Table of Contents

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under Rule14a-12 | |

| Fidelity Advisor Series I, Fidelity Advisor Series VII, Fidelity Advisor Series VIII, Fidelity Capital Trust, Fidelity Commonwealth Trust, Fidelity Commonwealth Trust II, Fidelity Concord Street Trust, Fidelity Contrafund, Fidelity Covington Trust, Fidelity Destiny Portfolios, Fidelity Devonshire Trust, Fidelity Financial Trust, Fidelity Hastings Street Trust, Fidelity Investment Trust, Fidelity Magellan Fund, Fidelity Mt. Vernon Street Trust, Fidelity Puritan Trust, Fidelity Securities Fund, Fidelity Select Portfolios, Fidelity Summer Street Trust, and Fidelity Trend Fund | ||

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11:

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total Fee Paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

IMPORTANT

Proxy Materials

PLEASE CAST YOUR VOTE NOW!

FIDELITY ADVISOR SERIES I

FIDELITY ADVISOR SERIES VII

FIDELITY ADVISOR SERIES VIII

FIDELITY CAPITAL TRUST

FIDELITY COMMONWEALTH TRUST

FIDELITY COMMONWEALTH TRUST II

FIDELITY CONCORD STREET TRUST

FIDELITY CONTRAFUND

FIDELITY COVINGTON TRUST

FIDELITY DESTINY PORTFOLIOS

FIDELITY DEVONSHIRE TRUST

FIDELITY FINANCIAL TRUST

FIDELITY HASTINGS STREET TRUST

FIDELITY INVESTMENT TRUST

FIDELITY MAGELLAN FUND

FIDELITY MT. VERNON STREET TRUST

FIDELITY PURITAN TRUST

FIDELITY SECURITIES FUND

FIDELITY SELECT PORTFOLIOS

FIDELITY SUMMER STREET TRUST

FIDELITY TREND FUND

Dear Shareholder:

A special meeting of shareholders of the Fidelity® funds mentioned above will be held on June 9, 2020. The purpose of the meeting is to provide you with the opportunity to vote on important proposals that affects the funds and your investment in them. As a shareholder, you have the opportunity to voice your opinion on the matters that affect your funds. This package contains information about the proposals and the materials to use when casting your vote.

Please read the enclosed materials and cast your vote on the proxy card(s). Please vote your shares promptly. Your vote is extremely important, no matter how large or small your holdings may be.

Each of the proposals has been carefully reviewed by the Board of Trustees. The Trustees, most of whom are not affiliated with Fidelity, are responsible for protecting your interests as a shareholder. The Trustees believe that four of these proposals are in the best interests of shareholders – the proposal to elect a Board of Trustees, the proposals to convert fundamental investment policies to non-fundamental for certain funds, and the proposal to modify the fundamental investment policy and concentration policy for Fidelity Advisor® Semiconductors Fund. They recommend that youvote for these proposals. They recommend that you voteagainst the proposals submitted by shareholders of certain funds.

The following Q&A is provided to assist you in understanding the proposals. Each of the proposals is described in greater detail in the enclosed proxy statement.

Voting is quick and easy. To cast your vote, you may:

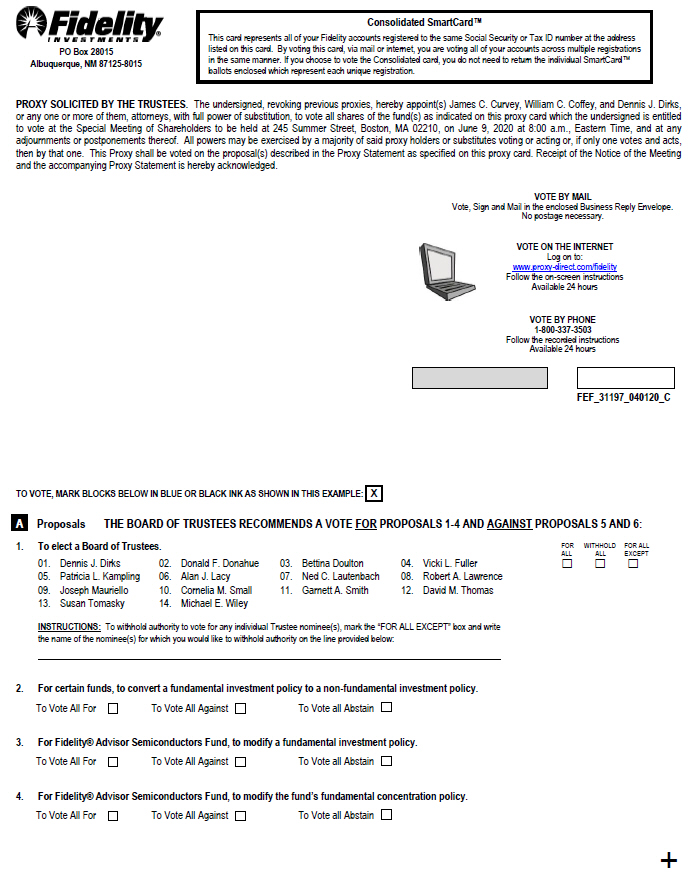

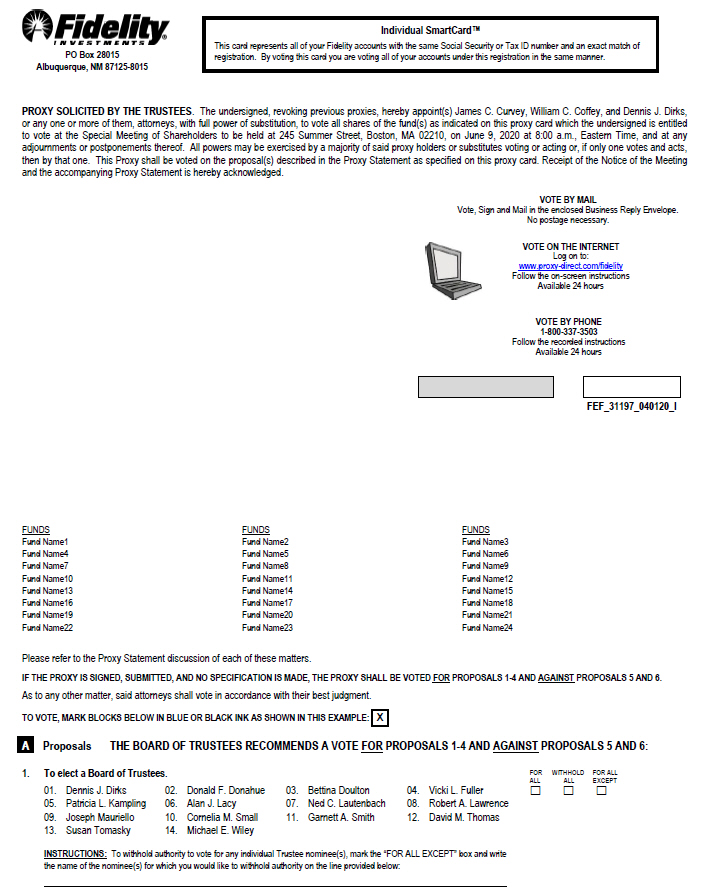

| • | Vote your shares by visiting the web site indicated on your proxy card(s), enter the control number found on the card(s) and follow the on-line instructions, |

OR

| • | Vote your shares by calling the toll-free number indicated on your proxy card(s), enter the control number found on the card(s) and follow the recorded instructions, |

OR

| • | If you have received a paper copy of the proxy card, vote your shares by completing the proxy card(s) and returning the signed card(s) in the postage-paid envelope. |

If you have any questions before you vote, please call Fidelity using the contact information applicable to your funds located in the table in the enclosed Q&A. We’ll be glad to help you get your vote in quickly. Thank you for your participation in this important initiative.

Sincerely,

James C. Curvey

Chairman

Table of Contents

Important information to help you understand and vote on the proposals

Please read the full text of the proxy statement. Below is a brief overview of the proposals to be voted upon. Your vote is important. We appreciate you placing your trust in Fidelity and look forward to helping you achieve your financial goals.

What proposals am I being asked to vote on?

