UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number: | 811-1530 |

| Name of Registrant: | Vanguard Explorer Fund |

| Address of Registrant: | P.O. Box 2600 |

| Valley Forge, PA 19482 | |

| Name and address of agent for service: | Heidi Stam, Esquire |

| P.O. Box 876 | |

| Valley Forge, PA 19482 | |

| Registrant’s telephone number, including area code: | (610) 669-1000 |

| Date of fiscal year end: | October 31 |

| Date of reporting period: | November 1, 2008 – October 31, 2009 |

| Item 1: Reports to Shareholders |

| Vanguard Explorer™ Fund |

| Annual Report |

| October 31, 2009 |

> For fiscal year 2009, Vanguard Explorer Fund’s Investor Shares returned

about 14%, a result that bested peer funds but trailed the fund’s

unmanaged benchmark.

> All but one sector in the fund posted gains as stocks bounced back from a

severe bear market.

> Information technology stocks, the fund’s largest position, accounted for

about half of the fund’s gains.

| Contents | |

| Your Fund’s Total Returns | 1 |

| President’s Letter | 2 |

| Advisors’ Report | 8 |

| Results of Proxy Voting | 14 |

| Fund Profile | 16 |

| Performance Summary | 17 |

| Financial Statements | 19 |

| Your Fund’s After-Tax Returns | 32 |

| About Your Fund’s Expenses | 33 |

| Glossary | 35 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

Cover photograph: Veronica Coia.

Your Fund’s Total Returns

| Fiscal Year Ended October 31, 2009 | ||

| Ticker | Total | |

| Symbol | Returns | |

| Vanguard Explorer Fund | ||

| Investor Shares | VEXPX | 14.46% |

| AdmiralTM Shares1 | VEXRX | 14.66 |

| Russell 2500 Growth Index | 18.21 | |

| Small-Cap Growth Funds Average2 | 12.85 |

| Your Fund’s Performance at a Glance | ||||

| October 31, 2008–October 31, 2009 | ||||

| Distributions Per Share | ||||

| Starting | Ending | Income | Capital | |

| Share Price | Share Price | Dividends | Gains | |

| Vanguard Explorer Fund | ||||

| Investor Shares | $45.54 | $51.77 | $0.282 | $0.000 |

| Admiral Shares | 42.45 | 48.21 | 0.367 | 0.000 |

1 A lower-cost class of shares available to many longtime shareholders and to those with significant investments in the fund.

2 Derived from data provided by Lipper Inc.

1

President’s Letter

Dear Shareholder,

Vanguard Explorer Fund’s Investor Shares returned about 14% for the fiscal year ended October 31, 2009. The fund trailed its benchmark, the Russell 2500 Growth Index, which returned about 18% for the period, but topped the average return for competing funds.

For the 12-month period, the majority of the fund’s advance came from two sectors: information technology and consumer discretionary. Meanwhile, fund holdings in health care and consumer staples underperformed those sectors as represented in the index.

If you own shares of the fund in a taxable account, you may wish to review the discussion on the fund’s after-tax returns that appears later in this report.

A vicious bear market quickly turned bullish

A year ago, the global financial system stood on the brink of collapse as the expanding U.S. credit crisis precipitated the deepest worldwide recession since World War II. Since then, markets have pulled back from the depths and, in fact, have rallied impressively. Although U.S. unemployment has risen to double digits and signs of a robust recovery are hard to find, the global economy has begun to revive. For the first time in more than a year, U.S. gross domestic product registered growth, as reported by the Commerce Department for the third quarter of calendar 2009.

2

U.S. stocks recorded positive returns for the fiscal year ended October 31 as the market’s losses during the first four months of the period—marking the final plunge of a historic bear market—were erased by a remarkable rally beginning in March. Global stocks did even better, thanks to some renewed strength in developed markets and a powerful upswing in emerging markets that actually had some prognosticators worrying about a new asset bubble. Reminders of the markets’ travails are nevertheless apparent in the index returns for the past three years, where negative figures are the rule. Even the five-year returns for U.S. stocks as of October 31 were barely positive, further evidence of the long-term damage done by the collapse of the real estate bubble.

The bond market experienced an equally dramatic turnaround

The stock market’s rapid fall and recovery were matched by an equally dramatic turnaround in the bond market. At the end of 2008, as the credit markets virtually shut down, risk-averse investors flocked to U.S. Treasury bonds. The effect was to widen the difference between the lower yields of Treasuries and the higher yields of corporate bonds to a margin not seen since the Great Depression.

Central banks around the world responded to the economic slowdown by lowering interest rates and implementing other aggressive stimulus programs. Meanwhile, governments boosted spending in hopes of reversing the recessionary tide. As fears of a worldwide depression eased, investors’

| Market Barometer | |||

| Average Annual Total Returns | |||

| Periods Ended October 31, 2009 | |||

| One Year | Three Years | Five Years | |

| Stocks | |||

| Russell 1000 Index (Large-caps) | 11.20% | –6.84% | 0.71% |

| Russell 2000 Index (Small-caps) | 6.46 | –8.51 | 0.59 |

| Dow Jones U.S. Total Stock Market Index | 11.34 | –6.55 | 1.06 |

| MSCI All Country World Index ex USA (International) | 34.79 | –2.49 | 7.58 |

| Bonds | |||

| Barclays Capital U.S. Aggregate Bond Index (Broad taxable market) | 13.79% | 6.35% | 5.05% |

| Barclays Capital Municipal Bond Index | 13.60 | 4.17 | 4.15 |

| Citigroup 3-Month Treasury Bill Index | 0.28 | 2.50 | 2.94 |

| CPI | |||

| Consumer Price Index | –0.18% | 2.32% | 2.52% |

3

appetite for risk returned to more normal levels. The receding pessimism raised demand for corporate bonds, raising their prices and bringing down their yields. Over the past 12 months, both taxable and municipal bonds returned more than 13%.

However, the Fed’s easy-money campaign had a predictable effect on short-term savings vehicles such as money market funds, whose yields track prevailing short-term rates. In December 2008, the Fed reduced its target for the federal funds rate, a benchmark for the interest rates paid by money market instruments and other very short-term securities, to between 0% and 0.25%. The Fed has said it expects to maintain its target at this level “for an extended period.”

Technology stocks boosted the fund’s return

Leading the Explorer Fund’s advance for the 12 months ended October 31 were information technology stocks (+26%), which made up about one-quarter of the fund’s holdings on average during the period.

The fund’s IT holdings advanced smartly as investors anticipated higher spending on hardware, software, and related services. Riverbed Technology Inc., a communications equipment provider, and Euronet Worldwide, an electronic transaction servicer that is one of the fund’s top ten holdings, were two of the best performers in this sector. However, the fund’s IT portfolio underperformed its counterpart in the Russell 2500 Growth

| Expense Ratios1 | |||

| Your Fund Compared With Its Peer Group | |||

| Small-Cap | |||

| Investor | Admiral | Growth Funds | |

| Shares | Shares | Average | |

| Explorer Fund | 0.51% | 0.32% | 1.61% |

1 The fund expense ratios shown are from the prospectus dated February 20, 2009, and represent estimated costs for the current fiscal year

based on the fund’s net assets as of the prospectus date. For the fiscal year ended October 31, 2009, the expense ratios were 0.54% for

Investor Shares and 0.34% for Admiral Shares. The peer-group expense ratio is derived from data provided by Lipper Inc. and captures

information through year-end 2008.

4

Index, even though it represented a greater portion of assets in the fund than in the index.

The fund was hampered a bit by some selections in health care, the second-largest sector in the portfolio. In particular, Explorer’s biotechnology holdings (–5%) proved to be a notable drag on performance, even as health care overall gained 10% in the fund.

The fund’s consumer staples stocks (+3%) performed tepidly. For example, because the fund had only a short-term, negligible position in Whole Foods Market, a stock that made a sizable contribution to the index’s return, the fund missed out as the high-end food retailer tripled in price on a much-improved sales outlook. The advisors’ selections in financials also held the fund

back. However, the effect was muted by the relatively small size of the consumer staples and financial sectors in the index and the fund.

