UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02105

Fidelity Salem Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | June 30 |

Date of reporting period: | June 30, 2021 |

Item 1.

Reports to Stockholders

Fidelity® Defined Maturity Funds

Fidelity® Municipal Income 2021 Fund

Fidelity® Municipal Income 2023 Fund

Fidelity® Municipal Income 2025 Fund

June 30, 2021

Includes Fidelity and Fidelity Advisor share classes

Contents

Fidelity® Municipal Income 2021 Fund | |

Fidelity® Municipal Income 2023 Fund | |

Fidelity® Municipal Income 2025 Fund | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 if you’re an individual investing directly with Fidelity, call 1-800-835-5092 if you’re a plan sponsor or participant with Fidelity as your recordkeeper or call 1-877-208-0098 on institutional accounts or if you’re an advisor or invest through one to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2021 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Funds nor Fidelity Distributors Corporation is a bank.

Note to Shareholders:

Early in 2020, the outbreak and spread of a new coronavirus emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and the outlook for corporate earnings. The virus causes a respiratory disease known as COVID-19. On March 11, 2020 the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread.

In the weeks following, as the crisis worsened, we witnessed an escalating human tragedy with wide-scale social and economic consequences from coronavirus-containment measures. The outbreak of COVID-19 prompted a number of measures to limit the spread, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and – given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. Amid the turmoil, global governments and central banks took unprecedented action to help support consumers, businesses, and the broader economies, and to limit disruption to financial systems.

The situation continues to unfold, and the extent and duration of its impact on financial markets and the economy remain highly uncertain. Extreme events such as the coronavirus crisis are “exogenous shocks” that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets.

Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we’re taking extra steps to be responsive to customer needs. We encourage you to visit our websites, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

Fidelity® Municipal Income 2021 Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended June 30, 2021 | Past 1 year | Past 5 years | Past 10 years |

| Class A (incl. 2.75% sales charge) | (2.38)% | 0.21% | 2.47% |

| Fidelity® Municipal Income 2021 Fund | 0.63% | 1.02% | 3.01% |

| Class I | 0.54% | 1.00% | 2.94% |

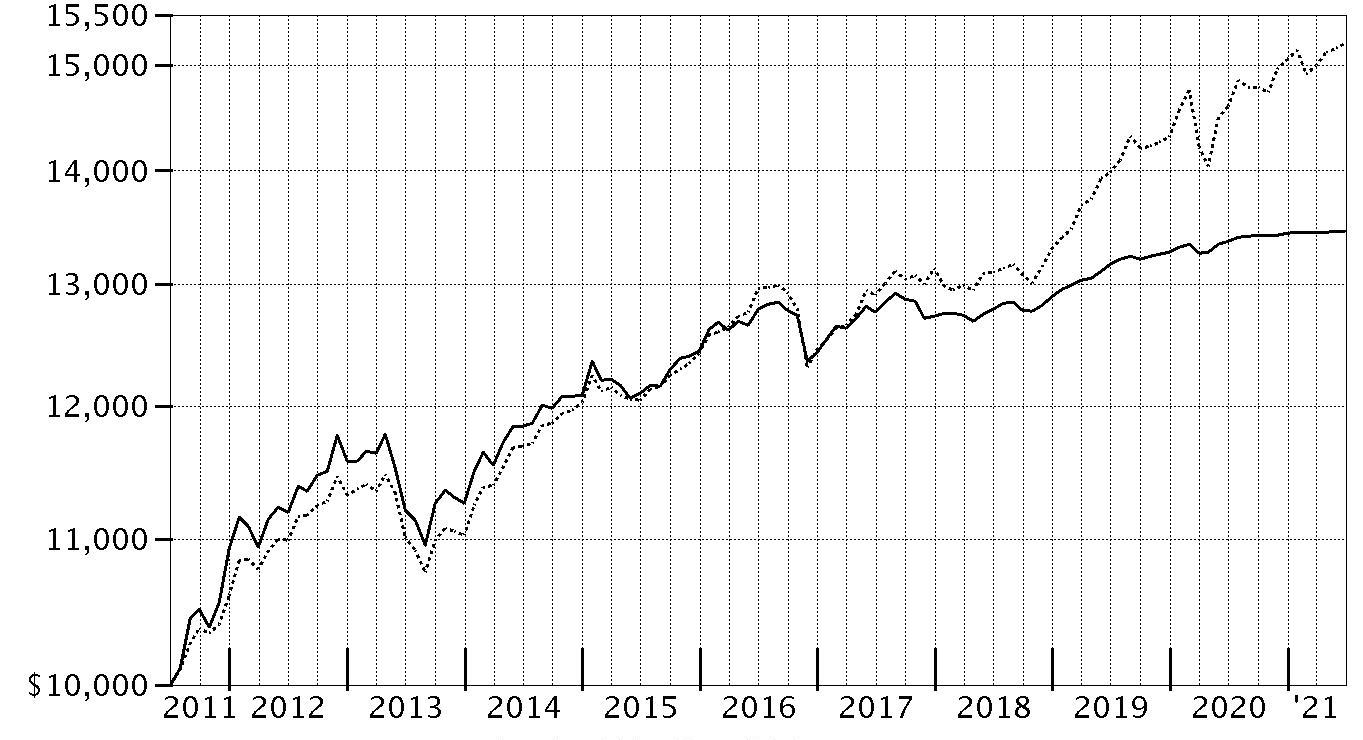

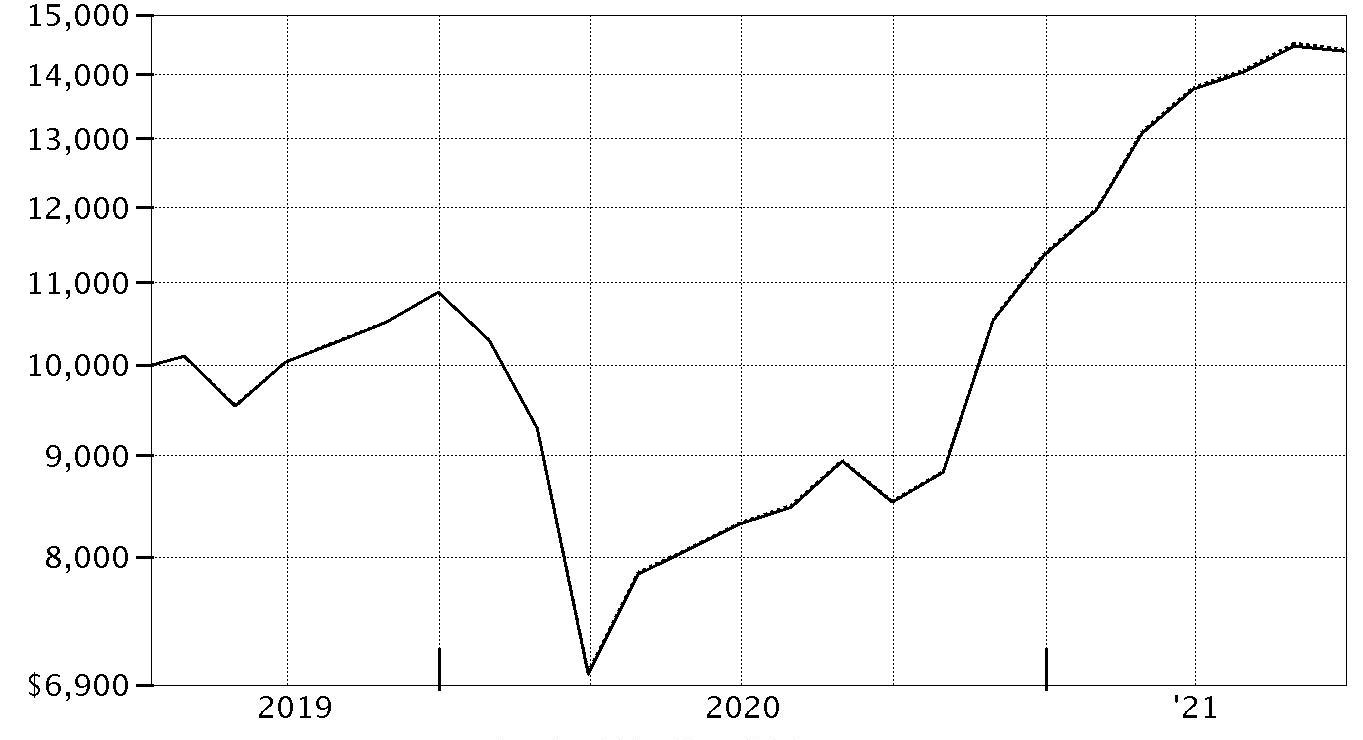

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Fidelity® Municipal Income 2021 Fund, a class of the fund, on May 19, 2011, when the fund started.

The chart shows how the value of your investment would have changed, and also shows how the Bloomberg Municipal Bond Index performed over the same period.

| Period Ending Values | ||

| $13,452 | Fidelity® Municipal Income 2021 Fund | |

| $15,213 | Bloomberg Municipal Bond Index | |

Effective August 24, 2021, all Bloomberg Barclays Indices were re-branded as Bloomberg Indices.

Fidelity® Municipal Income 2023 Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| Periods ended June 30, 2021 | Past 1 year | Past 5 years | Life of PortfolioA |

