UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT UNDER SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the calendar year ended December 31, 2006

COMMISSION FILE NO.: 0-10449

TVI CORPORATION

(Exact name of registrant as specified in its charter)

| | |

| Maryland | | 52-1085536 |

(State or other jurisdiction of incorporation or incorporation) | | (I.R.S. Employer Identification No.) |

7100 Holladay Tyler Road, Glenn Dale, MD 20769

(Address of principal executive offices, including zip code)

(301) 352-8800

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock $.01 Par Value

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form l0-K or any amendment to this Form l0-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer (as defined in Rule 12b-2 of the Act).

Large Accelerated Filer ¨ Accelerated Filer x Non-Accelerated Filer ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of June 30, 2006, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $109,000,000 based on the closing price of the common stock on the Nasdaq Stock Market on June 30, 2006. As of March 1, 2007 there were33,227,740 shares of common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Information required by Items 10 through 14 of Part III of this Form 10-K, to the extent not set forth herein, is incorporated herein by reference to portions of the registrant’s definitive proxy statement for the registrant’s 2007 Annual Meeting of Stockholders, which will be filed with the Securities and Exchange Commission not later than 120 days after the end of the fiscal year ended December 31, 2006. Except with respect to the information specifically incorporated by reference in this Form 10-K, the registrant’s definitive proxy statement is not deemed to be filed as a part of this Form 10-K.

TABLE OF CONTENTS FOR FORM 10-K

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

In this report, the terms “TVI,” “Company,” “we,” “us” and “our” refer to TVI Corporation and its subsidiaries, unless otherwise noted or the context otherwise indicates.

In addition to historical information, this Annual Report on Form 10-K contains “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such statements are subject to known and unknown risks, uncertainties and other factors that could cause the actual results to differ materially from those contemplated by the statements. In some cases, you can identify these so-called “forward-looking statements” by words like “may,” “will,” “should,” “expects,” “plans,” “seeks,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” or “continue” or the negative of those words and other comparable words. You should be aware that those statements only reflect our predictions. Actual events or results may differ substantially. Important factors that could cause our actual results to be materially different from the forward-looking statements are disclosed under the heading Item 1A—Risk Factors. Any such statements should be considered in light of various risks and uncertainties that could cause results to differ materially from expectations, estimates or forecasts expressed. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date of this Form 10-K.

All subsequent written or oral forward-looking statements attributable to TVI are expressly qualified in their entirety by the cautionary statements included in this document. TVI undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

ii

PART I

Overview

TVI Corporation is a Maryland corporation formed in 1977. We are a global supplier of homeland security, infection control, respiratory and filtration products for first receivers, such as hospitals, and first responders, such as law enforcement agencies, fire departments and public health agencies. We are also a provider of shelter and equipment rental services for special events and disaster relief needs. In November 2005, we acquired Safety Tech International, Inc. (“STI”), a privately-held supplier of powered air purifying respirators (“PAPRs”). As a result of the acquisition, STI became a wholly owned subsidiary of TVI. In October 2006, we acquired substantially all of the assets of privately-held Signature Special Event Services, LLC, a leading provider of full-service rental services for traditional special events and disaster relief needs with broad temporary infrastructure offerings. The assets and operations we acquired from Signature Special Event Services, LLC are conducted through our wholly owned subsidiary Signature Special Event Services, Inc. (“SSES”).

We design, manufacture, market and supply shelter systems, thermal marking devices, filtration systems and infection control products primarily for homeland security agencies, hospitals, the military, law enforcement agencies and fire departments and public health agencies. Our shelter systems include nuclear, biological and chemical decontamination systems, hospital surge capacity systems and infection control systems, most of which employ our proprietary articulating frame.

We also design, manufacture, market and supply PAPRs through our STI subsidiary, and plan to also supply disposable filter canisters for the first responder, military, healthcare and industrial markets. Subject to first article approval, we anticipate the operational launch of our high-capacity filter canister manufacturing line in our Glenn Dale, Maryland facility.

We are also a national provider of turn-key shelter and equipment rental services for disaster relief, military, government, industrial, sporting, hospitality and other special event needs through our SSES subsidiary. With facilities in Maryland, Florida, Kentucky, North Carolina and California, our extensive in-house inventory enables us to address events of any size and complexity, including extremely large-scale deployments such as our deployment of more than 600,000 square feet of tents, 2,500 tons of heating, ventilation and air conditioning (“HVAC”) capacity, and 22 miles of power distribution at 40 sites within Texas, Louisiana, Florida and Mississippi as an integral part of the disaster response effort in connection with Hurricane Katrina. In addition to a substantial inventory of tents, our inventory of rental equipment includes flooring, lighting, mobile kitchens, catering equipment, generators, power distribution and HVAC equipment.

We seek to continue our growth strategy by expanding our product and services offerings and target markets. We intend to do so by organically developing new offerings and opportunities, capitalizing on synergies that arise among our shelter and related business and our more recently acquired businesses and by continuing to pursue acquisition opportunities.

Our headquarters are located in Glenn Dale, Maryland where we manufacture most of our products. We also have operations in Frederick, Maryland where we manufacture our PAPRs products. Our SSES subsidiary is headquartered in Frederick, Maryland and has branch facilities in California, Florida, Kentucky, Maryland and North Carolina.

Segment Information

TVI has organized into three reportable segments as a result of our acquisitions of STI and SSES, our integration and realignment efforts with respect to these acquisitions and our recently completed high-capacity

1

filter canister manufacturing line. These segments are Shelters and Related Products (shelter systems, surge capacity and infection control systems and command and control systems and our isolation and thermal products), Personal Protection Equipment (PAPRs and filters) and SSES Rental Services. For additional information relating to our reportable segments, refer to Note 17 in the Notes to Consolidated Financial Statements included in this Form 10-K. The principal products and services of each of our operating segments are discussed under a separate caption below.

Shelters and Related Products

At the time of our formation in 1977, our initial product offerings included thermal targets and thermal range markers. Our products lines have expanded significantly since that time to include a broad variety of shelter and thermal products to address the requirements of our customers.

Shelter Products

We supply our first receiver and first responder customers with integrated total solution systems for decontamination, command and control, forensic investigation, disaster assistance, communication centers and patient and containment isolation. Our shelter systems include decontamination systems, chem/bio isolation systems, infection control systems, mobile hospital systems, command and control shelters, and crime scene management and investigation systems. Our decontamination systems facilitate the decontamination of people who have been exposed to toxic compounds, including chemical, biological, radiological and nuclear (“CBRN”) agents. Contamination can result from any catastrophic event including natural disasters (e.g., tornadoes or hurricanes), industrial incidents (e.g., chemical spills) or acts of terror. We also market trailerized first responder systems customized to customers’ requirements. These trailer systems provide for portability, on-site power generation, air conditioning, lighting, water and nuclear, biological and chemical (“NBC”) filtration.

Our chem/bio isolation product line incorporates innovative technology to reduce exposure to contaminants during a chemical and/or biological incident. Targeted at the health care and military markets, the chem/bio shelter system coupled with leading edge military-grade filtration equipment capture airborne biological and chemical contaminants and quickly provide first receivers with the ability to set up and isolate patients at any location.

