UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3114

Fidelity Select Portfolios

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Marc Bryant, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | February 28 |

|

|

Date of reporting period: | February 28, 2015 |

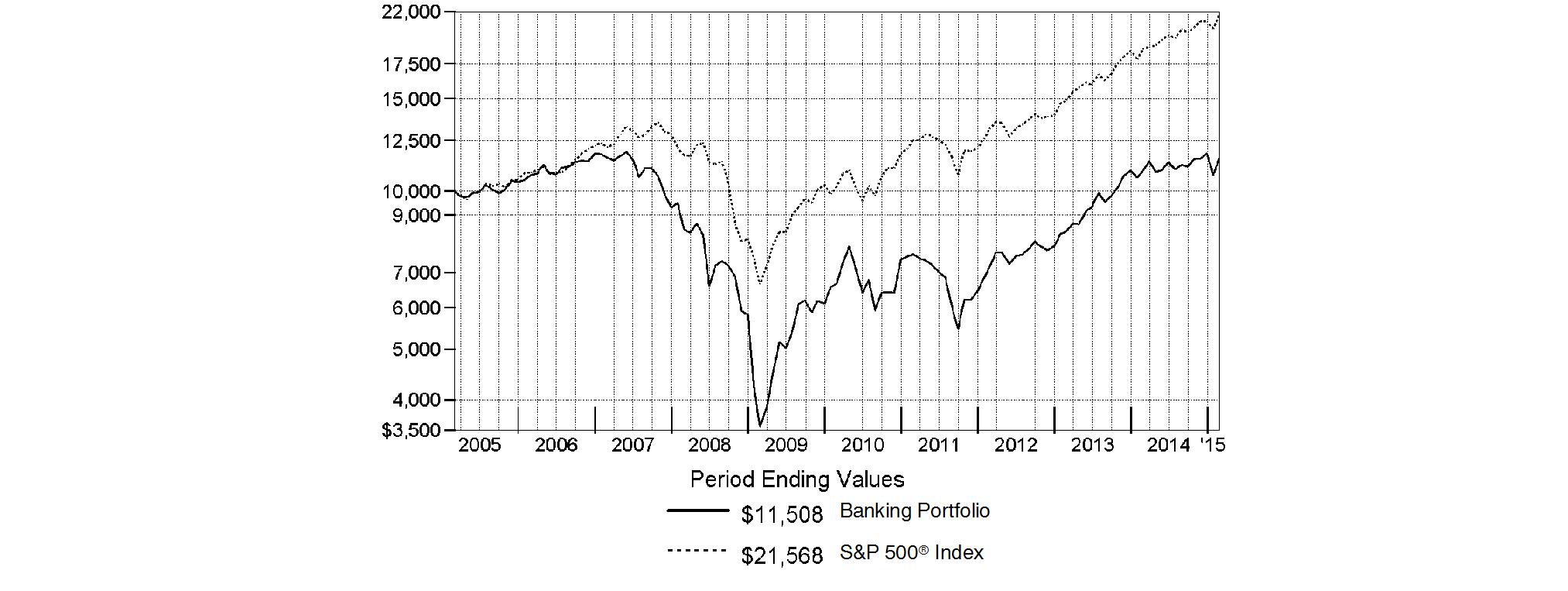

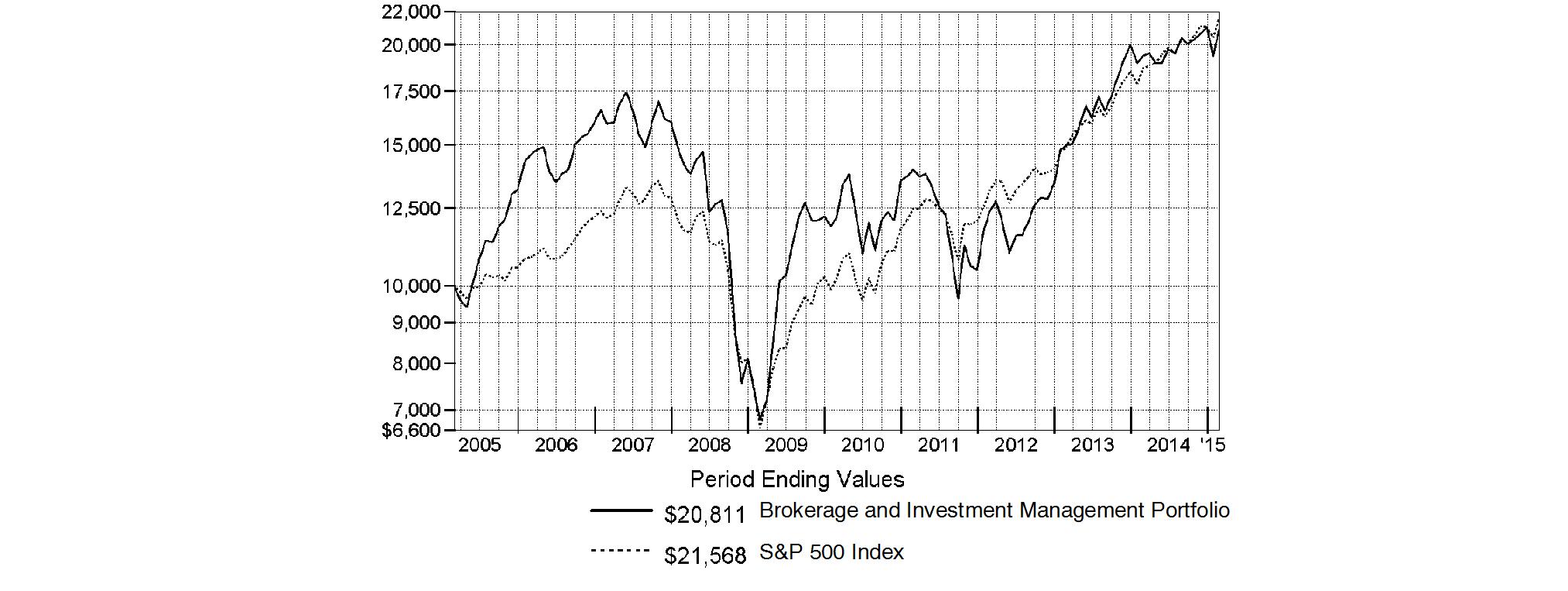

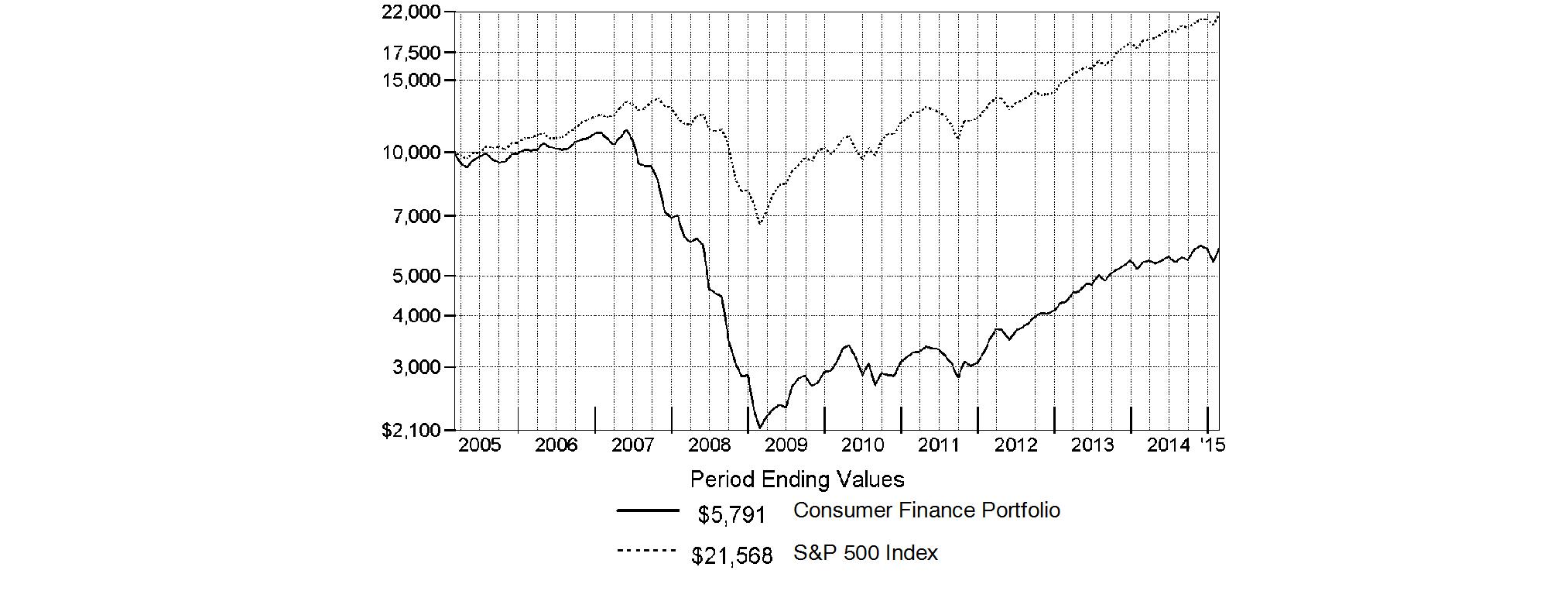

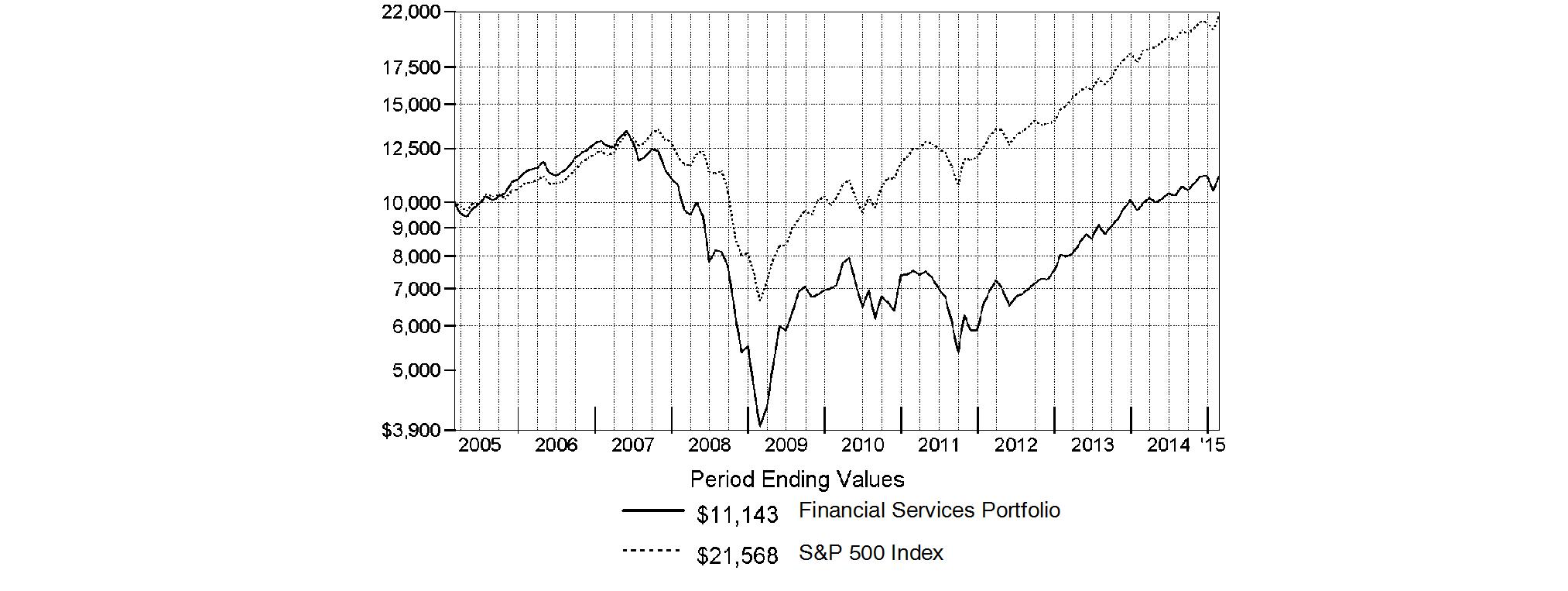

This report on Form N-CSR relates solely to the Registrant's Air Transportation Portfolio, Automotive Portfolio, Banking Portfolio, Biotechnology Portfolio, Brokerage and Investment Management Portfolio, Construction and Housing Portfolio, Consumer Discretionary Portfolio, Consumer Finance Portfolio, Defense and Aerospace Portfolio, Environment and Alternative Energy Portfolio, Financial Services Portfolio, Health Care Portfolio, Industrial Equipment Portfolio, Industrials Portfolio, Insurance Portfolio, Leisure Portfolio, Medical Delivery Portfolio, Medical Equipment and Systems Portfolio, Multimedia Portfolio, Pharmaceuticals Portfolio, Retailing Portfolio and Transportation Portfolio series (each, a "Fund" and collectively, the "Funds").

Item 1. Reports to Stockholders

Fidelity®

Select Portfolios®

Industrials Sector

Air Transportation Portfolio

Defense and Aerospace Portfolio

Environment and Alternative Energy Portfolio

Industrial Equipment Portfolio

Industrials Portfolio

Transportation Portfolio

Annual Report

February 28, 2015

(Fidelity Cover Art)

Contents

Shareholder Expense Example |

| |

Air Transportation Portfolio | Performance | |

| Management's Discussion | |

| Investment Changes | |

| Investments | |

| Financial Statements | |

Defense and Aerospace Portfolio | Performance | |

| Management's Discussion | |

| Investment Changes | |

| Investments | |

| Financial Statements | |

Environment and Alternative Energy Portfolio | Performance | |

| Management's Discussion | |

| Investment Changes | |

| Investments | |

| Financial Statements | |

Industrial Equipment Portfolio | Performance | |

| Management's Discussion | |

| Investment Changes | |

| Investments | |

| Financial Statements | |

Industrials Portfolio | Performance | |

| Management's Discussion | |

| Investment Changes | |

| Investments | |

| Financial Statements | |

Transportation Portfolio | Performance | |

| Management's Discussion | |

| Investment Changes | |

| Investments | |

| Financial Statements | |

Notes to Financial Statements |

| |

Report of Independent Registered Public Accounting Firm |

| |

Trustees and Officers |

| |

Distributions |

| |

Board Approval of Investment Advisory Contracts and Management Fees |

|

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2015 FMR LLC. All rights reserved.

Annual Report

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

Annual Report

Shareholder Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including redemption fees and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (September 1, 2014 to February 28, 2015).

