QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

- ý

- ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2008

OR

- o

- TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-06605

EQUIFAX INC.

(Exact name of registrant as specified in its charter)

| | |

| Georgia | | 58-0401110 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

1550 Peachtree Street, N.W.

Atlanta, Georgia | |

30309 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code:404-885-8000

Securities registered pursuant to Section 12(b) of the Act:

| | |

| Title of each class | | Name of each exchange on which registered |

| Common Stock, $1.25 par value per share | | New York Stock Exchange |

| Common Stock Purchase Rights | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Exchange Act ("Act"). ý YES o NO

Indicate by check mark if Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

o YES ý NO

Indicate by check mark whether Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý YES o NO

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | |

| | ý Large accelerated filer | | o Accelerated filer | | o Non-accelerated filer | | o Smaller reporting company |

| | | | (Do not check if a smaller reporting company) |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). o YES ý NO

As of June 30, 2008, the aggregate market value of Registrant's common stock held by non-affiliates of Registrant was approximately $4,322,249,330 based on the closing sale price as reported on the New York Stock Exchange. At January 31, 2009, there were 126,478,384 shares of Registrant's common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of Registrant's definitive proxy statement for its 2009 annual meeting of shareholders are incorporated by reference in Part III of this 10-K.

FORWARD-LOOKING STATEMENTS

This report contains information that may constitute "forward-looking statements." Generally, the words "believe," "expect," "intend," "estimate," "anticipate," "project," "will" and similar expressions identify forward-looking statements, which generally are not historical in nature. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future are forward-looking statements. Management believes that these forward-looking statements are reasonable as and when made. However, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our Company's historical experience and our present expectations or projections. These risks and uncertainties include, but are not limited to, those described below in Item 1A. Risk Factors, and elsewhere in this report and those described from time to time in our future reports filed with the Securities and Exchange Commission, or SEC. As a result of such risks and uncertainties, we urge you not to place undue reliance on any such forward-looking statements. Forward-looking statements speak only as of the date when made. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

PART I

ITEM 1. BUSINESS

INTRODUCTION

Equifax Inc. is a leading global provider of information solutions for businesses and consumers. We have a large and diversified group of clients and customers, including financial institutions, corporations, governments and individuals. Our products and services are based on comprehensive databases of consumer and business information derived from numerous types of credit, financial, public record, demographic and marketing data. We use proprietary analytical tools to analyze this data to create customized insights, decision-making solutions and processing services for businesses. We help consumers understand, manage and protect their personal information and to make more informed financial decisions. Additionally, we are a leading provider of payroll-related and human resources business process outsourcing services in the United States of America, or U.S.

We currently operate in three global regions: North America (U.S. and Canada), Europe (the United Kingdom, or U.K., Spain and Portugal) and Latin America (Argentina, Brazil, Chile, Ecuador, El Salvador, Honduras, Peru and Uruguay). We also maintain support operations in Costa Rica and the Republic of Ireland. During 2008, we expanded into Russia by acquiring an equity interest in a consumer credit information company. Of the countries in which we operate, 73% of our revenue was generated in the U.S. during 2008.

Equifax was originally incorporated under the laws of the State of Georgia in 1913, and its predecessor company dates back to 1899. As used herein, the terms Equifax, the Company, we, our and us refer to Equifax Inc., a Georgia corporation, and its consolidated subsidiaries as a combined entity, except where it is clear that the terms mean only Equifax Inc.

AVAILABLE INFORMATION

On our Internet web site,www.equifax.com, we post the following filings as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. These reports are required by the Securities Exchange Act of 1934 and include annual reports on Form 10-K; quarterly reports on Form 10-Q; current reports on Form 8-K; proxy statements on Schedule 14A; and any amendments to these reports or statements. The SEC also maintains a website,www.sec.gov, that contains reports, proxy and information statements regarding issuers that file electronically with the SEC. The content on any website referred to in this Form 10-K is not incorporated by reference into this Form 10-K unless expressly noted.

BUSINESS SEGMENTS

We are organized and report our business results in five operating segments, as follows:

- •

- U.S. Consumer Information Solutions (USCIS) — provides consumer information solutions to businesses in the U.S. including online credit data and credit decision

2

technology solutions (OCIS), mortgage reporting and settlement solutions, consumer credit-based marketing services (CMS) and direct marketing services (DMS) based on demographic and other consumer information.

- •

- International — includes our Canada Consumer, Europe and Latin America business units. Products and services offered are similar to those available in the USCIS, North America Commercial Solutions and North America Personal Solutions operating segments but vary by geographic region.

- •

- TALX — provides services enabling clients to outsource and automate the performance of certain payroll and human resources business processes, including employment and income verification, tax management and talent management services.

- •

- North America Personal Solutions — provides products to consumers enabling them to monitor and protect their credit, credit score and identity information and make more informed financial decisions.

- •

- North America Commercial Solutions — provides credit, financial, marketing and other information regarding businesses in the U.S. and Canada.

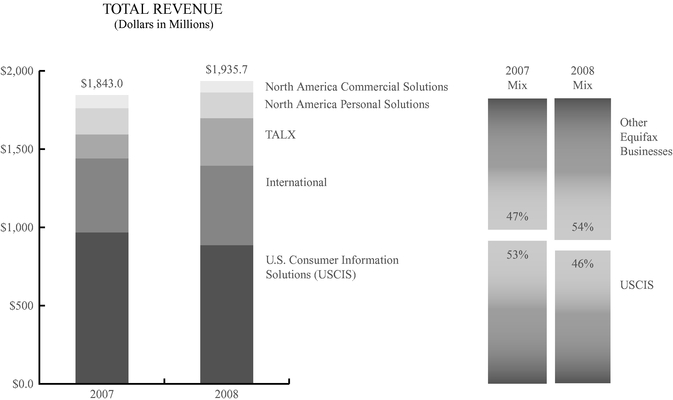

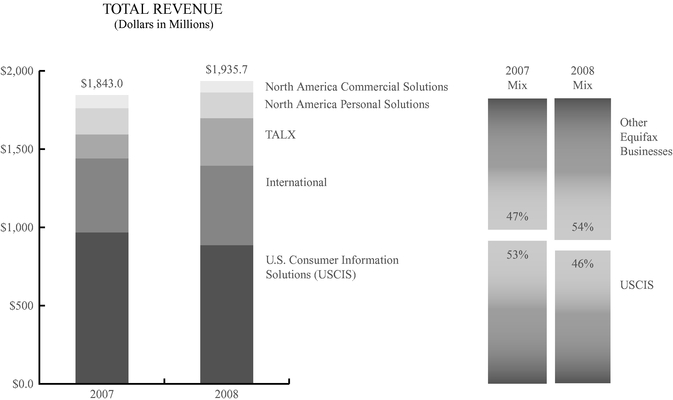

Our revenue base and business mix are diversified among our five segments. As depicted in the chart below regarding our business mix, our core U.S. consumer credit reporting operating segment, USCIS, represented 46% of consolidated revenue in 2008 compared to 53% in 2007. Revenue from our newest operating segment, TALX Corporation, or TALX, was included from the date of its acquisition on May 15, 2007.

