| | |

OMB APPROVAL |

OMB Number: | | 3235-0570 |

| |

Expires: | | Nov. 30, 2005 |

|

Estimated average burden |

hours per response: | | 5.0 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-3254

Strong Large Cap Growth Fund, Inc., on behalf of Strong Large Cap Growth Fund

(Exact name of registrant as specified in charter)

| | |

| P.O. Box 2936 Milwaukee, WI | | 53201 |

| (Address of principal executive offices) | | (Zip code) |

Richard Smirl, Strong Capital Management, Inc.

P.O. Box 2936 Milwaukee, WI 53201

(Name and address of agent for service)

Registrant’s telephone number, including area code: (414) 359-3400

Date of fiscal year end: December 31

Date of reporting period: June 30, 2004

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. (S) 3507.

Item 1. Reports to Shareholders

Semiannual Report | June 30, 2004

Strong

Growth

Funds

| | |

| Strong Blue Chip Fund | | |

| Strong Discovery Fund | | |

| Strong Endeavor Fund | | |

Strong Large Cap Growth Fund | | |

Strong U.S. Emerging Growth Fund | | |

Strong Enterprise Fund | | |

Strong Growth 20 Fund | | |

Strong Growth Fund | | |

Strong Large Company Growth Fund | | |

|

| SEMIANNUAL REPORT | June 30, 2004 |

Strong

Growth

Funds

Table of Contents

| | |

Market Update From Dick Weiss January 1, 2004, to June 30, 2004 | | |

| |

| | |

Uncertainty is the Enemy

In our last report back in January, the overall U.S. economy displayed definite signs of strengthening — job growth was gaining momentum, and consumer confidence was on the rise. There was some muffled muttering about deflation, but it lacked enough conviction to cause alarm. All in all, it looked like a relatively promising picture.

Six months out, things seem not quite so sanguine. Fears of inflation have replaced the whispers of deflation, and the Federal Reserve has begun what doubtless will be a series of rate hikes well into 2005. While the overall economy has exceeded expectations, the good news on that front has not been sufficient to overshadow a host of uncertainties in the military and political worlds.

Before we address those uncertainties, let’s devote a moment to the topic of inflation. In the history of markets, there seems to be a point at which a rising rate of inflation causes the market’s price-to-earnings ratios to contract. Historically, that point would be around seven percent. While it seems highly unlikely that the inflation rate is going to get anywhere near that mark in the foreseeable future, there is some suggestion that nowadays, because of the way the Consumer Price Index is calculated, that number could be closer to five percent. If that is indeed a more realistic calculation, it’s possible that we could hit five percent inflation and a negative impact on stock valuations.

In my estimation though, the prospect for serious inflation pales in comparison to other uncertainties currently plaguing the market (e.g., the outcome of the U.S. presidential race this fall and the continuing political fallout surrounding Iraq).

With regard to the War on Terrorism and the issue of Iraq, investors are faced every day with news that can give them pause. While the war seems to be on track, the outcome in Iraq is dependent on how rapidly that nation can defeat the insurgents and restore the rule of law now that the Iraqis themselves have taken charge. We believe that expectations may be too low in that regard.

On the political front, the market seemed to peak around the moment when Democratic candidate Senator John Kerry pulled even with President George W. Bush in the polls. Nothing makes the prospects for economic prosperity harder to decipher than a presidential race featuring two candidates with widely differing views on virtually every issue domestically and internationally. For the stock market, that spells uncertainty with a capital U.

We believe stock valuations today are neither cheap, nor particularly overvalued based upon earnings projections for 2005. They are, rather, sort of stuck somewhere in the middle. In order for stocks to start moving in a positive direction, the market needs an injection of confidence. So the relevant question becomes, in short: What needs to happen in order to inspire that sense of confidence?

The answer? In a word — clarity.

On the inflation front, we anticipate clarity will not come for some time. We expect the Federal Reserve will continue to raise rates until it gets ahead of the inflation curve. It’s unclear just how many hikes and of what magnitude will accomplish that. Nonetheless, if inflationary fears were the single biggest element of uncertainty out there today, we would feel confident that the problem could be contained.

The fate of Iraq and the outcome of the presidential election loom larger and seem far more complicated. If the public perceives that progress is being made in Iraq and democracy will indeed triumph, the market will likely anticipate the reelection of President Bush. If the daily diagnosis on Iraq is less favorable, the political uncertainty weighing on the market will continue for the next several months.

Notwithstanding all the ambiguity, we are beginning to see corners of the market where good values are emerging. Energy has been one of the more promising areas and should continue to benefit from strong fundamentals. Even in the areas of the technology sector, where we believe stocks have been chronically overvalued, values have begun to return to earth. There are even some computer software companies that look attractive to us.

In order for stocks to start moving in a positive direction, the market needs an injection of confidence.

In stock-picker parlance, what we have today is a market of individual stocks rather than — as we saw in 2003 — a rising stock market. In the former, money is a lot harder to make; in the latter, the rising tide seems to lift all issues almost indiscriminately.

We believe the market should continue this year’s trend, which is a much more value- and fundamentals-oriented market. Make no mistake: this is not a “story” market where people dream about distant possibilities and, on the strength of those illusions, stocks soar to 100 times earnings. This is a market where, if you do your homework and stick to what is real rather than imagined, we think you can discover common stocks worth owning.

Given all the uncertainty that exists in the world, there are practical limits to just how high the market can go. But with an economy that continues to show strength and interest rates still on the low side, there are also practical limits to how low the market can go. That environment should favor professional investors who exhibit good discipline in both their buy and sell decisions.

One final piece of practical advice: when uncertainty is the order of the day, resist doing anything dramatic with your money. Sometimes the “muddle-through” approach proves best.

... if you do your homework and stick to what is real rather than imagined, we think you can uncover common stocks worth owning.

|

Richard T. Weiss |

Vice Chairman |

Strong Financial Corporation |

Strong Blue Chip Fund

After a strong 2003, equity markets cooled somewhat in the first half of 2004, though economic growth continued. Against this backdrop, the Strong Blue Chip Fund posted a return of 3.96% for the six months ended June 30, 2004. This placed it slightly ahead of its broad-based benchmark, the S&P 500 Index, which returned 3.44% for the same period.

Stocks moved in a narrow range

While equity markets have at times been volatile during the first half of 2004, for the most part the S&P 500 has been caught in a trading range, with stocks fluctuating within a relatively narrow band. While it is not unusual for stocks to take a breather following the type of large gains they saw last year, other factors have played a role in muting equity returns. These factors included the continuing situation in Iraq, impending Federal Reserve interest-rate hikes, high energy prices, and worries about the impact of slowing Chinese growth on the Asian regional and global economies.

April was a particularly challenging month for the markets and the Fund. At that point, a sharp improvement in employment data sparked fears that the economic recovery would spark a new round of inflation and lead to substantially higher interest rates. These concerns were aggravated by the fact that it was not clear when, and to what extent, the Federal Reserve might raise rates. This turn in market sentiment was exaggerated, in our view, driven more by emotion than by any true need for concern. Because the Fund had significant positions in stocks most likely to be negatively affected by such concerns, our performance suffered during this time.

Investor sentiment began to improve somewhat near the end of May, as the market once again focused its attention on the good news regarding strong corporate profits and new job creation. Equities in the portfolio that had been hurt by investors’ concerns in April had largely stabilized and recovered by the end of the period.

