UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________

Form 10-K

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2020

or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to __________

Commission file number 1-584

FERRO CORPORATION

(Exact name of registrant as specified in its charter)

Ohio | 34-0217820 | |

(State or Other Jurisdiction of Incorporation or Organization) | (IRS Employer Identification No.) | |

6060 Parkland Blvd. Suite 250 Mayfield Heights, OH (Address of Principal Executive Offices) | 44124 (Zip Code) |

Registrant’s telephone number, including area code: 216-875-5600

Securities Registered Pursuant to section 12(b) of the Act: | ||||||||

Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||||||

Common Stock, par value $1.00 | FOE | NYSE | ||||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES x NO o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES o NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). YES x NO o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o | Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(c)) by the registered public accounting firm that prepared or issued its audit report. x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES o NO x

The aggregate market value of Ferro Corporation Common Stock, par value $1.00, held by non-affiliates and based on the closing sale price as of June 30, 2020, was approximately $964,203,000.

On January 31, 2021, there were 82,384,177 shares of Ferro Corporation Common Stock, par value $1.00 outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for Ferro Corporation’s 2021 Annual Meeting of Shareholders are incorporated into Part III of this Annual Report on Form 10-K.

TABLE OF CONTENTS

PART I | ||

Item 1 | Page 3 | |

Item 1A | Page 8 | |

Item 1B | Page 17 | |

Item 2 | Page 17 | |

Item 3 | Page 17 | |

Item 4 | Page 17 | |

PART II | ||

Item 5 | Page 19 | |

Item 6 | Page 20 | |

Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | Page 21 |

Item 7A | Page 38 | |

Item 8 | Page 39 | |

Item 9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | Page 86 |

Item 9A | Page 86 | |

Item 9B | Page 88 | |

PART III | ||

Item 10 | Page 89 | |

Item 11 | Page 89 | |

Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | Page 89 |

Item 13 | Certain Relationships and Related Transactions, and Director Independence | Page 90 |

Item 14 | Page 90 | |

PART IV | ||

Item 15 | Page 91 | |

PART I

Item 1 — Business

History, Organization and Products

Ferro Corporation is a leading producer of specialty materials that are sold to a broad range of manufacturers who, in turn, make products for many end-use markets. When we use the terms “Ferro,” “we,” “us” or “the Company,” we are referring to Ferro Corporation and its subsidiaries unless indicated otherwise.

Ferro’s products fall into two general categories: functional coatings, which perform specific functions in the end products and manufacturing processes of our customers; and color solutions, which provide performance and aesthetic characteristics to our customers’ products. Our products are manufactured in approximately 48 facilities around the world. They include frits, porcelain and other glass enamels, glazes, stains, decorating colors, pigments, inks, polishing materials, dielectrics, electronic glasses, and other specialty coatings.

Ferro develops and delivers innovative products to our customers based on our strengths in the following technologies:

Particle Engineering — Our ability to design and produce very small particles made of a broad variety of materials, with precisely controlled characteristics of shape, size and particle distribution. We have proven expertise in dispersing these particles within liquid, paste and gel formulations.

Color and Glass Science — Our understanding of the chemistry required to develop and produce pigments that provide color characteristics ideally suited to customers’ applications. We have a demonstrated ability to manufacture glass-based and certain other coatings with properties that precisely meet customers’ needs in a broad variety of applications.

Surface Chemistry and Surface Application Technology — Our understanding of chemicals and materials used to develop products and processes that involve the interface between layers and the surface properties of materials.

Formulation — Our ability to develop and manufacture combinations of materials that deliver specific performance characteristics designed to work within customers’ particular products and manufacturing processes.

We differentiate our Company in our industry by innovation, development of new products and services, the consistent high quality of our products, combined with delivery of localized technical service and customized application technology support. Our value-added technology services assist customers in their material specification and evaluation, product design, and manufacturing process characterization in order to help them optimize the application of our products.

Ferro’s operations are divided into the four business units, which comprise two reportable segments, listed below:

Tile Coating Systems(1) | ||

Porcelain Enamel(2) | ||

Functional Coatings | ||

Color Solutions |

(1)Tile Coating Systems was historically a part of Performance Coatings reportable segment. As of December 31, 2019, the results of the Tile Coatings business portion of Tile Coating Systems are reported as discontinued operations, for financial reporting purposes.

(2)Porcelain Enamel, previously a part of the Performance Coatings reportable segment, is integrated into the Functional Coatings reportable segment, for financial reporting purposes.

During the fourth quarter of 2019, we entered into a definitive agreement to sell substantially all of the assets and liabilities of the Tile Coating Systems business unit (the “Tile Coatings business”). The related assets and liabilities of our Tile Coatings business were classified as held-for-sale in the accompanying consolidated balance sheets. Therefore, the associated operating results, net of income tax, have been classified as discontinued operations in the accompanying consolidated statements of operations for all periods presented. Refer to Note 4 to the consolidated financial statements under Item 8 of this Annual Report on Form 10-K for a discussion of the potential sale of the Tile Coatings business. Throughout this Annual Report on Form 10-K, unless otherwise indicated, amounts and activity are presented on a continuing operations basis.

On February 25, 2021, we completed the sale of our Tile Coatings business to Pigments Spain, S.L., a company of the Esmalglass-Itaca-Fritta group, which is a portfolio company of certain Lone Star Funds, for $460.0 million in cash, subject to post-closing adjustments. The transaction resulted in net proceeds of approximately $420.0 million after expenses.

Financial information about our segments is included herein in Note 21 to the consolidated financial statements under Item 8 of this Annual Report on Form 10-K.

Markets and Customers

Ferro’s products are used in a variety of product applications, within the following markets:

Appliances | Electronics | |

Automotive | Industrial products | |

Building and renovation | Packaging | |

Consumer products | Sanitary |

Many of our products are used as functional or aesthetic coatings for a variety of different substrates on our customers’ products, such as metals, ceramics, glass, plastic, wood and concrete. Other products are used to manufacture electronic components and other technology products. Still other products are added during our customers’ manufacturing processes to provide desired properties to their end product. Often, Ferro materials are a small portion of the total cost of our customers’ products, but they can be critical to the functionality or appearance of those products.

Our customers include manufacturers of ceramic tile, major appliances, construction materials, automobile parts, automobiles, architectural and container glass, and electronic components and devices. Many of our customers, including makers of major appliances and automobile parts, purchase materials from more than one of our business units. Our customer base is well diversified both geographically and by end market.

We generally sell our products directly to our customers. However, a portion of our business uses indirect sales channels, such as agents and distributors, to deliver products to market. In 2020, no single customer or related group of customers represented more than 10% of net sales. In addition, none of our reportable segments is dependent on any single customer or related group of customers.

Seasonality

Although not seasonal, in certain of our technology-driven markets, our customers’ business is often characterized by product campaigns with defined life cycles, which can result in uneven demand as product ramp-up periods are followed by down-cycle periods. As our innovation activity increases in line with our value creation strategy, we expect this type of business also to increase. This type of market operates on a different cycle from the majority of our business. We do not regard any material part of our business to be seasonal. However, customer demand has historically been higher in the second quarter when building and renovation markets are particularly active, and the second quarter has also normally been the strongest for sales and operating profit.

