QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2007 |

OR |

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to |

Commission file number 001-06605 |

EQUIFAX INC.

(Exact name of registrant as specified in its charter)

| Georgia | | 58-0401110 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

1550 Peachtree Street, N.W.

Atlanta, Georgia |

|

30309 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code:404-885-8000

Securities registered pursuant to Section 12(b) of the Act:

Title of each class

| | Name of each exchange on which registered

|

|---|

| Common Stock, $1.25 par value per share | | New York Stock Exchange |

| Common Stock Purchase Rights | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Exchange Act ("Act"). ý YES o NO

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o YES ý NO

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý YES o NO

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| ý Large accelerated filer | | o Accelerated filer | | o Non-accelerated filer

(Do not check if a smaller reporting company) | | o Smaller reporting company |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). o YES ý NO

As of June 29, 2007, the aggregate market value of the registrant's common stock held by non-affiliates of the registrant was $6,338,028,699 based on the closing sale price as reported on the New York Stock Exchange. At January 31, 2008, there were 129,644,930 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Registrant's definitive proxy statement relating to its annual meeting of shareholders to be held on May 9, 2008 is incorporated by reference in Part III to the extent described therein.

PART I

ITEM 1. BUSINESS

OVERVIEW

Equifax Inc. (which may be referred to as Equifax, the Company, we, us or our) is a leading global provider of information solutions for businesses and consumers. Our products and services are based on comprehensive databases of consumer and business information derived from numerous types of credit, financial, public record, demographic and marketing data. We use proprietary analytical tools to analyze this data to create customized insights, decision-making solutions and processing services for businesses. We help consumers understand, manage and protect their personal information and to make more informed financial decisions. Upon our acquisition of TALX Corporation, or TALX, on May 15, 2007, we became a leading provider of payroll-related and human resources business process outsourcing services in the United States of America, or U.S.

We currently operate in three global regions: North America (U.S., Canada and Costa Rica), Europe (the United Kingdom, or U.K., the Republic of Ireland, Spain and Portugal) and Latin America (Brazil, Argentina, Chile, El Salvador, Honduras, Peru and Uruguay). Of the countries in which we operate, 73% of our revenue was generated in the U.S. during 2007.

We are organized and report our business results in five operating segments, as follows:

- •

- U.S. Consumer Information Solutions (USCIS)—provides consumer information solutions to businesses in the U.S. including online credit data and credit decision technology solutions, mortgage reporting and settlement solutions, consumer credit-based marketing services and direct marketing services based on demographic and other consumer information.

- •

- TALX—provides services enabling clients to outsource and automate the performance of certain payroll and human resources business processes, including employment and income verification, tax management and talent management services.

- •

- North America Personal Solutions—provides products to consumers enabling them to monitor and protect their credit information and make more informed financial decisions.

- •

- North America Commercial Solutions—provides credit, financial, marketing and other information regarding businesses in the U.S. and Canada.

- •

- International—includes our Canada Consumer, Europe and Latin America business units. Products and services offered are similar to those available in the USCIS, North America Commercial Solutions and North America Personal Solutions operating segments but vary by geographic region.

2

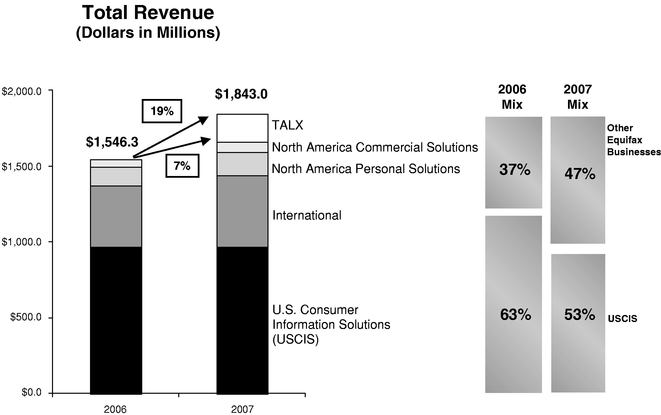

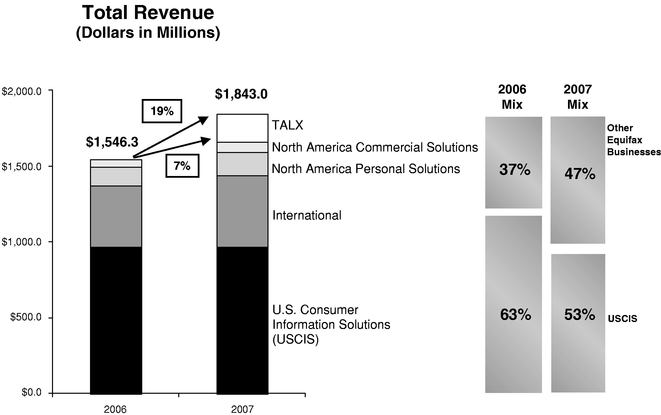

Our revenue base and business mix are diversified among our five segments as depicted in the following chart. We have further diversified the mix of products and services we offer during 2007. As depicted in the chart below regarding our business mix, our core credit reporting operating segment, USCIS, represented 53% of consolidated revenue in 2007 compared to 63% in 2006. Revenue from our newest operating segment, TALX, was generated from the date of its acquisition on May 15, 2007 through the end of the fiscal year. TALX represented 12% of our revenue growth in 2007, while the traditional Equifax operating segments contributed 7%. In our most recent quarter, the fourth quarter of 2007, USCIS represented 47% of total company revenue, while TALX represented 15% of company revenue.

For More Information About Us

We were founded in Atlanta, Georgia, in 1899, incorporated in Georgia in 1913, and have been known as Equifax Inc. since 1975. We have been publicly owned since 1965, have been listed on the New York Stock Exchange since 1971 and are a member of the S&P 500 and certain other stock indices.

On our Internet web site,www.equifax.com, we post the following filings as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission, or SEC. These reports are required by the Securities Exchange Act of 1934 and include annual reports on Form 10-K; quarterly reports on Form 10-Q; current reports on Form 8-K; proxy statements on Schedule 14A; and any amendments to these reports or statements. The SEC also maintains a web site,www.sec.gov, that contains reports, proxy and information statements regarding issuers that file electronically with the SEC. The content on any web site referred to in this Form 10-K is not incorporated by reference into this Form 10-K unless expressly noted.

3

PRODUCTS AND SERVICES

Our product and service offerings are highly diversified and include consumer and business credit information, information database management, marketing information, decisioning and analytical tools, and identity verification services that enable businesses to increase the speed and quality of their decision making regarding credit offers and other services, mitigate fraud, manage portfolio risk and customer relationships and develop marketing strategies. We offer a portfolio of products marketed to individual consumers that enable them to better understand, manage and protect their financial affairs. We provide employment and income verification and human resources business process outsourcing services.

The following chart depicts the types of services offered by each of the business units within our segments.