You are being asked to vote on the following proposals:

| 1. | To elect a Board of Trustees. |

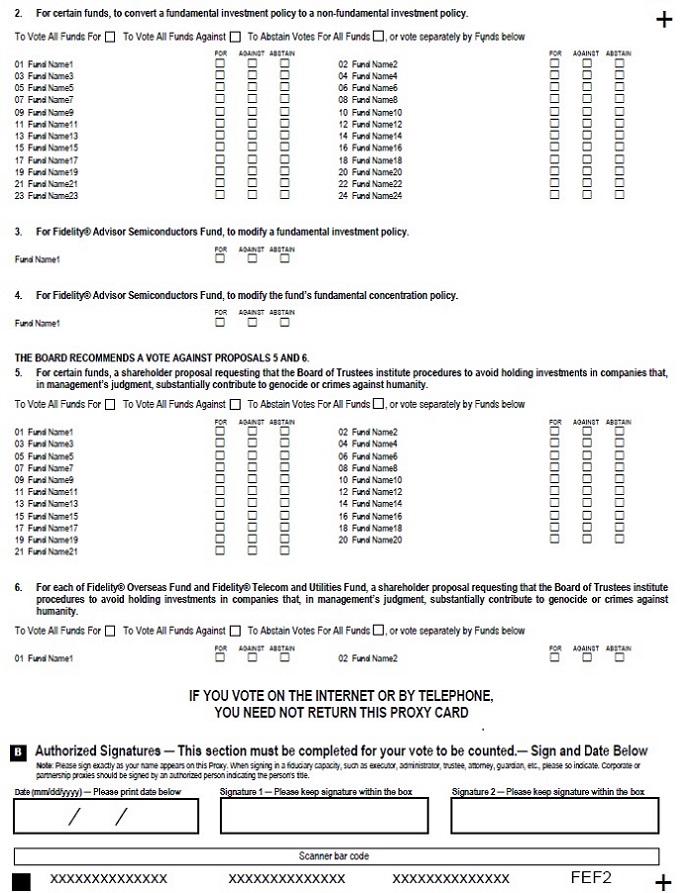

| 2. | For shareholders of certain funds, to convert a fundamental investment policy to non-fundamental. |

| 3. | For shareholders of Fidelity Advisor® Semiconductors Fund, to modify the fund’s fundamental investment policy. |

| 4. | For shareholders of Fidelity Advisor® Semiconductors Fund, to modify the fund’s fundamental concentration policy. |

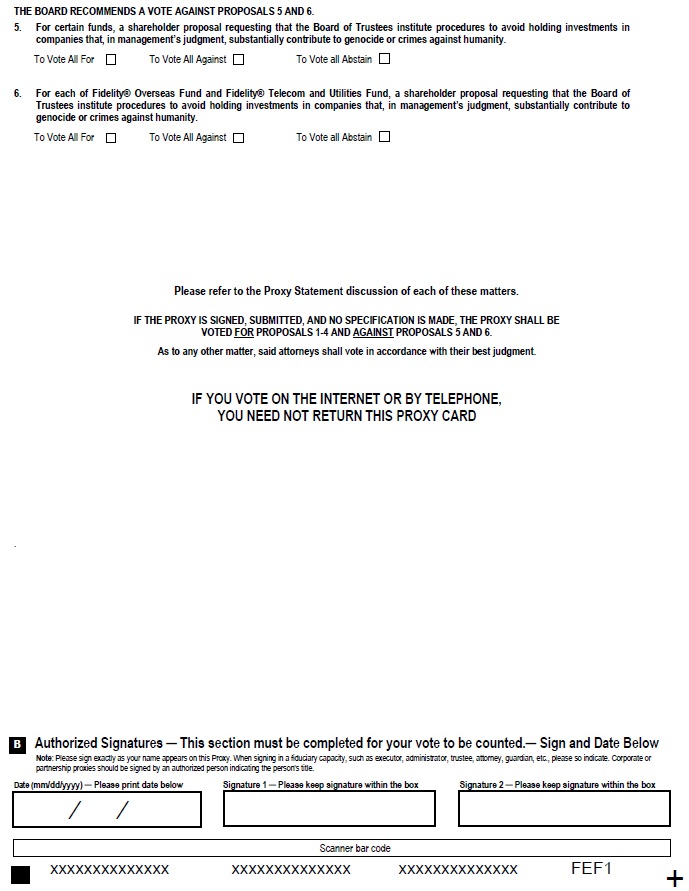

| 5. | For certain funds, a shareholder proposal requesting that the Board of Trustees institute procedures to avoid holding investments in companies that, in management’s judgment, substantially contribute to genocide or crimes against humanity. Certain shareholders of the above-referenced funds (for purposes of Proposal 5, each a “Fund”) have advised the Funds that they intend to present the shareholder proposal at the Meeting. For the reasons set forth after the proposal, the Board of Trustees recommends a vote “Against” the proposal. |

| 6. | For shareholders of Fidelity® Overseas Fund and Fidelity® Telecom and Utilities Fund, a shareholder proposal requesting that the Board of Trustees institute procedures to avoid holding investments in companies that, in management’s judgment, substantially contribute to genocide or crimes against humanity. Certain shareholders of Fidelity® Overseas Fund and Fidelity® Telecom and Utilities Fund have advised the Funds that they intend to present the shareholder proposal at the Meeting. For the reasons set forth after the proposal, the Board of Trustees recommends a vote “Against” the proposal. |

1. To elect a Board of Trustees.

What role does the Board play?

The Trustees serve as representatives of the funds’ shareholders. Members of the Board are fiduciaries and have an obligation to serve the best interests of shareholders, including consideration of policy changes. In addition, the Trustees review fund performance, oversee fund activities, and review contractual arrangements with companies that provide services to the funds.

The Board of Trustees has unanimously approved the proposal and recommends that you vote to approve it.

2. For shareholders of certain funds, to convert a fundamental investment policy to non-fundamental.

Why am I being asked to convert a fundamental investment policy to non-fundamental?

When a policy is fundamental, it requires both board and shareholder approval to change. A non-fundamental policy can be changed by board vote alone.

When a policy can only be changed with shareholder approval, it is difficult and costly for a fund to update and revise its policy, if needed, when market conditions change. Converting to non-fundamental provides greater flexibility to react to market changes in a timely and cost-effective manner.

Will the change from fundamental to non-fundamental change how the funds are managed?

No, there are no plans to change the way any fund is currently managed.

The Board of Trustees has unanimously approved the proposal and recommends that you vote to approve it.

3. For shareholders of Fidelity Advisor Semiconductors Fund, to modify the fund’s fundamental investment policy.

Why am I being asked to approve the modification of the fundamental investment policy?

Fidelity Advisor Semiconductors Fund currently has a fundamental investment policy of investing in companies engaged in the design, manufacture, or sale of electronic components (semiconductors, connectors, printed circuit boards and other components); equipment vendors to electronic component manufacturers; electronic component distributors; and electronic instruments and electronic systems vendors.

However, as the fund’s name suggests, it invests primarily in companies engaged the design manufacture, or sale of semiconductors and semiconductor equipment. Shareholder approval is required to modify the policy in order to reflect semiconductors instead of electronics. The change will not impact the way the fund is managed.

The Board of Trustees has unanimously approved the proposal and recommends that you vote to approve it.

Table of Contents

4. For shareholders of Fidelity Advisor Semiconductors Fund, to modify the fund’s fundamental concentration policy.

Why am I being asked to modify the fundamental concentration policy?

Fidelity Advisor Semiconductors Fund currently has a fundamental concentration policy that uses generic language. However, as the fund’s name suggests, the fund concentrates in semiconductors and semiconductor industries. Shareholder approval is required to modify the policy to replace the generic language with “semiconductors industries”. The change will not impact the way the fund is managed.

The Board of Trustees has unanimously approved the proposal and recommends that you vote to approve it.

General Questions on the Proxy

Who is Computershare Limited?

Computershare Limited is a third party proxy vendor that had been hired to call shareholders and record proxy votes. In order to hold a shareholder meeting, quorum must be reached. If quorum is not attained, the meeting may adjourn to a future date. The trust attempts to reach shareholders via multiple mailings to remind them to cast their vote. As the meeting approaches, phone calls may be made to clients who have not yet voted their shares so that the shareholder meeting does not have to be postponed.

Voting your shares immediately will help minimize additional solicitation expenses and prevent the need to make a call to you to solicit your vote.

How many votes am I entitled to cast?

As a shareholder, you are entitled to one vote for each dollar of net asset value you own of each of the funds on the record date. The record date is April 13, 2020.

How do I vote my shares?

You can vote your shares by visiting the web site indicated on your proxy card and following the on-line instructions. You may also vote by touch-tone telephone by calling the toll-free number printed on your proxy card(s) and following the recorded instructions. In addition, you may vote by completing and signing the enclosed proxy card(s) and mailing them in the enclosed postage-paid envelope. If you need any assistance, or have any questions regarding the proposals or how to vote your shares, please call Fidelity at the toll-free number on your proxy card or notice.

How do I sign the proxy card?

| Individual Accounts: | Shareholders should sign exactly as their names appear on the account registration shown on the card or form. | |

| Joint Accounts: | Either owner may sign, but the name of the person signing should conform exactly to a name shown in the registration. | |

| All Other Accounts: | The person signing must indicate his or her capacity. For example, a trustee for a trust or other entity should sign, “Ann B. Collins, Trustee.” | |

| 1.9898164.100 | EQ-PXL-0320 | |||

Table of Contents

Important Notice Regarding the Availability of Proxy Materials for the

Shareholder Meeting to be held on June 9, 2020

The Letter to Shareholders, Notice of Meeting, and Proxy Statement are available at www.proxy-direct.com/fidelity

FIDELITY ADVISOR SERIES I

FIDELITY ADVISOR SERIES VII

FIDELITY ADVISOR SERIES VIII

FIDELITY CAPITAL TRUST

FIDELITY COMMONWEALTH TRUST

FIDELITY COMMONWEALTH TRUST II

FIDELITY CONCORD STREET TRUST

FIDELITY CONTRAFUND

FIDELITY COVINGTON TRUST

FIDELITY DESTINY PORTFOLIOS

FIDELITY DEVONSHIRE TRUST

FIDELITY FINANCIAL TRUST

FIDELITY HASTINGS STREET TRUST

FIDELITY INVESTMENT TRUST

FIDELITY MAGELLAN FUND

FIDELITY MT. VERNON STREET TRUST

FIDELITY PURITAN TRUST

FIDELITY SECURITIES FUND

FIDELITY SELECT PORTFOLIOS

FIDELITY SUMMER STREET TRUST

FIDELITY TREND FUND

245 Summer Street, Boston, Massachusetts 02210

1-800-544-8544 (Retail funds and/or classes)

1-800-FIDELITY (Fidelity ETFs)

1-800-596-3222 (Advisor classes)

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To the Shareholders of the above trusts:

NOTICE IS HEREBY GIVEN that a Special Meeting of Shareholders (the Meeting) of the above-named trusts (the trusts) will be held at an office of the trusts, 245 Summer Street, Boston, Massachusetts 02210 (at the corner of Summer Street and Dorchester Avenue, next to Boston’s South Station) on June 9, 2020, at 8 a.m. Eastern Time (ET). Appendix A contains a list of the funds in the trusts (the funds).