PRODUCTS AND SERVICES

Our product and service offerings are highly diversified and include consumer and business credit information, information database management, marketing information, decisioning and analytical tools, and identity verification services that enable businesses to increase the speed and quality of their decision making regarding credit offers and other services, mitigate fraud, manage portfolio risk and customer relationships and develop marketing strategies. We also offer a portfolio of products marketed to individual consumers that enable them to better understand, manage and protect their financial affairs, and we provide employment and income verification and human resources business process outsourcing services.

3

The following chart depicts the types of products and services offered by each of the business units within our segments.

Summary of Key Products and Services by Business Unit

| | | | | | | | | | | | | | | | | | | | | | |

| | |

|---|

| | USCIS | |

| |

| | International | | TALX |

|---|

| | OCIS

| | CMS

| | DMS

| | Mortgage

Services

| | North

America

Personal

Solutions

| | North

America

Commercial

Solutions

| | Canada

Consumer

| | Europe

| | Latin

America

| | The Work

Number®

| | Tax & Talent

Management

Services

|

|---|

| |

|---|

Online consumer credit reports | | X | | | | | | X | | X | | | | X | | X | | X | | | | |

| |

Consumer scores and analytical services | | X | | X | | X | | X | | X | | | | X | | X | | X | | | | |

| |

Enabling technology services (i.e., credit decisioning platforms) | | X | | | | | | X | | | | X | | X | | X | | X | | | | |

| |

Consumer identity authentication | | X | | | | | | | | | | | | X | | X | | X | | | | |

| |

Consumer marketing services and database management | | | | X | | X | | X | | | | | | X | | X | | X | | | | |

| |

Business credit reports, scores and analytical services | | | | | | | | | | | | X | | | | X | | X | | | | |

| |

Business marketing services and database management | | | | | | | | | | | | X | | | | X | | X | | | | |

| |

Business demographic information | | | | | | X | | | | | | X | | | | X | | | | | | |

| |

Direct to consumer credit monitoring | | | | | | | | | | X | | | | | | X | | | | | | |

| |

Mortgage settlement services | | | | | | | | X | | | | | | | | | | | | | | |

| |

Employment and income verification | | | | | | | | | | | | | | | | | | | | X | | |

| |

Tax management services | | | | | | | | | | | | | | | | | | | | | | X |

| |

Talent management services | | | | | | | | | | | | | | | | | | | | | | X |

| |

Each of our operating segments is described more fully below.

USCIS

USCIS provides consumer information solutions to businesses in the U.S. through four product lines, as follows:

Online Consumer Information Solutions (OCIS). OCIS products are derived from large databases of credit information that we maintain about individual consumers, including credit history, current credit status and consumer address information. Our customers utilize the credit report information we provide to make decisions for a wide range of credit and business purposes, such as whether, and on what terms, to approve auto loans or credit card applications, whether to allow a consumer to open a new utility or telephone account and similar business uses. We offer other analytical and predictive services based on the information in the consumer credit information databases to help further mitigate the risk of granting credit by verifying the identity of a consumer seeking credit, predicting the risk of consumer bankruptcy, or indicating the credit applicant's risk potential for account delinquency, for example. These risk management services, as well as fraud detection and prevention services, enable our customers to monitor default rates and proactively manage their existing credit card or other consumer loan accounts.

OCIS customers access products through a full range of electronic distribution mechanisms, including direct real-time access, which facilitates instant decisions,

4

e.g., for the immediate granting of credit. We also create and host customized decisioning technology for customers to obtain custom scores and analytical results along with consumer credit information to enhance the timeliness and quality of their decision-making process. These enabling technology applications facilitate pre-approved offers of credit and automate a variety of credit decisions through our Interconnect and Decision Power online technology platforms as well as automate loan underwriting processes with our LoanCenter platform.

Mortgage Solutions. Our Mortgage Solutions products, offered in the U.S., consist of specialized credit reports that combine the reports of the three major consumer credit reporting agencies (Equifax, Experian and TransUnion) into a single credit report provided in an online format, commonly referred to as a tri-merge report. Mortgage lenders use these tri-merge reports in making their mortgage underwriting decisions. We also offer certain mortgage settlement services, such as appraisal, title and closing services, with our traditional mortgage service offerings, with certain of these services provided by third parties.

Credit Marketing Services (CMS). Our CMS products enable customers to manage their customer marketing efforts for efficiency and effectiveness; identify and acquire new customers for credit relationships; and realize additional revenue from existing customers. These products utilize information derived from the credit-based consumer data that also underlies our OCIS products, provided in a batch output formatted to meet our customers needs. Customers use this detailed information to make decisions about which consumers to target for their credit-based marketing campaigns. We also provide account review services which assist our customers in managing their customers and prescreen services that help our clients identify potential new customers.

Direct Marketing Services (DMS). Our DMS products enable customers to target specifically defined market segments and individuals based on individual consumer demographic characteristics; design more effective and economically-efficient marketing campaigns; facilitate improved direct mail response; and increase customer loyalty. We offer this information in the form of a list of consumers having specific attributes for ease of use by our customers. These lists categorize consumers based on meeting certain characteristics, interests or demographic attributes (e.g., those having recently acquired a new home). Much of the information used in these products is purchased or licensed from third parties under contracts which generally have one to three year terms. We compile the remainder of the data that we use from public record sources and information that is gathered from consumers directly through voluntary data submissions to us, an example of which is product registration cards. Since the purchased or licensed data is obtained from public sources or other lists containing data that is generally available from multiple sources, in the event that a termination of one or more of these contracts occurs, we believe we could readily acquire the data from other sources. The information in our DMS products is generally less regulated and restricted than the credit information that we maintain; see the "Information Security and Government Regulation" section below. We also offer database management services which facilitate our customers' use of demographic and credit data for marketing purposes.

International

The International operating segment includes our Canada Consumer, Europe and Latin America business units. These business units offer products that are similar to those available in the USCIS operating segment, although data sources tend to rely more heavily on government agencies than in the U.S. These products generate revenue in Argentina, Brazil, Canada, Chile, Ecuador, El Salvador, Honduras, Peru, Portugal, Spain, the U.K. and Uruguay, with support operations located in the Republic of Ireland and Costa Rica.

Canada Consumer. Similar to our OCIS, Mortgage Solutions and CMS business units, Canada Consumer offers products derived from the credit information that we maintain about individual consumers. We offer many products in Canada, including credit reporting and scoring, consumer marketing, risk management, fraud detection and modeling services, together with certain of our decisioning products that facilitate pre-approved offers of credit and automate a variety of credit decisions.

5

Europe. Our European operation provides information solutions, marketing and personal solutions products. Information solutions and personal solutions products are generated from credit records that we maintain and include credit reporting and scoring, risk management, fraud detection and modeling services. Both of these products are sold in the U.K. and our information solutions products are sold in Portugal and Spain. Our commercial products, such as business credit reporting and commercial risk management services, are only available in the U.K. Marketing products, which are similar to those offered in our CMS and DMS business units, are primarily available in the U.K., though we offer some products in Spain as well. We maintain support operations in the Republic of Ireland.

