UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02628

Fidelity Municipal Trust

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | December 31 |

| |

Date of reporting period: | June 30, 2006 |

Item 1. Reports to Stockholders

| | Fidelity®

Michigan Municipal Income

Fund

and

Fidelity

Michigan Municipal Money

Market Fund

|

| | Semiannual Report

June 30, 2006

|

| Contents | | | | |

| |

| |

| Chairman’s Message | | 3 | | Ned Johnson’s message to shareholders |

| Shareholder Expense | | 4 | | An example of shareholder expenses. |

| Example | | | | |

| Fidelity Michigan Municipal Income Fund |

| Investment Changes | | 6 | | A summary of major shifts in the fund’s |

| | | | | investments over the past six months. |

| Investments | | 7 | | A complete list of the fund’s investments with |

| | | | | their market values. |

| Financial Statements | | 18 | | Statements of assets and liabilities, operations, |

| | | | | and changes in net assets, |

| | | | | as well as financial highlights. |

| Fidelity Michigan Municipal Money Market Fund |

| Investment Changes | | 22 | | A summary of major shifts in the fund’s investments |

| | | | | over the past six months and one year. |

| Investments | | 23 | | A complete list of the fund’s investments. |

| Financial Statements | | 32 | | Statements of assets and liabilities, operations, |

| | | | | and changes in net assets, |

| | | | | as well as financial highlights. |

| Notes | | 36 | | Notes to the Financial Statements |

| Proxy Voting Results | | 42 | | |

| Board Approval of | | 44 | | |

| Investment Advisory | | | | |

| Contracts and | | | | |

| Management Fees | | | | |

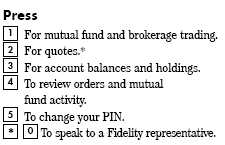

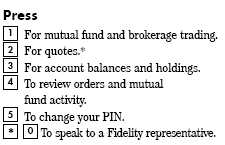

| | To view a fund’s proxy voting guidelines and proxy voting record for the 12 month period ended

June 30, visit www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commis

sion’s (SEC) web site at www.sec.gov. You may also call 1-800-544-8544 to request a free copy of

the proxy voting guidelines.

Standard & Poor’s, S&P and S&P 500 are registered service marks of The McGraw Hill Companies, Inc.

and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR

Corp. or an affiliated company.

|

| | This report and the financial statements contained herein are submitted for the general

information of the shareholders of the funds. This report is not authorized for distribution to

prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third

quarters of each fiscal year on Form N Q. Forms N Q are available on the SEC’s web site at

http://www.sec.gov. A fund’s Forms N Q may be reviewed and copied at the SEC’s Public Reference

Room in Washington, DC. Information regarding the operation of the SEC’s Public Reference

Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund’s portfolio

holdings, view the most recent quarterly holdings report, semiannual report, or annual report

on Fidelity’s web site at http://www.fidelity.com/holdings.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

|

Semiannual Report 2

Chairman’s Message

(photograph of Edward C. Johnson 3d)

Dear Shareholder:

Although many securities markets made gains in early 2006, inflation concerns led to mixed results through the year’s mid point. Financial markets are always unpredictable. There are, however, a number of time tested principles that can put the historical odds in your favor.

One of the basic tenets is to invest for the long term. Over time, riding out the markets’ inevitable ups and downs has proven much more effective than selling into panic or chasing the hottest trend. Even missing only a few of the markets’ best days can significantly diminish investor returns. Patience also affords the benefits of compounding of earning interest on additional income or reinvested dividends and capital gains. There are tax advantages and cost benefits to consider as well. The more you sell, the more taxes you pay, and the more you trade, the higher the costs. While staying the course doesn’t eliminate risk, it can considerably lessen the effect of short term declines.

You can further manage your investing risk through diversification. And today, more than ever, geographic diversification should be taken into account. Studies indicate that asset allocation is the single most important determinant of a portfolio’s long term success. The right mix of stocks, bonds and cash aligned to your particular risk tolerance and investment objective is very important. Age appropriate rebalancing is also an essential aspect of asset allocation. For younger investors, an emphasis on equities which historically have been the best performing asset class over time is encouraged. As investors near their specific goal, such as retirement or sending a child to college, consideration may be given to replacing volatile assets (e.g. common stocks) with more stable fixed investments (bonds or savings plans).

A third investment principle investing regularly can help lower the average cost of your purchases. Investing a certain amount of money each month or quarter helps ensure you won’t pay for all your shares at market highs. This strategy known as dollar cost averaging also reduces unconstructive “emotion” from investing, helping shareholders avoid selling weak performers just prior to an upswing, or chasing a hot performer just before a correction.

We invite you to contact us via the Internet, through our Investor Centers or over the phone. It is our privilege to provide you the information you need to make the investments that are right for you.

Sincerely,

/s/ Edward C. Johnson 3d

Edward C. Johnson 3d

3 Semiannual Report

Shareholder Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, and (2) on going costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2006 to June 30, 2006).

The first line of the accompanying table for each fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each fund provides information about hypothetical account values and hypothetical expenses based on a fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | | Expenses Paid |

| | | | | Beginning | | | | Ending | | | | During Period* |

| | | | | Account Value | | | | Account Value | | | | January 1, 2006 |

| | | | | January 1, 2006 | | | | June 30, 2006 | | | | to June 30, 2006 |

| Fidelity Michigan Municipal | | | | | | | | | | | | |

| Income Fund | | | | | | | | | | | | |

| Actual | | | | $ 1,000.00 | | | | $ 999.90 | | | | $ 2.48 |

| HypotheticalA | | | | $ 1,000.00 | | | | $ 1,022.32 | | | | $ 2.51 |

| Fidelity Michigan Municipal | | | | | | | | | | | | |

| Money Market Fund | | | | | | | | | | | | |

| Actual | | | | $ 1,000.00 | | | | $ 1,014.10 | | | | $ 2.75 |

| HypotheticalA | | | | $ 1,000.00 | | | | $ 1,022.07 | | | | $ 2.76 |

| |

| A 5% return per year before expenses | | | | | | | | |

* Expenses are equal to each Fund’s annualized expense ratio (shown in the table below); multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one half year period).

| | | Annualized |

| | | Expense Ratio |

| Fidelity Michigan Municipal Income Fund | | 50% |

| Fidelity Michigan Municipal Money Market Fund | | 55% |

5 Semiannual Report

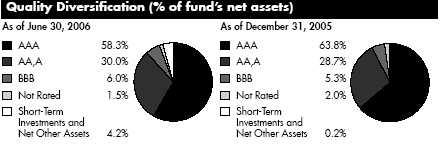

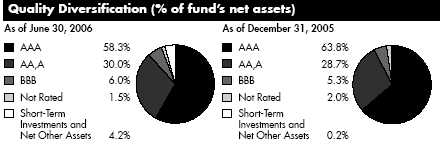

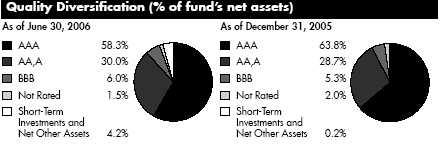

| Fidelity Michigan Municipal Income Fund | | | | |

| Investment Changes | | | | |

| |

| |

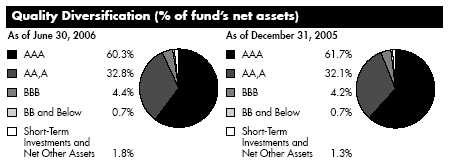

| Top Five Sectors as of June 30, 2006 | | | | |

| | | % of fund’s | | % of fund’s net assets |

| | | net assets | | 6 months ago |

| General Obligations | | 41.2 | | 45.5 |

| Escrowed/Pre Refunded | | 25.5 | | 19.2 |

| Water & Sewer | | 13.9 | | 12.8 |

| Health Care | | 6.3 | | 7.3 |

| Special Tax | | 5.0 | | 5.5 |

Average Years to Maturity as of June 30, 2006 | | |

| | | | | 6 months ago |

| Years | | 10.2 | | 11.1 |

Average years to maturity is based on the average time remaining to the stated maturity date of each bond, weighted by the market value of each bond.

| Duration as of June 30, 2006 | | | | |

| | | | | | | 6 months ago |

| Years | | | | 6.0 | | 6.1 |

Duration shows how much a bond fund’s price fluctuates with changes in comparable interest rates. If rates rise 1%, for example, a fund with a five year duration is likely to lose about 5% of its value. Other factors also can influence a bond fund’s performance and share price. Accordingly, a bond fund’s actual performance may differ from this example.

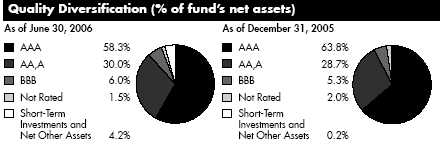

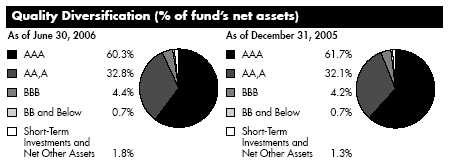

We have used ratings from Moody’s® Investors Services, Inc. Where Moody’s ratings are not available, we have used S&P® ratings.

Semiannual Report 6

| Fidelity Michigan Municipal Income Fund | | | | |

| Investments June 30, 2006 (Unaudited) |

| Showing Percentage of Net Assets | | | | |

| |

| Municipal Bonds 99.8% | | | | |

| | | Principal | | Value |

| | | Amount | | (Note 1) |

| Guam 0.1% | | | | |

| Guam Wtrwks. Auth. Wtr. and Wastewtr. Sys. Rev. | | | | |

| 5.875% 7/1/35 | | $ 615,000 | | $ 640,713 |

| Michigan – 98.8% | | | | |

| Anchor Bay School District 2000 School Bldg. & Site | | | | |

| Series III, 5.25% 5/1/31 (Pre-Refunded to 5/1/12 @ | | | | |

| 100) (d) | | 9,300,000 | | 9,907,662 |

| Ann Arbor Bldg. Auth. Series 2005 A: | | | | |

| 5% 3/1/17 (MBIA Insured) | | 1,405,000 | | 1,459,907 |

| 5% 3/1/18 (MBIA Insured) | | 1,440,000 | | 1,496,275 |

| Ann Arbor Econ. Dev. Corp. Ltd. Oblig. Rev. (Glacier | | | | |

| Hills, Inc. Proj.) 8.375% 1/15/19 (Escrowed to | | | | |

| Maturity) (d) | | 2,916,000 | | 3,608,492 |

| Bay City Gen. Oblig. 0% 6/1/15 (AMBAC Insured) | | 1,725,000 | | 1,156,682 |

| Birmingham County School District Series II, 5.25% | | | | |

| 11/1/19 (Pre-Refunded to 11/1/10 @ 100) (d) | | 1,200,000 | | 1,263,276 |

| Brighton Area School District Livingston County Series II, | | | | |

| 0% 5/1/15 (AMBAC Insured) | | 10,000,000 | | 6,730,600 |

| Byron Ctr. Pub. Schools 5.5% 5/1/16 | | 1,055,000 | | 1,113,531 |

| Caledonia Cmnty. Schools Counties of Kent, Allegan and | | | | |

| Barry: | | | | |

| 5.25% 5/1/17 | | 1,370,000 | | 1,449,460 |

| 5.25% 5/1/18 | | 1,100,000 | | 1,161,798 |

| Carman-Ainsworth Cmnty. School District: | | | | |

| 5% 5/1/14 (FSA Insured) | | 1,765,000 | | 1,861,793 |

| 5% 5/1/16 (FSA Insured) | | 1,000,000 | | 1,047,130 |

| 5% 5/1/17 (FSA Insured) | | 2,065,000 | | 2,154,642 |

| 5.5% 5/1/14 (Pre-Refunded to 5/1/12 @ 100) (d) | | 1,755,000 | | 1,892,259 |

| 5.5% 5/1/15 (Pre-Refunded to 5/1/12 @ 100) (d) | | 1,850,000 | | 1,994,689 |

| 5.5% 5/1/17 (Pre-Refunded to 5/1/12 @ 100) (d) | | 2,060,000 | | 2,221,113 |

| Carrier Creek Drainage District #326 5% 6/1/16 | | | | |

| (AMBAC Insured) | | 1,620,000 | | 1,696,982 |

| Charles Stewart Mott Cmnty. College 5% 5/1/17 (MBIA | | | | |

| Insured) | | 1,675,000 | | 1,747,712 |

| Chippewa Valley Schools: | | | | |

| Series I, 5.375% 5/1/17 (Pre-Refunded to 5/1/11 @ | | | | |

| 100) (d) | | 1,000,000 | | 1,061,920 |

| 5.5% 5/1/17 (Pre-Refunded to 5/1/12 @ 100) (d) | | 1,125,000 | | 1,212,986 |

| Clarkston Cmnty. Schools: | | | | |

| 5.25% 5/1/29 (Pre-Refunded to 5/1/13 @ 100) (d) . | | 5,000,000 | | 5,351,050 |

| 5.375% 5/1/21 (Pre-Refunded to 5/1/13 @ 100) (d) | | 1,950,000 | | 2,101,301 |

| 5.375% 5/1/22 (Pre-Refunded to 5/1/13 @ 100) (d) | | 1,150,000 | | 1,239,229 |

| Comstock Park Pub. Schools 5% 5/1/16 (FSA Insured) . | | 1,000,000 | | 1,046,380 |

See accompanying notes which are an integral part of the financial statements.

