UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

| |

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

OR

|

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from_________to ________

Commission File Number: 0-10200

SEI INVESTMENTS COMPANY

(Exact name of registrant as specified in its charter)

|

| | |

| | | |

| Pennsylvania | | 23-1707341 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

| 1 Freedom Valley Drive, Oaks, Pennsylvania | | 19456-1100 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code 610-676-1000

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| | | |

| Title of each class | | Name of each exchange on which registered |

| Common Stock, par value $.01 per share | | The NASDAQ Stock Market LLC (The NASDAQ Global Select Market®) |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer x | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No ý

The aggregate market value of the voting common stock held by non-affiliates of the registrant was approximately $2.7 billion based on the closing price of $19.89 as reported by NASDAQ on June 29, 2012 (the last business day of the registrant’s most recently completed second fiscal quarter). For purposes of making this calculation only, the registrant has defined affiliates as including all executive officers, directors and beneficial owners of more than ten percent of the common stock of the registrant.

The number of shares outstanding of the registrant's common stock, as of the close of business on January 31, 2013:

|

| | |

| | | |

| Common Stock, $.01 par value | | 172,642,438 |

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the following documents are incorporated by reference herein:

|

| |

| 1 | The definitive proxy statement relating to the registrant’s 2013 Annual Meeting of Shareholders, to be filed within 120 days after the end of the fiscal year covered by this annual report, is incorporated by reference in Part III hereof. |

SEI Investments Company

Fiscal Year Ended December 31, 2012

TABLE OF CONTENTS

|

| | |

| | | Page |

| PART I |

| Item 1. | Business. | |

| Item 1A. | Risk Factors. | |

| Item 1B. | Unresolved Staff Comments. | |

| Item 2. | Properties. | |

| Item 3. | Legal Proceedings. | |

| Item 4. | Mine Safety Disclosures. | |

| |

| PART II |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. | |

| Item 6. | Selected Financial Data. | |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. | |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk. | |

| Item 8. | Financial Statements and Supplementary Data. | |

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure. | |

| Item 9A. | Controls and Procedures. | |

| Item 9B. | Other Information. | |

| |

| PART III |

| Item 10. | Directors, Executive Officers and Corporate Governance. | |

| Item 11. | Executive Compensation. | |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. | |

| Item 14. | Principal Accounting Fees and Services. | |

| |

| PART IV |

| Item 15. | Exhibits, Financial Statement Schedules. | |

PART I

Forward Looking Statements

This Annual Report on Form 10-K contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve certain known and unknown risks, uncertainties and other factors, many of which are beyond our control, and are not limited to those discussed in Item 1A, “Risk Factors.” All statements that do not relate to historical or current facts are forward-looking statements. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” and other words and terms of similar meaning in connection with any discussion of future operating or financial performance. In particular, these include statements relating to present or anticipated products and markets, future revenues, capital expenditures, expansion plans, future financing and liquidity, personnel, and other statements regarding matters that are not historical facts or statements of current condition.

Any or all forward-looking statements contained within this Annual Report on Form 10-K may turn out to be wrong. They can be affected by inaccurate assumptions we might make, or by known or unknown risks and uncertainties. Many factors mentioned in the discussion below will be important in determining future results. Consequently, we cannot guarantee any forward-looking statements. Actual future results may vary materially.

We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. You are advised, however, to consult any further disclosures we make on related subjects in our filings with the U.S. Securities and Exchange Commission (SEC).

Item 1. Business.

Overview

SEI (NASDAQ: SEIC) is a leading global provider of investment processing, investment management, and investment operations solutions. We help corporations, financial institutions, financial advisors, and ultra-high-net-worth families create and manage wealth by providing comprehensive, innovative, investment and investment-business solutions. As of December 31, 2012, through its subsidiaries and partnerships in which the company has a significant interest, SEI manages or administers $458.4 billion in mutual fund and pooled or separately managed assets, including $201.5 billion in assets under management and $256.9 billion in client assets under administration. Our affiliate, LSV Asset Management (LSV), manages $60.9 billion of assets which are included as assets under management.

Our wealth management business solutions include:

| |

| • | Investment processing outsourcing solutions for banks, trust companies, independent wealth advisers, and investment managers; |

| |

| • | Investment management programs for affluent individual investors and for institutional investors, including retirement plan sponsors, and not-for-profit organizations; and |

| |

| • | Investment operations outsourcing solutions for investment management firms, banks and investment companies that sponsor and distribute mutual funds, hedge funds, and alternative investments. |

General Development of the Business

For over 40 years, SEI has been a leading provider of wealth management business solutions for the financial services industry.

We began doing business in 1968 by providing computer-based training simulations for bank loan officers. We developed an investment accounting system for bank trust departments in 1972 and became a leading provider of investment-processing outsourcing services to banks and trust institutions in the United States. Later, we broadened these outsourcing services and began offering bank clients a family of mutual funds, as well as investment-operations outsourcing services. We became a public company in 1981.

We began to adapt these solutions, and develop new wealth management solutions, for selected global markets in the 1990's, including: investment advisors, retirement plan sponsors and institutional investors, asset management distribution firms, investment managers, and affluent individual investors. Today, we serve approximately 6,600 clients in the United States, Canada, the United Kingdom, continental Europe, South Africa, and East Asia

In each of these markets, we have combined our core competencies - investment processing, investment management, and investment operations - to deliver broader and more strategic solutions for clients and markets. Today, we offer a global wealth platform and investment services for private banks and wealth services firms; a complete life and wealth platform for operating an investment advisory business; a comprehensive fiduciary management solution for retirement plan sponsors and institutional investors; a total operational outsourcing solution for investment managers; and a complete life and wealth solution for ultra-high-net-worth families.

Strategy

We seek to achieve growth in earnings and shareholder value by strengthening our position as a provider of global wealth management solutions. To achieve this objective, we have implemented these strategies:

Create broader solutions for wealth service firms. Banks, investment managers and financial advisors seek to enter new markets, expand their service offerings, provide a differentiated experience to their clients, improve efficiencies, reduce risks, and better manage their businesses. We offer next generation business solutions integrating technology, operating processes, and financial products designed to help these institutions better serve their clients and provide opportunities to improve their business success.

Help institutional investors manage retirement plans and operating capital. Retirement plan sponsors, not-for-profit organizations, and other institutional investors strive to meet their financial objectives while reducing business risk. We deliver customized investment management solutions, as part of a complete solution offering, that enable investors to make better decisions about their investments and to manage their assets more effectively.

Help affluent individual investors manage their life and wealth goals. These investors demand a holistic wealth management experience that focuses on their life goals and provides them with an integrated array of financial services that includes substantially more than traditional wealth management offerings. We help these investors identify their goals and offer comprehensive life and wealth advisory services including life planning, investments, and other financial services.

Expand globally. Global markets are large and present significant opportunities for growth. We have evolved U.S. business models for the global wealth management marketplace, focusing on the needs of institutional investors, private banks, independent wealth advisers, investment managers, investment advisors, and affluent individual investors.

