UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3114

Fidelity Select Portfolios

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | February 28 |

|

|

Date of reporting period: | February 28, 2011 |

Item 1. Reports to Stockholders

Fidelity®

Select Portfolios®

Consumer Discretionary Sector

Automotive Portfolio

Construction and Housing Portfolio

Consumer Discretionary Portfolio

Leisure Portfolio

Multimedia Portfolio

Retailing Portfolio

Annual Report

February 28, 2011

(2_fidelity_logos) (Registered_Trademark)

Contents

Chairman's Message |

| |

Shareholder Expense Example |

| |

Automotive Portfolio | Performance | |

| Management's Discussion | |

| Investment Changes | |

| Investments | |

| Financial Statements | |

Construction and Housing Portfolio | Performance | |

| Management's Discussion | |

| Investment Changes | |

| Investments | |

| Financial Statements | |

Consumer Discretionary Portfolio | Performance | |

| Management's Discussion | |

| Investment Changes | |

| Investments | |

| Financial Statements | |

Leisure Portfolio | Performance | |

| Management's Discussion | |

| Investment Changes | |

| Investments | |

| Financial Statements | |

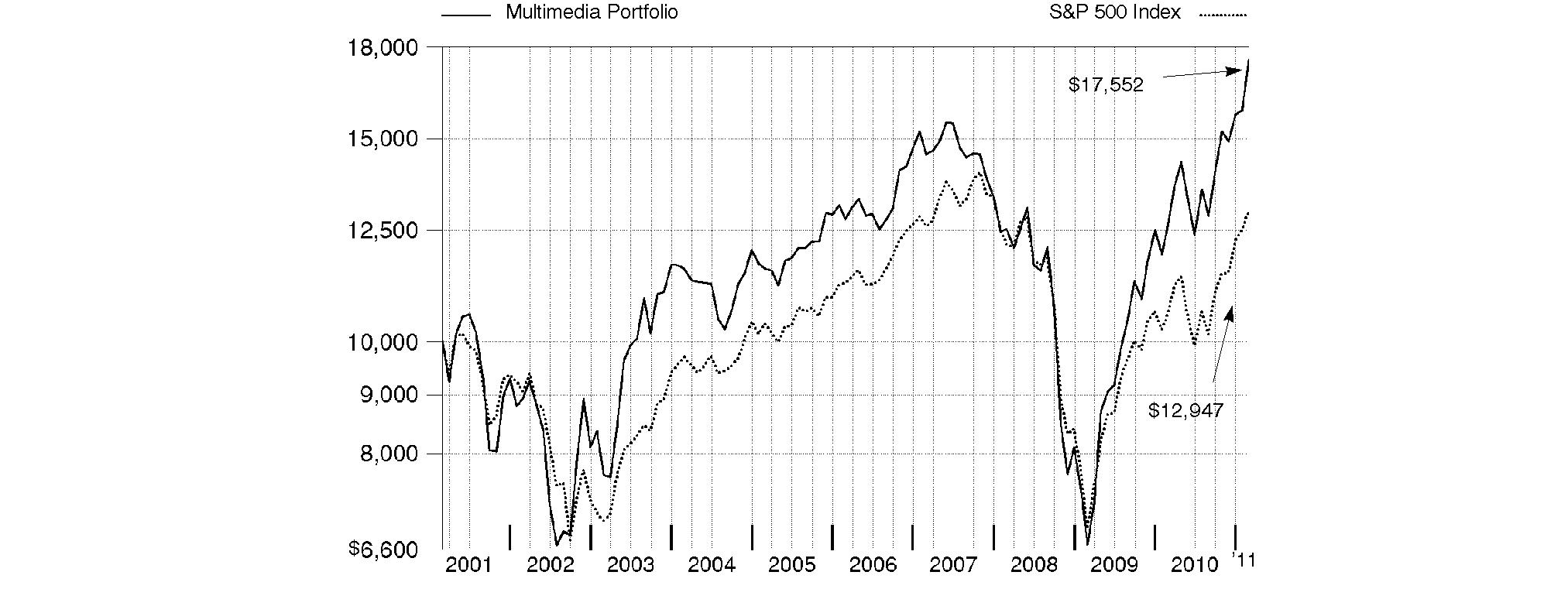

Multimedia Portfolio | Performance | |

| Management's Discussion | |

| Investment Changes | |

| Investments | |

| Financial Statements | |

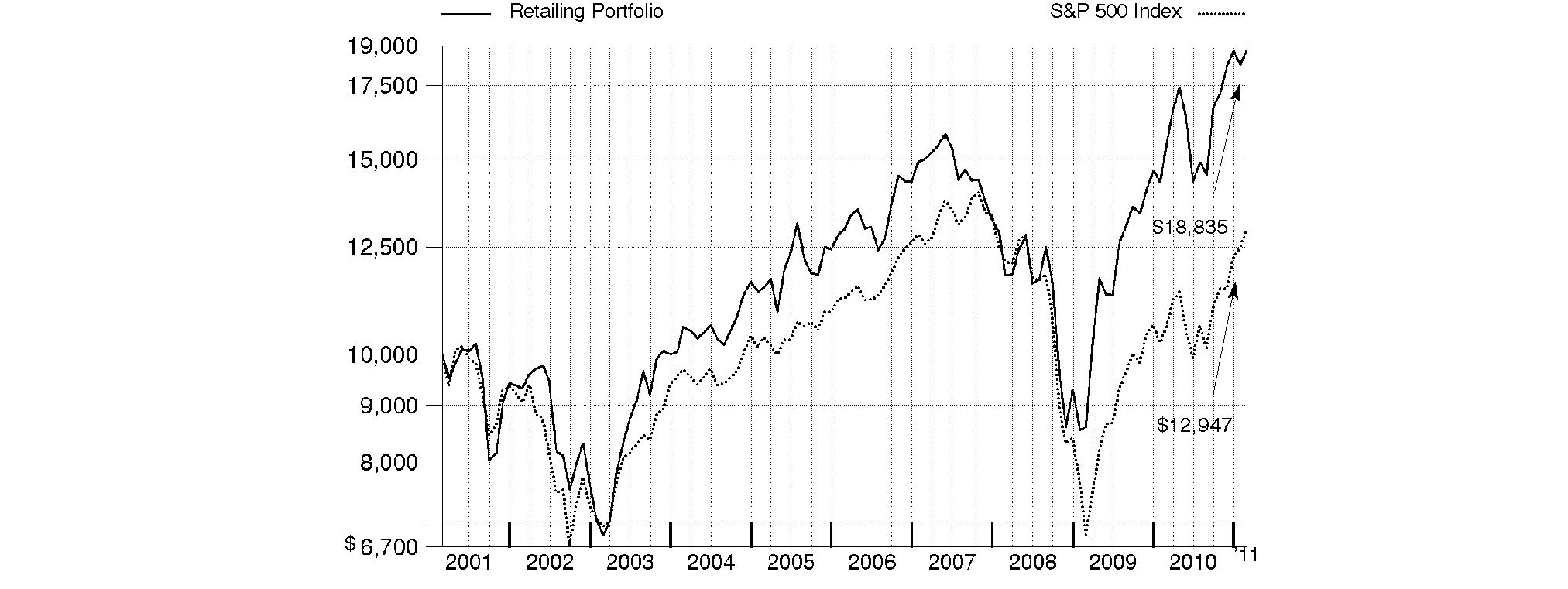

Retailing Portfolio | Performance | |

| Management's Discussion | |

| Investment Changes | |

| Investments | |

| Financial Statements | |

Notes to Financial Statements |

| |

Report of Independent Registered Public Accounting Firm |

| |

Trustees and Officers |

| |

Distributions |

| |

Prospectus | P-1 |

|

Annual Report

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

Annual Report

Chairman's Message

(photo_of_James_C_Curvey)

Dear Shareholder:

Following a year in which the investment environment was volatile but generally supportive of most major asset classes, 2011 has begun on a positive note. U.S. equities gained ground in January and February, reaching their highest point since June 2008, amid indications the U.S. economy had turned a corner. Still, questions remained about the longer-term outlook, most notably persistently high unemployment. Financial markets are always unpredictable, of course, but there also are several time-tested investment principles that can help put the odds in your favor.

One of the basic tenets is to invest for the long term. Over time, riding out the markets' inevitable ups and downs has proven much more effective than selling into panic or chasing the hottest trend. Even missing only a few of the markets' best days can significantly diminish investor returns. Patience also affords the benefits of compounding - of earning interest on additional income or reinvested dividends and capital gains. There can be tax advantages and cost benefits to consider as well. While staying the course doesn't eliminate risk, it can considerably lessen the effect of short-term declines.

You can further manage your investing risk through diversification. And today, more than ever, geographic diversification should be taken into account. Studies indicate that asset allocation is the single most important determinant of a portfolio's long-term success. The right mix of stocks, bonds and cash - aligned to your particular risk tolerance and investment objective - is very important. Age-appropriate rebalancing is also an essential aspect of asset allocation. For younger investors, an emphasis on equities - which historically have been the best-performing asset class over time - is encouraged. As investors near their specific goal, such as retirement or sending a child to college, consideration may be given to replacing volatile assets (e.g. common stocks) with more-stable fixed investments (bonds or saving plans).

A third principle - investing regularly - can help lower the average cost of your purchases. Investing a certain amount of money each month or quarter helps ensure you won't pay for all your shares at market highs. This strategy - known as dollar cost averaging - also reduces "emotion" from investing, helping shareholders avoid selling weak performers just prior to an upswing, or chasing a hot performer just before a correction.

We invite you to contact us via the Internet, through our Investor Centers or by phone. It is our privilege to provide you the information you need to make the investments that are right for you.

Sincerely,

(The acting chairman's signature appears here.)

James C. Curvey

Acting Chairman

Annual Report

Shareholder Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including redemption fees, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (September 1, 2010 to February 28, 2011).

Actual Expenses

The first line of the accompanying table for each fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, each Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each fund provides information about hypothetical account values and hypothetical expenses based on a fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, each Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Annualized Expense Ratio | Beginning | Ending | Expenses Paid |

Automotive Portfolio | .89% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,481.40 | $ 5.48 |

HypotheticalA |

| $ 1,000.00 | $ 1,020.38 | $ 4.46 |

Construction and Housing Portfolio | .96% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,342.30 | $ 5.58 |

HypotheticalA |

| $ 1,000.00 | $ 1,020.03 | $ 4.81 |

Consumer Discretionary Portfolio | .93% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,305.70 | $ 5.32 |

HypotheticalA |

| $ 1,000.00 | $ 1,020.18 | $ 4.66 |

Leisure Portfolio | .89% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,253.30 | $ 4.97 |

HypotheticalA |

| $ 1,000.00 | $ 1,020.38 | $ 4.46 |

Multimedia Portfolio | .90% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,366.10 | $ 5.28 |

HypotheticalA |

| $ 1,000.00 | $ 1,020.33 | $ 4.51 |

Retailing Portfolio | .92% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,298.20 | $ 5.24 |

HypotheticalA |

| $ 1,000.00 | $ 1,020.23 | $ 4.61 |

A 5% return per year before expenses

* Expenses are equal to each Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Annual Report

Automotive Portfolio

Performance: The Bottom Line

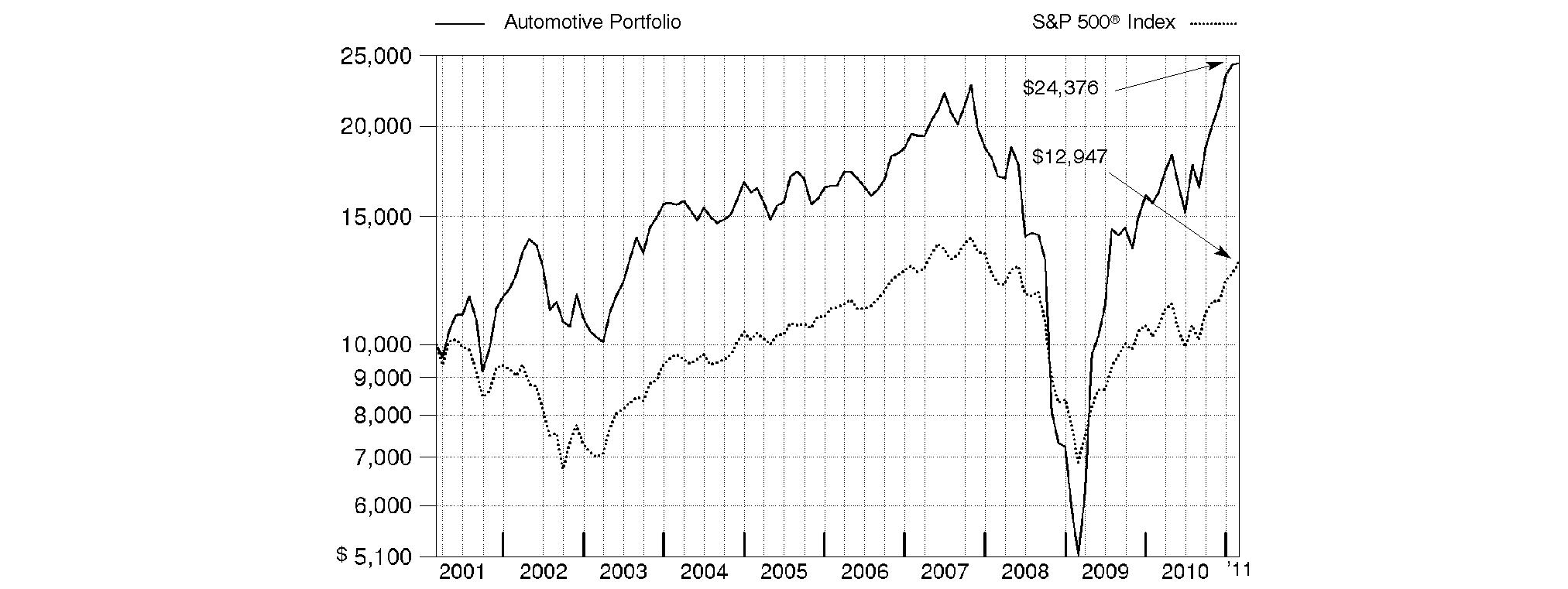

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended February 28, 2011 | Past 1 | Past 5 | Past 10 |