Our MK-1TM infection control system provides hospitals with the means to convert standard patient treatment rooms into negative pressure isolation rooms. This system enables public health care providers to quickly isolate patients with life threatening communicable diseases from the rest of the hospital patient community.

Our mobile hospital systems offer the first receiver market large, rapidly deployable hospital systems designed to serve as surge capacity or field hospitals. These mobile hospital systems incorporate TVI’s inflatable shelters, generators, air filtration systems, water and lighting, making the hospital mobile and ready for any incident. Mobile hospital systems have become a high priority product as a result of concerns regarding the potential for a flu pandemic, as well as other larger scale potential disasters.

Our command and control shelters and crime scene management and investigation shelters offer rapidly deployable field facilities to the military, first responders and law enforcement agencies.

The core component of most of our shelter systems is our patented articulating frame. Our articulating frame technology is comprised of rigid rods and hinges configured to enable rapid deployment of an extremely strong shelter in a matter of seconds without the need for additional set-up equipment such as air tanks, compressors or blowers. Supporting equipment that completes the shelter systems includes lighting, air and water heaters, power generators, flooring, trailers and air filtration elements.

2

Thermal Products

In addition to our shelter products, since 1977, we have designed, manufactured, marketed and supplied thermal products. Our thermal product offerings include infrared raised angle marking systems (“IRAMS”), thermal targets and thermal range markers, soldier combat identifiers and vehicle markers for the military and law enforcement markets. We also supply a variety of marking and signaling products that can be used not only with thermal sights and other forward looking infrared (“FLIR”) systems, but also with night vision goggles.

Personal Protection Equipment

We are expanding our presence in the personal protection equipment market, focusing on PAPRs and disposable filter canisters for the first responder, military, healthcare and industrial markets.

PAPRs

We entered this market in April 2004 by forming CAPA Manufacturing Corp. (“CAPA”) and acquiring the assets of CAPA Manufacturing, LLC, adding a line of PAPRs and related proprietary respiration products as well as respirator research design and manufacturing capabilities. In November 2005, we significantly expanded our product offerings in the PAPRs market by acquiring STI. STI manufactures PAPRs and related proprietary respiration products, enabling us to offer a wide range of powered air products to a variety of market segments. These include the U.S. military, hospitals, first responders, industrial, and laboratory, decontamination and natural catastrophe response markets.

STI’s PAPRs systems, masks, filter cartridges and accessories are currently used by U.S. Special Forces, Fixed and Rotary Wing Aviators, National Guard WMD response teams, Mass Casualty Decontamination teams, and SWAT and special operations personnel, both domestically and internationally. STI also manufactures products on a private label basis for large original equipment manufacturers (��OEMs”).

STI continues to develop new products, which we believe will enhance our ability to serve the full spectrum of the PAPRs market. STI has established close working relationships with its key customer groups, particularly the federal government, first responders and the military. STI has several next-generation products under review with the National Institute for Occupational Safety and Health (“NIOSH”), and has received NIOSH approval for certain of its products. We expect these new STI products to enable us to expand our presence in commercial markets, including the industrial and biotechnology markets. NIOSH has established new CBRN standards for all classes of respirators and we intend to address these new standards and seek required approvals.

Filter Canisters

We have established a high-capacity filter canister production line to manufacture disposable filter canisters for the first responder, military, healthcare and industrial markets. These filter canisters are a necessary component in respirators and powered air respirators that filter CBRN agents, inorganic particulates, and toxic gases. The filter canister production line is located at our Glenn Dale, Maryland facility and we believe that our facility will be the most technically-advanced high-capacity filter canister manufacturing operation in the United States. In October 2006, we announced our receipt of an order valued at approximately $2.0 million from the U.S. Army TACOM Life Cycle Management Command for TVI’s C2A1 filter canisters, subject to first article approval. We have commenced first article testing and anticipate commencing production of our C2A1 canisters subject to first article approval by the Army. We also continue to pursue the commercial filter canister market and have received NIOSH approval to incorporate our filter canister into one of our PAPRs designs. We are pursuing NIOSH approval for a number of additional commercial applications in an effort to begin sales to OEMs. In addition, we have submitted certain of our filter canisters for Central European Norm (“CEN”) approval.

3

SSES Rental Services

Through our SSES subsidiary we provide turn-key temporary venues and facilities for a variety of special events and other uses, including sporting events, social events, corporate events, institutional uses, government and military uses, and disaster relief. The primary support services that we offer are tenting, power generation, HVAC, and self-contained mobile kitchens. Additional support products and services that we offer include lighting, temporary fencing, carpeting, computer aided design (“CAD”) layout services and a variety of other related items.

Tenting

Our tent products consist of two basic types of structures: clear span structures and tension structures. Clear span structures provide unobstructed interior space and cover areas from 10 feet wide to over 164 feet wide with lengths to 500 feet or more. The clear spans use an engineered box beam aluminum frame design with an integrated vinyl skin to provide a clean, tight temporary facility. Tension structures use an engineered, sculptured, high peak pole design ranging from 10 feet to 120 feet wide in varying lengths. We are able to outfit both styles of tenting with a variety of wall types, floors, doors, lights, interior partitions and decorative liners.

Power Generation/HVAC

We provide temporary power and temperature control solutions as a separate service offering and in conjunction with our tent services. Our sound attenuated generators range in size from 5500 watt portable units to trailer-mounted One Meg Twin Pak units capable of supplying power for a variety of needs from small events to television broadcasts to large-scale disaster relief. In addition, we also offer complete cable and distribution packages, transformers, cable ramps, switchgear and other related services. Our HVAC capability includes 10, 20 and 25 ton units that are capable of supplying air conditioning or heating for any tent structure in our inventory. We also offer HVAC capability for buildings or other permanent venues in need of temporary climate control. Our HVAC units integrate directly into our tent sidewalls creating an attractive and seamless venue.

Mobile Kitchens

We provide rapidly deployable temporary food service solutions for small and large scale special events, institutional kitchen renovations and disaster relief projects. Our mobile kitchens are self contained units housed in interlocking 20 feet and 40 feet trailers and provide up to 15,000 square feet of enclosed workspace. Plumbing, electrical wiring and propane lines are pre-assembled for quick on-site set up. We also offer a variety of appliances and equipment that compliment our mobile kitchens including ovens, gas and electric ranges, refrigeration units, sinks, dishwashers, stainless work tables and other utensils and equipment. Our standard installations include fire suppression systems and vent systems.

Strategy and Markets

Through organic development and strategic acquisition opportunities, we plan to diversify and grow our business to continue to address the changing requirements and capitalize on the corresponding opportunities of our three business segments. With the recent addition of SSES, we anticipate that our more diverse offerings of products and services will position us well to address the first receiver and first responder markets and SSES’s core commercial special event market.

Our revenue for the year ended December 31, 2006 was primarily derived from the major markets for our shelter and PAPRs systems (the homeland security, first responder, first receiver and military markets). Our revenue for November and December 2006 also includes the results of SSES. We have expanded our shelter and related products and personal protection equipment products to meet the increasingly demanding requirements of our target markets. For example, we have significantly added to our mobile hospital surge systems offerings and significantly enhanced the features of our infection control products. We accomplished this expansion through our continued commitment to research and development (“R&D”), capital expenditures and

4

strategic commercial relationships. Additionally, we have invested in the development of our new filter canister line, which we believe will be the most technically advanced high-capacity filter manufacturing operation in the U.S. On October 31, 2006, we announced that we had received an order valued at approximately $2.0 million from the U.S. Army TACOM Life Cycle Management Command for TVI’s C2A1 filter canisters, subject to first article approval. The contract is TVI’s first military order for its filter canister manufacturing line. We also continue to pursue strategic commercial relationships with third parties to address, among other things, situations where the economics support the decision to pursue the relationship rather than pursue in-house development of the capability.

