UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3114

Fidelity Select Portfolios

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Marc Bryant, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | February 28 |

| |

Date of reporting period: | February 28, 2017 |

Item 1.

Reports to Stockholders

Fidelity Advisor Focus Funds®

Class A, Class T (to be named Class M), Class C and Class I Fidelity Advisor® Consumer Staples Fund

Fidelity Advisor® Gold Fund

Fidelity Advisor® Materials Fund

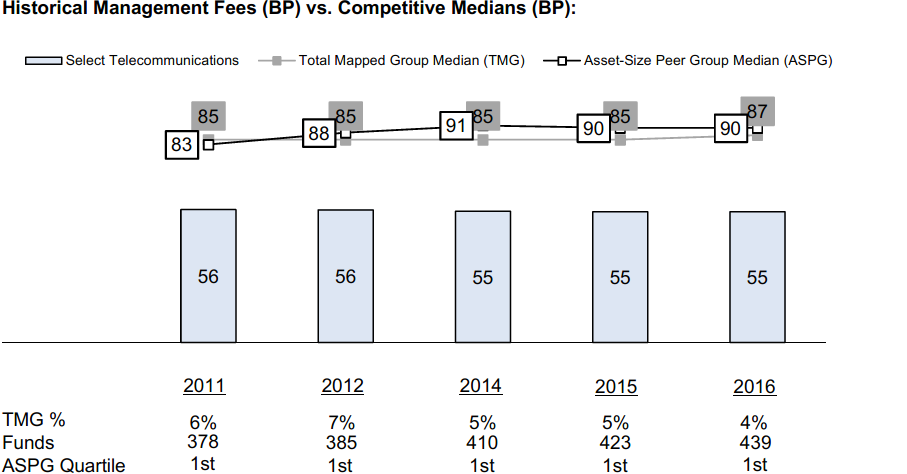

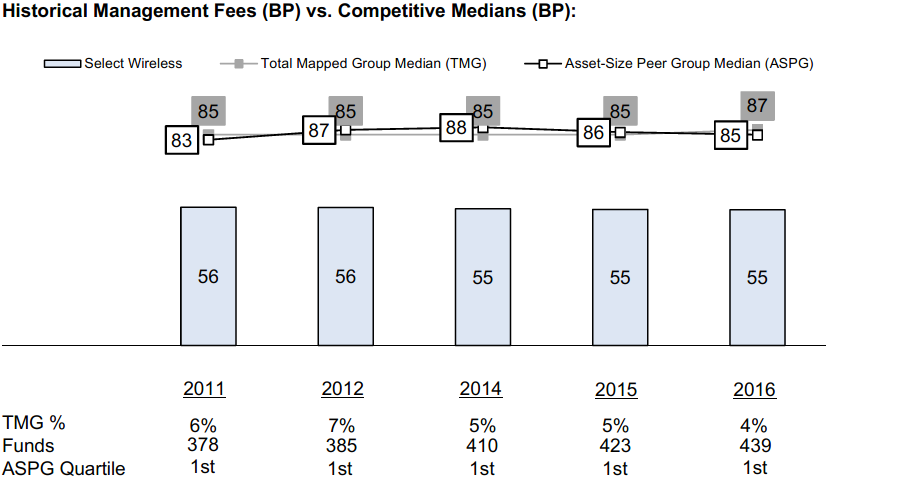

Fidelity Advisor® Telecommunications Fund

Annual Report February 28, 2017 Each Advisor fund listed above is a class of the Fidelity® Select Portfolios® |

|

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2017 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Funds nor Fidelity Distributors Corporation is a bank.

Fidelity Advisor® Consumer Staples Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended February 28, 2017 | Past 1 year | Past 5 years | Past 10 years |

| Class A (incl. 5.75% sales charge) | 5.47% | 10.04% | 8.99% |

| Class T (incl. 3.50% sales charge) | 7.71% | 10.25% | 8.95% |

| Class C (incl. contingent deferred sales charge) | 10.07% | 10.52% | 8.82% |

| Class I | 12.22% | 11.63% | 9.93% |

Class C shares' contingent deferred sales charges included in the past one year, past five years and past ten years total return figures are 1%, 0% and 0%, respectively.