Automotive Portfolio | 50.90% | 8.05% | 9.32% |

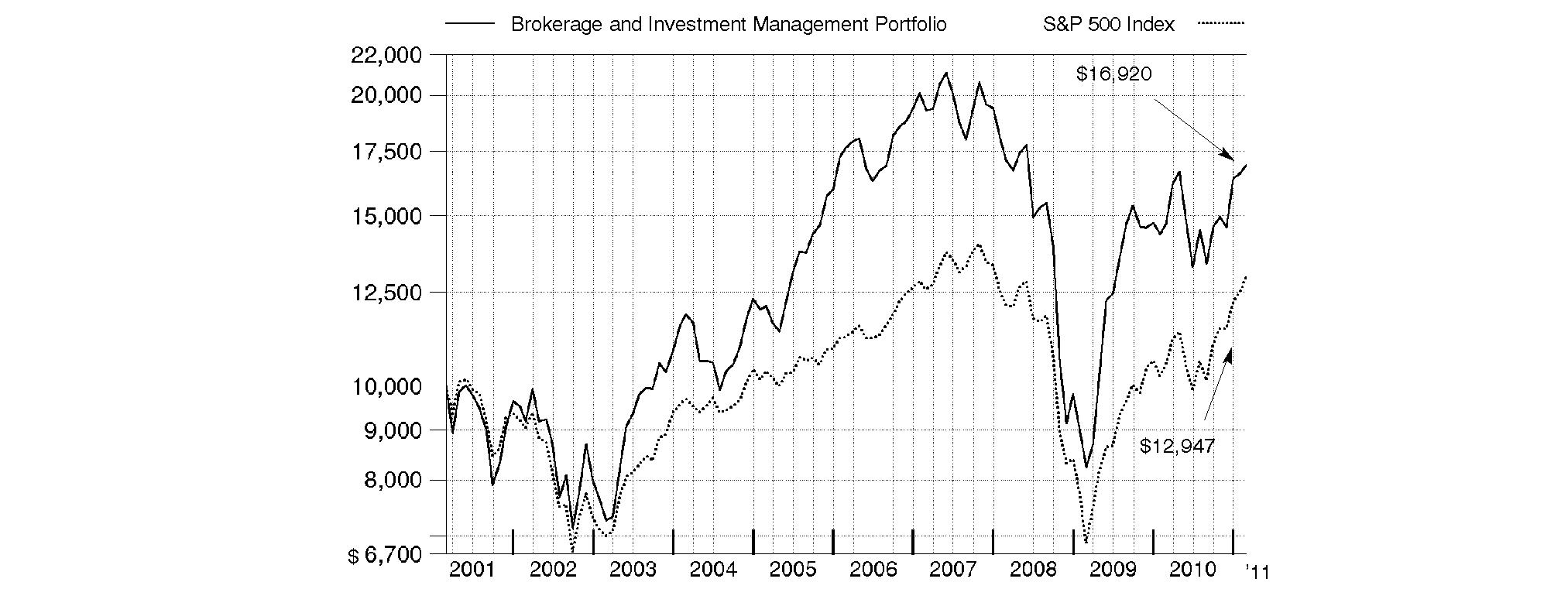

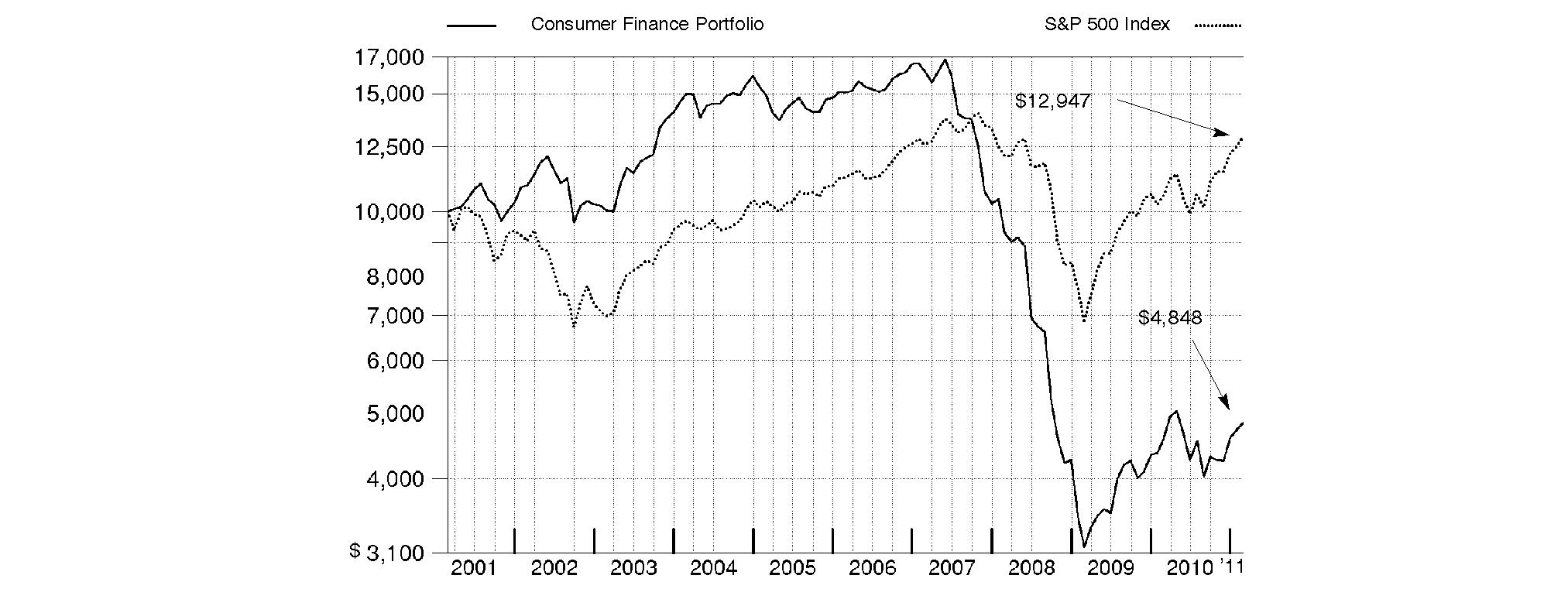

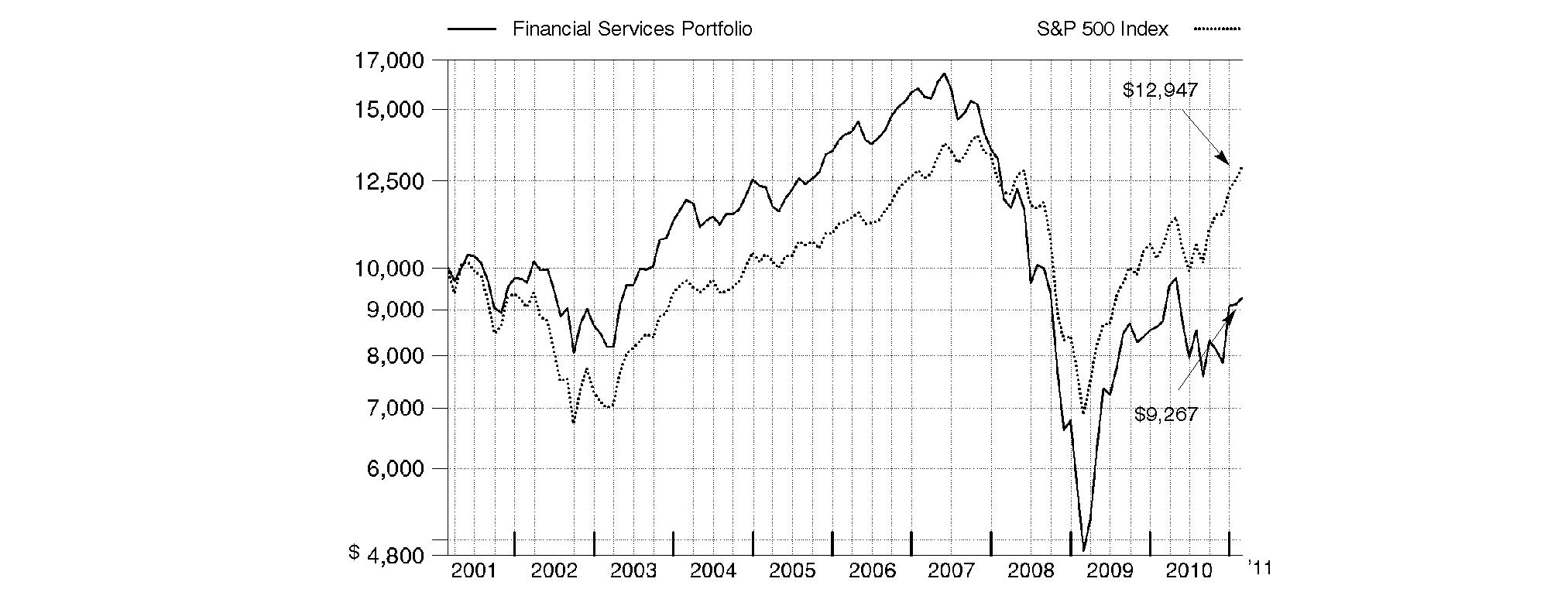

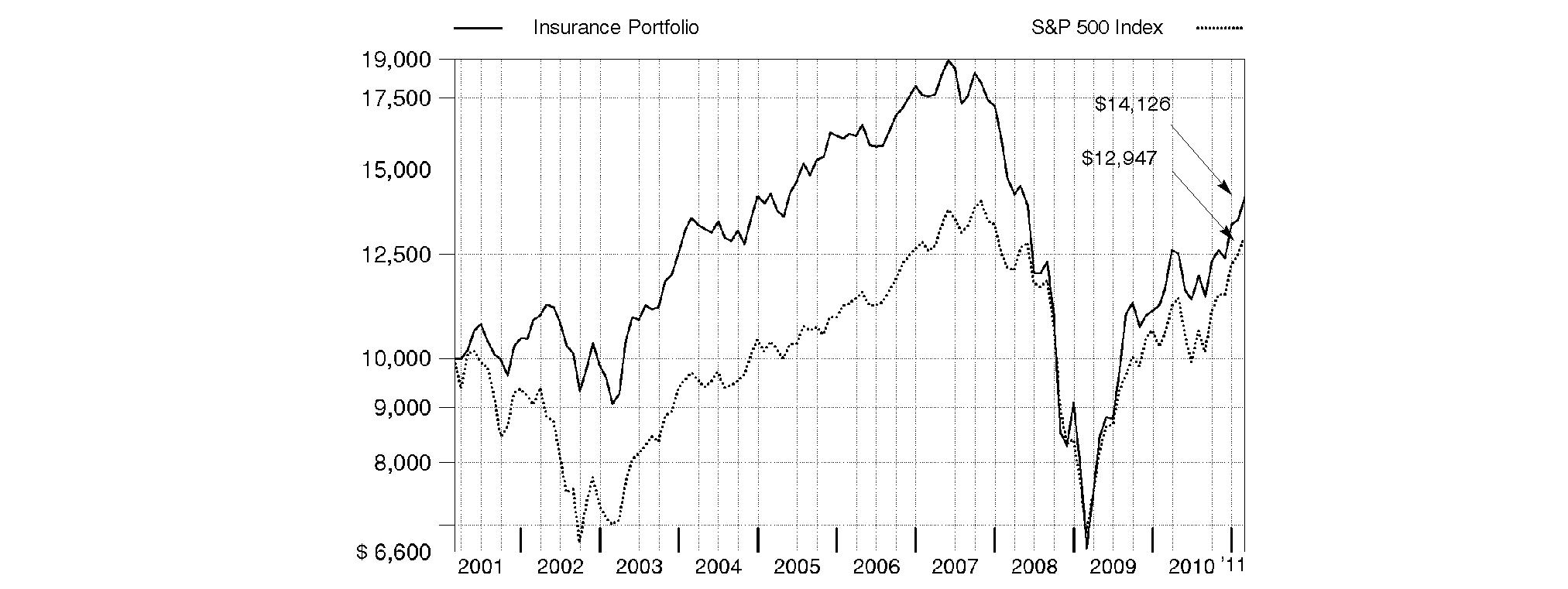

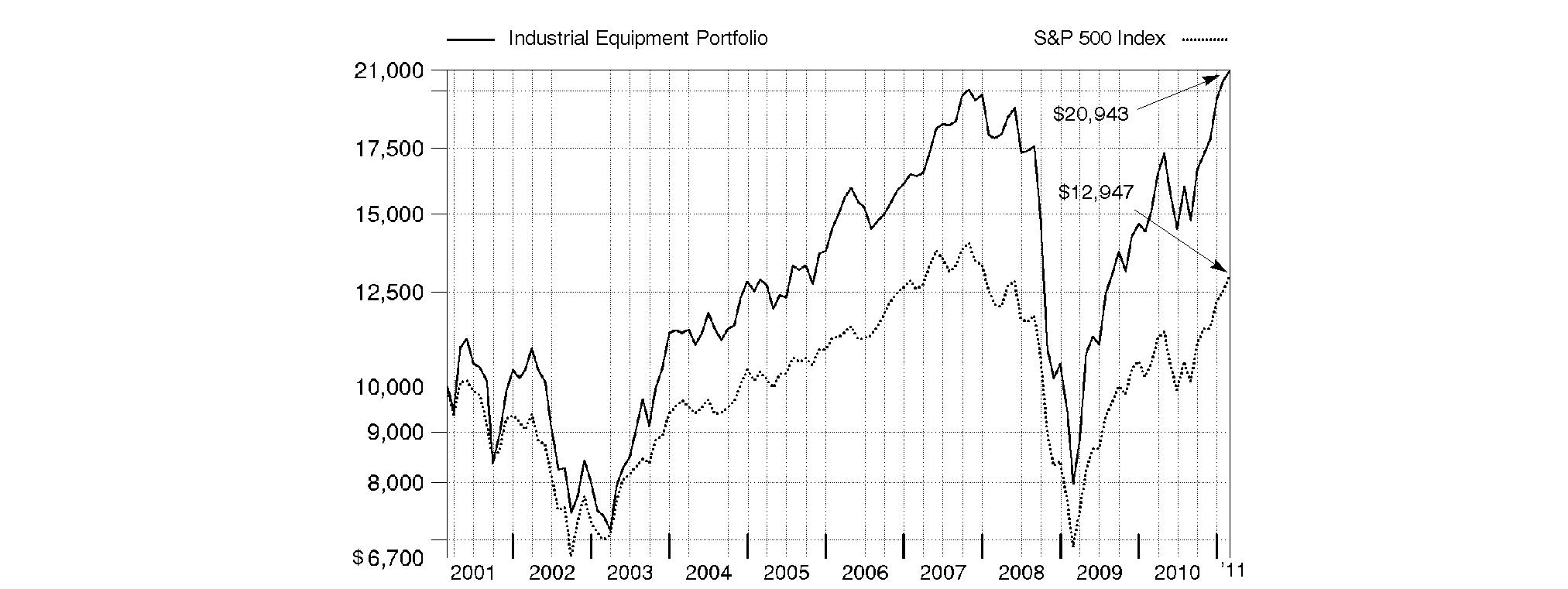

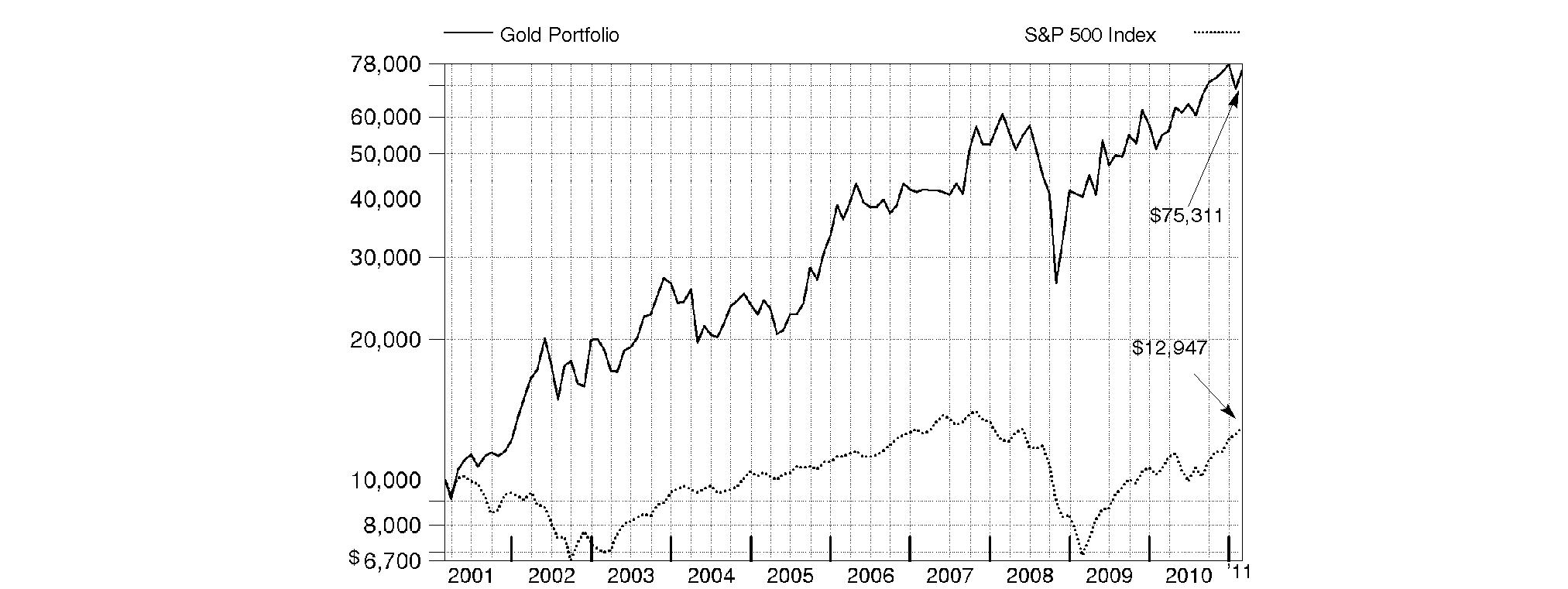

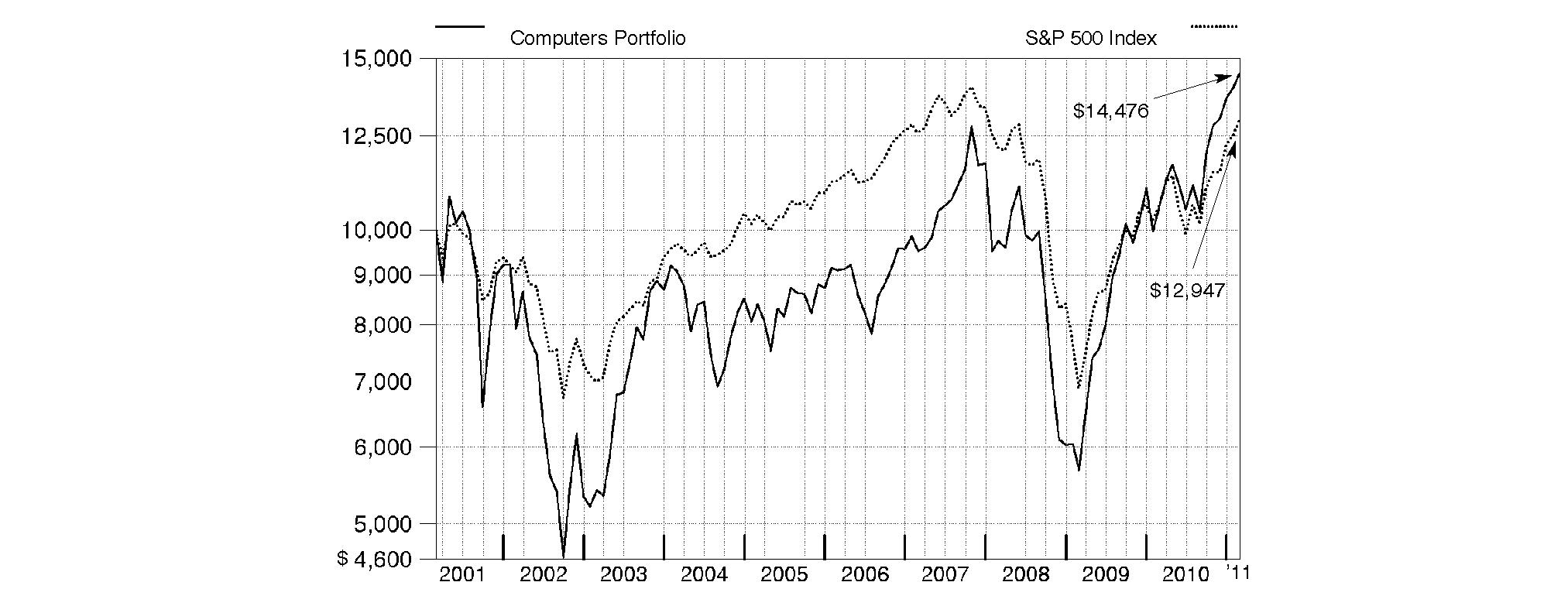

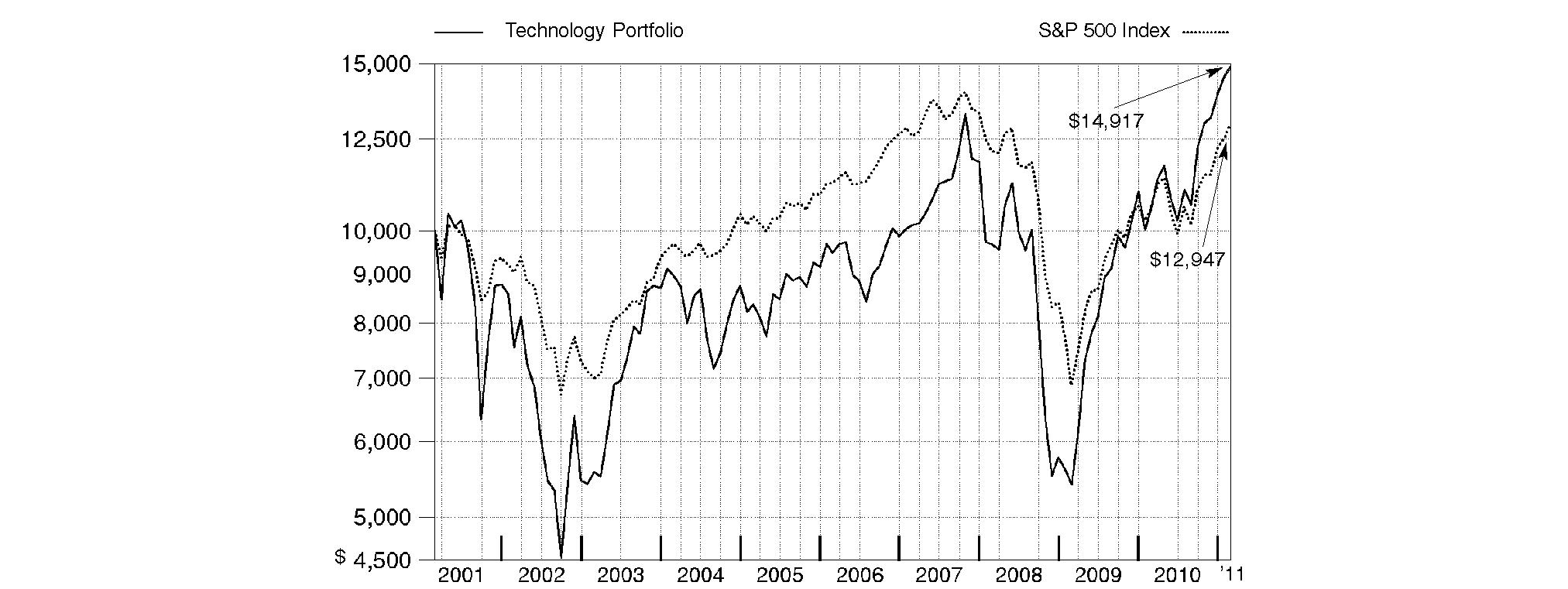

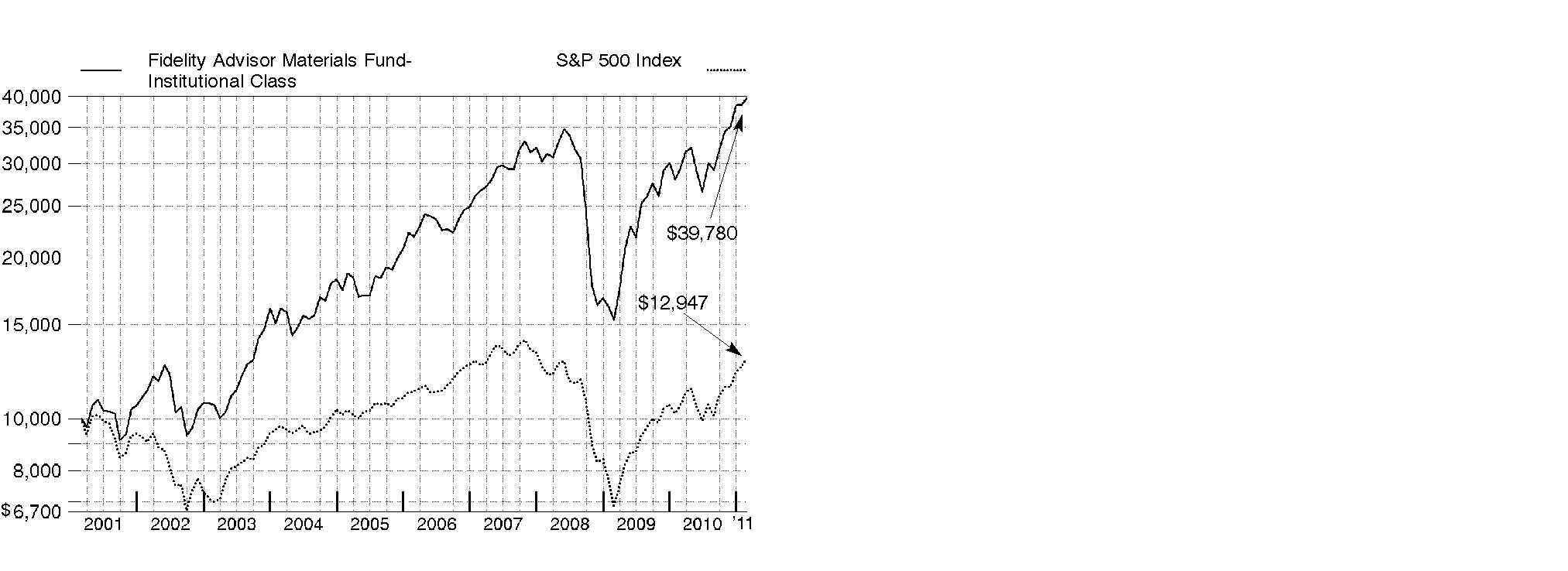

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Automotive Portfolio on February 28, 2001. The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

Annual Report

Automotive Portfolio

Management's Discussion of Fund Performance

Market Recap: Steady economic growth, encouraging monetary policy, improving credit-market conditions, an uptick in merger-and-acquisition activity and better-than-expected corporate earnings propelled U.S. stock markets forward during the 12-month period ending February 28, 2011. Uncertainty over the global effects of the debt crisis in Europe and China's attempt to rein in its economy plagued equities during the spring, but markets reacted positively to the Federal Reserve's second round of stimulative quantitative easing and the Congressional midterm elections in November, followed in December by the extension of Bush-era tax policies. For the full year, the S&P 500® Index advanced 22.57%, with all but one of the 10 major sectors tracked by MSCI U.S. Investable Market classifications delivering a double-digit gain. While cyclically oriented sectors benefited from an overall improving economy, less economically sensitive sectors fell short of the broad market. Energy and materials stocks performed best, while the health care and consumer staples groups struggled the most.