Actual Expenses

The first line of the accompanying table for each fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, each Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each fund provides information about hypothetical account values and hypothetical expenses based on a fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, each Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Annualized | Beginning | Ending | Expenses Paid |

Air Transportation Portfolio | .83% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,123.90 | $ 4.37 |

HypotheticalA |

| $ 1,000.00 | $ 1,020.68 | $ 4.16 |

Defense and Aerospace Portfolio | .79% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,145.80 | $ 4.20 |

HypotheticalA |

| $ 1,000.00 | $ 1,020.88 | $ 3.96 |

Environment and Alternative Energy Portfolio | .93% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,015.80 | $ 4.65 |

HypotheticalA |

| $ 1,000.00 | $ 1,020.18 | $ 4.66 |

Industrial Equipment Portfolio | .78% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,026.70 | $ 3.92 |

HypotheticalA |

| $ 1,000.00 | $ 1,020.93 | $ 3.91 |

Industrials Portfolio | .77% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,068.60 | $ 3.95 |

HypotheticalA |

| $ 1,000.00 | $ 1,020.98 | $ 3.86 |

Transportation Portfolio | .81% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,125.60 | $ 4.27 |

HypotheticalA |

| $ 1,000.00 | $ 1,020.78 | $ 4.06 |

A 5% return per year before expenses

B Annualized expense ratio reflects expenses net of applicable fee waivers.

* Expenses are equal to each Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Annual Report

Air Transportation Portfolio

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended February 28, 2015 | Past 1 | Past 5 | Past 10 |

Air Transportation Portfolio | 21.93% | 20.54% | 13.13% |

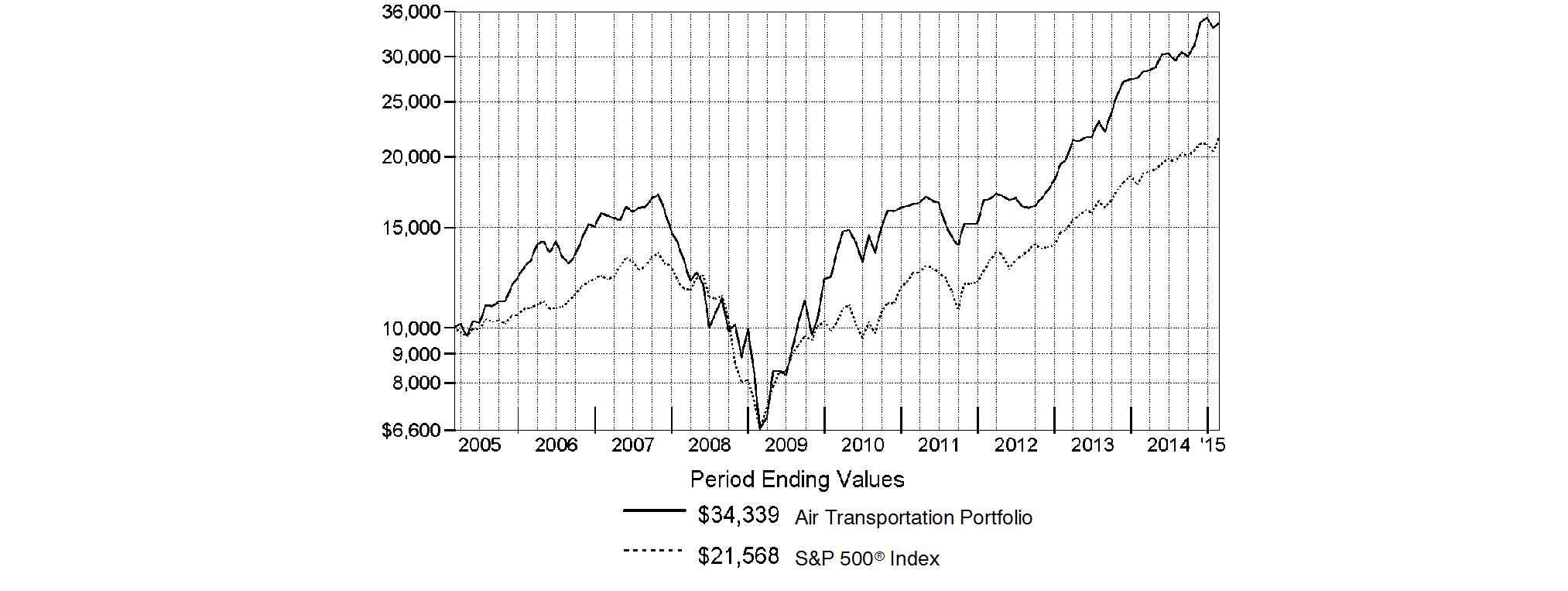

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Air Transportation Portfolio on February 28, 2005. The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

Annual Report

Air Transportation Portfolio

Management's Discussion of Fund Performance

Market Recap: The U.S. stock market closed near its all-time high for the 12 months ending February 28, 2015, supported by low interest rates and the relative strength of the U.S. economy and dollar. The large-cap S&P 500® Index returned 15.51%. Growth stocks in the index outperformed value-oriented names. The tech-heavy Nasdaq Composite Index® rose 16.58%, while the small-cap Russell 2000® Index advanced 5.63%, rallying from early-period weakness amid growth and valuation worries. Among the 10 major market sectors tracked by MSCI U.S. IMI 25-50 classifications, most notched a double-digit gain, led by health care (+24%), consumer staples (+21%), information technology (+20%) and utilities (+15%). Conversely, energy (-9%) was the only sector to lose ground, reflecting a sharp drop in crude prices beginning midyear and attributed to weaker global demand and a U.S. supply boom. Volatility spiked to a three-year high in October amid concerns about economic growth and Ebola, as well as unrest in Syria, Iraq and Ukraine. Nevertheless, the S&P 500® finished the period well above its mid-October nadir, bolstered by the relative economic strength of the U.S., which marked a six-year low in its unemployment rate, and consumer confidence that declined only slightly from its 11-year high reached in January.

Comments from Matthew Moulis, Portfolio Manager of Air Transportation Portfolio: For the year, the fund returned 21.93%, trailing the 25.99% of the S&P® Custom Air Transportation Index but well ahead of the broadly based S&P 500®. Aided by an ongoing U.S. economic recovery and sharply declining oil prices, airlines were standout performers in the industry index. Compared with that index, the fund's performance was hurt by stock selection, especially in the airlines and air freight & logistics groups. The fund had a modest overweighting in airlines, which partially offset unrewarding stock picking here. Not owning Allegiant Travel for much of the period and carrying an underweighting in Southwest Airlines, two strong-performing airline stocks in the industry index, were the two biggest relative detractors. I was cautious about both stocks because they were more expensive than many other U.S. carriers. In January, I established an underweighted position in Allegiant because I thought its older, less-fuel-efficient fleet stood to benefit disproportionately from lower fuel costs. Around the same time, I added to our position in Southwest, although it remained an underweighting at period end. Not having a stake in XPO Logistics also hurt, as this index name bolted to a gain of about 40%. I'll also mention overweighted exposure to the lagging shares of Hub Group, an intermodal freight and logistics company focused on providing road and rail connections. I thought the stock was excessively penalized by the market and added to the fund's share count here. Additionally, a modest cash position dampened relative performance, and the stronger U.S. dollar was another challenging factor, as it hampered the fund's foreign holdings. Conversely, our top relative contributor was an underweighting in lagging index component Textron, which has aircraft, defense, industrial and finance businesses. Although the stock did poorly in the first half of the period, I thought I saw a buying opportunity and increased this position to an overweighting by period end. Spirit AeroSystems Holdings, a maker of fuselages and other aircraft components, was a contributor I overweighted for the entire 12-month period. Overweightings in Delta Air Lines and American Airlines Group also worked to our benefit.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Air Transportation Portfolio

Investment Changes (Unaudited)

Top Ten Stocks as of February 28, 2015 | ||

| % of fund's | % of fund's net assets |

The Boeing Co. | 10.5 | 12.0 |

American Airlines Group, Inc. | 9.1 | 4.6 |

United Parcel Service, Inc. Class B | 8.7 | 8.2 |

Delta Air Lines, Inc. | 8.2 | 8.1 |

FedEx Corp. | 7.6 | 6.1 |

Precision Castparts Corp. | 5.9 | 6.5 |

United Continental Holdings, Inc. | 4.5 | 5.0 |

Textron, Inc. | 4.4 | 1.7 |

Southwest Airlines Co. | 4.2 | 4.9 |

Spirit AeroSystems Holdings, Inc. Class A | 3.6 | 2.4 |

| 66.7 | |

Top Industries (% of fund's net assets) | |||

As of February 28, 2015 | |||

| Aerospace & Defense | 36.6% |

|

| Airlines | 35.3% |

|

| Air Freight & Logistics | 25.7% |

|

| Road & Rail | 0.8% |

|

| Machinery | 0.0%† |

|

| All Others* | 1.6% |

|

As of August 31, 2014 | |||

| Aerospace & Defense | 36.9% |

|

| Airlines | 35.4% |

|

| Air Freight & Logistics | 24.6% |

|

| Transportation Infrastructure | 0.4% |

|

| Road & Rail | 0.1% |

|

| All Others* | 2.6% |

|

* Includes short-term investments and net other assets (liabilities). |

† Amount represents less than 0.1% |

Annual Report

Air Transportation Portfolio

Investments February 28, 2015

Showing Percentage of Net Assets

Common Stocks - 96.3% | |||

Shares | Value | ||

AEROSPACE & DEFENSE - 34.5% | |||

Aerospace & Defense - 34.5% | |||

BE Aerospace, Inc. | 327,700 | $ 20,822,058 | |

Bombardier, Inc. Class B (sub. vtg.) | 4,026,900 | 8,375,282 | |

Honeywell International, Inc. | 28,600 | 2,939,508 | |

Precision Castparts Corp. | 197,159 | 42,645,492 | |

Rockwell Collins, Inc. | 168,800 | 15,036,704 | |

Spirit AeroSystems Holdings, Inc. Class A (a) | 527,500 | 25,958,275 | |

Textron, Inc. | 708,800 | 31,406,928 | |

The Boeing Co. | 496,600 | 74,912,110 | |

TransDigm Group, Inc. | 19,300 | 4,185,398 | |

Triumph Group, Inc. | 298,900 | 17,871,231 | |

United Technologies Corp. | 25,200 | 3,072,132 | |

| 247,225,118 | ||

AIR FREIGHT & LOGISTICS - 25.7% | |||

Air Freight & Logistics - 25.7% | |||

Atlas Air Worldwide Holdings, Inc. (a) | 92,500 | 4,194,875 | |

C.H. Robinson Worldwide, Inc. (d) | 269,100 | 19,994,130 | |

Expeditors International of Washington, Inc. | 182,607 | 8,819,918 | |

FedEx Corp. | 308,300 | 54,562,934 | |

Forward Air Corp. | 187,800 | 10,047,300 | |

Hub Group, Inc. Class A (a) | 270,378 | 10,915,160 | |

Park-Ohio Holdings Corp. | 133,590 | 7,714,823 | |

United Parcel Service, Inc. Class B | 612,300 | 62,289,279 | |

UTi Worldwide, Inc. (a) | 403,400 | 5,276,472 | |

| 183,814,891 | ||

AIRLINES - 35.3% | |||

Airlines - 35.3% | |||

Air Canada (a) | 1,073,800 | 10,599,706 | |

Alaska Air Group, Inc. | 310,800 | 19,782,420 | |

Allegiant Travel Co. | 21,100 | 3,874,382 | |

American Airlines Group, Inc. | 1,353,900 | 64,851,810 | |

Dart Group PLC | 5,286 | 23,850 | |

Delta Air Lines, Inc. | 1,320,802 | 58,802,105 | |

Hawaiian Holdings, Inc. (a)(d) | 183,600 | 3,398,436 | |

Ryanair Holdings PLC sponsored ADR | 137,500 | 8,710,625 | |

Southwest Airlines Co. | 697,400 | 30,155,576 | |

Spirit Airlines, Inc. (a) | 139,500 | 10,850,310 | |

United Continental Holdings, Inc. (a) | 498,985 | 32,523,842 | |

Virgin America, Inc. | 8,800 | 308,352 | |

WestJet Airlines Ltd. | 314,500 | 7,371,290 | |

Wizz Air Holdings PLC | 84,306 | 1,705,041 | |

| 252,957,745 | ||

| |||

Shares | Value | ||

MACHINERY - 0.0% | |||

Construction Machinery & Heavy Trucks - 0.0% | |||

ASL Marine Holdings Ltd. | 235,000 | $ 72,422 | |

ROAD & RAIL - 0.8% | |||

Trucking - 0.8% | |||

Roadrunner Transportation Systems, Inc. (a) | 47,100 | 1,209,057 | |

Swift Transporation Co. (a) | 145,200 | 4,106,256 | |

| 5,315,313 | ||

TOTAL COMMON STOCKS (Cost $571,932,318) |

| ||

Nonconvertible Preferred Stocks - 2.1% | |||

|

|

|

|

AEROSPACE & DEFENSE - 2.1% | |||

Aerospace & Defense - 2.1% | |||

Embraer SA sponsored ADR (d) | 432,600 |

| |

Money Market Funds - 5.3% | |||

|

|

|

|

Fidelity Cash Central Fund, 0.13% (b) | 9,256,174 | 9,256,174 | |

Fidelity Securities Lending Cash Central Fund, 0.13% (b)(c) | 28,731,300 | 28,731,300 | |

TOTAL MONEY MARKET FUNDS (Cost $37,987,474) |

| ||

TOTAL INVESTMENT PORTFOLIO - 103.7% (Cost $625,547,542) | 742,509,637 |

NET OTHER ASSETS (LIABILITIES) - (3.7)% | (26,584,206) | ||

NET ASSETS - 100% | $ 715,925,431 | ||

Legend |

(a) Non-income producing |

(b) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

(c) Investment made with cash collateral received from securities on loan. |

(d) Security or a portion of the security is on loan at period end. |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned |

Fidelity Cash Central Fund | $ 14,756 |

Fidelity Securities Lending Cash Central Fund | 73,505 |

Total | $ 88,261 |

Other Information |

All investments are categorized as Level 1 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Air Transportation Portfolio

Financial Statements

Statement of Assets and Liabilities

| February 28, 2015 | |

|

|

|

Assets | ||

Investment in securities, at value (including securities loaned of $27,934,523) - See accompanying schedule: Unaffiliated issuers (cost $587,560,068) | $ 704,522,163 |

|

Fidelity Central Funds (cost $37,987,474) | 37,987,474 |

|

Total Investments (cost $625,547,542) |

| $ 742,509,637 |

Receivable for investments sold | 5,417,208 | |

Receivable for fund shares sold | 1,535,198 | |

Dividends receivable | 1,245,485 | |

Distributions receivable from Fidelity Central Funds | 3,738 | |

Prepaid expenses | 1,582 | |

Other receivables | 454 | |

Total assets | 750,713,302 | |

|

|

|

Liabilities | ||

Payable to custodian bank | $ 3,598 | |

Payable for investments purchased | 278,915 | |

Payable for fund shares redeemed | 5,247,888 | |

Accrued management fee | 339,992 | |

Other affiliated payables | 137,234 | |

Other payables and accrued expenses | 48,944 | |

Collateral on securities loaned, at value | 28,731,300 | |

Total liabilities | 34,787,871 | |

|

|

|

Net Assets | $ 715,925,431 | |

Net Assets consist of: |

| |

Paid in capital | $ 598,579,118 | |

Undistributed net investment income | 404,199 | |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | (20,119) | |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | 116,962,233 | |