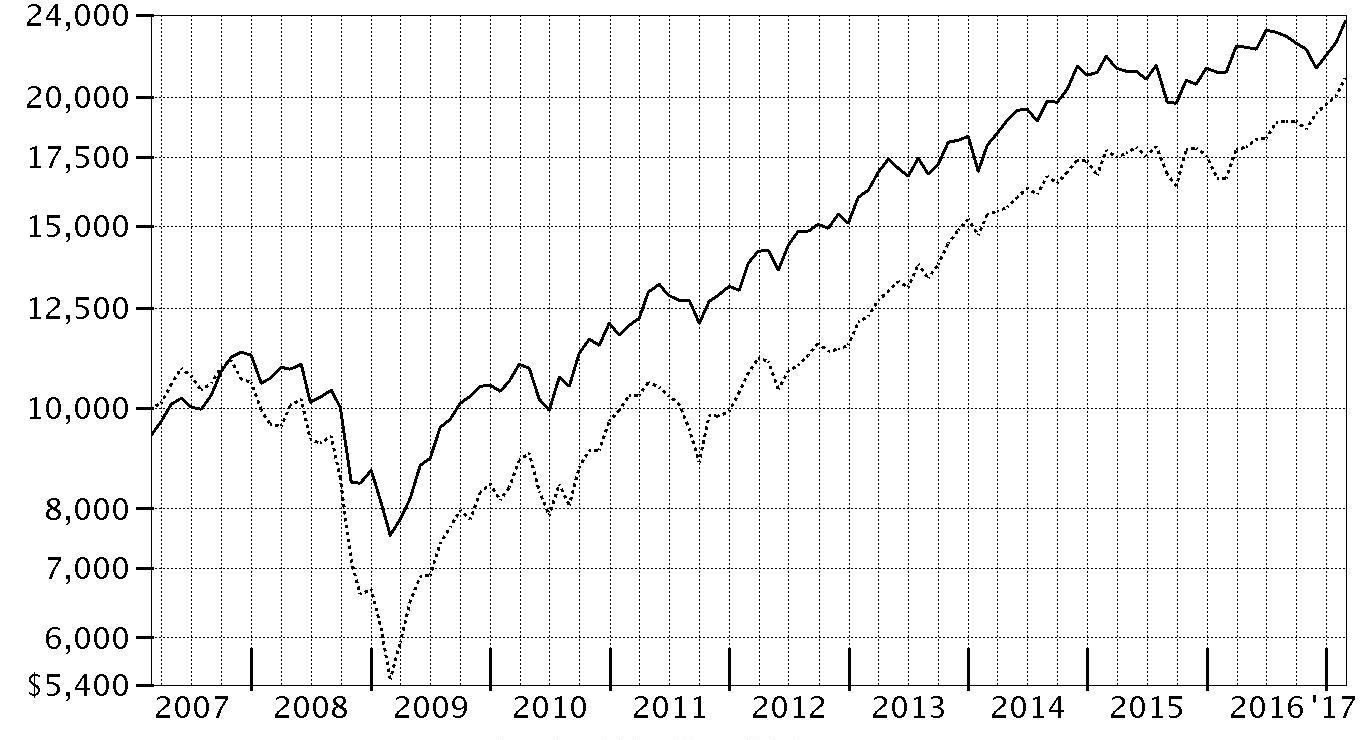

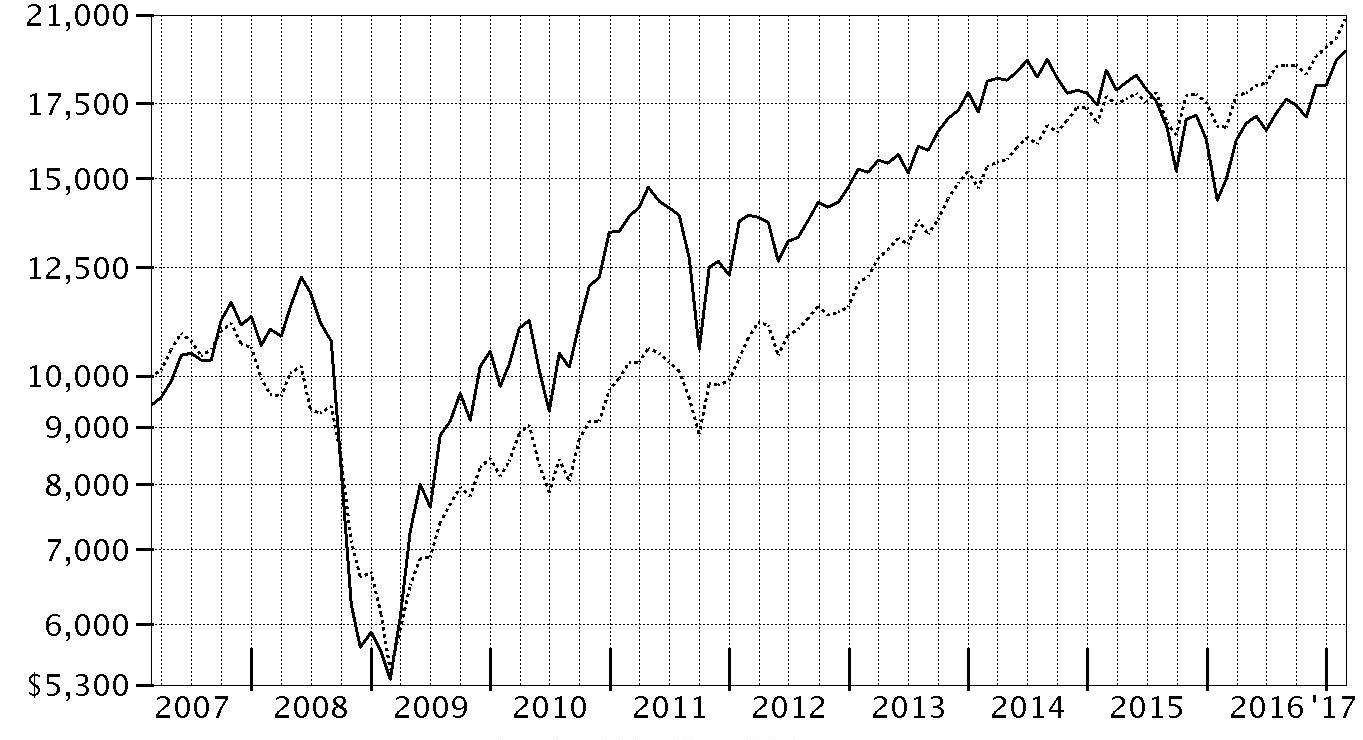

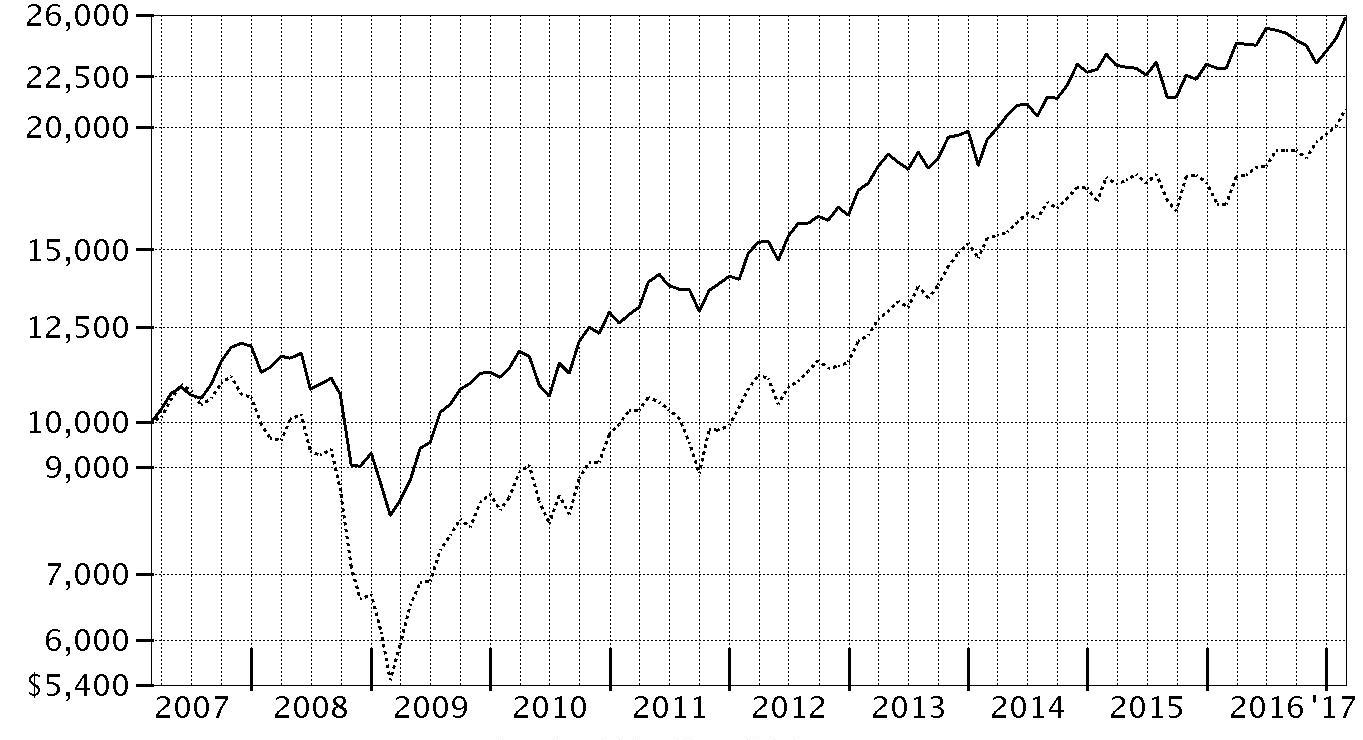

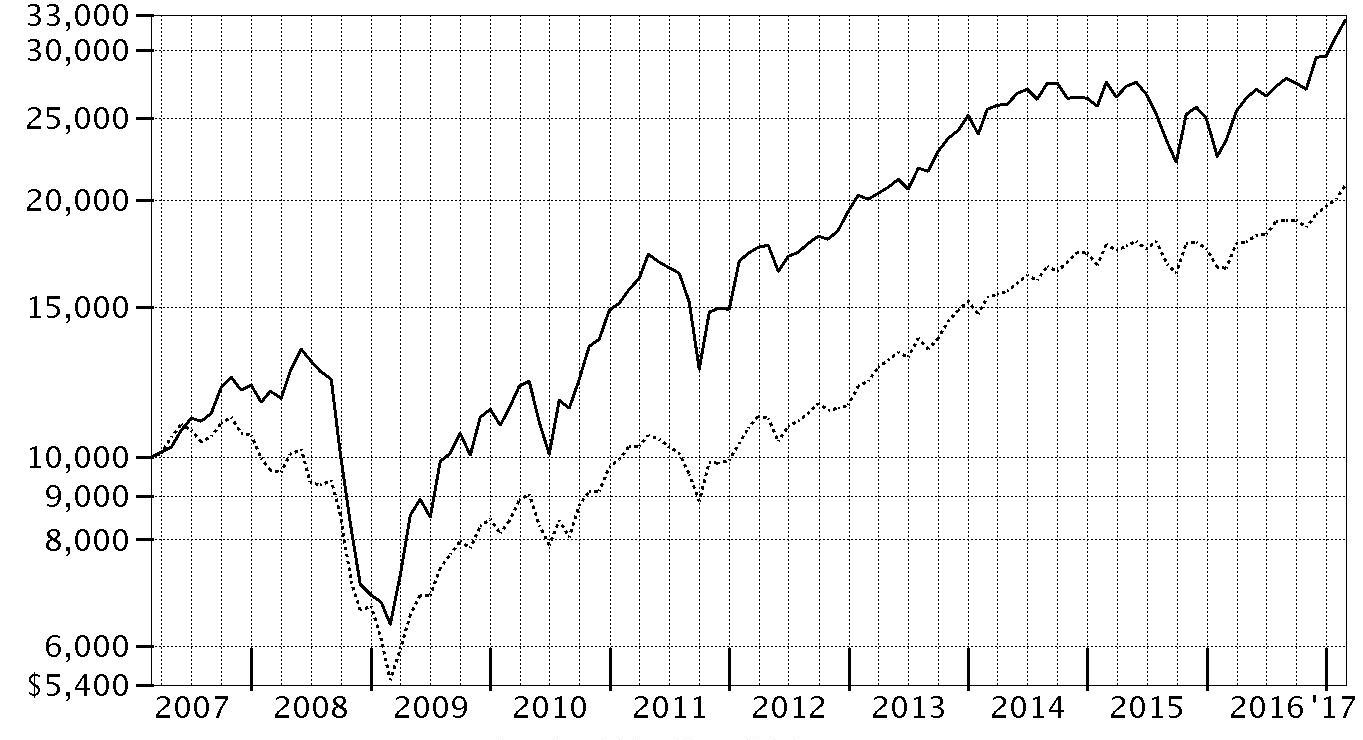

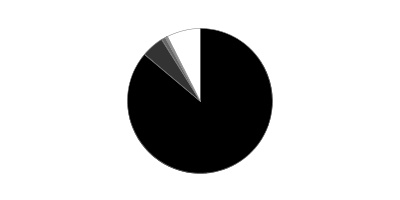

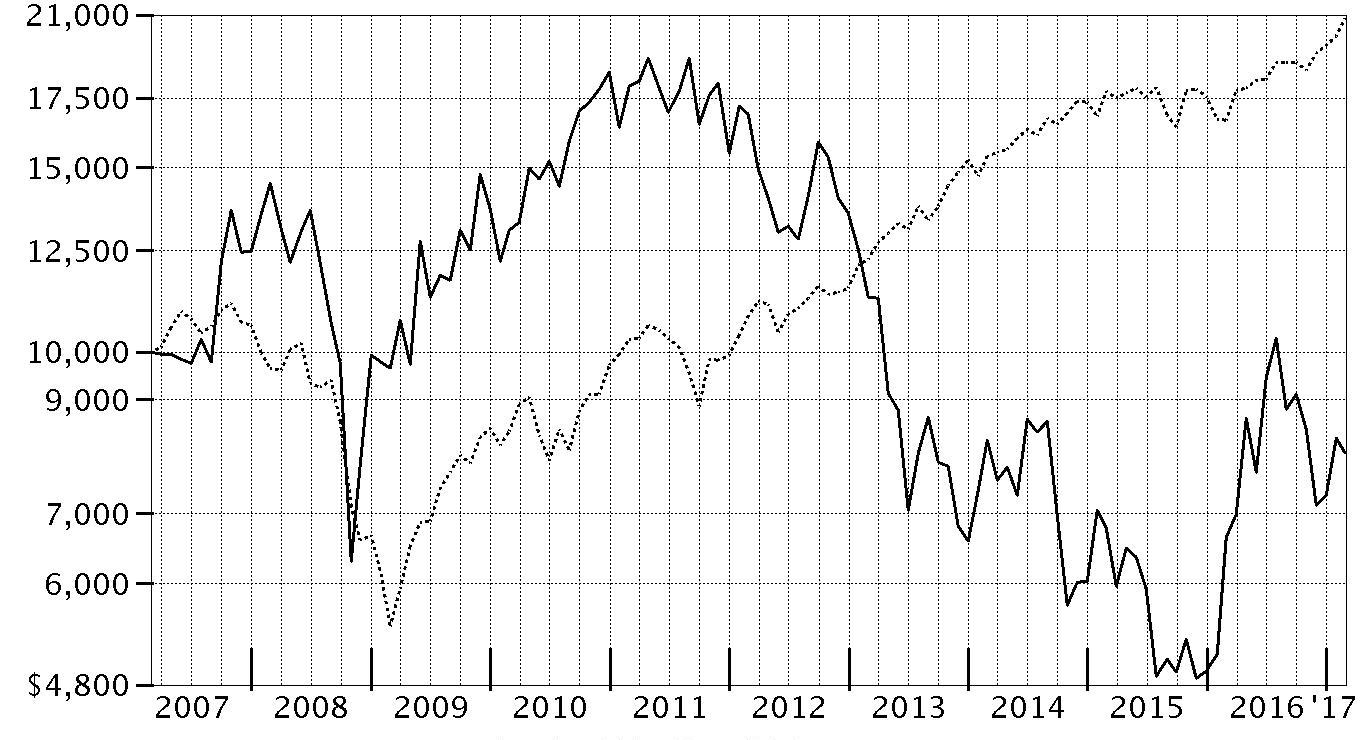

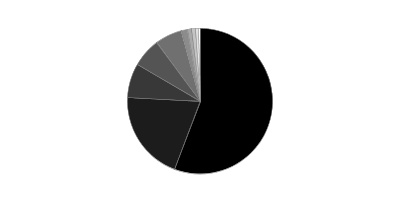

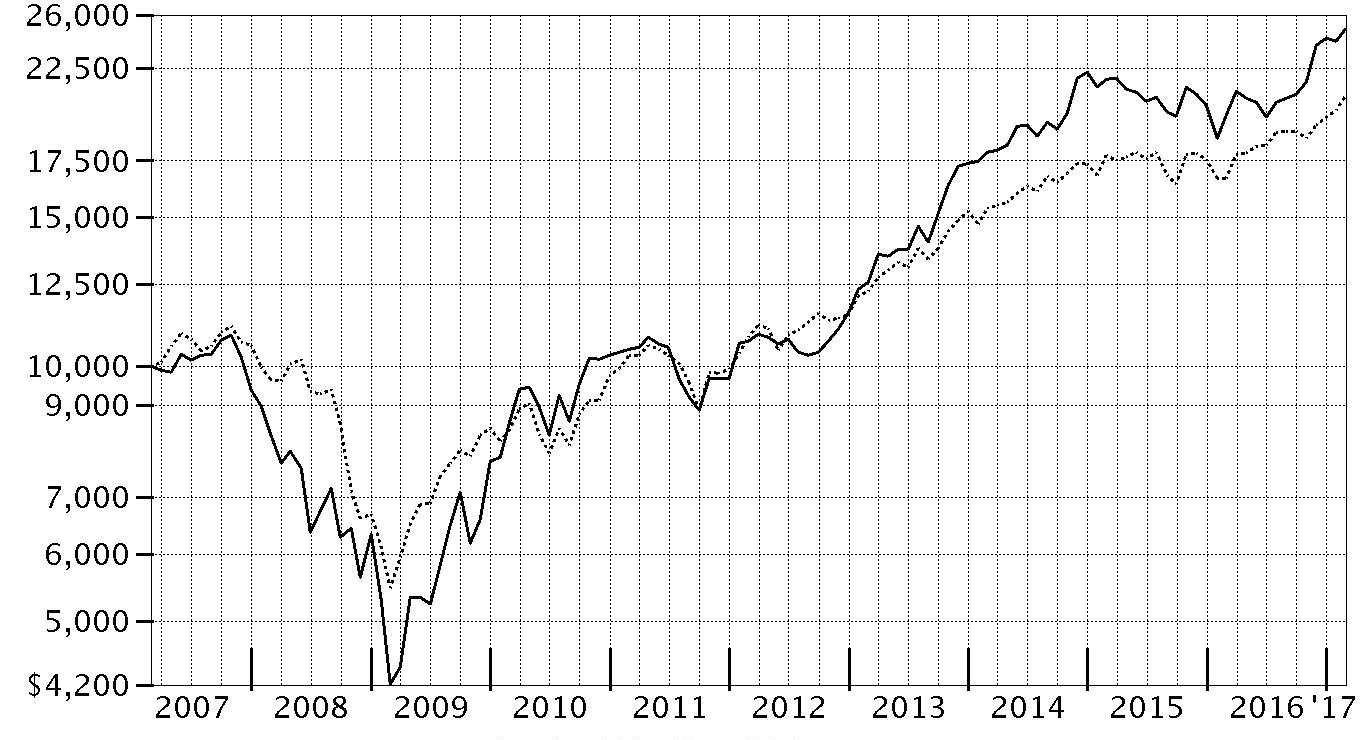

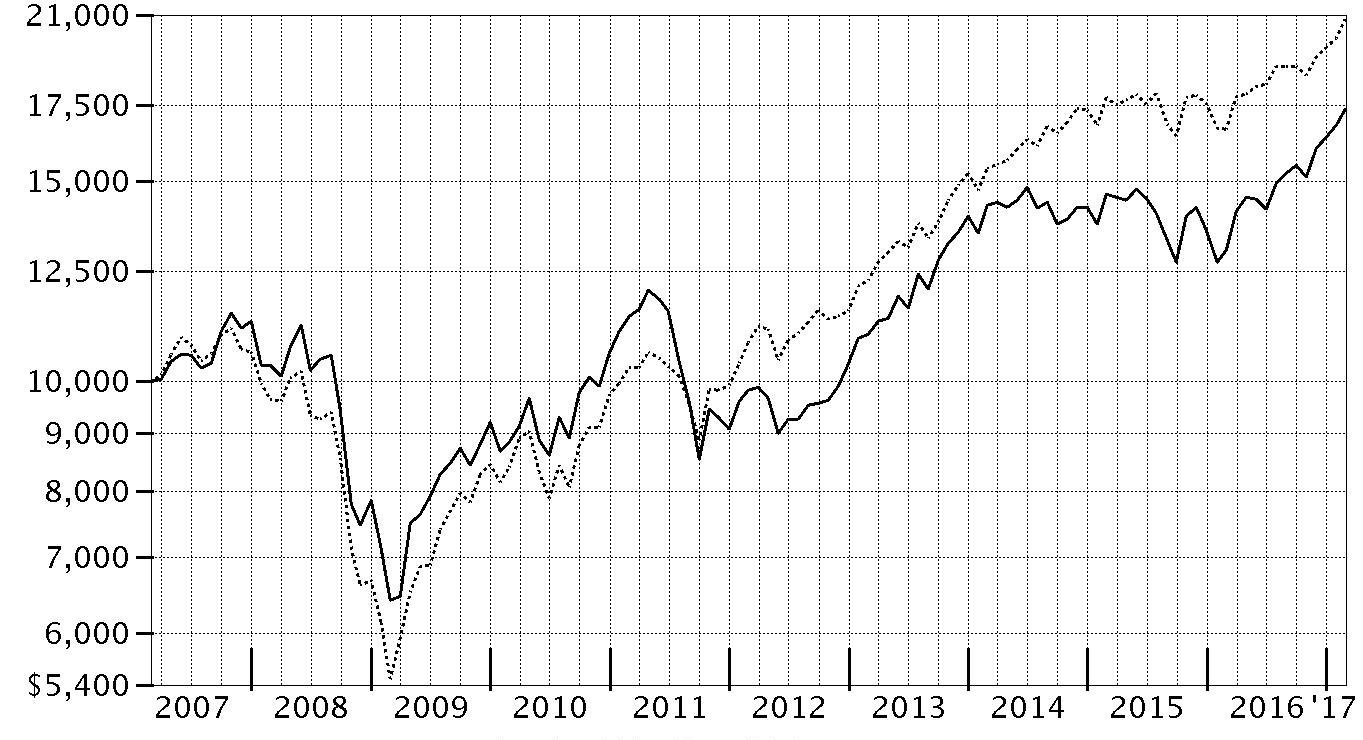

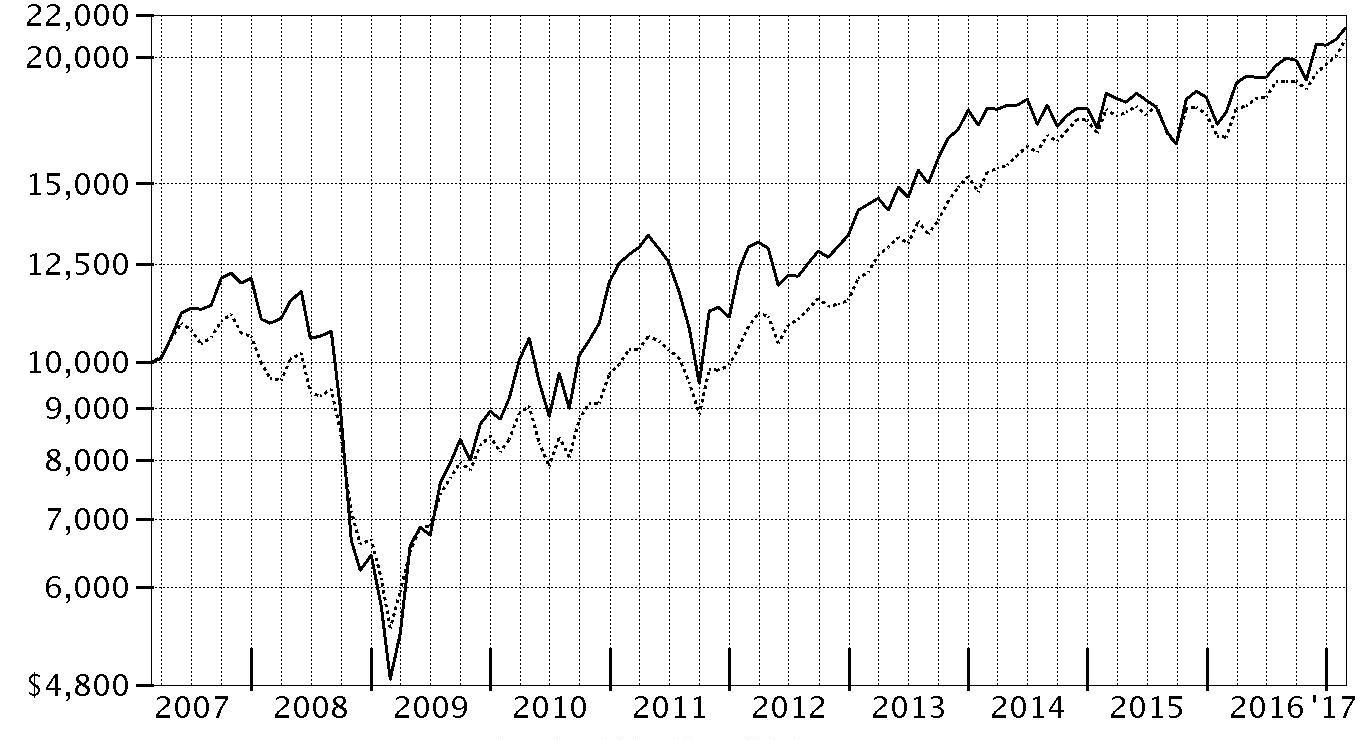

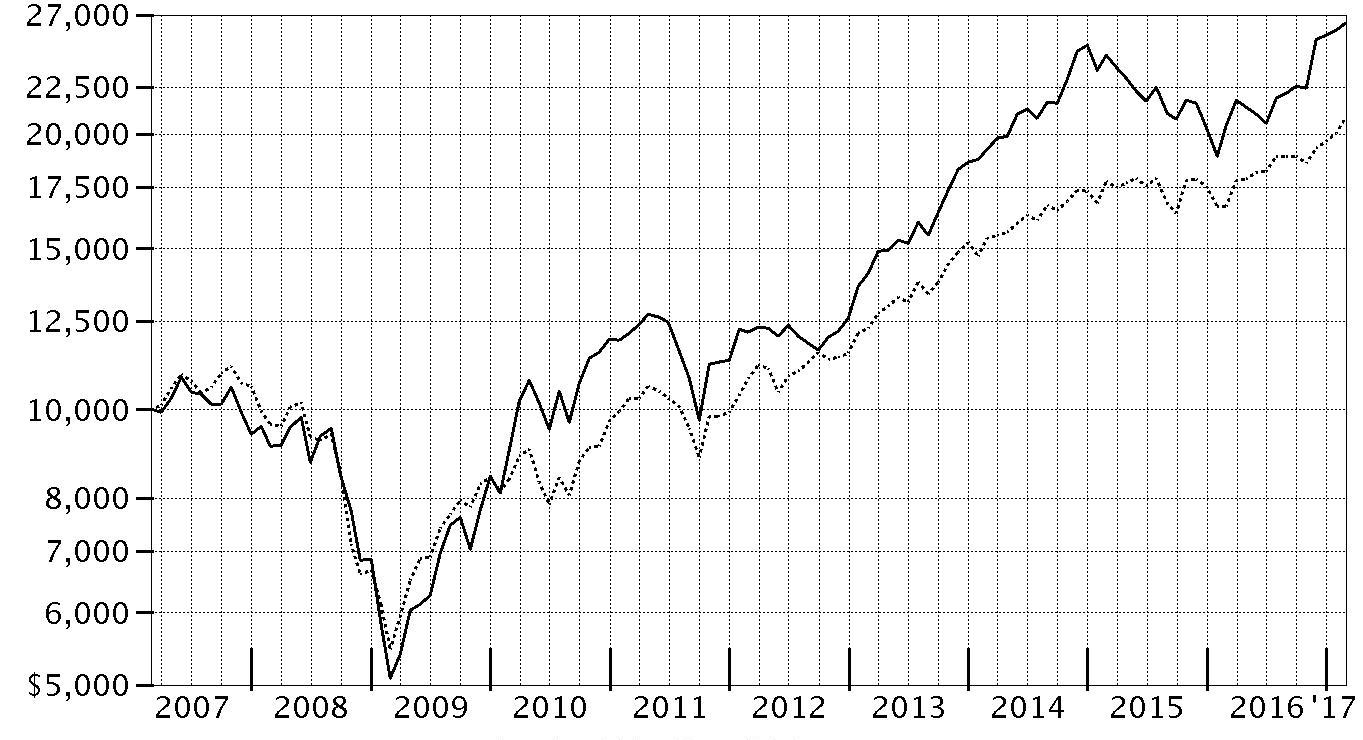

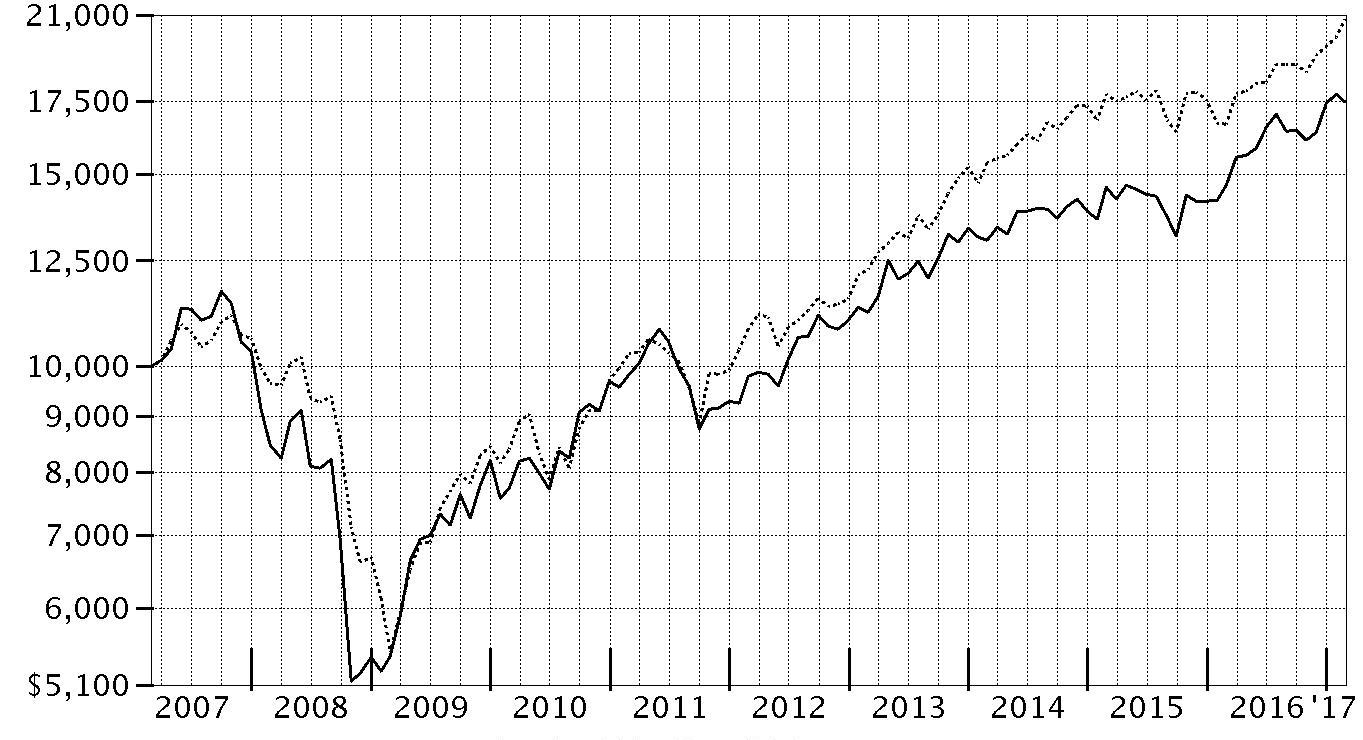

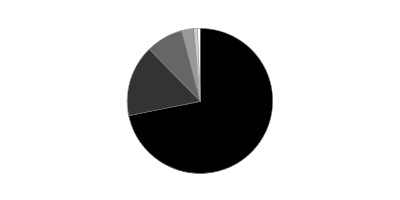

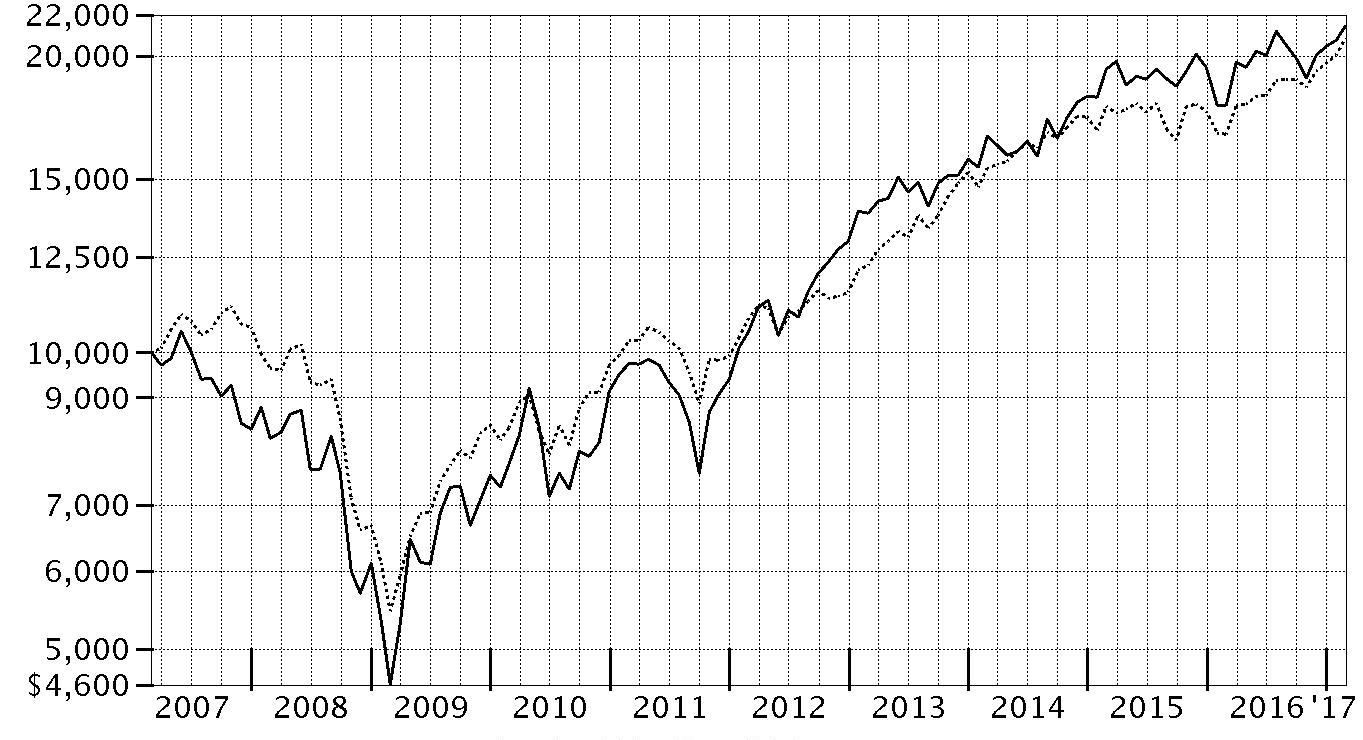

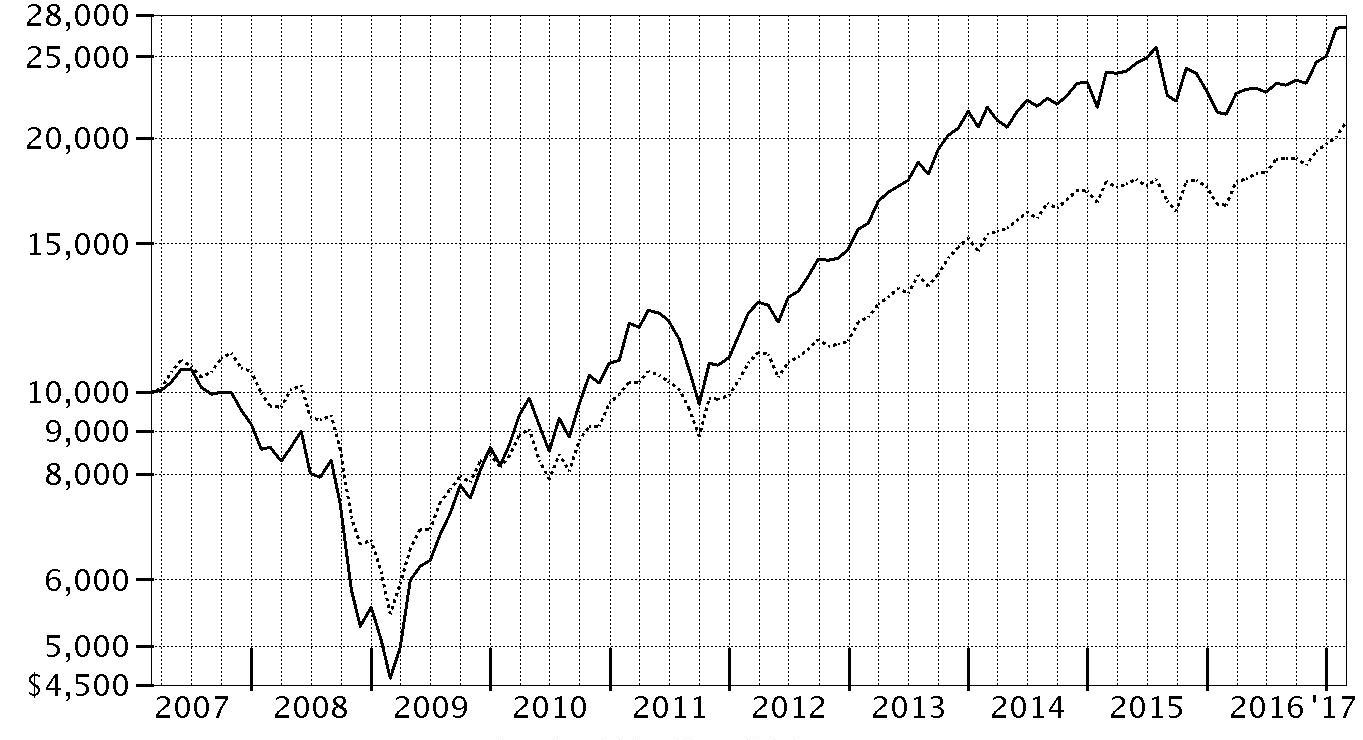

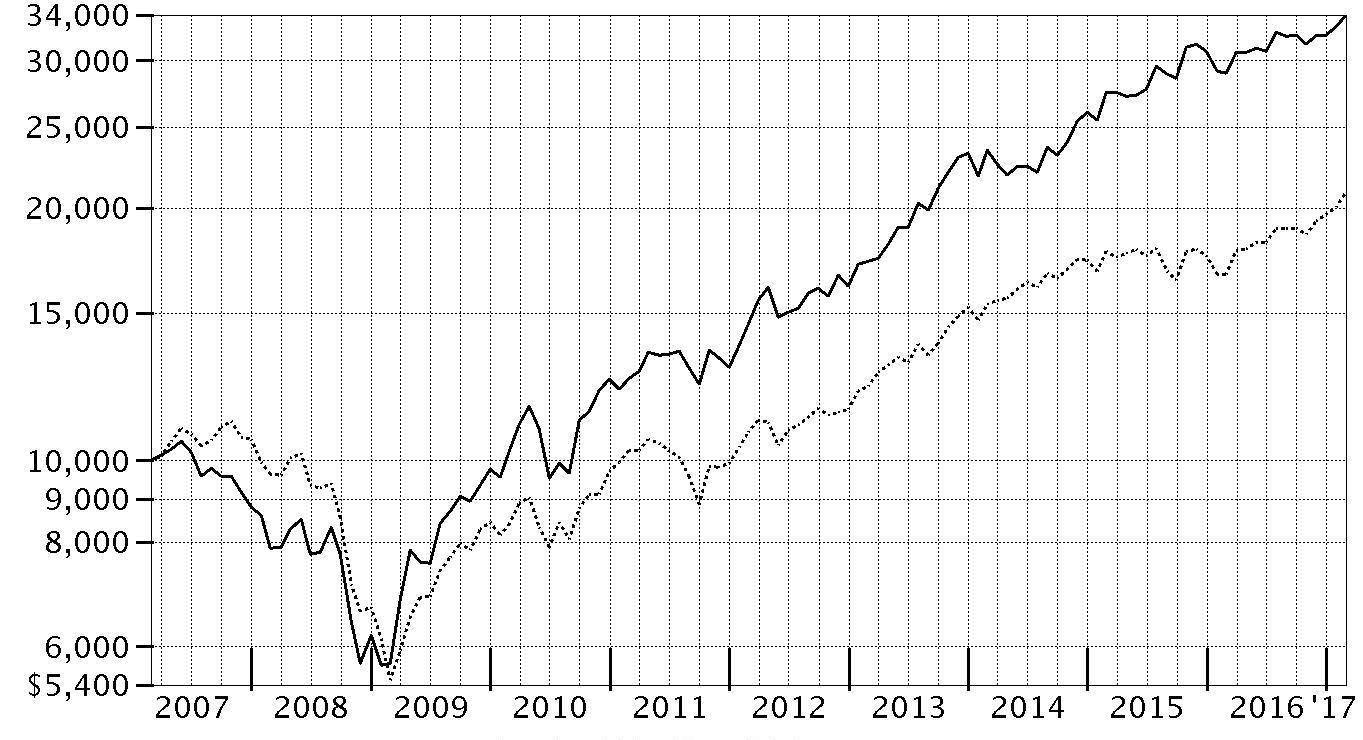

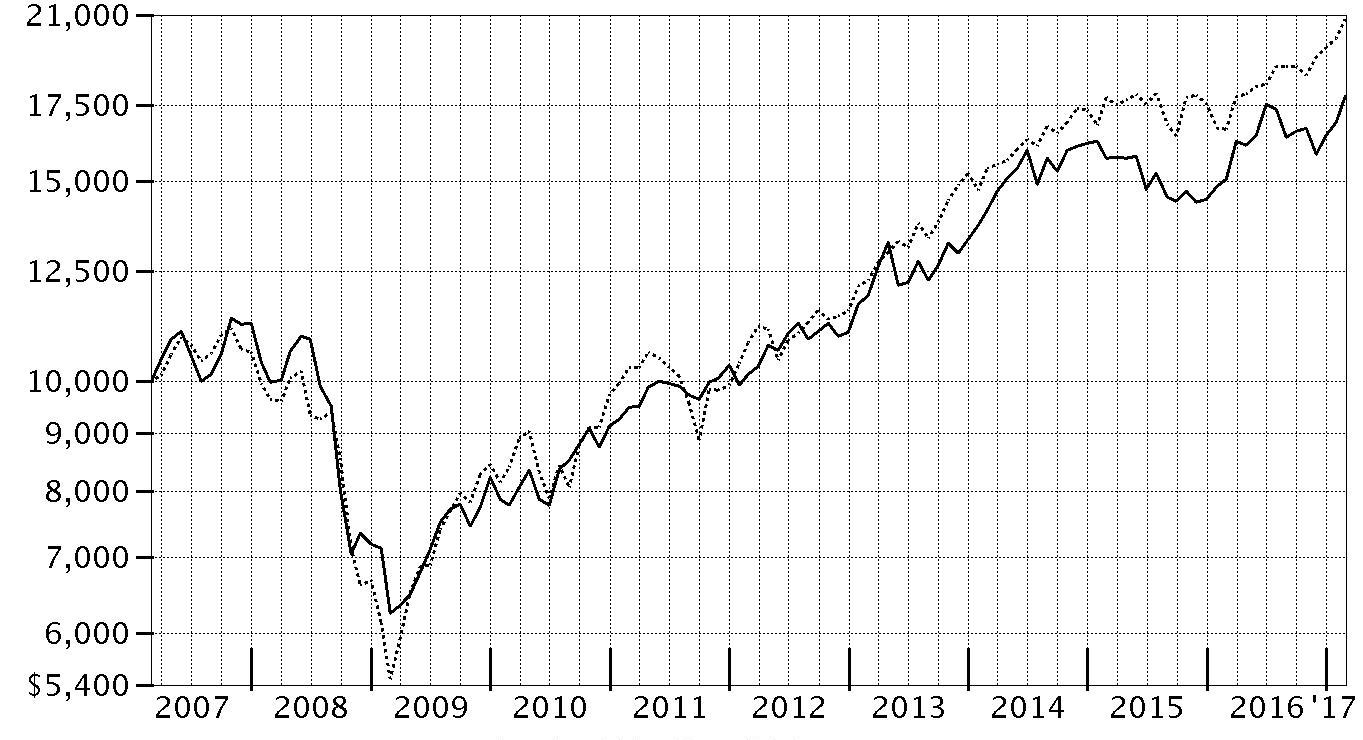

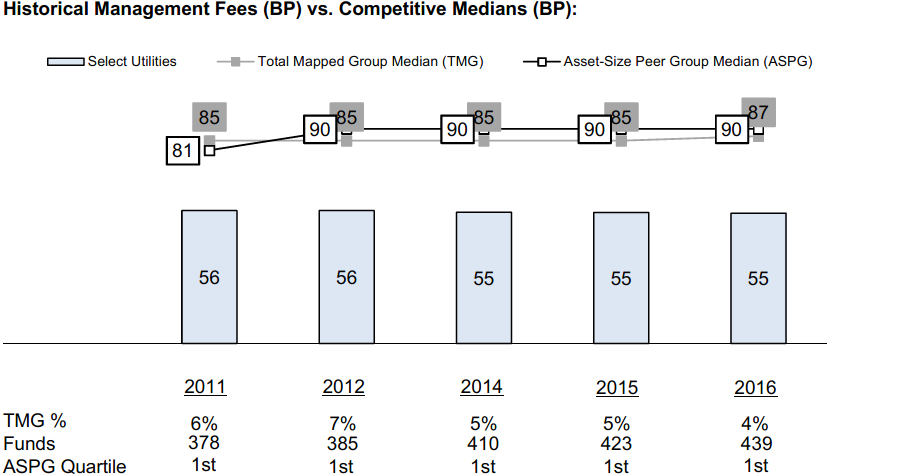