Comments from Michael Weaver, Portfolio Manager of Automotive Portfolio: For the year, the fund returned 50.90%, significantly outperforming both the 44.72% gain of its industry benchmark, the S&P® Custom Automobiles & Components Index, and the S&P 500®. Relative to its industry index, strong stock selection - particularly in the auto parts and equipment group - and favorable overall market positioning fueled the fund's outperformance. Underweighting the lagging automobile manufacturers group and slightly overweighting the construction/farm machinery/heavy trucks category, along with solid stock picking in both areas, bolstered relative performance. Security selection in the out-of-benchmark automotive retail group also helped. The biggest individual contributors were substantially overweighted positions in TRW Automotive Holdings, a leading supplier of airbags and other safety equipment, and Tenneco, a maker of vehicle emission-system components. Underweighting underperforming Japanese manufacturer and index heavyweight Toyota Motor also contributed, as did an out-of-benchmark investment in automotive retailer Lithia Motors. On the downside, a small stake in bonds issued by General Motors and security selection in consumer electronics were the primary detractors. In addition to GM, individual detractors included an underweighting in Canada-based Magna International, which makes automotive chassis, interiors and metal stampings, and a non-index position in Harman International, which produces audio products and electronic systems. Some holdings mentioned in this update were not held at period end.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Automotive Portfolio

Investment Changes (Unaudited)

Top Ten Stocks as of February 28, 2011 | ||

| % of fund's | % of fund's net assets |

Toyota Motor Corp. sponsored ADR | 11.7 | 9.6 |

Ford Motor Co. | 10.0 | 9.3 |

Honda Motor Co. Ltd. sponsored ADR | 8.9 | 8.3 |

Lear Corp. | 7.0 | 0.0 |

TRW Automotive Holdings Corp. | 6.8 | 7.1 |

Tenneco, Inc. | 4.9 | 4.9 |

Johnson Controls, Inc. | 4.7 | 5.7 |

BorgWarner, Inc. | 4.5 | 5.7 |

Harley-Davidson, Inc. | 4.1 | 2.2 |

Magna International, Inc. Class A (sub. vtg.) | 3.9 | 4.6 |

| 66.5 | |

Top Industries (% of fund's net assets) | |||

As of February 28, 2011 | |||

| Auto Components | 52.6% |

|

| Automobiles | 42.4% |

|

| Specialty Retail | 3.2% |

|

| Machinery | 1.2% |

|

| All Others* | 0.6% |

|

As of August 31, 2010 | |||

| Auto Components | 49.2% |

|

| Automobiles | 30.9% |

|

| Specialty Retail | 11.7% |

|

| Household Durables | 2.8% |

|

| Machinery | 2.5% |

|

| All Others* | 2.9% |

|

* Includes short-term investments and net other assets. |

Annual Report

Automotive Portfolio

Investments February 28, 2011

Showing Percentage of Net Assets

Common Stocks - 95.4% | |||

Shares | Value | ||

AUTO COMPONENTS - 52.6% | |||

Auto Parts & Equipment - 50.6% | |||

American Axle & Manufacturing Holdings, Inc. (a) | 564,900 | $ 7,552,713 | |

Amerigon, Inc. (a)(e) | 200,400 | 2,733,456 | |

Autoliv, Inc. | 178,155 | 13,342,028 | |

BorgWarner, Inc. (a) | 217,600 | 16,887,936 | |

Dana Holding Corp. (a) | 577,200 | 10,897,536 | |

Delphi Corp. Class B (a) | 300 | 6,270,000 | |

Drew Industries, Inc. | 32,100 | 742,473 | |

Exide Technologies (a) | 555,500 | 6,610,450 | |

Federal-Mogul Corp. Class A (a) | 346,824 | 7,286,772 | |

Fuel Systems Solutions, Inc. (a) | 14,200 | 413,504 | |

Gentex Corp. | 187,300 | 5,671,444 | |

Johnson Controls, Inc. | 431,670 | 17,612,136 | |

Lear Corp. | 247,400 | 26,174,920 | |

Magna International, Inc. Class A | 299,384 | 14,749,575 | |

Martinrea International, Inc. (a) | 221,500 | 2,041,107 | |

Modine Manufacturing Co. (a) | 200,200 | 2,962,960 | |

Stoneridge, Inc. (a) | 132,589 | 1,999,442 | |

Tenneco, Inc. (a) | 455,280 | 18,156,566 | |

Tower International, Inc. | 101,300 | 1,752,490 | |

TRW Automotive Holdings Corp. (a) | 445,100 | 25,281,680 | |

| 189,139,188 | ||

Tires & Rubber - 2.0% | |||

Cooper Tire & Rubber Co. | 134,500 | 3,155,370 | |

The Goodyear Tire & Rubber Co. (a) | 300,026 | 4,254,369 | |

| 7,409,739 | ||

TOTAL AUTO COMPONENTS | 196,548,927 | ||

AUTOMOBILES - 38.4% | |||

Automobile Manufacturers - 34.3% | |||

Ford Motor Co. (a) | 2,476,661 | 37,273,748 | |

General Motors Co. | 338,900 | 11,363,317 | |

Honda Motor Co. Ltd. sponsored ADR (e) | 762,200 | 33,300,518 | |

Thor Industries, Inc. | 53,500 | 1,778,340 | |

Toyota Motor Corp. sponsored ADR (e) | 468,000 | 43,664,399 | |

Winnebago Industries, Inc. (a) | 49,400 | 714,324 | |

| 128,094,646 | ||

Motorcycle Manufacturers - 4.1% | |||

Harley-Davidson, Inc. | 374,900 | 15,303,418 | |

TOTAL AUTOMOBILES | 143,398,064 | ||

MACHINERY - 1.2% | |||

Construction & Farm Machinery & Heavy Trucks - 1.2% | |||

Accuride Corp. (a) | 111,100 | 1,554,289 | |

ArvinMeritor, Inc. (a) | 172,100 | 3,084,032 | |

| 4,638,321 | ||

| |||

Shares | Value | ||

SPECIALTY RETAIL - 3.2% | |||

Automotive Retail - 3.2% | |||

Asbury Automotive Group, Inc. (a) | 185,126 | $ 3,415,575 | |

Group 1 Automotive, Inc. (e) | 58,300 | 2,463,175 | |

Sonic Automotive, Inc. Class A (sub. vtg.) (e) | 415,900 | 5,980,642 | |

| 11,859,392 | ||

TOTAL COMMON STOCKS (Cost $281,985,275) | 356,444,704 | ||

Nonconvertible Bonds - 4.0% | ||||

| Principal Amount |

| ||

AUTOMOBILES - 4.0% | ||||

Automobile Manufacturers - 4.0% | ||||

General Motors Corp.: | ||||

6.75% 5/1/28 (d) | $ 31,005,000 | 9,766,575 | ||

7.125% 7/15/13 (d) | 12,970,000 | 4,117,975 | ||

7.2% 1/15/49 (d) | 10,000 | 3,200 | ||

8.25% 7/15/23 (d) | 3,030,000 | 969,600 | ||

8.375% 7/15/33 (d) | 25,000 | 8,313 | ||

| 14,865,663 | |||

Money Market Funds - 21.7% | |||

Shares |

| ||

Fidelity Securities Lending Cash Central Fund, 0.21% (b)(c) | 81,313,075 | 81,313,075 | |

TOTAL INVESTMENT PORTFOLIO - 121.1% (Cost $379,737,589) | 452,623,442 | |

NET OTHER ASSETS (LIABILITIES) - (21.1)% | (78,991,845) | |

NET ASSETS - 100% | $ 373,631,597 | |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

(c) Investment made with cash collateral received from securities on loan. |

(d) Non-income producing - Security is in default. |

(e) Security or a portion of the security is on loan at period end. |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned |

Fidelity Cash Central Fund | $ 13,720 |

Fidelity Securities Lending Cash Central Fund | 99,057 |

Total | $ 112,777 |

Other Information |

The following is a summary of the inputs used, as of February 28, 2011, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

Valuation Inputs at Reporting Date: | ||||

Description | Total | Level 1 | Level 2 | Level 3 |

Investments in Securities: | ||||

Common Stocks | $ 356,444,704 | $ 350,174,704 | $ 6,270,000 | $ - |

Nonconvertible Bonds | 14,865,663 | - | 14,865,663 | - |

Money Market Funds | 81,313,075 | 81,313,075 | - | - |

Total Investments in Securities: | $ 452,623,442 | $ 431,487,779 | $ 21,135,663 | $ - |

Distribution of investments by country of issue, as a percentage of total net assets, is as follows: (Unaudited) |

United States of America | 75.0% |

Japan | 20.6% |

Canada | 4.4% |

| 100.0% |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Automotive Portfolio

Financial Statements

Statement of Assets and Liabilities

| February 28, 2011 | |

|

|

|

Assets | ||

Investment in securities, at value (including securities loaned of $80,509,909) - See accompanying schedule: Unaffiliated issuers (cost $298,424,514) | $ 371,310,367 |

|

Fidelity Central Funds (cost $81,313,075) | 81,313,075 |

|

Total Investments (cost $379,737,589) |

| $ 452,623,442 |

Cash | 269 | |

Receivable for investments sold | 13,296,518 | |

Receivable for fund shares sold | 1,090,392 | |

Dividends receivable | 249,991 | |

Distributions receivable from Fidelity Central Funds | 13,611 | |

Prepaid expenses | 192 | |

Other receivables | 6,970 | |

Total assets | 467,281,385 | |

|

|

|

Liabilities | ||

Payable for fund shares redeemed | $ 6,051,273 | |

Accrued management fee | 191,168 | |

Notes payable to affiliates | 5,979,000 | |

Other affiliated payables | 81,469 | |

Other payables and accrued expenses | 33,803 | |

Collateral on securities loaned, at value | 81,313,075 | |

Total liabilities | 93,649,788 | |

|

|

|

Net Assets | $ 373,631,597 | |

Net Assets consist of: |

| |

Paid in capital | $ 297,505,507 | |

Accumulated net investment loss | (6,345) | |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | 3,246,754 | |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | 72,885,681 | |

Net Assets, for 7,972,418 shares outstanding | $ 373,631,597 | |

Net Asset Value, offering price and redemption price per share ($373,631,597 ÷ 7,972,418 shares) | $ 46.87 | |

Statement of Operations

| Year ended February 28, 2011 | |

|

|

|

Investment Income |

|

|

Dividends |

| $ 1,271,062 |

Interest |

| 507 |

Income from Fidelity Central Funds (including $99,057 from security lending) |

| 112,777 |

Total income |

| 1,384,346 |

|

|

|

Expenses | ||

Management fee | $ 1,101,180 | |

Transfer agent fees | 451,459 | |

Accounting and security lending fees | 83,247 | |

Custodian fees and expenses | 16,040 | |

Independent trustees' compensation | 977 | |

Registration fees | 71,171 | |

Audit | 40,010 | |

Legal | 547 | |

Interest | 1,451 | |

Miscellaneous | 1,625 | |

Total expenses before reductions | 1,767,707 | |

Expense reductions | (7,579) | 1,760,128 |

Net investment income (loss) | (375,782) | |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | ||

Investment securities: |

|

|

Unaffiliated issuers | 8,977,599 | |

Foreign currency transactions | 34,798 | |

Total net realized gain (loss) |

| 9,012,397 |

Change in net unrealized appreciation (depreciation) on: Investment securities | 57,048,582 | |

Assets and liabilities in foreign currencies | 73 | |

Total change in net unrealized appreciation (depreciation) |

| 57,048,655 |

Net gain (loss) | 66,061,052 | |

Net increase (decrease) in net assets resulting from operations | $ 65,685,270 | |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Changes in Net Assets

| Year ended February 28, | Year ended |

Increase (Decrease) in Net Assets |

|

|

Operations |

|

|

Net investment income (loss) | $ (375,782) | $ (223,089) |

Net realized gain (loss) | 9,012,397 | 12,547,740 |

Change in net unrealized appreciation (depreciation) | 57,048,655 | 32,049,790 |

Net increase (decrease) in net assets resulting from operations | 65,685,270 | 44,374,441 |

Distributions to shareholders from net investment income | - | (69,440) |

Distributions to shareholders from net realized gain | (3,086,154) | - |

Total distributions | (3,086,154) | (69,440) |

Share transactions | 420,037,518 | 237,075,048 |

Reinvestment of distributions | 2,936,075 | 67,208 |

Cost of shares redeemed | (258,021,780) | (143,070,227) |

Net increase (decrease) in net assets resulting from share transactions | 164,951,813 | 94,072,029 |

Redemption fees | 58,011 | 64,595 |

Total increase (decrease) in net assets | 227,608,940 | 138,441,625 |

|

|

|

Net Assets | ||

Beginning of period | 146,022,657 | 7,581,032 |

End of period (including accumulated net investment loss of $6,345 and accumulated net investment loss of $60, respectively) | $ 373,631,597 | $ 146,022,657 |

Other Information Shares | ||

Sold | 10,011,164 | 8,989,665 |

Issued in reinvestment of distributions | 85,450 | 3,926 |

Redeemed | (6,740,636) | (5,130,314) |

Net increase (decrease) | 3,355,978 | 3,863,277 |

Financial Highlights

Years ended February 28, | 2011 | 2010 | 2009 | 2008 F | 2007 |

Selected Per-Share Data |

|

|

|

|

|

Net asset value, beginning of period | $ 31.63 | $ 10.07 | $ 34.23 | $ 40.24 | $ 34.35 |

Income from Investment Operations |

|

|

|

|

|

Net investment income (loss) B | (.08) | (.06) | .42 | .18 | .06 |

Net realized and unrealized gain (loss) | 15.94 | 21.67 | (24.30) | (4.98) | 5.85 |

Total from investment operations | 15.86 | 21.61 | (23.88) | (4.80) | 5.91 |

Distributions from net investment income | - | (.07) | (.28) | (.13) | (.06) |

Distributions from net realized gain | (.63) | - | (.01) | (1.11) | - |

Total distributions | (.63) | (.07) | (.29) | (1.24) | (.06) |

Redemption fees added to paid in capital B | .01 | .02 | .01 | .03 | .04 |

Net asset value, end of period | $ 46.87 | $ 31.63 | $ 10.07 | $ 34.23 | $ 40.24 |

Total Return A | 50.90% | 215.39% | (69.99)% | (12.11)% | 17.33% |

Ratios to Average Net Assets C, E |

|

|

|

|

|

Expenses before reductions | .91% | .99% | 1.47% | 1.19% | 1.58% |

Expenses net of fee waivers, if any | .91% | .99% | 1.15% | 1.15% | 1.22% |

Expenses net of all reductions | .91% | .97% | 1.15% | 1.15% | 1.21% |

Net investment income (loss) | (.19)% | (.23)% | 1.73% | .44% | .16% |

Supplemental Data |

|

|

|

|

|

Net assets, end of period (000 omitted) | $ 373,632 | $ 146,023 | $ 7,581 | $ 25,823 | $ 47,708 |

Portfolio turnover rate D | 91% | 156% | 156% | 258% | 256% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown. B Calculated based on average shares outstanding during the period. C Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. D Amount does not include the portfolio activity of any underlying Fidelity Central Funds. E Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund. F For the year ended February 29. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Construction and Housing Portfolio

Performance: The Bottom Line

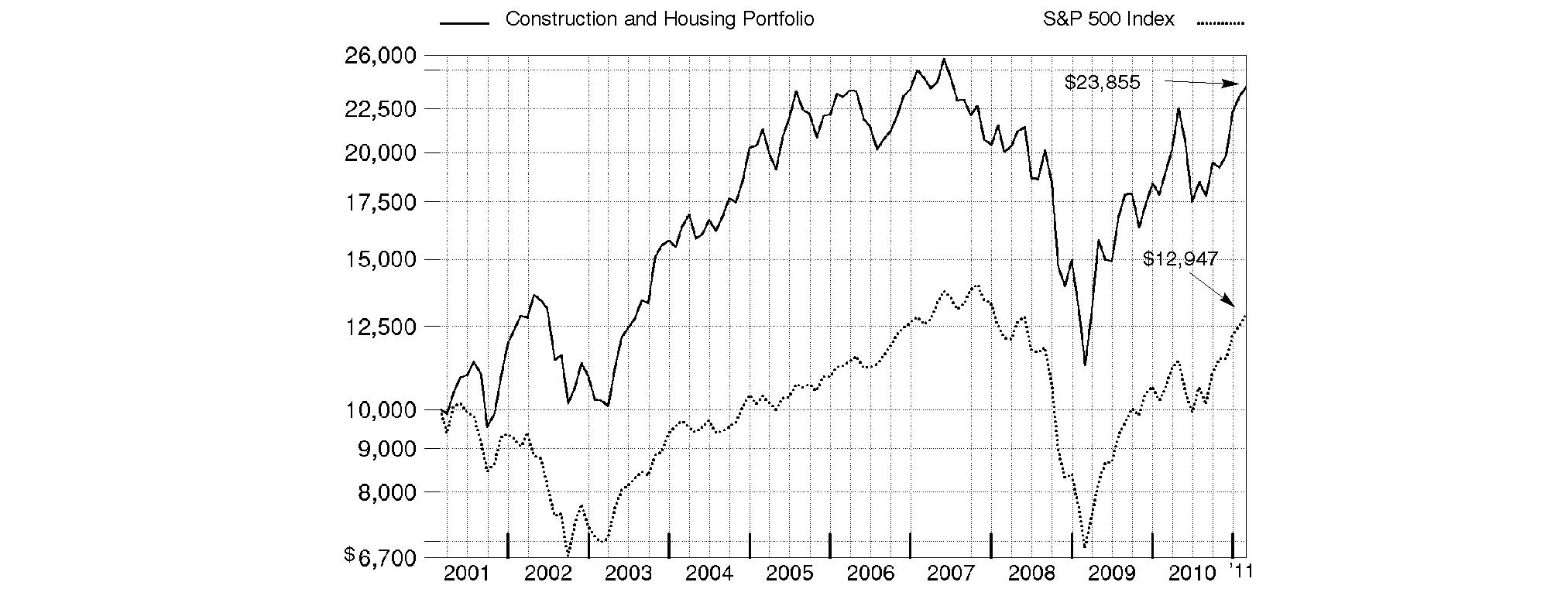

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended February 28, 2011 | Past 1 | Past 5 | Past 10 |