7 Semiannual Report

| Fidelity Michigan Municipal Income Fund | | | | | | | | |

| Investments (Unaudited) continued | | | | | | | | |

| |

| Municipal Bonds continued | | | | | | | | | | |

| | | | | | | Principal | | | | Value |

| | | | | | | Amount | | | | (Note 1) |

| Michigan – continued | | | | | | | | | | |

| Constantine Pub. Schools: | | | | | | | | | | |

| 5% 5/1/25 | | | | | | $ 1,130,000 | | | | $ 1,159,459 |

| 5% 5/1/25 (Pre-Refunded to 11/1/12 @ 100) (d) | | | | | | 1,120,000 | | | | 1,181,298 |

| 5.5% 5/1/18 (Pre-Refunded to 11/1/12 @ 100) (d) | | | | | | 1,220,000 | | | | 1,320,516 |

| 5.5% 5/1/19 (Pre-Refunded to 11/1/12 @ 100) (d) | | | | | | 1,245,000 | | | | 1,347,576 |

| 5.5% 5/1/20 (Pre-Refunded to 11/1/12 @ 100) (d) | | | | | | 1,245,000 | | | | 1,347,576 |

| 5.5% 5/1/21 (Pre-Refunded to 11/1/12 @ 100) (d) | | | | | | 1,250,000 | | | | 1,352,988 |

| Crawford AuSable School District (School Bldg. & Site | | | | | | | | | | |

| Proj.) Series 2001, 5.625% 5/1/18 (Pre-Refunded to | | | | | | | | | | |

| 5/1/11 @ 100) (d) | | | | | | 1,100,000 | | | | 1,177,583 |

| Detroit City School District: | | | | | | | | | | |

| Series 2005 A, 5.25% 5/1/30 (FSA Insured) | | | | | | 5,000,000 | | | | 5,383,750 |

| Series A: | | | | | | | | | | |

| 5.5% 5/1/11 (FSA Insured) | | | | | | 2,000,000 | | | | 2,133,800 |

| 5.5% 5/1/16 (Pre-Refunded to 5/1/12 @ 100) (d) | | | | | | 1,500,000 | | | | 1,613,280 |

| 5.5% 5/1/18 (Pre-Refunded to 5/1/12 @ 100) (d) | | | | | | 1,000,000 | | | | 1,075,520 |

| 5.5% 5/1/18 (Pre-Refunded to 5/1/13 @ 100) (d) | | | | | | 2,000,000 | | | | 2,169,940 |

| 5.5% 5/1/20 (Pre-Refunded to 5/1/12 @ 100) (d) | | | | | | 3,050,000 | | | | 3,280,336 |

| Series B, 5.25% 5/1/15 (FGIC Insured) | | | | | | 3,085,000 | | | | 3,267,663 |

| Detroit Convention Facilities Rev. (Cobo Hall Expansion | | | | | | | | | | |

| Proj.): | | | | | | | | | | |

| 5% 9/30/11 (MBIA Insured) | | | | | | 3,000,000 | | | | 3,145,980 |

| 5% 9/30/12 (MBIA Insured) | | | | | | 4,765,000 | | | | 5,019,928 |

| Detroit Gen. Oblig.: | | | | | | | | | | |

| (Distributable State Aid Proj.) 5.25% 5/1/09 (AMBAC | | | | | | | | |

| Insured) | | | | | | 4,525,000 | | | | 4,677,809 |

| Series 2003 A, 5% 4/1/11 (XL Cap. Assurance, Inc. | | | | | | | | | | |

| Insured) | | | | | | 1,430,000 | | | | 1,481,065 |

| Series 2005 B, 5% 4/1/13 (FSA Insured) | | | | | | 1,830,000 | | | | 1,910,630 |

| Series 2005 C, 5% 4/1/13 (FSA Insured) | | | | | | 1,985,000 | | | | 2,072,459 |

| Series B1, 5% 4/1/13 (AMBAC Insured) | | | | | | 2,000,000 | | | | 2,088,120 |

| 5.5% 4/1/17 (Pre-Refunded to 4/1/11 @ 100) (d) | | | | | | 2,615,000 | | | | 2,788,348 |

| 5.5% 4/1/19 (Pre-Refunded to 4/1/11 @ 100) (d) | | | | | | 1,500,000 | | | | 1,599,435 |

| 5.5% 4/1/20 (Pre-Refunded to 4/1/11 @ 100) (d) | | | | | | 1,250,000 | | | | 1,332,863 |

| Detroit Swr. Disp. Rev.: | | | | | | | | | | |

| Series 2001 D1, 5.5%, tender 7/1/08 (MBIA | | | | | | | | | | |

| Insured) (b) | | | | | | 10,000,000 | | | | 10,279,700 |

| Series A: | | | | | | | | | | |

| 0% 7/1/14 (FGIC Insured) | | | | | | 6,730,000 | | | | 4,720,759 |

| 5.125% 7/1/31 (FGIC Insured) | | | | | | 8,020,000 | | | | 8,202,054 |

| Detroit Wtr. Supply Sys. Rev.: | | | | | | | | | | |

| Series 2001 A, 5.25% 7/1/33 (FGIC Insured) | | | | | | 6,390,000 | | | | 6,604,768 |

See accompanying notes which are an integral part of the financial statements.

| Municipal Bonds continued | | | | | | | | | | |

| | | | | | | Principal | | | | Value |

| | | | | | | Amount | | | | (Note 1) |

| Michigan – continued | | | | | | | | | | |

| Detroit Wtr. Supply Sys. Rev.: – continued | | | | | | | | | | |

| Series A: | | | | | | | | | | |

| 5.5% 7/1/15 (Pre-Refunded to 1/1/10 @ 101) (d) | | | | | | $ 3,675,000 | | | | $ 3,889,620 |

| 5.75% 7/1/11 (MBIA Insured) | | | | | | 3,050,000 | | | | 3,294,824 |

| Series B: | | | | | | | | | | |

| 5.25% 7/1/17 (MBIA Insured) | | | | | | 2,760,000 | | | | 2,909,951 |

| 5.5% 7/1/33 (FGIC Insured) | | | | | | 10,000,000 | | | | 10,637,400 |

| 6.5% 7/1/15 (FGIC Insured) | | | | | | 6,025,000 | | | | 6,989,723 |

| Dexter Cmnty. Schools 5% 5/1/18 (Liquidity Facility | | | | | | | | | | |

| Sumitomo Bank Lease Fin., Inc. (SBLF)) | | | | | | 1,955,000 | | | | 2,026,846 |

| Dundee Cmnty. School District: | | | | | | | | | | |

| Series 2000, 5.375% 5/1/27 (Pre-Refunded to | | | | | | | | | | |

| 5/1/10 @ 100) (d) | | | | | | 1,195,000 | | | | 1,256,483 |

| 5.375% 5/1/19 (Pre-Refunded to 5/1/10 @ 100) (d) | | | | 1,000,000 | | | | 1,051,450 |

| Durand Area Schools Gen. Oblig.: | | | | | | | | | | |

| 5% 5/1/27 (FSA Insured) | | | | | | 1,225,000 | | | | 1,255,503 |

| 5% 5/1/28 (FSA Insured) | | | | | | 1,250,000 | | | | 1,278,150 |

| 5% 5/1/29 (FSA Insured) | | | | | | 1,275,000 | | | | 1,297,695 |

| East China School District 5.5% 5/1/17 (Pre-Refunded | | | | | | | | | | |

| to 11/1/11 @ 100) (d) | | | | | | 1,775,000 | | | | 1,905,729 |

| East Grand Rapids Pub. School District: | | | | | | | | | | |

| 5% 5/1/16 (FSA Insured) | | | | | | 1,425,000 | | | | 1,484,793 |

| 5% 5/1/17 (FSA Insured) | | | | | | 1,985,000 | | | | 2,062,951 |

| 5.5% 5/1/17 | | | | | | 1,690,000 | | | | 1,772,827 |

| East Lansing School District Gen. Oblig. Series B, 5% | | | | | | | | | | |

| 5/1/30 (MBIA Insured) | | | | | | 3,530,000 | | | | 3,608,084 |

| Eastern Michigan Univ. Revs. Series 2000 B, 5.625% | | | | | | | | | | |

| 6/1/30 (Pre-Refunded to 6/1/10 @ 100) (d) | | | | | | 1,250,000 | | | | 1,326,850 |

| Farmington Pub. School District 5% 5/1/18 (FSA | | | | | | | | | | |

| Insured) | | | | | | 4,500,000 | | | | 4,671,990 |

| Fenton Area Pub. Schools 5% 5/1/14 (FGIC Insured) | | | | | | 1,775,000 | | | | 1,866,288 |

| Ferris State Univ. Rev.: | | | | | | | | | | |

| 5% 10/1/16 (MBIA Insured) | | | | | | 1,255,000 | | | | 1,306,468 |

| 5% 10/1/17 (MBIA Insured) | | | | | | 1,320,000 | | | | 1,369,513 |

| Flushing Cmnty. Schools: | | | | | | | | | | |

| 5.25% 5/1/17 (Pre-Refunded to 5/1/13 @ 100) (d) | | | | | | 1,000,000 | | | | 1,070,210 |

| 5.25% 5/1/18 (Pre-Refunded to 5/1/13 @ 100) (d) | | | | | | 1,030,000 | | | | 1,102,316 |

| Fraser Pub. School District: | | | | | | | | | | |

| 5% 5/1/16 (FSA Insured) | | | | | | 1,055,000 | | | | 1,101,578 |

| 5% 5/1/17 (FSA Insured) | | | | | | 1,615,000 | | | | 1,685,107 |

| Garden City School District: | | | | | | | | | | |

| 5% 5/1/14 (FSA Insured) | | | | | | 1,210,000 | | | | 1,272,230 |

See accompanying notes which are an integral part of the financial statements.