Net Assets, for 9,794,637 shares outstanding | $ 715,925,431 | |

Net Asset Value, offering price and redemption price per share ($715,925,431 ÷ 9,794,637 shares) | $ 73.09 | |

Statement of Operations

| Year ended February 28, 2015 | |

|

|

|

Investment Income |

|

|

Dividends |

| $ 3,640,579 |

Special dividends |

| 1,570,000 |

Interest |

| 32,395 |

Income from Fidelity Central Funds (including $73,505 from security lending) |

| 88,261 |

Total income |

| 5,331,235 |

|

|

|

Expenses | ||

Management fee | $ 2,613,627 | |

Transfer agent fees | 928,187 | |

Accounting and security lending fees | 182,269 | |

Custodian fees and expenses | 29,626 | |

Independent trustees' compensation | 8,527 | |

Registration fees | 108,344 | |

Audit | 41,379 | |

Legal | 3,329 | |

Miscellaneous | 14,096 | |

Total expenses before reductions | 3,929,384 | |

Expense reductions | (687) | 3,928,697 |

Net investment income (loss) | 1,402,538 | |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | ||

Investment securities: |

|

|

Unaffiliated issuers | 13,784,115 | |

Foreign currency transactions | 9,757 | |

Redemption in-kind with affiliated entities | 34,333,787 | |

Total net realized gain (loss) |

| 48,127,659 |

Change in net unrealized appreciation (depreciation) on: Investment securities | 37,708,875 | |

Assets and liabilities in foreign currencies | 138 | |

Total change in net unrealized appreciation (depreciation) |

| 37,709,013 |

Net gain (loss) | 85,836,672 | |

Net increase (decrease) in net assets resulting from operations | $ 87,239,210 | |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Air Transportation Portfolio

Financial Statements - continued

Statement of Changes in Net Assets

| Year ended | Year ended |

Increase (Decrease) in Net Assets |

|

|

Operations |

|

|

Net investment income (loss) | $ 1,402,538 | $ 481,935 |

Net realized gain (loss) | 48,127,659 | 7,546,940 |

Change in net unrealized appreciation (depreciation) | 37,709,013 | 58,042,588 |

Net increase (decrease) in net assets resulting from operations | 87,239,210 | 66,071,463 |

Distributions to shareholders from net investment income | (630,886) | (283,510) |

Distributions to shareholders from net realized gain | (8,759,130) | (6,866,621) |

Total distributions | (9,390,016) | (7,150,131) |

Share transactions | 756,163,010 | 455,387,601 |

Reinvestment of distributions | 9,070,010 | 6,829,818 |

Cost of shares redeemed | (478,208,807) | (261,051,115) |

Net increase (decrease) in net assets resulting from share transactions | 287,024,213 | 201,166,304 |

Redemption fees | 92,355 | 35,151 |

Total increase (decrease) in net assets | 364,965,762 | 260,122,787 |

|

|

|

Net Assets | ||

Beginning of period | 350,959,669 | 90,836,882 |

End of period (including undistributed net investment income of $404,199 and undistributed net investment income of $146,694, respectively) | $ 715,925,431 | $ 350,959,669 |

Other Information Shares | ||

Sold | 11,025,387 | 8,314,236 |

Issued in reinvestment of distributions | 130,079 | 121,717 |

Redeemed | (7,112,132) | (4,750,627) |

Net increase (decrease) | 4,043,334 | 3,685,326 |

Financial Highlights

Years ended February 28, | 2015 | 2014 | 2013 | 2012 I | 2011 |

Selected Per-Share Data |

|

|

|

|

|

Net asset value, beginning of period | $ 61.02 | $ 43.97 | $ 38.12 | $ 43.05 | $ 35.32 |

Income from Investment Operations |

|

|

|

|

|

Net investment income (loss) B | .20 L | .12 | .21E | .05 | .17 F |

Net realized and unrealized gain (loss) | 13.09 | 18.28 | 6.44 | .46 | 7.68 |

Total from investment operations | 13.29 | 18.40 | 6.65 | .51 | 7.85 |

Distributions from net investment income | (.08) | (.06) | (.15) | (.05) | (.13) |

Distributions from net realized gain | (1.14) | (1.30) | (.66) | (5.39) | - |

Total distributions | (1.23) M | (1.36) | (.80) K | (5.44) | (.13) |

Redemption fees added to paid in capital B | .01 | .01 | - J | - J | .01 |

Net asset value, end of period | $ 73.09 | $ 61.02 | $ 43.97 | $ 38.12 | $ 43.05 |

Total ReturnA | 21.93% | 42.26% | 17.62% | 2.01% | 22.26% |

Ratios to Average Net AssetsC, G |

|

|

|

|

|

Expenses before reductions | .83% | .87% | .94% | .96% | .92% |

Expenses net of fee waivers, if any | .83% | .87% | .94% | .96% | .92% |

Expenses net of all reductions | .83% | .86% | .92% | .95% | .91% |

Net investment income (loss) | .30% L | .22% | .54% E | .12% | .43% F |

Supplemental Data |

|

|

|

|

|

Net assets, end of period (000 omitted) | $ 715,925 | $ 350,960 | $ 90,837 | $ 72,652 | $ 113,471 |

Portfolio turnover rateD | 65% H | 125% | 74% | 102% | 161% |

ATotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown. BCalculated based on average shares outstanding during the period. CFees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. DAmount does not include the portfolio activity of any underlying Fidelity Central Funds. EInvestment income per share reflects a large, non-recurring dividend which amounted to $.07 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been .35%. FInvestment income per share reflects a large, non-recurring dividend which amounted to $.12 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been .14%. GExpense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund. HPortfolio turnover rate excludes securities received or delivered in-kind. IFor the year ended February 29. JAmount represents less than $.01 per share. KTotal distributions of $.80 per share is comprised of distributions from net investment income of $.147 and distributions from net realized gain of $.655 per share. LInvestment income per share reflects a large, non-recurring dividend which amounted to $.22 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been (.04)%. MTotal distributions of $1.23 per share is comprised of distributions from net investment income of $.084 and distributions from net realized gain of $1.144 per share. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Defense and Aerospace Portfolio

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended February 28, 2015 | Past 1 | Past 5 | Past 10 |

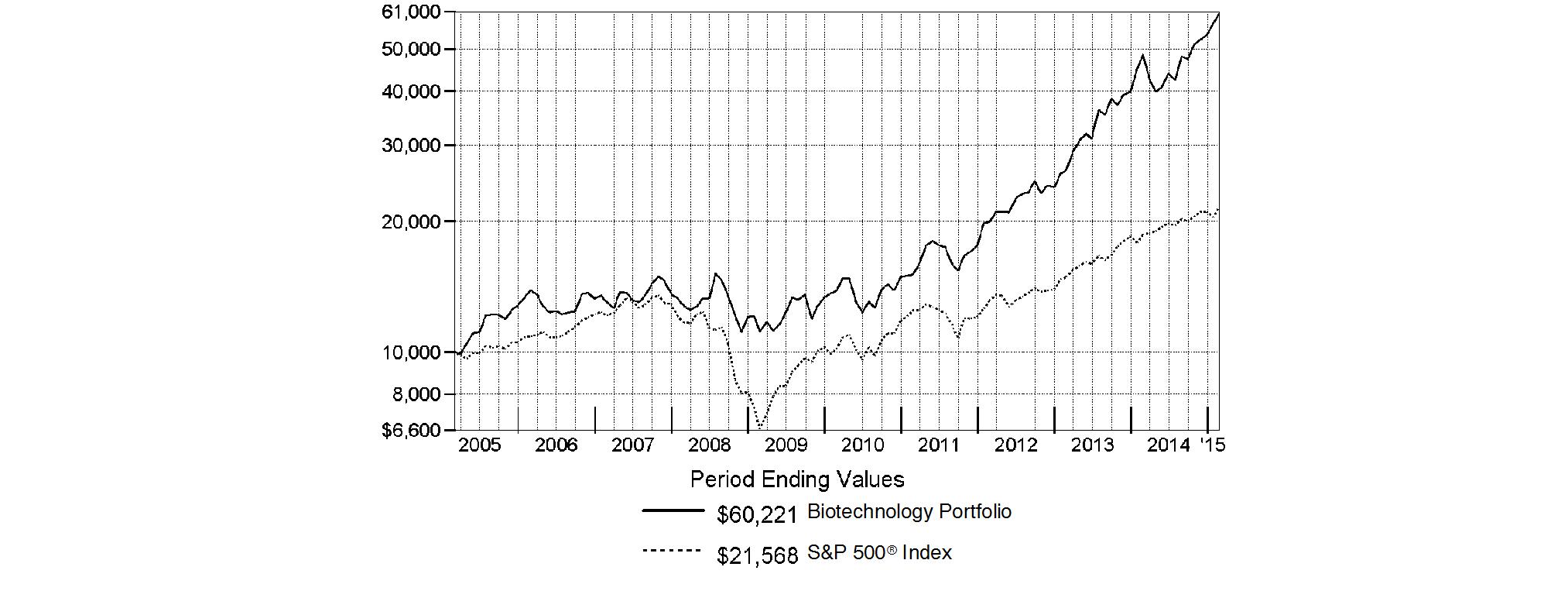

Defense and Aerospace Portfolio | 12.53% | 19.28% | 11.63% |

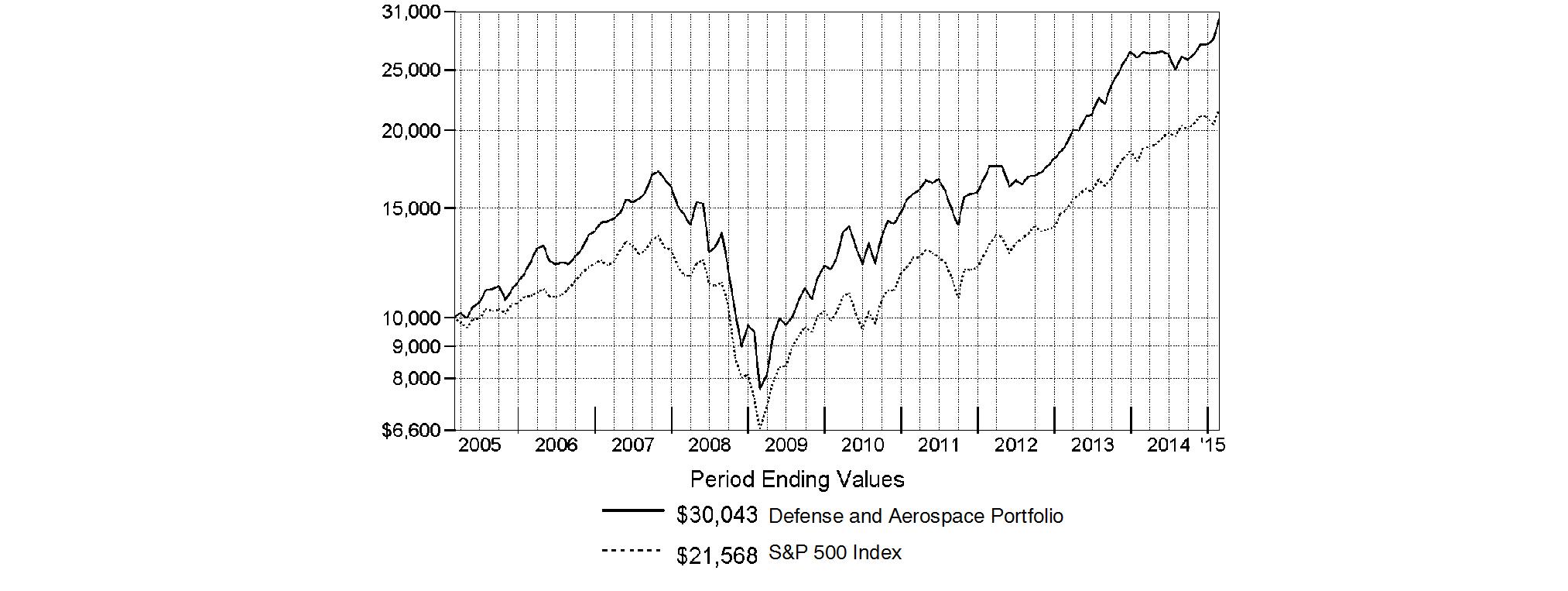

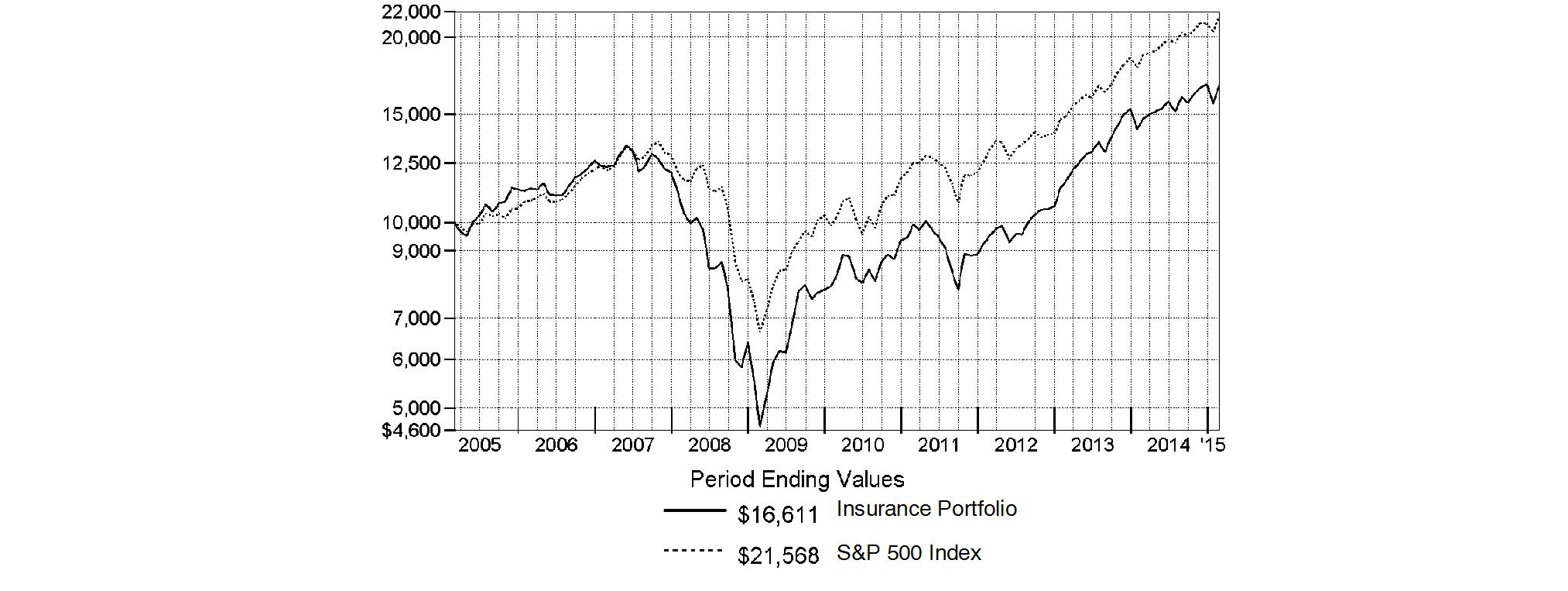

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Defense and Aerospace Portfolio on February 28, 2005. The chart shows how the value of your investment would have changed, and also shows how the S&P 500 Index performed over the same period.