Competition

In most of our markets, we have a substantial number of competitors, none of which is dominant. Due to the diverse nature of our product lines, no single competitor directly matches all of our product offerings. Our competition varies by product and by region, and is based primarily on product quality, performance and functionality, as well as on pricing, customer service, technical support, and the ability to develop custom products to meet specific customer applications.

We are a worldwide leader in the production of specialty coatings and enamels for glass enamels, porcelain enamel, and ceramic tile coatings. There is strong competition in our markets, ranging from large multinational corporations to local producers. While many of our customers purchase customized products and formulations from us, our customers could generally buy from other sources, if necessary.

Raw Materials and Supplier Relations

Raw materials widely used in our operations include:

Metal Oxides: | Other Inorganic Materials: | |

Aluminum oxide(1) | Boron(2) | |

Chrome oxide(1) (2) | Clay(2) | |

Cobalt oxide(1)(2) | Feldspar(2) | |

Iron oxide(1) | Lithium(2) | |

Lead oxide(1) | Silica(2) | |

Nickel oxide(1)(2) | Soda ash(1) | |

Titanium dioxide(1)(2) | Zircon(2) | |

Zinc oxide(2) | ||

Zirconium dioxide(2) |

Precious and Non-precious Metals: | Energy: | |

Bismuth(1) | Electricity | |

Chrome(1)(2) | Natural gas | |

Copper(1) | ||

Gold(1) | ||

Molybdenum(1) | ||

Silver(1) | ||

Vanadium(1) |

(1)Primarily used by the Functional Coatings and the Color Solutions reportable segments.

(2)Primarily used by the Tile Coating Systems and Porcelain Enamel business. As of December 31, 2019, Tile Coating Systems results are reported as discontinued operations and Porcelain Enamel has been integrated into the Functional Coatings reportable segment.

These raw materials make up a large portion of our product costs in certain of our product lines, and fluctuations in the cost of raw materials can have a significant impact on the financial performance of the related businesses. We attempt to pass through raw material cost increases to our customers.

We have a broad supplier base and, in many instances, multiple sources of essential raw materials are available worldwide if problems arise with any particular supplier. We maintain many comprehensive supplier agreements for strategic and critical raw materials. We did not encounter raw material shortages in 2020 that significantly affected our manufacturing operations, but we are subject to volatile raw material costs or material availability that can affect our results of operations.

Environmental Matters

We handle, process, use and store hazardous materials as part of the production of some of our products. As a result, we operate production facilities that are subject to a broad array of environmental laws and regulations in the countries in which we operate, particularly for wastes, wastewater discharges and air emissions. In addition, some of our products are subject to restrictions under laws or regulations, such as California’s Proposition 65, the Toxic Substances and Control Act and the European Union’s (“EU”) chemical substances directive. The costs to comply with the complex environmental laws and regulations applicable to our operations are significant and will continue for the industry and us for the foreseeable future. These routine costs are expensed as they are incurred. While these costs may increase in the future, they are not expected to have a material impact on our financial position, liquidity or results of operations. We believe that we are in substantial compliance with the environmental laws and regulations applicable to our operations. We also believe that, to the extent that we may not be in compliance with such regulations, such non-compliance will not have a materially adverse effect on our financial position, liquidity or results of operations.

Our policy is to operate our plants and facilities in a manner that protects the environment and the health and safety of our employees and the public. We intend to continue to make expenditures for environmental and health and safety protection and improvements in a timely manner consistent with available technology. Although we cannot precisely predict future environmental, health and safety spending, we do not expect the costs to have a material impact on our financial position, liquidity or results of operations. Capital expenditures for environmental, health and safety protection were $2.6 million in 2020, $4.5 million in 2019, and $5.8 million in 2018. We also accrue for environmental remediation costs when it is probable that a liability has been incurred and we can reasonably estimate the amount. We determine the timing and amount of any liability based upon assumptions regarding future events, and inherent uncertainties exist in such evaluations primarily due to unknown conditions or circumstances, changing governmental regulations and legal standards regarding liability, and evolving technologies. We adjust these liabilities periodically as remediation-related efforts progress, the nature and extent of contamination becomes more certain, or as additional technical or legal information becomes available.

Research and Development

We are involved worldwide in research and development activities relating to new and existing products, services and technologies required by our customers’ continually changing markets. Our research and development resources are organized into centers of excellence that support our regional and worldwide major business units. These centers are augmented by local laboratories that provide technical service and support to meet customer and market needs in various geographic areas.

Total expenditures for product and application technology, including research and development, customer technical support and other related activities, were $35.6 million in 2020, $41.0 million in 2019, and $40.1 million in 2018.

Patents, Trademarks and Licenses

We own a substantial number of patents and patent applications relating to our various products and their uses. While these patents are of importance to us and we exercise diligence to ensure that they are valid, we do not believe that the invalidity or expiration of any single patent or group of patents would have a material adverse effect on our businesses. Our patents will expire at various dates through the year 2039. We also use a number of trademarks that are important to our businesses as a whole or to particular segments of our business. We believe that these trademarks are adequately protected.

Human Capital

We provide employee benefits and programs in recruiting, retention, performance management, and training that aim to enable us to develop, create and fully leverage the strengths of our workforce to help exceed customer expectations and ongoing growth objectives.

At December 31, 2020, we employed 5,615 full-time employees, including 5,120 employees in our foreign consolidated subsidiaries and 495 in the United States (“U.S.”). At December 31, 2020, 2,031 of our employees in our foreign consolidated subsidiaries were associated with the Tile Coatings business. Total employment decreased by 151 in our foreign subsidiaries and decreased by 156 in the U.S. from the prior year end primarily due to our cost optimization initiatives.

Collective bargaining agreements cover 4.2% of our U.S. workforce. Approximately 1.4% of all U.S. employees are affected by a labor agreement that expires in 2024. We consider our relations with our employees, including those covered by collective bargaining agreements, to be good.

Our employees in Europe have protections afforded them by local laws and regulations through unions and works councils. Some of these laws and regulations may affect the timing, amount and nature of restructuring and cost reduction programs in that region.

Domestic and Foreign Operations

We began international operations in 1927. Our products are manufactured and/or distributed through our consolidated subsidiaries and unconsolidated affiliates in the following countries:

Consolidated Subsidiaries:

Argentina | France | Malaysia (1) | Taiwan |

Australia | Germany | Mexico | Thailand |

Belgium | India | Netherlands | Turkey |

Brazil | Indonesia | Poland (1) | United Kingdom |

Canada | Ireland | Portugal | United States |

China | Israel | Romania | Vietnam(1) |

Colombia | Italy | Russia | |

Egypt (1) | Japan | Spain |

Unconsolidated Affiliates:

China | Egypt(1) | South Korea | |

Ecuador (1) | Spain |

(1) Indicates operations associated with the Tile Coatings business which were discontinued with the completion of the sale during the first quarter of 2021.