The purpose of the Meeting is to consider and act upon the following proposals and to transact such other business as may properly come before the Meeting or any adjournments thereof.

| 1. | To elect a Board of Trustees. |

| 2. | For certain funds, to convert a fundamental investment policy to anon-fundamental investment policy. |

| 3. | For Fidelity Advisor® Semiconductors Fund, to modify a fundamental investment policy. |

| 4. | For Fidelity Advisor® Semiconductors Fund, to modify the fund’s fundamental concentration policy. |

| 5. | For certain funds, a shareholder proposal requesting that the Board of Trustees institute procedures to avoid holding investments in companies that, in management’s judgment, substantially contribute to genocide or crimes against humanity. |

| 6. | For each of Fidelity® Overseas Fund and Fidelity® Telecom and Utilities Fund, a shareholder proposal requesting that the Board of Trustees institute procedures to avoid holding investments in companies that, in management’s judgment, substantially contribute to genocide or crimes against humanity. |

The Board of Trustees has fixed the close of business on April 13, 2020, as the record date for the determination of the shareholders of each of the funds entitled to notice of, and to vote at, such Meeting and any adjournments thereof.

By order of the Board of Trustees,

CYNTHIA LO BESSETTE

Secretary

April 13, 2020

Table of Contents

Your vote is important – please vote your shares promptly.

Shareholders are invited to attend the Meeting in person. Admission to the Meeting will be on afirst-come,first-served basis and will require picture identification. Shareholders arriving after the start of the Meeting may be denied entry. Cameras, cell phones, recording equipment and other electronic devices will not be permitted. Fidelity reserves the right to inspect any persons or items prior to admission to the Meeting.

Any shareholder who does not expect to attend the Meeting is urged to vote using thetouch-tone telephone or internet voting instructions that follow or by indicating voting instructions on the enclosed proxy card, dating and signing it, and returning it in the envelope provided, which needs no postage if mailed in the United States. In order to avoid unnecessary expense, we ask your cooperation in responding promptly, no matter how large or small your holdings may be. If you wish to wait until the Meeting to vote your shares, you will need to request a paper ballot at the Meeting in order to do so.

INSTRUCTIONS FOR EXECUTING PROXY CARD

The following general rules for executing proxy cards may be of assistance to you and help avoid the time and expense involved in validating your vote if you fail to execute your proxy card properly.

| 1. | Individual Accounts: Your name should be signed exactly as it appears in the registration on the proxy card. |

| 2. | Joint Accounts: Either party may sign, but the name of the party signing should conform exactly to a name shown in the registration. |

| 3. | All other accounts should show the capacity of the individual signing. This can be shown either in the form of the account registration itself or by the individual executing the proxy card. For example: |

REGISTRATION | VALID SIGNATURE | |||||||

| A. | 1) | ABC Corp. | John Smith, Treasurer | |||||

| 2) | ABC Corp. | John Smith, Treasurer | ||||||

| c/o John Smith, Treasurer | ||||||||

| B. | 1) | ABC Corp. Profit Sharing Plan | Ann B. Collins, Trustee | |||||

| 2) | ABC Trust | Ann B. Collins, Trustee | ||||||

| 3) | Ann B. Collins, Trustee | Ann B. Collins, Trustee | ||||||

| u/t/d 12/28/78 | ||||||||

| C. | 1) | Anthony B. Craft, Cust. | Anthony B. Craft | |||||

| f/b/o Anthony B. Craft, Jr. | ||||||||

| UGMA | ||||||||

INSTRUCTIONS FOR VOTING BY TOUCH-TONE TELEPHONE OR THROUGH THE INTERNET

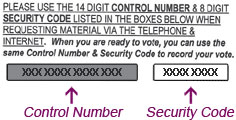

| 1. | Read the proxy statement, and have your proxy card or notice handy. |

| 2. | Call the toll-free number or visit the web site indicated on your proxy card or notice. |

| 3. | Enter the number found in either the box on the front of your proxy card or on the proposal page(s) of your notice. |

| 4. | Follow the recorded oron-line instructions to cast your vote. |

Table of Contents

PROXY STATEMENT

SPECIAL MEETING OF SHAREHOLDERS OF

FIDELITY ADVISOR SERIES I

FIDELITY ADVISOR SERIES VII

FIDELITY ADVISOR SERIES VIII

FIDELITY CAPITAL TRUST

FIDELITY COMMONWEALTH TRUST

FIDELITY COMMONWEALTH TRUST II

FIDELITY CONCORD STREET TRUST

FIDELITY CONTRAFUND

FIDELITY COVINGTON TRUST

FIDELITY DESTINY PORTFOLIOS

FIDELITY DEVONSHIRE TRUST

FIDELITY FINANCIAL TRUST

FIDELITY HASTINGS STREET TRUST

FIDELITY INVESTMENT TRUST

FIDELITY MAGELLAN FUND

FIDELITY MT. VERNON STREET TRUST

FIDELITY PURITAN TRUST

FIDELITY SECURITIES FUND

FIDELITY SELECT PORTFOLIOS

FIDELITY SUMMER STREET TRUST

FIDELITY TREND FUND

TO BE HELD ON JUNE 9, 2020

This Proxy Statement is furnished in connection with a solicitation of proxies made by, and on behalf of, the Board of Trustees of the above-named trusts (the trusts) to be used at the Special Meeting of Shareholders and at any adjournments thereof (the Meeting), to be held on June 9, 2020 at 8 a.m. ET at 245 Summer Street, Boston, Massachusetts 02210, an office of the trusts. Appendix A contains a list of the funds in each trust (the funds).

The following table summarizes the proposals applicable to each fund:

| Proposal# | Proposal Description | Applicable Fund | Page | |||

| 1. | To elect a Board of Trustees. | All funds. See Appendix A for a list of funds in each trust. | 3 | |||

| 2. | To convert a fundamental investment policy to anon-fundamental investment policy. | Funds listed in Appendix B. | 7 | |||

| 3. | To modify a fundamental investment policy. | Fidelity Advisor® Semiconductors Fund. | 8 | |||

| 4. | To modify the fund’s fundamental concentration policy. | Fidelity Advisor® Semiconductors Fund. | 8 | |||

| 5. | A shareholder proposal requesting that the Board of Trustees institute procedures to avoid holding investments in companies that, in management’s judgment, substantially contribute to genocide or crimes against humanity. | Fidelity® 500 Index Fund, Fidelity® Balanced Fund, Fidelity® Blue Chip Growth Fund, Fidelity® Capital & Income Fund, Fidelity® Capital Appreciation Fund, Fidelity® Contrafund®, Fidelity® Convertible Securities Fund, Fidelity® Diversified International Fund, Fidelity® Dividend Growth Fund, Fidelity® Equity Dividend Income Fund, Fidelity® Equity-Income Fund, Fidelity® Export and Multinational Fund, Fidelity® Growth & Income Portfolio, Fidelity® Growth Company Fund, Fidelity® Independence Fund, Fidelity® International Discovery Fund, Fidelity® International Index Fund, Fidelity® Leveraged Company Stock Fund and Fidelity® Low-Priced Stock Fund | 9 | |||

| 6. | A shareholder proposal requesting that the Board of Trustees institute procedures to avoid holding investments in companies that, in management’s judgment, substantially contribute to genocide or crimes against humanity. | Fidelity® Overseas Fund and Fidelity® Telecom and Utilities Fund | 11 | |||

Table of Contents

The purpose of the Meeting is set forth in the accompanying Notice. The solicitation is being made primarily by the mailing of the Notice of Internet Availability of Proxy Materials and the distribution of this Proxy Statement and the accompanying proxy card on or about April 13, 2020. Supplementary solicitations may be made by mail, telephone, facsimile, electronic means or by personal interview by representatives of the trusts. In addition, Computershare Limited (Computershare) may be paid on aper-call basis to solicit shareholders by telephone on behalf of the funds in the trusts. The funds may also arrange to have votes recorded by telephone. Computershare may be paid on aper-call basis forvote-by-phone solicitations on behalf of the funds. The approximate anticipated total cost of these services is detailed in Appendix C.

If the funds record votes by telephone or through the internet, they will use procedures designed to authenticate shareholders’ identities, to allow shareholders to authorize the voting of their shares in accordance with their instructions, and to confirm that their instructions have been properly recorded. Proxies voted by telephone or through the internet may be revoked at any time before they are voted at the Meeting.

Some shareholders will not automatically receive a copy of this entire Proxy Statement in the mail, but will instead receive a notice that informs them of how to access all of the proxy materials on a publicly available website (commonly referred to as “notice and access”). Shareholders who receive such a notice will not be able to return the notice to have their vote recorded. However, they can access the proxy materials at www.proxydirect.com/fidelity to vote eligible shares or may use the instructions on the notice to request a paper or email copy of the proxy materials at no charge.