On the other hand, the fund’s energy holdings (+13%)—particularly stocks of companies involved in oil and gas exploration—were solid performers. The fund’s advisors selected companies that took advantage of rising energy prices and advances in oil and gas extraction. The fund also got a boost from its materials stocks (+30%) as demand kicked back into gear after slowing during the depths of the recession.

| Total Returns | |

| Ten Years Ended October 31, 2009 | |

| Average | |

| Annual Return | |

| Explorer Fund Investor Shares | 4.72% |

| Russell 2500 Growth Index | 1.56 |

| Small-Cap Growth Funds Average1 | 0.88 |

The figures shown represent past performance, which is not a guarantee of future results. (Current performance

may be lower or higher than the performance data cited. For performance data current to the most recent month-

end, visit our website at www.vanguard.com/performance.) Note, too, that both investment returns and principal

value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost.

1 Derived from data provided by Lipper Inc.

5

For more information on the fund’s positioning and performance during the year, please see the Advisors’ Report that follows this letter.

A word on expenses

The fund’s expense ratio has risen over the past fiscal year. The explanation is threefold.

First, over the course of the year, the fund’s average net assets declined below their level in fiscal 2008, meaning the fund’s fixed expenses have accounted for a modestly higher percentage of fund assets. Second, the Vanguard funds' contracts with external advisors typically include breakpoint pricing. As assets rise above a breakpoint threshold, advisory fees are paid at a lower rate. When assets fall, a smaller portion of assets is subject to the lower rate, causing the overall rate to increase. Over time, breakpoint pricing has helped shareholders benefit from the economies of scale produced by growth in the fund’s assets.

Finally, Vanguard’s contracts with external advisors generally include incentive-fee provisions and penalties that are contingent on the advisors’ performance relative to their benchmarks. This fee structure helps to ensure that the interests of the fund shareholders and advisors remain aligned. Over the past year, the advisory fee penalty diminished as the fund’s relative performance improved. The fund’s financial statements include more information about Vanguard Explorer Fund’s incentive fee.

Long-term results, while diminished by the downturn, are still solid

When considering a fund’s past performance, Vanguard encourages investors to focus on long-term results. With that being said, an investment’s long-term track record can be distorted, for better or worse, by the most recent short-term results. Although the Explorer Fund delivered strong returns for the most recent 12-month period, the big losses that preceded this rebound have taken a big chunk from its long-term record.

Over the past ten years, the Explorer Fund’s Investor Shares have returned an average of nearly 5% annually. Just two years ago, at the end of the 2007 fiscal year, the fund had an average yearly return of about 10%. Although the long-term results have been noticeably weakened by the market’s recent historic downturn, the fund has performed significantly better than both its benchmark and peer group over the past ten years.

We continue to have confidence in Explorer’s advisors and their valuation-conscious approach to selecting small-company growth stocks. We believe that the fund will continue to provide solid results over the long term.

6

A long-term perspective is still paramount

Although recent months have brought good news for both stock prices and investors, the losses realized in the not-so-distant past won’t be easily forgotten. And, although the stock market seems to be moving in the right direction for now, there’s really no way to be certain what the future will bring.

Uncertainty is the one thing that we can count on in the financial markets. Because of this, Vanguard encourages investors to continue to rely on time-tested principles, including maintaining a long-term perspective and sticking to your plan. By creating and staying with a well-balanced and diversified portfolio that is consistent with your long-term goals, time horizon, and risk tolerance, you’ll have a much better chance of achieving your financial objectives.

We believe that the Explorer Fund, with its low costs and diversification across small-cap growth companies, can be a valuable part of such a well-balanced portfolio.

Thank you for your continued confidence in Vanguard.

Sincerely,

F. William McNabb III

President and Chief Executive Officer

November 17, 2009

| 7 |

Advisors’ Report

For the fiscal year ended October 31, 2009, Vanguard Explorer Fund returned 14.46% for Investor Shares and 14.66% for the lower-cost Admiral Shares. Your fund is managed by seven independent advisors, a strategy that enhances the fund’s diversification by providing exposure to distinct, yet complementary, investment approaches. It’s not uncommon for different advisors to have different views about individual securities or the broader investment environment.

The table following this report lists the advisors, the amount and percentage of fund assets each manages, and brief descriptions of their investment strategies. The advisors have provided the following assessment of the investment environment during the past 12 months and the notable successes and shortfalls in their portfolios. These comments were prepared on November 20, 2009.

Granahan Investment

Management, Inc.

Portfolio Manager:

Jack Granahan, CFA, Managing Partner

Investment environment: The market rally that began in March has been robust, as fears of financial collapse have receded and appetite for risk has increased. Corporate managements have been generally cautious in giving earnings guidance. That, plus significant cost cutting, allowed many of their estimates to be exceeded through the end of September. At some point, as further cost cuts become more difficult, revenue growth will have to become stronger. In the third calendar quarter, 37% of the companies in our portfolio showed revenue growth.

The government’s huge liquidity injections and low rates, and resultant weaker dollar, also undoubtedly have contributed to higher equity prices.

Successes: Most of our biggest gains were in technology and health care, where it was possible to find some companies that were able to grow through the difficult economic conditions. In technology, stocks like SuccessFactors, Salesforce.com, and Concur all performed well as their on-demand software increased customer productivity and lowered costs. Other tech winners included Riverbed Technology and Blue Coat Systems in network optimization. Our strong contributors in health care included Edwards Lifesciences, whose minimally invasive heart valve product showed promise; Align Technology, which saw resilience in the sales of its Invisalign clear braces; and Medarex, which was acquired at a 90% price premium by Bristol-Myers.

Other sectors that recorded positive performance in our portfolio were industrials and energy, as both good stock selection and fortuitous underweighting helped.

Shortfalls: Consumer staples was our worst-performing sector, as two regional supermarkets, Ruddick and Spartan, were down in an otherwise positive sector. We added to Ruddick and recently began to sell our smaller Spartan position.

8

The large consumer discretionary sector produced our highest absolute return for the year but lagged the benchmark sector. Holdings that penalized our portfolio included Skechers, a position we eliminated, and Marchex, which we have reduced.

Wellington Management

Company, LLP

Portfolio Manager:

Kenneth L. Abrams, Senior Vice President

and Equity Portfolio Manager

Investment environment: After months of declines, markets returned to positive territory in April and continued to march higher through the end of the period. With the Federal Reserve maintaining interest rates near zero, investors shifted back into riskier assets, and many stocks that had been punished during the financial crisis rebounded sharply. Signs of economic stabilization overshadowed concerns about high unemployment and weak home prices.

Successes: Our portion of the fund benefited from favorable selections in the materials, consumer discretionary, and information technology sectors. We received solid performances, for example, from holdings in Solutia, TRW Automotive, and Red Hat. Solutia shares gained on improving sales, higher manufacturing and utilization rates, and continued cost controls. TRW Automotive shares rallied in anticipation of a rebound in global auto production. And Red Hat has seen solid results as the firm’s

value-oriented product offerings proved compelling in the challenging market environment.

Shortfalls: Conversely, our industrials holdings—including Covanta and US Airways—were the primary detractors over the trailing 12 months. We eliminated our position in Covanta because we expect that recessionary pressures will lead to longer than expected weakness in the pricing of waste disposal and recycled metal. Shares of US Airways fell as the U.S. airline industry was hurt badly in 2009 by the global economic recession and resulting decline in passenger demand.

Kalmar Investment Advisers

Portfolio Manager:

Ford B. Draper, Jr., President and

Chief Investment Officer

Investment environment: The bear market bottom on March 9 was followed by an enormous rally that went nearly straight up before leveling off recently. Driving this was a pronounced shift in investor sentiment from despair to relief that the financial system and economy were recovering. The markets are now wrestling with the question of whether the recovery—and company earnings progress—will be weak or strong.