Latin America. Our Latin American operation provides consumer and commercial information solutions products and marketing products. We offer a full range of consumer products, generated from credit records that we maintain, including credit reporting and scoring, risk management, identity verification and fraud detection services. Our consumer products are the primary source of revenue in each of the countries in which we operate, with the exception of Brazil where we are a market leader in commercial products. We offer our commercial products, which include credit reporting, decisioning tools and risk management services, in varying degrees to the countries we serve. We also provide a variety of consumer and commercial marketing products generated from our credit information databases, including business profile analysis, business prospect lists and database management, in varying degrees to the countries we serve. The other countries in which we operate include Argentina, Chile, Ecuador, El Salvador, Honduras, Peru and Uruguay.

TALX

TALX operates in the U.S. through two business units, as follows:

The Work Number® (TWN Services). TWN Services include employment and income verification services; W-2 management services (which include initial distribution, reissue and correction of W-2 forms); paperless pay services that enable employees to electronically receive pay statement information as well as review and change direct deposit account or W-4 information; integrated electronic time capture and reporting services; paperless new-hire services to bring new workers on board using electronic forms; and I-9 management services designed to help clients electronically comply with the immigration laws that require employers to complete an I-9 form for each new hire.

TWN Services enable employers to direct third-party verifiers to our website or to a toll-free telephone number to verify the employee's employment status and income data. We also offer an offline research verification service, which expands employment verification services to locate data which is not included in our existing TWN database. In 2008, we increased our services to provide income verifications through the Internal Revenue Service, using theIRS Direct® product.

We rely on payroll data from over 1,900 organizations, including over half of the Fortune 500, to regularly update the TWN database. This data is updated as employers transmit data electronically directly to us each payroll period. Employers contract to provide this data to us for specified periods under the terms of contracts which range from one to five years. We use this data to provide employment and income verifications to third-party verifiers; the fees we charge for these services are generally per transaction. After the expiration of the applicable contract, absent renewal by mutual agreement of the parties, we generally do not have any further right to use the employment data we obtained pursuant to the contract. We have not experienced significant turnover in the employer contributors to the TWN database because we generally do not charge them to add their employment data to the database and the verification service we offer relieves them of the administrative burden and expense of responding to third party employment verification requests. The database contained 188.9 million employment records at December 31, 2008.

Tax and Talent Management Services. These services are aimed at reducing the cost to the human resources function of businesses by assisting with employment tax matters and planning and improving the cost-effectiveness of talent recruitment and management. We offer a broad suite of services designed to reduce the cost of unemployment

6

claims through effective claims representation and management and efficient processing and to better manage the tax rate that employers are assessed for unemployment taxes. We also offer our customers comprehensive services designed to research the opportunity for obtaining employer-based tax credits (e.g., the federal work opportunity and welfare to work tax credits as well as employment-based state tax credits), process the necessary filings and assist the customer in obtaining the tax credit. In talent management, we also offer secure, electronic-based psychometric testing and assessments, as well as onboarding services using online forms to complete the new hire process for employees of corporate and government agencies.

North America Personal Solutions

Our Personal Solutions products give consumers information to make financial decisions and monitor and protect credit, credit score and identity information through our Credit Watch, Score Watch and ID Patrol monitoring products. Consumers can obtain a copy of credit file information about them and their credit score. We offer monitoring products for consumers who are concerned about identity theft and data breaches, including the Credit Report Control service that allows consumers subscribing to our credit monitoring products to restrict access to their credit report to mitigate unauthorized use of Equifax credit file information by third parties. Our products are available to consumers directly and through relationships with business partners who distribute our products or provide these services to their employees or customers.

North America Commercial Solutions

Our Commercial Solutions products are derived from databases of credit, financial and marketing information regarding businesses in the U.S. and Canada. The business records included in the U.S. credit database have been developed primarily as a part of the Small Business Financial Exchange, Inc., or SBFE. SBFE members, which include a number of commercial lending financial institutions, contribute their data to the member-owned SBFE database which we exclusively manage. Our contract with the SBFE to manage this database is scheduled to expire in 2012, unless renewed by mutual agreement of the parties. The information comprising the database is generally not owned by us, and the participating organizations could discontinue contributing information to the database or our management contract may not be renewed; however, we believe that such an event is unlikely because contributors to the database use the aggregated information in the database to conduct their business and we have a good working relationship with the SBFE members as one of the original founders of this database.

Other databases we have compiled include loan; credit card; public records and leasing history data; trade accounts receivable performance; and Secretary of State and SEC registration information. We also offer scoring and analytical services that provide additional information to help mitigate the credit risk assumed by our customers. We also have a marketing database which hosts approximately 44 million commercial demographic data records from around the world helping companies to identify corporate family structures for enterprise visibility of customers and suppliers.

OUR BUSINESS STRATEGY

Our strategic objective is to be the trusted provider of information solutions that empower our customers to make critical decisions with greater confidence. Data is at the core of our value proposition to our customers. Through our people and technology, we create differentiated value for our customers by focusing on unique data for credit risk evaluation and high value, information-based decisions. Our long-term corporate growth strategy is driven by the following initiatives:

- •

- Increase penetration of our customers' information solutions needs. We continue to increase our share of our customers' spending on information-related services through the development and introduction of new products, pricing our services in accordance with the value they create for customers, increasing the range of current services utilized by customers, and improving the quality of sales and customer support interactions with consumers.

7

- •

- Deploy enabling technology systems and analytics globally. We continue to invest in new technology to enhance the cost-effectiveness, security and functionality of the services we offer and differentiate our products from those offered by our competitors. In addition to custom products for large customers, we seek to develop off-the-shelf enabling technology platforms that are more cost-effective for medium- and smaller-sized customers. We also develop predictive scores and analytics to help customers acquire and manage accounts. We develop industry scores for risk, bankruptcy and specific loan products as well as custom models.

- •

- Invest in unique data sources. We continue to invest in unique sources of credit and non-credit information to enhance the variety and quality of our services and improve our customers' confidence in data-based business decisions. Our TALX business will continue to add employee files in the TWN Services database. Areas of focus for investment in new sources of data include, among others, positive payment data, real estate data and new commercial business data.

- •

- Pursue new vertical markets and expand into emerging markets. We see numerous opportunities to expand in related or emerging markets both in the U.S. and internationally. As an example, we acquired TALX in 2007, which has employment data that expands on the types of services we can offer our customers. Internationally, we expanded into Russia in 2008. We intend to continue to add to our business growth through expansion into new developing and emerging markets such as India and China.