Annual Report

Defense and Aerospace Portfolio

Management's Discussion of Fund Performance

Market Recap: The U.S. stock market closed near its all-time high for the 12 months ending February 28, 2015, supported by low interest rates and the relative strength of the U.S. economy and dollar. The large-cap S&P 500® Index returned 15.51%. Growth stocks in the index outperformed value-oriented names. The tech-heavy Nasdaq Composite Index® rose 16.58%, while the small-cap Russell 2000® Index advanced 5.63%, rallying from early-period weakness amid growth and valuation worries. Among the 10 major market sectors tracked by MSCI U.S. IMI 25-50 classifications, most notched a double-digit gain, led by health care (+24%), consumer staples (+21%), information technology (+20%) and utilities (+15%). Conversely, energy (-9%) was the only sector to lose ground, reflecting a sharp drop in crude prices beginning midyear and attributed to weaker global demand and a U.S. supply boom. Volatility spiked to a three-year high in October amid concerns about economic growth and Ebola, as well as unrest in Syria, Iraq and Ukraine. Nevertheless, the S&P 500® finished the period well above its mid-October nadir, bolstered by the relative economic strength of the U.S., which marked a six-year low in its unemployment rate, and consumer confidence that declined only slightly from its 11-year high reached in January.

Comments from Douglas Scott, Portfolio Manager of Defense and Aerospace Portfolio: For the year, the fund returned 12.53%, trailing the 13.19% return of the MSCI U.S. IMI Aerospace & Defense 25-50 Index and also lagging the S&P 500® Index. Aerospace & defense stocks lagged the broader market but still managed a solid gain, with especially strong performance by the major defense contractors. Commercial aerospace stocks turned in a relatively weak result despite the solid fundamentals of companies in that group. Compared with the MSCI index, not owning the strong-performing shares of major defense contractors Northrop Grumman and Lockheed Martin, and substantially underweighting General Dynamics, hurt the fund's results. Additionally, performance suffered due to Spirit AeroSystems Holdings, a strong-performing index component I decided against owning, and an out-of-benchmark position in Paris-based Safran, a manufacturer of aircraft and rocket engines and propulsion systems. This was mostly a case of unrewarding timing on my part, as the fund carried its largest stake earlier in the period, when the stock was relatively flat. Overall, the fund's foreign investments dampened performance because of a stronger U.S. dollar, although European aerospace names were somewhat helped because their costs are denominated in euros and much of their revenues are in dollars. Conversely, a sizable overweighting in shipbuilder Huntington Ingalls Industries was among the fund's biggest holdings and the top relative contributor. Aerospace and defense information solutions provider Exelis also outperformed. I liked this stock's inexpensive valuation, and apparently so did Harris, which submitted an offer to buy the company in February. Soon after this announcement, I sold the stock to lock in profits. Lastly, overweighting aircraft components maker TransDigm Group was a timely decision. Earnings growth continued to be strong, and this stock posted a 40% gain during the period.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Defense and Aerospace Portfolio

Investment Changes (Unaudited)

Top Ten Stocks as of February 28, 2015 | ||

| % of fund's | % of fund's net assets |

United Technologies Corp. | 18.6 | 20.5 |

The Boeing Co. | 16.0 | 17.2 |

Raytheon Co. | 5.7 | 1.8 |

Huntington Ingalls Industries, Inc. | 5.2 | 6.3 |

Rockwell Collins, Inc. | 4.7 | 1.0 |

Textron, Inc. | 4.4 | 5.3 |

L-3 Communications Holdings, Inc. | 4.3 | 4.4 |

Honeywell International, Inc. | 4.0 | 4.5 |

TransDigm Group, Inc. | 3.9 | 4.1 |

Orbital ATK, Inc. | 3.6 | 0.0 |

| 70.4 | |

Top Industries (% of fund's net assets) | |||

As of February 28, 2015 | |||

| Aerospace & Defense | 92.5% |

|

| Leisure Products | 2.0% |

|

| Chemicals | 1.3% |

|

| Electrical Equipment | 0.0%† |

|

| Metals & Mining | 0.0%† |

|

| All Others* | 4.2% |

|

As of August 31, 2014 | |||

| Aerospace & Defense | 97.7% |

|

| Chemicals | 1.5% |

|

| Electrical Equipment | 0.0%† |

|

| Metals & Mining | 0.0%† |

|

| All Others* | 0.8% |

|

* Includes short-term investments and net other assets (liabilities). |

† Amount represents less than 0.1% |

Annual Report

Defense and Aerospace Portfolio

Investments February 28, 2015

Showing Percentage of Net Assets

Common Stocks - 95.8% | |||

Shares | Value | ||

AEROSPACE & DEFENSE - 92.5% | |||

Aerospace & Defense - 92.5% | |||

BAE Systems PLC | 3,037,797 | $ 24,950,283 | |

BE Aerospace, Inc. | 285,000 | 18,108,900 | |

Esterline Technologies Corp. (a) | 271,634 | 32,012,067 | |

GenCorp, Inc. (non-vtg.) (a) | 686,431 | 13,248,118 | |

General Dynamics Corp. | 81,200 | 11,268,936 | |

HEICO Corp. (d) | 221,625 | 13,133,498 | |

Honeywell International, Inc. | 367,876 | 37,810,295 | |

Huntington Ingalls Industries, Inc. | 346,676 | 48,995,719 | |

L-3 Communications Holdings, Inc. | 315,818 | 40,876,324 | |

Meggitt PLC | 3,352,187 | 28,205,243 | |

Orbital ATK, Inc. | 511,543 | 33,905,070 | |

Precision Castparts Corp. | 33,694 | 7,288,012 | |

Raytheon Co. | 495,356 | 53,879,872 | |

Rockwell Collins, Inc. | 501,772 | 44,697,850 | |

Safran SA | 258,300 | 18,181,284 | |

Teledyne Technologies, Inc. (a) | 208,626 | 21,035,760 | |

Textron, Inc. | 935,400 | 41,447,574 | |

The Boeing Co. | 1,006,031 | 151,759,776 | |

TransDigm Group, Inc. | 172,733 | 37,458,878 | |

Triumph Group, Inc. | 362,335 | 21,664,010 | |

United Technologies Corp. | 1,450,201 | 176,794,004 | |

| 876,721,473 | ||

CHEMICALS - 1.3% | |||

Specialty Chemicals - 1.3% | |||

Cytec Industries, Inc. | 234,432 | 12,314,713 | |

ELECTRICAL EQUIPMENT - 0.0% | |||

Electrical Components & Equipment - 0.0% | |||

AMETEK, Inc. | 599 | 31,831 | |

LEISURE PRODUCTS - 2.0% | |||

Leisure Products - 2.0% | |||

Vista Outdoor, Inc. (a) | 442,886 | 19,336,403 | |

| |||

Shares | Value | ||

METALS & MINING - 0.0% | |||

Steel - 0.0% | |||

Carpenter Technology Corp. | 200 | $ 8,472 | |

TOTAL COMMON STOCKS (Cost $576,486,498) |

| ||

Money Market Funds - 5.0% | |||

|

|

|

|

Fidelity Cash Central Fund, 0.13% (b) | 44,887,762 | 44,887,762 | |

Fidelity Securities Lending Cash Central Fund, 0.13% (b)(c) | 2,108,750 | 2,108,750 | |

TOTAL MONEY MARKET FUNDS (Cost $46,996,512) |

| ||

TOTAL INVESTMENT PORTFOLIO - 100.8% (Cost $623,483,010) | 955,409,404 |

NET OTHER ASSETS (LIABILITIES) - (0.8)% | (7,253,646) | ||

NET ASSETS - 100% | $ 948,155,758 | ||

Legend |

(a) Non-income producing |

(b) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

(c) Investment made with cash collateral received from securities on loan. |

(d) Security or a portion of the security is on loan at period end. |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned |

Fidelity Cash Central Fund | $ 7,780 |

Fidelity Securities Lending Cash Central Fund | 36,837 |

Total | $ 44,617 |

Other Information |

All investments are categorized as Level 1 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Defense and Aerospace Portfolio

Financial Statements

Statement of Assets and Liabilities

| February 28, 2015 | |

|

|

|

Assets | ||

Investment in securities, at value (including securities loaned of $2,074,100) - See accompanying schedule: Unaffiliated issuers (cost $576,486,498) | $ 908,412,892 |

|

Fidelity Central Funds (cost $46,996,512) | 46,996,512 |

|

Total Investments (cost $623,483,010) |

| $ 955,409,404 |

Receivable for fund shares sold | 4,180,756 | |

Dividends receivable | 2,396,151 | |

Distributions receivable from Fidelity Central Funds | 3,684 | |

Prepaid expenses | 3,226 | |

Other receivables | 17,130 | |

Total assets | 962,010,351 | |

|

|

|

Liabilities | ||

Payable for investments purchased | $ 10,082,692 | |

Payable for fund shares redeemed | 1,050,173 | |

Accrued management fee | 407,801 | |

Other affiliated payables | 156,158 | |

Other payables and accrued expenses | 49,019 | |

Collateral on securities loaned, at value | 2,108,750 | |

Total liabilities | 13,854,593 | |

|

|

|

Net Assets | $ 948,155,758 | |

Net Assets consist of: |

| |

Paid in capital | $ 582,894,054 | |

Undistributed net investment income | 2,197,778 | |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | 31,137,532 | |

Net unrealized appreciation (depreciation) on investments | 331,926,394 | |

Net Assets, for 7,351,932 shares outstanding | $ 948,155,758 | |

Net Asset Value, offering price and redemption price per share ($948,155,758 ÷ 7,351,932 shares) | $ 128.97 | |

Statement of Operations

| Year ended February 28, 2015 | |

|

|

|

Investment Income |

|

|

Dividends |

| $ 9,670,003 |

Special dividends |

| 4,780,825 |

Interest |

| 11 |

Income from Fidelity Central Funds (including $36,837 from security lending) |

| 44,617 |

Total income |

| 14,495,456 |

|

|

|

Expenses | ||

Management fee | $ 4,713,020 | |

Transfer agent fees | 1,664,290 | |

Accounting and security lending fees | 292,963 | |

Custodian fees and expenses | 15,841 | |

Independent trustees' compensation | 17,126 | |

Registration fees | 38,764 | |

Audit | 39,342 | |

Legal | 6,278 | |

Interest | 2,056 | |

Miscellaneous | 11,562 | |

Total expenses before reductions | 6,801,242 | |

Expense reductions | (1,618) | 6,799,624 |

Net investment income (loss) | 7,695,832 | |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | ||

Investment securities: |

|

|

Unaffiliated issuers | 50,298,719 | |

Foreign currency transactions | (5,045) | |

Total net realized gain (loss) |

| 50,293,674 |

Change in net unrealized appreciation (depreciation) on investment securities | 37,285,780 | |

Net gain (loss) | 87,579,454 | |

Net increase (decrease) in net assets resulting from operations | $ 95,275,286 | |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Changes in Net Assets

| Year ended | Year ended |

Increase (Decrease) in Net Assets |

|

|

Operations |

|

|

Net investment income (loss) | $ 7,695,832 | $ 5,553,635 |

Net realized gain (loss) | 50,293,674 | 82,268,583 |

Change in net unrealized appreciation (depreciation) | 37,285,780 | 174,135,772 |

Net increase (decrease) in net assets resulting from operations | 95,275,286 | 261,957,990 |

Distributions to shareholders from net investment income | (6,773,084) | (4,764,402) |

Distributions to shareholders from net realized gain | (49,828,078) | (42,855,160) |

Total distributions | (56,601,162) | (47,619,562) |

Share transactions | 202,060,866 | 401,810,559 |

Reinvestment of distributions | 54,381,038 | 45,690,950 |

Cost of shares redeemed | (370,380,329) | (245,341,421) |

Net increase (decrease) in net assets resulting from share transactions | (113,938,425) | 202,160,088 |

Redemption fees | 26,928 | 35,338 |

Total increase (decrease) in net assets | (75,237,373) | 416,533,854 |

|

|

|

Net Assets | ||

Beginning of period | 1,023,393,131 | 606,859,277 |

End of period (including undistributed net investment income of $2,197,778 and undistributed net investment income of $1,569,587, respectively) | $ 948,155,758 | $ 1,023,393,131 |

Other Information Shares | ||

Sold | 1,668,989 | 3,564,948 |

Issued in reinvestment of distributions | 477,347 | 390,076 |

Redeemed | (3,145,035) | (2,219,786) |

Net increase (decrease) | (998,699) | 1,735,238 |

Financial Highlights

Years ended February 28, | 2015 | 2014 | 2013 | 2012 G | 2011 |

Selected Per-Share Data |

|

|

|

|

|

Net asset value, beginning of period | $ 122.55 | $ 91.73 | $ 86.02 | $ 78.21 | $ 62.05 |

Income from Investment Operations |

|

|

|

|

|

Net investment income (loss) B | 1.06 J | .77 | 1.17 E | .56 | .42 |

Net realized and unrealized gain (loss) | 13.14 | 36.34 | 5.94 | 7.87 | 16.17 |

Total from investment operations | 14.20 | 37.11 | 7.11 | 8.43 | 16.59 |

Distributions from net investment income | (.97) | (.64) | (1.21) | (.51) | (.43) |

Distributions from net realized gain | (6.81) | (5.65) | (.19) | (.12) | - |

Total distributions | (7.78) | (6.29) | (1.40) | (.62) I | (.43) |

Redemption fees added to paid in capital B, H | - | - | - | - | - |

Net asset value, end of period | $ 128.97 | $ 122.55 | $ 91.73 | $ 86.02 | $ 78.21 |

Total ReturnA | 12.53% | 40.85% | 8.37% | 10.87% | 26.79% |

Ratios to Average Net AssetsC, F |

|

|

|

|

|

Expenses before reductions | .79% | .81% | .84% | .86% | .88% |

Expenses net of fee waivers, if any | .79% | .81% | .84% | .86% | .88% |

Expenses net of all reductions | .79% | .81% | .83% | .86% | .88% |

Net investment income (loss) | .90% J | .70% | 1.39% E | .72% | .62% |

Supplemental Data |

|

|

|

|

|

Net assets, end of period (000 omitted) | $ 948,156 | $ 1,023,393 | $ 606,859 | $ 681,154 | $ 677,961 |

Portfolio turnover rateD | 20% | 48% | 56% | 56% | 43% |

ATotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown. BCalculated based on average shares outstanding during the period. CFees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. DAmount does not include the portfolio activity of any underlying Fidelity Central Funds. EInvestment income per share reflects a large, non-recurring dividend which amounted to $.34 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been .99%. FExpense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund. GFor the year ended February 29. HAmount represents less than $.01 per share. ITotal distributions of $.62 per share is comprised of distributions from net investment income of $.508 and distributions from net realized gain of $.115 per share. JInvestment income per share reflects a large, non-recurring dividend which amounted to $.66 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been .34%. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Environment and Alternative Energy Portfolio

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended February 28, 2015 | Past 1 | Past 5 | Past 10 |

Environment and Alternative Energy Portfolio A | 2.19% | 10.56% | 6.17% |

A Prior to July 1, 2010, Environment and Alternative Energy Portfolio was named Environmental Portfolio, and the fund operated under certain different investment policies and compared its performance to a different additional index. The fund's historical performance may not represent its current investment policies.