Historically, our product line was primarily designed to address the decontamination market. We believe that the decontamination market continues to be a source of significant business. We also believe, however, that spending by customers in the decontamination market is slowing and therefore will not continue at prior levels as customers in that market begin to satisfy their more immediate inventory needs. We plan to continue our growth and diversification strategy to, among other things, address the slowing that we perceive in the decontamination market and the growth opportunities that we believe exist in other first responder and first receiver markets, particularly the hospital surge and infection control markets.

In addition to organic growth, we plan to pursue strategic acquisition opportunities. We continue to seek acquisition targets that will further our product diversification strategy, better position us within our target markets and potentially open opportunities in new markets that are related to our core competencies.

With respect to our SSES Rental Services segment, we plan to continue to pursue SSES’s established position in the commercial special event industry while targeting expansion of SSES’s efforts in the disaster relief market, a market in which TVI is well positioned. SSES maintains relationships with some of the nation’s largest and most prestigious events including PGA® golf events and the Preakness Stakes®. More recently, SSES has targeted the disaster relief market providing significant levels of service to government and military entities, as well as private companies, including power and energy companies, hospitals and healthcare organizations, within this market. We believe that significant opportunities exist to expand the business of SSES within the disaster relief market, based, among other things, on SSES’s capabilities, synergies resulting from the similar businesses of SSES and TVI, and SSES’s developing and TVI’s established presence in the disaster relief market.

Distribution

Approximately 90% and 97% of our sales in 2006 and 2005, respectively, were sales within the U.S. and 10% and 3% of our sales in 2006 and 2005, respectively, were outside the U.S. Approximately 60% and 68% of our sales in 2006 and 2005, respectively, were made through our U.S. distributors. Approximately 18% and 60% of or our sales in 2006 and 2005, respectively, were attributable to Fisher Scientific Company LLC, and approximately 13% and 4% of or our sales in 2006 and 2005, respectively, were attributable to W.W. Grainger, Inc.

We have developed significant distribution channels within the U.S. for the safety and homeland security markets and healthcare markets. In addition to our U.S. distributor partners, as of March 1, 2007, we had seven direct sales personnel located throughout the U.S., providing direct sales in most of the states within the continental U.S. We also maintain relationships with distributors in Canada, Europe and the Pacific and Far East.

STI and SSES primarily maintain direct relationships with their customers.

Competitors

Rapidly deployable shelter systems generally employ one of two types of shelter frames, air beam and rigid articulating frame. The products differ in the composition of the skeletal system that provides the rigidity to the fabric skin. A frame comprised of rigid rods and hinges is referred to as an “articulating” system, while a frame comprised of inflatable air chambers (similar to river rafts or Zodiac® boats) is referred to as an “air beam system.” We primarily use our patented articulating frame system for most of our products. It is light-weight and requires

5

no additional set up equipment, such as air tanks, compressors or electric blowers; therefore, it requires very little system deployment time. In addition, our articulating frame does not sag over time or require re-inflation. Four of our competitors use an air beam frame: Zumro (domestic), Aireshelta (U.K.), ACD (Netherlands) and Hughes Safety Showers (U.K.). One competitor, DHS Systems, LLC, manufactures an articulating product similar to ours. A third shelter construction-type sold in this industry has a self-supporting shell. The product relies on an accordion style corrugated plastic, and the only manufacturer that we are aware of using this system is UniFold.

We also supply large inflatable shelters, which utilize a unique air beam technology offering a durable, clear-span shelter capability to the hospital surge market. Competitors in this space include Blue-Med Response, Western Shelter and DHS Systems, all of which use rigid frame construction for their mobile hospital products.

Our primary competitors with respect to PAPRs are 3-M Company, North Safety Products, ILC Dover and Mine Safety Appliances Company.

The competitive landscape within the event services industry continues to increase. Consolidation among our competition is creating larger and more diverse companies. As we are one of the largest U.S. event services companies, the ongoing consolidation creates a more direct competitive threat in our primary markets. On the large national event level we have experienced less competition as few companies in the industry have the assets and capability to compete for these events.

Competition in these markets is based on any one or a combination of the following factors: price, functionality and interoperability, manufacturing capability, installation, services, existing business, customer and distribution relationships, scalability and the ability of products and services to meet customers’ immediate and future requirements. Many of our existing and potential competitors have significantly greater financial, technical and marketing resources, and greater manufacturing capacity, as well as better established relationships with distributors and end users, than we do.

Manufacturing Operations

We manufacture most of our products, including our shelter systems and filter canisters, at our headquarters facility in Glenn Dale, Maryland. We manufacture our PAPRs products at our Frederick, Maryland facility. SSES maintains smaller manufacturing facilities in Maryland at which it assembles certain portions of its tent, power generation and mobile kitchen products. We use various levels of automation to improve floor space utilization.

Raw Materials

We use only commercially available materials in the manufacture of our products. Many of the component parts of our products, however, are custom designed and single sourced. See “Risk Factors—We may not be able to obtain critical components.”

Intellectual Property

We hold various patents, trade secrets, trademarks, and other rights for our products, services, and processes. We have received patent protection on our articulating shelter frame, a collapsible display framework, a rapidly deployable roller transfer device, a thermal image identification system and a collapsible and rapidly deployable hazardous material containment device. Additionally, we currently have a number of domestic and foreign patent applications pending for new products ranging from decontamination and infection control equipment to advanced HVAC systems to chemical-biological filtration devices and respiratory systems to thermal products and devices. There are no active royalty or licensing agreements for our products.

We hold U.S. federal registration and common law rights in certain of our trademarks. Additionally, we have applications currently pending with the U.S. Patent and Trademark Office for U.S. trademarks and the Office of Harmonization in the Internal Market (“OHIM”) for European Community trademarks.

6

Government Regulations

We are subject to various regulations including the Federal Acquisition Regulations, the International Traffic in Arms Regulations (“ITAR”) export restrictions, the Bureau of Alcohol, Tobacco, Firearms and Explosives (“BATF”) import restrictions, certain Occupational Safety and Health Administration (“OSHA”) requirements and certain environmental regulations. Certain switches, blowers and breathing tube assemblies are subject to ITAR, requiring us to obtain export licenses from the U.S. Department of State to sell such products to foreign buyers. We also are registered with the BATF as an Importer of U.S. Munitions Import List Articles to obtain permits for the importation of certain respirators, gas masks and filters.

Our PAPRs and filter canister products are subject to regulation by numerous governmental bodies. The principal source of U.S. federal regulation for PAPRs and filter canisters is the Occupational Safety and Health Act of 1970, which created both OSHA regarding worker safety standards and the NIOSH for safety-product certification. We currently have several next-generation PAPRs products and filter canister products under review with NIOSH. Our PAPRs and filter canister products may also be subject to foreign laws and regulations. The schedule and outcome of regulatory review and approval, including by NIOSH, of our products has been and remains unpredictable.

