)(c) | 382,937 | 62,357,461 | |

| TG Therapeutics, Inc. (b)(c) | 821,996 | 3,945,581 | |

| Threshold Pharmaceuticals, Inc. (b)(c) | 26,804 | 13,858 | |

| Trevena, Inc. (c) | 261,522 | 1,825,424 | |

| Ultragenyx Pharmaceutical, Inc. (c) | 366,427 | 27,485,689 | |

| United Therapeutics Corp. (c) | 56,723 | 9,281,584 | |

| Vanda Pharmaceuticals, Inc. (c) | 207,779 | 2,940,073 | |

| Versartis, Inc. (c) | 497,816 | 7,118,769 | |

| Vertex Pharmaceuticals, Inc. (c) | 684,134 | 58,746,587 | |

| Vical, Inc. (c) | 63,286 | 137,963 | |

| Vital Therapies, Inc. (b)(c) | 266,087 | 1,317,131 | |

| Voyager Therapeutics, Inc. (b)(c) | 1,016,525 | 12,116,978 | |

| Voyager Therapeutics, Inc. (a) | 282,352 | 3,365,636 | |

| Xencor, Inc. (c) | 310,108 | 7,389,874 | |

| Zafgen, Inc. (c) | 1,356,174 | 5,709,493 | |

| 2,107,863,385 | |||

| Capital Markets - 0.1% | |||

| Asset Management & Custody Banks - 0.1% | |||

| RPI International Holdings LP (e) | 12,210 | 1,605,310 | |

| Health Care Equipment & Supplies - 0.2% | |||

| Health Care Equipment - 0.2% | |||

| Bellerophon Therapeutics, Inc. (b)(c) | 217,800 | 141,570 | |

| Novocure Ltd. (b)(c) | 185,941 | 1,180,725 | |

| Novocure Ltd. (a) | 155,553 | 987,762 | |

| Vermillion, Inc. (c) | 991,800 | 1,229,832 | |

| Zosano Pharma Corp. (b)(c) | 598,503 | 718,204 | |

| 4,258,093 | |||

| Health Care Technology - 0.0% | |||

| Health Care Technology - 0.0% | |||

| NantHealth, Inc. (b) | 120,400 | 980,056 | |

| Life Sciences Tools & Services - 0.0% | |||

| Life Sciences Tools & Services - 0.0% | |||

| Transgenomic, Inc. (c) | 13,500 | 9,315 | |

| Transgenomic, Inc. warrants 2/3/17 (c) | 81,000 | 1 | |

| 9,316 | |||

| Personal Products - 0.0% | |||

| Personal Products - 0.0% | |||

| MYOS Corp. (c) | 6,666 | 18,598 | |

| Pharmaceuticals - 9.9% | |||

| Pharmaceuticals - 9.9% | |||

| Achaogen, Inc. (b)(c) | 431,602 | 6,970,372 | |

| Adimab LLC (c)(e)(f) | 398,401 | 9,848,473 | |

| Afferent Pharmaceuticals, Inc. rights 12/31/24 (c) | 1,915,787 | 1,839,156 | |

| Aradigm Corp. (c) | 8,786 | 17,133 | |

| Avexis, Inc. (b) | 478,538 | 26,692,850 | |

| Axsome Therapeutics, Inc. (b)(c) | 766,409 | 3,755,404 | |

| Cempra, Inc. (b)(c) | 1,094,178 | 3,446,661 | |

| Dermira, Inc. (c) | 566,145 | 16,667,309 | |

| Egalet Corp. (b)(c) | 1,252,974 | 6,127,043 | |

| GW Pharmaceuticals PLC ADR (b)(c) | 278,067 | 31,972,144 | |

| Horizon Pharma PLC (c) | 754,256 | 12,347,171 | |

| Intra-Cellular Therapies, Inc. (c) | 128,154 | 1,850,544 | |

| Jazz Pharmaceuticals PLC (c) | 128,167 | 15,626,121 | |

| Jounce Therapeutics, Inc. | 431,376 | 6,436,993 | |

| Kolltan Pharmaceuticals, Inc. rights (c) | 1,610,391 | 289,870 | |

| MyoKardia, Inc. (c) | 704,734 | 7,893,021 | |

| MyoKardia, Inc. (a) | 484,646 | 5,428,035 | |

| Nektar Therapeutics (c) | 153,932 | 1,864,117 | |

| NeurogesX, Inc. (c) | 150,000 | 750 | |

| Ocular Therapeutix, Inc. (b)(c) | 252,171 | 1,654,242 | |

| Pacira Pharmaceuticals, Inc. (c) | 307,884 | 11,838,140 | |

| Paratek Pharmaceuticals, Inc. (c) | 799,460 | 12,071,846 | |

| Reata Pharmaceuticals, Inc. (b) | 33,969 | 845,828 | |

| Repros Therapeutics, Inc. (b)(c) | 623,854 | 792,295 | |

| Stemcentrx, Inc. rights 12/31/21 (c) | 208,907 | 591,207 | |

| Tetraphase Pharmaceuticals, Inc. (c) | 361,931 | 1,386,196 | |

| The Medicines Company (b)(c) | 565,722 | 20,394,278 | |

| TherapeuticsMD, Inc. (b)(c) | 1,497,500 | 8,700,475 | |

| Theravance Biopharma, Inc. (b)(c) | 274,903 | 8,236,094 | |

| WAVE Life Sciences (c) | 143,544 | 4,126,890 | |

| WAVE Life Sciences (a) | 230,144 | 6,616,640 | |

| Zogenix, Inc. (b)(c) | 320,211 | 2,577,699 | |

| Zogenix, Inc. warrants 7/27/17 (c) | 32,985 | 12 | |

| 238,905,009 | |||

| TOTAL COMMON STOCKS | |||

| (Cost $2,229,023,514) | 2,353,639,767 | ||

| Preferred Stocks - 1.6% | |||

| Convertible Preferred Stocks - 1.6% | |||

| Biotechnology - 1.3% | |||

| Biotechnology - 1.3% | |||

| 23andMe, Inc. Series E (c)(e) | 341,730 | 2,921,792 | |

| Axcella Health, Inc. Series C (c)(e) | 341,857 | 5,876,522 | |

| Immunocore Ltd. Series A (c)(e) | 17,149 | 3,807,065 | |

| Moderna Therapeutics, Inc.: | |||

| Series D (e) | 269,180 | 2,363,400 | |

| Series E (e) | 544,100 | 4,777,198 | |

| Ovid Therapeutics, Inc. Series B (c)(e) | 246,448 | 1,663,524 | |

| RaNA Therapeutics LLC: | |||

| Series B (c)(e) | 1,310,353 | 2,594,499 | |

| Series C (e) | 1,010,101 | 2,000,000 | |

| Scholar Rock LLC Series B (c)(e) | 1,083,994 | 2,796,705 | |

| Twist Bioscience Corp.: | |||

| Series C (c)(e) | 1,866,791 | 2,632,175 | |

| Series D (c)(e) | 453,587 | 639,558 | |

| 32,072,438 | |||

| Health Care Providers & Services - 0.1% | |||

| Health Care Services - 0.1% | |||

| Allena Pharmaceuticals, Inc. Series C (c)(e) | 1,505,538 | 3,251,962 | |

| Health Care Technology - 0.1% | |||

| Health Care Technology - 0.1% | |||

| Codiak Biosciences, Inc.: | |||

| Series A (c)(e) | 213,402 | 563,381 | |

| Series B (c)(e) | 693,558 | 1,830,993 | |