Stocks that helped performance

Two of the Fund’s stronger performers came from the Internet sector: Yahoo! and eBay. Yahoo! benefited from continued gains in market share for its Internet search feature, as well as growth in its online advertising. eBay benefited from good growth in its core business, online auction listings. Although they have already performed quite well, we believed the strong fundamentals of these companies justified continuing to own them in the Fund.

Holdings in the energy sector also made a positive contribution to the Fund’s performance. Within this arena, we made our largest investments in large, integrated oil companies, which benefited from higher demand for oil, strong margins on refining operations, and low debt levels that helped to mute the impact of rising interest rates. In our assessment, these companies remain reasonably priced. Many projections of their earnings — and thus estimates of appropriate valuations — are based on an assumption that oil prices may decline significantly in coming months; we are not convinced that prices will in fact drop soon. Should they stay at more elevated levels, these companies’ earnings could rise further. We are confident that even at these higher levels, oil prices are not so high as to put a severe crimp in economic growth. Energy consumption per unit of Gross Domestic Product (GDP) is dramatically lower than it was in the 1970s, indicating a level of efficiency that allows the economy to absorb higher prices.

Our investment outlook

We anticipate that investor sentiment should continue to improve in coming months, in keeping with the generally positive economic environment we see. GDP has been growing steadily for ten consecutive quarters, and we believe there is plenty of reason to expect the recovery to be sustained for some time to come. Corporate earnings are also strong. Including the fourth quarter of 2003, the S&P 500 companies have experienced two consecutive quarters of year-over-year earnings growth well in excess of 20%, with another similar gain expected for the second quarter of 2004.

We anticipate that the positive data surrounding corporate profits, job creation, and economic activity should in time be sufficient to help the equity markets break out of their trading range.

Thank you for your investment in the Strong Blue Chip Fund.

|

| Karen E. McGrath |

| Portfolio Manager |

2

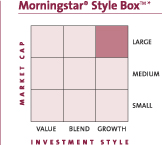

Fund Highlights

Average Annual Total Returns

As of 6-30-04

| | | |

Investor Class

| | | |

1-year | | 22.07 | % |

5-year | | –6.87 | % |

Since Fund Inception (6-30-97) | | 3.06 | % |

Performance is historical and does not guarantee future results. Investment returns and principal value will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most recent month-end performance.

Risks: Stock funds should only be considered for long-term goals as values fluctuate in response to the activities of individual companies and general market and economic conditions.

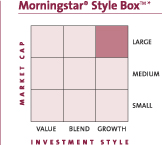

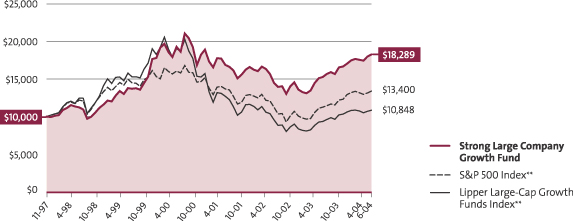

Growth of an Assumed $10,000 Investment†

from 6-30-97 to 6-30-04

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

| * | The Morningstar Style Box™ reveals a fund’s investment strategy. For equity funds, the vertical axis shows the market capitalization of the stocks owned and the horizontal axis shows investment style (value, blend, or growth). |

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the S&P 500 Index and the Lipper Large-Cap Growth Funds Index. Results include the reinvestment of all dividends and capital gains distributions. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

Fee Waivers: From time to time, the Fund’s advisor and/or administrator has waived fees and/or absorbed Fund expenses, which has resulted in higher returns. As of 6-30-04, there are waivers and/or absorptions in effect.

Percentage Restrictions: The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

Definitions: **The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index (stock price times number of shares outstanding), with each stock’s weight in the Index proportionate to its market value. The Lipper Large-Cap Growth Funds Index is the average of the 30 largest funds in the Lipper Large-Cap Growth Funds Category. Source of the S&P Index data is Standard & Poor’s Micropal. Source of the Lipper Index data is Lipper.

It is not possible to invest directly in an index.

3

Strong Discovery Fund

During the first half of 2004, the Strong Discovery Fund gained 5.47%. This return fell short of the Fund’s broad-based benchmark, the Russell 2000 Index, which rose 6.76% during the same time frame.

The underperformance can be partly attributed to disappointing results from Select Medical Corporation, a health-care equipment company. The stock fell after the government proposed some changes to how health-care providers would be reimbursed for Medicare claims. In response to the decline, we sold our position in Select Medical during the period — though, unfortunately, not soon enough to avoid a negative impact on the portfolio. A tendency of growth investments to lag their value counterparts during the past six months also hurt relative performance. These negative influences were counterbalanced by positive performance from the Fund’s consumer discretionary and telecommunications holdings.

Concern about interest rates and inflation

Continued growth in corporate profits and operating margins helped support further increases in stock prices during the first six months of 2004, although these gains were much less robust than those realized in 2003. As the stock recovery continued to take hold, investors began to look ahead to the potential for higher interest rates, more inflation, and continued high energy prices — all factors that could limit equity returns in the future. Interest rates were a particular concern; the threat of further rate hikes from the Federal Reserve Board kept a ceiling on corporate valuations, even as the companies reported solid first-quarter profits.

Supporting our investment thesis

Our approach to portfolio management relies on the careful selection of individual securities through collaborative research. We strive to “surround” each company that we consider for investment. In other words, our team of portfolio managers and analysts interviews not only the companies’ management, but also their competitors, suppliers, and customers. We want to acquire unique insights to support — or reject, in the cases of companies that fail to meet our strict requirements — our investment thesis for each individual stock.

Applying this research approach, the Fund held a position in PETsMART, the country’s largest retailer of pet supplies and services. We believed that PETsMART, with more than 650 stores in 59 of the nation’s top 60 markets and with new sales initiatives underway, would continue to produce strong revenue growth. We were attracted to PETsMART’s strategy to further expand revenue by offering grooming, training, and veterinary services at more of its retail locations. These services are highly profitable for the company and have been increasing revenues at an annual pace of 25%. Furthermore, these services have been well received by customers and have helped generate more store visits. Thanks in part to PETsMART’s impressive revenue growth during the period, the company’s stock contributed positively to the Fund’s performance.

Another important holding for the Fund was Crown Castle International, which owns and leases towers and transmission networks for wireless communications systems. Our industry research revealed that wireless carriers have two top priorities: 1) improving the voice quality on their communications networks; and 2) rolling out next-generation networks to enable subscribers to access online services at high speeds. Competition between carriers has become increasingly fierce, however, and as the companies acquire ever more customers, they must continue to upgrade and expand their networks to meet the increased demand. We believed that Crown Castle was in a strong position to capitalize on these trends. As the nation’s second largest wireless tower operator, the company has a presence in nearly three-quarters of the 100 largest markets in the United States. During the period, Crown Castle’s strong competitive position led to impressive growth in the company’s free-cash flow (cash flow after expenses).

A market shift ahead?

Although corporate earnings and profitability are expected to continue to rise, we believe that stock valuations are already reflecting these likely trends. Thus, we are looking for gains from this point to be produced by a select group of high-quality stocks with predictable earnings. Against this backdrop, we plan to focus on companies with promising opportunities to reinvest in their core business to generate stable revenue and profit growth, and the ability to keep prices high in a competitive business environment. We believe the Fund is well positioned for an environment that rewards quality, as the Fund generally invests in high-quality, small- and mid-cap names.