COMPETITION

The market for our products and services is highly competitive and is subject to constant change. Our competitors vary widely in size and the nature of the products and services they offer. Sources of competition are numerous and include the following:

- •

- Competition for our consumer information solutions and personal solutions products varies by both application and industry, but generally includes two global consumer credit reporting companies, Experian Group Limited, or Experian, and TransUnion LLC, or TransUnion, both of which offer a range of consumer credit reporting products that are similar to products we offer, as well as a large number of smaller competitors who offer competing products in specialized areas such as fraud prevention, data vendors, providers of automated data processing services, and software companies offering credit modeling rules or analytical development tools. We believe that our products offer our customers an advantage over those of our competitors because of the quality of our data files, which we believe to be superior in terms of depth and accuracy and the differentiated information solutions services and decisioning technology that provides customers greater value. Our competitive strategy is to emphasize customer solutions and quality while remaining competitive on price. Our marketing services products also compete with the foregoing companies and others who offer demographic information products, including Acxiom Corporation, Harte-Hanks, Inc. and infoUSA, Inc. We also compete with Fair Isaac Corporation with respect to our analytical tools.

- •

- Competition for our commercial solutions products primarily includes Experian and The Dun & Bradstreet Corporation and providers of these services in the international markets we serve. We believe our U.S. small business loan information from financial institutions creates a unique database and product for the small business segment of that market.

- •

- Competition for our employment and income verification services includes large employers who serve their own needs through in-house systems to manage verification as well as outsourcers who manage verification services through a call center. Competition for complementary TWN Services includes payroll processors such as Automatic Data Processing, Inc., or ADP, Paychex, Inc. and Ceridian Corporation. Competitors of our Tax Management Services include in-house management of this function primarily by large employers; ADP; and a number of smaller regional firms that offer tax management services (including Barnett Associates, Thomas & Thorngren, UC Advantage). Talent Management Services competitors include assessment service providers that offer proprietary content (Previsor, Inc., Development Dimensions International, Brainbench, Inc.), human resources consulting firms (AON Corporation, Watson Wyatt Worldwide, Inc., Right Management Consulting) and assessment or test publishers that have proprietary delivery platforms (Devine Group, Inc., Hogan Assessments Systems, Inc., SHL Group plc).

8

We believe that none of our competitors offers the same mix of products and services as we do. Certain competitors may have larger shares of particular geographic or product markets or operate in geographic areas where we do not currently have a presence.

We assess the principal competitive factors affecting our markets to include: product attributes such as quality, adaptability, scalability, interoperability, functionality and ease-of-use; product price; technical performance; access to unique proprietary databases; availability in application service provider, or ASP, format; quickness of response, flexibility and customer services and support; the effectiveness of sales and marketing efforts; existing market penetration; new product innovation; and our reputation as a trusted steward of information.

MARKETS AND CUSTOMERS

Our products and services serve clients across a wide range of industries, including financial services, consumer, human resources, commercial, retail, telecommunications, automotive, utilities, brokerage, healthcare and insurance industries, as well as state and federal governments. We also serve consumers directly. Our revenue stream is highly diversified with our largest customer providing less than 2% of total revenue. The following table outlines the various end-users we serve:

| | | | | | | |

| | Percentage of

Consolidated

Revenue

| |

|---|

| | |

|---|

| | 2008

| | 2007

| |

|---|

| | |

|---|

Financial | | | 31 | % | | 32 | % |

Mortgage | | | 11 | % | | 12 | % |

Consumer | | | 10 | % | | 10 | % |

Human Resources | | | 9 | % | | 5 | % |

Commercial | | | 7 | % | | 8 | % |

Retail | | | 7 | % | | 7 | % |

Telecommunications | | | 7 | % | | 5 | % |

Automotive | | | 5 | % | | 7 | % |

Other(1) | | | 13 | % | | 14 | % |

| | |

| | | 100 | % | | 100 | % |

| | |

- (1)

- Other includes revenue from government, marketing services, insurance and healthcare end-users.

We market our products and services primarily through our own direct sales organization that is organized around sales teams that focus on customer segments typically aligned by vertical markets and geography. Sales groups are based in our headquarters and in field offices located in the U.S. and in markets outside the U.S. We also market our products and services through indirect channels, including alliance partners, joint ventures and other resellers. In addition, we sell through direct mail and various websites, such aswww.equifax.com.

Our largest geographic market segments are North America (the U.S. and Canada); Europe (the U.K., Spain and Portugal); and Latin America (Argentina, Brazil, Chile, Ecuador, El Salvador, Honduras, Peru and Uruguay). We also maintain support operations in Costa Rica and the Republic of Ireland. In 2008, we expanded into Russia by acquiring a minority equity interest in a consumer credit reporting agency.

Revenue from international customers, including end-users and resellers, amounted to 27% of our total revenue in both 2008 and 2007 and 28% of our total revenue in 2006.

TECHNOLOGY AND INTELLECTUAL PROPERTY

We generally seek protection under federal, state and foreign laws for strategic or financially important intellectual property developed in connection with our business. Certain intellectual property, where appropriate, is protected by registration under applicable trademark laws or by prosecution of patent applications. We own several patents registered in the U.S. and certain foreign countries. We also have certain registered trademarks in the U.S. and in many foreign countries. The most important of these are "Equifax," "TALX" and many variations thereof. These trademarks are used in connection with most of our product lines and services. Although these patents and trademarks are important and valuable assets in the aggregate, no single patent, group of patents or trademark, other than our Equifax trademark, is critical to the success of our business.

9

We license other companies to use certain data, technology and other intellectual property rights we own or control, primarily as core components of our products and services, on terms that are consistent with customary industry standards and that are designed to protect our interest in our intellectual property. An example of this type of arrangement is our contract to exclusively manage the SBFE database from 2007 until 2012.

We are licensed by others to use certain data, technology and other intellectual property rights they own or control, none of which is material to our business except for a license from Fair Isaac Corporation, relating to certain credit-scoring algorithms and the right to sell credit scores derived from them, which license has a five-year term expiring in June 2013 and provides for usage-based fees. Additionally, the licenses do not contain early termination provisions except for standard provisions providing the right to terminate in the event of breach by other party. We do not hold any franchises or concessions that are material to our business or results of operations.

INFORMATION SECURITY AND GOVERNMENT REGULATION

Safeguarding the privacy and security of consumer credit information, whether delivered online or in an offline format, is a top priority. We recognize the importance of secure online transactions and we maintain physical, administrative, and technical safeguards to protect personal and business identifiable information. We have security protocols and measures in place to protect information from unauthorized access or alteration. These measures include internal and external firewalls, physical security and technological security measures, and encryption of certain data.

Our databases are regularly updated by information provided by financial institutions, telecommunications companies, other trade credit providers, public records vendors and governments. Various laws and regulations govern the collection and use of this information. These laws and regulations impact how we are able to provide information to our customers and have significantly increased our compliance costs. We are subject to differing laws and regulations depending on where we operate.

U.S. Data and Privacy Protection

Our U.S. operations are subject to various federal and state laws and regulations governing the collection, protection and use of consumer credit and other information, and imposing sanctions for the misuse of such information or unauthorized access to data. Many of these provisions also affect our customers' use of consumer credit or other data we furnish. The information underlying our North America Commercial Services and Direct Marketing Services businesses is less regulated than the other portions of our business. A significant portion of the information maintained by our Direct Marketing Services business is voluntarily provided by individuals, thus this information is subject to fewer restrictions on use.