9 Semiannual Report

| Fidelity Michigan Municipal Income Fund | | | | | | | | |

| Investments (Unaudited) continued | | | | | | | | |

| |

| Municipal Bonds continued | | | | | | | | | | |

| | | | | | | Principal | | | | Value |

| | | | | | | Amount | | | | (Note 1) |

| Michigan – continued | | | | | | | | | | |

| Garden City School District: – continued | | | | | | | | | | |

| 5% 5/1/17 (FSA Insured) | | | | | | $ 1,390,000 | | | | $ 1,445,183 |

| Genesee County Gen. Oblig. Series A: | | | | | | | | | | |

| 5% 5/1/17 (MBIA Insured) | | | | | | 1,355,000 | | | | 1,403,780 |

| 5% 5/1/18 (MBIA Insured) | | | | | | 1,505,000 | | | | 1,553,657 |

| Gibraltar School District: | | | | | | | | | | |

| 5% 5/1/16 (FSA Insured) | | | | | | 1,230,000 | | | | 1,278,831 |

| 5% 5/1/17 (FSA Insured) | | | | | | 1,230,000 | | | | 1,274,280 |

| 5.5% 5/1/18 (Pre-Refunded to 11/1/12 @ 100) (d) | | | | | | 1,200,000 | | | | 1,298,868 |

| 5.5% 5/1/21 (Pre-Refunded to 11/1/12 @ 100) (d) | | | | | | 1,200,000 | | | | 1,298,868 |

| Grand Blanc Cmnty. Schools 5.5% 5/1/13 (FGIC | | | | | | | | | | |

| Insured) | | | | | | 1,000,000 | | | | 1,063,780 |

| Grand Rapids Downtown Dev. Auth. Tax Increment Rev. | | | | | | | | | | |

| 0% 6/1/11 (MBIA Insured) | | | | | | 3,160,000 | | | | 2,571,229 |

| Grand Rapids San. Swr. Sys. Rev. 5% 1/1/34 (MBIA | | | | | | | | | | |

| Insured) | | | | | | 3,000,000 | | | | 3,056,520 |

| Grand Rapids Wtr. Supply Sys.: | | | | | | | | | | |

| 5% 1/1/35 (FGIC Insured) | | | | | | 5,000,000 | | | | 5,098,350 |

| 5.75% 1/1/11 (FGIC Insured) | | | | | | 2,020,000 | | | | 2,168,127 |

| Grosse Ile Township School District Unltd. Tax Gen. | | | | | | | | | | |

| Oblig.: | | | | | | | | | | |

| 5% 5/1/29 (MBIA Insured) | | | | | | 1,950,000 | | | | 1,992,374 |

| 5% 5/1/32 (MBIA Insured) | | | | | | 1,950,000 | | | | 1,984,710 |

| Hamilton Cmnty. Schools District 5% 5/1/24 (FGIC | | | | | | | | | | |

| Insured) | | | | | | 1,500,000 | | | | 1,515,735 |

| Haslett Pub. Schools 5% 5/1/16 (MBIA Insured) | | | | | | 1,100,000 | | | | 1,143,670 |

| Howell Pub. Schools 0% 5/1/10 (AMBAC Insured) | | | | | | 1,130,000 | | | | 964,116 |

| Hudsonville Pub. Schools 5% 5/1/16 (FSA Insured) | | | | | | 1,000,000 | | | | 1,039,700 |

| Huron School District 5.625% 5/1/16 (Pre-Refunded to | | | | | | | | | | |

| 5/1/11 @ 100) (d) | | | | | | 1,050,000 | | | | 1,126,430 |

| Huron Valley School District: | | | | | | | | | | |

| 0% 5/1/10 (FGIC Insured) | | | | | | 2,500,000 | | | | 2,133,000 |

| 0% 5/1/11 (FGIC Insured) | | | | | | 5,830,000 | | | | 4,760,428 |

| 0% 5/1/12 (FGIC Insured) | | | | | | 1,420,000 | | | | 1,107,316 |

| 5.25% 5/1/16 | | | | | | 2,450,000 | | | | 2,601,018 |

| Kent Hosp. Fin. Auth. Hosp. Facilities Rev.: | | | | | | | | | | |

| (Butterworth Hosp. Proj.) Series A, 7.25% 1/15/13 | | | | | | 3,685,000 | | | | 4,053,242 |

| (Spectrum Health Proj.) Series A: | | | | | | | | | | |

| 5.375% 1/15/11 | | | | | | 2,420,000 | | | | 2,494,488 |

| 5.375% 1/15/12 | | | | | | 2,505,000 | | | | 2,584,083 |

See accompanying notes which are an integral part of the financial statements.

| Municipal Bonds continued | | | | | | | | |

| | | | | Principal | | | | Value |

| | | | | Amount | | | | (Note 1) |

| Michigan – continued | | | | | | | | |

| L’Anse Creuse Pub. Schools: | | | | | | | | |

| 5.375% 5/1/18 (Pre-Refunded to 11/1/12 @ | | | | | | | | |

| 100) (d) | | | | $ 1,000,000 | | | | $ 1,070,860 |

| 5.375% 5/1/20 (Pre-Refunded to 11/1/12 @ | | | | | | | | |

| 100) (d) | | | | 1,000,000 | | | | 1,072,590 |

| Lake Orion Cmnty. School District 5.25% 5/1/27 (Pre- | | | | | | | | |

| Refunded to 5/1/12 @ 100) (d) | | | | 1,150,000 | | | | 1,222,071 |

| Lansing Bldg. Auth. Rev. 0% 6/1/12 (AMBAC Insured) . | | | | 3,000,000 | | | | 2,331,060 |

| Lawton Cmnty. Schools 5.5% 5/1/19 (Pre-Refunded to | | | | | | | | |

| 11/1/11 @ 100) (d) | | | | 1,050,000 | | | | 1,124,729 |

| Livonia Muni. Bldg. Auth. 5% 5/1/17 (FGIC Insured) | | | | 1,100,000 | | | | 1,122,902 |

| Livonia Pub. School District Series II, 0% 5/1/21 (FGIC | | | | | | | | |

| Insured) (Pre-Refunded to 5/1/07 @ 39.31) (d) | | | | 8,480,000 | | | | 3,229,099 |

| Michigan Bldg. Auth. Rev. (Facilities Prog.): | | | | | | | | |

| Series II, 5% 10/15/33 (AMBAC Insured) | | | | 3,000,000 | | | | 3,060,030 |

| Series III, 5% 10/15/10 (MBIA Insured) | | | | 1,000,000 | | | | 1,042,070 |

| Michigan Comprehensive Trans. Rev. Series B: | | | | | | | | |

| 5.25% 5/15/11 (FSA Insured) | | | | 1,475,000 | | | | 1,558,264 |

| 5.25% 5/15/16 (Pre-Refunded to 5/15/12 @ | | | | | | | | |

| 100) (d) | | | | 3,850,000 | | | | 4,092,743 |

| Michigan Ctfs. of Prtn. 5.75% 6/1/17 (Pre-Refunded to | | | | | | | | |

| 6/1/10 @ 100) (d) | | | | 3,000,000 | | | | 3,197,880 |

| Michigan Gen. Oblig. (Envir. Protection Prog.) 6.25% | | | | | | | | |

| 11/1/12 | | | | 2,665,000 | | | | 2,895,443 |

| Michigan Higher Ed. Student Ln. Auth. Rev. Series XII W, | | | | | | | | |

| 4.875% 9/1/10 (AMBAC Insured) (c) | | | | 3,000,000 | | | | 3,037,470 |

| Michigan Hosp. Fin. Auth. Hosp. Rev.: | | | | | | | | |

| (Ascension Health Cr. Group Proj.) Series A: | | | | | | | | |

| 5%, tender 4/1/11 (b) | | | | 2,035,000 | | | | 2,105,024 |

| 6% 11/15/19 (Pre-Refunded to 11/15/09 @ | | | | | | | | |

| 101) (d) | | | | 10,645,000 | | | | 11,403,868 |

| (Crittenton Hosp. Proj.) Series A: | | | | | | | | |

| 5.5% 3/1/13 | | | | 455,000 | | | | 478,742 |

| 5.5% 3/1/14 | | | | 1,300,000 | | | | 1,368,601 |

| 5.5% 3/1/15 | | | | 1,985,000 | | | | 2,087,426 |

| (Genesys Reg’l. Med. Hosp. Proj.) Series A, 5.3% | | | | | | | | |

| 10/1/11 (Escrowed to Maturity) (d) | | | | 1,000,000 | | | | 1,040,560 |

| (Henry Ford Health Sys. Proj.): | | | | | | | | |

| Series 2003 A, 5.5% 3/1/14 (Pre-Refunded to | | | | | | | | |

| 3/1/13 @ 100) (d) | | | | 2,000,000 | | | | 2,154,240 |

| Series A: | | | | | | | | |

| 5% 11/15/09 | | | | 650,000 | | | | 667,531 |

| 5% 11/15/12 | | | | 1,485,000 | | | | 1,542,217 |

See accompanying notes which are an integral part of the financial statements.

11 Semiannual Report

| Fidelity Michigan Municipal Income Fund | | | | | | | | |

| Investments (Unaudited) continued | | | | | | | | |

| |

| Municipal Bonds continued | | | | | | | | |

| | | | | Principal | | | | Value |

| | | | | Amount | | | | (Note 1) |

| Michigan – continued | | | | | | | | |

| Michigan Hosp. Fin. Auth. Hosp. Rev.: – continued | | | | | | | | |

| (Henry Ford Health Sys. Proj.): | | | | | | | | |

| Series A: | | | | | | | | |

| 5% 11/15/14 | | | | $ 1,000,000 | | | | $ 1,038,690 |

| 6% 11/15/19 (Pre-Refunded to 11/15/09 @ | | | | | | | | |

| 101) (d) | | | | 1,945,000 | | | | 2,083,659 |

| 6% 9/1/12 (Escrowed to Maturity) (d) | | | | 1,500,000 | | | | 1,647,525 |

| (Mercy Health Svcs. Proj.): | | | | | | | | |

| Series 1996 R, 5.375% 8/15/26 (Escrowed to | | | | | | | | |

| Maturity) (d) | | | | 2,500,000 | | | | 2,527,425 |

| Series Q: | | | | | | | | |

| 5.25% 8/15/10 (Escrowed to Maturity) (d) | | | | 2,195,000 | | | | 2,219,935 |

| 5.375% 8/15/26 (Escrowed to Maturity) (d) | | | | 2,450,000 | | | | 2,476,877 |

| 6% 8/15/08 (Escrowed to Maturity) (d) | | | | 1,130,000 | | | | 1,144,283 |

| 6% 8/15/10 (Escrowed to Maturity) (d) | | | | 1,265,000 | | | | 1,281,319 |

| Series R, 5.375% 8/15/16 (Escrowed to | | | | | | | | |

| Maturity) (d) | | | | 2,500,000 | | | | 2,527,700 |

| (MidMichigan Health Obligated Group Prog.) Series | | | | | | | | |

| 2002 A, 5.5% 4/15/18 (AMBAC Insured) | | | | 2,000,000 | | | | 2,119,340 |

| (Oakwood Obligated Group Proj.) 5.5% 11/1/11 | | | | 3,000,000 | | | | 3,175,200 |

| (Saint John Hosp. & Med. Ctr. Proj.) Series A, 6% | | | | | | | | |

| 5/15/09 (Escrowed to Maturity) (d) | | | | 1,710,000 | | | | 1,797,159 |

| (Sisters of Mercy Health Corp. Proj.) Series P, 5.375% | | | | | | | | |

| 8/15/14 (Escrowed to Maturity) (d) | | | | 570,000 | | | | 599,007 |

| (Sparrow Hosp. Obligated Group Proj.): | | | | | | | | |

| 5.5% 11/15/21 | | | | 1,435,000 | | | | 1,503,808 |

| 5.625% 11/15/31 | | | | 4,500,000 | | | | 4,671,135 |

| (Trinity Health Sys. Proj.) Series 2000 A, 6% 12/1/27 | | | | 1,535,000 | | | | 1,651,952 |

| Michigan Muni. Bond Auth. Rev.: | | | | | | | | |

| (Detroit School District Proj.) Series B, 5% 6/1/12 | | | | | | | | |

| (FSA Insured) | | | | 7,300,000 | | | | 7,633,318 |

| (Local Govt. Ln. Prog.): | | | | | | | | |

| Series A: | | | | | | | | |

| 0% 12/1/07 (FGIC Insured) | | | | 5,340,000 | | | | 5,057,674 |

| 4.75% 12/1/09 (FGIC Insured) | | | | 6,000,000 | | | | 6,003,180 |

| Series CA, 0% 6/15/13 (FSA Insured) | | | | 3,850,000 | | | | 2,844,188 |

| Series G, 0% 5/1/19 (AMBAC Insured) | | | | 1,865,000 | | | | 1,017,861 |

| 7.5% 11/1/09 (AMBAC Insured) | | | | 15,000 | | | | 15,032 |

| Series C, 5% 5/1/11 | | | | 2,085,000 | | | | 2,180,097 |

| 5% 10/1/23 | | | | 5,000,000 | | | | 5,159,850 |

| 5.375% 10/1/19 | | | | 2,005,000 | | | | 2,145,430 |

| Michigan Strategic Fund Exempt Facilities Rev. (Waste | | | | | | | | |

| Mgmt., Inc. Proj.) 3.75%, tender 8/1/07 (b)(c) | | | | 3,000,000 | | | | 2,980,080 |