Fundamental Principles

We are guided by these fundamental principles in managing the business and adopting these growth strategies:

| |

| • | Achieve organic growth in revenue and earnings. We seek to grow the business by providing additional services to clients, adding new clients, introducing new products, and adapting products for new markets. |

| |

| • | Forge long-term client relationships. We strive to achieve high levels of customer satisfaction and to forge close and long lasting client relationships. We believe these relationships enable us to market additional services, and acquire knowledge and insights that fuel the product development process. |

| |

| • | Invest in product development. We continually enhance products and services to keep pace with industry developments, regulatory requirements, and the emerging needs of markets and clients. We believe ongoing investments in research and development give us a competitive advantage in our markets. |

| |

| • | Maintain financial strength. We adopt business models that generate recurring revenues and positive cash flows. Predictable cash flows serve as a source of funds for continuing operations, investments in new products, common stock repurchases, and dividend payments. |

| |

| • | Leverage investments across the business. We create scalable, enterprise-wide solutions designed to serve the needs of multiple markets, potentially offering operating efficiencies that can benefit corporate profitability. |

| |

| • | Create value for shareholders. The objective of achieving long-term sustainable growth in revenues and earnings strongly influences the management of the business. This philosophy guides corporate management practices, strategic planning activities, and employee compensation practices. |

Products and Services

Investment Processing

Investment processing solutions consist of application and business process outsourcing services, professional services, and transaction-based services. We deliver these solutions to providers of institutional and private client wealth management services, including banks, trust companies, independent wealth advisers, and other financial services firms. We also deliver these solutions, combined with our investment management programs, to investment advisory firms and other financial services firms that provide wealth management services to their advisory clients.

Our investment processing solutions are enabled through two platforms, TRUST 3000® and the Global Wealth Platform (GWP). TRUST 3000® is a comprehensive trust accounting and investment system that provides securities processing and investment accounting for all types of domestic and global securities, and support for multiple account types, including personal trust, corporate trust, institutional trust, and non-trust investment accounts. GWP is an investment accounting and

securities processing system with capabilities that include global securities processing, trade-date and multi-currency accounting and reporting. The platform is designed around the client and portfolio management processes. This enables financial firms to institutionalize their client processes around an investor’s investment objectives, facilitating a transition to model-based portfolio management, providing an improved client experience, while minimizing the expense and risk associated with investment operations. We began delivering GWP to private banks and independent wealth advisers in the United Kingdom in 2007. In U.S. markets, we converted a small group of advisors onto GWP in 2011 and converted our first bank in 2012.

Application and business process outsourcing revenues from investment processing services are earned as monthly fees from contracted services including software licenses, information processing, and investment operations and are primarily earned based upon the type and number of investor accounts serviced. Investment processing revenues may also be earned as a percentage of the clients’ assets processed on the platforms. These revenues are recognized in Information processing and software servicing fees on the accompanying Consolidated Statements of Operations. Professional services revenues are earned from contracted, project-oriented services, including client implementations, and are recognized in Information processing and software servicing fees on the accompanying Consolidated Statements of Operations. Transaction-based revenues are earned from trade execution services and are recognized as Transaction-based and trade execution fees on the accompanying Consolidated Statements of Operations.

Investment Management Programs

Investment management programs consist of money market, fixed-income and equity mutual funds and other collective investment products, alternative investment portfolios, and separately managed accounts. We serve as the sponsor, administrator and investment advisor for many of these products. We distribute these programs primarily through investment advisory firms, including investment advisors and banks, and directly to institutional or individual investors.

We have expanded these investment management programs to include other consultative, operational, and technology components, and have created comprehensive solutions tailored to the needs of a specific market. These components may include investment strategies, consulting services, administrative and processing services, and technology tools.

Investors in our investment programs typically follow an investment strategy constructed according to our disciplined investment process and invest in a globally diversified portfolio that consists of multiple classes and investment styles. Our investment process is based on five principles: asset allocation and appropriate diversification, both of which are important to investment performance; a portfolio design process that identifies the drivers of investment returns for each asset class; manager selection, where we act as a manager-of-managers, selecting style-specific managers from a global network of money managers; a portfolio construction process implemented through selected managers, and properly diversified among asset classes and drivers of investment returns; and risk management processes that monitor portfolios to ensure risk objectives are met.

As of December 31, 2012, we managed $140.5 billion in assets including: $112.8 billion invested in fixed-income and equity funds, or through separately managed account programs; $11.4 billion invested in liquidity or money market funds; and $16.3 billion invested in collective trust fund programs. An additional $60.9 billion in assets is managed by our unconsolidated affiliate LSV, a registered investment advisor that specializes in value equity management for their institutional clients.

Revenues from investment management programs are primarily earned as a contractual percentage of net assets under management. These revenues are recognized in Asset management, administration and distribution fees on the accompanying Consolidated Statements of Operations. Our interest in the earnings of LSV is recognized in Equity in earnings of unconsolidated affiliates on the accompanying Consolidated Statements of Operations.

Investment Operations

Investment operations outsourcing solutions consist of accounting and administration services, and distribution support services. We deliver these solutions to investment management firms that offer traditional and alternative products. We support traditional managers who advise a variety of investment products including mutual funds, UCITS schemes, collective investment trusts (CITs), exchange-traded funds (ETFs), institutional accounts and separately managed accounts. We also provide comprehensive solutions to investment managers worldwide that sponsor and distribute alternative investments such as hedge funds, funds of hedge funds, private equity funds and real estate funds, across both registered and partnership structures.

Accounting and administration services include account and fund administration, investment portfolio and fund accounting; cash administration and treasury services; trade capture, settlement and reconciliation; trustee and custodial services; legal, audit and tax support; and investor services. Distribution support services may include access to distribution platforms and

market and industry analyses to identify specific product distribution opportunities. These solutions are delivered by utilizing a highly integrated, robust, and scalable technology platform adapted to fit the specific business needs of our investment manager clients.

As of December 31, 2012, we administered $256.8 billion in client assets for traditional and alternative investment fund products, including mutual funds, CITs, hedge funds, and private equity funds. Revenues from these products are primarily earned based on a contractual percentage of net assets under administration.

Revenues for the processing of institutional separate accounts and separately managed accounts are generally earned on the number of investor accounts serviced. Assets associated with this separate account processing are not included in reported assets under administration. Both revenue categories are recognized in Asset management, administration and distribution fees on the accompanying Consolidated Statements of Operations.

Business Segments

Business segments are generally organized around our target markets. Financial information about each business segment is contained in Note 13 to the Consolidated Financial Statements. Our business segments are:

Private Banks – provides investment processing and investment management programs to banks and trust institutions worldwide, independent wealth advisers located in the United Kingdom, and financial advisors in Canada;

Investment Advisors – provides investment management programs to affluent investors through a network of independent registered investment advisors, financial planners, and other investment professionals in the United States;

Institutional Investors – provides investment management programs and administrative outsourcing solutions to retirement plan sponsors, hospitals, and not-for-profit organizations worldwide;

Investment Managers – provides investment operations outsourcing solutions to investment managers, fund companies and banking institutions located in the United States, and to investment managers worldwide of alternative asset classes such as hedge funds, funds of hedge funds, and private equity funds across both registered and partnership structures; and

Investments in New Businesses – provides investment management programs to ultra-high-net-worth families residing in the United States through the SEI Wealth Network® and conducts other research and development activities.