Thank you for your investment in the Strong Discovery Fund. We appreciate the trust you have placed in our team.

| | |

| Thomas J. Pence | | James M. Leach |

Portfolio Co-Manager | | Portfolio Co-Manager |

4

Fund Highlights

Average Annual Total Returns

As of 6-30-04

| | | |

Investor Class

| | | |

1-year | | 29.56 | % |

5-year | | 9.00 | % |

10-year | | 9.65 | % |

Since Fund Inception (12-31-87) | | 12.53 | % |

Performance is historical and does not guarantee future results. Investment returns and principal value will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most recent month-end performance.

Risks: Stock funds should only be considered for long-term goals as values fluctuate in response to the activities of individual companies and general market and economic conditions.

Because smaller companies often have narrower markets and limited financial resources, investments in these stocks present more risk than investments in those of larger, more established companies.

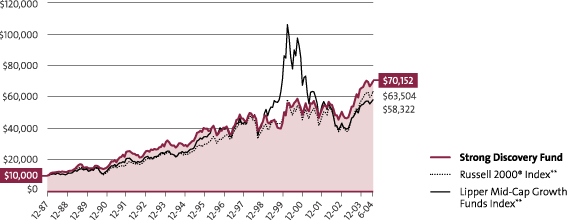

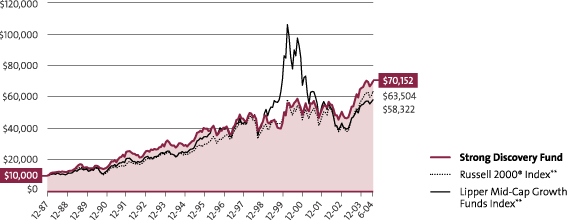

Growth of an Assumed $10,000 Investment†

from 12-31-87 to 6-30-04

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

| * | The Morningstar Style Box™ reveals a fund’s investment strategy. For equity funds, the vertical axis shows the market capitalization of the stocks owned and the horizontal axis shows investment style (value, blend, or growth). |

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the Russell 2000® Index and the Lipper Mid-Cap Growth Funds Index. Results include the reinvestment of all dividends and capital gains distributions. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

Fee Waivers: From time to time, the Fund’s advisor and/or administrator has waived fees and/or absorbed Fund expenses, which has resulted in higher returns. As of 6-30-04, there are waivers and/or absorptions in effect.

Percentage Restrictions: The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

Definitions: **The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index, which represents approximately 8% of the total market capitalization of the Russell 3000® Index. The Lipper Mid-Cap Growth Funds Index is the average of the 30 largest funds in the Lipper Mid-Cap Growth Funds Category. Source of the Russell Index data is Standard & Poor’s Micropal. Source of the Lipper Index data is Lipper. It is not possible to invest directly in an index.

5

Strong Endeavor Fund

During the first half of 2004, the Strong Endeavor Fund gained 4.72%, outpacing its broad-based benchmark, the S&P 500 Index, which rose 3.44%. During the year, the Endeavor Fund was positioned in companies that were poised to deliver strong profit growth relative to the broad market. Specifically, the Fund’s strong returns were driven by holdings in the industrial, health care, and information technology sectors.

“Surrounding” our investments

Our approach to portfolio management relies on the careful selection of individual securities through collaborative research. We strive to “surround” each company that we consider for investment. In other words, our team of portfolio managers and analysts interviews not only the company’s management, but also its competitors, suppliers, and customers. We want to acquire unique insights to support — or reject, in the cases of companies that do not meet our strict requirements — our investment thesis for each individual stock.

Our investment process also emphasizes financial analysis, including a careful review of corporate income statements as well as the assets on corporate balance sheets. We believe that a company’s balance sheet provides the best way to forecast that business’s future results. We are especially interested in determining the sources of revenue and earnings. We also pay close attention to cash flow and how much investment will be required to generate future cash flow and earnings growth.

Opportunities in Teva and Tyco

Applying our approach, we reviewed a number of potential investment opportunities in the health care sector during the period. As our research progressed, we became concerned about the lack of new products forthcoming by many large-cap pharmaceutical companies, as well as the considerable number of drugs due to lose their patent protection in the near future. Accordingly, we maintained little exposure to these “name-brand” pharmaceutical businesses. Instead we built a position in Teva Pharmaceutical, the world’s leading developer and manufacturer of generic drugs as well as a supplier of a growing line of branded drugs.

We believed Teva had an outstanding competitive position, as the company dominated the generic drug market in the United States. In addition, Teva’s management team has shown a consistent ability to execute its business strategy, made evident by the company’s track record of stable and diversified earnings. Furthermore, Teva has an impressive pipeline of upcoming products, with over 80 applications for new drugs pending regulatory approval in the U.S. alone. The company also has shown success with its branded drug offerings, such as Copaxone, well on its way to becoming the leading treatment for multiple sclerosis in the United States. Thanks to these strong business trends, Teva has been able to produce solid revenue and earnings growth, and the stock was a significant contributor to the Fund’s performance during the past six months.

We used a similarly careful analysis to increase our position in Tyco International, a company recently beset by a number of questions about its accounting and corporate governance practices. We started evaluating Tyco after the company installed a new senior management team. Soon, we began to see evidence of a significant cultural and financial transformation. Thanks to its new leadership, Tyco has moved from a struggling organization into a company that is increasingly recognized for its impressive cash-flow-generation potential. We grew confident in Tyco’s ability to generate growth through its market-leading positions in health care, fire and security products, and electronics. During the past six months, our position in this stock provided a strong contribution to the Fund’s returns.

Market shift ahead?

We are looking for the second half of 2004 to be a more challenging environment for the market than the first half was. As corporate profits continue to grow, the rate of growth will eventually slow down as companies find it more difficult to surpass prior results. Also, the expectation for further increases in interest rates will place a cap on equity valuations — leaving only limited additional upside potential, in our view. In this environment, we expect the market to begin to reward higher-quality companies with highly predictable earnings and recurring revenues.

Thank you for your investment in the Strong Endeavor Fund. We sincerely appreciate the trust you have placed in us.

Thomas J. Pence

Portfolio Manager

6

Fund Highlights

Average Annual Total Returns

As of 6-30-04

| | | |

Investor Class

| | | |

1-year | | 22.00 | % |

Since Fund Inception (4-6-01) | | –0.75 | % |

Performance is historical and does not guarantee future results. Investment returns and principal value will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most recent month-end performance.

Risks: Stock funds should only be considered for long-term goals as values fluctuate in response to the activities of individual companies and general market and economic conditions.