Summary of Key Products and Services by Business Unit

| |

|

|---|

| | USCIS

| |

| |

| | International

| | TALX

|

|---|

| | OCIS

| | CMS

| | DMS

| | Mortgage Services

| | North America Personal Solutions

| | North America Commercial Solutions

| | Canada Consumer

| | Europe

| | Latin America

| | The Work Number®

| | Tax & Talent Management Services

|

|---|

|

|---|

| Online consumer credit reports | | X | | | | | | X | | X | | | | X | | X | | X | | | | |

|

| Consumer scores and analytical services | | X | | X | | X | | X | | X | | | | X | | X | | X | | | | |

|

| Enabling technology services (i.e., credit decisioning platforms) | | X | | | | | | X | | | | X | | X | | X | | X | | | | |

|

| Consumer identity authentication | | X | | | | | | | | | | | | X | | X | | X | | | | |

|

| Consumer marketing services and database management | | | | X | | X | | X | | | | | | X | | X | | X | | | | |

|

| Business credit reports, scores and analytical services | | | | | | | | | | | | X | | | | X | | X | | | | |

|

| Business marketing services and database management | | | | | | | | | | | | X | | | | X | | X | | | | |

|

| Business demographic information | | | | | | X | | | | | | X | | | | X | | | | | | |

|

| Direct to consumer credit monitoring | | | | | | | | | | X | | | | | | X | | | | | | |

|

| Mortgage settlement services | | | | | | | | X | | | | | | | | | | | | | | |

|

| Income and employment verification | | | | | | | | | | | | | | | | | | | | X | | |

|

| Tax management services | | | | | | | | | | | | | | | | | | | | | | X |

|

| Talent management services | | | | | | | | | | | | | | | | | | | | | | X |

|

4

Each of our segments is described more fully below.

USCIS

USCIS provides consumer information solutions to businesses in the U.S. through four product lines, as follows:

Online Consumer Information Solutions (OCIS). OCIS products are derived from large databases of credit information that we maintain about individual consumers, including credit history, current credit status and consumer address information. Our customers utilize the credit report information we provide to make decisions for a wide range of credit and business purposes, such as whether, and on what terms, to approve auto loans or credit card applications, whether to allow a consumer to open a new utility or telephone account and similar business uses. We offer other analytical and predictive services based on the information in the consumer credit information databases to help further mitigate risk of granting credit by verifying the identity of a consumer seeking credit, predicting the risk of consumer bankruptcy, or indicating the credit applicant's risk potential for account delinquency, for example. These risk management services, as well as fraud detection and prevention services, enable our customers to monitor default rates and proactively manage their existing credit card or other consumer loan accounts.

OCIS customers access products through a full range of electronic distribution mechanisms, including direct real-time access, which facilitates instant decisions, e.g., for the immediate granting of credit. We also create and host customized decisioning technology for customers to obtain custom scores and analytical results along with consumer credit information to enhance the timeliness and quality of their decision-making process. These enabling technology applications facilitate pre-approved offers of credit and automate a variety of credit decisions through our Interconnect and Decision Power online technology platforms as well as automate loan underwriting processes with our LoanCenter platform.

Mortgage Reporting Solutions (Mortgage Services). Our Mortgage Services products, offered in the U.S., consist of specialized credit reports that combine the reports of the three major consumer credit reporting agencies (Equifax, Experian and TransUnion) into one credit report provided in an online format, commonly referred to as a tri-merge credit report. Mortgage lenders use these tri-merge reports in making their mortgage underwriting decisions. We also offer, through our settlement services joint venture with ATM Corporation, certain mortgage settlement services, such as appraisal, title and closing services, with our traditional mortgage service offerings.

Credit Marketing Services (CMS). Our CMS products enable customers to manage their customer marketing efforts for efficiency and effectiveness; identify and acquire new customers for credit relationships; and realize additional revenue from existing customers. These products utilize information derived from the credit-based consumer data that also underlies our OCIS products, provided in a batch output formatted to meet our customers needs. Customers use this detailed information to make decisions about which consumers to target for their credit-based marketing campaigns. We also provide account review services which assist our customers in managing their customers and prescreen services that help our clients identify potential new customers.

Direct Marketing Services (DMS). Our DMS products enable customers to target specifically defined market segments and individuals based on individual consumer demographic characteristics; design more effective and economically-efficient marketing campaigns; facilitate improved direct mail response; and increase customer loyalty. We offer this information in the form of a list of consumers having specific attributes for ease of use by our customers. These lists categorize consumers based on meeting certain characteristics, interests or demographic attributes (e.g., those having recently acquired a new home). The information used in these products is acquired from third-party data compilers or is

5

gathered from consumers directly through voluntary data submissions to us, an example of which is product registration cards. This permission-based information is generally less regulated and restricted than the credit information that we maintain; see the "Information Security and Government Regulation" section below. We also offer database management services which facilitate our customers' use of demographic and credit data for marketing purposes.

TALX

TALX operates in the U.S. through two business units, as follows:

The Work Number® (TWN Services). TWN Services include employment and income verification services; W-2 management services (which include initial distribution, reissue and correction of W-2 forms); paperless pay services that enable employees to electronically receive pay statement information as well as review and change direct deposit account or W-4 information; integrated electronic time capture and reporting services; paperless new-hire services to bring new workers on board using electronic forms; and I-9 management services designed to help clients electronically comply with the immigration laws that require employers to complete an I-9 form for each new hire.

TWN Services enable employers to direct third-party verifiers to our website or to a toll-free telephone number to verify the employee's employment status and income data. During 2007, we launched a new TWN service, Find It, which expands employment verification services to locate data which is not included in our existing TWN database.

We rely on payroll data from over 1,600 organizations, including over half of the Fortune 500, to regularly update the TWN database. The database contained over 165.9 million employment records at December 31, 2007.

Tax and Talent Management Services. These services are aimed at reducing the cost to the human resources function of businesses by assisting with employment tax matters and planning and improving the cost-effectiveness of talent management. We offer a broad suite of services designed to reduce the cost of unemployment claims through effective claims representation and management and efficient processing and to better manage the tax rate that employers are assessed for unemployment taxes. We also offer our customers comprehensive services designed to research the opportunity for obtaining employer-based tax credits, for example the federal work opportunity and welfare to work tax credits as well as employment-based state tax credits, process the necessary filings and assist the customer in obtaining the tax credit. In talent management, we also offer secure, electronic-based psychometric testing and assessments, as well as onboarding services using online forms to complete the new hire process for employees of corporate and government agencies.

North America Personal Solutions

Our Personal Solutions products give consumers information to make financial decisions and monitor and protect credit and credit score information through our Credit Watch and Score Watch monitoring products. Consumers can obtain a copy of credit file information about them and their credit score. We offer monitoring products for consumers who are concerned about identity theft and data breaches. In November 2007, we launched the Credit Report Control service that allows consumers subscribing to our credit monitoring products to restrict access to their credit report to mitigate unauthorized use of Equifax credit file information by third parties. Our products are available to consumers directly and through relationships with business partners who distribute our products or provide these services to their employees or customers.