The percentage of consolidated revenues generated by each business segment for the last three years was:

|

| | | | | | | | | |

| | | 2012 | | 2011 | | 2010 |

| Private Banks | | 37 | % | | 37 | % | | 38 | % |

| Investment Advisors | | 20 | % | | 20 | % | | 20 | % |

| Institutional Investors | | 23 | % | | 23 | % | | 23 | % |

| Investment Managers | | 19 | % | | 19 | % | | 18 | % |

| Investments in New Businesses | | 1 | % | | 1 | % | | 1 | % |

| | | 100 | % | | 100 | % | | 100 | % |

Private Banks

The Private Banks segment delivers a comprehensive outsourcing solution integrating investment processing services, investment management and distribution programs, and business expertise to banks and trust institutions worldwide, independent wealth advisers and other wealth managers located in the United Kingdom, and financial advisors in Canada. We own, maintain and operate the software applications and information processing facilities for all of our investment processing solutions.

Private banks and other trust organizations who utilize our TRUST 3000® application solution outsource investment processing technology software and computer processing, but retain responsibility for investment operations, client administration, and investment management. These clients operate our TRUST 3000® application remotely while fully supported by our data center using dedicated telecommunications networks. The TRUST 3000® application solution includes a dedicated relationship team that supports our client’s business. We assist our clients by strategically evaluating their systems and process needs as their businesses change.

Our TRUST 3000® business solution was designed for private banks and other trust organizations that prefer to outsource their entire investment operation. With the TRUST 3000® business solution, we assume the entire back-office processing function. This comprehensive solution includes: investment processing; account access and reporting; audit, compliance and regulatory

support data generation; custody and safekeeping of assets; income collections; securities settlement; and other related trust activities.

Client contracts for investment processing solutions offered through TRUST 3000® have initial terms that are generally three to seven years in length. New clients undergo a business transformation process which can take a few months for smaller institutions and up to 15 months or more for larger institutions. During the transformation process, we collaborate with new clients to understand their strategic business goals and objectives. During this transformation, systems, operations, and business processes are evaluated and optimized to meet client objectives. We typically earn a one-time implementation fee for these business transformation services. We begin to earn processing revenues after the client completes the transformation process and commences operation.

At December 31, 2012, we had significant relationships with 110 banks and trust institutions in the United States. Our principal competitors for this business are: Fidelity National Information Services, Inc., SunGard Data Systems Inc., State Street Corporation, Fi-Tek LLC, Charles Schwab & Co., Inc. and Fidelity Investments. Many large financial institutions develop, operate and maintain proprietary investment and trust accounting systems. We consider these “in-house” solutions to be a form of competition.

GWP provides an integrated operating infrastructure enabling our clients to adapt to the changing needs of their clients and their business by offering advanced global processing capabilities, client and portfolio management processes, an open-architecture, modular design, and continuous worldwide operation. The implementation of new clients onto the platform follows either a conversion of existing client assets or a business transition process which moves new client assets onto the platform as the client grows their business with a contractual minimum fee in place.

Client contracts for investment processing solutions offered through GWP have initial terms that are generally five to seven years in length. At December 31, 2012, we had significant relationships with 20 banks, independent wealth advisers and other wealth managers located in the United Kingdom. In addition, we converted our first bank located in the United States onto GWP on December 31, 2012. Our principal competitors for this business are: Pershing LLC, FNZ UK Ltd., Temenos Group AG, Avaloq, TD Direct Investing (Europe) Ltd. and smaller technology firms. We also consider “in-house” solutions to be a form of competition.

This segment also offers investment management programs for banks and distribution partners worldwide. At December 31, 2012, we had approximately 320 investment management clients. We also had single-product relationships with approximately 85 additional banks and trust institutions. The principal competitors for this business are: Federated Investors, Inc., Russell Investment Group, Fidelity Investments, Franklin Templeton Investments, discretionary portfolio managers and various multi-manager investment programs offered by other firms. We also consider “in-house” internal asset management capabilities to be a form of competition.

Investment Advisors

The Investment Advisors segment offers wealth management solutions to registered investment advisors, many of whom are affiliated with or are registered as independent broker-dealers, financial planners, and life insurance agents located throughout the United States. These wealth management solutions include our investment management programs and back-office investment processing outsourcing services and are usually offered on a bundled basis. We also help advisors manage and grow their businesses by giving them access to our marketing support programs, business assessment assistance and recommended management practices. Our solutions aim to help investment advisors reduce risk, improve quality, and gain operational efficiency to devote more of their resources to servicing their clients and acquiring new clients.

Advisors are responsible for the investor relationship which includes creating financial plans, implementing investment strategies and educating and servicing their customers. Advisors may customize portfolios to include separate account managers provided through our programs as well as SEI-sponsored mutual funds. Our wealth and investment programs are designed to be attractive to affluent or high-net-worth individual investors with over $250 thousand of investable assets and small to medium-sized institutional plans.

We continually enhance our offering to meet the emerging needs of our advisors and their end clients. For example, in 2011 and 2012, we converted a small group of advisors onto GWP. Our testing with these clients will continue through 2013. We anticipate the enhanced service offerings enabled through GWP will provide a more diverse range of back-office investment processing outsourcing services and investment management solutions.

We estimate we have business relationships with over 5,400 financial advisors at December 31, 2012. Our definition of a client for this segment includes financial advisors who have exceeded a minimal level of customer assets invested in our investment products. Our business is primarily based on approximately 1,100 investment advisors who, at December 31, 2012, had at least

$5.0 million each in customer assets invested in our mutual funds and separately managed accounts. Revenues are earned largely as a percentage of average assets under management.

The principal competition for our investment management products is from other money managers, other turnkey asset management providers, mutual fund companies, custody service providers and the proprietary investment management programs of broker dealers. In the advisor distributor channel, the principal competitors include AssetMark Investment Services Inc., Brinker Capital, EnvestNet Asset Management, Inc., Fidelity Investments, Lockwood Advisors, Inc., a subsidiary of The Bank of New York Mellon, Charles Schwab & Co., Inc., and other broker-dealers. As we introduce GWP, we expect to more directly compete with custody service providers.

Institutional Investors

The Institutional Investors segment offers investment management programs and administrative outsourcing solutions for retirement plan sponsors, hospitals, and not-for-profit organizations globally. Clients can outsource their investment management needs and the administration for defined benefit plans, defined contribution plans, endowments, foundations, and other balance sheet assets.

The fiduciary management outsourcing program provides a strategic platform integrating the Manager-of-Managers investment process, plan administration services, and consulting services. Plan administration services include trustee, custodial, benefit payment services, record-keeping services, and donor administration. Consulting services include actuarial services, asset liability modeling, and the customization of an asset allocation plan that is designed to meet long-term objectives.

By outsourcing retirement plan services, we believe clients benefit from an investment approach built around an investment strategy designed to meet the client's long-term business and plan objectives and an investment process that removes the responsibility of manager selection, ongoing monitoring and termination. This approach is designed to reduce business risk, provide ongoing due diligence, and increase operational efficiency. Nonprofit organizations can manage volatility through more diversified portfolios and focus more resources on achieving their overall mission. Healthcare organizations benefit from customized asset allocations that help provide improved balance sheet protection and overall financial risk management.

Fees are primarily earned as a percentage of average assets under management. At December 31, 2012, we had relationships with approximately 475 investment management clients. The principal competitors for this segment are Russell Investments, Northern Trust Corporation, investment consultants and consulting firms with investment advisory and/or actuarial capabilities.