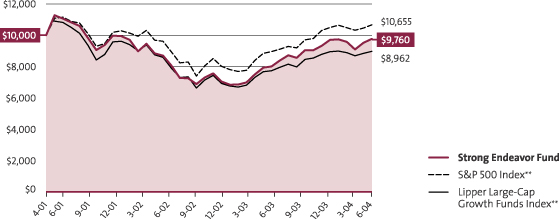

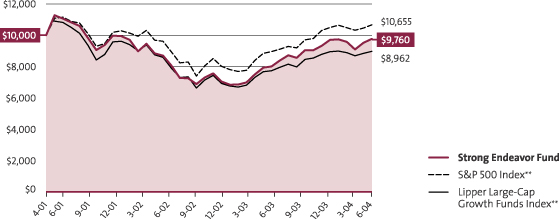

Growth of an Assumed $10,000 Investment†

from 4-6-01 to 6-30-04

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

| * | The Morningstar Style BoxTM reveals a fund’s investment strategy. For equity funds, the vertical axis shows the market capitalization of the stocks owned and the horizontal axis shows investment style (value, blend, or growth). |

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with a similar investment in the S&P 500 Index and the Lipper Large-Cap Growth Funds Index. Results include the reinvestment of all dividends and capital gains distributions. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. To equalize time periods, the indices’ performances were prorated for the month of April 2001. |

Fee Waivers: From time to time, the Fund’s advisor and/or administrator has waived fees and/or absorbed Fund expenses, which has resulted in higher returns. As of 6-30-04, there are waivers and/or absorptions in effect.

Percentage Restrictions: The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

Definitions: **The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index (stock price times number of shares outstanding), with each stock’s weight in the Index proportionate to its market value. The Lipper Large-Cap Growth Funds Index is the average of the 30 largest funds in the Lipper Large-Cap Growth Funds Category. Source of the S&P Index data is Standard & Poor’s Micropal. Source of the Lipper Index data is Lipper.

It is not possible to invest directly in an index.

7

Strong Large Cap Growth Fund

The first half of 2004 ended on a positive note for investors in the Strong Large Cap Growth Fund. The Fund performed in line with its broad-based benchmark, the S&P 500 Index. For the six months ended June 30, 2004, the Fund posted a return of 3.34%, while the Index returned 3.44%.

Gains were moderate

Larger cap stocks traded in a narrow range over the past six months as the market digested its healthy gains from 2003. Concerns about higher interest rates, rising energy prices, and the Iraqi conflict have kept a lid on stock returns this year, despite the positive backdrop of rising corporate profits and the continued strength of the U.S. economy.

Large-capitalization growth stocks, which have lagged other segments of the market for the past few years, started to show some relative performance improvement versus smaller and more value-oriented stocks in the last few months of the period, though smaller stocks still outperformed for the period overall.

Investment criteria focus on fundamentals

Our investment philosophy in managing the Fund is to focus on large-capitalization growth companies that are dominant or gaining share in their respective industries, are in a sector where business conditions are strong, and have the management talent to sustain their earnings growth for the foreseeable future. We research these companies through traditional fundamental analysis of corporate financial statements and industry statistics, as well as with face-to-face meetings with management. On a similar note, decisions to sell a stock are usually based on indications of deteriorating business fundamentals, changes in management, or both.

We believe dynamic and visionary CEOs are critical to the success of large companies. Without them, it is too easy for bureaucracy and the “law of large numbers” to create significant growth barriers for organizations as they can be hampered by their sheer size. We also try to invest in those areas of the economy that have the benefit of broad, secular tailwinds that can help companies to grow their earnings at faster rates than the overall economy. Four companies from very different industries — Internet leader Yahoo!, retailer Target, consumer products giant Procter and Gamble, and orthopedic products maker Zimmer Holdings — all exemplify the attributes that we seek. These dominant, well-managed growth companies were among the Fund’s stronger-performing stocks for the first half of 2004.

A positive economic backdrop

We anticipate that, in the coming months, the U. S. economy will be able to maintain its ocean liner-like momentum. Although interest rates and inflation are rising, they should remain moderately low by historical standards. We also believe employment figures should continue to improve, as companies gain further confidence in the sustainability of the current economic expansion and add more workers to their payrolls.

Against that backdrop, we would expect that stock performance should be in line with earnings-growth rates. We continue to favor those companies that can benefit most from economic expansion, particularly those in the technology, industrial, and consumer discretionary sectors. We also have a modest emphasis on energy-related companies that we believe can show strong earnings growth due to higher oil and gas prices.

As always, we will continue to stay true to our investment process and discipline. Thank you for the trust and confidence you have placed in the Strong Large Cap Growth Fund.

Bruce C. Olson

Portfolio Manager

8

Fund Highlights

Average Annual Total Returns

As of 6-30-04

| | | |

Investor Class

| | | |

1-year | | 15.35 | % |

5-year | | –5.73 | % |

10-year | | 7.82 | % |

Since Fund Inception (12-30-81) | | 11.71 | % |

Performance is historical and does not guarantee future results. Investment returns and principal value will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most recent month-end performance.

Risks: Stock funds should only be considered for long-term goals as values fluctuate in response to the activities of individual companies and general market and economic conditions.

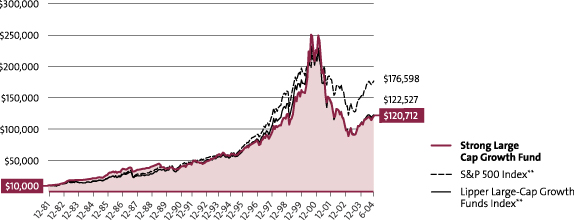

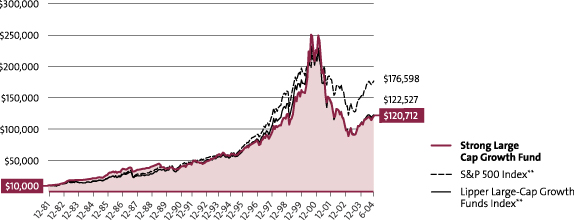

Growth of an Assumed $10,000 Investment†

from 12-30-81 to 6-30-04

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

| * | The Morningstar Style BoxTM reveals a fund’s investment strategy. For equity funds, the vertical axis shows the market capitalization of the stocks owned and the horizontal axis shows investment style (value, blend, or growth). |

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the S&P 500 Index and the Lipper Large-Cap Growth Funds Index. Results include the reinvestment of all dividends and capital gains distributions. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

Fee Waivers: From time to time, the Fund’s advisor and/or administrator has waived fees and/or absorbed Fund expenses, which has resulted in higher returns. As of 6-30-04, there are waivers and/or absorptions in effect.

Percentage Restrictions: The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

Definitions: **The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index (stock price times number of shares outstanding), with each stock’s weight in the Index proportionate to its market value. The Lipper Large-Cap Growth Funds Index is the average of the 30 largest funds in the Lipper Large-Cap Growth Funds Category. Source of the S&P Index data is Standard & Poor’s Micropal. Source of the Lipper Index data is Lipper.

It is not possible to invest directly in an index.

9

Strong U.S. Emerging Growth Fund

After a very strong year for the Fund in 2003, the first half of 2004 was more difficult. For the six months ended June 30, 2004, the Strong U.S. Emerging Growth Fund returned 1.01%, placing it behind its broad-based benchmark, the Russell 2000 Index, which returned 6.76% for the same period. The Fund’s underperformance occurred primarily in the year’s first quarter. During the second quarter, the Fund’s performance was more closely in line with the benchmark’s.

Factors in our performance

There were two primary factors driving the Fund’s under-performance. The first reason was tied to the overall state of the economy. There was a general contraction of stock valuations that took place in January and February, as weak economic data caused many investors to question the strength of the recovery and thus, to lose some confidence in stocks’ growth prospects. Then, in the second quarter, the economy began to pick up steam. In response, the Federal Reserve signaled that it was ready to raise short-term interest rates to help keep the economy from overheating and to help keep inflation in check. Higher interest rates have traditionally hurt the fastest-growing companies — the type we favor for this portfolio — the most.