Research and Development Activities

We spent $1.2 million, $1.1 million and $1.0 million for R&D in the years ended December 31, 2006, 2005 and 2004, respectively. These amounts do not include our investment in our recently completed filter canister production line. Additionally, in conjunction with our acquisition of STI, we entered into a Research and Development Agreement (the “R&D Agreement”) with Safety Tech AG, a Swiss corporation (“STAG”), and Hans Hauser, a principal of STAG, to formalize STAG’s historical R&D relationship with STI. Under the R&D Agreement, STAG provides to STI, on an exclusive basis, research, design, development and other related services in connection with STI’s respiratory products.

We believe that our commitment to R&D is important to the implementation of our business strategy. To address the changing requirements of our customers in the rapidly emerging military, domestic and international markets, we must continue to invest in innovations that lead to new product offerings.

Seasonality

With respect to our Shelters and Related Products and Personal Protection Equipment segments, there are no significant seasonal aspects to our operations. Our SSES Rental Services segment traditionally experiences stronger performance during the second and third quarters. Further, SSES’s disaster relief and government business is subject to seasonality and significant unpredictability given the correlation of this business to natural and man-made disasters such as earthquakes, hurricanes and the defense against CBRN attacks.

Impact of Environmental Laws

We are subject to a variety of environmental regulations relating to the use, storage, discharge and disposal of hazardous chemicals used during the manufacturing process and in connection with SSES’s business. We believe we are in substantial compliance with all federal, state and local environmental laws and have not experienced any significant costs associated with compliance with environmental laws; however, we cannot be certain that violations will not occur, which could have a material adverse effect on our financial results.

Employees

As of March 1, 2007, we had approximately 280 full-time employees. None of our employees are represented by a union. We consider our relations with our employees to be good.

7

Available Information

We make available free of charge through our Internet website,www.tvicorp.com, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission.

Our business, results of operations and financial condition are subject to a number of risks, including the risks set forth below. You should carefully consider these risks. Additional risks and uncertainties, including those that are not yet identified or that we currently believe are not significant, may also adversely affect our business, results of operations and financial condition.

Our growth strategy includes capital expenditures and pursuing strategic acquisitions and investments, which may not prove to be successful and may dilute our current stockholders’ percentage ownership.

Our business strategy includes making capital outlays, such as for the construction of our filter line, and acquiring or making strategic investments in other companies with a view to expanding our portfolio of products and services, expanding into new markets and businesses, acquiring new technologies, and accelerating the development of new or improved products. To do so, we may use a significant amount of our cash reserves, incur debt or assume indebtedness or issue equity that would dilute our current stockholders’ percentage ownership. Most recently, we acquired Signature Special Event Services, LLC through our wholly owned SSES subsidiary for a cash purchase price of $21.75 million, including our working capital adjustment as of the closing. We borrowed approximately $23.5 million under our new credit facility with Branch, Banking & Trust Company to pay the cash purchase price and pay other amounts in connection with the acquisition and the new credit facility and related expenses and fees. Acquisitions and strategic investments involve numerous risks, including those associated with the acquisition of SSES. In addition, the operations of SSES are significantly more capital intensive than our pre-acquisition businesses, which may require us to increase our borrowings or use cash resources to fund SSES’s operations.

Acquisitions are a key part of our business strategy; however, such acquisitions may not achieve all or any of their intended benefits.

Our acquisitions of STI and SSES involve various risks, including the incurrence of significant new secured indebtedness; the potential that customer relationships may be adversely impacted resulting in less or no revenue from such customers; the potential loss of key employees; the risk of diverting management’s attention from normal daily operations of our existing businesses; potential difficulties in completing projects or contracts associated with in-process inventory; risks of entering markets in which we have no or limited direct prior experience; initial dependence on unfamiliar supply chains or relatively small supply partners; and insufficient revenues to offset increased expenses associated with the acquisition. We also may encounter other risks in our acquisition strategy, including:

| | • | | increased competition for acquisitions, which may increase the cost of our acquisitions; |

| | • | | our failure to discover material liabilities in target companies; and |

| | • | | the failure of prior owners of any acquired businesses or their employees to comply with applicable laws or regulations such as the Federal Acquisition Regulations and health, safety, employment and environmental laws, or their failure to fulfill their contractual obligations to the federal government or other clients. |

8

In connection with our acquisitions of STI and SSES, as well as future acquisitions, we have and may continue to incur significant acquisition costs and expenses as well as amortization expenses related to intangible assets. We also may incur significant write-offs of goodwill associated with STI, SSES or other companies, businesses or technologies that we may acquire in the future. Our operating results could be adversely and materially affected by these costs, expenses and write-offs.

There can be no assurance that our acquisitions of STI or SSES will be successful and will not materially adversely affect our business, operating results, or financial condition. We must also manage any growth resulting from the acquisitions effectively. Failure to manage such growth effectively and successfully integrate the operations of STI, SSES or any future acquisition could have a material adverse effect on our business financial condition and results of operations.

We may have difficulty integrating the operations of any companies we acquire, which may adversely affect our results of operations.

The success of our acquisition strategy significantly depends upon our ability to successfully integrate any businesses we may acquire, including our recent acquisition of SSES. The integration of SSES and other businesses we may acquire in the future into our operations may result in unforeseen events or operating difficulties, absorb significant management attention and require significant financial resources that would otherwise be available for the ongoing organic development of our businesses. These integration difficulties could include:

| | • | | the integration of personnel with disparate business backgrounds; |

| | • | | the loss of key employees of acquired companies; |

| | • | | the transition to new information, supply and distribution systems; |

| | • | | the coordination of geographically dispersed organizations; |

| | • | | the reconciliation of different corporate cultures; and |

| | • | | the integration of disclosure and financial reporting controls of acquired companies with our controls and, where applicable, improvement of the acquired company’s controls. |

For these or other reasons, we may be unable to retain key clients or to retain or renew contracts of acquired companies. Moreover, any acquired business may fail to generate the revenues or net income we expected or produce the efficiencies or cost-savings that we anticipated. Any of these outcomes could materially adversely affect our business, financial condition and operating results.

Our indebtedness under our senior secured credit facility could limit our ability to grow and compete.

As of December 31, 2006, we had $26.7 million of indebtedness outstanding under our senior credit facility with Branch Banking & Trust Company (“BB&T”). The facility is secured by a lien on substantially all of our assets. Our indebtedness under the senior secured credit facility could have important consequences to our business. For example, it could:

| | • | | limit our ability to borrow additional funds or obtain additional financing in the future; |

| | • | | limit our ability to pursue acquisition opportunities; |

| | • | | expose us to greater interest rate risk since the interest rate on borrowings under our senior secured credit facility is variable; |

| | • | | limit our flexibility to plan for and react to changes in our business and our industry and make us less flexible in responding to changing economic conditions; and |

| | • | | make us more vulnerable to economic downturns and less able to withstand competitive pressures. |

Refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources” for a discussion of the terms of and limitations on borrowings under our senior secured credit facility with BB&T.

The agreement governing our senior secured credit facility contains various covenants that limit our management’s discretion in the operation of our business.