Financial information for geographic areas is included in Note 21 to the consolidated financial statements under Item 8 of this Annual Report on Form 10-K. More than 60% of our net sales are outside of the U.S. We sell products into approximately 98 countries.

Our U.S. parent company receives technical service fees and/or royalties from many of its foreign subsidiaries. As a matter of corporate policy, the foreign subsidiaries have historically been expected to remit a portion of their annual earnings to the U.S. parent company as dividends. To the extent earnings of foreign subsidiaries are not remitted to the U.S. parent company, those earnings are indefinitely re-invested in those subsidiaries.

Available Information

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, including any amendments, will be made available free of charge on our website, www.ferro.com, as soon as reasonably practical, following the filing of the reports with the U.S. Securities and Exchange Commission (“SEC”). Our Corporate Governance Principles, Code of Business Conduct, Guidelines for Determining Director Independence, and charters for our Audit Committee, Compensation Committee and Governance and Nomination Committee are available free of charge either on our website or to any shareholder who requests them from the Ferro Corporation Investor Relations Department located at 6060 Parkland Blvd., Suite 250, Mayfield Heights, Ohio, 44124.

Forward-Looking Statements

Certain statements contained here and in future filings with the SEC reflect our expectations with respect to future performance and constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements are subject to a variety of uncertainties, unknown risks and other factors concerning our operations and the business environment, which are difficult to predict and are beyond our control.

Item 1A — Risk Factors

Many factors could cause our actual results to differ materially from those suggested by statements contained in this filing and could adversely affect our future financial performance. Such factors include the following:

Risks Related to Our Business and Strategy

We sell our products into industries where demand has been unpredictable, cyclical or heavily influenced by consumer spending, and such demand and our results of operations may be further impacted by macro-economic circumstances.

We sell our products to a wide variety of customers who supply many different market segments. Many of these market segments, including building and renovation, major appliances, transportation, and electronics, are cyclical or closely tied to consumer demand. Consumer demand may change and is difficult to accurately forecast. Change in demand and incorrect forecasts of demand or unforeseen reductions in demand can adversely affect costs and profitability due to factors, including but not limited to underused manufacturing capacity, excess inventory, or working capital needs. Our sales and operations planning processes and forecasting systems and modeling tools may not accurately predict changes in demand for our products or other market conditions.

Our results of operations are materially affected by conditions in capital markets and economies in the U.S. and elsewhere around the world. Concerns over fluctuating prices, energy costs, geopolitical issues, government deficits and debt loads, and the availability and cost of credit have contributed to economic uncertainty around the world. Our customers may be impacted by these conditions and may modify, delay, or cancel plans to purchase our products. Additionally, if customers are not successful in generating sufficient revenue or are precluded from securing financing, they may not be able to pay, or may delay payment of, accounts receivable that are owed to us. A reduction in demand or inability of customers to pay us for our products may adversely affect our earnings and cash flow.

We strive to improve operating margins through sales growth, price increases, new products, productivity gains, optimization initiatives, and improved purchasing techniques, but we may not achieve the desired improvements.

We work to improve operating profit margins through activities such as growing sales, increasing economies of scale, raising prices, introducing new products, improving manufacturing processes, reformulating products, reducing the use of raw materials, and adopting purchasing techniques that lower costs or provide increased cost predictability. However, these activities depend on a combination of factors, including improved product design and engineering, effective manufacturing process control initiatives, cost-effective redistribution of production, and other efforts that may not be as successful as anticipated. Likewise, the success of sales growth and price increases depends not only on our actions but also on the strength of customer demand and competitors' pricing responses, which are not fully predictable. Failure to successfully implement actions to improve operating margins could adversely affect our financial performance.

The global scope of our operations exposes us to risks related to currency conversion rates, new and different regulatory schemes and changing economic, regulatory, social and political conditions around the world.

More than 60% of our net sales during 2020 were outside of the U.S. In order to support our customers, access regional markets and compete effectively, our operations are located around the world. Our operations are subject to multiple and changing economic, regulatory, social and political conditions and we are subject to risks relating to currency conversion rates. We also may encounter difficulties expanding into additional growth markets around the world. Other risks inherent in our operations include the following:

New, different and unpredictable legal and regulatory requirements and enforcement mechanisms in the U.S. and other countries;

Challenges related to obtaining export licenses, import or export duties or import quotas, export controls and restrictions administered by, for example, the Office of Foreign Assets Control or other trade restrictions or barriers;

Increased costs, and decreased availability, of transportation or shipping;

Credit risks and financial conditions of local customers and distributors;

Risk of nationalization of private enterprises by governments, or restrictions on investments;

Potentially adverse tax consequences, including imposition or increase of withholding and other taxes on remittances and other payments by subsidiaries; and

Political, economic and social conditions, including political instability and organized crime in certain countries, the possibility of hyperinflationary conditions and deflation and public health crises, such as pandemics and epidemics.

We have subsidiaries in Israel, Turkey, Mexico and Colombia, which are located in or near regions that are politically volatile or subject to high levels of crime and violence. Such conditions could potentially impact our ability to operate and to recover both the cost of our investments and earnings from those investments. While we attempt to anticipate these circumstances and manage our business appropriately in each location where we do business, these circumstances are often beyond our control and difficult to forecast.

The consequences of these risks may have significant adverse effects on our results of operations or financial position, and if we fail to comply with applicable laws and regulations, we could be exposed to civil and criminal penalties, reputational harm, and restrictions on our operations.

Our businesses depend on a continuous stream of new products and services, and failure to introduce new products and services could affect our sales, profitability and liquidity.

We strive to remain competitive through innovation, including by continually developing and introducing new and improved products and services. Customers evaluate our products and services in comparison to those offered by our competitors. A failure to introduce new products and services at the right time that are price competitive and that meet the needs of our customers could adversely affect our sales or could require us to respond by lowering prices. In addition, when we invest in new product development, we face risks related to production delays, cost over-runs and unanticipated technical difficulties, which could impact sales, profitability and/or liquidity.

We may not be able to complete or successfully integrate previous or future acquisitions into our business, which could adversely affect our business or results of operations.

We have pursued and we intend to continue to pursue acquisitions. Our success in accomplishing growth through acquisitions may be limited by the availability and suitability of acquisition candidates and by our financial resources, including available cash and borrowing capacity. Acquisitions involve numerous risks, including difficulty determining appropriate valuation, integrating operations, information systems, technologies, services and products of the acquired product lines or business, personnel turnover, and the diversion of management’s attention from other business matters. In addition, we may be unable to achieve anticipated benefits from these acquisitions in the timeframe that we anticipate, or at all, which could adversely affect our business or results of operations.

Certain of the markets for our products and services are highly competitive and subject to intense price competition, which could adversely affect our sales and earnings performance.

Our customers typically have multiple suppliers from which to choose. If we are unwilling or unable to provide products and services at competitive prices, and if other factors, such as product performance and value-added services, do not provide an offsetting competitive advantage, customers may reduce, discontinue, or decide not to purchase our products. If we could not secure alternate customers for lost business, our sales and earnings performance could be adversely affected.