These laws and regulations that may be applied to portions of our business include, but are not limited to, the following:

- •

- The Fair Credit Reporting Act, or FCRA, which governs among other things the reporting of information to credit reporting agencies that engage in the practice of assembling or evaluating certain information relating to consumers, including Equifax's credit reporting business; making prescreened offers of credit; the sharing of consumer report information among affiliated and unaffiliated third parties; access to credit scores; and requirements for data furnishers and users of consumer report information. Violation of the FCRA, or of similar state laws, can result in an award of actual damages, as well as statutory and/or punitive damages in the event of a willful violation.

- •

- The Fair and Accurate Credit Transactions Act of 2003, or FACT Act, which amended the FCRA and requires, among other things, nationwide consumer credit reporting agencies, such as us, upon the request of a consumer, to place a fraud alert in the consumer's credit file stating that the consumer may be the victim of identity theft or other fraud, and furnish a free annual credit file disclosure to consumers through a centralized request facility we have established with the other nationwide credit reporting agencies. The FACT Act also includes current or pending rules requiring financial institutions to develop policies and procedures to identify potential identity theft, and consumer credit report notice requirements for lenders that use consumer report information

10

in connection with risk-based credit pricing actions. Entities that furnish information to consumer reporting agencies are required to implement procedures and policies regarding the accuracy and integrity of the furnished information and regarding the correction of previously furnished information that is later determined to be inaccurate. Mortgage lenders are required to disclose credit scores to consumers. Additionally, the FACT Act prohibits a business that receives consumer information from an affiliate from using that information for marketing purposes unless the consumer is first provided a notice and an opportunity to direct the business not to use the information for such marketing purposes ("opt-out"), subject to certain exceptions.

- •

- The Financial Services Modernization Act of 1999, or Gramm-Leach-Bliley Act, or GLB, which, among other things, regulates the use of non-public personal financial information of consumers that is held by financial institutions. Equifax is subject to various GLB provisions, including rules relating to the physical, administrative and technological protection of non-public personal financial information. Breach of the GLB can result in civil and/or criminal liability and sanctions by regulatory authorities, such as fines of up to $100,000 per violation and up to five years imprisonment for individuals.

- •

- The Health Insurance Portability and Accountability Act of 1996, or HIPAA, which requires reasonable safeguards to prevent intentional or unintentional use or disclosure of protected health information.

- •

- Federal and state laws governing the use of the Internet and regulating telemarketing, including the federal Controlling the Assault of Non-Solicited Pornography and Marketing Act of 2003, or CAN-SPAM, which regulates commercial email, prohibits false or misleading header information, requires that a commercial email be identified as an advertisement, and requires that commercial emails give recipients an opt-out method.

- •

- Fannie Mae and Freddie Mac regulations applicable to our credit reporting and mortgage solutions products, the Real Estate Settlement Procedures Act and HUD's Regulation X, which requires the disclosure of certain basic information to borrowers concerning settlement costs and prohibits the charging of unearned fees and certain "kickbacks" or other fees for referrals in connection with a residential mortgage settlement service.

A number of states in the U.S. have passed versions of security breach notification and credit file freeze legislation. A file freeze enables consumers, including identity theft victims, or in certain states recipients of data breach notices or all consumers, to place and lift a freeze on access to their credit files. File freeze laws impose differing requirements on credit reporting agencies with respect to how and when to respond to such credit file freeze requests and in the fees, if any, the agencies may charge for freeze-related actions.

We continue to monitor federal and state legislative and regulatory issues involving data privacy and protection.

International Data and Privacy Protection

We are subject to data protection, privacy and consumer credit laws and regulations in the foreign countries where we do business.

- •

- In Canada, the Personal Information Protection and Electronic Documents Act (2000) applies to organizations with respect to personal information that they collect, use or disclose in the course of commercial activities. It requires compliance with the National Standard of Canada Model Code for the Protection of Personal Information, covering accountability and identifying purposes, consent, collection, use, disclosure, retention, accuracy, safeguards, individual access and compliance. The Federal Privacy Commissioner is invested with powers of investigation and intervention, and provisions of Canadian law regarding civil liability apply in the event of unlawful processing which is prejudicial to the persons concerned.

- •

- In Europe, Equifax is subject to the European Union, or EU, data protection laws, including the comprehensive EU Directive on Data Protection (1995), which imposes a number of obligations on Equifax with respect to use of personal data, and includes a prohibition on the transfer of personal information from the EU to other countries that do not provide consumers with an "adequate" level of privacy or security. The EU standard for adequacy is generally stricter and more comprehensive than that of the U.S. and most other countries. In the U.K., the Data Protection Act of 1998 regulates the manner in which we can use third-party data. In addition, regulatory limitations affect our use of the Electoral Roll, one of our key data sources in the U.K. Generally, the data underlying

11

the products offered by our U.K. Information Services and Personal Solutions product lines, excluding our Commercial Services products, are subject to these regulations. In Spain and Portugal, the privacy laws which are subject to the EU Directive on Data Protection regulate all credit bureau and personal solutions activities. Except for negative data, the laws in Spain and Portugal generally require consumer consent for all Equifax activities.

- •

- In Latin America, consumer data protection and privacy laws and regulations exist in Argentina, Chile, Peru and Uruguay. Uruguay generally follows the EU data protection model. There are also constitutional provisions in Argentina, Brazil, Chile, Peru and certain other countries which declare the right to seek judicial protection regarding the use of personal data, and in many of those countries grant individuals the right to access and correction of information in the possession of data controllers.

TALX

The Tax Management business within our TALX segment is potentially impacted by changes in U.S. tax laws or interpretations, for example, those pertaining to work opportunity tax credits and unemployment compensation claims. A subsidiary of TALX, Talent Management, provides employee testing, assessment and talent management services to the federal government through a number of primary contracts and subcontracts with federal agencies, including the Transportation Security Administration. These contracts may be adversely affected by changes in U.S. federal government programs or contractor requirements, including the adoption of new laws or regulations.

PERSONNEL

Equifax employed approximately 6,500 employees in 15 countries as of December 31, 2008. None of our U.S. employees are subject to a collective bargaining agreement and no work stoppages have been experienced. Pursuant to local laws, our employees in Brazil, Spain and Argentina are subject to collective bargaining agreements that govern general salary and compensation matters, basic benefits and hours of work. Equifax is not a party to these agreements.

EXECUTIVE OFFICERS OF EQUIFAX

The executive officers of Equifax and their ages and titles are set forth below. Business experience for the past five years is provided in accordance with SEC rules.

Richard F. Smith (49). Mr. Smith has been Chairman and Chief Executive Officer since December 15, 2005. He was named Chairman-Elect and Chief Executive Officer effective September 19, 2005 and was elected as a Director on September 22, 2005. Prior to that, Mr. Smith served as Chief Operating Officer, GE Insurance Solutions, from 2004 to September 2005 and President and Chief Executive Officer of GE Property and Casualty Reinsurance from 2003 to 2004.