| Class A (incl. 2.75% sales charge) | (0.99)% | 1.00% | 1.99% |

| Fidelity® Municipal Income 2023 Fund | 2.06% | 1.81% | 2.60% |

| Class I | 2.06% | 1.81% | 2.60% |

A From April 23, 2013

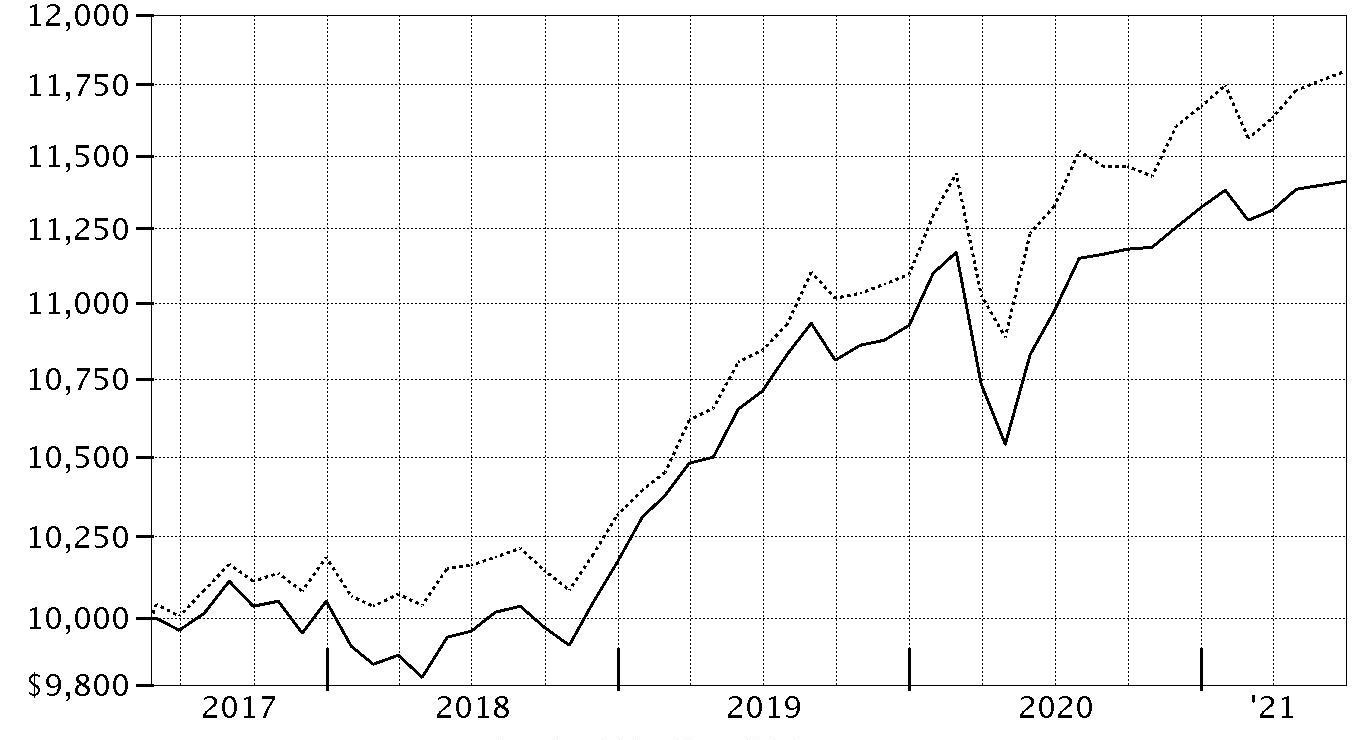

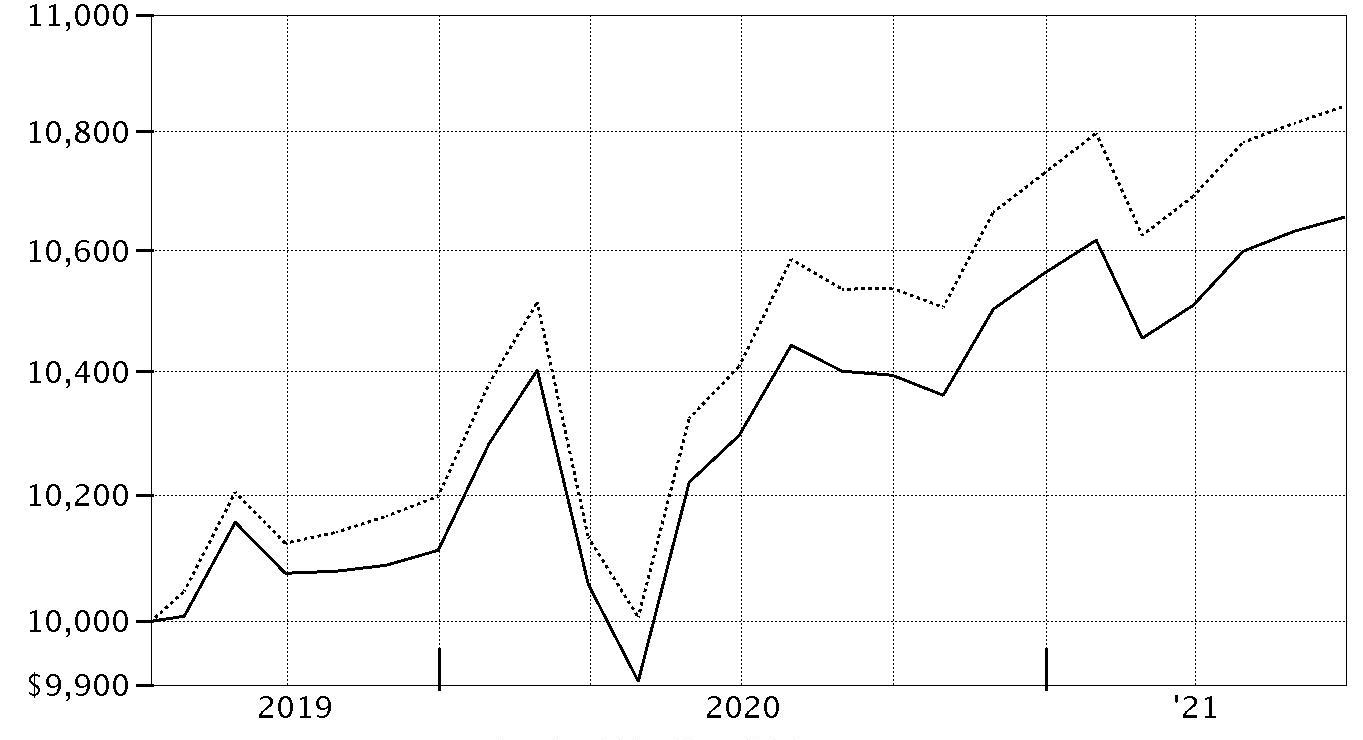

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Fidelity® Municipal Income 2023 Fund, a class of the fund, on April 23, 2013, when the fund started.

The chart shows how the value of your investment would have changed, and also shows how the Bloomberg Municipal Bond Index performed over the same period.

| Period Ending Values | ||

| $12,337 | Fidelity® Municipal Income 2023 Fund | |

| $13,285 | Bloomberg Municipal Bond Index | |

Effective August 24, 2021, all Bloomberg Barclays Indices were re-branded as Bloomberg Indices.

Fidelity® Municipal Income 2025 Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| Periods ended June 30, 2021 | Past 1 year | Life of PortfolioA |

| Class A (incl. 2.75% sales charge) | 0.90% | 2.32% |

| Fidelity® Municipal Income 2025 Fund | 4.01% | 3.28% |

| Class I | 3.91% | 3.28% |

A From May 25, 2017

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Fidelity® Municipal Income 2025 Fund, a class of the fund, on May 25, 2017, when the fund started.

The chart shows how the value of your investment would have changed, and also shows how the Bloomberg Municipal Bond Index performed over the same period.

| Period Ending Values | ||

| $11,413 | Fidelity® Municipal Income 2025 Fund | |

| $11,797 | Bloomberg Municipal Bond Index | |

Effective August 24, 2021, all Bloomberg Barclays Indices were re-branded as Bloomberg Indices.

Management's Discussion of Fund Performance

Market Recap: Tax-exempt municipal bonds posted a gain for the 12 months ending June 30, 2021, driven by robust investor demand in an environment shaped by an improved fiscal outlook for many municipal issuers, increased muni-bond supply, the threat of rising interest rates and growing inflation fears. The Bloomberg Municipal Bond Index rose 4.17% for the period. Better-than-expected economic data pressured muni yields and credit spreads in the latter half of 2020. In December 2020 and January 2021, the muni market rallied amid economic optimism due to the rollout of effective COVID-19 vaccination programs. Munis were further bolstered by an easing of credit concerns that had been triggered by the economic shutdowns caused by COVID-19. Also, investor demand for tax-exempt munis increased due to the Biden administration’s plan to push for higher taxes to fund health care, education and infrastructure programs. Tax collections took less of a hit than originally feared and historic aid from the U.S. Congress for muni issuers helped fill budget gaps. In February, the municipal market suffered a modest decline, reflecting investor concerns that stimulus-induced inflation could diminish real bond returns over time. Munis then generated small monthly gains from March through the end of June, propelled by better-than-expected tax revenue from many state and local governments.Comments from Co-Managers Elizah McLaughlin, Cormac Cullen and Michael Maka: For the fiscal year ending June 30, 2021, the share classes (excluding sales charges, if applicable) of the 2021, 2023 and 2025 funds posted gains that outpaced their respective Bloomberg benchmarks. We focused on longer-term objectives and sought to generate attractive tax-exempt income and competitive risk-adjusted returns over time. Versus their respective indexes, sector allocation contributed to relative performance, particularly the funds' overweightings in various outperforming segments including health care, tobacco. higher education, and airports. Larger-than-benchmark exposure to lower-rated investment-grade securities also helped the funds since these securities outpaced higher-quality securities. An overweighting in Illinois bonds boosted the relative result of the 2023 fund, while a smaller-than-benchmark exposure there hurt the 2025 fund. The 2023 fund’s relative return was helped by its overweighting in New Jersey-related credits. For the 2025 fund, underweighting New York Transportation Authority bonds detracted from its relative performance. The 2021 fund was hurt by its shorter-than-benchmark duration. Differences in the way fund holdings and index components were priced hampered the relative result of the 2023 and 2025 funds.The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Note to shareholders: On or about July 9, 2021, the 2021 fund reached its target date and was liquidated, distributing its assets in cash to shareholders.Fidelity® Municipal Income 2021 Fund

Investment Summary (Unaudited)

Top Five States as of June 30, 2021

| % of fund's net assets | |

| New York | 11.5 |

| New Jersey | 11.4 |

| Nevada | 9.7 |

| Florida | 9.3 |

| Texas | 8.9 |

Top Five Sectors as of June 30, 2021

| % of fund's net assets | |

| Health Care | 19.5 |

| Transportation | 14.7 |

| Escrowed/Pre-Refunded | 12.4 |

| Special Tax | 10.3 |

| Electric Utilities | 10.1 |

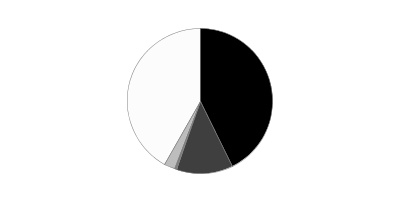

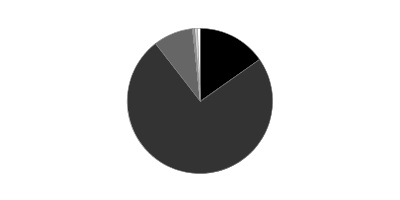

Quality Diversification (% of fund's net assets)

| As of June 30, 2021 | ||

| AA,A | 42.7% | |

| BBB | 12.5% | |

| BB and Below | 0.6% | |

| Not Rated | 2.4% | |

| Short-Term Investments and Net Other Assets | 41.8% | |

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

Fidelity® Municipal Income 2021 Fund

Schedule of Investments June 30, 2021

Showing Percentage of Net Assets

| Municipal Bonds - 58.2% | |||

| Principal Amount | Value | ||

| Arizona - 5.0% | |||

| Phoenix Civic Impt. Board Arpt. Rev. Series 2017 A, 5% 7/1/21 (a) | 1,000,000 | 1,000,000 | |

| Tucson Street & Hwy. User Rev. Series 2011, 5% 7/1/21 | 300,000 | 300,000 | |

| Univ. Med. Ctr. Corp. Hosp. Rev. Series 2011, 6% 7/1/39 (Pre-Refunded to 7/1/21 @ 100) | 240,000 | 240,000 | |