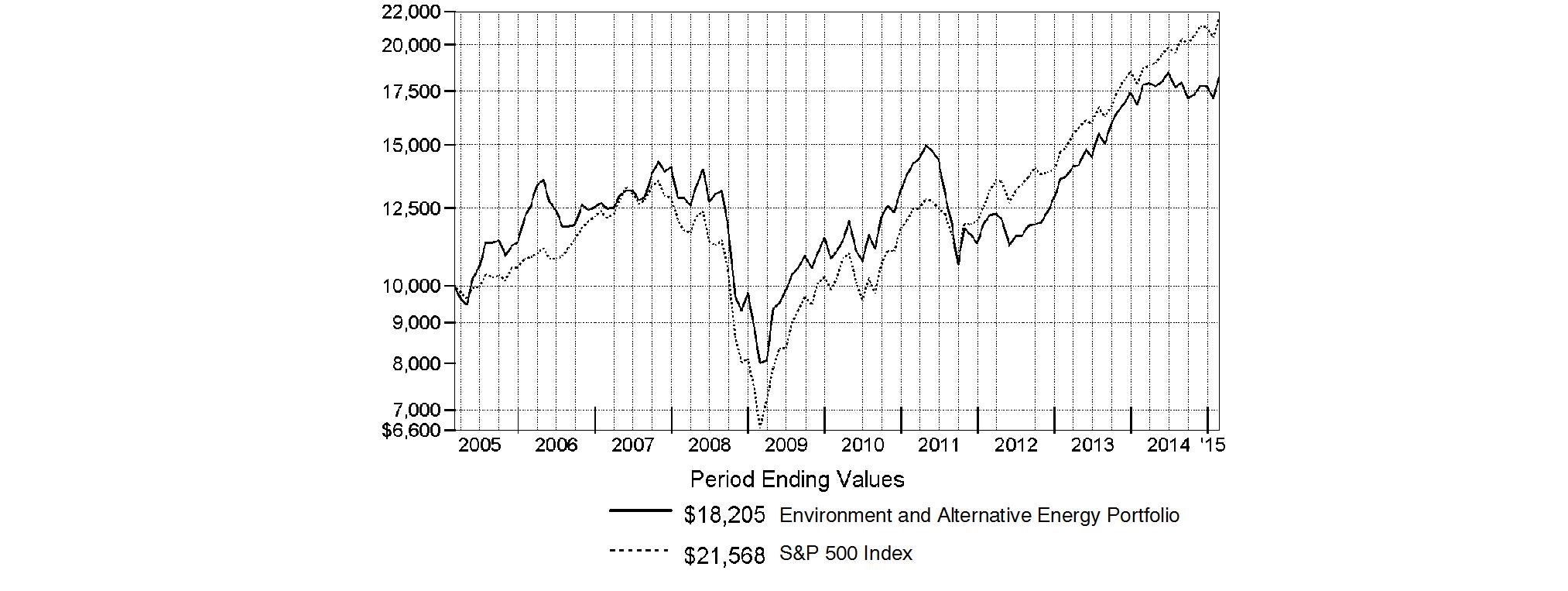

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Environment and Alternative Energy Portfolio on February 28, 2005. The chart shows how the value of your investment would have changed, and also shows how the S&P 500 Index performed over the same period.

Annual Report

Environment and Alternative Energy Portfolio

Management's Discussion of Fund Performance

Market Recap: The U.S. stock market closed near its all-time high for the 12 months ending February 28, 2015, supported by low interest rates and the relative strength of the U.S. economy and dollar. The large-cap S&P 500® Index returned 15.51%. Growth stocks in the index outperformed value-oriented names. The tech-heavy Nasdaq Composite Index® rose 16.58%, while the small-cap Russell 2000® Index advanced 5.63%, rallying from early-period weakness amid growth and valuation worries. Among the 10 major market sectors tracked by MSCI U.S. IMI 25-50 classifications, most notched a double-digit gain, led by health care (+24%), consumer staples (+21%), information technology (+20%) and utilities (+15%). Conversely, energy (-9%) was the only sector to lose ground, reflecting a sharp drop in crude prices beginning midyear and attributed to weaker global demand and a U.S. supply boom. Volatility spiked to a three-year high in October amid concerns about economic growth and Ebola, as well as unrest in Syria, Iraq and Ukraine. Nevertheless, the S&P 500® finished the period well above its mid-October nadir, bolstered by the relative economic strength of the U.S., which marked a six-year low in its unemployment rate, and consumer confidence that declined only slightly from its 11-year high reached in January.

Comments from Kevin Walenta, who became Portfolio Manager of Environment and Alternative Energy Portfolio on November 1, 2014: For the year, the fund returned 2.19%, lagging the 7.10% gain of its benchmark, the FTSE® Environmental Opportunities & Alternative Energy Index, and the broad-based S&P 500®. The steep decline in oil prices this past year hurt demand for alternative energy and energy-efficient products. However, some segments, such as environmental & facility services, benefited as lower energy costs reduced their operational or input costs. An average overweighting in several companies adversely affected by falling energy prices hurt performance versus the benchmark. The chief disappointment here was Denmark-based wind turbine supplier Vestas Wind Systems. Elsewhere, an out-of-index stake in Austria-based LED and lighting component maker Zumtobel Group detracted, as weak economic growth in Europe pressured demand for its products. The surging U.S. dollar further hindered these and other foreign holdings, hampering the fund's relative performance. By contrast, the fund benefited from owning U.S.-based Covanta Holding, an environmental & facility services company with highly predictable and recurring revenues that attracted investors. All of the stocks mentioned were eliminated from the portfolio before period end.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Environment and Alternative Energy Portfolio

Investment Changes (Unaudited)

Top Ten Stocks as of February 28, 2015 | ||

| % of fund's | % of fund's net assets |

Honeywell International, Inc. | 10.9 | 0.0 |

Praxair, Inc. | 7.4 | 0.0 |

Deere & Co. | 6.4 | 0.0 |

Delphi Automotive PLC | 6.3 | 0.0 |

Cummins, Inc. | 5.0 | 0.0 |

3M Co. | 4.8 | 0.0 |

Tenneco, Inc. | 4.6 | 0.0 |

Parker Hannifin Corp. | 4.3 | 0.0 |

Rockwell Automation, Inc. | 4.1 | 0.0 |

A.O. Smith Corp. | 4.0 | 0.0 |

| 57.8 | |

Top Industries (% of fund's net assets) | |||

As of February 28, 2015 | |||

| Energy Efficiency | 49.5% |

|

| Pollution Control | 10.6% |

|

| Water Infrastructure & Technologies | 10.5% |

|

| Environmental Support Services | 9.1% |

|

| Food Agriculture & Forestry | 7.8% |

|

| All Others* | 12.5% |

|

As of August 31, 2014 | |||

| Renewable & Alternative Energy | 84.5% |

|

| Energy Efficiency | 5.2% |

|

| Environmental Support Services | 4.7% |

|

| All Others* | 5.6% |

|

* Includes short-term investments and net other assets (liabilities). |

Annual Report

Environment and Alternative Energy Portfolio

Investments February 28, 2015

Showing Percentage of Net Assets

Common Stocks - 95.9% | |||

Shares | Value | ||

Energy Efficiency - 49.5% | |||

Buildings Energy Efficiency - 7.1% | |||

A.O. Smith Corp. | 55,800 | $ 3,517,074 | |

Johnson Controls, Inc. | 2,800 | 142,268 | |

Lennox International, Inc. | 24,900 | 2,596,074 | |

TOTAL BUILDINGS ENERGY EFFICIENCY | 6,255,416 | ||

Diversified Energy Efficiency - 13.8% | |||

Honeywell International, Inc. | 94,600 | 9,722,988 | |

Linear Technology Corp. | 52,900 | 2,548,987 | |

TOTAL DIVERSIFIED ENERGY EFFICIENCY | 12,271,975 | ||

Industrial Energy Efficiency - 17.1% | |||

Emerson Electric Co. | 10,900 | 631,328 | |

EnerSys | 49,300 | 3,219,290 | |

Praxair, Inc. | 51,400 | 6,574,060 | |

Rockwell Automation, Inc. | 31,100 | 3,639,944 | |

Rogers Corp. (a) | 13,400 | 1,048,952 | |

TOTAL INDUSTRIAL ENERGY EFFICIENCY | 15,113,574 | ||

Transport Energy Efficiency - 11.5% | |||

BorgWarner, Inc. | 36,500 | 2,243,290 | |

Delphi Automotive PLC | 70,900 | 5,589,756 | |

Innospec, Inc. | 53,800 | 2,376,346 | |

TOTAL TRANSPORT ENERGY EFFICIENCY | 10,209,392 | ||

TOTAL ENERGY EFFICIENCY | 43,850,357 | ||

Environmental Support Services - 9.1% | |||

Diversified Environmental - 9.1% | |||

3M Co. | 25,100 | 4,233,115 | |

Parker Hannifin Corp. | 31,200 | 3,827,928 | |

TOTAL DIVERSIFIED ENVIRONMENTAL | 8,061,043 | ||

Food Agriculture & Forestry - 7.8% | |||

Logistics, Food Safety and Packaging - 0.2% | |||

Bunge Ltd. | 2,400 | 196,272 | |

Sustainable and Efficient Agriculture - 6.4% | |||

Deere & Co. | 62,500 | 5,662,500 | |

| |||

Shares | Value | ||

Sustainable Forestry and Plantations - 1.2% | |||

Potlatch Corp. | 27,100 | $ 1,082,103 | |

TOTAL FOOD AGRICULTURE & FORESTRY | 6,940,875 | ||

Pollution Control - 10.6% | |||

Environmental Testing and Gas Sensing - 1.0% | |||

Thermo Fisher Scientific, Inc. | 6,700 | 871,000 | |

Pollution Control Solutions - 9.6% | |||

Cummins, Inc. | 31,200 | 4,437,576 | |

Tenneco, Inc. (a) | 70,000 | 4,076,800 | |

TOTAL POLLUTION CONTROL SOLUTIONS | 8,514,376 | ||

TOTAL POLLUTION CONTROL | 9,385,376 | ||

Renewable & Alternative Energy - 6.9% | |||

Renewable Energy Developers and Independent Power Producers - 6.7% | |||

Enel SpA | 140,071 | 645,482 | |

Energias de Portugal SA | 116,423 | 459,378 | |

Fortum Corp. | 18,500 | 421,501 | |

Iberdrola SA (d) | 487,318 | 3,330,350 | |

IDACORP, Inc. | 8,500 | 532,270 | |

Portland General Electric Co. | 15,800 | 589,182 | |

TOTAL RENEWABLE ENERGY DEVELOPERS AND INDEPENDENT POWER PRODUCERS | 5,978,163 | ||

Solar Energy Generation Equipment - 0.2% | |||

Canadian Solar, Inc. (a) | 6,000 | 177,750 | |

TOTAL RENEWABLE & ALTERNATIVE ENERGY | 6,155,913 | ||

Waste Management & Technologies - 1.5% | |||

Recycling and Value Added Waste Processing - 1.5% | |||

Copart, Inc. (a) | 34,800 | 1,302,216 | |

Water Infrastructure & Technologies - 10.5% | |||

Diversified Water Infrastructure and Technology - 2.3% | |||

Danaher Corp. | 22,900 | 1,998,712 | |

Water Infrastructure - 7.7% | |||

Roper Industries, Inc. | 19,700 | 3,301,129 | |

Valmont Industries, Inc. (d) | 28,100 | 3,502,665 | |

TOTAL WATER INFRASTRUCTURE | 6,803,794 | ||

Water Treatment Equipment - 0.5% | |||

Ecolab, Inc. | 4,000 | 462,160 | |

TOTAL WATER INFRASTRUCTURE & TECHNOLOGIES | 9,264,666 | ||

TOTAL COMMON STOCKS (Cost $79,454,288) |

| ||

Cash Equivalents - 10.4% | |||

Shares | Value | ||

Fidelity Cash Central Fund, 0.13% (b) | 3,435,080 | $ 3,435,080 | |

Fidelity Securities Lending Cash Central Fund, 0.13% (b)(c) | 5,745,275 | 5,745,275 | |

TOTAL CASH EQUIVALENTS (Cost $9,180,355) |

| ||

TOTAL INVESTMENT PORTFOLIO - 106.3% (Cost $88,634,643) | 94,140,801 |

NET OTHER ASSETS (LIABILITIES) - (6.3)% | (5,568,126) | ||

NET ASSETS - 100% | $ 88,572,675 | ||

Legend |

(a) Non-income producing |

(b) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

(c) Investment made with cash collateral received from securities on loan. |

(d) Security or a portion of the security is on loan at period end. |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned |

Fidelity Cash Central Fund | $ 2,803 |

Fidelity Securities Lending Cash Central Fund | 93,243 |

Total | $ 96,046 |

Other Information |

All investments are categorized as Level 1 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements. |

Distribution of investments by country or territory of incorporation, as a percentage of total net assets, is as follows (Unaudited): |

United States of America | 87.9% |

Bailiwick of Jersey | 6.3% |

Spain | 3.7% |

Others (Individually Less Than 1%) | 2.1% |

| 100.0% |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Environment and Alternative Energy Portfolio

Financial Statements

Statement of Assets and Liabilities

| February 28, 2015 | |

|

|

|

Assets | ||

Investment in securities, at value (including securities loaned of $5,563,147) - See accompanying schedule: Unaffiliated issuers (cost $79,454,288) | $ 84,960,446 |

|

Fidelity Central Funds (cost $9,180,355) | 9,180,355 |

|

Total Investments (cost $88,634,643) |

| $ 94,140,801 |

Cash |

| 90 |

Receivable for investments sold | 179,671 | |

Receivable for fund shares sold | 205,016 | |

Dividends receivable | 161,258 | |

Distributions receivable from Fidelity Central Funds | 2,635 | |

Prepaid expenses | 390 | |

Other receivables | 63 | |

Total assets | 94,689,924 | |

|

|

|

Liabilities | ||

Payable for investments purchased | $ 177,318 | |

Payable for fund shares redeemed | 100,573 | |

Accrued management fee | 39,922 | |

Other affiliated payables | 22,165 | |

Other payables and accrued expenses | 31,996 | |

Collateral on securities loaned, at value | 5,745,275 | |

Total liabilities | 6,117,249 | |

|

|

|

Net Assets | $ 88,572,675 | |

Net Assets consist of: |

| |

Paid in capital | $ 81,291,694 | |

Undistributed net investment income | 43,112 | |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | 1,733,007 | |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | 5,504,862 | |