Investment Managers

The Investment Managers segment provides a platform of comprehensive investment operations outsourcing solutions to investment managers globally. This array of front-, middle- and back-office investment processing services integrates best-in-class industry tools and technology to support a manager's diverse business needs across multiple product types and structures, investment strategies and asset classes. For those managers offering traditional products such as mutual funds, collective investment trusts, exchange-traded funds, and institutional and separate accounts, we provide outsourcing services including fund and investment accounting, administration, reconciliation, investor servicing and client reporting. We also provide comprehensive solutions to managers focused on alternative investments who manage hedge funds, funds of hedge funds, private equity funds, real estate and infrastructure funds, across registered, partnership and separate account structures domiciled in the United States and overseas.

Over the past few years, investors have faced multiple market crises and rising volatility. Fund managers have responded with a range of innovative products designed to better manage volatility and offer alternatives to pure long-only investing historically used in traditional markets. The clear line that had once separated traditional and alternative investment products continues to blur as traditional managers utilize tools historically used by alternative managers, while alternative managers increasingly are launching registered products and taking advantage of broader distribution channels. Anticipating this long-term trend and that of an increasingly empowered investor base, we have focused on the needs of the investor and manager rather than provide services aligned to specific products or asset classes. We also continually enhance our solutions to anticipate and adapt to economic, regulatory and industry changes.

By applying operating services, market-leading technologies, and business and regulatory knowledge, our comprehensive array of investment operations solutions help investment managers focus on their core competencies of portfolio management and client service. We provide managers with more than just the required data they need to run their investment products successfully; through award-wining technology and market knowledge, we also strive to deliver the information and insight necessary to allow them to better manage their business.

Contracts for our investment operations outsourcing services generally have terms ranging from three to five years. Fees are primarily earned as a percentage of average assets under management and administration. A portion of the revenues for this

segment are earned as account servicing fees. At December 31, 2012, we had relationships with approximately 220 investment management companies and alternative investment managers. Our competitors vary according to the asset class or solution provided and include large global custodian banks such as State Street, BNY Mellon and Northern Trust as well as smaller more specialized firms.

Investments in New Businesses

The Investments in New Businesses segment represents other business ventures or research and development activities intended to expand our solutions to new or existing markets including ultra-high-net-worth families who reside in the United States. This segment includes the costs associated with business development in the Middle East through our Dubai office and the development of a new internet-based investment management application. The family wealth management solution offers flexible family-office type services through a highly personalized solution while utilizing the Manager-of-Managers investment process.

The principal competitors for the family wealth solution are diversified financial services providers focused on the ultra-high-net-worth market.

Research and Development

We are devoting significant resources to research and development, including expenditures for new technology platforms, enhancements to existing technology platforms, and new investment products and services. We spent approximately $79.6 million in 2012, $118.6 million in 2011, and $105.6 million in 2010, of which we capitalized approximately $31.0 million in 2012, $41.0 million in 2011, and $38.7 million in 2010 relating to the development of new technology platforms. Total research and development expenditures as a percentage of revenues were 8.0 percent in 2012, 12.8 percent in 2011, and 11.7 percent in 2010. In 2012, we redefined our definition of research and development expenditures to only include development costs pertaining to new products and services in which an approved delivery plan for one of our existing target markets has been implemented and no longer include expenditures for investments or research activities related to the analysis of products and services for potential target markets. Our research and development expenditures are included in Compensation, benefits and other personnel and Consulting, outsourcing and professional fees on the accompanying Consolidated Statements of Operations.

The majority of our research and development spending is related to building GWP, which combines business service processing with asset management and distribution services. The platform offers to our customers a client-centric, rather than an account-centric, process with model-based portfolio management services through a single platform. The platform utilizes our proprietary applications with those built by third-party providers, and integrates them into a single technology solution, providing a common user experience. This integration supports straight-through business processing and enables the transformation of our clients’ trust services from operational investment processing services to client value-added services.

The solution will serve markets in the United Kingdom, United States, Canada and continental European markets. GWP provides the technology platform for the business solutions now being marketed to private banks and independent wealth adviser organizations in the United Kingdom. In U.S. markets, we believe the demand for the advanced capabilities of the new platform will enable us to market our services to global wealth managers and existing clients in the Private Banks segment and significantly extend, expand and improve the services we offer in the Investment Advisors segment.

GWP will eventually be used at some level by most of our business segments representing a significant upgrade to our infrastructure. The platform will enable ourselves and our clients to manage the entire lifecycle of wealth services through a single solution. The workflow automation, firm’s business rules and straight through processing to the street will dramatically change the client experience, help firms manage risk and allow for total transparency.

Marketing and Sales

Our business solutions are directly marketed to potential clients in our target markets. We employ approximately 100 sales representatives who operate from offices located throughout the United States, Canada, the United Kingdom, continental Europe, South Africa, Asia and other locations.

Customers

In 2012, no single customer accounted for more than ten percent of revenues in any business segment.

Personnel

At January 31, 2013, we had 2,516 full-time and 63 part-time employees. Employee unions do not represent any of our employees. Management considers employee relations to be generally good.

Regulatory Considerations

SEI is a savings and loan holding company subject to supervision and regulation by the Board of Governors of the Federal Reserve System (the Federal Reserve). Prior to July 21, 2011, SEI was subject to supervision by the Office of Thrift Supervision (the OTS). As a result of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Dodd-Frank), the OTS was eliminated and the Federal Reserve became SEI's primary regulator. Prior to Dodd-Frank, SEI was not subject to any specific consolidated regulatory capital requirements but was required to maintain capital that is sufficient to support the holding company and its subsidiaries' business activities and the risks inherent in those activities. SEI is currently subject to those same requirements today. However, as a result of Dodd-Frank, SEI will be subject to minimum leverage and minimum risk-based capital ratios that will be set by the Federal Reserve. The Federal Reserve has published three Notices of Proposed Rules that are intended to establish an integrated regulatory capital framework. These proposed rules would apply to all savings and loan holding companies. The proposed rules include changes, among many things, to increase the quantity and quality of capital, revise the definition of capital, and establish limitations on capital distributions and certain bonus payments under specific conditions. Also, the proposed rules would revise the criteria for calculating risk-weighted assets to enhance risk sensitivity. SEI would be required to use risk weighting to assign different levels of risk to different classes of assets to determine appropriate levels of required capital. Since SEI is not currently subject to any specific consolidated regulatory capital requirement, the proposed rules could have a significant impact on our financial position, earnings and liquidity.

Our principal, regulated wholly-owned subsidiaries are SEI Investments Distribution Co., or SIDCO, SEI Investments Management Corporation, or SIMC, SEI Private Trust Company, or SPTC, SEI Trust Company, or STC, and SEI Investments (Europe) Limited, or SIEL. SIDCO is a broker-dealer registered with the SEC under the Securities and Exchange Act of 1934 and is a member of the Financial Industry Regulatory Authority, Inc. (FINRA). SIMC is an investment advisor registered with the SEC under the Investment Advisers Act of 1940. SPTC is a limited purpose federal thrift chartered and regulated by the Office of the Comptroller of the Currency. STC is a Pennsylvania trust company, regulated by the Pennsylvania Department of Banking. SIEL is an investment manager and financial institution subject to regulation by the Financial Services Authority of the United Kingdom. In addition, various SEI subsidiaries are subject to the jurisdiction of regulatory authorities in Canada, the Republic of Ireland and other foreign countries. The Company has a minority ownership interest in LSV, which is also an investment advisor registered with the SEC.