| TOTAL ARIZONA | 1,540,000 | ||

| California - 3.5% | |||

| San Diego County Reg'l. Arpt. Auth. Arpt. Rev. Series 2017 B, 5% 7/1/21 (a) | 465,000 | 465,000 | |

| Washington Township Health Care District Rev. Series 2017 B, 5% 7/1/21 | 600,000 | 600,000 | |

| TOTAL CALIFORNIA | 1,065,000 | ||

| Connecticut - 2.3% | |||

| Connecticut Health & Edl. Facilities Auth. Rev.: | |||

| Series K1, 5% 7/1/21 | $500,000 | $500,000 | |

| Series K3, 5% 7/1/21 | 210,000 | 210,000 | |

| TOTAL CONNECTICUT | 710,000 | ||

| Florida - 4.4% | |||

| Duval County School Board Ctfs. of Prtn. Series 2015 B, 5% 7/1/21 | 425,000 | 425,000 | |

| Florida Board of Ed. Lottery Rev. Series 2016 B, 5% 7/1/21 | 165,000 | 165,000 | |

| Florida Dept. of Envir. Protection Rev. Series 2011 B, 5% 7/1/21 | 750,000 | 750,000 | |

| TOTAL FLORIDA | 1,340,000 | ||

| Illinois - 1.8% | |||

| Illinois Gen. Oblig. Series 2013, 5% 7/1/21 | 510,000 | 510,000 | |

| Illinois Reg'l. Trans. Auth. Series 2017 A, 5% 7/1/21 | 50,000 | 50,000 | |

| TOTAL ILLINOIS | 560,000 | ||

| Maine - 2.0% | |||

| Maine Health & Higher Edl. Facilities Auth. Rev. Series 2017 B, 4% 7/1/21 | 100,000 | 100,000 | |

| Maine Tpk. Auth. Tpk. Rev. Series 2004, 5.25% 7/1/21 (FSA Insured) | 500,000 | 500,000 | |

| TOTAL MAINE | 600,000 | ||

| Massachusetts - 0.8% | |||

| Massachusetts Dev. Fin. Agcy. Rev. Series 2016, 5% 7/1/21 | 250,000 | 250,000 | |

| Michigan - 2.6% | |||

| Flint Hosp. Bldg. Auth. Rev. Series 2020, 5% 7/1/21 | 180,000 | 180,000 | |

| Michigan Fin. Auth. Rev. Series 2015 D1, 5% 7/1/21 | 500,000 | 500,000 | |

| Saginaw Hosp. Fin. Auth. Hosp. Rev. Series 2020 J, 5% 7/1/21 | 100,000 | 100,000 | |

| TOTAL MICHIGAN | 780,000 | ||

| Missouri - 0.3% | |||

| Saint Louis Arpt. Rev. Series 2017 A, 5% 7/1/21 (FSA Insured) | 100,000 | 100,000 | |

| Nevada - 9.7% | |||

| Clark County Arpt. Rev.: | |||

| Series 2017 C, 5% 7/1/21 (Escrowed to Maturity) (a) | 2,725,000 | 2,725,000 | |

| Series 2018 A, 5% 7/1/21 (Escrowed to Maturity) | 250,000 | 250,000 | |

| TOTAL NEVADA | 2,975,000 | ||

| New Jersey - 9.8% | |||

| Bayonne Gen. Oblig. Series 2016, 5% 7/1/21 (Build America Mutual Assurance Insured) | 695,000 | 695,000 | |

| New Jersey Edl. Facilities Auth. Rev.: | |||

| Series 2011 A, 5% 7/1/21 | 540,000 | 540,000 | |

| Series 2013 A, 5% 7/1/21 (Escrowed to Maturity) | 100,000 | 100,000 | |

| New Jersey Edl. Facility (Stevens Institute of Technolgy Proj.) Series 2017 A, 5% 7/1/21 | 490,000 | 490,000 | |

| New Jersey Health Care Facilities Fing. Auth. Rev.: | |||

| Series 2011, 5% 7/1/21 | 1,000,000 | 1,000,000 | |

| Series 2017 A, 5% 7/1/21 | 170,000 | 170,000 | |

| TOTAL NEW JERSEY | 2,995,000 | ||

| New York - 3.7% | |||

| Nassau County Local Econ. Assistance Corp. (Univ. Hosp. Proj.) Series 2012, 5% 7/1/21 | 500,000 | 500,000 | |

| New York Dorm. Auth. Rev.: | |||

| Series 2014, 5% 7/1/21 | 335,000 | 335,000 | |

| Series 2020 A, 5% 7/1/21 | 100,000 | 100,000 | |

| Saratoga County Cap. Resources Rev. Series A, 5% 7/1/21 | 200,000 | 200,000 | |

| TOTAL NEW YORK | 1,135,000 | ||

| Oregon - 2.8% | |||

| Port of Portland Arpt. Rev.: | |||

| Series 22, 5% 7/1/21 (a) | 650,000 | 650,000 | |

| Series 26 C, 5% 7/1/21 (a) | 200,000 | 200,000 | |

| TOTAL OREGON | 850,000 | ||

| Pennsylvania, New Jersey - 1.1% | |||

| Delaware River Joint Toll Bridge Commission Pennsylvania-New Jersey Bridge Rev. Series 2015, 5% 7/1/21 | 325,000 | 325,000 | |

| South Dakota - 0.8% | |||

| South Dakota Health & Edl. Facilities Auth. Rev. Series 2017, 5% 7/1/21 | 255,000 | 255,000 | |

| Texas - 7.3% | |||

| Houston Arpt. Sys. Rev.: | |||

| Series 2011 B, 5% 7/1/21 | 250,000 | 250,000 | |

| Series 2018 C, 5% 7/1/21 (a) | 1,000,000 | 1,000,000 | |

| Lubbock Health Facilities Dev. Corp. Rev. (St. Joseph Health Sys. Proj.) Series 2008 B, 5% 7/1/21 | 500,000 | 500,000 | |

| Tyler Health Facilities Dev. Corp. Hosp. Rev. (Mother Frances Hosp. Reg'l. Health Care Ctr. Proj.) Series 2011, 5% 7/1/21 (Escrowed to Maturity) | 500,000 | 500,000 | |

| TOTAL TEXAS | 2,250,000 | ||

| Wisconsin - 0.3% | |||

| Wisconsin Health & Edl. Facilities (Agnesian Healthcare Proj.) Series 2017, 5% 7/1/21 | 100,000 | 100,000 | |

| TOTAL MUNICIPAL BONDS | |||

| (Cost $17,830,000) | 17,830,000 | ||

| Municipal Notes - 33.3% | |||

| Alabama - 3.3% | |||

| Wilsonville Indl. Dev. Board Poll. Cont. Rev. (Alabama Pwr. Co. Proj.) Series D, 0.04% 7/1/21, VRDN (b) | 1,000,000 | $1,000,000 | |

| California - 2.9% | |||

| Irvine Impt. Bond Act of 1915 Series 2006 B, 0.01% 7/1/21, LOC U.S. Bank NA, Cincinnati, VRDN (b) | 900,000 | 900,000 | |

| Florida - 4.9% | |||

| Escambia County Poll. Cont. Rev. (Gulf Pwr. Co. Proj.) Series 1997, 0.05% 7/1/21, VRDN (b) | 1,000,000 | 1,000,000 | |

| Gainesville Utils. Sys. Rev. Series 2019 C, 0.01% 7/1/21, LOC Bank of America NA, VRDN (b) | 500,000 | 500,000 | |

| TOTAL FLORIDA | 1,500,000 | ||

| Indiana - 5.2% | |||

| Indiana Dev. Fin. Auth. Envir. Rev. (Duke Energy Indiana, Inc. Proj.) Series 2009 A4, 0.04% 7/1/21, LOC Sumitomo Mitsui Banking Corp., VRDN (b) | 600,000 | 600,000 | |

| Indiana Fin. Auth. Health Sys. Rev. (Sisters of Saint Francis Health Svcs., Inc. Obligated Group Proj.) Series 2008 J, 0.01% 7/1/21, LOC Barclays Bank PLC, VRDN (b) | 1,000,000 | 1,000,000 | |

| TOTAL INDIANA | 1,600,000 | ||

| Louisiana - 0.7% | |||

| Saint Charles Parish Poll. Cont. Rev. (Shell Oil Co.-Norco Proj.) Series 1991, 0.04% 7/1/21, VRDN (a)(b) | 200,000 | 200,000 | |

| Michigan - 2.0% | |||

| Michigan Strategic Fund Ltd. Oblig. Rev. (Henry Ford Museum & Greenfield Village Proj.) Series 2002, 0.04% 7/1/21, LOC Comerica Bank, VRDN (b) | 600,000 | 600,000 | |

| New Jersey - 1.6% | |||

| Union County Poll. Cont. Fing. Auth. Poll. Cont. Rev. (Exxon Mobil Proj.) Series 1994, 0.01% 7/1/21, VRDN (b) | 500,000 | 500,000 | |

| New York - 7.8% | |||

| New York City Gen. Oblig. Series 2013 A2, 0.02% 7/1/21 (Liquidity Facility Mizuho Corporate Bank Ltd.), VRDN (b) | 1,000,000 | 1,000,000 | |

| New York City Transitional Fin. Auth. Rev. Series 2014, 0.02% 7/1/21 (Liquidity Facility Mizuho Corporate Bank Ltd.), VRDN (b) | 1,000,000 | 1,000,000 | |

| New York Hsg. Fin. Agcy. Rev. (350 West 43rd Street Hsg. Proj.) Series 2002 A, 0.05% 7/1/21, LOC Landesbank Hessen-Thuringen, VRDN (a)(b) | 400,000 | 400,000 | |

| TOTAL NEW YORK | 2,400,000 | ||

| Texas - 1.6% | |||

| Port Arthur Navigation District Poll. Cont. Rev. (Texaco, Inc. Proj.) Series 1994, 0.01% 7/1/21, VRDN (b) | 500,000 | 500,000 | |

| Wisconsin - 3.3% | |||

| Univ. of Wisconsin Hosp. & Clinics Auth. Series B, 0.03% 7/1/21 (Liquidity Facility JPMorgan Chase Bank), VRDN (b) | 1,000,000 | 1,000,000 | |

| TOTAL MUNICIPAL NOTES | |||

| (Cost $10,200,000) | 10,200,000 | ||

| TOTAL INVESTMENT IN SECURITIES - 91.5% | |||

| (Cost $28,030,000) | 28,030,000 | ||

| NET OTHER ASSETS (LIABILITIES) - 8.5% | 2,606,039 | ||

| NET ASSETS - 100% | $30,636,039 |

Security Type Abbreviations

VRDN – VARIABLE RATE DEMAND NOTE (A debt instrument that is payable upon demand, either daily, weekly or monthly)

Legend

(a) Private activity obligations whose interest is subject to the federal alternative minimum tax for individuals.