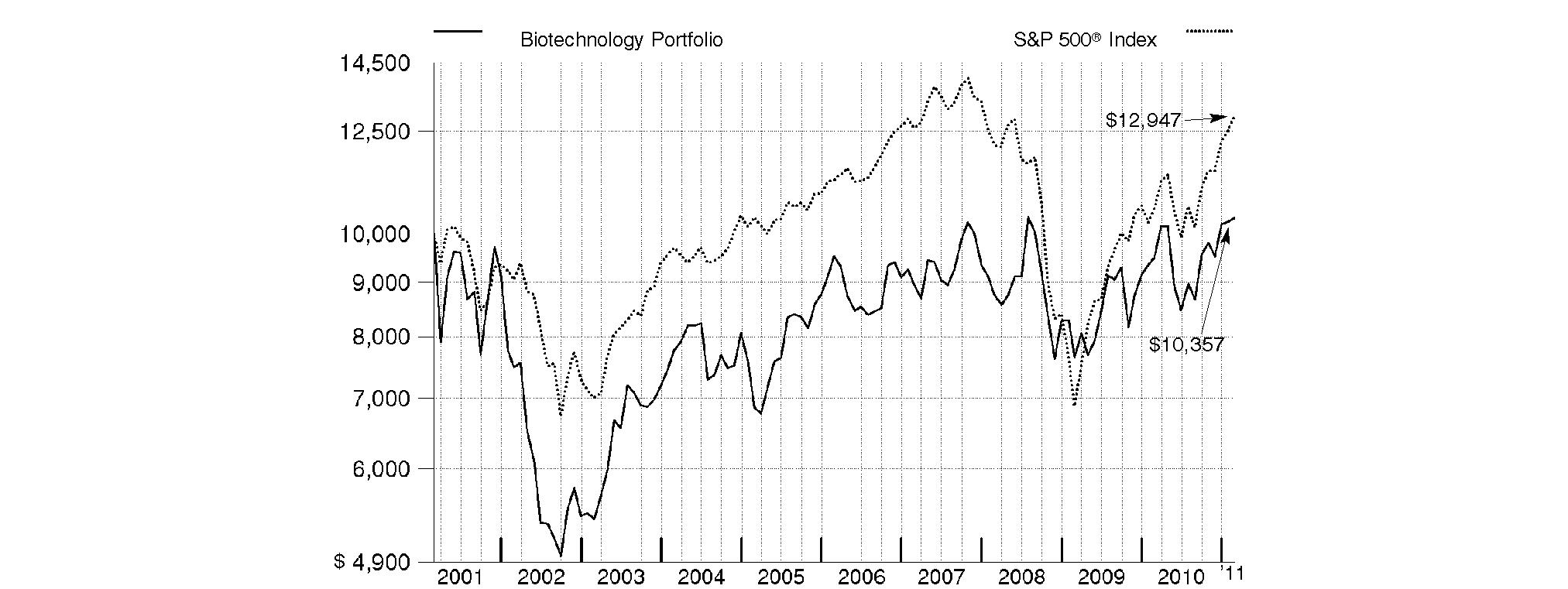

Construction and Housing Portfolio | 26.24% | 0.55% | 9.08% |

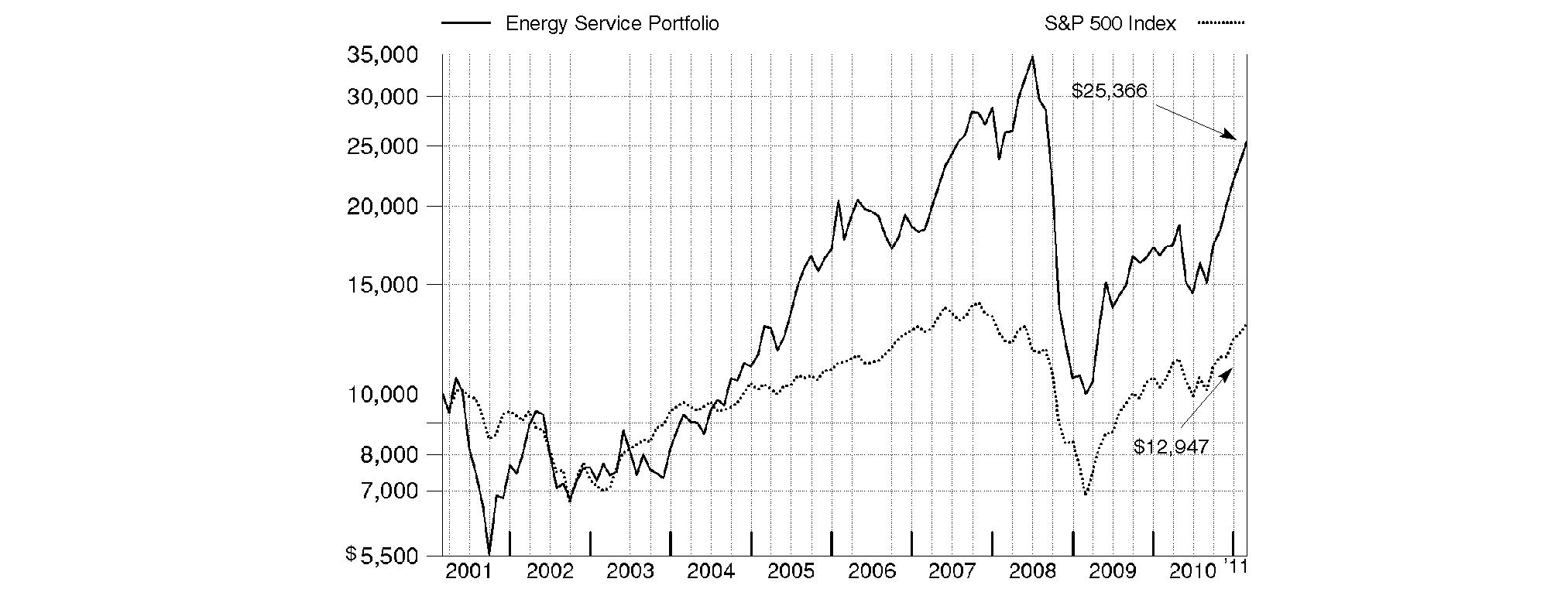

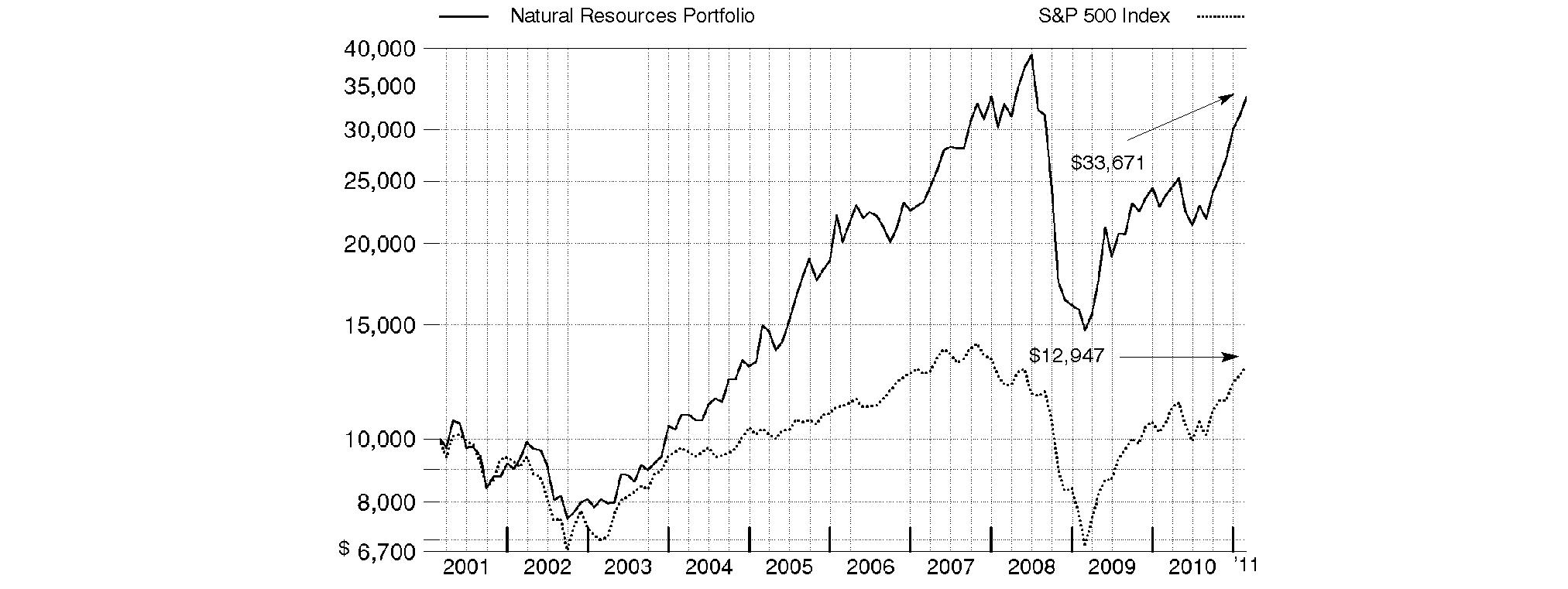

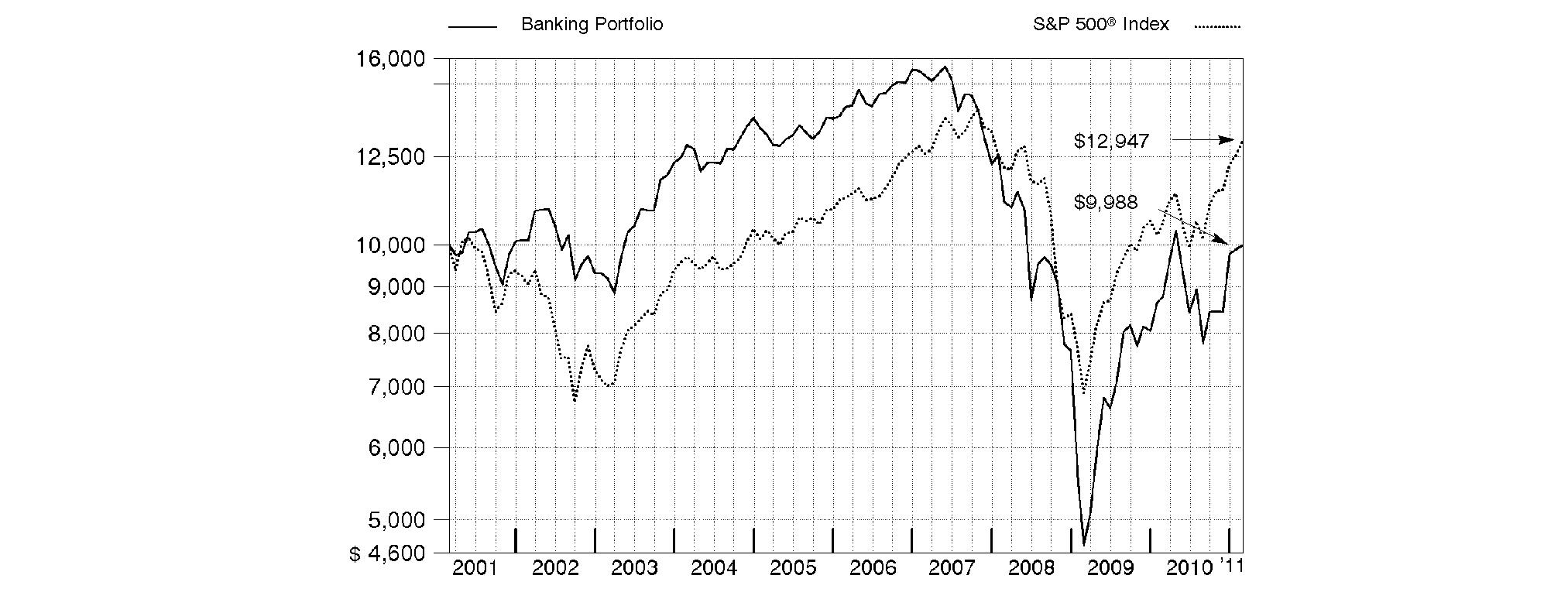

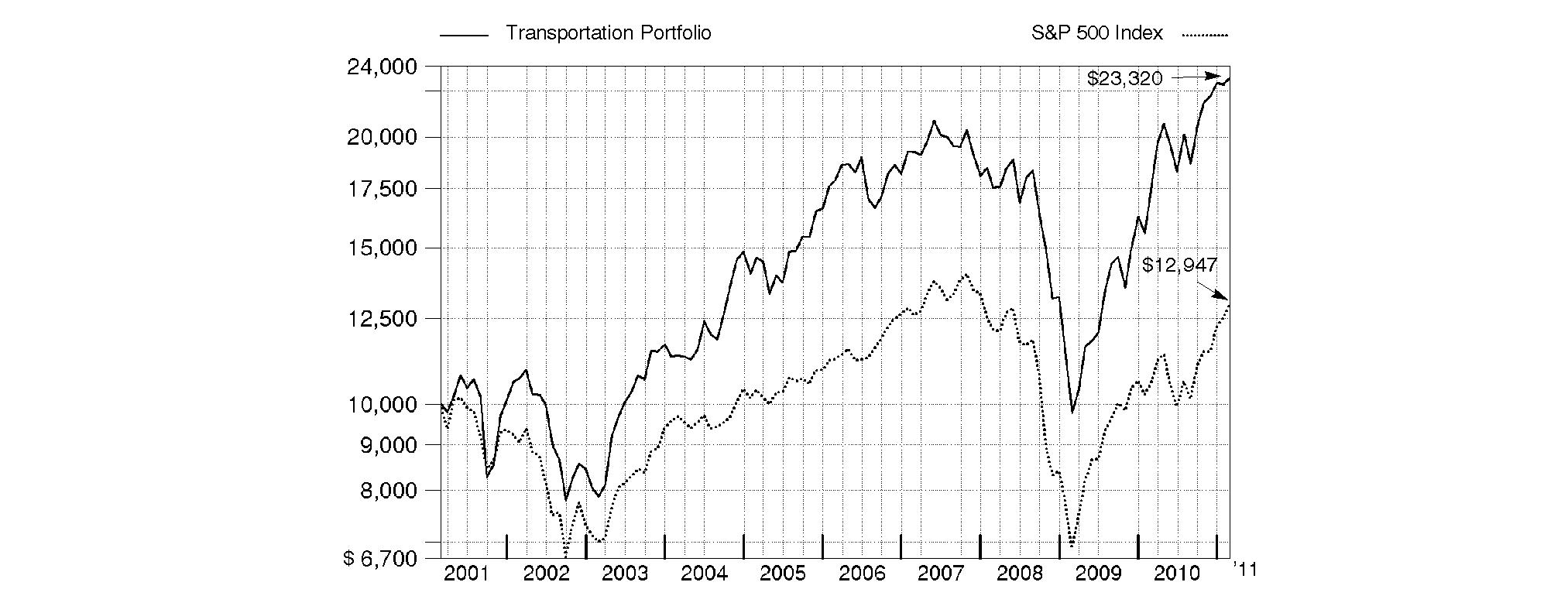

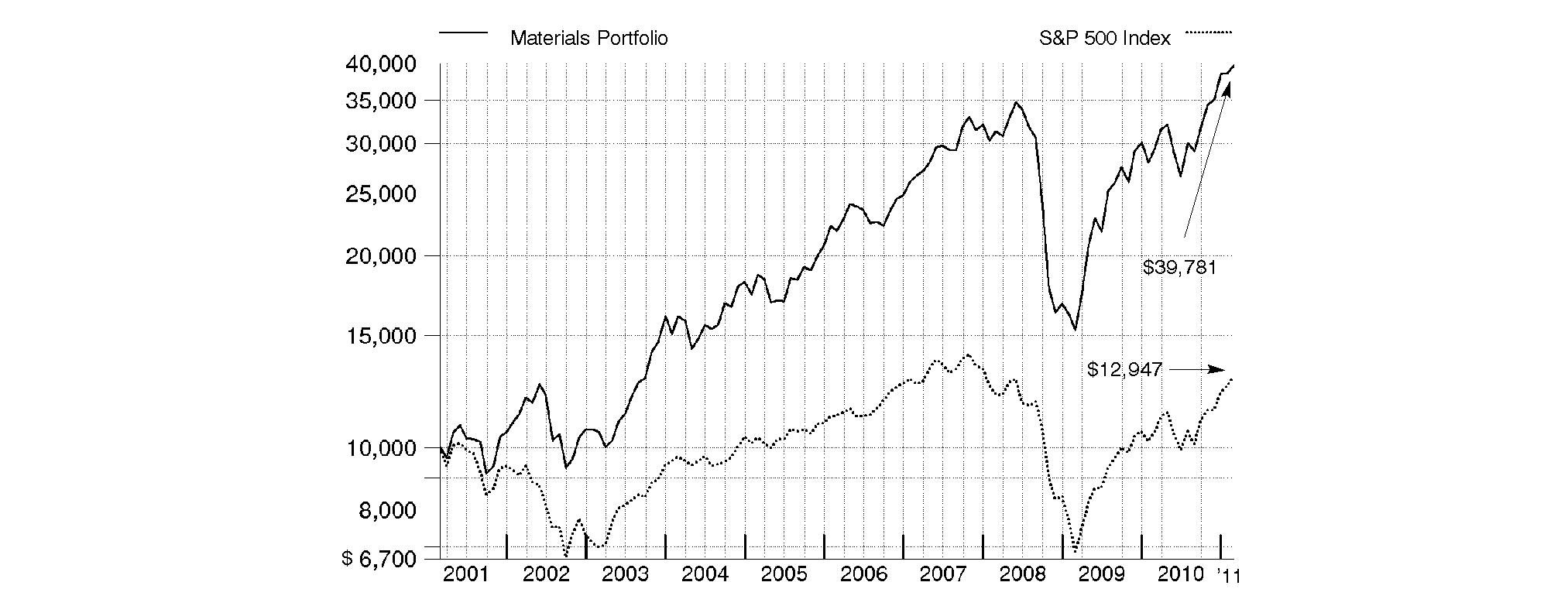

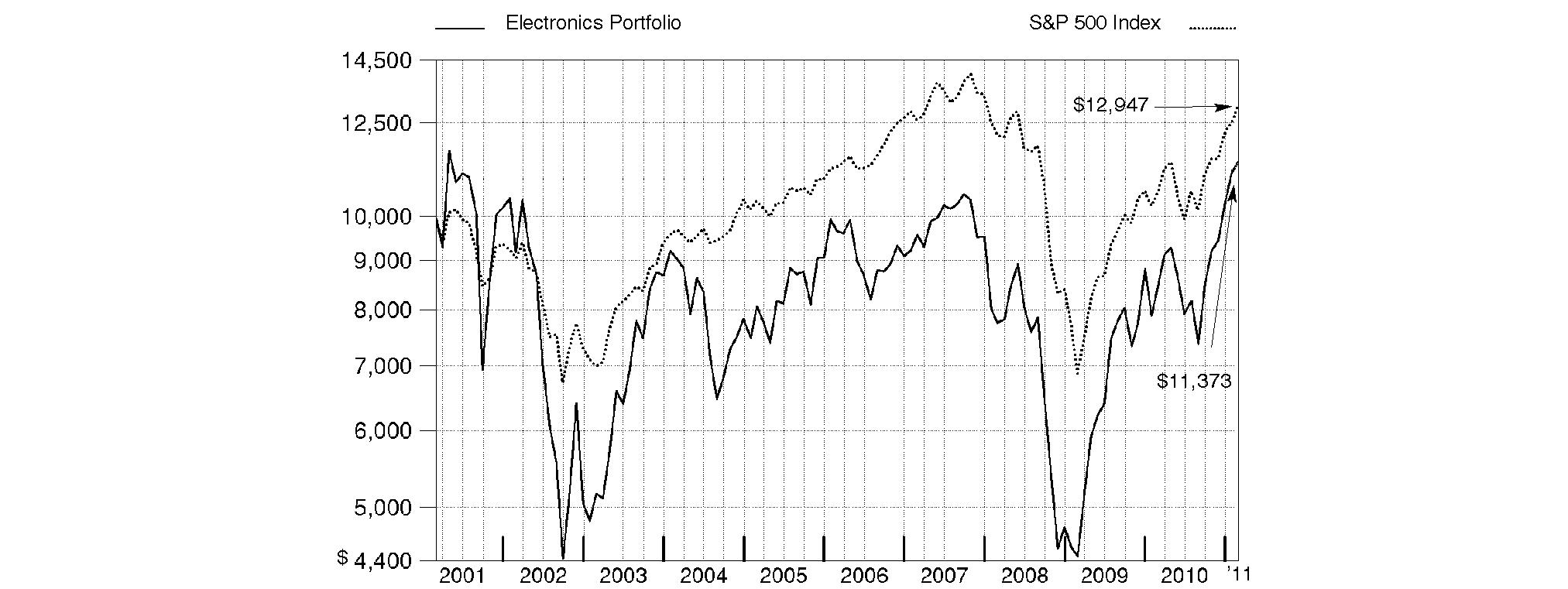

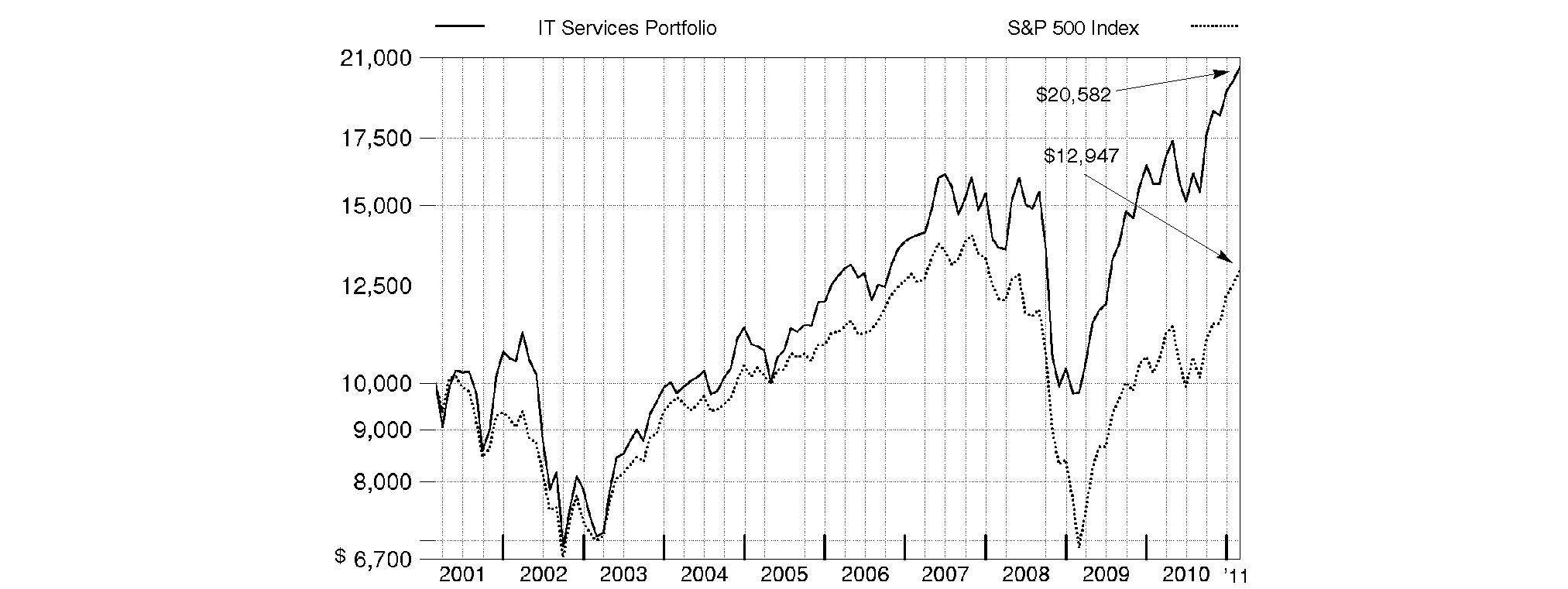

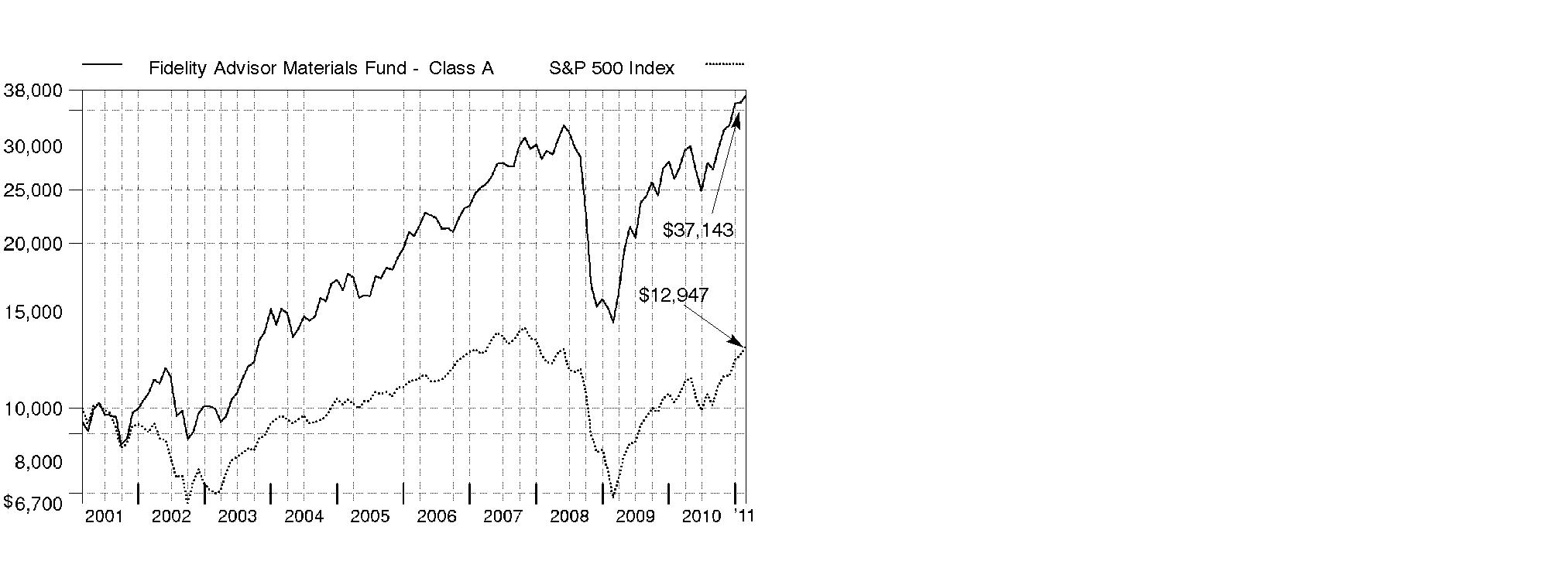

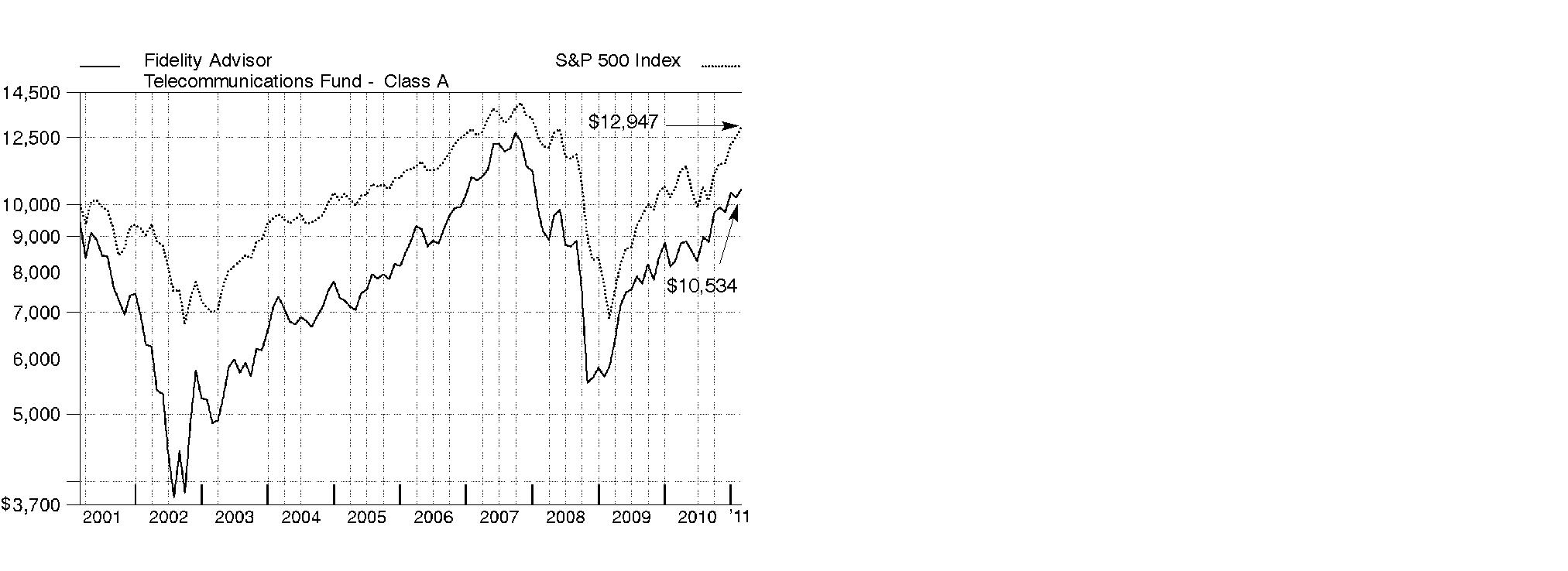

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Construction and Housing Portfolio on February 28, 2001. The chart shows how the value of your investment would have changed, and also shows how the S&P 500 Index performed over the same period.

Annual Report

Construction and Housing Portfolio

Management's Discussion of Fund Performance

Market Recap: Steady economic growth, encouraging monetary policy, improving credit-market conditions, an uptick in merger-and-acquisition activity and better-than-expected corporate earnings propelled U.S. stock markets forward during the 12-month period ending February 28, 2011. Uncertainty over the global effects of the debt crisis in Europe and China's attempt to rein in its economy plagued equities during the spring, but markets reacted positively to the Federal Reserve's second round of stimulative quantitative easing and the Congressional midterm elections in November, followed in December by the extension of Bush-era tax policies. For the full year, the S&P 500® Index advanced 22.57%, with all but one of the 10 major sectors tracked by MSCI U.S. Investable Market classifications delivering a double-digit gain. While cyclically oriented sectors benefited from an overall improving economy, less economically sensitive sectors fell short of the broad market. Energy and materials stocks performed best, while the health care and consumer staples groups struggled the most.

Comments from Daniel Kelley, Portfolio Manager of Construction and Housing Portfolio: For the year, the fund returned 26.24%, beating the 24.78% return of its sector benchmark, the MSCI® U.S. IM Custom Construction & Housing 25/50 Index, and the broadly based S&P 500®. The fund's outperformance of the MSCI index was driven primarily by robust stock picking and an overweighting in the construction and engineering group, an industry where I increased the portfolio's exposure during the period. This area gained momentum when project demand, or backlog, began to rebound. This uptick in orders boosted the industry's stocks, including our stakes in KBR and Fluor, both large global engineering firms. Another lift came from stakes in two out-of-index groups - retail real estate investment trusts (REITs) and real estate services. In the former, shopping center landlord CBL & Associates Properties gained ground, while in the latter, commercial real estate broker CB Richard Ellis Group moved up nicely. CB Richard Ellis' stock was sold prior to period end. Shares of both companies benefited from improving trends in commercial real estate that bolstered their business activities. The fund also had a good result from underweighting the construction materials area, including a lighter-than-index stake in crushed stone producer Vulcan Materials. Positioning in diversified real estate activities and building products also contributed. On the flip side, the biggest relative detractor was our significant overweighting and poor security selection in the homebuilding area, including the fund's two biggest individual detractors, PulteGroup and KB Home. Both stocks underperformed along with the entire industry, and were also beset with company-specific problems. Pulte had trouble digesting a poorly timed acquisition, while the U.S. Securities and Exchange Commission investigated KB's accounting practices. KB also had problems with a joint venture in Las Vegas and an onerous cost structure that further hampered margins. Elsewhere, the fund had some poor results in residential REITs, where our sizable underweighting was costly, including a lighter-than-index stake in rental property manager AvalonBay Communities and untimely ownership of Equity Residential.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Construction and Housing Portfolio

Investment Changes (Unaudited)

Top Ten Stocks as of February 28, 2011 | ||

| % of fund's | % of fund's net assets |

Home Depot, Inc. | 19.0 | 23.3 |

Lowe's Companies, Inc. | 16.9 | 12.4 |

Equity Residential (SBI) | 7.7 | 7.2 |

Fluor Corp. | 4.7 | 5.5 |

Foster Wheeler Ag | 4.5 | 3.5 |

Jacobs Engineering Group, Inc. | 4.3 | 1.7 |

Toll Brothers, Inc. | 3.9 | 3.9 |

Lennar Corp. Class A | 3.7 | 3.3 |

Vulcan Materials Co. | 3.6 | 1.3 |

KBR, Inc. | 2.5 | 3.8 |

| 70.8 | |

Top Industries (% of fund's net assets) | |||

As of February 28, 2011 | |||

| Specialty Retail | 35.9% |

|

| Construction & Engineering | 23.1% |

|

| Real Estate Investment Trusts | 17.6% |

|

| Household Durables | 12.2% |

|

| Construction Materials | 4.6% |

|

| All Others* | 6.6% |

|

As of August 31, 2010 | |||

| Specialty Retail | 35.9% |

|

| Real Estate Investment Trusts | 20.0% |

|

| Construction & Engineering | 18.4% |

|

| Household Durables | 15.3% |

|

| Building Products | 4.8% |

|

| All Others* | 5.6% |

|

* Includes short-term investments and net other assets. |

Annual Report

Construction and Housing Portfolio

Investments February 28, 2011

Showing Percentage of Net Assets

Common Stocks - 99.5% | |||

Shares | Value | ||

BUILDING PRODUCTS - 3.5% | |||

Building Products - 3.5% | |||

Masco Corp. | 91,800 | $ 1,247,562 | |

Owens Corning (a) | 50,169 | 1,792,538 | |

Quanex Building Products Corp. | 45,143 | 852,751 | |

| 3,892,851 | ||

CONSTRUCTION & ENGINEERING - 23.1% | |||

Construction & Engineering - 23.1% | |||

AECOM Technology Corp. (a) | 33,900 | 970,896 | |

Dycom Industries, Inc. (a) | 116,700 | 2,014,242 | |

Fluor Corp. | 74,500 | 5,271,620 | |

Foster Wheeler AG (a) | 139,300 | 5,037,088 | |

Granite Construction, Inc. | 18,700 | 532,950 | |

Jacobs Engineering Group, Inc. (a) | 95,600 | 4,785,736 | |

KBR, Inc. | 85,400 | 2,801,120 | |

Shaw Group, Inc. (a) | 60,950 | 2,420,934 | |

URS Corp. (a) | 45,371 | 2,111,113 | |

| 25,945,699 | ||

CONSTRUCTION MATERIALS - 4.6% | |||

Construction Materials - 4.6% | |||

Eagle Materials, Inc. | 33,400 | 1,079,488 | |

Vulcan Materials Co. (d) | 88,500 | 4,057,725 | |

| 5,137,213 | ||

HOUSEHOLD DURABLES - 12.2% | |||

Homebuilding - 12.2% | |||

Beazer Homes USA, Inc. (a)(d) | 91,978 | 427,698 | |

D.R. Horton, Inc. | 201,437 | 2,385,014 | |

KB Home (d) | 54,763 | 725,610 | |

Lennar Corp. Class A | 207,478 | 4,182,756 | |

M.D.C. Holdings, Inc. | 25,900 | 679,875 | |

M/I Homes, Inc. (a) | 15,293 | 204,162 | |

PulteGroup, Inc. (a) | 66,683 | 460,113 | |

Ryland Group, Inc. | 18,200 | 315,952 | |

Toll Brothers, Inc. (a) | 203,250 | 4,321,095 | |

| 13,702,275 | ||

REAL ESTATE INVESTMENT TRUSTS - 17.6% | |||

Residential REITs - 17.4% | |||

American Campus Communities, Inc. | 16,200 | 541,404 | |

Apartment Investment & Management Co. Class A | 28,371 | 727,716 | |

AvalonBay Communities, Inc. | 17,969 | 2,174,788 | |

BRE Properties, Inc. | 6,900 | 327,819 | |

Camden Property Trust (SBI) | 34,800 | 2,059,116 | |

Education Realty Trust, Inc. | 57,600 | 475,200 | |

Equity Residential (SBI) | 157,600 | 8,685,336 | |

Essex Property Trust, Inc. | 9,500 | 1,175,910 | |

Mid-America Apartment Communities, Inc. | 11,470 | 745,206 | |

| |||

Shares | Value | ||

Post Properties, Inc. | 47,500 | $ 1,852,500 | |

UDR, Inc. | 32,238 | 784,028 | |

| 19,549,023 | ||

Retail REITs - 0.2% | |||

CBL & Associates Properties, Inc. | 13,600 | 242,760 | |

TOTAL REAL ESTATE INVESTMENT TRUSTS | 19,791,783 | ||

REAL ESTATE MANAGEMENT & DEVELOPMENT - 2.6% | |||

Diversified Real Estate Activities - 1.3% | |||

The St. Joe Co. (a)(d) | 52,600 | 1,408,628 | |

Real Estate Operating Companies - 1.3% | |||

Forest City Enterprises, Inc. Class A (a)(d) | 78,800 | 1,489,320 | |