The Company, its regulated subsidiaries, their regulated services and solutions and their customers are all subject to extensive legislation, regulation and supervision that recently has been subject to, and continues to experience, significant change and increased regulatory activity. These changes and regulatory activities could have a material adverse affect on us and our clients.

The various governmental agencies and self-regulatory authorities that regulate or supervise the Company and its subsidiaries have broad administrative powers. In the event of a failure to comply with laws, regulations and requirements of these agencies and authorities, the possible sanctions that may be imposed include the suspension of individual employees, limitations on our ability to engage in business for specified periods of time, the revocation of applicable registration as a broker-dealer, investment advisor or other regulated entity, and, as the case may be, censures and fines. Additionally, certain securities and banking laws applicable to us and our subsidiaries provide for certain private rights of action that could give rise to civil litigation. Any litigation could have significant financial and non-financial consequences including monetary judgments and the requirement to take action or limit activities that could ultimately affect our business.

Governmental scrutiny from regulators, legislative bodies and law enforcement agencies with respect to matters relating to our regulated subsidiaries and their activities, services and solutions, our business practices, our past actions and other matters has increased dramatically in the past several years. Responding to these examinations, investigations, actions and lawsuits, regardless of the ultimate outcome of the proceeding, is time consuming and expensive and can divert the time and effort of our senior management from our business. Penalties and fines sought by regulatory authorities have increased substantially over the last several years, and certain regulators have been more likely in recent years to commence enforcement actions or to advance or support legislation targeted at the financial services industry. During 2012, we were increasingly subject to inquiries from examinations and investigations by supervisory and enforcement divisions of regulatory authorities and we expect that trend to continue in 2013. We believe this is also the case with many of our regulated clients. Governmental scrutiny and legal and enforcement proceedings can also have a negative impact on our reputation, our relationship with clients and prospective clients, and on the morale and performance of our employees, which could adversely affect our businesses and results of operations.

We are subject to the USA PATRIOT Act of 2001, which contains anti-money laundering and financial transparency laws and requires implementation of regulations applicable to financial services companies, including standards for verifying client identification and monitoring client transactions and detecting and reporting suspicious activities. Anti-money laundering laws outside the United States contain similar requirements. We offer investment and banking solutions that also are subject to regulation by the federal and state securities and banking authorities, as well as foreign regulatory authorities, where applicable. Existing or future regulations that affect these solutions could lead to a reduction in sales of these solutions or require modifications of these solutions.

Compliance with existing and future regulations and responding to and complying with recent increased regulatory activity affecting broker-dealers, investment advisors, investment companies, financial institutions and their service providers could have a significant impact on us. We periodically undergo regulatory examinations and respond to regulatory inquiries and document requests. In addition, recent legislative activity in the United States (including the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 and attendant rule making activities) and in other jurisdictions (including the European Union and the United Kingdom) have made and continue to make, extensive changes to the laws regulating financial services firms. As a result of these examinations, inquiries and requests, as a result of increased civil litigation activity, and as a result of these new laws and regulations, we engage legal counsel, review our compliance procedures, solution and service offerings, and business operations, and make changes as we deem necessary. These additional activities and required changes may result in increased expense or may reduce revenues.

Our bank clients are subject to supervision by federal and state banking authorities concerning the manner in which such clients purchase and receive our products and services. Our plan sponsor clients and our subsidiaries providing services to those clients are subject to supervision by the Department of Labor and compliance with employee benefit regulations. Investment advisor and broker-dealer clients are regulated by the SEC, state securities authorities, or FINRA. Existing or future regulations applicable to our clients may affect our clients’ purchase of our products and services.

In addition, see the discussion of governmental regulations in Item 1A “Risk Factors” for a description of the risks that proposed regulatory changes may present for our business.

Available Information

We maintain a website at www.seic.com and make available free of charge through the Investors section of this website our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. We include our website in this Annual Report on Form 10-K only as an inactive textual reference and do not intend it to be an active link to our website. The material on our website is not part of this Annual Report on Form 10-K.

Item 1A. Risk Factors.

We believe that the risks and uncertainties described below are those that impose the greatest threat to the sustainability of our business. However, there are other risks and uncertainties that exist that may be unknown to us or, in the present opinion of our management, do not currently pose a material risk of harm to us. The risk and uncertainties facing our business, including those described below, could materially adversely affect our business, results of operations, financial condition and liquidity.

Our revenues and earnings are affected by changes in capital markets. A majority of our revenues are earned based on the value of assets invested in investment products that we manage or administer. Significant fluctuations in securities prices may materially affect the value of these assets and may also influence an investor’s decision to invest in and maintain an investment in a mutual fund or other investment product. As a result, our revenues and earnings derived from assets under management and administration could be adversely affected.

We are dependent on third party pricing services for the valuation of securities invested in our investment products. The majority of the securities held by our investment products are valued using quoted prices from active markets gathered by external third party pricing services. Securities for which market prices are not readily available are valued in accordance with procedures applicable to that investment product. These procedures may utilize unobservable inputs that are not gathered from any active markets and involve considerable judgment. If these valuations prove to be inaccurate, our revenues and earnings from assets under management could be adversely affected.

We are exposed to product development risk. We continually strive to increase revenues and meet our customers' needs by introducing new products and services. As a result, we are subject to product development risk, which may result in loss if we are unable to develop and deliver fully functional products to our target markets that address our clients' needs and that are developed on a timely basis and reflect an attractive value proposition. The majority of our product development risk pertains

to GWP, our newest technology that serves U.K., European and U.S. clients. It is designed to drive our entry into global private bank and wealth services markets and expand our U.S. market opportunity, improve client experience capabilities and strengthen operating efficiencies by providing straight through business processing solutions and transform the front, middle and back office operations that exist today. New product development is primarily for the purpose of enhancing our competitive position in the industry. In the event that we fail to develop products or services at an acceptable cost or on a timely basis or if we fail to deliver functional products and services which are of sound, economic value to our clients and our target markets, or an inability to support the product in a cost-effective and compliant manner, we may recognize significant financial losses from the acceleration of amortization expense or impairment charges related to the product.

We are dependent upon third-party service providers in our operations. We utilize numerous third-party service providers located in the United States and offshore locations in our operations, in the development of new products, and in the maintenance of our proprietary systems. A failure by a third-party service provider could expose us to an inability to provide contractual services to our clients in a timely basis. Additionally, if a third-party service provider is unable to provide these services, we may incur significant costs to either internalize some of these services or find a suitable alternative.

We serve as the investment advisor for many of the products offered through our investment management programs and utilize the services of investment sub-advisers to manage the majority of these assets. A failure in the performance of our due diligence processes and controls related to the supervision and oversight of these firms in detecting and addressing conflicts of interest, fraudulent activity, noncompliance with relevant securities and other laws could cause us to suffer financial loss, regulatory sanctions or damage to our reputation.

Poor fund performance may affect our revenues and earnings. Our ability to maintain our existing clients and attract new clients may be negatively affected if the performance of our mutual funds and other investment products, relative to market conditions and other comparable competitive investment products, is lower. Investors may decide to place their investable funds elsewhere which would reduce the amount of assets we manage resulting in a decrease in our revenues.