See accompanying notes which are an integral part of the financial statements.

| Municipal Bonds continued | | | | | | | | |

| | | | | Principal | | | | Value |

| | | | | Amount | | | | (Note 1) |

| Michigan – continued | | | | | | | | |

| Michigan Strategic Fund Ltd. Oblig. Rev. (Detroit Edison | | | | | | | | |

| Co. Proj.): | | | | | | | | |

| Series A, 5.55% 9/1/29 (MBIA Insured) (c) | | | | $ 1,000,000 | | | | $ 1,041,680 |

| Series BB: | | | | | | | | |

| 7% 7/15/08 (MBIA Insured) | | | | 2,200,000 | | | | 2,330,658 |

| 7% 5/1/21 (AMBAC Insured) | | | | 8,520,000 | | | | 10,667,210 |

| Michigan Trunk Line: | | | | | | | | |

| Series A: | | | | | | | | |

| 0% 10/1/11 (AMBAC Insured) | | | | 3,630,000 | | | | 2,911,042 |

| 5.5% 11/1/16 | | | | 3,000,000 | | | | 3,297,300 |

| 5.25% 11/1/15 (FGIC Insured) (a) | | | | 5,000,000 | | | | 5,381,150 |

| 5.25% 10/1/16 (FSA Insured) | | | | 3,000,000 | | | | 3,177,810 |

| Mona Shores School District 6.75% 5/1/10 (FGIC | | | | | | | | |

| Insured) | | | | 2,220,000 | | | | 2,433,275 |

| Montague Pub. School District: | | | | | | | | |

| 5.5% 5/1/16 | | | | 1,005,000 | | | | 1,060,265 |

| 5.5% 5/1/17 | | | | 1,005,000 | | | | 1,058,808 |

| 5.5% 5/1/19 | | | | 1,090,000 | | | | 1,145,187 |

| Morenci Area Schools 5.25% 5/1/21 (Pre-Refunded to | | | | | | | | |

| 5/1/12 @ 100) (d) | | | | 1,410,000 | | | | 1,502,129 |

| Mount Clemens Cmnty. School District: | | | | | | | | |

| 0% 5/1/17 | | | | 5,000,000 | | | | 2,448,550 |

| 5.5% 5/1/16 (Pre-Refunded to 11/1/11 @ 100) (d) . | | | | 1,000,000 | | | | 1,073,650 |

| Muskegon Heights Wtr. Sys. Rev. Series 2000 A: | | | | | | | | |

| 5.625% 11/1/20 (Pre-Refunded to 11/1/10 @ | | | | | | | | |

| 100) (d) | | | | 2,075,000 | | | | 2,215,042 |

| 5.625% 11/1/30 (Pre-Refunded to 11/1/10 @ | | | | | | | | |

| 100) (d) | | | | 1,570,000 | | | | 1,675,959 |

| New Haven Cmnty. Schools 5.25% 5/1/18 (Pre-Re- | | | | | | | | |

| funded to 11/1/12 @ 100) (d) | | | | 1,175,000 | | | | 1,255,558 |

| New Lothrop Area Pub. Schools Gen. Oblig. 5% | | | | | | | | |

| 5/1/35 (FSA Insured) | | | | 1,000,000 | | | | 1,015,570 |

| Northville Pub. Schools: | | | | | | | | |

| Series II: | | | | | | | | |

| 5% 5/1/15 (FSA Insured) | | | | 1,525,000 | | | | 1,610,598 |

| 5% 5/1/16 (FSA Insured) | | | | 1,475,000 | | | | 1,533,558 |

| 5% 5/1/17 (FSA Insured) | | | | 3,675,000 | | | | 3,826,998 |

| Northwestern Michigan Cmnty. College Impt.: | | | | | | | | |

| 5.5% 4/1/14 (FGIC Insured) | | | | 285,000 | | | | 297,574 |

| 5.5% 4/1/15 (FGIC Insured) | | | | 170,000 | | | | 177,500 |

| Northwestern Michigan College Gen. Oblig. 5% 4/1/14 | | | | | | | | |

| (AMBAC Insured) | | | | 2,000,000 | | | | 2,101,920 |

See accompanying notes which are an integral part of the financial statements.

13 Semiannual Report

| Fidelity Michigan Municipal Income Fund | | | | | | | | |

| Investments (Unaudited) continued | | | | | | | | |

| |

| Municipal Bonds continued | | | | | | | | |

| | | | | Principal | | | | Value |

| | | | | Amount | | | | (Note 1) |

| Michigan – continued | | | | | | | | |

| Oakland Univ. Rev. 5% 5/15/12 (AMBAC Insured) | | | | $ 1,020,000 | | | | $ 1,068,950 |

| Okemos Pub. School District: | | | | | | | | |

| 0% 5/1/12 (MBIA Insured) | | | | 2,500,000 | | | | 1,949,500 |

| 0% 5/1/13 (MBIA Insured) | | | | 1,700,000 | | | | 1,262,573 |

| Ovid-Elsie Area Schools Counties of Clinton, Shawassee, | | | | | | | | |

| Saginaw and Gratiot 5% 5/1/18 (Pre-Refunded to | | | | | | | | |

| 11/1/12 @ 100) (d) | | | | 1,515,000 | | | | 1,597,916 |

| Petoskey Pub. School District: | | | | | | | | |

| 5% 5/1/14 (MBIA Insured) | | | | 1,430,000 | | | | 1,498,697 |

| 5% 5/1/16 (MBIA Insured) | | | | 1,945,000 | | | | 2,036,668 |

| Plainwell Cmnty. School District: | | | | | | | | |

| 5% 5/1/15 (FSA Insured) | | | | 1,030,000 | | | | 1,083,941 |

| 5% 5/1/16 (FSA Insured) | | | | 1,025,000 | | | | 1,077,142 |

| 5.5% 5/1/14 | | | | 1,000,000 | | | | 1,077,760 |

| 5.5% 5/1/16 (Pre-Refunded to 11/1/12 @ 100) (d) . | | | | 1,000,000 | | | | 1,079,490 |

| Port Huron Area School District County of Saint Clair: | | | | | | | | |

| 0% 5/1/08 (Liquidity Facility Michigan School Bond | | | | | | | | |

| Ln. Fund) | | | | 1,975,000 | | | | 1,838,666 |

| 5.25% 5/1/16 | | | | 1,175,000 | | | | 1,249,483 |

| 5.25% 5/1/17 | | | | 2,125,000 | | | | 2,252,436 |

| 5.25% 5/1/18 | | | | 2,175,000 | | | | 2,295,539 |

| Riverview Cmnty. School District: | | | | | | | | |

| 5% 5/1/14 | | | | 905,000 | | | | 953,399 |

| 5% 5/1/15 | | | | 955,000 | | | | 1,002,817 |

| 5% 5/1/17 | | | | 1,000,000 | | | | 1,041,960 |

| 5% 5/1/18 | | | | 1,000,000 | | | | 1,039,270 |

| Rochester Cmnty. School District: | | | | | | | | |

| Series II, 5.5% 5/1/16 (Pre-Refunded to 11/1/11 @ | | | | | | | | |

| 100) (d) | | | | 1,125,000 | | | | 1,207,856 |

| 5% 5/1/19 (MBIA Insured) | | | | 1,000,000 | | | | 1,055,230 |

| Royal Oak Hosp. Fin. Auth. Hosp. Rev. (William | | | | | | | | |

| Beaumont Hosp. Proj.) Series M, 5.25% 11/15/31 | | | | | | | | |

| (MBIA Insured) | | | | 2,000,000 | | | | 2,047,640 |

| Saint Clair County Gen. Oblig.: | | | | | | | | |

| 5% 4/1/17 (AMBAC Insured) | | | | 1,380,000 | | | | 1,433,710 |

| 5% 4/1/19 (AMBAC Insured) | | | | 1,475,000 | | | | 1,528,484 |

| Saint Joseph School District 5.5% 5/1/18 (Pre-Refunded | | | | | | | | |

| to 11/1/11 @ 100) (d) | | | | 1,065,000 | | | | 1,143,437 |

| South Haven Pub. Schools: | | | | | | | | |

| 5% 5/1/21 (Pre-Refunded to 5/1/13 @ 100) (d) | | | | 1,450,000 | | | | 1,530,403 |

| 5% 5/1/22 (Pre-Refunded to 5/1/13 @ 100) (d) | | | | 1,350,000 | | | | 1,424,858 |

| South Lyon Cmnty. Schools (School Bldg. and Site Prog.) | | | | | | | | |

| 5.25% 5/1/15 (FGIC Insured) | | | | 1,000,000 | | | | 1,060,540 |

See accompanying notes which are an integral part of the financial statements.

| Municipal Bonds continued | | | | | | | | | | |

| | | | | | | Principal | | | | Value |

| | | | | | | Amount | | | | (Note 1) |

| Michigan – continued | | | | | | | | | | |

| South Redford School District 5% 5/1/16 (MBIA Insured) | | | | | | $ 1,125,000 | | | | $ 1,173,836 |

| Southfield Library Bldg. Auth. 5.5% 5/1/21 (Pre- | | | | | | | | | | |

| Refunded to 5/1/10 @ 100) (d) | | | | | | 1,425,000 | | | | 1,504,586 |

| Southfield Pub. Schools: | | | | | | | | | | |

| Series A: | | | | | | | | | | |

| 5.25% 5/1/17 (Liquidity Facility Sumitomo Bank | | | | | | | | | | |

| Lease Fin., Inc. (SBLF)) | | | | | | 1,025,000 | | | | 1,084,450 |

| 5.25% 5/1/18 (Liquidity Facility Sumitomo Bank | | | | | | | | | | |

| Lease Fin., Inc. (SBLF)) | | | | | | 1,025,000 | | | | 1,082,585 |

| 5.25% 5/1/19 (Liquidity Facility Sumitomo Bank | | | | | | | | | | |

| Lease Fin., Inc. (SBLF)) | | | | | | 1,025,000 | | | | 1,082,585 |

| 5.25% 5/1/20 (Liquidity Facility Sumitomo Bank | | | | | | | | | | |

| Lease Fin., Inc. (SBLF)) | | | | | | 1,025,000 | | | | 1,081,959 |

| Series B: | | | | | | | | | | |

| 5.125% 5/1/16 (FSA Insured) | | | | | | 2,780,000 | | | | 2,928,869 |

| 5.25% 5/1/25 (FSA Insured) | | | | | | 6,500,000 | | | | 6,817,915 |

| Taylor City Bldg. Auth. County of Wayne Bldg. Auth. | | | | | | | | | | |

| Pub. Facilities 5% 10/1/21 (MBIA Insured) | | | | | | 1,735,000 | | | | 1,787,952 |