We are subject to a number of restrictive covenants under our credit facilities, which could affect our flexibility to fund ongoing operations and strategic initiatives, and, if we are unable to maintain compliance with such covenants, could lead to significant challenges in meeting our liquidity requirements.

Our Amended Credit Facility, entered into on April 25, 2018, contains a number of restrictive covenants, including those described in more detail in Note 9 to the consolidated financial statements under Item 8 of this Annual Report on Form 10-K. These covenants include limitations on use of loan proceeds, limitations on the Company’s ability to pay dividends and repurchase stock, limitations on acquisitions and dispositions and limitations on certain types of investments. The Amended Credit Facility also contains standard provisions relating to conditions of borrowing and customary events of default, including the non-payment of obligations by the Company and the bankruptcy of the Company. Specific to the 2018 Revolving Facility, the Company is subject to a financial covenant regarding the Company’s maximum leverage ratio. If an event of default occurs, all amounts outstanding under the Amended Credit Facility may be accelerated and become immediately due and payable. The Amended Credit Facility is described in more detail in Note 9 to the consolidated financial statements under Item 8 of this Annual Report on Form 10-K.

Our strategy includes seeking opportunities in new growth markets, and failure to identify or successfully enter such markets could affect our ability to grow our revenues and earnings.

Certain of our products are sold into mature markets and part of our strategy is to identify and enter into markets growing more rapidly. These growth opportunities may involve new geographies, new product lines, new technologies, or new customers. We may not successfully exploit such opportunities and our ability to increase our revenue and earnings could be impacted as a result.

If we are unable to protect our intellectual property rights, including trade secrets, or to successfully resolve claims of infringement brought against us, our product sales and financial performance could be adversely affected.

Our performance may depend in part on our ability to establish, protect and enforce intellectual property rights with respect to our products, technologies and proprietary rights and to defend against any claims of infringement, which involves complex legal, scientific and factual questions and uncertainties. We may have to rely on litigation to enforce our intellectual property rights. The intellectual property laws and practice of some countries may not protect our interests to the same extent as the laws and practices of the U.S. In addition, we may face claims of infringement that could interfere with our ability to use technology or other intellectual property rights that are material to our business operations. If litigation that we initiate is unsuccessful, we may not be able to protect the value of some of our intellectual property. In the event a claim of infringement against us is successful, we may be required to pay royalties or license fees to continue to use technology or other intellectual property rights that we have been using or we may be unable to obtain necessary licenses from third parties at a reasonable cost or within a reasonable time.

We may not be successful in implementing our strategies to increase our return on invested capital, internal rate of return, or other return metrics.

We are taking steps to generate a higher return on our investments. There are risks associated with the implementation of these steps, which may be complicated and may involve substantial capital investment. To the extent we fail to achieve these strategies, our results of operations may be adversely affected.

Many of our assets are encumbered by liens that have been granted to lenders, and those liens affect our flexibility to dispose of property and businesses.

Certain of our debt obligations are secured by substantially all of our assets. These liens could reduce our ability and/or extend the time to dispose of property and businesses, as these liens must be cleared or waived by the lenders prior to any disposition. These security interests are described in more detail in Note 9 to the consolidated financial statements under Item 8 of this Annual Report on Form 10-K.

The divestiture of our Tile Coatings business may have material adverse effects on our financial condition, results of operations or cash flows.

In December 2019, we announced that we had entered into an asset and stock purchase agreement pursuant to which Ferro has agreed to sell Ferro’s global tile coating systems business (the “Tile Coatings business”) to Pigments Spain S.L. The consummation of the sale of the Tile Coatings business involves risks, including difficulties in the separation of operations, services, products, IT systems and personnel, the diversion of management’s attention from other business matters, the disruption of our business, the potential loss of key employees and the retention of uncertain contingent liabilities related to the divested business, any of which could result in a material adverse effect to our financial condition, results of operations or cash flows. We cannot be certain that we will be successful in managing these or any other significant risks that we encounter as a result of divesting the Tile Coatings business.

Risks Related to Our Operations

We depend on reliable sources of energy and raw materials, minerals and other supplies, at a reasonable cost, but the availability of these materials and supplies could be interrupted and/or their prices could change and adversely affect our sales and profitability.

We purchase energy and many raw materials to manufacture our products. Changes in their availability or price could affect our ability to manufacture enough products to meet customers’ demands or to manufacture products profitably. We try to maintain multiple sources of raw materials and supplies where practical, but this may not prevent changes in their availability or cost and, for certain raw materials, there may not be alternative sources. We may not be able to pass cost increases through to our customers. Significant disruptions in availability or cost increases could adversely affect our manufacturing volume or costs, which could negatively affect product sales or profitability of our operations.

We have undertaken and continue to undertake optimization initiatives, to rationalize our operations and improve our operating performance, but we may not be able to implement and/or administer these initiatives in the manner contemplated and these initiatives may not produce the desired results.

We have undertaken, and intend to continue undertaking, optimization initiatives to rationalize our operations to improve our operational performance. These initiatives may involve, among other things, changes to the operations of recently acquired business, the transfer of manufacturing to new or existing facilities, the divestiture of certain assets, and restructuring programs that involve plant closures and staff reductions, which could be material in their nature with respect to the investments, costs and potential benefits. These initiatives also may involve changes in the management and delivery of functional services. Although we expect these initiatives to help us achieve operational efficiencies and cost savings, we may not be able to implement and/or administer these initiatives in the manner contemplated, which could cause the initiatives to fail to achieve the desired results. In addition, transfer and consolidation of manufacturing operations may involve substantial capital expenses and the transfer of manufacturing processes and personnel from one site to another, with resultant inefficiencies and other issues at the receiving site as it starts up, the need for requalification of our products and for ISO or other certifications of our products. We may experience shortages of affected products, delays and higher than expected expenses. Changes in functional services may prove ineffective, inefficient and disruptive. Accordingly, the initiatives that we have implemented and those that we may implement in the future may not improve our operating performance and may not help us achieve cost savings. Failure to successfully implement and/or administer these initiatives could have an adverse effect on our financial performance.

We rely on information systems to conduct our business and interruption, or damage to, or failure or compromise of, these systems may adversely affect our business and results of operations.

We rely on information systems to obtain, process, analyze and manage data to forecast and facilitate the purchase of raw materials and the distribution of our products; to receive, process, and ship orders on a timely basis; to run and operate our facilities; to account for our product and service transactions with customers; to manage the accurate billing and collections for thousands of customers; to process payments to suppliers; and to manage data and records relating to our employees, contractors, and other individuals. Our business and results of operations may be adversely affected if these systems are interrupted, damaged, or compromised or if they fail for any extended period, due to events including but not limited to programming errors, aging information systems infrastructure and software and required maintenance or replacement, computer viruses and security breaches. Information privacy and cyber security risks have generally increased in recent years because of the proliferation of new technologies and the increased sophistication and activities of perpetrators of cyber-attacks. We may incur significant costs to implement the security measures that we feel are necessary to protect our information systems. However, our information systems may remain vulnerable to damage despite our implementation of security measures that we deem to be appropriate.