| 2,394,374 | |||

| Pharmaceuticals - 0.1% | |||

| Pharmaceuticals - 0.1% | |||

| Afferent Pharmaceuticals, Inc. Series C (c)(e) | 1,915,787 | 881,262 | |

| TOTAL CONVERTIBLE PREFERRED STOCKS | 38,600,036 | ||

| Nonconvertible Preferred Stocks - 0.0% | |||

| Biotechnology - 0.0% | |||

| Biotechnology - 0.0% | |||

| Yumanity Holdings LLC Class A (e) | 151,084 | 1,166,368 | |

| TOTAL PREFERRED STOCKS | |||

| (Cost $34,445,416) | 39,766,404 | ||

| Money Market Funds - 9.1% | |||

| Fidelity Cash Central Fund, 0.62% (g) | 18,419,135 | 18,422,819 | |

| Fidelity Securities Lending Cash Central Fund 0.65% (g)(h) | 200,615,365 | 200,655,488 | |

| TOTAL MONEY MARKET FUNDS | |||

| (Cost $219,043,424) | 219,078,307 | ||

| TOTAL INVESTMENT PORTFOLIO - 108.4% | |||

| (Cost $2,482,512,354) | 2,612,484,478 | ||

| NET OTHER ASSETS (LIABILITIES) - (8.4)% | (203,059,605) | ||

| NET ASSETS - 100% | $2,409,424,873 |

Legend

(a) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $40,841,889 or 1.7% of net assets.

(b) Security or a portion of the security is on loan at period end.

(c) Non-income producing

(d) A portion of the security is subject to a forward commitment to sell.

(e) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $51,220,187 or 2.1% of net assets.

(f) Investment is owned by a wholly-owned subsidiary (Subsidiary) that is treated as a corporation for U.S. tax purposes.

(g) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(h) Investment made with cash collateral received from securities on loan.

Additional information on each restricted holding is as follows:

| Security | Acquisition Date | Acquisition Cost |

| 23andMe, Inc. Series E | 6/18/15 | $3,700,003 |

| Adimab LLC | 9/17/14 - 6/5/15 | $6,416,091 |

| Afferent Pharmaceuticals, Inc. Series C | 7/1/15 | $862,104 |

| Allena Pharmaceuticals, Inc. Series C | 11/25/15 | $3,989,676 |

| Axcella Health, Inc. Series C | 1/30/15 | $3,445,919 |

| Codiak Biosciences, Inc. Series A | 11/12/15 | $213,402 |

| Codiak Biosciences, Inc. Series B | 11/12/15 | $2,080,674 |

| Immunocore Ltd. Series A | 7/27/15 | $3,227,085 |

| Moderna Therapeutics, Inc. Series D | 11/6/13 | $1,300,630 |

| Moderna Therapeutics, Inc. Series E | 12/18/14 | $2,628,996 |

| Ovid Therapeutics, Inc. Series B | 8/10/15 | $1,535,371 |

| RaNA Therapeutics LLC Series B | 7/17/15 | $1,415,181 |

| RaNA Therapeutics LLC Series C | 12/22/16 | $2,000,000 |

| RPI International Holdings LP | 5/21/15 | $1,439,559 |

| Scholar Rock LLC Series B | 12/17/15 | $3,251,982 |

| Twist Bioscience Corp. Series C | 5/29/15 | $2,800,000 |

| Twist Bioscience Corp. Series D | 1/8/16 | $973,262 |

| Yumanity Holdings LLC Class A | 2/8/16 | $1,021,131 |

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $50,246 |

| Fidelity Securities Lending Cash Central Fund | 1,494,931 |

| Total | $1,545,177 |

Investment Valuation

The following is a summary of the inputs used, as of January 31, 2017, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: | ||||

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | ||||

| Common Stocks | $2,353,639,767 | $2,331,621,519 | $7,843,482 | $14,174,766 |

| Preferred Stocks | 39,766,404 | -- | -- | 39,766,404 |

| Money Market Funds | 219,078,307 | 219,078,307 | -- | -- |

| Total Investments in Securities: | $2,612,484,478 | $2,550,699,826 | $7,843,482 | $53,941,170 |

The following is a reconciliation of Investments in Securities for which Level 3 inputs were used in determining value:

| Investments in Securities: | |

| Common Stocks | |

| Beginning Balance | $12,938,513 |

| Total Realized Gain (Loss) | -- |

| Total Unrealized Gain (Loss) | 316,520 |

| Cost of Purchases | 919,733 |

| Proceeds of Sales | -- |

| Amortization/Accretion | -- |

| Transfers in to Level 3 | -- |

| Transfers out of Level 3 | -- |

| Ending Balance | $14,174,766 |

| The change in unrealized gain (loss) for the period attributable to Level 3 securities held at January 31, 2017 | $316,519 |

| Preferred Stocks | |

| Beginning Balance | $44,517,148 |

| Total Realized Gain (Loss) | 845,519 |

| Total Unrealized Gain (Loss) | (567,264) |

| Cost of Purchases | 5,929,626 |

| Proceeds of Sales | (10,958,625) |

| Amortization/Accretion | -- |

| Transfers in to Level 3 | -- |

| Transfers out of Level 3 | -- |

| Ending Balance | $39,766,404 |

| The change in unrealized gain (loss) for the period attributable to Level 3 securities held at January 31, 2017 | $1,871,523 |

The information used in the above reconciliations represents fiscal year to date activity for any Investments in Securities identified as using Level 3 inputs at either the beginning or the end of the current fiscal period. Transfers in or out of Level 3 represent the beginning value of any Security or Instrument where a change in the pricing level occurred from the beginning to the end of the period. The cost of purchases and the proceeds of sales may include securities received or delivered through corporate actions or exchanges.