(b) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Municipal Cash Central Fund | $974 |

| Total | $974 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable.

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Fund | Value, beginning of period | Purchases | Sales Proceeds | Realized Gain/Loss | Change in Unrealized appreciation (depreciation) | Value, end of period | % ownership, end of period |

| Fidelity Municipal Cash Central Fund 0.04% | $1,190,000 | $13,258,000 | $14,448,536 | $536 | $-- | $-- | 0.0% |

| Total | $1,190,000 | $13,258,000 | $14,448,536 | $536 | $-- | $-- |

Investment Valuation

The following is a summary of the inputs used, as of June 30, 2021, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: | ||||

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | ||||

| Municipal Securities | $28,030,000 | $-- | $28,030,000 | $-- |

| Total Investments in Securities: | $28,030,000 | $-- | $28,030,000 | $-- |

Other Information

The distribution of municipal securities by revenue source, as a percentage of total Net Assets, is as follows (Unaudited):

| Health Care | 19.5% |

| Transportation | 14.7% |

| Escrowed/Pre-Refunded | 12.4% |

| Other | 10.5% |

| Special Tax | 10.3% |

| Electric Utilities | 10.1% |

| General Obligations | 8.6% |

| Education | 7.0% |

| Others* (Individually Less Than 5%) | 6.9% |

| 100.0% |

* Includes net other assets

See accompanying notes which are an integral part of the financial statements.

Fidelity® Municipal Income 2021 Fund

Financial Statements

Statement of Assets and Liabilities

| June 30, 2021 | ||

| Assets | ||

| Investment in securities, at value — See accompanying schedule: Unaffiliated issuers (cost $28,030,000) | $28,030,000 | |

| Cash | 2,178,465 | |

| Interest receivable | 447,220 | |

| Other receivables | 235 | |

| Total assets | 30,655,920 | |

| Liabilities | ||

| Payable for fund shares redeemed | $2,865 | |

| Distributions payable | 6,113 | |

| Accrued management fee | 7,772 | |

| Transfer agent fee payable | 2,590 | |

| Distribution and service plan fees payable | 541 | |

| Total liabilities | 19,881 | |

| Net Assets | $30,636,039 | |

| Net Assets consist of: | ||

| Paid in capital | $30,636,031 | |

| Total accumulated earnings (loss) | 8 | |

| Net Assets | $30,636,039 | |

| Net Asset Value and Maximum Offering Price | ||

| Class A: | ||

| Net Asset Value and redemption price per share ($2,574,784 ÷ 243,241 shares)(a) | $10.59 | |

| Maximum offering price per share (100/97.25 of $10.59) | $10.89 | |

| Municipal Income 2021: | ||

| Net Asset Value, offering price and redemption price per share ($21,621,647 ÷ 2,042,640 shares) | $10.59 | |

| Class I: | ||

| Net Asset Value, offering price and redemption price per share ($6,439,608 ÷ 608,372 shares) | $10.58 |

(a) Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Year ended June 30, 2021 | ||

| Investment Income | ||

| Interest | $879,580 | |

| Income from Fidelity Central Funds | 955 | |

| Total income | 880,535 | |

| Expenses | ||

| Management fee | $121,707 | |

| Transfer agent fees | 40,569 | |

| Distribution and service plan fees | 11,066 | |

| Independent trustees' fees and expenses | 124 | |

| Miscellaneous | 55 | |

| Total expenses before reductions | 173,521 | |

| Expense reductions | (308) | |

| Total expenses after reductions | 173,213 | |

| Net investment income (loss) | 707,322 | |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | 175,811 | |

| Fidelity Central Funds | 536 | |

| Capital gain distributions from Fidelity Central Funds | 19 | |

| Total net realized gain (loss) | 176,366 | |

| Change in net unrealized appreciation (depreciation) on investment securities | (627,521) | |

| Net gain (loss) | (451,155) | |

| Net increase (decrease) in net assets resulting from operations | $256,167 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Year ended June 30, 2021 | Year ended June 30, 2020 | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $707,322 | $1,028,817 |

| Net realized gain (loss) | 176,366 | 136,474 |

| Change in net unrealized appreciation (depreciation) | (627,521) | (381,945) |

| Net increase (decrease) in net assets resulting from operations | 256,167 | 783,346 |

| Distributions to shareholders | (908,067) | (1,083,370) |

| Share transactions - net increase (decrease) | (20,214,622) | (938,474) |

| Total increase (decrease) in net assets | (20,866,522) | (1,238,498) |

| Net Assets | ||

| Beginning of period | 51,502,561 | 52,741,059 |

| End of period | $30,636,039 | $51,502,561 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Fidelity Municipal Income 2021 Fund Class A

| Years ended June 30, | 2021 | 2020 | 2019 | 2018 | 2017 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $10.76 | $10.83 | $10.74 | $10.93 | $11.19 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | .163 | .195 | .196 | .186 | .188 |

| Net realized and unrealized gain (loss) | (.122) | (.058) | .090 | (.191) | (.238) |

| Total from investment operations | .041 | .137 | .286 | (.005) | (.050) |

| Distributions from net investment income | (.159) | (.195) | (.196) | (.185) | (.188) |

| Distributions from net realized gain | (.052) | (.012) | – | – | (.022) |

| Total distributions | (.211) | (.207) | (.196) | (.185) | (.210) |

| Redemption fees added to paid in capitalA | – | – | – | – | –B |

| Net asset value, end of period | $10.59 | $10.76 | $10.83 | $10.74 | $10.93 |

| Total ReturnC,D | .38% | 1.28% | 2.69% | (.04)% | (.44)% |

| Ratios to Average Net AssetsE,F | |||||

| Expenses before reductions | .65% | .65% | .65% | .65% | .65% |

| Expenses net of fee waivers, if any | .65% | .65% | .65% | .65% | .65% |

| Expenses net of all reductions | .65% | .65% | .65% | .65% | .65% |

| Net investment income (loss) | 1.52% | 1.81% | 1.82% | 1.71% | 1.71% |

| Supplemental Data | |||||

| Net assets, end of period (000 omitted) | $2,575 | $5,620 | $5,435 | $7,399 | $11,790 |

| Portfolio turnover rateG | -% | 6% | 3% | 8% | 14% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.0005 per share.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Total returns do not include the effect of the sales charges.

E Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

G Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Municipal Income 2021 Fund

| Years ended June 30, | 2021 | 2020 | 2019 | 2018 | 2017 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $10.76 | $10.83 | $10.74 | $10.93 | $11.19 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | .189 | .222 | .222 | .212 | .215 |

| Net realized and unrealized gain (loss) | (.121) | (.058) | .091 | (.190) | (.238) |

| Total from investment operations | .068 | .164 | .313 | .022 | (.023) |

| Distributions from net investment income | (.186) | (.222) | (.223) | (.212) | (.215) |

| Distributions from net realized gain | (.052) | (.012) | – | – | (.022) |

| Total distributions | (.238) | (.234) | (.223) | (.212) | (.237) |

| Redemption fees added to paid in capitalA | – | – | – | – | –B |

| Net asset value, end of period | $10.59 | $10.76 | $10.83 | $10.74 | $10.93 |

| Total ReturnC | .63% | 1.53% | 2.95% | .21% | (.19)% |

| Ratios to Average Net AssetsD,E | |||||

| Expenses before reductions | .40% | .40% | .40% | .40% | .40% |

| Expenses net of fee waivers, if any | .40% | .40% | .40% | .40% | .40% |

| Expenses net of all reductions | .40% | .40% | .40% | .40% | .40% |

| Net investment income (loss) | 1.77% | 2.06% | 2.07% | 1.96% | 1.96% |

| Supplemental Data | |||||

| Net assets, end of period (000 omitted) | $21,622 | $33,722 | $34,247 | $33,746 | $36,809 |

| Portfolio turnover rateF | -% | 6% | 3% | 8% | 14% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.0005 per share.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

F Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Municipal Income 2021 Fund Class I

| Years ended June 30, | 2021 | 2020 | 2019 | 2018 | 2017 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $10.76 | $10.83 | $10.74 | $10.93 | $11.19 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | .190 | .222 | .222 | .212 | .215 |

| Net realized and unrealized gain (loss) | (.132) | (.058) | .091 | (.190) | (.238) |

| Total from investment operations | .058 | .164 | .313 | .022 | (.023) |

| Distributions from net investment income | (.186) | (.222) | (.223) | (.212) | (.215) |

| Distributions from net realized gain | (.052) | (.012) | – | – | (.022) |

| Total distributions | (.238) | (.234) | (.223) | (.212) | (.237) |

| Redemption fees added to paid in capitalA | – | – | – | – | –B |

| Net asset value, end of period | $10.58 | $10.76 | $10.83 | $10.74 | $10.93 |

| Total ReturnC | .54% | 1.53% | 2.95% | .21% | (.19)% |

| Ratios to Average Net AssetsD,E | |||||

| Expenses before reductions | .40% | .40% | .40% | .40% | .40% |

| Expenses net of fee waivers, if any | .40% | .40% | .40% | .40% | .40% |

| Expenses net of all reductions | .40% | .40% | .40% | .40% | .40% |

| Net investment income (loss) | 1.77% | 2.06% | 2.07% | 1.96% | 1.96% |

| Supplemental Data | |||||

| Net assets, end of period (000 omitted) | $6,440 | $12,161 | $13,060 | $22,313 | $19,120 |

| Portfolio turnover rateF | -% | 6% | 3% | 8% | 14% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.0005 per share.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

F Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity® Municipal Income 2023 Fund

Investment Summary (Unaudited)