In addition, third-party service providers are responsible for managing a significant portion of our information systems, and we are subject to risk because of possible information privacy and security breaches of those third parties. Any system failure, accident or security breach involving our or a third-party’s information system could result in disruptions to our operations. A breach in the security of our information systems could include the theft of our intellectual property or trade secrets, negatively impact our manufacturing operations, or result in the compromise of personal information of our employees, customers or suppliers. While we have, from time to time, experienced system failures, accidents and security breaches involving our information systems, these incidents have not had a material impact on our operations. To the extent that any system failure, accident or security breach results in material disruptions to our operations or the theft, loss or disclosure of, or damage to, material data or confidential information, our reputation, business, financial condition, and results of operations could be materially adversely affected.

We have limited or no redundancy for certain of our manufacturing operations, and damage to our facilities or interference with our operations could interrupt our business, increase our costs of doing business and impair our ability to deliver our products on a timely basis.

If certain of our existing production facilities become incapable of manufacturing products for any reason, including through interruption of our supply chain, we may be unable to meet production requirements, we may lose revenue and we may not be able to maintain our relationships with our customers. Without operation of certain existing production facilities, we may be unable or limited in our ability to deliver products until we restore the manufacturing capability at the particular facility, find an alternative manufacturing facility or arrange an alternative source of supply. Although we carry business interruption insurance to cover lost revenue and profits in an amount we consider adequate, this insurance does not cover all possible situations or expenses. We may not be able to recover from or be compensated for the loss of opportunity and potential adverse impact on relations with our existing customers resulting from our inability to produce and deliver products for them.

If we are unable to attract and retain key personnel, our business could be materially adversely affected.

Our business substantially depends on the continued service of key members of our management. The loss of the services of a key member of our management could have a material adverse effect on our business. Our future success will also depend on our ability to attract and retain highly skilled personnel, such as engineering, marketing and senior management professionals. Competition for these employees is intense, and we could experience difficulty from time to time in hiring and retaining the personnel necessary to support our business. If we do not succeed in retaining our current employees and attracting new skilled employees, our business could be materially adversely affected.

Our multi-jurisdictional tax structure may not provide favorable tax efficiencies.

We conduct our business operations in a number of countries and are subject to taxation in those jurisdictions. While we seek to minimize our worldwide effective tax rate, our corporate structure may not optimize tax efficiency opportunities. We develop our tax position based upon the anticipated nature and structure of our business and the tax laws, administrative practices and judicial decisions now in effect in the countries in which we have assets or conduct business, which are subject to change or differing interpretations. In addition, our effective tax rate could be adversely affected by several other factors, including: increases in expenses that are not deductible for tax purposes, the tax effects of restructuring charges or purchase accounting for acquisitions, changes related to our ability to ultimately realize future benefits attributed to our deferred tax assets, including those related to other-than-temporary impairment, and a change in our decision to indefinitely reinvest foreign earnings. Further, we are subject to review and audit by both domestic and foreign tax authorities, which may result in adverse decisions. Increased tax expense could have a negative effect on our operating results and financial condition.

If we are unable to manage our general and administrative expenses, our business, financial condition or results of operations could be negatively impacted.

We may not be able to effectively manage our administrative expense in all circumstances. While we attempt to effectively manage such expenses, including through projects designed to create administrative efficiencies, increases in staff-related and other administrative expenses may occur from time to time. We have made significant efforts to achieve general and administrative cost savings and improve our operational performance. As a part of these initiatives, we have and will continue to consolidate business and management operations and enter into arrangements with third parties offering cost savings. It cannot be assured that our strategies to reduce our general and administrative costs and improve our operating performance will be successful or achieve the anticipated savings.

We are subject to risks associated with outsourcing functions to third parties.

We have entered into outsourcing agreements with third parties, and rely on such parties, to provide certain services in support of our business. One such vendor provides a number of business services related to our information systems and finance and accounting activity. Arrangements with third-party service providers may make our operations vulnerable if vendors fail to provide the expected service or there are changes in their own operations, financial condition, or other matters outside of our control. If these service providers are unable to perform to our requirements or to provide the level of service expected, our operating results and financial condition may suffer and we may be forced to pursue alternatives to provide these services, which could result in delays, business disruptions and additional expenses.

Our implementation and operation of business information systems and processes could adversely affect our results of operations and cash flow.

We implement and operate information systems and related business processes for our business operations. Implementation and operation of information systems and related processes involves risk, including risks related to programming and data transfer. Costs of implementation also could be greater than anticipated. In addition, we may be unable or decide not to implement such systems and processes in certain locations. Inherent risks, decisions and constraints related to implementation and operation of information systems could result in operating inefficiencies and could impact our ability to perform business transactions. These risks could adversely impact our results of operations, financial condition, and cash flows.

Legal and Regulatory Risks

We operate in regions of the world where it can be difficult for a multi-national company, such as Ferro, to compete lawfully with local competitors, which may cause us to lose business opportunities.

We pursue business opportunities around the world and many of our most promising growth opportunities are in markets such as, the People’s Republic of China, Latin America, the Asia Pacific region, India and the Middle East. Although we have been able to compete successfully in those markets to date, local laws and customs can make it difficult for a multi-national company, such as Ferro, to compete on a “level playing field” with local competitors without engaging in conduct that would be illegal under U.S. or other countries’ anti-bribery laws. Our strict policy of observing the highest standards of legal and ethical conduct may cause us to lose some otherwise attractive business opportunities to competitors in these regions.

Regulatory authorities in the U.S., European Union and elsewhere are taking a more aggressive approach to regulating hazardous materials and other substances, and those regulations could affect sales of our products.

Legislation and regulations concerning hazardous materials and other substances can restrict the sale of products and/or increase the cost of producing them. Some of our products are subject to restrictions under laws or regulations such as California’s Proposition 65 and the EU’s chemical substances directive. The EU “REACH” registration system requires us to perform studies of some of our products or components of our products and to register the information in a central database, increasing the cost of these products. As a result of such regulations, our ability to sell certain products may be curtailed and customers may avoid purchasing some products in favor of less regulated, less hazardous or less costly alternatives. It may be impractical for us to continue manufacturing heavily regulated products, and we may incur costs to shut down or transition such operations to alternative products. These circumstances could adversely affect our business, including our sales and operating profits.

Our operations are subject to operating hazards and to stringent environmental, health and safety regulations, and compliance with those regulations could require us to make significant investments.

Our production facilities are subject to hazards associated with the manufacture, handling, storage, and transportation of chemical materials and products. These hazards can cause personal injury and loss of life, severe damage to, or destruction of, property and equipment and environmental contamination and other environmental damage and could have an adverse effect on our business, financial condition or results of operations.

We strive to maintain our production facilities and conduct our manufacturing operations in a manner that is safe and in compliance with all applicable environmental, health and safety regulations. Compliance with changing regulations, or other circumstances, may require us to make significant capital investments, incur training costs, make changes in manufacturing processes or product formulations, or incur costs that could adversely affect our profitability, and violations of these laws could lead to substantial fines and penalties. These costs may not affect competitors in the same way that they affect us due to differences in product formulations, manufacturing locations or other factors, and we could be at a competitive disadvantage, which might adversely affect financial performance.

