UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 0-6233

1st Source Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Indiana | | 35-1068133 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 100 North Michigan Street | | |

| South Bend, | IN | | 46601 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (574) 235-2000

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock — without par value | | SRCE | | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | x | | Accelerated filer | ☐ | |

| | | | | | |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ | |

| | | | | | |

| | | | Emerging growth company | ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No x

The aggregate market value of the voting common stock held by non-affiliates of the registrant as of June 30, 2023 was $805,217,724

The number of shares outstanding of each of the registrant’s classes of stock as of February 16, 2024: Common Stock, without par value — 24,460,642 shares

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the 2024 Proxy Statement for the 2024 annual meeting of shareholders to be held April 25, 2024, are incorporated by reference into Part III.

TABLE OF CONTENTS

Part I

Item 1. Business.

1ST SOURCE CORPORATION

1st Source Corporation, an Indiana corporation incorporated in 1971, is a bank holding company headquartered in South Bend, Indiana that provides, through its subsidiaries (collectively referred to as “1st Source”, the “Company”, “we”, and “our”), a broad array of financial products and services. 1st Source Bank (“Bank”), its banking subsidiary, offers commercial and consumer banking services, trust and wealth advisory services, and insurance to individual and business clients through most of our 78 banking center locations in 18 counties in Indiana and Michigan and Sarasota County in Florida. 1st Source Bank’s Specialty Finance Group, with 18 locations nationwide, offers specialized financing services for construction equipment, new and pre-owned private and cargo aircraft, and various vehicle types (cars, trucks, vans) for fleet purposes. While our Specialty Finance lending portfolio is concentrated in certain equipment types, we serve a diverse client base. We are not dependent upon any single industry or client. At December 31, 2023, we had consolidated total assets of $8.73 billion, total loans and leases of $6.52 billion, total deposits of $7.04 billion, and total shareholders’ equity of $989.57 million.

Our principal executive office is located at 100 North Michigan Street, South Bend, Indiana 46601 and our telephone number is (574) 235-2000. Access to our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports is available, free of charge, at www.1stsource.com soon after the material is electronically filed with or furnished to the Securities and Exchange Commission (SEC). Information on our website is not incorporated by reference into this Form 10-K or our other public filings. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at www.sec.gov.

1ST SOURCE BANK

Business Services — 1st Source Bank provides commercial, small business, agricultural, and real estate loans primarily to privately owned businesses to finance industrial and commercial properties, equipment, inventories and accounts receivable, acquisitions and for general corporate purposes. Other business services include commercial leasing, treasury management services, payment services, including digital and real time/immediate payments, Fedwires, ACH and merchant services and retirement planning services.

Renewable Energy Financing — 1st Source Bank provides financing for commercial solar projects across the contiguous United States, with a focus in the Northeast and Midwest. We provide construction and permanent loans, and tax equity investments for community solar, commercial and industrial, small utility scale, university, and municipal projects. Project sizes generally range from five megawatts to 20 megawatts.

Consumer Services — 1st Source Bank provides a full range of consumer banking products and services through our banking centers, client service center, and on-line. Traditional banking services include checking and savings accounts, certificates of deposits, Health Savings Accounts and Individual Retirement Accounts as well as loans, credit cards, mortgages and home equity lines of credit. 1st Source also offers a full line of on-line and mobile banking products. Our Automated Teller Machine network supports our debit and credit card program. Consumers also have the ability to obtain consumer loans, credit cards, real estate mortgage loans and home equity lines of credit in any of our banking centers or on-line. 1st Source also offers insurance products through 1st Source Insurance offices or in our banking centers. We also offer a variety of financial planning (through our network of financial advisors), financial literacy, and other consultative services.

Trust and Wealth Advisory Services — 1st Source Bank provides a wide range of trust, investment, agency, and custodial services for individual, estate and trust, corporate, and not-for-profit clients, as well as employee benefit plans and charitable foundations.

Specialty Finance Group Services — Our Specialty Finance Group provides comprehensive commercial equipment loan and lease products in four areas: construction equipment; new and pre-owned aircraft; auto and light trucks; and medium and heavy duty trucks.

Construction equipment financing includes financing of new and pre-owned equipment (i.e., bulldozers, excavators, cranes, loaders, and asphalt and concrete plants etc.). Construction equipment finance receivables generally range from $100,000 to $33 million with fixed or variable interest rates and terms of one to ten years.

Aircraft financing consists of financings for new and pre-owned general aviation aircraft (including helicopters) for private and corporate users, aircraft distributors and dealers, charter operators, cargo carriers, and other aircraft operators. 1st Source Bank provides selective international aircraft financing, primarily in Mexico and Brazil. Aircraft finance receivables generally range from $500,000 to $25 million with fixed or variable interest rates and terms of one to ten years.

We offer auto and light truck fleet financing for new and pre-owned vehicles to automobile and light truck rental companies, commercial leasing companies, and single unit fleet financing for users of specialty vehicles (step vans, vocational work trucks, motor coaches, shuttle buses and funeral cars). The auto and light truck finance receivables generally range from $100,000 to $45 million with fixed or variable interest rates and terms of one to eight years.

The medium and heavy duty truck division provides new and pre-owned fleet financing for highway tractors, medium duty trucks and trailers to the trucking industry. Medium and heavy duty truck finance receivables generally range from $50,000 to $20 million with fixed or variable interest rates and terms of three to eight years.

The Specialty Finance Group operates through 1st Source Bank and its subsidiaries including: Michigan Transportation Finance Corporation, 1st Source Specialty Finance, Inc., SFG Aircraft, Inc., 1st Source Intermediate Holding, LLC, SFG Commercial Aircraft Leasing, Inc., and SFG Equipment Leasing Corporation I.

1ST SOURCE INSURANCE, INC.

1st Source Insurance, Inc. is our insurance agency subsidiary placing property and casualty, individual and group health, and life insurance for individuals and businesses. 1st Source Insurance, Inc. has ten offices.

OTHER CONSOLIDATED SUBSIDIARIES

1st Portfolio Management, Inc. owns and manages certain available-for-sale investment securities.

1st Source Bank is the managing general partner in nine subsidiaries that have interests in tax-advantaged investments with third parties.

We have other subsidiaries that are not significant to the consolidated entity.

1ST SOURCE MASTER TRUST

1st Source Master Trust is an unconsolidated subsidiary created to issue $57.00 million of trust preferred securities and lending the proceeds to 1st Source. We guarantee, on a limited basis, payments of distributions on the trust preferred securities and payments on redemption of the trust preferred securities.

COMPETITION

We compete with other banks, some of which are affiliated with large bank holding companies headquartered outside of our principal market. The Bank also competes with other financial service companies, such as credit unions. securities firms, insurance companies, finance or mortgage companies, real estate investment trusts, and some governmental agencies. We generally compete on the basis of client service and responsiveness to client needs, available loan and deposit products, the rates of interest charged on loans and leases, the rates of interest paid for funds, other credit and service charges, the quality of services rendered, the convenience of banking facilities, and in the case of loans and leases to large commercial borrowers, relative lending limits.

Additional competition for depositors’ funds comes from United States Government securities, private issuers of debt obligations, and suppliers of other investment alternatives for depositors. Many of our non-bank competitors are not subject to the same extensive Federal and State regulations that govern bank holding companies and banks. Such non-bank competitors may, as a result, have certain advantages over us in providing some services.