So far the rally has been led by a snap back in the smallest, least profitable, most cyclically stretched companies. In contrast, we will maintain our focus on high-quality, self-funding businesses that are increasing their competitive advantages. They should

9

grow even more powerfully if the recovery proves stronger than expected, but far more successfully than most if the recovery is anemic—a good combination.

Successes: In keeping with our bottom-up growth style, our largest contributors came from a mix of industries and were typified by companies that grew successfully despite the sinking economy. These included Rovi, Niko Resources, Cooper Companies, and EnerSys.

Shortfalls: Our largest detractor from relative returns was health care, as our holdings suffered from the uncertainty created by the debate over health care reform, and were affected by operational issues in companies such as Psychiatric Solutions and Immucor.

Vanguard Quantitative Equity Group

Portfolio Manager:

James D. Troyer, CFA, Principal

Investment environment: The panic of the first part of the year drove down all stocks, regardless of individual characteristics, as investors sought to exit the market. In March, the survival of companies that had almost ceased to exist seemed more likely, and these firms roared back to life. Unfortunately, many of these firms had attributes that our model does not seek, such as negative earnings, low margins, and low growth. Value-oriented stocks, which we prefer, were particularly out of favor during the year, presenting our investment process with a significant headwind.

While we are disappointed with our performance for the year, we are not surprised that we lagged during this period. All investment styles endure periods of underperformance. Our benchmark, the Russell 2500 Growth Index, returned 18.21% for the fiscal year. The index had dropped slightly more than 12% through the end of March, and then reversed course with a return of more than 34% for the remainder of the fiscal year.

Successes: We enjoyed success in industrials, with holdings such as Bucyrus International, and in telecommunications, including our position in Centennial Cellular.

Shortfalls: Pharmaceuticals and energy stocks were our least successful industries; our positions in Perrigo and Whiting Pete, for example, hurt performance.

AXA Rosenberg Investment

Management LLC

Portfolio manager:

William E. Ricks, Ph.D., Americas Chief

Executive and Chief Investment Officer

Investment environment: In late 2008, investors witnessed an unprecedented decline in earnings, which prompted record levels of analysts’ revisions. Company earnings became dramatically less certain because of the downward pressure from slowing economies. As a result, investors have shifted their attention to companies with more predictable earnings, albeit with lower earnings growth, over those

10

companies that have greater variability in their earnings outlook. This has driven investors to pay up for “certainty” in earnings and to deemphasize the price paid to purchase those earnings, which presented a challenge to our investment process.

The first few months of 2009 continued to represent a volatile and challenging market environment for active stock pickers. Two key factors were sharp moves in sentiment among sectors and a lack of price discipline exhibited by investors. In particular, previously battered securities sharply rebounded in March and led the rally that continued through the end of the third quarter.

Successes: Our underweighting of financials provided the portfolio with the best overall sector contribution. However, while the underweighting in the sector was rewarded, stock selection partially offset the benefit. Our most significantly underweighted positions were in miscellaneous financial firms and real estate investment trusts. REITs have been challenged in the current economic environment because vacancy rates have increased while their rental rates have declined. An underweight position in Taubman Centers, a retail REIT, aided performance. Within the sector, however, there was wide dispersion in performance.

Many of the troubled financial firms saw their fortunes improve dramatically over the most recent six months. Our proprietary earnings outlook for the sector

forecasted weak earnings, which prevented us from owning many of the high-risk stocks that rallied strongly.

In addition to financials, the energy sector also contributed to performance, because of both sector positioning and stock selection. Our relative performance was helped because we avoided stocks such as Penn Virginia (–45%) and Comstock Resources (–17%).

Shortfalls: The dramatic rally that started in March has been led by beaten-down stocks with poor trailing and forecasted earnings. As a result, stock selection within most sectors hurt our relative performance. Our most challenging sector was technology. Our portfolio’s overweighted position in software companies was driven by firms with strong balance sheets, low interest expense, reasonable valuation levels, and attractive longer-term earnings outlooks; these underperformed the benchmark’s software stocks. However, the earnings outlook for many of the companies that rallied strongly was, in fact, weak.

Chartwell Investment Partners, L.P.

Portfolio Managers:

Edward N. Antoian, CFA, CPA,

Managing Partner

John A. Heffern, Managing Partner and

Senior Portfolio Manager

Investment environment: Cost control amid still-tepid revenues has supported profit margins and fueled a rally in public market valuations. This focus on cost control is evident in the continued

11

weakness in national employment data. Capital and labor are two fundamental economic inputs, and it is clear that capital and profits are being protected at the expense of labor. We expect continued stability in corporate margins, but a sluggish recovery overall. Our stock selection is based on our expectation that enhanced incremental margins will drive superior investment performance as the year draws to a close and we look to further recovery in 2010.

Successes: Stock selection within consumer staples added value. Jarden, a manufacturer of consumer lifestyle products, performed particularly well. Energy and consumer services also helped relative performance.

Shortfalls: Three sectors accounted for nearly all of the portfolio’s underperformance: health care, technology, and industrials. Stock selection disappointed in health care, most notably within medical specialties, hospital and nursing management, and biotechnology. After a strong 2008, two consulting firms, FTI Consulting and Huron Consulting, weighed heavily on our industrials portfolio.

Century Capital Management, LLC

Portfolio Manager:

Alexander L. Thorndike, Chief Investment

Officer and Managing Partner

Investment environment: The pendulum has swung from the severe financial shock of last fall back toward a stabilized economy, and a prevailing rally in the

capital markets has helped improve investor sentiment. Corporate productivity and profitability are encouraging, but consumers remain challenged by high unemployment, high debt, and depressed housing prices. In our opinion, the credit markets and consumer spending will remain constrained for some time, which will have an impact on future economic growth.

We believe that high-quality, competitively advantaged companies will lead the market both in the near future and over the long term. These companies should be best positioned to experience market-share gains, pricing power, and profitable growth in an expansionary environment, and we have positioned the portfolio accordingly to take advantage of seismic shifts during a recovery.

Successes: Health care was our best-performing sector during the period. Top performers included Bruker and Brookdale Senior Living. Financials also contributed to performance, particularly MFA Financial and Eaton Vance.

Shortfalls: Consumer discretionary and consumer staples were our weakest sectors during the period. Matthews International and Ralcorp Holdings, for example, detracted from performance.

Vanguard Explorer Fund Investment Advisors

| Fund Assets Managed | |||

| Investment Advisor | % | $ Million | Investment Strategy |

| Granahan Investment | 25 | 1,960 | Bases its investment process on the beliefs that |

| Management, Inc. | earnings drive stock prices and that small, dynamic | ||

| companies with exceptional growth prospects | |||

| have the greatest long-term potential. A bottom-up, | |||

| fundamental approach places companies in one of | |||

| three life-cycle categories: pioneer, core growth, and | |||

| special situation. In each, the process looks for | |||

| companies with strong earnings growth and | |||

| leadership in their markets. | |||

| Wellington Management | 19 | 1,478 | Conducts research and analysis of individual companies |

| Company, LLP | to select stocks believed to have exceptional growth | ||

| potential relative to their market valuations. Each stock | |||

| is considered individually before purchase, and | |||

| company developments are continually monitored | |||

| for comparison with expectations for growth. | |||

| Kalmar Investment Advisers | 14 | 1,126 | Employs a “growth-with-value” strategy using |

| creative, bottom-up research to uncover vigorously | |||

| growing, high-quality businesses whose stocks can be | |||

| bought while inefficiently valued. The strategy has a | |||

| dual objective of strong returns with lower risk. | |||

| Vanguard Quantitative Equity Group | 13 | 1,053 | Employs a quantitative fundamental management |

| approach, using models that assess valuation, growth | |||

| prospects, management decisions, market sentiment, | |||

| and earnings quality of companies as compared | |||

| with their peers. | |||

| AXA Rosenberg Investment | 12 | 975 | Employs an investment philosophy grounded in |

| Management LLC | fundamental analysis using a two-part quantitative | ||

| model: a valuation model, which compares a stock’s | |||

| price to its fair value, and an earnings-forecast model, | |||

| which identifies companies likely to have superior | |||

| earnings. | |||

| Chartwell Investment Partners, L.P. | 8 | 644 | Uses a bottom-up, fundamental, research-driven |

| stock-selection strategy focusing on companies with | |||

| sustainable growth, strong management teams, | |||

| competitive positions, and outstanding product and | |||

| service offerings. These companies should continually | |||

| demonstrate growth in earnings per share. | |||

| Century Capital Management, LLC | 7 | 524 | Employs a fundamental, bottom-up approach that |

| attempts to identify reasonably priced companies that | |||

| will grow faster than the overall market. Companies | |||

| also must have a superior return on equity, high | |||

| recurring revenues, and improving margins. | |||

| Cash Investments | 2 | 169 | These short-term reserves are invested by Vanguard |

| in equity index products to simulate investment in | |||

| stocks. Each advisor also may maintain a modest | |||

| cash position. | |||

+

13

Results of Proxy Voting

At a special meeting of shareholders on July 2, 2009, fund shareholders approved the following two proposals:

Proposal 1—Elect trustees for each fund.*

The individuals listed in the table below were elected as trustees for each fund. All trustees with the exception of Messrs. McNabb and Volanakis (both of whom already served as directors of The Vanguard Group, Inc.) served as trustees to the funds prior to the shareholder meeting.

| Percentage | |||

| Trustee | For | Withheld | For |

| John J. Brennan | 103,465,394 | 2,806,805 | 97.4% |

| Charles D. Ellis | 103,271,931 | 3,000,269 | 97.2% |

| Emerson U. Fullwood | 103,377,134 | 2,895,066 | 97.3% |

| Rajiv L. Gupta | 103,330,487 | 2,941,713 | 97.2% |

| Amy Gutmann | 103,464,972 | 2,807,228 | 97.4% |

| JoAnn Heffernan Heisen | 103,384,202 | 2,887,997 | 97.3% |

| F. William McNabb III | 103,465,892 | 2,806,307 | 97.4% |

| Andre F. Perold | 103,336,178 | 2,936,021 | 97.2% |

| Alfred M. Rankin, Jr. | 103,446,662 | 2,825,537 | 97.3% |

| Peter F. Volanakis | 103,513,635 | 2,758,565 | 97.4% |

| * Results are for all funds within the same trust. |

Proposal 2—Update and standardize the funds’ fundamental policies regarding:

(a) Purchasing and selling real estate.

(b) Issuing senior securities.

(c) Borrowing money.

(d) Making loans.

(e) Purchasing and selling commodities.

(f) Concentrating investments in a particular industry or group of industries.

(g) Eliminating outdated fundamental investment policies not required by law.

The revised fundamental policies are clearly stated and simple, yet comprehensive, making oversight and compliance more efficient than under the former policies. The revised fundamental policies will allow the funds to respond more quickly to regulatory and market changes, while avoiding the costs and delays associated with successive shareholder meetings.

| Broker | Percentage | ||||

| Explorer Fund | For | Abstain | Against | Non-Votes | For |

| 2a | 99,658,844 | 1,193,928 | 3,315,368 | 2,104,060 | 93.8% |

| 2b | 98,828,846 | 1,332,443 | 4,006,843 | 2,104,068 | 93.0% |

| 2c | 95,245,834 | 1,371,183 | 7,551,118 | 2,104,064 | 89.6% |

| 2d | 97,146,896 | 1,351,338 | 5,669,899 | 2,104,066 | 91.4% |

| 2e | 97,677,627 | 1,273,287 | 5,217,220 | 2,104,066 | 91.9% |

| 2f | 99,392,168 | 1,259,395 | 3,516,572 | 2,104,065 | 93.5% |

| 2g | 99,510,365 | 1,235,084 | 3,422,685 | 2,104,065 | 93.6% |

14

Fund shareholders did not approve this proposal:

Proposal 3—Institute procedures to prevent holding investments in companies that, in the judgment of the board, substantially contribute to genocide or crimes against humanity, the most egregious violations of human rights.

The trustees recommended a vote against the proposal because it called for procedures that duplicate existing practices and procedures of the Vanguard funds.

| Broker | Percentage | ||||

| Vanguard Fund | For | Abstain | Against | Non-Votes | For |

| Explorer Fund | 11,570,118 | 4,697,780 | 87,900,228 | 2,104,073 | 10.9% |

15

Explorer Fund

Fund Profile

As of October 31, 2009

| Portfolio Characteristics | |||

| Comparative | Broad | ||

| Fund | Index1 | Index2 | |

| Number of Stocks | 1,089 | 1,569 | 4,310 |

| Median Market Cap | $1.8B | $1.9B | $28.3B |

| Price/Earnings Ratio | 71.3x | 49.9x | 30.3x |

| Price/Book Ratio | 2.2x | 2.7x | 2.1x |

| Yield3 | 0.8% | 1.9% | |

| Investor Shares | 0.1% | ||

| Admiral Shares | 0.4% | ||

| Return on Equity | 13.7% | 14.9% | 19.4% |

| Earnings Growth Rate | 11.4% | 12.8% | 9.3% |

| Foreign Holdings | 3.5% | 0.0% | 0.0% |

| Turnover Rate | 95% | — | — |

| Expense Ratio4 | — | — | |

| Investor Shares | 0.51% | ||

| Admiral Shares | 0.32% | ||

| Short-Term Reserves | 2.8% | — | — |

| Sector Diversification (% of equity exposure) | |||

| Comparative | Broad | ||

| Fund | Index1 | Index2 | |

| Consumer Discretionary | 16.0% | 17.2% | 10.0% |

| Consumer Staples | 3.6 | 4.7 | 10.3 |

| Energy | 5.1 | 4.6 | 11.6 |

| Financials | 7.3 | 8.6 | 16.3 |

| Health Care | 17.8 | 19.1 | 11.9 |

| Industrials | 15.1 | 14.8 | 10.4 |

| Information Technology | 27.8 | 23.5 | 19.1 |

| Materials | 5.9 | 4.8 | 3.8 |

| Telecommunication | |||

| Services | 0.7 | 1.6 | 2.8 |

| Utilities | 0.7 | 1.1 | 3.8 |

| Volatility Measures5 | ||

| Fund Versus | Fund Versus | |

| Comparative Index1 | Broad Index2 | |

| R-Squared | 0.99 | 0.95 |

| Beta | 0.94 | 1.11 |

| Ten Largest Holdings6 (% of total net assets) | ||

| Alliance Data | data processing and | |

| Systems Corp. | outsourced services | 0.7% |

| MSC Industrial | trading companies | |

| Direct Co., Inc. Class A | and distributors | 0.7 |

| Euronet Worldwide Inc. | data processing | |

| and outsourced | ||

| services | 0.6 | |

| ON Semiconductor Corp. | semiconductors | 0.6 |

| Polycom, Inc. | communications | |

| equipment | 0.6 | |

| TiVo Inc. | application software | 0.6 |

| DeVry Inc. | education services | 0.5 |

| Sapient Corp. | IT consulting | |

| and other services | 0.5 | |

| Edwards Lifesciences Corp. | health care | |

| equipment | 0.5 | |

| Sensient Technologies Corp. | specialty chemicals | 0.5 |

| Top Ten | 5.8% | |

Investment Focus

1 Russell 2500 Growth Index.

2 Dow Jones U.S. Total Stock Market Index.

3 30-day SEC yield for the fund; annualized dividend yield for the indexes. See the Glossary.

4 The expense ratios shown are from the prospectuses dated February 20, 2009, and represent estimated costs for the current fiscal year

based on the fund’s net assets as of the prospectus date. For the fiscal year ended October 31, 2009, the expense ratios were 0.54% for

Investor Shares and 0.34% for Admiral Shares.