6

North America Commercial Solutions

Our Commercial Solutions products are derived from databases of credit, financial and marketing information regarding businesses in the U.S. and Canada. The business records included in the U.S. credit database have been developed primarily as a part of the Small Business Financial Exchange, Inc., or SBFE. We exclusively manage the SBFE database under contract with the owners of the data which include a number of commercial lending financial institutions. This contract was renewed in 2007 and expires in 2012. Our company's database includes loan, credit card, public records and leasing history data, as well as trade accounts receivable performance. In 2007, we further enhanced the depth of the database by adding Secretary of State and SEC registration information. We also offer scoring and analytical services, provided in an online format to customers obtaining a commercial credit report, that provide additional information to help mitigate the credit risk assumed by our customers. We also have a database which links approximately 35 million commercial demographic data records from around the world to build corporate family structures for enterprise visibility of customers and suppliers.

International

The International operating segment includes our Canada Consumer, Europe and Latin America business units. These business units offer products that are similar to those available in the USCIS operating segment, although data sources tend to rely more heavily on government agencies than in the U.S. These products generate revenue in Argentina, Brazil, Canada, Chile, El Salvador, Honduras, Peru, Portugal, Spain, the U.K. and Uruguay, with support operations located in the Republic of Ireland and Costa Rica.

Canada Consumer. Similar to our OCIS, Mortgage Services and CMS business units, Canada Consumer offers products derived from the credit information that we maintain about individual consumers. We offer many products in Canada, including credit reporting and scoring, consumer marketing, risk management, fraud detection and modeling services, together with certain of our decisioning products that facilitate pre-approved offers of credit and automate a variety of credit decisions.

Europe. Our European operation provides information solutions, marketing and personal solutions products. Information solutions and personal solutions products are generated from credit records that we maintain and include credit reporting and scoring, risk management, fraud detection and modeling services. They are sold in the U.K., Portugal and Spain. Our commercial products, such as business credit reporting and commercial risk management services, are only available in the U.K. Marketing products, which are similar to those offered in our CMS and DMS business units, are primarily available in the U.K., though we offer some products in Spain as well. We maintain support operations in the Republic of Ireland.

Latin America. Our Latin American operation provides consumer and commercial information solutions products and marketing products. We offer a full range of consumer products, generated from credit records that we maintain, including credit reporting and scoring, risk management, identity verification and fraud detection services. Our consumer products are the primary source of revenue in each of the countries in which we operate, with the exception of Brazil where we are a market leader in commercial products. We offer our commercial products, which include credit reporting, decisioning tools and risk management services, in varying degrees to the countries we serve. We also provide a variety of consumer and commercial marketing products generated from our credit information databases, including account profitability and business profile analysis, business prospect lists and database management, in varying degrees to the countries we serve. The other countries in which we operate include Argentina, Chile, El Salvador, Honduras, Peru and Uruguay.

7

OUR BUSINESS STRATEGY

Our strategic objective is to be the trusted provider of information solutions that empower our customers to make critical decisions with greater confidence. Data is at the core of our value proposition to our customers. Through our people and technology, we create differentiated value for our customers by focusing on unique data for credit risk evaluation and high value, information-based decisions. Our long-term corporate growth strategy is driven by the following initiatives:

- •

- Increase penetration of our customers' information solutions needs. We continue to increase our share of our customers' spending on information-related services through the development and introduction of new products, pricing our services in accordance with the value they create for customers, increasing the range of current services utilized by customers, and improving the quality of sales and customer support interactions with consumers.

- •

- Deploy enabling technology systems and analytics globally. We continue to invest in new technology to enhance the cost-effectiveness, security and functionality of the services we offer and differentiate our products from those offered by our competitors. In addition to custom products for large customers, we seek to develop off-the-shelf enabling technology platforms that are more cost-effective for medium- and smaller-sized customers.

- •

- Invest in unique data sources. We continue to invest in unique sources of credit and non-credit information to enhance the variety and quality of our services and improve our customers' confidence in data-based business decisions. Our North America Personal Solutions business is investing in data to enable consumers to more effectively manage their identity using online tools. Our TALX business will continue to add employee files in the TWN Services database. Areas of focus for investment in new sources of data include, among others, positive payment data, real estate data and new commercial business data.

- •

- Pursue new vertical markets and expand into emerging markets. We see numerous opportunities to expand in related or emerging markets both in the U.S. and internationally. As an example, we acquired TALX, which has employment data that expands on the types of services we can offer our customers. Internationally, we intend to add to our business growth through expansion into new developing and emerging markets such as India, Russia, Mexico and China.

COMPETITION

The market for our products and services is highly competitive and is subject to constant change. Our competitors vary widely in size and the nature of the products and services they offer. Sources of competition are numerous and include the following:

- •

- Competition for our consumer information solutions and personal solutions products varies by both application and industry, but generally includes two global consumer credit reporting companies, Experian Group Limited, or Experian, and TransUnion LLC, or TransUnion, both of which offer a range of consumer credit reporting products that are similar to products we offer, as well as a large number of smaller competitors who offer competing products in specialized areas such as fraud prevention, data vendors, providers of automated data processing services, and software companies offering credit modeling rules or analytical development tools. We believe that our products offer our customers an advantage over those of our competitors because of the quality of our data files, which we believe to be superior in terms of depth and accuracy and the differentiated information solutions services and decisioning technology that provides customers greater value. Our competitive strategy is to emphasize product features and quality while remaining competitive on price. Our marketing services products also compete with the foregoing companies and others who offer demographic information products, including

8

Acxiom Corporation, or Acxiom, Harte-Hanks, Inc. and infoUSA, Inc. We also compete with Fair Isaac Corporation with respect to our analytical tools.

- •

- Competition for our commercial solutions products primarily includes Experian and The Dun & Bradstreet Corporation. We believe our small business loan information from financial institutions creates a unique database and product for the small business segment of that market.

- •

- Competition for our employment and income verification services includes large employers who serve their own needs through in-house systems to manage verification as well as outsourcers who manage verification services through a call center. Competition for complementary TWN Services includes payroll processors such as Automatic Data Processing, Inc., or ADP, Paychex, Inc. and Ceridian Corporation. Competitors of our Tax Management Services include in-house management of this function primarily by large employers; ADP; and a number of smaller regional firms that offer tax management services (Barnett Associates, Thomas & Thorngren, UC Advantage). Talent Management Services competitors include assessment service providers that offer proprietary content (Previsor, Inc., Development Dimensions International, Brainbench, Inc.), human resources consulting firms (AON Corporation, Watson Wyatt Worldwide, Inc., Right Management Consulting) and assessment or test publishers that have proprietary delivery platforms (Devine Group, Inc., Hogan Assessments Systems, Inc., SHL Group plc).

We believe that none of our competitors offers the same mix of products and services as we do. Certain competitors may have larger shares of particular geographic or product markets or operate in geographic areas where we do not currently have a presence.

We assess the principal competitive factors affecting our markets to include: technical performance; access to unique proprietary databases; availability in application service provider (ASP) format; product attributes such as quality, adaptability, scalability, interoperability, functionality and ease-of-use; product price; quickness of response, flexibility and customer services and support; the effectiveness of sales and marketing efforts; existing market penetration; new product innovation; and our reputation as a trusted steward of information.