Top Five States as of June 30, 2021

| % of fund's net assets | |

| Illinois | 12.8 |

| Florida | 7.7 |

| New Jersey | 7.5 |

| New York | 7.3 |

| Ohio | 6.5 |

Top Five Sectors as of June 30, 2021

| % of fund's net assets | |

| General Obligations | 28.0 |

| Health Care | 21.1 |

| Transportation | 16.5 |

| Special Tax | 8.8 |

| Electric Utilities | 7.9 |

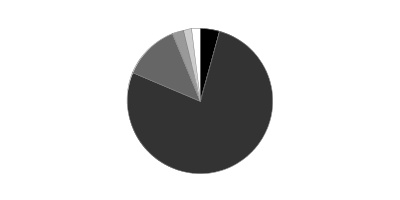

Quality Diversification (% of fund's net assets)

| As of June 30, 2021 | ||

| AAA | 4.3% | |

| AA,A | 77.0% | |

| BBB | 12.5% | |

| BB and Below | 2.6% | |

| Not Rated | 1.7% | |

| Short-Term Investments and Net Other Assets | 1.9% | |

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

Fidelity® Municipal Income 2023 Fund

Schedule of Investments June 30, 2021

Showing Percentage of Net Assets

| Municipal Bonds - 98.3% | |||

| Principal Amount | Value | ||

| Alabama - 2.6% | |||

| Alabama Pub. School & College Auth. Rev. Series 2020 A, 5% 11/1/23 | 100,000 | 111,125 | |

| Birmingham Arpt. Auth. Arpt. Series 2020, 5% 7/1/23 (Build America Mutual Assurance Insured) | 325,000 | 355,949 | |

| Mobile County Board of School Commissioners: | |||

| Series 2016 A, 5% 3/1/23 | $500,000 | $537,705 | |

| Series 2016 B, 5% 3/1/23 | 150,000 | 161,311 | |

| TOTAL ALABAMA | 1,166,090 | ||

| Arizona - 3.0% | |||

| Arizona Indl. Dev. Auth. Rev. (Provident Group-Eastern Michigan Univ. Parking Proj.) Series 2018, 4% 5/1/23 | 330,000 | 336,877 | |

| Chandler Indl. Dev. Auth. Indl. Dev. Rev. Bonds (Intel Corp. Proj.) Series 2005, 2.4%, tender 8/14/23 (a) | 130,000 | 135,472 | |

| Pima County Swr. Sys. Rev. Series 2020 A, 5% 7/1/23 | 100,000 | 109,586 | |

| Tucson Ctfs. of Prtn.: | |||

| Series 2012, 5% 7/1/23 (FSA Insured) | 450,000 | 490,580 | |

| Series 2015, 5% 7/1/23 (FSA Insured) | 250,000 | 272,545 | |

| TOTAL ARIZONA | 1,345,060 | ||

| California - 3.5% | |||

| California Gen. Oblig. Series 2017, 5% 8/1/23 | 200,000 | 220,066 | |

| California Health Facilities Fing. Auth. Rev. Series 2013 A: | |||

| 5% 3/1/23 | 110,000 | 118,698 | |

| 5% 8/15/52 (Pre-Refunded to 8/15/23 @ 100) | 100,000 | 110,034 | |

| Los Angeles Dept. Arpt. Rev. Series 2018 C, 5% 5/15/23 (b) | 120,000 | 130,615 | |

| Los Angeles Unified School District: | |||

| Series 2020 C, 5% 7/1/23 | 300,000 | 328,885 | |

| Series A, 5% 7/1/23 | 250,000 | 274,071 | |

| Riverside County Trans. Commission Toll Rev. Series 2013 A, 0% 6/1/23 | 200,000 | 194,230 | |

| Washington Township Health Care District Rev. Series 2017 B, 5% 7/1/23 | 200,000 | 216,740 | |

| TOTAL CALIFORNIA | 1,593,339 | ||

| Colorado - 1.2% | |||

| Colorado Health Facilities Auth. Bonds (Valley View Hosp. Assoc. Proj.) Series 2018, 2.8%, tender 5/15/23 (a) | 190,000 | 196,130 | |

| Colorado Reg'l. Trans. District Ctfs. of Prtn. Series 2014 A, 5% 6/1/23 | 200,000 | 217,500 | |

| Univ. of Colorado Enterprise Sys. Rev. Series 2014 A, 5% 6/1/23 | 100,000 | 109,194 | |

| TOTAL COLORADO | 522,824 | ||

| Connecticut - 3.3% | |||

| Connecticut Gen. Oblig.: | |||

| Series 2016 B, 5% 5/15/23 | 175,000 | 190,825 | |

| Series 2018 C, 5% 6/15/23 | 200,000 | 218,877 | |

| Series 2019 A, 5% 4/15/23 | 200,000 | 217,293 | |

| Series 2020 A, 5% 1/15/23 | 125,000 | 134,317 | |

| Connecticut Health & Edl. Facilities Auth. Rev. Series K1, 5% 7/1/23 | 500,000 | 539,876 | |

| Connecticut Hsg. Fin. Auth. Series C, 5% 5/15/23 (b) | 100,000 | 108,159 | |

| Connecticut Muni. Elec. Energy Coop. Pwr. Supply Sys. Rev. Series 2013 A, 5% 1/1/23 | 100,000 | 107,174 | |

| TOTAL CONNECTICUT | 1,516,521 | ||

| Florida - 7.7% | |||

| Broward County School Board Ctfs. of Prtn.: | |||

| Series 2015 A, 5% 7/1/23 | 250,000 | 273,438 | |

| Series 2015 B, 5% 7/1/23 | 45,000 | 49,219 | |

| Duval County School Board Ctfs. of Prtn. Series 2015 B, 5% 7/1/23 | 500,000 | 546,876 | |

| Escambia County Poll. Cont. Rev. (Gulf Pwr. Co. Proj.) Series 2003, 2.6% 6/1/23 | 300,000 | 312,421 | |

| Florida Board of Ed. Lottery Rev. Series 2016 A, 5% 7/1/23 | 530,000 | 580,919 | |

| Lake County School Board Ctfs. of Prtn. Series 2015 B, 5% 6/1/23 (FSA Insured) | 500,000 | 544,959 | |

| Miami-Dade County Expressway Auth.: | |||

| Series 2014 A, 4% 7/1/23 | 200,000 | 214,064 | |

| Series 2014 B, 5% 7/1/23 | 90,000 | 98,116 | |

| Miami-Dade County School Board Ctfs. of Prtn.: | |||

| Series 2015 A, 5% 5/1/23 | 30,000 | 32,582 | |

| Series 2015 D, 5% 2/1/23 | 650,000 | 699,724 | |

| Seminole County School Board Ctfs. of Prtn. Series 2012 A, 5% 7/1/23 | 145,000 | 158,594 | |

| TOTAL FLORIDA | 3,510,912 | ||

| Georgia - 1.2% | |||

| Bartow County Dev. Auth. Poll. Cont. Rev. Bonds (Georgia Pwr. Co. Plant Bowen Proj.) Series 2009 1st, 2.75%, tender 3/15/23 (a) | 300,000 | 312,018 | |

| Georgia Muni. Elec. Auth. Pwr. Rev. Series GG, 5% 1/1/23 | 210,000 | 224,999 | |

| TOTAL GEORGIA | 537,017 | ||

| Illinois - 12.8% | |||

| Chicago Midway Arpt. Rev. Series 2013 B, 5% 1/1/23 | 400,000 | 428,257 | |

| Chicago O'Hare Int'l. Arpt. Rev. Series 2013 C, 5% 1/1/23 (b) | 200,000 | 213,972 | |

| Chicago Transit Auth. Cap. Grant Receipts Rev. Series 2017, 5% 6/1/23 | 500,000 | 544,758 | |

| Illinois Fin. Auth. Rev.: | |||

| Series 2016 C, 5% 2/15/23 | 500,000 | 539,174 | |

| Series 2016 E, 5% 2/15/23 | 125,000 | 134,666 | |

| Series 2019, 5% 4/1/23 | 500,000 | 541,388 | |

| Illinois Gen. Oblig.: | |||

| Series 2013, 5% 7/1/23 | 295,000 | 321,808 | |

| Series 2014, 5% 2/1/23 | 250,000 | 268,326 | |

| Illinois Muni. Elec. Agcy. Pwr. Supply Series 2015 A, 5% 2/1/23 | 510,000 | 548,169 | |

| Illinois Reg'l. Trans. Auth. Series 2003 A, 5.5% 7/1/23 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | 80,000 | 87,874 | |

| Illinois Sales Tax Rev. Series 2013, 5% 6/15/23 | 815,000 | 883,909 | |

| Kendall, Kane & Will Counties Cmnty. Unit School District #308 Series 2016, 5% 2/1/23 | 500,000 | 533,632 | |

| Metropolitan Pier & Exposition: | |||

| (McCormick Place Expansion Proj.) Series 1996 A, 0% 6/15/23 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | 140,000 | 137,681 | |

| Series 2002: | |||

| 5.7% 6/15/23 | 45,000 | 49,609 | |

| 5.7% 6/15/23 (Escrowed to Maturity) | 50,000 | 55,160 | |

| Railsplitter Tobacco Settlement Auth. Rev. Series 2017, 5% 6/1/23 | 500,000 | 545,060 | |

| TOTAL ILLINOIS | 5,833,443 | ||

| Indiana - 2.8% | |||

| Indiana Hsg. & Cmnty. Dev. Auth. Series A, 5% 7/1/23 | 580,000 | 635,232 | |

| Indianapolis Local Pub. Impt.: | |||

| (Indianapolis Arpt. Auth. Proj.) Series 2016 A1, 5% 1/1/23 (b) | 500,000 | 534,073 | |

| Series 2021 A, 5% 6/1/23 | 100,000 | 108,891 | |

| TOTAL INDIANA | 1,278,196 | ||

| Kentucky - 0.6% | |||

| Kentucky Tpk. Auth. Econ. Dev. Road Rev. (Revitalization Projs.) Series B, 4% 7/1/23 | 275,000 | 294,338 | |

| Louisiana - 1.4% | |||

| St. John Baptist Parish Rev. Bonds (Marathon Oil Corp.) Series 2017, 2%, tender 4/1/23 (a) | 45,000 | 46,030 | |

| Tobacco Settlement Fing. Corp. Series 2013 A, 5% 5/15/23 | 540,000 | 589,152 | |

| TOTAL LOUISIANA | 635,182 | ||

| Maine - 0.5% | |||

| Maine Health & Higher Edl. Facilities Auth. Rev. Series 2013, 3% 7/1/23 (Escrowed to Maturity) | 200,000 | 210,662 | |

| Maryland - 1.7% | |||

| Baltimore County Gen. Oblig. Series 2021, 5% 3/1/23 | 200,000 | 216,199 | |

| Maryland Trans. Auth. Trans. Facility Projs. Rev. Series 2021 A, 5% 7/1/23 | 500,000 | 548,036 | |

| TOTAL MARYLAND | 764,235 | ||

| Massachusetts - 3.8% | |||

| Massachusetts Bay Trans. Auth. Sales Tax Rev.: | |||

| Series 2003 C, 5.25% 7/1/23 | 125,000 | 137,632 | |

| Series 2005 B, 5.5% 7/1/23 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | 50,000�� | 55,302 | |

| Massachusetts Dev. Fin. Agcy. Rev.: | |||

| Series 2016, 5% 7/1/23 | 230,000 | 251,031 | |

| Series 2019 A, 5% 7/1/23 | 200,000 | 217,742 | |

| Massachusetts Edl. Fing. Auth. Rev. Series 2018 B, 5% 7/1/23 (b) | 135,000 | 147,316 | |

| Massachusetts Gen. Oblig. Series 2, 5% 4/1/23 | 300,000 | 325,385 | |

| Massachusetts Port Auth. Rev. Series 2017 A, 5% 7/1/23 (b) | 545,000 | 595,980 | |

| TOTAL MASSACHUSETTS | 1,730,388 | ||

| Michigan - 1.8% | |||

| Detroit Swr. Disp. Rev. Series 2004 A, 5.25% 7/1/23 (FSA Insured) | 50,000 | 54,862 | |