Our senior secured credit facility with BB&T contains various covenants that restrict our ability to, among other things:

| | • | | obtain additional financing in the future for working capital, capital expenditures, acquisitions, general corporate or other purposes; |

| | • | | borrow under the facility based upon borrowing base limitations; |

| | • | | pay dividends and make other distributions; |

| | • | | merge, consolidate or transfer all or substantially all of our assets; or |

Our senior secured credit facility with BB&T also requires that we comply with certain financial and other covenants, including an obligation to maintain a certain ratio of funded debt to EBITDA. As of December 31, 2006, we were not in compliance with this funded debt requirement. Although BB&T has granted to us a waiver of our compliance with this covenant and any corresponding event of default as of December 31, 2006, there is no assurance that BB&T will provide a waiver in the event of any future non-compliance. A failure to comply with this covenant and other provisions of our senior secured credit facility in the future could result in an event of default under the facility, which could, among other things, permit acceleration of the debt under the facility.

SSES generally does not have long-term agreements with its customers and generally does not have a significant backlog of unfilled orders, making its revenue and operating results in any quarter difficult to forecast and substantially dependent upon customer orders received and fulfilled in that quarter.

SSES generally does not have long-term agreements with its customers. Rather, SSES’s revenue derives from customer business relationships that were historically developed and maintained. If SSES is unable to maintain strong business relationships with these customers or unable to retain key employees that maintain these relationships, TVI’s results of operations or financial condition may be materially and adversely affected. Further, many of SSES’s customers place orders for deliveries with little or no advance contact. These orders generally have no cancellation or rescheduling penalty provisions. Therefore, cancellations, reductions or delays of orders from any significant customer could have a material adverse effect on our business, financial condition and results of operations.

9

A significant portion of our sales are to federal, state and local governmental entities, the loss or significant reduction of which would have a material adverse impact on our business, financial condition and results of operations.

The loss or significant reduction in government funding of programs in which we participate or the funded agency’s decision not to spend appropriated funds could materially adversely affect our future revenues, earnings and cash flows and thus our ability to meet our financial obligations. U.S. government contracts are conditioned upon Congress’ continuing approval of the amount of necessary spending. Congress usually appropriates funds for a given program each fiscal year even though contract periods of performance may exceed one year. Consequently, at the beginning of a major program, the contract is usually partially funded, and additional monies are normally committed to the contract only if Congress makes appropriations for future fiscal years. State contracts are generally subject to similar funding considerations. Therefore, if Congress does not appropriate funds for programs under which the government procures our products, the lack of funds may result in a loss or significant reduction of our government sales. In addition, even if funded, an agency may elect not to spend appropriated funds for various reasons, which would have a similar potential adverse effect on our business, financial condition and results of operations.

Selling to the U.S. government subjects us to unfavorable termination provisions and other review and regulation.

Companies such as ours that are engaged in supplying defense-related services and equipment to U.S. government agencies are subject to certain business risks peculiar to the defense industry. These risks include the ability of the U.S. government to unilaterally suspend us from receiving new orders or contracts pending resolution of alleged violations of procurement laws or regulations; terminate existing orders or contracts; reduce the value of existing orders or contracts; audit our contract-related costs and fees, including allocated indirect costs; and control and potentially prohibit the export of our products.

Because we rely on a limited number of third party distributors for the marketing, sale and support of our products, the termination or disruption of these relationships may materially adversely affect our revenue.

We sell the majority of our products through a limited number of independent distributors and third party sales agents, such as Fisher Scientific Company LLC in the U.S. and Canada, W.W. Grainger, Inc. in the U.S. and Professional Protection Systems Ltd. and OPEC Systems internationally. Approximately 18% and 60% of our total sales in 2006 and 2005, respectively, were made through Fisher Scientific; approximately 13% and 4% of our total sales in 2006 and 2005, respectively, were made through W.W. Grainger. We anticipate that our distributors will continue to account for most of our sales in our Shelters and Related Products segment for the foreseeable future. We have a limited ability to influence our distributors’ marketing efforts and relying on distributors could harm our business for various reasons, including that the agreements with our distributors may contain unfavorable terms, such as exclusivity provisions or early termination rights; such agreements may terminate prematurely or result in litigation due to disagreements; our distributors may not devote sufficient resources to the sale of our products or may be unsuccessful in their efforts to sell our products or otherwise impair our reputation; existing relationships with our distributors may preclude us from entering into new arrangements; and we may not be able to negotiate new distributor agreements on acceptable terms.

We are subject to economic, political and other risks associated with our international sales, which could materially adversely affect our business.

A portion of our revenue is generated from the international sale of our products through distributors, predominately in Canada, Western Europe and Australia. Net revenue outside the United States was approximately 10%, 3% and 13% of our total net revenue in 2006, 2005 and 2004, respectively. Our international sales are subject to a variety of factors, including changes in the political or economic conditions in a country or region; future fluctuations in exchange rates; trade protection measures and import or export licensing requirements; difficulty in effectively managing our international distributors; and differing tax laws and regulatory requirements, and changes in those laws and requirements. If we are unable to adapt to the requirements of our international customers or the markets in which they operate, we may experience a material adverse effect on our international sales.

10

The purchase orders and contracts governing the purchase for our products may commit us to unfavorable terms.

We generally sell our shelter systems and most other products pursuant to purchase orders issued by the purchasing party. Although we attempt to ensure that the terms of such purchase orders are acceptable to us, some purchase orders may contain unfavorable terms, such as heightened performance or warranty obligations or return rights. Additionally, our larger customers may use purchase orders with established terms that are not subject to negotiation or change by us.

Additionally, we generally provide certain products, including our thermal products, through formal contracts with the U.S. and state governments. These contracts generally can be terminated by the government either for its convenience or if we default by failing to perform under the contract. Termination for convenience provisions provide only for our recovery of costs incurred or committed settlement expenses and profit on the work completed prior to termination. Termination for default provisions provide for the contractor to be liable for excess costs incurred by the U.S. government in procuring undelivered items from another source. These contracts are generally fixed price contracts, as the price we charge is not subject to adjustment based on cost incurred to perform the required work under the contract. Therefore, we fully absorb cost overruns on these fixed price contracts and this reduces our profit margin on the contract. Failure to anticipate technical problems, estimate costs accurately or control costs during performance of a fixed price contract may reduce our profit or cause a loss on such contracts.

The planned expansion of our operations will place a significant strain on our management, financial controls, operations systems, personnel, and other resources.

Our ability to manage our future growth, should it occur, will depend in large part upon a number of factors including our ability to efficiently: build and train sales and marketing staff to create an expanding presence in the rapidly evolving market for our products and services and keep them fully informed over time regarding the technical features, issues and key selling points of our products and services; build, provide incentives for and support strong distribution channel partners and keep them informed regarding technical features, issues and key selling points of our products and services; develop our customer support capacity for direct and indirect sales personnel so that we can provide customer support without diverting engineering resources from product development efforts; and expand our internal management and financial controls and the systems supporting such controls, such as our enterprise resource planning systems, significantly to maintain control over our operations and provide support to other functional areas as the number of our personnel and size of our organization increases.

We may not succeed with these efforts. Our failure to efficiently expand and develop these areas could cause our expenses to grow and our revenues to decline or grow more slowly than expected and could otherwise impair our growth.

We may not be able to obtain critical components.