Unless otherwise indicated in Appendix A, (i) the expenses in connection with preparing this Proxy Statement, its enclosures, and all solicitations and (ii) the expenses associated with reimbursing brokerage firms and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of shares, will be borne by each fund.

For a fund whose management contract with Fidelity Management & Research Company LLC (FMR) obligates FMR to pay certain fund level expenses, the expenses in connection with preparing this Proxy Statement and its enclosures and all solicitations will be borne by FMR. FMR will reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of shares.

Appendix A lists each fund’s auditor and fiscal year end. The principal business address of FMR, each fund’s investment adviser, is 245 Summer Street, Boston, Massachusetts 02210. Each fund’ssub-adviser(s) and eachsub-adviser’s principal business address are included in Appendix D. The principal business address of Fidelity Distributors Company LLC, each fund’s principal underwriter and distribution agent, is 100 Salem Street, Smithfield, Rhode Island 02917.

If the enclosed proxy is executed and returned, or an internet or telephonic vote is delivered, that vote may nevertheless be revoked at any time prior to its use by written notification received by a trust, by the execution of a later-dated proxy, by a trust’s receipt of a subsequent valid internet or telephonic vote, or by attending the Meeting and voting in person.

All proxies solicited by the Board of Trustees that are properly executed and received by the Secretary prior to the Meeting, and are not revoked, will be voted at the Meeting. Shares represented by such proxies will be voted in accordance with the instructions thereon. If no specification is made on a properly executed proxy, it will be voted FOR Proposals 1, 2, 3, and 4 and AGAINST Proposals 5 and 6. All shares that are voted and votes to ABSTAIN will be counted towards establishing a quorum, as will brokernon-votes. (Brokernon-votes are shares for which (i) the beneficial owner has not voted and (ii) the broker holding the shares does not have discretionary authority to vote on the particular matter.)

With respect to fund shares held in Fidelity individual retirement accounts (including Traditional, Rollover, SEP, SARSEP, Roth and SIMPLE IRAs), the IRA Custodian will vote those shares for which it has received instructions from shareholders only in accordance with such instructions. If Fidelity IRA shareholders do not vote their shares, the IRA Custodian will vote their shares for them, in the same proportion as other Fidelity IRA shareholders have voted. For Fidelity fund investments in a Fidelity Series Fund, Fidelity generally will vote in a manner consistent with the recommendation of the Fidelity Series Fund’s Board of Trustees on all proposals.

With respect to Proposal 1,one-third of each trust’s outstanding voting securities entitled to vote constitutes a quorum for the transaction of business at the Meeting. With respect to Proposals 2, 3, 4, 5, and 6,one-third of the impacted fund’s outstanding voting securities entitled to vote constitutes a quorum for the transaction of business at the Meeting. If a quorum is not present at a Meeting, or if a quorum is present at a Meeting but sufficient votes to approve one or more of the proposed items are not received, or if other matters arise requiring shareholder attention, the persons named as proxy agents may propose one or more adjournments of the Meeting to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of a majority of those shares present at the Meeting or represented by proxy. When voting on a proposed adjournment, the persons named as proxy agents will vote FOR the proposed adjournment all shares that they are entitled to vote with respect to each item, unless directed to vote AGAINST an item, in which case such shares will be voted AGAINST the proposed adjournment with respect to that item. However, if sufficient votes to achieve quorum on Proposals 5 and 6 have not been received, the persons named as proxy agents may vote in favor of a proposed adjournment with respect to those items. A shareholder vote may be taken on one or more of the items in this Proxy Statement prior to such adjournment if sufficient votes have been received and it is otherwise appropriate.

Shares of each fund and class, if applicable, issued and outstanding as of February 29, 2020 are indicated in Appendix E.

Information regarding record and/or beneficial ownership of each fund and class, as applicable, is included in Appendix F.

2

Table of Contents

Certain shares are registered to FMR or an FMR affiliate. To the extent that FMR and/or another entity or entities of which FMR LLC is the ultimate parent has discretion to vote, these shares will be voted at the Meeting FOR Proposals 1, 2, 3, and 4 and AGAINST Proposals 5 and 6. Otherwise, these shares will be voted in accordance with the plan or agreement governing the shares. Although the terms of the plans and agreements vary, generally the shares must be voted either (i) in accordance with instructions received from shareholders or (ii) in accordance with instructions received from shareholders and, for shareholders who do not vote, in the same proportion as certain other shareholders have voted. Certain funds and accounts that are managed by FMR or its affiliates (including funds of funds) invest in other funds and may at times have substantial investments in one or more funds. Although these funds generally intend to vote their shares of underlying funds using echo voting procedures (that is, in the same proportion as the holders of all other shares of the particular underlying fund), they reserve the right, on acase-by-case basis, to vote in another manner, which may include voting all shares as recommended by the Board.

Shareholders of record at the close of business on April 13, 2020 will be entitled to vote at the Meeting. Each such shareholder will be entitled to one vote for each dollar of net asset value held on that date, with fractional dollar amounts entitled to a proportional fractional vote.

We intend to hold the Meeting in person as set forth in this Proxy Statement. However, we are actively monitoring the coronavirus (COVID-19); we are sensitive to the public health and travel concerns our shareholders may have and the protocols that federal, state, and local governments may impose. As a result, the date, time, location or means of conducting the Meeting may change. In the event of such a change, the funds will post an announcement online at www.proxy-direct.com/fidelity and file the announcement on the Securities and Exchange Commission’s (“SEC”) EDGAR system, among other steps, but may not deliver additional soliciting materials to shareholders or otherwise amend the funds’ proxy materials. Although no decision has been made, the funds may consider imposing additional procedures or limitations on Meeting attendees or conducting the Meeting as a “virtual” shareholder meeting through the internet or other electronic means in lieu of an in-person meeting, subject to any restrictions imposed by applicable law. Please monitor the website at www.proxy-direct.com/fidelity for updated information. If you are planning to attend the Meeting, please check the website one week prior to the Meeting date. As always, we encourage you to vote your shares prior to the Meeting.

For a free copy of each fund’s annual and/or semiannual reports, call Fidelity at1-800-544-8544 (other than for Advisor classes),1-800-FIDELITY (Fidelity ETFs), or1-800-596-3222 (Advisor classes only), visit Fidelity’s web sites at www.fidelity.com or institutional.fidelity.com, or write to Fidelity Distributors Company LLC at 100 Salem Street, Smithfield, Rhode Island 02917.

VOTE REQUIRED: Approval of Proposal 1 requires the affirmative vote of a plurality of the shares of the applicable trust voted in person or by proxy at the Meeting. Approval of Proposals 2, 3, and 4 requires the affirmative vote of a “majority of the outstanding voting securities” of the appropriate fund. Under the Investment Company Act of 1940 (1940 Act), the vote of a “majority of the outstanding voting securities” means the affirmative vote of the lesser of (a) 67% or more of the voting securities present at the Meeting or represented by proxy if the holders of more than 50% of the outstanding voting securities are present or represented by proxy or (b) more than 50% of the outstanding voting securities. Approval of Proposals 5 and 6 requires the affirmative vote of a majority of the shares of the appropriate fund voted in person or by proxy at the Meeting. With respect to Proposals 2, 3, 4, 5, and 6 votes to ABSTAIN and brokernon-votes will have the same effect as votes cast AGAINST the Proposals. With respect to Proposal 1, votes to ABSTAIN and brokernon-votes will have no effect.

TO ELECT A BOARD OF TRUSTEES

The purpose of this proposal is to elect a Board of Trustees of each trust. Pursuant to the provisions of the Trust Instrument of each trust, the Trustees have determined that the number of Trustees shall be fixed at 14. It is intended that the enclosed proxy will be voted for the nominees listed below unless such authority has been withheld in the proxy.

Appendix G shows the composition of the Board of Trustees of each trust and the length of service of each Trustee and member of the Advisory Board. Except for Bettina Doulton and Robert A. Lawrence, all nominees named below are currently Trustees or Advisory Board Members of the trusts and have served in that capacity continuously since originally elected or appointed. Certain nominees were previously elected by shareholders to serve as Trustees of certain trusts, while other nominees were initially appointed by the Trustees and have not yet been elected by shareholders of all trusts. With respect to the nominees not previously elected by shareholders of one or more trusts, the trusts’ Governance and Nominating Committee identified Donald F. Donahue, Garnett A. Smith, and Michael E. Wiley as candidates; a third-party search firm retained by the Independent Trustees identified Vicki L. Fuller, Patricia L. Kampling, and Susan Tomasky as candidates; and an executive officer of FMR identified Ms. Doulton and Mr. Lawrence as candidates. The Governance and Nominating Committee has recommended all Independent Trustee candidates.

In the election of Trustees, those nominees receiving the highest number of votes cast at the Meeting, provided a quorum is present, shall be elected. A nominee shall be elected immediately upon shareholder approval, except that for Fidelity Advisor Series VIII, Fidelity Concord Street Trust, Fidelity Investment Trust, Fidelity Puritan Trust and Fidelity Securities Fund, the election of Ms. Doulton will be effective on or before January 1, 2021. For each such trust, the election of the nominees (excluding Ms. Doulton) will result in a board comprised of 14 Trustees, the maximum number permitted under the trust’s organizational documents. Accordingly, Ms. Doulton’s election will be effective once there is a vacancy on the board, which is currently expected to be January 1, 2021.