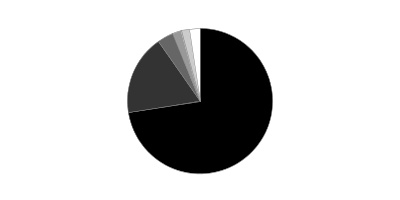

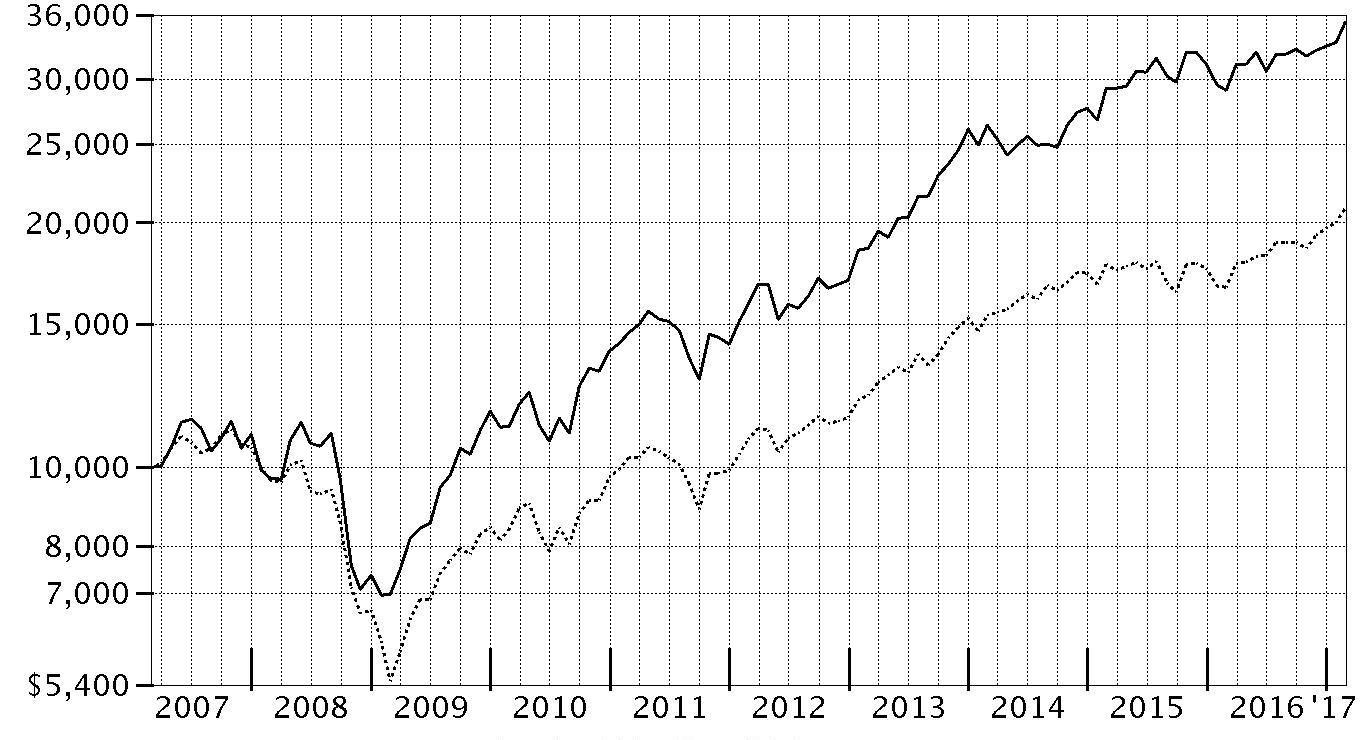

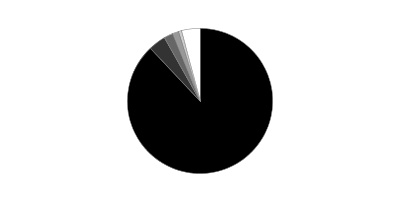

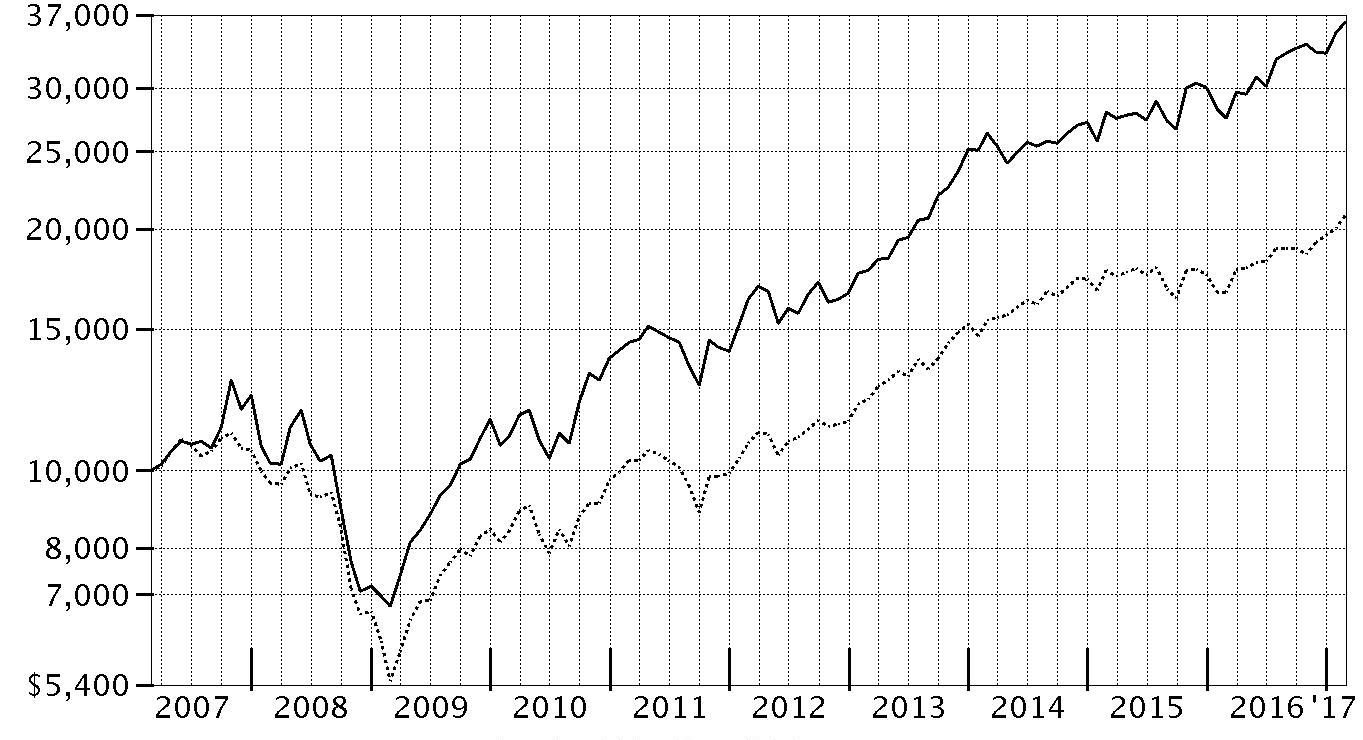

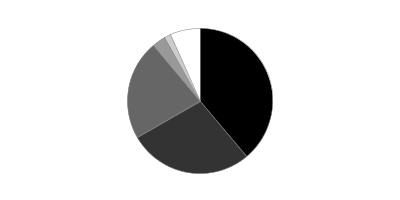

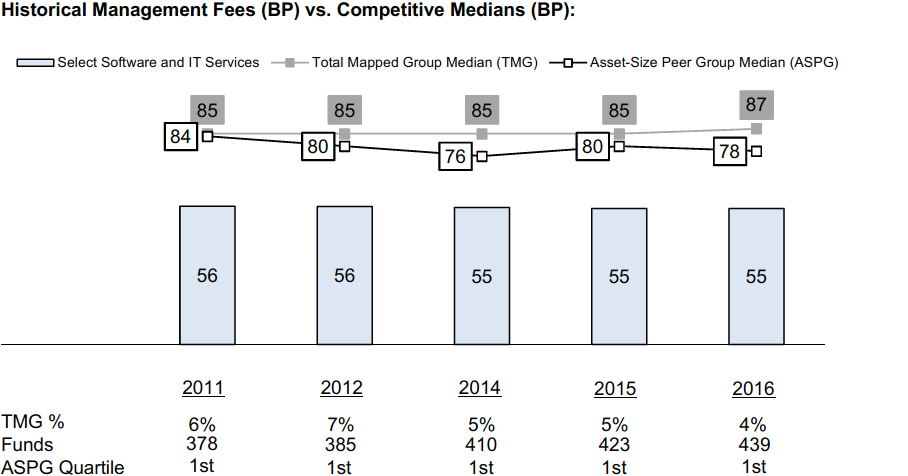

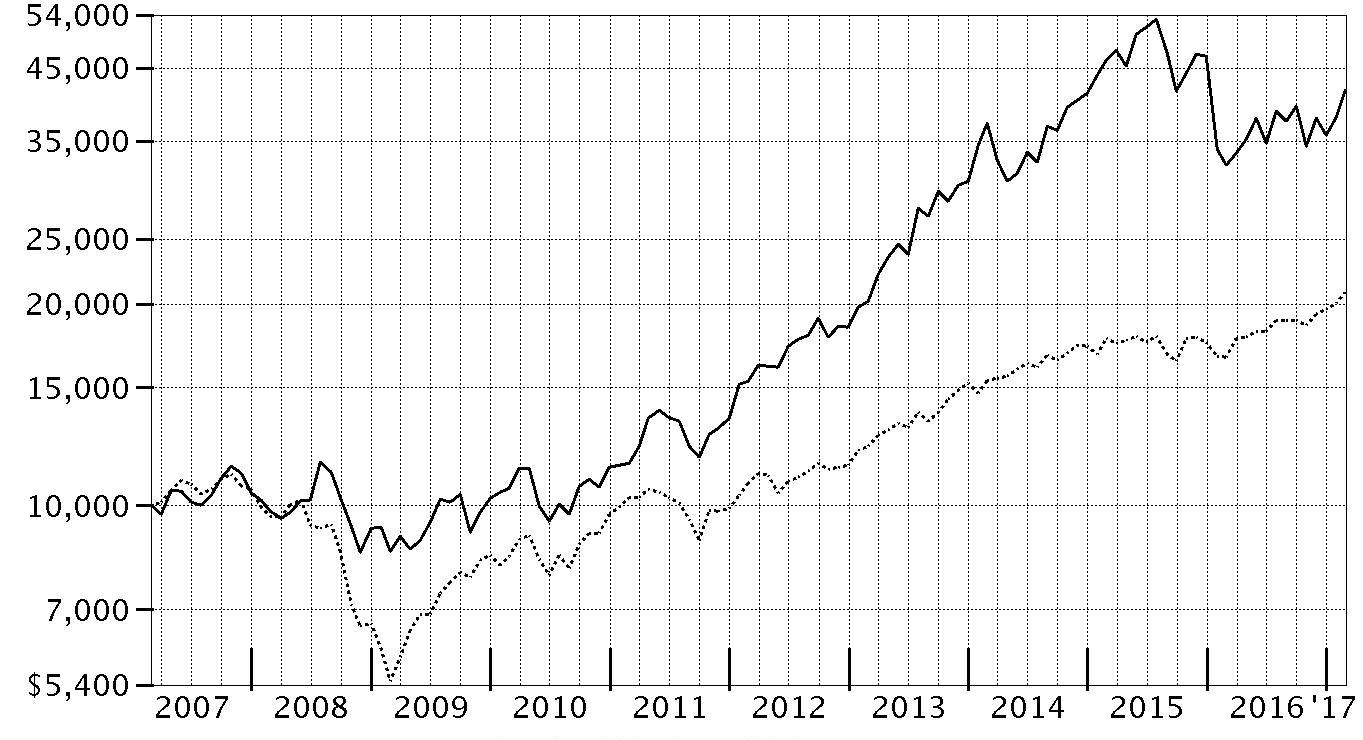

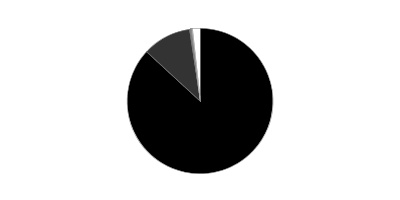

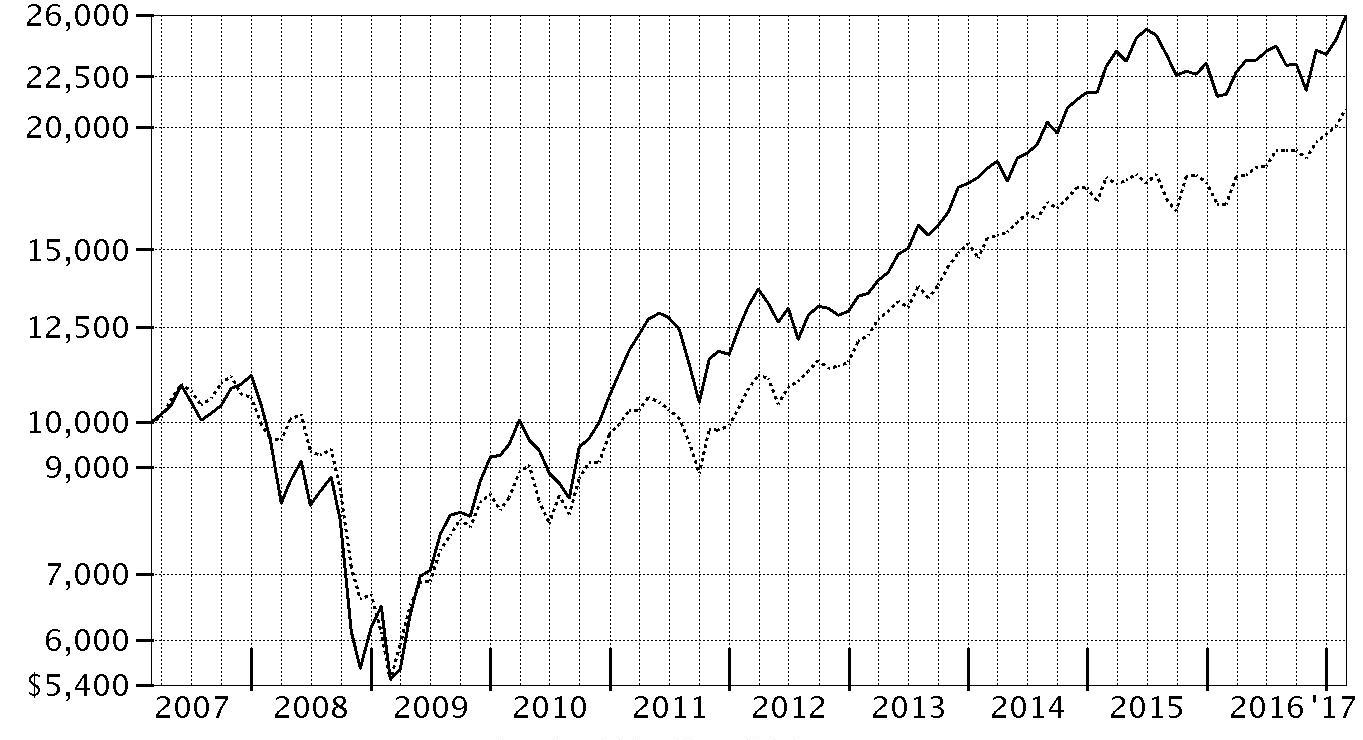

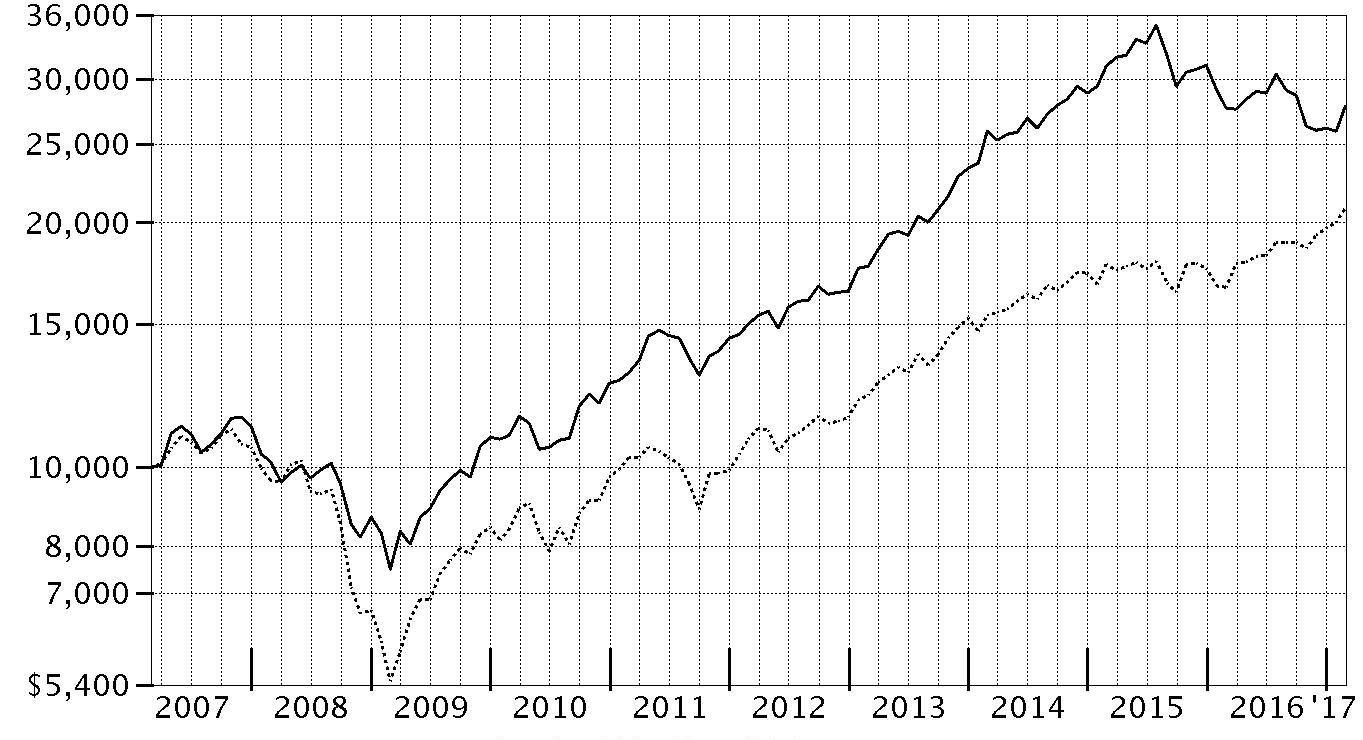

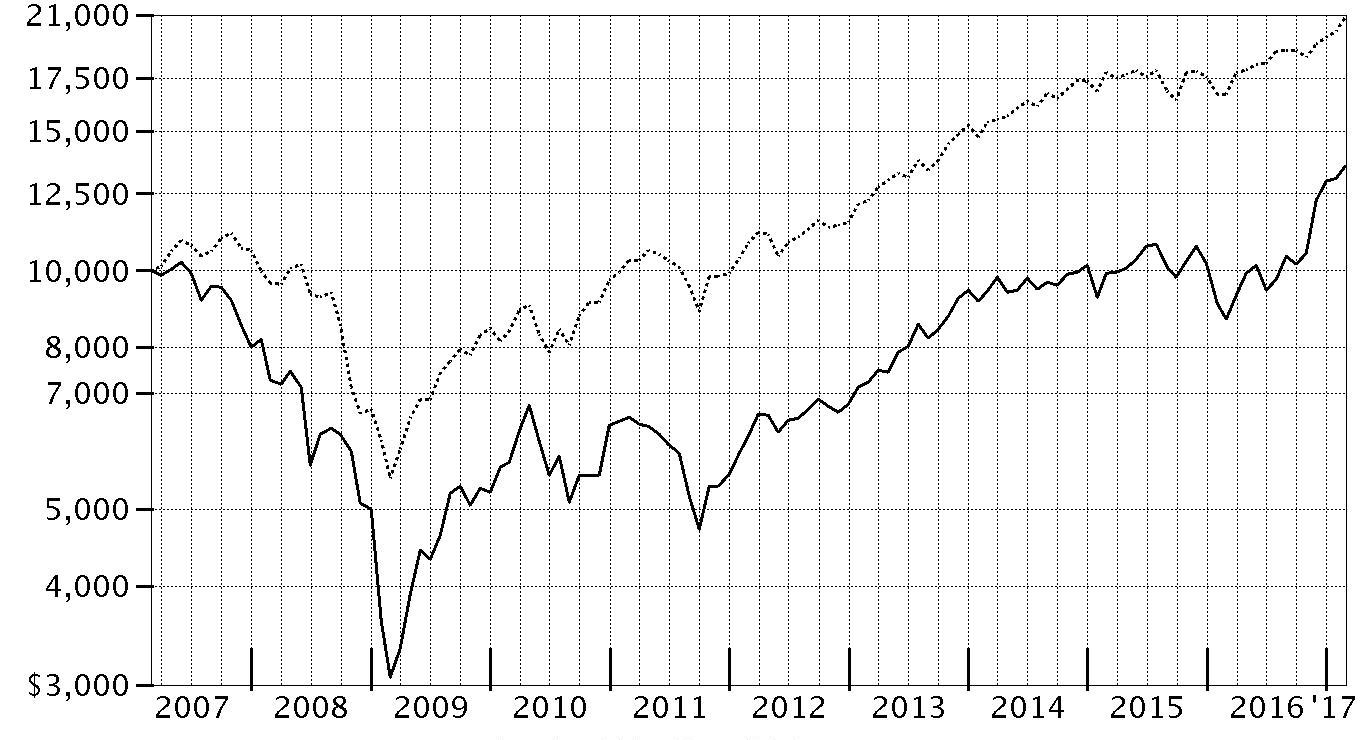

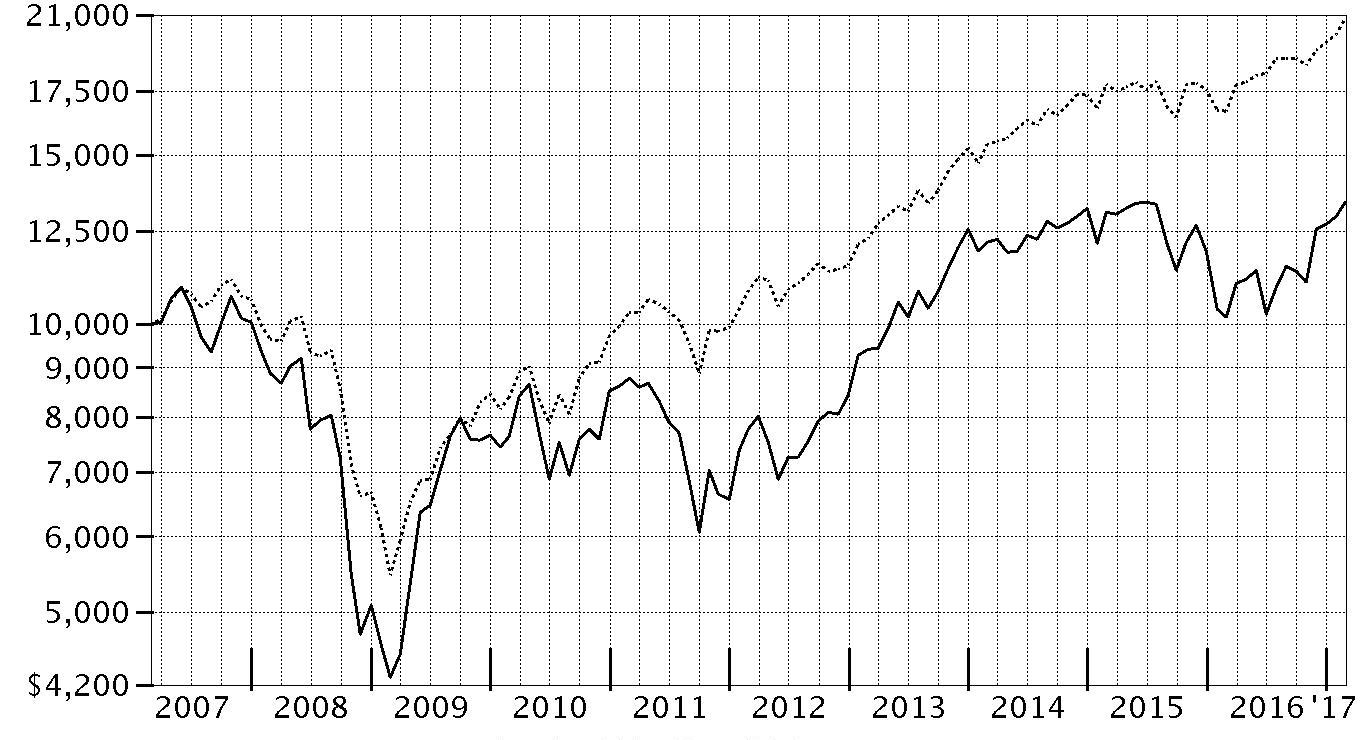

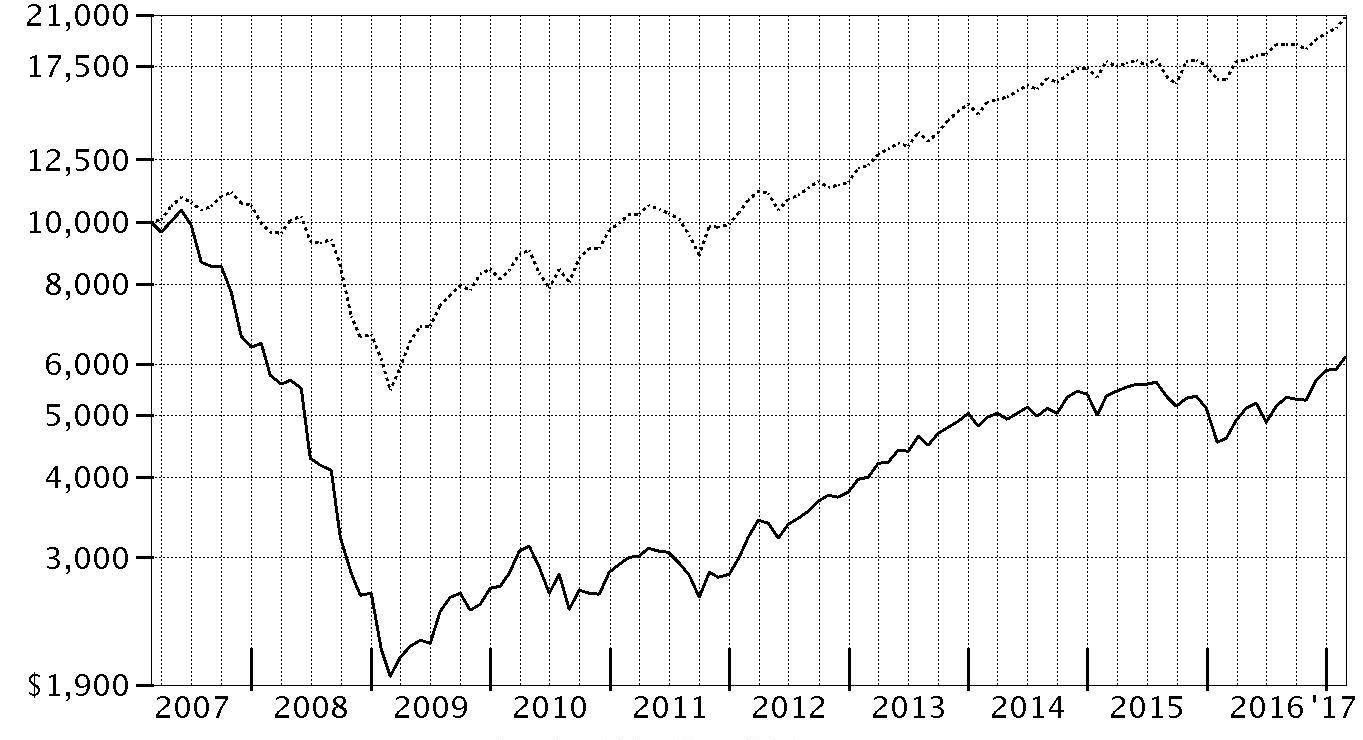

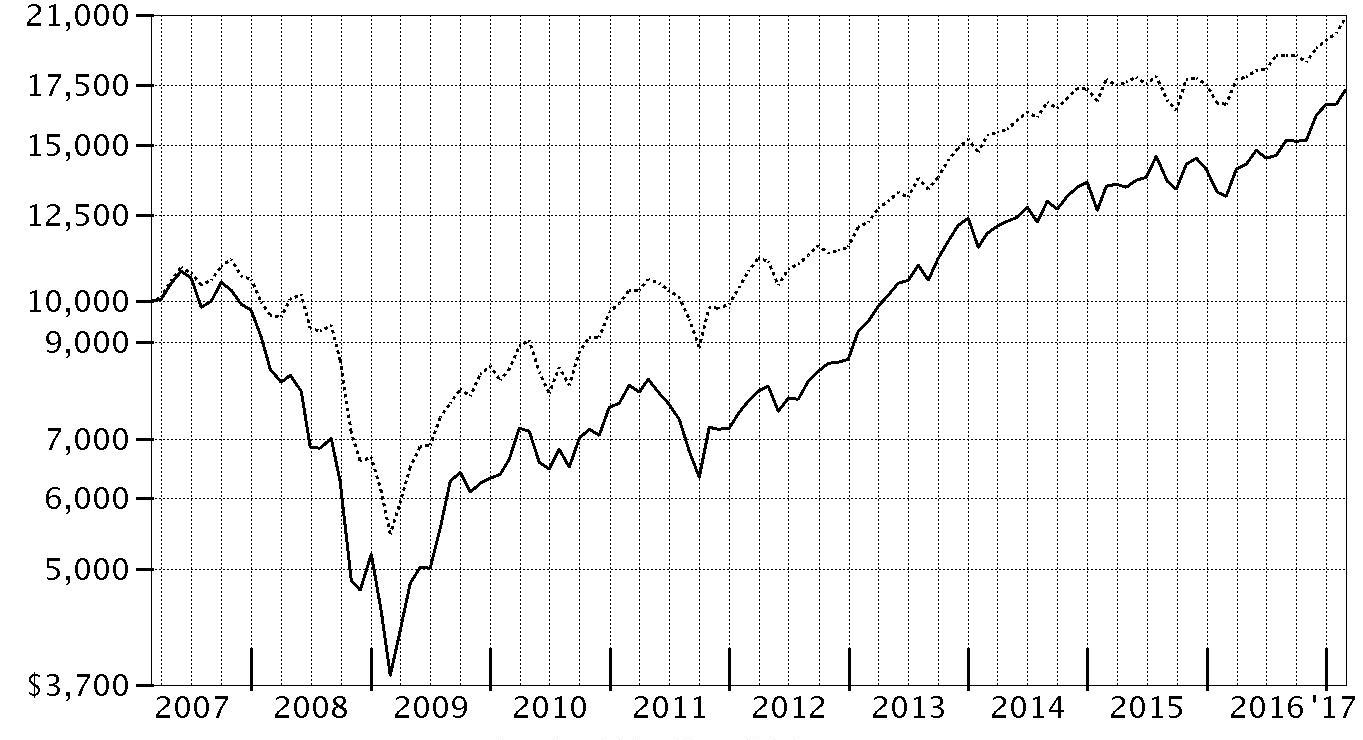

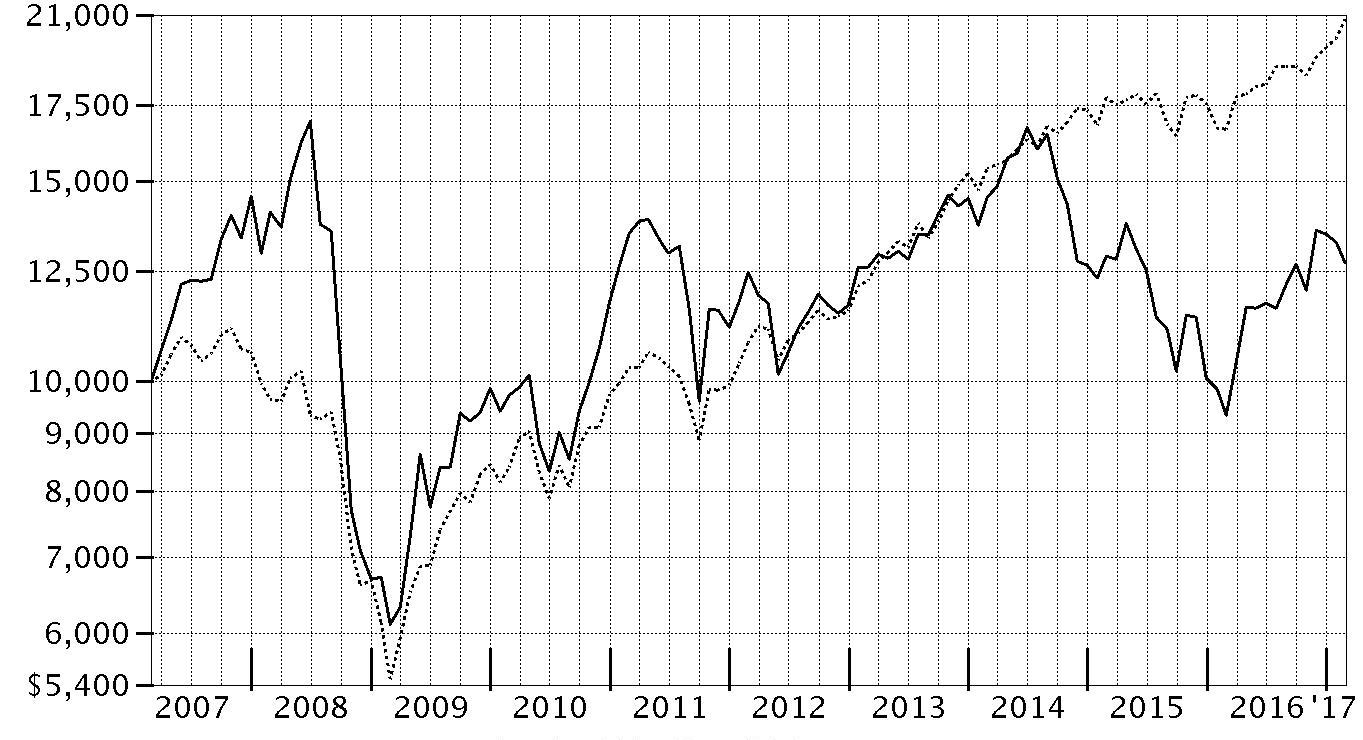

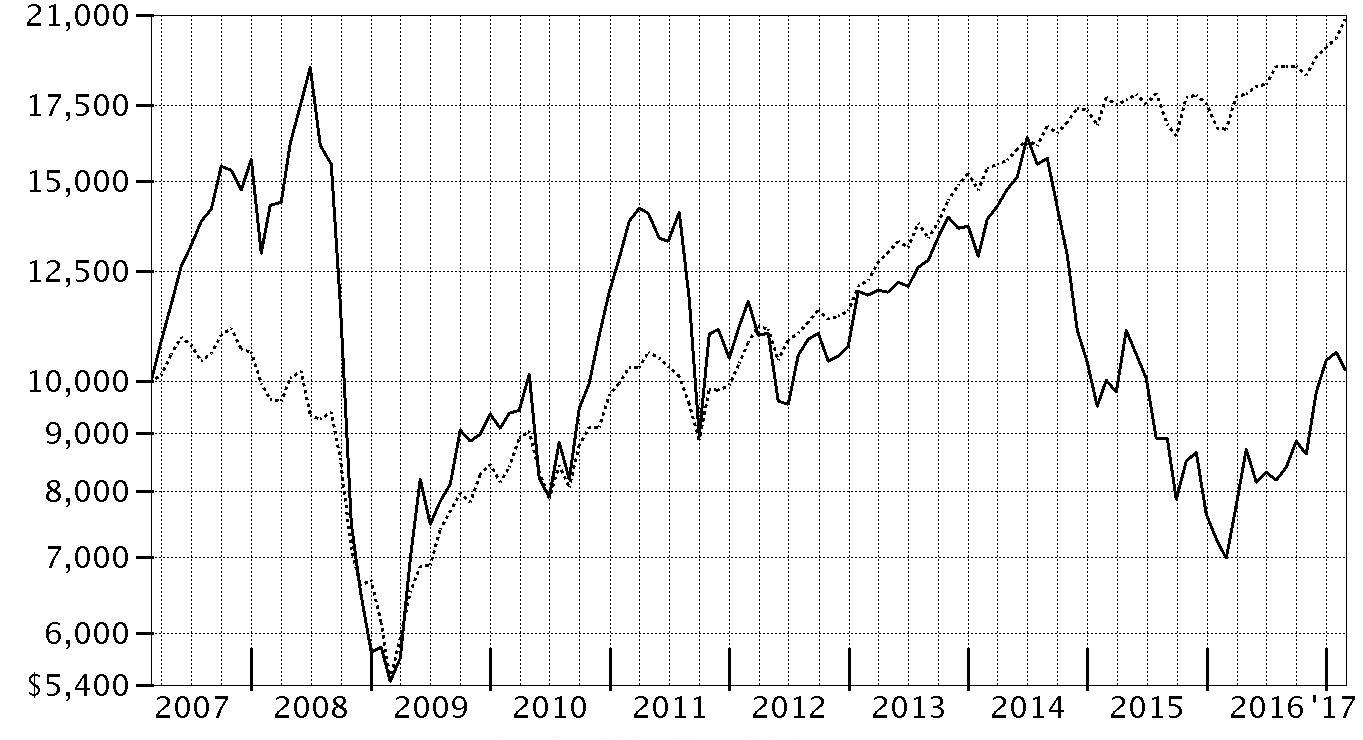

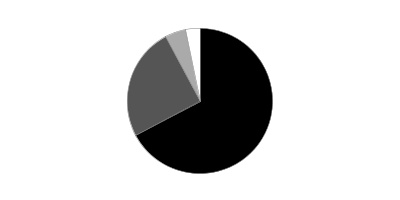

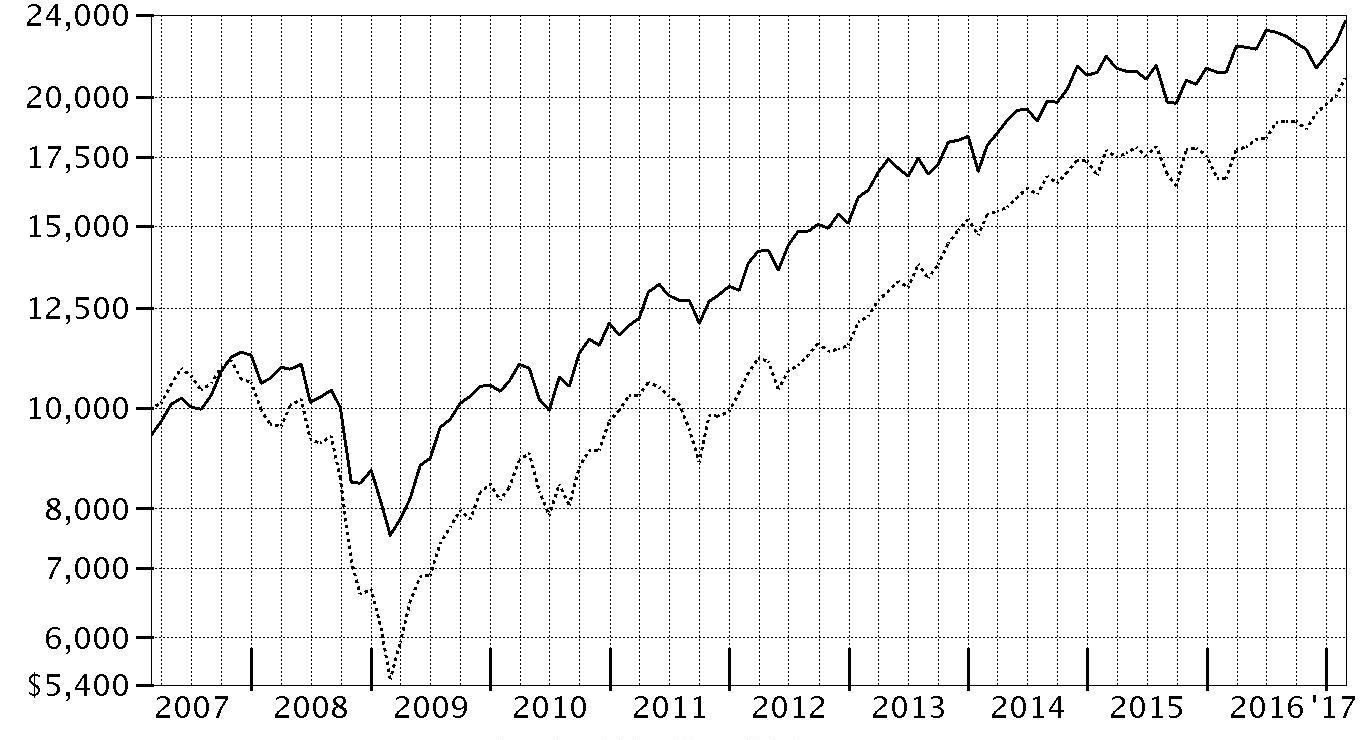

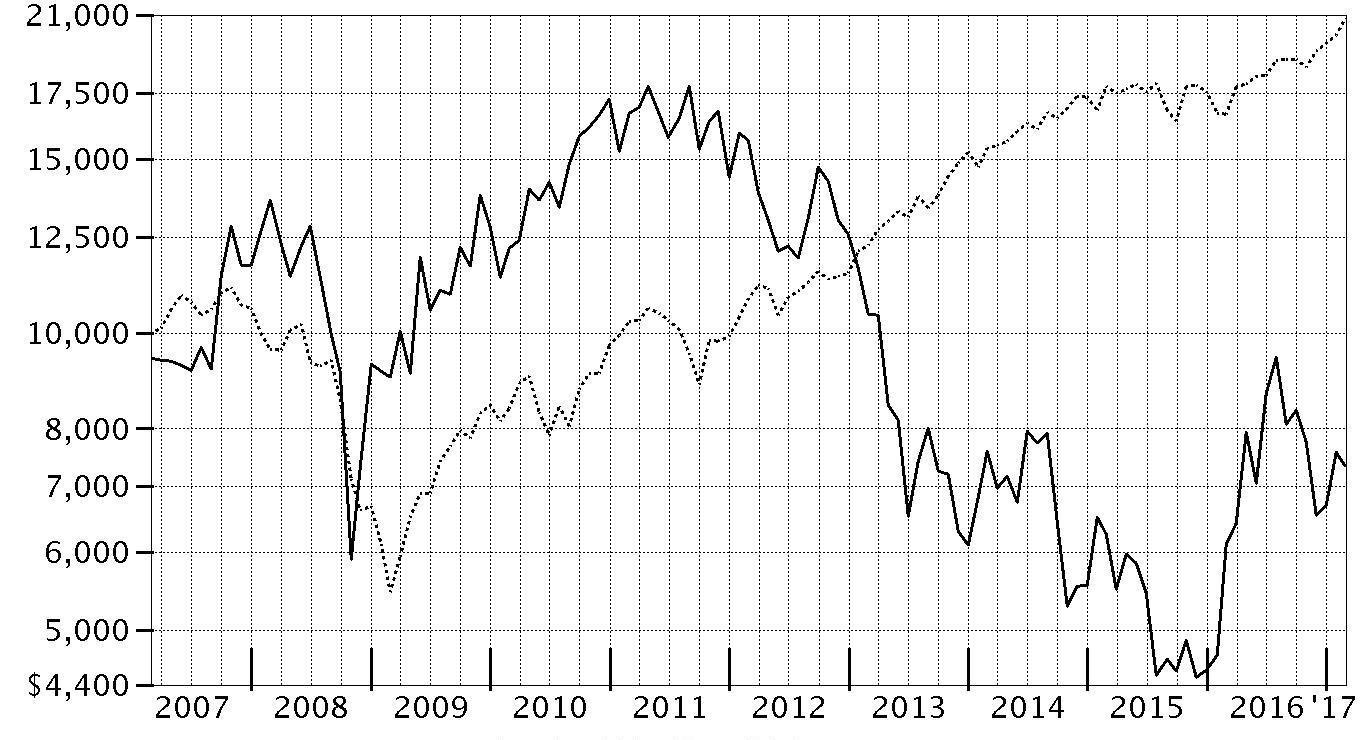