| Tecumseh Pub. Schools 5.5% 5/1/30 (Pre-Refunded to | | | | | | | | | | |

| 5/1/10 @ 100) (d) | | | | | | 1,250,000 | | | | 1,319,813 |

| Troy School District: | | | | | | | | | | |

| 5% 5/1/13 (MBIA Insured) | | | | | | 1,000,000 | | | | 1,053,620 |

| 5% 5/1/15 | | | | | | 2,135,000 | | | | 2,241,899 |

| 5% 5/1/15 (MBIA Insured) | | | | | | 1,000,000 | | | | 1,056,130 |

| 5% 5/1/16 (MBIA Insured) | | | | | | 1,000,000 | | | | 1,056,350 |

| Utica Cmnty. Schools: | | | | | | | | | | |

| 5% 5/1/17 | | | | | | 3,000,000 | | | | 3,126,660 |

| 5.25% 5/1/15 | | | | | | 725,000 | | | | 773,234 |

| 5.375% 5/1/16 | | | | | | 2,250,000 | | | | 2,419,020 |

| 5.5% 5/1/17 | | | | | | 1,000,000 | | | | 1,081,870 |

| Warren Consolidated School District 5.375% 5/1/16 | | | | | | | | | | |

| (FSA Insured) | | | | | | 2,350,000 | | | | 2,490,601 |

| Waverly Cmnty. School District: | | | | | | | | | | |

| 5% 5/1/11 (FSA Insured) | | | | | | 1,000,000 | | | | 1,045,170 |

| 5% 5/1/17 (FSA Insured) | | | | | | 3,090,000 | | | | 3,237,949 |

| 5.75% 5/1/14 (Pre-Refunded to 5/1/10 @ 100) (d) | | . | | | | 1,000,000 | | | | 1,064,630 |

| 5.75% 5/1/16 (Pre-Refunded to 5/1/10 @ 100) (d) | | . | | | | 1,000,000 | | | | 1,064,630 |

| Wayne Charter County Gen. Oblig. Series 2001 A, | | | | | | | | | | |

| 5.5% 12/1/17 (MBIA Insured) | | | | | | 1,000,000 | | | | 1,049,940 |

| West Ottawa Pub. School District 5.25% 5/1/10 (FGIC | | | | | | | | | | |

| Insured) | | | | | | 850,000 | | | | 859,733 |

| Whitehall District Schools 5.5% 5/1/15 (Pre-Refunded | | | | | | | | | | |

| to 11/1/11 @ 100) (d) | | | | | | 1,000,000 | | | | 1,073,650 |

See accompanying notes which are an integral part of the financial statements.

15 Semiannual Report

| Fidelity Michigan Municipal Income Fund | | | | | | |

| Investments (Unaudited) continued | | | | | | |

| |

| Municipal Bonds continued | | | | | | |

| | | | | Principal | | Value |

| | | | | Amount | | (Note 1) |

| Michigan – continued | | | | | | |

| Williamston Cmnty. Schools Gen. Oblig. 5% 5/1/18 | | | | | | |

| (FGIC Insured) | | | | $ 1,000,000 | | $ 1,039,700 |

| Willow Run Cmnty. Schools County of Washtenaw: | | | | | | |

| 5% 5/1/17 (FSA Insured) | | | | 1,875,000 | | 1,949,438 |

| 5.5% 5/1/16 (Pre-Refunded to 5/1/11 @ 100) (d) | | | | 1,630,000 | | 1,739,797 |

| Woodhaven-Brownstown School District County of | | | | | | |

| Wayne: | | | | | | |

| 5.375% 5/1/16 | | | | 1,710,000 | | 1,832,727 |

| 5.375% 5/1/18 (FSA Insured) | | | | 1,875,000 | | 2,009,569 |

| Wyandotte City School District 5.375% 5/1/20 (Pre-Re- | | | | | | |

| funded to 5/1/12 @ 100) (d) | | | | 1,050,000 | | 1,125,359 |

| Wyandotte Elec. Rev.: | | | | | | |

| 5.375% 10/1/14 (MBIA Insured) | | | | 3,485,000 | | 3,625,027 |

| 5.375% 10/1/15 (MBIA Insured) | | | | 1,670,000 | | 1,737,101 |

| Wyoming Sewage Disp. Sys. Rev. 5% 6/1/30 (MBIA | | | | | | |

| Insured) | | | | 4,000,000 | | 4,089,240 |

| Zeeland Pub. Schools: | | | | | | |

| 5% 5/1/16 (FGIC Insured) | | | | 2,035,000 | | 2,129,383 |

| 5% 5/1/17 (FGIC Insured) | | | | 1,500,000 | | 1,565,115 |

| 5.25% 5/1/16 (MBIA Insured) | | | | 1,050,000 | | 1,114,869 |

| | | | | | | 538,219,895 |

| |

| Puerto Rico 0.9% | | | | | | |

| Puerto Rico Commonwealth Hwy. & Trans. Auth. Hwy. | | | | | | |

| Rev. Series 1996 Y, 5% 7/1/36 (MBIA Insured) | | | | 2,500,000 | | 2,549,225 |

| Puerto Rico Commonwealth Hwy. & Trans. Auth. Trans. | | | | | | |

| Rev. Series L, 5.25% 7/1/38 (AMBAC Insured) | | | | $ 1,000,000 | | $ 1,080,070 |

| Puerto Rico Elec. Pwr. Auth. Pwr. Rev. Series QQ, 5.5% | | | | | | |

| 7/1/18 (XL Cap. Assurance, Inc. Insured) | | | | 1,000,000 | | 1,100,630 |

| | | | | | | 4,729,925 |

| |

| |

| TOTAL INVESTMENT PORTFOLIO 99.8% | | | | | | |

| (Cost $537,269,015) | | | | | | 543,590,533 |

| |

| NET OTHER ASSETS – 0.2% | | | | | | 845,864 |

| NET ASSETS 100% | | | | | | $ 544,436,397 |

See accompanying notes which are an integral part of the financial statements.

Legend

(a) Security or a portion of the security

purchased on a delayed delivery or

when-issued basis.

(b) The coupon rate shown on floating or

adjustable rate securities represents the

rate at period end.

(c) Private activity obligations whose

interest is subject to the federal

alternative minimum tax for individuals.

(d) Security collateralized by an amount

sufficient to pay interest and principal.

|

Other Information

The distribution of municipal securities by revenue source, as a percentage of total net assets, is as follows:

| General Obligations | | 41.2% |

| Escrowed/Pre Refunded | | 25.5% |

| Water & Sewer | | 13.9% |

| Health Care | | 6.3% |

| Special Tax | | 5.0% |

| Others* (individually less than 5%) | | 8.1% |

| | | 100.0% |

*Includes net other assets

See accompanying notes which are an integral part of the financial statements.

17 Semiannual Report

| Fidelity Michigan Municipal Income Fund | | | | |

| Financial Statements | | | | | | |

| |

| Statement of Assets and Liabilities | | | | | | |

| | | | | June 30, 2006 (Unaudited) |

| |

| Assets | | | | | | |

| Investment in securities, at value See accompanying | | | | | | |

| schedule: | | | | | | |

| Unaffiliated issuers (cost $537,269,015) | | | | | | $ 543,590,533 |

| Cash | | | | | | 1,012,731 |

| Receivable for fund shares sold | | | | | | 546,031 |

| Interest receivable | | | | | | 5,813,396 |

| Prepaid expenses | | | | | | 1,146 |

| Other receivables | | | | | | 74,790 |

| Total assets | | | | | | 551,038,627 |

| |

| Liabilities | | | | | | |

| Payable for investments purchased on a delayed delivery | | | | |

| basis | | | | $ 5,373,150 | | |

| Payable for fund shares redeemed | | | | 324,485 | | |

| Distributions payable | | | | 606,971 | | |

| Accrued management fee | | | | 168,323 | | |

| Other affiliated payables | | | | 96,242 | | |

| Other payables and accrued expenses | | | | 33,059 | | |

| Total liabilities | | | | | | 6,602,230 |

| |

| Net Assets | | | | | | $ 544,436,397 |

| Net Assets consist of: | | | | | | |

| Paid in capital | | | | | | $ 537,591,380 |

| Undistributed net investment income | | | | | | 204,116 |

| Accumulated undistributed net realized gain (loss) on | | | | | | |

| investments | | | | | | 319,383 |

| Net unrealized appreciation (depreciation) on | | | | | | |

| investments | | | | | | 6,321,518 |

| Net Assets, for 46,919,343 shares outstanding | | | | | | $ 544,436,397 |

| Net Asset Value, offering price and redemption price per | | | | |

| share ($544,436,397 ÷ 46,919,343 shares) | | | | | | $ 11.60 |

See accompanying notes which are an integral part of the financial statements.

| Statement of Operations | | | | | | |

| | | Six months ended June 30, 2006 (Unaudited) |

| |

| Investment Income | | | | | | |

| Interest | | | | | | $ 12,229,596 |

| |

| Expenses | | | | | | |

| Management fee | | | | $ 1,031,550 | | |

| Transfer agent fees | | | | 220,164 | | |

| Accounting fees and expenses | | | | 66,796 | | |

| Independent trustees’ compensation | | | | 1,082 | | |

| Custodian fees and expenses | | | | 4,345 | | |

| Registration fees | | | | 19,256 | | |

| Audit | | | | 24,990 | | |

| Legal | | | | 3,155 | | |

| Miscellaneous | | | | 3,065 | | |

| Total expenses before reductions | | | | 1,374,403 | | |

| Expense reductions | | | | (202,603) | | 1,171,800 |

| |

| Net investment income | | | | | | 11,057,796 |

| Realized and Unrealized Gain (Loss) | | | | | | |

| Net realized gain (loss) on: | | | | | | |

| Investment securities: | | | | | | |

| Unaffiliated issuers | | | | 380,991 | | |

| Futures contracts | | | | 179,150 | | |

| Total net realized gain (loss) | | | | | | 560,141 |

| Change in net unrealized appreciation (depreciation) on: | | | | |

| Investment securities | | | | (11,523,285) | | |

| Futures contracts | | | | 67,273 | | |

| Total change in net unrealized appreciation | | | | | | |

| (depreciation) | | | | | | (11,456,012) |

| Net gain (loss) | | | | | | (10,895,871) |

| Net increase (decrease) in net assets resulting from | | | | | | |

| operations | | | | | | $ 161,925 |

See accompanying notes which are an integral part of the financial statements.