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor® Biotechnology Fund

Financial Statements

Statement of Assets and Liabilities

| January 31, 2017 (Unaudited) | ||

| Assets | ||

| Investment in securities, at value (including securities loaned of $204,087,316) — See accompanying schedule: Unaffiliated issuers (cost $2,263,468,930) | $2,393,406,171 | |

| Fidelity Central Funds (cost $219,043,424) | 219,078,307 | |

| Total Investments (cost $2,482,512,354) | $2,612,484,478 | |

| Cash | 42,641 | |

| Restricted cash | 43,038 | |

| Receivable for investments sold | 7,681,320 | |

| Receivable for securities sold on a when-issued basis | 12,946,613 | |

| Receivable for fund shares sold | 4,810,208 | |

| Dividends receivable | 41,559 | |

| Distributions receivable from Fidelity Central Funds | 214,889 | |

| Prepaid expenses | 11,755 | |

| Other receivables | 47,698 | |

| Total assets | 2,638,324,199 | |

| Liabilities | ||

| Payable for investments purchased | $4,016,615 | |

| Commitment to sell securities on a when-issued basis | 13,206,330 | |

| Payable for fund shares redeemed | 8,686,871 | |

| Accrued management fee | 1,106,104 | |

| Distribution and service plan fees payable | 718,813 | |

| Other affiliated payables | 475,450 | |

| Other payables and accrued expenses | 85,978 | |

| Collateral on Securities Loaned | 200,603,165 | |

| Total liabilities | 228,899,326 | |

| Net Assets | $2,409,424,873 | |

| Net Assets consist of: | ||

| Paid in capital | $2,498,064,127 | |

| Accumulated net investment loss | (20,495,584) | |

| Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | (197,856,077) | |

| Net unrealized appreciation (depreciation) on investments | 129,712,407 | |

| Net Assets | $2,409,424,873 | |

| Calculation of Maximum Offering Price | ||

| Class A: | ||

| Net Asset Value and redemption price per share ($909,143,036 ÷ 43,216,735 shares) | $21.04 | |

| Maximum offering price per share (100/94.25 of $21.04) | $22.32 | |

| Class T: | ||

| Net Asset Value and redemption price per share ($114,755,526 ÷ 5,733,518 shares) | $20.01 | |

| Maximum offering price per share (100/96.50 of $20.01) | $20.74 | |

| Class C: | ||

| Net Asset Value and offering price per share ($568,706,996 ÷ 31,020,930 shares)(a) | $18.33 | |

| Class I: | ||

| Net Asset Value, offering price and redemption price per share ($816,819,315 ÷ 36,837,656 shares) | $22.17 |

(a) Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Six months ended January 31, 2017 (Unaudited) | ||

| Investment Income | ||

| Dividends | $1,391,816 | |

| Income from Fidelity Central Funds (including $1,494,931 from security lending) | 1,545,177 | |

| Total income | 2,936,993 | |

| Expenses | ||

| Management fee | $7,094,897 | |

| Transfer agent fees | 2,628,770 | |

| Distribution and service plan fees | 4,625,874 | |

| Accounting and security lending fees | 411,256 | |

| Custodian fees and expenses | 70,820 | |

| Independent trustees' fees and expenses | 28,266 | |

| Registration fees | 102,140 | |

| Audit | 31,717 | |

| Legal | 23,013 | |

| Miscellaneous | 16,494 | |

| Total expenses before reductions | 15,033,247 | |

| Expense reductions | (85,560) | 14,947,687 |

| Net investment income (loss) | (12,010,694) | |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | 19,682,051 | |

| Fidelity Central Funds | 20,987 | |

| Foreign currency transactions | (2,785) | |

| Total net realized gain (loss) | 19,700,253 | |

| Change in net unrealized appreciation (depreciation) on: | ||

| Investment Securities | (64,870,986) | |

| When-issued commitments | (259,717) | |

| Total change in unrealized appreciation (depreciation) | (65,130,703) | |

| Net gain (loss) | (45,430,450) | |

| Net increase (decrease) in net assets resulting from operations | $(57,441,144) |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Six months ended January 31, 2017 (Unaudited) | Year ended July 31, 2016 | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $(12,010,694) | $(24,689,601) |

| Net realized gain (loss) | 19,700,253 | (205,980,039) |

| Change in net unrealized appreciation (depreciation) | (65,130,703) | (1,017,727,981) |

| Net increase (decrease) in net assets resulting from operations | (57,441,144) | (1,248,397,621) |

| Distributions to shareholders from net realized gain | – | (189,321,949) |

| Share transactions - net increase (decrease) | (319,113,345) | 98,205,004 |

| Redemption fees | 47,949 | 265,724 |

| Total increase (decrease) in net assets | (376,506,540) | (1,339,248,842) |

| Net Assets | ||

| Beginning of period | 2,785,931,413 | 4,125,180,255 |

| End of period | $2,409,424,873 | $2,785,931,413 |

| Other Information | ||

| Accumulated net investment loss end of period | $(20,495,584) | $(8,484,890) |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Advisor Biotechnology Fund Class A

| Six months ended (Unaudited) January 31, | Years ended July 31, | |||||

| 2017 | 2016 | 2015 | 2014 | 2013�� | 2012 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $21.39 | $31.43 | $20.19 | $17.25 | $11.79 | $8.81 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A | (.09) | (.16) | (.20) | (.13) | (.09) | (.07) |

| Net realized and unrealized gain (loss) | (.26) | (8.48) | 12.04 | 3.12 | 6.24 | 3.05 |

| Total from investment operations | (.35) | (8.64) | 11.84 | 2.99 | 6.15 | 2.98 |

| Distributions from net realized gain | – | (1.40) | (.60) | (.05) | (.69) | – |

| Total distributions | – | (1.40) | (.60) | (.05) | (.69) | – |

| Redemption fees added to paid in capitalA,B | – | – | – | – | – | – |

| Net asset value, end of period | $21.04 | $21.39 | $31.43 | $20.19 | $17.25 | $11.79 |

| Total ReturnC,D,E | (1.64)% | (28.55)% | 59.66% | 17.38% | 54.94% | 33.83% |

| Ratios to Average Net AssetsF,G | ||||||

| Expenses before reductions | 1.05%H | 1.05% | 1.04% | 1.08% | 1.15% | 1.27% |

| Expenses net of fee waivers, if any | 1.05%H | 1.05% | 1.04% | 1.08% | 1.15% | 1.27% |

| Expenses net of all reductions | 1.05%H | 1.04% | 1.04% | 1.08% | 1.14% | 1.27% |

| Net investment income (loss) | (.82)%H | (.69)% | (.75)% | (.68)% | (.63)% | (.73)% |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $909,143 | $1,080,733 | $1,560,528 | $602,625 | $286,695 | $68,993 |

| Portfolio turnover rateI | 40%H | 29% | 26% | 50% | 22% | 82% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.005 per share.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Total returns do not include the effect of the sales charges.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Annualized