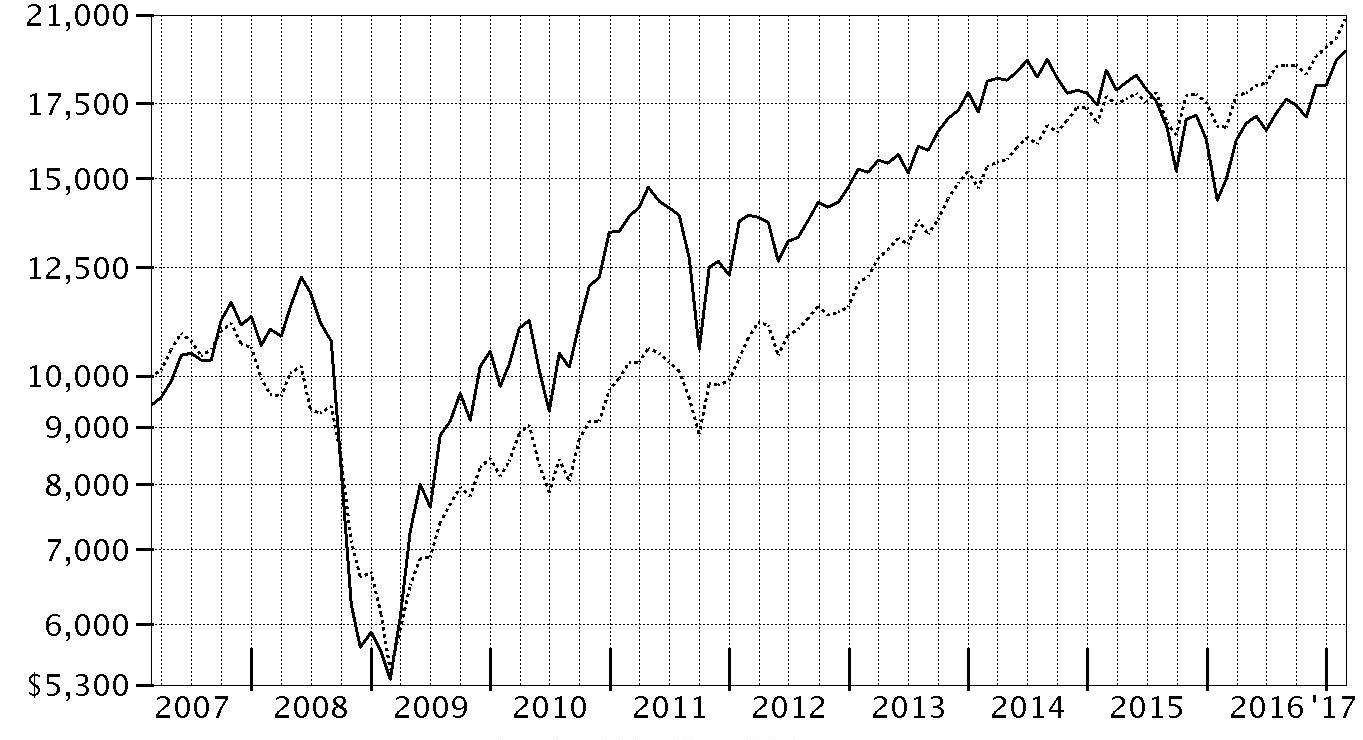

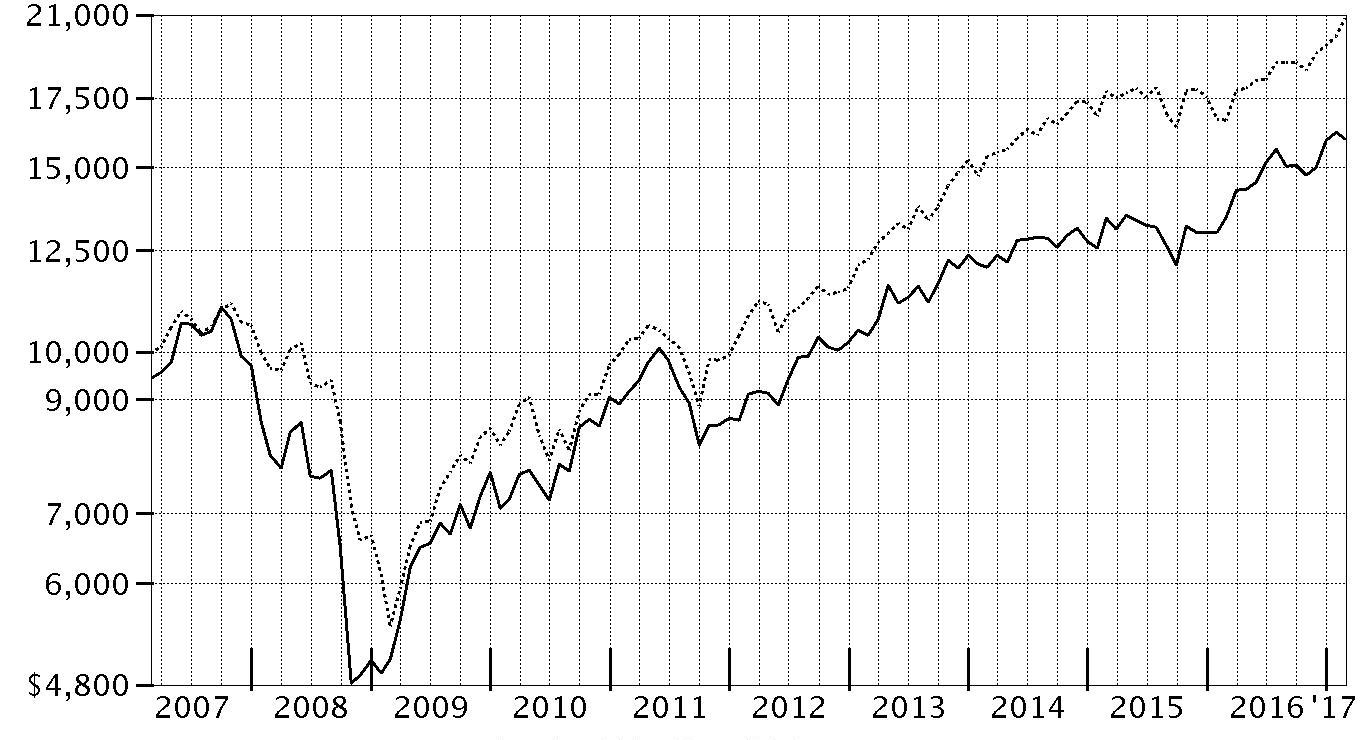

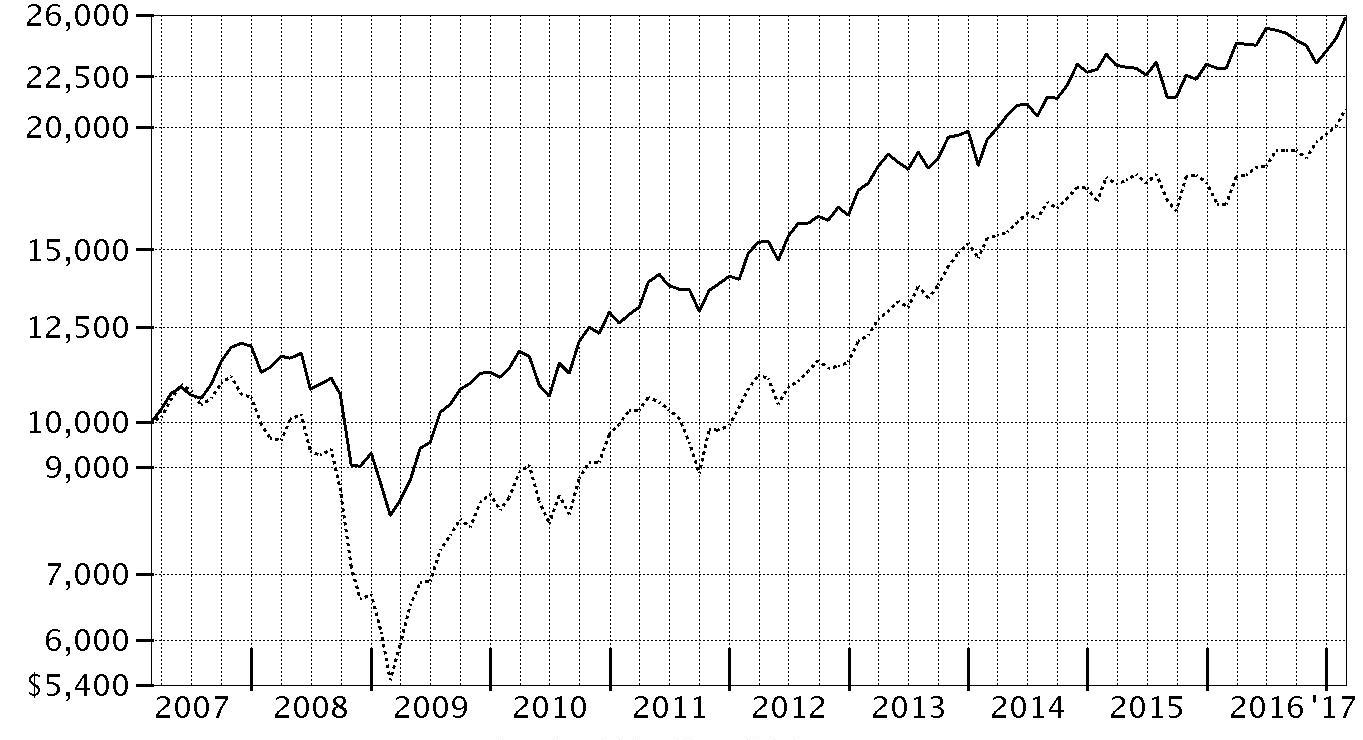

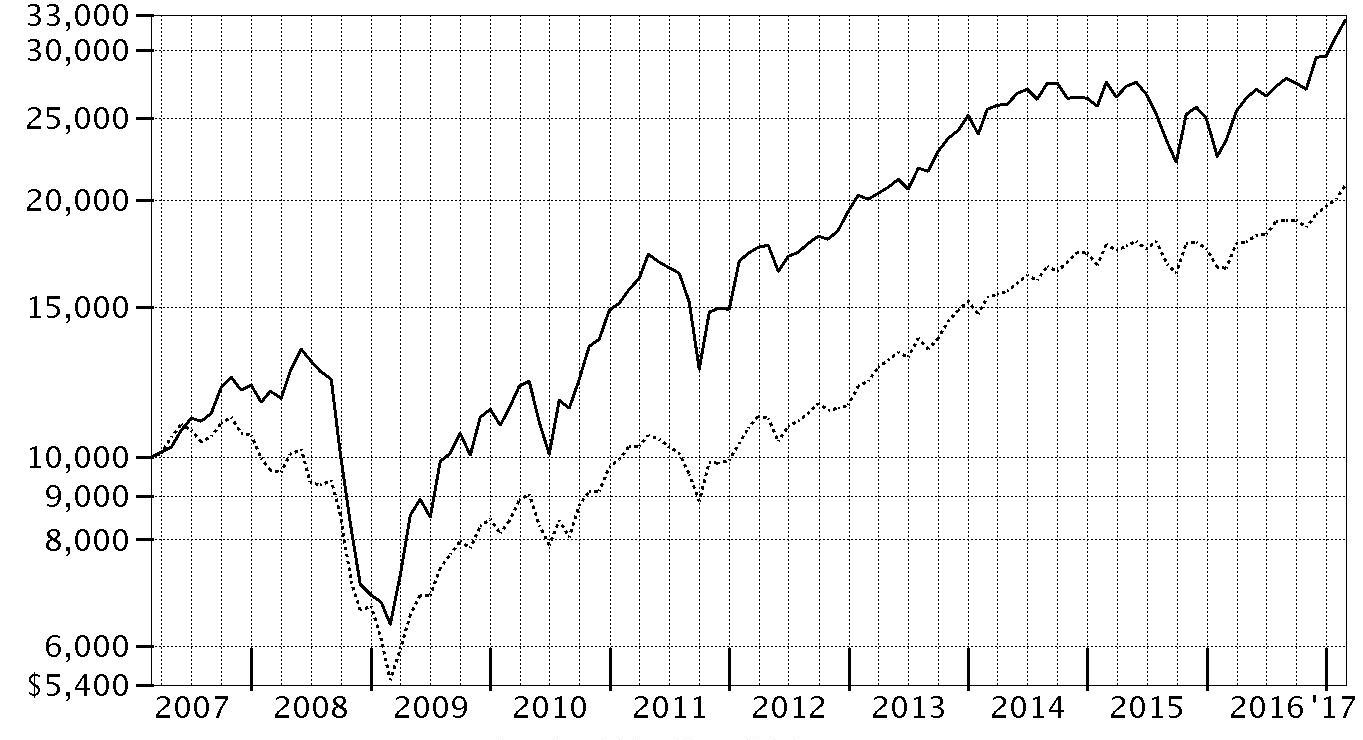

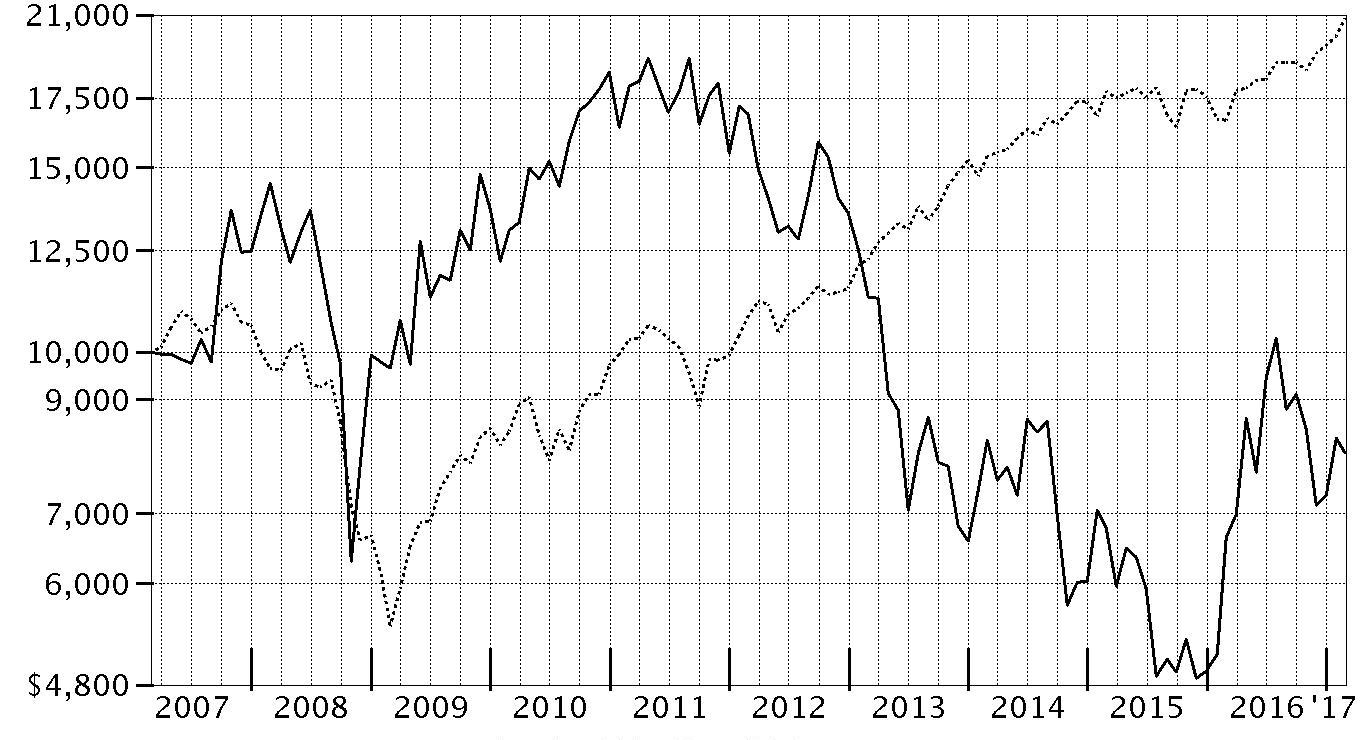

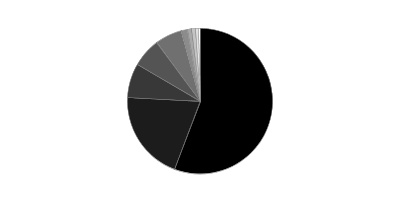

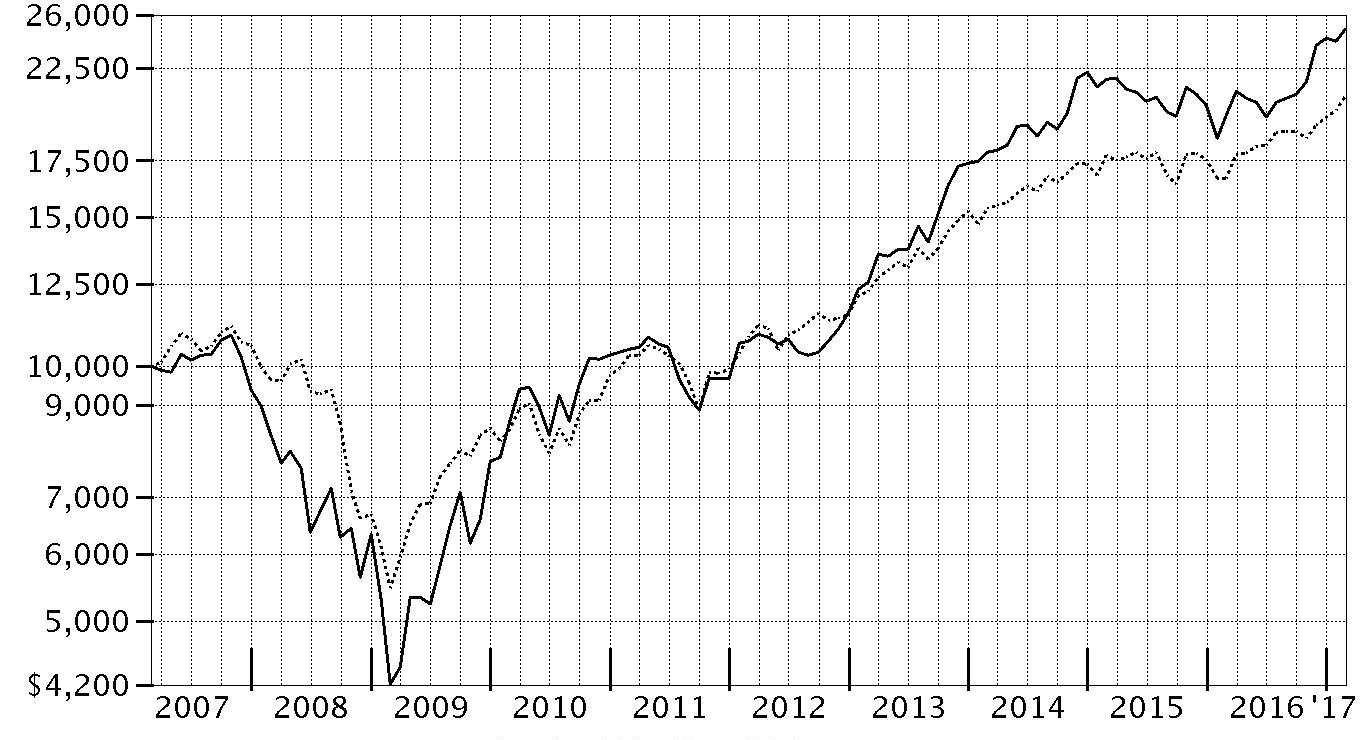

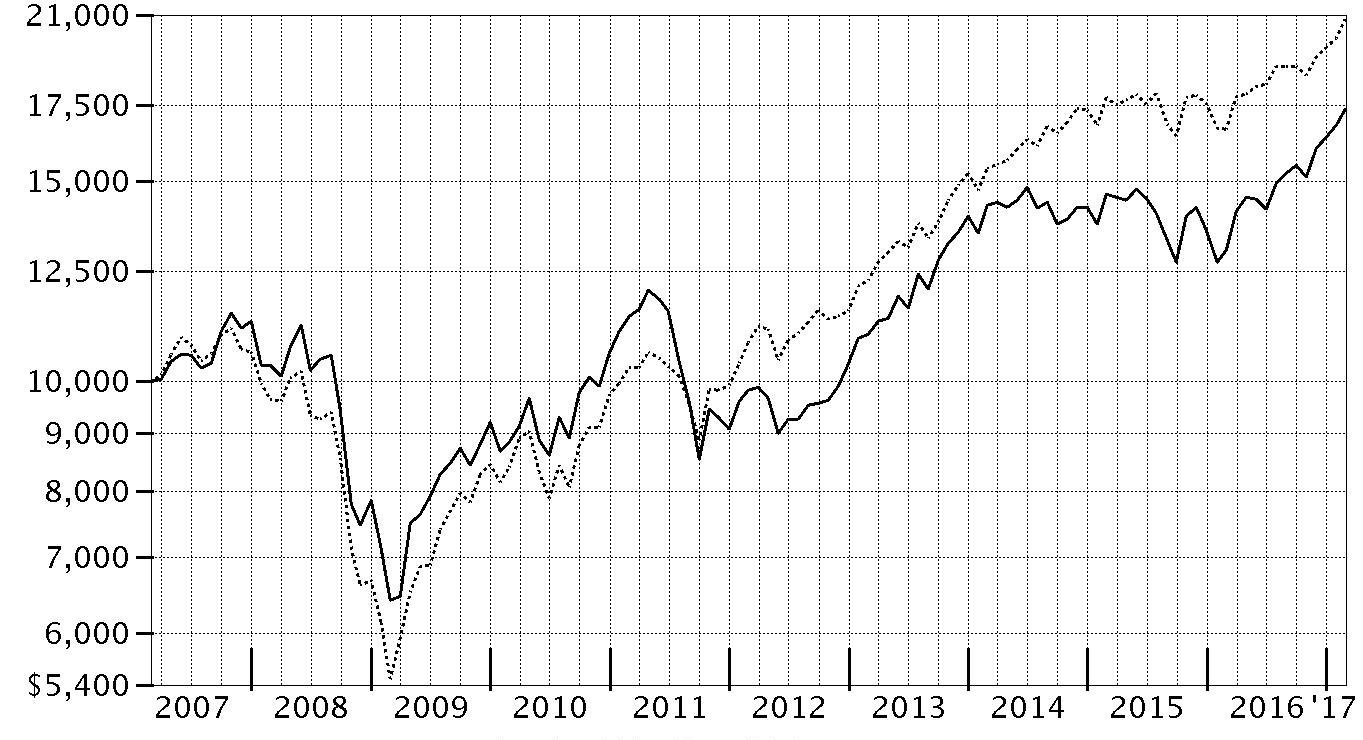

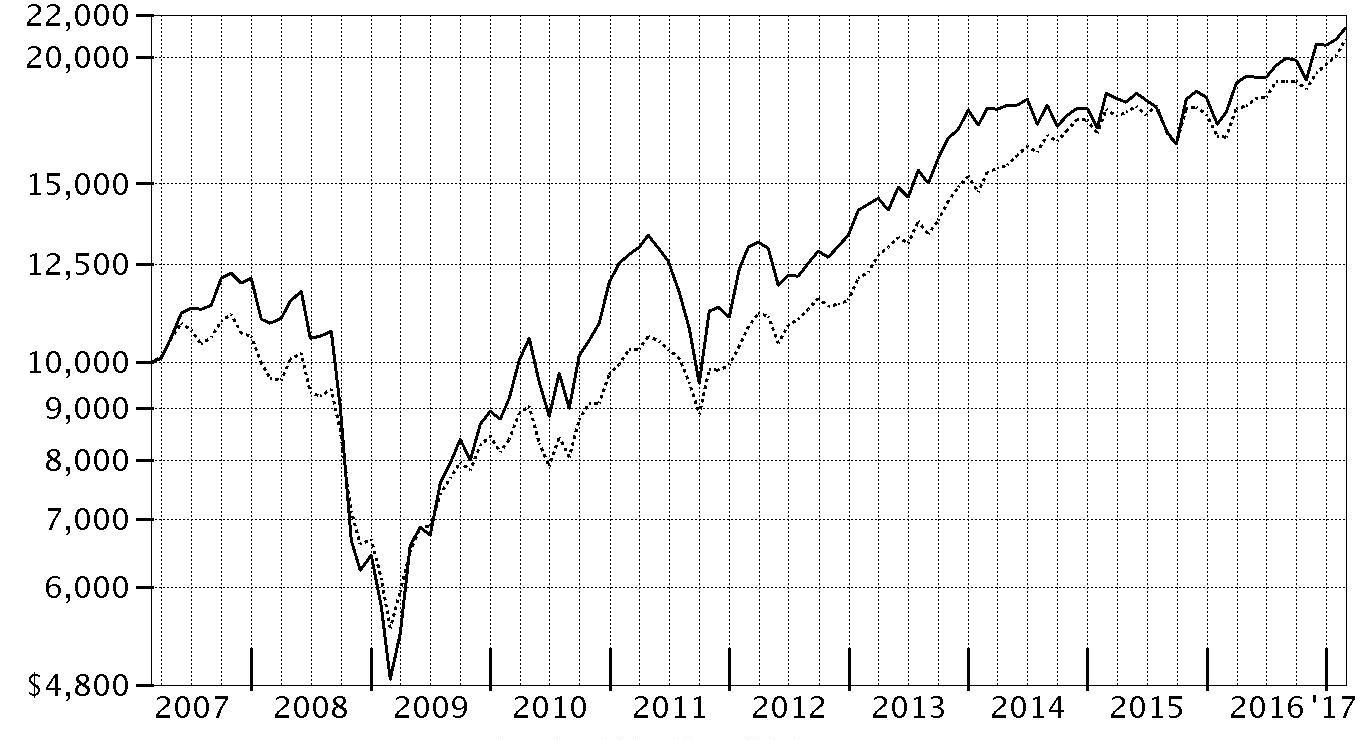

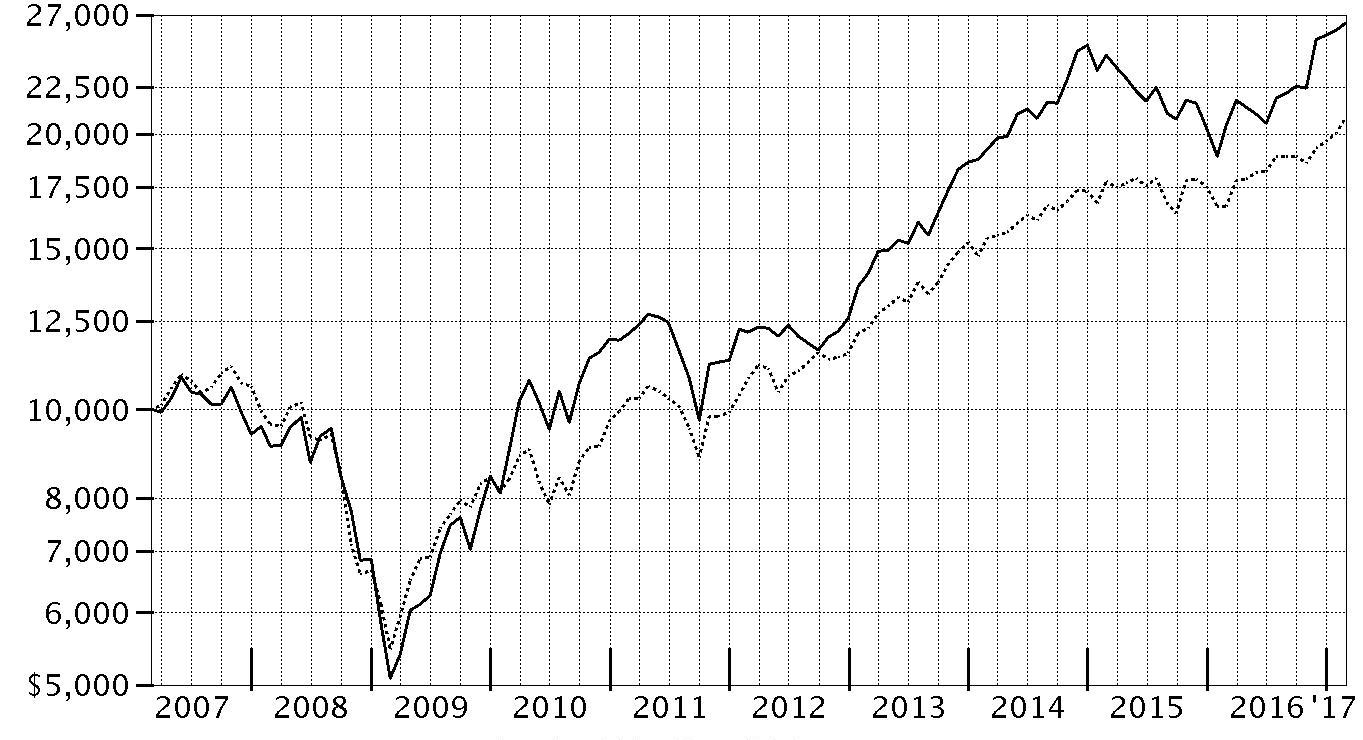

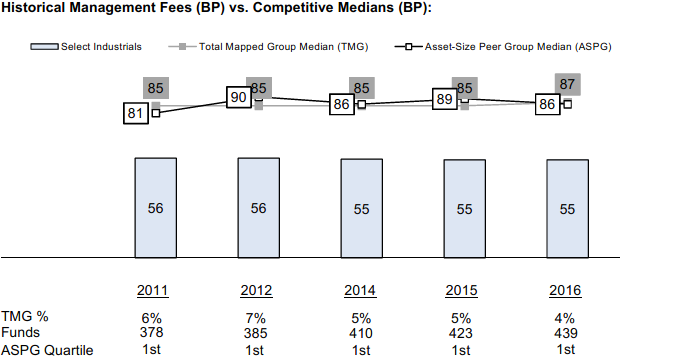

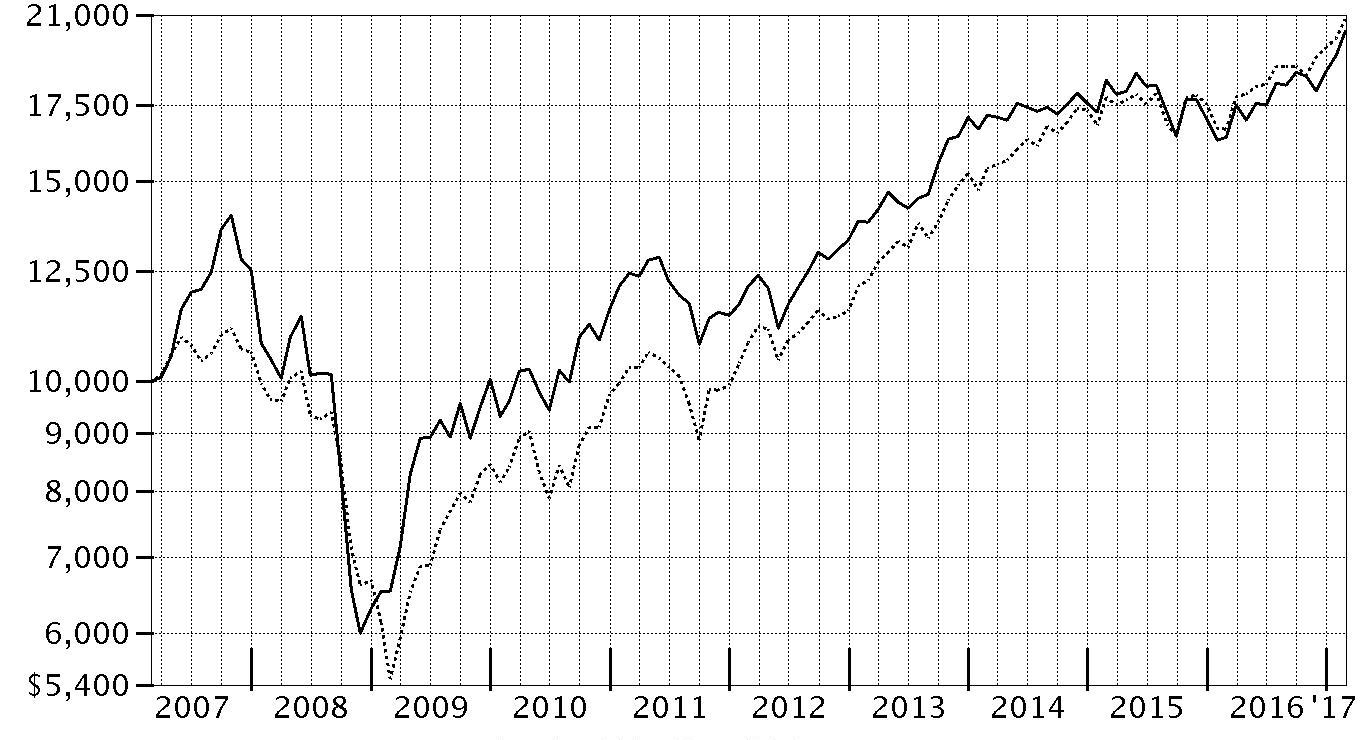

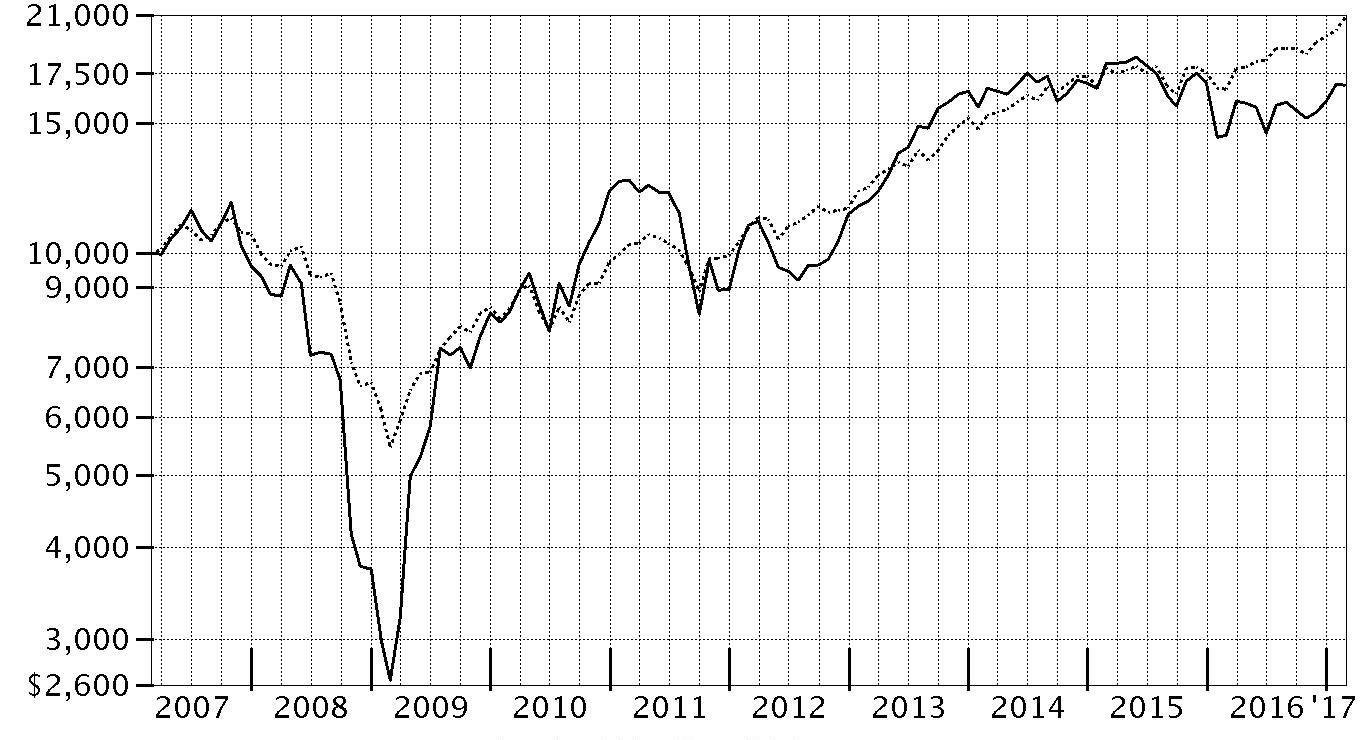

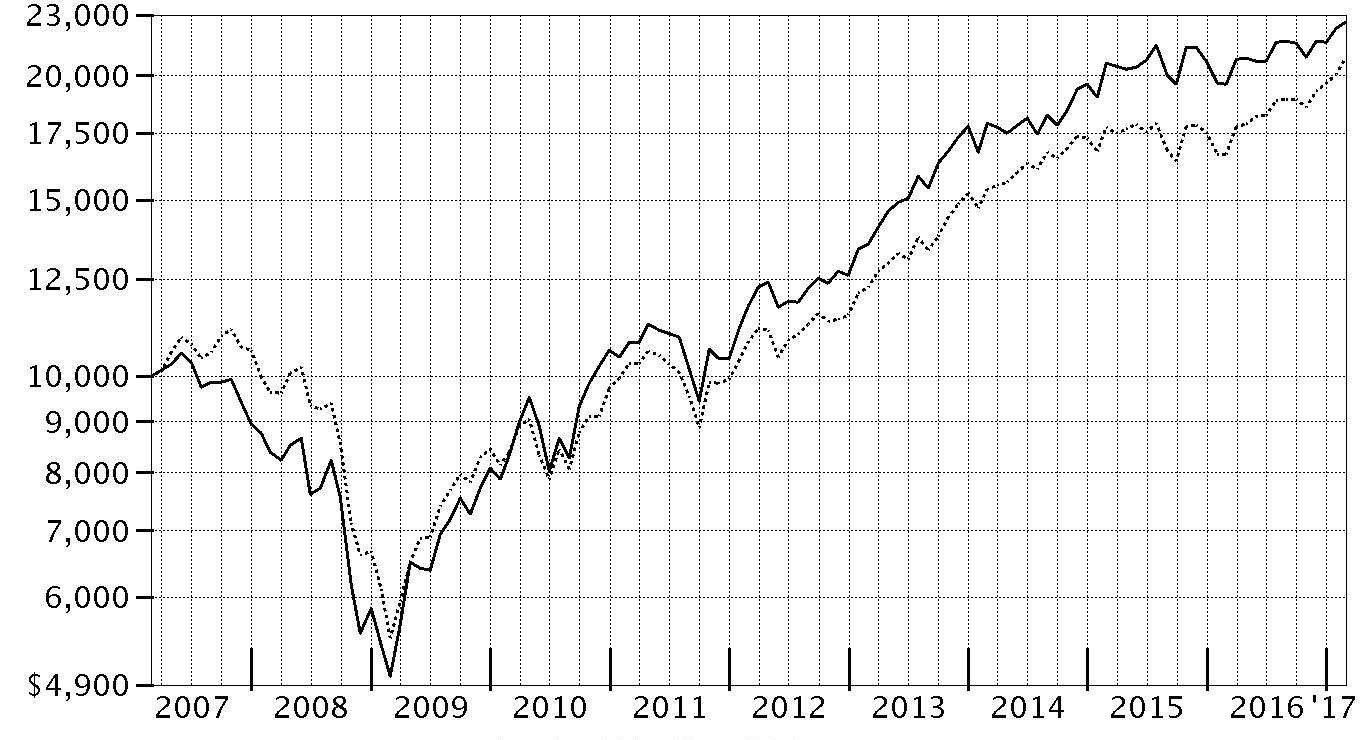

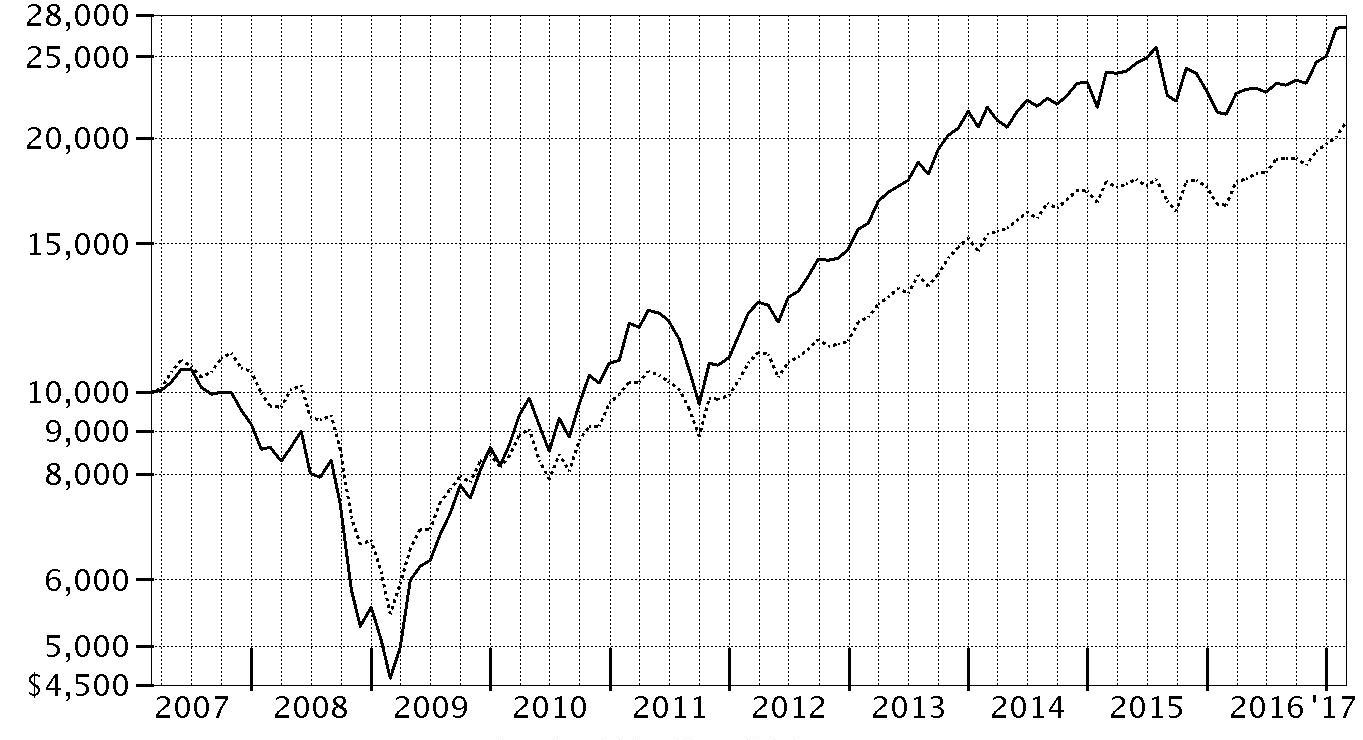

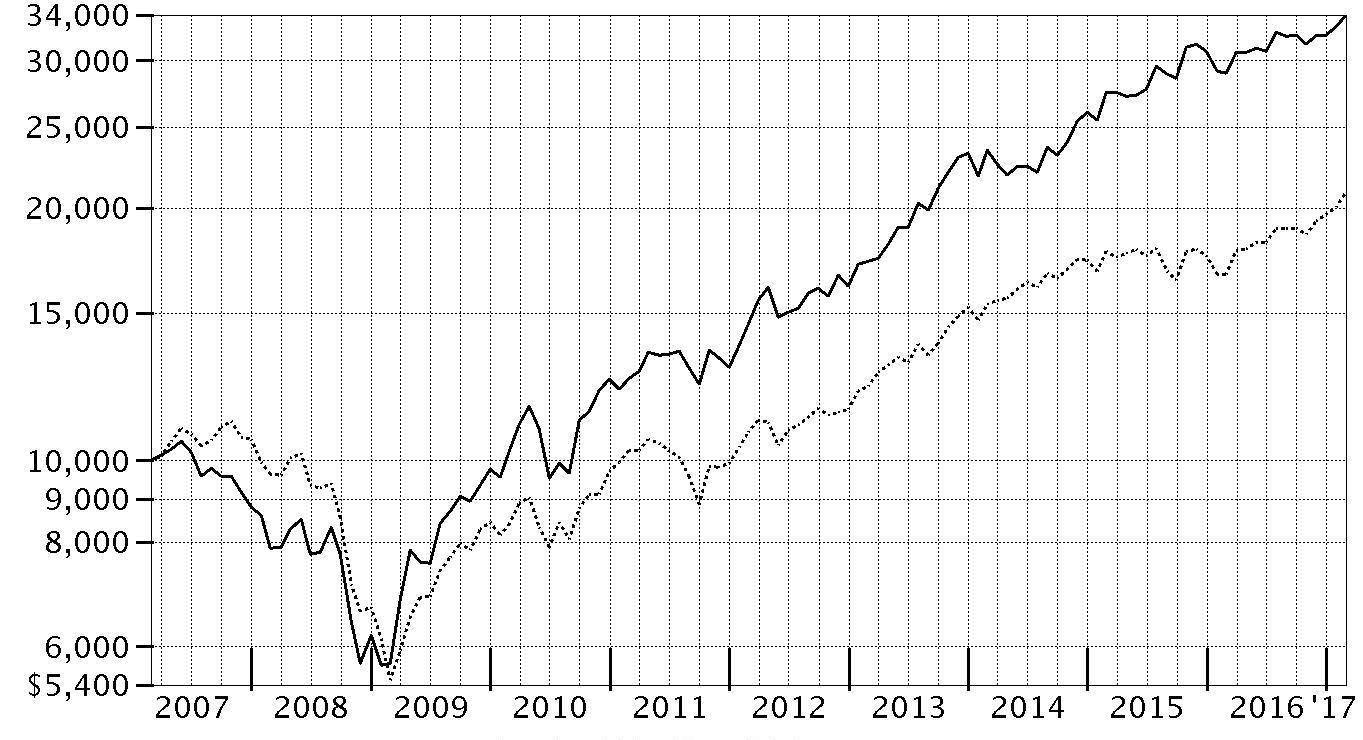

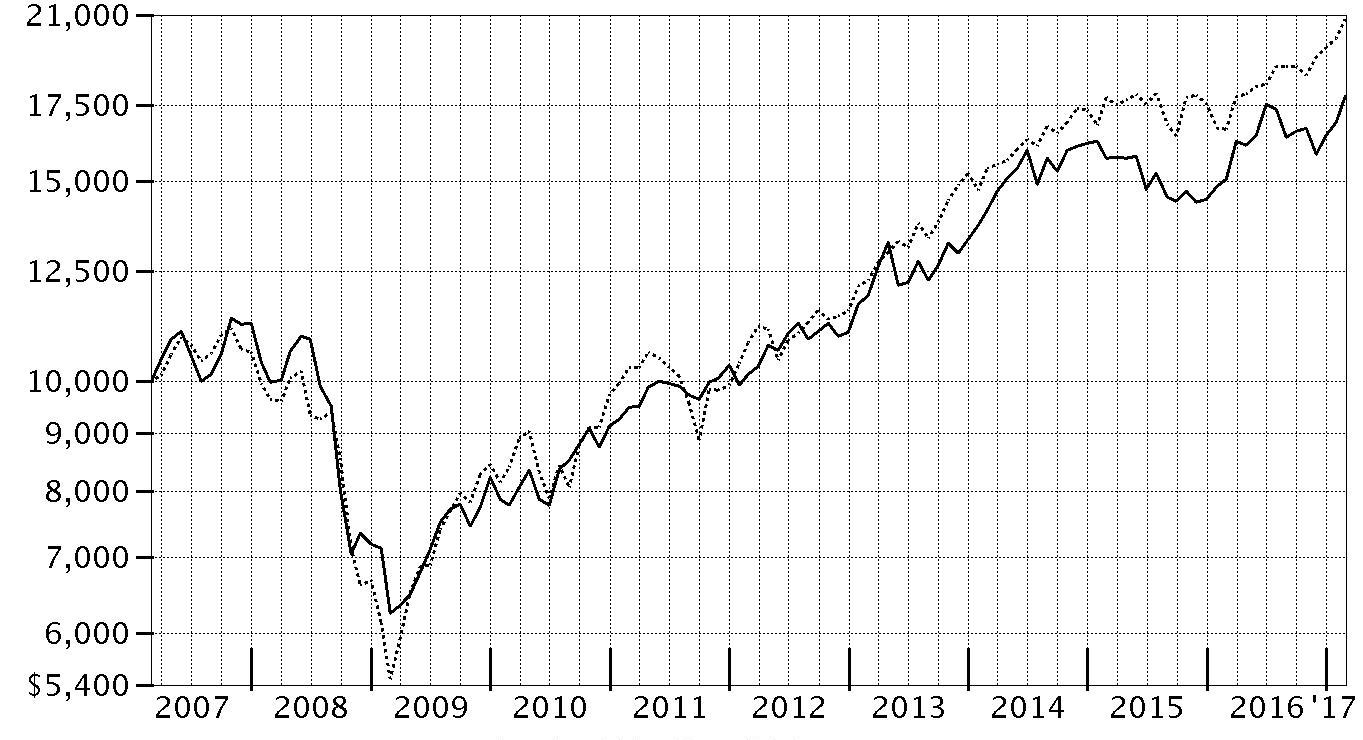

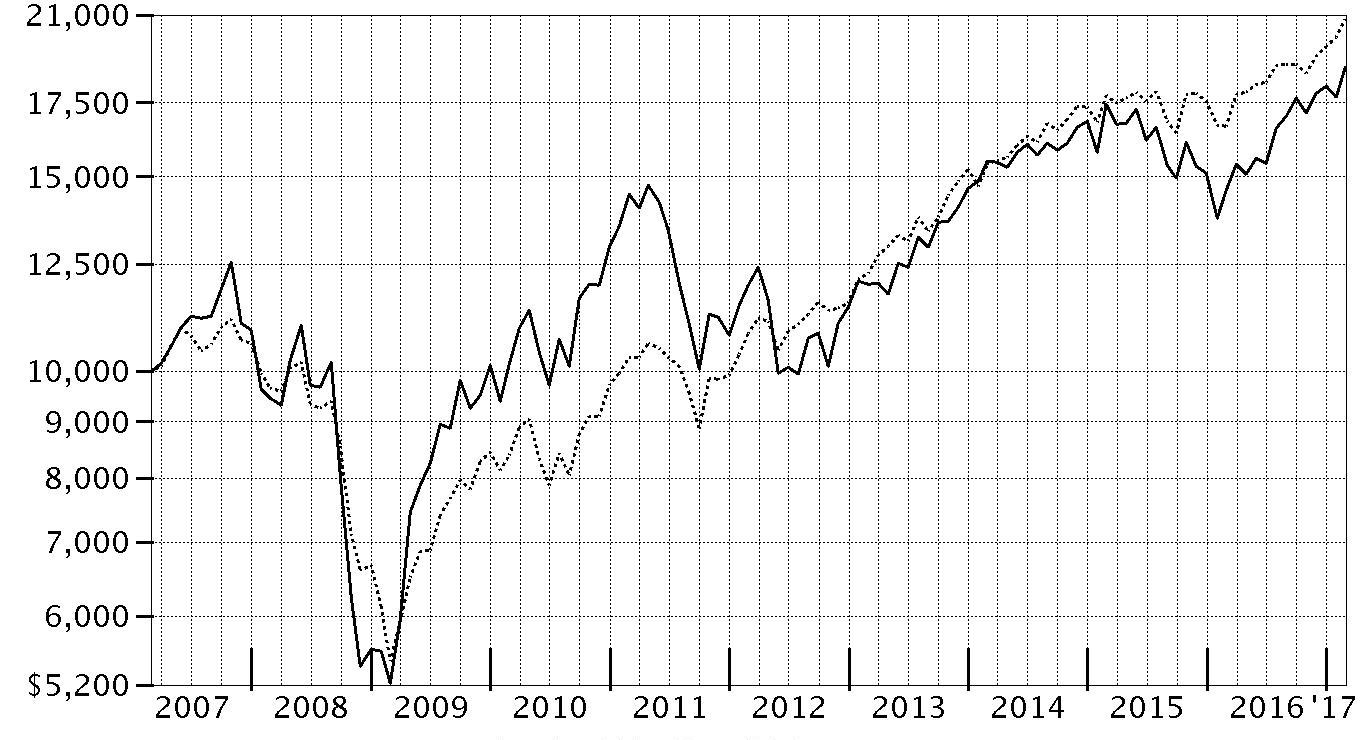