3

Table of Contents

Except for Messrs. Lawrence and Wiley and Mses. Doulton, Fuller, Kampling, and Tomasky, each of the nominees currently oversees 301 Fidelity funds. Mr. Wiley currently oversees 199 Fidelity funds. If elected, each nominee will oversee 301 Fidelity funds upon effectiveness of their election with respect to all trusts.

James C. Curvey also currently serves as Trustee of each trust and Jonathan Chiel currently serves as trustee of Fidelity Advisor Series VIII, Fidelity Concord Street Trust, Fidelity Investment Trust, Fidelity Puritan Trust, and Fidelity Securities Fund. Mr. Chiel is not nominated for election by shareholders but will continue to serve as a Trustee of such trusts following the election. Mr. Chiel currently oversees 172 Fidelity funds. Mr. Curvey recently announced his retirement from the Board and, as a result, is not standing for reelection.

The nominees you are being asked to elect as Trustees of the funds are as follows:

Interested Nominees*:

Correspondence intended for each Interested Nominee (that is, the nominees that are interested persons (as defined in the 1940 Act)) may be sent to Fidelity Investments, 245 Summer Street, Boston, Massachusetts 02210.

Name, Year of Birth; Principal Occupations and Other Relevant Experience+

Bettina Doulton (1964)

Prior to her retirement, Ms. Doulton served in a variety of positions at Fidelity Investments, including as a managing director of research (2006-2007), portfolio manager to certain Fidelity funds (1993-2005), equity analyst and portfolio assistant (1990-1993), and research assistant (1987-1990). Ms. Doulton currently owns and operates Phi Builders + Architects and Cellardoor Winery. Previously, Ms. Doulton served as a member of the Board of Brown Capital Management, LLC (2013-2018).

Robert A. Lawrence (1952)

Mr. Lawrence currently serves as Chairman of the Board of Trustees of the Strategic Advisers Funds (14 funds). Prior to his retirement in 2008, Mr. Lawrence served as Vice President of certain Fidelity funds (2006-2008), Senior Vice President, Head of High Income Division of Fidelity Management & Research Company (investment adviser firm, 2006-2008), and President of Fidelity Strategic Investments (investment adviser firm, 2002-2005).

| * | Determined to be an “Interested Nominee” by virtue of, among other things, his or her affiliation with the trusts or various entities under common control with FMR. |

| + | The information includes each nominee’s principal occupation during the last five years and other information relating to the experience, attributes, and skills relevant to the nominee’s qualifications to serve as a Trustee, which led to the conclusion that the nominee should serve as a Trustee for each fund. |

Independent Nominees:

Correspondence intended for each Independent Nominee (that is, the nominees that are not interested persons (as defined in the 1940 Act)) may be sent to Fidelity Investments, P.O. Box 55235, Boston, Massachusetts 02205-5235.

Name, Year of Birth; Principal Occupations and Other Relevant Experience+

Dennis J. Dirks (1948)

Mr. Dirks also serves as Trustee of other Fidelity® funds. Prior to his retirement in May 2003, Mr. Dirks served as Chief Operating Officer and as a member of the Board of The Depository Trust & Clearing Corporation (financial markets infrastructure), President, Chief Operating Officer and a member of the Board of The Depository Trust Company (DTC), President and a member of the Board of the National Securities Clearing Corporation (NSCC), Chief Executive Officer and a member of the Board of the Government Securities Clearing Corporation and Chief Executive Officer and a member of the Board of the Mortgage-Backed Securities Clearing Corporation. Mr. Dirks currently serves as a member of the Finance Committee (2016-present) and Board (2017-present) and is Treasurer (2018-present) of the Asolo Repertory Theatre.

Donald F. Donahue (1950)

Mr. Donahue also serves as Trustee of other Fidelity® funds. Mr. Donahue serves as President and Chief Executive Officer of Miranda Partners, LLC (risk consulting for the financial services industry, 2012-present). Previously, Mr. Donahue served as Chief Executive Officer (2006-2012), Chief Operating Officer (2003-2006) and Managing Director, Customer Marketing and Development (1999-2003) of The Depository Trust & Clearing Corporation (financial markets infrastructure). Mr. Donahue currently serves as a member (2007-present) andCo-Chairman (2016-present) of the Board of United Way of New York, a member of the Board of NYC Leadership Academy (2012-present) and a member of the Board of Advisors of Ripple Labs, Inc. (financial services, 2015-present). Mr. Donahue previously served as a member of the Advisory Board of certain Fidelity® funds (2015-2018).

4

Table of Contents

Name, Year of Birth; Principal Occupations and Other Relevant Experience+

Vicki L. Fuller (1957)

Ms. Fuller also serves as Member of the Advisory Board of other Fidelity® funds. Previously, Ms. Fuller served as Chief Investment Officer of the New York State Common Retirement Fund (2012-2018) and held a variety of positions at AllianceBernstein L.P. (global asset management, 1985-2012), including Managing Director (2006-2012) and Senior Vice President and Senior Portfolio Manager (2001-2006). Ms. Fuller currently serves as a member of the Board, Audit Committee and Nominating and Governance Committee of The Williams Companies, Inc. (natural gas infrastructure, 2018-present) and as a member of the Board of Treliant, LLC (consulting, 2019-present).

Patricia L. Kampling (1959)

Ms. Kampling also serves as Member of the Advisory Board of other Fidelity® funds. Prior to her retirement, Ms. Kampling served as Chairman of the Board and Chief Executive Officer (2012-2019), President and Chief Operating Officer (2011-2012) and Executive Vice President and Chief Financial Officer (2010-2011) of Alliant Energy Corporation. Ms. Kampling currently serves as a member of the Board, Compensation Committee and Executive Committee and as Chair of the Audit Committee of Briggs & Stratton Corporation (manufacturing, 2011-present) and as a member of the Board, Audit, Finance and Risk Committee and Safety, Environmental, Technology and Operations Committee of American Water Works Company, Inc. (utilities company, 2019-present). In addition, Ms. Kampling currently serves as a member of the Board of the Nature Conservancy, Wisconsin Chapter (2019-present). Previously, Ms. Kampling served as a member of the Board of Interstate Power and Light Company (2012-2019) and Wisconsin Power and Light Company (2012-2019) (each a subsidiary of Alliant Energy Corporation) and as a member of the Board and Workforce Development Committee of the Business Roundtable (2018-2019).

Alan J. Lacy (1953)

Mr. Lacy also serves as Trustee of other Fidelity® funds. Previously, Mr. Lacy served as Senior Adviser (2007-2014) of Oak Hill Capital Partners, L.P. (private equity), Chief Executive Officer (2005) and Vice Chairman (2005-2006) of Sears Holdings Corporation (retail), Chief Executive Officer and Chairman of the Board of Sears, Roebuck and Co. (retail, 2000-2005) and Chairman (2014-2017) and a member of the Board (2010-2017) of Dave & Buster’s Entertainment, Inc. (restaurant and entertainment complexes). Mr. Lacy currently serves as a member of the Board of Bristol-Myers Squibb Company (global pharmaceuticals, 2008-present), Trustee of the California Chapter of The Nature Conservancy (2015-present) and a member of the Board of the Center for Advanced Study in the Behavioral Sciences at Stanford University (2015-present).

Ned C. Lautenbach (1944)

Co-Lead Independent Trustee

Mr. Lautenbach also serves as Trustee of other Fidelity® funds. Mr. Lautenbach currently serves as Chair of the Board of Governors, State University System of Florida (2013-present) and is a member of the Council on Foreign Relations (1994-present). He is also a member and has in the past served as Chairman of the Board of Directors of Artis-Naples (2012-Present). Previously, Mr. Lautenbach served as a member and then Lead Director of the Board of Directors of Eaton Corporation (diversified industrial, 1997-2016). He was also a Partner at Clayton, Dubilier & Rice, LLC (private equity investment, 1998-2010); as well as Director of Sony Corporation (2006-2007). In addition, Mr. Lautenbach had a30-year career with IBM (technology company), during which time he served as Senior Vice President and as a member of the Corporate Executive Committee (1968-1998).

Joseph Mauriello (1944)

Mr. Mauriello also serves as Trustee of other Fidelity® funds. Prior to his retirement in January 2006, Mr. Mauriello served in numerous senior management positions including Deputy Chairman and Chief Operating Officer (2004-2005) and Vice Chairman of Financial Services (2002-2004) of KPMG LLP US (professional services, 1965-2005). Mr. Mauriello currently serves as a member of the Independent Directors Council Governing Council (2015-present). Previously, Mr. Mauriello served as a member of the Board of XL Group plc. (global insurance andre-insurance, 2006-2018).

Cornelia M. Small (1944)

Ms. Small also serves as Trustee of other Fidelity® funds. Previously, Ms. Small served as Chief Investment Officer, Director of Global Equity Investments and a member of the Board of Scudder, Stevens & Clark and Scudder Kemper Investments. Ms. Small previously served as a member of the Board (2009-2019) and Chair of the Investment Committee (2010-2019) of the Teagle Foundation and a member of the Investment Committee of the Berkshire Taconic Community Foundation (2008-2019).

Garnett A. Smith (1947)

Mr. Smith also serves as Trustee of other Fidelity® funds. Prior to his retirement, Mr. Smith served as Chairman and Chief Executive Officer (1990-1997) and President (1986-1990) of Inbrand Corp. (manufacturer of personal absorbent products). Prior to his employment with Inbrand Corp., he was employed by a retail fabric chain and North Carolina National Bank (now Bank of America). Mr. Smith previously served as a member of the Advisory Board of certain Fidelity® funds (2012-2013).