Net Assets, for 4,229,970 shares outstanding | $ 88,572,675 | |

Net Asset Value, offering price and redemption price per share ($88,572,675 ÷ 4,229,970 shares) | $ 20.94 | |

Statement of Operations

| Year ended February 28, 2015 | |

|

|

|

Investment Income |

|

|

Dividends |

| $ 1,476,011 |

Interest |

| 8,148 |

Income from Fidelity Central Funds (including $93,243 from security lending) |

| 96,046 |

Total income |

| 1,580,205 |

|

|

|

Expenses | ||

Management fee | $ 531,982 | |

Transfer agent fees | 251,347 | |

Accounting and security lending fees | 38,675 | |

Custodian fees and expenses | 6,134 | |

Independent trustees' compensation | 1,935 | |

Registration fees | 21,046 | |

Audit | 38,811 | |

Legal | 662 | |

Miscellaneous | 1,250 | |

Total expenses before reductions | 891,842 | |

Expense reductions | (88) | 891,754 |

Net investment income (loss) | 688,451 | |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | ||

Investment securities: |

|

|

Unaffiliated issuers | 21,122,529 | |

Foreign currency transactions | (5,958) | |

Total net realized gain (loss) |

| 21,116,571 |

Change in net unrealized appreciation (depreciation) on: Investment securities | (20,168,561) | |

Assets and liabilities in foreign currencies | (1,350) | |

Total change in net unrealized appreciation (depreciation) |

| (20,169,911) |

Net gain (loss) | 946,660 | |

Net increase (decrease) in net assets resulting from operations | $ 1,635,111 | |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Changes in Net Assets

| Year ended | Year ended |

Increase (Decrease) in Net Assets |

|

|

Operations |

|

|

Net investment income (loss) | $ 688,451 | $ 589,401 |

Net realized gain (loss) | 21,116,571 | 5,379,320 |

Change in net unrealized appreciation (depreciation) | (20,169,911) | 15,625,963 |

Net increase (decrease) in net assets resulting from operations | 1,635,111 | 21,594,684 |

Distributions to shareholders from net investment income | (560,254) | (701,353) |

Distributions to shareholders from net realized gain | (10,675,033) | - |

Total distributions | (11,235,287) | (701,353) |

Share transactions | 24,999,440 | 41,113,758 |

Reinvestment of distributions | 10,697,844 | 672,436 |

Cost of shares redeemed | (40,397,558) | (41,831,872) |

Net increase (decrease) in net assets resulting from share transactions | (4,700,274) | (45,678) |

Redemption fees | 4,105 | 3,514 |

Total increase (decrease) in net assets | (14,296,345) | 20,851,167 |

|

|

|

Net Assets | ||

Beginning of period | 102,869,020 | 82,017,853 |

End of period (including undistributed net investment income of $43,112 and distributions in excess of net investment income of $105,356, respectively) | $ 88,572,675 | $ 102,869,020 |

Other Information Shares | ||

Sold | 1,107,316 | 1,933,973 |

Issued in reinvestment of distributions | 516,769 | 31,610 |

Redeemed | (1,798,133) | (2,087,703) |

Net increase (decrease) | (174,048) | (122,120) |

Financial Highlights

Years ended February 28, | 2015 | 2014 | 2013 | 2012 F | 2011 |

Selected Per-Share Data |

|

|

|

|

|

Net asset value, beginning of period | $ 23.36 | $ 18.12 | $ 16.32 | $ 19.19 | $ 14.94 |

Income from Investment Operations |

|

|

|

|

|

Net investment income (loss) B | .16 | .14 | .18 | .20 | .10 |

Net realized and unrealized gain (loss) | .31 | 5.27 | 1.77 | (2.88) | 4.22 |

Total from investment operations | .47 | 5.41 | 1.95 | (2.68) | 4.32 |

Distributions from net investment income | (.14) | (.17) | (.15) | (.19) | (.07) |

Distributions from net realized gain | (2.75) | - | - | - | - |

Total distributions | (2.89) | (.17) | (.15) | (.19) | (.07) |

Redemption fees added to paid in capital B, G | - | - | - | - | - |

Net asset value, end of period | $ 20.94 | $ 23.36 | $ 18.12 | $ 16.32 | $ 19.19 |

Total ReturnA | 2.19% | 29.97% | 12.02% | (13.92)% | 28.96% |

Ratios to Average Net AssetsC, E |

|

|

|

|

|

Expenses before reductions | .92% | .97% | .99% | 1.01% | 1.08% |

Expenses net of fee waivers, if any | .92% | .97% | .99% | 1.01% | 1.08% |

Expenses net of all reductions | .92% | .97% | .97% | 1.00% | 1.07% |

Net investment income (loss) | .71% | .70% | 1.10% | 1.15% | .59% |

Supplemental Data |

|

|

|

|

|

Net assets, end of period (000 omitted) | $ 88,573 | $ 102,869 | $ 82,018 | $ 77,943 | $ 96,864 |

Portfolio turnover rateD | 160% | 28% | 54% | 183% | 190% |

ATotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown. BCalculated based on average shares outstanding during the period. CFees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. DAmount does not include the portfolio activity of any underlying Fidelity Central Funds. EExpense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund. FFor the year ended February 29. GAmount represents less than $.01 per share. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Industrial Equipment Portfolio

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended February 28, 2015 | Past 1 | Past 5 | Past 10 |