We compete against these financial institutions by being convenient to do business with, and by taking the time to listen and understand our clients’ needs. We deliver personalized, one-on-one banking through knowledgeable local members of the community always keeping the clients’ best interest in mind while offering a full array of products and highly personalized services. We rely on our history and our reputation in northern Indiana dating back to 1863.

OUR PEOPLE

At December 31, 2023, we had approximately 1,170 colleagues on a full-time equivalent basis. As a service-driven business, our long-term success depends on our people. And as we have grown, the importance of our talent strategy has intensified. We are committed to a multi-dimensional approach to talent and culture.

Diversity, Equity, and Inclusion — We cultivate diversity in all forms as part of building a strong culture in which inclusion and belonging are paramount. Our culture is what unifies our colleagues across our diverse business model, ensures we are best positioned to serve our diverse clients and propels our continuous evolution.

•For the second consecutive year, all new employees completed a series of facilitated training sessions on unconscious bias within six months of hire.

•Diversity in leadership starts with our Board of Directors and we are proud to report that five of our twelve Board Members (42%) are women or minority.

•For the seventh consecutive year, more than 21% of our new hires were diverse colleagues.

•In 2023, the Company was recognized by Newsweek as a Greatest Workplace for Parents and Families and by Forbes as a Best Midsize Employer and Best-In-State Bank.

Training and Talent Development — We believe a critical driver of our future growth is the ability to grow leaders. We provide developmental opportunities for our colleagues at all levels through a robust set of formal and informal programs.

•1st Source University enables colleagues to build skills and knowledge in multiple facets of our business.

•In 2023, 1st Source colleagues completed over 40,000 training modules consisting of over 1,310 different courses covering topics such as regulations, leadership development, relationship building, cybersecurity, communication, and unconscious bias.

•The 1st Source L.E.A.D. program is a set of immersive experiences and collaborative interactions, developing leadership capability over a twelve-month period. The program is built around a series of best-in-class leadership principles.

•The Commercial Banker Development Program is a rotational program for recent college graduates designed to expose participants to fundamentals of commercial banking.

•The Tuition Reimbursement Program reflects our culture of continuous learning. In 2023, we reimbursed over $163,000 to colleagues for tuition at 16 different Colleges and Universities with an average of approximately $3,600 per colleague who used the benefit.

•To encourage our colleagues to build careers delivering the highest levels of outstanding client service at 1st Source Bank, we developed mastery career paths for critical roles including personal and commercial banking, management and pre-management, and customer service. In 2023, 56 career paths were tracked in our new Learning Management System. 897 career paths were accessed by our colleagues, 411 were completed, and more than 6,700 skills were developed.

•The Business of Banking series, facilitated internally, helps colleagues learn more about the banking industry as well as different areas of 1st Source Bank.

Community Engagement — Our organization is only as strong as the communities we serve. 1st Source and our colleagues are proud to support our local schools, nonprofits, and faith groups.

•In 2023, our colleagues donated approximately 14,300 hours to a total of 600 different organizations.

•In 2023, our colleagues contributed over $186,000 to local United Way organizations.

•In 2023, 1st Source contributed over $700,000 to over 470 deserving and successful community service organizations.

REGULATION AND SUPERVISION

General — 1st Source and the Bank are extensively regulated under federal and state law. To the extent the following information describes statutory or regulatory provisions, it is qualified in its entirety by reference to the particular statutory and regulatory provisions.

We are a registered bank holding company under the Bank Holding Company Act of 1956, as amended (BHCA), subject to regulation, supervision, and examination by the Board of Governors of the Federal Reserve System (Federal Reserve). We are required to file annual reports with the Federal Reserve and provide additional information as required.

The Bank, as an Indiana state bank and member of the Federal Reserve System, is subject to prudential supervision by the Indiana Department of Financial Institutions (DFI) and the Federal Reserve Bank of Chicago (FRB Chicago). 1st Source Bank is regularly examined by and subject to regulations promulgated by the DFI and the Federal Reserve. Because the Federal Deposit Insurance Corporation (FDIC) provides deposit insurance to the Bank, we are also subject to supervision and regulation by the FDIC (even though the FDIC is not our primary Federal regulator). The Bank is also subject to regulations promulgated by the Consumer Financial Protection Bureau (CFPB) and to supervision for compliance with such regulations by the DFI and the FRB Chicago.

Bank Holding Company Act — Under the BHCA our activities are limited to (i) business so closely related to banking, managing, or controlling banks as to be a proper incident thereto and (ii) non-bank activities, determined by law or regulation, to be closely related to the business of banking or of managing or controlling banks. The BHCA also requires a bank holding company to obtain approval from the Federal Reserve before (i) acquiring or holding more than 5% voting interest in any bank or bank holding company, (ii) acquiring all or substantially all of the assets of another bank or bank holding company, or (iii) merging or consolidating with another bank holding company.

Capital Standards — The federal bank regulatory agencies use capital adequacy guidelines in their examination and regulation of bank holding companies and banks. If capital falls below the minimum levels established by these guidelines, a bank holding company or bank must submit an acceptable plan for achieving compliance with the capital guidelines and, until its capital sufficiently improves, will be subject to denial of applications and appropriate supervisory enforcement actions. For banks, the FDIC’s prompt corrective action regulations establish five capital levels for financial institutions (“well capitalized,” “adequately capitalized,” “undercapitalized,” “significantly undercapitalized,” and “critically undercapitalized”), and impose mandatory regulatory scrutiny and limitations on institutions that are less than adequately capitalized. At December 31, 2023, the Bank was categorized as “well capitalized,” meaning that our total risk-based capital ratio exceeded 10.00%, our Tier 1 risk-based capital ratio exceeded 8.00%, our common equity Tier 1 risk-based capital ratio exceeded 6.50%, our leverage ratio exceeded 5.00%, and we are not subject to a regulatory order, agreement, or directive to meet and maintain a specific capital level for any capital measure. 1st Source and the Bank have elected not to utilize the community bank leverage ratio framework adopted by the Federal Reserve and the other federal banking agencies in 2020. Regulatory capital requirements to which we are subject are disclosed in Part II, Item 8, Financial Statements and Supplementary Data — Note 20 of the Notes to Consolidated Financial Statements. As of December 31, 2023, we were in compliance with all applicable regulatory capital requirements and guidelines.

Securities and Exchange Commission (SEC) and The NASDAQ Stock Market (NASDAQ) — We are subject to regulations promulgated by the SEC and certain states for matters relating to the offering and sale of our securities. We are subject to the disclosure and regulatory requirements of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. We are listed on the NASDAQ Global Select Market under the trading symbol “SRCE,” and we are subject to the rules of NASDAQ for listed companies.

Gramm-Leach-Bliley Act of 1999 (GLBA) — The GLBA provides for financial activities that a bank may conduct through a financial subsidiary and established a distinct type of bank holding company, known as a financial holding company, which may engage in defined activities that are “financial in nature.” These activities include securities and insurance brokerage, securities underwriting, insurance underwriting, and merchant banking. We do not currently intend to file notice with the Federal Reserve to become a financial holding company or to engage in expanded financial activities through a financial subsidiary of the Bank.