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Advisor Biotechnology Fund Class T

| Six months ended (Unaudited) January 31, | Years ended July 31, | |||||

| 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $20.39 | $30.06 | $19.39 | $16.63 | $11.42 | $8.56 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A | (.12) | (.22) | (.27) | (.19) | (.12) | (.10) |

| Net realized and unrealized gain (loss) | (.26) | (8.10) | 11.54 | 3.00 | 6.02 | 2.96 |

| Total from investment operations | (.38) | (8.32) | 11.27 | 2.81 | 5.90 | 2.86 |

| Distributions from net realized gain | – | (1.35) | (.60) | (.05) | (.69) | – |

| Total distributions | – | (1.35) | (.60) | (.05) | (.69) | – |

| Redemption fees added to paid in capitalA,B | – | – | – | – | – | – |

| Net asset value, end of period | $20.01 | $20.39 | $30.06 | $19.39 | $16.63 | $11.42 |

| Total ReturnC,D,E | (1.86)% | (28.75)% | 59.17% | 16.95% | 54.50% | 33.41% |

| Ratios to Average Net AssetsF,G | ||||||

| Expenses before reductions | 1.39%H | 1.37% | 1.35% | 1.41% | 1.46% | 1.56% |

| Expenses net of fee waivers, if any | 1.39%H | 1.37% | 1.35% | 1.41% | 1.46% | 1.56% |

| Expenses net of all reductions | 1.38%H | 1.37% | 1.34% | 1.40% | 1.46% | 1.56% |

| Net investment income (loss) | (1.16)%H | (1.01)% | (1.05)% | (1.01)% | (.94)% | (1.02)% |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $114,756 | $131,928 | $196,393 | $95,945 | $67,887 | $28,154 |

| Portfolio turnover rateI | 40%H | 29% | 26% | 50% | 22% | 82% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.005 per share.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Total returns do not include the effect of the sales charges.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Annualized

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Advisor Biotechnology Fund Class C

| Six months ended (Unaudited) January 31, | Years ended July 31, | |||||

| 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $18.71 | $27.78 | $18.04 | $15.53 | $10.76 | $8.10 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A | (.14) | (.29) | (.35) | (.25) | (.17) | (.13) |

| Net realized and unrealized gain (loss) | (.24) | (7.46) | 10.69 | 2.81 | 5.63 | 2.79 |

| Total from investment operations | (.38) | (7.75) | 10.34 | 2.56 | 5.46 | 2.66 |

| Distributions from net realized gain | – | (1.32) | (.60) | (.05) | (.69) | – |

| Total distributions | – | (1.32) | (.60) | (.05) | (.69) | – |

| Redemption fees added to paid in capitalA,B | – | – | – | – | – | – |

| Net asset value, end of period | $18.33 | $18.71 | $27.78 | $18.04 | $15.53 | $10.76 |

| Total ReturnC,D,E | (2.03)% | (29.06)% | 58.43% | 16.54% | 53.71% | 32.84% |

| Ratios to Average Net AssetsF,G | ||||||

| Expenses before reductions | 1.80%H | 1.80% | 1.79% | 1.83% | 1.88% | 2.01% |

| Expenses net of fee waivers, if any | 1.80%H | 1.80% | 1.79% | 1.83% | 1.88% | 2.01% |

| Expenses net of all reductions | 1.79%H | 1.79% | 1.79% | 1.83% | 1.87% | 2.01% |

| Net investment income (loss) | (1.57)%H | (1.44)% | (1.49)% | (1.43)% | (1.36)% | (1.47)% |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $568,707 | $665,036 | $956,495 | $359,967 | $146,684 | $31,710 |

| Portfolio turnover rateI | 40%H | 29% | 26% | 50% | 22% | 82% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.005 per share.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Total returns do not include the effect of the contingent deferred sales charge.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Annualized

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Advisor Biotechnology Fund Class I

| Six months ended (Unaudited) January 31, | Years ended July 31, | |||||

| 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $22.52 | $32.95 | $21.10 | $17.97 | $12.22 | $9.10 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A | (.06) | (.10) | (.14) | (.08) | (.05) | (.04) |

| Net realized and unrealized gain (loss) | (.29) | (8.89) | 12.60 | 3.26 | 6.49 | 3.16 |

| Total from investment operations | (.35) | (8.99) | 12.46 | 3.18 | 6.44 | 3.12 |

| Distributions from net investment income | – | – | –B | – | – | – |

| Distributions from net realized gain | – | (1.44) | (.60) | (.05) | (.69) | – |

| Total distributions | – | (1.44) | (.61)C | (.05) | (.69) | – |

| Redemption fees added to paid in capitalA,B | – | – | – | – | – | – |

| Net asset value, end of period | $22.17 | $22.52 | $32.95 | $21.10 | $17.97 | $12.22 |

| Total ReturnD,E | (1.55)% | (28.32)% | 60.00% | 17.74% | 55.39% | 34.29% |

| Ratios to Average Net AssetsF,G | ||||||

| Expenses before reductions | .78%H | .78% | .78% | .81% | .85% | .95% |

| Expenses net of fee waivers, if any | .78%H | .78% | .78% | .81% | .85% | .95% |

| Expenses net of all reductions | .78%H | .78% | .77% | .80% | .84% | .94% |

| Net investment income (loss) | (.55)%H | (.42)% | (.48)% | (.41)% | (.32)% | (.40)% |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $816,819 | $908,234 | $1,403,666 | $465,889 | $177,926 | $26,772 |

| Portfolio turnover rateI | 40%H | 29% | 26% | 50% | 22% | 82% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.005 per share.

C Total distributions of $.61 per share is comprised of distributions from net investment income of $.003 and distributions from net realized gain of $.604 per share.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Annualized

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor® Communications Equipment Fund

Investment Summary (Unaudited)

Top Ten Stocks as of January 31, 2017

| % of fund's net assets | % of fund's net assets 6 months ago | |

| Cisco Systems, Inc. | 22.8 | 19.8 |

| Qualcomm, Inc. | 15.7 | 17.6 |

| CommScope Holding Co., Inc. | 6.5 | 5.2 |

| Telefonaktiebolaget LM Ericsson (B Shares) sponsored ADR | 5.2 | 4.9 |

| Harris Corp. | 4.9 | 4.9 |

| F5 Networks, Inc. | 4.5 | 5.5 |

| Nokia Corp. sponsored ADR | 4.4 | 4.6 |

| Juniper Networks, Inc. | 4.3 | 4.4 |

| Brocade Communications Systems, Inc. | 2.2 | 4.3 |

| Finisar Corp. | 2.1 | 1.7 |

| 72.6 |

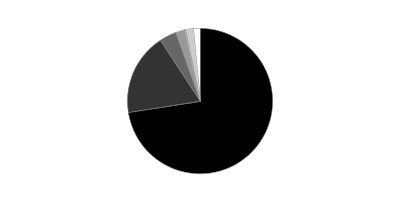

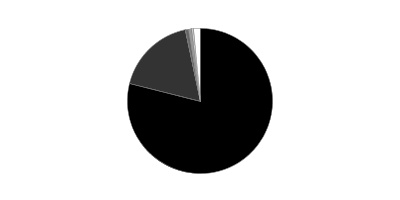

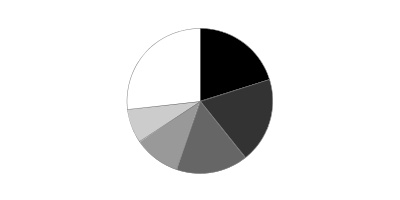

Top Industries (% of fund's net assets)

| As of January 31, 2017 | ||

| Communications Equipment | 74.5% | |

| Semiconductors & Semiconductor Equipment | 18.1% | |

| Electronic Equipment & Components | 2.3% | |

| Technology Hardware, Storage & Peripherals | 2.0% | |

| Internet Software & Services | 1.8% | |

| All Others* | 1.3% | |

| As of July 31, 2016 | ||

| Communications Equipment | 72.5% | |

| Semiconductors & Semiconductor Equipment | 18.3% | |

| Technology Hardware, Storage & Peripherals | 3.8% | |

| Electronic Equipment & Components | 2.1% | |

| Internet Software & Services | 1.8% | |

| All Others* | 1.5% | |

Prior period industry classifications reflect the categories in place as of the date indicated and have not been adjusted to reflect current industry classifications.