Industrial Equipment Portfolio | 3.36% | 14.87% | 8.88% |

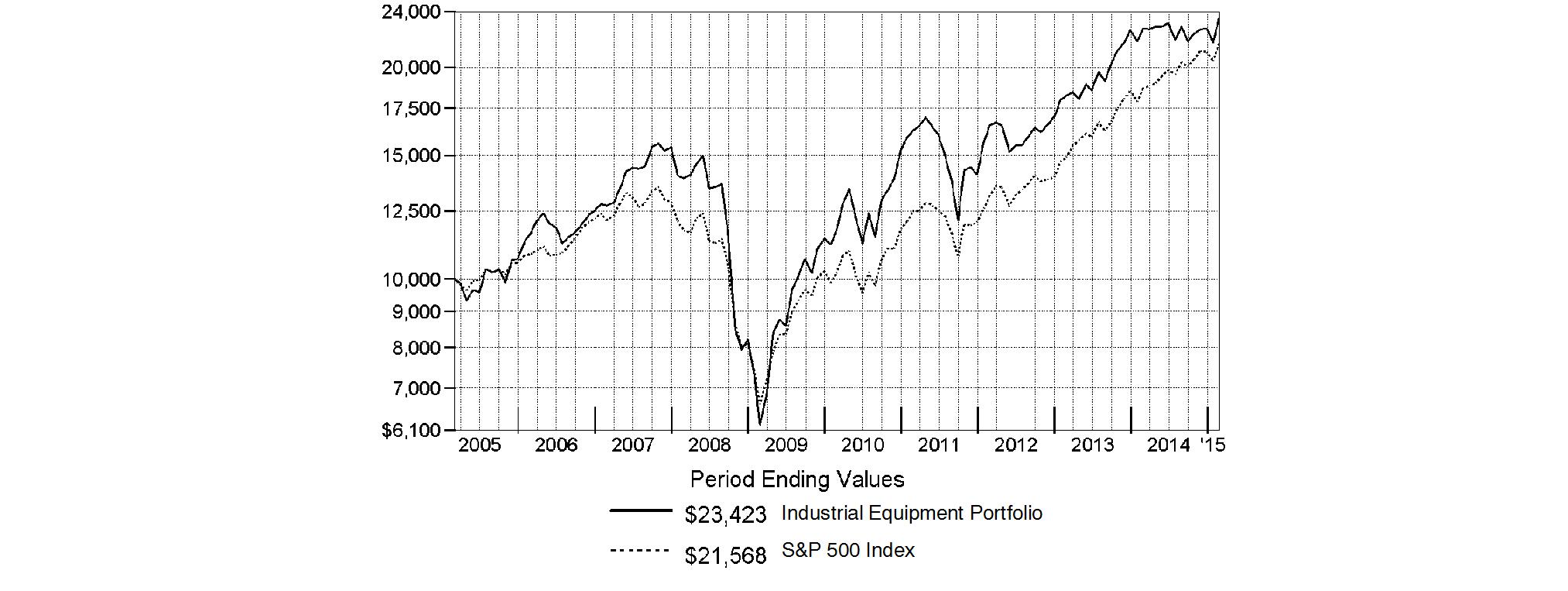

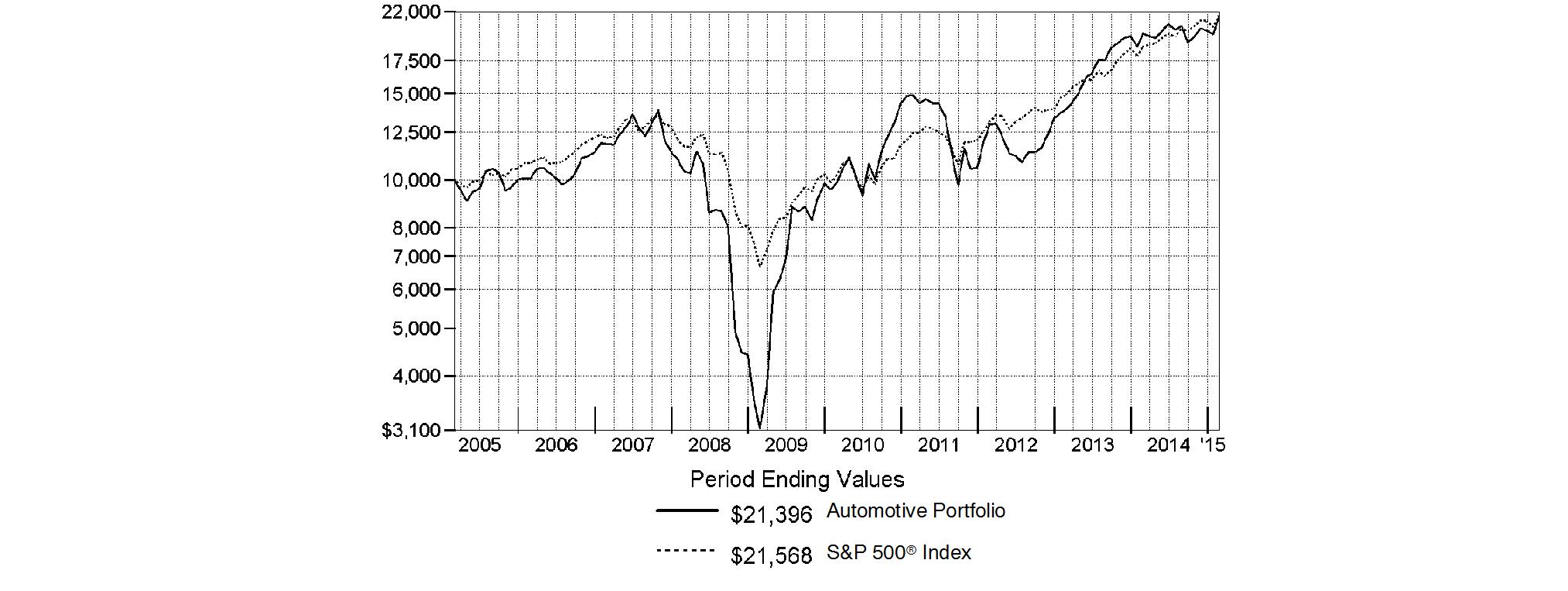

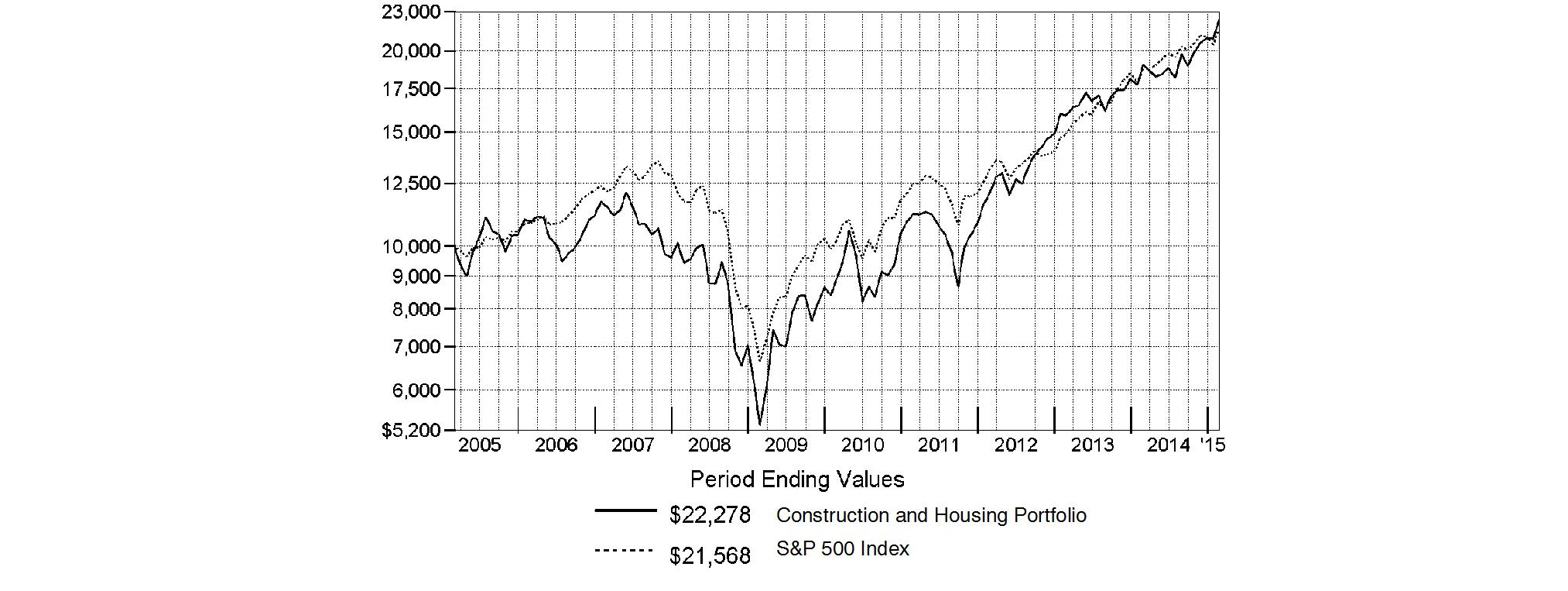

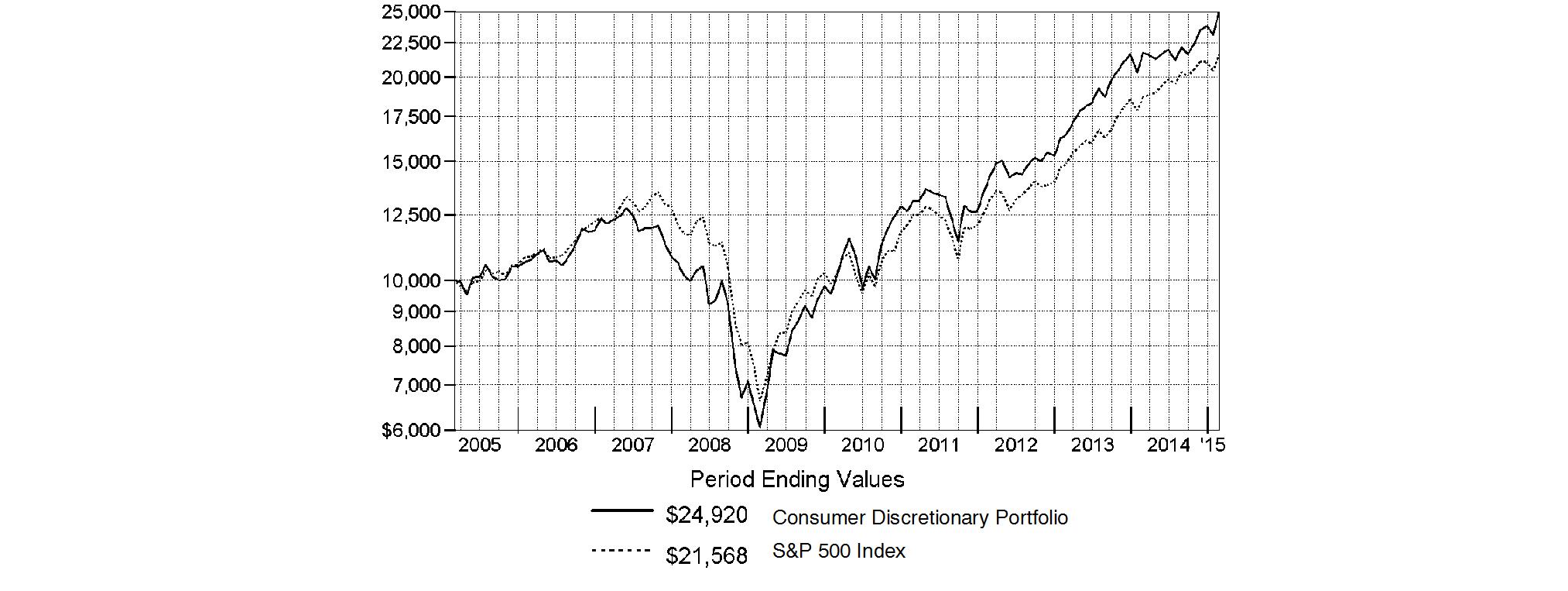

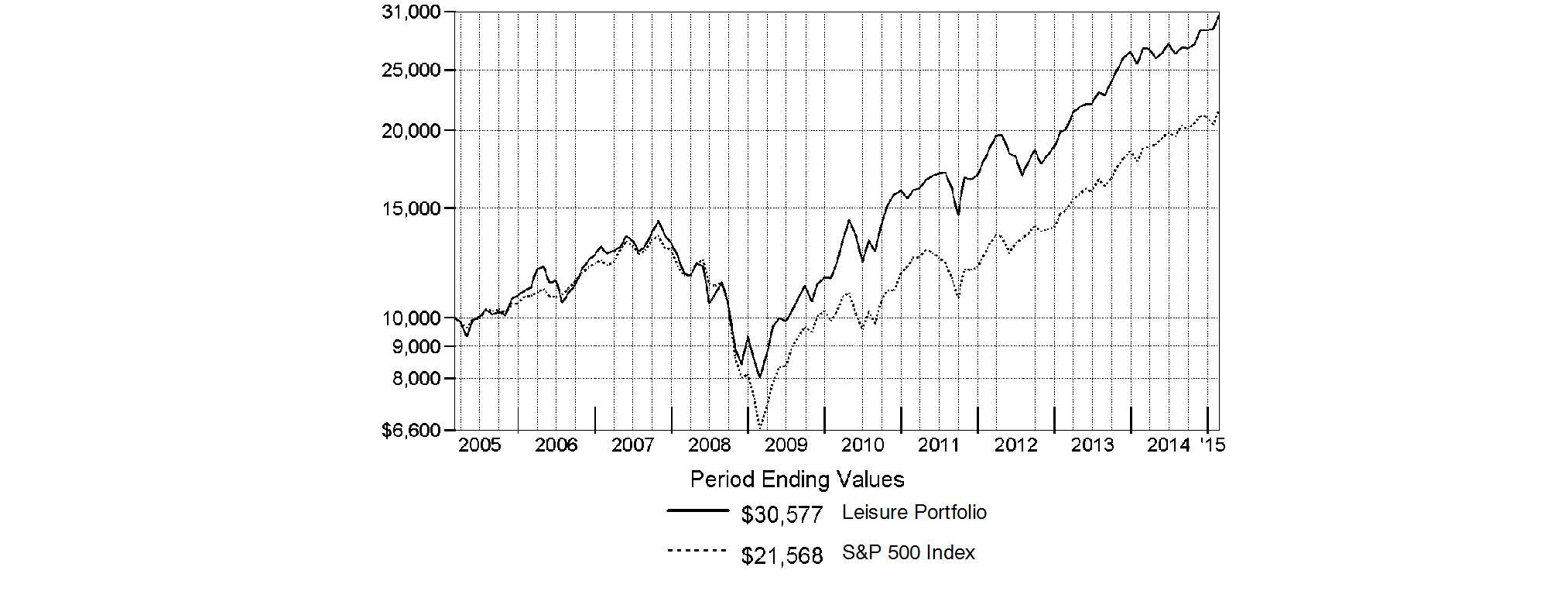

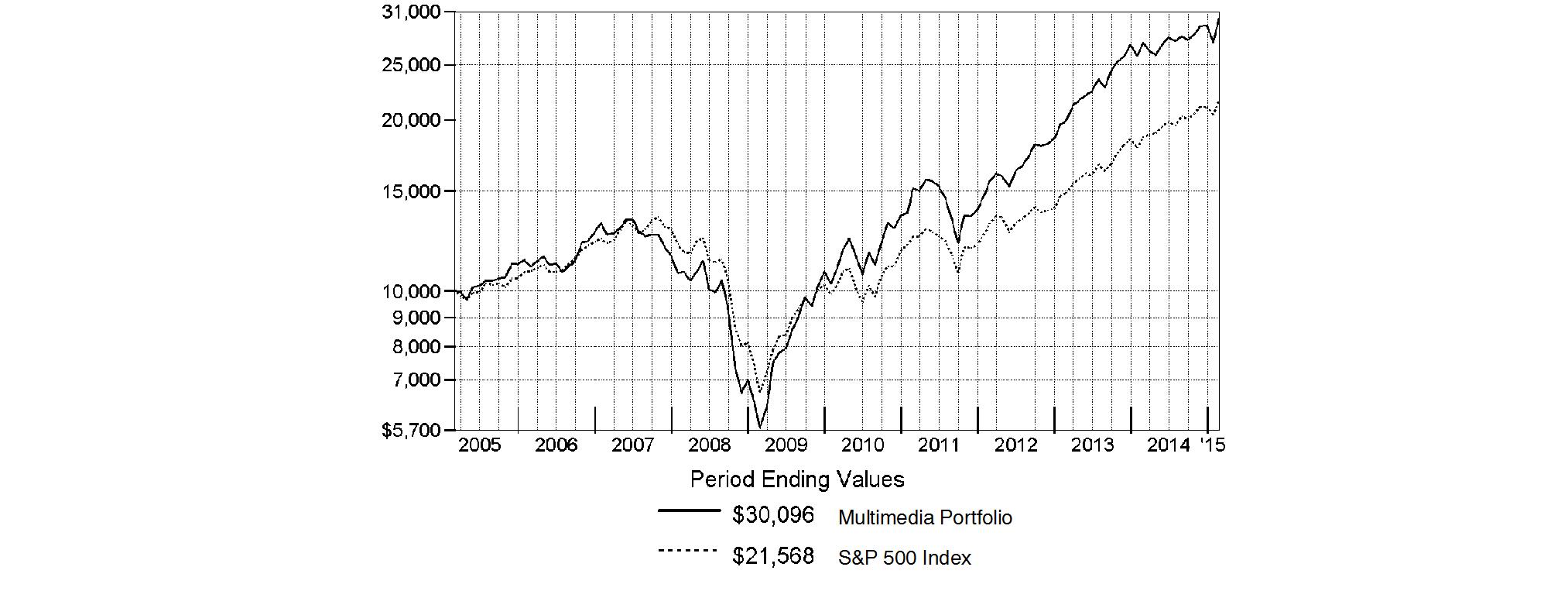

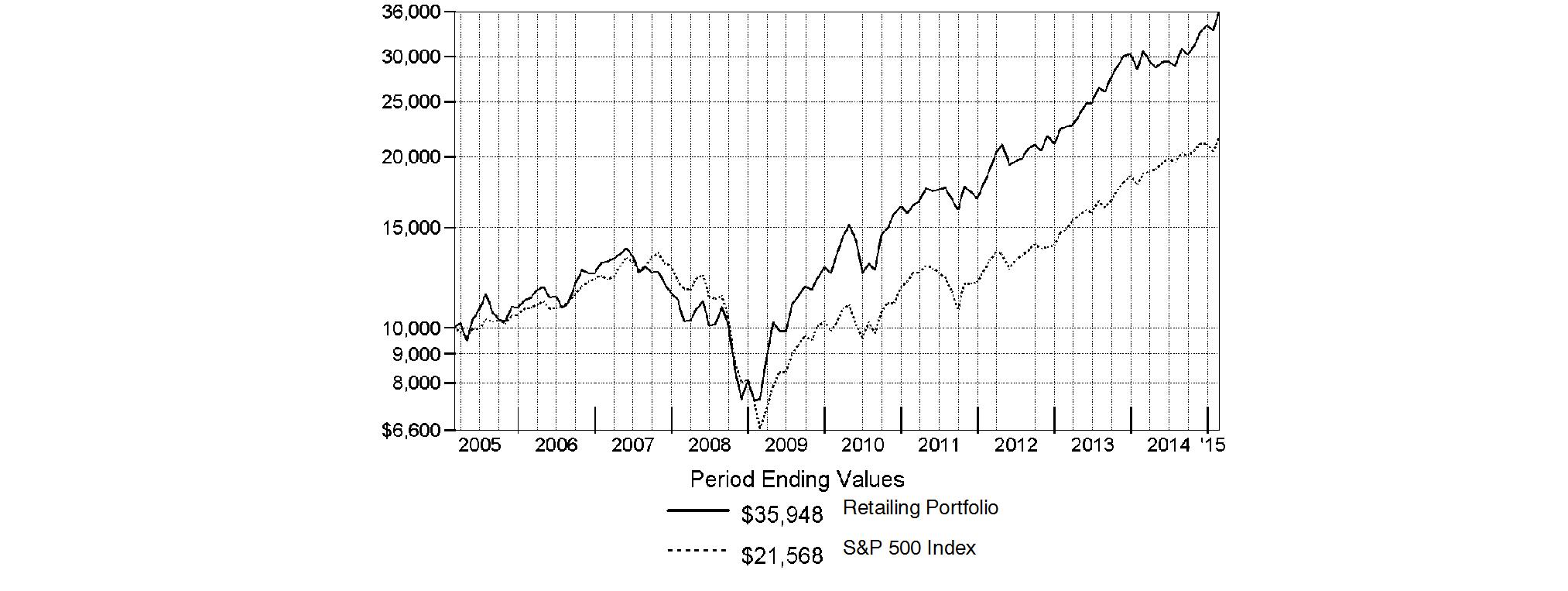

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Industrial Equipment Portfolio on February 28, 2005. The chart shows how the value of your investment would have changed, and also shows how the S&P 500 Index performed over the same period.

Annual Report

Industrial Equipment Portfolio

Management's Discussion of Fund Performance

Market Recap: The U.S. stock market closed near its all-time high for the 12 months ending February 28, 2015, supported by low interest rates and the relative strength of the U.S. economy and dollar. The large-cap S&P 500® Index returned 15.51%. Growth stocks in the index outperformed value-oriented names. The tech-heavy Nasdaq Composite Index® rose 16.58%, while the small-cap Russell 2000® Index advanced 5.63%, rallying from early-period weakness amid growth and valuation worries. Among the 10 major market sectors tracked by MSCI U.S. IMI 25-50 classifications, most notched a double-digit gain, led by health care (+24%), consumer staples (+21%), information technology (+20%) and utilities (+15%). Conversely, energy (-9%) was the only sector to lose ground, reflecting a sharp drop in crude prices beginning midyear and attributed to weaker global demand and a U.S. supply boom. Volatility spiked to a three-year high in October amid concerns about economic growth and Ebola, as well as unrest in Syria, Iraq and Ukraine. Nevertheless, the S&P 500® finished the period well above its mid-October nadir, bolstered by the relative economic strength of the U.S., which marked a six-year low in its unemployment rate, and consumer confidence that declined only slightly from its 11-year high reached in January.