TOTAL REAL ESTATE MANAGEMENT & DEVELOPMENT | 2,897,948 | ||

SPECIALTY RETAIL - 35.9% | |||

Home Improvement Retail - 35.9% | |||

Home Depot, Inc. | 568,490 | 21,301,320 | |

Lowe's Companies, Inc. | 724,934 | 18,971,523 | |

| 40,272,843 | ||

TOTAL COMMON STOCKS (Cost $101,522,653) | 111,640,612 | ||

Money Market Funds - 6.1% | |||

|

|

|

|

Fidelity Cash Central Fund, 0.19% (b) | 591,914 | 591,914 | |

Fidelity Securities Lending Cash Central Fund, 0.21% (b)(c) | 6,292,250 | 6,292,250 | |

TOTAL MONEY MARKET FUNDS (Cost $6,884,164) | 6,884,164 | ||

TOTAL INVESTMENT PORTFOLIO - 105.6% (Cost $108,406,817) | 118,524,776 | |

NET OTHER ASSETS (LIABILITIES) - (5.6)% | (6,324,384) | |

NET ASSETS - 100% | $ 112,200,392 | |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

(c) Investment made with cash collateral received from securities on loan. |

(d) Security or a portion of the security is on loan at period end. |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned |

Fidelity Cash Central Fund | $ 1,813 |

Fidelity Securities Lending Cash Central Fund | 29,226 |

Total | $ 31,039 |

Other Information |

All investments are categorized as Level 1 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

Income Tax Information |

At February 28, 2011, the Fund had a capital loss carryforward of approximately $7,977,983 of which $2,451,853 and $5,526,130 will expire in fiscal 2017 and 2018, respectively. Capital loss carryforwards are only available to offset future capital gains of the Fund to the extent provided by regulations and may be limited. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Construction and Housing Portfolio

Financial Statements

Statement of Assets and Liabilities

| February 28, 2011 | |

|

|

|

Assets | ||

Investment in securities, at value (including securities loaned of $6,136,438) - See accompanying schedule: Unaffiliated issuers (cost $101,522,653) | $ 111,640,612 |

|

Fidelity Central Funds (cost $6,884,164) | 6,884,164 |

|

Total Investments (cost $108,406,817) |

| $ 118,524,776 |

Receivable for investments sold | 2,199,209 | |

Receivable for fund shares sold | 792,842 | |

Dividends receivable | 21,500 | |

Distributions receivable from Fidelity Central Funds | 13,532 | |

Prepaid expenses | 167 | |

Other receivables | 145 | |

Total assets | 121,552,171 | |

|

|

|

Liabilities | ||

Payable for investments purchased | $ 355,203 | |

Payable for fund shares redeemed | 2,592,631 | |

Accrued management fee | 52,884 | |

Other affiliated payables | 28,748 | |

Other payables and accrued expenses | 30,063 | |

Collateral on securities loaned, at value | 6,292,250 | |

Total liabilities | 9,351,779 | |

|

|

|

Net Assets | $ 112,200,392 | |

Net Assets consist of: |

| |

Paid in capital | $ 114,892,022 | |

Accumulated undistributed net realized gain (loss) on investments | (12,809,589) | |

Net unrealized appreciation (depreciation) on investments | 10,117,959 | |

Net Assets, for 2,997,329 shares outstanding | $ 112,200,392 | |

Net Asset Value, offering price and redemption price per share ($112,200,392 ÷ 2,997,329 shares) | $ 37.43 | |

Statement of Operations

| Year ended February 28, 2011 | |

|

|

|

Investment Income |

|

|

Dividends |

| $ 1,547,430 |

Income from Fidelity Central Funds (including $29,226 from security lending) |

| 31,039 |

Total income |

| 1,578,469 |

|

|

|

Expenses | ||

Management fee | $ 577,960 | |

Transfer agent fees | 299,639 | |

Accounting and security lending fees | 41,453 | |

Custodian fees and expenses | 22,794 | |

Independent trustees' compensation | 581 | |

Registration fees | 26,383 | |

Audit | 40,315 | |

Legal | 405 | |

Miscellaneous | 1,341 | |

Total expenses before reductions | 1,010,871 | |

Expense reductions | (1,672) | 1,009,199 |

Net investment income (loss) | 569,270 | |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | ||

Investment securities: |

|

|

Unaffiliated issuers | 5,292,320 | |

Change in net unrealized appreciation (depreciation) on investment securities | 10,423,658 | |

Net gain (loss) | 15,715,978 | |

Net increase (decrease) in net assets resulting from operations | $ 16,285,248 | |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Changes in Net Assets

| Year ended February 28, | Year ended February 28, |

Increase (Decrease) in Net Assets |

|

|

Operations |

|

|

Net investment income (loss) | $ 569,270 | $ 855,068 |

Net realized gain (loss) | 5,292,320 | (2,154,284) |

Change in net unrealized appreciation (depreciation) | 10,423,658 | 43,777,995 |

Net increase (decrease) in net assets resulting from operations | 16,285,248 | 42,478,779 |

Distributions to shareholders from net investment income | (783,306) | (826,043) |

Share transactions | 85,158,733 | 78,915,369 |

Reinvestment of distributions | 743,388 | 800,902 |

Cost of shares redeemed | (88,789,200) | (104,036,666) |

Net increase (decrease) in net assets resulting from share transactions | (2,887,079) | (24,320,395) |

Redemption fees | 23,680 | 10,659 |

Total increase (decrease) in net assets | 12,638,543 | 17,343,000 |

|

|

|

Net Assets | ||

Beginning of period | 99,561,849 | 82,218,849 |

End of period (including undistributed net investment income of $0 and undistributed net investment income of $102,753, respectively) | $ 112,200,392 | $ 99,561,849 |

Other Information Shares | ||

Sold | 2,478,458 | 3,118,032 |

Issued in reinvestment of distributions | 21,868 | 28,811 |

Redeemed | (2,833,936) | (4,380,076) |

Net increase (decrease) | (333,610) | (1,233,233) |

Financial Highlights

Years ended February 28, | 2011 | 2010 | 2009 | 2008 F | 2007 |

Selected Per-Share Data |

|

|

|

|

|

Net asset value, beginning of period | $ 29.89 | $ 18.01 | $ 33.19 | $ 45.98 | $ 49.42 |

Income from Investment Operations |

|

|

|

|

|

Net investment income (loss) B | .18 | .22 | .31 | .26 | .19 |

Net realized and unrealized gain (loss) | 7.63 | 11.91 | (14.35) | (8.49) | 2.28 |

Total from investment operations | 7.81 | 12.13 | (14.04) | (8.23) | 2.47 |

Distributions from net investment income | (.28) | (.25) | (.30) | (.16) | (.05) |

Distributions from net realized gain | - | - | (.85) | (4.41) | (5.87) |

Total distributions | (.28) | (.25) | (1.15) | (4.57) | (5.92) |

Redemption fees added to paid in capital B | .01 | - G | .01 | .01 | .01 |

Net asset value, end of period | $ 37.43 | $ 29.89 | $ 18.01 | $ 33.19 | $ 45.98 |

Total Return A | 26.24% | 67.46% | (43.68)% | (18.11)% | 5.41% |

Ratios to Average Net Assets C,E |

|

|

|

|

|

Expenses before reductions | .98% | 1.01% | 1.03% | .98% | 1.02% |

Expenses net of fee waivers, if any | .98% | 1.01% | 1.03% | .98% | 1.02% |

Expenses net of all reductions | .98% | 1.01% | 1.02% | .97% | 1.02% |

Net investment income (loss) | .55% | .84% | 1.14% | .63% | .41% |

Supplemental Data |

|

|

|

|

|

Net assets, end of period (000 omitted) | $ 112,200 | $ 99,562 | $ 82,219 | $ 84,685 | $ 163,981 |

Portfolio turnover rate D | 101% | 82% | 85% | 102% | 54% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown. B Calculated based on average shares outstanding during the period. C Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. DAmount does not include the portfolio activity of any underlying Fidelity Central Funds. E Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund. F For the year ended February 29. G Amount represents less than $.01 per share. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Consumer Discretionary Portfolio

Performance: The Bottom Line

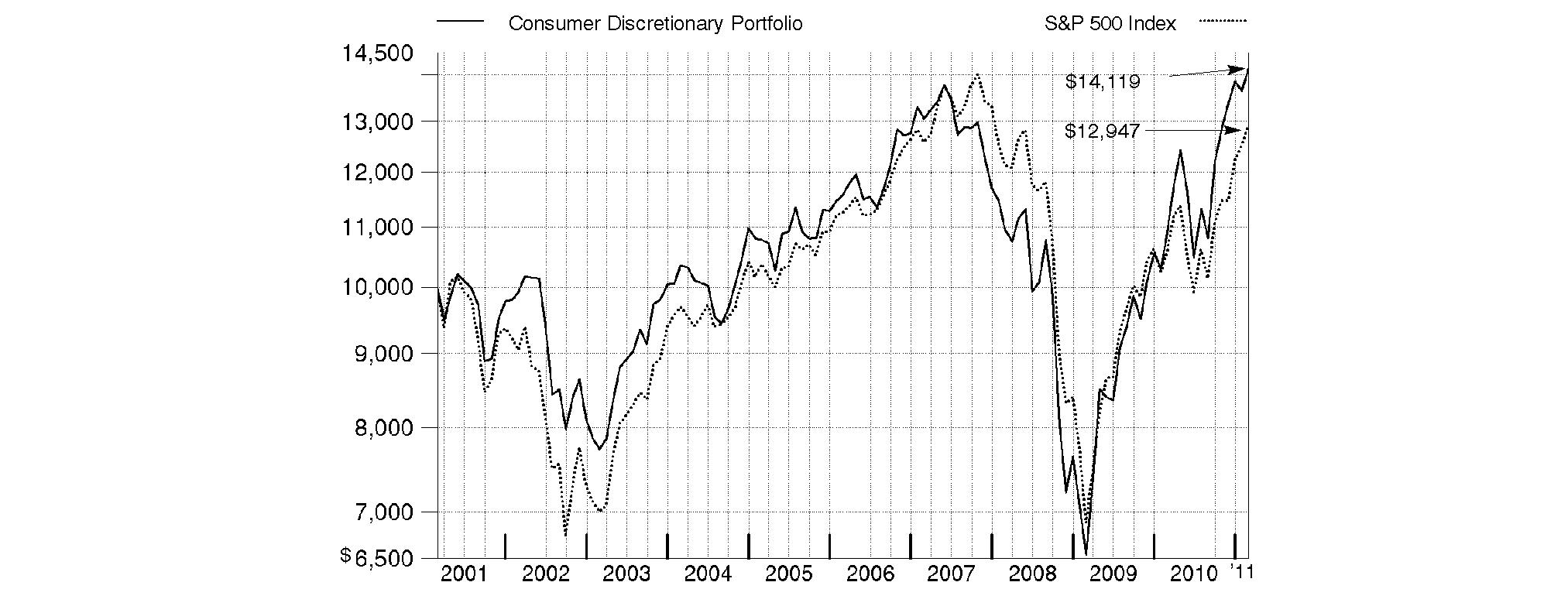

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended February 28, 2011 | Past 1 | Past 5 | Past 10 |

Consumer Discretionary Portfolio A | 29.75% | 4.07% | 3.51% |

A Prior to October 1, 2006, Consumer Discretionary Portfolio operated under certain different investment policies. The historical performance for the fund may not represent its current investment policies.