19 Semiannual Report

| Fidelity Michigan Municipal Income Fund | | | | | | | | |

| Financial Statements continued | | | | | | | | |

| |

| Statement of Changes in Net Assets | | | | | | | | |

| | | | | Six months ended | | | | Year ended |

| | | | | June 30, 2006 | | | | December 31, |

| | | | | (Unaudited) | | | | 2005 |

| Increase (Decrease) in Net Assets | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income | | | | $ 11,057,796 | | | | $ 22,485,171 |

| Net realized gain (loss) | | | | 560,141 | | | | 4,556,306 |

| Change in net unrealized appreciation (depreciation) . | | | | (11,456,012) | | | | (11,968,775) |

| Net increase (decrease) in net assets resulting | | | | | | | | |

| from operations | | | | 161,925 | | | | 15,072,702 |

| Distributions to shareholders from net investment income . | | | | (11,111,421) | | | | (22,452,478) |

| Distributions to shareholders from net realized gain | | | | (239,486) | | | | (5,430,741) |

| Total distributions | | | | (11,350,907) | | | | (27,883,219) |

| Share transactions | | | | | | | | |

| Proceeds from sales of shares | | | | 33,931,926 | | | | 91,467,289 |

| Reinvestment of distributions | | | | 7,548,200 | | | | 18,797,338 |

| Cost of shares redeemed | | | | (51,339,866) | | | | (91,856,609) |

| Net increase (decrease) in net assets resulting from | | | | | | | | |

| share transactions | | | | (9,859,740) | | | | 18,408,018 |

| Redemption fees | | | | 1,003 | | | | 3,250 |

| Total increase (decrease) in net assets | | | | (21,047,719) | | | | 5,600,751 |

| |

| Net Assets | | | | | | | | |

| Beginning of period | | | | 565,484,116 | | | | 559,883,365 |

| End of period (including undistributed net investment | | | | | | | | |

| income of $204,116 and undistributed net invest- | | | | | | | | |

| ment income of $260,167, respectively) | | | | $ 544,436,397 | | | | $ 565,484,116 |

| |

| Other Information | | | | | | | | |

| Shares | | | | | | | | |

| Sold | | | | 2,885,300 | | | | 7,616,556 |

| Issued in reinvestment of distributions | | | | 643,386 | | | | 1,570,055 |

| Redeemed | | | | (4,370,114) | | | | (7,675,047) |

| Net increase (decrease) | | | | (841,428) | | | | 1,511,564 |

See accompanying notes which are an integral part of the financial statements.

| Financial Highlights | | | | | | | | | | |

| |

| | | Six months ended | | | | | | | | | | |

| | | June 30, 2006 | | Years ended December 31, |

| | | (Unaudited) | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 |

| Selected Per Share Data | | | | | | | | | | | | |

| Net asset value, | | | | | | | | | | | | |

| beginning of period | | $ 11.84 | | $ 12.11 | | $ 12.22 | | $ 12.04 | | $ 11.47 | | $ 11.48 |

| Income from Investment | | | | | | | | | | | | |

| Operations | | | | | | | | | | | | |

| Net investment | | | | | | | | | | | | |

| incomeD | | .233 | | .472 | | .491 | | .513 | | .532 | | .552 |

| Net realized and | | | | | | | | | | | | |

| unrealized gain | | | | | | | | | | | | |

| (loss) | | (.234) | | (.155) | | (.026) | | .180 | | .568 | | (.010) |

| Total from investment | | | | | | | | | | | | |

| operations | | (.001) | | .317 | | .465 | | .693 | | 1.100 | | .542 |

| Distributions from net | | | | | | | | | | | | |

| investment income . | | (.234) | | (.472) | | (.490) | | (.513) | | (.530) | | (.552) |

| Distributions from net | | | | | | | | | | | | |

| realized gain | | (.005) | | (.115) | | (.085) | | — | | — | | — |

| Total distributions | | (.239) | | (.587) | | (.575) | | (.513) | | (.530) | | (.552) |

| Redemption fees | | | | | | | | | | | | |

| added to paid in | | | | | | | | | | | | |

| capitalD,F | | — | | — | | — | | — | | — | | — |

| Net asset value, | | | | | | | | | | | | |

| end of period | | $ 11.60 | | $ 11.84 | | $ 12.11 | | $ 12.22 | | $ 12.04 | | $ 11.47 |

| Total ReturnB,C | | (.01)% | | 2.67% | | 3.90% | | 5.87% | | 9.78% | | 4.77% |

| Ratios to Average Net AssetsE | | | | | | | | | | | | |

| Expenses before | | | | | | | | | | | | |

| reductions | | .50%A | | .49% | | .50% | | .50% | | .50% | | .50% |

| Expenses net of | | | | | | | | | | | | |

| fee waivers, | | | | | | | | | | | | |

| if any | | .50%A | | .49% | | .50% | | .50% | | .50% | | .50% |

| Expenses net of all | | | | | | | | | | | | |

| reductions | | .42%A | | .45% | | .48% | | .49% | | .48% | | .44% |

| Net investment | | | | | | | | | | | | |

| income | | 4.00%A | | 3.94% | | 4.05% | | 4.22% | | 4.51% | | 4.76% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, | | | | | | | | | | | | |

| end of period | | | | | | | | | | | | |

| (000 omitted) | | $544,436 | | $565,484 | | $559,883 | | $561,394 | | $572,242 | | $505,534 |

| Portfolio turnover | | | | | | | | | | | | |

| rate | | 10%A | | 23% | | 12% | | 23% | | 17% | | 19% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Calculated based on average shares outstanding during the period.

E Expense ratios reflect operating expenses of the fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or

expense offset arrangements and do not represent the amount paid by the fund during periods when reimbursements or reductions occur.

Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrange

ments. Expenses net of all reductions represent the net expenses paid by the fund.

F Amount represents less than $.001 per share.

|

See accompanying notes which are an integral part of the financial statements.

21 Semiannual Report

| Fidelity Michigan Municipal Money Market Fund | | | | |

| Investment Changes | | | | | | |

| |

| |

| Maturity Diversification | | | | | | |

| Days | | % of fund’s | | % of fund’s | | % of fund’s |

| | | investments | | investments | | investments |

| | | 6/30/06 | | 12/31/05 | | 6/30/05 |

| 0 – 30 | | 89.1 | | 92.8 | | 90.7 |

| 31 – 90 | | 1.7 | | 0.0 | | 2.2 |

| 91 – 180 | | 7.2 | | 3.3 | | 3.6 |

| 181 – 397 | | 2.0 | | 3.9 | | 3.5 |

Weighted Average Maturity | | | | | | |

| | | 6/30/06 | | 12/31/05 | | 6/30/05 |

| Fidelity Michigan Municipal Money | | | | | | |

| Market Fund | | 21 Days | | 19 Days | | 21 Days |

| All Tax Free Money Market Funds | | | | | | |

| Average* | | 21 Days | | 29 Days | | 24 Days |

*Source: iMoneyNet, Inc.

Semiannual Report 22

| Fidelity Michigan Municipal Money Market Fund | | |

| Investments June 30, 2006 (Unaudited) |

| Showing Percentage of Net Assets | | | | |

| |

| Municipal Securities 97.3% | | | | |

| | | Principal | | Value |

| | | Amount | | (Note 1) |

| Michigan – 95.3% | | | | |

| Allen Park Pub. School District Participating VRDN Series ROC | | | | |

| II R4007, 4.01% (Liquidity Facility Citigroup Global Markets | | | | |

| Hldgs., Inc.) (a)(d) | | $ 5,110,000 | | $ 5,110,000 |

| Charlotte Hosp. Fin. Auth. Ltd. Oblig. Rev. (Hayes Green | | | | |

| Beach Proj.) 4.02%, LOC Fifth Third Bank, Cincinnati, | | | | |

| VRDN (a) | | 13,675,000 | | 13,675,000 |

| Clarkston Cmnty. Schools Participating VRDN Series ROC II | | | | |

| R4519, 4.01% (Liquidity Facility Citigroup Global Markets | | | | |

| Hldgs., Inc.) (a)(d) | | 6,085,000 | | 6,085,000 |

| Clinton Econ. Dev. Corp. Rev. (Clinton Area Care Ctr. Proj.) | | | | |

| 4.02%, LOC Northern Trust Co., Chicago, VRDN (a) | | 4,720,000 | | 4,720,000 |

| Comstock Park Pub. Schools Participating VRDN Series ROC II | | | | |

| R 2178, 4.01% (Liquidity Facility Citigroup Global Markets | | | | |

| Hldgs., Inc.) (a)(d) | | 1,325,000 | | 1,325,000 |

| Delta County Econ. Dev. Corp. Envir. Impt. Rev. Participating | | | | |

| VRDN Series PT 2371, 4.04% (Liquidity Facility Merrill Lynch | | | | |

| & Co., Inc.) (a)(d) | | 3,100,000 | | 3,100,000 |

| Detroit City School District: | | | | |

| Bonds Series A, 5% 5/1/07 (FGIC Insured) | | 5,000,000 | | 5,053,446 |

| Participating VRDN: | | | | |

| ROC II R1033, 4.01% (Liquidity Facility Citigroup Global | | | | |

| Markets Hldgs., Inc.) (a)(d) | | 2,310,000 | | 2,310,000 |

| Series AAB 04 39, 4.01% (Liquidity Facility ABN AMRO | | | | |

| Bank NV) (a)(d) | | 5,800,000 | | 5,800,000 |

| Series Macon 05 R, 4.01% (Liquidity Facility Bank of | | | | |

| America NA) (a)(d) | | 8,495,000 | | 8,495,000 |

| Series Macon 06 J, 3.99% (Liquidity Facility Bank of | | | | |

| America NA) (a)(d) | | 3,575,000 | | 3,575,000 |

| Series PA 997, 4% (Liquidity Facility Merrill Lynch & Co., | | | | |

| Inc.) (a)(d) | | 8,840,000 | | 8,840,000 |

| Series PT 2158, 4% (Liquidity Facility Merrill Lynch & Co., | | | | |

| Inc.) (a)(d) | | 7,935,000 | | 7,935,000 |

| Series PT 3364, 4% (Liquidity Facility Bayerische Hypo-und | | | | |

| Vereinsbank AG) (a)(d) | | 6,985,000 | | 6,985,000 |

| Series Putters 1311, 4.01% (Liquidity Facility JPMorgan | | | | |

| Chase Bank) (a)(d) | | 3,125,000 | | 3,125,000 |

| Series ROC II R4004, 4.01% (Liquidity Facility Citigroup | | | | |

| Global Markets Hldgs., Inc.) (a)(d) | | 5,735,000 | | 5,735,000 |

| Detroit Econ. Dev. Corp. Resource Recovery Rev. Participating | | | | |

| VRDN Series Merlots 01 A90, 4.06% (Liquidity Facility | | | | |

| Wachovia Bank NA) (a)(b)(d) | | 2,500,000 | | 2,500,000 |

| Detroit Gen. Oblig.: | | | | |

| Bonds Series 2004 B, 5% 4/1/07 (FSA Insured) | | 1,285,000 | | 1,296,598 |

See accompanying notes which are an integral part of the financial statements.

23 Semiannual Report

| Fidelity Michigan Municipal Money Market Fund | | | | |

| Investments (Unaudited) continued | | | | | | |

| |

| Municipal Securities continued | | | | | | |

| | | Principal | | | | Value |

| | | Amount | | | | (Note 1) |

| Michigan – continued | | | | | | |

| Detroit Gen. Oblig.: – continued | | | | | | |

| TAN 4.5% 3/1/07, LOC Bank of Nova Scotia, New York | | | | | | |

| Agcy. | | $ 2,400,000 | | | | $ 2,411,995 |

| Detroit Swr. Disp. Rev. Participating VRDN: | | | | | | |

| Series AAB 05 3, 4.01% (Liquidity Facility ABN-AMRO Bank | | | | | | |

| NV) (a)(d) | | 6,500,000 | | | | 6,500,000 |

| Series Macon 02 G, 4.05% (Liquidity Facility Bank of | | | | | | |

| America NA) (a)(d) | | 8,520,000 | | | | 8,520,000 |

| Series Merlots 00 I, 4.01% (Liquidity Facility Wachovia Bank | | | | | | |

| NA) (a)(d) | | 9,300,000 | | | | 9,300,000 |

| Series Merlots 01 A103, 4.01% (Liquidity Facility Bank of | | | | | | |

| New York, New York) (a)(d) | | 9,985,000 | | | | 9,985,000 |

| Series Merlots 06 B1, 4.01% (Liquidity Facility Wachovia | | | | | | |

| Bank NA) (a)(d) | | 5,495,000 | | | | 5,495,000 |

| Series PA 1183, 4% (Liquidity Facility Merrill Lynch & Co., | | | | | | |

| Inc.) (a)(d) | | 5,000,000 | | | | 5,000,000 |

| Series ROC II R4014, 4.01% (Liquidity Facility Citigroup | | | | | | |

| Global Markets Hldgs., Inc.) (a)(d) | | 2,065,000 | | | | 2,065,000 |

| Series SGB 47, 4.01% (Liquidity Facility Societe | | | | | | |

| Generale) (a)(d) | | 5,800,000 | | | | 5,800,000 |

| Detroit Wtr. Supply Sys. Rev.: | | | | | | |

| Bonds: | | | | | | |

| Series B, 5.1% 7/1/07 (MBIA Insured) | | 1,000,000 | | | | 1,014,469 |

| Series PT 2587, 3.68%, tender 9/1/06 (Liquidity Facility | | | | | | |

| Dexia Cr. Local de France) (a)(d)(e) | | 3,260,000 | | | | 3,260,000 |

| Participating VRDN Series Merlots 00 D, 4.01% (Liquidity | | | | | | |

| Facility Wachovia Bank NA) (a)(d) | | 4,500,000 | | | | 4,500,000 |

| Detroit Wtr. Sys. Rev. Participating VRDN Series EGL 99 2202, | | | | | | |

| 4.02% (Liquidity Facility Citibank NA, New York) (a)(d) | | 8,200,000 | | | | 8,200,000 |