5 For an explanation of R-squared, beta, and other terms used here, see the Glossary.

6 The holdings listed exclude any temporary cash investments and equity index products.

16

Explorer Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

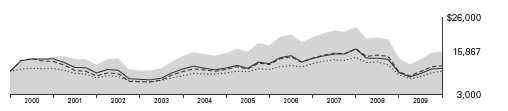

Cumulative Performance: October 31, 1999–October 31, 2009

Initial Investment of $10,000

| Average Annual Total Returns | Final Value | |||

| Periods Ended October 31, 2009 | of a $10,000 | |||

| One Year | Five Years | Ten Years | Investment | |

| Explorer Fund Investor Shares1 | 14.46% | 0.54% | 4.72% | $15,867 |

| Dow Jones U.S. Total Stock Market Index | 11.34 | 1.06 | 0.06 | 10,056 |

| Russell 2500 Growth Index | 18.21 | 2.00 | 1.56 | 11,680 |

| Small-Cap Growth Funds Average2 | 12.85 | –0.18 | 0.88 | 10,914 |

| Final Value | ||||

| Since | of a $100,000 | |||

| One Year | Five Years | Inception3 | Investment | |

| Explorer Fund Admiral Shares | 14.66% | 0.71% | 3.31% | $129,632 |

| Dow Jones U.S. Total Stock Market Index | 11.34 | 1.06 | 2.19 | 118,874 |

| Russell 2500 Growth Index | 18.21 | 2.00 | 3.32 | 129,724 |

1 Total returns do not include the account service fee that may be applicable to certain accounts with balances below $10,000.

2 Derived from data provided by Lipper Inc.

3 Performance for the fund’s Admiral Shares and comparative standards is calculated since the Admiral Shares’ inception:

November 12, 2001.

17

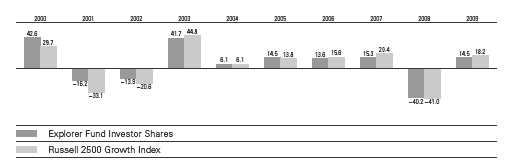

Explorer Fund

Fiscal-Year Total Returns (%): October 31, 1999–October 31, 2009

Average Annual Total Returns: Periods Ended September 30, 2009

This table presents average annual total returns through the latest calendar quarter—rather than through the end of the fiscal period. Securities and Exchange Commission rules require that we provide this information.

| Inception Date | One Year | Five Years | Ten Years | |

| Investor Shares1 | 12/11/1967 | –3.83% | 2.24% | 5.62% |

| Admiral Shares | 11/12/2001 | –3.66 | 2.41 | 4.112 |

1 Total returns do not include the account service fee that may be applicable to certain accounts with balances below $10,000.

2 Return since inception.

See Financial Highlights for dividend and capital gains information.

18

Explorer Fund

Financial Statements

Statement of Net Assets—Investments Summary

As of October 31, 2009

This Statement summarizes the fund’s holdings by asset type. Details are reported for each of the fund’s 50 largest individual holdings and for investments that, in total for any issuer, represent more than 1% of the fund’s net assets. The total value of smaller holdings is reported as a single amount within each category.

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the complete listing of the fund’s holdings is available electronically on Vanguard.com and on the Securities and Exchange Commission’s website (www.sec.gov), or you can have it mailed to you without charge by calling 800-662-7447. For the first and third fiscal quarters, the fund files the lists with the SEC on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| Market | Percentage | |||