9

MARKETS AND CUSTOMERS

Our products and services serve clients across a wide range of industries, including financial services, retail, telecommunications, utilities, automotive, brokerage, healthcare and insurance industries, as well as state and federal governments. We also serve consumers directly. Our revenue stream is highly diversified with our largest customer providing less than 3% of total revenue. The following table outlines the various end-users we serve:

| | Percentage of

Consolidated Revenue

| |

|---|

| Financial | | 32 | % |

| Mortgage | | 12 | % |

| Consumer | | 10 | % |

| Commercial | | 8 | % |

| Retail | | 7 | % |

| Automotive | | 7 | % |

| Human Resources | | 5 | % |

| Telecommunications | | 5 | % |

| Other(1) | | 14 | % |

| | |

| |

| | | 100 | % |

| | |

| |

- (1)

- Other includes revenues from government, marketing services, insurance and healthcare end-users.

We market our products and services primarily through our own direct sales organization that is organized around sales teams that focus on customer segments typically aligned by vertical markets and geography. Sales groups are based in our headquarters and in field offices located in the U.S. and in markets outside the U.S. We also market our products and services through indirect channels, including alliance partners, joint ventures and other resellers. In addition, we sell through direct mail and various websites, such as www.equifax.com.

Our largest geographic market segments are North America (the U.S., Canada, Costa Rica); Europe (the U.K., the Republic of Ireland, Spain and Portugal); and Latin America (Argentina, Brazil, Chile, El Salvador, Honduras, Peru and Uruguay).

Revenue from international customers, including end-users and resellers, amounted to 27%, 28% and 27% of our total revenue in 2007, 2006 and 2005, respectively.

TECHNOLOGY AND INTELLECTUAL PROPERTY

We generally seek protection under federal, state and foreign laws for strategic or financially important intellectual property developed in connection with our business. Certain intellectual property, where appropriate, is protected by registration under applicable trademark laws or by prosecution of patent applications. We own several patents registered in the U.S. and certain foreign countries. We also have certain registered trademarks in the U.S. and in many foreign countries. The most important of these are "Equifax," "TALX" and many variations thereof. These trademarks are used in connection with most of our product lines and services. Although these patents and trademarks are important and valuable assets in the aggregate, no single patent, group of patents or trademark, other than our Equifax trademark, is critical to the success of our business.

We license other companies to use certain data, technology and other intellectual property rights we own or control, primarily as core components of our products and services, on terms that are consistent with customary industry standards and that are designed to protect our interest in our

10

intellectual property. An example of this type of arrangement is our contract to exclusively manage the SBFE database from 2007 until 2012.

We are licensed by others to use certain data, technology and other intellectual property rights they own or control, none of which is material to our business except for licenses from (1) Fair Isaac Corporation, relating to certain credit-scoring algorithms and the right to sell credit scores derived from them, which licenses have varying durations and generally provide for usage-based fees; and (2) Seisint, Inc., relating to a software platform which facilitates sales by our DMS and CMS units. These licenses have ten-year terms that began in 2002 and may be renewed on an annual basis thereafter. We do not hold any franchises or concessions that are material to our business or results of operations.

INFORMATION SECURITY AND GOVERNMENT REGULATION

Safeguarding the privacy and security of consumer credit information, whether delivered online or in an offline format, is a top priority. We recognize the importance of secure online transactions and we maintain physical, administrative, and technical safeguards to protect personal and business identifiable information. We have security protocols and measures in place to protect information from unauthorized access or alteration. These measures include internal and external firewalls, physical security and technological security measures, and encryption of certain data.

Our databases are regularly updated by information provided by financial institutions, telecommunications companies, other trade credit providers, public records vendors and governments. Various laws and regulations govern the collection and use of this information. These laws and regulations impact how we are able to provide information to our customers and have significantly increased our compliance costs. We are subject to differing laws and regulations depending on where we operate.

U.S. Data and Privacy Protection

Our U.S. operations are subject to various federal and state laws and regulations governing the collection, protection and use of consumer credit and other information, and imposing sanctions for the misuse of such information or unauthorized access to data. Many of these provisions also affect our customers' use of consumer credit or other data we furnish. The information underlying our North America Commercial Services and Direct Marketing Services businesses is less regulated than the other portions of our business. A significant portion of the information maintained by our Direct Marketing Services business is voluntarily provided by individuals, thus this information is subject to fewer restrictions on use.

These laws and regulations that may be applied to portions of our business include, but are not limited to, the following:

- •

- The Fair Credit Reporting Act, or FCRA, which governs among other things the reporting of information to credit reporting agencies that engage in the practice of assembling or evaluating certain information relating to consumers, including Equifax's credit reporting business; making prescreened offers of credit; the sharing of consumer report information among affiliated and unaffiliated third parties; access to credit scores; and requirements for data furnishers and users of consumer report information. Violation of the FCRA, or of similar state laws, can result in an award of actual damages, as well as statutory and/or punitive damages in the event of a willful violation.

- •

- The Fair and Accurate Credit Transactions Act of 2003, or FACT Act, which amended the FCRA and requires nationwide consumer credit reporting agencies, such as us, to furnish a free annual credit file disclosure to consumers, upon request, through a centralized request facility we

11

have established with the other nationwide credit reporting agencies. The FACT Act also included requirements for financial institutions to develop policies and procedures to identify potential identity theft and, upon the request of a consumer, to place a fraud alert in the consumer's credit file stating that the consumer may be the victim of identity theft or other fraud; consumer credit report notice requirements for lenders that use consumer report information in connection with risk-based credit pricing actions; requirements for entities that furnish information to consumer reporting agencies to implement procedures and policies regarding the accuracy and integrity of the furnished information and regarding the correction of previously furnished information that is later determined to be inaccurate; and a requirement for mortgage lenders to disclose credit scores to consumers. Additionally, the FACT Act prohibits a business that receives consumer information from an affiliate from using that information for marketing purposes unless the consumer is first provided a notice and an opportunity to direct the business not to use the information for such marketing purposes ("opt-out"), subject to certain exceptions.

- •

- The Financial Services Modernization Act of 1999, or Gramm-Leach-Bliley Act, or GLB, which, among other things, regulates the use of non-public personal financial information of consumers that is held by financial institutions. Equifax is subject to various GLB provisions, including rules relating to the physical, administrative and technological protection of non-public personal financial information. Breach of the GLB can result in civil and/or criminal liability and sanctions by regulatory authorities, such as fines of up to $100,000 per violation and up to five years imprisonment for individuals.

- •

- The Health Insurance Portability and Accountability Act of 1996, or HIPAA, which requires reasonable safeguards to prevent intentional or unintentional use or disclosure of protected health information.

- •

- Federal and state laws governing the use of the Internet and regulating telemarketing, including the federal Controlling the Assault of Non-Solicited Pornography and Marketing Act of 2003, or CAN-SPAM, which regulates commercial email, prohibits false or misleading header information, requires that a commercial email be identified as an advertisement, and requires that commercial emails give recipients an opt-out method.

- •

- Fannie Mae and Freddie Mac regulations applicable to our credit reporting and mortgage services products, the Real Estate Settlement Procedures Act and HUD's Regulation X, which requires the disclosure of certain basic information to borrowers concerning settlement costs and prohibits the charging of unearned fees and certain "kickbacks" or other fees for referrals in connection with a residential mortgage settlement service.

A number of states in the U.S. have passed versions of security breach notification and credit file freeze legislation. A file freeze enables identity theft victims, or in certain states recipients of data breach notices or all consumers, to place and lift a freeze on access to their credit files. File freeze laws impose differing requirements on credit reporting agencies with respect to how and when to respond to such credit file freeze requests and in the fees the agencies may charge for freeze-related actions.