We purchase a number of critical custom components from single source vendors for which alternative sources may not be available. Delays or interruptions in the supply of these components could result in delays or reductions in product shipments. The purchase of these components from outside suppliers on a single source basis subjects us to risks, including the continued availability of supplies, price increases and potential quality assurance problems. While alternative suppliers may be available, these suppliers must be identified and qualified. We cannot be certain that any such suppliers will meet our required qualifications or that alternative suppliers can be identified in a timely fashion, if at all. Consolidations involving suppliers could reduce further the number of component alternatives and affect the cost of such supplies. An increase in the cost of such supplies could make our products less competitive. Production delays, lower margins or less competitive product pricing could have a material adverse effect on our business, financial condition and results of operations.

11

Our future financial performance will depend in large part on the successful development, demand for and acceptance of our products and services.

The market for our shelter, decontamination, PAPRs and other products and systems, as well as the market for our SSES rental services, may not grow, may grow at a slower rate than we expect or may diminish. Furthermore, the market may not accept our products. If the market fails to perform as we anticipate, or if the market fails to accept our products, our business could suffer.

Additionally, we must enhance the functionality of our products to maintain successful commercialization and continued acceptance of our product offerings. If we are unable to identify and develop new enhancements to existing products on a timely and cost-effective basis, or if new enhancements do not achieve market acceptance, we may experience customer dissatisfaction, reduction or cancellation of orders and loss of revenue. The life cycle of our products is difficult to predict and the market for many of our products is characterized by rapid technological change, changing customer preferences and evolving industry standards. The introduction of products employing new technologies and emerging industry standards could render our existing products obsolete and unmarketable.

We are subject to significant government regulation.

The U.S. legal and regulatory environment governing our products is subject to constant change. Further changes in the regulatory environment relating to the marketing of our shelter, decontamination systems, PAPRs and our other products, that increase the administrative and operational costs associated with the marketing of our systems and other products or that increase the likelihood or scope of competition, could harm our business and financial results.

Although we have received NIOSH approval to incorporate our filter canister into one of our own PAPRs designs, we currently have several commercial filter applications for OEMs under review with NIOSH. If regulatory review and approval takes longer than we anticipate or if NIOSH does not grant the approvals that we seek, the delay or lack of regulatory approval may have a material adverse effect on our business, financial condition and results of operations.

The regulation of our shelter, decontamination systems and other products outside the United States will vary by country. Noncompliance with foreign country requirements may include some or all of the risks associated with noncompliance with U.S. regulation as well as other risks.

The variable and often long sales cycles for our products could cause significant fluctuation in our quarterly and annual results.

The typical sales cycle of our shelter, decontamination systems and our other products is unpredictable and generally involves a significant commitment of resources by our customers. A customer’s decision to purchase our products generally involves the evaluation of the available alternatives by a significant number of personnel in various functional areas and often is subject to delays over which we may have little or no control, including budgeting constraints, internal procurement and other purchase review procedures and the inclusion or exclusion of our products on customer approved standards list. Accordingly, we typically must expend substantial resources educating prospective customers about our products. Therefore, the length of time between the date of initial contact with the potential customer or distribution channel partner and the related sale of our products may be as much as one year, with the larger sales generally requiring significantly more time. Additionally, the length of time between the date of initial contact and the sale is often subject to delays over which we may have little or no control, including the receipt of necessary government funding. As a result, our ability to predict the timing and amount of specific sales is limited. If we experience any delay or failure in completing sales, we may incur significant expense without generating any associated revenue which, if significant, could have a material adverse effect on our business and could cause operating results to vary significantly from quarter-to-quarter.

12

If we are unable to attract, retain and motivate key management and personnel, we may become unable to operate our business effectively.

We depend to a significant degree on the skills, experience and efforts of our key executive officers and our employees, as well as members of our sales, administrative, technical and services personnel. Qualified personnel are in great demand throughout our industry, and our future success depends in large part on our ability to attract, train, motivate and retain highly skilled employees and the ability of our executive officers and other members of senior management to work effectively as a team. The loss of the services of any executive officer or the failure to attract and retain the highly trained technical personnel that are integral to our sales, product development, service and support teams, could have a material adverse effect on our business.

Our products rely on intellectual property rights. Any failure by us to obtain and protect these rights could enable our competitors to market products with similar features that may reduce demand for our products, which would adversely affect our revenues. Additionally, we could be subject to claims that our products violate the intellectual property rights of others.

Although we seek to protect our products through a combination of patent, trade secret, copyright, and trademark law, there is no guarantee that our methods of protecting our intellectual property rights in the United States or abroad will be adequate. Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy or otherwise obtain and use our products or technologies. Policing unauthorized use of our products is difficult, and we cannot be certain that the steps we have taken will prevent misappropriation of our technology, particularly in foreign countries where the laws may not protect our intellectual property rights as fully as those in the United States. If we are unable to protect our proprietary technology or that of our customers, our results of operations and any competitive advantage that we may have may be materially and adversely affected.

We generally enter into confidentiality or other agreements with our employees, consultants, channel partners and other corporate partners, and do control access to our intellectual properties and the distribution of our proprietary information. These measures afford only limited protection and may prove to be inadequate. Others may develop technologies that are similar or superior to our technology or design around the intellectual properties we own or utilize.

We expect that products may be increasingly subject to third-party infringement claims as the number of competitors in the markets that we serve grows and the functionality of products in different industry segments grows and overlaps. Although we are not aware that our products employ technology that infringes any proprietary rights of third parties, there has been significant litigation in recent years in the United States involving patents and other intellectual property rights, and third parties may assert infringement claims against us. Regardless of whether these claims have any merit, they could be time-consuming to defend; result in costly litigation; divert our management’s attention and resources; cause product shipment delays; or require us to enter into royalty or licensing agreements, which may not be available on terms acceptable to us, if at all.

A successful claim of product infringement against us or our failure or inability to license the infringed or similar technology could damage our business because we would not be able to sell our products without redeveloping them or otherwise incurring significant additional expenses and we may be judged liable for significant damages.

13

Our products may contain unknown defects that could result in product liability claims or decrease market acceptance and have a material adverse effect on our business, results of operations and financial condition.

We have offered, and continue to offer, various warranties on our products. Our products may contain unknown defects or result in failures, which are not detected until after commercial distribution and use. Any of these defects could be significant and could harm our business, financial condition and results of operations. Any significant defects or errors may result in costly litigation; diversion of management’s attention and resources; loss of sales; delay in market acceptance of our products; increase in our product development costs; or damage to our reputation.

In addition, the sale and support of our products may entail the risk of product liability or warranty claims based on personal injury or other damages due to such defects or failures. Although we maintain reserves for warranty-related claims that we believe to be adequate, we cannot assure you that warranty expense levels or the results of any warranty-related legal proceedings will not exceed our reserves. Additionally, although we carry comprehensive general liability insurance and product liability insurance for damages that may arise from our products, our current insurance coverage may be insufficient to protect us from all liability that may be imposed under these types of claims. Consequently, the marketing of our products entails product liability and other risks and could have a material adverse effect on our business, financial condition and results of operations.

Intense competition in our industry could limit our ability to attract and retain customers.