Our business could be adversely affected by safety, environmental, social and product stewardship issues.

We may be impacted by and may not be able to adequately address safety, human health, social, product liability and environmental risks associated with our current and historical products, product life cycles, and production processes and the obligations that follow from them. This could adversely impact employees, communities, stakeholders, the environment, our reputation and our business, financial condition, and the results of our operations. Public perception of the risks associated with our current or past products, their respective life cycles, and production processes could impact product acceptance and influence the regulatory environment in which we operate.

Our business is subject to a variety of domestic and international laws, rules, policies and other obligations regarding data protection.

The processing and storage of certain information is increasingly subject to privacy and data security regulations and many such regulations are country-specific. The interpretation and application of data protection laws in the U.S., Europe and elsewhere, including but not limited to the California Consumer Privacy Act and the General Data Protection Regulation (the “GDPR”), are uncertain, evolving and may be inconsistent among jurisdictions. Complying with these various laws may be difficult and could cause us to incur substantial costs or require us to change our business practices in a manner adverse to our business. We may be required to expend additional resources to continue to enhance our information privacy and security measures, investigate and remediate any information security vulnerabilities and/or comply with regulatory requirements.

Changes in U.S. and other governments’ trade policies and other factors beyond our control may adversely impact our business, financial condition and results of operations.

Tariffs, retaliatory tariffs or other trade restrictions on products and materials that we or our customers and suppliers export or import could affect demand for our products. Direct or indirect consequences of tariffs, retaliatory tariffs or other trade restrictions may also alter the competitive landscape of our products in one or more regions of the world. Trade tensions or other governmental action related to tariffs or international trade agreements or policies has the potential to negatively impact our business, financial condition and results of operations.

Sales of our products to certain customers or into certain industries may expose us to different and complex regulatory regimes.

We seek to expand our customer base and the industries into which we sell. Selling products to certain customers or into certain industries, such as governments or the defense industry, requires compliance with regulatory regimes that can be complex and difficult to navigate. Our failure to comply with these regulations could result in liabilities or damage to our reputation, which could negatively impact our business, financial condition, or results of operations.

We are exposed to lawsuits, governmental investigations and proceedings relating to current and historical operations and products, which could harm our business.

We are from time to time exposed to certain lawsuits, governmental investigations and proceedings relating to current and historical operations and products, which may include claims involving product liability, environmental compliance, hazardous materials, infringement of intellectual property rights of third parties, work place safety, employment and other claims. Due to the uncertainties of litigation, we can give no assurance that we will prevail on claims made against us in the lawsuits that we currently face or that additional claims will not be made against us in the future. Lawsuits or claims, if they were to result in a ruling adverse to us or otherwise result in an obligation on the part of the Company, could give rise to substantial liability, which could have a material adverse effect on our business, financial condition, or results of operations.

We are subject to stringent labor and employment laws in certain jurisdictions in which we operate, we are party to various collective bargaining arrangements, and our relationship with our employees could deteriorate, which could adversely impact our operations.

A majority of our full-time employees are employed outside the U.S. In certain jurisdictions where we operate, labor and employment laws are relatively stringent and, in many cases, grant significant job protection to certain employees, including rights on termination of employment. In addition, in certain countries where we operate, our employees are members of unions or are represented by works councils. We are often required to consult with and seek the consent or advice of these unions and/or works councils. These regulations and laws, coupled with the requirement to seek consent or consult with the relevant unions or works councils, could have a significant impact on our flexibility in managing costs and responding to market changes.

Furthermore, approximately 4.2% of our U.S. employees as of December 31, 2020, are subject to collective bargaining arrangements or similar arrangements. Approximately 1.4% of all U.S. employees are affected by a labor agreement that expires in 2024. While we expect to be able to renew these agreements without significant disruption to our business when they are scheduled to expire, there can be no assurance that we will be able to negotiate labor agreements on satisfactory terms or that actions by our employees will not be disruptive to our business. If these workers were to engage in a strike, work stoppage or other slowdown or if other employees were to become unionized, we could experience a significant disruption of our operations and/or higher ongoing labor costs, which could adversely affect our business, financial condition and results of operations.

There are risks associated with the manufacture and sale of our materials into industries that make products for sensitive applications.

We manufacture and sell materials to parties that make products for sensitive applications, such as medical devices. The supply of materials that enter the human body involves the risk of illness or injury to consumers, as well as commercial risks. Injury to consumers could result from, among other things, improper use, tampering by unauthorized third parties, or the introduction into the material of foreign objects, substances, chemicals and other agents during the manufacturing, packaging, storage, handling or transportation phases. Shipment of adulterated materials may be a violation of law and may lead to an increased risk of exposure to product liability or other claims, product recalls and increased scrutiny by federal and state regulatory agencies. Such claims or liabilities may not be covered by our insurance or by any rights of indemnity or contribution that we may have against third parties. In addition, the negative publicity surrounding any assertion that our materials caused illness or injury could have a material adverse effect on our reputation with existing and potential customers, which could negatively impact our business, operating results or financial condition.

General Risks

The impact of the novel coronavirus (“COVID-19”) may exacerbate the risks discussed therein, any of which could have a material effect on the Company.

Since the first quarter of 2020, there has been a world-wide impact from the COVID-19 pandemic, including in Asia, Europe, the Middle East, and North and South America, all of which are regions in which Ferro has operations. Authorities have implemented numerous measures to try to contain the virus, such as travel bans and restrictions, quarantines, shelter in place orders, and business shutdowns. The measures taken by the authorities have impacted and may further impact certain of our workforce and operations, the operations of our customers, and those of our vendors and suppliers. Although certain jurisdictions have eased restrictions, because of recurring outbreaks and new strain of the virus there still is considerable uncertainty regarding measures that authorities may implement in the future, which may restrict our operations and those of our suppliers and customers and disrupt logistics and other supply and distribution service providers. The spread of COVID-19 has caused us to modify certain of our business practices with respect to certain products (including site operations, employee workplace practices, travel, and participation in meetings, events, and conferences), and we may take further actions as required or recommended by authorities or deemed to be in the best interests of our employees and business partners. There is no certainty that such measures will be sufficient to mitigate the risks posed by the virus, and our ability to perform critical functions could be adversely affected. These circumstances could negatively impact our business, results of operations, financial condition and cash flows.

The degree to which COVID-19 will impact our results in the future depends on many factors, which are highly uncertain and cannot be predicted, including, but not limited to, the duration of the pandemic, actions to contain the virus or limit its impact, the availability, administration and effectiveness of vaccines, and the speed and extent to which normal economic and operating conditions resume. Even after the COVID-19 outbreak has subsided, we may experience material adverse impacts to our business as a result of the potential sustained economic impact and any recession or other macroeconomic weakness that may occur.

We depend on external financial resources, and the economic environment and credit market uncertainty could interrupt our access to capital markets, borrowings, or financial transactions to hedge certain risks, which could adversely affect our financial condition.