* Includes short-term investments and net other assets (liabilities).

Fidelity Advisor® Communications Equipment Fund

Investments January 31, 2017 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks - 99.8% | |||

| Shares | Value | ||

| Communications Equipment - 74.5% | |||

| Communications Equipment - 74.5% | |||

| ADTRAN, Inc. | 7,840 | $171,696 | |

| Arista Networks, Inc. (a)(b) | 1,280 | 120,320 | |

| Arris International PLC (b) | 11,294 | 322,783 | |

| Brocade Communications Systems, Inc. | 32,865 | 409,827 | |

| Calix Networks, Inc. (b) | 9,620 | 69,264 | |

| Cisco Systems, Inc. | 139,084 | 4,272,656 | |

| CommScope Holding Co., Inc. (b) | 32,080 | 1,213,266 | |

| Comtech Telecommunications Corp. | 3,430 | 36,804 | |

| EchoStar Holding Corp. Class A (b) | 2,130 | 108,481 | |

| EXFO, Inc. (b) | 1,300 | 7,670 | |

| F5 Networks, Inc. (b) | 6,305 | 845,059 | |

| Finisar Corp. (b) | 13,510 | 399,491 | |

| Harris Corp. | 8,950 | 919,255 | |

| Infinera Corp. (b) | 6,517 | 58,718 | |

| InterDigital, Inc. | 3,100 | 289,540 | |

| Ixia (b) | 10,330 | 200,919 | |

| Juniper Networks, Inc. | 29,798 | 797,990 | |

| Lumentum Holdings, Inc. (b) | 2,960 | 112,332 | |

| Mitel Networks Corp. (b) | 7,660 | 53,160 | |

| Motorola Solutions, Inc. | 3,359 | 271,105 | |

| NETGEAR, Inc. (b) | 2,090 | 118,921 | |

| NetScout Systems, Inc. (b) | 8,180 | 272,394 | |

| Nokia Corp. | 1,300 | 5,837 | |

| Nokia Corp. sponsored ADR (a) | 179,990 | 813,555 | |

| Palo Alto Networks, Inc. (b) | 2,680 | 395,461 | |

| Plantronics, Inc. | 1,940 | 109,765 | |

| Radware Ltd. (b) | 9,190 | 135,001 | |

| Sandvine Corp. (U.K.) | 29,100 | 63,064 | |

| ShoreTel, Inc. (b) | 7,700 | 53,515 | |

| Sonus Networks, Inc. (b) | 9,750 | 62,205 | |

| Telefonaktiebolaget LM Ericsson (B Shares) sponsored ADR | 163,840 | 965,018 | |

| ViaSat, Inc. (b) | 690 | 44,788 | |

| Viavi Solutions, Inc. (b) | 25,290 | 226,346 | |

| 13,946,206 | |||

| Electronic Equipment & Components - 2.3% | |||

| Electronic Components - 0.2% | |||

| II-VI, Inc. (b) | 1,190 | 43,435 | |

| Electronic Manufacturing Services - 0.8% | |||

| Fabrinet (b) | 1,000 | 42,130 | |

| Jabil Circuit, Inc. | 3,200 | 76,736 | |

| TE Connectivity Ltd. | 290 | 21,562 | |

| 140,428 | |||

| Technology Distributors - 1.3% | |||

| CDW Corp. | 2,550 | 131,351 | |

| Dell Technologies, Inc. (b) | 1,734 | 109,225 | |

| 240,576 | |||

| TOTAL ELECTRONIC EQUIPMENT & COMPONENTS | 424,439 | ||

| Internet Software & Services - 1.8% | |||

| Internet Software & Services - 1.8% | |||

| Alphabet, Inc.: | |||

| Class A (b) | 189 | 155,016 | |

| Class C (b) | 148 | 117,925 | |

| Web.com Group, Inc. (b) | 3,680 | 69,736 | |

| 342,677 | |||

| IT Services - 0.3% | |||

| IT Consulting & Other Services - 0.3% | |||

| Cognizant Technology Solutions Corp. Class A (b) | 880 | 46,279 | |

| Semiconductors & Semiconductor Equipment - 18.1% | |||

| Semiconductors - 18.1% | |||

| Acacia Communications, Inc. | 360 | 20,941 | |

| Broadcom Ltd. | 665 | 132,668 | |

| GSI Technology, Inc. (b) | 2,200 | 13,442 | |

| Maxim Integrated Products, Inc. | 1,450 | 64,496 | |

| NXP Semiconductors NV (b) | 1,510 | 147,754 | |

| ON Semiconductor Corp. (b) | 4,860 | 64,735 | |

| Qorvo, Inc. (b) | 80 | 5,137 | |

| Qualcomm, Inc. | 54,961 | 2,936,566 | |

| 3,385,739 | |||

| Software - 0.8% | |||

| Systems Software - 0.8% | |||

| Check Point Software Technologies Ltd. (b) | 1,520 | 150,130 | |

| Technology Hardware, Storage & Peripherals - 2.0% | |||

| Technology Hardware, Storage & Peripherals - 2.0% | |||

| Apple, Inc. | 160 | 19,416 | |

| BlackBerry Ltd. (b) | 27,200 | 191,889 | |

| HP, Inc. | 6,990 | 105,200 | |

| Samsung Electronics Co. Ltd. | 37 | 63,389 | |

| 379,894 | |||

| TOTAL COMMON STOCKS | |||

| (Cost $16,144,636) | 18,675,364 | ||

| Money Market Funds - 6.5% | |||

| Fidelity Cash Central Fund, 0.62% (c) | 505,650 | 505,751 | |

| Fidelity Securities Lending Cash Central Fund 0.65% (c)(d) | 714,361 | 714,504 | |

| TOTAL MONEY MARKET FUNDS | |||

| (Cost $1,220,255) | 1,220,255 | ||

| TOTAL INVESTMENT PORTFOLIO - 106.3% | |||

| (Cost $17,364,891) | 19,895,619 | ||

| NET OTHER ASSETS (LIABILITIES) - (6.3)% | (1,173,075) | ||

| NET ASSETS - 100% | $18,722,544 |

Legend

(a) Security or a portion of the security is on loan at period end.