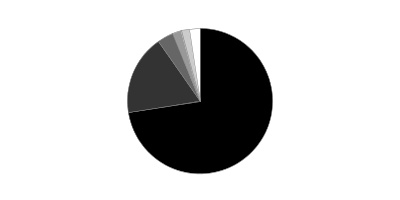

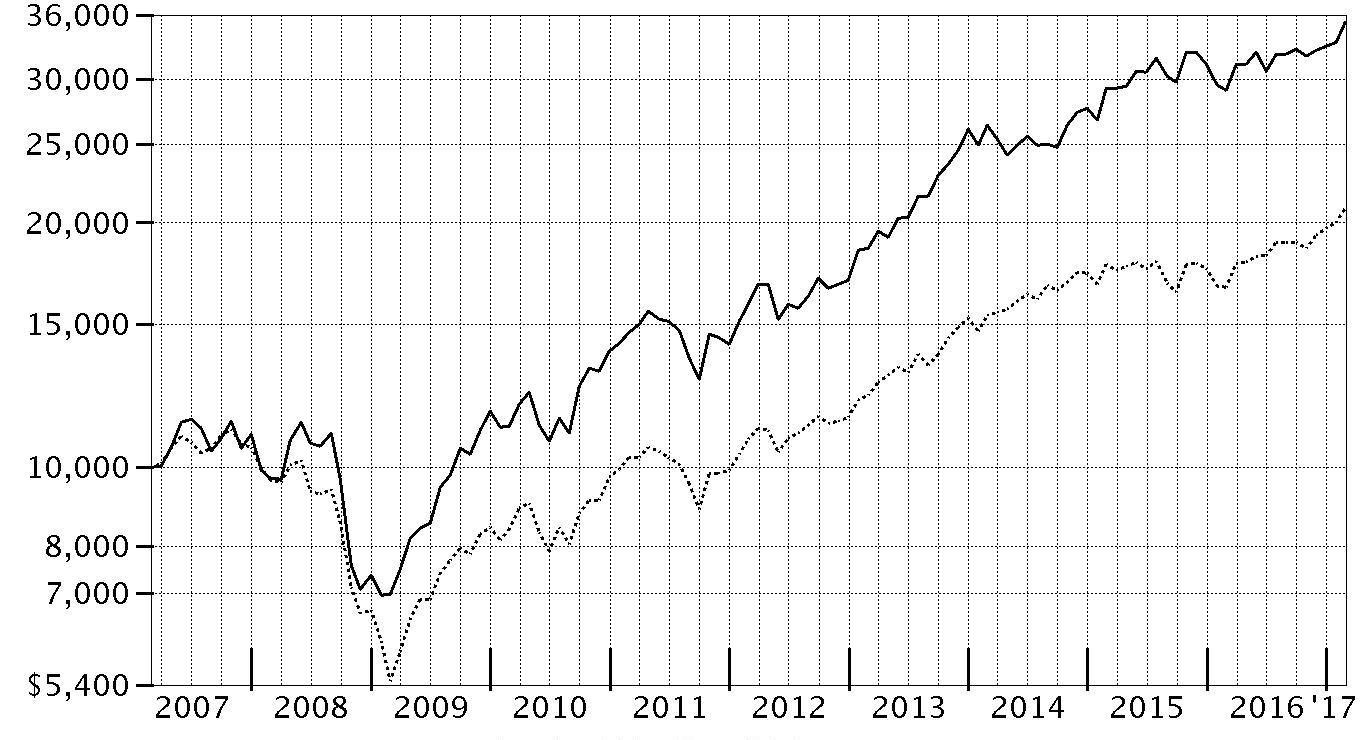

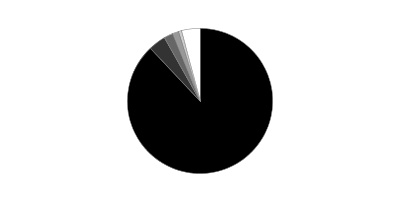

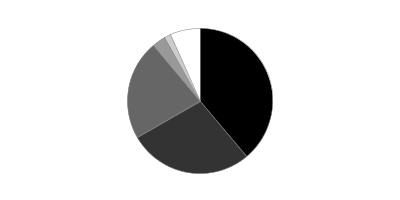

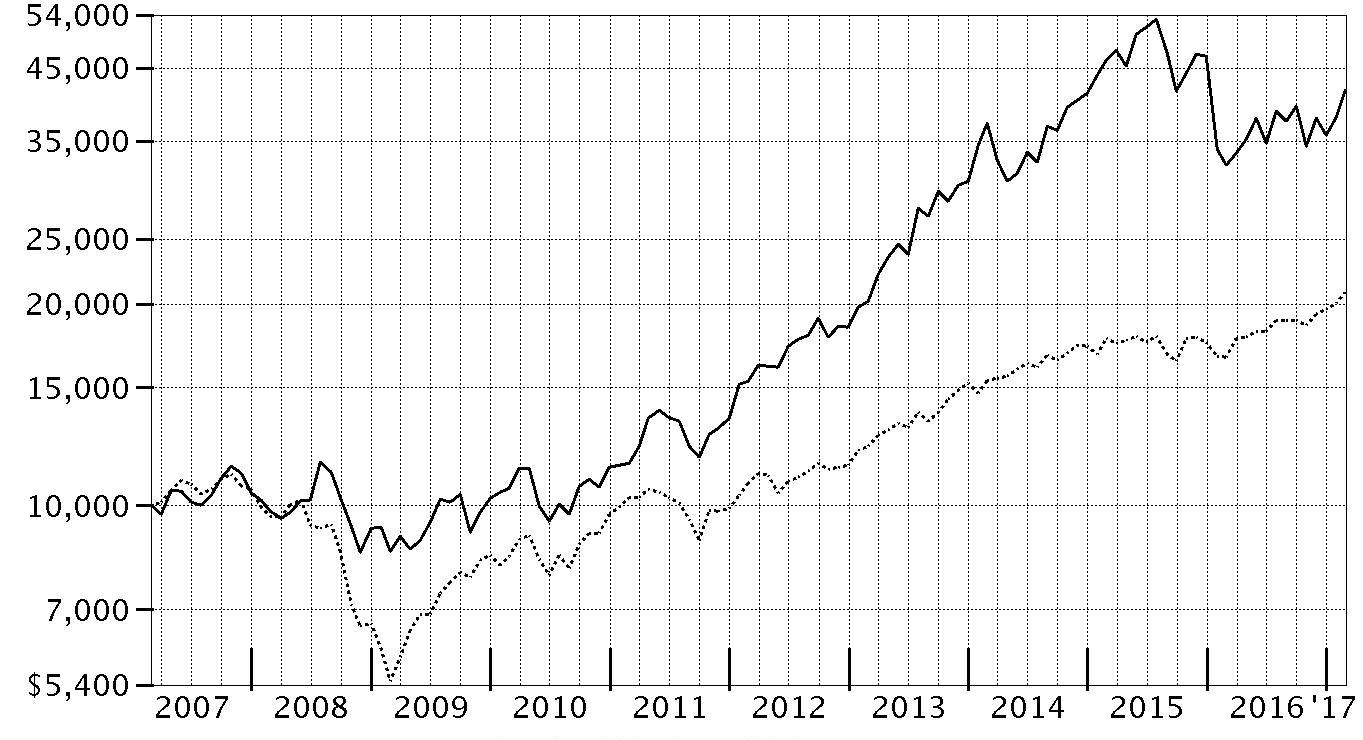

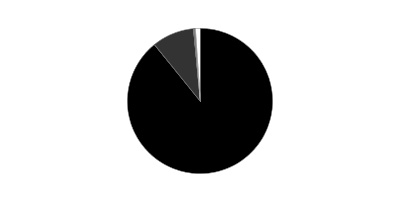

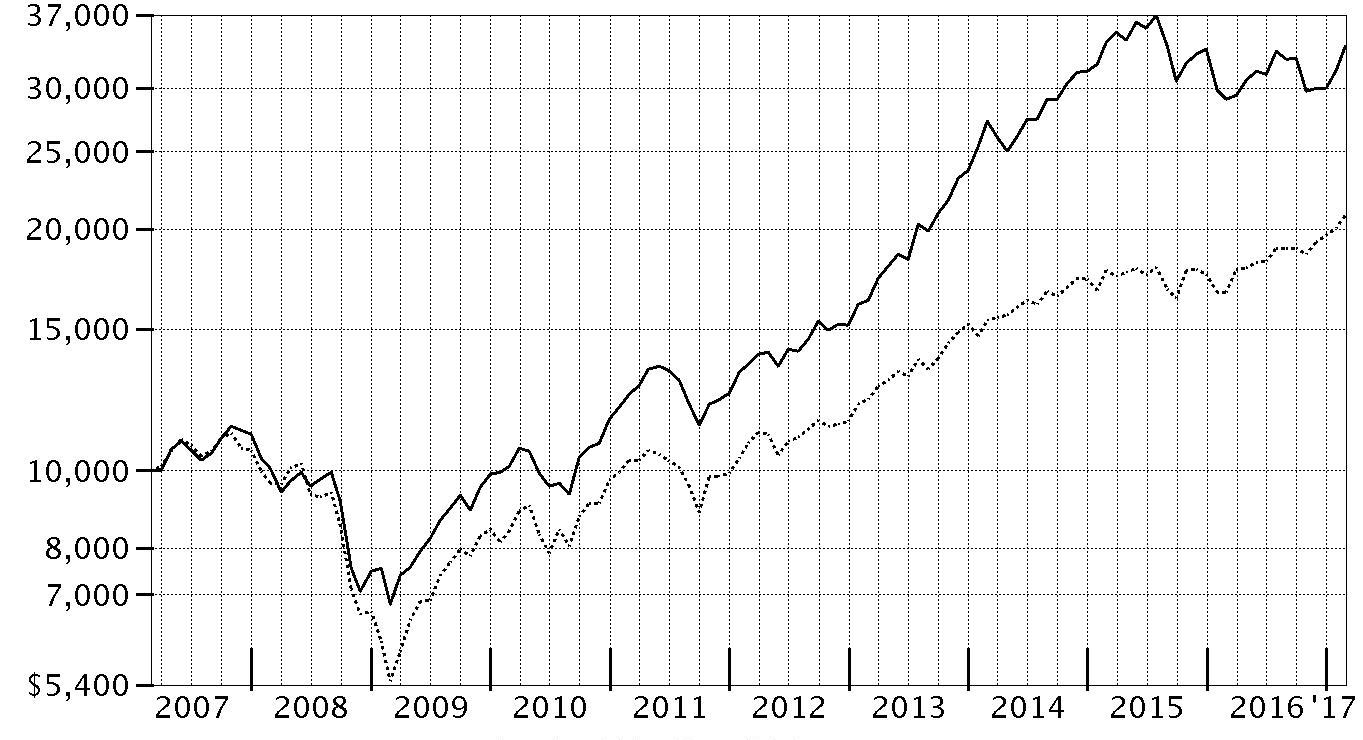

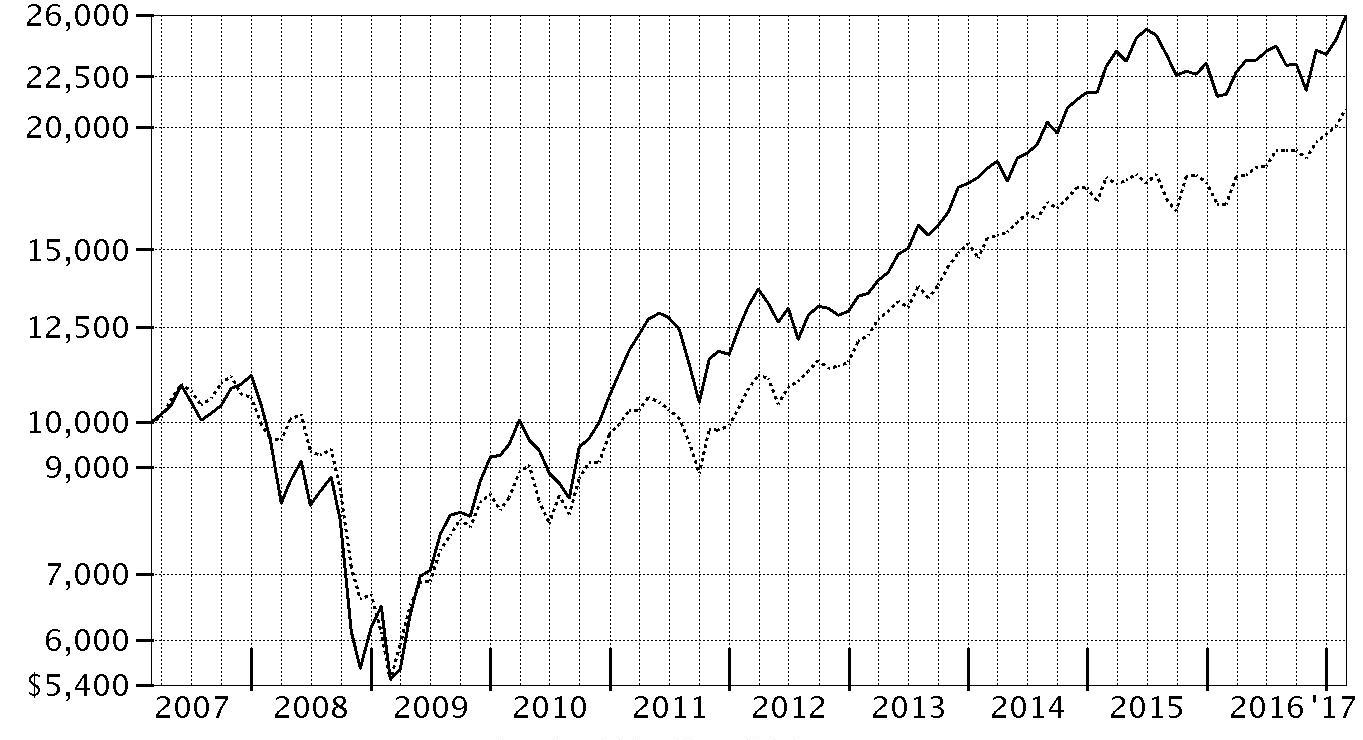

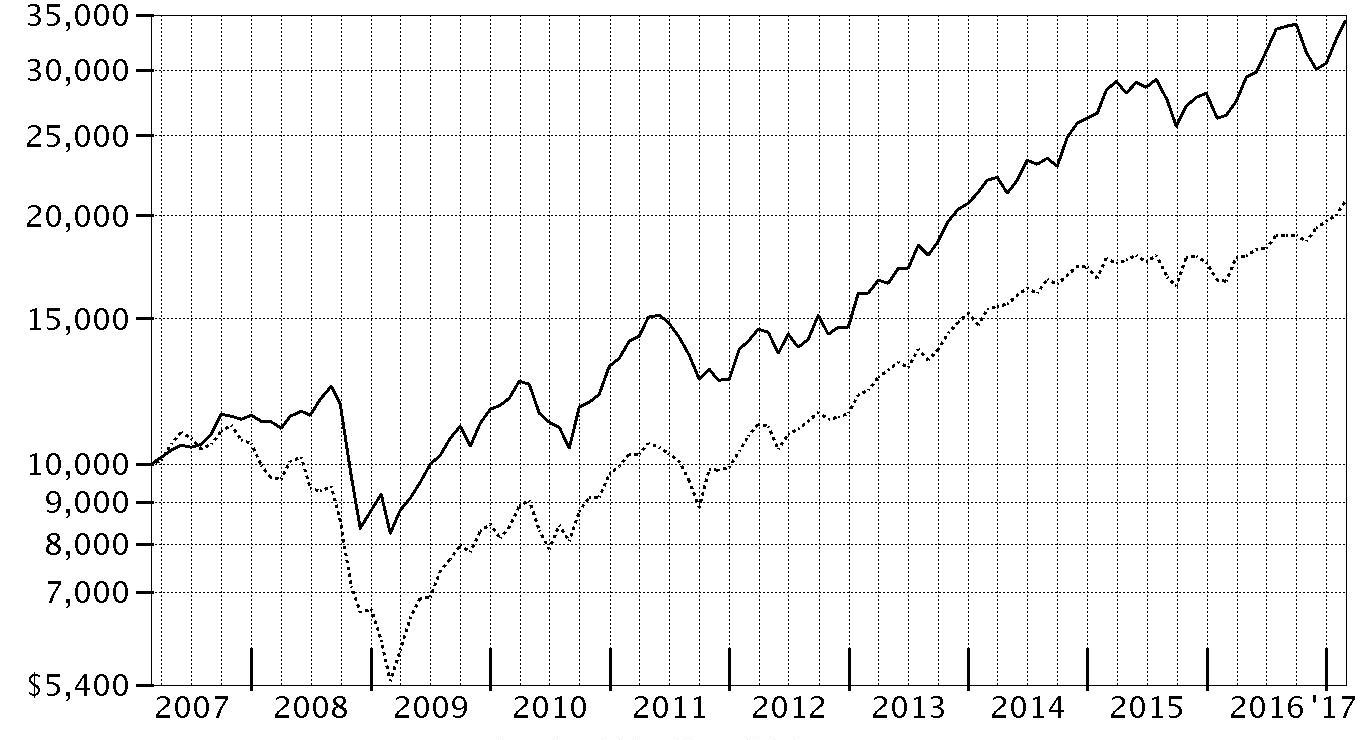

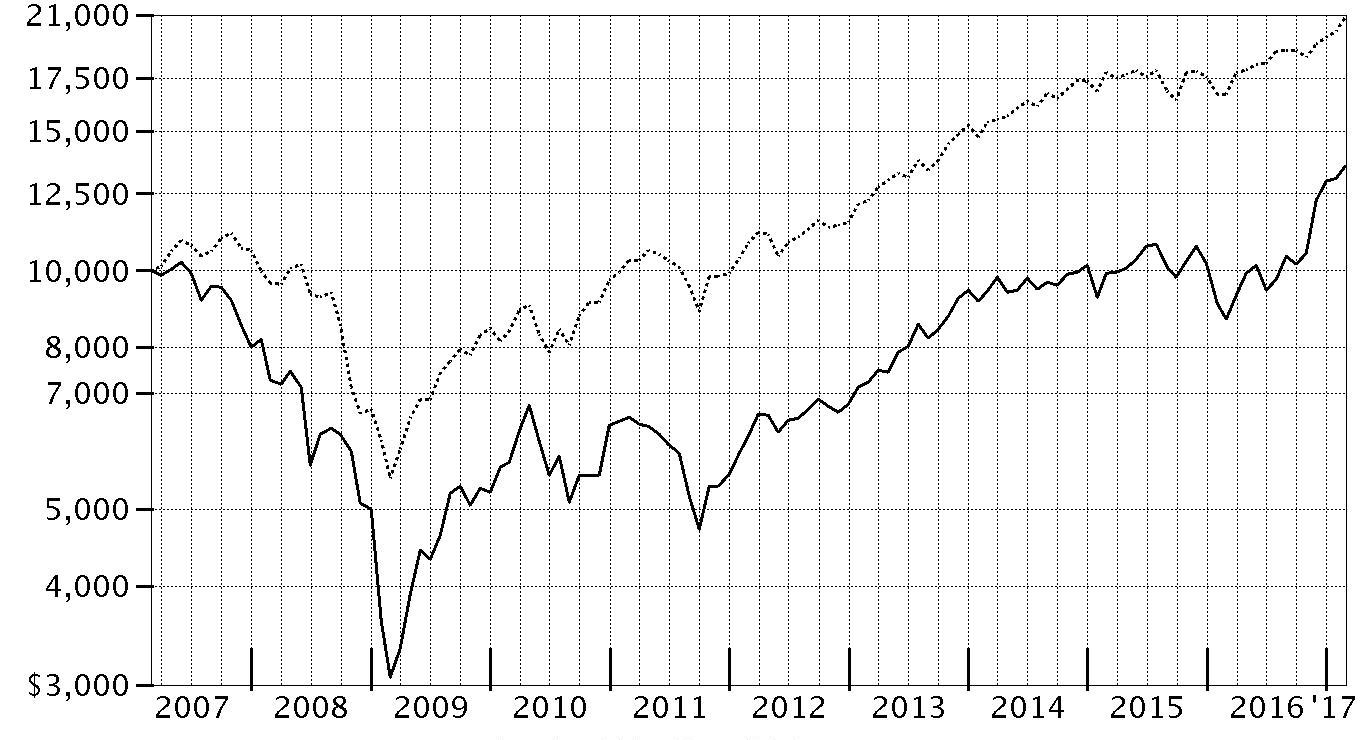

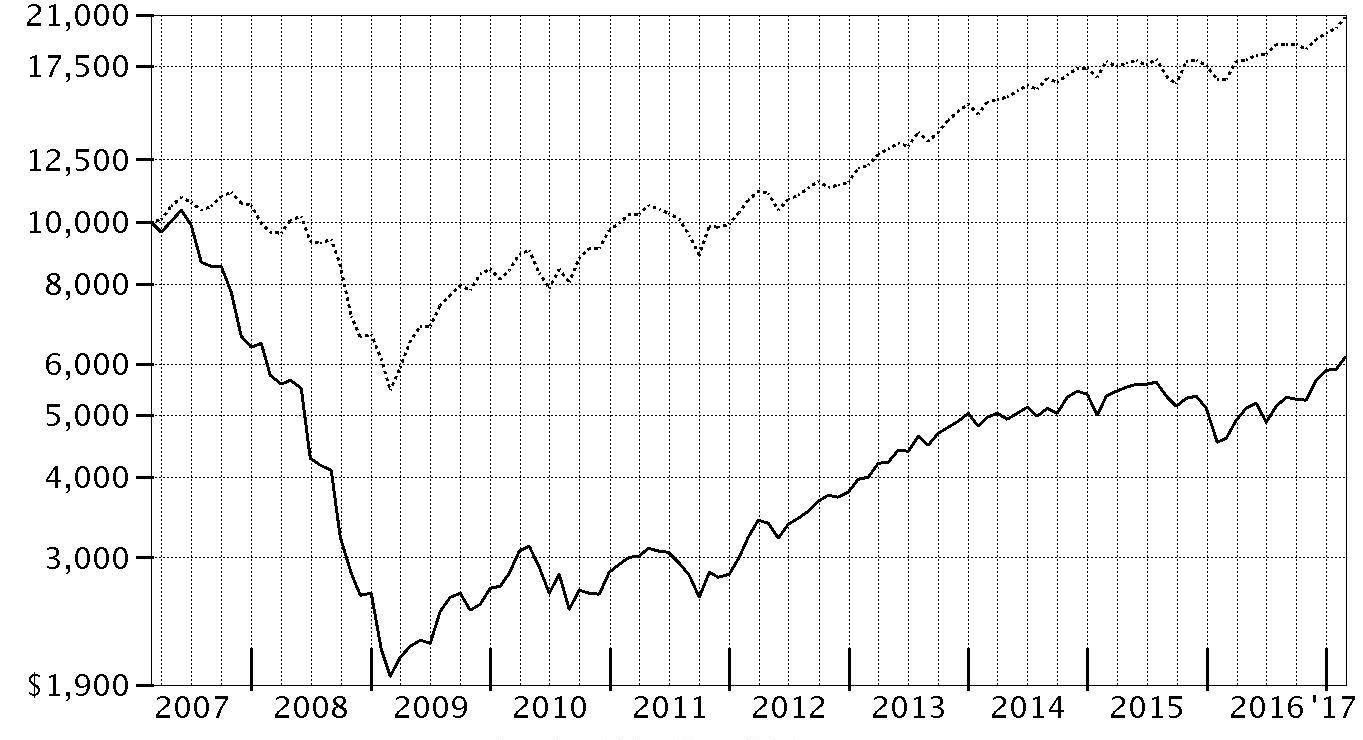

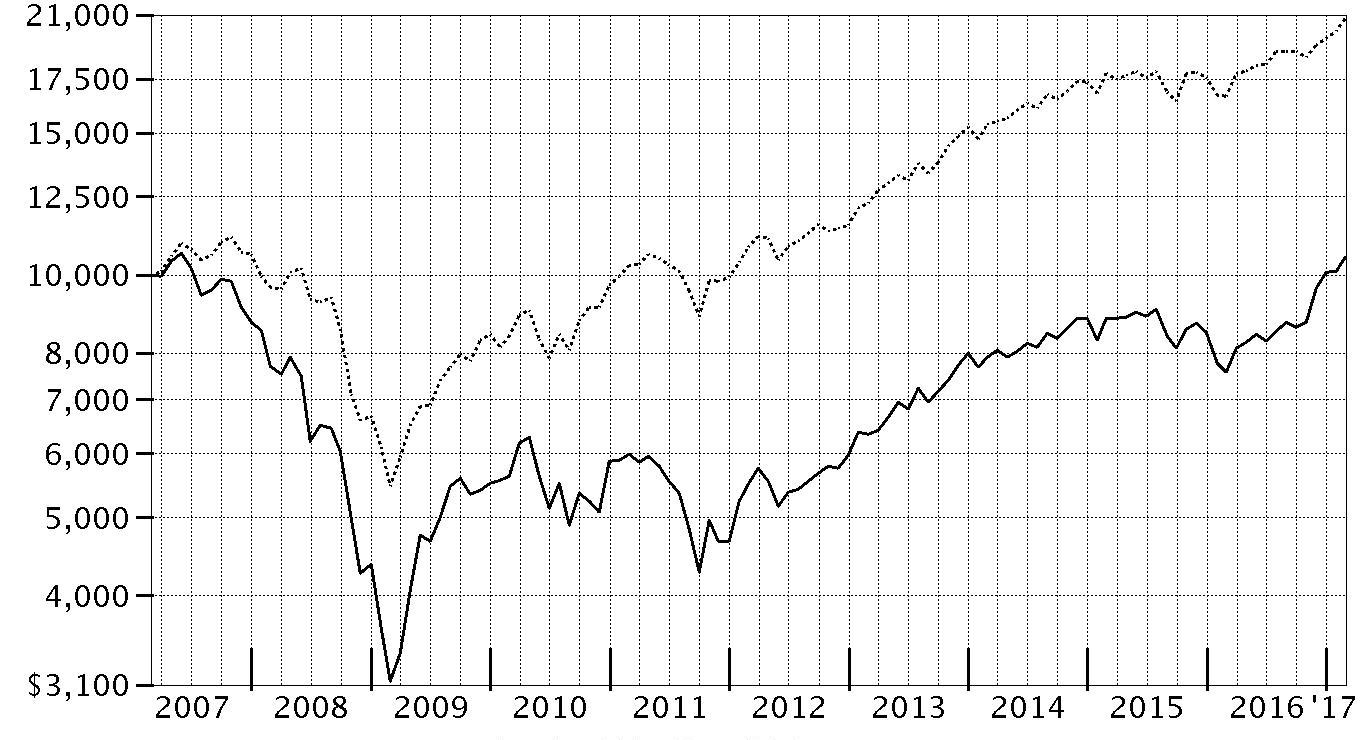

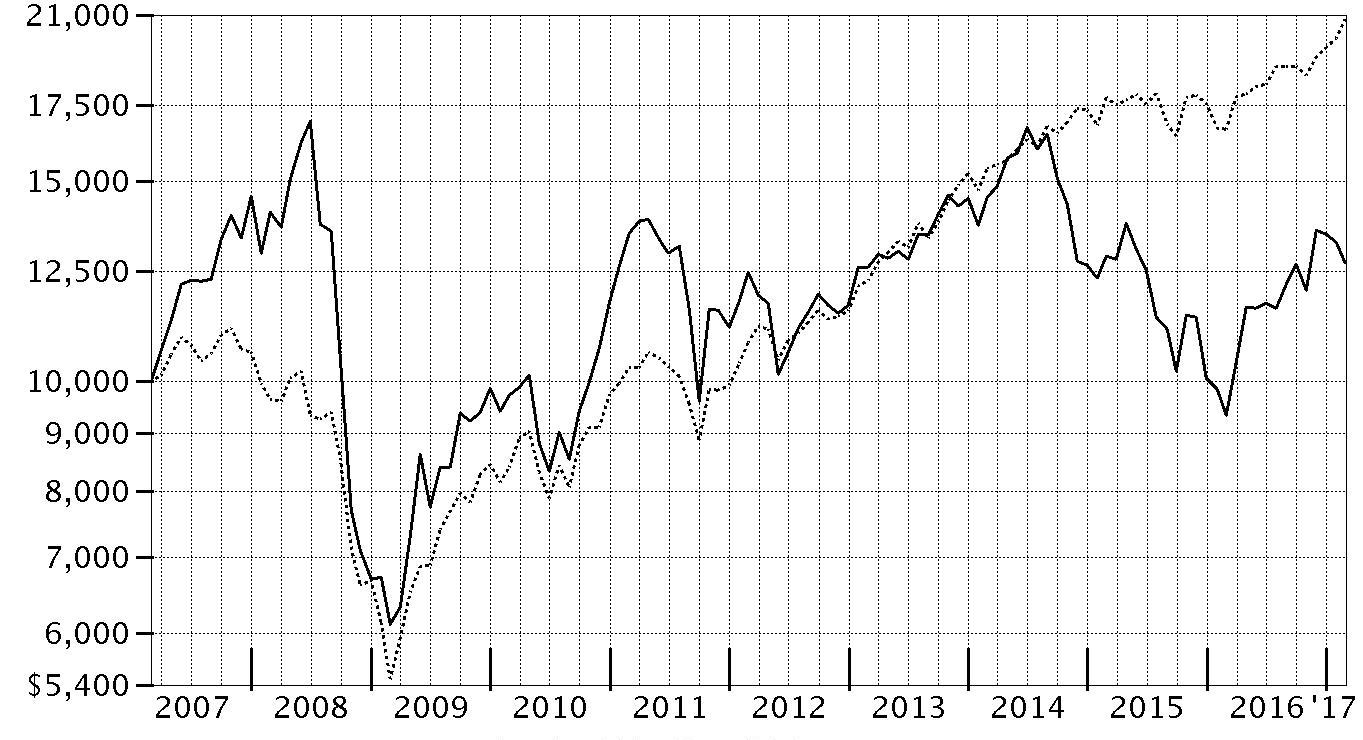

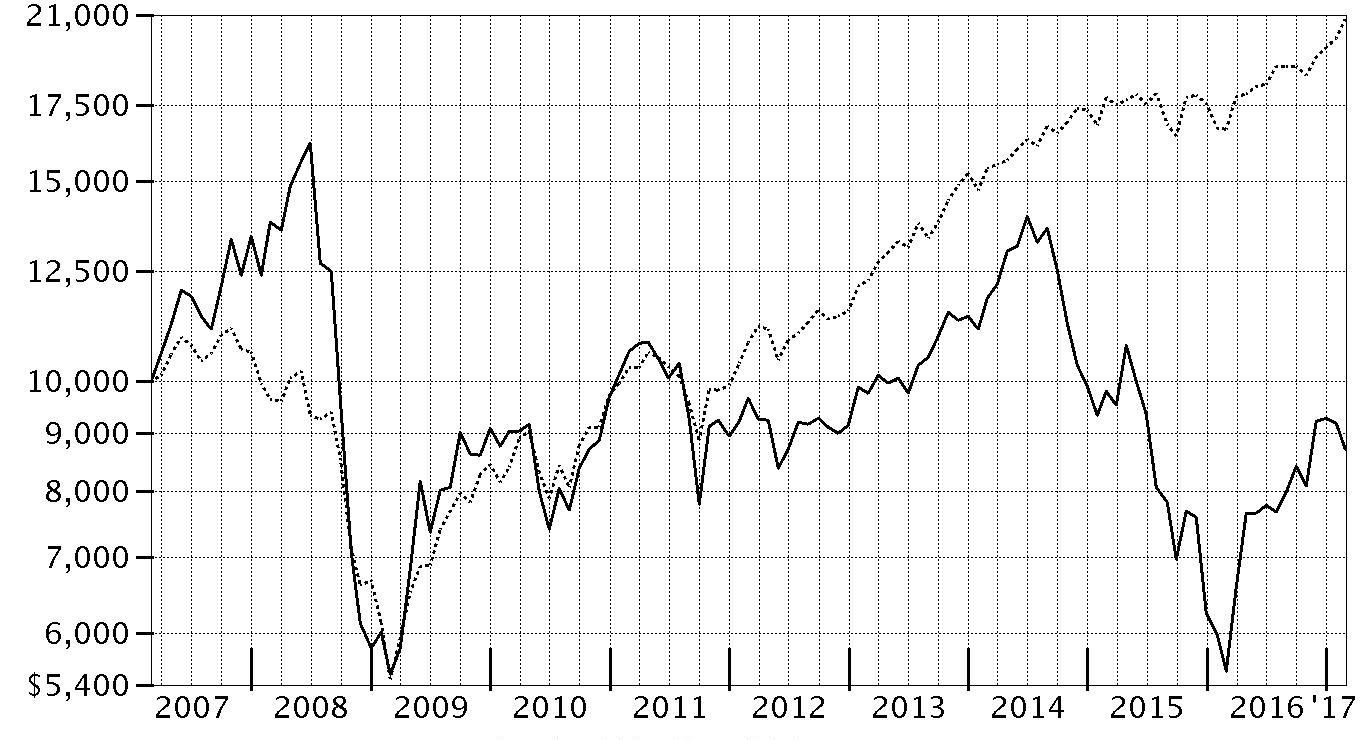

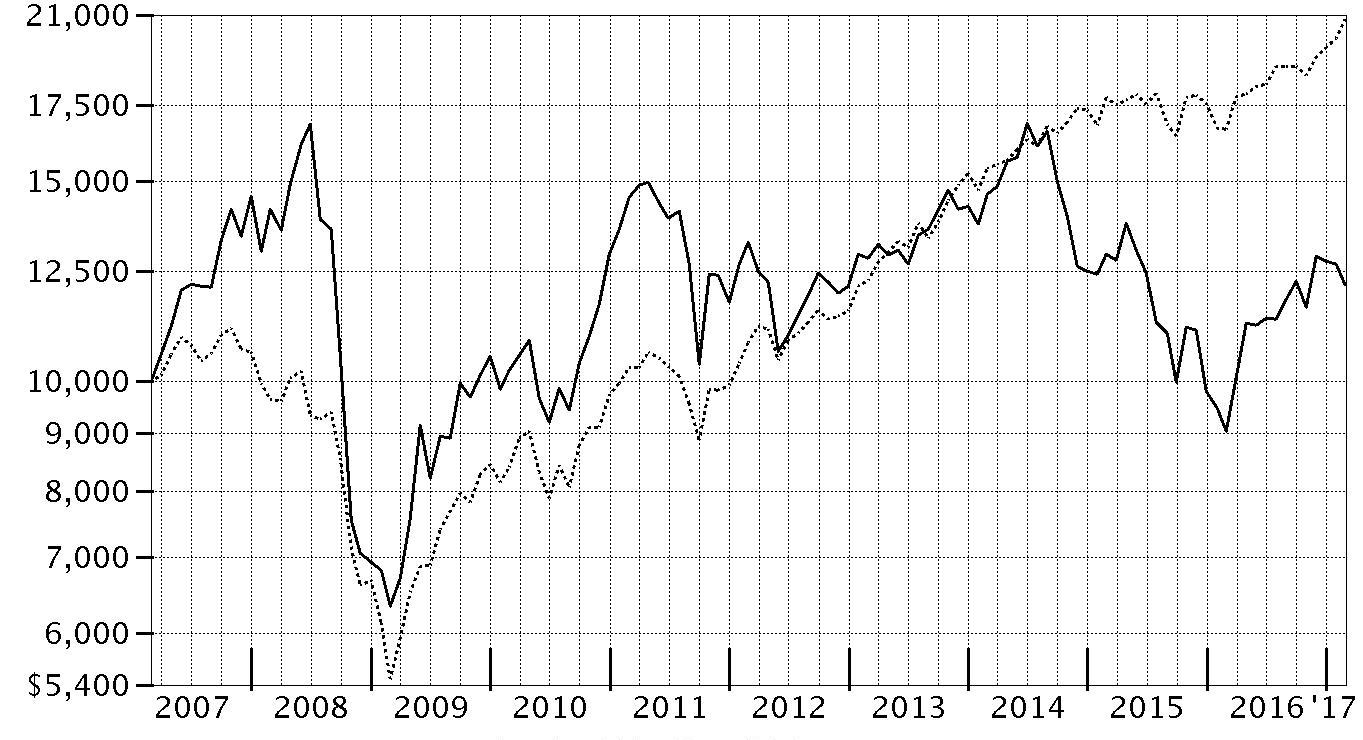

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity Advisor® Consumer Staples Fund - Class A on February 28, 2007, and the current 5.75% sales charge was paid.