At December 31, 2020, we had approximately $800.3 million of short-term and long-term debt with varying maturities and approximately $92.3 million of off-balance sheet arrangements, including consignment arrangements for precious metals, bank guarantees, and standby letters of credit. These arrangements have allowed us to make investments in growth opportunities and fund working capital requirements. In addition, we may enter into financial transactions to hedge certain risks, including foreign exchange, commodity pricing, interest rates, and sourcing of certain raw materials. Our continued access to capital markets and the stability of our lenders, customers and financial partners, and their willingness to support our needs, are essential to our liquidity and our ability to meet our current obligations and to fund operations and our strategic initiatives. An interruption in our access to external financing or financial transactions to hedge risk could adversely affect our business prospects and financial condition. See further information regarding our liquidity in “Capital Resources and Liquidity” under Item 7 and in Note 9 to the consolidated financial statements under Item 8 of this Annual Report on Form 10-K.

In addition, on July 27, 2017, the Financial Conduct Authority (FCA) in the U.K. announced that it would phase out LIBOR as a benchmark by the end of calendar year 2021. The expected discontinuation of LIBOR may require us to amend certain agreements governing our debt and, although the U.S. and other jurisdictions are working to replace LIBOR with alternative reference rates, we cannot predict what alternative index, margin adjustments and related terms would be negotiated with our counterparties. As a result, our interest expense could increase.

Interest rates on some of our borrowings are variable, and our borrowing costs could be adversely affected by interest rate increases.

Portions of our debt obligations have variable interest rates. Generally, when interest rates rise, our cost of borrowings increases. We estimate, based on the debt obligations outstanding at December 31, 2020, that a one percent increase in interest rates would cause interest expense to increase by $2.6 million annually. Although interest rates have remained relatively stable over the past few years, future increases could raise our cost of borrowings and adversely affect our financial performance. See further information regarding our interest rates on our debt obligations in “Quantitative and Qualitative Disclosures about Market Risk” under Item 7A and in Note 9 to the consolidated financial statements under Item 8 of this Form 10-K.

Employee benefit costs, including postretirement costs, constitute a significant element of our annual expenses, and funding these costs could adversely affect our financial condition.

Employee benefit costs are a significant element of our cost structure. Certain expenses, particularly postretirement costs under defined benefit pension plans and healthcare costs for employees and retirees, may increase significantly at a rate that is difficult to forecast and may adversely affect our financial results, financial condition or cash flows. Changes in the applicable discount rate can affect our postretirement obligations. Declines in global capital markets may cause reductions in the value of our pension plan assets. Such circumstances could have an adverse effect on future pension expense and funding requirements. Further information regarding our retirement benefits is presented in Note 13 to the consolidated financial statements under Item 8 of this Annual Report on Form 10-K.

We are exposed to intangible asset risk, and a write down of our intangible assets could have an adverse impact on our operating results and financial position.

We have recorded intangible assets, including goodwill, in connection with business acquisitions. We are required to perform goodwill impairment tests on at least an annual basis and whenever events or circumstances indicate that the carrying value may not be recoverable from estimated future cash flows. As a result of our annual and other periodic evaluations, we may determine that the intangible asset values need to be written down to their fair values, which could result in material charges that could be adverse to our operating results and financial position. See further information regarding our goodwill and other intangible assets in “Critical Accounting Policies” under Item 7 and in Note 8 to the consolidated financial statements under Item 8 of this Form 10-K.

We are exposed to risks associated with acts of God, terrorists and others, as well as fires, explosions, wars, riots, accidents, embargoes, natural disasters, strikes and other work stoppages, quarantines and other governmental actions, and other events or circumstances that are beyond our control.

Ferro is exposed to risks from various events that are beyond our control, which may have significant effects on our results of operations. While we attempt to mitigate these risks through appropriate loss prevention measures, insurance, contingency planning and other means, we may not be able to anticipate all risks or to reasonably or cost-effectively manage those risks that we do anticipate. As a result, our operations could be adversely affected by circumstances or events in ways that are significant and/or long lasting.

The risks and uncertainties identified above are not the only risks that we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial also may adversely affect us. If any known or unknown risks and uncertainties develop into actual events, these developments could have material adverse effects on our financial position, results of operations, and cash flows.

Item 1B — Unresolved Staff Comments

None.

Item 2 — Properties

We lease our corporate headquarters, which is located at 6060 Parkland Blvd., Mayfield Heights, Ohio. The Company owns other corporate facilities worldwide. We own principal manufacturing plants that range in size from 21,000 sq. ft. to over 700,000 sq. ft. Plants we own with more than 250,000 sq. ft. are located in Spain; Germany; Belgium; Colombia; Mexico; Cleveland, Ohio; and Penn Yan, New York. The locations of principal manufacturing plants by reportable segment are as follows:

Color Solutions — U.S.: Penn Yan, New York and Norcross, Georgia. Outside the U.S.: Colombia, China, India, Belgium, France, Romania and Spain.

Functional Coatings — U.S.: Washington, Pennsylvania; King of Prussia, Pennsylvania and Orrville, Ohio. Outside the U.S.: Brazil, China, France, Germany, Mexico, Portugal, Spain, and the United Kingdom.

In addition, we lease manufacturing facilities for the Functional Coatings reportable segment in the United Kingdom; Germany; Japan; Israel; and Turkey. We also lease manufacturing facilities in Taiwan for Color Solutions. Manufacturing plants in Argentina, Egypt, Indonesia, Italy, Poland and Thailand, which were historically reported in the legacy Performance Coatings reportable segment, are considered held-for-sale as of December 31, 2020. In some instances, the manufacturing facilities are used for two or more segments. Leased facilities range in size from 12,000 sq. ft. to over 100,000 sq. ft.

Item 3 — Legal Proceedings

In November 2017, Suffolk County Water Authority filed a complaint, Suffolk County Water Authority v. The Dow Chemical Company et al., against the Company and a number of other companies in the U.S. Federal Court for the Eastern District of New York with regard to the product 1,4 dioxane. The plaintiff alleges, among other things, that the Suffolk County water supply is contaminated with 1,4 dioxane and that the defendants are liable for unspecified costs of cleanup and remediation of the water supply, among other damages. The Company has not manufactured 1,4 dioxane since 2008, denies the allegations related to liability for the plaintiff’s claims, and is vigorously defending this proceeding. Since December 2018, additional complaints were filed in the same court by 25 other New York water suppliers against the Company and others making substantially similar allegations regarding the contamination of their respective water supplies with 1,4 dioxane. An additional complaint also was filed by the Hicksville Water District against the Company and others in New York State Supreme Court making substantially similar allegations and seeking damages of $900 million. The Company is likewise vigorously defending these additional actions. The Company currently does not expect the outcome of these proceedings to have a material adverse impact on its consolidated financial condition, results of operations, or cash flows, net of any insurance coverage. However, it is not possible to predict the ultimate outcome of these proceedings due to the unpredictable nature of litigation.

In addition to the proceedings described above, the Company and its consolidated subsidiaries are subject from time to time to various claims, lawsuits, investigations, and proceedings related to products, services, contracts, environmental, health and safety, employment, intellectual property, and other matters, including with respect to divested businesses. The outcome of such matters is unpredictable, our assessment of them may change, and resolution of them could have a material adverse effect on the Company’s consolidated financial position, results of operations, or cash flows. We do not currently expect the resolution of such matters to materially affect the consolidated financial position, results of operations, or cash flows of the Company.