| Flint Hosp. Bldg. Auth. Rev. Series 2020, 5% 7/1/23 | 195,000 | 209,344 | |

| Grand Traverse County Hosp. Fin. Auth. Series 2014 C, 5% 7/1/23 | 390,000 | 426,974 | |

| Saginaw Hosp. Fin. Auth. Hosp. Rev. Series 2020 J, 5% 7/1/23 | 100,000 | 109,165 | |

| TOTAL MICHIGAN | 800,345 | ||

| Minnesota - 0.6% | |||

| Anoka-Hennepin Independent School District 11 Series 2014 A, 5% 2/1/23 | 250,000 | 267,926 | |

| Nebraska - 1.1% | |||

| Nebraska Pub. Pwr. District Rev. Bonds Series 2020 A, 0.6%, tender 7/1/23 (a) | 500,000 | 503,071 | |

| Nevada - 3.3% | |||

| Clark County Poll. Cont. Rev. Bonds Series 2017, 1.65%, tender 3/31/23 (a) | 585,000 | 598,039 | |

| Clark County School District Series 2018 A, 5% 6/15/23 | 450,000 | 491,546 | |

| Nevada Lease Rev. Ctfs. Prtn. (Bldg. 1 Proj.) Series 2013, 5% 4/1/23 | 380,000 | 411,176 | |

| TOTAL NEVADA | 1,500,761 | ||

| New Jersey - 7.5% | |||

| Camden County Impt. Auth. Health Care Redev. Rev. Series 2014 A, 5% 2/15/23 | 250,000 | 268,020 | |

| Carteret School District Series 2020, 2% 2/1/23 | 300,000 | 307,400 | |

| New Jersey Econ. Dev. Auth. Rev.: | |||

| Series 2013, 5% 3/1/23 | 550,000 | 592,720 | |

| Series 2015 XX, 5% 6/15/23 | 250,000 | 273,081 | |

| New Jersey Edl. Facilities Auth. Rev. Series 2013 A, 5% 7/1/23 (Escrowed to Maturity) | 100,000 | 109,478 | |

| New Jersey Health Care Facilities Fing. Auth. Rev.: | |||

| Series 2013 A, 5% 7/1/23 | 200,000 | 219,088 | |

| Series 2013, 5% 7/1/23 | 200,000 | 218,835 | |

| Series 2016 A: | |||

| 5% 7/1/23 | 250,000 | 273,702 | |

| 5% 7/1/23 | 90,000 | 97,777 | |

| Series 2016, 5% 7/1/23 | 325,000 | 353,015 | |

| New Jersey Tobacco Settlement Fing. Corp. Series 2018 A, 5% 6/1/23 | 240,000 | 261,575 | |

| New Jersey Trans. Trust Fund Auth. Series 2004 A, 5.75% 6/15/23 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | 255,000 | 282,584 | |

| Rutgers State Univ. Rev. Series Q, 5% 5/1/23 | 150,000 | 162,652 | |

| TOTAL NEW JERSEY | 3,419,927 | ||

| New York - 7.3% | |||

| Hudson Yards Infrastructure Corp. New York Rev. Series A, 4% 2/15/23 | 250,000 | 264,537 | |

| Monroe County Gen. Oblig. Series 2019 A, 5% 6/1/23 | 250,000 | 272,782 | |

| Monroe County Indl. Dev. Corp. Univ. of Rochester, Proj.) Series 2017 A, 5% 7/1/23 | 100,000 | 109,375 | |

| Nassau County Local Econ. Assistance Corp.: | |||

| (Catholic Health Svcs. of Long Island Obligated Group Proj.) Series 2014, 5% 7/1/23 | 350,000 | 382,666 | |

| Series 2014 B, 5% 7/1/23 | 285,000 | 311,599 | |

| New York City Gen. Oblig. Series 2021 F1, 5% 3/1/23 | 100,000 | 107,942 | |

| New York Dorm. Auth. Rev. Series 2015 A, 5% 5/1/23 | 530,000 | 575,416 | |

| New York Dorm. Auth. Sales Tax Rev. Series 2018 F, 5% 3/15/23 (b) | 175,000 | 189,437 | |

| New York Metropolitan Trans. Auth. Rev. Series 2020 A, 5% 2/1/23 | 300,000 | 321,919 | |

| New York State Dorm. Auth. Series 2017 A, 5% 2/15/23 | 400,000 | 431,407 | |

| Saratoga County Cap. Resources Rev. Series A, 5% 7/1/23 | 300,000 | 328,315 | |

| TOTAL NEW YORK | 3,295,395 | ||

| New York And New Jersey - 1.2% | |||

| Port Auth. of New York & New Jersey Series 189, 5% 5/1/23 | 510,000 | 554,488 | |

| North Carolina - 0.5% | |||

| North Carolina Grant Anticipation Rev. Series 2017, 5% 3/1/23 | 100,000 | 107,820 | |

| Raleigh Durham Arpt. Auth. Arpt. Rev. Series 2017 A, 5% 5/1/23 (b) | 100,000 | 108,627 | |

| TOTAL NORTH CAROLINA | 216,447 | ||

| Ohio - 6.5% | |||

| Cleveland Arpt. Sys. Rev. Series 2016 A, 5% 1/1/23 (FSA Insured) | 500,000 | 535,322 | |

| Fairfield County Hosp. Facilities Rev. (Fairfield Med. Ctr. Proj.) Series 2013, 5% 6/15/23 | 400,000 | 427,663 | |

| Franklin County Hosp. Facilities Rev. Bonds (U.S. Health Corp. of Columbus Proj.) Series 2011 B, 5%, tender 5/15/23 (a) | 750,000 | 814,574 | |

| Hamilton County Hosp. Facilities Rev. Series 2014, 5% 2/1/23 | 100,000 | 107,335 | |

| Lancaster Port Auth. Gas Rev. Series 2019, 5% 2/1/23 | 200,000 | 214,902 | |

| Univ. of Akron Gen. Receipts Series 2019 A, 5% 1/1/23 | 300,000 | 320,818 | |

| Univ. of Toledo Gen. Receipts Series 2018 A, 5% 6/1/23 | 500,000 | 542,747 | |

| TOTAL OHIO | 2,963,361 | ||

| Oregon - 1.2% | |||

| Clackamas County Hosp. Facility Auth. (Williamette View, Inc.) Series 2017 A, 4% 5/15/23 | 250,000 | 261,192 | |

| Port of Portland Arpt. Rev. Series 22, 5% 7/1/23 (b) | 250,000 | 272,702 | |

| TOTAL OREGON | 533,894 | ||

| Pennsylvania - 4.9% | |||

| Commonwealth Fing. Auth. Rev. Series 2020 A, 5% 6/1/23 | 200,000 | 218,266 | |

| Indiana County Hosp. Auth. Series 2014 A, 5% 6/1/23 | 325,000 | 346,407 | |

| Lehigh County Gen. Purp. Hosp. Rev. Series 2019 A, 5% 7/1/23 | 100,000 | 109,565 | |

| Pennsylvania Ctfs. Prtn. Series 2018 A, 5% 7/1/23 | 250,000 | 273,280 | |

| Pennsylvania Gen. Oblig. Series 2013, 5% 4/1/23 | 325,000 | 352,261 | |

| Pennsylvania State Univ. Series 2020 A, 5% 9/1/23 | 305,000 | 336,486 | |

| Philadelphia Arpt. Rev. Series 2017 B, 5% 7/1/23 | 100,000 | 109,523 | |

| Philadelphia Wtr. & Wastewtr. Rev. Series 2014 A, 5% 7/1/23 | 100,000 | 109,544 | |

| State Pub. School Bldg. Auth. Lease Rev. (Philadelphia School District Proj.) Series 2015 A, 5% 6/1/23 | 340,000 | 367,503 | |

| TOTAL PENNSYLVANIA | 2,222,835 | ||

| Rhode Island - 0.6% | |||

| Rhode Island Health & Edl. Bldg. Corp. Higher Ed. Facilities Rev. Series 2013 A, 5% 5/15/23 | 250,000 | 272,410 | |

| South Carolina - 0.2% | |||

| South Carolina Ports Auth. Ports Rev. Series 2019 B, 5% 7/1/23 (b) | 100,000 | 108,976 | |

| South Dakota - 0.4% | |||

| South Dakota Health & Edl. Facilities Auth. Rev. (Avera Health Proj.) Series 2017, 5% 7/1/23 | 150,000 | 163,779 | |

| Tennessee - 1.6% | |||

| Memphis-Shelby County Arpt. Auth. Arpt. Rev. Series 2020 B, 5% 7/1/23 (b) | 200,000 | 218,414 | |

| Tennessee Energy Acquisition Corp. Bonds (Gas Rev. Proj.) Series A, 4%, tender 5/1/23 (a) | 500,000 | 530,828 | |

| TOTAL TENNESSEE | 749,242 | ||

| Texas - 5.9% | |||

| Dallas Independent School District Series 2021, 4% 2/15/23 | 800,000 | 849,474 | |

| Houston Independent School District Bonds Series 2012, 4%, tender 6/1/23 (a) | 300,000 | 321,134 | |

| Lower Colorado River Auth. Rev.: | |||

| Series 2013, 5% 5/15/23 | 610,000 | 664,200 | |

| Series 2015 B, 5% 5/15/23 | 250,000 | 272,213 | |

| North Texas Tollway Auth. Rev.: | |||

| Series 2014: | |||

| 5% 1/1/23 | 115,000 | 123,320 | |

| 5% 1/1/23 | 185,000 | 198,272 | |

| Series 2015 B, 5% 1/1/23 | 250,000 | 267,935 | |

| TOTAL TEXAS | 2,696,548 | ||

| Virginia - 1.8% | |||

| King George County Indl. Dev. Auth. Solid Waste Disp. Fac. Rev. (King George Landfill, Inc. Proj.) Series 2003 A, 2.5% 6/1/23 (a)(b) | 200,000 | 208,234 | |

| Salem Econ. Dev. Auth. Series 2020, 5% 4/1/23 | 250,000 | 268,866 | |

| Stafford County Econ. Dev. Auth. Hosp. Facilities Rev. Series 2016, 5% 6/15/23 | 200,000 | 217,725 | |

| York County Econ. Dev. Auth. Poll. Cont. Rev. Bonds (Virginia Elec. and Pwr. Co. Proj.) Series 2009 A, 1.9%, tender 6/1/23 (a) | 100,000 | 102,440 | |

| TOTAL VIRGINIA | 797,265 | ||

| Washington - 3.9% | |||

| Port of Seattle Rev.: | |||

| Series 2013, 5% 7/1/23 (b) | 250,000 | 273,438 | |

| Series 2015 B, 5% 3/1/23 | 250,000 | 269,986 | |

| Port of Seattle Spl. Facility Rev. Series 2013, 5% 6/1/23 (b) | 300,000 | 324,447 | |

| Washington Ctfs. of Prtn. Series 2013 B, 4% 7/1/23 | 300,000 | 322,781 | |

| Washington Gen. Oblig. Series 2003 C, 0% 6/1/23 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | 160,000 | 158,916 | |

| Washington Health Care Facilities Auth. Rev. (Overlake Hosp. Med. Ctr., WA. Proj.) Series 2017 B, 5% 7/1/23 | 380,000 | 414,347 | |

| TOTAL WASHINGTON | 1,763,915 | ||

| Wisconsin - 1.2% | |||

| Wisconsin Health & Edl. Facilities (Agnesian Healthcare Proj.) Series 2017, 5% 7/1/23 | 500,000 | 547,087 | |

| Wyoming - 0.7% | |||

| Laramie County Hosp. Rev. (Cheyenne Reg'l. Med. Ctr. Proj.) Series 2021, 4% 5/1/23 | 285,000 | 304,332 | |

| TOTAL MUNICIPAL BONDS | |||

| (Cost $43,428,104) | 44,620,211 | ||

| TOTAL INVESTMENT IN SECURITIES - 98.3% | |||

| (Cost $43,428,104) | 44,620,211 | ||

| NET OTHER ASSETS (LIABILITIES) - 1.7% | 774,082 | ||

| NET ASSETS - 100% | $45,394,293 |

Legend

(a) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

(b) Private activity obligations whose interest is subject to the federal alternative minimum tax for individuals.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Municipal Cash Central Fund | $487 |

| Total | $487 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable.