Our earnings are affected by the performance of LSV. We maintain a minority ownership interest in LSV which is a significant contributor to our earnings. LSV is a registered investment advisor that provides investment advisory services to institutions, including pension plans and investment companies. LSV is a value-oriented, contrarian money manager offering a deep-value investment alternative utilizing a proprietary equity investment model to identify securities generally considered to be out of favor by the market. A majority of the revenues earned by LSV are based on the value of assets invested in investment products they manage. Volatility in the capital markets or poor investment performance on the part of LSV, on a relative basis or an absolute basis, could result in a significant reduction in their assets under management and revenues and a reduction in performance fees. Consequently, LSV's contribution to our earnings through our minority ownership could be adversely affected.

Our Company and our clients are subject to extensive governmental regulation. Our various business activities are conducted through entities which may be registered with or regulated by the Securities and Exchange Commission (SEC) as an investment advisor, a broker-dealer, a transfer agent, or an investment company, with federal or state banking authorities as a trust company, or with federal banking authorities as a savings association holding company. Our broker-dealer is also a member of the Financial Industry Regulatory Authority and is subject to its rules and oversight. In addition, some of our foreign subsidiaries are registered with, and subject to the oversight of, regulatory authorities primarily in the United Kingdom, the Republic of Ireland and Canada. Many of our clients are subject to substantial regulation by federal and state banking, securities or insurance authorities or the Department of Labor. Compliance with existing and future regulations, responding to and complying with recent regulatory activity affecting broker-dealers, investment advisors, investment companies and their service providers and financial institutions, and examination or other supervisory activities of our regulators or of the regulators of our clients, could have a significant impact on our operations or business or our ability to provide certain products or services.

We offer investment and banking products that also are subject to regulation by the federal and state securities and banking authorities, as well as foreign regulatory authorities, where applicable. Existing or future regulations that affect these products could lead to a reduction in sales of these products or an increase in the cost of providing these products.

The fees and assessments imposed on our regulated subsidiaries by federal, state and foreign regulatory authorities could have a significant impact on us. In the current regulatory environment, the frequency and scope of regulatory reform may lead to an increase in fees and assessments resulting in increased expense, or an increase or change in regulatory requirements which could affect our operations and business.

We are subject to litigation and regulatory examinations and investigations. The financial services industry faces substantial regulatory risks and litigation. Like many firms operating within the financial services industry, we are experiencing a difficult regulatory environment across our markets. Our current scale and reach as a provider to the financial services industry; the

increased regulatory oversight of the financial services industry generally; new laws and regulations affecting the financial services industry and ever-changing regulatory interpretations of existing laws and regulations, have made this an increasingly challenging and costly regulatory environment in which to operate. These examinations or investigations could result in the identification of matters that may require remediation activities or enforcement proceedings by the regulator. The direct and indirect costs of responding to these examinations, or of defending ourselves in any litigation could be significant. Additionally, actions brought against us may result in settlements, awards, injunctions, fines and penalties. The outcome of any litigations or regulatory actions is inherently difficult to predict and could have an adverse affect on our ability to offer some of our products and services.

Consolidation within our target markets may affect our business. Merger and acquisition activity between banks and other financial institutions could reduce the number of existing and prospective clients or reduce the amount of revenue we receive from retained clients. Consolidation activities may also cause larger institutions to internalize some or all of our services. These factors may negatively impact our ability to generate future growth in revenues and earnings.

We are exposed to systems and technology risks. Through our proprietary systems, we maintain and process data for our clients that is critical to their business operations. An unanticipated interruption of service may have significant ramifications, such as lost data, damaged software codes, or inaccurate processing of transactions. As a result, the costs necessary to rectify these problems may be substantial.

We are exposed to data security risks. A failure to safeguard the integrity and confidentiality of client data and our proprietary data from the infiltration by an unauthorized user that is either stored on or transmitted between our proprietary systems or to other third party service provider systems may lead to modifications or theft of critical and sensitive data pertaining to us or our clients. The costs incurred to correct client data and prevent further unauthorized access to our data or client data could be extensive.

We are dependent upon third party approvals. Many of the investment advisors through which we distribute our investment offerings are affiliated with independent broker-dealers or other networks, which have regulatory responsibility for the advisor’s practice. As part of the regulatory oversight, these broker-dealers or networks must approve the use of our investment products by affiliated advisors within their networks. Failure to receive such approval, or the withdrawal of such approval, could adversely affect the marketing of our investment products.

We are exposed to operational risks. Operational risk generally refers to the risk of loss resulting from our operations, including, but not limited to, improper or unauthorized execution and processing of transactions, deficiencies in our operating systems, inefficiencies in our operational business units, business disruptions and inadequacies or breaches in our internal control processes. We operate different businesses in diverse markets and are reliant on the ability of our employees and systems to process large volumes of transactions often within short time frames. In the event of a breakdown or improper operation of systems, human error or improper action by employees, we could suffer financial loss, regulatory sanctions or damage to our reputation. In order to mitigate and control operational risk, we continue to enhance policies and procedures that are designed to identify and manage operational risk.

We are subject to financial and non-financial covenants which may restrict our ability to manage liquidity needs. Our $300 million five-year senior unsecured revolving credit facility (Credit Facility) contains financial and non-financial covenants. The non-financial covenants include restrictions on indebtedness, mergers and acquisitions, sale of assets and investments. In the event of default, we have restrictions on paying dividends and repurchasing our common stock. We have one financial covenant, the Leverage Ratio, which restricts the level of indebtedness we can incur to a maximum of 1.75 times earnings before interest, taxes, depreciation and amortization (EBITDA). We believe our primary risk is with the financial covenant if we were to incur significant unexpected losses that would impact the EBITDA calculation. This would increase the Leverage Ratio and restrict the amount we could borrow under the Credit Facility. A restriction on our ability to fully utilize our Credit Facility may negatively affect our operating results, liquidity and financial condition.

Changes in, or interpretation of, accounting principles could affect our revenues and earnings. We prepare our consolidated financial statements in accordance with generally accepted accounting principles. A change in these principles can have a significant effect on our reported results and may even retrospectively affect previously reported results.

Changes in, or interpretations of, tax rules and regulations may adversely affect our effective tax rates. Unanticipated changes in our tax rates could affect our future results of operations. Our future effective tax rates could be adversely affected by changes in tax laws or the interpretation of tax laws. We are subject to possible examinations of our income tax returns by the Internal Revenue Service and state and foreign tax authorities. We regularly assess the likelihood of outcomes resulting from these examinations to determine the adequacy of our provision for income taxes, however, there can be no assurance that the final determination of any examination will not have an adverse effect on our operating results or financial position.

Currency fluctuations could negatively affect our future revenues and earnings as our business grows globally. We operate and invest globally to expand our business into foreign markets. Our foreign subsidiaries use the local currency as the functional currency. As these businesses evolve, our exposure to changes in currency exchange rates may increase. Adverse movements in currency exchange rates may negatively affect our operating results, liquidity and financial condition.

We rely on our executive officers and senior management. Most of our executive officers and senior management personnel do not have employment agreements with us. The loss of these individuals may have a material adverse affect on our future operations.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

Our corporate headquarters is located in Oaks, Pennsylvania and consists of nine buildings situated on approximately 90 acres. We own and operate the land and buildings, which encompass approximately 486,000 square feet of office space and 34,000 square feet of data center space. We lease other offices which aggregate 65,000 square feet. We also own a 3,400 square foot condominium that is used for business purposes in New York, New York.