| Value• | of Net | |||

| Shares | ($000) | Assets | ||

| Common Stocks | ||||

| Consumer Discretionary | ||||

| DeVry Inc. | 765,356 | 42,317 | 0.5% | |

| * | WMS Industries Inc. | 918,421 | 36,718 | 0.5% |

| * | GameStop Corp. Class A | 1,442,865 | 35,047 | 0.4% |

| * | DreamWorks Animation SKG Inc. Class A | 1,055,100 | 33,763 | 0.4% |

| * | Warnaco Group Inc. | 769,986 | 31,208 | 0.4% |

| Penske Auto Group Inc. | 1,894,920 | 29,674 | 0.4% | |

| * | O’Reilly Automotive Inc. | 795,121 | 29,642 | 0.4% |

| Consumer Discretionary—Other † | 966,037 | 12.2% | ||

| 1,204,406 | 15.2% | |||

| Consumer Staples | ||||

| Ruddick Corp. | 1,301,060 | 34,764 | 0.4% | |

| Nu Skin Enterprises Inc. Class A | 1,426,850 | 32,475 | 0.4% | |

| Consumer Staples—Other † | 205,649 | 2.6% | ||

| 272,888 | 3.4% | |||

| Energy | ||||

| ^ | Core Laboratories NV | 282,090 | 29,422 | 0.4% |

| Energy—Other † | 352,063 | 4.4% | ||

| 381,485 | 4.8% | |||

| Exchange-Traded Funds | ||||

| 1 | Vanguard Small-Cap ETF | 1,165,083 | 60,608 | 0.7% |

| ^,1 | Vanguard Small-Cap Growth ETF | 713,200 | 38,227 | 0.5% |

| ^ | iShares Russell 2000 Index Fund | 523,200 | 29,482 | 0.4% |

| 128,317 | 1.6% | |||

| Financials | ||||

| Discover Financial Services | 2,455,400 | 34,719 | 0.4% | |

| * | Jefferies Group Inc. | 1,257,963 | 32,833 | 0.4% |

| Cash America International Inc. | 984,600 | 29,794 | 0.4% | |

| Financials—Other † | 433,956 | 5.5% | ||

| 531,302 | 6.7% | |||

19

Explorer Fund

| Market | Percentage | |||

| Value• | of Net | |||

| Shares | ($000) | Assets | ||

| Health Care | ||||

| * | Edwards Lifesciences Corp. | 538,850 | 41,459 | 0.5% |

| * | ResMed Inc. | 800,375 | 39,386 | 0.5% |

| Beckman Coulter Inc. | 559,630 | 36,001 | 0.5% | |

| * | Henry Schein Inc. | 680,188 | 35,934 | 0.4% |

| * | Mettler-Toledo International Inc. | 339,309 | 33,083 | 0.4% |

| * | IDEXX Laboratories Inc. | 644,360 | 32,940 | 0.4% |

| * | ICON PLC ADR | 1,303,082 | 32,186 | 0.4% |

| Cooper Cos. Inc. | 1,106,730 | 31,000 | 0.4% | |

| * | QIAGEN NV | 1,477,200 | 30,770 | 0.4% |

| DENTSPLY International Inc. | 851,300 | 28,059 | 0.4% | |

| Health Care—Other † | 1,005,684 | 12.7% | ||

| 1,346,502 | 17.0% | |||

| Industrials | ||||

| MSC Industrial Direct Co. Class A | 1,237,140 | 53,259 | 0.7% | |

| * | Stericycle Inc. | 710,600 | 37,214 | 0.5% |

| ^ | Ritchie Bros Auctioneers Inc. | 1,476,000 | 32,354 | 0.4% |

| * | Corrections Corp. of America | 1,226,054 | 29,352 | 0.4% |

| Equifax Inc. | 1,002,684 | 27,453 | 0.3% | |

| Industrials—Other † | 960,653 | 12.1% | ||

| 1,140,285 | 14.4% | |||

| Information Technology | ||||

| *,^ | Alliance Data Systems Corp. | 1,075,756 | 59,145 | 0.7% |

| * | Euronet Worldwide Inc. | 2,026,474 | 47,926 | 0.6% |

| * | ON Semiconductor Corp. | 6,939,310 | 46,424 | 0.6% |

| * | Polycom Inc. | 2,151,338 | 46,189 | 0.6% |

| * | TiVo Inc. | 4,017,260 | 43,708 | 0.6% |

| * | Sapient Corp. | 5,096,458 | 41,485 | 0.5% |

| * | Informatica Corp. | 1,655,257 | 35,141 | 0.4% |

| * | Ingram Micro Inc. | 1,964,813 | 34,679 | 0.4% |

| * | Red Hat Inc. | 1,286,693 | 33,210 | 0.4% |

| * | Teradyne Inc. | 3,934,740 | 32,934 | 0.4% |

| * | FEI Co. | 1,379,593 | 32,848 | 0.4% |

| * | Sybase Inc. | 780,886 | 30,892 | 0.4% |

| * | NICE Systems Ltd. ADR | 990,595 | 30,679 | 0.4% |

| * | Concur Technologies Inc. | 851,687 | 30,354 | 0.4% |

| Factset Research Systems Inc. | 473,800 | 30,347 | 0.4% | |

| * | PMC - Sierra Inc. | 3,509,451 | 29,901 | 0.4% |

| * | Ariba Inc. | 2,440,485 | 28,847 | 0.4% |

| * | MICROS Systems Inc. | 1,046,239 | 28,165 | 0.4% |

| Information Technology—Other † | 1,427,882 | 18.0% | ||

| 2,090,756 | 26.4% | |||

| Materials | ||||

| Sensient Technologies Corp. | 1,596,950 | 40,387 | 0.5% | |

| Albemarle Corp. | 1,021,170 | 32,249 | 0.4% | |

| * | Solutia Inc. | 2,713,783 | 29,852 | 0.4% |

| Materials—Other † | 344,123 | 4.3% | ||

| 446,611 | 5.6% | |||

| Telecommunication Services † | 54,416 | 0.7% | ||

| Utilities † | 47,537 | 0.6% | ||

| Total Common Stocks (Cost $7,330,799) | 7,644,505 | 96.4%2 | ||

| Temporary Cash Investments | ||||

20

Explorer Fund

| Market | Percentage | |||

| Value• | of Net | |||

| Coupon | Shares | ($000) | Assets | |

| Money Market Fund | ||||

| 3,4 Vanguard Market Liquidity Fund | 0.225% | 370,767,569 | 370,768 | 4.7% |

| 5U.S. Government and Agency Obligations † | 18,294 | 0.2% | ||

| Repurchase Agreement † | 12,000 | 0.2% | ||

| Total Temporary Cash Investments (Cost $401,053) | 401,062 | 5.1%2 | ||

| Total Investments (Cost $7,731,852) | 8,045,567 | 101.5% | ||

| Other Assets and Liabilities | ||||

| Other Assets | 130,582 | 1.6% | ||

| Liabilities4 | (246,712) | (3.1%) | ||

| (116,130) | (1.5%) | |||

| Net Assets | 7,929,437 | 100.0% | ||

| At October 31, 2009, net assets consisted of: | ||||

| Amount | ||||

| ($000) | ||||

| Paid-in Capital | 9,860,604 | |||

| Overdistributed Net Investment Income | (4,365) | |||

| Accumulated Net Realized Losses | (2,238,236) | |||

| Unrealized Appreciation (Depreciation) | ||||

| Investment Securities | 313,715 | |||

| Futures Contracts | (2,286) | |||

| Foreign Currencies | 5 | |||

| Net Assets | 7,929,437 | |||

| Investor Shares—Net Assets | ||||

| Applicable to 109,676,526 outstanding $.001 par value shares of | ||||

| beneficial interest (unlimited authorization) | 5,677,413 | |||

| Net Asset Value Per Share—Investor Shares | $51.77 | |||

| Admiral Shares—Net Assets | ||||

| Applicable to 46,709,709 outstanding $.001 par value shares of | ||||

| beneficial interest (unlimited authorization) | 2,252,024 | |||

| Net Asset Value Per Share—Admiral Shares | $48.21 | |||

• See Note A in Notes to Financial Statements.

* Non-income-producing security.

^ Part of security position is on loan to broker-dealers. The total value of securities on loan is $101,748,000.

† Represents the aggregate value, by category, of securities that are not among the 50 largest holdings and, in total for any issuer, represent

1% or less of net assets.

1 Considered an affiliated company of the fund as the issuer is another member of The Vanguard Group.

2 The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to futures

investments, the fund’s effective common stock and temporary cash investment positions represent 97.3% and 4.2%, respectively, of net

assets.

3 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the

7-day yield.

4 Includes $111,157,000 of collateral received for securities on loan.

5 Securities with a value of $18,294,000 have been segregated as initial margin for open futures contracts.

ADR—American Depositary Receipt.

See accompanying Notes, which are an integral part of the Financial Statements.

21

Explorer Fund

Statement of Operations

| Year Ended | |

| October 31, 2009 | |

| ($000) | |

| Investment Income | |

| Income | |

| Dividends1,2 | 56,491 |

| Interest2 | 2,652 |

| Security Lending | 4,935 |

| Total Income | 64,078 |

| Expenses | |

| Investment Advisory Fees—Note B | |

| Basic Fee | 14,344 |

| Performance Adjustment | (376) |

| The Vanguard Group—Note C | |

| Management and Administrative—Investor Shares | 14,796 |

| Management and Administrative—Admiral Shares | 2,122 |

| Marketing and Distribution—Investor Shares | 1,338 |

| Marketing and Distribution—Admiral Shares | 569 |

| Custodian Fees | 169 |

| Auditing Fees | 33 |

| Shareholders’ Reports and Proxies—Investor Shares | 399 |

| Shareholders’ Reports and Proxies—Admiral Shares | 83 |

| Trustees’ Fees and Expenses | 16 |

| Total Expenses | 33,493 |

| Expenses Paid Indirectly | (398) |

| Net Expenses | 33,095 |

| Net Investment Income | 30,983 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold2 | (1,398,698) |

| Futures Contracts | (4,735) |

| Foreign Currencies | (375) |

| Realized Net Gain (Loss) | (1,403,808) |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities | 2,374,912 |

| Futures Contracts | 9,562 |

| Foreign Currencies | 100 |

| Change in Unrealized Appreciation (Depreciation) | 2,384,574 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 1,011,749 |

1 Dividends are net of foreign withholding taxes of $237,000.

2 Dividend income, interest income, and realized net gain (loss) from affiliated companies of the fund were $1,549,000, $2,396,000, and

($8,493,000), respectively.

See accompanying Notes, which are an integral part of the Financial Statements.

22

Explorer Fund

Statement of Changes in Net Assets

| Year Ended October 31, | ||

| 2009 | 2008 | |

| ($000) | ($000) | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net Investment Income | 30,983 | 46,416 |

| Realized Net Gain (Loss) | (1,403,808) | (795,075) |

| Change in Unrealized Appreciation (Depreciation) | 2,384,574 | (4,113,294) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 1,011,749 | (4,861,953) |

| Distributions | ||

| Net Investment Income | ||

| Investor Shares | (31,118) | (32,844) |

| Admiral Shares | (17,117) | (19,834) |

| Realized Capital Gain1 | ||

| Investor Shares | — | (718,966) |

| Admiral Shares | — | (293,376) |

| Total Distributions | (48,235) | (1,065,020) |

| Capital Share Transactions | ||

| Investor Shares | (49,810) | 294,591 |

| Admiral Shares | (33,340) | 92,430 |

| Net Increase (Decrease) from Capital Share Transactions | (83,150) | 387,021 |

| Total Increase (Decrease) | 880,364 | (5,539,952) |

| Net Assets | ||

| Beginning of Period | 7,049,073 | 12,589,025 |

| End of Period2 | 7,929,437 | 7,049,073 |

1 Includes fiscal 2008 short-term gain distributions totaling $233,468,000. Short-term gain distributions are treated as ordinary income

dividends for tax purposes.

2 Net Assets—End of Period includes undistributed (overdistributed) net investment income of ($4,365,000) and $13,262,000.

See accompanying Notes, which are an integral part of the Financial Statements.