Comments from Boris Shepov, Portfolio Manager of Industrial Equipment Portfolio: For the year, the fund returned 3.36%, trailing the 5.80% gain of the MSCI U.S. IMI Capital Goods 25-50 Index and also lagging the S&P 500®. Our MSCI benchmark muddled through most of the reporting period, as improvement in U.S. industrial end markets was offset by weakness in Europe, China and Brazil, and geopolitical risks in Iraq, Syria and Ukraine. Additionally, a significant decline in the commodities complex - crude oil, in particular - had a negative effect on the outlook for industrial end markets tied to oil and gas, as well as mining. Versus the MSCI index, construction machinery & heavy trucks was the group that had by far the most negative impact on performance. This was largely due to a sizable overweighting in Manitowoc, a crane and food-service equipment company and the fund's largest individual detractor. I more than doubled the fund's share count in this stock during the period. In industrial conglomerates, underweighting and ultimately selling strong-performing index name 3M detracted. Two other detractors were from construction & engineering, where an overweighting partially offset favorable stock picking. One of these was MasTec, which I sold in December. AECOM also detracted. Here, though, I thought the stock's decline was overdone. Consequently, I built AECOM into the fund's second-largest overweighting by period end. Conversely, a sizable overweighting in URS was a noteworthy contributor in the construction & engineering segment and the fund's top relative contributor. I liked the company's double-digit free-cash-flow yield and capital allocation possibilities, and in July URS announced plans to be acquired by AECOM, which lifted URS's stock. The deal closed in October. A non-index stake in business information provider Dun & Bradstreet also contributed, as did overweighting aircraft maker Boeing.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Industrial Equipment Portfolio

Investment Changes (Unaudited)

Top Ten Stocks as of February 28, 2015 | ||

| % of fund's | % of fund's net assets |

United Technologies Corp. | 9.6 | 9.7 |

Manitowoc Co., Inc. | 9.3 | 3.8 |

The Boeing Co. | 7.7 | 8.3 |

General Electric Co. | 6.1 | 5.9 |

Danaher Corp. | 5.3 | 5.0 |

AECOM Technology Corp. | 5.2 | 1.4 |

Honeywell International, Inc. | 4.8 | 5.5 |

Caterpillar, Inc. | 3.8 | 5.8 |

Global Brass & Copper Holdings, Inc. | 3.1 | 2.4 |

Cummins, Inc. | 3.0 | 2.5 |

| 57.9 | |

Top Industries (% of fund's net assets) | |||

As of February 28, 2015 | |||

| Machinery | 32.9% |

|

| Aerospace & Defense | 31.5% |

|

| Industrial Conglomerates | 11.4% |

|

| Construction & Engineering | 5.2% |

|

| Electrical Equipment | 4.1% |

|

| All Others* | 14.9% |

|

As of August 31, 2014 | |||

| Aerospace & Defense | 33.4% |

|

| Machinery | 26.7% |

|

| Industrial Conglomerates | 12.0% |

|

| Construction & Engineering | 6.0% |

|

| Electrical Equipment | 6.0% |

|

| All Others* | 15.9% |

|

* Includes short-term investments and net other assets (liabilities). |

Annual Report

Industrial Equipment Portfolio

Investments February 28, 2015

Showing Percentage of Net Assets

Common Stocks - 99.4% | |||

Shares | Value | ||

AEROSPACE & DEFENSE - 31.5% | |||

Aerospace & Defense - 31.5% | |||

Honeywell International, Inc. | 106,200 | $ 10,915,236 | |

Huntington Ingalls Industries, Inc. | 21,500 | 3,038,595 | |

L-3 Communications Holdings, Inc. | 46,000 | 5,953,780 | |

Northrop Grumman Corp. | 40,800 | 6,760,968 | |

Teledyne Technologies, Inc. (a) | 26,300 | 2,651,829 | |

Textron, Inc. | 10,000 | 443,100 | |

The Boeing Co. | 117,200 | 17,679,620 | |

Triumph Group, Inc. | 40,800 | 2,439,432 | |

United Technologies Corp. | 180,100 | 21,955,992 | |

| 71,838,552 | ||

AUTO COMPONENTS - 1.4% | |||

Auto Parts & Equipment - 1.4% | |||

Johnson Controls, Inc. | 63,700 | 3,236,597 | |

BUILDING PRODUCTS - 1.5% | |||

Building Products - 1.5% | |||

Lennox International, Inc. | 33,500 | 3,492,710 | |

CONSTRUCTION & ENGINEERING - 5.2% | |||

Construction & Engineering - 5.2% | |||

AECOM Technology Corp. (a) | 396,717 | 11,925,309 | |

DIVERSIFIED CONSUMER SERVICES - 2.1% | |||

Specialized Consumer Services - 2.1% | |||

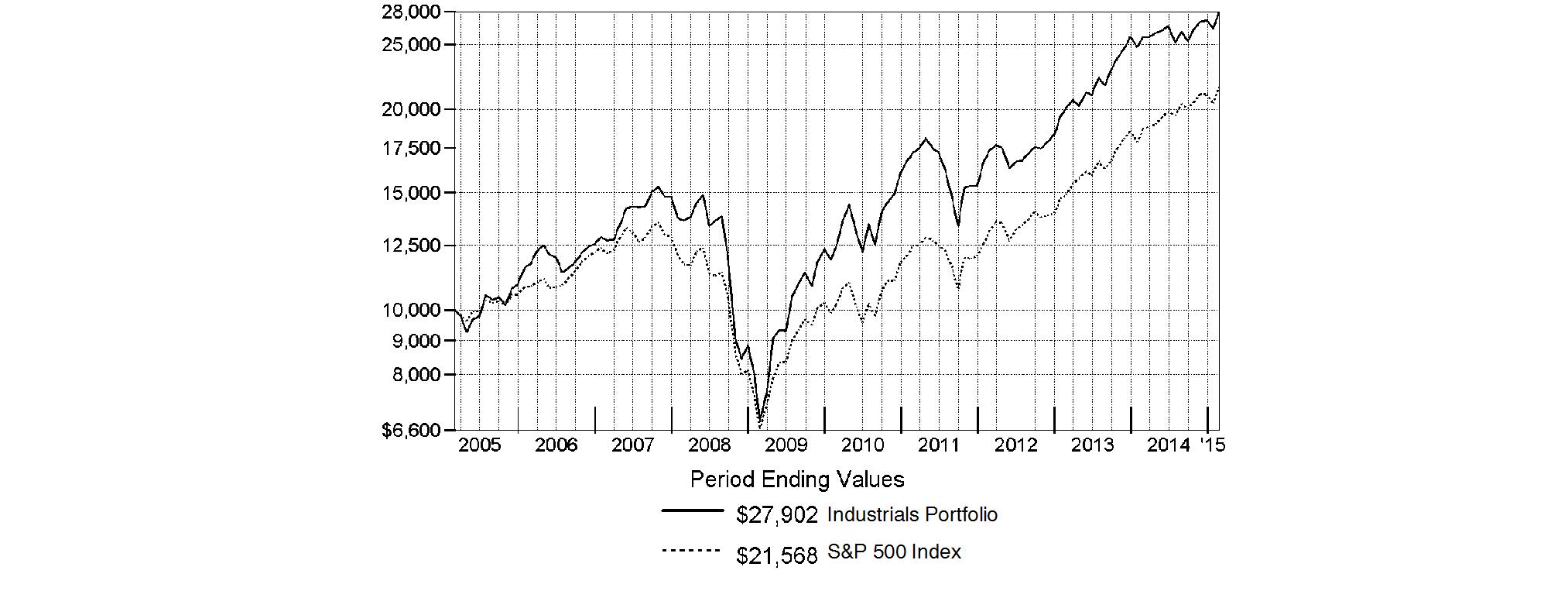

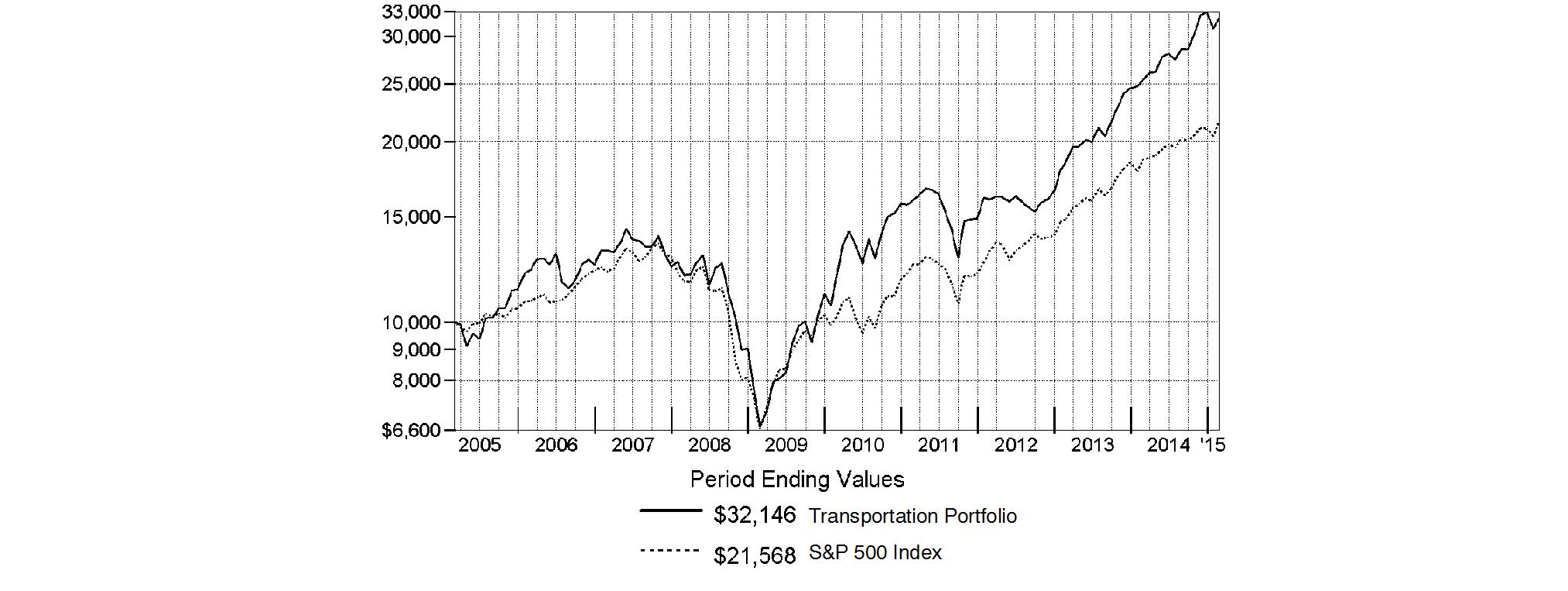

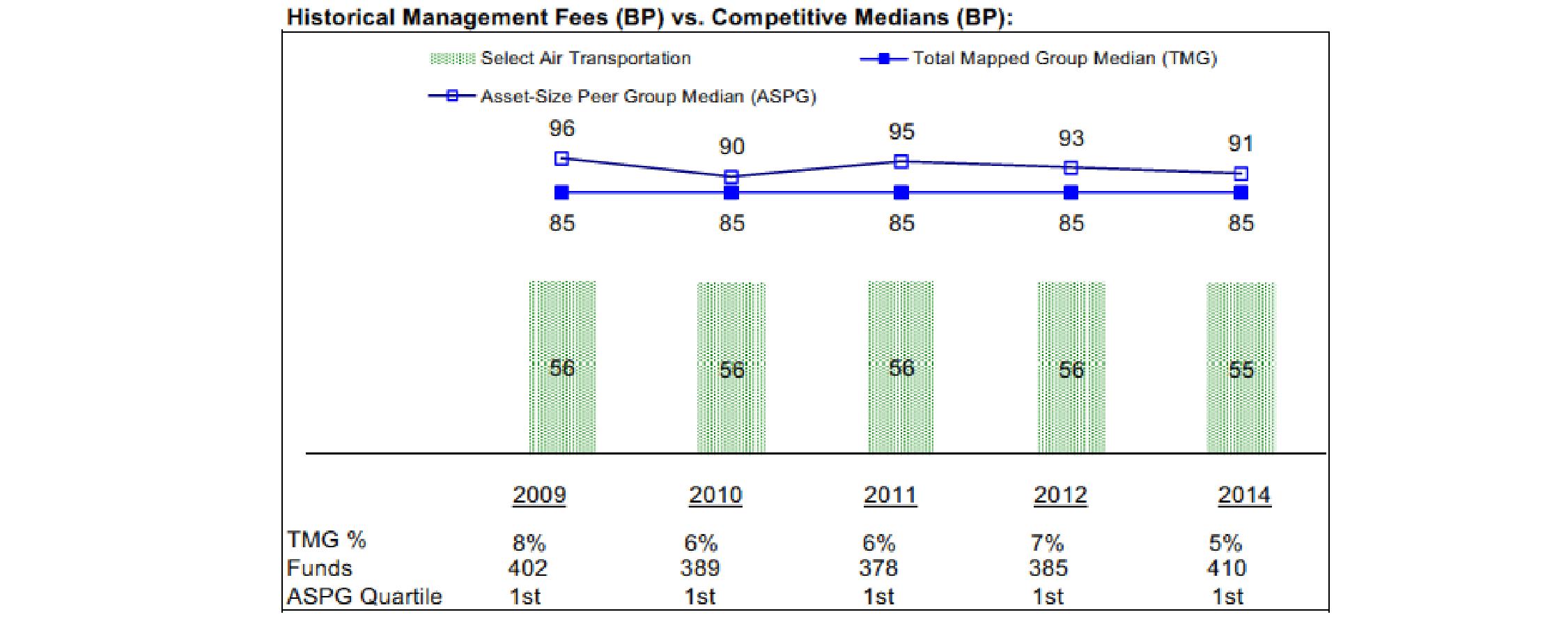

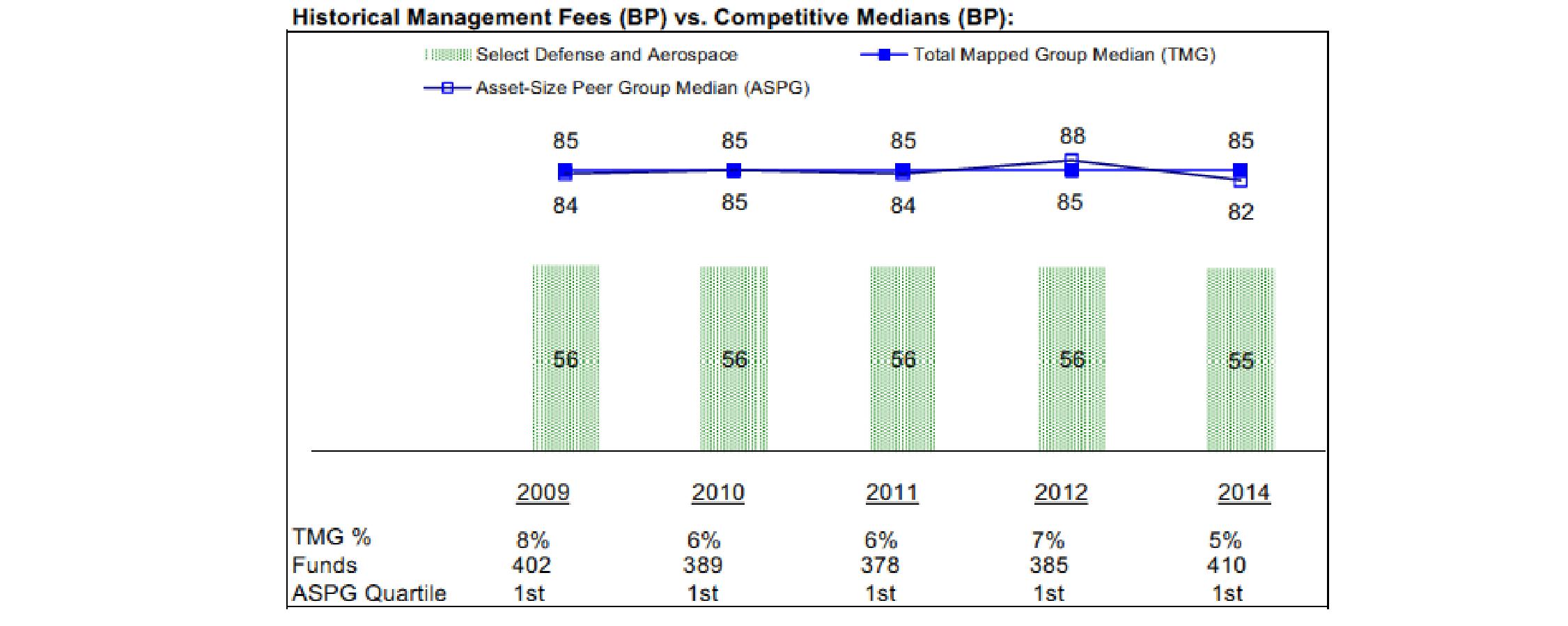

H&R Block, Inc. | 104,500 | 3,568,675 | |