The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

| Period Ending Values |

| $23,651 | Fidelity Advisor® Consumer Staples Fund - Class A |

| $20,834 | S&P 500® Index |

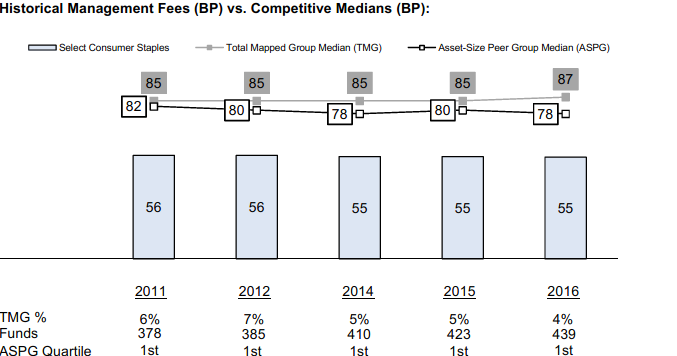

Fidelity Advisor® Consumer Staples Fund

Management's Discussion of Fund Performance

Market Recap: The U.S. equity bellwether S&P 500

® index gained 24.98% for the year ending February 28, 2017, rising sharply in the period’s final four months on renewed optimism for economic growth. The beginning of the period saw improving investor sentiment amid U.S. job gains, a rally in energy, and other stimuli that helped keep the seven-year bull uptrend intact. Markets tumbled briefly following Brexit – the U.K.’s June vote to exit the European Union –recovering quickly to settle into a flattish stretch until the November U.S. presidential election. Stocks then broke out in response to Donald Trump’s surprise victory, surging to a series of new all-time highs on expectations for reflation and fiscal stimulus. For the year, financials (+47%) proved the top-performing sector by far, riding an uptick in bond yields and a rally in banks, especially post-election. Industrials (+27%), energy (+26%) and materials (+28%) also fared well, the latter two driven by a cyclical rebound in commodity prices. Information technology rose 33%, despite cooling off late in 2016. Conversely, real estate and health care each returned 15%, lagging the broad market on prospects of rising interest rates and an uncertain political and regulatory outlook, respectively. An improved backdrop for riskier assets curbed dividend-rich telecom services (+9%), consumer staples (+12%) and utilities (+16%).

Comments from Portfolio Manager Robert Lee: For the year, the fund's share classes (excluding sales charges, if applicable) rose roughly 11% to 12%, compared with the 12.16% return of the MSCI sector index, and significantly lagging the broader S&P 500

® index. Against stable global economic data and improving prices for energy and certain other commodities, consumer staples came up short of the broad market this period. In addition, Trump's election ignited investors' hopes of potential business-friendly reforms, along with their expectations for a rise in inflation. As a result, typically more-defensive areas of the market, including consumer staples, suffered amid a shift toward riskier assets. Versus the MSCI sector index, the fund’s largest relative detractors were sizable stakes in CVS Health and Kroger. Shares of pharmacy retailer and health care company CVS fell on downward earnings guidance, as the firm lost some large contracts to competitor Walgreens Boots Alliance – another large fund holding. Meanwhile, grocer Kroger also reduced its earnings estimates, as food deflation led to slower sales growth and less fixed-cost leverage, and as investors began to fear an acceleration in price competition within the food retail industry. Conversely, a non-index stake in U.K.-based British American Tobacco (BAT) was by far the fund’s biggest individual contributor and among its largest holdings. The stock returned 22% for the fund, partly helped by news in January that BAT would buy the remaining stake in competitor Reynolds American that it did not own, making it the world’s largest publicly traded tobacco company. Bunge, a producer of fertilizer, processed grains and soybeans, also was significantly additive. Favorable crop conditions in key markets increased earnings expectations for the global agribusiness and food company.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

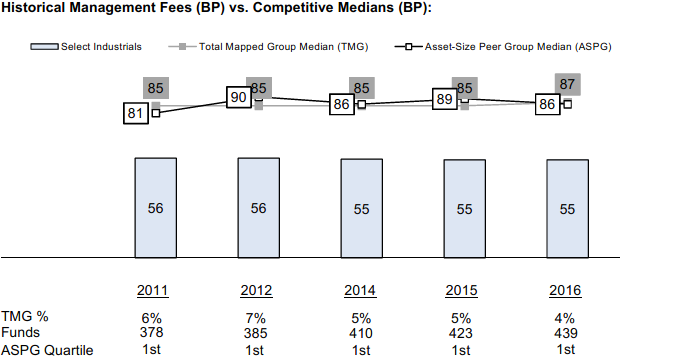

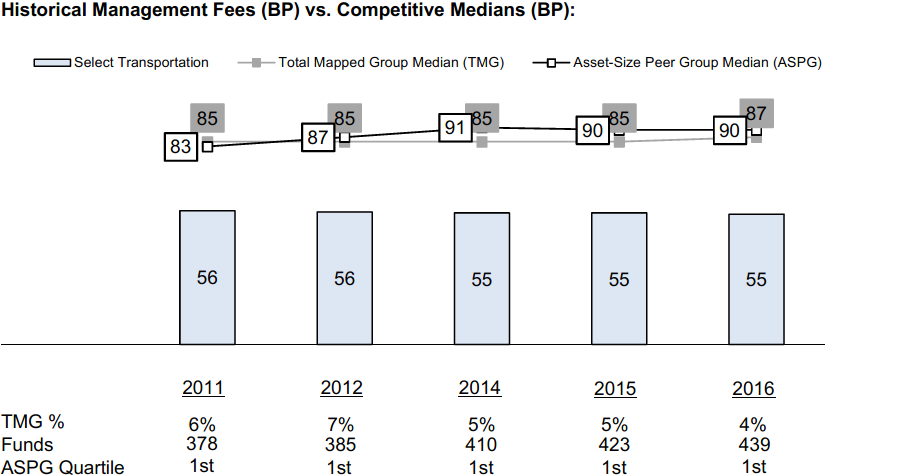

Consumer Staples Portfolio

Investment Summary (Unaudited)

Top Ten Stocks as of February 28, 2017

| | % of fund's net assets | % of fund's net assets 6 months ago |

| Philip Morris International, Inc. | 11.7 | 4.1 |

| British American Tobacco PLC sponsored ADR | 11.6 | 10.9 |

| CVS Health Corp. | 8.4 | 9.2 |

| Kroger Co. | 6.0 | 6.2 |

| Reynolds American, Inc. | 5.2 | 4.8 |

| Altria Group, Inc. | 4.9 | 4.1 |

| The Coca-Cola Co. | 4.9 | 3.9 |

| Estee Lauder Companies, Inc. Class A | 4.8 | 0.8 |

| Procter & Gamble Co. | 3.9 | 12.3 |

| Colgate-Palmolive Co. | 3.8 | 2.7 |

| | 65.2 | |

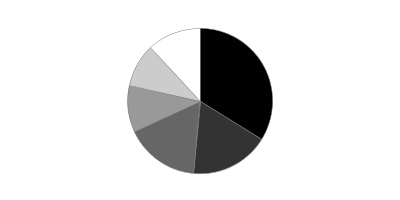

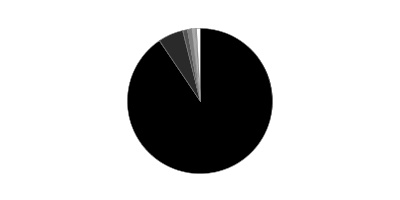

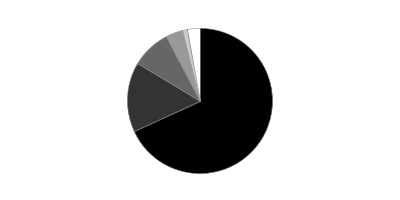

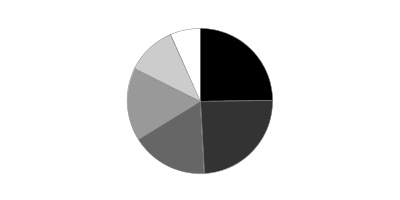

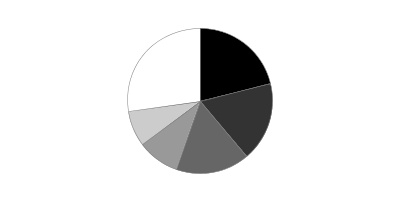

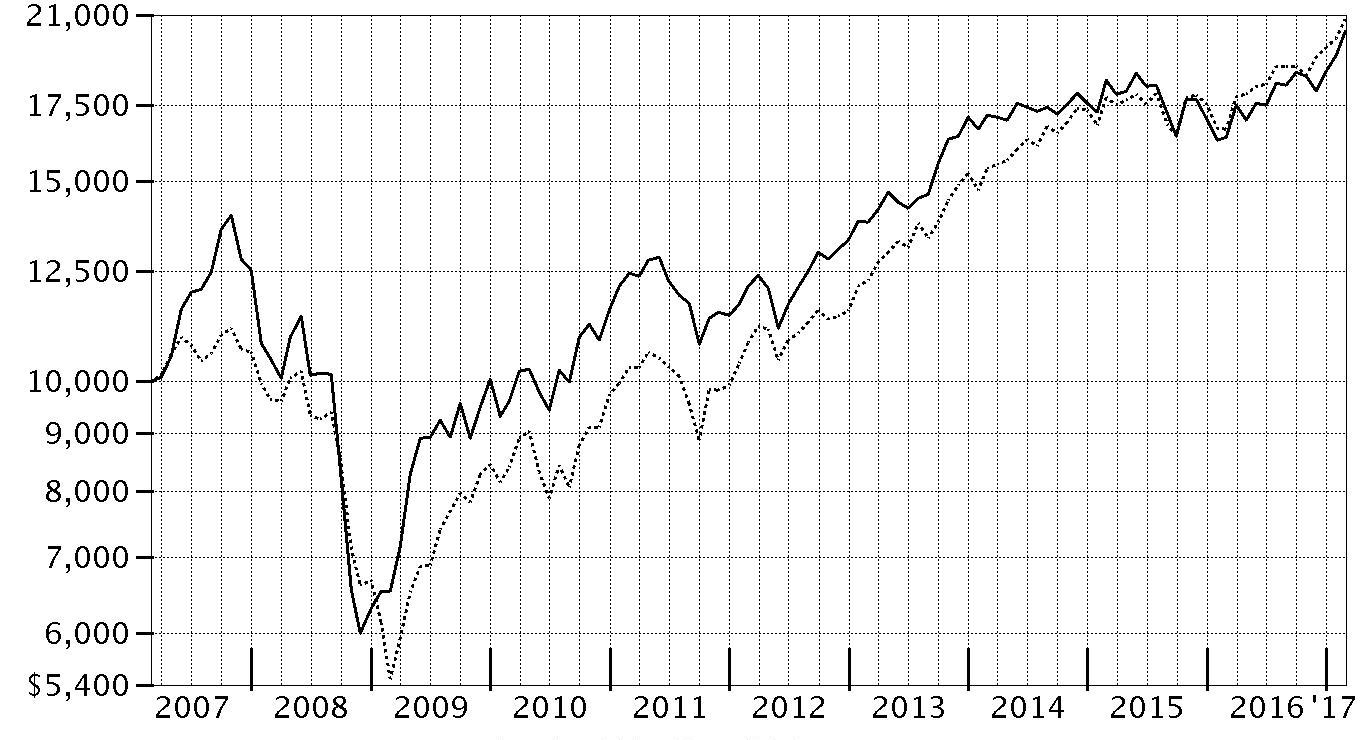

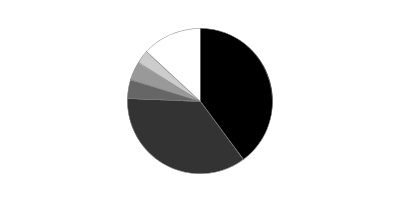

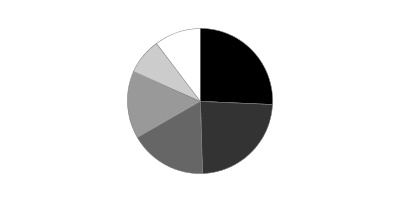

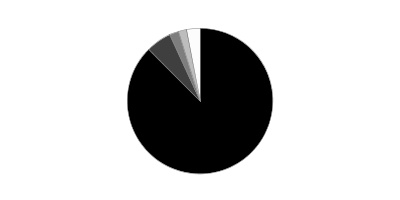

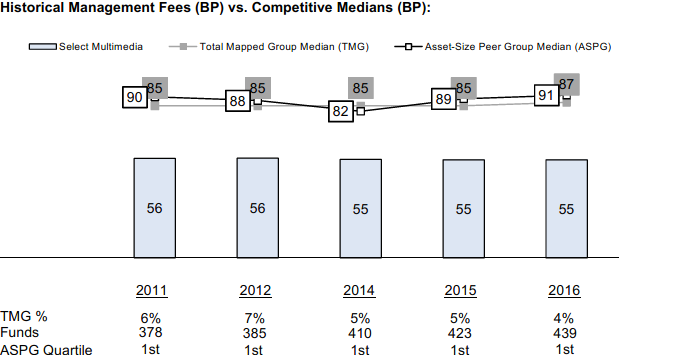

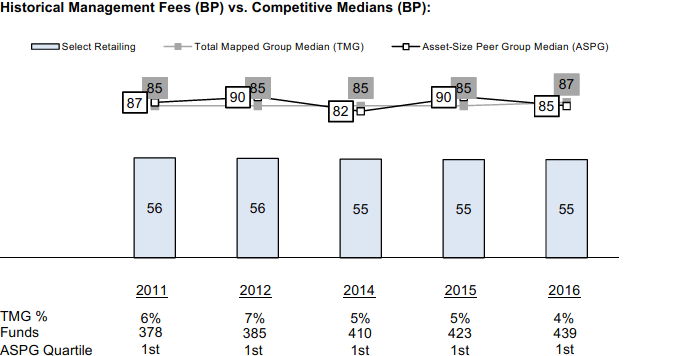

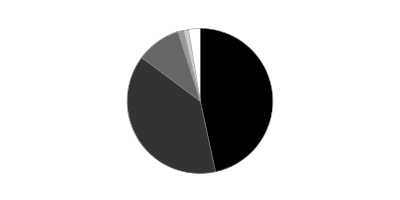

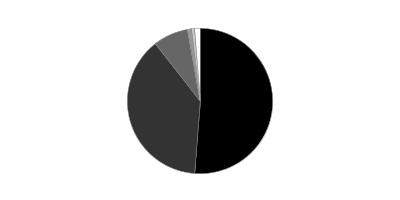

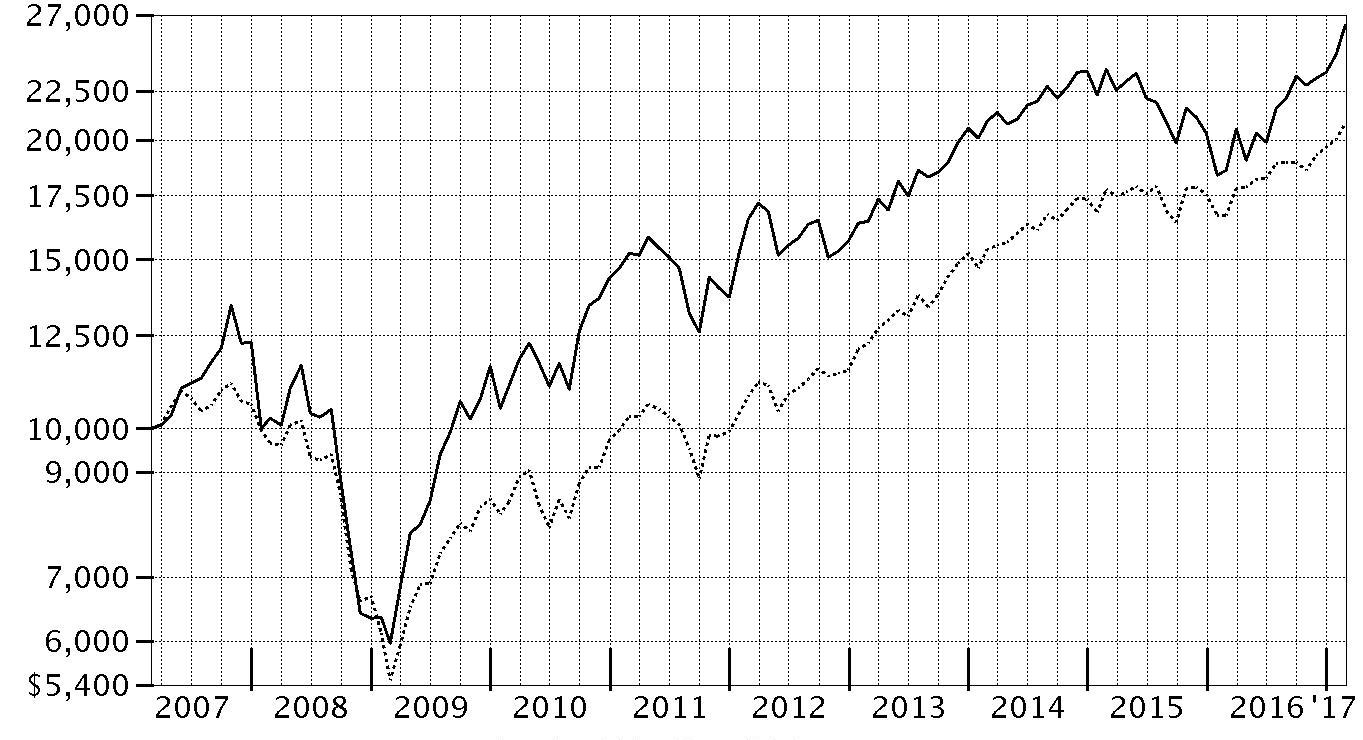

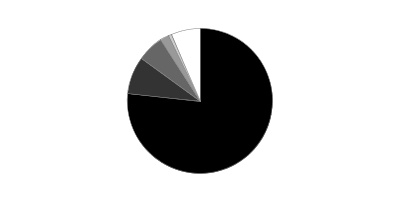

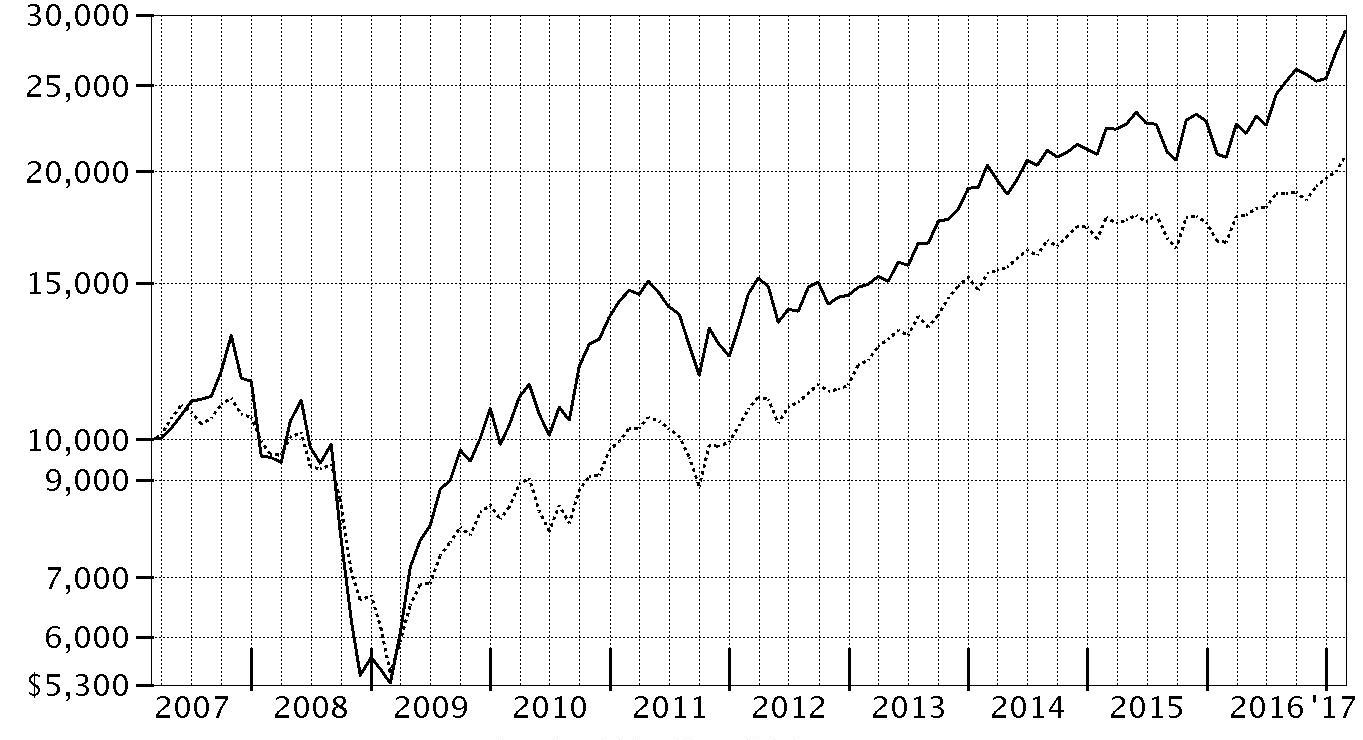

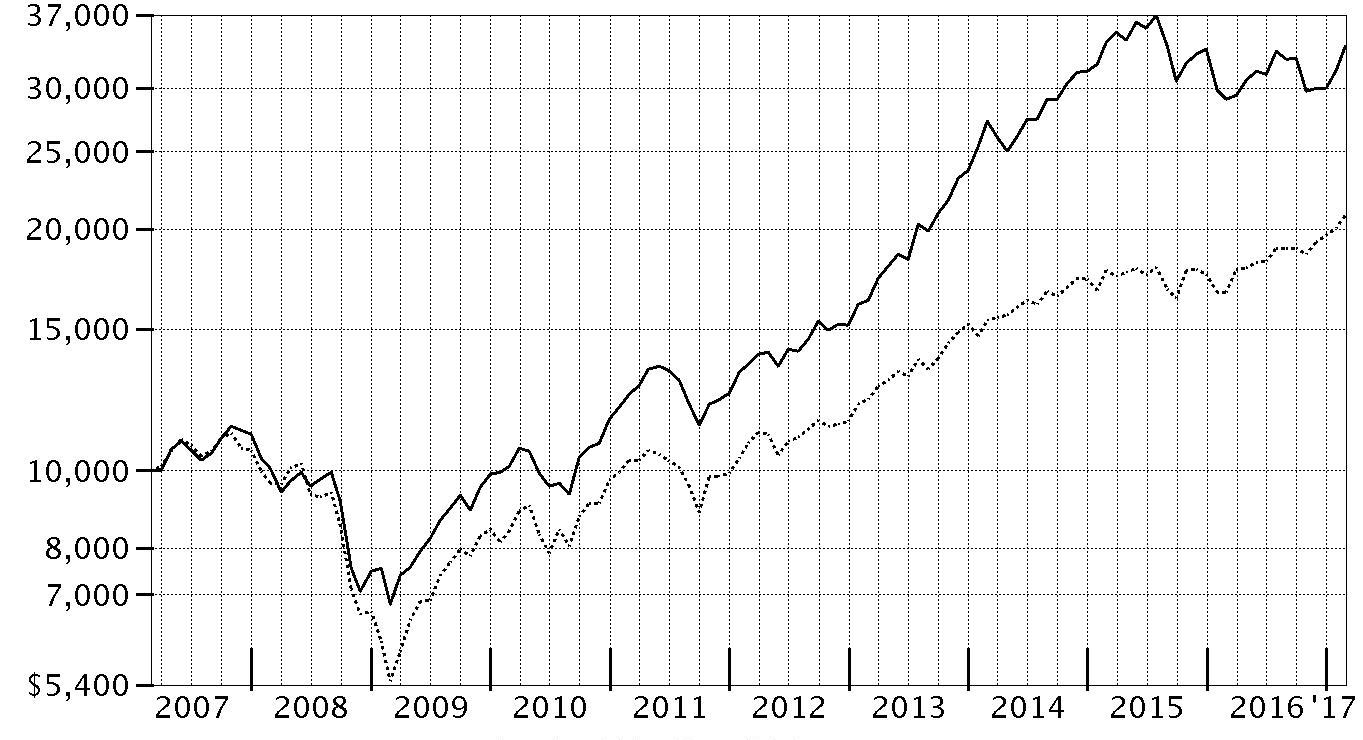

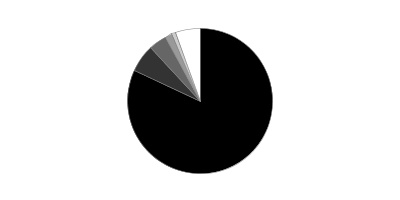

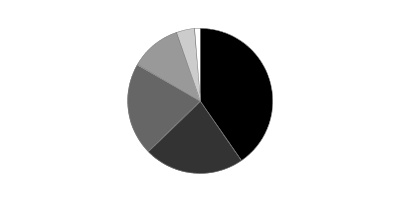

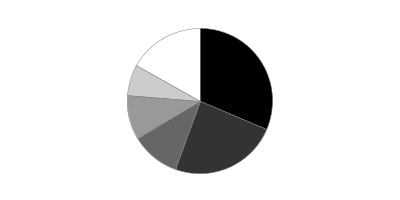

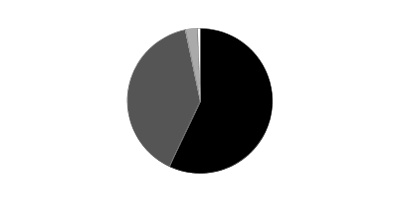

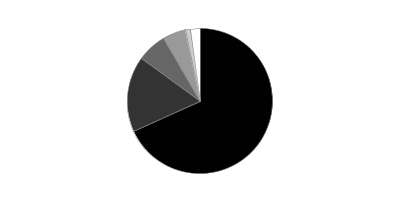

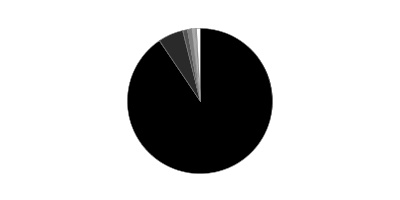

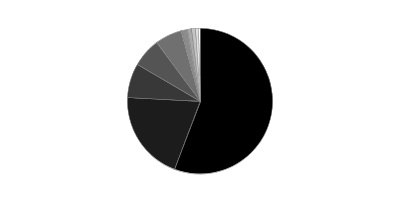

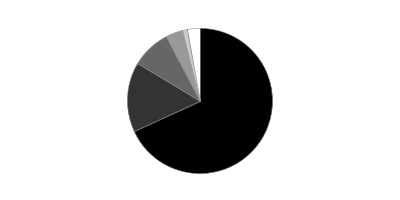

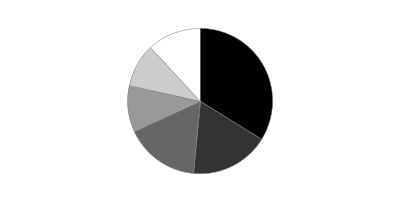

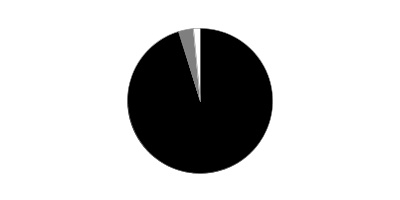

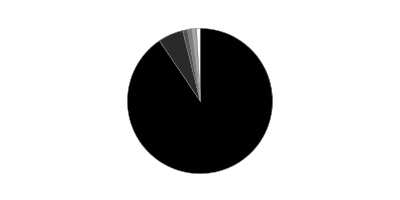

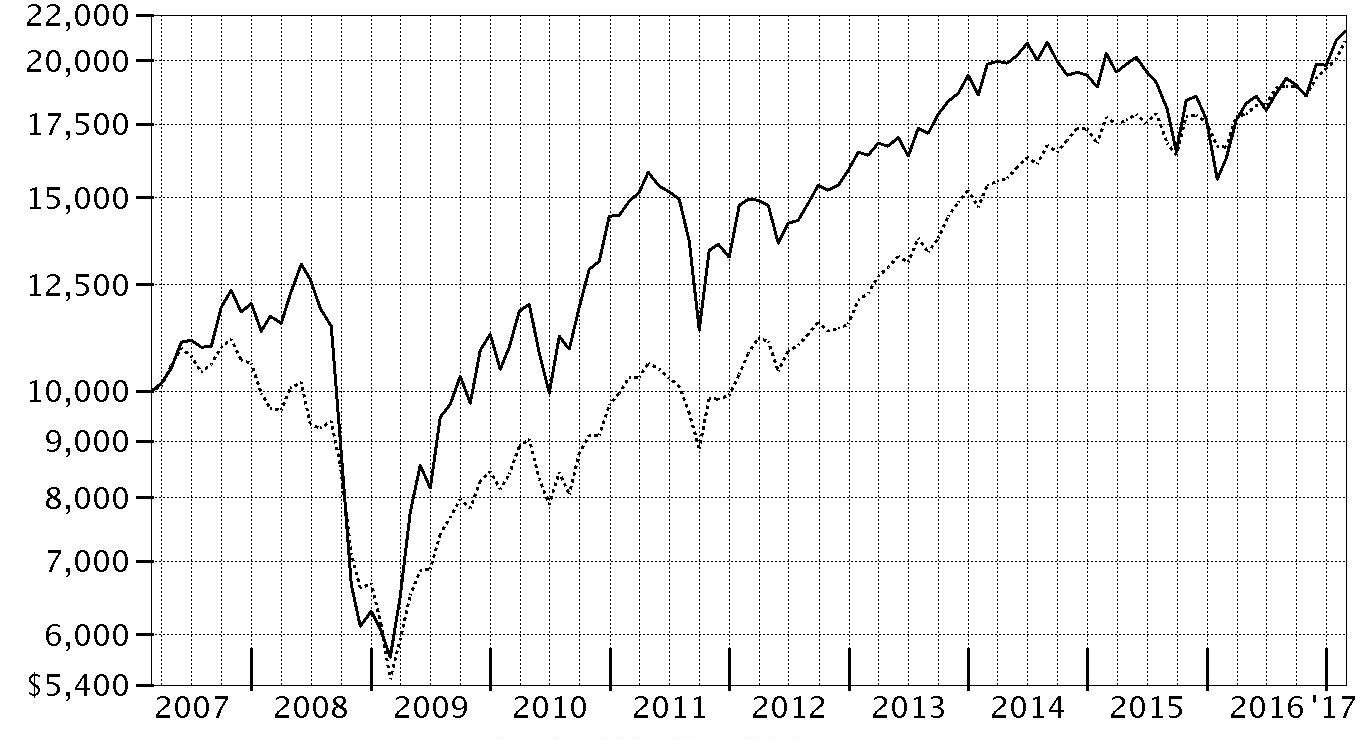

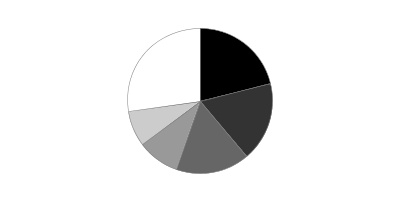

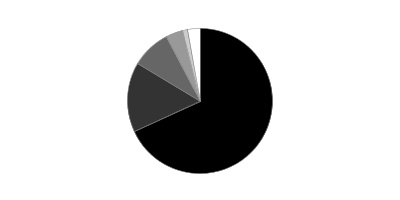

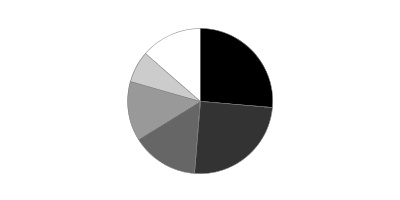

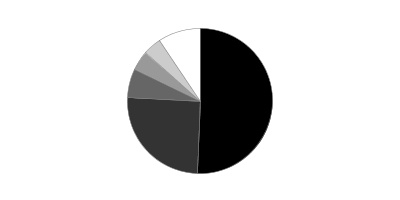

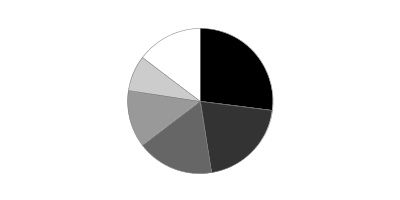

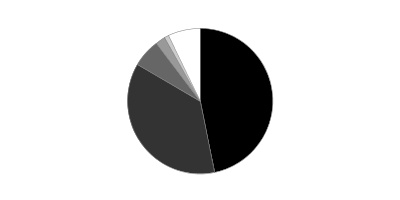

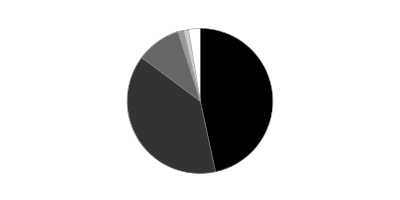

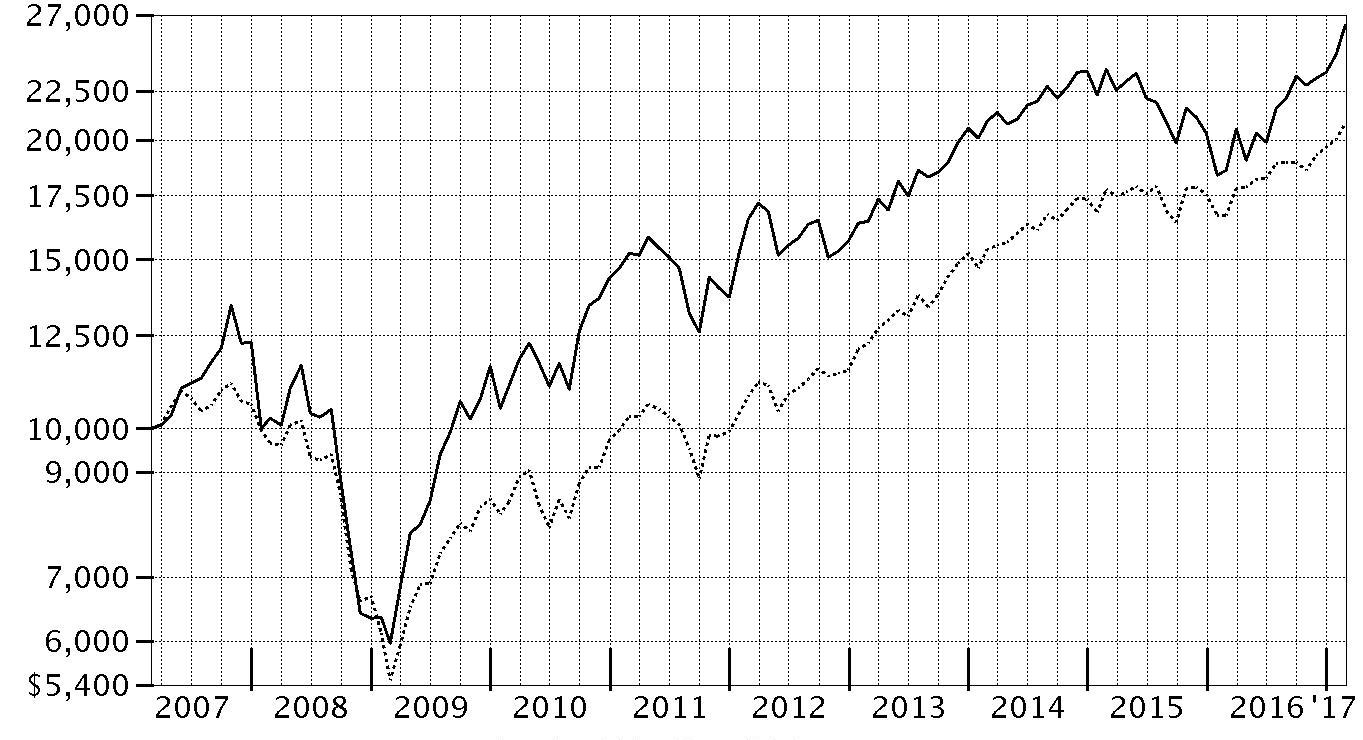

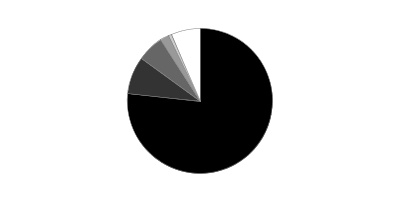

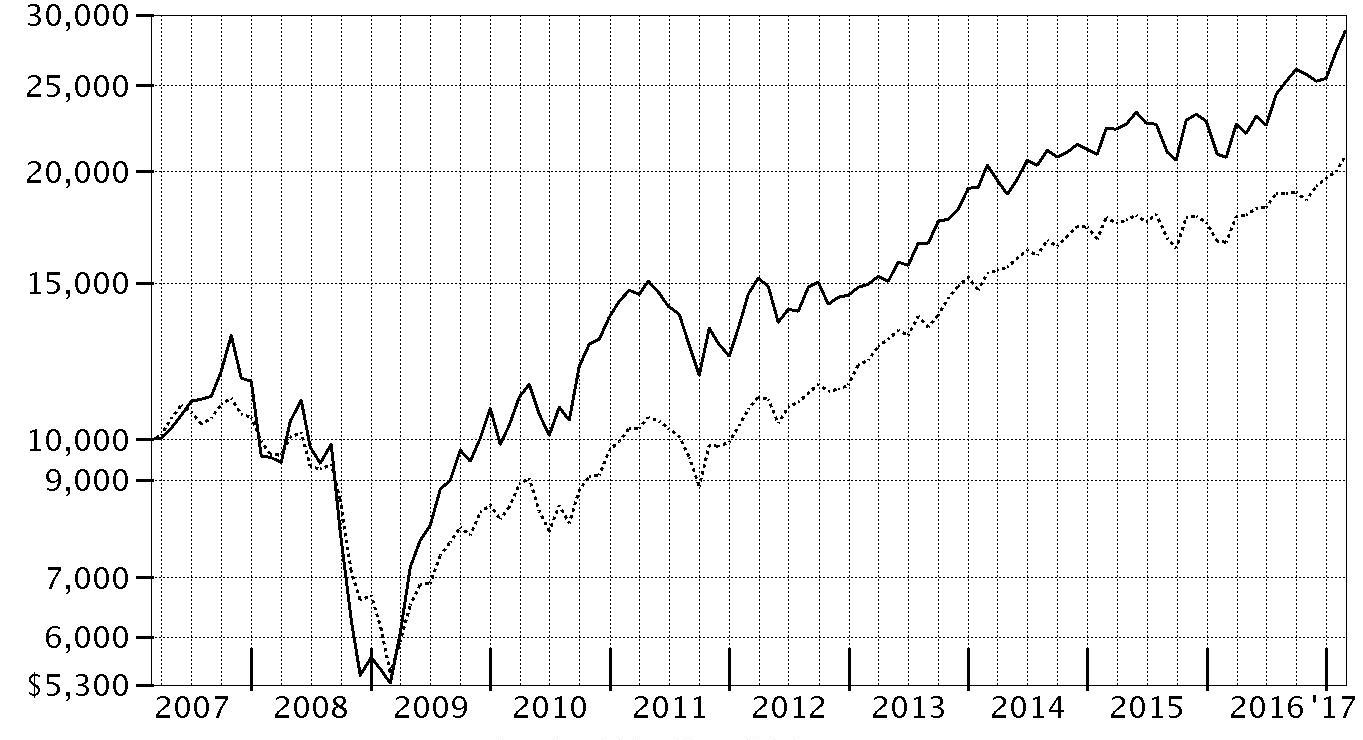

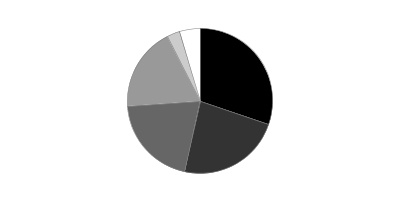

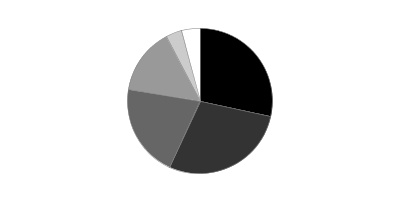

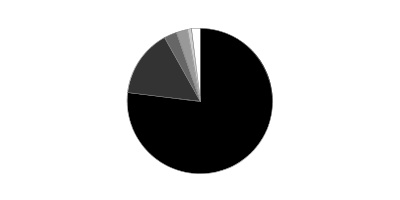

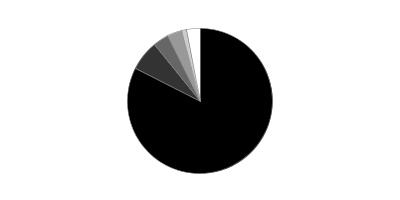

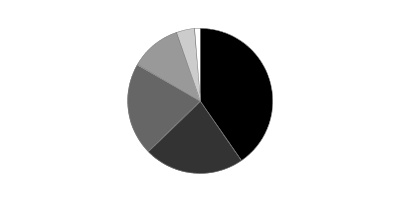

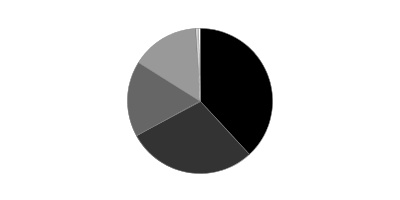

Top Industries (% of fund's net assets)

| As of February 28, 2017 |

| | Tobacco | 33.8% |

| | Food & Staples Retailing | 17.6% |

| | Beverages | 16.6% |

| | Food Products | 10.4% |

| | Personal Products | 9.7% |

| | All Others* | 11.9% |

* Includes Short-Term investments and Net Other Assets (Liabilities).