(b) Non-income producing

(c) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(d) Investment made with cash collateral received from securities on loan.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $836 |

| Fidelity Securities Lending Cash Central Fund | 1,058 |

| Total | $1,894 |

Investment Valuation

All investments are categorized as Level 1 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

Other Information

Distribution of investments by country or territory of incorporation, as a percentage of Total Net Assets, is as follows (Unaudited):

| United States of America | 83.4% |

| Sweden | 5.2% |

| Finland | 4.4% |

| United Kingdom | 1.7% |

| Canada | 1.6% |

| Israel | 1.5% |

| Others (Individually Less Than 1%) | 2.2% |

| 100.0% |

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor® Communications Equipment Fund

Financial Statements

Statement of Assets and Liabilities

| January 31, 2017 (Unaudited) | ||

| Assets | ||

| Investment in securities, at value (including securities loaned of $681,876) — See accompanying schedule: Unaffiliated issuers (cost $16,144,636) | $18,675,364 | |

| Fidelity Central Funds (cost $1,220,255) | 1,220,255 | |

| Total Investments (cost $17,364,891) | $19,895,619 | |

| Receivable for investments sold | 47,154 | |

| Receivable for fund shares sold | 36,921 | |

| Dividends receivable | 2,107 | |

| Distributions receivable from Fidelity Central Funds | 316 | |

| Prepaid expenses | 51 | |

| Receivable from investment adviser for expense reductions | 1,003 | |

| Other receivables | 54 | |

| Total assets | 19,983,225 | |

| Liabilities | ||

| Payable to custodian bank | $61 | |

| Payable for investments purchased | 278,717 | |

| Payable for fund shares redeemed | 219,084 | |

| Accrued management fee | 8,869 | |

| Distribution and service plan fees payable | 5,565 | |

| Other affiliated payables | 4,837 | |

| Other payables and accrued expenses | 29,098 | |

| Collateral on Securities Loaned | 714,450 | |

| Total liabilities | 1,260,681 | |

| Net Assets | $18,722,544 | |

| Net Assets consist of: | ||

| Paid in capital | $16,243,259 | |

| Undistributed net investment income | 11,234 | |

| Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | (62,703) | |

| Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | 2,530,754 | |

| Net Assets | $18,722,544 | |

| Calculation of Maximum Offering Price | ||

| Class A: | ||

| Net Asset Value and redemption price per share ($6,203,927 ÷ 491,720 shares) | $12.62 | |

| Maximum offering price per share (100/94.25 of $12.62) | $13.39 | |

| Class T: | ||

| Net Asset Value and redemption price per share ($4,029,607 ÷ 331,184 shares) | $12.17 | |

| Maximum offering price per share (100/96.50 of $12.17) | $12.61 | |

| Class C: | ||

| Net Asset Value and offering price per share ($3,054,259 ÷ 272,853 shares)(a) | $11.19 | |

| Class I: | ||

| Net Asset Value, offering price and redemption price per share ($5,434,751 ÷ 415,151 shares) | $13.09 |

(a) Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Six months ended January 31, 2017 (Unaudited) | ||

| Investment Income | ||

| Dividends | $141,839 | |

| Income from Fidelity Central Funds (including $1,058 from security lending) | 1,894 | |

| Total income | 143,733 | |

| Expenses | ||

| Management fee | $46,794 | |

| Transfer agent fees | 24,151 | |

| Distribution and service plan fees | 30,291 | |

| Accounting and security lending fees | 3,386 | |

| Custodian fees and expenses | 9,567 | |

| Independent trustees' fees and expenses | 172 | |

| Registration fees | 47,440 | |

| Audit | 24,363 | |

| Legal | 2,598 | |

| Miscellaneous | 221 | |

| Total expenses before reductions | 188,983 | |

| Expense reductions | (61,192) | 127,791 |

| Net investment income (loss) | 15,942 | |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | 90,594 | |

| Fidelity Central Funds | 633 | |

| Foreign currency transactions | 51 | |

| Total net realized gain (loss) | 91,278 | |

| Change in net unrealized appreciation (depreciation) on: Investment securities | 857,497 | |

| Assets and liabilities in foreign currencies | 26 | |

| Total change in net unrealized appreciation (depreciation) | 857,523 | |

| Net gain (loss) | 948,801 | |

| Net increase (decrease) in net assets resulting from operations | $964,743 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Six months ended January 31, 2017 (Unaudited) | Year ended July 31, 2016 | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $15,942 | $65,928 |

| Net realized gain (loss) | 91,278 | 270,090 |

| Change in net unrealized appreciation (depreciation) | 857,523 | (534,618) |

| Net increase (decrease) in net assets resulting from operations | 964,743 | (198,600) |

| Distributions to shareholders from net investment income | (70,635) | – |

| Distributions to shareholders from net realized gain | (269,853) | (387,325) |

| Total distributions | (340,488) | (387,325) |

| Share transactions - net increase (decrease) | 6,199,411 | (628,642) |

| Redemption fees | 370 | 148 |

| Total increase (decrease) in net assets | 6,824,036 | (1,214,419) |

| Net Assets | ||

| Beginning of period | 11,898,508 | 13,112,927 |

| End of period | $18,722,544 | $11,898,508 |

| Other Information | ||

| Undistributed net investment income end of period | $11,234 | $65,927 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Advisor Communications Equipment Fund Class A

| Six months ended (Unaudited) January 31, | Years ended July 31, | |||||

| 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $12.09 | $12.57 | $11.94 | $10.22 | $7.71 | $9.73 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A | .02 | .09 | .02 | .04B | .02 | (.01) |

| Net realized and unrealized gain (loss) | .74 | (.20) | .64 | 1.68 | 2.50 | (1.81) |

| Total from investment operations | .76 | (.11) | .66 | 1.72 | 2.52 | (1.82) |

| Distributions from net investment income | (.05) | – | (.03) | – | (.01) | – |

| Distributions from net realized gain | (.18) | (.37) | – | – | – | (.20) |

| Total distributions | (.23) | (.37) | (.03) | – | (.01) | (.20) |

| Redemption fees added to paid in capitalA,C | – | – | – | – | – | – |

| Net asset value, end of period | $12.62 | $12.09 | $12.57 | $11.94 | $10.22 | $7.71 |

| Total ReturnD,E,F | 6.23% | (.53)% | 5.54% | 16.83% | 32.65% | (18.88)% |

| Ratios to Average Net AssetsG,H | ||||||

| Expenses before reductions | 2.11%I | 2.10% | 1.90% | 1.96% | 2.22% | 1.96% |

| Expenses net of fee waivers, if any | 1.40%I | 1.40% | 1.40% | 1.40% | 1.40% | 1.40% |

| Expenses net of all reductions | 1.40%I | 1.40% | 1.39% | 1.39% | 1.37% | 1.39% |

| Net investment income (loss) | .29%I | .81% | .16% | .40%B | .18% | (.16)% |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $6,204 | $4,536 | $4,806 | $4,725 | $3,962 | $3,568 |

| Portfolio turnover rateJ | 54%I | 29% | 60% | 160% | 33% | 79% |

A Calculated based on average shares outstanding during the period.