Item 4 — Mine Safety Disclosures

Not applicable.

Information about our Executive Officers

The executive officers of the Company as of February 24, 2021, are listed below, along with their ages and business experience during the past five years. The year indicates when the individual was named to the indicated position with Ferro, unless otherwise indicated.

Peter T. Thomas — 65

Chairman of the Board of Directors, 2014

President and Chief Executive Officer, 2013

Mark H. Duesenberg — 59

Vice President, General Counsel and Secretary, 2008

Benjamin J. Schlater — 45

Group Vice President and Chief Financial Officer, 2019

Vice President and Chief Financial Officer, 2016

Vice President, Corporate Development and Strategy, 2015

PART II

Item 5 — Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities

Our common stock is listed on the New York Stock Exchange under the ticker symbol FOE. On January 31, 2021, we had 793 shareholders of record for our common stock, and the closing price of the common stock was $13.79 per share.

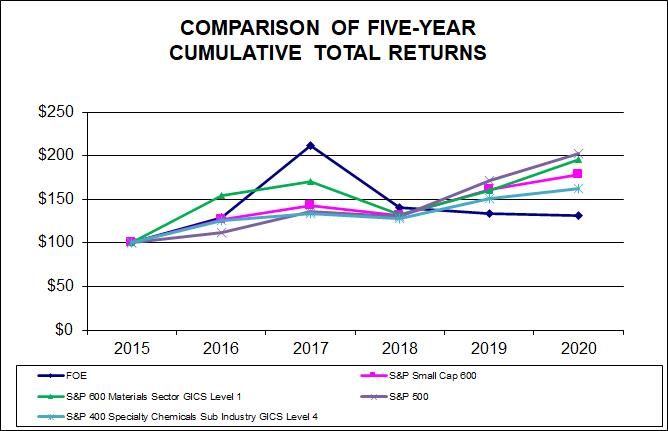

The chart below compares Ferro’s cumulative total shareholder return for the five years ended December 31, 2020, to that of the Standard & Poor’s 500 and Standard & Poor’s 400 Specialty Chemicals Indexes, on which the Company was formerly listed, and the Standard & Poor’s 600 Material Sector and Standard & Poor’s Small Cap 600 Indexes, on which the Company is currently listed. In all cases, the information is presented on a dividend-reinvested basis and assumes investment of $100.00 on December 31, 2015. At December 31, 2020, the closing price of our common stock was $14.63 per share.

Our Board of Directors has not declared any dividends on common stock during 2020 or 2019. The Company’s Amended Credit Facility restricts the amount of dividends we can pay on our common stock. Any future dividends declared would be at the discretion of our Board of Directors and would depend on our financial condition, results of operations, cash flows, contractual obligations, the terms of our financing agreements at the time a dividend is considered, and other relevant factors. For further discussion, see Management’s Discussion and Analysis of Financial Condition and Results of Operations under Item 7 of this Annual Report on Form 10-K.

In October 2018, the Company’s Board of Directors approved a new share repurchase program under which the Company is authorized to repurchase up to an additional $50 million of the Company’s outstanding common stock on the open market, including through Rule 10b5-1 plans, in privately negotiated transactions, or otherwise. This new program is in addition to the $100 million of authorization previously approved and announced.

The Company made no repurchases during 2020. The Company repurchased 1,440,678 shares of common stock at an average price of $17.35 per share for a total cost of $25.0 million during 2019. As of December 31, 2020, $46.2 million remains authorized under the program for the repurchase of common stock.

The following table summarizes purchases of our common stock by the Company and affiliated purchasers during the three months ended December 31, 2020:

Total Number of | Maximum Dollar | |||||||||||

Share Purchased | Amount that May | |||||||||||

Total Number | Average | as Part of Publicly | Yet Be Purchased | |||||||||

of Shares | Price Paid | Announced Plans | Under the Plans | |||||||||

(Dollars in thousands, except for per share amounts) | Purchased | per Share | or Programs | or Programs | ||||||||

October 1, 2020 to October 31, 2020 | — | $ | — | — | $ | 46,192,535 | ||||||

November 1, 2020 to November 30, 2020 | — | $ | — | — | $ | 46,192,535 | ||||||

December 1, 2020 to December 31, 2020 | — | $ | — | — | $ | 46,192,535 | ||||||

Total | — | — | ||||||||||

Item 6 — Selected Financial Data

The following table presents selected financial data for the last five years ended December 31st:

(Dollars in thousands, except for per share data) | 2020 | 2019 | 2018 | 2017(1) | 2016(1) | ||||||||||

Net sales | $ | 958,954 | $ | 1,014,457 | $ | 1,074,696 | $ | 996,382 | $ | 794,465 | |||||

Income from continuing operations | 30,040 | 34,826 | 56,050 | 35,659 | 38,123 | ||||||||||

Basic earnings per share from continuing operations attributable to Ferro Corporation common shareholders | 0.35 | 0.41 | 0.66 | 0.45 | 0.44 | ||||||||||

Diluted earnings per share from continuing operations attributable to Ferro Corporation common shareholders | 0.35 | 0.41 | 0.65 | 0.44 | 0.43 | ||||||||||

Cash dividends declared per common shares | - | - | - | - | - | ||||||||||

Total assets(2) | 1,960,933 | 1,834,621 | 1,866,076 | 1,682,202 | 1,283,769 | ||||||||||

Long-term debt, including current portion | 800,348 | 807,565 | 815,002 | 735,267 | 563,033 | ||||||||||

(1)Long-term debt, including current portion for indicated years include portions attributable to discontinued operations. Refer to Note 4 to the consolidated financial statements under Item 8 of this Annual Report on Form 10-K for additional details related to the sale of our Tile Coatings business.

(2)Total assets for 2020, 2019 and 2018 include loans receivables of $55.1 million, $23.7 million and $53.6 million, respectively, which were previously eliminated as certain intercompany amounts are expected to be assumed by the Tile Coatings business buyer. The related liabilities are classified as current and non-current liabilities held-for-sale in the consolidated financial statements.

In 2019, we adopted the provisions of the Financial Accounting Standards Board (“FASB”) Accounting Standards Update (“ASU”) 2016-02. The ASU requires the recognition of a lease asset on the balance sheet for operating leases with a term greater than one year. The adoption resulted in $28.6 million recognized as total right-of-use assets and total lease liabilities on our consolidated balance sheet as of January 1, 2019.

Item 7 — Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

During the year ended December 31, 2020, net sales decreased $55.5 million, or 5.5%, compared with 2019. Net sales decreased by $36.6 million and $18.9 million in Functional Coatings and Color Solutions, respectively. Gross profit decreased $14.2 million compared with 2019; as a percentage of net sales, it increased approximately 20 basis points to 30.6%, from 30.4% in the prior year. The decrease in gross profit was primarily attributable to a decrease in Functional Coatings of $17.1 million, partially mitigated by an increase in Color Solutions of $4.1 million.