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Fund | Value, beginning of period | Purchases | Sales Proceeds | Realized Gain/Loss | Change in Unrealized appreciation (depreciation) | Value, end of period | % ownership, end of period |

| Fidelity Municipal Cash Central Fund 0.04% | $600,000 | $7,227,000 | $7,827,111 | $111 | $-- | $-- | 0.0% |

| Total | $600,000 | $7,227,000 | $7,827,111 | $111 | $-- | $-- |

Investment Valuation

The following is a summary of the inputs used, as of June 30, 2021, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: | ||||

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | ||||

| Municipal Securities | $44,620,211 | $-- | $44,620,211 | $-- |

| Total Investments in Securities: | $44,620,211 | $-- | $44,620,211 | $-- |

Other Information

The distribution of municipal securities by revenue source, as a percentage of total Net Assets, is as follows (Unaudited):

| General Obligations | 28.0% |

| Health Care | 21.1% |

| Transportation | 16.5% |

| Special Tax | 8.8% |

| Electric Utilities | 7.9% |

| Education | 7.0% |

| Others* (Individually Less Than 5%) | 10.7% |

| 100.0% |

* Includes net other assets

See accompanying notes which are an integral part of the financial statements.

Fidelity® Municipal Income 2023 Fund

Financial Statements

Statement of Assets and Liabilities

| June 30, 2021 | ||

| Assets | ||

| Investment in securities, at value — See accompanying schedule: Unaffiliated issuers (cost $43,428,104) | $44,620,211 | |

| Cash | 187,959 | |

| Receivable for fund shares sold | 75 | |

| Interest receivable | 619,876 | |

| Other receivables | 152 | |

| Total assets | 45,428,273 | |

| Liabilities | ||

| Payable for fund shares redeemed | $5,131 | |

| Distributions payable | 13,000 | |

| Accrued management fee | 11,398 | |

| Transfer agent fee payable | 3,800 | |

| Distribution and service plan fees payable | 651 | |

| Total liabilities | 33,980 | |

| Net Assets | $45,394,293 | |

| Net Assets consist of: | ||

| Paid in capital | $44,245,088 | |

| Total accumulated earnings (loss) | 1,149,205 | |

| Net Assets | $45,394,293 | |

| Net Asset Value and Maximum Offering Price | ||

| Class A: | ||

| Net Asset Value and redemption price per share ($3,126,407 ÷ 299,465 shares)(a) | $10.44 | |

| Maximum offering price per share (100/97.25 of $10.44) | $10.74 | |

| Municipal Income 2023: | ||

| Net Asset Value, offering price and redemption price per share ($32,626,875 ÷ 3,125,359 shares) | $10.44 | |

| Class I: | ||

| Net Asset Value, offering price and redemption price per share ($9,641,011 ÷ 923,486 shares) | $10.44 |

(a) Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Year ended June 30, 2021 | ||

| Investment Income | ||

| Interest | $833,878 | |

| Income from Fidelity Central Funds | 487 | |

| Total income | 834,365 | |

| Expenses | ||

| Management fee | $122,610 | |

| Transfer agent fees | 40,871 | |

| Distribution and service plan fees | 7,239 | |

| Independent trustees' fees and expenses | 114 | |

| Miscellaneous | 41 | |

| Total expenses before reductions | 170,875 | |

| Expense reductions | (364) | |

| Total expenses after reductions | 170,511 | |

| Net investment income (loss) | 663,854 | |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | 52,190 | |

| Fidelity Central Funds | 111 | |

| Total net realized gain (loss) | 52,301 | |

| Change in net unrealized appreciation (depreciation) on investment securities | 58,904 | |

| Net gain (loss) | 111,205 | |

| Net increase (decrease) in net assets resulting from operations | $775,059 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Year ended June 30, 2021 | Year ended June 30, 2020 | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $663,854 | $734,861 |

| Net realized gain (loss) | 52,301 | 61,900 |

| Change in net unrealized appreciation (depreciation) | 58,904 | 42,967 |

| Net increase (decrease) in net assets resulting from operations | 775,059 | 839,728 |

| Distributions to shareholders | (662,941) | (733,954) |

| Share transactions - net increase (decrease) | 7,832,661 | 2,250,190 |

| Total increase (decrease) in net assets | 7,944,779 | 2,355,964 |

| Net Assets | ||

| Beginning of period | 37,449,514 | 35,093,550 |

| End of period | $45,394,293 | $37,449,514 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Fidelity Municipal Income 2023 Fund Class A

| Years ended June 30, | 2021 | 2020 | 2019 | 2018 | 2017 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $10.40 | $10.34 | $10.08 | $10.25 | $10.54 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | .146 | .183 | .189 | .175 | .183 |

| Net realized and unrealized gain (loss) | .041 | .060 | .259 | (.171) | (.272) |

| Total from investment operations | .187 | .243 | .448 | .004 | (.089) |

| Distributions from net investment income | (.147) | (.183) | (.188) | (.174) | (.184) |

| Distributions from net realized gain | – | – | – | – | (.017) |

| Total distributions | (.147) | (.183) | (.188) | (.174) | (.201) |

| Redemption fees added to paid in capitalA | – | – | – | – | –B |

| Net asset value, end of period | $10.44 | $10.40 | $10.34 | $10.08 | $10.25 |

| Total ReturnC,D | 1.81% | 2.37% | 4.50% | .04% | (.83)% |

| Ratios to Average Net AssetsE,F | |||||

| Expenses before reductions | .65% | .65% | .65% | .65% | .65% |

| Expenses net of fee waivers, if any | .65% | .65% | .65% | .65% | .65% |

| Expenses net of all reductions | .65% | .65% | .65% | .65% | .65% |

| Net investment income (loss) | 1.39% | 1.77% | 1.86% | 1.71% | 1.78% |

| Supplemental Data | |||||

| Net assets, end of period (000 omitted) | $3,126 | $2,675 | $2,487 | $2,390 | $3,352 |

| Portfolio turnover rateG | 9% | 10% | 18% | 12% | 8% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.0005 per share.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Total returns do not include the effect of the sales charges.

E Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

G Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Municipal Income 2023 Fund

| Years ended June 30, | 2021 | 2020 | 2019 | 2018 | 2017 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $10.40 | $10.34 | $10.08 | $10.24 | $10.54 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | .171 | .209 | .214 | .199 | .209 |

| Net realized and unrealized gain (loss) | .042 | .060 | .260 | (.159) | (.283) |

| Total from investment operations | .213 | .269 | .474 | .040 | (.074) |

| Distributions from net investment income | (.173) | (.209) | (.214) | (.200) | (.209) |

| Distributions from net realized gain | – | – | – | – | (.017) |

| Total distributions | (.173) | (.209) | (.214) | (.200) | (.226) |

| Redemption fees added to paid in capitalA | – | – | – | – | –B |

| Net asset value, end of period | $10.44 | $10.40 | $10.34 | $10.08 | $10.24 |

| Total ReturnC | 2.06% | 2.63% | 4.76% | .39% | (.68)% |

| Ratios to Average Net AssetsD,E | |||||

| Expenses before reductions | .40% | .40% | .40% | .40% | .40% |

| Expenses net of fee waivers, if any | .40% | .40% | .40% | .40% | .40% |

| Expenses net of all reductions | .40% | .40% | .40% | .40% | .40% |

| Net investment income (loss) | 1.64% | 2.02% | 2.11% | 1.96% | 2.03% |

| Supplemental Data | |||||

| Net assets, end of period (000 omitted) | $32,627 | $25,058 | $23,223 | $18,883 | $14,238 |

| Portfolio turnover rateF | 9% | 10% | 18% | 12% | 8% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.0005 per share.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

F Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Municipal Income 2023 Fund Class I

| Years ended June 30, | 2021 | 2020 | 2019 | 2018 | 2017 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $10.40 | $10.34 | $10.08 | $10.24 | $10.54 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | .172 | .209 | .213 | .199 | .209 |

| Net realized and unrealized gain (loss) | .041 | .060 | .261 | (.159) | (.283) |

| Total from investment operations | .213 | .269 | .474 | .040 | (.074) |

| Distributions from net investment income | (.173) | (.209) | (.214) | (.200) | (.209) |

| Distributions from net realized gain | – | – | – | – | (.017) |

| Total distributions | (.173) | (.209) | (.214) | (.200) | (.226) |

| Redemption fees added to paid in capitalA | – | – | – | – | –B |

| Net asset value, end of period | $10.44 | $10.40 | $10.34 | $10.08 | $10.24 |

| Total ReturnC | 2.06% | 2.63% | 4.76% | .39% | (.68)% |

| Ratios to Average Net AssetsD,E | |||||

| Expenses before reductions | .40% | .40% | .40% | .40% | .40% |

| Expenses net of fee waivers, if any | .40% | .40% | .40% | .40% | .40% |

| Expenses net of all reductions | .40% | .40% | .40% | .40% | .40% |

| Net investment income (loss) | 1.64% | 2.02% | 2.11% | 1.96% | 2.03% |

| Supplemental Data | |||||

| Net assets, end of period (000 omitted) | $9,641 | $9,716 | $9,384 | $13,944 | $11,649 |

| Portfolio turnover rateF | 9% | 10% | 18% | 12% | 8% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.0005 per share.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

F Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity® Municipal Income 2025 Fund

Investment Summary (Unaudited)