5

Table of Contents

Name, Year of Birth; Principal Occupations and Other Relevant Experience+

David M. Thomas (1949)

Co-Lead Independent Trustee

Mr. Thomas also serves as Trustee of other Fidelity® funds. Previously, Mr. Thomas served as Executive Chairman (2005-2006) and Chairman and Chief Executive Officer (2000-2005) of IMS Health, Inc. (pharmaceutical and healthcare information solutions). Mr. Thomas currently serves asNon-Executive Chairman of the Board of Fortune Brands Home and Security (home and security products, 2011-present) and a member of the Board (2004-present) and Presiding Director (2013-present) of Interpublic Group of Companies, Inc. (marketing communication).

Susan Tomasky (1953)

Ms. Tomasky also serves as Member of the Advisory Board of other Fidelity® funds. Prior to her retirement, Ms. Tomasky served in various executive officer positions at American Electric Power Company, Inc. (1998-2011), including most recently as President of AEP Transmission (2007-2011). Ms. Tomasky currently serves as a member of the Board and Sustainability Committee and as Chair of the Audit Committee of Marathon Petroleum Corporation (2018-present) and as a member of the Board, Corporate Governance Committee and Organization and Compensation Committee and as Chair of the Audit Committee of Public Service Enterprise Group, Inc. (utilities company, 2012-present). In addition, Ms. Tomasky currently serves as a member of the Board of the Columbus Regional Airport Authority (2007-present), as a member of the Board of the Royal Shakespeare Company – America (2009-present), as a member of the Board of the Columbus Association for the Performing Arts (2011-present) and as a member of the Board of Kenyon College (2016-present). Previously, Ms. Tomasky served as a member of the Board (2011-2019) and as Lead Independent Director (2015-2018) of Andeavor Corporation (previously Tesoro Corporation) (independent oil refiner and marketer) and as a member of the Board of Summit Midstream Partners LP (energy, 2012-2018).

Michael E. Wiley (1950)

Mr. Wiley also serves as Trustee or Member of the Advisory Board of other Fidelity® funds. Previously, Mr. Wiley served as Chairman, President and CEO of Baker Hughes, Inc. (oilfield services, 2000-2004). Mr. Wiley currently serves as a member of the Board of High Point Resources (exploration and production, 2005-present). Previously, Mr. Wiley served as a member of the Board of Andeavor Corporation (independent oil refiner and marketer, 2005-2018) and a member of the Board of Andeavor Logistics LP (natural resources logistics, 2015-2018).

| + | The information includes the nominee’s principal occupation during the last five years and other information relating to the experience, attributes, and skills relevant to the nominee’s qualifications to serve as a Trustee, which led to the conclusion that the nominee should serve as a Trustee for each fund. |

As of February 29, 2020, the Trustees and nominees for election as Trustee and the officers of the trusts and each fund owned, in the aggregate, less than 1% of each fund’s outstanding shares.

During the period May 1, 2018 through February 29, 2020, no transactions were entered into by Trustees and nominees as Trustee of the trust involving more than 1% of the voting common,non-voting common and equivalent stock, or preferred stock of FMR LLC.

The Trustees hold office without limit in time except that (a) any Trustee may resign; (b) any Trustee may be removed by written instrument, signed by at leasttwo-thirds of the number of Trustees prior to such removal; (c) any Trustee who requests to be retired or who has become incapacitated by illness or injury may be retired by written instrument signed by a majority of the other Trustees; and (d) a Trustee may be removed at any special meeting of shareholders by atwo-thirds vote of the outstanding voting securities of the trust. Each Independent Trustee shall retire not later than the last day of the calendar year in which his or her 75th birthday occurs. The Independent Trustees may waive this mandatory retirement age policy with respect to individual Trustees. In case a vacancy shall for any reason exist, the remaining Trustees will fill such vacancy by appointing another Trustee, so long as, immediately after such appointment, at leasttwo-thirds of the Trustees have been elected by shareholders. If, at any time, less than a majority of the Trustees holding office has been elected by the shareholders, the Trustees then in office will promptly call a shareholders’ meeting for the purpose of electing a Board of Trustees. Otherwise, there will normally be no meeting of shareholders for the purpose of electing Trustees.

Appendix H sets forth the number of Board meetings held during each fund’s last fiscal year.

For more information about the current Trustees who are not nominees in this Proxy Statement, refer to the section entitled “Trustees, Advisory Board Members, and Officers of the Funds.” For information about the funds’ Board structure and risk oversight function, and current standing committees of the funds’ Trustees, refer to the section entitled “Board Structure and Oversight Function and Standing Committees of the Funds’ Trustees.”

The dollar range of equity securities beneficially owned as of March 31, 2020 by each nominee and Trustee in each fund and in all funds in the aggregate within the same fund family overseen or to be overseen by the nominee or Trustees is included in Appendix I.

Trustee compensation information for each fund covered by this Proxy Statement is included in Appendix J.

The Board of Trustees recommends that shareholders vote FOR Proposal 1.

6

Table of Contents

TO CONVERT A FUNDAMENTAL INVESTMENT POLICY TO ANON-FUNDAMENTAL INVESTMENT POLICY

Each fund listed in Appendix B

The investment policy for each fund set forth in Appendix K (Policy) is “fundamental,” meaning that it may only be changed by a vote of shareholders of the fund. Each such Policy sets forth the fund’s investment objective and, in certain cases, related policy language. The Board of Trustees recommends that shareholders approve the proposal to make each Policynon-fundamental.

Because each fund’s Policy can only be changed with shareholder approval, it can be difficult, expensive and time consuming for a fund to revise its Policy in response to changes in the market. If approved, this change will allow the Board of Trustees to change each fund’s Policy without the delay and expense of a shareholder vote. If in the future, if the Board of Trustees approves a change to a fund’s Policy, shareholders would receive notice of such change and the fund’s prospectus would be updated accordingly. If this proposal is approved, shareholders will not have the right to vote on any future change to a fund’s Policy. Converting each Policy tonon-fundamental would bring the funds in line with industry practice as well as with the practices of certain other Fidelity funds and could potentially avoid entirely, or reduce, future proxy costs and provide greater flexibility for evolution over time. There is no present intention to change the way in which any fund is currently managed if the proposal is approved.

In connection with this proposal, the Board of Trustees also recommends that shareholders approve changes to the Policy for each of Fidelity 500 Index Fund, Fidelity Flex® 500 Index Fund, and Fidelity® Magellan® Fund in order to removenon-standard and unnecessary language, as set forth in the chart below (strikethrough language is to be deleted). These proposed changes are a streamlining measure and are not presently intended to affect how each fund is managed. For all other funds, the existing Policy as it appears in Appendix K would become anon-fundamental policy for the fund without the need for further revision.

| Fidelity 500 Index Fund | Fidelity 500 Index Fund seeks to provide investment results that correspond to the total return (i.e., the combination of capital changes and income) performance of common stocks publicly traded in the United States.

| |

| Fidelity Flex® 500 Index Fund | Fidelity Flex 500 Index Fund seeks to provide investment results that correspond to the total return (i.e., the combination of capital changes and income) performance of common stocks publicly traded in the United States.

| |

| Fidelity® Magellan® Fund | Fidelity Magellan Fund seeks capital appreciation |

Conclusion. The Board of Trustees has concluded that the proposal will benefit each fund and its shareholders.The Trustees recommend voting FOR the proposal. If the conversion of the Policy from fundamental tonon-fundamental is approved by a fund’s shareholders, the change (including the additional changes described above for Fidelity 500 Index Fund, Fidelity Flex 500 Index Fund, and Fidelity Magellan Fund) will take effect in conjunction with the fund’s next annual prospectus revision. If Proposal 2 is not approved by a fund’s shareholders, the Policy will remain a fundamental policy for that fund.

7

Table of Contents

TO MODIFY A FUNDAMENTAL INVESTMENT POLICY

Fidelity Advisor Semiconductors Fund

The purpose of this proposal is to modify Fidelity Advisor Semiconductors Fund’s fundamental investment policy to reflect that it invests primarily in securities of companies engaged in the semiconductors industries, rather than companies engaged in the electronics industries more broadly. The changes to the fundamental investment policy will not affect how the fund is managed.

Fidelity Advisor Semiconductors Fund has a fundamental policy of investing primarily in companies engaged in the design, manufacture, or sale of electronic components (semiconductors, connectors, printed circuit boards and other components); equipment vendors to electronic component manufacturers; electronic component distributors; and electronic instruments and electronic systems vendors. Because this “invest primarily” policy is fundamental, it can only be changed by a vote of the fund’s shareholders.

The fund also has a narrower policy of investing primarily in companies engaged in the design, manufacture, or sale of semiconductors and semiconductor equipment. The policy is anon-fundamental policy that can be changed without a vote of the fund’s shareholders. The fund has a policy to invest at least 80% of its assets in securities of companies principally engaged in these activities. The fund’s 80% policy can be changed without a vote only upon 60 days’ prior notice to shareholders of the fund.

The narrower policy is consistent with the fund’s name, which was changed from Fidelity Advisor Electronics Fund to Fidelity Advisor Semiconductors Fund in October 2016 to better communicate the fund’s long-term investment focus and positioning in the marketplace. The electronics industry has evolved dramatically over the past few decades and the term “electronics” is a broad term that could apply to many companies in many different industries. In contrast, the term “semiconductors” more fully describes the fund’s investment focus on companies engaged in the design, manufacture or sale of semiconductors and related products and of semiconductor equipment.