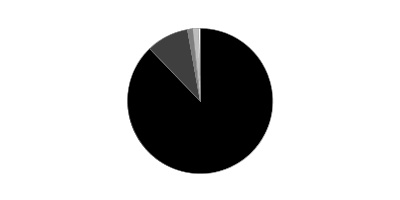

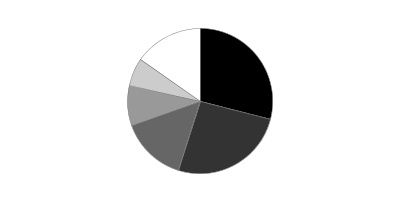

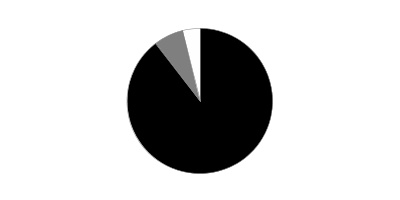

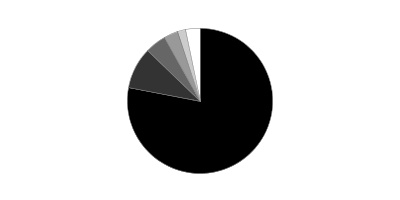

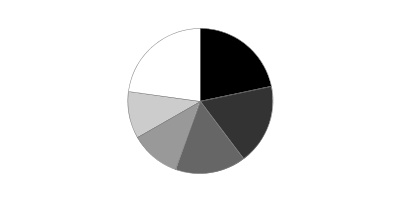

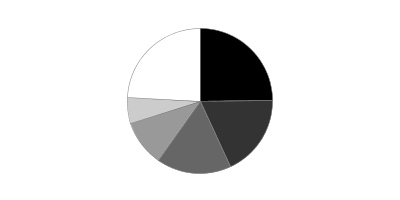

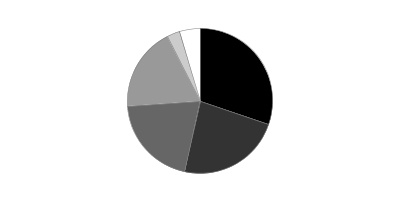

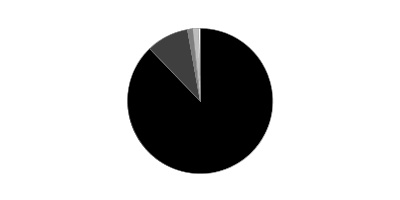

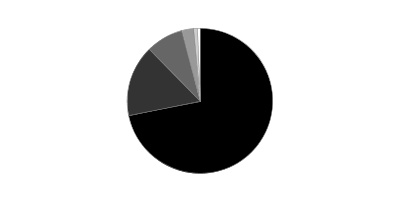

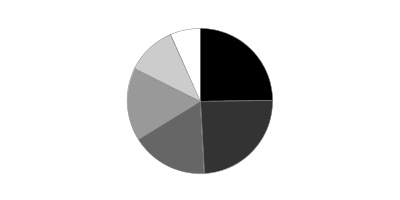

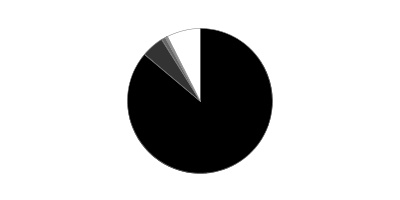

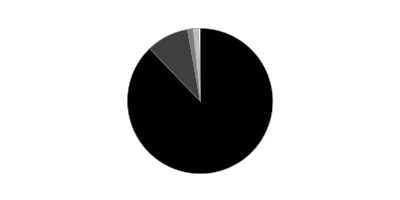

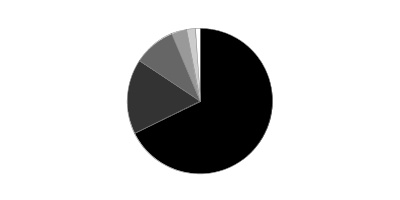

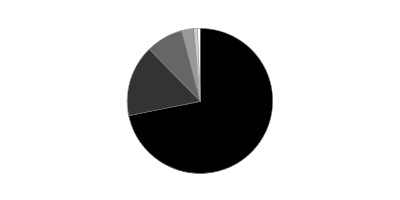

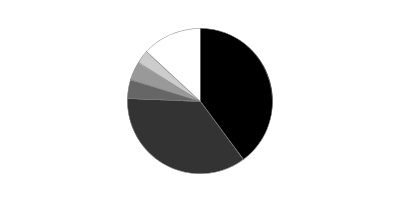

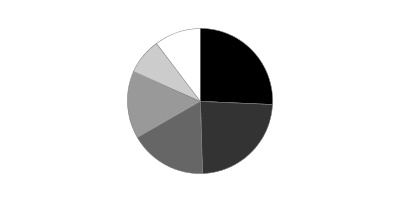

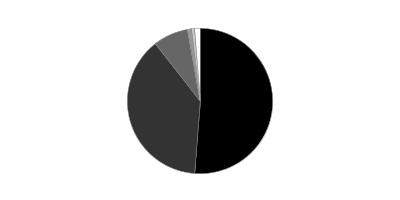

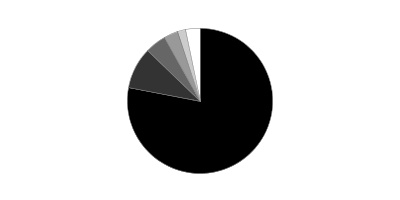

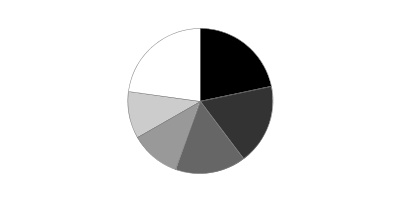

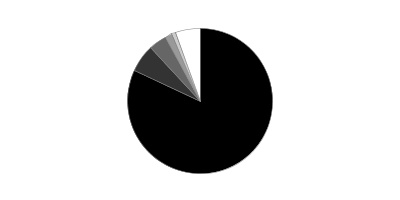

| As of August 31, 2016 |

| | Food & Staples Retailing | 24.9% |

| | Tobacco | 24.2% |

| | Beverages | 17.0% |

| | Household Products | 16.2% |

| | Food Products | 11.1% |

| | All Others* | 6.6% |

* Includes Short-Term investments and Net Other Assets (Liabilities).

Prior period industry classifications reflect the categories in place as of the date indicated and have not been adjusted to reflect current industry classifications.

Consumer Staples Portfolio

Investments February 28, 2017

Showing Percentage of Net Assets

| Common Stocks - 97.7% | | | |

| | | Shares | Value |

| Beverages - 16.4% | | | |

| Brewers - 2.8% | | | |

| Anheuser-Busch InBev SA NV | | 670,590 | $73,353,629 |

| China Resources Beer Holdings Co. Ltd. (a) | | 3,468,000 | 7,871,563 |

| | | | 81,225,192 |

| Distillers & Vintners - 3.2% | | | |

| Brown-Forman Corp. Class B (non-vtg.) | | 195,168 | 9,516,392 |

| Constellation Brands, Inc. Class A (sub. vtg.) | | 213,600 | 33,921,816 |

| Kweichow Moutai Co. Ltd. (A Shares) | | 268,853 | 13,883,937 |

| Pernod Ricard SA | | 238,376 | 27,248,584 |

| Wuliangye Yibin Co. Ltd. Class A | | 1,314,309 | 7,570,757 |

| | | | 92,141,486 |

| Soft Drinks - 10.4% | | | |

| Britvic PLC | | 2,255,964 | 17,677,661 |

| Coca-Cola Bottling Co. Consolidated | | 150,638 | 25,920,281 |

| Coca-Cola European Partners PLC | | 47,700 | 1,654,713 |

| Coca-Cola FEMSA S.A.B. de CV sponsored ADR | | 64,529 | 4,235,038 |

| Coca-Cola Icecek Sanayi A/S | | 611,162 | 5,888,088 |

| Embotelladora Andina SA Series A sponsored ADR Series A | | 287,573 | 5,808,975 |

| Monster Beverage Corp. (a) | | 2,113,502 | 87,583,523 |

| PepsiCo, Inc. | | 68,800 | 7,594,144 |

| The Coca-Cola Co. | | 3,336,218 | 139,987,707 |

| | | | 296,350,130 |

|

| TOTAL BEVERAGES | | | 469,716,808 |

|

| Food & Staples Retailing - 17.6% | | | |

| Drug Retail - 11.3% | | | |

| CVS Health Corp. | | 2,978,903 | 240,040,004 |

| Drogasil SA (a) | | 343,600 | 6,481,814 |

| Rite Aid Corp. (a) | | 1,031,800 | 6,190,800 |

| Walgreens Boots Alliance, Inc. | | 829,524 | 71,654,283 |

| | | | 324,366,901 |

| Food Retail - 6.0% | | | |

| Kroger Co. | | 5,395,670 | 171,582,306 |

| Hypermarkets & Super Centers - 0.3% | | | |

| Wal-Mart Stores, Inc. | | 123,800 | 8,781,134 |

|

| TOTAL FOOD & STAPLES RETAILING | | | 504,730,341 |

|

| Food Products - 10.4% | | | |

| Agricultural Products - 2.7% | | | |

| Bunge Ltd. | | 944,844 | 77,335,481 |

| Packaged Foods & Meats - 7.7% | | | |

| Amplify Snack Brands, Inc. (a) | | 284,938 | 2,855,079 |

| Blue Buffalo Pet Products, Inc. (a) | | 490,676 | 11,992,121 |

| Mead Johnson Nutrition Co. Class A | | 240,640 | 21,125,786 |

| Mondelez International, Inc. | | 1,379,358 | 60,581,403 |

| Nestle SA | | 231,912 | 17,114,683 |

| The Hain Celestial Group, Inc. (a) | | 1,191,666 | 42,161,143 |

| TreeHouse Foods, Inc. (a) | | 762,959 | 64,912,552 |

| | | | 220,742,767 |

|

| TOTAL FOOD PRODUCTS | | | 298,078,248 |

|

| Hotels, Restaurants & Leisure - 0.7% | | | |

| Restaurants - 0.7% | | | |

| U.S. Foods Holding Corp. | | 737,016 | 20,304,791 |

| Household Products - 9.1% | | | |

| Household Products - 9.1% | | | |

| Colgate-Palmolive Co. | | 1,478,196 | 107,878,744 |

| Kimberly-Clark Corp. | | 145,466 | 19,281,518 |

| Procter & Gamble Co. | | 1,231,261 | 112,130,939 |

| Spectrum Brands Holdings, Inc. (b) | | 147,105 | 19,965,091 |

| | | | 259,256,292 |

| Personal Products - 9.7% | | | |

| Personal Products - 9.7% | | | |

| Avon Products, Inc. (a) | | 2,634,800 | 11,593,120 |

| Coty, Inc. Class A (b) | | 4,174,597 | 78,398,932 |

| Estee Lauder Companies, Inc. Class A | | 1,652,639 | 136,921,141 |

| Herbalife Ltd. (a) | | 289,610 | 16,360,069 |

| L'Oreal SA | | 82,100 | 15,268,767 |

| Unilever NV (Certificaten Van Aandelen) (Bearer) | | 295,700 | 13,997,879 |

| Unilever PLC sponsored ADR (b) | | 108,400 | 5,146,832 |

| | | | 277,686,740 |

| Tobacco - 33.8% | | | |

| Tobacco - 33.8% | | | |

| Altria Group, Inc. | | 1,877,045 | 140,628,211 |

| British American Tobacco PLC sponsored ADR (b) | | 5,187,692 | 331,182,257 |

| ITC Ltd. | | 2,461,847 | 9,673,980 |

| Philip Morris International, Inc. | | 3,065,591 | 335,222,374 |

| Reynolds American, Inc. | | 2,431,523 | 149,708,871 |

| | | | 966,415,693 |

| TOTAL COMMON STOCKS | | | |

| (Cost $2,136,570,932) | | | 2,796,188,913 |

|

| Nonconvertible Preferred Stocks - 0.2% | | | |

| Beverages - 0.2% | | | |

| Brewers - 0.2% | | | |

| Ambev SA sponsored ADR | | | |

| (Cost $4,208,238) | | 1,079,010 | 6,139,567 |

|

| Money Market Funds - 14.5% | | | |

| Fidelity Cash Central Fund, 0.60% (c) | | 67,980,774 | 67,994,370 |

| Fidelity Securities Lending Cash Central Fund 0.62% (c)(d) | | 345,125,337 | 345,194,362 |

| TOTAL MONEY MARKET FUNDS | | | |

| (Cost $413,159,142) | | | 413,188,732 |

| TOTAL INVESTMENT PORTFOLIO - 112.4% | | | |

| (Cost $2,553,938,312) | | | 3,215,517,212 |

| NET OTHER ASSETS (LIABILITIES) - (12.4)% | | | (354,007,815) |

| NET ASSETS - 100% | | | $2,861,509,397 |

Legend

(a) Non-income producing

(b) Security or a portion of the security is on loan at period end.

(c) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

(d) Investment made with cash collateral received from securities on loan.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $259,718 |

| Fidelity Securities Lending Cash Central Fund | 1,515,619 |

| Total | $1,775,337 |

Investment Valuation

The following is a summary of the inputs used, as of February 28, 2017, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | | | | |

| Common Stocks | $2,796,188,913 | $2,685,240,908 | $110,948,005 | $-- |

| Nonconvertible Preferred Stocks | 6,139,567 | 6,139,567 | -- | -- |

| Money Market Funds | 413,188,732 | 413,188,732 | -- | -- |

| Total Investments in Securities: | $3,215,517,212 | $3,104,569,207 | $110,948,005 | $-- |

Other Information

Distribution of investments by country or territory of incorporation, as a percentage of Total Net Assets, is as follows (Unaudited):

| United States of America | 76.8% |

| United Kingdom | 12.5% |

| Bermuda | 2.7% |

| Belgium | 2.5% |

| France | 1.4% |

| Others (Individually Less Than 1%) | 4.1% |

| | 100.0% |

See accompanying notes which are an integral part of the financial statements.

Consumer Staples Portfolio

Financial Statements

Statement of Assets and Liabilities

| | | February 28, 2017 |

| Assets | | |

Investment in securities, at value (including securities loaned of $336,402,757) — See accompanying schedule:

Unaffiliated issuers (cost $2,140,779,170) | $2,802,328,480 | |

| Fidelity Central Funds (cost $413,159,142) | 413,188,732 | |

| Total Investments (cost $2,553,938,312) | | $3,215,517,212 |

| Receivable for investments sold | | 1,470,144 |

| Receivable for fund shares sold | | 7,125,395 |

| Dividends receivable | | 3,442,599 |

| Distributions receivable from Fidelity Central Funds | | 494,426 |

| Prepaid expenses | | 12,955 |

| Other receivables | | 172,464 |

| Total assets | | 3,228,235,195 |

| Liabilities | | |

| Payable to custodian bank | $147 | |

| Payable for investments purchased | 12,917,380 | |

| Payable for fund shares redeemed | 5,656,387 | |

| Accrued management fee | 1,282,517 | |

| Distribution and service plan fees payable | 399,595 | |

| Other affiliated payables | 499,023 | |

| Other payables and accrued expenses | 796,673 | |

| Collateral on securities loaned | 345,174,076 | |

| Total liabilities | | 366,725,798 |

| Net Assets | | $2,861,509,397 |

| Net Assets consist of: | | |

| Paid in capital | | $2,161,673,906 |

| Undistributed net investment income | | 4,801,401 |

| Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | 34,120,683 |

| Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 660,913,407 |

| Net Assets | | $2,861,509,397 |

| Calculation of Maximum Offering Price | | |

| Class A: | | |

| Net Asset Value and redemption price per share ($522,014,431 ÷ 5,427,232 shares) | | $96.18 |

| Maximum offering price per share (100/94.25 of $96.18) | | $102.05 |

| Class T: | | |

| Net Asset Value and redemption price per share ($89,924,874 ÷ 942,418 shares) | | $95.42 |

| Maximum offering price per share (100/96.50 of $95.42) | | $98.88 |

| Class C: | | |

| Net Asset Value and offering price per share ($308,350,291 ÷ 3,284,096 shares)(a) | | $93.89 |

| Consumer Staples: | | |

| Net Asset Value, offering price and redemption price per share ($1,665,603,660 ÷ 17,170,009 shares) | | $97.01 |

| Class I: | | |

| Net Asset Value, offering price and redemption price per share ($275,616,141 ÷ 2,846,783 shares) | | $96.82 |

(a) Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| | | Year ended February 28, 2017 |

| Investment Income | | |

| Dividends | | $74,847,125 |

| Income from Fidelity Central Funds | | 1,775,337 |

| Total income | | 76,622,462 |

| Expenses | | |

| Management fee | $17,449,594 | |

| Transfer agent fees | 5,832,031 | |

| Distribution and service plan fees | 4,855,574 | |

| Accounting and security lending fees | 951,646 | |

| Custodian fees and expenses | 90,578 | |

| Independent trustees' fees and expenses | 70,084 | |

| Registration fees | 222,336 | |

| Audit | 57,796 | |

| Legal | 45,597 | |

| Interest | 3,438 | |

| Miscellaneous | 41,607 | |

| Total expenses before reductions | 29,620,281 | |

| Expense reductions | (283,563) | 29,336,718 |

| Net investment income (loss) | | 47,285,744 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 132,377,339 | |

| Redemptions in-kind with affiliated entities | 85,065,706 | |

| Fidelity Central Funds | (7,690) | |

| Foreign currency transactions | (102,855) | |

| Total net realized gain (loss) | | 217,332,500 |

Change in net unrealized appreciation (depreciation) on:

Investment securities (net of increase in deferred foreign taxes of $618,798) | 57,306,523 | |

| Assets and liabilities in foreign currencies | 1,526 | |

| Total change in net unrealized appreciation (depreciation) | | 57,308,049 |

| Net gain (loss) | | 274,640,549 |

| Net increase (decrease) in net assets resulting from operations | | $321,926,293 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| | Year ended February 28, 2017 | Year ended February 29, 2016 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $47,285,744 | $45,297,947 |

| Net realized gain (loss) | 217,332,500 | 141,211,479 |

| Change in net unrealized appreciation (depreciation) | 57,308,049 | (292,128,539) |

| Net increase (decrease) in net assets resulting from operations | 321,926,293 | (105,619,113) |

| Distributions to shareholders from net investment income | (44,327,157) | (42,428,021) |

| Distributions to shareholders from net realized gain | (82,139,579) | (202,474,580) |

| Total distributions | (126,466,736) | (244,902,601) |

| Share transactions - net increase (decrease) | (395,070,237) | 299,448,347 |

| Redemption fees | 44,026 | 52,041 |

| Total increase (decrease) in net assets | (199,566,654) | (51,021,326) |

| Net Assets | | |

| Beginning of period | 3,061,076,051 | 3,112,097,377 |

| End of period | $2,861,509,397 | $3,061,076,051 |

| Other Information | | |

| Undistributed net investment income end of period | $4,801,401 | $4,626,720 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Consumer Staples Portfolio Class A

| Years ended February 28, | 2017 | 2016A | 2015 | 2014 | 2013 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $89.78 | $101.33 | $87.93 | $85.67 | $74.90 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)B | 1.28 | 1.34 | 1.37 | 1.43 | 1.26 |

| Net realized and unrealized gain (loss) | 9.12 | (4.86) | 17.28 | 7.51 | 11.73 |

| Total from investment operations | 10.40 | (3.52) | 18.65 | 8.94 | 12.99 |

| Distributions from net investment income | (1.37) | (1.31) | (1.28) | (1.44) | (1.08) |

| Distributions from net realized gain | (2.64) | (6.72) | (3.98) | (5.24) | (1.14) |

| Total distributions | (4.00)C | (8.03) | (5.25)D | (6.68) | (2.22) |

| Redemption fees added to paid in capitalB,E | – | – | – | – | – |

| Net asset value, end of period | $96.18 | $89.78 | $101.33 | $87.93 | $85.67 |

| Total ReturnF,G | 11.91% | (3.51)% | 21.95% | 10.53% | 17.60% |

| Ratios to Average Net AssetsH,I | | | | | |

| Expenses before reductions | 1.04% | 1.04% | 1.05% | 1.06% | 1.08% |

| Expenses net of fee waivers, if any | 1.04% | 1.04% | 1.05% | 1.06% | 1.08% |

| Expenses net of all reductions | 1.03% | 1.04% | 1.05% | 1.06% | 1.08% |

| Net investment income (loss) | 1.37% | 1.45% | 1.45% | 1.61% | 1.58% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $522,014 | $470,249 | $414,151 | $329,459 | $277,329 |

| Portfolio turnover rateJ | 56%K | 63% | 42%K | 31% | 28% |

A For the year ended February 29.

B Calculated based on average shares outstanding during the period.

C Total distributions of $4.00 per share is comprised of distributions from net investment income of $1.365 and distributions from net realized gain of $2.636 per share.

D Total distributions of $5.25 per share is comprised of distributions from net investment income of $1.275 and distributions from net realized gain of $3.976 per share.

E Amount represents less than $.005 per share.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Total returns do not include the effect of the sales charges.

H Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

J Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

K Portfolio turnover rate excludes securities received or delivered in-kind.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Consumer Staples Portfolio Class T

| Years ended February 28, | 2017 | 2016A | 2015 | 2014 | 2013 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $89.10 | $100.61 | $87.37 | $85.18 | $74.49 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)B | 1.01 | 1.08 | 1.10 | 1.18 | 1.03 |

| Net realized and unrealized gain (loss) | 9.07 | (4.83) | 17.15 | 7.46 | 11.68 |

| Total from investment operations | 10.08 | (3.75) | 18.25 | 8.64 | 12.71 |

| Distributions from net investment income | (1.12) | (1.04) | (1.04) | (1.21) | (.88) |

| Distributions from net realized gain | (2.64) | (6.72) | (3.98) | (5.24) | (1.14) |

| Total distributions | (3.76) | (7.76) | (5.01)C | (6.45) | (2.02) |

| Redemption fees added to paid in capitalB,D | – | – | – | – | – |

| Net asset value, end of period | $95.42 | $89.10 | $100.61 | $87.37 | $85.18 |

| Total ReturnE,F | 11.61% | (3.78)% | 21.60% | 10.23% | 17.29% |

| Ratios to Average Net AssetsG,H | | | | | |

| Expenses before reductions | 1.32% | 1.32% | 1.32% | 1.33% | 1.36% |

| Expenses net of fee waivers, if any | 1.32% | 1.32% | 1.32% | 1.33% | 1.36% |

| Expenses net of all reductions | 1.31% | 1.31% | 1.32% | 1.33% | 1.35% |

| Net investment income (loss) | 1.09% | 1.17% | 1.18% | 1.34% | 1.30% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $89,925 | $76,586 | $81,489 | $61,421 | $52,024 |

| Portfolio turnover rateI | 56%J | 63% | 42%J | 31% | 28% |

A For the year ended February 29.

B Calculated based on average shares outstanding during the period.

C Total distributions of $5.01 per share is comprised of distributions from net investment income of $1.036 and distributions from net realized gain of $3.976 per share.

D Amount represents less than $.005 per share.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Total returns do not include the effect of the sales charges.

G Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

J Portfolio turnover rate excludes securities received or delivered in-kind.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Consumer Staples Portfolio Class C

| Years ended February 28, | 2017 | 2016A | 2015 | 2014 | 2013 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $87.77 | $99.27 | $86.32 | $84.28 | $73.75 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)B | .56 | .63 | .65 | .75 | .65 |

| Net realized and unrealized gain (loss) | 8.92 | (4.75) | 16.93 | 7.36 | 11.55 |

| Total from investment operations | 9.48 | (4.12) | 17.58 | 8.11 | 12.20 |

| Distributions from net investment income | (.73) | (.65) | (.65) | (.84) | (.53) |

| Distributions from net realized gain | (2.64) | (6.72) | (3.98) | (5.24) | (1.14) |

| Total distributions | (3.36)C | (7.38)D | (4.63) | (6.07)E | (1.67) |

| Redemption fees added to paid in capitalB,F | – | – | – | – | – |

| Net asset value, end of period | $93.89 | $87.77 | $99.27 | $86.32 | $84.28 |

| Total ReturnG,H | 11.07% | (4.23)% | 21.03% | 9.70% | 16.73% |

| Ratios to Average Net AssetsI,J | | | | | |

| Expenses before reductions | 1.80% | 1.80% | 1.80% | 1.82% | 1.83% |

| Expenses net of fee waivers, if any | 1.79% | 1.80% | 1.80% | 1.82% | 1.83% |

| Expenses net of all reductions | 1.79% | 1.79% | 1.80% | 1.81% | 1.82% |

| Net investment income (loss) | .61% | .69% | .70% | .85% | .83% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $308,350 | $250,576 | $228,151 | $164,669 | $134,966 |

| Portfolio turnover rateK | 56%L | 63% | 42%L | 31% | 28% |

A For the year ended February 29.

B Calculated based on average shares outstanding during the period.

C Total distributions of $3.36 per share is comprised of distributions from net investment income of $.726 and distributions from net realized gain of $2.636 per share.

D Total distributions of $7.38 per share is comprised of distributions from net investment income of $.651 and distributions from net realized gain of $6.724 per share.

E Total distributions of $6.07 per share is comprised of distributions from net investment income of $.837 and distributions from net realized gain of $5.237 per share.

F Amount represents less than $.005 per share.

G Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

H Total returns do not include the effect of the contingent deferred sales charge.

I Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

J Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

K Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

L Portfolio turnover rate excludes securities received or delivered in-kind.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Consumer Staples Portfolio

| Years ended February 28, | 2017 | 2016A | 2015 | 2014 | 2013 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $90.48 | $102.03 | $88.51 | $86.17 | $75.29 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)B | 1.56 | 1.61 | 1.64 | 1.69 | 1.48 |

| Net realized and unrealized gain (loss) | 9.20 | (4.89) | 17.40 | 7.55 | 11.82 |

| Total from investment operations | 10.76 | (3.28) | 19.04 | 9.24 | 13.30 |

| Distributions from net investment income | (1.60) | (1.55) | (1.54) | (1.66) | (1.28) |

| Distributions from net realized gain | (2.64) | (6.72) | (3.98) | (5.24) | (1.14) |

| Total distributions | (4.23)C | (8.27) | (5.52) | (6.90) | (2.42) |

| Redemption fees added to paid in capitalB,D | – | – | – | – | – |

| Net asset value, end of period | $97.01 | $90.48 | $102.03 | $88.51 | $86.17 |

| Total ReturnE | 12.24% | (3.25)% | 22.27% | 10.82% | 17.94% |

| Ratios to Average Net AssetsF,G | | | | | |

| Expenses before reductions | .76% | .77% | .77% | .79% | .81% |

| Expenses net of fee waivers, if any | .76% | .77% | .77% | .79% | .81% |

| Expenses net of all reductions | .76% | .76% | .77% | .79% | .80% |

| Net investment income (loss) | 1.64% | 1.72% | 1.73% | 1.88% | 1.85% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $1,665,604 | $2,039,983 | $2,173,970 | $1,328,594 | $1,425,055 |

| Portfolio turnover rateH | 56%I | 63% | 42%I | 31% | 28% |

A For the year ended February 29.

B Calculated based on average shares outstanding during the period.

C Total distributions of $4.23 per share is comprised of distributions from net investment income of $1.596 and distributions from net realized gain of $2.636 per share.

D Amount represents less than $.005 per share.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

I Portfolio turnover rate excludes securities received or delivered in-kind.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Consumer Staples Portfolio Class I

| Years ended February 28, | 2017 | 2016A | 2015 | 2014 | 2013 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $90.34 | $101.91 | $88.33 | $85.92 | $75.14 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)B | 1.54 | 1.60 | 1.59 | 1.66 | 1.45 |

| Net realized and unrealized gain (loss) | 9.19 | (4.89) | 17.40 | 7.53 | 11.79 |

| Total from investment operations | 10.73 | (3.29) | 18.99 | 9.19 | 13.24 |

| Distributions from net investment income | (1.61) | (1.55) | (1.44) | (1.54) | (1.32) |

| Distributions from net realized gain | (2.64) | (6.72) | (3.98) | (5.24) | (1.14) |

| Total distributions | (4.25) | (8.28)C | (5.41)D | (6.78) | (2.46) |

| Redemption fees added to paid in capitalB,E | – | – | – | – | – |

| Net asset value, end of period | $96.82 | $90.34 | $101.91 | $88.33 | $85.92 |

| Total ReturnF | 12.22% | (3.26)% | 22.26% | 10.80% | 17.90% |

| Ratios to Average Net AssetsG,H | | | | | |

| Expenses before reductions | .78% | .78% | .80% | .82% | .85% |

| Expenses net of fee waivers, if any | .78% | .77% | .80% | .82% | .85% |

| Expenses net of all reductions | .77% | .77% | .80% | .82% | .84% |

| Net investment income (loss) | 1.63% | 1.71% | 1.70% | 1.85% | 1.81% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $275,616 | $216,836 | $198,538 | $154,271 | $378,731 |

| Portfolio turnover rateI | 56%J | 63% | 42%J | 31% | 28% |

A For the year ended February 29.

B Calculated based on average shares outstanding during the period.

C Total distributions of $8.28 per share is comprised of distributions from net investment income of $1.553 and distributions from net realized gain of $6.724 per share.

D Total distributions of $5.41 per share is comprised of distributions from net investment income of $1.436 and distributions from net realized gain of $3.976 per share.

E Amount represents less than $.005 per share.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

J Portfolio turnover rate excludes securities received or delivered in-kind.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements

For the period ended February 28, 2017

1. Organization.

Consumer Staples Portfolio (the Fund) is a non-diversified fund of Fidelity Select Portfolios (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund invests primarily in securities of companies whose principal business activities fall within specific industries. The Fund offers Class A, Class T, Class C, Consumer Staples and Class I shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class.

After the close of business on June 24, 2016, all outstanding Class B shares were converted to Class A shares. All current fiscal period dollar and share amounts for Class B presented in the Notes to Financial Statements are for the period March 1, 2016 through June 24, 2016.

In March 2017, the Board of Trustees approved a change in the name of Class T to Class M effective after the close of business on March 24, 2017.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .005%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC website or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fair Value Committee (the Committee) established by the Fund's investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. Utilizing these techniques may result in transfers between Level 1 and Level 2. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Investments in open-end mutual funds ,including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of February 28, 2017 is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Certain distributions received by the Fund represent a return of capital or capital gain. The Fund determines the components of these distributions subsequent to the ex-dividend date, based upon receipt of tax filings or other correspondence relating to the underlying investment. These distributions are recorded as a reduction of cost of investments and/or as a realized gain. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Deferred Trustee Compensation. Under a Deferred Compensation Plan (the Plan), independent Trustees may elect to defer receipt of a portion of their annual compensation. Deferred amounts are invested in a cross-section of Fidelity funds, are marked-to-market and remain in the Fund until distributed in accordance with the Plan. The investment of deferred amounts and the offsetting payable to the Trustees are included in the accompanying Statement of Assets and Liabilities.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of February 28, 2017, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests. The Fund is subject to a tax imposed on capital gains by certain countries in which it invests. An estimated deferred tax liability for net unrealized appreciation on the applicable securities is included in Other payables and accrued expenses on the Statement of Assets & Liabilities.

Distributions are declared and recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. In addition, the Fund claimed a portion of the payment made to redeeming shareholders as a distribution for income tax purposes.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, deferred trustees compensation and losses deferred due to wash sales.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

| Gross unrealized appreciation | $700,011,718 |

| Gross unrealized depreciation | (43,745,466) |

| Net unrealized appreciation (depreciation) on securities | $656,266,252 |

| Tax Cost | $2,559,250,960 |

The tax-based components of distributable earnings as of period end were as follows:

| Undistributed ordinary income | $4,923,518 |

| Undistributed long-term capital gain | $39,433,331 |

| Net unrealized appreciation (depreciation) on securities and other investments | $656,219,557 |

The tax character of distributions paid was as follows:

| | February 28, 2017 | February 29, 2016 |

| Ordinary Income | $67,916,475 | $ 74,502,566 |

| Long-term Capital Gains | 58,550,261 | 170,400,035 |

| Total | $126,466,736 | $ 244,902,601 |

Trading (Redemption) Fees. Shares held by investors in the Fund less than 30 days may be subject to a redemption fee equal to .75% of the NAV of shares redeemed. All redemption fees, which reduce the proceeds of the shareholder redemption, are retained by the Fund and accounted for as an addition to paid in capital. In November 2016, the Board of Trustees approved the elimination of these redemption fees effective December 12, 2016.

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securites and in-kind transactions, aggregated $1,728,107,751 and $1,942,329,048, respectively.

5. Fees and Other Transactions with Affiliates.

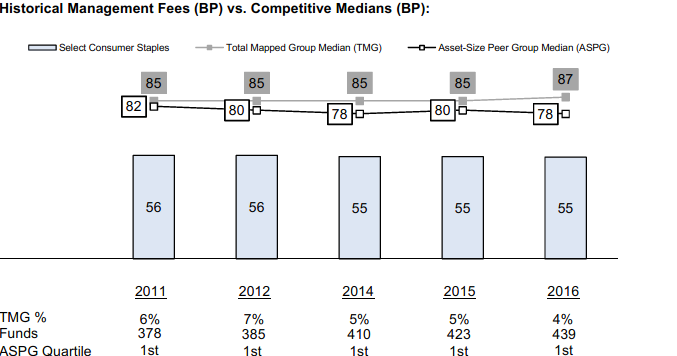

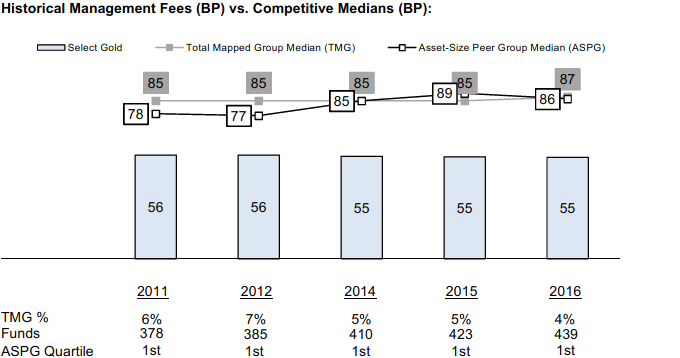

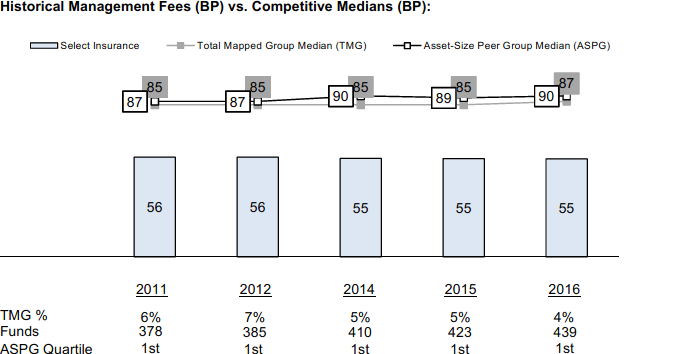

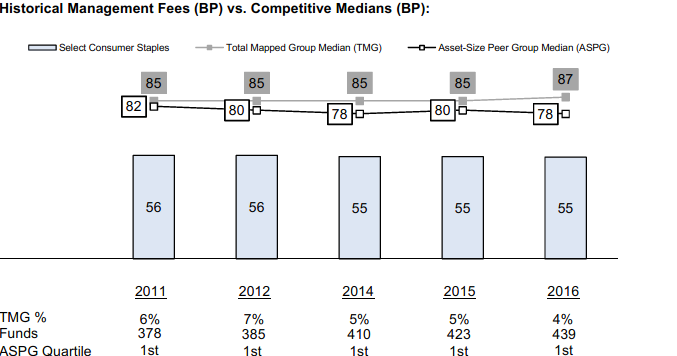

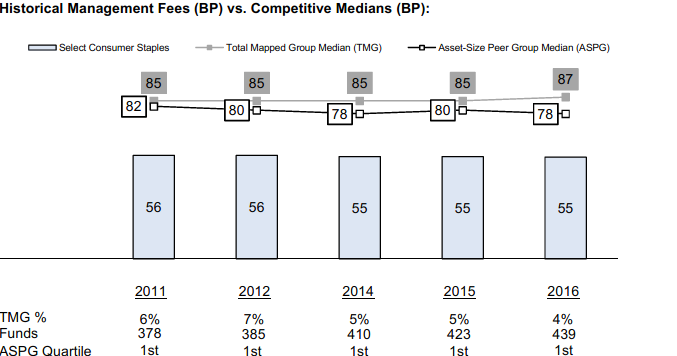

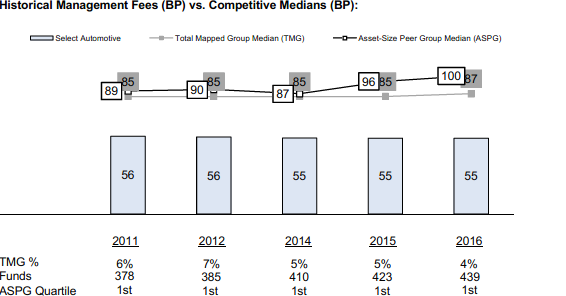

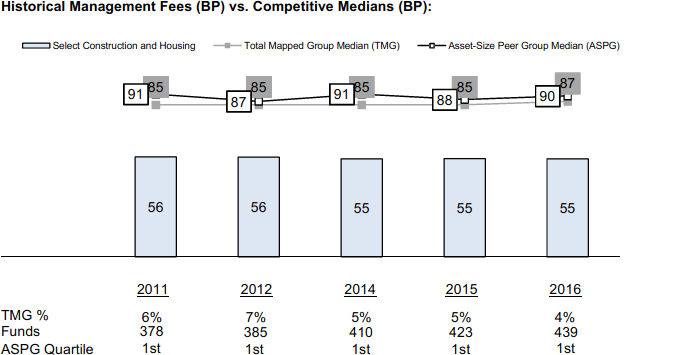

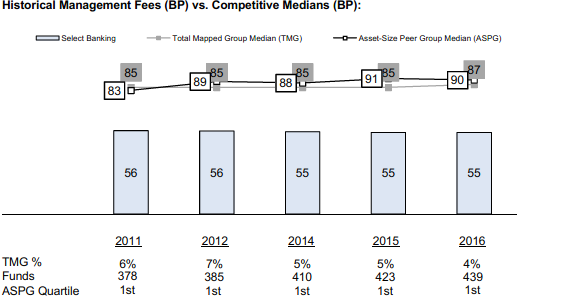

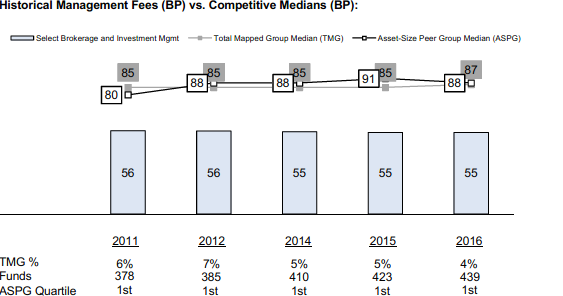

Management Fee. Fidelity SelectCo, LLC (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .30% of the Fund's average net assets and an annualized group fee rate that averaged .25 % during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by Fidelity Management & Research Company (FMR) and the investment adviser. The group fee rate decreases as assets under management increase and increases as assets under management decrease. For the reporting period, the total annual management fee rate was .55% of the Fund's average net assets.

Distribution and Service Plan Fees. In accordance with Rule 12b-1 of the 1940 Act, the Fund has adopted separate Distribution and Service Plans for each class of shares. Certain classes pay Fidelity Distributors Corporation (FDC), an affiliate of the investment adviser, separate Distribution and Service Fees, each of which is based on an annual percentage of each class' average net assets. In addition, FDC may pay financial intermediaries for selling shares of the Fund and providing shareholder support services. For the period, the Distribution and Service Fee rates, total fees and amounts retained by FDC were as follows:

| | Distribution

Fee | Service

Fee | Total Fees | Retained

by FDC |

| Class A | -% | .25% | $1,339,266 | $– |

| Class T | .25% | .25% | 436,934 | – |

| Class B | .75% | .25% | 18,669 | 14,002 |

| Class C | .75% | .25% | 3,060,705 | 786,573 |

| | | | $4,855,574 | $800,575 |

Sales Load. FDC may receive a front-end sales charge of up to 5.75% for selling Class A shares and 3.50% for selling Class T shares, some of which is paid to financial intermediaries for selling shares of the Fund. Depending on the holding period, FDC may receive contingent deferred sales charges levied on Class A, Class T, Class B and Class C redemptions. The deferred sales charges range from 5.00% to 1.00% for Class B shares, 1.00% for Class C shares, 1.00% for certain purchases of Class A shares and .25% for certain purchases of Class T shares.

For the period, sales charge amounts retained by FDC were as follows:

| | Retained

by FDC |

| Class A | $454,705 |

| Class T | 51,077 |

| Class B(a) | 19 |

| Class C(a) | 51,246 |

| | $557,047 |

(a) When Class B and Class C shares are initially sold, FDC pays commissions from its own resources to financial intermediaries through which the sales are made.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc., (FIIOC), an affiliate of the investment adviser, is the transfer, dividend disbursing and shareholder servicing agent for each class of the Fund. FIIOC receives account fees and asset-based fees that vary according to the account size and type of account of the shareholders of the respective classes of the Fund. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements.

For the period, transfer agent fees for each class were as follows:

| | Amount | % of

Class-Level Average

Net Assets |

| Class A | $1,074,330 | .20 |

| Class T | 198,886 | .23 |

| Class B | 4,085 | .22 |

| Class C | 619,029 | .20 |

| Consumer Staples | 3,384,602 | .17 |

| Class I | 551,099 | .19 |

| | $5,832,031 | |

Accounting and Security Lending Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions.

Brokerage Commissions. The Fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were $30,116 for the period.

Interfund Lending Program. Pursuant to an Exemptive Order issued by the SEC, the Fund, along with other registered investment companies having management contracts with FMR or other affiliated entities of FMR, may participate in an interfund lending program. This program provides an alternative credit facility allowing the funds to borrow from, or lend money to, other participating affiliated funds. At period end, there were no interfund loans outstanding. The Fund's activity in this program during the period for which loans were outstanding was as follows:

| Borrower or Lender | Average Loan Balance | Weighted Average Interest Rate | Interest Expense |

| Borrower | $7,265,050 | .74% | $2,995 |

Interfund Trades. The Fund may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note.

Redemptions In-Kind. During the period, 2,230,314 shares of the Fund held by an affiliated entity were redeemed in-kind for investments and cash with a value of $205,991,818. The net realized gain of $85,065,706 on investments delivered through in-kind redemptions is included in the accompanying Statement of Operations. The amount of in-kind redemptions is included in share transactions in the accompanying Statement of Changes in Net Assets as well as Note 11: Share Transactions. The Fund recognized no gain or loss for federal income tax purposes.

6. Committed Line of Credit.

The Fund participates with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro-rata portion of the line of credit, which amounted to $9,764 and is reflected in Miscellaneous expenses on the Statement of Operations. During the period, the Fund did not borrow on this line of credit.

7. Security Lending.

The Fund lends portfolio securities through a lending agent from time to time in order to earn additional income. On the settlement date of the loan, the Fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. The Fund or borrower may terminate the loan at any time, and if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, the Fund may apply collateral received from the borrower against the obligation. The Fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. The value of loaned securities and cash collateral at period end are disclosed on the Fund's Statement of Assets and Liabilities. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. Total security lending income during the period amounted to $1,515,619.

8. Bank Borrowings.

The Fund is permitted to have bank borrowings for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity requirements. The Fund has established borrowing arrangements with certain banks. The interest rate on the borrowings is the bank's base rate, as revised from time to time. The average loan balance during the period for which loans were outstanding amounted to $2,290,333. The weighted average interest rate was 1.16%. The interest expense amounted to $443 under the bank borrowing program. At period end, there were no bank borrowings outstanding.

9. Expense Reductions.

Commissions paid to certain brokers with whom the investment adviser, or its affiliates, places trades on behalf of the Fund include an amount in addition to trade execution, which may be rebated back to the Fund to offset certain expenses. This amount totaled $256,302 for the period.

Through arrangements with the Fund's custodian, credits realized as a result of certain uninvested cash balances were used to reduce the Fund's expense. During the period, these credits reduced the Fund's custody expense by $3,219.

In addition, during the period the investment adviser reimbursed and/or waived a portion of fund-level operating expenses in the amount of $24,042.

10. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

| | Year ended

February 28, 2017 | Year ended February 29, 2016 |

| From net investment income | | |

| Class A | $7,577,410 | $5,892,374 |

| Class T | 1,043,893 | 832,225 |

| Class B | – | 21,356 |

| Class C | 2,453,649 | 1,681,417 |

| Consumer Staples | 28,450,076 | 30,907,531 |

| Class I | 4,802,129 | 3,093,118 |

| Total | $44,327,157 | $42,428,021 |

| From net realized gain | | |

| Class A | $14,585,099 | $29,492,766 |

| Class T | 2,440,856 | 5,430,950 |

| Class B | 38,559 | 809,700 |

| Class C | 8,724,413 | 16,753,262 |

| Consumer Staples | 48,589,839 | 136,504,977 |

| Class I | 7,760,813 | 13,482,925 |

| Total | $82,139,579 | $202,474,580 |

11. Share Transactions.

Share transactions for each class were as follows and may contain automatic conversions between classes or exchanges between affiliated funds:

| | Shares | Shares | Dollars | Dollars |

| | Year ended

February 28, 2017 | Year ended February 29, 2016 | Year ended

February 28, 2017 | Year ended February 29, 2016 |

| Class A | | | | |

| Shares sold | 2,074,631 | 1,973,363 | $195,949,659 | $181,606,150 |

| Reinvestment of distributions | 237,892 | 372,764 | 21,465,950 | 34,290,264 |

| Shares redeemed | (2,123,267) | (1,195,463) | (197,828,865) | (110,798,612) |

| Net increase (decrease) | 189,256 | 1,150,664 | $19,586,744 | $105,097,802 |

| Class T | | | | |

| Shares sold | 258,361 | 197,944 | $24,169,768 | $18,205,532 |

| Reinvestment of distributions | 37,389 | 66,110 | 3,349,216 | 6,055,600 |

| Shares redeemed | (212,844) | (214,470) | (19,792,973) | (19,884,944) |

| Net increase (decrease) | 82,906 | 49,584 | $7,726,011 | $4,376,188 |

| Class B | | | | |

| Shares sold | 1,629 | 4,002 | $151,958 | $364,996 |

| Reinvestment of distributions | 379 | 8,400 | 35,399 | 777,774 |

| Shares redeemed | (78,913) | (93,279) | (7,397,851) | (8,496,255) |

| Net increase (decrease) | (76,905) | (80,877) | $(7,210,494) | $(7,353,485) |

| Class C | | | | |

| Shares sold | 1,245,446 | 926,964 | $115,155,143 | $84,032,895 |

| Reinvestment of distributions | 115,157 | 181,545 | 10,152,865 | 16,369,686 |

| Shares redeemed | (931,585) | (551,638) | (84,513,838) | (49,873,026) |

| Net increase (decrease) | 429,018 | 556,871 | $40,794,170 | $50,529,555 |

| Consumer Staples | | | | |

| Shares sold | 4,086,473 | 5,277,258 | $389,479,615 | $487,809,315 |

| Reinvestment of distributions | 801,941 | 1,736,133 | 73,103,322 | 161,200,153 |

| Shares redeemed | (10,263,589)(a) | (5,774,399) | (963,924,332)(a) | (543,103,364) |

| Net increase (decrease) | (5,375,175) | 1,238,992 | $(501,341,395) | $105,906,104 |

| Class I | | | | |

| Shares sold | 2,282,645 | 1,318,941 | $217,344,361 | $121,982,188 |

| Reinvestment of distributions | 121,641 | 148,325 | 11,031,386 | 13,734,363 |

| Shares redeemed | (1,957,632) | (1,015,396) | (183,001,020) | (94,824,368) |

| Net increase (decrease) | 446,654 | 451,870 | $45,374,727 | $40,892,183 |

(a) Amount includes in-kind redemptions (see Note 5: Redemptions In-Kind)

12. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Fidelity Advisor® Gold Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended February 28, 2017 | Past 1 year | Past 5 years | Past 10 years |

| Class A (incl. 5.75% sales charge) | 13.07% | (15.10)% | (3.06)% |

| Class T (incl. 3.50% sales charge) | 15.43% | (14.94)% | (3.08)% |

| Class C (incl. contingent deferred sales charge) | 18.19% | (14.71)% | (3.20)% |

| Class I | 20.41% | (13.80)% | (2.17)% |

Class C shares' contingent deferred sales charges included in the past one year, past five years and past ten years total return figures are 1%, 0% and 0%, respectively.