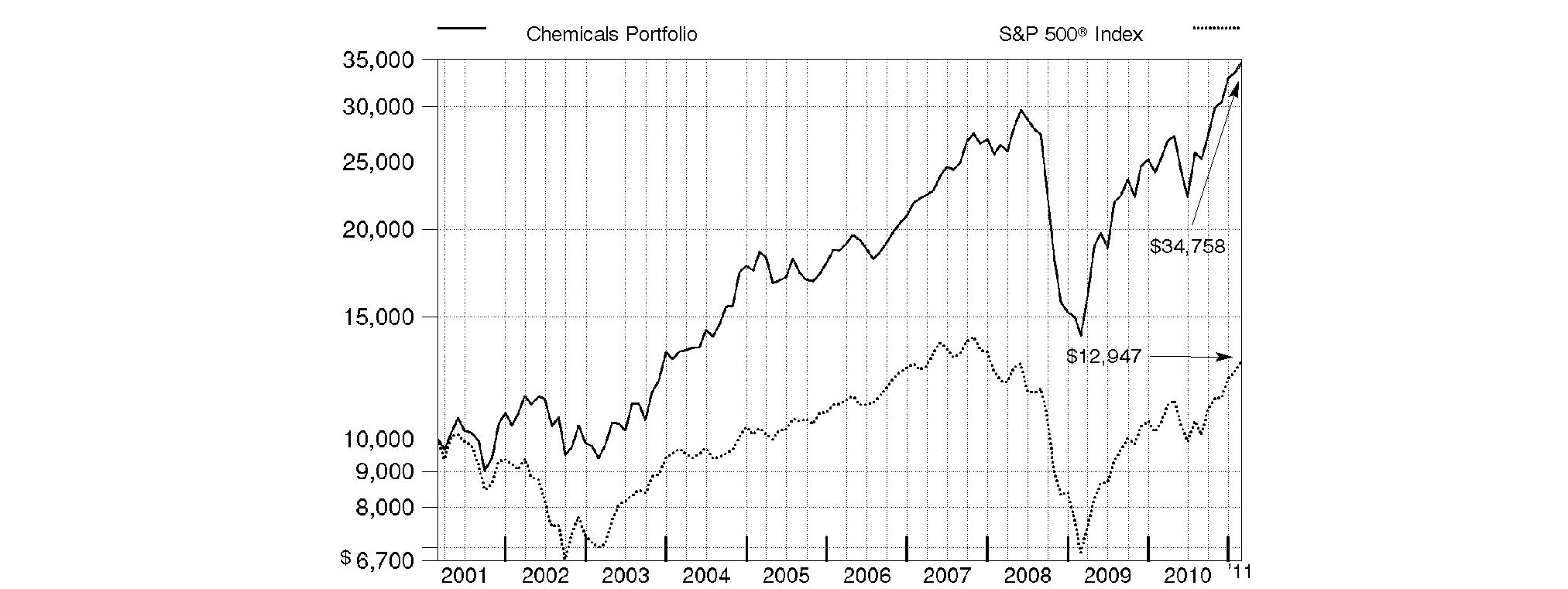

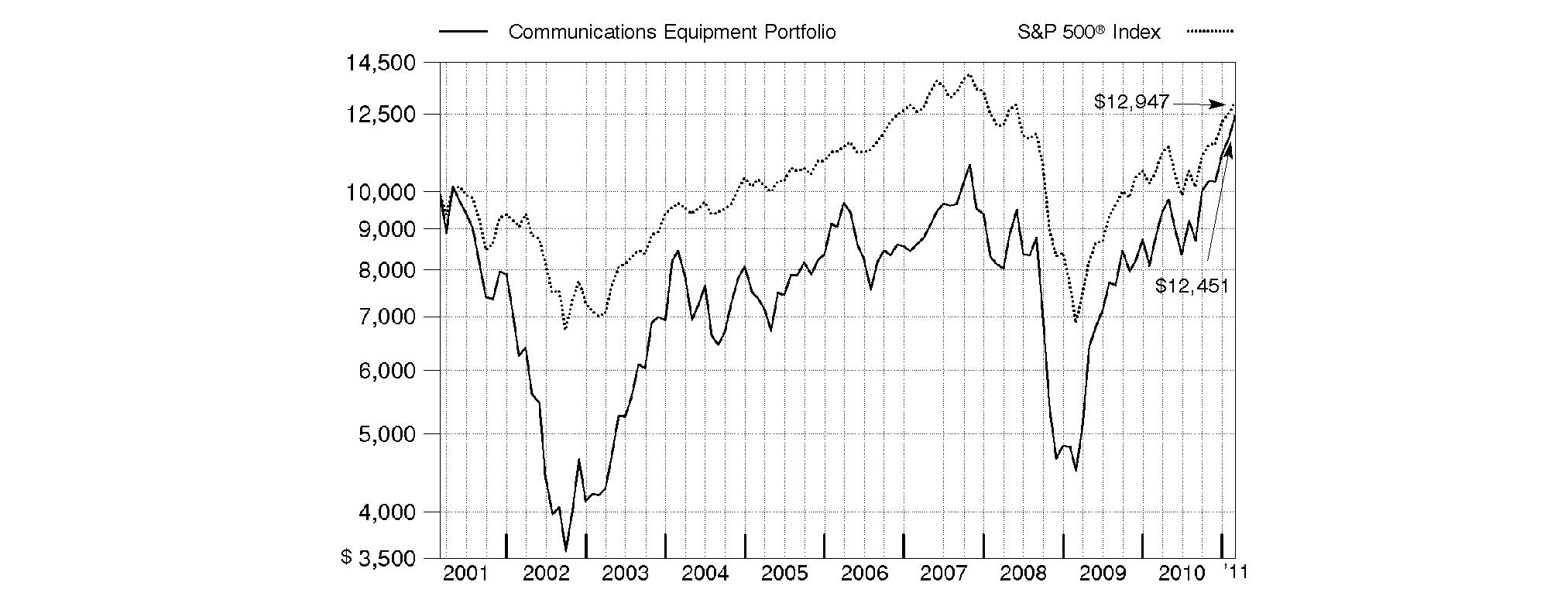

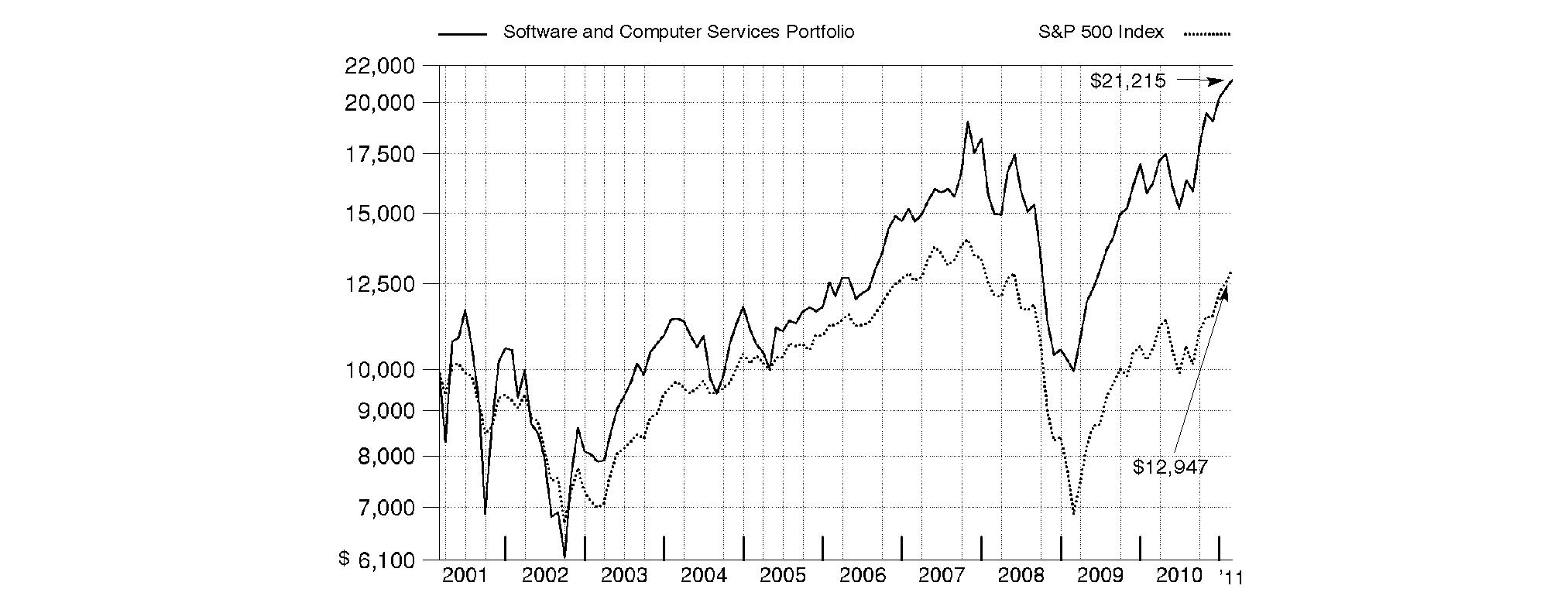

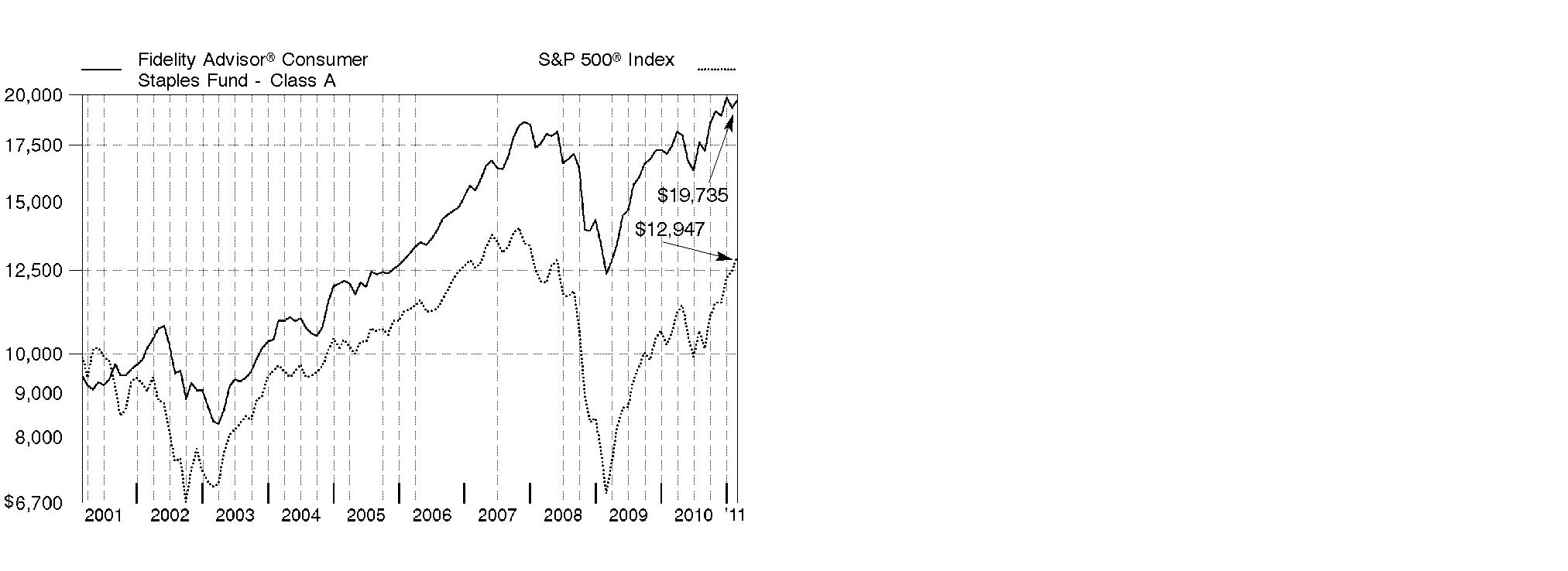

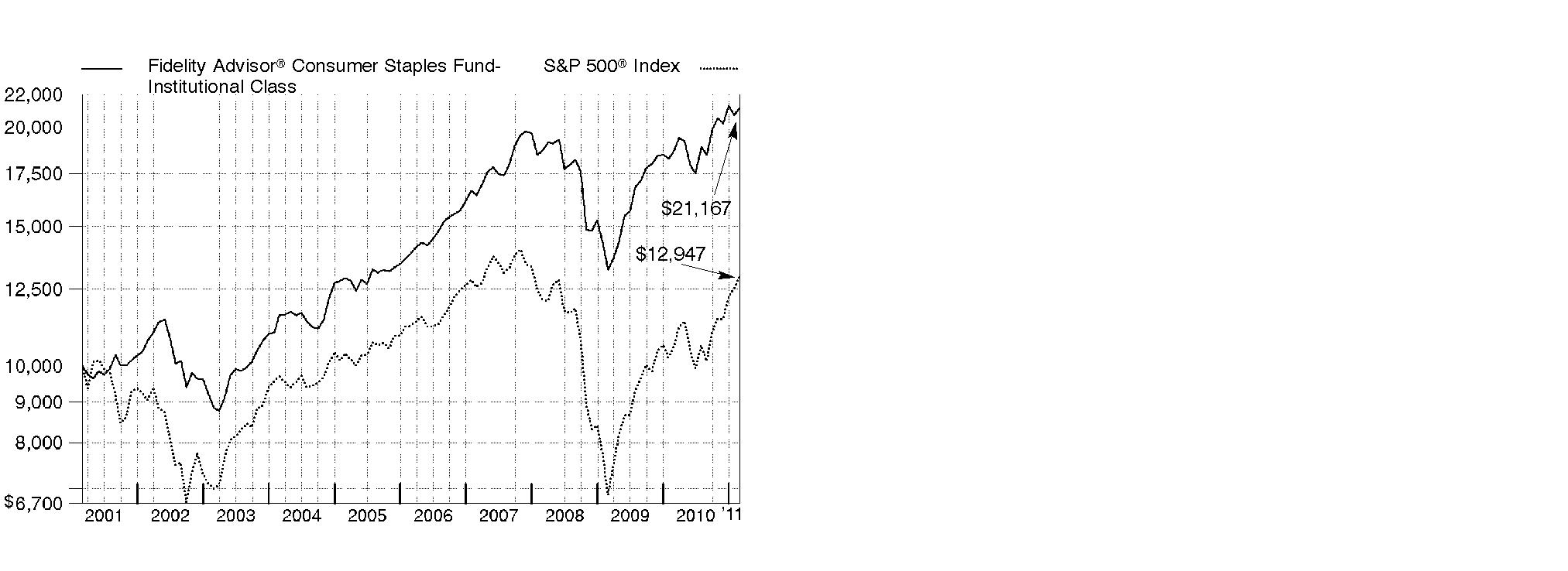

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Consumer Discretionary Portfolio on February 28, 2001. The chart shows how the value of your investment would have changed, and also shows how the S&P 500 Index performed over the same period.

Annual Report

Consumer Discretionary Portfolio

Management's Discussion of Fund Performance

Market Recap: Steady economic growth, encouraging monetary policy, improving credit-market conditions, an uptick in merger-and-acquisition activity and better-than-expected corporate earnings propelled U.S. stock markets forward during the 12-month period ending February 28, 2011. Uncertainty over the global effects of the debt crisis in Europe and China's attempt to rein in its economy plagued equities during the spring, but markets reacted positively to the Federal Reserve's second round of stimulative quantitative easing and the Congressional midterm elections in November, followed in December by the extension of Bush-era tax policies. For the full year, the S&P 500® Index advanced 22.57%, with all but one of the 10 major sectors tracked by MSCI U.S. Investable Market classifications delivering a double-digit gain. While cyclically oriented sectors benefited from an overall improving economy, less economically sensitive sectors fell short of the broad market. Energy and materials stocks performed best, while the health care and consumer staples groups struggled the most.