Item 3. Legal Proceedings.

One of SEI's principal subsidiaries, SIDCO, has been named as a defendant in certain putative class action complaints (the Complaints) related to leveraged exchange traded funds (ETFs) advised by ProShares Advisors, LLC. The first complaint was filed on August 5, 2009 and the subsequent cases were all consolidated in the Southern District of New York. The Complaints are purportedly made on behalf of all persons that purchased or otherwise acquired shares in various ProShares leveraged ETFs pursuant or traceable to allegedly false and misleading registration statements, prospectuses and statements of additional information. The Complaints name as defendants ProShares Advisors, LLC; ProShares Trust; ProShares Trust II, SIDCO, and various officers and trustees to ProShares Advisors, LLC; ProShares Trust and ProShares Trust II. The Complaints allege that SIDCO was the distributor and principal underwriter for the various ProShares leveraged ETFs that were distributed to authorized participants and ultimately shareholders. The Complaints allege that the registration statements for the ProShares ETFs were materially false and misleading because they failed adequately to describe the nature and risks of the investments and claim that SIDCO is liable for these purportedly material misstatements and omissions under Section 11 of the Securities Act of 1933. Defendants moved to dismiss the amended complaint filed by plaintiffs, and on September 7, 2012, the District Court for the Southern District of New York issued an opinion dismissing with prejudice the plaintiffs' amended complaint. Plaintiffs filed with the Second Circuit Court of Appeals a notice of appeal of the District Court's decision. Plaintiffs-appellants filed their brief on December 17, 2012 and later filed a corrected brief on January 3, 2013. The brief of defendants-appellees was filed on February 1, 2013. While the outcome of this litigation is uncertain given its early phase, SEI believes that it has valid defenses to plaintiffs' claims and intends to defend the lawsuits vigorously.

SEI has been named in six lawsuits filed in Louisiana. Five lawsuits were filed in the 19th Judicial District Court for the Parish of East Baton Rouge, State of Louisiana. One of the five actions purports to set forth claims on behalf of a class and also names SPTC as a defendant and, as described below, was certified as a class in December 2012. Two of the other actions also name SPTC as a defendant. All five actions name various defendants in addition to SEI, and, in all five actions, the plaintiffs purport to bring a cause of action under the Louisiana Securities Act. The class action originally included a claim against SEI and SPTC for an alleged violation of the Louisiana Unfair Trade Practices Act. Two of the other five actions include claims for violations of the Louisiana Racketeering Act and possibly conspiracy. In addition, another group of plaintiffs have filed a lawsuit in the 23rd Judicial District Court for the Parish of Ascension, State of Louisiana, against SEI and SPTC and other defendants asserting claims of negligence, breach of contract, breach of fiduciary duty, violations of the uniform fiduciaries law, negligent misrepresentation, detrimental reliance, violations of the Louisiana Securities Act and Louisiana Racketeering Act and conspiracy. The underlying allegations in all the actions are purportedly related to the role of SPTC in providing back-office services to Stanford Trust Company. The petitions allege that SEI and SPTC aided and abetted or otherwise participated in the sale of “certificates of deposit” issued by Stanford International Bank. Two of the five actions filed in East Baton Rouge were removed to federal court and transferred by the Judicial Panel on Multidistrict Litigation to United States District Court for the Northern District of Texas. On August 31, 2011, the United States District Court for the Northern District of Texas issued an order and judgment that the causes of action alleged against SEI in the two removed actions were preempted by federal law and the Court dismissed these cases with prejudice. Plaintiffs appealed this ruling, and on March 19, 2012, a panel of the Court of Appeals for the Fifth Circuit reversed the decision of the United States District Court and remanded the actions for further proceedings. On July 18, 2012, SEI filed a petition for certiorari in the United States Supreme Court, seeking review of the decision by the United States Court of Appeals for the Eleventh Circuit to permit the claims against SEI to proceed. The

Company believes that the trial court correctly concluded that the claims against SEI were barred by the federal Securities Litigation Uniform Standards Act and is requesting that the Supreme Court reinstate that dismissal. On January 18, 2013, the Supreme Court granted the petition for certiorari, and the Court will consider the case in the fall of this year.

SEI and SPTC filed exceptions in the class action pending in East Baton Rouge, which the Court granted in part and dismissed the claims under the Louisiana Unfair Trade Practices Act and denied in part as to the other exceptions. SEI and SPTC filed an answer to the East Baton Rouge class action; plaintiffs filed a motion for class certification; and SEI and SPTC also filed a motion for summary judgment against certain named plaintiffs which the Court stated will not be set for hearing until after the hearing on the class certification motion. The Court in the East Baton Rouge action held a hearing on class certification on September 20, 2012. By oral decision on December 5, 2012 and later entered in a judgment signed on December 17, 2012 that was subsequently amended, the Court in East Baton Rouge certified a class to be composed of persons who purchased any Stanford International Bank certificates of deposit (“SIB CDs”) in Louisiana between January 1, 2007 and February 13, 2009; persons who renewed any SIB CD in Louisiana between January 1, 2007 and February 13, 2009; or any person for whom the Stanford Trust Company purchased SIB CDs in Louisiana between January 1, 2007 and February 13, 2009. On January 30, 2013, SEI and SPTC filed motions for appeal from the judgments that stated SEI's and SPTC's intention to move to stay the litigation. On February 1, 2013, plaintiffs filed a Motion for Leave to File First Amended and Restated Class Action Petition in which they ask the Court to allow them to amend the petition in this case to add additional facts that were developed during discovery and adding claims against certain of SEI's insurance carriers. On February 5, 2013, the Court granted two of the motions for appeal and the motion for leave to amend. While the outcome of this litigation is uncertain given its early phase, SEI and SPTC believe that they have valid defenses to plaintiffs' claims and intend to defend the lawsuits vigorously.

The case filed in Ascension Parish was also removed to federal court and transferred by the Judicial Panel on Multidistrict Litigation to the Northern District of Texas. The schedule for responding to that complaint has not yet been established. The plaintiffs in the remaining two cases in East Baton Rouge have granted SEI an extension to respond to the filings.

Because of the uncertainty of the make-up of the classes, the outcome of the proceeding in the U.S. Supreme Court, the specific theories of liability that may survive a motion for summary judgment or other dispositive motion, the lack of discovery regarding damages, causation, mitigation and other aspects that may ultimately bear upon loss, the Company is not reasonably able to provide an estimate of loss, if any, with respect to the foregoing lawsuits.

Executive Officers of the Registrant

Information about our executive officers is contained in Item 10 of this report and is incorporated by reference into this Part I.

Item 4. Mine Safety Disclosures.