Top Five States as of June 30, 2021

| % of fund's net assets | |

| Pennsylvania | 11.2 |

| Connecticut | 10.5 |

| Massachusetts | 9.8 |

| Illinois | 9.7 |

| Florida | 7.2 |

Top Five Sectors as of June 30, 2021

| % of fund's net assets | |

| Health Care | 27.9 |

| Education | 21.6 |

| Transportation | 21.6 |

| General Obligations | 11.0 |

| Housing | 5.4 |

Quality Diversification (% of fund's net assets)

| As of June 30, 2021 | ||

| AAA | 8.3% | |

| AA,A | 63.8% | |

| BBB | 19.8% | |

| BB and Below | 4.5% | |

| Not Rated | 0.9% | |

| Short-Term Investments and Net Other Assets | 2.7% | |

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

Fidelity® Municipal Income 2025 Fund

Schedule of Investments June 30, 2021

Showing Percentage of Net Assets

| Municipal Bonds - 97.4% | |||

| Principal Amount | Value | ||

| Alabama - 0.4% | |||

| Montgomery Med. Clinic Facilities Series 2015, 5% 3/1/25 | 100,000 | 112,979 | |

| Arizona - 2.6% | |||

| Glendale Trans. Excise Tax Rev. Series 2015, 5% 7/1/25 (FSA Insured) | 75,000 | 88,420 | |

| Phoenix Civic Impt. Board Arpt. Rev.: | |||

| Series 2017 A, 5% 7/1/25 (a) | $250,000 | $293,647 | |

| Series 2017 B, 5% 7/1/25 | 250,000 | 295,169 | |

| TOTAL ARIZONA | 677,236 | ||

| California - 2.2% | |||

| Poway Unified School District Series 2009, 0% 8/1/25 | 90,000 | 87,204 | |

| San Diego County Reg'l. Arpt. Auth. Arpt. Rev. (Sub Lien Proj.) Series 2017 B, 5% 7/1/25 (a) | 150,000 | 175,993 | |

| Washington Township Health Care District Rev. Series 2017 B, 5% 7/1/25 | 270,000 | 310,890 | |

| TOTAL CALIFORNIA | 574,087 | ||

| Colorado - 0.7% | |||

| E-470 Pub. Hwy. Auth. Rev. Series 1997 B, 0% 9/1/25 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | 200,000 | 192,864 | |

| Connecticut - 10.5% | |||

| Connecticut Gen. Oblig.: | |||

| Series 2015 B, 5% 6/15/25 | 175,000 | 206,307 | |

| Series 2016 D, 5% 8/15/25 | 330,000 | 391,219 | |

| Connecticut Health & Edl. Facilities Auth. Rev.: | |||

| (Quinnipiac Univ., Ct. Proj.) Series M, 5% 7/1/25 | 40,000 | 46,776 | |

| (Sacred Heart Univ., CT. Proj.) Series 2017 I-1, 5% 7/1/25 | 400,000 | 466,725 | |

| Series K1, 5% 7/1/25 | 280,000 | 318,286 | |

| Series K3, 5% 7/1/25 | 200,000 | 227,347 | |

| Series N, 5% 7/1/25 | 50,000 | 57,763 | |

| Connecticut Hsg. Fin. Auth. Series C, 5% 5/15/25 (a) | 935,000 | 1,076,182 | |

| TOTAL CONNECTICUT | 2,790,605 | ||

| District Of Columbia - 1.4% | |||

| District of Columbia Rev. Series 2018, 5% 10/1/25 | 75,000 | 87,839 | |

| Washington D.C. Metropolitan Transit Auth. Rev. Series 2017 B, 5% 7/1/25 | 250,000 | 294,733 | |

| TOTAL DISTRICT OF COLUMBIA | 382,572 | ||

| Florida - 7.2% | |||

| Broward County Arpt. Sys. Rev. Series 2017, 5% 10/1/25 (a) | 500,000 | 591,101 | |

| Greater Orlando Aviation Auth. Arpt. Facilities Rev. Series 2017 A, 5% 10/1/25 (a) | 300,000 | 354,661 | |

| Lakeland Hosp. Sys. Rev. Series 2016, 5% 11/15/25 | 430,000 | 509,056 | |

| Palm Beach County School Board Ctfs. of Prtn. Series 2018 A, 5% 8/1/25 | 50,000 | 59,043 | |

| Seminole County School Board Ctfs. of Prtn. Series 2016 C, 5% 7/1/25 | 40,000 | 46,966 | |

| South Miami Health Facilities Auth. Hosp. Rev. (Baptist Med. Ctr., FL. Proj.) Series 2017, 5% 8/15/25 | 200,000 | 235,845 | |

| Tampa Hosp. Rev. (H. Lee Moffitt Cancer Ctr. Proj.) Series 2016 B, 5% 7/1/25 | 100,000 | 117,459 | |

| TOTAL FLORIDA | 1,914,131 | ||

| Georgia - 0.2% | |||

| Atlanta Arpt. Rev. Series 2019 B, 5% 7/1/25 (a) | 50,000 | 58,729 | |

| Hawaii - 1.1% | |||

| Honolulu City and County Wastewtr. Sys. Series 2016 B, 5% 7/1/25 | 250,000 | 295,278 | |

| Illinois - 9.7% | |||

| Chicago O'Hare Int'l. Arpt. Rev. Series 2017 D, 5% 1/1/25 (a) | 100,000 | 115,067 | |

| Chicago Transit Auth. Cap. Grant Receipts Rev. Series 2017, 5% 6/1/25 | 250,000 | 293,062 | |

| Illinois Fin. Auth. Rev.: | |||

| (Edward-Elmhurst Healthcare) Series 2017 A, 5% 1/1/25 | 145,000 | 167,611 | |

| (Northwestern Memorial Hosp.,IL. Proj.) Series 2017 A, 5% 7/15/25 | 200,000 | 236,267 | |

| Series 2016, 5% 5/15/25 | 250,000 | 292,631 | |

| Series 2019, 5% 9/1/25 | 200,000 | 235,681 | |

| Illinois Gen. Oblig.: | |||

| Series 2013, 5.5% 7/1/25 | 200,000 | 219,917 | |

| Series 2017 D, 5% 11/1/25 | 25,000 | 29,445 | |

| Illinois Sales Tax Rev. Series 2016 D, 5% 6/15/25 | 100,000 | 116,319 | |

| Kendall, Kane & Will Counties Cmnty. Unit School District #308 Series 2008, 0% 2/1/25 (FSA Insured) | 185,000 | 178,850 | |

| Metropolitan Pier & Exposition Series 1994 A, 0% 6/15/25 | 270,000 | 257,017 | |

| Railsplitter Tobacco Settlement Auth. Rev. Series 2017, 5% 6/1/25 | 365,000 | 427,871 | |

| TOTAL ILLINOIS | 2,569,738 | ||

| Indiana - 1.7% | |||

| Indiana Fin. Auth. Health Sys. Rev. Bonds Series 2019 B, 2.25%, tender 7/1/25 (b) | 55,000 | 58,358 | |

| Indiana Fin. Auth. Rev. (Cmnty. Foundation of Northwest Indiana Obligated Group) Series 2016, 5% 9/1/25 | 25,000 | 29,455 | |

| Indiana Hsg. & Cmnty. Dev. Auth. Series A, 5% 7/1/25 | 300,000 | 352,767 | |

| TOTAL INDIANA | 440,580 | ||

| Kentucky - 1.8% | |||

| Kentucky State Property & Buildings Commission Rev.: | |||

| (Kentucky St) Series 2016, 5% 10/1/25 | 100,000 | 118,313 | |

| (Proj. No. 118) Series 2018, 5% 4/1/25 | 300,000 | 347,672 | |

| TOTAL KENTUCKY | 465,985 | ||

| Louisiana - 0.4% | |||

| New Orleans Aviation Board Rev. (North Term. Proj.) Series 2017 B, 5% 1/1/25 (a) | 100,000 | 115,030 | |

| Maine - 3.5% | |||

| Maine Health & Higher Edl. Facilities Auth. Rev.: | |||

| Series 2013, 5% 7/1/25 (Pre-Refunded to 7/1/23 @ 100) | 265,000 | 289,838 | |

| Series 2017 A, 4% 7/1/25 | 465,000 | 523,901 | |

| Series 2017 B, 4% 7/1/25 | 100,000 | 112,667 | |

| TOTAL MAINE | 926,406 | ||

| Maryland - 0.7% | |||

| Maryland Health & Higher Edl. Facilities Auth. Rev. (Lifebridge Health Proj.) Series 2017, 5% 7/1/25 | 150,000 | 175,863 | |

| Massachusetts - 9.8% | |||

| Massachusetts Commonwealth Trans. Fund Rev. (Rail Enhancement Prog.) Series 2021 B, 5% 6/1/25 | 375,000 | 442,150 | |

| Massachusetts Dev. Fin. Agcy. Rev.: | |||

| (Fisher College) Series 2017, 5% 4/1/25 | 250,000 | 289,324 | |

| Bonds Series 2017 A2, 5%, tender 1/30/25 (b) | 10,000 | 11,618 | |

| Caregroup, Inc. Series 2015 H-1, 5% 7/1/25 | 150,000 | 176,579 | |

| Series 2019 K, 5% 7/1/25 | 50,000 | 58,860 | |

| Series 2019, 5% 7/1/25 | 170,000 | 199,238 | |

| Series 2020 A, 5% 10/15/25 | 650,000 | 777,282 | |

| Massachusetts Edl. Fing. Auth. Rev. Series 2017 A, 5% 7/1/25 (a) | 250,000 | 292,026 | |

| Massachusetts Port Auth. Rev. Series 2019 C, 5% 7/1/25 (a) | 300,000 | 352,506 | |

| TOTAL MASSACHUSETTS | 2,599,583 | ||

| Michigan - 3.5% | |||

| Flint Hosp. Bldg. Auth. Rev. Series 2020, 5% 7/1/25 | 300,000 | 340,895 | |

| Grand Traverse County Hosp. Fin. Auth. Series 2019 A, 5% 7/1/25 | 150,000 | 176,644 | |

| Saginaw Hosp. Fin. Auth. Hosp. Rev. Series 2020 J, 5% 7/1/25 | 100,000 | 116,897 | |

| Warren Consolidated School District Series 2017, 4% 5/1/25 (FSA Insured) | 250,000 | 280,865 | |

| TOTAL MICHIGAN | 915,301 | ||

| Missouri - 4.0% | |||

| Saint Louis Arpt. Rev.: | |||

| Series 2017 A, 5% 7/1/25 (FSA Insured) | 370,000 | 436,367 | |

| Series 2017 B, 5% 7/1/25 (FSA Insured) (a) | 250,000 | 293,106 | |

| Series 2019 C, 5% 7/1/25 | 290,000 | 341,512 | |

| TOTAL MISSOURI | 1,070,985 | ||

| Nevada - 0.3% | |||

| Clark County School District Series 2017 A, 5% 6/15/25 | 60,000 | 70,476 | |

| New Hampshire - 1.4% | |||