The Board of Trustees recommends that shareholders approve a modification to the fund’s fundamental “invest primarily” policy to reflect the more narrow investment focus of the fund, as set forth in the chart below (bold languageis to be added andstrikethrough language is to be deleted). If the modification is approved, the fund’s fundamental “invest primarily” policy will match its currentnon-fundamental investment policy. As a result, thenon-fundamental investment policy would no longer be necessary and would be removed.

| Fidelity Advisor Semiconductors Fund | The fund has a policy of investing primarily in companies engaged in the design, manufacture, or sale ofsemiconductors and semiconductor equipment |

Conclusion. The Board of Trustees has concluded that the proposal will benefit Fidelity Advisor Semiconductors Fund and its shareholders.The Trustees recommend voting FOR the proposal. If the modification of the fundamental “invest primarily” policy is approved by shareholders, the change (including the removal of thenon-fundamental policy described above) will take effect in conjunction with the fund’s next annual prospectus revision. If Proposal 3 is not approved by the fund’s shareholders, the fundamental “invest primarily” policy will remain unchanged, and the fund will continue to have a separate, narrowernon-fundamental “invest primarily” policy. For Proposals 3 and 4, neither proposal is contingent on one another, meaning that a proposal will be implemented if approved by the fund’s shareholders, even if its shareholders have not also approved the other proposal.

TO MODIFY THE FUND’S FUNDAMENTAL CONCENTRATION POLICY

Fidelity Advisor Semiconductors Fund

The purpose of this proposal is to modify the industry concentration policy for Fidelity Advisor Semiconductors Fund to better reflect its investment focus. The 1940 Act requires funds to state a policy regarding concentration of investments in a particular industry, and to make the policy fundamental (changeable only by shareholder vote). The SEC has taken the position that a fund that invests more than 25% of its total assets in a particular industry is concentrating its investments.

Fidelity Advisor Semiconductors Fund has a fundamental concentration policy that refers generically to its investment strategy, while the concentration policies for other Fidelity sector funds cite specific industries. The Board of Trustees, including the Independent Trustees, has approved, and recommends that shareholders approve, proposed changes to the fund’s concentration policy to standardize the approach with that used by the other Fidelity sector funds.

As described above in Proposal 3, the fund is designed to offer targeted exposure to the securities of companies principally engaged in the design, manufacture, or sale of semiconductors and semiconductor equipment. By modifying the concentration policy as proposed, the fund’s concentration policy will specifically cite the fund’s name while providing flexibility in determining whether an

8

Table of Contents

issuer is principally engaged in activities related to the semiconductors industries. The proposed concentration policy would simply describe more explicitly how the fund already invests. There is no present intention to change the way in which the fund is currently managed or otherwise change its investment policies if the proposal is approved by the fund’s shareholders.

The proposed changes to the fund’s concentration policy are set forth in the chart below (bold languageis to be added andstrikethrough language is to be deleted). The fund’s concentration policy would continue to be subject to the “look through” and other interpretive disclosure included in the fund’s current statement of additional information.

| Fidelity Advisor Semiconductors Fund | The fund may not purchase the securities of any issuer if, as a result, less than 25% of the fund’s total assets would be invested in the securities of issuers principally engaged in the |

Conclusion. The Board of Trustees has concluded that the proposal will benefit Fidelity Advisor Semiconductors Fund and its shareholders.The Trustees recommend voting FOR the proposal. If the modification to the fundamental concentration policy is approved by shareholders, the change will take effect in conjunction with the fund’s next annual prospectus revision. If the modification to the fundamental concentration policy is not approved by the fund’s shareholders, the existing concentration policy will remain in effect for the fund. For Proposals 3 and 4, neither proposal is contingent on one another, meaning that a proposal will be implemented if approved by the fund’s shareholders, even if its shareholders have not also approved the other proposal.

SHAREHOLDER PROPOSAL REQUESTING THAT THE BOARD OF TRUSTEES INSTITUTE PROCEDURES TO AVOID HOLDING INVESTMENTS IN COMPANIES THAT, IN MANAGEMENT’S JUDGMENT, SUBSTANTIALLY CONTRIBUTE TO GENOCIDE OR CRIMES AGAINST HUMANITY

Fidelity 500 Index Fund, Fidelity Balanced Fund, Fidelity Blue Chip Growth Fund, Fidelity Capital & Income Fund, Fidelity Capital Appreciation Fund, Fidelity® Contrafund®, Fidelity Convertible Securities Fund, Fidelity Diversified International Fund, Fidelity Dividend Growth Fund, Fidelity Equity Dividend Income Fund, Fidelity Equity-Income Fund, Fidelity Export and Multinational Fund, Fidelity Growth & Income Portfolio, Fidelity Growth Company Fund, Fidelity Independence Fund, Fidelity International Discovery Fund, Fidelity International Index Fund, Fidelity Leveraged Company Stock Fund and FidelityLow-Priced Stock Fund

Certain shareholders of above listed funds (for purposes of Proposal 5 only, each a “Fund”) have advised the Funds that they intend to present the following shareholder proposal at the Meeting. For the reasons set forth after the proposal, the Board of Trustees recommends a vote “AGAINST” the proposal. No Fund is responsible for the contents of the proposal or the supporting statements. A Fund will provide the names, addresses, and shareholdings (to the Fund’s knowledge) of the proponents of a shareholder proposal upon written request sent to the Secretary of the Fund, attention “Fund Shareholder Meetings,” 245 Summer Street, Mailzone V10A, Boston, Massachusetts 02210, or by calling1-617-563-9021.

Proposal

WHEREAS, we believe that:

1. Investors do not want their investments to help fund genocide.

a) While reasonable people may disagree about socially responsible investing, few want their investments to help fund genocide.

b) KRC Research’s 2010 study showed that 88% of respondents want their mutual funds to be genocide-free.

c) Millions of Fidelity investors have voted for genocide-free investing proposals, submitted by supporters of Investors Against Genocide, despite active management opposition. As many as 29% of Fidelity shareholders voted in favor in 2013 and 31% in 2008.

d) In 2012, a genocide-free investing proposal at an ING mutual fund passed decisively, 59.8% to 10.7% with 29.5% abstaining.

2. The example of PetroChina shows that current policies do not adequately support genocide-free investing because Fidelity and the funds it manages:

a) Are large and long-term investors in PetroChina. PetroChina, through its controlling shareholder, China National Petroleum Company, is Sudan’s largest business partner, thereby helping fund ongoing government-sponsored genocide and crimes against humanity.

b) Unnecessarily expose shareholders to the significant financial, operational and reputational risks of the China National Petroleum group’s operations in areas affected by genocide and mass atrocities.

c) Actively opposed earlier shareholder requests for genocide-free investing.

9

Table of Contents

d) Continued to buy shares of problem companies even after becoming aware of the investments’ connection to genocide in the Darfur region of Sudan.

e) Claimed to have a policy addressing extreme human rights issues, but has taken no action to avoid problem investments.

f) Made investments in PetroChina that, while legal, are inconsistent with U.S. sanctions explicitly prohibiting transactions relating to Sudan’s petroleum industry.

3. Individuals, through ownership of shares of Fidelity funds, may inadvertently invest in companies that help support genocide. With no policy to prevent these investments, Fidelity may at any time add or increase holdings in problem companies.

4. No sound reasons prevent having a genocide-free investing policy because:

a) Ample alternative investments exist.

b) Avoiding problem companies need not have a significant effect on investment performance, as shown in Gary Brinson’s classic asset allocation study.

c) Only a handful of Fidelity’s U.S. funds would be affected, because most of Fidelity’s holdings of problem companies such as PetroChina are by Fidelity funds sold outside the U.S.

d) Appropriate disclosure can address any legal concerns regarding the exclusion of problem companies.

e) Management can easily obtain independent assessments to identify companies connected to genocide.

f) Other large financial firms such as T. Rowe Price and TIAA-CREF have avoided investments connected to genocide by divesting problem companies such as PetroChina.

5. Investor action can influence foreign governments, as in South Africa. Similar action on Talisman Energy helped end the conflict in South Sudan.

RESOLVED

Shareholders request that the Board institute transparent procedures to avoid holding investments in companies that, in management’s judgment, substantially contribute to genocide or crimes against humanity, the most egregious violations of human rights. Such procedures may include time-limited engagement with problem companies if management believes that their behavior can be changed.

* * *

Statement of Opposition

The Fidelity Equity and High Income Board of Trustees recommends that you vote AGAINST this proposal.

Fidelity, as investment adviser to the Funds, seeks to achieve the best investment results for each Fund consistent with the stated investment policies of the relevant Fund. In doing so, Fidelity is obligated to limit such Fund’s investments to holdings that are lawful under the laws of the United States. The Fidelity Equity and High Income Board of Trustees has procedures in place to review fund performance as investment adviser to the Funds, including each Fund’s compliance with all applicable laws.

Fidelity is committed to complying fully with applicable law, including any investment sanctions that the United States government might enact.

The Fidelity Equity and High Income Board of Trustees recognizes and respects that investors, including those investing in the Funds, have other investment opportunities open to them should they wish to avoid investments in certain companies or countries. Shareholders of the Funds, however, choose to invest based on the specific stated investment policies of the relevant fund. If adopted, this proposal would limit investments by the Funds that would be lawful under the laws of the United States. For this reason, the Board of Trustees recommends that you vote AGAINST this proposal.