None.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Price Range of Common Stock and Dividends:

Our common stock is traded on The Nasdaq Global Select Market® (NASDAQ) under the symbol “SEIC.” The following table shows the high and low sales prices for our common stock as reported by NASDAQ and the dividends declared on our common stock for the last two years. Our Board of Directors intends to declare future dividends on a semiannual basis.

|

| | | | | | | | | | | | |

| 2012 | | High | | Low | | Dividends |

| First Quarter | | $ | 21.58 |

| | $ | 17.00 |

| | $ | — |

|

| Second Quarter | | 21.24 |

| | 17.03 |

| | 0.15 |

|

| Third Quarter | | 22.84 |

| | 19.31 |

| | — |

|

| Fourth Quarter | | 23.51 |

| | 20.79 |

| | 0.48 |

|

|

| | | | | | | | | | | | |

| 2011 | | High | | Low | | Dividends |

| First Quarter | | $ | 24.87 |

| | $ | 21.64 |

| | $ | — |

|

| Second Quarter | | 24.24 |

| | 21.19 |

| | 0.12 |

|

| Third Quarter | | 23.11 |

| | 14.63 |

| | — |

|

| Fourth Quarter | | 17.52 |

| | 13.73 |

| | 0.15 |

|

According to the records of our transfer agent, there were 377 holders of record of our common stock on January 31, 2013. Because many of such shares are held by brokers and other institutions on behalf of stockholders, we are unable to estimate the total number of stockholders represented by these record holders.

For information on our equity compensation plans, refer to Note 8 to the Consolidated Financial Statements and Item 12 of this Annual Report on Form 10-K.

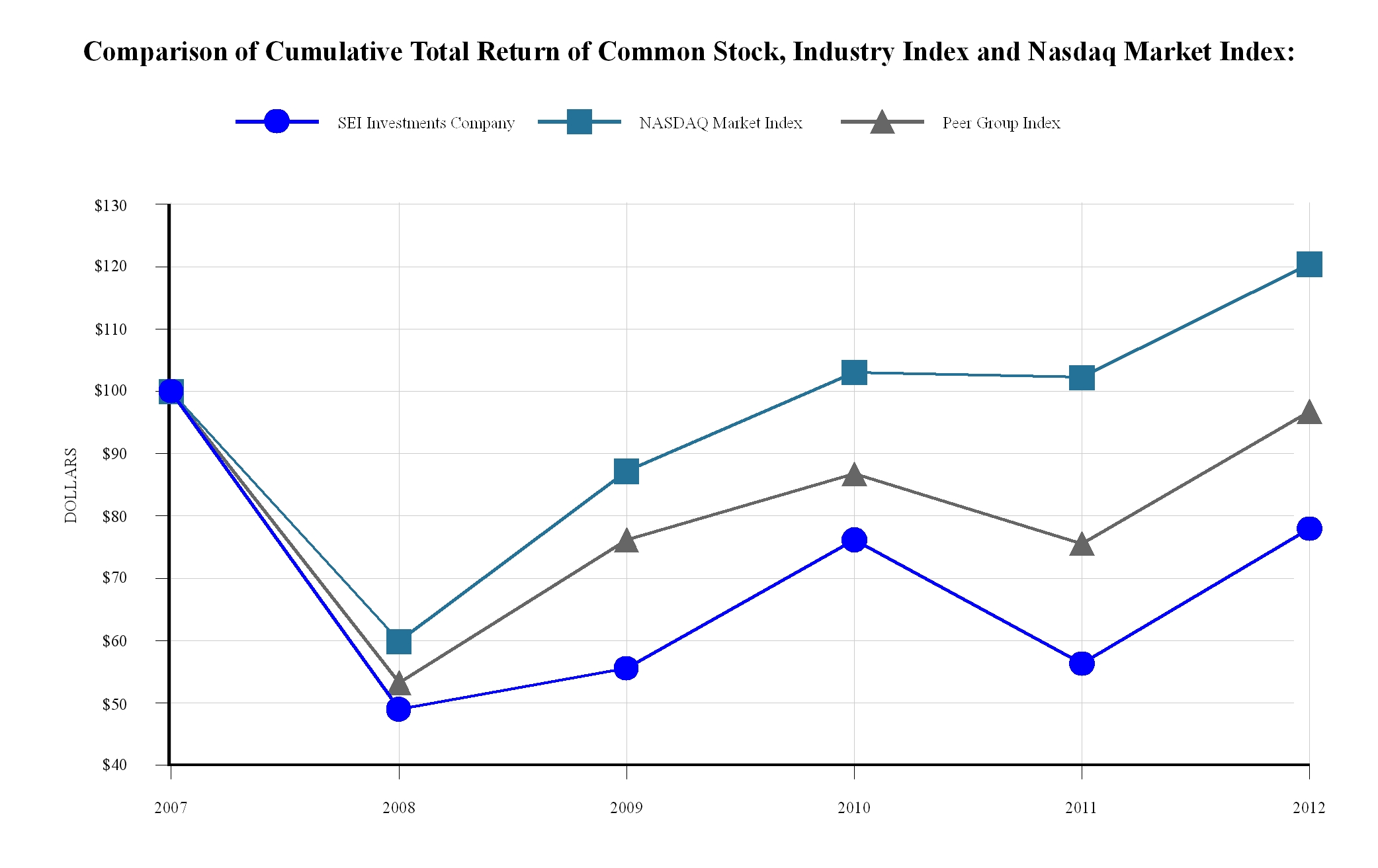

ASSUMES $100 INVESTED ON JANUARY 1, 2008 & DIVIDENDS REINVESTED

FISCAL YEAR ENDED DECEMBER 31,

Issuer Purchases of Equity Securities:

Our Board of Directors has authorized the repurchase of up to $2.078 billion worth of our common stock through multiple authorizations. Currently, there is no expiration date for our common stock repurchase program (See Note 8 to the Consolidated Financial Statements).

Information regarding the repurchase of common stock during the three months ended December 31, 2012 is:

|

| | | | | | | | | | | | | | |

| Period | | Total Number of Shares Purchased | | Average Price Paid per Share | | Total Number of Shares Purchased as Part of Publicly Announced Program | | Approximate Dollar Value of Shares that May Yet Be Purchased Under the Program |

| October 1 – 31, 2012 | | 125,000 |

| | $ | 21.89 |

| | 125,000 |

| | $ | 80,022,000 |

|

| November 1 – 30, 2012 | | 895,000 |

| | 21.95 |

| | 895,000 |

| | 60,373,000 |

|

| December 1 – 31, 2012 | | 860,000 |

| | 22.51 |

| | 860,000 |

| | 91,012,000 |

|

| Total | | 1,880,000 |

| | $ | 22.21 |

| | 1,880,000 |

| | |

Item 6. Selected Financial Data.

(In thousands, except per-share data)

This table presents selected consolidated financial information for the five-year period ended December 31, 2012. This data should be read in conjunction with the financial statements and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in this Annual Report on Form 10-K.

|

| | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, | | 2012 | | 2011 | | 2010 (A) | | 2009 | | 2008 |

| Revenues | | $ | 992,522 |

| | $ | 929,727 |

| | $ | 900,835 |

| | $ | 1,060,548 |

| | $ | 1,247,919 |

|

| Total expenses | | 780,956 |

| | 725,662 |

| | 683,302 |

| | 696,841 |

| | 751,570 |

|

| Income from operations | | 211,566 |

| | 204,065 |

| | 217,533 |

| | 363,707 |

| | 496,349 |

|

| Other income (expense) | | 117,930 |

| | 114,422 |

| | 152,248 |

| | (1,389 | ) | | (142,119 | ) |

| Income before income taxes | | 329,496 |

| | 318,487 |

| | 369,781 |

| | 362,318 |

| | 354,230 |

|

| Income taxes | | 121,462 |

| | 111,837 |