We continue to monitor federal and state legislative and regulatory issues involving data privacy and protection.

International Data and Privacy Protection

We are subject to data protection, privacy and consumer credit laws and regulations in the foreign countries where we do business.

- •

- In Canada, the Personal Information Protection and Electronic Documents Act (2000) applies to organizations with respect to personal information that they collect, use or disclose in the course

12

of commercial activities. It requires compliance with the National Standard of Canada Model Code for the Protection of Personal Information, covering accountability and identifying purposes, consent, collection, use, disclosure, retention, accuracy, safeguards, individual access and compliance. The Federal Privacy Commissioner is invested with powers of investigation and intervention, and provisions of Canadian law regarding civil liability apply in the event of unlawful processing which is prejudicial to the persons concerned.

- •

- In Europe, we are subject to the European Union, or EU, data protection laws, including the comprehensive EU Directive on Data Protection (1995), which imposes a number of obligations on Equifax with respect to use of personal data, and includes a prohibition on the transfer of personal information from the EU to other countries that do not provide consumers with an "adequate" level of privacy or security. The EU standard for adequacy is generally stricter and more comprehensive than that of the U.S. and most other countries. In the U.K., the Data Protection Act of 1998 regulates the manner in which we can use third-party data. Recent regulatory limitations affect our use of the Electoral Roll, one of our key data sources in the U.K. Generally, the data underlying the products offered by our U.K. Information Services and Personal Solutions product lines, excluding our Commercial Services products, are subject to these regulations. In Spain and Portugal, the privacy laws which are subject to the EU Directive on Data Protection regulate all credit bureau and personal solutions activities. Except for negative data, the laws in Spain and Portugal generally require consumer consent for all Equifax activities.

- •

- In Latin America, most countries generally follow the EU data protection model. This includes consumer data protection and privacy laws and regulations in Argentina, Chile, Peru and Uruguay. There are also constitutional provisions in Argentina, Brazil, Chile, Peru and certain other countries which declare the right to a judicial hearing on the use of personal data, and grant individuals the right to access and correct information in the possession of data controllers in many of those countries.

TALX

The Tax Management business within our TALX segment is potentially impacted by changes in U.S. tax laws or interpretations, for example, those pertaining to work opportunity tax credits and unemployment compensation claims. A subsidiary of TALX, Talent Management, provides employee testing, assessment and talent management services to the federal government through a number of prime and subcontracts with federal agencies, including the Transportation Security Administration. These contracts may be adversely affected by changes in U.S. federal government programs or contractor requirements, including the adoption of new laws or regulations.

PERSONNEL

We employed approximately 7,000 employees in 14 countries as of December 31, 2007. None of our U.S. employees are subject to a collective bargaining agreement and no work stoppages have been experienced. Pursuant to local laws, our employees in Brazil, Spain and Argentina are subject to collective bargaining agreements that govern general salary and compensation matters, basic benefits and hours of work. Equifax is not a party to these agreements. Information regarding our executives is included in "Executive Officers of the Registrant" below.

13

EXECUTIVE OFFICERS OF THE REGISTRANT

The persons serving as our executive officers as of February 27, 2008, together with their ages, positions and brief summaries of their business experience, are as follows:

Name

| | Age

| | Position

| | Executive Officer Since

|

|---|

| Richard F. Smith | | 48 | | Chairman and Chief Executive Officer | | 2005 |

Lee Adrean |

|

56 |

|

Corporate Vice President and Chief Financial Officer |

|

2006 |

Kent E. Mast |

|

64 |

|

Corporate Vice President and Chief Legal Officer |

|

2000 |

Coretha M. Rushing |

|

51 |

|

Corporate Vice President and Chief Human Resources Officer |

|

2006 |

Paul J. Springman |

|

62 |

|

Corporate Vice President and Chief Marketing Officer |

|

2002 |

Robert J. Webb |

|

39 |

|

Corporate Vice President and Chief Information Officer |

|

2006 |

J. Dann Adams |

|

50 |

|

President, U.S. Consumer Information Solutions |

|

2006 |

William W. Canfield |

|

69 |

|

President, TALX |

|

2007 |

Steven P. Ely |

|

52 |

|

President, North America Personal Solutions |

|

2007 |

Rodolfo O. Ploder |

|

47 |

|

President, International |

|

2006 |

Michael S. Shannon |

|

52 |

|

President, North America Commercial Solutions |

|

2006 |

Nuala M. King |

|

54 |

|

Senior Vice President and Corporate Controller |

|

2004 |

There are no family relationships among our executive officers, nor are there any arrangements or understandings between any of the officers and any other persons pursuant to which they were selected as officers, except that Mr. Canfield was appointed to the Board at the effective time of the merger of TALX with and into a subsidiary of Equifax pursuant to the terms of that certain Agreement and Plan of Merger dated February 14, 2007, among TALX Corporation, Equifax and Chipper Corporation.

Mr. Smith has been Chairman and Chief Executive Officer since December 15, 2005. He was named Chairman-Elect and Chief Executive Officer effective September 19, 2005 and was elected as a Director on September 22, 2005. Prior to that, Mr. Smith served as Chief Operating Officer, GE Insurance Solutions, from 2004 to September 2005; as President and Chief Executive Officer of GE Property and Casualty Reinsurance from 2003 to 2004; as President and Chief Executive Officer of GE Property and Casualty Reinsurance—Americas of GE Global Insurance Holdings Corp. from 2001 to 2003; and as President and Chief Executive Officer, GE Capital Fleet Services from 1995 to 2000.

Mr. Adrean joined Equifax as Corporate Vice President and Chief Financial Officer in October 2006. Prior to joining Equifax, he served as Executive Vice President and Chief Financial Officer of NDCHealth Corporation since 2004. Prior thereto, he served as Executive Vice President and Chief Financial Officer of EarthLink, Inc. where he was employed from 2000 until 2004.

Mr. Mast has served as Chief Legal Officer since he joined Equifax in 2000. His responsibilities include legal services, global sourcing, security and compliance, government and legislative relations, corporate governance and privacy functions.

14

Ms. Rushing joined Equifax in May 2006 as Corporate Vice President and Chief Administrative Officer. Prior to joining Equifax, Ms. Rushing served as an executive coach and HR Consultant with Atlanta-based Cameron Wesley LLC. Prior thereto, she was Senior Vice President of Human Resources at The Coca-Cola Company, where she was employed from 1996 until 2004.

Mr. Springman has served as Chief Marketing Officer since February 2004. He joined Equifax in 1990 and has held various executive positions, most recently serving as the head of the Predictive Sciences unit from August 2002 until February 2004. Prior thereto, Mr. Springman served as Group Executive, North America Information Solutions from September 2001 until August 2002.

Mr. Webb joined Equifax in November 2004 as the Chief Technology Officer. Prior to joining Equifax, Mr. Webb was employed by General Electric Corporation from 1996 to 2004, where he held Chief Information Officer positions for GE Commercial Finance, GE Global Consumer Finance and GE Energy Services. Prior thereto, he worked as an information technology and management consultant with EDS and Andersen Consulting.