B Net Investment income per share reflects a large, non-recurring dividend which amounted to $.03 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been .14%.

C Amount represents less than $.005 per share.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Total returns do not include the effect of the sales charges.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

I Annualized

J Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Advisor Communications Equipment Fund Class T

| Six months ended (Unaudited) January 31, | Years ended July 31, | |||||

| 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $11.65 | $12.15 | $11.55 | $9.91 | $7.49 | $9.48 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A | – | .06 | (.01) | .02B | (.01) | (.03) |

| Net realized and unrealized gain (loss) | .72 | (.20) | .62 | 1.62 | 2.43 | (1.76) |

| Total from investment operations | .72 | (.14) | .61 | 1.64 | 2.42 | (1.79) |

| Distributions from net investment income | (.02) | – | (.01) | – | – | – |

| Distributions from net realized gain | (.18) | (.36) | – | – | – | (.20) |

| Total distributions | (.20) | (.36) | (.01) | – | – | (.20) |

| Redemption fees added to paid in capitalA,C | – | – | – | – | – | – |

| Net asset value, end of period | $12.17 | $11.65 | $12.15 | $11.55 | $9.91 | $7.49 |

| Total ReturnD,E,F | 6.13% | (.83)% | 5.24% | 16.55% | 32.31% | (19.06)% |

| Ratios to Average Net AssetsG,H | ||||||

| Expenses before reductions | 2.43%I | 2.41% | 2.19% | 2.25% | 2.52% | 2.27% |

| Expenses net of fee waivers, if any | 1.65%I | 1.65% | 1.65% | 1.65% | 1.65% | 1.65% |

| Expenses net of all reductions | 1.65%I | 1.65% | 1.64% | 1.64% | 1.62% | 1.64% |

| Net investment income (loss) | .04%I | .56% | (.09)% | .14%B | (.07)% | (.41)% |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $4,030 | $3,674 | $4,029 | $3,995 | $3,342 | $2,843 |

| Portfolio turnover rateJ | 54%I | 29% | 60% | 160% | 33% | 79% |

A Calculated based on average shares outstanding during the period.

B Net Investment income per share reflects a large, non-recurring dividend which amounted to $.03 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been (.11) %.

C Amount represents less than $.005 per share.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Total returns do not include the effect of the sales charges.

G Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Annualized

J Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Advisor Communications Equipment Fund Class C

| Six months ended (Unaudited) January 31, | Years ended July 31, | |||||

| 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $10.74 | $11.27 | $10.76 | $9.28 | $7.05 | $8.98 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A | (.03) | .01 | (.07) | (.04)B | (.05) | (.07) |

| Net realized and unrealized gain (loss) | .66 | (.19) | .58 | 1.52 | 2.28 | (1.66) |

| Total from investment operations | .63 | (.18) | .51 | 1.48 | 2.23 | (1.73) |

| Distributions from net investment income | – | – | – | – | – | – |

| Distributions from net realized gain | (.18) | (.35) | – | – | – | (.20) |

| Total distributions | (.18) | (.35) | – | – | – | (.20) |

| Redemption fees added to paid in capitalA,C | – | – | – | – | – | – |

| Net asset value, end of period | $11.19 | $10.74 | $11.27 | $10.76 | $9.28 | $7.05 |

| Total ReturnD,E,F | 5.79% | (1.29)% | 4.74% | 15.95% | 31.63% | (19.47)% |

| Ratios to Average Net AssetsG,H | ||||||

| Expenses before reductions | 2.87%I | 2.86% | 2.65% | 2.73% | 2.98% | 2.71% |

| Expenses net of fee waivers, if any | 2.15%I | 2.15% | 2.15% | 2.15% | 2.15% | 2.15% |

| Expenses net of all reductions | 2.15%I | 2.15% | 2.14% | 2.14% | 2.12% | 2.14% |

| Net investment income (loss) | (.46)%I | .06% | (.59)% | (.35)%B | (.57)% | (.91)% |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $3,054 | $2,479 | $2,966 | $2,744 | $2,334 | $2,142 |

| Portfolio turnover rateJ | 54%I | 29% | 60% | 160% | 33% | 79% |

A Calculated based on average shares outstanding during the period.

B Net Investment income per share reflects a large, non-recurring dividend which amounted to $.03 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been (.61) %.

C Amount represents less than $.005 per share.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Total returns do not include the effect of the contingent deferred sales charge.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

I Annualized

J Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Advisor Communications Equipment Fund Class I

| Six months ended (Unaudited) January 31, | Years ended July 31, | |||||

| 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $12.54 | $13.01 | $12.35 | $10.55 | $7.95 | $10.00 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A | .04 | .12 | .05 | .08B | .04 | .01 |

| Net realized and unrealized gain (loss) | .77 | (.20) | .67 | 1.72 | 2.58 | (1.86) |

| Total from investment operations | .81 | (.08) | .72 | 1.80 | 2.62 | (1.85) |

| Distributions from net investment income | (.08) | – | (.06) | – | (.02) | – |

| Distributions from net realized gain | (.18) | (.39) | – | – | – | (.20) |

| Total distributions | (.26) | (.39) | (.06) | – | (.02) | (.20) |

| Redemption fees added to paid in capitalA,C | – | – | – | – | – | – |

| Net asset value, end of period | $13.09 | $12.54 | $13.01 | $12.35 | $10.55 | $7.95 |

| Total ReturnD,E | 6.37% | (.33)% | 5.83% | 17.06% | 32.92% | (18.66)% |

| Ratios to Average Net AssetsF,G | ||||||

| Expenses before reductions | 1.83%H | 1.69% | 1.57% | 1.45% | 1.93% | 1.66% |

| Expenses net of fee waivers, if any | 1.15%H | 1.15% | 1.15% | 1.15% | 1.15% | 1.15% |

| Expenses net of all reductions | 1.15%H | 1.14% | 1.14% | 1.14% | 1.12% | 1.13% |

| Net investment income (loss) | .54%H | 1.06% | .41% | .65%B | .43% | .10% |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $5,435 | $1,209 | $1,024 | $2,592 | $855 | $721 |

| Portfolio turnover rateI | 54%H | 29% | 60% | 160% | 33% | 79% |

A Calculated based on average shares outstanding during the period.

B Net Investment income per share reflects a large, non-recurring dividend which amounted to $.03 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been .39%.