Lee Adrean (57). Mr. Adrean has been Corporate Vice President and Chief Financial Officer since October 2006. Prior to joining Equifax, he served as Executive Vice President and Chief Financial Officer of NDCHealth Corporation from 2004 to 2006. Prior thereto, he served as Executive Vice President and Chief Financial Officer of EarthLink, Inc. from 2000 until 2004.

Kent E. Mast (65). Mr. Mast has served as Chief Legal Officer since he joined Equifax in 2000. His responsibilities include legal services, global sourcing, security and compliance, government and legislative relations, corporate governance and privacy functions.

Coretha M. Rushing (52). Ms. Rushing has been Corporate Vice President and Chief Administrative Officer since 2006. Prior to joining Equifax, she served as an executive coach and HR Consultant with Atlanta-based Cameron Wesley LLC. Prior thereto, she was Senior Vice President of Human Resources at The Coca-Cola Company, where she was employed from 1996 until 2004.

Paul J. Springman (63). Mr. Springman has served as Chief Marketing Officer since February 2004. Prior thereto, he was head of the Predictive Sciences unit from August 2002 until February 2004.

Robert J. Webb (40). Mr. Webb has been Chief Information Officer since November 2004. Prior to joining Equifax, Mr. Webb was employed by General Electric Corporation from 1996 to 2004, where he held Chief Information Officer

12

positions for GE Commercial Finance, GE Global Consumer Finance and GE Energy Services.

J. Dann Adams (51). Mr. Adams has been President, U.S. Consumer Information Solutions since 2007. Prior thereto, he served as Group Executive, North America Information Services from November 2003 until December 2006.

William W. Canfield (70). Mr. Canfield has been President, TALX since May 2007. Prior thereto, he served as Chairman, President and Chief Executive Officer of TALX Corporation since 1988.

Steven P. Ely (53). Mr. Ely has been President, North American Personal Solutions since 2007. Prior thereto, he served as Group Executive, Personal Solutions from August 2005 until December 2006 and Senior Vice President of Product Management and Marketing from February 2004 until August 2005.

Rudolfo M. Ploder (48). Mr. Ploder has been President, International since January 2007. Prior thereto, he was Group Executive, Latin America from February 2004 to January 2007.

Michael S. Shannon (53). Mr. Shannon has been President, North America Commercial Solutions, since January 2007. Prior thereto, he was Group Executive, Europe from February 2002 until December 2006.

Nuala M. King (55). Ms. King has been Senior Vice President and Controller since May 2006. Prior thereto, she was Vice President and Corporate Controller from March 2004 to April 2006. Prior to joining Equifax, Ms. King served as Corporate Controller for UPS Capital from March 2001 until March 2004.

ITEM 1A. RISK FACTORS

In addition to the other information set forth in this report, you should carefully consider the following factors, which could materially affect our business, financial condition or future results. The risks described below are not the only risks facing us. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition or results of operations.

Declining general economic conditions and uncertainties in the global credit and equity markets may adversely affect our operating results and financial condition.

Our business is sensitive to changes in general economic conditions and particularly the level of consumer and commercial credit activity, both inside and outside the U.S. The U.S. economy has been in a recession since December 2007, according to the National Bureau of Economic Research, and it is widely believed that certain elements of the economy, such as housing, were in decline before that time. Other foreign economies in which we compete are also now demonstrating lower growth rates or recessionary declines in economic activity. Worldwide financial markets have experienced extreme disruption in recent months, including, among other things, extreme volatility in security prices, severely diminished liquidity and credit availability, credit rating downgrades, and declining valuations of investments. These factors contributed to reduced demand for our products and services in the fourth quarter of 2008.

We are unable to predict how long the economic downturn will last. However, a continuing economic downturn and financial market disruptions may continue to adversely impact our business through lower demand for consumer credit data and increases in the cancellation or deferral of new credit decision technology and marketing projects; increased pressure on the prices for our products and services; greater difficulty in collecting accounts receivable; reduced access to the credit markets to meet short-term cash needs in the U.S. and fund strategic initiatives; and greater risk of impairment to the value, and a detriment to the liquidity, of our defined benefit pension plan investment portfolio.

Our operating results and financial condition could be harmed if the markets into which we sell our products decline or do not grow as anticipated.

Any decline in our customers' markets or in general economic conditions, including declines related to the current market disruptions described above, would likely result in a reduction in demand for our products and services. In general, our customers use our credit information and related services to process applications for new credit cards, automobile loans, home mortgages, home equity loans and other consumer loans. They also use our credit information

13

and services to monitor existing credit relationships. Consumer demand for credit (i.e., rates of spending and levels of indebtedness) tends to grow more slowly or decline during periods of economic contraction or slow economic growth. Rising rates of interest or reduced access to credit may reduce consumer demand for mortgage loans and also impact our mortgage solutions business. Also, if our customers' markets decline, we may not be able to collect on outstanding amounts due to us. Such decline could harm our consolidated financial position, results of operations, cash flows, and stock price, and could limit our ability to sustain profitability. Also, in such an environment, pricing pressures could intensify. Since a significant portion of our operating expenses is relatively fixed in nature due to sales, research and development and other costs, if we were unable to respond quickly enough these pricing pressures could further reduce our gross margins.

We could face increased competitive pricing pressures.

In the current difficult economic environment, pricing pressures could intensify. Some of our competitors may choose to sell products competitive to ours at lower prices by accepting lower margins and profitability, or may be able to sell products competitive to ours at lower prices given proprietary ownership of data, technical superiority or economies of scale. Price reductions by our competitors could negatively impact our margins and results of operations, and could also harm our ability to obtain new customers on favorable terms. Historically, certain of our products have experienced declines in per unit pricing due to competitive factors and customer demand. If prices decline in the future at faster rates than in the past due to unforeseen changes in competition or customer demand, our business could be adversely affected. Since a significant portion of our operating expenses is relatively fixed in nature due to sales, research and development and other costs, if we were unable to respond quickly enough these pricing pressures could further reduce our gross margins.

The loss of access to credit and other data from external sources could harm our ability to provide our products and services.

We rely extensively upon data from external sources to maintain our proprietary and non-proprietary databases, including data received from customers, strategic partners and various government and public record sources. Our data sources could withdraw their data from us for a variety of reasons, including legislatively or judicially imposed restrictions on use. We also compete with several of our third-party data suppliers. If a substantial number of data sources or certain key data sources were to withdraw or be unable to provide their data, if we were to lose access to data due to government regulation, or if the collection of data becomes uneconomical, our ability to provide products and services to our clients could be materially adversely impacted, which could result in decreased revenues, net income and earnings per share.

Our markets are highly competitive and new product introductions and pricing strategies being offered by our competitors could decrease our sales and market share or require us to reduce our prices in a manner that reduces our operating margins.