The other reason for the Fund’s underperformance was a result of certain stock selections we made with respect to our investment in the hospice services area, which accounted for two of our largest positions. One company that provided tremendous returns last year, Odyssey HealthCare, unexpectedly lowered its guidance on its fourth-quarter earnings. This event hurt not only this company’s stock price, but also those of other companies in the industry. The cost to our overall returns was almost two full percentage points. We have subsequently sold both of our holdings in this area, as the outlook remains uncertain.

On a broader note, the highest-growth areas of the market, such as technology, significantly underperformed more defensive sectors, such as energy. On the whole, value style stocks outperformed growth stocks.

Positioned for a stronger economy

Entering 2004, we did not make any substantial changes to our overall positioning from 2003; the portfolio remained poised to benefit from an improving business environment and increasing consumer confidence. This positioning appears to still be appropriate, as we are now seeing an American economy that continues to gain strength. Despite sluggish job growth early in 2004, recent data indicated the economy added more than 300,000 jobs in March alone. This continued into the second quarter.

Manufacturing orders and retail spending have also been strong so far this year. The vast majority of companies with which we spoke expressed solid optimism about their businesses. Although the potential for further interest-rate increases during the year remains, we believe this trend presents limited risk to the companies in the portfolio. This is because we look for companies with little debt, and we have also significantly underweighted stocks from the financial sector compared to the Russell 2000 index, which could face the most volatility from rising rates. In the short term, it is true that some stocks may fluctuate in value due to interest-rate concerns. In the longer view, however, we believe profit growth ultimately drives stock performance, and that this Fund’s portfolio of high-quality, fast-growing companies should be able to do well in this environment.

Our outlook for the second half

Now that the Federal Reserve has raised short-term rates, we think the worst of the resulting volatility is behind us. Normally, small-cap growth stocks appreciate in value after one or two Federal Reserve rate hikes — and we think that is all it will take to cool down the economy. We expect to see strong corporate earnings in the upcoming quarters as well. Given that we believe many stocks have been taken down to reasonable valuations, such earnings improvements could help to drive their prices higher, which may help the small-cap growth sector to perform well in the second half of the year.

Thank you for your investment in the Strong U.S. Emerging Growth Fund.

|

| Thomas L. Press |

| Portfolio Co-Manager |

|

| Donald M. Longlet |

| Portfolio Co-Manager |

|

| Robert E. Scott |

| Portfolio Co-Manager |

10

Fund Highlights

Average Annual Total Returns

As of 6-30-04

| | | |

Investor Class

| | | |

1-year | | 25.63 | % |

5-year | | 4.89 | % |

Since Fund Inception (12-31-98) | | 8.50 | % |

Performance is historical and does not guarantee future results. Investment returns and principal value will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most recent month-end performance.

Risks: Stock funds should only be considered for long-term goals as values fluctuate in response to the activities of individual companies and general market and economic conditions.

Because smaller companies often have narrower markets and limited financial resources, investments in these stocks present more risk than investments in those of larger, more established companies.

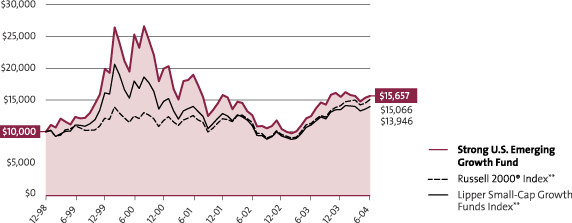

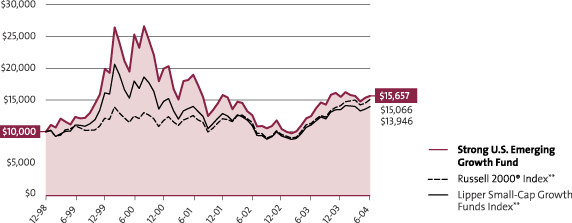

Growth of an Assumed $10,000 Investment†

from 12-31-98 to 6-30-04

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

| * | The Morningstar Style Box™ reveals a fund’s investment strategy. For equity funds, the vertical axis shows the market capitalization of the stocks owned and the horizontal axis shows investment style (value, blend, or growth). |

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the Russell 2000® Index and the Lipper Small-Cap Growth Funds Index. Results include the reinvestment of all dividends and capital gains distributions. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

Performance Information: From time to time, the Fund’s performance was significantly enhanced through investments in initial public offerings (IPOs). In addition, the effect of IPOs purchased when the Fund’s asset base was small may have been magnified. Given these circumstances, you should not expect that such enhanced returns can be consistently achieved. Please consider this before investing.

Fee Waivers: From time to time, the Fund’s advisor and/or administrator has waived fees and/or absorbed Fund expenses, which has resulted in higher returns. As of 6-30-04, there are waivers and/or absorptions in effect.

Percentage Restrictions: The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

Definitions: **The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index, which represents approximately 8% of the total market capitalization of the Russell 3000® Index. The Lipper Small-Cap Growth Funds Index is the average of the 30 largest funds in the Lipper Small-Cap Growth Funds Category. Source of the Russell Index data is Standard & Poor’s Micropal. Source of the Lipper Index data is Lipper. It is not possible to invest directly in an index.

11

Strong Enterprise Fund

During the first half of 2004, the Strong Enterprise Fund Investor Class gained 5.28%. This return fell short of the Fund’s broad-based benchmark, the Russell Midcap Index, which advanced 6.67% during the same time frame.

The underperformance can be partly attributed to disappointing results from Select Medical, a health-care equipment company. The stock fell after the government proposed some changes to how health-care providers would be reimbursed for Medicare claims. In response to the decline, we sold our position in Select Medical during the period — though, unfortunately, not soon enough to avoid a negative impact on the portfolio. This negative influence was counterbalanced by positive performance from the Fund’s consumer discretionary holdings, which benefited from continued strength in consumer spending.

Reduced gains in 2004

Continued growth in corporate profits and operating margins helped support further increases in stock prices during the first six months of 2004, although these gains were much less robust than those realized in 2003. As the stock recovery continued to take hold, investors began to look ahead to the potential for higher interest rates, more inflation, and continued high energy prices — all factors that could limit equity returns in the future. Interest rates were a particular concern; the threat of further rate hikes from the Federal Reserve Board kept a ceiling on corporate valuations, even as the companies reported solid first-quarter profits.

Thorough company research

Our approach to portfolio management relies on the careful selection of individual securities through collaborative research. We strive to “surround” each company that we consider for investment. In other words, our team of portfolio managers and analysts interviews not only the companies’ management, but also their competitors, suppliers, and customers. We want to acquire unique insights to support — or reject, in the cases of companies that fail to meet our strict requirements — our investment thesis for each individual stock.

Applying this approach, the Fund continued to benefit from a position in Harman International, which develops high-fidelity audio products and electronic systems for consumers and businesses. Our research led us to Harman almost two years ago, as the company was delivering multimedia and “infotainment” systems to BMW and other auto manufacturers. In recent years, automakers have responded to consumer demand by incorporating an increasing number of multimedia applications in vehicles. Since our original identification of Harman as a solid growth business, the company has continued to expand its product lineup and serve a growing roster of impressive clients — including Mercedes, BMW, Audi, Porsche, and Chrysler — with highly profitable infotainment systems.