C Amount represents less than $.005 per share.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

G Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

H Annualized

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor® Consumer Discretionary Fund

Investment Summary (Unaudited)

Top Ten Stocks as of January 31, 2017

| % of fund's net assets | % of fund's net assets 6 months ago | |

| Amazon.com, Inc. | 14.6 | 14.3 |

| The Walt Disney Co. | 10.3 | 8.1 |

| Home Depot, Inc. | 9.5 | 8.5 |

| Charter Communications, Inc. Class A | 7.0 | 6.6 |

| NIKE, Inc. Class B | 5.8 | 4.7 |

| L Brands, Inc. | 4.3 | 4.4 |

| Dollar Tree, Inc. | 4.0 | 0.7 |

| TJX Companies, Inc. | 3.3 | 1.5 |

| Time Warner, Inc. | 2.5 | 0.8 |

| Spectrum Brands Holdings, Inc. | 2.2 | 1.4 |

| 63.5 |

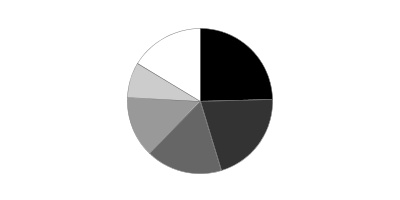

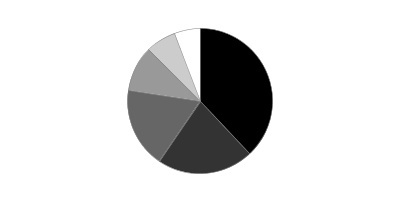

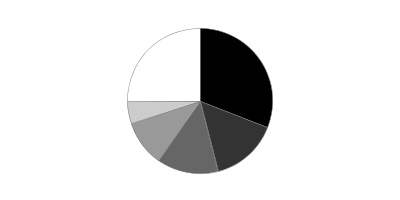

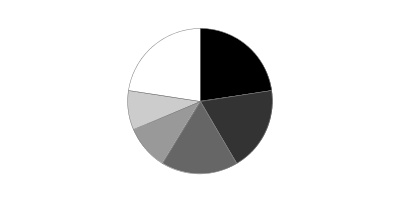

Top Industries (% of fund's net assets)

| As of January 31, 2017 | ||

| Media | 24.6% | |

| Specialty Retail | 20.7% | |

| Internet & Direct Marketing Retail | 16.9% | |

| Hotels, Restaurants & Leisure | 13.5% | |

| Textiles, Apparel & Luxury Goods | 8.0% | |

| All Others* | 16.3% | |

| As of July 31, 2016 | ||

| Specialty Retail | 26.4% | |

| Media | 22.1% | |

| Internet & Catalog Retail | 16.2% | |

| Hotels, Restaurants & Leisure | 14.6% | |

| Textiles, Apparel & Luxury Goods | 8.4% | |

| All Others* | 12.3% | |

Prior period industry classifications reflect the categories in place as of the date indicated and have not been adjusted to reflect current industry classifications.

* Includes short-term investments and net other assets (liabilities).

Fidelity Advisor® Consumer Discretionary Fund

Investments January 31, 2017 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks - 96.1% | |||

| Shares | Value | ||

| Automobiles - 0.4% | |||

| Automobile Manufacturers - 0.4% | |||

| Ferrari NV | 16,700 | $1,037,571 | |

| Beverages - 1.2% | |||

| Soft Drinks - 1.2% | |||

| Monster Beverage Corp. (a) | 77,847 | 3,316,282 | |

| Distributors - 1.3% | |||

| Distributors - 1.3% | |||

| LKQ Corp. (a) | 120,200 | 3,835,582 | |

| Food & Staples Retailing - 0.1% | |||

| Food Retail - 0.1% | |||

| Zhou Hei Ya International Holdings Co. Ltd. | 326,000 | 287,429 | |

| Hotels, Restaurants & Leisure - 13.5% | |||

| Casinos & Gaming - 1.2% | |||

| Churchill Downs, Inc. | 300 | 43,005 | |

| Las Vegas Sands Corp. | 66,480 | 3,495,518 | |

| 3,538,523 | |||

| Hotels, Resorts & Cruise Lines - 3.5% | |||

| Hilton Grand Vacations, Inc. (a) | 45,300 | 1,328,649 | |

| Hilton Worldwide Holdings, Inc. | 107,207 | 6,172,979 | |

| Park Hotels & Resorts, Inc. | 90,600 | 2,458,884 | |

| 9,960,512 | |||

| Leisure Facilities - 1.5% | |||

| International Speedway Corp. Class A | 21,800 | 798,970 | |

| Vail Resorts, Inc. | 20,240 | 3,471,970 | |

| 4,270,940 | |||

| Restaurants - 7.3% | |||

| Buffalo Wild Wings, Inc. (a) | 24,700 | 3,729,700 | |

| Darden Restaurants, Inc. | 47,725 | 3,497,288 | |

| Del Frisco's Restaurant Group, Inc. (a) | 41,395 | 724,413 | |

| Domino's Pizza, Inc. | 26,640 | 4,649,746 | |

| Jack in the Box, Inc. | 19,200 | 2,072,064 | |

| McDonald's Corp. | 1,680 | 205,918 | |

| Starbucks Corp. | 93,176 | 5,145,179 | |

| U.S. Foods Holding Corp. | 28,600 | 777,920 | |

| 20,802,228 | |||

| TOTAL HOTELS, RESTAURANTS & LEISURE | 38,572,203 | ||

| Household Durables - 1.2% | |||

| Household Appliances - 1.2% | |||

| Techtronic Industries Co. Ltd. | 971,000 | 3,358,310 | |

| Household Products - 2.2% | |||

| Household Products - 2.2% | |||

| Spectrum Brands Holdings, Inc. | 47,658 | 6,357,101 | |

| Internet & Direct Marketing Retail - 16.9% | |||

| Internet& Direct Marketing Retail - 16.9% | |||

| Amazon.com, Inc. (a) | 50,480 | 41,569,267 | |

| Liberty Interactive Corp. QVC Group Series A (a) | 210,869 | 4,044,467 | |

| Ocado Group PLC (a)(b) | 861,337 | 2,702,403 | |

| 48,316,137 | |||

| Leisure Products - 1.1% | |||

| Leisure Products - 1.1% | |||

| Mattel, Inc. | 125,200 | 3,281,492 | |

| Media - 24.3% | |||

| Advertising - 1.8% | |||

| Interpublic Group of Companies, Inc. | 213,676 | 5,027,796 | |

| Cable & Satellite - 9.7% | |||

| Charter Communications, Inc. Class A (a) | 61,594 | 19,953,376 | |

| Comcast Corp. Class A | 83,300 | 6,282,486 | |

| Sirius XM Holdings, Inc. (b) | 303,300 | 1,431,576 | |

| 27,667,438 | |||

| Movies & Entertainment - 12.8% | |||

| The Walt Disney Co. | 266,206 | 29,455,694 | |

| Time Warner, Inc. | 73,716 | 7,139,395 | |

| 36,595,089 | |||

| TOTAL MEDIA | 69,290,323 | ||

| Multiline Retail - 4.5% | |||

| General Merchandise Stores - 4.5% | |||