Financial Privacy — The GLBA also includes privacy protections for nonpublic personal information held by financial institutions regarding their customers. Rules under GLBA limit the ability of banks to disclose non-public information about customers to nonaffiliated third parties. These limitations require disclosure of privacy policies to consumers and, in some circumstances, allow consumers to prevent disclosure of certain personal information to a nonaffiliated third party. The privacy provisions of the GLBA affect how consumer information is transmitted through diversified financial companies and conveyed to outside vendors. We are also subject to various state laws, including the California Consumer Privacy Act, that generally require us (directly or indirectly through our vendors) to protect the personal information of individual customers and notify them if confidentiality of their personal information is or may have been compromised as the result of a data security breach or failure.

USA Patriot Act of 2001 — Regulations under the USA Patriot Act require financial institutions to maintain appropriate controls to combat money laundering activities, perform due diligence of private banking and correspondent accounts, establish standards for verifying customer identity, and provide records related to suspected anti-money laundering activities upon request from federal authorities. A financial institution’s failure to comply with these regulations could result in fines or sanctions, including restrictions on conducting acquisitions or establishing new branches, and could also have other serious legal and reputational consequences for the institution.

Community Reinvestment Act of 1977 (CRA) — The CRA requires federal banking regulators to evaluate the record of the financial institutions they examined in meeting the credit needs of their local communities, including low and moderate income neighborhoods. Federal banking regulators will consider our performance in these areas as they review any applications we may file to engage in mergers or acquisitions or to open a branch or facility.

On October 24, 2023, federal banking agencies issued a final rule designed to strengthen and modernize the regulations implementing the CRA. The changes are designed to encourage banks to expand access to credit, investment and banking services in low- and moderate-income communities, adapt to industry changes including mobile and internet banking, provide greater clarity and consistency in the application of CRA regulations and tailor CRA evaluations and data collection to bank size and type.

Laws and Regulations Governing Extensions of Credit — The Bank is subject to restrictions imposed by the Federal Reserve Act on extensions of credit to 1st Source or our subsidiaries, and on investments in our securities and the use of our securities as collateral for loans to any borrowers. These restrictions may limit our ability to obtain funds from the Bank for our cash needs, including funds for acquisitions and for payment of dividends, interest and operating expenses. Further, the BHCA, certain regulations issued by the Federal Reserve, state laws and many other federal laws govern extensions of credit and generally prohibit a bank from extending credit, engaging in a lease or sale of property, or furnishing services to a customer on condition that the customer request and obtain additional services from the bank’s holding company or from one of its subsidiaries.

The Bank is also subject to numerous restrictions imposed by the Federal Reserve Act on extensions of credit to executive officers, directors, principal shareholders of the Bank or 1st Source or any related interest of such persons.

Reserve Requirements — Federal Reserve regulations require depository institutions to maintain reserves against their transaction account deposits. In March 2020, in response to the COVID-19 pandemic, the Federal Reserve set the reserve requirement ratio for all net transaction accounts to zero percent, and this requirement remained in place throughout 2023; therefore, all of the Bank’s net transaction accounts as of December 31, 2023 were exempt from reserve requirements.

Dividends — The ability of the Bank to pay dividends is limited by state and federal laws and regulations that require the Bank to obtain the prior approval of the DFI and the FRB Chicago before paying a dividend that, together with other dividends it has paid during a calendar year, would exceed the sum of its net income for the year to date combined with its retained net income for the previous two years. The amount of dividends the Bank may pay may also be limited by certain covenant agreements and by the principles of prudent bank management. See Part II, Item 5, Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities for further discussion of dividend limitations.

Monetary Policy and Economic Control — The commercial banking business also is affected by the monetary policies of the Federal Reserve. Changes in the discount rate on member bank borrowing, availability of borrowing at the “discount window,” open market operations, the imposition of changes in reserve requirements against member banks’ deposits and assets of foreign branches, and the imposition of, and changes in, reserve requirements against certain borrowings by banks and their affiliates, are some of the tools of monetary policy available to the Federal Reserve. These monetary policies are used in varying combinations to influence overall growth and distributions of bank loans, investments, and deposits, and such use may affect interest rates charged on loans and leases or paid on deposits. The monetary policies of the Federal Reserve have had a significant effect on the operating results of commercial banks and are expected to do so in the future. The monetary policies of the Federal Reserve are influenced by various factors, including economic growth, inflation, unemployment, short-term and long-term changes in the international trade balance, and in the fiscal policies of the U.S. Government. Future monetary policies and the effect of such policies on our future business and earnings, and the effect on the future business and earnings of the Bank cannot be predicted.

In March 2023, the Federal Reserve created a Bank Term Funding Program (BTFP) to provide funding to eligible depository institutions in addition to the funding provided through its “discount window.” The BTFP offers loans up to one year in length that can be prepaid without penalty. The amount that can be borrowed under the BTFP is based upon the par value of the securities pledged as collateral to the Federal Reserve. Advances can be requested under the BTFP until March 11, 2024. At December 31, 2023, the Bank had $100 million of BTFP borrowings.

Sarbanes-Oxley Act of 2002 (SOA) — The SOA includes provisions intended to enhance corporate responsibility and protect investors by improving the accuracy and reliability of corporate disclosures pursuant to the securities laws, and which increase penalties for accounting and auditing improprieties at public traded companies. The SOA generally applies to all companies, including 1st Source, that file or are required to file periodic reports with the SEC under the Exchange Act.

SOA also addresses functions and responsibilities of audit committees of public companies. The statute, by mandating certain stock exchange listing rules, makes the audit committee directly responsible for the appointment, compensation, and oversight of the work of the company’s outside auditor, and requires the auditor to report directly to the audit committee. The SOA requires that audit committees be empowered to engage independent counsel and other advisors, and requires a public company to provide funding to pay the company’s auditors and any advisors the audit committee retains.

Consumer Financial Protection Laws — The Bank is subject to numerous federal and state consumer financial protection laws and regulations that extensively govern its transactions with consumers. These laws include, but are not limited to, the Equal Credit Opportunity Act, the Fair Credit Reporting Act, the Truth in Lending Act, the Truth in Savings Act, the Electronic Funds Transfer Act, the Expedited Funds Availability Act, the Home Mortgage Disclosure Act, the Fair Housing Act, the Real Estate Settlement Procedures Act, the Fair Debt Collection Practices Act, and the Service Members Civil Relief Act. The Bank must also comply with applicable state usury and other credit and deposit related laws and regulations and other laws and regulations prohibiting unfair, deceptive and abusive acts and practices. These laws and regulations, among other things, require disclosures of the cost of credit and the terms of deposit accounts, prohibit discrimination in credit transactions, regulate the use of credit report information, restrict the Bank’s ability to raise interest rates and subject the Bank to substantial regulatory oversight. Violations of these laws may expose us to liability from potential lawsuits brought by affected customers. Federal bank regulators, state attorneys general and state and local consumer protection agencies may also seek to enforce these consumer financial protection laws, in which case we may be subject to regulatory sanctions, civil money penalties, and customer rescission rights. Failure to comply with these laws may also cause the Federal Reserve or DFI to deny approval of any applications we may file to engage in merger and acquisition transactions with other financial institutions or open a new banking center.