Mr. Adams assumed his current position in January 2007. He joined Equifax in 1999 and has served as Group Executive, North America Information Services from November 2003 until December 2006; Senior Vice President, Equifax North America Sales from October 2001 until October 2003; and Senior Vice President, Financial Services from February 1999 until October 2001.

Mr. Canfield joined Equifax in May 2007 upon Equifax's acquisition of TALX Corporation, for which he served as President and Chief Executive Officer from 1987 and Chairman since 1988.

Mr. Ely joined Equifax in February 2004 and was appointed President, North American Personal Solutions in January 2007. He served as Group Executive, Personal Solutions from August 2005 until December 2006 when he assumed his current position. From February 2004 until August 2005, Mr. Ely was Senior Vice President of Product Management and Marketing. Prior to joining Equifax, he was Senior Vice President, Worldwide Marketing of S1 Corporation from June 2001 until September 2003, and held senior marketing and software development management positions with NetVendor, Per-Se Technologies, Dun & Bradstreet Software, Sybase and NCR Corporation prior to that.

Mr. Ploder joined Equifax in February 2004 and is President, International. Prior to that position, he was Group Executive, Latin America. Before joining Equifax, he was employed by MCI where he had been Vice President, International since 1999. Prior thereto, Mr. Ploder spent 13 years in the telecommunications industry, primarily in international management positions.

Mr. Shannon assumed his current position in January 2007. Since joining Equifax in 1992, he has held various executive positions including, most recently, Group Executive, Europe from February 2002 until December 2006, and Managing Director, U.K. from July 2001 until February 2002.

Ms. King joined Equifax in March 2004 as Vice President and Corporate Controller. Prior to joining Equifax, Ms. King served as Corporate Controller for UPS Capital from March 2001 until March 2004 and, prior thereto, held various executive positions with The Coca-Cola Company.

15

ITEM 1A. RISK FACTORS

Set forth below are some of the risks and uncertainties that, if they were to occur, could materially and adversely affect our business or that could cause our actual results to differ materially from the results contemplated by the forward-looking statements contained in this report and the other public statements we make.

Forward-looking statements involve matters that are not historical or current facts. Words such as "may," "could," "should," "would," "believe," "expect," "anticipate," "estimate," "intend," "seeks," "plan," "project," "continue," "predict," or other words or expressions of similar meaning are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

Forward-looking statements include, but are not limited to:

- •

- Projections of revenues, income, net income per share, capital expenditures, dividends, capital structure, or other financial measures;

- •

- Descriptions of anticipated plans or objectives of our management for operations, products or services;

- •

- Forecasts of performance; and

- •

- Assumptions regarding any of the foregoing.

For example, our forward-looking statements include our expectations regarding:

- •

- Regarding Note 4 of the Notes to Consolidated Financial Statements, and our future liquidity needs discussed under "Liquidity and Financial Condition," our ability to generate cash from operating activities and any declines in our credit ratings or financial condition which could restrict our access to the capital markets or materially increase our financing costs;

- •

- With respect to our pension funding obligations and expected rate of return on plan assets discussed in "Pension Plans" in Management's Discussion and Analysis of Financial Conditions and Results of Operations, or MD&A, in this Form 10-K, the impact of changes in accounting standards and pension funding laws and regulations, measurement of pension and other postretirement plan assets and pension liabilities, actuarial assumptions and future investment returns on pension assets and pension liabilities;

- •

- With respect to Note 5 of the Notes to Consolidated Financial Statements, "Commitments and Contingencies", and "Contractual Obligations, Commercial Commitments and Other Contingencies" in MD&A, changes in the market value of our assets or the actual cost of our commitments or contingencies, including, without limitation, the negotiated or appraised price payable under the CSC option, if exercised;

- •

- Regarding Note 3 of the Notes to Consolidated Financial Statements, estimated future amortization expense related to definite lived purchased intangible assets at December 31, 2007, our ability to accurately estimate the fair value of such assets;

- •

- Regarding Notes 2 and 3 of the Notes to Consolidated Financial Statements, the fact that amounts recorded at December 31, 2007, related to the acquisition of TALX, and the associated estimates of future amortization, are preliminary estimates that will be finalized upon the completion of federal and state tax returns and valuation of acquired fixed assets;

- •

- With respect to our business outlook discussed under "Business Overview" in MD&A, our views on the health and future growth of the U.S. and global economies during 2008; and

- •

- With respect to our USCIS business discussed under "Results of Operations—Twelve Months Ended December 31, 2007, 2006 and 2005" in MD&A, our ability to protect operating margins during 2008.

16

You should not unduly rely on forward-looking statements. They represent our expectations about the future and are not guarantees. Forward-looking statements are only as of the date they were made, and, except as required by law, they might not be updated to reflect changes as they occur after the forward-looking statements are made.

Risks and Uncertainties

Risks Related to Our Business and Growth Strategy

If we are not successful in implementing our long-term growth strategy, we may be unable to grow our business and our results of operations may be adversely affected.

We have developed a long-term growth strategy which includes (1) increasing our share of our customers' spending on information-related services through the development and introduction of new products, pricing our services in accordance with the value they create for customers, increasing the range of current services utilized by customers, and improving the quality of sales and customer support interactions with consumers; (2) increasing our customers' use of our proprietary analytical, predictive and enabling technologies; (3) investing in and developing new, differentiated data sources that provide unique value to customers in their highest value decisioning needs; and (4) expanding into key emerging opportunities via acquisitions, partnerships, and/or internal development, including related markets in the U.S., such as initiatives in the commercial, collections, and healthcare markets, as well as new geographic markets outside the U.S. If we are unable to successfully execute our growth strategy, we may not be able to grow our business, growth may occur more slowly than we anticipate, or our revenues, net income and earnings per share may decline.

We may incur risks related to acquisitions or significant investment in businesses which could jeopardize the success of these acquisitions and increase our costs.

Our long-term strategy includes growth through acquisitions and investments in businesses that offer complementary products, services and technologies. Any acquisitions or investments, including our recent acquisition of TALX as described in Part II, Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations," will be accompanied by the risks commonly encountered in acquisitions of businesses. Such risks include:

- •

- The financial and strategic goals for the acquired and combined business may not be achieved;

- •

- The possibility that we will pay more than the acquired companies or assets are worth;

- •

- Unexpected liabilities arising out of the acquired businesses;

- •

- The difficulty of assimilating the systems, operations and personnel of the acquired businesses;

- •

- The potential disruption of our ongoing business;

- •

- The potential dilution of our existing shareholders and earnings per share;

- •

- Unanticipated legal risks and costs;

- •

- The distraction of management from our ongoing business; and

- •

- The impairment of relationships with employees and customers as a result of any integration of new management personnel.

These factors could harm our business, results of operations or financial position, particularly in the event of a significant acquisition. The acquisition of businesses having a significant presence outside the U.S. will increase our relative exposure to the risks of conducting operations in international markets.

17

Deterioration of current economic conditions may decrease our customers' demand for consumer credit information, which may harm our results of operations.