23

Explorer Fund

Financial Highlights

| Investor Shares | |||||

| For a Share Outstanding | Year Ended October 31 | ||||

| Throughout Each Period | 2009 | 2008 | 2007 | 2006 | 2005 |

| Net Asset Value, Beginning of Period | $45.54 | $83.93 | $80.26 | $76.67 | $67.01 |

| Investment Operations | |||||

| Net Investment Income | .178 | .295 | .362 | .302 | .111 |

| Net Realized and Unrealized Gain (Loss) | |||||

| on Investments | 6.334 | (31.589) | 11.052 | 9.724 | 9.622 |

| Total from Investment Operations | 6.512 | (31.294) | 11.414 | 10.026 | 9.733 |

| Distributions | |||||

| Dividends from Net Investment Income | (.282) | (.310) | (.320) | (.230) | — |

| Distributions from Realized Capital Gains | — | (6.786) | (7.424) | (6.206) | (.073) |

| Total Distributions | (.282) | (7.096) | (7.744) | (6.436) | (.073) |

| Net Asset Value, End of Period | $51.77 | $45.54 | $83.93 | $80.26 | $76.67 |

| Total Return1 | 14.46% | –40.17% | 15.31% | 13.59% | 14.53% |

| Ratios/Supplemental Data | |||||

| Net Assets, End of Period (Millions) | $5,677 | $5,026 | $8,937 | $8,517 | $7,836 |

| Ratio of Total Expenses to | |||||

| Average Net Assets2 | 0.54% | 0.44% | 0.41% | 0.46% | 0.51% |

| Ratio of Net Investment Income to | |||||

| Average Net Assets | 0.38% | 0.40% | 0.44% | 0.36% | 0.16% |

| Portfolio Turnover Rate | 95% | 112% | 90% | 96% | 80% |

1 Total returns do not include the account service fee that may be applicable to certain accounts with balances below $10,000.

2 Includes performance-based investment advisory fee increases (decreases) of (0.01%), (0.02%), (0.04%), (0.03%), and (0.01%).

See accompanying Notes, which are an integral part of the Financial Statements.

24

Explorer Fund

Financial Highlights

| Admiral Shares | |||||

| For a Share Outstanding | Year Ended October 31 | ||||

| Throughout Each Period | 2009 | 2008 | 2007 | 2006 | 2005 |

| Net Asset Value, Beginning of Period | $42.45 | $78.25 | $74.82 | $71.47 | $62.37 |

| Investment Operations | |||||

| Net Investment Income | .246 | .385 | .478 | .422 | .215 |

| Net Realized and Unrealized Gain (Loss) | |||||

| on Investments | 5.881 | (29.442) | 10.299 | 9.050 | 8.953 |

| Total from Investment Operations | 6.127 | (29.057) | 10.777 | 9.472 | 9.168 |

| Distributions | |||||

| Dividends from Net Investment Income | (.367) | (.427) | (.437) | (.346) | — |

| Distributions from Realized Capital Gains | — | (6.316) | (6.910) | (5.776) | (.068) |

| Total Distributions | (.367) | (6.743) | (7.347) | (6.122) | (.068) |

| Net Asset Value, End of Period | $48.21 | $42.45 | $78.25 | $74.82 | $71.47 |

| Total Return | 14.66% | –40.07% | 15.53% | 13.79% | 14.70% |

| Ratios/Supplemental Data | |||||

| Net Assets, End of Period (Millions) | $2,252 | $2,023 | $3,652 | $3,264 | $2,402 |

| Ratio of Total Expenses to | |||||

| Average Net Assets1 | 0.34% | 0.26% | 0.23% | 0.28% | 0.34% |

| Ratio of Net Investment Income to | |||||

| Average Net Assets | 0.58% | 0.58% | 0.62% | 0.54% | 0.33% |

| Portfolio Turnover Rate | 95% | 112% | 90% | 96% | 80% |

1 Includes performance-based investment advisory fee increases (decreases) of (0.01%), (0.02%), (0.04%), (0.03%), and (0.01%).

See accompanying Notes, which are an integral part of the Financial Statements.

25

Explorer Fund

Notes to Financial Statements

Vanguard Explorer Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund offers two classes of shares: Investor Shares and Admiral Shares. Investor Shares are available to any investor who meets the fund’s minimum purchase requirements. Admiral Shares are designed for investors who meet certain administrative, service, tenure, and account-size criteria.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued at their fair values calculated according to procedures adopted by the board of trustees. These procedures include obtaining quotations from an independent pricing service, monitoring news to identify significant market- or security-specific events, and evaluating changes in the values of foreign market proxies (for example, ADRs, futures contracts, or exchange-traded funds), between the time the foreign markets close and the fund’s pricing time. When fair-value pricing is employed, the prices of securities used by a fund to calculate its net asset value may differ from quoted or published prices for the same securities. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Temporary cash investments acquired over 60 days to maturity are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Other temporary cash investments are valued at amortized cost, which approximates market value.

2. Foreign Currency: Securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars using exchange rates obtained from an independent third party as of the fund’s pricing time on the valuation date. Realized gains (losses) and unrealized appreciation (depreciation) on investment securities include the effects of changes in exchange rates since the securities were purchased, combined with the effects of changes in security prices. Fluctuations in the value of other assets and liabilities resulting from changes in exchange rates are recorded as unrealized foreign currency gains (losses) until the assets or liabilities are settled in cash, at which time they are recorded as realized foreign currency gains (losses).

3. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market.

Futures contracts are valued at their quoted daily settlement prices. The aggregate principal amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

26

Explorer Fund

4. Repurchase Agreements: The fund may invest in repurchase agreements. Securities pledged as collateral for repurchase agreements are held by a custodian bank until the agreements mature. Each agreement requires that the market value of the collateral be sufficient to cover payments of interest and principal; however, in the event of default or bankruptcy by the other party to the agreement, retention of the collateral may be subject to legal proceedings.

5. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (October 31, 2006–2009), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

6. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

7. Security Lending: The fund may lend its securities to qualified institutional borrowers to earn additional income. Security loans are required to be secured at all times by collateral at least equal to the market value of securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability for the return of the collateral, during the period the securities are on loan. Security lending income represents the income earned on investing cash collateral, less expenses associated with the loan.

8. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

Each class of shares has equal rights as to assets and earnings, except that each class separately bears certain class-specific expenses related to maintenance of shareholder accounts (included in Management and Administrative expenses), shareholder reporting, and proxies. Marketing and distribution expenses are allocated to each class of shares based on a method approved by the board of trustees. Income, other non-class-specific expenses, and gains and losses on investments are allocated to each class of shares based on its relative net assets.

B. Granahan Investment Management, Inc., Wellington Management Company, LLP, Kalmar Investment Advisers, AXA Rosenberg Investment Management LLC, Chartwell Investment Partners, L.P., and Century Capital Management, LLC, each provide investment advisory services to a portion of the fund for a fee calculated at an annual percentage rate of average net assets managed by the advisor. The basic fees of Chartwell Investment Partners, L.P., Granahan Investment Management, Inc., Kalmar Investment Advisers, and Wellington Management Company, LLP, are subject to quarterly adjustments based on performance for the preceding three years relative to the Russell 2500 Growth Index. The basic fee for AXA Rosenberg Investment Management LLC is subject to quarterly adjustments based on performance since July 31, 2007, relative to the Russell 2500 Growth Index. The basic fee for Century Capital Management, LLC, is subject to quarterly adjustments based on performance since October 31, 2008, relative to a 50/50 blend of the Russell 2500 Index and Russell 2500 Growth Index.

The Vanguard Group provides investment advisory services to a portion of the fund on an at-cost basis; the fund paid Vanguard advisory fees of $374,000 for the year ended October 31, 2009.

For the year ended October 31, 2009, the aggregate investment advisory fee represented an effective annual basic rate of 0.21% of the fund’s average net assets, before a decrease of $376,000 (0.01%) based on performance.

27

Explorer Fund

C. The Vanguard Group furnishes at cost corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At October 31, 2009, the fund had contributed capital of $1,761,000 to Vanguard (included in Other Assets), representing 0.02% of the fund’s net assets and 0.70% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

D. The fund has asked its investment advisors to direct certain security trades, subject to obtaining the best price and execution, to brokers who have agreed to rebate to the fund part of the commissions generated. Such rebates are used solely to reduce the fund’s management and administrative expenses. The fund’s custodian bank has also agreed to reduce its fees when the fund maintains cash on deposit in the non-interest-bearing custody account. For the year ended October 31, 2009, these arrangements reduced the fund’s management and administrative expenses by $391,000 and custodian fees by $7,000. The total expense reduction represented an effective annual rate of 0.01% of the fund’s average net assets.

E. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

The following table summarizes the fund’s investments as of October 31, 2009, based on the inputs used to value them:

| Level 1 | Level 2 | Level 3 | |

| Investments | ($000) | ($000) | ($000) |

| Common Stocks | 7,596,435 | 48,070 | — |

| Temporary Cash Investments | 370,768 | 30,294 | — |

| Futures Contracts—Assets1 | 527 | — | — |

| Futures Contracts—Liabilities1 | (2,814) | — | — |

| Total | 7,964,916 | 78,364 | — |

1 Represents variation margin on the last day of the reporting period.

28

Explorer Fund

The following table summarizes changes in investments valued based on Level 3 inputs during the year ended October 31, 2009:

| Investments in | |

| Common Stocks | |

| Amount Valued Based on Level 3 Inputs | ($000) |

| Balance as of October 31, 2008 | 4,568 |

| Transfers out of Level 3 | (2,712) |

| Change in Unrealized Appreciation (Depreciation) | (1,856) |

| Balance as of October 31, 2009 | — |

F. At October 31, 2009, the aggregate settlement value of open futures contracts and the related unrealized appreciation (depreciation) were:

| ($000) | ||||

| Number of | Aggregate | Unrealized | ||

| Long (Short) | Settlement | Appreciation | ||

| Futures Contracts | Expiration | Contracts | Value | (Depreciation) |

| S&P MidCap 400 Index | December 2009 | 91 | 29,912 | (1,137) |

| E-mini NASDAQ 100 Index | December 2009 | 837 | 27,880 | (378) |

| E-mini Russell 2000 Index | December 2009 | 231 | 12,978 | (771) |

Unrealized appreciation (depreciation) on open futures contracts is required to be treated as realized gain (loss) for tax purposes.

G. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

During the year ended October 31, 2009, the fund realized net foreign currency losses of $375,000, which decreased distributable net income for tax purposes; accordingly, such losses have been reclassified from accumulated net realized losses to undistributed net investment income.

For tax purposes, at October 31, 2009, the fund had $15,403,000 of ordinary income available for distribution. The fund had available capital loss carryforwards totaling $2,229,101,000 to offset future net capital gains of $784,127,000 through October 31, 2016, and $1,444,974,000 through October 31, 2017.

At October 31, 2009, the cost of investment securities for tax purposes was $7,743,448,000. Net unrealized appreciation of investment securities for tax purposes was $302,119,000, consisting of unrealized gains of $1,015,229,000 on securities that had risen in value since their purchase and $713,110,000 in unrealized losses on securities that had fallen in value since their purchase.

29

Explorer Fund

H. During the year ended October 31, 2009, the fund purchased $6,335,492,000 of investment securities and sold $6,284,295,000 of investment securities, other than temporary cash investments.

I. Certain of the fund’s investments are in companies that are considered to be affiliated companies of the fund because the fund owns more than 5% of the outstanding voting securities of the company. Transactions during the period in securities of these companies were as follows:

| Current Period Transactions | |||||

| Oct. 31, 2008 | Proceeds from | Oct. 31, 2009 | |||

| Market | Purchases | Securities | Dividend | Market | |

| Value | at Cost | Sold | Income | Value | |

| ($000) | ($000) | ($000) | ($000) | ($000) | |

| Advanta Corp. Class A | 2,425 | — | 1,410 | 180 | — |

| Hollywood Media Corp. | NA1 | 107 | 1,245 | — | NA1 |

| 2,425 | 180 | — | |||

1 Not applicable—At October 31, 2008, and October 31, 2009, the issuer was not an affiliated company of the fund, but it was affiliated

during the period.

J. Capital share transactions for each class of shares were:

| Year Ended October 31, | ||||

| 2009 | 2008 | |||

| Amount | Shares | Amount | Shares | |

| ($000) | (000) | ($000) | (000) | |

| Investor Shares | ||||

| Issued | 834,745 | 18,954 | 981,528 | 15,527 |

| Issued in Lieu of Cash Distributions | 30,644 | 746 | 742,180 | 10,728 |

| Redeemed | (915,199) | (20,390) | (1,429,117) | (22,368) |

| Net Increase (Decrease)—Investor Shares | (49,810) | (690) | 294,591 | 3,887 |

| Admiral Shares | ||||

| Issued | 411,846 | 10,050 | 459,208 | 7,554 |

| Issued in Lieu of Cash Distributions | 15,592 | 408 | 293,573 | 4,559 |

| Redeemed | (460,778) | (11,416) | (660,351) | (11,114) |

| Net Increase (Decrease)—Admiral Shares | (33,340) | (958) | 92,430 | 999 |

K. In preparing the financial statements as of October 31, 2009, management considered the impact of subsequent events occurring through December 15, 2009, for potential recognition or disclosure in these financial statements.

30

Report of Independent Registered

Public Accounting Firm

To the Trustees and Shareholders of Vanguard Explorer Fund:

In our opinion, the accompanying statement of net assets--investments summary and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Vanguard Explorer Fund (the “Fund”) at October 31, 2009, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at October 31, 2009 by correspondence with the custodians and brokers and by agreement to the underlying ownership records of Vanguard Market Liquidity Fund, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

December 15, 2009

Special 2009 tax information (unaudited) for Vanguard Explorer Fund

This information for the fiscal year ended October 31, 2009, is included pursuant to provisions of the Internal Revenue Code.

The fund distributed $48,236,000 of qualified dividend income to shareholders during the fiscal year.

For corporate shareholders, 100.0% of investment income (dividend income plus short-term gains, if any) qualifies for the dividends-received deduction.

31

Your Fund’s After-Tax Returns

This table presents returns for your fund both before and after taxes. The after-tax returns are shown in two ways: (1) assuming that an investor owned the fund during the entire period and paid taxes on the fund’s distributions, and (2) assuming that an investor paid taxes on the fund’s distributions and sold all shares at the end of each period.

Calculations are based on the highest individual federal income tax and capital gains tax rates in effect at the times of the distributions and the hypothetical sales. State and local taxes were not considered. After-tax returns reflect any qualified dividend income, using actual prior-year figures and estimates for 2009. (In the example, returns after the sale of fund shares may be higher than those assuming no sale. This occurs when the sale would have produced a capital loss. The calculation assumes that the investor received a tax deduction for the loss.)

The table shows returns for Investor Shares only; returns for other share classes will differ. Please note that your actual after-tax returns will depend on your tax situation and may differ from those shown. Also note that if you own the fund in a tax-deferred account, such as an individual retirement account or a 401(k) plan, this information does not apply to you. Such accounts are not subject to current taxes.

Finally, keep in mind that a fund’s performance—whether before or after taxes—does not guarantee future results.

| Average Annual Total Returns: Explorer Fund Investor Shares1 | |||

| Periods Ended October 31, 2009 | |||

| One | Five | Ten | |

| Year | Years | Years | |

| Returns Before Taxes | 14.46% | 0.54% | 4.72% |

| Returns After Taxes on Distributions | 14.34 | –0.48 | 3.17 |

| Returns After Taxes on Distributions and Sale of Fund Shares | 9.51 | 0.44 | 3.51 |

1 Total returns do not include the account service fee that may be applicable to certain accounts with balances below $10,000.

32

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the fund’s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading “Expenses Paid During Period.”

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund’s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

| Six Months Ended October 31, 2009 | |||

| Beginning | Ending | Expenses | |

| Account Value | Account Value | Paid During | |

| Explorer Fund | 4/30/2009 | 10/31/2009 | Period1 |

| Based on Actual Fund Return | |||

| Investor Shares | $1,000.00 | $1,171.80 | $2.79 |

| Admiral Shares | 1,000.00 | 1,172.99 | 1.75 |

| Based on Hypothetical 5% Yearly Return | |||

| Investor Shares | $1,000.00 | $1,022.63 | $2.60 |

| Admiral Shares | 1,000.00 | 1,023.59 | 1.63 |