Dodd-Frank Wall Street Reform and Consumer Protection Act — The Dodd-Frank Act includes provisions that, among other things, relax rules on interstate branching, allow financial institutions to pay interest on business checking accounts, and impose heightened capital requirements on bank holding companies. The Dodd-Frank Act also established the CFPB as an independent entity within the Federal Reserve, and transferred to the CFPB primary responsibility for administering substantially all federal consumer compliance protection laws. The Dodd-Frank Act also authorizes the CFPB to promulgate consumer protection regulations that apply to all entities, including banks, that offer consumer financial services or products. It also includes a series of provisions covering mortgage loan origination standards affecting, among other things, originator compensation, minimum repayment standards, and pre-payment penalties.

The Volcker Rule — The Dodd-Frank Act prohibits banks and their affiliates from engaging in proprietary trading and from investing in and sponsoring hedge funds and private equity funds. This provision is commonly called the “Volcker Rule.” The regulations implementing the Volcker Rule exempt the Bank, as a bank with less than $10 billion in total consolidated assets that does not engage in any covered activities other than trading in certain government, agency, state or municipal obligations, from any significant compliance obligations under the Volcker Rule.

Item 1A. Risk Factors.

An investment in our common stock is subject to risks inherent to our business. The material risks and uncertainties that we believe affect us are described below. See “Forward Looking Statements” under Item 7 of this report for a discussion of other important factors that can affect our business.

Credit Risks

We are subject to credit risks relating to our loan and lease portfolios — Commercial and commercial real estate loans generally involve higher credit risks than residential real estate and consumer loans. Because payments on loans secured by commercial real estate or equipment are often dependent upon the successful operation and management of the underlying assets, repayment of such loans may be influenced to a great extent by conditions in the market or the economy. We seek to mitigate these risks through our underwriting standards. Most commercial and industrial loans are secured by the assets being financed or other business assets; however, some loans may be made on an unsecured basis.

We offer both fixed-rate and adjustable-rate consumer mortgage loans secured by properties, substantially all of which are located in our primary market area. Adjustable-rate mortgage loans help reduce our exposure to changes in interest rates; however, during periods of rising interest rates, the risk of default on adjustable-rate mortgage loans may increase as a result of repricing and the increased payments required from the borrower. Additionally, some residential mortgages are sold into the secondary market and serviced by our principal banking subsidiary, 1st Source Bank.

Consumer loans are primarily all other non-real estate loans to individuals in our regional market area. Consumer loans can entail risk, particularly in the case of loans that are unsecured or secured by rapidly depreciating assets. In these cases, any repossessed collateral may not provide an adequate source of repayment of the outstanding loan balance. The remaining deficiency often does not warrant further substantial collection efforts against the borrower beyond obtaining a deficiency judgment. In addition, consumer loan collections are dependent on the borrower’s continuing financial stability, and thus are more likely to be adversely affected by job loss, divorce, illness, or personal bankruptcy.

The 1st Source Specialty Finance Group loan and lease portfolio consists of commercial loans and leases secured by construction and transportation equipment, including aircraft, autos, trucks, and vans.

Our construction and transportation related businesses could be adversely affected by slowdowns in the economy. Clients who rely on the use of assets financed through the Specialty Finance Group to produce income could be negatively affected, and we could experience substantial loan and lease losses. By the nature of the businesses these clients operate in, we could be adversely affected by rapid increases or decreases in fuel costs, terrorist and other potential attacks, and other destabilizing events. These factors could contribute to the deterioration of the quality of our loan and lease portfolio, as they could have a negative impact on the travel and transportation sensitive businesses for which our Specialty Finance Group provides financing.

Our aircraft portfolio has foreign exposure, particularly in Mexico and Brazil. Currency fluctuations could have a negative impact on our client’s cost of paying dollar denominated debts and, as a result, we could experience higher delinquency in this portfolio. Also, since some of the relationships in this portfolio are large, a slowdown in these markets could have a significant adverse impact on our performance.

In addition, our leasing and equipment financing activity is subject to the risk of cyclical downturns, industry concentration and clumping, and other adverse economic developments affecting these industries and markets. This area of lending, with transportation in particular, is dependent upon general economic conditions and the strength of the travel, construction, and transportation industries.

Our allowance for credit losses may prove to be insufficient to absorb losses in our loan and lease portfolio — There is always a risk that borrowers may not repay borrowings. The determination of the appropriate level of the allowance for credit losses inherently involves a high degree of subjectivity and requires us to make significant estimates of current credit risks and future trends, all of which may undergo material changes. Our allowance for credit losses may not be sufficient to cover the loan and lease losses that we may actually incur. If we experience defaults by borrowers in any of our businesses, our earnings could be negatively affected. Changes in local economic conditions could adversely affect credit quality, particularly in our local business loan and lease portfolio. Changes in national or international economic conditions could also adversely affect the quality of our loan and lease portfolio and negate, to some extent, the benefits of national or international diversification through our Specialty Finance Group’s portfolio. In addition, bank regulatory agencies periodically review our allowance for credit losses and may require an increase in the provision for credit losses or the recognition of further loan or lease charge-offs based upon their judgments, which may be different from ours.

The soundness of other financial institutions could adversely affect us — Financial services institutions are interrelated as a result of trading, clearing, counterparty, or other relationships. We have exposure to many different industries and counterparties, and we routinely execute transactions with counterparties in the financial services industry, including commercial banks, brokers and dealers, investment banks, and other institutional clients. Many of these transactions expose us to credit risk in the event of a default by our counterparty or client. In addition, our credit risk may be exacerbated when the collateral held by us cannot be realized or is liquidated at prices not sufficient to recover the full amount of the credit or derivative exposure due us. Any such losses could have a material adverse effect on our financial condition and results of operations.

We may be adversely affected by climate change and related legislative and regulatory initiatives — Federal and state legislatures and regulatory agencies continue to propose and advance numerous legislative and regulatory initiatives seeking to mitigate the effects of climate change. As a financial institution, it is unclear how future governmental regulations and shifts in business trends resulting from increased concern about climate change will affect our operations, however, natural or man-made disasters and severe weather events may cause operational disruptions and damage to both our properties and properties securing our loans. Losses resulting from these disasters and severe weather events may make it more difficult for borrowers to timely repay their loans. Additionally, our customers who finance vehicles and equipment reliant on fossil fuels could face cost increases, asset value reductions, operating process changes, and the like. If these events occur, we may experience a decrease in the value of our loan and lease portfolio and our revenue, and may incur additional operational expenses, each of which could have a material adverse effect on our financial condition and results of operations.

Market Risks

Fluctuations in interest rates could reduce our profitability and affect the value of our assets — Like other financial institutions, we are subject to interest rate risk. Our primary source of income is net interest income, which is the difference between interest earned on loans and leases and investments, and interest paid on deposits and borrowings. We expect that we will periodically experience imbalances in the interest rate sensitivities of our assets and liabilities and the relationships of various interest rates to each other. Over any defined period of time, our interest-earning assets may be more sensitive to changes in market interest rates than our interest-bearing liabilities, or vice-versa. In addition, the individual market interest rates underlying our loan and lease and deposit products may not change to the same degree over a given time period. If market interest rates should move contrary to our position, earnings may be negatively affected. In addition, loan and lease volume and quality and deposit volume and mix can be affected by market interest rates as can the businesses of our clients. Changes in levels of market interest rates could have a material adverse effect on our net interest spread, asset quality, origination volume, and overall profitability. Additionally, changes in levels of market interest rates could cause our debt securities available-for-sale to move into unrealized loss positions which is a negative component of total shareholders’ equity.