10

Table of Contents

SHAREHOLDER PROPOSAL REQUESTING THAT THE BOARD OF TRUSTEES INSTITUTE PROCEDURES TO AVOID HOLDING INVESTMENTS IN COMPANIES THAT, IN MANAGEMENT’S JUDGMENT, SUBSTANTIALLY CONTRIBUTE TO GENOCIDE OR CRIMES AGAINST HUMANITY

Fidelity Overseas Fund and Fidelity Telecom and Utilities Fund

Certain shareholders of the Fidelity Overseas Fund and Fidelity Telecom and Utilities Fund (for purposes of Proposal 6 only, each a “Fund”) have advised the Funds that they intend to present the following shareholder proposal at the Meeting. For the reasons set forth after the proposal, the Board of Trustees recommends a vote “AGAINST” the proposal. No Fund is responsible for the contents of the proposal or the supporting statements. A Fund will provide the names, addresses, and shareholdings (to the Fund’s knowledge) of the proponents of a shareholder proposal upon written request sent to the Secretary of the Fund, attention “Fund Shareholder Meetings,” 245 Summer Street, Mailzone V10A, Boston, Massachusetts 02210, or by calling1-617-563-9021.

Proposal

WHEREAS

We believe that:

1. While reasonable people may disagree about socially responsible investing, few want their investments to help fund genocide. KRC Research’s 2010 study showed 88% of respondents want their mutual funds to be genocide-free.

2. Millions of Fidelity investors voted for genocide-free investing proposals, submitted by supporters of Investors Against Genocide. Details on genocide-free investing are available at http://bit.ly/2AiqPWD.

3. Fidelity has opposed genocide-free investing since the issue was raised in 2006.

4. Genocide-free investing is consistent with the company’s values. Notably, Fidelity:

a) Signed the UN Principles for Responsible Investment in 2017, agreeing to incorporate social issues into investment decision-making processes and “better align investors with broader objectives of society.”

b) Published its “Commitment to responsible investing.”

c) States that “by investing in companies which operate with high standards of corporate responsibility we can protect and enhance investment returns for our clients.”

d) Claims a “rigorousbottom-up research process” that provides an“in-depth understanding of Environmental, Social and Governance (ESG) issues at a company.”

e) Boasts it is “continually striving for enhanced ESG policies and integration into our investment process.”

5. Examples demonstrate that Fidelity’s policies inadequately support genocide-free investing because Fidelity and funds it manages:

a) Have for many years been large holders of both PetroChina and Sinopec. PetroChina’s controlling parent, CNPC, is Sudan’s largest oil partner, thereby helping fund genocide there. CNPC/PetroChina also partners with Syria. Sinopec, another oil company, also operates in both countries.

b) Claim to have a policy addressing extreme human rights issues, but have taken no action to avoid problem investments.

6. Individuals, by owning Fidelity funds, may inadvertently invest in companies that help support genocide. With no policy to prevent these investments, Fidelity may at any time increase holdings in problem companies.

7. Fidelity can implement a genocide-free investing policy because:

a) Ample alternative investments exist.

b) Avoiding problem companies need not significantly affect investment performance, as shown in Gary Brinson’s classic asset allocation study.

c) Appropriate disclosure can address any legal concerns regarding exclusion of problem companies, even in index funds that sample rather than replicate their index.

d) Management can easily obtain independent assessments to identify companies connected to genocide.

e) Other large financial firms (including T. Rowe Price and TIAA) have policies to avoid such investments.

f) Procedures may include time-limited engagement with problem companies if management believes that their behavior can be changed.

11

Table of Contents

g) In the rare case that the company believes it cannot avoid an investment tied to genocide, it can prominently disclose the issue to shareholders.

h) Only a handful of Fidelity’s U.S. funds would be affected, because most of Fidelity’s holdings of problem companies such as PetroChina are by Fidelity funds sold outside the U.S.

RESOLVED

Shareholders request that the Board institute transparent procedures to avoid holding or recommending investments in companies that, in management’s judgment, substantially contribute to genocide or crimes against humanity, the most egregious violations of human rights.

* * *

Statement of Opposition

The Fidelity Equity and High Income Board of Trustees recommends that you vote AGAINST this proposal.

Fidelity, as investment adviser to the Funds, seeks to achieve the best investment results for each Fund consistent with the stated investment policies of the relevant Fund. In doing so, Fidelity is obligated to limit such Fund’s investments to holdings that are lawful under the laws of the United States. The Fidelity Equity and High Income Board of Trustees has procedures in place to review fund performance as investment adviser to the Funds, including each Fund’s compliance with all applicable laws.

Fidelity is committed to complying fully with applicable law, including any investment sanctions that the United States government might enact.

The Fidelity Equity and High Income Board of Trustees recognizes and respects that investors, including those investing in the Funds, have other investment opportunities open to them should they wish to avoid investments in certain companies or countries. Shareholders of the Funds, however, choose to invest based on the specific stated investment policies of the relevant fund. If adopted, this proposal would limit investments by the Funds that would be lawful under the laws of the United States. For this reason, the Board of Trustees recommends that you vote AGAINST this proposal.

OTHER BUSINESS

The Board knows of no other business to be brought before the Meeting. However, if any other matters properly come before the Meeting, it is the intention that proxies that do not contain specific instructions to the contrary will be voted on such matters in accordance with the judgment of the persons therein designated.

TRUSTEES, ADVISORY BOARD MEMBERS, AND

OFFICERS OF THE FUNDS

Appendix G shows the composition of the Board of Trustees of each trust and the Advisory Board Members, if any, of each trust. The officers of the funds include: Elizabeth Paige Baumann, Craig S. Brown, John J. Burke III, William C. Coffey, Timothy M. Cohen, Jonathan Davis, Laura M. Del Prato, Colm A. Hogan, Pamela R. Holding, Cynthia Lo Bessette, Chris Maher, Kenneth B. Robins, Stacie M. Smith, Marc L. Spector, and Jim Wegmann. Additional information about Messrs. Dirks, Donahue, Lacy, Lautenbach, Mauriello, Smith, Thomas, and Wiley and Mses. Fuller, Kampling, Small, and Tomasky can be found in Proposal 1. Additional information about Messrs. Chiel and Curvey, Peter S. Lynch, and the officers of the funds can be found in the following table.

Interested Trustees*:

Correspondence intended for a Trustee who is an interested person may be sent to Fidelity Investments, 245 Summer Street, Boston, Massachusetts 02210.

Name, Year of Birth; Principal Occupations and Other Relevant Experience+

Jonathan Chiel (1957)

Mr. Chiel also serves as Trustee of other Fidelity® funds. Mr. Chiel is Executive Vice President and General Counsel for FMR LLC (diversified financial services company, 2012-present). Previously, Mr. Chiel served as general counsel (2004-2012) and senior vice president and deputy general counsel (2000-2004) for John Hancock Financial Services; a partner with Choate, Hall & Stewart (1996-2000) (law firm); and an Assistant United States Attorney for the United States Attorney’s Office of the District of Massachusetts(1986-95), including Chief of the Criminal Division (1993-1995). Mr. Chiel is a director on the boards of the Boston Bar Foundation and the Maimonides School.

12

Table of Contents

Name, Year of Birth; Principal Occupations and Other Relevant Experience+

James C. Curvey (1935)

Chairman of the Board of Trustees

Mr. Curvey also serves as Trustee of other Fidelity® funds. Mr. Curvey is Vice Chairman (2007-present) and Director of FMR LLC (diversified financial services company). In addition, Mr. Curvey is an Overseer Emeritus for the Boston Symphony Orchestra, a Director of Artis-Naples, and a Trustee of Brewster Academy in Wolfeboro, New Hampshire. Previously, Mr. Curvey served as a Director of Fidelity Research & Analysis Co. (investment adviser firm, 2009-2018), Director of Fidelity Investments Money Management, Inc. (investment adviser firm, 2009-2014) and a Director of FMR and FMR Co., Inc. (investment adviser firms, 2007-2014).

| * | Determined to be an “Interested Trustee” by virtue of, among other things, his affiliation with the trusts or various entities under common control with FMR. |

| + | The information includes the Trustee’s principal occupation during the last five years and other information relating to the experience, attributes, and skills relevant to the Trustee’s qualifications to serve as a Trustee, which led to the conclusion that the Trustee should serve as a Trustee for each fund. |

Advisory Board Members and Officers:

The officers and Advisory Board Members hold office without limit in time, except that any officer or Advisory Board Member may resign or may be removed by a vote of a majority of the Trustees at any regular meeting or any special meeting of the Trustees. Correspondence intended for each officer and Mr. Lynch may be sent to Fidelity Investments, 245 Summer Street, Boston, Massachusetts 02210.

Name, Year of Birth; Principal Occupation

Peter S. Lynch (1944)

Mr. Lynch also serves as Member of the Advisory Board of other Fidelity® funds. Mr. Lynch is Vice Chairman and a Director of Fidelity Management & Research Company LLC (investment adviser firm). In addition, Mr. Lynch serves as a Trustee of Boston College and as the Chairman of the Inner-City Scholarship Fund. Previously, Mr. Lynch served as Vice Chairman and a Director of FMR Co., Inc. (investment adviser firm) and on the Special Olympics International Board of Directors (1997-2006).

Elizabeth Paige Baumann (1968)

Year of Election or Appointment: 2017

Anti-Money Laundering (AML) Officer