Although we continue to take steps to diversify our lines of business, consumer credit reports we sell in the U.S. and certain international markets, including the U.K., Canada and in Latin America, remain a core product. In general, our customers use our credit information and related services to process applications for new credit cards, automobile loans, home mortgages, home equity loans and other consumer loans. They also use our credit information and services to monitor existing credit relationships. Consumer demand for credit (i.e., rates of spending and levels of indebtedness) tends to grow more slowly or decline during periods of economic contraction or slow economic growth. Rising rates of interest may reduce consumer demand for mortgage loans and also impact our mortgage services joint venture. A decline in consumer demand for credit or in levels of employment may reduce our customers' demand for our consumer credit information. Consequently, our revenues from consumer credit information products and services could be negatively affected and our results of operations harmed if consumer demand for credit decreases. In addition, if current economic conditions in the U.S. decline further, this decline could detrimentally impact the economies of the countries outside the U.S. in which we operate and could influence customer demand for our non-consumer credit information-based businesses, including North America Commercial Solutions and TALX, which could further negatively impact our results of operations.

The loss of access to credit and other data from external sources could harm our ability to provide our products and services.

We rely extensively upon data from external sources to maintain our proprietary and non-proprietary databases, including data received from customers, strategic partners and various government and public record sources. Our data sources could withdraw their data from us for a variety of reasons, including legislatively or judicially imposed restrictions on use. We also compete with several of our third-party data suppliers. If a substantial number of data sources or certain key data sources were to withdraw or be unable to provide their data, if we were to lose access to data due to government regulation, or if the collection of data becomes uneconomical, our ability to provide products and services to our clients could be materially adversely impacted, which could result in decreased revenues, net income and earnings per share.

Our markets are highly competitive and new product introductions and pricing strategies being offered by our competitors could decrease our sales and market share or require us to reduce our prices in a manner that reduces our operating margins.

We operate in a number of geographic, product and service markets that are highly competitive, as described above under "Competition." We currently have a business relationship with Fair Isaac Corporation to resell their credit scoring product and are also involved in litigation with that firm arising from our development with TransUnion and Experian of the VantageScore (SM) credit scoring product which is competitive with Fair Isaac's products. Competitors may develop products and services that are superior to or that achieve greater market acceptance than our products and services.

The sizes of our competitors vary across market segments, as do the resources we have allocated to the segments we target. Therefore, some of our competitors may have significantly greater financial, technical, marketing or other resources than we do in one or more of our market segments, or overall. As a result, our competitors may be in a position to respond more quickly than we can to new or emerging technologies and changes in customer requirements, or may devote greater resources than we can to the development, promotion, sale and support of products and services. Moreover, new competitors or alliances among our competitors may emerge and potentially reduce our market share, revenue or margins. If we are unable to respond as quickly or effectively to changes in customer

18

requirements as our competition, our ability to expand our business and sell our products and services will be negatively affected.

Some of our competitors also may choose to sell products competitive to ours at lower prices by accepting lower margins and profitability, or may be able to sell products competitive to ours at lower prices given proprietary ownership of data, technical superiority or economies of scale. Price reductions by our competitors could negatively impact our margins and results of operations, and could also harm our ability to obtain new customers on favorable terms. Historically, certain of our products have experienced declines in per unit pricing due to competitive factors and customer demand. If prices decline in the future at faster rates than in the past due to unforeseen changes in competition or customer demand, our business could be adversely affected.

Our ability to increase our revenues will depend to some extent upon introducing new products and services, and if the marketplace does not accept these new products and services, our revenues may remain flat or decline.

To increase our revenues, we must enhance and improve existing products and continue to introduce new products and new versions of existing products that keep pace with technological developments, satisfy increasingly sophisticated customer requirements and achieve market acceptance. We believe much of our future growth prospects will rest on our ability to continue to expand into newer products and services. Products that we plan to market in the future are in various stages of development. We cannot assure that the marketplace will accept these products. If our current or potential customers are not willing to switch to or adopt our new products and services, our ability to increase revenues or improve operating margins will be impaired.

If we fail to keep up with rapidly changing technologies, our products and services could become less competitive or obsolete.

In our markets, technology changes rapidly and there are continuous improvements in computer hardware, network operating systems, programming tools, programming languages, operating systems, database technology and the use of the Internet. Advances in technology may result in changing customer preferences for products and services and delivery formats. If we fail to enhance our current products and develop new products in response to changes in technology, industry standards or customer preferences, our products and services could rapidly become less competitive or obsolete. Our future success will depend, in part, upon our ability to internally develop new and competitive technologies; use leading third-party technologies effectively; continue to develop our technical expertise; anticipate and effectively respond to changing customer needs; and influence and respond to emerging industry standards and other technological changes.

If we are unable to raise sufficient additional capital at an acceptable cost, we may be unable to continue to effectively compete and expand our business.

We may require additional capital to purchase assets, complete strategic acquisitions, repurchase shares on the open market or for general liquidity needs. Declines in our credit rating or limits on our ability to sell additional shares may adversely affect our ability to raise capital or materially increase our cost of capital. Our inability to raise additional capital at a reasonable cost may adversely impact our revenue growth and the price of our stock.

We may suffer adverse financial consequences if Computer Sciences Corporation requires us to purchase its credit reporting business when the public equity or debt markets or other financing conditions are unfavorable to us.

In 1988, we entered into an agreement with Computer Sciences Corporation, or CSC, and certain of its affiliates under which CSC's credit reporting agencies utilize our computerized credit database

19

services. Under this agreement, CSC has an option, exercisable at any time, to sell its credit reporting business to us. The option expires in August 2013. The option exercise price will be determined by an appraisal process and would be due in cash within 180 days after the exercise of the option. We estimate that if CSC were to exercise the option today, the option price would be approximately $650.0 million to $725.0 million. This estimate is based solely on our internal analysis of the value of the business, current market conditions and other factors, all of which are subject to constant change. Therefore, the actual option exercise price could be materially higher or lower than the estimated amount. If CSC were to exercise its option, we would have to obtain additional sources of funding. We believe that this funding would be available from sources such as additional bank lines of credit and the issuance of public debt and/or equity. However, the availability and terms of any such capital financing would be subject to a number of factors, including credit market conditions, the state of the equity markets, general economic conditions and our financial performance and condition. Because we do not control the timing of CSC's exercise of its option, we could be required to seek such financing and increase our debt levels at a time when market or other conditions are unfavorable.

Our international operations subject us to additional business risks and related costs that may reduce our profitability or revenues.

During 2007, we generated approximately 27% of our revenues from business outside the U.S. As part of our growth strategy, we plan to continue to pursue opportunities outside the U.S. As a result, our future operating results could be negatively affected by a variety of factors, many of which are beyond our control. Risks that could give rise to incremental costs in our international operations include: political and economic instability; changes in regulatory requirements and policy and the adoption of laws detrimental to our operations, such as legislation relating to the collection and use of personal data; negative impact of currency exchange rate fluctuations; potentially adverse tax consequences; increased restrictions on the repatriation of earnings; and general economic conditions in international markets. We may not be able to avoid significant expenditures should one or more of these risk factors occur.

Security is critically important to our business, and breaches of security, or the perception that e-commerce is not secure, could harm our business and reputation.