Comments from John Harris, Portfolio Manager of Consumer Discretionary Portfolio: For the 12 months ending February 28, 2011, the fund returned 29.75%, lagging the 32.58% return of its sector benchmark, the MSCI® U.S. IM Consumer Discretionary 25/50 Index but handily topping the broadly based S&P 500®. The portfolio lagged its sector benchmark primarily as a result of weak stock picking in Internet retail and home improvement retail. Within Internet retail, the fund's lack of exposure to movie-subscription service and index component Netflix hurt when subscriber growth boosted the stock. Overweighting the home improvement retail industry was a big disappointment, including an outsized stake in Lowe's, the fund's second-largest holding, which continued to struggle in the face of weak housing reports and sluggish sales of big-ticket items such as appliances. The retail apparel industry had some poor performers, including shares of urban-oriented off-price retailer Citi Trends, which fell in August when the chain missed its earnings target. Underweighting cable TV provider Comcast proved costly when the firm's shares responded well to the company's "triple play" offering of cable TV, phone and Internet. On the flip side, security selection in the automobile manufacturing industry was a bright spot, with an out-of-index position in BMW pumping up returns, as the firm benefited from an attractive vehicle lineup and growing demand for its luxury cars in China. Solid picks in specialized consumer services helped, including a stake in upscale auction house Sotheby's. Overweighting casinos and gaming was a positive, including a significantly larger-than-index position in casino operator Las Vegas Sands, the fund's top individual contributor. The firm's shares benefited from increased consumer spending in the U.S. and from the successful opening of the firm's Singapore property. Media stocks contributed, with an overweighting in U.K. cable TV provider Virgin Media paying off. Some of the stocks I've discussed were sold from the fund prior to period end.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Consumer Discretionary Portfolio

Investment Changes (Unaudited)

Top Ten Stocks as of February 28, 2011 | ||

| % of fund's | % of fund's net assets |

The Walt Disney Co. | 5.7 | 5.6 |

Lowe's Companies, Inc. | 5.6 | 5.9 |

Amazon.com, Inc. | 4.4 | 4.0 |

McDonald's Corp. | 3.8 | 6.6 |

Target Corp. | 3.6 | 4.3 |

News Corp. Class A | 3.5 | 0.0 |

DIRECTV | 2.8 | 3.8 |

Bed Bath & Beyond, Inc. | 2.7 | 2.4 |

TJX Companies, Inc. | 2.4 | 1.9 |

Starbucks Corp. | 2.2 | 1.9 |

| 36.7 | |

Top Industries (% of fund's net assets) | |||

As of February 28, 2011 | |||

| Media | 27.6% |

|

| Specialty Retail | 21.1% |

|

| Hotels, Restaurants & Leisure | 18.7% |

|

| Internet & Catalog Retail | 6.6% |

|

| Textiles, Apparel & Luxury Goods | 5.0% |

|

| All Others* | 21.0% |

|

As of August 31, 2010 | |||

| Media | 24.1% |

|

| Specialty Retail | 21.6% |

|

| Hotels, Restaurants & Leisure | 21.2% |

|

| Internet & Catalog Retail | 6.1% |

|

| Multiline Retail | 6.0% |

|

| All Others* | 21.0% |

|

* Includes short-term investments and net other assets. |

Annual Report

Consumer Discretionary Portfolio

Investments February 28, 2011

Showing Percentage of Net Assets

Common Stocks - 99.2% | |||

Shares | Value | ||

AUTO COMPONENTS - 3.0% | |||

Auto Parts & Equipment - 3.0% | |||

Autoliv, Inc. | 36,744 | $ 2,751,758 | |

Gentex Corp. | 16,900 | 511,732 | |

Tenneco, Inc. (a) | 31,597 | 1,260,088 | |

TRW Automotive Holdings Corp. (a) | 28,736 | 1,632,205 | |

| 6,155,783 | ||

AUTOMOBILES - 2.7% | |||

Automobile Manufacturers - 2.7% | |||

Bayerische Motoren Werke AG (BMW) | 16,500 | 1,338,421 | |

General Motors Co. | 125,298 | 4,201,242 | |

| 5,539,663 | ||

DISTRIBUTORS - 0.5% | |||

Distributors - 0.5% | |||

Li & Fung Ltd. | 174,000 | 1,059,014 | |

DIVERSIFIED CONSUMER SERVICES - 2.8% | |||

Education Services - 1.4% | |||

DeVry, Inc. | 27,000 | 1,464,750 | |

Grand Canyon Education, Inc. (a) | 79,395 | 1,276,672 | |

| 2,741,422 | ||

Specialized Consumer Services - 1.4% | |||

Sotheby's Class A (ltd. vtg.) | 29,740 | 1,463,803 | |

Steiner Leisure Ltd. (a) | 30,795 | 1,452,292 | |

| 2,916,095 | ||

TOTAL DIVERSIFIED CONSUMER SERVICES | 5,657,517 | ||

ELECTRONIC EQUIPMENT & COMPONENTS - 0.2% | |||

Technology Distributors - 0.2% | |||

Funtalk China Holdings Ltd. (a) | 81,400 | 415,954 | |

FOOD & STAPLES RETAILING - 1.9% | |||

Drug Retail - 0.1% | |||

Droga Raia SA | 10,000 | 142,445 | |

Hypermarkets & Super Centers - 1.8% | |||

BJ's Wholesale Club, Inc. (a) | 10,889 | 527,245 | |

Costco Wholesale Corp. | 41,712 | 3,119,640 | |

| 3,646,885 | ||

TOTAL FOOD & STAPLES RETAILING | 3,789,330 | ||

HOTELS, RESTAURANTS & LEISURE - 18.7% | |||

Casinos & Gaming - 4.2% | |||

Betfair Group PLC | 33,600 | 474,176 | |

Las Vegas Sands Corp. unit | 4,160 | 3,287,856 | |

Pinnacle Entertainment, Inc. (a) | 82,725 | 1,086,179 | |

WMS Industries, Inc. (a) | 55,596 | 2,212,165 | |

Wynn Resorts Ltd. | 11,900 | 1,462,867 | |

| 8,523,243 | ||

| |||

Shares | Value | ||

Hotels, Resorts & Cruise Lines - 3.7% | |||

Accor SA | 22,072 | $ 1,037,903 | |

China Lodging Group Ltd. ADR (d) | 33,507 | 553,536 | |

Club Mediterranee SA (a) | 4,500 | 108,209 | |

Marriott International, Inc. Class A | 42,900 | 1,682,109 | |

Starwood Hotels & Resorts Worldwide, Inc. | 54,370 | 3,322,007 | |

Wyndham Worldwide Corp. | 23,103 | 722,662 | |

| 7,426,426 | ||

Restaurants - 10.8% | |||

BJ's Restaurants, Inc. (a) | 45,584 | 1,638,745 | |

Bravo Brio Restaurant Group, Inc. | 20,781 | 358,057 | |

Darden Restaurants, Inc. | 56,892 | 2,681,320 | |

McDonald's Corp. | 101,550 | 7,685,304 | |

P.F. Chang's China Bistro, Inc. (d) | 33,107 | 1,537,489 | |

Panera Bread Co. Class A (a) | 4,400 | 513,700 | |

Ruth's Hospitality Group, Inc. (a) | 197,090 | 987,421 | |

Starbucks Corp. | 135,180 | 4,458,236 | |

Texas Roadhouse, Inc. Class A | 124,000 | 2,105,520 | |

| 21,965,792 | ||

TOTAL HOTELS, RESTAURANTS & LEISURE | 37,915,461 | ||

HOUSEHOLD DURABLES - 2.5% | |||

Home Furnishings - 1.3% | |||

Tempur-Pedic International, Inc. (a) | 56,000 | 2,628,640 | |

Homebuilding - 1.2% | |||

Lennar Corp. Class A | 85,589 | 1,725,474 | |

Toll Brothers, Inc. (a) | 30,700 | 652,682 | |

| 2,378,156 | ||

TOTAL HOUSEHOLD DURABLES | 5,006,796 | ||

INTERNET & CATALOG RETAIL - 6.6% | |||

Internet Retail - 6.6% | |||

Amazon.com, Inc. (a) | 51,908 | 8,995,137 | |

Expedia, Inc. | 60,397 | 1,199,484 | |

Ocado Group PLC (a)(d) | 134,400 | 439,214 | |

Priceline.com, Inc. (a) | 5,996 | 2,721,464 | |

| 13,355,299 | ||

INTERNET SOFTWARE & SERVICES - 1.0% | |||

Internet Software & Services - 1.0% | |||

eBay, Inc. (a) | 61,437 | 2,058,447 | |

LEISURE EQUIPMENT & PRODUCTS - 0.4% | |||

Leisure Products - 0.4% | |||

Hasbro, Inc. | 20,500 | 920,450 | |

MEDIA - 27.6% | |||

Advertising - 2.1% | |||

Lamar Advertising Co. Class A (a) | 47,500 | 1,841,575 | |

National CineMedia, Inc. | 121,449 | 2,294,172 | |

| 4,135,747 | ||

Common Stocks - continued | |||

Shares | Value | ||

MEDIA - CONTINUED | |||

Broadcasting - 1.0% | |||

Discovery Communications, Inc. (a) | 32,800 | $ 1,414,008 | |

Scripps Networks Interactive, Inc. Class A | 12,243 | 635,901 | |

| 2,049,909 | ||

Cable & Satellite - 11.0% | |||

Comcast Corp.: | |||

Class A | 86,316 | 2,223,500 | |

Class A (special) (non-vtg.) | 112,452 | 2,734,833 | |

DIRECTV (a) | 123,897 | 5,695,545 | |

Kabel Deutschland Holding AG | 38,166 | 2,079,375 | |

Sirius XM Radio, Inc. (a) | 775,624 | 1,403,879 | |

Time Warner Cable, Inc. | 57,208 | 4,129,273 | |

Virgin Media, Inc. | 148,253 | 4,038,412 | |

| 22,304,817 | ||

Movies & Entertainment - 12.8% | |||

News Corp. Class A | 408,200 | 7,090,434 | |

The Walt Disney Co. | 263,067 | 11,506,550 | |

Time Warner, Inc. | 91,700 | 3,502,940 | |

Viacom, Inc. Class B (non-vtg.) | 88,801 | 3,965,853 | |

| 26,065,777 | ||

Publishing - 0.7% | |||

United Business Media Ltd. | 123,900 | 1,435,280 | |

TOTAL MEDIA | 55,991,530 | ||

MULTILINE RETAIL - 4.9% | |||

Department Stores - 1.3% | |||

Macy's, Inc. | 70,465 | 1,684,114 | |

Nordstrom, Inc. | 23,400 | 1,059,084 | |

| 2,743,198 | ||

General Merchandise Stores - 3.6% | |||

Target Corp. | 138,073 | 7,255,736 | |

TOTAL MULTILINE RETAIL | 9,998,934 | ||

PROFESSIONAL SERVICES - 0.3% | |||

Research & Consulting Services - 0.3% | |||

Nielsen Holdings B.V. (a) | 25,400 | 675,386 | |

SPECIALTY RETAIL - 21.1% | |||

Apparel Retail - 6.3% | |||

Body Central Corp. | 4,200 | 71,652 | |

Chico's FAS, Inc. | 142,900 | 1,963,446 | |

Citi Trends, Inc. (a) | 101,612 | 2,234,448 | |

Fast Retailing Co. Ltd. | 3,400 | 533,849 | |

H&M Hennes & Mauritz AB (B Shares) | 16,801 | 549,169 | |

TJX Companies, Inc. | 98,718 | 4,923,067 | |

Urban Outfitters, Inc. (a) | 64,014 | 2,456,857 | |

| 12,732,488 | ||

| |||

Shares | Value | ||

Automotive Retail - 1.4% | |||

Advance Auto Parts, Inc. | 42,300 | $ 2,651,364 | |

Lentuo International, Inc. ADR | 34,300 | 175,616 | |

| 2,826,980 | ||

Computer & Electronics Retail - 0.5% | |||

Best Buy Co., Inc. | 27,800 | 896,272 | |

Carphone Warehouse Group PLC (a) | 12,600 | 83,377 | |

| 979,649 | ||

Home Improvement Retail - 7.0% | |||

Home Depot, Inc. | 41,954 | 1,572,016 | |

Lowe's Companies, Inc. | 433,903 | 11,355,242 | |

Lumber Liquidators Holdings, Inc. (a)(d) | 59,800 | 1,392,144 | |

| 14,319,402 | ||

Homefurnishing Retail - 2.7% | |||

Bed Bath & Beyond, Inc. (a) | 114,061 | 5,492,037 | |

Specialty Stores - 3.2% | |||

Hengdeli Holdings Ltd. | 984,000 | 535,717 | |

OfficeMax, Inc. (a) | 162,604 | 2,234,179 | |

Tractor Supply Co. | 51,340 | 2,673,274 | |

Ulta Salon, Cosmetics & Fragrance, Inc. (a) | 23,404 | 976,649 | |

| 6,419,819 | ||

TOTAL SPECIALTY RETAIL | 42,770,375 | ||

TEXTILES, APPAREL & LUXURY GOODS - 5.0% | |||

Apparel, Accessories & Luxury Goods - 3.0% | |||

China Xiniya Fashion Ltd. ADR (d) | 65,900 | 301,163 | |

Phillips-Van Heusen Corp. | 25,400 | 1,524,254 | |

Polo Ralph Lauren Corp. Class A | 21,158 | 2,680,930 | |

Titan Industries Ltd. | 13,944 | 1,025,153 | |

Vera Bradley, Inc. | 19,538 | 671,130 | |

| 6,202,630 | ||

Footwear - 2.0% | |||

Iconix Brand Group, Inc. (a) | 41,900 | 925,990 | |

NIKE, Inc. Class B | 34,557 | 3,076,610 | |

| 4,002,600 | ||

TOTAL TEXTILES, APPAREL & LUXURY GOODS | 10,205,230 | ||

TOTAL COMMON STOCKS (Cost $168,998,271) | 201,515,169 | ||

Money Market Funds - 1.7% | |||

Shares | Value | ||

Fidelity Securities Lending Cash Central Fund, 0.21% (b)(c) | 3,311,000 | $ 3,311,000 | |

TOTAL INVESTMENT PORTFOLIO - 100.9% (Cost $172,309,271) | 204,826,169 | |

NET OTHER ASSETS (LIABILITIES) - (0.9)% | (1,743,014) | |

NET ASSETS - 100% | $ 203,083,155 | |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

(c) Investment made with cash collateral received from securities on loan. |

(d) Security or a portion of the security is on loan at period end. |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned |

Fidelity Cash Central Fund | $ 4,979 |

Fidelity Securities Lending Cash Central Fund | 29,650 |

Total | $ 34,629 |

Other Information |

The following is a summary of the inputs used, as of February 28, 2011, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

Valuation Inputs at Reporting Date: | ||||

Description | Total | Level 1 | Level 2 | Level 3 |

Investments in Securities: | ||||

Common Stocks | $ 201,515,169 | $ 197,693,464 | $ 3,821,705 | $ - |

Money Market Funds | 3,311,000 | 3,311,000 | - | - |

Total Investments in Securities: | $ 204,826,169 | $ 201,004,464 | $ 3,821,705 | $ - |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Consumer Discretionary Portfolio

Financial Statements

Statement of Assets and Liabilities

| February 28, 2011 | |

|

|

|

Assets | ||

Investment in securities, at value (including securities loaned of $3,186,237) - See accompanying schedule: Unaffiliated issuers (cost $168,998,271) | $ 201,515,169 |

|

Fidelity Central Funds (cost $3,311,000) | 3,311,000 |

|

Total Investments (cost $172,309,271) |

| $ 204,826,169 |

Cash | 201 | |

Receivable for investments sold | 9,725,938 | |

Receivable for fund shares sold | 257,772 | |

Dividends receivable | 223,838 | |

Distributions receivable from Fidelity Central Funds | 1,864 | |

Prepaid expenses | 232 | |

Other receivables | 3,900 | |

Total assets | 215,039,914 | |

|

|

|

Liabilities | ||

Payable for investments purchased | $ 4,363,111 | |

Payable for fund shares redeemed | 1,997,593 | |

Accrued management fee | 98,998 | |

Notes payable to affiliates | 2,090,000 | |

Other affiliated payables | 50,941 | |

Other payables and accrued expenses | 45,116 | |

Collateral on securities loaned, at value | 3,311,000 | |

Total liabilities | 11,956,759 | |

|

|

|

Net Assets | $ 203,083,155 | |

Net Assets consist of: |

| |

Paid in capital | $ 164,137,885 | |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | 6,428,492 | |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | 32,516,778 | |

Net Assets, for 8,129,086 shares outstanding | $ 203,083,155 | |

Net Asset Value, offering price and redemption price per share ($203,083,155 ÷ 8,129,086 shares) | $ 24.98 | |

Statement of Operations

| Year ended February 28, 2011 | |

|

|

|

Investment Income |

|

|

Dividends |

| $ 1,669,495 |

Income from Fidelity Central Funds (including $29,650 from security lending) |

| 34,629 |

Total income |

| 1,704,124 |

|

|

|

Expenses | ||

Management fee | $ 811,605 | |

Transfer agent fees | 369,856 | |

Accounting and security lending fees | 57,483 | |

Custodian fees and expenses | 70,481 | |

Independent trustees' compensation | 730 | |

Registration fees | 36,304 | |

Audit | 37,118 | |

Legal | 410 | |

Interest | 313 | |

Miscellaneous | 1,165 | |

Total expenses before reductions | 1,385,465 | |

Expense reductions | (17,398) | 1,368,067 |

Net investment income (loss) | 336,057 | |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | ||

Investment securities: |

|

|

Unaffiliated issuers (net of foreign taxes of $7,482) | 11,410,164 | |

Foreign currency transactions | 1,195 | |

Total net realized gain (loss) |

| 11,411,359 |

Change in net unrealized appreciation (depreciation) on: Investment securities | 22,349,698 | |

Assets and liabilities in foreign currencies | 22 | |

Total change in net unrealized appreciation (depreciation) |

| 22,349,720 |

Net gain (loss) | 33,761,079 | |

Net increase (decrease) in net assets resulting from operations | $ 34,097,136 | |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Changes in Net Assets

| Year ended February 28, | Year ended February 28, |

Increase (Decrease) in Net Assets |

|

|

Operations |

|

|

Net investment income (loss) | $ 336,057 | $ 196,969 |

Net realized gain (loss) | 11,411,359 | 2,571,128 |

Change in net unrealized appreciation (depreciation) | 22,349,720 | 19,170,461 |

Net increase (decrease) in net assets resulting from operations | 34,097,136 | 21,938,558 |

Distributions to shareholders from net investment income | (368,849) | (191,875) |

Distributions to shareholders from net realized gain | (911,441) | - |

Total distributions | (1,280,290) | (191,875) |

Share transactions | 196,721,754 | 58,076,902 |

Reinvestment of distributions | 1,230,039 | 189,124 |

Cost of shares redeemed | (104,711,980) | (24,328,431) |

Net increase (decrease) in net assets resulting from share transactions | 93,239,813 | 33,937,595 |

Redemption fees | 15,686 | 1,754 |

Total increase (decrease) in net assets | 126,072,345 | 55,686,032 |

|

|

|

Net Assets | ||

Beginning of period | 77,010,810 | 21,324,778 |

End of period (including undistributed net investment income of $0 and undistributed net investment income of $23,820, respectively) | $ 203,083,155 | $ 77,010,810 |

Other Information Shares | ||

Sold | 8,739,845 | 3,568,123 |

Issued in reinvestment of distributions | 50,160 | 10,486 |

Redeemed | (4,637,683) | (1,429,225) |

Net increase (decrease) | 4,152,322 | 2,149,384 |

Financial Highlights

Years ended February 28, | 2011 | 2010 | 2009 | 2008 G | 2007 |

Selected Per-Share Data |

|

|

|

|

|

Net asset value, beginning of period | $ 19.37 | $ 11.67 | $ 19.70 | $ 26.85 | $ 25.74 |

Income from Investment Operations |

|

|

|

|

|

Net investment income (loss) B | .05 | .06 | .10 | .01 | .11 E |

Net realized and unrealized gain (loss) | 5.71 | 7.70 | (8.05) | (3.95) | 3.15 |

Total from investment operations | 5.76 | 7.76 | (7.95) | (3.94) | 3.26 |

Distributions from net investment income | (.05) | (.06) | (.08) | (.06) | - |

Distributions from net realized gain | (.10) | - | (.01) | (3.15) | (2.16) |

Total distributions | (.15) | (.06) | (.09) | (3.21) | (2.16) |

Redemption fees added to paid in capital B | - H | - H | .01 | - H | .01 |

Net asset value, end of period | $ 24.98 | $ 19.37 | $ 11.67 | $ 19.70 | $ 26.85 |

Total Return A | 29.75% | 66.54% | (40.37)% | (16.15)% | 12.99% |

Ratios to Average Net Assets C, F |

|

|

|

|

|

Expenses before reductions | .96% | 1.10% | 1.19% | 1.12% | 1.14% |

Expenses net of fee waivers, if any | .96% | 1.10% | 1.15% | 1.12% | 1.14% |

Expenses net of all reductions | .95% | 1.08% | 1.15% | 1.12% | 1.13% |

Net investment income (loss) | .23% | .37% | .62% | .03% | .43% E |

Supplemental Data |

|

|

|

|

|

Net assets, end of period (000 omitted) | $ 203,083 | $ 77,011 | $ 21,325 | $ 24,297 | $ 40,249 |

Portfolio turnover rate D | 196% | 134% | 71% | 108% | 244% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown. B Calculated based on average shares outstanding during the period. C Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. D Amount does not include the portfolio activity of any underlying Fidelity Central Funds. E Investment income per share reflects a special dividend which amounted to $.12 per share. Excluding the special dividend, the ratio of net investment income (loss) to average net assets would have been (.03)%. F Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund. G For the year ended February 29. H Amount represents less than $.01 per share. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Leisure Portfolio

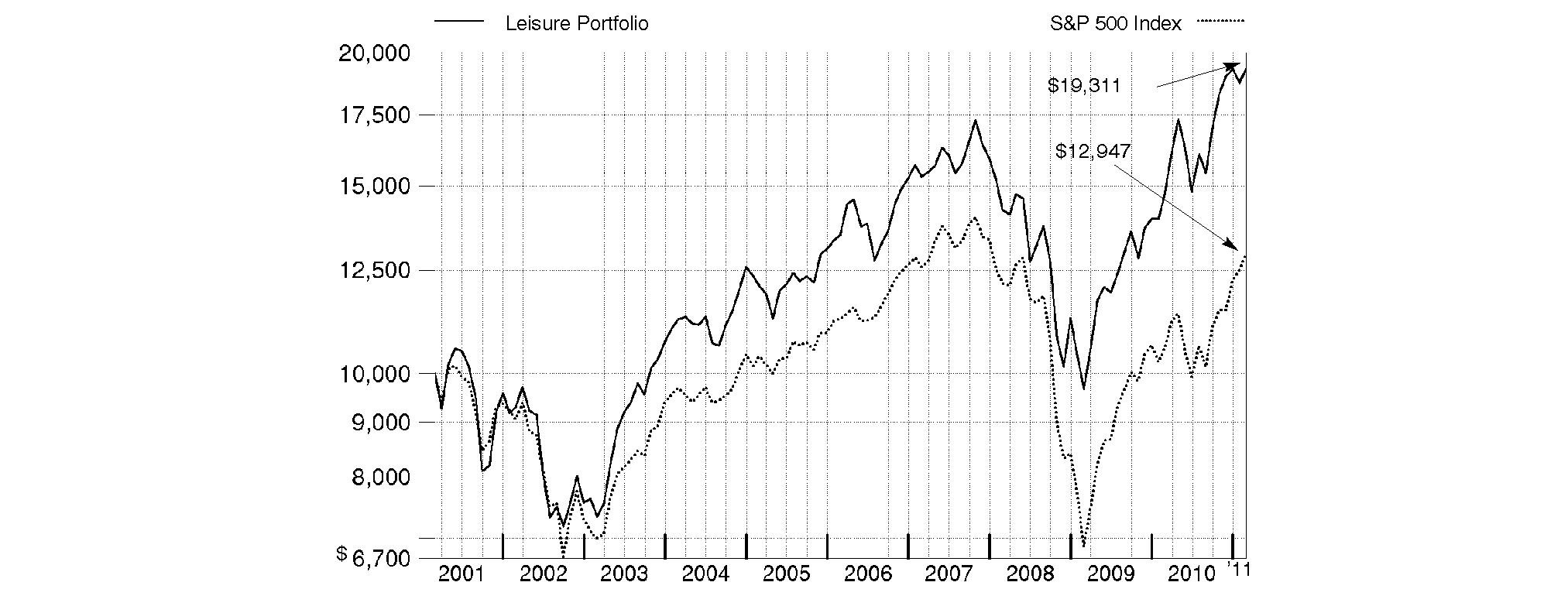

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended February 28, 2011 | Past 1 | Past 5 | Past 10 |