Market interest rates are beyond our control, and they fluctuate in response to general economic conditions and the policies of various governmental and regulatory agencies, in particular, the Federal Reserve Board. Changes in monetary policy, including changes in interest rates, may negatively affect our ability to originate loans and leases, the value of our assets and our ability to realize gains from the sale of our assets, all of which ultimately could affect our earnings.

Adverse changes in economic conditions could impair our financial condition and results of operations — We are impacted by general business and economic conditions in the United States and abroad. These conditions include short-term and long-term interest rates, inflation, money supply, political issues, legislative and regulatory changes, fluctuations in both debt and equity capital markets, broad trends in industry and finance, unemployment, infectious disease epidemics or outbreaks and the strength of the U.S. economy and the local economies in which we operate, all of which are beyond our control. A deterioration in economic conditions could result in an increase in loan delinquencies and non-performing assets, decreases in loan collateral values and a decrease in demand for our products and services.

Changes in economic conditions may negatively impact the fees generated by our trust and wealth advisory business — Trust and wealth advisory fees are largely based on the size of client relationships and the market value of assets held under management. Changes in general economic conditions and in the financial and securities markets may negatively impact the value of our clients’ wealth management accounts and the market value of assets held under management. Market declines, reductions in the value of our clients’ accounts, and the loss of wealth management clients may negatively impact the fees generated by our trust and wealth management business and could have an adverse effect on our business, financial condition and results of operations.

Continued elevated levels of inflation could adversely impact our business and results of operations — The U.S. has recently experienced elevated levels of inflation, with the consumer price index climbing approximately 7% in 2022 and increased at a more moderate rate in 2023. Continued elevated levels of inflation could have complex effects on our business and results of operations, some of which could be materially adverse. The Federal Reserve increased interest rates dramatically during 2022 and 2023 in an effort to halt and reverse continued elevated inflation, which has negatively impacted the value of our available-for-sale investment securities portfolio. In addition, inflation-related increases in our interest expense is due to increased rates paid on deposits. Elevated levels of inflation has also caused increased volatility and uncertainty in the business environment, which could adversely affect loan demand and our clients’ ability to repay indebtedness. Governmental responses to the current inflationary environment, such as severe changes to monetary and fiscal policy, or the imposition or threatened imposition of price controls, could adversely affect our business. The duration and severity of the current inflationary period and the resulting impact on us cannot be predicted with precision.

Liquidity Risks

We could experience an unexpected inability to obtain needed liquidity which could adversely affect our business, profitability, and viability as a going concern — The liquidity of a financial institution reflects its ability to meet loan requests, to accommodate possible outflows in deposits, and to take advantage of interest rate market opportunities and is essential to a financial institution’s business. The ability of a financial institution to meet its current financial obligations is a function of its balance sheet structure, its ability to liquidate assets, and its access to alternative sources of funds. The bank failures in the Spring of 2023 exemplify the potential serious results of the unexpected inability of insured depository institutions to obtain needed liquidity to satisfy deposit withdrawal requests, including how quickly such requests can accelerate once uninsured depositors lose confidence in an institution’s ability to satisfy its obligations to depositors. We seek to ensure our funding needs are met by maintaining a level of liquidity through asset and liability management. If we become unable to obtain funds when needed, it could have a material adverse effect on our business, financial condition, and results of operations. Additionally, under Indiana law governing the collateralization of public fund deposits, the Indiana Board for Depositories determines which financial institutions are required to pledge collateral based on the strength of their financial ratings. We have been informed that no collateral is required for our public fund deposits. However, the Board of Depositories could alter this requirement in the future, which could adversely affect our liquidity depending on the amount of collateral we may be required to pledge.

We rely on dividends from our subsidiaries — We receive substantially all of our revenue from dividends from our subsidiaries, including, primarily, the Bank. These dividends are the principal source of funds we use to pay dividends on our common stock and interest and principal on our debt. Various federal and state laws and regulations limit the amount of dividends our subsidiaries may pay to us. In the event our subsidiaries are unable to pay dividends to us, we may not be able to service debt, pay other obligations, or pay dividends on our common stock. Our inability to receive dividends from our subsidiaries could have a material adverse effect on our business, financial condition and results of operations.

Operational Risks

Our risk management framework could prove ineffective which could have a material adverse effect on our ability to mitigate risks and/or losses — We have established a risk management framework to identify and manage our risk exposure. This framework is comprised of various processes, systems and strategies, and is designed to manage the types of risk to which we are subject, including, credit, market, liquidity, operational, legal/compliance, and reputational risks. Our framework also includes financial, analytical and forecasting modeling methodologies which involve significant management assumptions and judgment that may not be accurate, particularly in times of market stress or other unforeseen circumstances. Additionally, our Board of Directors has adopted a risk appetite statement in consultation with management which sets forth certain thresholds and limits to govern our overall risk profile. There can be no assurance that our risk management framework will be effective under all circumstances or that it will adequately identify, manage or limit any risk of loss to us. Any such failure in our risk management framework could have a material adverse effect on our business, financial condition, and results of operations.

We are dependent upon the services of our management team — Our future success and profitability is substantially dependent upon our management and the banking acumen of our senior executives. We believe that our future results will also depend in part upon our ability to attract and retain highly skilled and qualified management. We are especially dependent on a limited number of key management personnel, many of whom do not have employment agreements with us. The loss of the chief executive officer and other senior management and key personnel could have a material adverse impact on our operations because other officers may not have the experience and expertise to readily replace these individuals. Many of these senior officers have primary contact with our clients and are important in maintaining personal relationships with our client base. The unexpected loss of services of one or more of these key employees could have a material adverse effect on our operations and possibly result in reduced revenues if we were unable to find suitable replacements promptly. Competition for senior personnel is intense, and we may not be successful in attracting and retaining such personnel. Changes in key personnel and their responsibilities may be disruptive to our businesses and could have a material adverse effect on our businesses, financial condition, and results of operations.

Technology security breaches — Information security risks have increased due to the sophistication and activities of organized crime, hackers, terrorists and other external parties and the use of online, telephone, and mobile banking channels by clients. Any compromise of our security could impair our reputation and deter our clients from using our banking services. Information security breaches can also disrupt the operation of information systems on which we depend, adversely affecting our business operations. Such events can result in costly remediation measures and litigation or governmental investigation and responding to security breaches can place unanticipated demands on the time and attention of management. We rely on security systems to provide the protection and authentication necessary to secure transmission of data against damage by theft, fire, power loss, telecommunications failure or a similar catastrophic event, as well as from security breaches, ransomware, denial of service attacks, viruses, worms, use of artificial intelligence and other disruptive problems caused by hackers. Computer break-ins, phishing and other disruptions of customer or vendor systems could also jeopardize the security of information stored in and transmitted through our computer systems and network infrastructure. We maintain a cyber insurance policy that is designed to cover a majority of loss resulting from cyber security breaches, but there is no assurance such coverage or other protective measures we employ will be adequate to address all potential material adverse impacts.