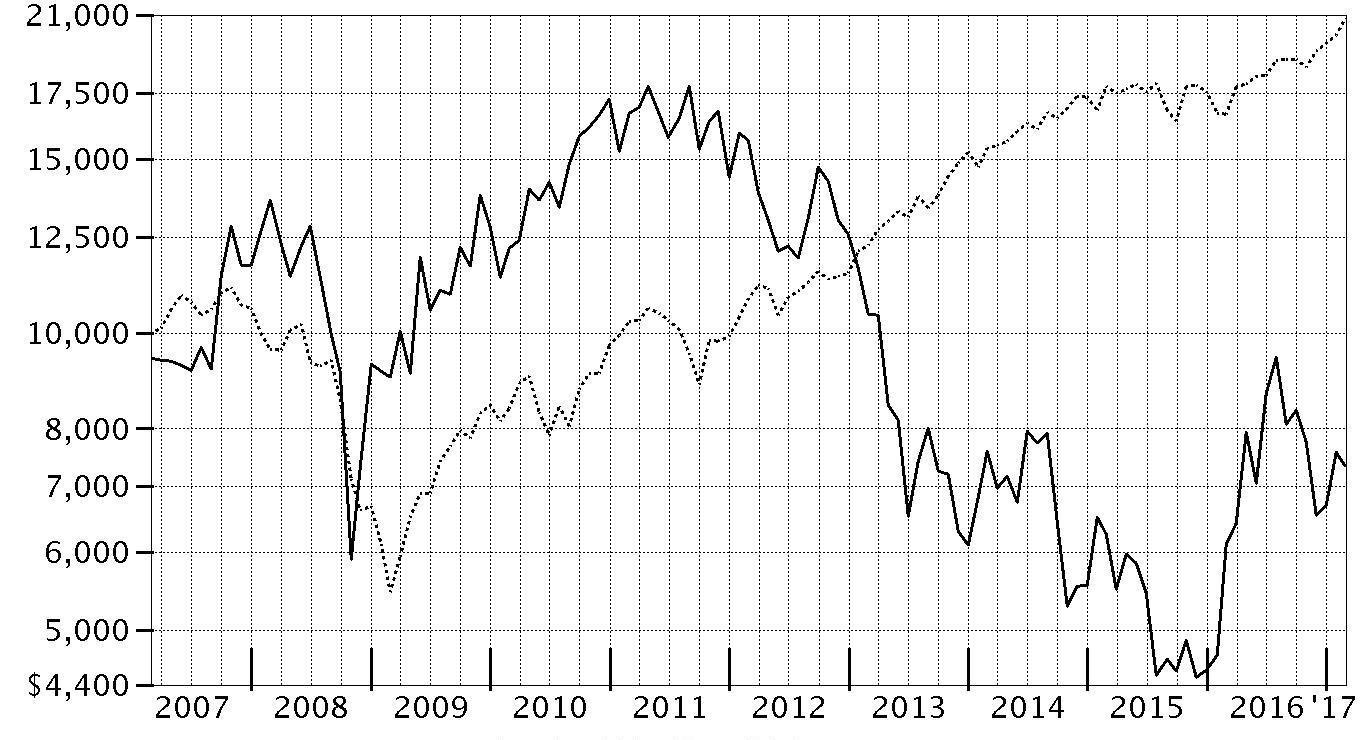

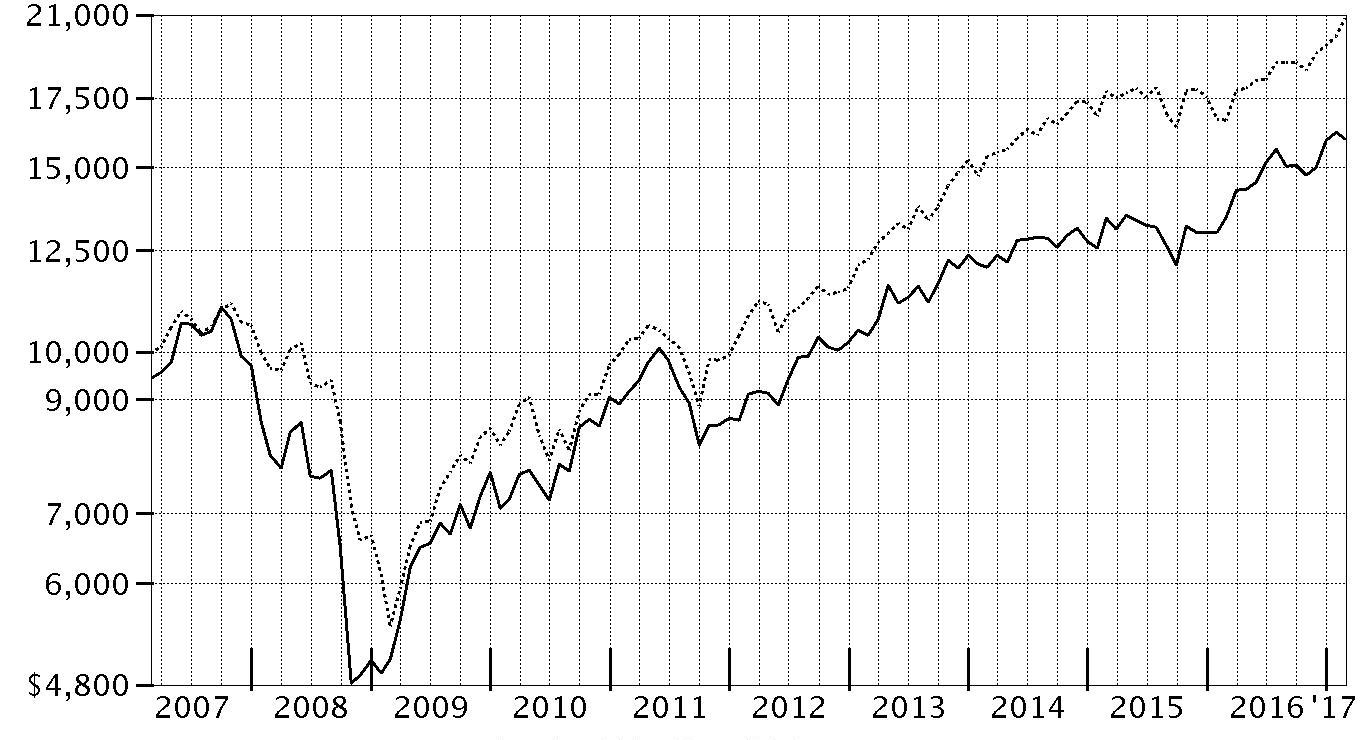

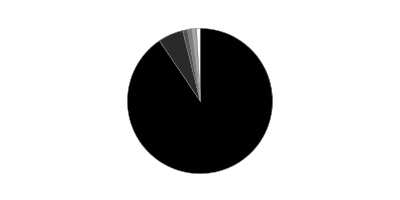

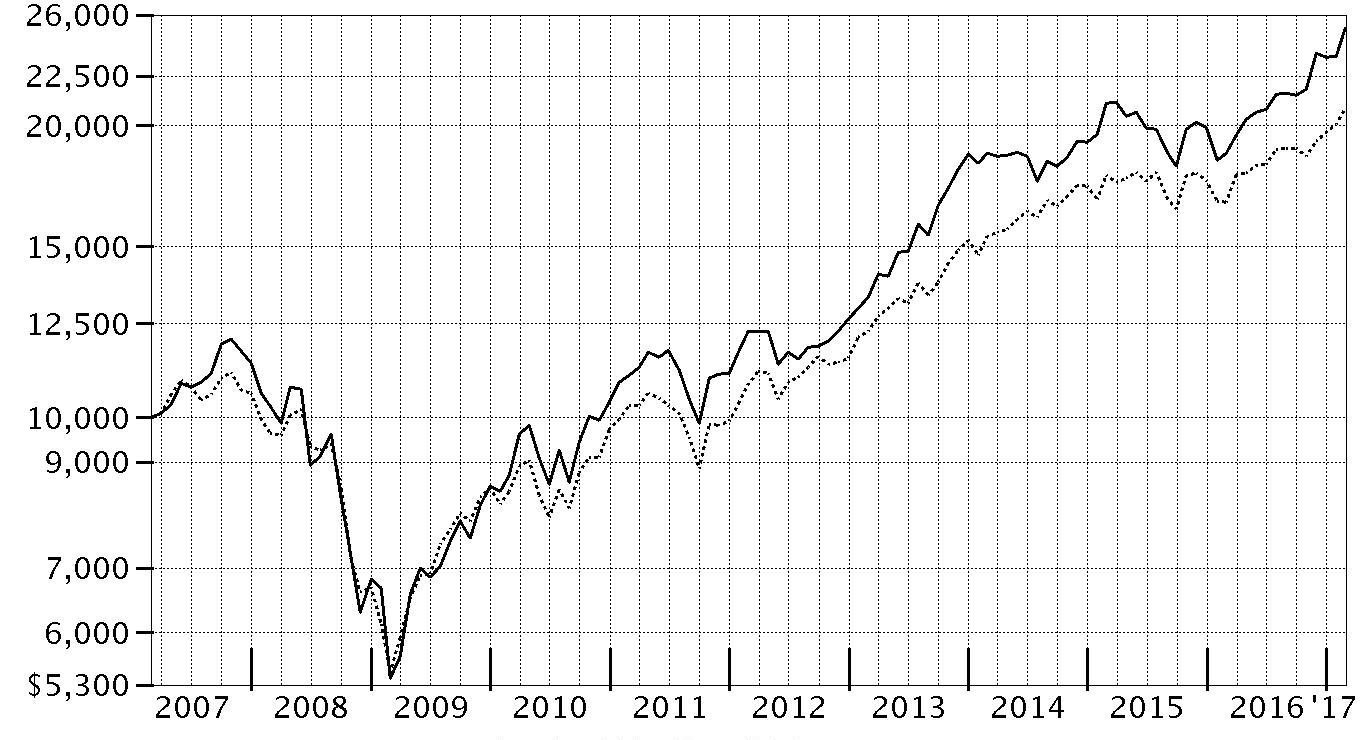

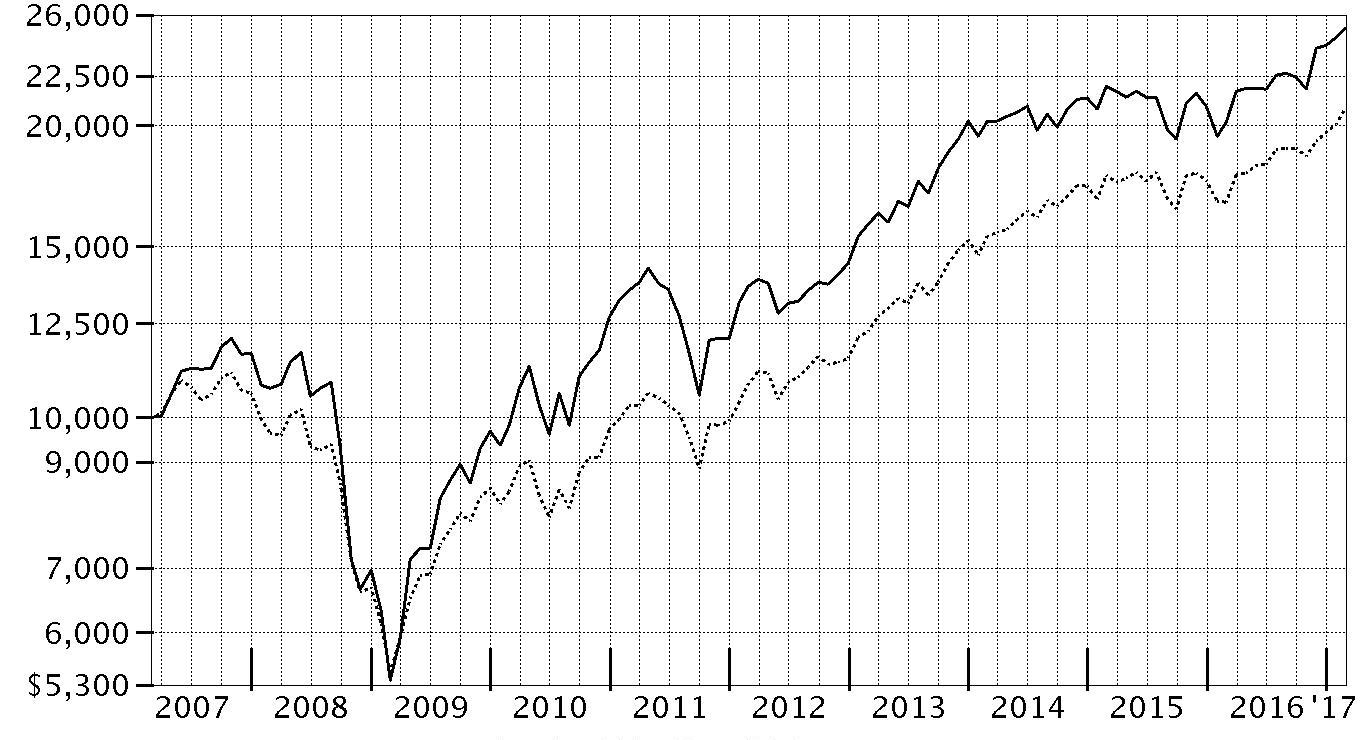

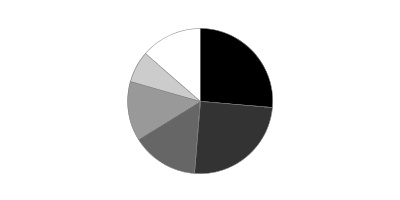

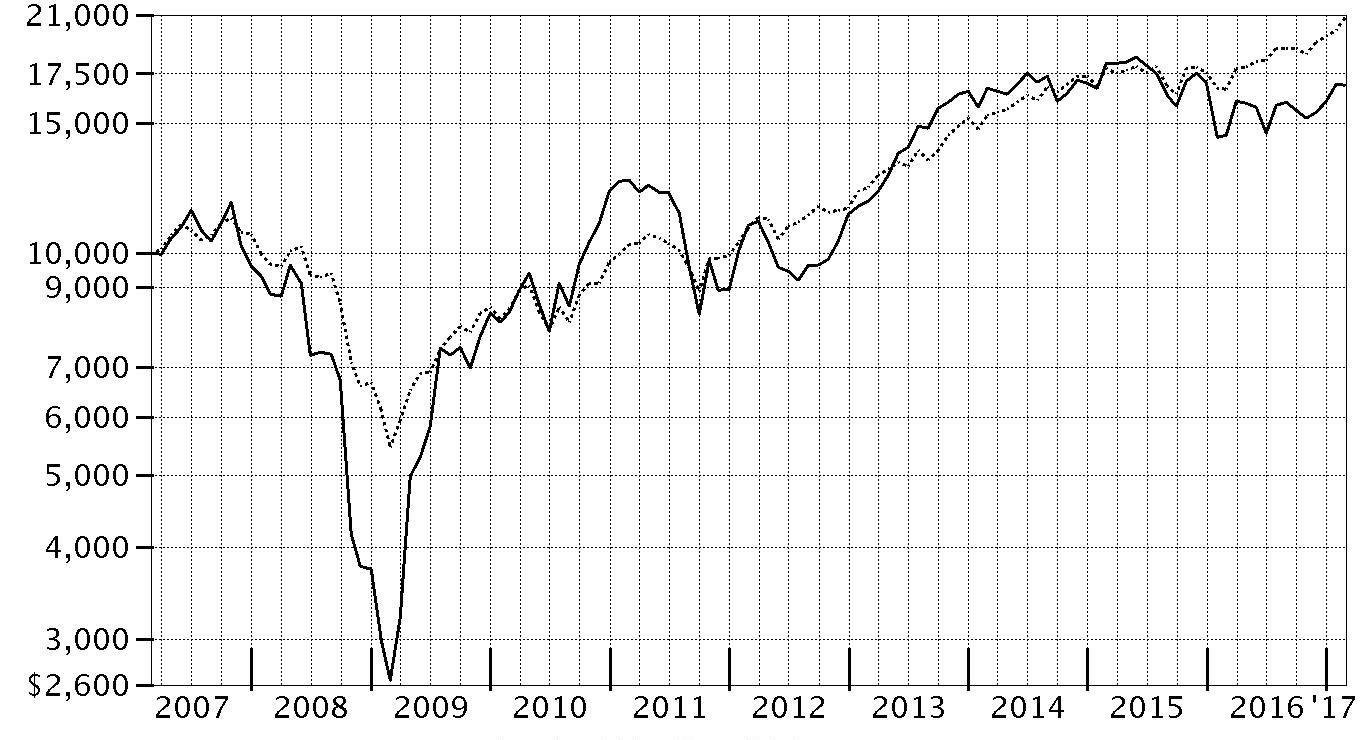

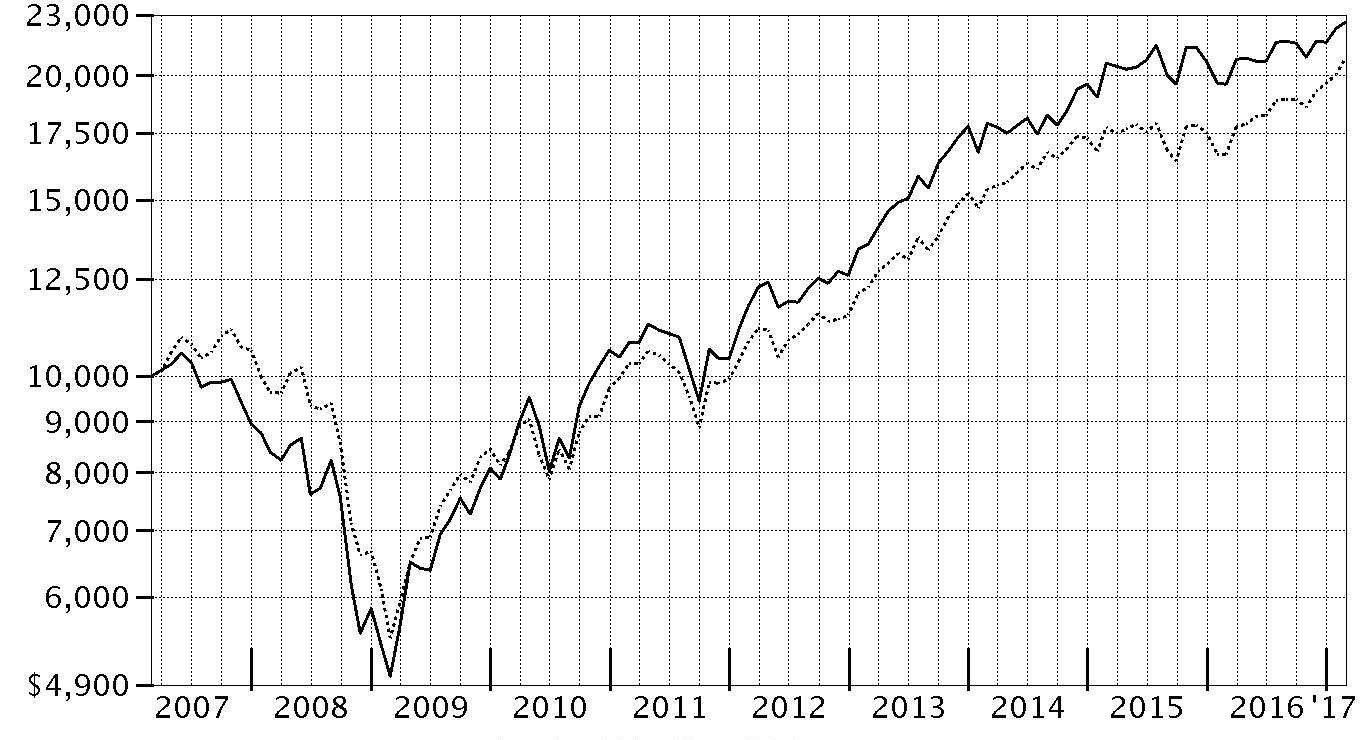

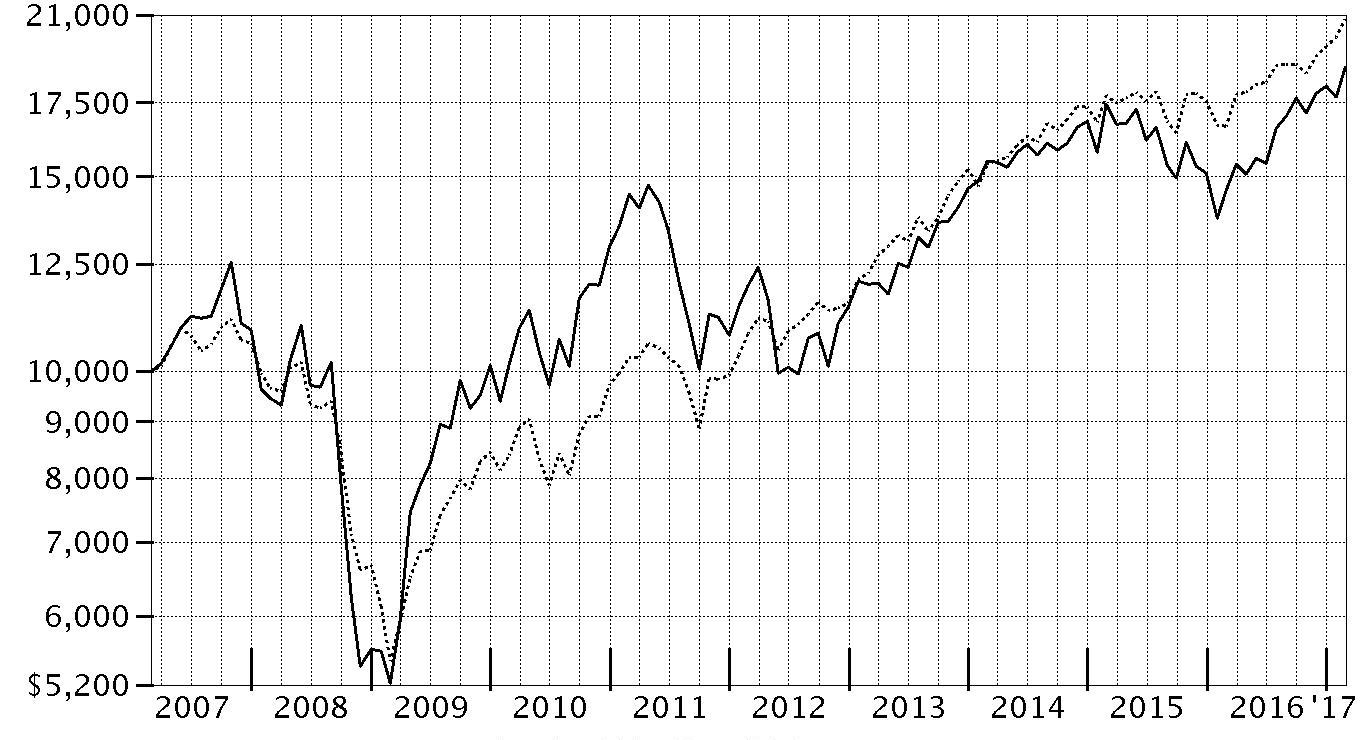

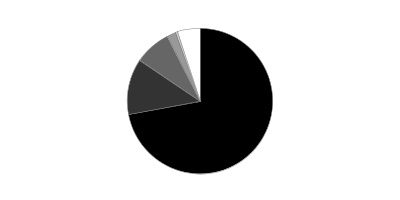

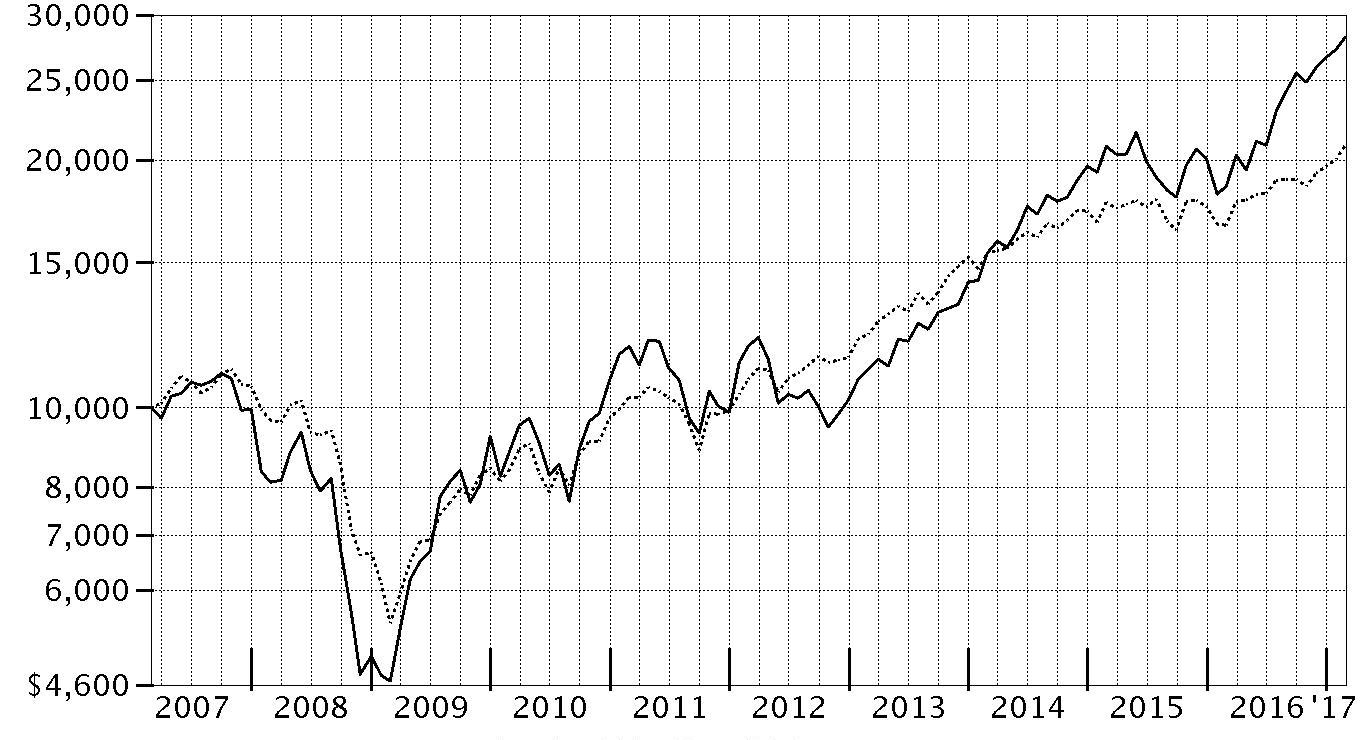

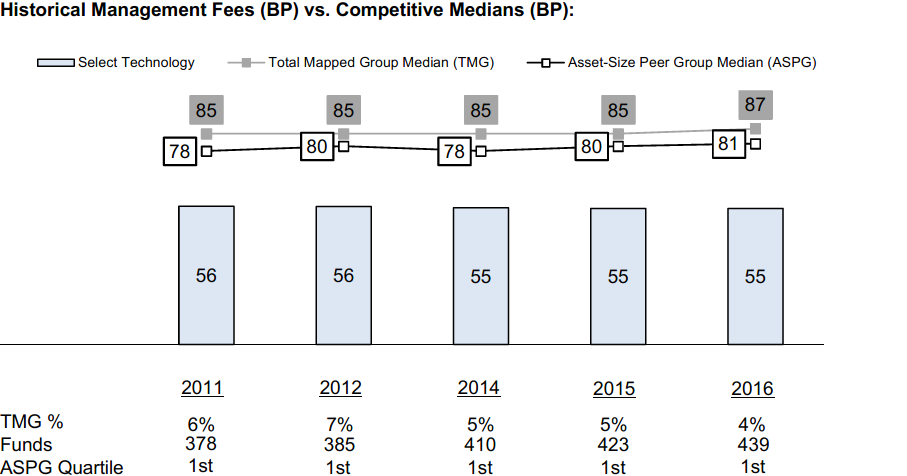

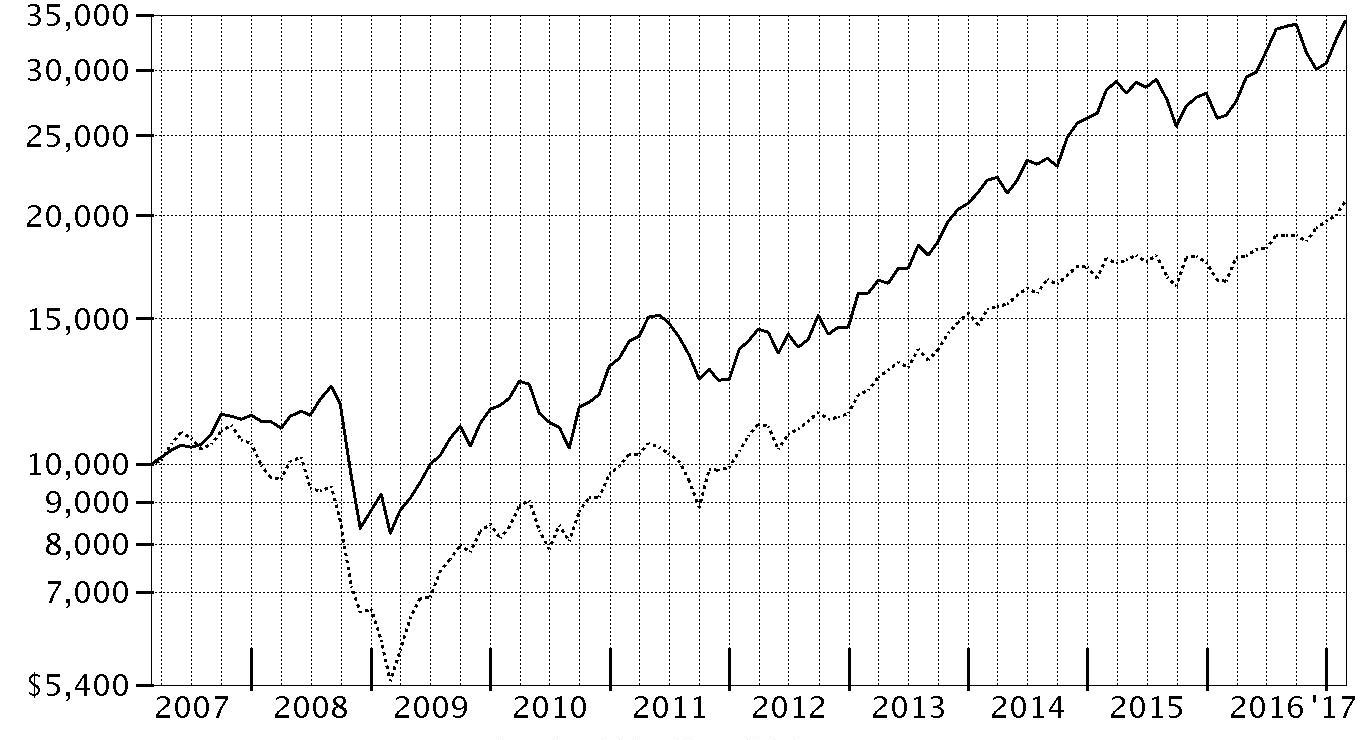

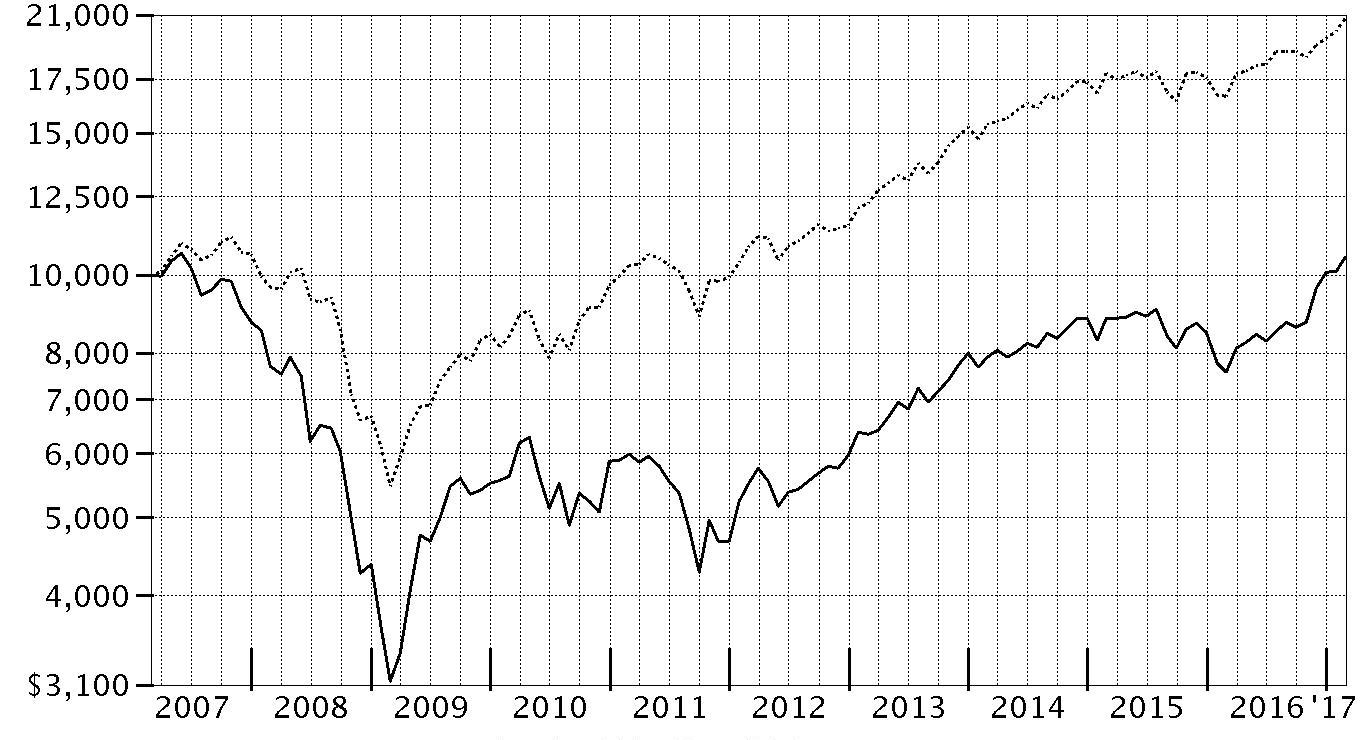

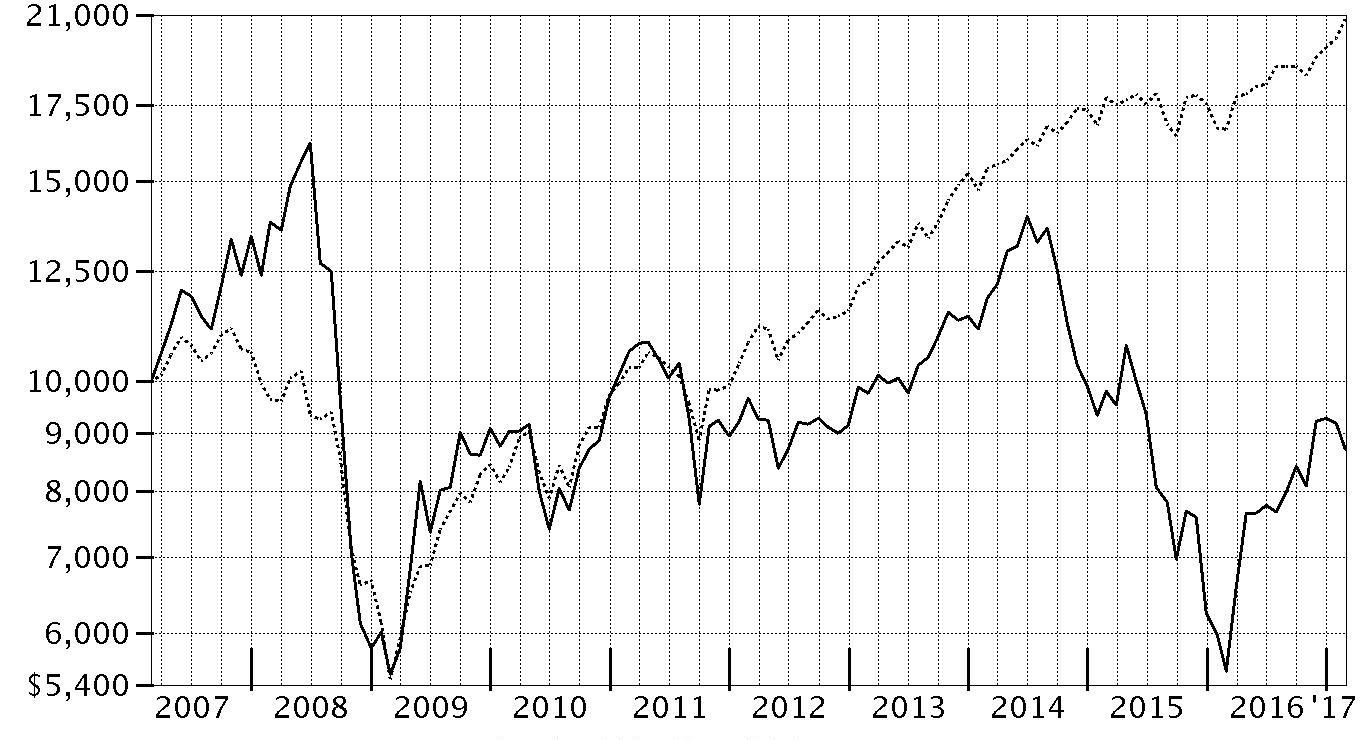

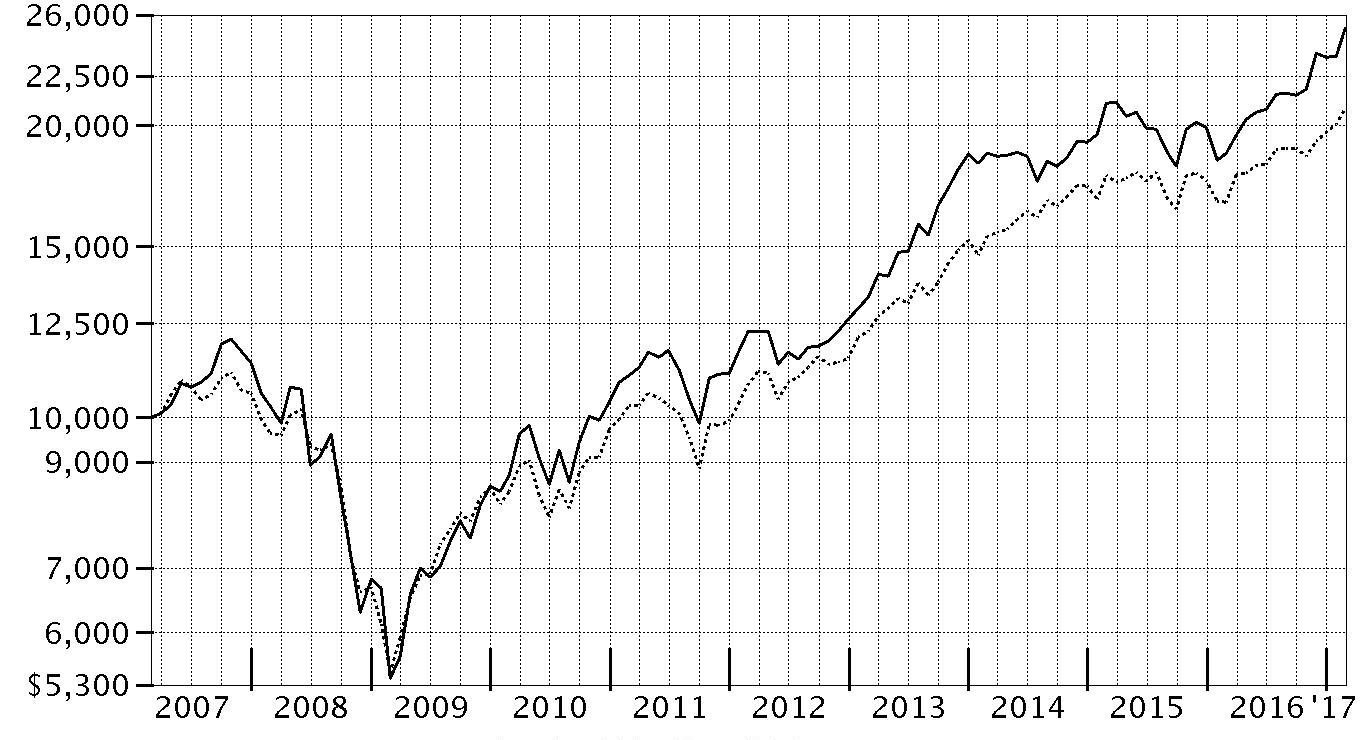

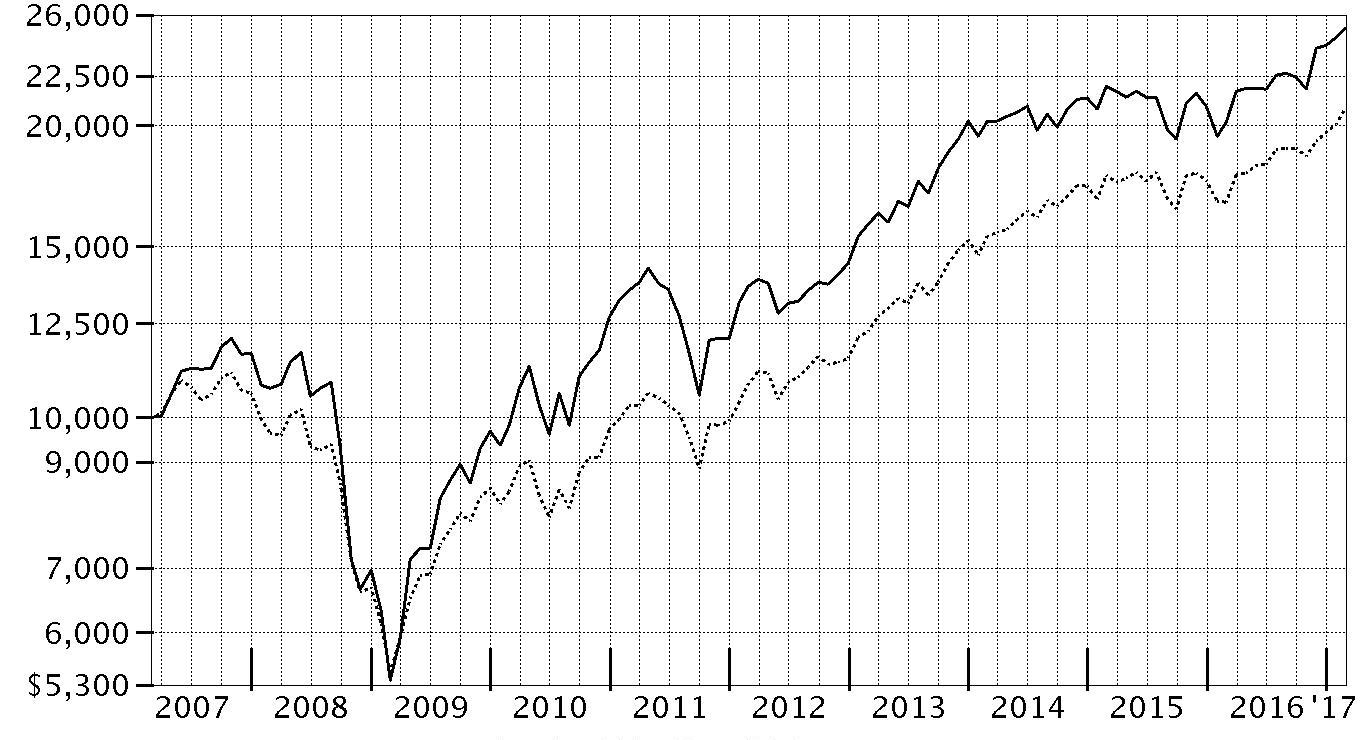

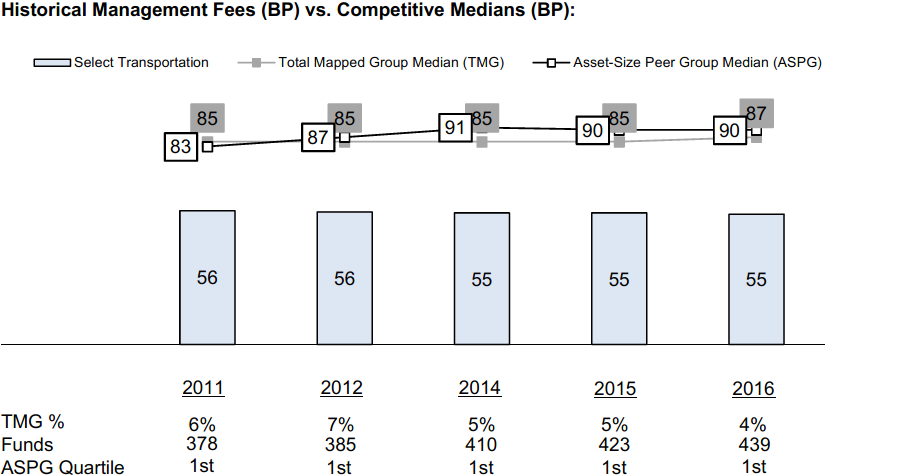

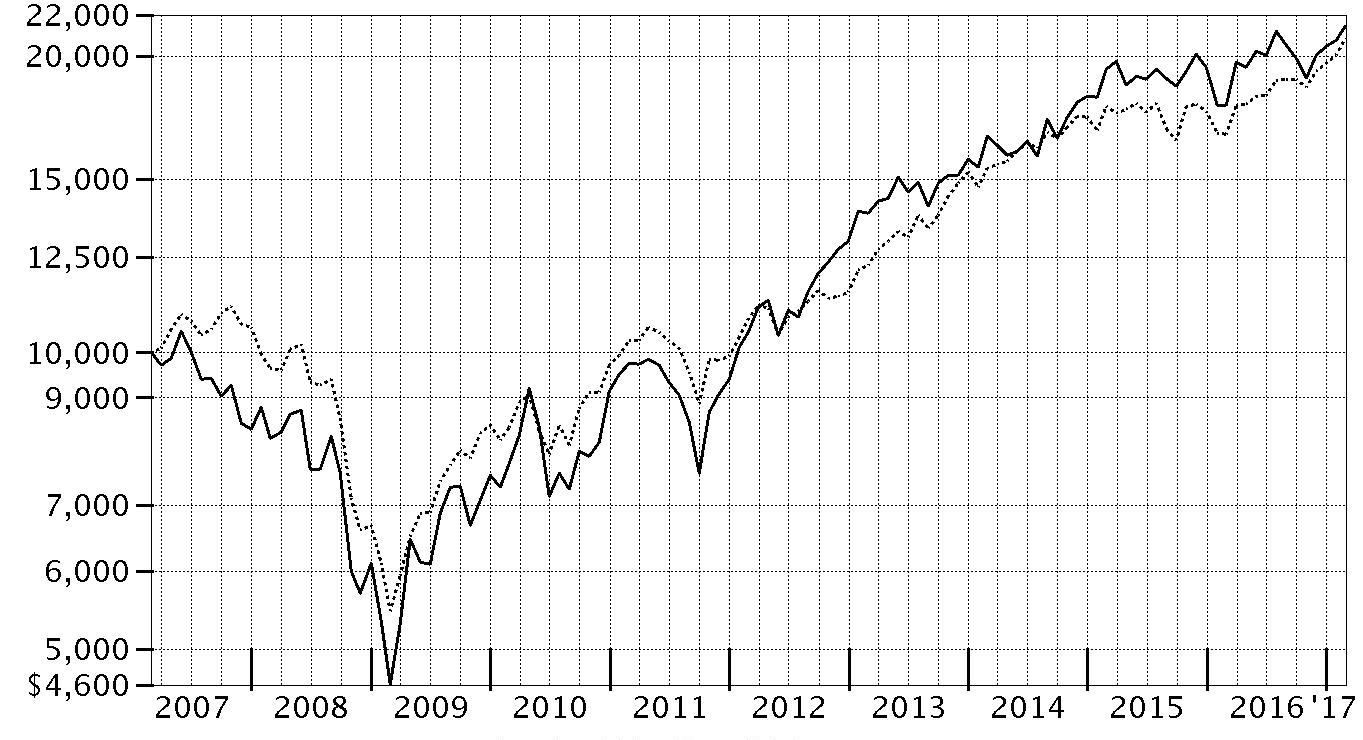

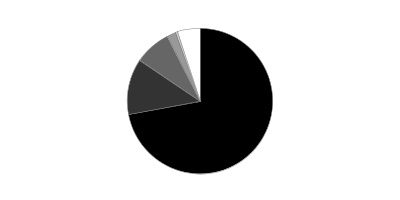

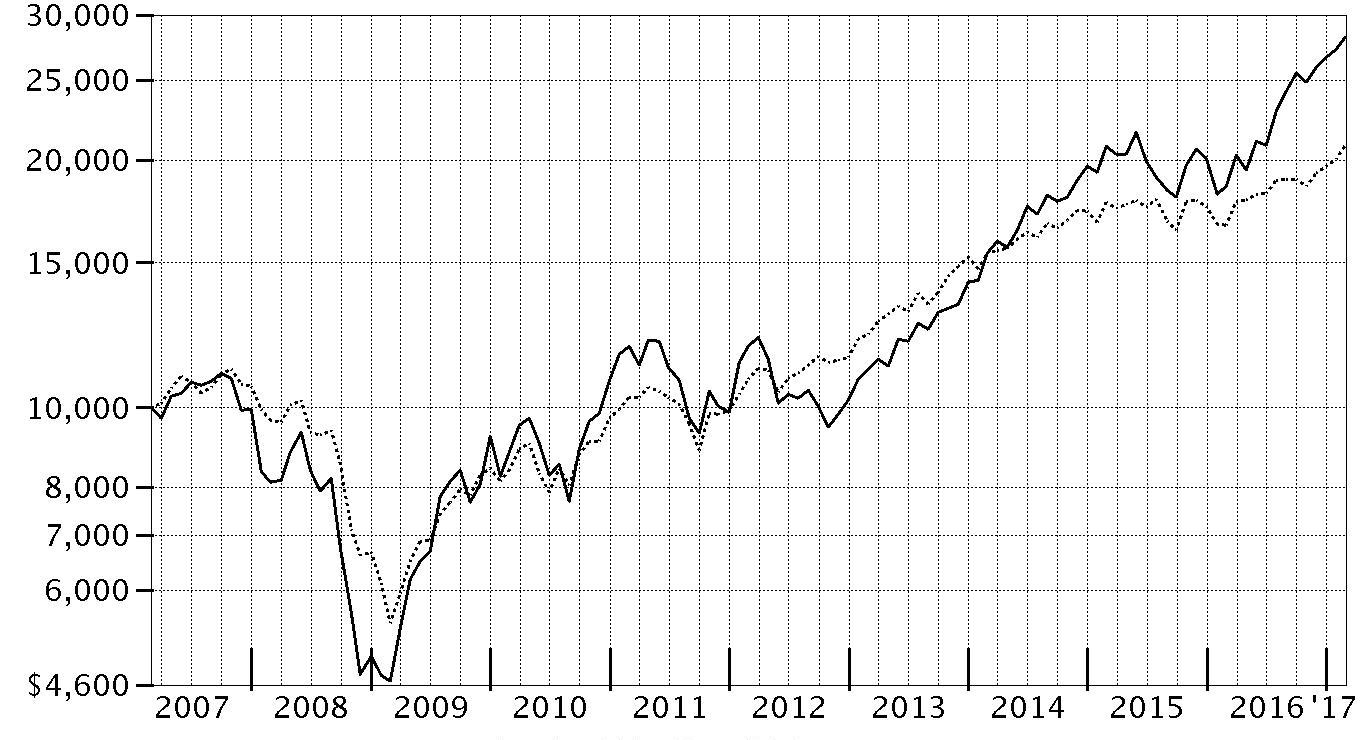

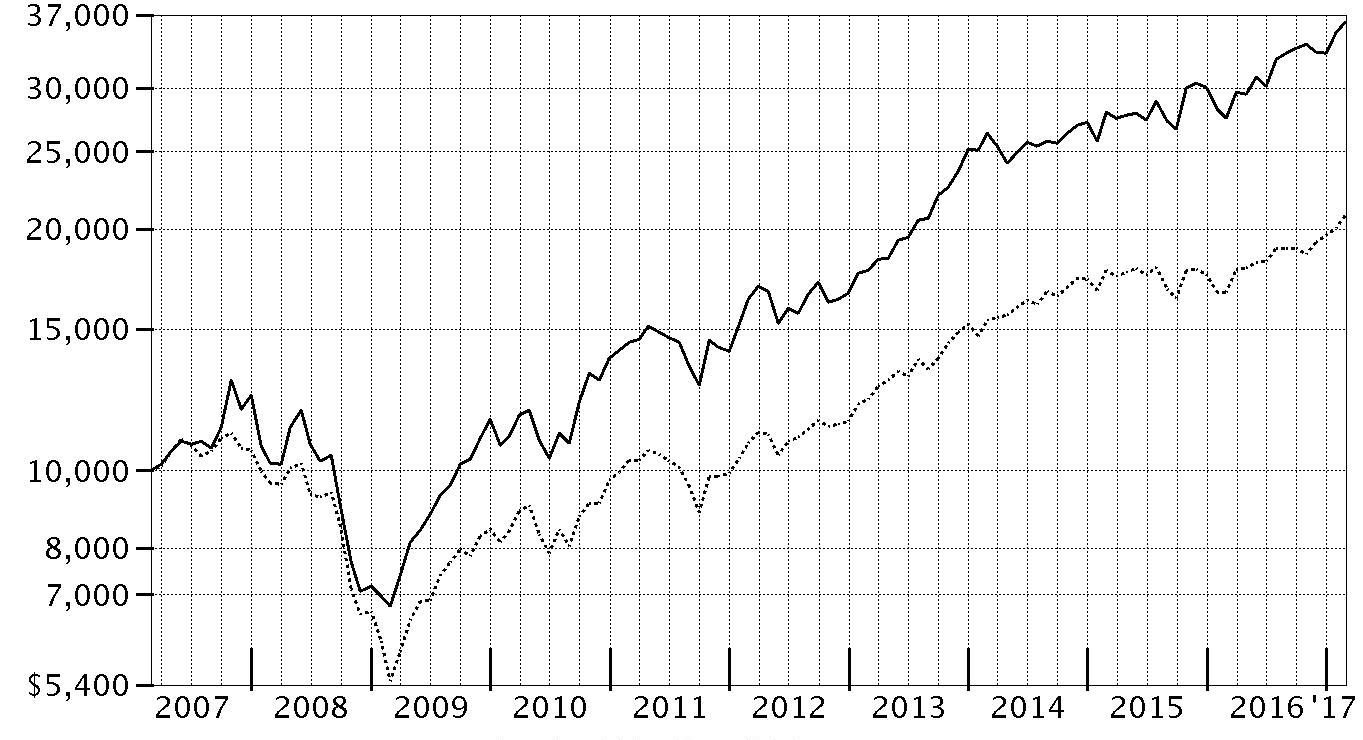

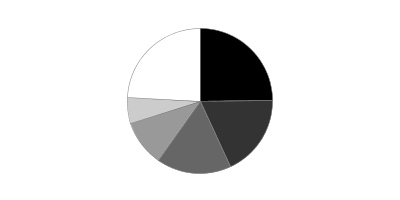

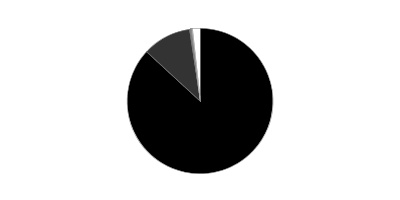

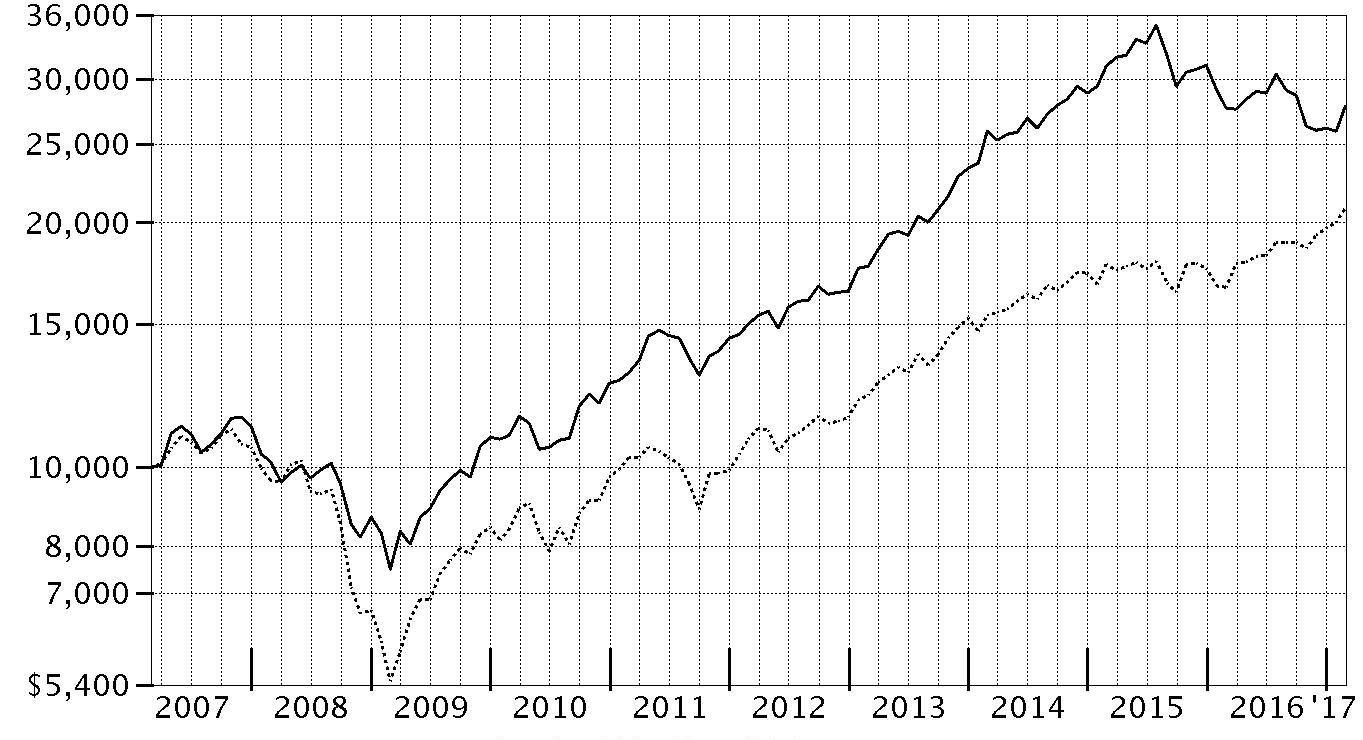

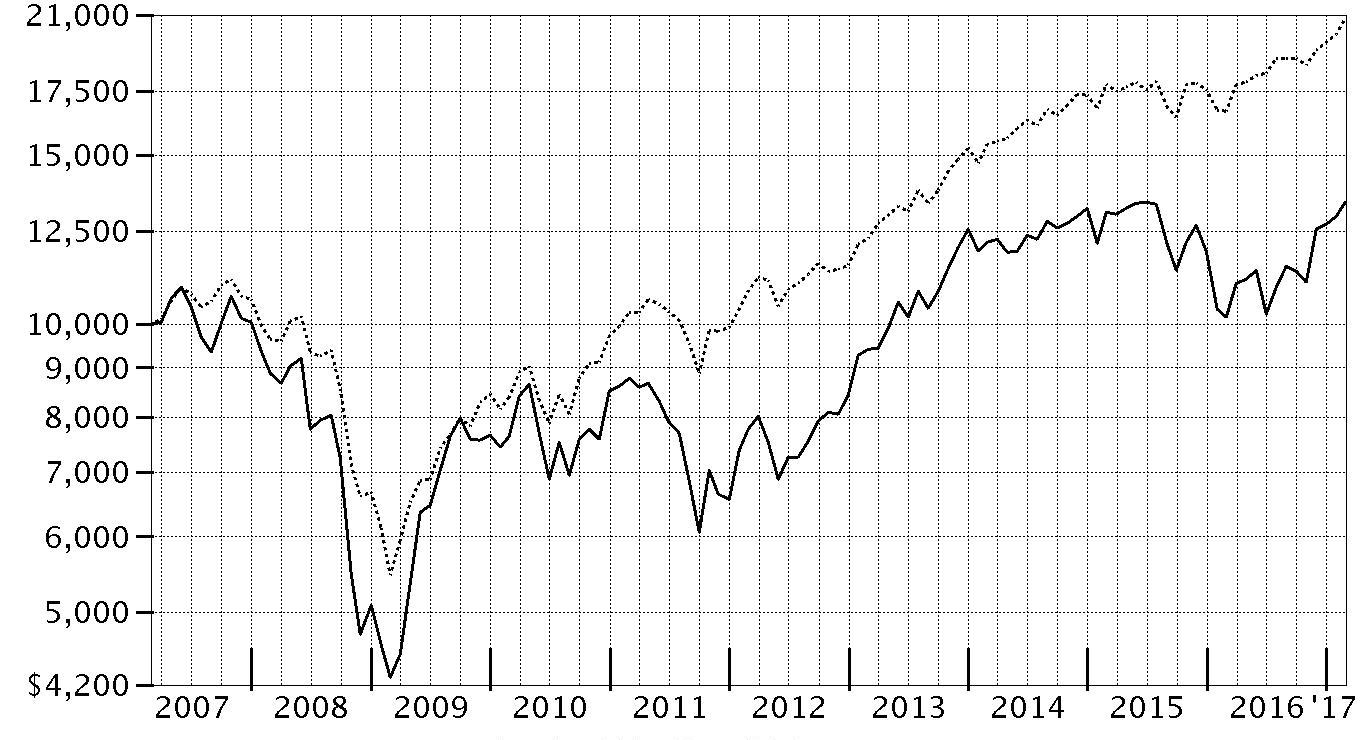

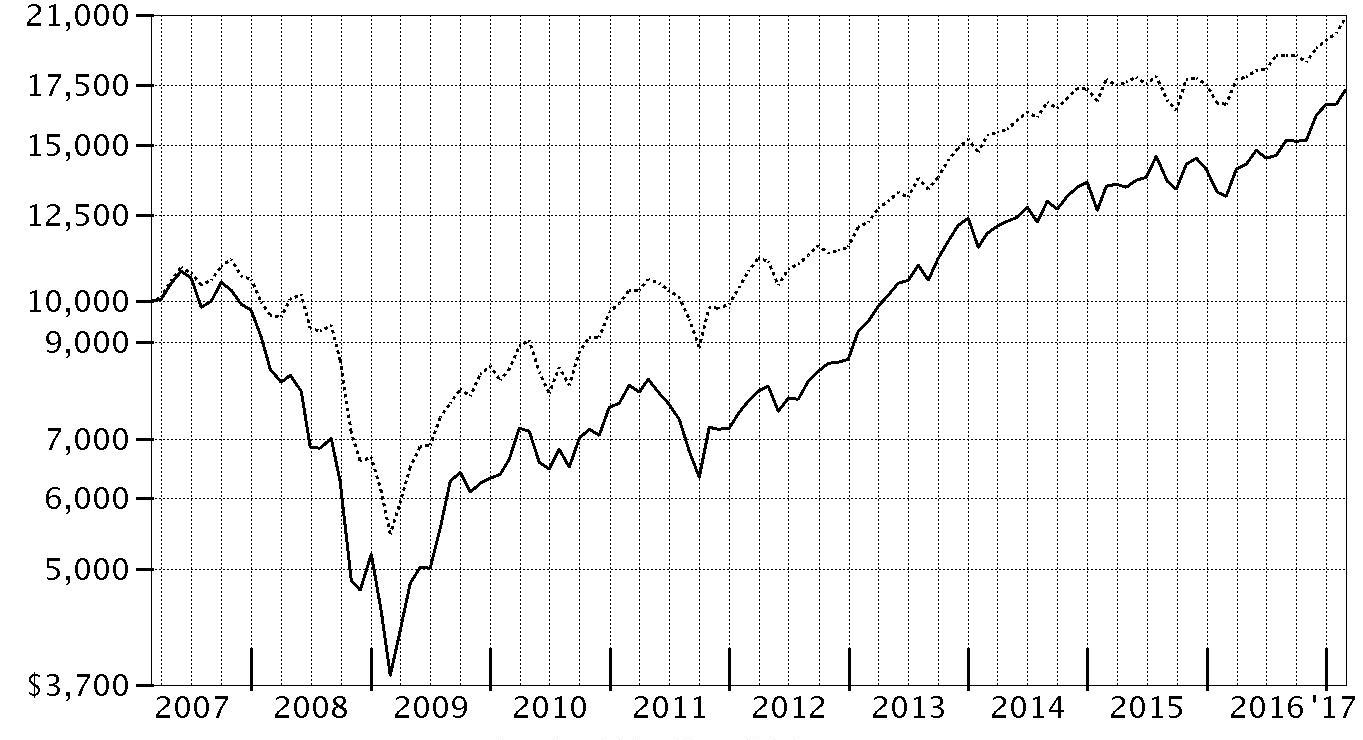

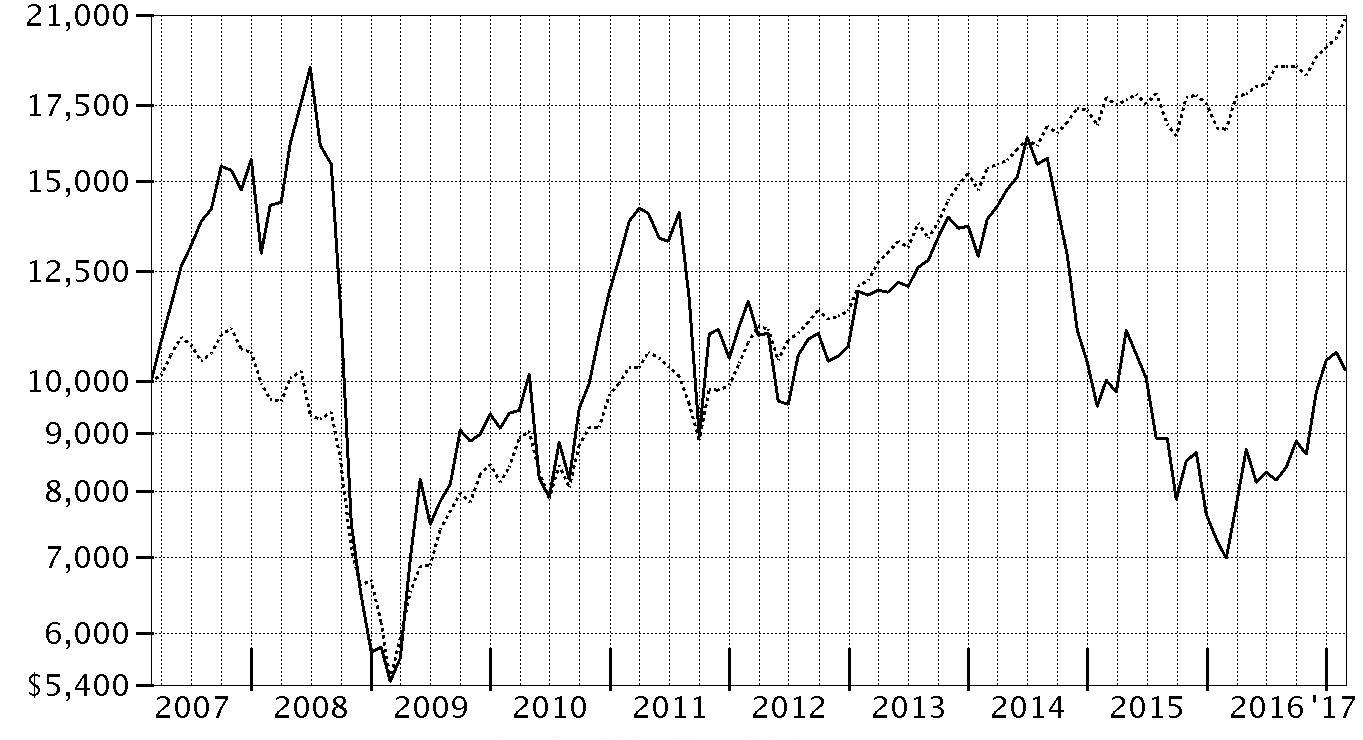

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity Advisor® Gold Fund - Class A on February 28, 2007, and the current 5.75% sales charge was paid.

The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

| Period Ending Values |

| $7,331 | Fidelity Advisor® Gold Fund - Class A |

| $20,834 | S&P 500® Index |

Fidelity Advisor® Gold Fund

Management's Discussion of Fund Performance

Market Recap: The U.S. equity bellwether S&P 500

® index gained 24.98% for the year ending February 28, 2017, rising sharply in the period’s final four months on renewed optimism for economic growth. The beginning of the period saw improving investor sentiment amid U.S. job gains, a rally in energy, and other stimuli that helped keep the seven-year bull uptrend intact. Markets tumbled briefly following Brexit – the U.K.’s June vote to exit the European Union – recovering quickly to settle into a flattish stretch until the November U.S. presidential election. Stocks then broke out in response to Donald Trump’s surprise victory, surging to a series of new all-time highs on expectations for reflation and fiscal stimulus. For the year, financials (+47%) proved the top-performing sector by far, riding an uptick in bond yields and a rally in banks, especially post-election. Industrials (+27%), energy (+26%) and materials (+28%) also fared well, the latter two driven by a cyclical rebound in commodity prices. Information technology rose 33%, despite cooling off late in 2016. Conversely, real estate and health care each returned 15%, lagging the broad market on prospects of rising interest rates and an uncertain political and regulatory outlook, respectively. An improved backdrop for riskier assets curbed dividend-rich telecom services (+9%), consumer staples (+12%) and utilities (+16%).

Comments from Portfolio Manager S. Joseph Wickwire II, CFA: For the year, most of the fund's share classes (excluding sales charges, if applicable) rose roughly 20%, underperforming the 21.88% return of the S&P

® Global BMI Gold Capped Index, and falling short of the broad-based S&P 500

®. It was a volatile year for gold and gold stocks. Both rallied in the first half of the fiscal year against a global backdrop of below-average economic growth, negative real interest rates, currency debasement and increasing political tension. After August, gold markets reversed course, falling steeply after Trump's election on expectations of a stronger dollar and higher interest rates. The asset class hit bottom in late December, and appearing oversold, then rebounded a bit through the end of February 2017. The commodity price finished flat for the year, however. Versus the S&P industry benchmark, the fund's biggest detractor by far was its non-index stake in bullion, with a 9% weighting, on average. I've tactically used gold and silver bullion for price exposure and liquidity reasons, but in the period's second half, gold-related equities gained favor among investors, hurting our bullion position. Among individual stocks, detractors included names we overweighted that underperformed, including Detour Gold and New Gold. These firms stuggled with operational execution. Another contributor, Premier Gold Mines, executed well but failed to attract investment interest, which caused it to underperform. Conversely, the fund was helped by overweighting names that significantly outperformed, such as B2Gold, the fund's biggest relative contributor by far. B2 executed well, made significant progress in key projects, and did not need to raise capital as the market anticipated. The stock returned 175% for the fund this year. Other contributors included Continental Gold and Torex Gold. All three stayed focused on their project pipelines and benefited from an improved gold environment in the period's first half.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Note to shareholders: On April 1, 2017, the fund’s industry benchmark will change from the S&P

® Global BMI Gold Capped Index (a custom index developed for Fidelity) to S&P

® Global BMI Gold Capped 20/45 Index (a public benchmark that became available more recently). Due to new international benchmark guidelines, S&P

® Dow Jones

® Indices has decided to stop offering its brand on custom benchmarks, effective March 31, 2017. Fidelity believes that the new S&P

® index will continue to provide shareholders with meaningful performance comparisons.

Gold Portfolio

Consolidated Investment Summary (Unaudited)

The information in the following tables is based on the consolidated investments of the Fund.

Top Ten Holdings as of February 28, 2017

| | % of fund's net assets | % of fund's net assets 6 months ago |

| Randgold Resources Ltd. sponsored ADR | 8.2 | 6.5 |

| Barrick Gold Corp. | 7.6 | 5.8 |

| Newmont Mining Corp. | 6.9 | 7.6 |

| Agnico Eagle Mines Ltd. (Canada) | 6.0 | 6.4 |

| B2Gold Corp. | 5.7 | 3.8 |

| Franco-Nevada Corp. | 5.3 | 5.3 |

| Newcrest Mining Ltd. | 4.5 | 5.4 |

| Silver Bullion | 4.0 | 4.8 |

| Goldcorp, Inc. | 3.8 | 3.2 |

| Torex Gold Resources, Inc. | 3.3 | 3.0 |

| | 55.3 | |

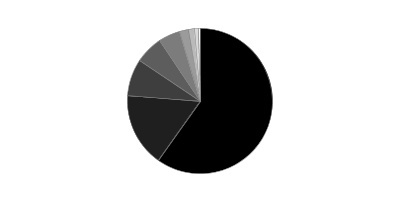

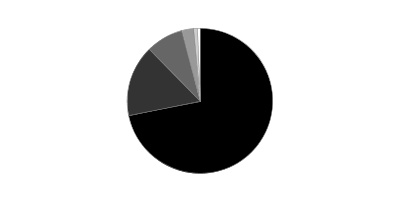

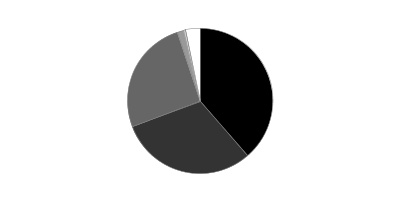

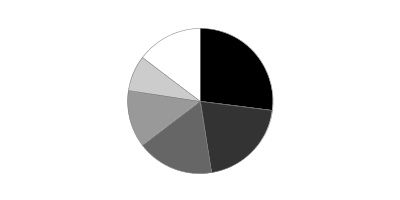

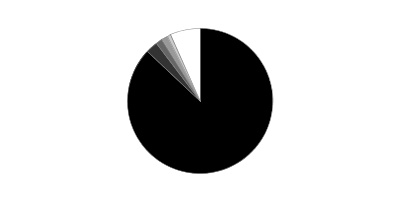

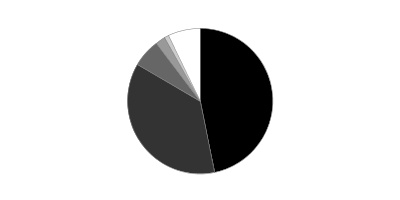

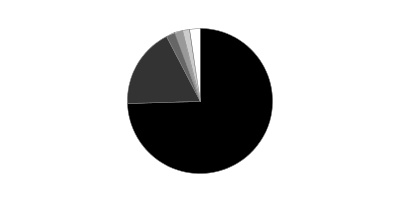

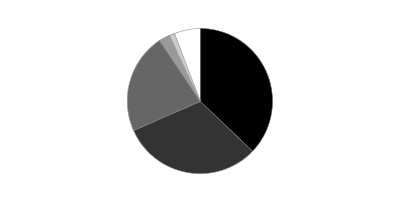

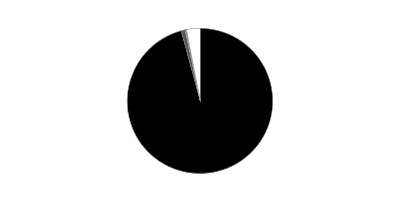

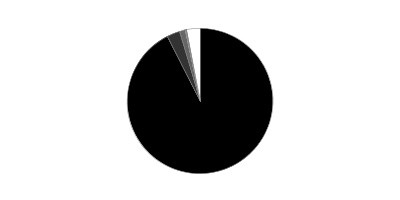

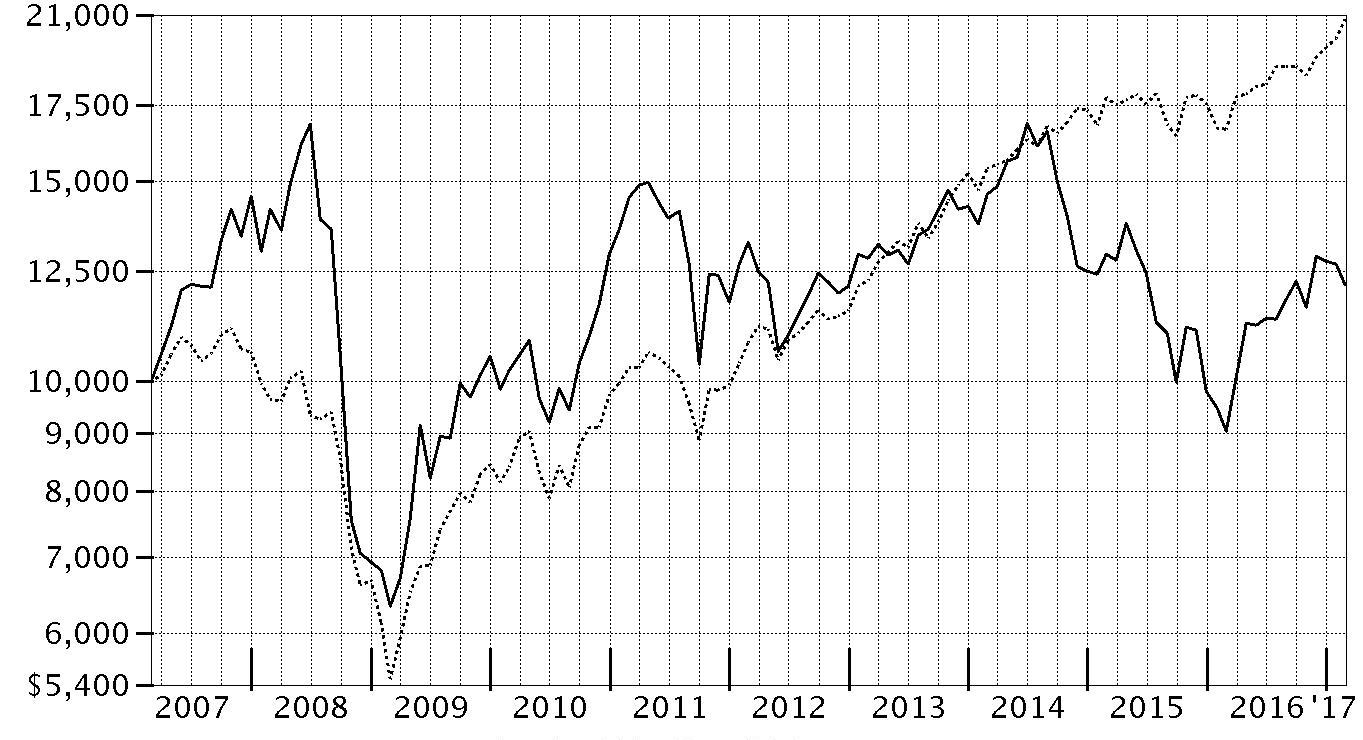

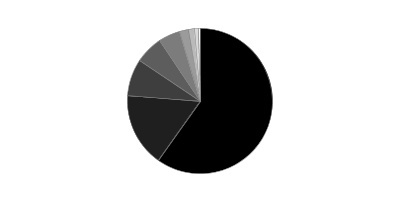

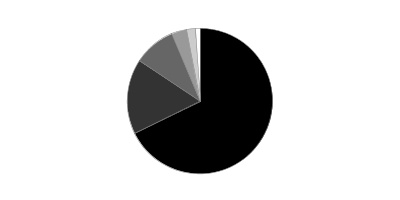

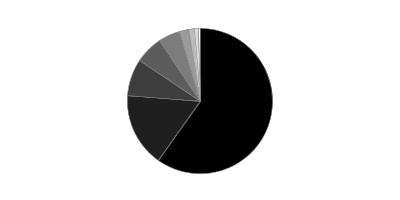

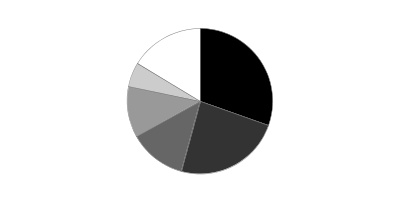

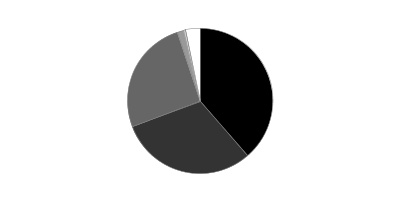

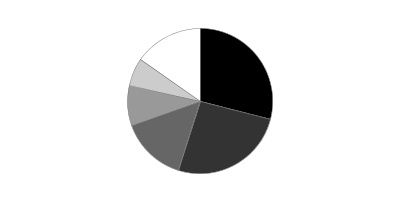

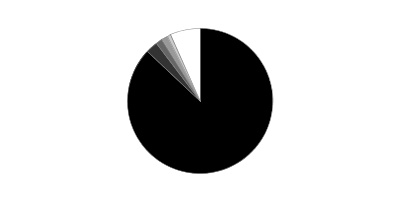

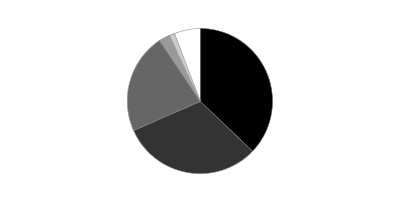

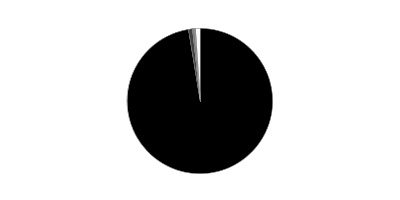

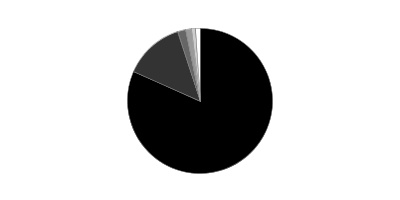

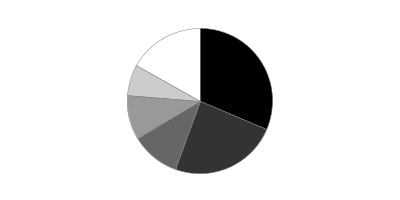

Top Industries (% of fund's net assets)

| As of February 28, 2017 |

| | Gold | 90.5% |

| | Commodities & Related Investments* | 5.7% |

| | Precious Metals & Minerals | 1.0% |

| | Silver | 1.0% |

| | Diversified Metals & Mining | 0.8% |

| | Copper | 0.3% |

| | All Others** | 0.7% |

* Includes gold bullion and/or silver bullion.

** Includes Short-Term investments and Net Other Assets (Liabilities).

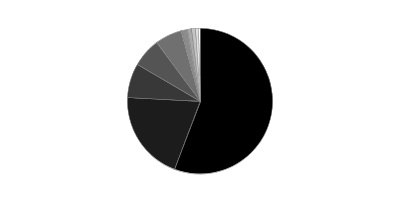

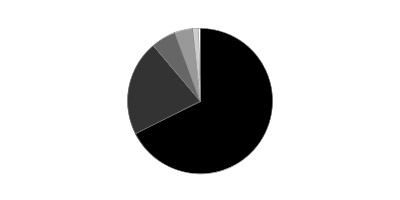

| As of August 31, 2016 |

| | Gold | 87.8% |

| | Commodities & Related Investments* | 9.4% |

| | Precious Metals & Minerals | 1.2% |

| | Silver | 1.2% |

| | Diversified Metals & Mining | 0.4% |

* Includes gold bullion and/or silver bullion.

Prior period industry classifications reflect the categories in place as of the date indicated and have not been adjusted to reflect current industry classifications.

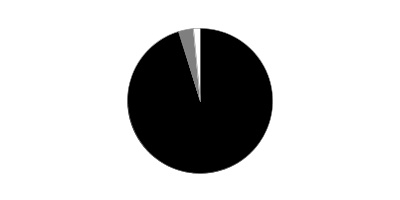

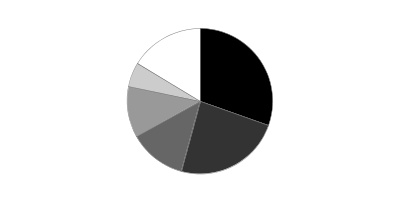

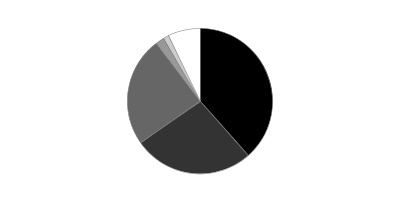

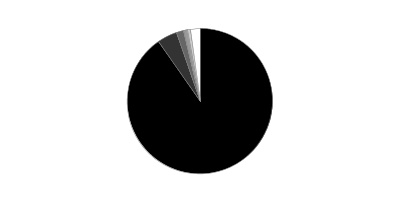

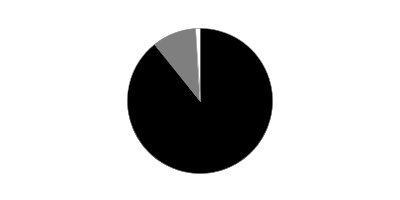

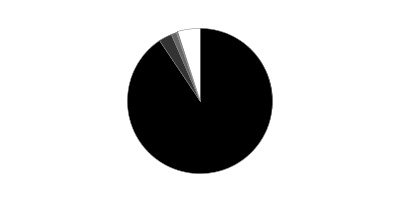

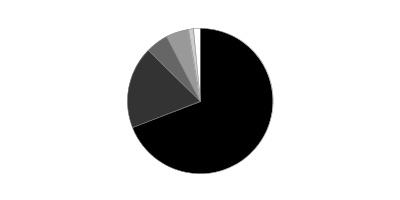

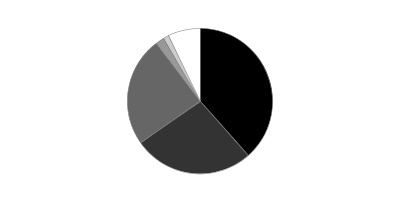

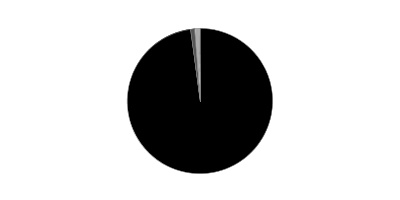

Geographic Diversification (% of fund's net assets)

| As of February 28, 2017 |

| | Canada | 59.8% |

| | United States of America* | 16.3% |

| | Bailiwick of Jersey | 8.3% |

| | Australia | 6.2% |

| | South Africa | 4.8% |

| | United Kingdom | 2.1% |

| | Cayman Islands | 1.2% |

| | Peru | 1.0% |

| | China | 0.3% |

* Includes Short-Term investments and Net Other Assets (Liabilities).

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable.

| As of August 31, 2016 |

| | Canada | 55.7% |

| | United States of America* | 20.0% |

| | Australia | 7.7% |

| | Bailiwick of Jersey | 6.5% |

| | South Africa | 5.9% |

| | United Kingdom | 1.4% |

| | Peru | 1.0% |

| | Cayman Islands | 0.8% |

| | China | 0.6% |

| | Other | 0.4% |

* Includes Short-Term investments and Net Other Assets (Liabilities).

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable.

Gold Portfolio

Consolidated Investments February 28, 2017

Showing Percentage of Net Assets

| Common Stocks - 93.6% | | | |

| | | Shares | Value |

| Australia - 6.2% | | | |

| Metals & Mining - 6.2% | | | |

| Gold - 6.2% | | | |

| Evolution Mining Ltd. | | 2,641,243 | $4,374,089 |

| Gold Road Resources Ltd. (a) | | 1,080,000 | 438,859 |

| Newcrest Mining Ltd. | | 4,118,268 | 69,906,520 |

| Northern Star Resources Ltd. | | 1,278,118 | 4,105,920 |

| Perseus Mining Ltd.: | | | |

| (Australia) (a) | | 1,717,134 | 408,123 |

| (Canada) (a) | | 1,300,000 | 313,206 |

| Resolute Mng Ltd. | | 3,125,161 | 3,857,658 |

| Saracen Mineral Holdings Ltd. (a) | | 8,122,787 | 6,788,237 |

| Silver Lake Resources Ltd. (a) | | 3,205,985 | 1,634,589 |

| St Barbara Ltd. (a) | | 1,847,257 | 3,597,382 |

| | | | 95,424,583 |

| Bailiwick of Jersey - 8.3% | | | |

| Metals & Mining - 8.3% | | | |

| Diversified Metals & Mining - 0.1% | | | |

| Glencore Xstrata PLC (a) | | 416,400 | 1,664,000 |

| Gold - 8.2% | | | |