Leisure Portfolio | 31.16% | 7.46% | 6.80% |

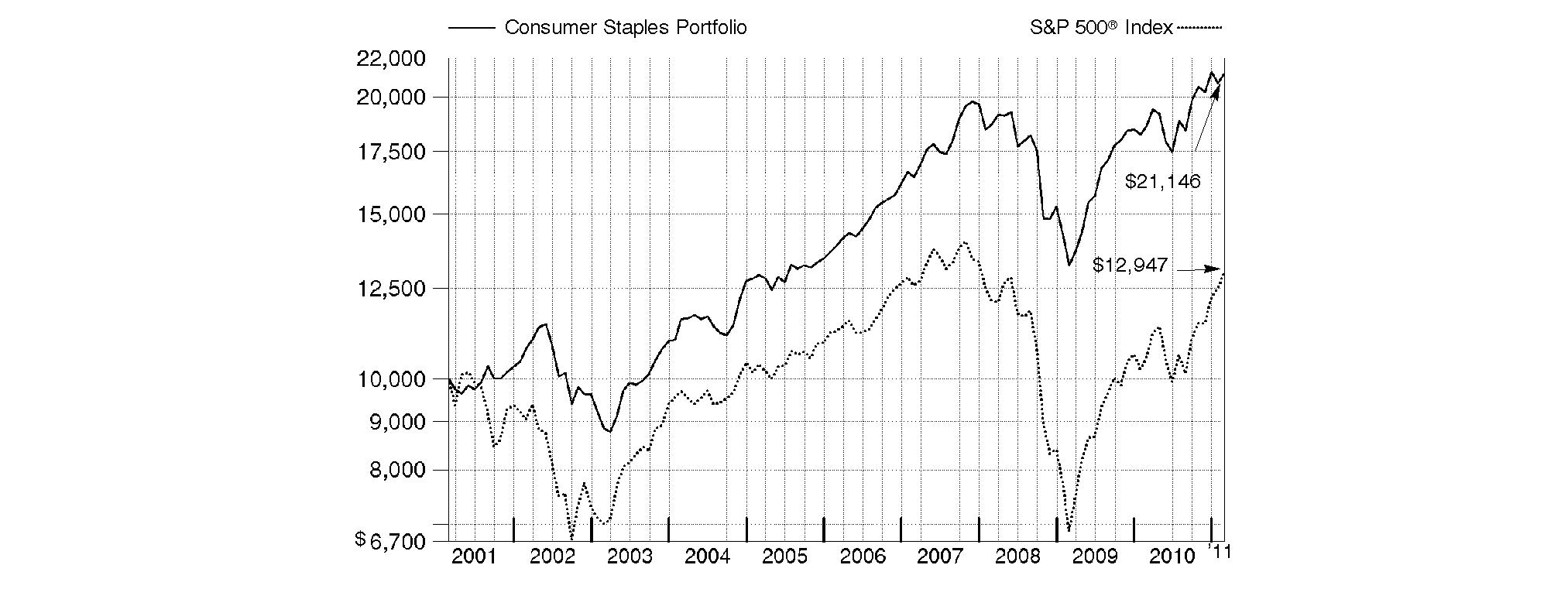

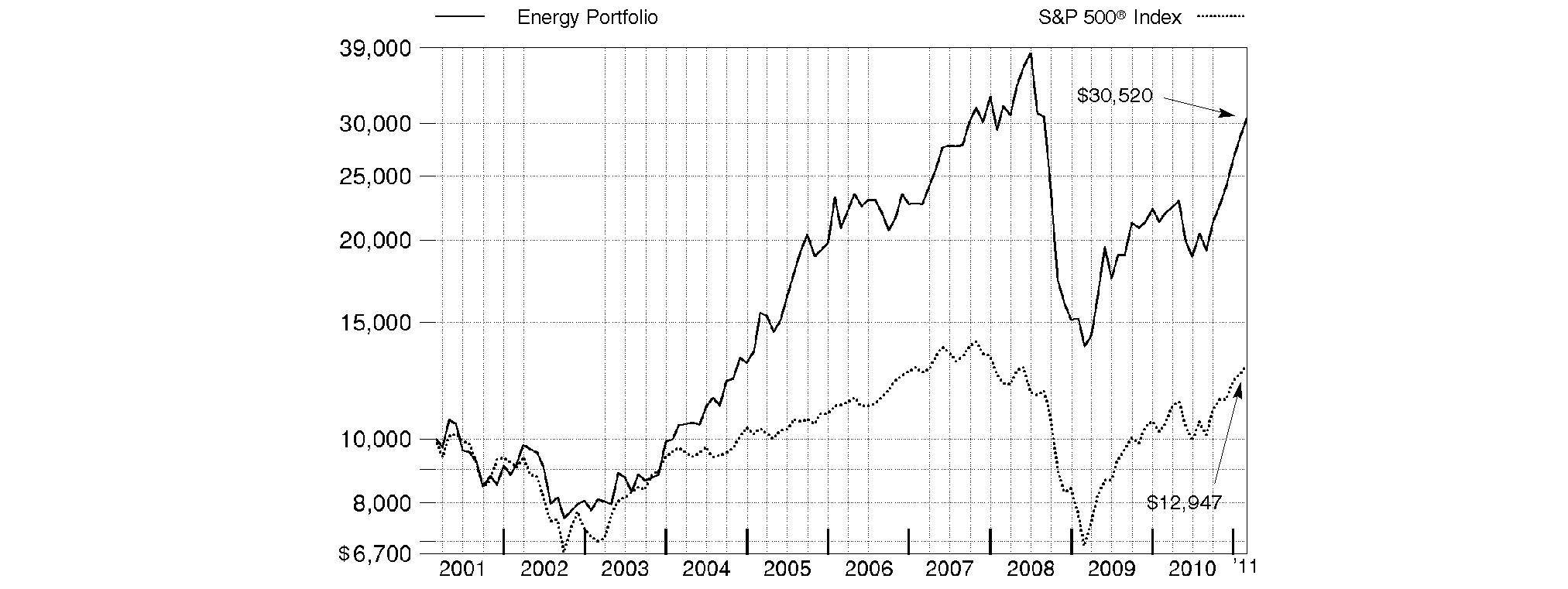

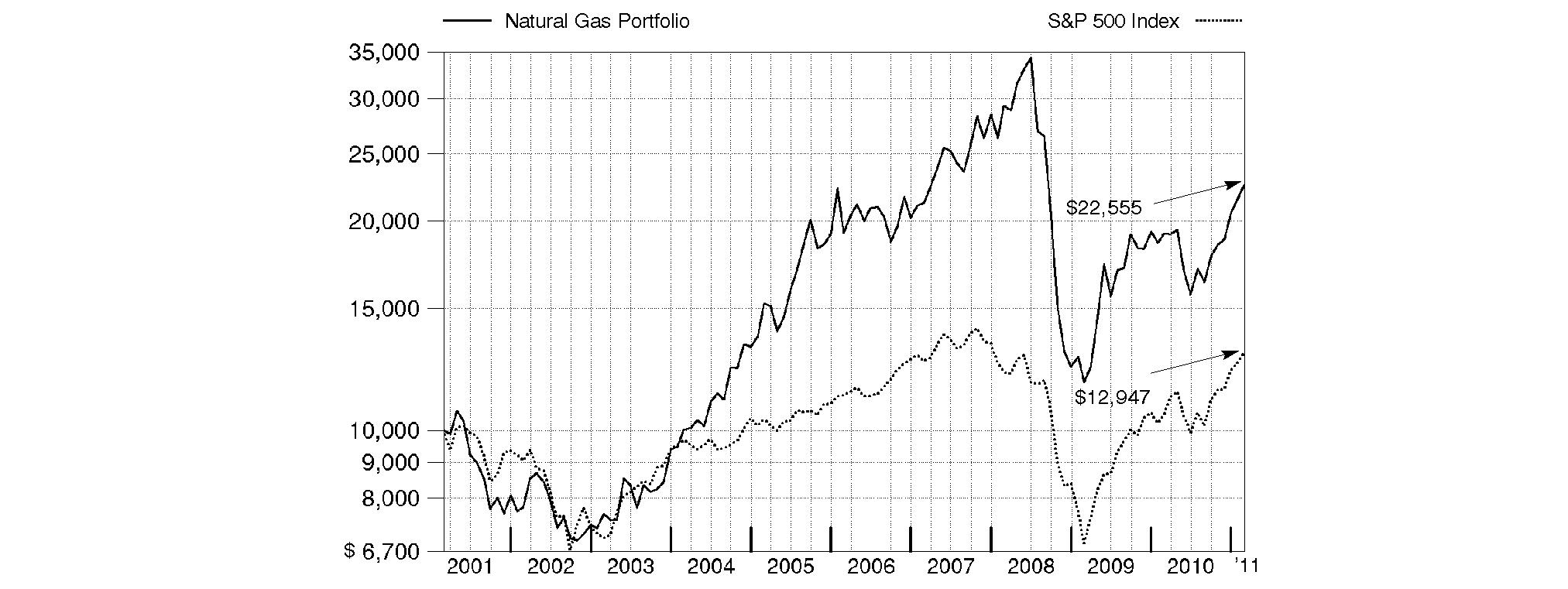

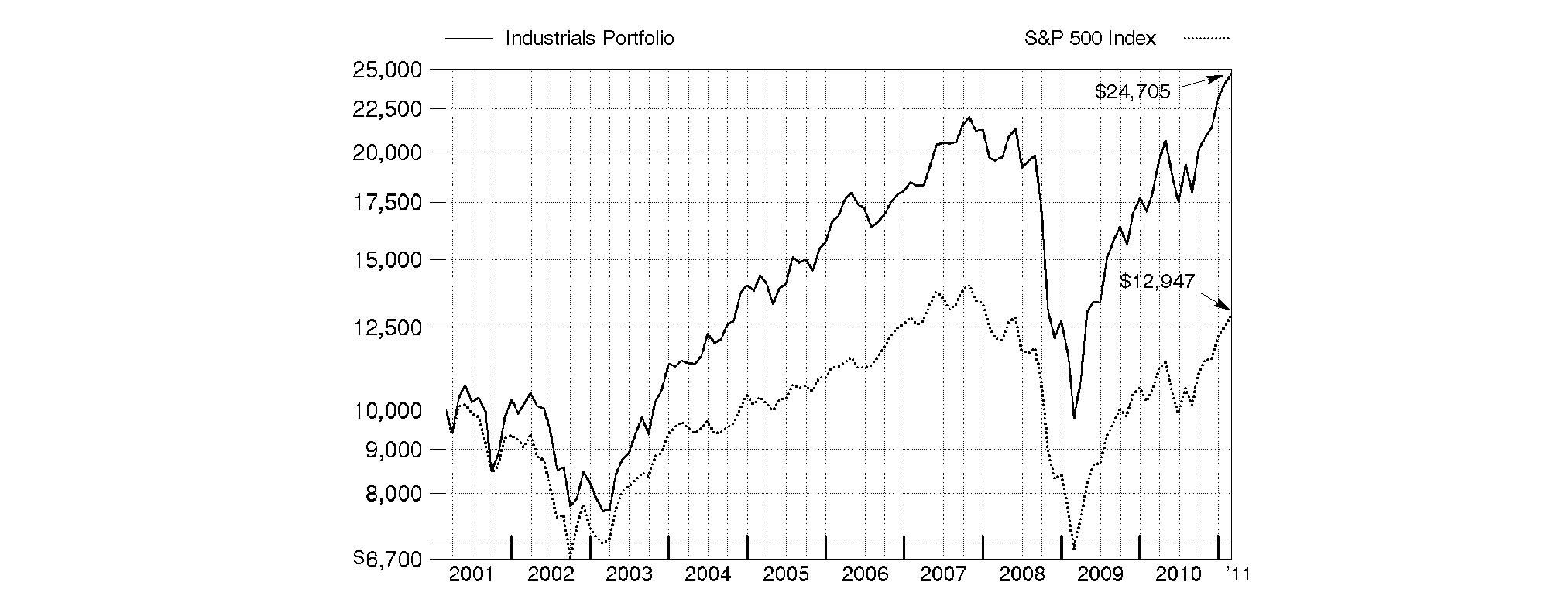

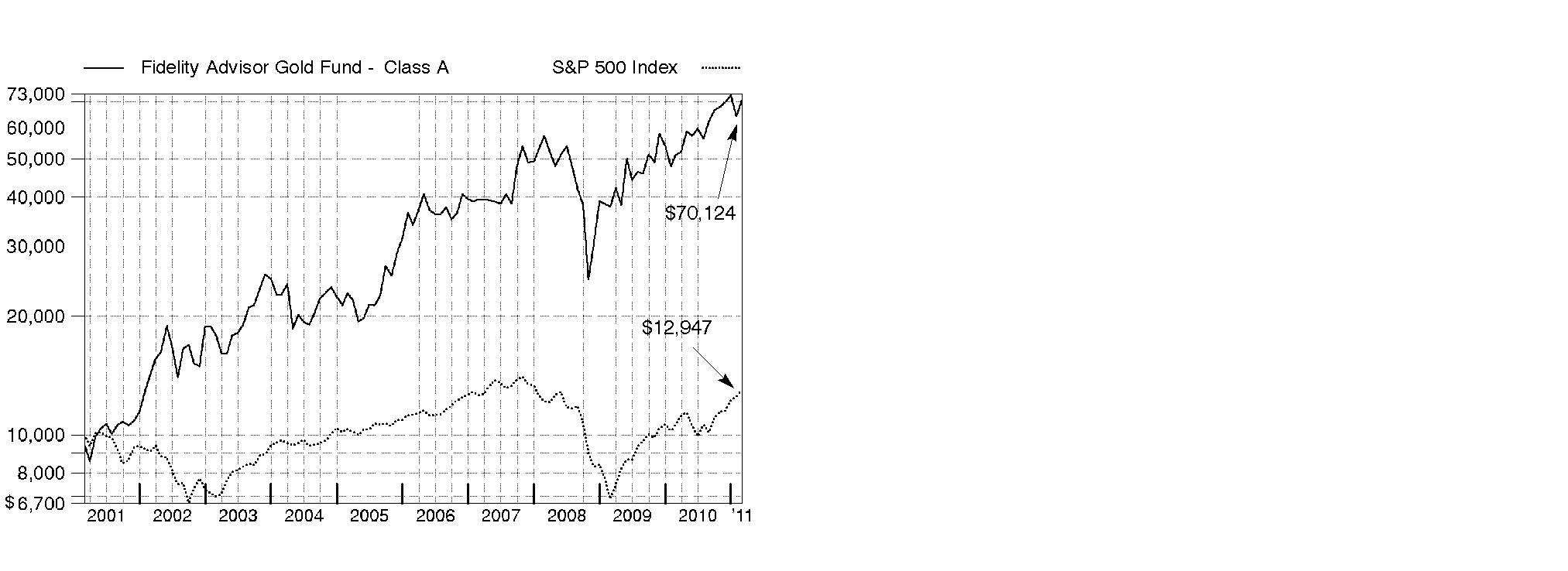

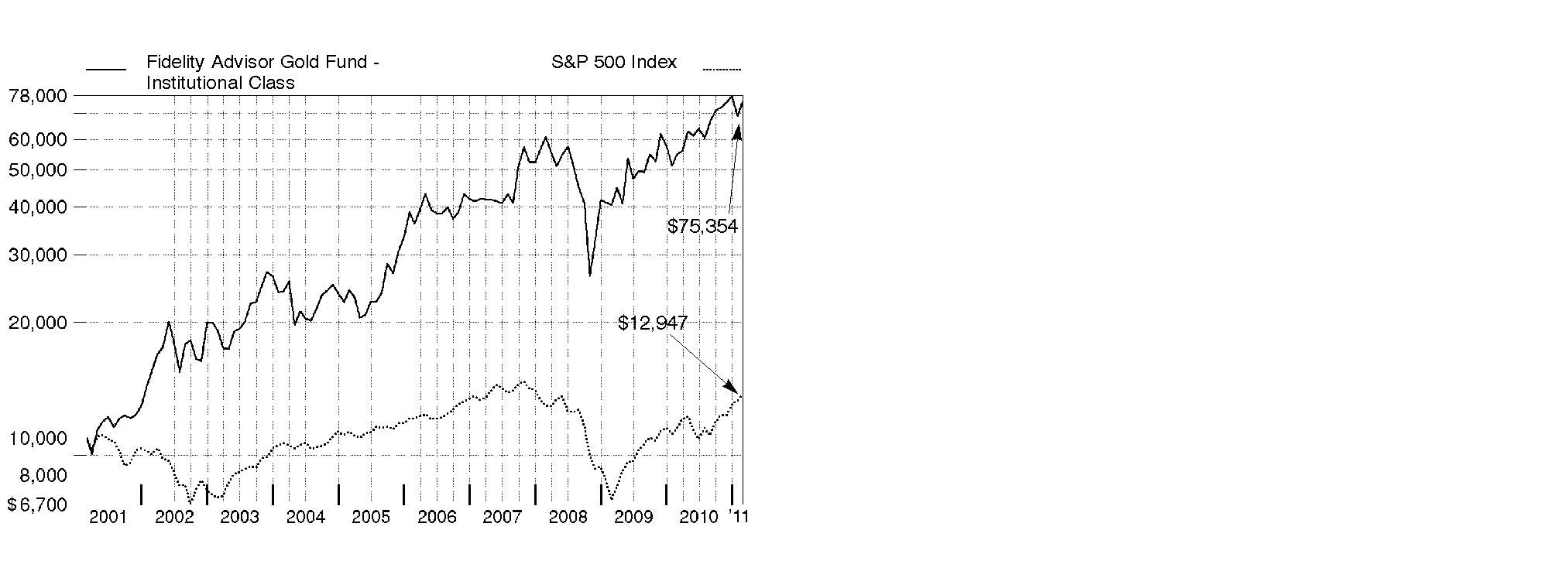

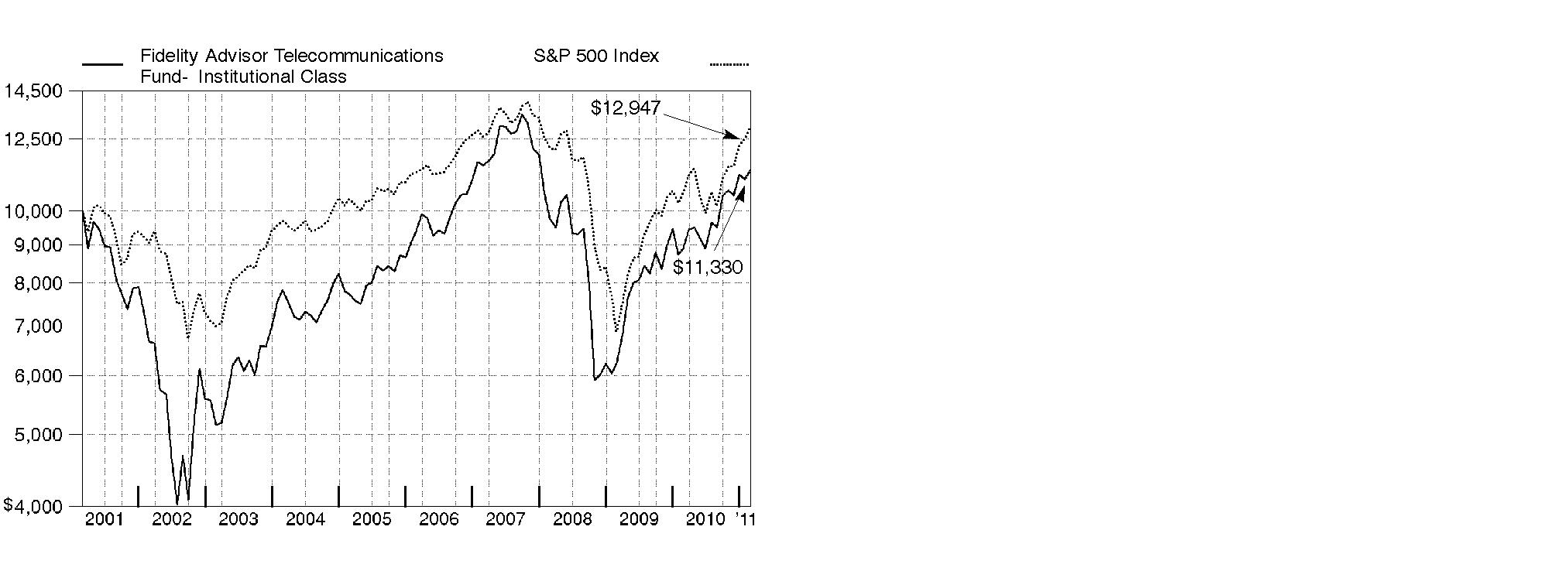

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Leisure Portfolio on February 28, 2001. The chart shows how the value of your investment would have changed, and also shows how the S&P 500 Index performed over the same period.

Annual Report

Leisure Portfolio

Management's Discussion of Fund Performance