We operate in a number of geographic, product and service markets that are highly competitive, as described above under "Item 1. Business — Competition." Competitors may develop products and services that are superior to or that achieve greater market acceptance than our products and services. The sizes of our competitors vary across market segments, as do the resources we have allocated to the segments we target. Therefore, some of our competitors may have significantly greater financial, technical, marketing or other resources than we do in one or more of our market segments, or overall. As a result, our competitors may be in a position to respond more quickly than we can to new or emerging technologies and changes in customer requirements, or may devote greater resources than we can to the development, promotion, sale and support of products and services. Moreover, new competitors or alliances among our competitors may emerge and potentially reduce our market share, revenue or margins. For example, we currently have a business relationship with Fair Isaac Corporation to resell their credit scoring products, and TransUnion and Experian with respect to the VantageScore (SM) credit scoring product which is competitive with certain of Fair Isaac's products.

14

Our cost reduction and restructuring initiatives may not result in anticipated savings or more efficient operations.

Over the past several years, we have implemented, and are continuing to implement, significant cost-reduction measures. These measures have been taken in an effort to improve our profitability, or maintain profitability in the face of pressure on revenues, and realign our company to focus on strategic initiatives. We have incurred restructuring charges in connection with these cost reduction efforts. If these measures are not fully completed or are not completed in a timely fashion, we may not realize their full potential benefit. Such efforts may be disruptive to our operations. These cost reduction measures may have the effect of reducing our talent pool and available resources and, consequently, could have long-term effects on our business by decreasing or slowing improvements in our products, affecting our ability to respond to customers, limiting our ability to expand in new markets and limiting our ability to hire and retain key personnel.

Disruptions in the capital and credit markets could adversely affect our ability to access short-term and long-term capital.

The capital and credit markets have become more volatile as a result of adverse conditions that have caused the failure and near failure of a large number of large financial services companies. Our access to funds under short-term credit facilities is dependent on the ability of the participating banks to meet their funding commitments. Those banks may not be able to meet their funding commitments if they experience shortages of capital and liquidity. Longer disruptions in the capital and credit markets as a result of uncertainty, changing or increased regulation, reduced alternatives or failures of significant financial institutions could adversely affect our access to capital needed for our business. In addition, if the cost of one or more of our strategic acquisition opportunities exceeds our existing resources, or the CSC option described below is exercised, we may be required to seek additional capital.

A decline in our credit ratings could adversely impact on ability to access capital and significantly increase our cost of capital.

Our ability to obtain adequate and cost effective financing depends on our credit ratings as well as the liquidity of financial markets. A negative change in our ratings outlook or any downgrade in our current investment-grade credit ratings by our rating agencies could adversely affect our cost and/or access to sources of liquidity and capital. Additionally, such a downgrade could further limit our access to private credit markets, increase the costs of borrowing under available credit lines and adversely affect our earnings.

If interest rates increase, our net income could be negatively affected.

We maintain levels of debt that we consider prudent based on our cash flows, interest coverage ratio and percentage of debt to capital. We use debt financing to lower our cost of capital, which increases our return on shareholders' equity. This exposes us to adverse changes in interest rates. When appropriate, we use derivative financial instruments to reduce our exposure to interest rate risks. We cannot assure you, however, that our financial risk management program will be successful in reducing the risks inherent in exposures to interest rate fluctuations. Our interest expense is also affected by our credit ratings. In assessing our credit strength, credit rating agencies consider our capital structure and financial policies as well as the aggregate balance sheet and other financial information for the Company. It is our expectation that the credit rating agencies will continue using this methodology. If our credit ratings were to be downgraded as a result of changes in our capital structure, changes in the credit rating agencies' methodology in assessing our credit strength or for any other reason, our cost of borrowing could increase.

We may suffer adverse financial consequences if Computer Sciences Corporation requires us to purchase its credit reporting business at a time when the public equity or debt markets or other financing conditions are unfavorable to us.

In 1988, we entered into an agreement with Computer Sciences Corporation, or CSC, and certain of its affiliates under which CSC's credit reporting agencies utilize our

15

computerized credit database services. Under this agreement, CSC has an option, exercisable at any time, to sell its credit reporting business to us. The option expires in August 2013. The option exercise price will be determined by an appraisal process and would be due in cash within 180 days after the exercise of the option. We estimate that if CSC were to exercise the option at December 31, 2008, the option price would have been approximately $600.0 million to $675.0 million. This estimate is based solely on our internal analysis of the value of the business, current market conditions and other factors, all of which are subject to constant change. Therefore, the actual option exercise price could be materially higher or lower than the estimated amount. If CSC were to exercise its option, we would have to obtain additional sources of funding. We believe that this funding would be available from sources such as additional bank lines of credit and the issuance of public debt and/or equity. However, the availability and terms of any such capital financing would be subject to a number of factors, including credit market conditions, the state of the equity markets, general economic conditions and our financial performance and condition. Because we do not control the timing of CSC's exercise of its option, we could be required to seek such financing and increase our debt levels at a time when market or other conditions are unfavorable.

If we are not able to achieve our overall long-term goals, the value of an investment in our Company could be negatively affected.

We have established and publicly announced certain long-term growth objectives. These objectives were based on our evaluation of our growth prospects, which are generally based on volume and sales potential of many product types, some of which are more profitable than others, and on an assessment of potential level or mix of product sales. There can be no assurance that we will achieve the required volume or revenue growth or mix of products necessary to achieve our growth objectives.

If we do not introduce successful new products and services in a timely manner, our products and services will become obsolete, and our operating results will suffer.

We generally sell our products in industries that are characterized by rapid technological changes, frequent new product and service introductions and changing industry standards. In addition, many of the markets in which we operate are seasonal and cyclical. Without the timely introduction of new products, services and enhancements, our products and services will become technologically or commercially obsolete over time, in which case our revenue and operating results would suffer. The success of our new products and services will depend on several factors, including our ability to properly identify customer needs; innovate and develop new technologies, services and applications; successfully commercialize new technologies in a timely manner; produce and deliver our products in sufficient volumes on time; differentiate our offerings from our competitors' offerings; price our products competitively; anticipate our competitors' development of new products, services or technological innovations; and control product quality in our product development process.

Dependence on outsourcing certain portions of our supply and distribution chain may adversely affect our ability to bring products to market and damage our reputation. Dependence on outsourced information technology and other administrative functions may impair our ability to operate effectively.

As part of our efforts to streamline operations and to cut costs, we have been outsourcing aspects of our application development, information technology, operational support and administrative functions and will continue to evaluate additional outsourcing. Although we have implemented service level agreements and have established monitoring controls, if our outsourcing vendors fail to perform their obligations in a timely manner or at satisfactory quality levels, our ability to bring products to market, our ability to support our customers, and our reputation could suffer. Any failure to perform on the part of these third party providers could impair our ability to operate effectively and could result in lower future revenue, unexecuted efficiencies and impact our results of operations and our stock price.

16

Much of our outsourcing takes place in developing countries and, as a result, may be subject to geopolitical uncertainty.

Failure to adjust our business due to changing market conditions or failure to estimate our customers' demand could adversely affect our income.

Our income could be harmed if we are unable to adjust our business to market fluctuations, including those caused by the seasonal or cyclical nature of the markets in which we operate. The sale of our products and services are dependent, to a large degree, on customers whose industries are subject to seasonal or cyclical trends in the demand for their products. For example, consumer demand for credit is particularly volatile, making demand difficult to anticipate.