Business-to-business and business-to-consumer electronic commerce, including that which is Internet-based, requires the secure transmission of confidential information over public networks. Several of our products are accessed through the Internet, including our consumer and commercial information services that are delivered via ePORT, our Internet delivery channel, and our Personal Solutions services accessible through the www.equifax.com website. Security breaches in connection with the delivery of our products and services via ePORT, our Personal Solutions website, or well-publicized security breaches not involving the Internet that may affect us or our industry, such as database intrusion, could be detrimental to our business, operating results and financial condition. We cannot be certain that advances in criminal capabilities, new discoveries in the field of cryptography or other developments will not compromise or breach the technology protecting the networks that access our products, consumer services and proprietary database information.

If we experience system failures, the delivery of our products and services to our customers could be delayed or interrupted, which could harm our business and reputation and result in the loss of customers.

Our ability to provide reliable service largely depends on the efficient and uninterrupted operation of our computer network systems and data centers. Some of these systems have been outsourced to third-party providers. Any significant interruptions could severely harm our business and reputation and result in a loss of customers. Our systems and operations could be exposed to damage or interruption from fire, natural disaster, power loss, war, terrorist act, telecommunications failure, unauthorized entry and computer viruses. The steps we have taken and are taking to prevent a system failure, including

20

backup disaster recovery systems, may not be successful, and our property and business interruption insurance may not be adequate to compensate us for all losses or failures that may occur.

The loss of key personnel, or the inability to attract and retain highly skilled personnel, could make it more difficult to run our business and reduce our likelihood of success.

We are dependent on our ability to attract and retain experienced sales, consulting, research and development, marketing, technical support and management personnel. The loss of our key employees and management might slow the achievement of important business goals. We may not be able to attract and retain skilled and experienced technical personnel on acceptable terms because of intense competition.

If our outside service providers and key vendors are not able to fulfill their service obligations, our business and operations could be disrupted, and our operating results could be harmed.

Outside service providers and vendors perform critical functions for us. While we have implemented service level agreements and have established monitoring controls, our operations could be disrupted if we do not successfully manage our service providers or if the service providers do not perform satisfactorily to agreed upon service levels. In addition, our business, reputation and operating results could be adversely affected.

If we fail to adequately protect our intellectual property rights, our ability to compete effectively could be diminished.

Our ability to compete effectively depends in part on the protection of our technology, products, services and brands through intellectual property right protections, including patents, copyrights, database rights, trade secrets and trademarks. The extent to which such rights can be protected and enforced varies in different jurisdictions.

We face and could continue to face claims for intellectual property infringement, which could subject us to significant monetary damages or limit or prohibit us from using some of our technologies, products and services.

There is a risk of litigation relating to our use or future use of intellectual property rights of third parties. Third-party infringement claims and any related litigation against us could subject us to liability for damages, restrict us from using and providing our technologies, products or services or operating our business generally, or require changes to be made to our technologies, products and services. We are currently a defendant in litigation brought by Fair Isaac Corporation arising from our development with TransUnion and Experian of the VantageScore credit scoring product that is competitive with Fair Isaac's products, in which the plaintiff has alleged trademark infringement, among other claims.

Our agreements with key long-term customers may not be renewed.

We have long-standing relationships with a number of our large customers. There can be no assurance that these relationships will continue, due to market competition, customer requirements and customer consolidation through mergers or acquisitions. Although our largest single customer represents less than 3% of our total revenue, the loss of a significant number of major customers could materially adversely affect our business, reputation, financial condition or operating results.

There may be further consolidation in our end-client markets.

To the extent that our existing clients merge with or are acquired by other entities who are not our clients or who use fewer of our services, such as in the financial services sector, we could be adversely impacted if the surviving entities use fewer of our services or discontinue use of our services altogether, or if the number of potential clients is thereby reduced.

21

Our tax provisions may not be adequate, which would require us to pay greater than expected taxes.

Although we believe we have made appropriate provisions for taxes in the various jurisdictions in which we operate on the basis of current law, due to possible changes of law or challenges from tax authorities under existing laws it is possible that the provision may turn out to be insufficient and this could materially affect our financial condition by causing us to incur additional tax expense.

The outcome of litigation or regulatory proceedings in which we are involved could subject us to significant monetary damages or restrictions on our ability to do business.

Various legal proceedings arise during the normal course of our business. These include individual consumer cases, class action lawsuits, and actions brought by regulators. While we do not currently believe that the outcome of any such pending or threatened litigation will have a material adverse effect on our financial position, litigation is inherently uncertain and adverse developments or outcomes can result in significant monetary damages, penalties or injunctive relief against us. Our insurance arrangements may be insufficient to cover an adverse judgment in a large lawsuit. See Part I, Item 3, "Legal Proceedings" for information on our material pending litigation.

Risks Relating to Our Industry

Changes in the legislative, regulatory and judicial environments may adversely affect our ability to collect, manage, aggregate and use data and may increase our costs of doing so.

The credit reporting, direct marketing and employment verification industries are subject to substantial government regulation relating to individual privacy and the collection, distribution and use of information about individuals. The information and personal data we collect is subject to a variety of government regulations, including, but not limited to, those described above under "Information Security and Government Regulation." In addition, public interest in individual privacy rights and the collection, protection, distribution and use of information about individuals may result in the adoption of new federal, state, local and foreign laws and regulations that could include increased compliance requirements and restrictions on the purchase, sale, maintenance, handling and sharing of information about consumers for commercial purposes. This could have a negative impact on our ability to collect such information provided by consumers voluntarily. Future laws and regulations with respect to the collection, management and use of data about individuals, and adverse publicity, judicial interpretations or potential litigation concerning the commercial use of such information may result in substantial regulatory compliance costs, litigation expense or a loss of revenue.

Risks Related to Our Common Stock

We have the ability to issue additional equity securities, which would lead to dilution of our issued and outstanding common stock and could contain terms and rights that are superior to those of our common stock.

The issuance of additional equity securities or securities convertible into equity securities could result in dilution of the then-existing shareholders' equity interests in us. We are authorized to issue, without shareholder approval, up to 300,000,000 shares of common stock, of which 133,433,311 shares were outstanding as of December 31, 2007, including shares held by employee benefits trusts. In addition, our Board of Directors has the authority to issue, without vote or action of shareholders, up to 10,000,000 shares of preferred stock in one or more series, and has the ability to fix the rights, preferences, privileges and restrictions of any such series. Any such series of preferred stock could contain dividend rights, conversion rights, voting rights, terms of redemption, redemption prices, liquidation preferences or other rights superior to the rights of holders of our common stock. If we issue convertible preferred stock, a subsequent conversion may dilute the current common shareholders' interest.

22

Provisions in our articles of incorporation, bylaws, shareholder rights plan, other agreements and Georgia law may make it difficult for a third-party to acquire us, even in situations that may be viewed as desirable by our shareholders.

Our articles of incorporation, bylaws, shareholder rights plan, other agreements and the Georgia Business Corporation Code of the State of Georgia, or Georgia Code, contain provisions that may delay or prevent an attempt by a third party to acquire control of our company. For example, our articles of incorporation:

- •

- Provide for classified terms for the members of our Board of Directors;

- •

- Authorize our Board of Directors to fill vacant directorships or to increase the size of the Board;

- •