Another important holding for the Fund was Crown Castle International, which owns and leases towers and transmission networks for wireless communications systems. Our industry research revealed that wireless carriers have two top priorities: 1) improving the voice quality on their communications networks; and 2) rolling out next-generation networks to enable subscribers to access online services at high speeds. Competition between carriers has become increasingly fierce, however, and as the companies acquire more customers, they must continue to upgrade and expand their networks to meet the increased demand. We believed that Crown Castle was in a strong position to capitalize on these trends. As the nation’s second largest wireless tower operator, the company has a presence in nearly three-quarters of the 100 largest markets in the United States. During the period, Crown Castle’s strong competitive position led to impressive growth in the company’s free-cash flow (cash flow after expenses).

Future challenges

Although corporate earnings and profitability are expected to continue to rise, we believe that stock valuations are already reflecting these likely trends. Thus, we are looking for gains from this point to be produced by a select group of high-quality stocks with predictable earnings. Against this backdrop, we plan to focus on companies with opportunities to reinvest in their core business, which will drive stable revenue and profit growth, and show the ability to keep prices high in a competitive business environment.

Thank you for your investment in the Strong Enterprise Fund. We appreciate the trust you have placed in our team.

|

Thomas J. Pence |

Portfolio Manager |

12

Fund Highlights

Average Annual Total Returns

As of 6-30-04

| | | |

Investor Class

| | | |

1-year | | 25.03 | % |

5-year | | 3.05 | % |

Since Fund Inception (9-30-98) | | 16.53 | % |

| |

Institutional Class1

| | | |

1-year | | 26.12 | % |

5-year | | 3.22 | % |

Since Fund Inception (9-30-98) | | 16.70 | % |

| |

Advisor Class2

| | | |

1-year | | 25.38 | % |

5-year | | 3.04 | % |

Since Fund Inception (9-30-98) | | 16.47 | % |

| |

Class K3

| | | |

1-year | | 25.80 | % |

5-year | | 3.30 | % |

Since Fund Inception (9-30-98) | | 16.77 | % |

Performance is historical and does not guarantee future results. Investment returns and principal value will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most recent month-end performance.

Risks: Stock funds should only be considered for long-term goals as values fluctuate in response to the activities of individual companies and general market and economic conditions.

Because smaller companies often have narrower markets and limited financial resources, investments in these stocks present more risk than investments in those of larger, more established companies.

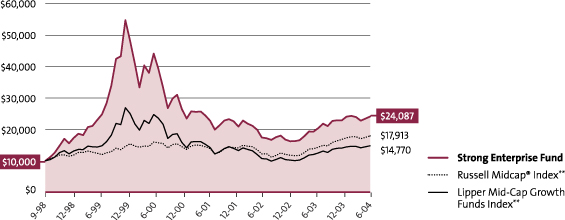

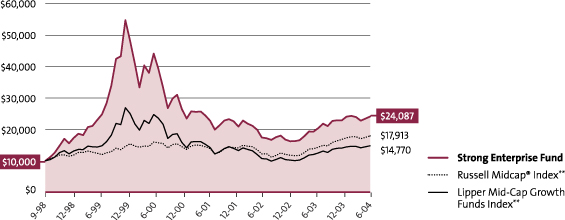

Growth of an Assumed $10,000 Investment

from 9-30-98 to 6-30-04

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

| * | The Morningstar Style Box™ reveals a fund’s investment strategy. For equity funds, the vertical axis shows the market capitalization of the stocks owned and the horizontal axis shows investment style (value, blend, or growth). |

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the Russell Midcap® Index and the Lipper Mid-Cap Growth Funds Index. Results include the reinvestment of all dividends and capital gains distributions. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. This graph is based on Investor Class shares only; performance for other classes will vary due to differences in fee structures. |

Performance Information: 1The performance of the Institutional Class shares prior to 6-30-03 is based on the Fund’s Investor Class shares’ performance.

2The performance of the Advisor Class shares prior to 2-24-00 is based on the Fund’s Investor Class shares’ performance, restated for the higher expense ratio of the Advisor Class shares.

3The performance of the Class K shares prior to 8-30-02 is based on the Fund’s Investor Class shares’ performance, and has not been restated for the lower expense ratio of the Class K shares.

Please consult a prospectus for information about all share classes.

Fee Waivers: From time to time, the Fund’s advisor and/or administrator has waived fees and/or absorbed Fund expenses, which has resulted in higher returns. As of 6-30-04, there are waivers and/or absorptions in effect.

Percentage Restrictions: The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

Definitions: **The Russell Midcap® Index measures the performance of the 800 smallest companies in the Russell 1000® Index, which represent approximately 26% of the total market capitalization of the Russell 1000® Index. The Lipper Mid-Cap Growth Funds Index is the average of the 30 largest funds in the Lipper Mid-Cap Growth Funds Category. Source of the Russell Index data is Standard & Poor’s Micropal. Source of the Lipper Index data is Lipper. It is not possible to invest directly in an index.

13

Strong Growth 20 Fund

The Strong Growth 20 Fund recorded positive performance for the first half of 2004, outperforming its broad-based benchmark, the S&P 500 Index. For the six months ended June 30, 2004, the Fund’s Investor Class shares returned 4.86%, while the S&P 500 Index returned 3.44% for the same period. The Fund was able to achieve this performance even though the value style of investing slightly outperformed the Fund’s growth style over the six months.

Internet and energy played a large role

The outperformance of the Strong Growth 20 Fund was driven primarily by its exposure to Internet-related companies, which represent one of the fastest-growing segments of the economy. During the period, the Fund held positions in such high-quality, fast-growing Internet-related stocks including eBay, Yahoo!, and Ask Jeeves.

Energy stocks also made a meaningful, positive contribution to the Fund’s performance. Such holdings as Ultra Petroleum and BJ Services Company were positioned to benefit from the high energy prices we saw during the first half of 2004. Ultra Petroleum, an exploration and production company, also benefited from its industry-leading natural gas production growth rate. Importantly, we expect their powerful volume growth to continue for several more quarters, driven by the strength of its drilling prospects and management’s solid track record of execution.

Among the areas of investment that were weaker for the Fund for the six months were homebuilding, generic drugs, software, and communications.

Studying companies closely

We believe that earnings and revenue growth are key factors in determining stock prices. We, therefore, focus a great deal of our stock-selection process on finding stocks that are experiencing — or have solid potential to experience — above-average growth in revenue and earnings. While identifying stocks that are experiencing this growth is essential, what matters even more in our investment strategy is determining which companies have growth trends that are sustainable, and which will only be short-lived.

To sort out the long-term winners from the disappointments, we employ thorough, hands-on research. We specifically focus on a company’s history of success in executing its strategy and the potential profitability of its business model. We also carefully consider whether the company’s strategy and operations mesh well with our overall economic view, and if it is being helped or hurt by any broader secular trends.

When we decide to sell a stock, our decision-making criteria are essentially the opposite of our buying criteria. We may sell a stock when we see deterioration in its fundamental qualities that may threaten the sustainability of a company’s existing or prospective growth. Conditions that could give us grounds for concern may include, but are not limited to, changes we see in the economy, a new competitive threat, or a change in management personnel or direction.