We also confront the risk of being compromised by emails sent by perpetrators posing as company executives or vendors in order to dupe company personnel into sending large sums of money to accounts controlled by the perpetrators. We require all our employees to complete annual information security awareness training to increase their awareness of these risks and to engage them in our mitigation efforts. If these precautions are not sufficient to protect our systems from data breaches or compromises, our reputation and business could be adversely affected.

We depend on the services of a variety of third-party vendors to meet data processing and communication needs and we have contracted with third parties to run their proprietary software on our behalf. While we perform reviews of security controls instituted by the vendor in accordance with industry standards and institute our own internal security controls, we rely on continued maintenance of the controls by the outside party to safeguard our customer data.

Additionally, we issue debit cards which are susceptible to compromise at the point of sale via the physical terminal through which transactions are processed and by other means of hacking. The security and integrity of these transactions are dependent upon the retailers’ vigilance and willingness to invest in technology and upgrades. Issuing debit cards to our clients exposes us to potential losses which, in the event of a data breach at one or more major retailers may adversely affect our business, financial condition, and results of operations.

We continually encounter technological change — The financial services industry is constantly undergoing rapid technological change with frequent introductions of new technology-driven products and services. Our future success depends, in part, upon our ability to address the needs of our clients competitively by using technology to provide products and services that will satisfy client demands, as well as create additional efficiencies within our operations. Many of our large competitors have substantially greater resources to invest in technological improvements. We may not be able to effectively implement new technology-driven products and services quickly or be successful in marketing these products and services to our clients. In addition, our implementation of certain new technologies, such as those related to artificial intelligence, automation and algorithms, in our business processes may have unintended consequences due to their limitations or our failure to use them effectively. Failure to successfully keep pace with technological change affecting the financial services industry could have a material adverse impact on our business and, in turn, our financial condition and results of operations.

Our accounting estimates rely on analytical and forecasting models — The processes we use to estimate our allowance for credit losses and to measure the fair value of financial instruments, as well as the processes used to estimate the effects of changing interest rates and other market measures on our financial condition and results of operations, depend upon the use of analytical and forecasting models. These models reflect assumptions that may not be accurate, particularly in times of market stress or other unforeseen circumstances. Even if these assumptions are adequate, the models may prove to be inadequate or inaccurate because of other flaws in their design or their implementation. Any such failure in our analytical or forecasting models could have a material adverse effect on our business, financial condition and results of operations.

Legal/Compliance Risks

We are subject to extensive government regulation and supervision — Our operations are subject to extensive federal and state regulation and supervision. Banking regulations are primarily intended to protect depositors’ funds, federal deposit insurance funds and the banking system as a whole, not security holders. These regulations affect our lending practices, capital structure, investment practices, dividend policy and growth, among other things. Congress and federal regulatory agencies continually review banking laws, regulations and policies for possible change. Changes to statutes, regulations or regulatory policies, including changes in interpretation or implementation of statutes, regulation or policies, could affect us in substantial and unpredictable ways. Such changes could subject us to additional costs and limit the types of financial services and products we may offer. Failure to comply with laws, regulations or policies could result in sanctions by regulatory agencies, civil money penalties and/or reputation damage, which could have a material adverse effect on our business, financial condition and results of operations.

Our investments and/or financings in certain tax-advantaged projects may not generate returns as anticipated and may have an adverse impact on our financial results — We invest and/or finance certain tax-advantaged projects promoting affordable housing, community redevelopment and renewable energy sources. Our investments in these projects are designed to generate a return primarily through the realization of federal and state income tax credits, and other tax benefits, over specified time periods. We are subject to the risk that previously recorded tax credits will not be able to be fully realized. Such credits are subject to recapture by taxing authorities based on compliance features required to be met at the project level which may not be met. The possible inability to realize these tax credits and other tax benefits can have a negative impact on our financial results. The risk of not being able to realize the tax credits and other tax benefits depends on many factors outside of our control, including changes in the applicable tax code and the ability of the projects to be completed and properly managed.

Substantial ownership concentration — Our directors, executive officers and 1st Source Bank, as trustee, collectively hold a significant ownership concentration of our common shares. Due to this significant level of ownership among our affiliates, our directors, executive officers, and 1st Source Bank, as trustee, may be able to influence the outcome of director elections or impact significant transactions, such as mergers or acquisitions, or any other matter that might otherwise be favored by other shareholders.

Reputational Risks

Competition from other financial services providers could adversely impact our results of operations — The banking and financial services business is highly competitive. We face competition in making loans and leases, attracting deposits and providing insurance, investment, trust and wealth advisory, and other financial services. Increased competition in the banking and financial services businesses may reduce our market share, impair our growth or cause the prices we charge for our services to decline. Our results of operations may be adversely impacted in future periods depending upon the level and nature of competition we encounter in our various market areas.

Managing reputational risk is important to attracting and maintaining customers, investors, and employees — Threats to our reputation can come from many sources, including adverse sentiment about financial institutions generally, unethical practices, employee misconduct, failure to deliver minimum standards of service or quality, data security failures, compliance deficiencies, and questionable or fraudulent activities of our customers. We have policies and procedures in place that seek to protect our reputation and promote ethical conduct. Nonetheless, negative publicity may arise regarding our business, employees, or customers, with or without merit, and could result in the loss of customers, investors, or employees, costly litigation, a decline in revenues, and increased government regulation.

In addition, focus among investors, customers, and regulators on environmental, social and governance (“ESG”) issues has continued to increase in recent years. Customers, prospective customers, investors or third parties evaluate us based on their assessment of our achievement of ESG objectives and may assign their ESG ratings to us. Such persons may believe that our practices, including our lending practices, are not sufficiently robust from an ESG perspective and may publish their views. Adverse publicity regarding such assessments of our ESG performance could damage our reputation or prospects. Adverse market perception can adversely affect the trading price of our shares.

Item 1B. Unresolved Staff Comments.

None

Item 1C. Cybersecurity.

Risk Management and Strategy

Our Board of Directors has delegated primary responsibility for oversight of cybersecurity risk management to the Audit, Finance & Risk Committee of the Board. The Committee receives quarterly reports from the Chief Information Security Officer (CISO) and Chief Risk Officer (CRO), respectively, and reviews them with such officers. These reports are made available to all board members concurrently. The CRO’s report includes evaluation of the level of cybersecurity risks and strength of mitigating controls. All board members are invited to attend the portion of the Committee’s meetings for review of reports received on risk management from management (e.g., the CRO, CISO, Chief Compliance Officer).

Our processes for assessing, identifying, and managing material risks from cybersecurity threats are based on examination guidance published by the Federal Financial Institution Examination Council (FFIEC), an interagency body established under the Financial Institutions Regulatory and Interest Rate Control Act of 1978. Consistent with FFIEC guidance, 1st Source selected and adheres to the risk management framework established by the Cybersecurity Risk Institute known as the “CRI Profile.” The CRI Profile is based primarily on the well-known National Institute of Standards and Technology’s (NIST) “Framework for Improving Critical Infrastructure Cybersecurity” and is tailored to ensure expectations of financial institution regulators are met. Our processes are designed to meet standards for all seven CRI Profile functions – governance, identification, detection, protection, response, recovery, and supply chain dependency management. In addition, we adhere to security standards set by the PCI Security Standards Council which are designed to ensure secure payments globally.