| East Lansing School District Gen. Oblig. Participating VRDN | | | | | | |

| Series SGA 114, 4.03% (Liquidity Facility Societe | | | | | | |

| Generale) (a)(d) | | 6,000,000 | | | | 6,000,000 |

| Ecorse Pub. School District Participating VRDN Series ROC II | | | | | | |

| R7520, 4.01% (Liquidity Facility Citibank NA) (a)(d) | | 5,635,000 | | | | 5,635,000 |

| Fitzgerald Pub. School District Participating VRDN Series | | | | | | |

| Putters 561, 4.01% (Liquidity Facility JPMorgan Chase | | | | | | |

| Bank) (a)(d) | | 4,990,000 | | | | 4,990,000 |

| Grand Rapids Econ. Dev. Corp. (Cornerstone Univ. Proj.) | | | | | | |

| 3.99%, LOC Nat’l. City Bank, VRDN (a) | | 1,800,000 | | | | 1,800,000 |

| Grand Rapids San. Swr. Sys. Rev. Impt. Participating VRDN | | | | | | |

| Series EGL 98 2201, 4.02% (Liquidity Facility Citibank | | | | | | |

| NA) (a)(d) | | 7,940,000 | | | | 7,940,000 |

See accompanying notes which are an integral part of the financial statements.

| Municipal Securities continued | | | | | | |

| | | Principal | | | | Value |

| | | Amount | | | | (Note 1) |

| Michigan – continued | | | | | | |

| Holland Charter Township Econ. Dev. Corp. Rev. (Chicago | | | | | | |

| Mission Proj.) 4.08%, LOC Comerica Bank, Detroit, | | | | | | |

| VRDN (a)(b) | | $ 2,335,000 | | | | $ 2,335,000 |

| Jonesville Cmnty. Schools Participating VRDN Series ROC II R | | | | | | |

| 7512, 4.01% (Liquidity Facility Citibank NA) (a)(d) | | 5,805,000 | | | | 5,805,000 |

| Kalamazoo Gen. Oblig. TAN 4.25% 12/1/06 | | 6,000,000 | | | | 6,023,244 |

| Lakeview School District Calhoun County Participating VRDN | | | | | | |

| Series PT 1624, 4% (Liquidity Facility Merrill Lynch & Co., | | | | | | |

| Inc.) (a)(d) | | 7,170,000 | | | | 7,170,000 |

| Michigan Bldg. Auth. Rev.: | | | | | | |

| Bonds (Facilities Prog.) Series I, 5.25% 10/15/06 (Escrowed | | | | | | |

| to Maturity) (c) | | 5,820,000 | | | | 5,843,611 |

| Participating VRDN: | | | | | | |

| Series AAB 03 35, 4.01% (Liquidity Facility ABN AMRO | | | | | | |

| Bank NV) (a)(d) | | 3,000,000 | | | | 3,000,000 |

| Series AAB 05 33, 4.01% (Liquidity Facility ABN AMRO | | | | | | |

| Bank NV) (a)(d) | | 5,995,000 | | | | 5,995,000 |

| Series EGL 01 2202, 4.02% (Liquidity Facility Citibank | | | | | | |

| NA, New York) (a)(d) | | 3,000,000 | | | | 3,000,000 |

| Series MS 00 481X, 4.01% (Liquidity Facility Morgan | | | | | | |

| Stanley) (a)(d) | | 2,670,000 | | | | 2,670,000 |

| Series ROC II R2064, 4.01% (Liquidity Facility Citigroup | | | | | | |

| Global Markets Hldgs., Inc.) (a)(d) | | 2,735,000 | | | | 2,735,000 |

| Series ROC II R4057, 4.01% (Liquidity Facility Citigroup | | | | | | |

| Global Markets Hldgs., Inc.) (a)(d) | | 2,200,000 | | | | 2,200,000 |

| Series ROC II R4551, 4.01% (Liquidity Facility Citigroup | | | | | | |

| Global Markets Hldgs., Inc.) (a)(d) | | 2,965,000 | | | | 2,965,000 |

| Series ROC II R550, 4.01% (Liquidity Facility Citibank | | | | | | |

| NA) (a)(d) | | 2,000,000 | | | | 2,000,000 |

| (Facilities Prog.) Series 2005 IIA, 3.98%, LOC DEPFA BANK | | | | | | |

| PLC, VRDN (a) | | 22,300,000 | | | | 22,300,000 |

| Michigan Gen. Oblig.: | | | | | | |

| Bonds Series 2005 C: | | | | | | |

| 3.65% tender 10/16/06 (Liquidity Facility DEPFA BANK | | | | | | |

| PLC), CP mode | | 7,100,000 | | | | 7,100,000 |

| 3.65% tender 10/16/06 (Liquidity Facility DEPFA BANK | | | | | | |

| PLC), CP mode | | 13,500,000 | | | | 13,500,000 |

| Participating VRDN Series PT 2021, 4% (Liquidity Facility | | | | | | |

| Merrill Lynch & Co., Inc.) (a)(d) | | 4,415,000 | | | | 4,415,000 |

| Michigan Higher Ed. Student Ln. Auth. Rev.: | | | | | | |

| Participating VRDN: | | | | | | |

Series LB 05 L20, 4.06% (Liquidity Facility Lehman | | | | | | |

Brothers Hldgs., Inc.) (a)(b)(d) 6,475,000 6,475,000 | | | | | | |

See accompanying notes which are an integral part of the financial statements.

25 Semiannual Report

| Fidelity Michigan Municipal Money Market Fund | | | | |

| Investments (Unaudited) continued | | | | | | |

| |

| Municipal Securities continued | | | | | | |

| | | | | Principal | | | | Value |

| | | | | Amount | | | | (Note 1) |

| Michigan – continued | | | | | | | | |

| Michigan Higher Ed. Student Ln. Auth. Rev.: – continued | | | | | | |

| Participating VRDN: | | | | | | | | |

| Series MS 1280, 4.04% (Liquidity Facility Morgan | | | | | | |

| Stanley) (a)(b)(d) | | | | $ 2,400,000 | | | | $ 2,400,000 |

| Series PA 1064, 4.04% (Liquidity Facility Merrill Lynch & | | | | | | |

| Co., Inc.) (a)(b)(d) | | | | 7,420,000 | | | | 7,420,000 |

| Series XII B, 4.03% (AMBAC Insured), VRDN (a)(b) | | 7,000,000 | | | | 7,000,000 |

| Michigan Hosp. Fin. Auth. Hosp. Rev.: | | | | | | | | |

| Bonds (Ascension Health Cr. Group Proj.) Series B, 5.3%, | | | | | | |

| tender 11/15/06 (a) | | | | 10,000,000 | | | | 10,058,754 |

| Participating VRDN Series ROC II R 588 CE, 4.02% | | | | | | |

| (Liquidity Facility Citibank NA) (a)(d) | | | | 6,405,000 | | | | 6,405,000 |

| (Health Care Equip. Ln. Prog.): | | | | | | | | |

| Series B, 4%, LOC Lasalle Bank Midwest NA, VRDN (a) | | 1,600,000 | | | | 1,600,000 |

| Series C, 4%, LOC Fifth Third Bank, Cincinnati, VRDN (a) . | | 7,500,000 | | | | 7,500,000 |

| Michigan Hosp. Fin. Auth. Rev. Series B, 4%, LOC Lasalle Bank | | | | | | |

| Midwest NA, VRDN (a) | | | | 3,600,000 | | | | 3,600,000 |

| Michigan Hsg. Dev. Auth. Multi-family Hsg. Rev. (Hunt Club | | | | | | |

| Apts. Proj.) 4.02%, LOC Fannie Mae, VRDN (a)(b) | | 5,595,000 | | | | 5,595,000 |

| Michigan Hsg. Dev. Auth. Rental Hsg. Rev.: | | | | | | |

| Series 2000 A, 4.02% (MBIA Insured), VRDN (a)(b) | | 3,190,000 | | | | 3,190,000 |

| Series 2002 A, 4.04% (MBIA Insured), VRDN (a)(b) | | 9,800,000 | | | | 9,800,000 |

| Series 2004 A, 4.02% (FGIC Insured), VRDN (a)(b) | | 5,000,000 | | | | 5,000,000 |

| Michigan Hsg. Dev. Auth. Single Family Mtg. Rev.: | | | | | | |

| Series 1999 B2, 4.03% (MBIA Insured), VRDN (a)(b) | | 3,400,000 | | | | 3,400,000 |

| Series 2002 A, 4.03% (MBIA Insured), VRDN (a)(b) | | 5,085,000 | | | | 5,085,000 |

| Series B, 4.06% (Liquidity Facility DEPFA BANK PLC), | | | | | | |

| VRDN (a)(b) | | | | 7,200,000 | | | | 7,200,000 |

| Michigan Muni. Bond Auth. Rev.: | | | | | | | | |

| Participating VRDN: | | | | | | | | |

| Series EGL 00 2201, 4.02% (Liquidity Facility Citibank | | | | | | |

| NA, New York) (a)(d) | | | | 3,500,000 | | | | 3,500,000 |

| Series MS 718, 4.01% (Liquidity Facility Morgan | | | | | | |

| Stanley) (a)(d) | | | | 26,144,500 | | | | 26,144,500 |

| Series MSTC 02 204, 4.03% (Liquidity Facility Bear | | | | | | |

| Stearns Companies, Inc.) (a)(d) | | | | 10,395,000 | | | | 10,395,000 |

| Series ROC II R 339, 4.01% (Liquidity Facility Citibank | | | | | | |

| NA) (a)(d) | | | | 12,985,000 | | | | 12,985,000 |

| RAN Series C, 4.25% 8/18/06, LOC JPMorgan Chase Bank | | 9,400,000 | | | | 9,405,323 |

| Michigan Strategic Fund Indl. Dev. Rev. (Althaus Family | | | | | | |

| Investors II Proj.) Series 1997, 4.27%, LOC Huntington Nat’l. | | | | | | |

| Bank, Columbus, VRDN (a) | | | | 1,720,000 | | | | 1,720,000 |

| |

| See accompanying notes which are an integral part of the financial statements. | | | | |