Our approach to the second half

Our outlook for the next few months remains upbeat. We anticipate that interest rates and inflation will both remain relatively low, and that growth in jobs and corporate earnings are likely to remain at healthy levels. We expect to carefully monitor these factors. The outcome of the presidential election in November could have important investment implications, so we anticipate closely watching developments on that front. In the meantime, we intend to continue to seek out the fastest-growing companies we can identify that we believe fit within the framework of our investment process.

We thank you for your continued investment in the Strong Growth 20 Fund.

|

Brandon M. Nelson |

Portfolio Manager |

14

Fund Highlights

Average Annual Total Returns

As of 6-30-04

| | | |

Investor Class

| | | |

1-year | | 19.95 | % |

5-year | | –3.52 | % |

Since Fund Inception (6-30-97) | | 6.74 | % |

| |

Advisor Class1

| | | |

1-year | | 20.28 | % |

5-year | | – 3.48 | % |

Since Fund Inception (6-30-97) | | 6.70 | % |

Performance is historical and does not guarantee future results. Investment returns and principal value will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most recent month-end performance.

Risks: Stock funds should only be considered for long-term goals as values fluctuate in response to the activities of individual companies and general market and economic conditions.

The Fund is nondiversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual stock volatility and market pressure than a fully diversified fund.

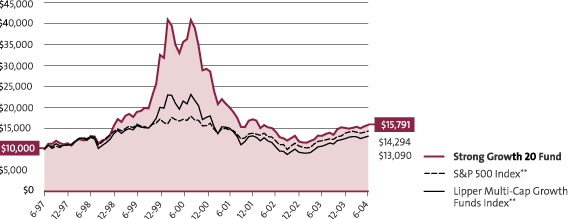

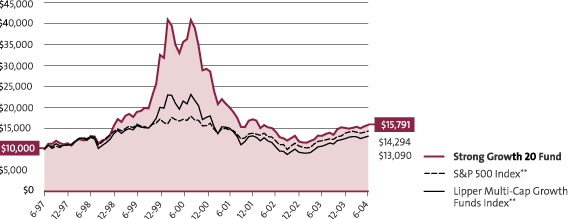

Growth of an Assumed $10,000 Investment†

from 6-30-97 to 6-30-04

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

| * | The Morningstar Style BoxTM reveals a fund’s investment strategy. For equity funds, the vertical axis shows the market capitalization of the stocks owned and the horizontal axis shows investment style (value, blend, or growth). |

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the S&P 500 Index and the Lipper Multi-Cap Growth Funds Index. Results include the reinvestment of all dividends and capital gains distributions. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. This graph is based on Investor Class shares only; performance for other classes will vary, due to differences in fee structures. |

Performance Information: 1The performance of the Advisor Class shares prior to 2-24-00 is based on the Fund’s Investor Class shares’ performance, restated for the higher expense ratio of the Advisor Class shares.

Please consult a prospectus for information about all share classes.

From time to time, the Fund’s performance was significantly enhanced through investments in initial public offerings (IPOs). In addition, the effect of IPOs purchased when the Fund’s asset base was small may have been magnified. Given these circumstances, you should not expect that such enhanced returns can be consistently achieved. Please consider this before investing.

Fee Waivers: From time to time, the Fund’s advisor and/or administrator has waived fees and/or absorbed Fund expenses, which has resulted in higher returns. As of 6-30-04, there are waivers and/or absorptions in effect.

Percentage Restrictions: The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

Definitions: **The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index (stock price times number of shares outstanding), with each stock’s weight in the Index proportionate to its market value. The Lipper Multi-Cap Growth Funds Index is the average of the 30 largest funds in the Lipper Multi-Cap Growth Funds Category. Source of the S&P Index data is Standard & Poor’s Micropal. Source of the Lipper Index data is Lipper. It is not possible to invest directly in an index.

15

Strong Growth Fund

The Strong Growth Fund had a good start to the year, with the Investor Class shares posting a return of 6.40% for the six months ended June 30, 2004. For the same period, its broad-based benchmark, the S&P 500 Index, returned 3.44%.

Taking advantage of a dynamic market

The strongest impact on the market during the first half of the period was continued greater than anticipated corporate earnings growth. Fortunately, the Fund was positioned to benefit from this occurrence. The other main variable influencing the market during the first half was the anticipation of the Federal Reserve’s reversal of its current accommodative short-term, interest-rate stance. We feel the portfolio was positioned for this occurrence.

The Fund continued to have strong allocations in economically sensitive sectors such as technology and in specific long-term growth opportunities tied to the consumer. We continued to research and explore opportunities in the health care sector, but have found many of the larger capitalization stocks to have lackluster growth prospects.

While value styles did outperform growth in the period, we were able to benefit from opportunistic investments in equities of high-quality, fast-growing growth stocks.

Research nets Yahoo!

Stock specific proprietary research continues to be at the heart of our portfolio process. We devote many hours to screening for the fastest growing public companies in the economy that also provide for the best chances for sustained growth. Once we identify these companies on paper, we hit the phones and the road to accumulate data from meetings and conversations with the companies themselves, their customers, their suppliers, and their competitors.

Sometimes a better investment idea comes from this confirmatory research than the original stock idea that generated the analysis. Once a stock makes it into the portfolio this process doesn’t halt, it is dynamic. We constantly research to recheck our theses, while taking into account the opportunity cost of not owning other growth stocks. We do not ignore the macros as they can provide strong headwinds or tailwinds to company-specific growth. We also monitor our portfolio risk on many levels, including sector allocations.

Yahoo! is a good example of the fruits of this process. It addresses a growth area in the economy. It is taking market share within its industry. Moreover, its growth prospects have been continually underestimated. While doing research on Yahoo!’s growth opportunities and the duration of that growth, we have found other exciting growth stocks to add to the portfolio.

Looking ahead to the second half

Our near-term outlook can be described as opportunistically optimistic. While we expect short-term interest rates to rise to a more historic level, we are encouraged that the yield curve remains steep, signaling the market’s expectations for continued economic growth. Within this pretext there are plenty of exciting opportunities to invest in growth stocks. We thank you for your continued support and investment.

Thomas C. Ognar

Portfolio Manager

16

Fund Highlights

Average Annual Total Returns

As of 6-30-04

| | | |

Investor Class

| | | |

1-year | | 20.89 | % |

5-year | | –1.43 | % |

10-year | | 11.72 | % |

Since Fund Inception (12-31-93) | | 11.79 | % |

| |

Institutional Class1

| | | |

1-year | | 21.56 | % |

5-year | | – 0.87 | % |

10-year | | 12.04 | % |

Since Fund Inception (12-31-93) | | 12.10 | % |

| |

Advisor Class2

| | | |

1-year | | 20.73 | % |

5-year | | –1.59 | % |

10-year | | 11.46 | % |

Since Fund Inception (12-31-93) | | 11.53 | % |

| |

Class C3

| | | |

1-year | | 18.64 | % |

5-year | | –2.46 | % |

10-year | | 10.47 | % |

Since Fund Inception (12-31-93) | | 10.53 | % |

| |

Class K4

| | | |

1-year | | 21.41 | % |

5-year | | –1.16 | % |

10-year | | 11.87 | % |

Since Fund Inception (12-31-93) | | 11.94 | % |

Performance is historical and does not guarantee future results. Investment returns and principal value will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most recent month-end performance.

Risks: Stock funds should only be considered for long-term goals as values fluctuate in response to the activities of individual companies and general market and economic conditions.