Risks from cybersecurity threats, including risks identified from previous cybersecurity incidents, have required significant investments over time in maturing our Information Security Program and attracting and retaining the personnel with requisite experience and expertise. In particular, the CISO has substantial relevant expertise in the financial services industry and formal training in the areas of information security and cybersecurity risk management. We will need to continue to make meaningful investments in cybersecurity controls for continuous improvement and maturation in response to constantly evolving cybersecurity threats. Cybersecurity threats will continue to be endemic to the financial services industry for the foreseeable future.

Governance

Our Board and senior management oversee our processes for management of cybersecurity risks consistent with the foregoing standards. Such oversight includes regular reporting by management to the Board on the adequacy of such processes and potential material issues identified. Before escalation to the Board, issues are generally identified and assessed through our risk governance structure established under our Enterprise Risk Management Program. The risk governance structure includes three distinct components: management oversight, third-party professional assessment, and separate oversight and review by our Internal Audit Department. Management oversight is maintained through several committees that serve as forums for further assessment, remediation, and escalation. These management oversight committees include the Information Security Committee, co-chaired by the CISO and CRO, the Operational and Compliance Risk Committee, chaired by the CFO, vice chaired by the CISO and Chief Compliance Officer, the IT Steering Committee, chaired by the Chief Information Officer, the Enterprise Risk Management Committee, chaired by the CRO and the executive management committee known as the Strategic Deployment Committee, chaired by the CEO.

We regularly engage third-party assessors, consultants, and auditors to test and evaluate our controls for managing cybersecurity threats. These include third-party engagements by management and by our Internal Audit Department for (i) regular penetration testing of our cyber defenses, including an annual PCI-certified penetration test, (ii) third-party “health checks” on supporting technology, including our security incident and event management system (SIEM) and vulnerability management program, and (iii) third-party social engineering tests of the effectiveness of our employee training for detection of invasive attempts by malevolent actors. In addition, the Federal Reserve and DFI examine our control environment for managing cybersecurity risks each year.

Our risk governance structure includes a Third-Party Risk Management Program with first-level oversight by management’s Third-Party Risk Management Committee and conforms to bank regulatory guidance. This program includes due diligence and periodic monitoring of the information security controls such providers have in place to protect our confidential data received, processed and/or stored by such providers.

The measures summarized above are intended to help ensure that 1st Source does not suffer a material adverse impact from security breaches, but, as cybersecurity risks evolve and increase in sophistication, we can provide no assurance that our financial condition or results of operations will not be adversely impacted. See “Item 1A. Risk Factors - Operational Risks - Technology Security Breaches.”

Item 2. Properties.

Our headquarters building is located in downtown South Bend, Indiana. The building is part of a larger complex, including a 300-room hotel and a 500-car parking garage. Our lease on this property runs through September 2027. As of December 31, 2023, 1st Source leases approximately 71% of the office space in this complex.

At December 31, 2023, we owned or leased properties where our 78 banking centers were located. Our facilities are located in Allen, DeKalb, Elkhart, Fulton, Huntington, Kosciusko, LaPorte, Marshall, Porter, Pulaski, St. Joseph, Starke, Tippecanoe, Wells, and Whitley Counties in the State of Indiana, Berrien, Cass, and Kalamazoo Counties in the State of Michigan, and Sarasota County in the state of Florida. 1st Source Bank also owns approximately 35 acres in St. Joseph County of which approximately 29 acres have been approved by the Board for development and construction of an operations and training facility. We are marketing the remaining six acres for sale. We anticipate moving forward with construction in the coming years subject to receiving appropriate agreements, approvals and authorizations from local city and county building and economic development authorities as well as market conditions including inflation levels and financing costs. Additionally, we utilize an operations center for business operations. The Bank leases additional properties to and from third parties under arms-length agreements.

Item 3. Legal Proceedings.

1st Source and its subsidiaries are involved in various legal proceedings that are inherent risks of, or incidental to, the conduct of our businesses. Management does not expect the outcome of any such proceedings will have a material adverse effect on our consolidated financial position or results of operations.

Item 4. Mine Safety Disclosures.

None

Part II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Our common stock is traded on the NASDAQ Global Select Market under the symbol “SRCE.” As of February 16, 2024, there were 1,593 holders of record of 1st Source common stock.

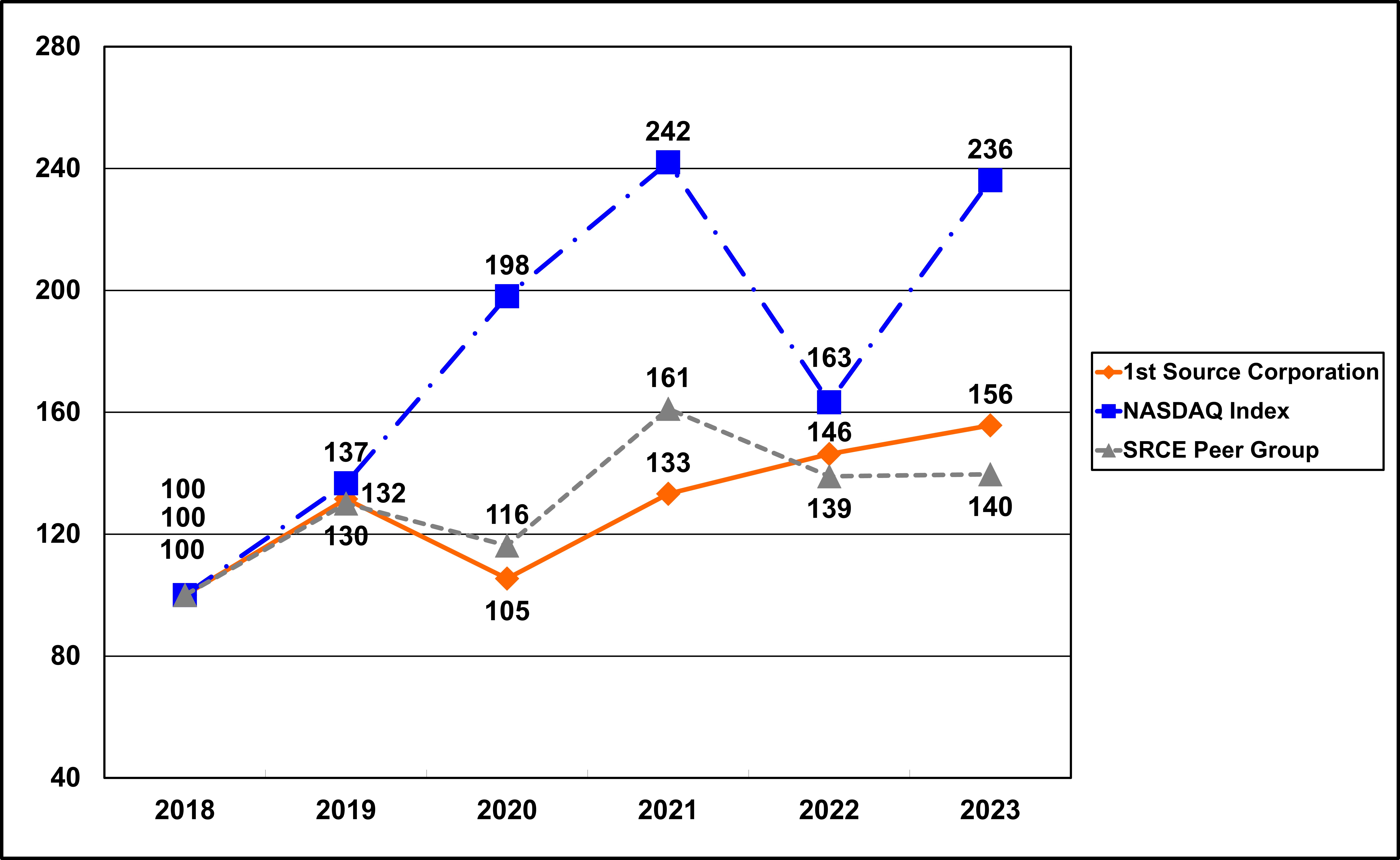

Comparison of Five Year Cumulative Total Return*

Among 1st Source, Morningstar Market Weighted NASDAQ Index** and Peer Group Index***

* Assumes $100 invested on December 31, 2018, in 1st Source Corporation common stock, NASDAQ market index, and peer group index.