| |

| Semiannual Report | | 26 | | | | | | |

| Municipal Securities continued | | | | | | |

| | | Principal | | | | Value |

| | | Amount | | | | (Note 1) |

| Michigan – continued | | | | | | |

| Michigan Strategic Fund Ltd. Oblig. Rev.: | | | | | | |

| Bonds (Dow Chemical Co. Proj.) 3.45% tender 7/3/06, CP | | | | | | |

| mode (b) | | $ 5,900,000 | | | | $ 5,900,000 |

| Participating VRDN Series Putters 858Z, 4.04% (Liquidity | | | | | | |

| Facility JPMorgan Chase Bank) (a)(b)(d) | | 12,170,000 | | | | 12,170,000 |

| (BC&C Proj.) 4.12%, LOC Comerica Bank, Detroit, | | | | | | |

| VRDN (a)(b) | | 1,405,000 | | | | 1,405,000 |

| (Biewer of Lansing LLC Proj.) Series 1999, 4.11%, LOC | | | | | | |

| Lasalle Bank Midwest NA, VRDN (a)(b) | | 965,000 | | | | 965,000 |

| (Bosal Ind. Proj.) Series 1998, 4.1%, LOC Bank of New | | | | | | |

| York, New York, VRDN (a)(b) | | 7,500,000 | | | | 7,500,000 |

| (CJS Properties LLC Proj.) 4.25%, LOC JPMorgan Chase | | | | | | |

| Bank, VRDN (a)(b) | | 1,700,000 | | | | 1,700,000 |

| (Conti Properties LLC Proj.) Series 1997, 4.12%, LOC | | | | | | |

| Comerica Bank, Detroit, VRDN (a)(b) | | 2,380,000 | | | | 2,380,000 |

| (Creative Foam Corp. Proj.) 4.25%, LOC JPMorgan Chase | | | | | | |

| Bank, VRDN (a)(b) | | 600,000 | | | | 600,000 |

| (Doss Ind. Dev. Co. Proj.) 4.25%, LOC JPMorgan Chase | | | | | | |

| Bank, VRDN (a)(b) | | 1,400,000 | | | | 1,400,000 |

| (Fintex LLC Proj.) Series 2000, 4.12%, LOC Comerica Bank, | | | | | | |

| Detroit, VRDN (a)(b) | | 1,705,000 | | | | 1,705,000 |

| (Future Fence Co. Proj.) 4.12%, LOC Comerica Bank, | | | | | | |

| Detroit, VRDN (a)(b) | | 2,330,000 | | | | 2,330,000 |

| (Holland Home Oblig. Group Proj.) 4.02%, LOC Huntington | | | | | | |

| Nat’l. Bank, Columbus, VRDN (a) | | 1,000,000 | | | | 1,000,000 |

| (Holland Plastics Corp. Proj.) 4.08%, LOC Lasalle Bank NA, | | | | | | |

| VRDN (a)(b) | | 4,000,000 | | | | 4,000,000 |

| (John H. Dekker & Sons Proj.) Series 1998, 4.11%, LOC | | | | | | |

| Lasalle Bank Midwest NA, VRDN (a)(b) | | 915,000 | | | | 915,000 |

| (K&M Engineering, Inc. Proj.) 4.12%, LOC Comerica Bank, | | | | | | |

| Detroit, VRDN (a)(b) | | 1,440,000 | | | | 1,440,000 |

| (LPB LLC Proj.) 4.25%, LOC Comerica Bank, Detroit, | | | | | | |

| VRDN (a)(b) | | 2,300,000 | | | | 2,300,000 |

| (Majestic Ind., Inc. Proj.) 4.12%, LOC Comerica Bank, | | | | | | |

| Detroit, VRDN (a)(b) | | 1,895,000 | | | | 1,895,000 |

| (Mans Proj.) Series 1998, 4.12%, LOC Comerica Bank, | | | | | | |

| Detroit, VRDN (a)(b) | | 1,380,000 | | | | 1,380,000 |

| (Mid-American Products, Inc. Proj.) Series 1998 4.08%, LOC | | | | | | |

| Comerica Bank, Detroit, VRDN (a)(b) | | 1,230,000 | | | | 1,230,000 |

| (Orchestra Place Renewal Proj.) Series 2000, 3.98%, LOC | | | | | | |

| ABN AMRO Bank NV, VRDN (a) | | 2,000,000 | | | | 2,000,000 |

| (PBL Enterprises, Inc. Proj.) Series 1997, 4.12%, LOC | | | | | | |

| Comerica Bank, Detroit, VRDN (a)(b) | | 1,745,000 | | | | 1,745,000 |

See accompanying notes which are an integral part of the financial statements.

27 Semiannual Report

| Fidelity Michigan Municipal Money Market Fund | | | | |

| Investments (Unaudited) continued | | | | | | |

| |

| Municipal Securities continued | | | | | | |

| | | Principal | | | | Value |

| | | Amount | | | | (Note 1) |

| Michigan – continued | | | | | | |

| Michigan Strategic Fund Ltd. Oblig. Rev.: – continued | | | | | | |

| (Pioneer Laboratories, Inc. Proj.) 4.05%, LOC JPMorgan | | | | | | |

| Chase Bank, VRDN (a)(b) | | $ 2,200,000 | | | | $ 2,200,000 |

| (S&S LLC Proj.) Series 2000, 4.22%, LOC Lasalle Bank | | | | | | |

| Midwest NA, VRDN (a)(b) | | 2,325,000 | | | | 2,325,000 |

| (SBC Ventures LLC Proj.) 4.12%, LOC Comerica Bank, | | | | | | |

| Detroit, VRDN (a)(b) | | 4,000,000 | | | | 4,000,000 |

| (TEI Invts. LLC Proj.) Series 1997, 4.12%, LOC Comerica | | | | | | |

| Bank, Detroit, VRDN (a)(b) | | 600,000 | | | | 600,000 |

| (Temperance Enterprise Proj.) Series 1996, 4.14%, LOC | | | | | | |

| Nat’l. City Bank, VRDN (a)(b) | | 1,680,000 | | | | 1,680,000 |

| (The Spiratex Co. Proj.) Series 1994, 4.3%, LOC JPMorgan | | | | | | |

| Chase Bank, VRDN (a)(b) | | 800,000 | | | | 800,000 |

| (The Van Andel Research Institute Proj.) Series 1999, 4%, | | | | | | |

| LOC Lasalle Bank Midwest NA, VRDN (a) | | 5,000,000 | | | | 5,000,000 |

| (Trilan LLC Proj.) 4.25%, LOC JPMorgan Chase Bank, | | | | | | |

| VRDN (a)(b) | | 3,600,000 | | | | 3,600,000 |

| (W.H. Porter, Inc. Proj.) Series 2001, 4.12%, LOC Comerica | | | | | | |

| Bank, Detroit, VRDN (a)(b) | | 2,775,000 | | | | 2,775,000 |

| (Windcrest Properties LLC Proj.) 4.13%, LOC Comerica | | | | | | |

| Bank, Detroit, VRDN (a)(b) | | 3,900,000 | | | | 3,900,000 |

| (YMCA Metropolitan Detroit Proj.) Series 2001, 4.02%, LOC | | | | | | |

| JPMorgan Chase Bank, VRDN (a) | | 12,175,000 | | | | 12,175,000 |

| Michigan Strategic Fund Rev. (Rest Haven Christian Services | | | | | | |

| Proj.) Series A, 4%, LOC KBC Bank NV, VRDN (a) | | 3,195,000 | | | | 3,195,000 |

| Michigan Strategic Fund Solid Waste Disp. Rev.: | | | | | | |

| Participating VRDN Series LB 05 F11, 4.11% (Lehman | | | | | | |

| Brothers Hldgs., Inc. Guaranteed) (Liquidity Facility | | | | | | |

| Lehman Brothers Hldgs., Inc.) (a)(b)(d) | | 5,000,000 | | | | 5,000,000 |

| (Grayling Gen. Station Proj.) Series 1990, 4.01%, LOC | | | | | | |

| Barclays Bank PLC, VRDN (a)(b) | | 8,197,000 | | | | 8,197,000 |

| Michigan Technological Univ. Series A, 3.97% (AMBAC | | | | | | |

| Insured), VRDN (a) | | 7,100,000 | | | | 7,100,000 |

| Michigan Trunk Line Fund Participating VRDN Series Clipper | | | | | | |

| 05 27, 4.01% (Liquidity Facility State Street Bank & Trust | | | | | | |

| Co., Boston) (a)(d) | | 6,500,000 | | | | 6,500,000 |

| Oakland County Econ. Dev. Corp. Ltd. Oblig. Rev.: | | | | | | |

| (Osmic, Inc. Proj.) Series 2001 A, 4.08%, LOC JPMorgan | | | | | | |

| Chase Bank, VRDN (a)(b) | | 6,300,000 | | | | 6,300,000 |

| (Progressive Metal Manufacturing Co. Proj.) 4.12%, LOC | | | | | | |

| Comerica Bank, Detroit, VRDN (a)(b) | | 4,000,000 | | | | 4,000,000 |

| Saint Clair County Econ. Dev. Corp. Poll. Cont. Rev. | | | | | | |

| Participating VRDN Series MS 00 282, 4.01% (Liquidity | | | | | | |

| Facility Morgan Stanley) (a)(d) | | 11,895,000 | | | | 11,895,000 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report 28

| Municipal Securities continued | | | | | | |

| | | | | Principal | | Value |

| | | | | Amount | | (Note 1) |

| Michigan – continued | | | | | | |

| Sanilac County Econ. Dev. Corp. (Marlette Cmnty. Hosp. Proj.) | | | | |

| Series 2001, 4.02%, LOC JPMorgan Chase Bank, VRDN (a) | | $ 11,910,000 | | $ 11,910,000 |

| Univ. of Michigan Univ. Revs. 3.55% 10/2/06, CP | | | | 10,000,000 | | 10,000,000 |

| Van Buren Township Local Dev. Fin. Auth. Participating VRDN | | | | | | |

| Series ROC 4518, 4.01% (Liquidity Facility Citigroup Global | | | | |

| Markets Hldgs., Inc.) (a)(d) | | | | 7,650,000 | | 7,650,000 |

| Waterford Econ. Dev. Corp. Ltd. Oblig. Rev. (Canterbury | | | | | | |

| Health Care, Inc. Proj.) 4.02%, LOC KBC Bank NV, | | | | | | |

| VRDN (a) | | | | 6,600,000 | | 6,600,000 |

| Wayne County Arpt. Auth. Rev. Participating VRDN: | | | | | | |

| Series EGL 06 16 Class A, 4.06% (Liquidity Facility Citibank | | | | |

| NA) (a)(b)(d) | | | | 4,950,000 | | 4,950,000 |

| Series EGL 720053029 Class A, 4.06% (Liquidity Facility | | | | | | |

| Citibank NA) (a)(b)(d) | | | | 6,600,000 | | 6,600,000 |

| Series Floaters 06 32, 4.04% (Liquidity Facility Goldman | | | | | | |

| Sachs Group, Inc.) (a)(b)(d) | | | | 8,300,000 | | 8,300,000 |

| Series Macon 05 T, 4.05% (Liquidity Facility Bank of | | | | | | |

| America NA) (a)(b)(d) | | | | 3,640,000 | | 3,640,000 |

| Series MT 115, 4.05% (Liquidity Facility Svenska | | | | | | |

| Handelsbanken AB) (a)(b)(d) | | | | 6,100,000 | | 6,100,000 |

| Series MT 203, 4.05% (Liquidity Facility Merrill Lynch & Co., | | | | |

| Inc.) (a)(b)(d) | | | | 6,500,000 | | 6,500,000 |

| Series Putters 1081Z, 4.04% (Liquidity Facility JPMorgan | | | | | | |

| Chase Bank) (a)(b)(d) | | | | 2,750,000 | | 2,750,000 |

| Series Putters 836, 4.04% (Liquidity Facility JPMorgan Chase | | | | |

| & Co.) (a)(b)(d) | | | | 6,075,000 | | 6,075,000 |

| Series ROC II R 9009, 4.06% (Liquidity Facility Citigroup, | | | | | | |

| Inc.) (a)(b)(d) | | | | 4,560,000 | | 4,560,000 |

| Series ROC II R442, 4.05% (Liquidity Facility Citibank | | | | | | |

| NA) (a)(b)(d) | | | | 6,795,000 | | 6,795,000 |