Poor investment performance of pension plan holdings and other factors impacting pension plan costs could unfavorably impact our results of operations and liquidity.

Our costs of providing for non-contributory defined benefit pension plans are dependent on a number of factors, such as the rates of return on plan assets, discount rates, the level of interest rates used to measure the required minimum funding levels of the plan, future government regulation and our required or voluntary contributions made to the plans. A significant decline in the value of investments that fund our pension plans, if not offset or mitigated by a decline in our liabilities, may significantly differ from or alter the values and actuarial assumptions used to calculate our future pension expense. A decline in the value of these investments could increase the expense of our pension plans, and we could be required to fund our plans with significant amounts of cash. Such cash funding obligations could have a material impact on our liquidity by reducing cash flows and could negatively affect results of operations.

If we are unable to expand our operations in developing and emerging markets, our growth rate could be negatively affected.

Our success depends in part on our ability to grow our business in developing and emerging markets, which in turn depends on economic and political conditions in those markets and on our ability to acquire or form strategic business alliances and joint ventures and to make necessary investments in facilities, training, marketing and technology. Moreover, the products and services we offer in developing and emerging markets must match our customers' demand for those products. Due to product price, limited purchasing power and differences in the development of consumer credit markets, there can be no assurance that our products will be accepted in any particular developing or emerging market.

Economic, political and other risks associated with international sales and operations could adversely affect our results of operations.

Because we sell our products and services worldwide, our business is subject to risks associated with doing business internationally. We anticipate that revenue from international operations will continue to represent a significant portion of our total revenue. In addition, many of our employees, suppliers, job functions and facilities are increasingly located outside the U.S. Accordingly, our future results could be harmed by a variety of factors, including changes in a specific country's or region's political, economic or other conditions; trade protection measures; data privacy and consumer protection regulations; negative consequences from changes in tax laws; difficulty in staffing and managing widespread operations; differing labor regulations; differing protection of intellectual property; unexpected changes in regulatory requirements; and geopolitical turmoil, including terrorism and war.

Fluctuations in foreign currency exchange could affect our financial results.

We earn revenues, pay expenses, own assets and incur liabilities in countries using currencies other than the U.S. dollar, including among others the British pound, the Euro, the Canadian dollar and the Brazilian real. In 2008, we derived approximately 27 percent of our net operating revenue from operations outside of the U.S. Because our consolidated financial statements are presented in U.S. dollars, we must translate revenues, income and expenses, as well as assets and liabilities, into U.S. dollars at exchange rates in effect during or at the end of each reporting period. Therefore, increases or decreases in the value of the U.S. dollar against other major currencies will affect our net operating revenues, operating income and the value of balance sheet items denominated in foreign currencies. Because of the geographic diversity of our operations, weaknesses in some currencies might be offset by

17

strengths in others over time. We may, but generally do not, use derivative financial instruments to reduce our net exposure to currency exchange rate fluctuations. However, we cannot assure you that fluctuations in foreign currency exchange rates, particularly the strengthening of the U.S. dollar against major currencies, would not materially affect our consolidated financial results.

The impact of consolidation in the financial services, mortgage, retail, telecommunications and other markets is difficult to predict and may harm our business.

The financial services, mortgage, retail and telecommunications industries are intensely competitive and have been subject to increasing consolidation. Consolidation in these and other industries which has occurred in the U.S. and certain foreign markets in 2008 and which may continue to occur in 2009 and beyond could result in lower average prices for the larger combined entities, lower combined purchases of our services than were purchased cumulatively by separate entities prior to consolidation, or existing competitors increasing their market share in newly consolidated entities, which could have a material adverse effect on our business, financial condition and results of operations if we are not retained or chosen as a service provider. We may not be able to compete successfully in an increasingly consolidated industry and cannot predict with certainty how industry consolidation will affect our competitors or us.

Our acquisitions, strategic alliances, joint ventures and divestitures may result in financial outcomes that are different than expected.

In the normal course of business, we frequently engage in discussions with third parties relating to possible acquisitions, strategic alliances, joint ventures and divestitures, and generally expect to complete several transactions per year that we believe are aligned with our strategic focus. We cannot provide assurances that we will be able to find appropriate candidates for acquisitions, reach agreement to acquire them, have the cash or other resources necessary to acquire them, or obtain requisite shareholder or regulatory approvals needed to close strategic acquisitions. The impact of future acquisitions on our business, operating results and financial condition are not known at this time. In the case of businesses we may acquire in the future, we may have difficulty assimilating these businesses and their products, services, technologies, and personnel into our operations. These difficulties could disrupt our ongoing business, distract our management and workforce, increase our expenses and materially adversely affect our operating results and financial condition. Also, we may not be able to retain key management and other critical employees after an acquisition. We may also acquire unanticipated liabilities. In addition to these risks, we may not realize all of the anticipated benefits of these acquisitions.

Our customers and we are subject to various governmental regulations, compliance with which may cause us to incur significant expenses, and if we fail to maintain satisfactory compliance with certain regulations, we could be subject to civil or criminal penalties.

Our businesses are subject to various significant international, federal, state and local regulations, including but not limited to privacy and consumer data protection, health and safety, tax, labor and environmental regulations. These regulations are complex, change frequently and have tended to become more stringent over time. We may be required to incur significant expenses to comply with these regulations or to remedy violations of these regulations. Any failure by us to comply with applicable government regulations could also result in cessation of our operations or portions of our operations or impositions of fines and restrictions on our ability to carry on or expand our operations. In addition, because many of our products are regulated or sold into regulated industries, we must comply with additional regulations in marketing our products.

We also have agreements relating to the sale of our products to government entities, including through the Performance Assessment Network subsidiary of our TALX business and, as a result, we are subject to various statutes and regulations that apply to companies doing business with the government. The laws governing government contracts differ from the laws governing private contracts. For example, many government contracts contain pricing terms and conditions that are not applicable to private contracts. We are also subject to investigation for compliance with the regulations governing government contracts. A failure to comply with these regulations might result in suspension of these contracts, or administrative penalties.

18

Third parties may claim that we are infringing their intellectual property and we could suffer significant litigation or licensing expenses or be prevented from selling products or services.

From time to time, third parties may claim that one or more of our products or services infringe their intellectual property rights. We analyze and take action in response to such claims on a case by case basis. Any dispute or litigation regarding patents or other intellectual property could be costly and time-consuming due to the complexity of our technology and the uncertainty of intellectual property litigation and could divert our management and key personnel from our business operations. A claim of intellectual property infringement could force us to enter into a costly or restrictive license agreement, which might not be available under acceptable terms or at all, or could subject us to significant damages or to an injunction against development and sale of certain of our products or services. Our intellectual property portfolio may not be useful in asserting a counterclaim, or negotiating a license, in response to a claim of intellectual property infringement. In certain of our businesses we rely on third party intellectual property licenses and we cannot ensure that these licenses will be available to us in the future on favorable terms or at all.

Third parties may infringe our intellectual property and we may suffer competitive injury or expend significant resources enforcing our rights.