** The Morningstar Weighted NASDAQ Index Return is calculated using all companies which trade as NASD Capital Markets, NASD Global Markets or NASD Global Select. It includes both domestic and foreign companies. The index is weighted by the then current shares outstanding and assumes dividends reinvested. The return is calculated on a monthly basis.

*** The peer group is a market-capitalization-weighted stock index of the 33 publicly-traded banking companies headquartered in Illinois, Indiana, Michigan, Ohio, and Wisconsin.

NOTE: Total return assumes reinvestment of dividends.

The following table shows our share repurchase activity during the three months ended December 31, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Period | | Total Number of

Shares Purchased | | Average Price

Paid Per Share | | Total Number of

Shares Purchased as

Part of Publicly Announced

Plans or Programs* | | Maximum Number (or Approximate

Dollar Value) of Shares that

may yet be Purchased Under

the Plans or Programs |

| October 01 - 31, 2023 | | — | | | $ | — | | | — | | | 1,000,000 | |

| November 01 - 30, 2023 | | — | | | — | | | — | | | 1,000,000 | |

| December 01 - 31, 2023 | | — | | | — | | | — | | | 1,000,000 | |

*1st Source maintains a stock repurchase plan that was authorized by the Board of Directors on October 19, 2023. Under the terms of the plan, 1st Source may repurchase up to 1,000,000 shares of its common stock from time to time to mitigate the potential dilutive effects of stock-based incentive plans and other potential uses of common stock for corporate purposes. 1st Source has not yet repurchased any shares under this Plan.

Payment of dividends by 1st Source is discussed under Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, Earnings Summary. Federal laws and regulations contain restrictions on the ability of 1st Source and the Bank to pay dividends. For information regarding restrictions on dividends, see Part I, Item 1, Business - Regulation and Supervision - Dividends and Part II, Item 8, Financial Statements and Supplementary Data - Note 20 of the Notes to Consolidated Financial Statements.

Item 6. [Reserved]

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

This analysis is intended to assist you in understanding our results of operations for each of the past three years and financial condition for each of the past two years.

FORWARD-LOOKING STATEMENTS

This report, including Management’s Discussion and Analysis of Financial Condition and Results of Operations, contains forward-looking statements. Forward-looking statements include statements with respect to our beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates, intentions, and future performance, and involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements.

All statements other than statements of historical fact are statements that could be forward-looking statements. Words such as “believe,” “contemplate,” “seek,” “estimate,” “plan,” “project,” “anticipate,” “possible,” “assume,” “expect,” “intend,” “targeted,” “continue,” “remain,” “will,” “should,” “indicate,” “would,” “may” and other similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future performance, nor should they be relied upon as representing management’s views as of any subsequent date.

All written or oral forward-looking statements that are made by or attributable to us are expressly qualified in their entirety by this cautionary notice. We have no obligation, and do not undertake, to update, revise, or correct any of the forward-looking statements after the date of this report, or after the respective dates on which such statements otherwise are made. We have expressed our expectations, beliefs, and projections in good faith and we believe they have a reasonable basis. However, we make no assurances that our expectations, beliefs, or projections will be achieved or accomplished. The results or outcomes indicated by our forward-looking statements may not be realized due to a variety of factors, including, without limitation, the following:

•Local, regional, national, and international economic conditions and the impact they may have on us and our clients and our assessment of that impact.

•Changes in the level of nonperforming assets and charge-offs.

•Changes in estimates of future cash reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements.

•The effects of and changes in trade and monetary and fiscal policies and laws, including the interest rate policies of the Federal Reserve Board.

•Inflation, interest rate, securities market, and monetary fluctuations, including substantial changes in the cost of fuel.

•Political instability, acts of war or terrorism, or cybersecurity threats.

•The spread of infectious diseases or pandemics.

•The timely development and acceptance of new products and services and perceived overall value of these products and services by others.

•Changes in consumer spending, borrowings, and savings habits.

•Changes in the financial performance and/or condition of our borrowers.

•Technological changes.

•The impact of climate change.

•Acquisitions and integration of acquired businesses.

•The ability to increase market share and control expenses.

•The ability to expand effectively into new markets that we target.

•Changes in the competitive environment.

•The effect of changes in laws and regulations (including laws and regulations concerning taxes, banking, securities, insurance, and climate change) with which we and our subsidiaries must comply.

•The effect of changes in accounting policies and practices and auditing requirements, as may be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight Board, the Financial Accounting Standards Board, and other accounting standard setters.

•Changes in our organization, compensation, and benefit plans.

•The costs and effects of legal and regulatory developments including the resolution of legal proceedings or regulatory or other governmental inquires and the results of regulatory examinations or reviews.

•Greater than expected costs or difficulties related to the integration of new products and lines of business.

•Our success at managing the risks described in Item 1A. Risk Factors.

APPLICATION OF CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Our consolidated financial statements are prepared in accordance with U.S. generally accepted accounting principles (GAAP) and follow general practices within the industries in which we operate. Application of these principles requires management to make estimates or judgments that affect the amounts reported in the financial statements and accompanying notes. These estimates or judgments reflect management’s view of the most appropriate manner in which to record and report our overall financial performance. Because these estimates or judgments are based on current circumstances, they may change over time or prove to be inaccurate based on actual experience. As such, changes in these estimates, judgments, and/or assumptions may have a significant impact on our financial statements. All accounting policies are important, and all policies described in Part II, Item 8, Financial Statements and Supplementary Data – Note 1 of the Notes to Consolidated Financial Statements (Note 1), should be reviewed for a greater understanding of how our financial performance is recorded and reported.

We have identified the following two policies as being critical because they require management to make particularly difficult, subjective, and/or complex estimates or judgments about matters that are inherently uncertain and because of the likelihood that materially different amounts would be reported under different conditions or using different assumptions. These policies relate to the determination of the allowance for loan and lease losses and fair value measurements. Management believes it has used the best information available to make the estimations or judgments necessary to value the related assets and liabilities. Actual performance that differs from estimates or judgments and future changes in the key variables could change future valuations and impact net income. Management has reviewed the application of these policies with the Audit, Finance and Risk Committee of the Board of Directors. Following is a discussion of the areas we view as our most critical accounting policies.