The markets for our products and services are intensely competitive. The markets for our products are characterized by evolving industry standards, changes in customer needs and preferences and opportunities relating to technological advancement, and are significantly affected by new product introductions and improvements. The markets for our services, including SSES’s event rental business, are characterized by high customer expectations with respect to performance and intense price competition. Many of our existing and potential competitors have longer operating histories, significantly greater financial, technical, marketing and other resources, greater name recognition, broader product offerings and a larger installed base of customers than us, any of which could provide them with a significant competitive advantage. Increased competition could also result in price reductions for our products and services and lower profit margins, either of which could materially and adversely affect our business, results of operations and financial condition.

We expect to face increased competition in the future from our current competitors. In addition, new competitors or alliances among existing and future competitors may emerge and rapidly gain significant market share, many of which may possess significantly greater financial, marketing, technical, personnel and other resources.

Our Common Stock is subject to significant price fluctuations.

Effective in August 2004, our Common Stock was listed and began trading on the NASDAQ Small Cap Market, now known as the NASDAQ Capital Market. Previously, our Common Stock traded on the OTC Bulletin Board. Historically, there has been a limited public market for our Common Stock.

The trading price of our Common Stock is likely to be volatile and sporadic. The stock market in general and, in particular, the market for small capitalization companies, has experienced extreme volatility in recent years. This volatility has often been unrelated to the operating performance of particular companies. Volatility in the market price of our Common Stock may prevent investors from being able to sell their Common Stock at or above the price such investors paid for their shares or at any price at all. In addition, in the event our operating results fall below the expectations of public market analysts, the market price of our Common Stock would likely be materially adversely affected.

14

We have adopted certain anti-takeover provisions that could prevent or delay a change in control.

Our Articles of Incorporation and Bylaws contain the following provisions: an “advance notice” provision setting forth procedures governing stockholder proposals and the nomination of directors, other than by or at the direction of the Board of Directors or a Board committee; and a “classified” Board structure, generally providing for three-year staggered terms of office for all members of our Board.

Additionally, in 2003 we adopted a Stockholders Rights Plan, which is designed to enable all TVI stockholders to realize the full value of their investment and to provide for fair and equal treatment for all TVI stockholders in the event that an unsolicited attempt is made to acquire the Company.

Although we believe that each of the above measures are designed to promote both effective corporate governance and orderly Board deliberations of important business matters, these provisions may discourage, delay or prevent a third party from acquiring or merging with TVI, even if such action may be considered favorable to some of TVI’s stockholders.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

Not applicable.

We lease our headquarters facility to house our administrative and manufacturing activities pursuant to a lease that expires on April 30, 2010. As of December 31, 2006, the facility consisted of approximately 118,000 square feet, of which approximately 109,000 square feet were used as manufacturing space. The address of our headquarters facility is 7100 Holladay Tyler Road, Glenn Dale, Maryland 20769.

We lease our STI facility in Frederick, Maryland pursuant to a lease that expires on June 15, 2008. As of December 31, 2006, STI’s Frederick, Maryland facility was comprised of approximately 22,000 square feet of space, of which approximately 18,000 was used as manufacturing space. The address of STI’s facility is 5703 Industry Lane, Frederick, Maryland 21704.

We lease our SSES headquarters facility in Frederick, Maryland pursuant to a lease with an entity owned substantially by two of our employees that expires on December 31, 2008. We may extend the lease for SSES’s headquarters facilities for additional three year terms. As of December 31, 2006, SSES’s Frederick, Maryland facility was comprised of approximately 55,000 square feet of space, of which approximately 18,000 was used as manufacturing space. The address of SSES’s headquarters facility is 285 Buchiemer Road, Frederick, Maryland 21701. SSES has additional branch and administrative facilities in Maryland, North Carolina, Florida, Kentucky and California.

Seattle Tarp Co., Inc. (“Seattle Tarp”) has filed a claim (“Arbitration Case”) in arbitration in Seattle, Washington with the American Arbitration Association (Case No. 75-181-Y-00070-05 JISI) against TVI and its wholly-owned subsidiary CAPA. Seattle Tarp alleges that TVI’s and CAPA’s hiring of a former Seattle Tarp employee (“Former STC Employee”) resulted in a breach of a confidentiality agreement and the unauthorized use of Seattle Tarp’s confidential information. We do not believe that there is any merit to the claim asserted by Seattle Tarp and are vigorously defending the matter. We cannot, however, currently estimate the outcome of this matter. In a separate but related matter, Seattle Tarp threatened to file a claim in arbitration against the Former STC Employee, alleging that the employee breached the terms of an agreement intended to protect his former employer, Seattle Tarp, by accepting employment with TVI. The employee has filed a petition (“Civil Action”) in the Superior Court of Washington in and for King County (Case No. 04-2-34129-9 SEA) seeking declaratory

15

judgment that no such breach occurred. Seattle Tarp has filed counterclaims alleging that in connection with his employment at TVI the employee is engaging in the unauthorized use of confidential information. Seattle Tarp is seeking damages under various theories of liability. The employee is vigorously pursuing the matter, and TVI is currently bearing the employee’s litigation expenses. We have agreed to consolidate the Civil Action with the Arbitration Case in a single proceeding as part of the Arbitration Case in Seattle, Washington with the American Arbitration Association.

We are, from time to time, a party to disputes arising from normal business activities, including various employee-related matters. In the opinion of our management, resolution of these matters will not have a material adverse effect upon our financial condition or future operating results.

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

No matters were submitted to a vote of the stockholders during the fourth quarter of 2006.

16

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information

Our Common Stock trades on the NASDAQ Capital Market under the symbol “TVIN”. Market prices include prices between dealers, may not reflect mark-ups, mark-downs or commissions and may not represent final actual transactions. The following table provides information on market prices for the periods indicated.

| | | | | | | | | | | | |

| | | 2006 |

| | | 1st Qtr. | | 2nd Qtr. | | 3rd Qtr. | | 4th Qtr. |

Low | | $ | 3.72 | | $ | 3.30 | | $ | 1.85 | | $ | 1.95 |

High | | | 4.35 | | | 4.00 | | | 3.61 | | | 3.15 |

| |

| | | 2005 |

| | | 1st Qtr. | | 2nd Qtr. | | 3rd Qtr. | | 4th Qtr. |

Low | | $ | 3.95 | | $ | 3.41 | | $ | 2.69 | | $ | 3.50 |

High | | | 5.15 | | | 5.38 | | | 4.49 | | | 4.80 |

Holders

We had an estimated 347 holders of record of our Common Stock as of March 1, 2007. Holders of our Common Stock are entitled to one vote for each share held on all matters submitted to a vote of the stockholders. No cumulative voting with respect to the election of directors is permitted by our Articles of Incorporation. The Common Stock is not entitled to preemptive rights and is not subject to conversion or redemption. Upon our liquidation, dissolution or winding-up, the assets legally available for distribution to stockholders are distributable ratably among the holders of the Common Stock after payment of liquidation preferences, if any, on any outstanding stock that may be issued in the future having prior rights on such distributions and payment of other claims of creditors. Each share of Common Stock outstanding as of the date of this Annual Report is validly issued, fully paid and nonassessable.

Dividends

The holders of outstanding shares of our Common Stock are entitled to receive dividends out of assets legally available therefore at such times and in such amounts as the board of directors from time to time may determine. There have been no dividends declared or paid on our Common Stock during the previous two years. In light of the working capital needs of the Company, it is unlikely that cash dividends will be declared and paid on our Common Stock in the foreseeable future and no payment of any dividends is contemplated by us for the foreseeable future. Additionally, the credit agreement TVI maintains with Branch Banking & Trust Company imposes significant limitations on our ability to declare and pay dividends.