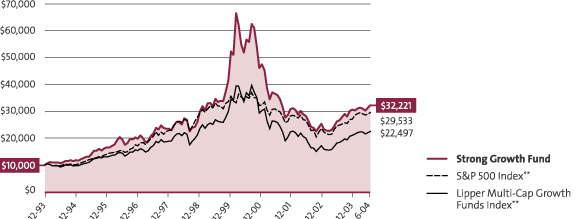

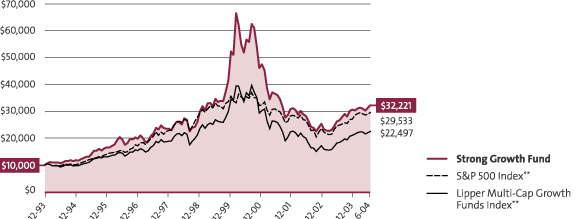

Growth of an Assumed $10,000 Investment†

from 12-31-93 to 6-30-04

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

| * | The Morningstar Style BoxTM reveals a fund’s investment strategy. For equity funds, the vertical axis shows the market capitalization of the stocks owned and the horizontal axis shows investment style (value, blend, or growth). |

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the S&P 500 Index and the Lipper Multi-Cap Growth Funds Index. Results include the reinvestment of all dividends and capital gains distributions. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. This graph is based on Investor Class shares only; performance for other classes will vary due to differences in fee structures. |

Performance Information: 1The performance of the Institutional Class shares prior to 2-24-00 is based on the Fund’s Investor Class shares’ performance, and has not been restated for the lower expense ratio of the Institutional Class shares.

2The performance of the Advisor Class shares prior to 2-24-00 is based on the Fund’s Investor Class shares’ performance, restated for the higher expense ratio of the Advisor Class shares.

3The performance of Class C shares prior to 12-26-02 is based on the Fund’s Investor Class shares’ performance, restated for the higher expense ratio of the Class C shares. Average annual total returns include a 1.00% contingent deferred sales charge imposed on redemptions made within 12 months of purchase.

4The performance of the Class K shares prior to 8-30-02 is based on the Fund’s Investor Class shares’ performance and has not been restated for the lower expense ratio of the Class K shares.

Please consult a prospectus for information about all share classes.

Fee Waivers: From time to time, the Fund’s advisor and/or administrator has waived fees and/or absorbed Fund expenses, which has resulted in higher returns. As of 6-30-04, there are waivers and/or absorptions in effect.

Percentage Restrictions: The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

Definitions: **The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index (stock price times number of shares outstanding), with each stock’s weight in the Index proportionate to its market value. The Lipper Multi-Cap Growth Funds Index is the average of the 30 largest funds in the Lipper Multi-Cap Growth Funds Category. Source of the S&P Index data is Standard & Poor’s Micropal. Source of the Lipper Index data is Lipper.

It is not possible to invest directly in an index.

17

Strong Large Company Growth Fund

During the first half of 2004, the Strong Large Company Growth Fund gained 7.19%, decisively outpacing the Fund’s broad-based benchmark, the S&P 500 Index, which rose 3.44%. The Fund was invested in companies poised to deliver stronger earnings and cash flow growth than the broad stock market. The Fund’s returns were driven by strong stock selection within health care and information technology.

Uncovering investment opportunities

Our approach to portfolio management relies on the careful selection of individual securities through collaborative research. We strive to “surround” each company that we consider for investment. In other words, our team of portfolio managers and analysts interviews not only the company’s management, but also their competitors, suppliers, and customers. We want to acquire unique insights to support — or reject, in the cases of companies that fail to meet our strict requirements — our investment thesis for each individual stock.

Opportunities in Teva and Yahoo!

Applying our approach, we reviewed a number of potential investment opportunities in the health care sector during the period. As our research progressed, we became concerned about the lack of new products forthcoming by many large-cap pharmaceutical companies, as well as the considerable number of drugs due to lose their patent protection in the near future. Accordingly, we maintained little exposure to these “name-brand” pharmaceutical businesses. Instead we built a position in Teva Pharmaceutical, the world’s leading developer and manufacturer of generic drugs as well as a supplier of a growing line of branded drugs.

We believe Teva has an outstanding competitive position, as the company dominates the generic drug market in the United States. In addition, Teva’s management team has shown a consistent ability to execute its business strategy, made evident by the company’s track record of stable and diversified earnings. Furthermore, Teva has an impressive pipeline of upcoming products, with over 80 applications for new drugs pending regulatory approval in the U.S. alone. The company also has shown success with its branded drug offerings, such as Copaxone, well on its way to becoming the nation’s leading treatment for multiple sclerosis. Thanks to these strong business trends, Teva has been able to produce solid revenue and earnings growth, and the stock was a significant contributor to the Fund’s performance during the past six months.

We also built a position in Yahoo!, a provider of Internet consumer and business services. Yahoo!’s business strength is driven by branded advertising. Our research led us to conclude that many companies plan to increase advertising spending in the near future. In addition, corporations appear to be particularly attracted to Internet advertising, especially since consumers now view 15% of their media content online. More and more advertisers, in fact, have been looking to the Internet as an effective alternative to traditional television advertising, which has been hurt by declining ratings and the proliferation of digital video recorders.

At the time of our research, we saw Yahoo! as very well positioned to take advantage of this shift in advertising spending. With 40% of Internet users using Yahoo!’s search function, the company enjoys strong brand recognition and a large user base. Yahoo! also is beginning to realize the benefit of offering a full suite of advertising products, including increasingly lucrative “paid search” advertising. Finally, we believed Yahoo! could continue to benefit from growth opportunities overseas; the company has been investing heavily to enter and take market share from less-sophisticated, regional Internet portals.

High-quality companies may benefit

For the rest of 2004, we expect corporate profits to continue to grow, but at a slower pace than investors have been experiencing in recent quarters. We believe the expectation for higher interest rates is likely to put a cap on stock valuations. One potentially positive factor for continued earnings growth would be a return to high levels of business spending, which lagged far behind consumer spending during the recent economic downturn. Should growth overseas outpace that in the United States, and if foreign currencies continue to outpace the U.S. dollar, domestic companies with significant international sales should benefit. Against the current economic and market backdrop, we expect stock investors to begin to reward higher-quality companies with relatively predictable earnings and recurring revenues.

Thank you for your investment in the Strong Large Company Growth Fund. We sincerely appreciate the trust you have placed in us.

Thomas J. Pence

Portfolio Manager

18

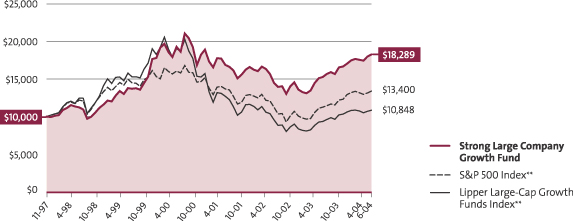

Fund Highlights

Average Annual Total Returns

As of 6-30-04

| | | |

Investor Class1

| | | |

1-year | | 19.73 | % |

5-year | | 5.81 | % |

Since Inception (11-3-97) | | 9.50 | % |

| |

Class K2

| | | |

1-year | | 20.32 | % |

5-year | | 5.91 | % |

Since Inception (11-3-97) | | 9.58 | % |

Performance is historical and does not guarantee future results. Investment returns and principal value will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most recent month-end performance.