Pursuant to the terms of our Stockholders’ Rights Agreement, the Board of Directors declared a dividend distribution of one preferred share purchase right (a “Right”) for each outstanding share of our Common Stock to stockholders of record as of the close of business on December 3, 2003 (the “Record Date”).

One Right will automatically attach to each share of Common Stock issued between the Record Date and the Distribution Date (as defined below). Until a Distribution Date, the Rights are neither exercisable nor traded separately from our Common Stock and the Common Stock certificates represent both the outstanding Common Stock and the outstanding Rights. Generally, Rights will detach from the Common Stock (that is, Rights Certificates will be distributed and will trade separately) and become exercisable shortly after any person or group acquires beneficial ownership of 15% or more of our outstanding Common Stock, or in the event that any person or group commences a tender or exchange offer which would result in that person or group beneficially owning

17

15% or more of our outstanding Common Stock. The date on which the Rights Certificates are distributed and become exercisable is referred to as the “Distribution Date.” Each Right entitles the registered holder thereof to purchase from the Company one one-hundredth of a share of Series A Preferred Stock, subject to adjustment under certain conditions specified in the Stockholders’ Rights Agreement. Upon the occurrence of a Flip-in Event (as defined in the Stockholders’ Rights Agreement) each holder of a Right, other than the acquiring company, will be entitled to purchase our Common Stock at one half of the then current market price.

Repurchase of Securities

We did not repurchase any of our Common Stock or other securities during the fourth quarter of 2006.

Performance Graph

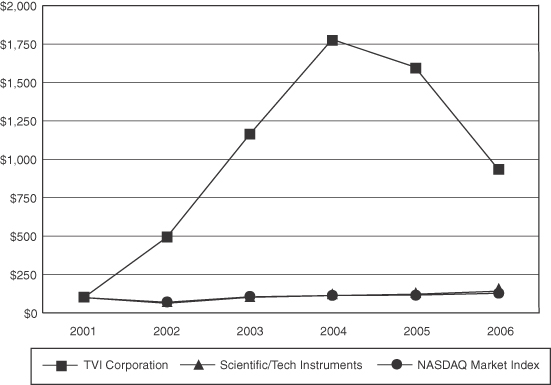

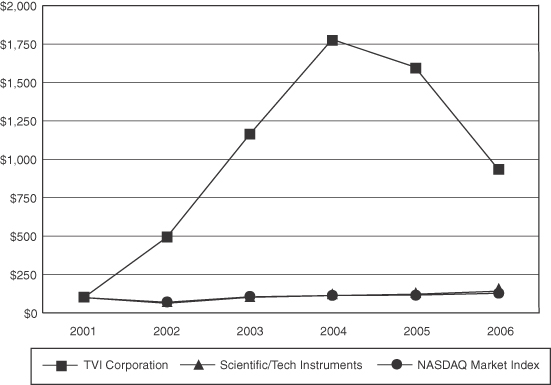

The following graph compares the yearly percentage change in cumulative total stockholder return on our common stock with the cumulative total return on the NASDAQ Market Index (Broad Market Index) and a Hemscott Group Index for scientific/technical instruments over the past five years from December 31, 2001 through December 31, 2006.

The cumulative total stockholder return is based on $100 invested in our common stock and in the respective indices on December 31, 2001. The stock prices on the performance graph are not necessarily indicative of future price performance.

CUMULATIVE TOTAL RETURN THROUGH DECEMBER 31, 2006

AMONG TVI CORPORATION, NASDAQ MARKET INDEX, AND HEMSCOTT GROUP

INDEX*

| * | Assumes $100 invested on December 31, 2001; assumes dividend reinvested; fiscal year ending December 31, 2006. |

18

| ITEM 6. | SELECTED FINANCIAL DATA |

The following selected consolidated financial data should be read in conjunction with the Consolidated Financial Statements and Notes thereto and with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and other financial data included elsewhere in this report. The consolidated statement of income data for the years ended December 31, 2006, 2005 and 2004, and the consolidated balance sheet data as of December 31, 2006 and 2005, have been derived from our audited consolidated financial statements included elsewhere in this report. The consolidated statement of income data for the years ended December 31, 2003 and 2002 and the consolidated balance sheet data as of December 31, 2004, 2003 and 2002 have been derived from our audited consolidated financial statements not included in this report. The historical results are not necessarily indicative of results to be expected in any future period.

Financial Highlights (in thousands, except per share amounts)

| | | | | | | | | | | | | | | |

| | | Year Ended December 31, |

| | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 |

Consolidated Statement of Income Data (1): | | | | | | | | | | | | | | | |

Net revenue | | $ | 36,165 | | $ | 32,836 | | $ | 37,862 | | $ | 27,218 | | $ | 11,128 |

Gross profit | | | 17,097 | | | 17,458 | | | 19,191 | | | 14,288 | | | 5,889 |

Operating income | | | 3,610 | | | 8,001 | | | 10,251 | | | 8,040 | | | 3,072 |

Net income | | $ | 1,908 | | $ | 5,038 | | $ | 6,442 | | $ | 5,367 | | $ | 4,431 |

Earnings per common share—basic | | $ | 0.06 | | $ | 0.17 | | $ | 0.22 | | $ | 0.20 | | $ | 0.17 |

Average number of common shares outstanding—basic | | | 32,751 | | | 30,325 | | | 29,082 | | | 27,249 | | | 26,321 |

Earnings per common share—diluted | | $ | 0.06 | | $ | 0.16 | | $ | 0.21 | | $ | 0.18 | | $ | 0.16 |

Average number of common shares outstanding—diluted | | | 33,120 | | | 30,844 | | | 30,250 | | | 29,470 | | | 28,546 |

| |

| | | As of December 31, |

| | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 |

Consolidated Balance Sheet Data (1): | | | | | | | | | | | | | | | |

Current assets | | $ | 27,407 | | $ | 20,745 | | $ | 20,414 | | $ | 14,572 | | $ | 6,935 |

Current liabilities | | | 7,680 | | | 6,794 | | | 3,103 | | | 3,203 | | | 882 |

Working capital | | | 19,727 | | | 13,951 | | | 17,311 | | | 11,369 | | | 6,053 |

Total assets | | | 72,791 | | | 41,538 | | | 23,670 | | | 15,343 | | | 7,200 |

Long-term liabilities | | | 26,413 | | | 255 | | | — | | | — | | | — |

Total liabilities | | | 34,093 | | | 7,049 | | | 3,310 | | | 3,203 | | | 882 |

Minority interest | | | — | | | 22 | | | — | | | — | | | — |

Stockholders’ equity | | $ | 38,698 | | $ | 34,467 | | $ | 20,360 | | $ | 12,140 | | $ | 6,318 |

| (1) | The Consolidated Statement of Income data for the year ended December 31, 2006 includes the results of operations of SSES from its acquisition on October 31, 2006. The Consolidated Statement of Income data for the year ended December 31, 2005 includes the results of operations of STI from its acquisition on November 8, 2005. See Note 3 to the Notes to Consolidated Financial Statements. |

19

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION |